|

|

市場調査レポート

商品コード

1773177

止血剤の世界市場:タイプ別、剤形別、用途別、エンドユーザー別、地域別 - 2030年までの予測Hemostats Market by Type (Thrombin, Combination, Gelatin, Collagen), Formulation (Matrix & Gel, Sheet & Pad, Sponge, Powder), Application (Orthopedic, General, Cardiovascular), End User (Hospital, Specialty Clinic), Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 止血剤の世界市場:タイプ別、剤形別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月16日

発行: MarketsandMarkets

ページ情報: 英文 262 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の止血剤の市場規模は2025年の29億米ドルから2030年には40億米ドルに達すると予測され、予測期間中のCAGRは6.4%になるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | タイプ別、剤形別、用途別、エンドユーザー別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、ラテンアメリカ、中東・アフリカ |

高齢者人口の増加により外科手術の需要が大幅に増加しており、現代ヘルスケアにおける止血剤の重要な役割が浮き彫りになっています。高齢になると、さまざまな慢性疾患にかかりやすくなり、機能的能力の回復や改善のために外科的矯正が必要となります。これには整形外科的な人工関節置換術や、より複雑な心臓血管や消化管の手術などが含まれます。加齢は、組織の回復力の低下や出血傾向の上昇などの生理的変化を伴います。従って、止血剤を適切に使用することは、高齢者の手術成績を最適化するために極めて重要です。世界の高齢化率の上昇に伴い、止血剤に対する需要もそれに応じて増加すると予測され、高齢者の複雑な外科治療への対応に不可欠であることが強調されています。とはいえ、高度な止血技術には法外なコストがかかるうえ、資源に乏しい環境では利用しにくいという課題があり、より広範な導入には困難が伴う可能性があります。

止血剤市場は、タイプ別に酸化再生セルロース系止血剤、トロンビン系止血剤、コンビネーション止血剤、ゼラチン系止血剤、コラーゲン系止血剤、その他止血剤に二分されます。止血剤の市場は、単剤止血剤と比較してコンビネーション止血剤の有効性が優れていることから急成長しています。これらの高度な止血剤は複数のメカニズムで作用し、外科的出血を効果的にコントロールする能力を高める。これらの併用療法による主な利点としては、術中出血量の減少、迅速かつ確実な止血、回復期間の短縮、輸血頻度の低下などが挙げられます。さらに、コンビネーション止血剤の導入は、入院期間の短縮や回復の早さなど、患者の転帰の改善にもつながっています。

世界の止血剤市場は、マトリックス&ゲル止血剤、シート&パッド止血剤、スポンジ止血剤、粉末止血剤に二分されます。スポンジ止血剤セグメントは、外科医やヘルスケア専門家の間でスポンジベースの製剤への信頼が高まっているため、最も急速な成長を遂げています。これらの止血スポンジは吸収性に優れ、使い勝手がよく、不規則な創傷形状によく適合するため、幅広い外科手術に適用できます。迅速な止血を促し、術後出血のリスクを軽減し、また、すぐに使用できる形態で販売されていることが多く、事前の準備が不要です。さらに、ほとんどのスポンジ止血剤は生体吸収性であるため、その後の除去の必要性がなく、潜在的な合併症を最小限に抑えることができます。最近の材料科学の動向により、生体適合性と抗菌性が向上したスポンジ止血剤が開発され、その臨床的嗜好はさらに確固たるものとなっています。これらの技術革新は、安全性プロファイルを改善するだけでなく、様々な外科的状況における有効性を最適化します。

止血剤市場は、用途別に整形外科、一般外科、神経外科、心臓血管外科、婦人科外科、再建外科、その他に区分されています。2024年には、整形外科分野が止血剤市場を独占しています。この動向は、関節炎、骨粗鬆症、肥満などの生活習慣に関連した疾患の有病率が上昇していることに起因しており、しばしば外科的介入を必要とする筋骨格系の合併症を引き起こしています。骨や関節の退行性障害にかかりやすい高齢化社会への人口動態の変化も、整形外科手術の需要増に大きく寄与しています。さらに、スポーツ関連の怪我や外傷性骨折の発生率が上昇しているため、正確な止血管理が重要な外科的介入がより多く必要とされています。臨床転帰を損なうことなく効果的な止血を優先する低侵襲整形外科手技への嗜好の高まりが、市場の需要をさらに押し上げています。さらに、新興市場におけるヘルスケアへのアクセスの改善と高度な止血剤の入手可能性が、整形外科手術におけるこれらの製品の幅広い採用を促進しています。

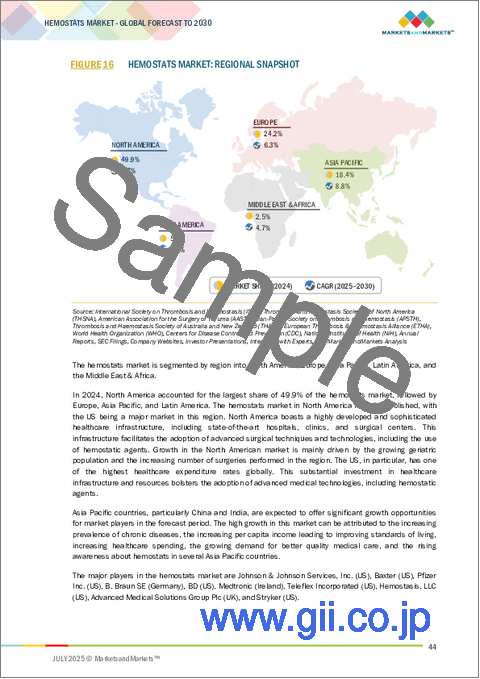

世界の止血剤市場は、北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカに区分されます。アジア太平洋は、主に新興国の堅調なGDP成長と可処分所得の増加によって、予測期間中に止血器具市場で大きく成長する見込みです。こうした経済動態は、幅広い層のヘルスケア支出の増加を促進しています。外科手術の急増、慢性疾患の有病率の上昇、ヘルスケアインフラの近代化の進行により、止血剤のような高度な外科用製品の需要が高まっています。さらに、先進医療技術の統合が進み、地方にまで広がっていることも市場を後押ししています。中国とインドにおける医療施設、特に病院やクリニックの急速な拡大と、疾病管理意識を高めるための政府の取り組みが、この成長の重要な要因となっています。加えて、アジア諸国における医療支出の大幅な増加は、医療提供者の購買力を高め、同地域における革新的な止血剤の採用を促進しています。

当レポートでは、世界の止血剤市場について調査し、タイプ別、剤形別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 技術分析

- 価格分析

- エコシステム/市場マップ

- 償還シナリオ

- バリューチェーン分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 貿易分析

- 規制状況

- 特許分析

- 主要な会議とイベント

- 主要な利害関係者と購入基準

- 隣接市場分析

- 顧客ビジネスに影響を与える動向/混乱

- アンメットニーズ/エンドユーザーの期待

- 止血剤市場における人工知能(AI)の影響

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 米国関税の影響- 止血剤市場

第6章 止血剤市場(タイプ別)

- イントロダクション

- 酸化再生セルロース系止血剤

- トロンビン系止血剤

- 複合止血剤

- ゼラチン系止血剤

- コラーゲンベースの止血剤

- その他

第7章 止血剤市場(剤形別)

- イントロダクション

- マトリックス&ゲル止血剤

- シート&パッド止血剤

- スポンジ止血剤

- 粉末止血剤

第8章 止血剤市場(用途別)

- イントロダクション

- 整形外科

- 一般外科

- 神経外科

- 心臓血管外科

- 再建手術

- 婦人科手術

- その他

第9章 止血剤市場(エンドユーザー別)

- イントロダクション

- 病院

- 専門クリニック

- その他

第10章 止血剤市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 市場の成長を支えるヘルスケアインフラの強化

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分配分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 評価と財務指標

- ブランド/製品比較

- 主要企業の研究開発費

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- JOHNSON & JOHNSON SERVICES, INC.

- BAXTER

- PFIZER INC.

- B. BRAUN SE

- BECTON, DICKINSON AND COMPANY(BD)

- TELEFLEX INCORPORATED

- MEDTRONIC PLC

- HEMOSTASIS, LLC

- STRYKER

- INTEGRA LIFESCIENCES

- ADVANCED MEDICAL SOLUTIONS GROUP PLC

- SAMYANG CORPORATION

- その他の企業

- MARINE POLYMER TECHNOLOGIES, INC.

- GELITA MEDICAL

- DILON TECHNOLOGIES

- BETATECH MEDICAL

- MERIL LIFE SCIENCES PVT. LTD.

- BIOCER DEVELOPMENT GMBH

- UNILENE

- KATSAN MEDICAL DEVICES

- TRICOL BIOMEDICAL

- 3-D MATRIX MEDICAL TECHNOLOGY

- HEMOSTAT MEDICAL GMBH

- CELOX MEDICAL LTD.

- ALTAYLAR MEDICAL

第13章 付録

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 RESEARCH ASSUMPTIONS

- TABLE 3 RISK ASSESSMENT

- TABLE 4 GERIATRIC POPULATION, BY REGION, 2016 VS. 2023

- TABLE 5 TOTAL NUMBER OF KNEE REPLACEMENTS, 2021

- TABLE 6 TOTAL NUMBER OF CORONARY ARTERY BYPASS GRAFT PROCEDURES, 2021

- TABLE 7 COST OF SURGICAL PROCEDURES: US VS. INDIA (USD)

- TABLE 8 INDICATIVE PRICING FOR HEMOSTATS

- TABLE 9 AVERAGE SELLING PRICE OF HEMOSTATS, BY REGION, 2022-2024 (USD)

- TABLE 10 ROLE IN ECOSYSTEM: HEMOSTATS MARKET

- TABLE 11 HEMOSTATS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 IMPORT DATA FOR HEMOSTATS (HS CODE: 300610), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR HEMOSTATS (HS CODE: 300610), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 CLASSIFICATION OF MEDICAL DEVICES BY US FDA

- TABLE 20 CLASSIFICATION OF MEDICAL DEVICES AND REVIEWING BODY IN JAPAN

- TABLE 21 NMPA MEDICAL DEVICES CLASSIFICATION

- TABLE 22 LIST OF MAJOR PATENTS IN HEMOSTATS MARKET 2022-2024

- TABLE 23 HEMOSTATS MARKET: DETAILED LIST OF KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 24 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS OF END USERS

- TABLE 25 KEY BUYING CRITERIA FOR END USERS

- TABLE 26 HEMOSTATS MARKET: UNMET NEEDS

- TABLE 27 HEMOSTATS MARKET: END-USER EXPECTATIONS

- TABLE 28 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 29 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR HEMOSTATS

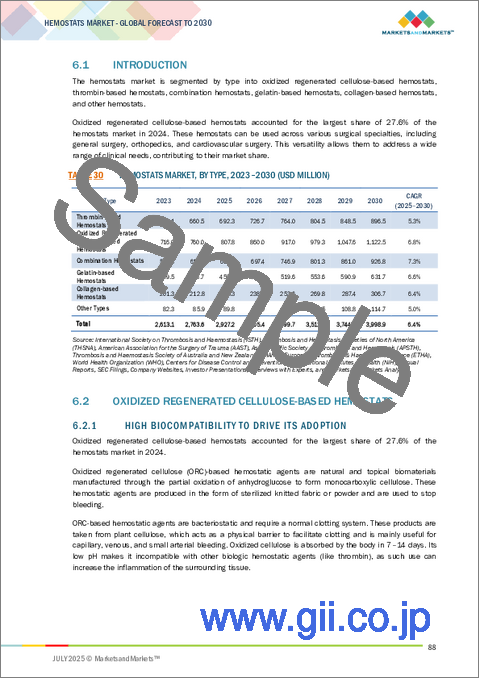

- TABLE 30 HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 31 MAJOR PRODUCTS IN OXIDIZED REGENERATED CELLULOSE-BASED HEMOSTATS MARKET

- TABLE 32 OXIDIZED REGENERATED CELLULOSE-BASED HEMOSTATS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 MAJOR PRODUCTS IN THROMBIN-BASED HEMOSTATS MARKET

- TABLE 34 THROMBIN-BASED HEMOSTATS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 MAJOR PRODUCTS IN COMBINATION HEMOSTATS MARKET

- TABLE 36 COMBINATION HEMOSTATS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 MAJOR PRODUCTS IN GELATIN-BASED HEMOSTATS MARKET

- TABLE 38 GELATIN-BASED HEMOSTATS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 MAJOR PRODUCTS IN COLLAGEN-BASED HEMOSTATS MARKET

- TABLE 40 COLLAGEN-BASED HEMOSTATS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 OTHER HEMOSTATS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 43 MATRIX & GEL HEMOSTATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 MATRIX & GEL HEMOSTATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 45 SHEET & PAD HEMOSTATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 SHEET & PAD HEMOSTATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 47 SPONGE HEMOSTATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 SPONGE HEMOSTATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 49 POWDER HEMOSTATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 POWDER HEMOSTATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 51 HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 52 NUMBER OF KNEE & HIP REPLACEMENTS, 2021

- TABLE 53 HEMOSTATS MARKET FOR ORTHOPEDIC SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 TOTAL NUMBER OF INGUINAL HERNIA REPAIR PROCEDURES, 2021

- TABLE 55 HEMOSTATS MARKET FOR GENERAL SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 HEMOSTATS MARKET FOR NEUROLOGICAL SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 HEMOSTATS MARKET FOR CARDIOVASCULAR SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 HEMOSTATS MARKET FOR RECONSTRUCTIVE SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 HEMOSTATS MARKET FOR GYNECOLOGICAL SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 HEMOSTATS MARKET FOR OTHER SURGICAL APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 62 HEMOSTATS MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 HEMOSTATS MARKET FOR SPECIALTY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 HEMOSTATS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 HEMOSTATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: HEMOSTATS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 71 US: KEY MACROINDICATORS

- TABLE 72 US: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 73 US: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 74 US: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 75 US: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 76 SURGICAL PROCEDURES PERFORMED IN CANADA, 2021

- TABLE 77 CANADA: KEY MACROINDICATORS

- TABLE 78 CANADA: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 CANADA: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 80 CANADA: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 81 CANADA: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: HEMOSTATS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 87 SURGICAL PROCEDURES PERFORMED IN GERMANY, 2021

- TABLE 88 GERMANY: KEY MACROINDICATORS

- TABLE 89 GERMANY: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 GERMANY: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 91 GERMANY: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 92 GERMANY: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 93 SURGICAL PROCEDURES PERFORMED IN UK, 2021

- TABLE 94 UK: KEY MACROINDICATORS

- TABLE 95 UK: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 UK: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 97 UK: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 98 UK: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 99 SURGICAL PROCEDURES PERFORMED IN FRANCE, 2021

- TABLE 100 FRANCE: KEY MACROINDICATORS

- TABLE 101 FRANCE: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 FRANCE: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 103 FRANCE: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 104 FRANCE: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 105 SURGICAL PROCEDURES PERFORMED IN ITALY, 2021

- TABLE 106 ITALY: KEY MACROINDICATORS

- TABLE 107 ITALY: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 ITALY: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 109 ITALY: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 110 ITALY: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 111 SURGICAL PROCEDURES PERFORMED IN SPAIN, 2021

- TABLE 112 SPAIN: KEY MACROINDICATORS

- TABLE 113 SPAIN: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 SPAIN: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 115 SPAIN: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 116 SPAIN: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 117 REST OF EUROPE: PERCENTAGE OF GDP ON HEALTHCARE EXPENDITURE, BY COUNTRY

- TABLE 118 REST OF EUROPE: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 REST OF EUROPE: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 120 REST OF EUROPE: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 121 REST OF EUROPE: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: HEMOSTATS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 127 CHINA: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 CHINA: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 129 CHINA: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 130 CHINA: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 131 JAPAN: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 JAPAN: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 133 JAPAN: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 134 JAPAN: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 135 INDIA: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 INDIA: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 137 INDIA: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 138 INDIA: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 139 AUSTRALIA: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 AUSTRALIA: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 141 AUSTRALIA: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 142 AUSTRALIA: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 143 SURGICAL PROCEDURES IN SOUTH KOREA, 2021

- TABLE 144 SOUTH KOREA: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 SOUTH KOREA: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 146 SOUTH KOREA: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 147 SOUTH KOREA: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 152 LATIN AMERICA: HEMOSTATS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 153 LATIN AMERICA: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 LATIN AMERICA: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 155 LATIN AMERICA: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 156 LATIN AMERICA: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 157 BRAZIL: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 BRAZIL: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 159 BRAZIL: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 160 BRAZIL: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 161 MEXICO: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 MEXICO: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 163 MEXICO: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 164 MEXICO: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 165 REST OF LATIN AMERICA: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 REST OF LATIN AMERICA: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 167 REST OF LATIN AMERICA: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 168 REST OF LATIN AMERICA: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: HEMOSTATS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 174 GCC COUNTRIES: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 GCC COUNTRIES: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 176 GCC COUNTRIES: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 177 GCC COUNTRIES: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST & AFRICA: HEMOSTATS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 REST OF MIDDLE EAST & AFRICA: HEMOSTATS MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 180 REST OF MIDDLE EAST & AFRICA: HEMOSTATS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST & AFRICA: HEMOSTATS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 182 STRATEGIES ADOPTED BY KEY PLAYERS IN HEMOSTATS MARKET, JANUARY 2022-MAY 2025

- TABLE 183 HEMOSTATS MARKET: DEGREE OF COMPETITION

- TABLE 184 HEMOSTATS MARKET: REGION FOOTPRINT

- TABLE 185 HEMOSTATS MARKET: TYPE FOOTPRINT

- TABLE 186 HEMOSTATS MARKET: FORMULATION FOOTPRINT

- TABLE 187 HEMOSTATS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 188 HEMOSTATS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 189 HEMOSTATS MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 190 HEMOSTATS MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 191 HEMOSTATS MARKET: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 192 HEMOSTATS MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 193 JOHNSON & JOHNSON: COMPANY OVERVIEW

- TABLE 194 JOHNSON & JOHNSON SERVICES, INC.: PRODUCTS OFFERED

- TABLE 195 JOHNSON & JOHNSON SERVICES, INC.: PRODUCTS LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 196 JOHNSON & JOHNSON SERVICES, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 197 JOHNSON & JOHNSON SERVICES, INC.: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 198 BAXTER: COMPANY OVERVIEW

- TABLE 199 BAXTER: PRODUCTS OFFERED

- TABLE 200 BAXTER: PRODUCTS APPROVALS & LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 201 BAXTER: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 202 PFIZER INC.: COMPANY OVERVIEW

- TABLE 203 PFIZER INC.: PRODUCTS OFFERED

- TABLE 204 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 205 B. BRAUN SE: PRODUCTS OFFERED

- TABLE 206 BD: COMPANY OVERVIEW

- TABLE 207 BD: PRODUCTS OFFERED

- TABLE 208 BD: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 209 TELEFLEX INCORPORATED: COMPANY OVERVIEW

- TABLE 210 TELEFLEX INCORPORATED: PRODUCTS OFFERED

- TABLE 211 TELEFLEX INCORPORATED: PRODUCTS APPROVALS & LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 212 TELEFLEX INCORPORATED: DEALS, JANUARY 2022-MAY 2025

- TABLE 213 TELEFLEX INCORPORATED: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 214 MEDTRONIC: COMPANY OVERVIEW

- TABLE 215 MEDTRONIC: PRODUCTS OFFERED

- TABLE 216 MEDTRONIC: PRODUCTS APPROVALS & LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 217 MEDTRONIC: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 218 HEMOSTASIS, LLC: COMPANY OVERVIEW

- TABLE 219 HEMOSTASIS, LLC: PRODUCTS OFFERED

- TABLE 220 HEMOSTASIS, LLC: DEALS, JANUARY 2022-MAY 2025

- TABLE 221 STRYKER: COMPANY OVERVIEW

- TABLE 222 STRYKER: PRODUCTS OFFERED

- TABLE 223 STRYKER: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 224 INTEGRA LIFESCIENCES: COMPANY OVERVIEW

- TABLE 225 INTEGRA LIFESCIENCES: PRODUCTS OFFERED

- TABLE 226 ADVANCED MEDICAL SOLUTIONS GROUP PLC: COMPANY OVERVIEW

- TABLE 227 ADVANCED MEDICAL SOLUTIONS GROUP PLC: PRODUCTS OFFERED

- TABLE 228 ADVANCED MEDICAL SOLUTIONS GROUP PLC: DEALS, JANUARY 2022-MAY 2025

- TABLE 229 SAMYANG CORPORATION: COMPANY OVERVIEW

- TABLE 230 SAMYANG CORPORATION: PRODUCTS OFFERED

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY END USER, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2024)

- FIGURE 6 REVENUE SHARE ANALYSIS FOR JHONSON & JOHNSON SERVICES, INC. (US) (2024)

- FIGURE 7 HEMOSTATS MARKET: SUPPLY SIDE ANALYSIS (2024)

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 CAGR PROJECTIONS FROM DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES ANALYSIS (2025-2030)

- FIGURE 10 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 HEMOSTATS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 HEMOSTATS MARKET, BY FORMULATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 HEMOSTATS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 HEMOSTATS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 HEMOSTATS MARKET: REGIONAL SNAPSHOT

- FIGURE 17 GROWING NEED TO MANAGE BLOOD LOSS IN PATIENTS DURING SURGICAL PROCEDURES TO DRIVE MARKET GROWTH

- FIGURE 18 CHINA TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC

- FIGURE 19 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 NORTH AMERICA TO DOMINATE HEMOSTATS MARKET DURING FORECAST PERIOD

- FIGURE 21 DEVELOPING MARKETS TO REGISTER HIGH GROWTH DURING FORECAST PERIOD

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HEMOSTATS MARKET

- FIGURE 23 HEMOSTATS MARKET: ROLE IN ECOSYSTEM, 2024

- FIGURE 24 HEMOSTATS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS: HEMOSTATS MARKET

- FIGURE 26 HEMOSTATS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 PREMARKET NOTIFICATION: 510(K) APPROVAL FOR MEDICAL DEVICES

- FIGURE 28 APPROVAL PROCESS FOR CLASS III MEDICAL DEVICES IN CANADA

- FIGURE 29 CE APPROVAL PROCESS IN EUROPE FOR HEMOSTATS

- FIGURE 30 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR HEMOSTATS MARKET (JANUARY 2014-DECEMBER 2024)

- FIGURE 31 TOP PATENT APPLICANT COUNTRIES FOR HEMOSTATS MARKET (JANUARY 2014-DECEMBER 2024)

- FIGURE 32 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS OF END USERS

- FIGURE 33 KEY BUYING CRITERIA FOR END USERS

- FIGURE 34 HEMOSTATS MARKET: ADJACENT MARKETS

- FIGURE 35 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 36 INVESTMENT/VENTURE CAPITAL SCENARIO IN HEMOSTATS MARKET, 2022-2024

- FIGURE 37 HEMOSTATS MARKET: GEOGRAPHIC SNAPSHOT (2025-2030)

- FIGURE 38 NORTH AMERICA: HEMOSTATS MARKET SNAPSHOT

- FIGURE 39 EUROPE: HEMOSTATS MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: HEMOSTATS MARKET SNAPSHOT

- FIGURE 41 REVENUE SHARE ANALYSIS OF KEY PLAYERS, 2022-2024

- FIGURE 42 MARKET SHARE ANALYSIS OF KEY PLAYERS IN HEMOSTATS MARKET (2024)

- FIGURE 43 HEMOSTATS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 HEMOSTATS MARKET: COMPANY FOOTPRINT

- FIGURE 45 HEMOSTATS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 EV/EBITDA OF KEY VENDORS

- FIGURE 47 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 48 HEMOSTATS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 49 R&D EXPENDITURE OF KEY PLAYERS IN HEMOSTATS MARKET, 2022-2024

- FIGURE 50 JOHNSON & JOHNSON SERVICES, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 51 BAXTER: COMPANY SNAPSHOT (2024)

- FIGURE 52 PFIZER INC.: COMPANY SNAPSHOT (2024)

- FIGURE 53 B. BRAUN SE: COMPANY SNAPSHOT: (2024)

- FIGURE 54 BD: COMPANY SNAPSHOT (2024)

- FIGURE 55 TELEFLEX INCORPORATED: COMPANY SNAPSHOT (2024)

- FIGURE 56 MEDTRONIC: COMPANY SNAPSHOT (2024)

- FIGURE 57 STRYKER: COMPANY SNAPSHOT (2024)

- FIGURE 58 INTEGRA LIFESCIENCES: COMPANY SNAPSHOT (2024)

- FIGURE 59 ADVANCED MEDICAL SOLUTIONS GROUP PLC: COMPANY SNAPSHOT (2024)

- FIGURE 60 SAMYANG CORPORATION: COMPANY SNAPSHOT (2024)

The global hemostats market is projected to reach 4.0 billion in 2030 from USD 2.9 billion in 2025, at a CAGR of 6.4% during the forecast period."

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Type, Formulation, Application, End User, and Region |

| Regions covered | Asia Pacific, North America, Europe, Latin America, and Middle East & Africa |

The escalating demographic of the elderly is driving a significant uptick in the demand for surgical interventions, highlighting the pivotal role of hemostatic agents within modern healthcare. As individuals age, they become more susceptible to a range of chronic conditions necessitating surgical correction to restore or improve functional capacity. This includes procedures such as orthopedic joint replacements and more complex cardiovascular and gastrointestinal surgeries. Aging is associated with physiological changes, including diminished tissue resilience and an elevated propensity for hemorrhage. Consequently, the judicious application of hemostatic agents is critical for optimizing surgical outcomes in geriatric patients. With the global aging population on the rise, the demand for hemostatic products is projected to escalate correspondingly, underscoring their essential contribution to addressing the intricate surgical care requirements of older adults. Nonetheless, the prohibitive costs of advanced hemostatic technologies coupled with limited accessibility in resource-constrained environments may pose challenges to their broader implementation.

"Combination hemostats segment accounted for the highest growth rate in the hemostats market, by type, during the study period."

The hemostats market is bifurcated into oxidized regenerated cellulose-based hemostats, thrombin-based hemostats, combination hemostats, gelatin-based hemostats, collagen-based hemostats, and other hemostats on the basis of type. The market for hemostatic agents is experiencing rapid growth due to the superior efficacy of combination hemostats compared to monotherapy products. These advanced hemostatic agents operate through multiple mechanisms, which enhance their ability to control surgical hemorrhage effectively. Key benefits associated with these combination products include decreased intraoperative blood loss, expedited and reliable hemostasis, reduced convalescence times, and a lower frequency of transfusion requirements. Furthermore, the implementation of combination hemostats has been linked to improved patient outcomes, such as shortened hospital stays and faster recovery trajectories.

"Sponge hemostats segment accounted for the highest growth rate in the hemostats market, by formulation, during the forecast period."

The global hemostats market is bifurcated into matrix & gel hemostats, sheet & pad hemostats, sponge hemostats, and powder hemostats. The sponge hemostats segment is experiencing the most rapid growth due to an increasing reliance on sponge-based formulations among surgeons and healthcare professionals, attributed to several key advantages. These hemostatic sponges are highly absorbent, user-friendly, and conform well to irregular wound geometries, making them applicable to a wide range of surgical procedures. They facilitate prompt hemostasis, mitigate the risk of postoperative bleeding, and are frequently available in ready-to-use formats, eliminating the need for prior preparation. Furthermore, most sponge hemostats are bioresorbable, which removes the necessity for subsequent removal and minimizes potential complications. Recent advancements in material science have led to the development of sponge hemostats with enhanced biocompatibility and antimicrobial properties, further solidifying their clinical preference. These innovations not only improve the safety profile but also optimize their effectiveness in various surgical contexts.

"By application, the orthopedic surgery segment accounted for the largest share of the hemostats market in 2024."

The hemostats market has been segmented into orthopedic surgery, general surgery, neurological surgery, cardiovascular surgery, gynecological surgery, reconstructive surgery, and other surgical applications, based on application. In 2024, the orthopedic surgery segment dominated the hemostats market, a trend driven by a rising prevalence of lifestyle-related conditions such as arthritis, osteoporosis, and obesity, which often lead to musculoskeletal complications requiring surgical intervention. The demographic shift towards an aging population, which is more susceptible to degenerative bone and joint disorders, also significantly contributes to the increased demand for orthopedic surgical procedures. Moreover, the escalating incidence of sports-related injuries and traumatic fractures necessitates a more substantial number of surgical interventions where precise hemostatic control is crucial. The growing preference for minimally invasive orthopedic techniques, which prioritize effective hemostasis without compromising clinical outcomes, further fuels market demand. Additionally, improved healthcare accessibility in emerging markets, coupled with the availability of advanced hemostatic agents, is facilitating the broader adoption of these products in orthopedic surgical practices.

"By region, the Asia Pacific was the fastest-growing region in the hemostats market in 2024."

The global hemostats market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is poised for significant growth in the hemostats market over the forecast period, primarily driven by robust GDP growth and rising disposable incomes in emerging economies. These economic dynamics are facilitating increased healthcare expenditure among broader demographics. The demand for sophisticated surgical products, such as hemostats, is escalating due to a surge in surgical procedures, a higher prevalence of chronic diseases, and the ongoing modernization of healthcare infrastructures. Moreover, the market is propelled by the increasing integration of advanced medical technologies, extending even into rural areas. The rapid expansion of healthcare facilities, particularly hospitals and clinics in China and India, combined with government initiatives to enhance disease management awareness, are critical contributors to this growth. Additionally, the significant uptick in healthcare spending across numerous Asian nations has bolstered the purchasing power of healthcare providers, thereby expediting the adoption of innovative hemostatic agents within the region.

The break-up of the profile of primary participants in the hemostats market:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, Director-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America - 6%, and Middle East & Africa- 4%

Prominent players in the hemostats market include Johnson & Johnson Services, Inc. (US), Baxter (US), Pfizer Inc. (US), B. Braun SE (Germany), BD (US), Teleflex Incorporated (US), Medtronic (Ireland), Hemostasis, LLC (US), Stryker ((US), Integra LifeSciences Corporation (US), Advanced Medical Solutions Group plc (UK), Samyang Corporation (South Korea), Marine Polymer Technologies, Inc. (US), GELITA MEDICAL (Germany), Dilon Technologies (US), Betatech Medical (Turkey), Meril Life Sciences Pvt. Ltd. (India), BioCer Development GmbH (Germany), Unilene (Peru), Katsan Medical Devices (Turkey), Tricol Biomedical (US), 3-D Matrix Medical Technology (Japan), Hemostat Medical GmbH (Germany), CELOX Medical Ltd. (UK), and Altaylar Medical (Turkey).

Research Coverage

The report analyzes the hemostats market, estimating the market size and potential for future growth across various segments, including end users, regions, applications, type, and formulation. Additionally, the report features a competitive analysis of the key players in the market, detailing their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report provides valuable insights for market leaders and new entrants in the hemostats industry, offering approximate revenue figures for the overall market and its subsegments. It assists stakeholders in understanding the competitive landscape, enabling them to position their businesses better and develop effective go-to-market strategies. Additionally, the report highlights key market drivers, restraints, challenges, and opportunities, helping stakeholders gauge the current state of the market.

This report provides insights into the following pointers:

- Analysis of key drivers (growing volume of surgical procedures performed, rising focus on R&D, and increasing emphasis on effective blood loss management in patients during surgeries), restraints (side effects and allergic reactions associated with hemostats), opportunities (increasing growth opportunities in emerging economies), and challenges (stringent regulatory framework, dearth of skilled personnel for effective use of hemostats, and high cost of hemostats) influencing the growth of the hemostats market.

- Market Penetration: It provides detailed information on the product portfolios that major players in the global hemostats market offer. The report covers various segments: end user, region, application, type, and formulation.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global hemostats market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the hemostats market across varied regions.

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global hemostats market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products and services, and capacities of the major competitors in the global hemostats market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HEMOSTATS MARKET

- 4.2 ASIA PACIFIC HEMOSTATS MARKET, BY END USER AND COUNTRY

- 4.3 HEMOSTATS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 REGIONAL MIX: HEMOSTATS MARKET (2023-2030)

- 4.5 HEMOSTATS MARKET: DEVELOPED VS. DEVELOPING MARKETS, 2025 VS. 2030 (USD MILLION)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing volume of surgical procedures performed

- 5.2.1.2 Increasing focus on R&D

- 5.2.1.3 Rising focus on effective blood loss management in patients during surgeries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Side effects and allergic reactions associated with hemostats

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth potential in emerging economies

- 5.2.3.2 Growing number of hospitals

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent regulatory requirements for hemostat products

- 5.2.4.2 Lack of skilled personnel for effective use of hemostats

- 5.2.4.3 High cost of hemostats

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 INCREASED POPULARITY OF COMBINATION HEMOSTATS

- 5.3.2 CONSOLIDATION OF HOSPITALS

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Passive hemostats

- 5.4.1.2 Chitosan-based hemostats

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Surgical adhesives

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Drug-eluting sutures for local therapeutic delivery

- 5.4.3.2 Barbed sutures

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND, BY HEMOSTAT

- 5.5.2 AVERAGE SELLING PRICE OF HEMOSTATS, BY REGION, 2022-2024 (USD)

- 5.6 ECOSYSTEM/MARKET MAP

- 5.7 REIMBURSEMENT SCENARIO

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 SUPPLY CHAIN ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HEMOSTATS (HS CODE: 300610), 2020-2024

- 5.11.2 EXPORT DATA FOR HEMOSTATS (HS CODE: 300610), 2020-2024

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY FRAMEWORK

- 5.12.2.1 North America

- 5.12.2.1.1 US

- 5.12.2.1.2 Canada

- 5.12.2.2 Europe

- 5.12.2.3 Asia Pacific

- 5.12.2.3.1 Japan

- 5.12.2.3.2 China

- 5.12.2.3.3 India

- 5.12.2.1 North America

- 5.13 PATENT ANALYSIS

- 5.13.1 PATENT PUBLICATION TRENDS FOR HEMOSTATS MARKET

- 5.13.2 JURISDICTION ANALYSIS: TOP APPLICANTS FOR PATENTS IN HEMOSTATS MARKET

- 5.14 KEY CONFERENCES & EVENTS

- 5.15 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 KEY BUYING CRITERIA

- 5.16 ADJACENT MARKET ANALYSIS

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.18 UNMET NEEDS/END-USER EXPECTATIONS

- 5.19 IMPACT OF ARTIFICIAL INTELLIGENCE (AI) ON HEMOSTATS MARKET

- 5.20 CASE STUDY ANALYSIS

- 5.20.1 EGYPT'S INCURA LEVERAGES MACHINE LEARNING TO REINVENT TRAUMA HEMOSTASIS

- 5.20.2 SOLE-SUPPLIER TRANSITION FOR HEMOSTATIC AGENTS AT OHIO STATE UNIVERSITY WEXNER MEDICAL CENTER

- 5.21 INVESTMENT AND FUNDING SCENARIO

- 5.22 IMPACT OF US TARIFF - HEMOSTATS MARKET

- 5.22.1 INTRODUCTION

- 5.22.2 KEY TARIFF RATES

- 5.22.3 PRICE IMPACT ANALYSIS

- 5.22.4 IMPACT ON REGION

- 5.22.4.1 US

- 5.22.4.2 Europe

- 5.22.4.3 Asia Pacific

- 5.22.5 IMPACT ON END-USE INDUSTRIES

6 HEMOSTATS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 OXIDIZED REGENERATED CELLULOSE-BASED HEMOSTATS

- 6.2.1 HIGH BIOCOMPATIBILITY TO DRIVE ITS ADOPTION

- 6.3 THROMBIN-BASED HEMOSTATS

- 6.3.1 DEVELOPMENTS IN RECOMBINANT THROMBIN PRODUCTS TO SUPPORT GROWTH

- 6.4 COMBINATION HEMOSTATS

- 6.4.1 ADVANCEMENTS IN COMBINATION MATERIALS TO DRIVE MARKET

- 6.5 GELATIN-BASED HEMOSTATS

- 6.5.1 HIGH ELASTICITY OFFERED BY GELATIN-BASED HEMOSTATS TO BOOST DEMAND

- 6.6 COLLAGEN-BASED HEMOSTATS

- 6.6.1 LOW COST AND REDUCED RISK OF DISEASE TRANSMISSION TO PROMOTE ADOPTION OF COLLAGEN-BASED HEMOSTATS

- 6.7 OTHER HEMOSTATS

7 HEMOSTATS MARKET, BY FORMULATION

- 7.1 INTRODUCTION

- 7.2 MATRIX & GEL HEMOSTATS

- 7.2.1 ABILITY OF MATRIX & GEL HEMOSTATS TO ENHANCE PLATELET AGGREGATION TO BOOST MARKET

- 7.3 SHEET & PAD HEMOSTATS

- 7.3.1 ABILITY TO CUT SHEET & PAD HEMOSTATS INTO ANY SHAPE OR SIZE TO FUEL ADOPTION

- 7.4 SPONGE HEMOSTATS

- 7.4.1 GROWING ACCEPTANCE OF SPONGE HEMOSTATS TO DRIVE DEMAND

- 7.5 POWDER HEMOSTATS

- 7.5.1 ABILITY TO SPRAY POWDER FORMULATIONS DIRECTLY ON WOUNDS TO DRIVE DEMAND

8 HEMOSTATS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 ORTHOPEDIC SURGERY

- 8.2.1 INCREASING INCIDENCE OF SPORTS INJURIES TO SUPPORT MARKET GROWTH

- 8.3 GENERAL SURGERY

- 8.3.1 INCREASING NUMBER OF HERNIA REPAIR PROCEDURES TO DRIVE GROWTH

- 8.4 NEUROLOGICAL SURGERY

- 8.4.1 GROWING PREVALENCE OF NEUROLOGICAL DISORDERS TO DRIVE MARKET

- 8.5 CARDIOVASCULAR SURGERY

- 8.5.1 RISING PREVALENCE OF CVD TO DRIVE ADOPTION OF HEMOSTATS

- 8.6 RECONSTRUCTIVE SURGERY

- 8.6.1 GROWING NUMBER OF COSMETIC SURGERIES TO SUPPORT MARKET GROWTH

- 8.7 GYNECOLOGICAL SURGERY

- 8.7.1 GROWING USE OF HEMOSTATS IN C-SECTION PROCEDURES TO CONTROL SURGICAL BLEEDING TO SUPPORT GROWTH

- 8.8 OTHER SURGICAL APPLICATIONS

9 HEMOSTATS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS

- 9.2.1 GROWING ADOPTION OF MINIMALLY INVASIVE SURGERIES TO BOOST ADOPTION OF HEMOSTATS

- 9.3 SPECIALTY CLINICS

- 9.3.1 EXPANDING SPECIALTY CLINICS TO PROMOTE MARKET GROWTH

- 9.4 OTHERS

10 HEMOSTATS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Strong healthcare infrastructure to support uptake of hemostats

- 10.2.3 CANADA

- 10.2.3.1 Growing geriatric population and increasing volume of surgeries to drive demand

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 High healthcare expenditure in Germany to drive market

- 10.3.3 UK

- 10.3.3.1 Growing volume of hernia repair and cardiovascular surgeries to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Presence of well-established healthcare system to drive market growth

- 10.3.5 ITALY

- 10.3.5.1 Increasing volume of surgeries to drive demand for hemostats

- 10.3.6 SPAIN

- 10.3.6.1 Growing healthcare budget and rising efforts to boost local manufacturing of medical products to drive market

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Growing number of hospitals and healthcare policy reforms to drive growth

- 10.4.3 JAPAN

- 10.4.3.1 Strong healthcare system and rising geriatric population to support market growth

- 10.4.4 INDIA

- 10.4.4.1 Rising healthcare awareness and favorable government support to drive market

- 10.4.5 AUSTRALIA

- 10.4.5.1 Well-established healthcare infrastructure to drive adoption of hemostats

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Growing number of cosmetic surgeries to drive demand for hemostats

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Brazil to dominate Latin American market for hemostats

- 10.5.3 MEXICO

- 10.5.3.1 Low-cost surgeries to drive medical tourism in Mexico

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 STRENGTHENING OF HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

- 10.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.3 GCC COUNTRIES

- 10.6.4 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN HEMOSTATS MARKET

- 11.3 REVENUE SHARE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 Formulation footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 VALUATION & FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 R&D EXPENDITURE OF KEY PLAYERS

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES AND APPROVALS

- 11.10.2 DEALS

- 11.10.3 EXPANSIONS

- 11.10.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 JOHNSON & JOHNSON SERVICES, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product approvals & launches

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 BAXTER

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product approvals & launches

- 12.1.2.3.2 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 PFIZER INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 B. BRAUN SE

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 BECTON, DICKINSON AND COMPANY (BD)

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 TELEFLEX INCORPORATED

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product approvals & launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Other developments

- 12.1.7 MEDTRONIC PLC

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product approvals & launches

- 12.1.7.3.2 Expansions

- 12.1.8 HEMOSTASIS, LLC

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 STRYKER

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Expansions

- 12.1.10 INTEGRA LIFESCIENCES

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 ADVANCED MEDICAL SOLUTIONS GROUP PLC

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.12 SAMYANG CORPORATION

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.1 JOHNSON & JOHNSON SERVICES, INC.

- 12.2 OTHER PLAYERS

- 12.2.1 MARINE POLYMER TECHNOLOGIES, INC.

- 12.2.2 GELITA MEDICAL

- 12.2.3 DILON TECHNOLOGIES

- 12.2.4 BETATECH MEDICAL

- 12.2.5 MERIL LIFE SCIENCES PVT. LTD.

- 12.2.6 BIOCER DEVELOPMENT GMBH

- 12.2.7 UNILENE

- 12.2.8 KATSAN MEDICAL DEVICES

- 12.2.9 TRICOL BIOMEDICAL

- 12.2.10 3-D MATRIX MEDICAL TECHNOLOGY

- 12.2.11 HEMOSTAT MEDICAL GMBH

- 12.2.12 CELOX MEDICAL LTD.

- 12.2.13 ALTAYLAR MEDICAL

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORT

- 13.5 AUTHOR DETAILS