|

|

市場調査レポート

商品コード

1774596

鉄筋の世界市場:タイプ別、プロセス別、コーティングタイプ別、バーサイズ別、最終用途部門別、地域別 - 2030年までの予測Steel Rebar Market by Type (Deformed, Mild), Process (BOS, EAF), Coating Type (Plain, Galvanized, Epoxy Coated), Bar Size (#3, #4, #5, #8), End-use Industry (Infrastructure, Housing & Industrial), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 鉄筋の世界市場:タイプ別、プロセス別、コーティングタイプ別、バーサイズ別、最終用途部門別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月17日

発行: MarketsandMarkets

ページ情報: 英文 291 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

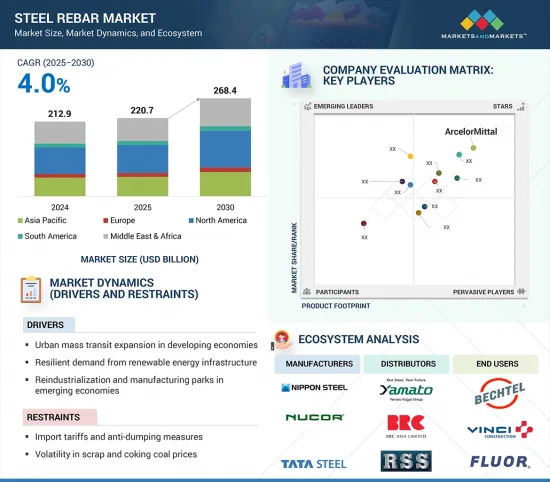

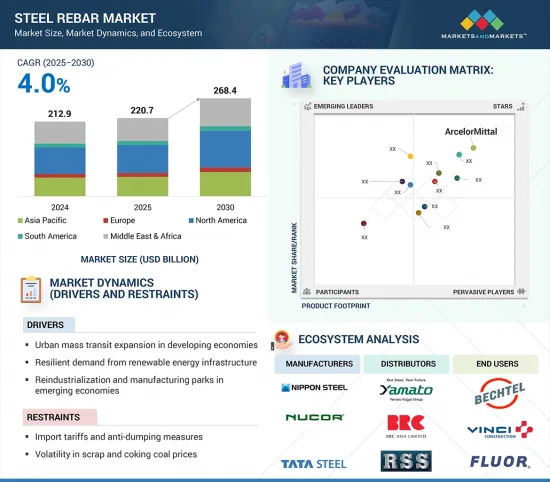

鉄筋の市場規模は、2024年に2,129億米ドルとなりました。

同市場は、4.0%のCAGRで拡大し、 2030年にはで2,684億米ドルに達すると予測されています。インフラ開発、都市住宅プロジェクト、産業用の建設増加が、世界各地の鉄筋市場を牽引し続けています。各国が新交通システム、スマートシティイニシアチブ、再生可能エネルギーインフラに投資している一方で、橋梁やその他の重要な構造物を含む構造的に健全な建物に対する重要なニーズが残っています。地震が発生しやすい地域では、鉄筋はコンクリートを補強する上で極めて重要であり、構造物が地震の揺れに耐えられるよう支援します。一方、新興国における人口増加と経済成長は、商業および住宅建設の成長を加速させています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル)/数量(キロトン) |

| セグメント | タイプ別、プロセス別、コーティングタイプ別、バーサイズ別、最終用途部門別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、南米 |

このような建築活動の急増は、鉄筋のような高性能建設材料の需要を押し上げています。さらに、技術の進歩により、錆びにくく、強度の高い鉄筋が作られるようになりました。これらの最新の選択肢は、より高い耐久性と低い長期メンテナンスコストを提供し、より弾力的で費用対効果の高い建設をもたらすため、エンジニアや請負業者にますます好まれています。

異形鉄筋は、より優れた引張強度を有し、より効果的に応力を処理し、様々な建設産業での使用に適しているため、最も高いCAGRを記録すると予測されます。波形鉄筋は、コンクリートとの結合を改善するために表面にリブや隆起があります。これにより、コンクリートと鋼鉄の間の結合強度が向上し、その結果、薬剤の耐荷重性が向上します。そのため、この材料は高層ビル、高速道路、橋、トンネル、耐震建築物に非常に適しています。

世界のインフラ投資の増加と都市化の加速に伴い、特にアジア太平洋、中東・アフリカなどの急速に発展している地域では、信頼性の高い高強度補強製品に対する需要が高まっています。政府や民間の開発業者は、新しい安全基準や性能基準を満たすために異形鉄筋を要求するようになってきています。さらに、熱機械処理(TMT)鉄筋や耐腐食グレードなどの高級製品の導入が、このセグメントの成長をさらに促進しています。異形鉄筋は、様々な直径、等級、長さのものがあり、出荷には多くのカスタマイズオプションがあります。その柔軟性により、ますます多くの市場で使用されるようになっています。より低いコスト、建設上の利点、多くの用途への適用可能性により、異形鉄筋セグメントは鉄筋市場で最も急速に成長し、最も回復力のある部分となっています。

電気アーク炉(EAF)は、その持続可能性、エネルギー効率、鉄鋼生産の脱炭素化に対する世界の関心の高まりから、予測期間中に最も高いCAGRを記録すると予測されます。電気アーク炉(EAF)は、特に金属スクラップが容易に入手でき、再生可能エネルギーが増加傾向にある地域では、近代的な製鉄に不可欠なものとなりつつあります。石炭と鉄鉱石に大きく依存する伝統的な高炉とは異なり、EAFは電気を使用して金属スクラップを溶解するため、プロセスがよりクリーンで柔軟性が高く、低炭素の未来に適しています。大規模な鉄鋼生産から、フェロチタン、マンガン、シリコンのような特殊合金製造まで、EAFは幅広いニーズに適応することができます。傾斜型炉であれ固定型炉であれ、あるいは合金鉄生産に使用されるサブマージアーク炉であれ、効率と持続可能性の両方の要求を満たすために、この技術は進化し続けています。トルコのような国々は、産業の成長と環境への責任のバランスを取りながら、EAF技術を採用しています。脱炭素化の世界の推進が続く中、EAFは単なる溶解ツール以上のものであることが証明されつつあります。

サーキュラー・エコノミー(循環型経済)の実践や、産業界の二酸化炭素排出量を削減するための環境政策の適用が拡大し、製鉄におけるEAFベースの生産への関心が高まっています。最新のEAF技術は、より高い生産性、より低い操業コスト、より安定した鉄鋼品質を可能にし、住宅、商業、インフラ・プロジェクトで使用される様々な鉄筋グレードの製造に適しています。

このプロセスは、米国、インド、欧州の一部など、低炭素製鉄を目的とした政策や投資が行われている他の国々でも普及しつつあります。グリーンビルディング基準とESG基準が影響力を持ち続ける一方で、EAFセグメントはより大きな地歩を占めると予想され、予測期間中、すべての鉄筋製造プロセスで最も速い成長率を生み出します。

急速な都市化、大規模なインフラと新しい建設活動、新興経済国の堅調な経済成長により、アジア太平洋地域は予測期間中に鉄筋市場で最も速いCAGRを持つと推定・予測されます。中国、インド、インドネシア、ベトナムのような国では、都市人口の増加に対応し、経済の回復力を刺激するために、道路、橋、鉄道、住宅、工業用建物などの建設プロジェクトが増加しています。

世界最大の鉄鋼生産国である中国は、現在も「一帯一路構想(Belt and Road Initiative)」などのプログラムで国内外のインフラに資金を供給しています。インドは、直接還元鉄(DRI)生産能力の増加だけでなく、政府主導の野心的なプログラムにより、世界の鉄筋市場における主要な成長エンジンとして急速に台頭しています。Pradhan Mantri Awas Yojana(PMAY)、Smart Cities Mission、PM Gati Shaktiのようなイニシアチブは、住宅やインフラセクター全体の鉄筋の大規模な需要を煽っています。このような国内建設の急増は、工業地帯、交通回廊、物流ハブへの外国投資を誘致している東南アジア全域で反映されており、これらすべてが鉄筋消費量の着実な増加を促しています。原材料へのアクセス、相対的に低い労働コスト、鉄鋼生産能力の拡大など、この地域の競争上の優位性は、その地位をさらに強化しています。特に新興経済諸国において、耐震性と高強度建設資材のニーズが高まるにつれ、アジア太平洋地域は今後数年間、最も高い成長率で世界の鉄筋市場をリードすると予想されます。

当レポートでは、世界の鉄筋市場について調査し、タイプ別、プロセス別、コーティングタイプ別、バーサイズ別、最終用途部門別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

第6章 業界動向

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 生成AIが鉄筋市場に与える影響

- 特許分析

- 主要申請者

- 貿易分析

- 2025年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- マクロ経済分析

- 投資と資金調達のシナリオ

- 2025年の米国関税の影響:鉄筋市場

第7章 鉄筋市場(タイプ別)

- イントロダクション

- 異形

- 軟鋼

第8章 鉄筋市場(プロセス別)

- イントロダクション

- 基本的な酸素製鋼

- 電気アーク炉

第9章 鉄筋市場(コーティングタイプ別)

- イントロダクション

- 普通炭素鋼鉄筋

- 亜鉛メッキ鋼鉄筋

- エポキシコーティング鋼鉄筋

第10章 鉄筋市場(バーサイズ別)

- イントロダクション

- #3バーサイズ

- #4バーサイズ

- #5バーサイズ

- #8バーサイズ

- その他

第11章 鉄筋市場(最終用途部門別)

- イントロダクション

- インフラ

- ハウジング

- 工業

第12章 鉄筋市場(地域別)

- イントロダクション

- 北米

- 北米の鉄筋市場(国別)

- 米国

- カナダ

- メキシコ

- アジア太平洋

- アジア太平洋の鉄筋市場(国別)

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他

- 欧州

- 欧州の鉄筋市場(国別)

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- ウクライナ

- トルコ

- その他

- 中東・アフリカ

- 中東・アフリカの鉄筋市場(国別)

- GCC諸国

- 南アフリカ

- その他

- 南米

- 南米の鉄筋市場(国別)

- ブラジル

- アルゼンチン

- その他

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析

- 企業評価と財務指標

- 財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合ベンチマーキング:スタートアップ/中小企業、2024年

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- NIPPON STEEL CORPORATION

- ARCELORMITTAL

- GERDAU S/A

- NUCOR CORPORATION

- COMMERCIAL METALS COMPANY

- TATA STEEL

- STEEL AUTHORITY OF INDIA LIMITED

- MECHEL PAO

- STEEL DYNAMICS, INC.

- NLMK GROUP

- JSW

- BAOSTEEL GROUP CO., LTD.

- その他の企業

- METINVEST

- PAO SEVERSTAL

- BYER STEEL CORPORATION

- DAIDO STEEL CO., LTD.

- ACERINOX

- HYUNDAI STEEL

- JIANGSU SHAGANG GROUP

- HBIS GROUP CO., LTD.

- EVRAZ PLC

- SWISS STEEL GROUP

- SUNFLAG IRON AND STEEL CO. LTD.

- OUTOKUMPU

- 7 STEEL UK

第15章 隣接市場と関連市場

第16章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE (USD/TON), 2024

- TABLE 2 AVERAGE SELLING PRICE OF KEY PLAYERS, BY REGION, 2021-2030 (USD/TON)

- TABLE 3 ROLE OF COMPANIES IN STEEL REBAR MARKET ECOSYSTEM

- TABLE 4 LIST OF PATENTS FOR STEEL REBAR:

- TABLE 5 IMPORT DATA RELATED TO HS CODE 7227, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 6 EXPORT DATA RELATED TO HS CODE 7227, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 7 KEY CONFERENCES AND EVENTS, STEEL REBAR MARKET (2025)

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END-USES

- TABLE 15 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 16 GLOBAL GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 17 WORLD CRUDE STEEL PRODUCTION, 2016- 2023 IN MILLION TONS (MT)

- TABLE 18 INFRASTRUCTURE INVESTMENT IMPACT ON THE STEEL REBAR MARKET BY REGION

- TABLE 19 KEY TARIFF RATES, 2025

- TABLE 20 STEEL REBAR MARKET, BY TYPE, 2021-2023 (MILLION TON)

- TABLE 21 STEEL REBAR MARKET, BY TYPE, 2024-2030 (MILLION TON)

- TABLE 22 STEEL REBAR MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 23 STEEL REBAR MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 24 STEEL REBAR MARKET, BY PROCESS, 2021-2023 (MILLION TON)

- TABLE 25 STEEL REBAR MARKET, BY PROCESS, 2024-2030 (MILLION TON)

- TABLE 26 STEEL REBAR MARKET, BY PROCESS, 2021-2023 (USD MILLION)

- TABLE 27 STEEL REBAR MARKET, BY PROCESS, 2024-2030 (USD MILLION)

- TABLE 28 STEEL REBAR MARKET, BY COATING TYPE, 2021-2023 (MILLION TON)

- TABLE 29 STEEL REBAR MARKET, BY COATING TYPE, 2024-2030 (MILLION TON)

- TABLE 30 STEEL REBAR MARKET, BY COATING TYPE, 2021-2023 (USD MILLION)

- TABLE 31 STEEL REBAR MARKET, BY COATING TYPE, 2024-2030 (USD MILLION)

- TABLE 32 REBAR SIZE CHART

- TABLE 33 STEEL REBAR MARKET, BY BAR SIZE, 2021-2023 (MILLION TON)

- TABLE 34 STEEL REBAR MARKET, BY BAR SIZE, 2024-2030 (MILLION TON)

- TABLE 35 STEEL REBAR MARKET, BY BAR SIZE, 2021-2023 (USD MILLION)

- TABLE 36 STEEL REBAR MARKET, BY BAR SIZE, 2024-2030 (USD MILLION)

- TABLE 37 STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 38 STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 39 STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 40 STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 41 STEEL REBAR MARKET, BY REGION, 2021-2023 (MILLION TON)

- TABLE 42 STEEL REBAR MARKET, BY REGION, 2024-2030 (MILLION TON)

- TABLE 43 STEEL REBAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 44 STEEL REBAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: STEEL REBAR MARKET, BY COUNTRY, 2021-2023 (MILLION TON)

- TABLE 46 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY COUNTRY, 2024-2030 (MILLION TON)

- TABLE 47 NORTH AMERICA: STEEL REBAR MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 48 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: STEEL REBAR MARKET, BY PROCESS, 2021-2023 (MILLION TON)

- TABLE 50 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY PROCESS, 2024-2030 (MILLION TON)

- TABLE 51 NORTH AMERICA: STEEL REBAR MARKET, BY PROCESS, 2021-2023 (USD MILLION)

- TABLE 52 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY PROCESS, 2024-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: STEEL REBAR MARKET, BY TYPE, 2021-2023 (MILLION TON)

- TABLE 54 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY TYPE, 2024-2030 (MILLION TON)

- TABLE 55 NORTH AMERICA: STEEL REBAR MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 56 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 58 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 59 NORTH AMERICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 60 NORTH AMERICA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 61 US: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 62 US: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 63 US: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 64 US: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 65 CANADA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 66 CANADA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 67 CANADA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 68 CANADA: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 69 MEXICO: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 70 MEXICO: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 71 MEXICO: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 72 MEXICO: STEEL REBAR MARKET SIZE, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 73 ASIA PACIFIC: STEEL REBAR MARKET, BY COUNTRY, 2021-2023 (MILLION TON)

- TABLE 74 ASIA PACIFIC: STEEL REBAR MARKET, BY COUNTRY, 2024-2030 (MILLION TON)

- TABLE 75 ASIA PACIFIC: STEEL REBAR MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 76 ASIA PACIFIC: STEEL REBAR MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: STEEL REBAR MARKET, BY PROCESS, 2021-2023 (MILLION TON)

- TABLE 78 ASIA PACIFIC: STEEL REBAR MARKET, BY PROCESS, 2024-2030 (MILLION TON)

- TABLE 79 ASIA PACIFIC: STEEL REBAR MARKET, BY PROCESS, 2021-2023 (USD MILLION)

- TABLE 80 ASIA PACIFIC: STEEL REBAR MARKET, BY PROCESS, 2024-2030 (USD MILLION)

- TABLE 81 ASIA PACIFIC: STEEL REBAR MARKET, BY TYPE, 2021-2023 (MILLION TON)

- TABLE 82 ASIA PACIFIC: STEEL REBAR MARKET, BY TYPE, 2024-2030 (MILLION TON)

- TABLE 83 ASIA PACIFIC: STEEL REBAR MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 84 ASIA PACIFIC: STEEL REBAR MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 86 ASIA PACIFIC: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 87 ASIA PACIFIC: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 88 ASIA PACIFIC: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 89 CHINA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 90 CHINA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 91 CHINA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 92 CHINA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 93 INDIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 94 INDIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 95 INDIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 96 INDIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 97 JAPAN: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 98 JAPAN: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 99 JAPAN: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 100 JAPAN: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 101 SOUTH KOREA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 102 SOUTH KOREA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 103 SOUTH KOREA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 104 SOUTH KOREA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 105 AUSTRALIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 106 AUSTRALIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 107 AUSTRALIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 108 AUSTRALIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 110 REST OF ASIA PACIFIC: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 111 REST OF ASIA PACIFIC: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 113 EUROPE: STEEL REBAR MARKET, BY COUNTRY, 2021-2023 (MILLION TON)

- TABLE 114 EUROPE: STEEL REBAR MARKET, BY COUNTRY, 2024-2030 (MILLION TON)

- TABLE 115 EUROPE: STEEL REBAR MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 116 EUROPE: STEEL REBAR MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 117 EUROPE: STEEL REBAR MARKET, BY PROCESS, 2021-2023 (MILLION TON)

- TABLE 118 EUROPE: STEEL REBAR MARKET, BY PROCESS, 2024-2030 (MILLION TON)

- TABLE 119 EUROPE: STEEL REBAR MARKET, BY PROCESS, 2021-2023 (USD MILLION)

- TABLE 120 EUROPE: STEEL REBAR MARKET, BY PROCESS, 2024-2030 (USD MILLION)

- TABLE 121 EUROPE: STEEL REBAR MARKET, BY TYPE, 2021-2023 (MILLION TON)

- TABLE 122 EUROPE: STEEL REBAR MARKET, BY TYPE, 2024-2030 (MILLION TON)

- TABLE 123 EUROPE: STEEL REBAR MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 124 EUROPE: STEEL REBAR MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 125 EUROPE: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 126 EUROPE: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 127 EUROPE: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 128 EUROPE: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 129 GERMANY: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 130 GERMANY: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 131 GERMANY: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 132 GERMANY: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 133 UK: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 134 UK: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 135 UK: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 136 UK: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 137 FRACE: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 138 FRANCE: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 139 FRANCE: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 140 FRANCE: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 141 ITALY: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 142 ITALY: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 143 ITALY: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 144 ITALY: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 145 SPAIN: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 146 SPAIN: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 147 SPAIN: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 148 SPAIN: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 149 RUSSIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 150 RUSSIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 151 RUSSIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 152 RUSSIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 153 UKRAINE: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 154 UKRAINE: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 155 UKRAINE: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 156 UKRAINE: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 157 TURKEY: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 158 TURKEY: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 159 TURKEY: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 160 TURKEY: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 161 REST OF EUROPE: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 162 REST OF EUROPE: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 163 REST OF EUROPE: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 164 REST OF EUROPE: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY COUNTRY, 2021-2023 (MILLION TON)

- TABLE 166 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY COUNTRY, 2024-2030 (MILLION TON)

- TABLE 167 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY PROCESS, 2021-2023 (MILLION TON)

- TABLE 170 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY PROCESS, 2024-2030 (MILLION TON)

- TABLE 171 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY PROCESS, 2021-2023 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY PROCESS, 2024-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY TYPE, 2021-2023 (MILLION TON)

- TABLE 174 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY TYPE, 2024-2030 (MILLION TON)

- TABLE 175 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 178 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 179 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 181 GCC COUNTRIES: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 182 GCC COUNTRIES: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 183 GCC COUNTRIES: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 184 GCC COUNTRIES: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 185 SAUDI ARABIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 186 SAUDI ARABIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 187 SAUDI ARABIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 188 SAUDI ARABIA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 189 UAE: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 190 UAE: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 191 UAE: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 192 UAE: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 193 REST OF GCC: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 194 REST OF GCC: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 195 REST OF GCC: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 196 REST OF GCC: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 197 SOUTH AFRICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 198 SOUTH AFRICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 199 SOUTH AFRICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 200 SOUTH AFRICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 201 REST OF MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 202 REST OF MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 203 REST OF MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST & AFRICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 205 SOUTH AMERICA: STEEL REBAR MARKET, BY COUNTRY, 2021-2023 (MILLION TON)

- TABLE 206 SOUTH AMERICA: STEEL REBAR MARKET, BY COUNTRY, 2024-2030 (MILLION TON)

- TABLE 207 SOUTH AMERICA: STEEL REBAR MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 208 SOUTH AMERICA: STEEL REBAR MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 209 SOUTH AMERICA: STEEL REBAR MARKET, BY PROCESS, 2021-2023 (MILLION TON)

- TABLE 210 SOUTH AMERICA: STEEL REBAR MARKET, BY PROCESS, 2024-2030 (MILLION TON)

- TABLE 211 SOUTH AMERICA: STEEL REBAR MARKET, BY PROCESS, 2021-2023 (USD MILLION)

- TABLE 212 SOUTH AMERICA: STEEL REBAR MARKET, BY PROCESS, 2024-2030 (USD MILLION)

- TABLE 213 SOUTH AMERICA: STEEL REBAR MARKET, BY TYPE, 2021-2023 (MILLION TON)

- TABLE 214 SOUTH AMERICA: STEEL REBAR MARKET, BY TYPE, 2024-2030 (MILLION TON)

- TABLE 215 SOUTH AMERICA: STEEL REBAR MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 216 SOUTH AMERICA: STEEL REBAR MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 217 SOUTH AMERICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 218 SOUTH AMERICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 219 SOUTH AMERICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 220 SOUTH AMERICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 221 BRAZIL: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 222 BRAZIL: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 223 BRAZIL: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 224 BRAZIL: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 225 ARGENTINA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 226 ARGENTINA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 227 ARGENTINA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 228 ARGENTINA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 229 REST OF SOUTH AMERICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (MILLION TON)

- TABLE 230 REST OF SOUTH AMERICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (MILLION TON)

- TABLE 231 REST OF SOUTH AMERICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 232 REST OF SOUTH AMERICA: STEEL REBAR MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 233 STEEL REBAR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY MARKET PLAYERS BETWEEN JANUARY 2021 AND APRIL 2025

- TABLE 234 STEEL REBAR MARKET: DEGREE OF COMPETITION

- TABLE 235 STEEL REBAR MARKET: REGION FOOTPRINT

- TABLE 236 STEEL REBAR MARKET: TYPE FOOTPRINT

- TABLE 237 STEEL REBAR MARKET: PROCESS FOOTPRINT

- TABLE 238 STEEL REBAR MARKET: COATING TYPE FOOTPRINT

- TABLE 239 STEEL REBAR MARKET: BAR SIZE FOOTPRINT

- TABLE 240 STEEL REBAR MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 241 STEEL REBAR MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 242 STEEL REBAR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 243 STEEL REBAR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 244 STEEL REBAR MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 245 STEEL REBAR MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 246 NIPPON STEEL CORPORATION: COMPANY OVERVIEW

- TABLE 247 NIPPON STEEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 NIPPON STEEL CORPORATION: DEALS, JANUARY 2021-MAY 2025

- TABLE 249 NIPPON STEEL CORPORATION: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 250 ARCELORMITTAL: COMPANY OVERVIEW

- TABLE 251 ARCELORMITTAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 ARCELORMITTAL: DEALS, JANUARY 2021-MAY 2025

- TABLE 253 ARCELORMITTAL: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 254 GERDAU S/A: COMPANY OVERVIEW

- TABLE 255 GERDAU S/A : PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 GERDAU S/A: DEALS, JANUARY 2021-MAY 2025

- TABLE 257 NUCOR CORPORATION: COMPANY OVERVIEW

- TABLE 258 NUCOR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 NUCOR CORPORATION: DEALS, JANUARY 2021-MAY 2025

- TABLE 260 NUCOR CORPORATION: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 261 COMMERCIAL METALS COMPANY: COMPANY OVERVIEW

- TABLE 262 COMMERCIAL METALS COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 COMMERCIAL METALS COMPANY: DEALS, JANUARY 2021-MAY 2025

- TABLE 264 COMMERCIAL METALS COMPANY: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 265 TATA STEEL: COMPANY OVERVIEW

- TABLE 266 TATA STEEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 TATA STEEL: DEALS, JANUARY 2021-MAY 2025

- TABLE 268 STEEL AUTHORITY OF INDIA LIMITED: COMPANY OVERVIEW

- TABLE 269 STEEL AUTHORITY OF INDIA LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 STEEL AUTHORITY OF INDIA LIMITED: DEALS, JANUARY 2021-MAY 2025

- TABLE 271 MECHEL PAO: COMPANY OVERVIEW

- TABLE 272 MECHEL PAO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 MECHEL PAO: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 274 STEEL DYNAMICS, INC.: COMPANY OVERVIEW

- TABLE 275 STEEL DYNAMICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 CLEARWATER PAPER CORPORATION: DEALS, JANUARY 2021-APRIL 2025

- TABLE 277 NLMK GROUP: COMPANY OVERVIEW

- TABLE 278 NLMK GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 NLMK GROUP: DEALS, JANUARY 2021-MAY 2025

- TABLE 280 NLMK GROUP: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 281 JSW: COMPANY OVERVIEW

- TABLE 282 JSW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 JSW: DEALS, JANUARY 2021-MAY 2025

- TABLE 284 JSW: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 285 BAOSTEEL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 286 BAOSTEEL GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 BAOSTEEL GROUP CO., LTD.: DEALS, JANUARY 2021-MAY 2025

- TABLE 288 BAOSTEEL GROUP CO., LTD.: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 289 METINVEST: COMPANY OVERVIEW

- TABLE 290 PAO SEVERSTAL: COMPANY OVERVIEW

- TABLE 291 BYER STEEL CORPORATION: COMPANY OVERVIEW

- TABLE 292 DAIDO STEEL CO., LTD.: COMPANY OVERVIEW

- TABLE 293 ACERINOX: COMPANY OVERVIEW

- TABLE 294 HYUNDAI STEEL: COMPANY OVERVIEW

- TABLE 295 JIANGSU SHAGANG GROUP: COMPANY OVERVIEW

- TABLE 296 HBIS GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 297 EVRAZ PLC: COMPANY OVERVIEW

- TABLE 298 SWISS STEEL GROUP: COMPANY OVERVIEW

- TABLE 299 SUNFLAG IRON AND STEEL CO. LTD.: COMPANY OVERVIEW

- TABLE 300 OUTOKUMPU: COMPANY OVERVIEW

- TABLE 301 7 STEEL UK: COMPANY OVERVIEW

- TABLE 302 LONG STEEL MARKET, BY PROCESS, 2018-2025 (MILLION TON)

- TABLE 303 LONG STEEL MARKET, BY PROCESS, 2018-2025 (USD BILLION)

- TABLE 304 LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (MILLION TON)

- TABLE 305 LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

- TABLE 306 LONG STEEL MARKET, BY END-USE INDUSTRY, 2018-2025 (MILLION TON)

- TABLE 307 LONG STEEL MARKET, BY END-USE INDUSTRY, 2018-2025 (USD BILLION)

- TABLE 308 LONG STEEL MARKET, BY REGION, 2018-2025 (MILLION TON)

- TABLE 309 LONG STEEL MARKET, BY REGION, 2018-2025 (USD BILLION)

List of Figures

- FIGURE 1 MARKET SEGMENTATION AND REGIONS COVERED

- FIGURE 2 STEEL REBAR MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 STEEL REBAR MARKET: APPROACH

- FIGURE 6 STEEL REBAR MARKET: DATA TRIANGULATION

- FIGURE 7 BASIC OXYGEN STEELMAKING ACCOUNTED FOR LARGER MARKET SHARE IN 2024

- FIGURE 8 DEFORMED SEGMENT HOLDS THE LARGEST MARKET SHARE IN 2024

- FIGURE 9 PLAIN CARBON TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 10 INFRASTRUCTURE TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 11 #3 TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC HELD LARGEST MARKET SHARE IN 2024

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING STEEL REBAR MARKET DURING FORECAST PERIOD

- FIGURE 14 DEFORMED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 INFRASTRUCTURE TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 16 #4 TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 17 PLAIN CARBON TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 18 BASIC OXYGEN STEELMAKING TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 19 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 STEEL REBAR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 AVERAGE SELLING PRICE TREND OF STEEL REBAR OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD/TON)

- FIGURE 23 STEEL REBAR MARKET: AVERAGE SELLING PRICE, BY REGION (USD/TON), 2021-2030

- FIGURE 24 STEEL REBAR MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 STEEL REBAR MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 LIST OF MAJOR PATENTS FOR DTEEL REBAR MARKET, 2014-2024

- FIGURE 27 REGIONAL ANALYSIS OF PATENTS GRANTED FOR STEEL REBAR MARKET, 2014-2024

- FIGURE 28 IMPORT DATA RELATED TO HS CODE 7227, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 29 EXPORT DATA RELATED TO HS CODE 7227, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 30 STEEL REBAR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 33 INVESTOR DEAL AND FUNDING TREND, 2020-2024 (USD MILLION)

- FIGURE 34 STEEL REBAR MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 35 STEEL REBAR MARKET, BY PROCESS, 2025 VS. 2030 (USD MILLION)

- FIGURE 36 STEEL REBAR MARKET, BY COATING TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 37 STEEL REBAR MARKET, BY BAR SIZE, 2025 VS. 2030 (USD MILLION)

- FIGURE 38 STEEL REBAR MARKET, BY END-USE SECTOR, 2025 VS. 2030 (USD MILLION)

- FIGURE 39 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR STEEL REBAR DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC: STEEL REBAR MARKET SNAPSHOT

- FIGURE 41 EUROPE: STEEL REBAR MARKET SNAPSHOT

- FIGURE 42 STEEL REBAR MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 43 STEEL REBAR PACKAGING MARKET SHARE ANALYSIS, 2024

- FIGURE 44 COMPANY VALUATION (USD BILLION)

- FIGURE 45 FINANCIAL MATRIX: EV/EBITDA RATIO

- FIGURE 46 YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA

- FIGURE 47 STEEL REBAR MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 48 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 49 STEEL REBAR MARKET: COMPANY FOOTPRINT

- FIGURE 50 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 51 NIPPON STEEL CORPORATION: COMPANY SNAPSHOT, 2024

- FIGURE 52 ARCELORMITTAL: COMPANY SNAPSHOT, 2024

- FIGURE 53 GERDAU S/A: COMPANY SNAPSHOT, 2024

- FIGURE 54 NUCOR CORPORATION: COMPANY SNAPSHOT, 2024

- FIGURE 55 COMMERCIAL METALS COMPANY: COMPANY SNAPSHOT, 2024

- FIGURE 56 TATA STEEL: COMPANY SNAPSHOT (2024)

- FIGURE 57 STEEL AUTHORITY OF INDIA LIMITED: COMPANY SNAPSHOT, 2024

- FIGURE 58 MECHEL PAO: COMPANY SNAPSHOT, 2024

- FIGURE 59 STEEL DYNAMICS, INC.: COMPANY SNAPSHOT, 2024

- FIGURE 60 NLMK GROUP: COMPANY SNAPSHOT, 2024

- FIGURE 61 JSW: COMPANY SNAPSHOT, 2024

The market for steel rebar was USD 212.9 billion in 2024, and it is projected to reach USD 268.4 billion by 2030, at a CAGR of 4.0%. Increasing infrastructure development, urban housing projects, and construction of industrial applications have continued to drive the steel rebar market across the globe. While countries are investing in new transportation systems, smart city initiatives, and renewable energy infrastructure, there remains a critical need for structurally sound buildings, including bridges and other essential structures. In earthquake-prone areas, steel rebar is crucial in reinforcing concrete, helping structures better withstand seismic shocks. Meanwhile, increasing populations and economic growth in emerging economies are accelerating growth in both commercial and residential construction.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion)/ Volume (Kiloton) |

| Segments | Type, Process, Coating Type, Bar Size, End-Use Sector, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, South America |

This surge in building activity boosts demand for high-performance construction materials like rebar. Additionally, technological advancements have led to the creation of rust-resistant, high-strength rebars. These modern options are increasingly favored by engineers and contractors because they provide greater durability and lower long-term maintenance costs, resulting in more resilient and cost-effective construction.

By type, the deformed segment accounted for the highest CAGR during the forecast period

Deformed steel rebar is projected to register the highest CAGR, as it possesses better tensile strength, handles stress more effectively, and is suitable for use in various construction industries. Corrugated rebar has surface ribs or ridges to improve the bond with the concrete. This increases the strength of the bond between the concrete and steel, and hence the load capacity of the agent. So the material is very appropriate for high buildings, high-speed ways, bridges, tunnels, and earthquake-resistant buildings.

The demand for reliable, high-strength reinforcement products is rising as global infrastructure investment increases and urbanization speeds up, especially in rapidly developing regions such as Asia Pacific, the Middle East, and Africa. Governments and private developers are increasingly requiring deformed rebar to meet new safety standards and performance criteria. Moreover, the introduction of premium products such as thermo-mechanically treated (TMT) bars and corrosion-resistant grades has further driven growth in this segment. Deformed rebar comes in various diameters, grades, and lengths, with many customization options for shipping. Its flexibility allows it to be used in a growing number of markets. Lower costs, construction advantages, and applicability for numerous uses have made the deformed rebar segment the fastest-growing and most resilient part of the steel rebar market.

By process, electric arc furnace (EAF) accounted for the highest CAGR during the forecast period

Electric arc furnace (EAF) is projected to record the highest CAGR during the forecast period, because of its sustainability, energy effectiveness, and increasing global focus on decarbonization of steel production. The electric arc furnace (EAF) is becoming an essential part of modern steelmaking, especially in regions where scrap metal is readily available and renewable energy is on the rise. Unlike traditional blast furnaces that rely heavily on coal and iron ore, EAFs use electricity to melt down scrap metal, making the process cleaner, more flexible, and better suited for a low-carbon future. From large-scale steel production to specialized alloy making like ferrotitanium, manganese, or silicon EAFs can be adapted to a wide range of needs. Whether it is a tilting or fixed type furnace, or even a submerged arc furnace used for ferroalloy production, the technology continues to evolve to meet the demands of both efficiency and sustainability. Countries like Turkiye are embracing EAF technology as they balance industrial growth with environmental responsibility. As the global push for decarbonization continues, EAFs are proving to be more than just a melting tool; they are helping shape a smarter, cleaner steel industry for the future.

Growing applications of circular economy practices and environmental policies to reduce industrial carbon footprints have increased interest in EAF-based production in steel-making. Modern EAF technology allows for greater productivity, lower operational costs, and more consistent steel quality, making it well-suited for manufacturing various rebar grades used in residential, commercial, and infrastructure projects.

The process is also catching on in other countries, including the US, India, and parts of Europe, where policies and investments are aimed at low-carbon steelmaking. While green building standards and ESG criteria continue to gain influence, the EAF segment is anticipated to gain more ground, producing the fastest growth rate for all steel rebar producing processes in the forecast period.

Asia Pacific accounted for the highest CAGR during the forecast period.

Among regions, Asia Pacific is estimated to have the fastest CAGR in the steel rebar market during the forecast period, with rapid urbanization, extensive infrastructural and new construction activities, and robust economic growth in emerging economies. Nations like China, India, Indonesia, and Vietnam are seeing an increase in construction projects such as roads, bridges, railways, residential and industrial buildings to accommodate growing urban populations and stimulate economic resilience.

The world's largest steel producer, China, is still financing both domestic and foreign infrastructure with programs such as the Belt and Road Initiative. India is quickly emerging as a major growth engine in the global steel rebar market, not only through its rising Direct Reduced Iron (DRI) capacity but also due to ambitious government-led programs. Initiatives like the Pradhan Mantri Awas Yojana (PMAY), Smart Cities Mission, and PM Gati Shakti are fueling massive demand for steel rebar across housing and infrastructure sectors. This surge in domestic construction is being mirrored across Southeast Asia, where countries are attracting foreign investments in industrial zones, transport corridors, and logistics hubs, all of which are driving steady increases in rebar consumption. The region's competitive advantages, such as access to raw materials, relatively low labor costs, and growing steelmaking capacity, further strengthen its position. As the need for earthquake-resistant and high-strength construction materials rises, particularly in developing economies, Asia Pacific is expected to lead the global steel rebar market with the highest growth rate over the coming years.

- By Company Type: Tier 1: 40%, Tier 2: 25%, Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, Others: 35%

- By Region: North America: 25%, Europe: 20%, Asia Pacific: 45%, Middle East & Africa: 5%, and South America: 5%.

Companies Covered:

NIPPON STEEL CORPORATION (Japan), ArcelorMittal (Luxemberg), Gerdau S/A (Brazil), Nucor Corporation (US), Commercial Metals Company (US), TATA Steel (India), Steel Authority of India Limited (India), Mechel PAO (Russia), Steel Dynamics, Inc. (US), NLMK Group (Russia), JSW (India), and Baosteel Group Co., Ltd. (China) are some key players in steel rebar Market.

Research Coverage

The market study covers the steel rebar market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on type, process, coating type, bar size, end-use sector, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the steel rebar market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall steel rebar market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provide them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

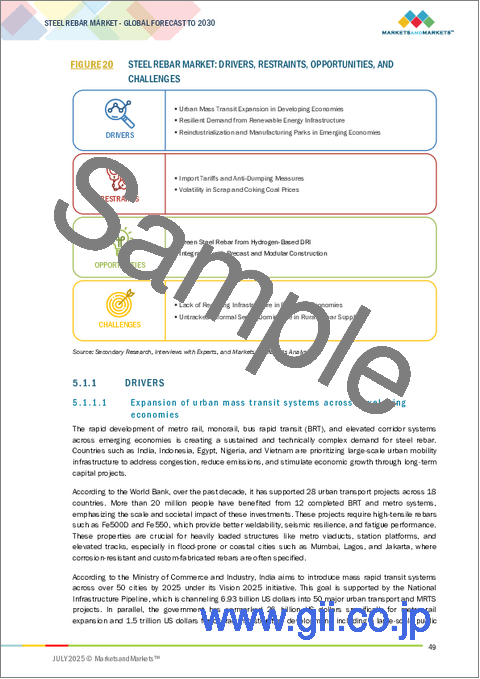

- Analysis of key drivers (Urban Mass Transit Expansion in Developing Economies and Resilient Demand from Renewable Energy Infrastructure), restraints (Import Tariffs and Anti-Dumping Measures), opportunities (Green Steel Rebar from Hydrogen-Based DRI and Integration with Precast and Modular Construction), and challenges (Lack of Recycling Infrastructure in Emerging Economies) influencing the growth of the steel rebar market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the steel rebar market

- Market Development: Comprehensive information about profitable markets - the report analyses the steel rebar market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the steel rebar market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Nippon Steel Corporation (Japan), ArcelorMittal (Luxembourg), Gerdau S/A (Brazil), , Nucor Corporation (US), Commercial Metals Company (US), TATA Steel (India), Steel Authority of India Limited (India), Mechel PAO (Russia), Steel Dynamics, Inc. (US), NLMK Group (Russia), JSW (India), and Baosteel Group Co., Ltd. (China) in the steel rebar market. The report also helps stakeholders understand the pulse of the steel rebar market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE APPROACH

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN STEEL REBAR MARKET

- 4.2 STEEL REBAR MARKET, BY TYPE

- 4.3 STEEL REBAR MARKET, BY END-USE SECTOR

- 4.4 STEEL REBAR MARKET, BY SIZE

- 4.5 STEEL REBAR MARKET, BY COATING TYPE

- 4.6 STEEL REBAR MARKET, BY PROCESS

- 4.7 STEEL REBAR MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.1.1 DRIVERS

- 5.1.1.1 Expansion of urban mass transit systems across developing economies

- 5.1.1.2 Resilient demand from renewable energy infrastructure

- 5.1.1.3 Reindustrialization and manufacturing parks in emerging economies

- 5.1.2 RESTRAINTS

- 5.1.2.1 Import tariffs and anti-dumping measures

- 5.1.2.2 Volatility in scrap and coking coal prices

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Green steel rebar from hydrogen-based DRI

- 5.1.3.2 Integration with precast and modular construction

- 5.1.4 CHALLENGES

- 5.1.4.1 Lack of recycling infrastructure in emerging economies

- 5.1.4.2 Untracked informal sector dominance in rural rebar supply

- 5.1.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Corrosion-Resistant Coatings

- 6.5.1.2 Non-Destructive Testing (NDT)

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Rebar Tracking and Tagging

- 6.5.2.2 Rebar Scanning and Detection Tools

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Self-Sensing Rebars

- 6.5.3.2 3D Printing of Rebar Cages

- 6.5.1 KEY TECHNOLOGIES

- 6.6 IMPACT OF GEN AI ON STEEL REBAR MARKET

- 6.7 PATENT ANALYSIS

- 6.7.1 INTRODUCTION

- 6.7.2 APPROACH

- 6.8 TOP APPLICANTS

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT DATA RELATED TO HS CODE 7227, BY COUNTRY, 2020-2024 (USD THOUSAND)

- 6.9.2 EXPORT DATA RELATED TO HS CODE 7227, BY COUNTRY, 2020-2024 (USD THOUSAND)

- 6.10 KEY CONFERENCES AND EVENTS IN 2025

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATORY FRAMEWORK

- 6.12 PORTER'S FIVE FORCES' ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 TATA ELXSI - AI-DRIVEN SUSTAINABLE AUTOMATION FOR STEEL INDUSTRY

- 6.14.2 PAN GULF TECHNOLOGIES - REBAR CASE STUDY: COMMERCIAL PROJECT IN KSA

- 6.14.3 HELIX STEEL - REBAR ALTERNATIVES USING MICRO REBAR TECHNOLOGY

- 6.15 MACROECONOMIC ANALYSIS

- 6.15.1 INTRODUCTION

- 6.15.2 GDP TRENDS AND FORECASTS

- 6.15.3 GLOBAL STEEL PRODUCTION AND REBAR DEMAND

- 6.15.4 INFRASTRUCTURE INVESTMENT IMPACT

- 6.16 INVESTMENT AND FUNDING SCENARIO

- 6.17 IMPACT OF 2025 US TARIFF: STEEL REBAR MARKET

- 6.17.1 INTRODUCTION

- 6.17.2 KEY TARIFF RATES

- 6.17.3 PRICE IMPACT ANALYSIS

- 6.17.4 KEY IMPACT ON VARIOUS REGIONS

- 6.17.4.1 US

- 6.17.4.2 Europe

- 6.17.4.3 Asia Pacific

- 6.17.5 END-USE SECTOR IMPACT

7 STEEL REBAR MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 DEFORMED

- 7.2.1 WIDE APPLICATIONS FOR STRUCTURAL STABILITY IN HIGH-STRENGTH CONCRETE TO DRIVE MARKET

- 7.3 MILD

- 7.3.1 DEMAND IN SPECIALIZED AND COST-EFFICIENT APPLICATIONS TO DRIVE MARKET

8 STEEL REBAR MARKET, BY PROCESS

- 8.1 INTRODUCTION

- 8.2 BASIC OXYGEN STEELMAKING

- 8.2.1 BASIC OXYGEN STEELMAKING EMPOWERS REBAR PRODUCTION AMIDST RECORD INFRASTRUCTURE INVESTMENT

- 8.3 ELECTRIC ARC FURNACE

- 8.3.1 FLEXIBLE, SUSTAINABLE, AND STRATEGICALLY ALIGNED FOR MODERN REBAR PRODUCTION

9 STEEL REBAR MARKET, BY COATING TYPE

- 9.1 INTRODUCTION

- 9.2 PLAIN CARBON STEEL REBAR

- 9.2.1 COST-EFFECTIVE AND STRUCTURALLY RELIABLE FOR STANDARD CONSTRUCTION ENVIRONMENTS TO DRIVE MARKET

- 9.3 GALVANIZED STEEL REBAR

- 9.3.1 RISING DEMAND FOR CORROSION-RESISTANT INFRASTRUCTURE SOLUTIONS TO DRIVE MARKET

- 9.4 EPOXY-COATED STEEL REBAR

- 9.4.1 STEADY DEMAND IN HIGHWAY AND MARINE INFRASTRUCTURE APPLICATIONS TO INFLUENCE MARKET

10 STEEL REBAR MARKET, BY BAR SIZE

- 10.1 INTRODUCTION

- 10.2 #3 BAR SIZE

- 10.2.1 IDEAL USE IN SWIMMING POOL FRAMES AND ROAD & HIGHWAY PAVING TO DRIVE DEMAND

- 10.3 #4 BAR SIZE

- 10.3.1 COMMON USE IN SLAB-ON-GRADE FOUNDATIONS AND WALL REINFORCEMENT TO DRIVE DEMAND

- 10.4 #5 BAR SIZE

- 10.4.1 WIDE APPLICATIONS IN BRIDGE DECKS, TRANSPORT STRUCTURES, AND MEDIUM TO HEAVY FOUNDATIONS TO DRIVE DEMAND

- 10.5 #8 BAR SIZE

- 10.5.1 SUBSTANTIAL CROSS-SECTIONAL AREA AND HIGH TENSILE STRENGTH TO DRIVE DEMAND IN HEAVY CIVIL CONSTRUCTION AND HIGH-STRENGTH CONCRETE STRUCTURES

- 10.6 OTHER BAR SIZES

11 STEEL REBAR MARKET, BY END-USE SECTOR

- 11.1 INTRODUCTION

- 11.2 INFRASTRUCTURE

- 11.2.1 RISING GLOBAL INVESTMENTS IN INFRASTRUCTURE SIGNIFICANTLY ACCELERATE STEEL REBAR DEMAND ACROSS URBAN AND TRANSPORT PROJECTS

- 11.3 HOUSING

- 11.3.1 GOVERNMENT-BACKED HOUSING INITIATIVES AND URBAN EXPANSION DRIVE CONSISTENT GROWTH IN STEEL REBAR DEMAND GLOBALLY

- 11.4 INDUSTRIAL

- 11.4.1 SURGING INVESTMENTS IN MANUFACTURING AND CLEAN ENERGY DRIVE STRONG STEEL REBAR DEMAND IN INDUSTRIAL CONSTRUCTION

12 STEEL REBAR MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA STEEL REBAR MARKET, BY COUNTRY

- 12.2.2 US

- 12.2.2.1 Government initiatives to drive market

- 12.2.3 CANADA

- 12.2.3.1 Rise in residential and non-residential construction activities to trigger market

- 12.2.4 MEXICO

- 12.2.4.1 Increase in infrastructure investment to drive market

- 12.3 ASIA PACIFIC

- 12.3.1 ASIA PACIFIC STEEL REBAR MARKET, BY COUNTRY

- 12.3.2 CHINA

- 12.3.2.1 Urban expansion and BRI infrastructure projects to drive demand

- 12.3.3 INDIA

- 12.3.3.1 Steady rise in steel rebar demand amid infrastructure expansion to drive market

- 12.3.4 JAPAN

- 12.3.4.1 Infrastructure resilience and global investments to drive demand

- 12.3.5 SOUTH KOREA

- 12.3.5.1 Industrial expansion and rapid housing and redevelopment projects to drive market

- 12.3.6 AUSTRALIA

- 12.3.6.1 Large-scale infrastructure, housing, and energy projects to drive demand

- 12.3.7 REST OF ASIA PACIFIC

- 12.4 EUROPE

- 12.4.1 EUROPE STEEL REBAR MARKET, BY COUNTRY

- 12.4.2 GERMANY

- 12.4.2.1 Infrastructure investments and population growth to drive market

- 12.4.3 UK

- 12.4.3.1 Rising government commitments to investments for infrastructure and green steel to drive market

- 12.4.4 FRANCE

- 12.4.4.1 Surging infrastructure, urban expansion, and housing recovery to drive market

- 12.4.5 ITALY

- 12.4.5.1 Extensive infrastructure and energy investments to drive market

- 12.4.6 SPAIN

- 12.4.6.1 Rising infrastructure and energy investments to drive demand

- 12.4.7 RUSSIA

- 12.4.7.1 Rising construction and infrastructure investments to drive market

- 12.4.8 UKRAINE

- 12.4.8.1 Reconstruction and infrastructure revitalization efforts to drive demand

- 12.4.9 TURKEY

- 12.4.9.1 Rising construction, infrastructure, and housing investments to drive demand

- 12.4.10 REST OF EUROPE

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA STEEL REBAR MARKET, BY COUNTRY

- 12.5.2 GCC COUNTRIES

- 12.5.2.1 Saudi Arabia

- 12.5.2.1.1 Robust infrastructure and housing investments to drive market

- 12.5.2.2 UAE

- 12.5.2.2.1 Strong infrastructure and real estate expansion to drive demand

- 12.5.2.3 Rest of GCC countries

- 12.5.2.1 Saudi Arabia

- 12.5.3 SOUTH AFRICA

- 12.5.3.1 Robust infrastructure and real estate developments to drive demand

- 12.5.4 REST OF MIDDLE EAST & AFRICA

- 12.6 SOUTH AMERICA

- 12.6.1 SOUTH AMERICA STEEL REBAR MARKET, BY COUNTRY

- 12.6.2 BRAZIL

- 12.6.2.1 Robust infrastructure and housing initiatives to demand

- 12.6.3 ARGENTINA

- 12.6.3.1 Rising infrastructure investments and urban resilience projects to drive market

- 12.6.4 REST OF SOUTH AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYERS STRATEGIES/ RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.5.1 COMPANY VALUATION

- 13.6 FINANCIAL METRICS

- 13.7 BRAND/PRODUCT COMPARISON

- 13.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.8.1 STARS

- 13.8.2 EMERGING LEADERS

- 13.8.3 PERVASIVE PLAYERS

- 13.8.4 PARTICIPANTS

- 13.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.8.5.1 Company footprint

- 13.8.5.2 Region footprint

- 13.8.5.3 Type footprint

- 13.8.5.4 Process footprint

- 13.8.5.5 Coating Type footprint

- 13.8.5.6 Bar Size footprint

- 13.8.5.7 End-use Industry footprint

- 13.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.9.1 PROGRESSIVE COMPANIES

- 13.9.2 RESPONSIVE COMPANIES

- 13.9.3 DYNAMIC COMPANIES

- 13.9.4 STARTING BLOCKS

- 13.10 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.10.1 DETAILED LIST OF KEY STARTUPS/SMES

- 13.10.2 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.11 COMPETITIVE SCENARIO

- 13.11.1 DEALS

- 13.11.2 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 NIPPON STEEL CORPORATION

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 ARCELORMITTAL

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 GERDAU S/A

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 NUCOR CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.3.2 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 COMMERCIAL METALS COMPANY

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.3.2 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 TATA STEEL

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.4 MnM view

- 14.1.7 STEEL AUTHORITY OF INDIA LIMITED

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.7.4 MnM view

- 14.1.8 MECHEL PAO

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Expansions

- 14.1.8.4 MnM view

- 14.1.9 STEEL DYNAMICS, INC.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.9.4 MnM view

- 14.1.10 NLMK GROUP

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Deals

- 14.1.10.3.2 Expansions

- 14.1.10.4 MnM view

- 14.1.11 JSW

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.3.2 Expansions

- 14.1.11.4 MnM view

- 14.1.12 BAOSTEEL GROUP CO., LTD.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.12.3.2 Expansions

- 14.1.12.4 MnM view

- 14.1.1 NIPPON STEEL CORPORATION

- 14.2 OTHER PLAYERS

- 14.2.1 METINVEST

- 14.2.2 PAO SEVERSTAL

- 14.2.3 BYER STEEL CORPORATION

- 14.2.4 DAIDO STEEL CO., LTD.

- 14.2.5 ACERINOX

- 14.2.6 HYUNDAI STEEL

- 14.2.7 JIANGSU SHAGANG GROUP

- 14.2.8 HBIS GROUP CO., LTD.

- 14.2.9 EVRAZ PLC

- 14.2.10 SWISS STEEL GROUP

- 14.2.11 SUNFLAG IRON AND STEEL CO. LTD.

- 14.2.12 OUTOKUMPU

- 14.2.13 7 STEEL UK

15 ADJACENT & RELATED MARKET

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.2.1 LONG STEEL MARKET

- 15.2.1.1 Market definition

- 15.2.1.2 Long steel market, by process

- 15.2.1.3 Long steel market, by product type

- 15.2.1.4 Long steel market, by end-use industry

- 15.2.1.5 Long steel market, by region

- 15.2.1 LONG STEEL MARKET

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS