|

|

市場調査レポート

商品コード

1772636

原子間力顕微鏡の世界市場:オファリング別、グレード別、用途別、地域別 - 2030年までの予測Atomic Force Microscopy Market by Offering (AFMs, Probes, Software), Grade (Industrial, Research), Application (Semiconductors & Electronics, Material Science & Nanotechnology, Life Sciences & Biomedical) and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 原子間力顕微鏡の世界市場:オファリング別、グレード別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月15日

発行: MarketsandMarkets

ページ情報: 英文 210 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の原子間力顕微鏡の市場規模は、2025年の5億4,180万米ドルから2030年には7億6,220万米ドルに成長し、予測期間中のCAGRは7.1%になると予測されています。

技術革新とナノテクノロジー研究への投資増加が原子間力顕微鏡市場の主要成長要因です。これらの装置はナノスケールのイメージングと精密な表面特性評価を提供し、半導体、材料科学、生命科学などの分野で不可欠なものとなっています。自動化、人工知能、高度なソフトウェア解析の統合により、ユーザーの使いやすさと測定精度が向上し、AFMの用途は研究機関だけでなく、産業界の品質管理環境にも広がっています。AFMは、小型化エレクトロニクスに対する需要の高まりと整合しているため、次世代製造に大きく関連し、学術・産業両方の領域で採用が加速しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | オファリング別、グレード別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

半導体、エレクトロニクス、自動車、エネルギー、その他いくつかの産業において、品質管理、故障解析、材料調査におけるAFM技術の採用が増加しているため、産業セグメントが最も高いCAGRを記録すると予測されています。製造プロセスの小型化が進み、ナノスケールの精度が重視されるようになるにつれて、AFMのような表面特性評価および計測ツールに対する需要が急速に高まっています。工業用AFMは、高速スキャン、自動操作、生産ラインへの統合などの高度な機能を備えており、インライン検査やプロセスモニタリングに適しています。さらに、産業界ではナノ材料開発や機能性コーティングへの投資が増加しており、AFMは表面粗さ、接着特性、薄膜の均一性を分析するために不可欠なものとなっています。

材料科学・ナノテクノロジー分野は、原子間力顕微鏡市場で第2位のシェアを占めると予測されています。原子間力顕微鏡は、表面形態、粗さ、機械的特性、分子間相互作用を原子レベルで研究するために広く利用されており、次世代材料の開発に不可欠です。ナノ構造材料、複合材料、グラフェンや遷移金属ジカルコゲナイドのような二次元材料への関心の高まりにより、学術・産業研究環境におけるAFMの採用が増加しています。さらに、政府機関や民間企業によるナノテクノロジーへの投資の増加と、研究機関と営利企業間の協力関係の強化が、このセグメントの成長を後押ししています。高速スキャニング、マルチパラメトリック測定モード、分光技術との統合など、AFM技術の進歩は、材料特性評価におけるAFMの有用性と精度を高めています。

ナノテクノロジー研究、半導体イノベーション、材料科学開発への注目の高まりが、主にアジア太平洋地域の原子間力顕微鏡市場を牽引しています。中国、日本、韓国、台湾などの国々は、先端製造業とエレクトロニクスにおける地位を強化するために、研究開発インフラに多額の投資を行っています。有利な政府政策や官民パートナーシップに支えられた半導体産業の急速な拡大が、AFMのような高分解能表面特性評価ツールに対する大きな需要を生み出しています。学術機関や研究機関も、ナノサイエンスやバイオテクノロジーのブレークスルーをサポートするためにAFMを採用しています。

当レポートでは、世界の原子間力顕微鏡市場について調査し、オファリング別、グレード別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 貿易分析

- 特許分析

- 技術分析

- AI/生成AIが原子間力顕微鏡市場に与える影響

- 2025年の米国関税の影響- 概要

第6章 原子間力顕微鏡市場(オファリング別)

- イントロダクション

- 原子間力顕微鏡

- プローブ

- ソフトウェア

第7章 原子間力顕微鏡市場(グレード別)

- イントロダクション

- 産業

- 研究

第8章 原子間力顕微鏡市場(用途別)

- イントロダクション

- 半導体およびエレクトロニクス

- 材料科学とナノテクノロジー

- 化学およびポリマー研究

- ライフサイエンスとバイオメディカル

- その他の用途

- 太陽電池

- 地球科学

- 法医学

- 食品技術

第9章 原子間力顕微鏡市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- ロシア

- スイス

- その他

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- 台湾

- オーストラリア

- シンガポール

- マレーシア

- タイ

- その他

- その他の地域

- 中東

- アフリカ

- 南米

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2023年~2025年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- BRUKER

- HITACHI HIGH-TECH CORPORATION

- OXFORD INSTRUMENTS

- PARK SYSTEMS

- SEMILAB INC.

- AFM WORKSHOP

- ANTON PAAR GMBH

- ATTOCUBE SYSTEMS GMBH

- HORIBA, LTD.

- NANOSURF

- NT-MDT SI

- その他の企業

- ANFATEC INSTRUMENTS AG

- A.P.E. RESEARCH

- CREATEC FISCHER & CO. GMBH

- CSINSTRUMENTS

- DME SCANNING PROBE MICROSCOPES

- GETEC MICROSCOPY GMBH

- ICSPI

- LABMATE SCIENTIFIC LLC

- LABTRON EQUIPMENT LTD.

- MAD CITY LABS INC.

- MOLECULAR VISTA

- NANOMAGNETICS INSTRUMENTS

- OME TECHNOLOGY CO., LTD.

- RHK TECHNOLOGY

第12章 付録

List of Tables

- TABLE 1 STUDY INCLUSIONS AND EXCLUSIONS

- TABLE 2 SUMMARY OF CHANGES IMPLEMENTED IN LATEST REPORT VERSION

- TABLE 3 RISK ASSESMENT ANALYSIS

- TABLE 4 IMPORT DATA FOR HS CODE 901210-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 5 EXPORT DATA FOR HS CODE 901210-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 6 LIST OF APPLIED/GRANTED PATENTS RELATED TO ATOMIC FORCE MICROSCOPY, 2020-2024

- TABLE 7 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 8 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 9 ATOMIC FORCE MICROSCOPY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 10 ATOMIC FORCE MICROSCOPY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 11 FEATURES OF ATOMIC FORCE MICROSCOPY PROBES, BY TIP COATING MATERIAL

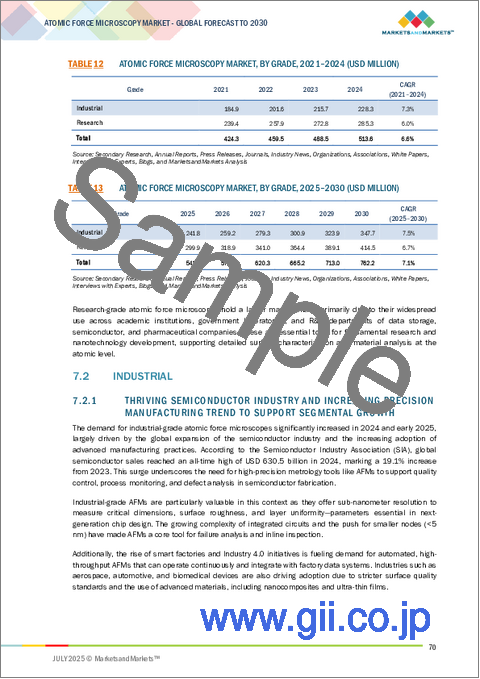

- TABLE 12 ATOMIC FORCE MICROSCOPY MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 13 ATOMIC FORCE MICROSCOPY MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 14 INDUSTRIAL: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 15 INDUSTRIAL: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 16 RESEARCH: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 17 RESEARCH: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 18 ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 19 ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 20 SEMICONDUCTORS & ELECTRONICS: ATOMIC FORCE MICROSCOPY MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 21 SEMICONDUCTORS & ELECTRONICS: ATOMIC FORCE MICROSCOPY MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 22 SEMICONDUCTORS & ELECTRONICS: ATOMIC FORCE MICROSCOPY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 23 SEMICONDUCTORS & ELECTRONICS: ATOMIC FORCE MICROSCOPY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 SEMICONDUCTORS & ELECTRONICS: ATOMIC FORCE MICROSCOPY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 25 SEMICONDUCTORS & ELECTRONICS: ATOMIC FORCE MICROSCOPY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 26 SEMICONDUCTORS & ELECTRONICS: ATOMIC FORCE MICROSCOPY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 27 SEMICONDUCTORS & ELECTRONICS: ATOMIC FORCE MICROSCOPY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 28 SEMICONDUCTORS & ELECTRONICS: ATOMIC FORCE MICROSCOPY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 29 SEMICONDUCTORS & ELECTRONICS: ATOMIC FORCE MICROSCOPY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 30 SEMICONDUCTORS & ELECTRONICS: ATOMIC FORCE MICROSCOPY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 SEMICONDUCTORS & ELECTRONICS: ATOMIC FORCE MICROSCOPY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 MATERIAL SCIENCE & NANOTECHNOLOGY: ATOMIC FORCE MICROSCOPY MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 33 MATERIAL SCIENCE & NANOTECHNOLOGY: ATOMIC FORCE MICROSCOPY MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 34 MATERIAL SCIENCE & NANOTECHNOLOGY: ATOMIC FORCE MICROSCOPY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 MATERIAL SCIENCE & NANOTECHNOLOGY: ATOMIC FORCE MICROSCOPY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 MATERIAL SCIENCE & NANOTECHNOLOGY: ATOMIC FORCE MICROSCOPY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 37 MATERIAL SCIENCE & NANOTECHNOLOGY: ATOMIC FORCE MICROSCOPY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 38 MATERIAL SCIENCE & NANOTECHNOLOGY: ATOMIC FORCE MICROSCOPY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 39 MATERIAL SCIENCE & NANOTECHNOLOGY: ATOMIC FORCE MICROSCOPY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 40 MATERIAL SCIENCE & NANOTECHNOLOGY: ATOMIC FORCE MICROSCOPY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 41 MATERIAL SCIENCE & NANOTECHNOLOGY: ATOMIC FORCE MICROSCOPY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 42 MATERIAL SCIENCE & NANOTECHNOLOGY: ATOMIC FORCE MICROSCOPY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 MATERIAL SCIENCE & NANOTECHNOLOGY: ATOMIC FORCE MICROSCOPY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 CHEMICAL & POLYMER RESEARCH: ATOMIC FORCE MICROSCOPY MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 45 CHEMICAL & POLYMER RESEARCH: ATOMIC FORCE MICROSCOPY MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 46 CHEMICAL & POLYMER RESEARCH: ATOMIC FORCE MICROSCOPY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 CHEMICAL & POLYMER RESEARCH: ATOMIC FORCE MICROSCOPY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 CHEMICAL & POLYMER RESEARCH: ATOMIC FORCE MICROSCOPY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 49 CHEMICAL & POLYMER RESEARCH: ATOMIC FORCE MICROSCOPY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 50 CHEMICAL & POLYMER RESEARCH: ATOMIC FORCE MICROSCOPY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 51 CHEMICAL & POLYMER RESEARCH: ATOMIC FORCE MICROSCOPY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 52 CHEMICAL & POLYMER RESEARCH: ATOMIC FORCE MICROSCOPY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 53 CHEMICAL & POLYMER RESEARCH: ATOMIC FORCE MICROSCOPY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 54 CHEMICAL & POLYMER RESEARCH: ATOMIC FORCE MICROSCOPY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 CHEMICAL & POLYMER RESEARCH: ATOMIC FORCE MICROSCOPY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 LIFE SCIENCES & BIOMEDICAL: ATOMIC FORCE MICROSCOPY MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 57 LIFE SCIENCES & BIOMEDICAL: ATOMIC FORCE MICROSCOPY MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 58 LIFE SCIENCES & BIOMEDICAL: ATOMIC FORCE MICROSCOPY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 LIFE SCIENCES & BIOMEDICAL: ATOMIC FORCE MICROSCOPY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 LIFE SCIENCES & BIOMEDICAL: ATOMIC FORCE MICROSCOPY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 61 LIFE SCIENCES & BIOMEDICAL: ATOMIC FORCE MICROSCOPY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 62 LIFE SCIENCES & BIOMEDICAL: ATOMIC FORCE MICROSCOPY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 63 LIFE SCIENCES & BIOMEDICAL: ATOMIC FORCE MICROSCOPY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 64 LIFE SCIENCES & BIOMEDICAL: ATOMIC FORCE MICROSCOPY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 65 LIFE SCIENCES & BIOMEDICAL: ATOMIC FORCE MICROSCOPY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 66 LIFE SCIENCES & BIOMEDICAL: ATOMIC FORCE MICROSCOPY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 LIFE SCIENCES & BIOMEDICAL: ATOMIC FORCE MICROSCOPY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 OTHER APPLICATIONS: ATOMIC FORCE MICROSCOPY MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 69 OTHER APPLICATIONS: ATOMIC FORCE MICROSCOPY MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 70 OTHER APPLICATIONS: ATOMIC FORCE MICROSCOPY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 OTHER APPLICATIONS: ATOMIC FORCE MICROSCOPY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 OTHER APPLICATIONS: ATOMIC FORCE MICROSCOPY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 OTHER APPLICATIONS: ATOMIC FORCE MICROSCOPY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 74 OTHER APPLICATIONS: ATOMIC FORCE MICROSCOPY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 75 OTHER APPLICATIONS: ATOMIC FORCE MICROSCOPY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 76 OTHER APPLICATIONS: ATOMIC FORCE MICROSCOPY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 77 OTHER APPLICATIONS: ATOMIC FORCE MICROSCOPY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 78 OTHER APPLICATIONS: ATOMIC FORCE MICROSCOPY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 OTHER APPLICATIONS: ATOMIC FORCE MICROSCOPY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 ATOMIC FORCE MICROSCOPY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 ATOMIC FORCE MICROSCOPY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: ATOMIC FORCE MICROSCOPY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: ATOMIC FORCE MICROSCOPY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 86 US: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 87 US: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 88 CANADA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 89 CANADA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 90 MEXICO: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 91 MEXICO: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: ATOMIC FORCE MICROSCOPY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 93 EUROPE: ATOMIC FORCE MICROSCOPY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 95 EUROPE: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 96 GERMANY: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 97 GERMANY: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 98 UK: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 99 UK: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 100 FRANCE: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 101 FRANCE: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 102 ITALY: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 103 ITALY: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 104 SPAIN: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 105 SPAIN: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 NETHERLANDS: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 107 NETHERLANDS: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 108 RUSSIA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 109 RUSSIA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 110 SWITZERLAND: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 111 SWITZERLAND: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 112 REST OF EUROPE: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 113 REST OF EUROPE: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ATOMIC FORCE MICROSCOPY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 115 ASIA PACIFIC: ATOMIC FORCE MICROSCOPY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 CHINA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 119 CHINA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 120 JAPAN: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 121 JAPAN: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 SOUTH KOREA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 123 SOUTH KOREA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 124 INDIA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 125 INDIA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 TAIWAN: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 127 TAIWAN: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 128 AUSTRALIA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 129 AUSTRALIA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 SINGAPORE: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 131 SINGAPORE: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 132 MALAYSIA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 133 MALAYSIA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 THAILAND: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 135 THAILAND: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 ROW: ATOMIC FORCE MICROSCOPY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 139 ROW: ATOMIC FORCE MICROSCOPY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 140 ROW: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 141 ROW: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 142 MIDDLE EAST: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 143 MIDDLE EAST: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 AFRICA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 145 AFRICA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 146 SOUTH AMERICA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 147 SOUTH AMERICA: ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 148 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- TABLE 149 SHARE ANALYSIS OF ATOMIC FORCE MICROSCOPY MARKET PLAYERS, 2024

- TABLE 150 ATOMIC FORCE MICROSCOPY MARKET: PRODUCT LAUNCHES, JANUARY 2023-JUNE 2025

- TABLE 151 ATOMIC FORCE MICROSCOPY MARKET: DEALS, JANUARY 2023-JUNE 2025

- TABLE 152 ATOMIC FORCE MICROSCOPY MARKET: EXPANSIONS, JANUARY 2023-JUNE 2025

- TABLE 153 BRUKER: COMPANY OVERVIEW

- TABLE 154 BRUKER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 BRUKER: PRODUCT LAUNCHES

- TABLE 156 BRUKER: DEALS

- TABLE 157 HITACHI HIGH-TECH CORPORATION: COMPANY OVERVIEW

- TABLE 158 HITACHI HIGH-TECH CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 OXFORD INSTRUMENTS: COMPANY OVERVIEW

- TABLE 160 OXFORD INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 OXFORD INSTRUMENTS: PRODUCT LAUNCHES

- TABLE 162 OXFORD INSTRUMENTS: EXPANSIONS

- TABLE 163 PARK SYSTEMS: COMPANY OVERVIEW

- TABLE 164 PARK SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 PARK SYSTEMS: PRODUCT LAUNCHES

- TABLE 166 PARK SYSTEMS: DEALS

- TABLE 167 SEMILAB INC.: COMPANY OVERVIEW

- TABLE 168 SEMILAB INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 SEMILAB INC.: PRODUCT LAUNCHES

- TABLE 170 AFM WORKSHOP: COMPANY OVERVIEW

- TABLE 171 AFM WORKSHOP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 AFM WORKSHOP: DEALS

- TABLE 173 ANTON PAAR GMBH: COMPANY OVERVIEW

- TABLE 174 ANTON PAAR GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 ANTON PAAR GMBH: EXPANSIONS

- TABLE 176 ATTOCUBE SYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 177 ATTOCUBE SYSTEMS GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 HORIBA, LTD.: BUSINESS OVERVIEW

- TABLE 179 HORIBA, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 HORIBA, LTD.: PRODUCT LAUNCHES

- TABLE 181 NANOSURF: COMPANY OVERVIEW

- TABLE 182 NANOSURF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 NANOSURF: EXPANSIONS

- TABLE 184 NT-MDT SI: COMPANY OVERVIEW

- TABLE 185 NT-MDT SI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 ANFATEC INSTRUMENTS AG: COMPANY OVERVIEW

- TABLE 187 A.P.E. RESEARCH: COMPANY OVERVIEW

- TABLE 188 CREATEC FISCHER & CO. GMBH: COMPANY OVERVIEW

- TABLE 189 CSINSTRUMENTS: COMPANY OVERVIEW

- TABLE 190 DME SCANNING PROBE MICROSCOPES: COMPANY OVERVIEW

- TABLE 191 GETEC MICROSCOPY GMBH: COMPANY OVERVIEW

- TABLE 192 ICSPI: COMPANY OVERVIEW

- TABLE 193 LABMATE SCIENTIFIC LLC: COMPANY OVERVIEW

- TABLE 194 LABTRON EQUIPMENT LTD.: COMPANY OVERVIEW

- TABLE 195 MAD CITY LABS INC.: COMPANY OVERVIEW

- TABLE 196 MOLECULAR VISTA: COMPANY OVERVIEW

- TABLE 197 NANOMAGNETICS INSTRUMENTS: COMPANY OVERVIEW

- TABLE 198 OME TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 199 RHK TECHNOLOGY: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ATOMIC FORCE MICROSCOPY MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 YEARS CONSIDERED FOR STUDY

- FIGURE 3 ATOMIC FORCE MICROSCOPY MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY SOURCES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE GENERATED BY COMPANIES IN ATOMIC FORCE MICROSCOPY MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 ASSUMPTIONS CONSIDERED FOR RESEARCH STUDY

- FIGURE 10 RESEARCH SEGMENT TO ACCOUNT FOR LARGER SHARE OF ATOMIC FORCE MICROSCOPY MARKET, BY GRADE, IN 2030

- FIGURE 11 ATOMIC FORCE MICROSCOPES TO HOLD MAJORITY OF MARKET SHARE, BY OFFERING, IN 2030

- FIGURE 12 ATOMIC FORCE MICROSCOPY MARKET FOR SEMICONDUCTORS & ELECTRONICS APPLICATIONS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC HELD LARGEST MARKET SHARE IN 2024

- FIGURE 14 COMMITTED SUPPORT FROM GOVERNMENTS TO PROMOTE NANOTECHNOLOGY AND NANOSCIENCE RESEARCH AND DEVELOPMENT DRIVES ATOMIC FORCE MICROSCOPY MARKET

- FIGURE 15 ATOMIC FORCE MICROSCOPES TO LEAD MARKET IN 2025

- FIGURE 16 RESEARCH SEGMENT TO HOLD LARGER MARKET SHARE IN 2025

- FIGURE 17 SEMICONDUCTORS & ELECTRONICS SEGMENT TO CAPTURE LARGEST SHARE OF ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION, IN 2025

- FIGURE 18 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN ATOMIC FORCE MICROSCOPY MARKET FROM 2025 TO 2030

- FIGURE 19 ATOMIC FORCE MICROSCOPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 IMPACT ANALYSIS: DRIVERS

- FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 23 IMPACT ANALYSIS: CHALLENGES

- FIGURE 24 IMPORT SCENARIO FOR HS CODE 901210-COMPLIANT PRODUCTS IN KEY COUNTRIES, 2020-2024 (USD MILLION)

- FIGURE 25 EXPORT SCENARIO FOR HS CODE 901210-COMPLIANT PRODUCTS IN KEY COUNTRIES, 2020-2024 (USD MILLION)

- FIGURE 26 ANALYSIS OF PATENTS GRANTED IN ATOMIC FORCE MICROSCOPY MARKET

- FIGURE 27 ATOMIC FORCE MICROSCOPES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 28 ATOMIC FORCE MICROSCOPY MARKET, BY GRADE

- FIGURE 29 RESEARCH-GRADE ATOMIC FORCE MICROSCOPES TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 30 ATOMIC FORCE MICROSCOPY MARKET: BY APPLICATION

- FIGURE 31 SEMICONDUCTOR & ELECTRONICS SEGMENT TO COMMAND ATOMIC FORCE MICROSCOPY MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN ATOMIC FORCE MICROSCOPY MARKET DURING FORECAST PERIOD

- FIGURE 33 SNAPSHOT: ATOMIC FORCE MICROSCOPY MARKET IN NORTH AMERICA

- FIGURE 34 SNAPSHOT: ATOMIC FORCE MICROSCOPY MARKET IN EUROPE

- FIGURE 35 SNAPSHOT: ATOMIC FORCE MICROSCOPY MARKET IN ASIA PACIFIC

- FIGURE 36 MARKET SHARE ANALYSIS, 2024

- FIGURE 37 COMPANY EVALUATION MATRIX, 2024

- FIGURE 38 BRUKER: COMPANY SNAPSHOT

- FIGURE 39 HITACHI HIGH-TECH CORPORATION: COMPANY SNAPSHOT

- FIGURE 40 OXFORD INSTRUMENTS: COMPANY SNAPSHOT

- FIGURE 41 PARK SYSTEMS: COMPANY SNAPSHOT

- FIGURE 42 HORIBA, LTD.: COMPANY SNAPSHOT

The global atomic force microscopy market is projected to grow from USD 541.8 million in 2025 to USD 762.2 million in 2030, at a CAGR of 7.1% during the forecast period. Technological innovations and rising investments in nanotechnology research are key growth drivers for the atomic force microscopy market. These instruments offer nanoscale imaging and precise surface characterization, making them indispensable in fields such as semiconductors, materials science, and life sciences. The integration of automation, artificial intelligence, and advanced software analytics enhances user accessibility and measurement accuracy, expanding AFM use beyond research institutions into industrial quality control environments. Their alignment with increasing demand for miniaturized electronics makes AFMs highly relevant for next-generation manufacturing, accelerating their adoption in both academic and industrial domains.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By offering, grade, application, and region |

| Regions covered | North America, Europe, APAC, RoW |

"Industrial segment to witness highest CAGR in atomic force microscopy market during forecasted period"

The industrial segment is expected to register the highest CAGR due to the increasing adoption of AFM technology in quality control, failure analysis, and materials research across semiconductors, electronics, automotive, energy, and several other industries. As manufacturing processes continue to miniaturize and emphasize nanoscale precision, the demand for surface characterization and metrology tools such as AFMs is growing rapidly. Industrial AFMs offer advanced features such as high-speed scanning, automated operation, and integration with production lines, making them suitable for inline inspection and process monitoring. Moreover, as industries increasingly invest in nanomaterial development and functional coatings, AFMs are becoming indispensable for analyzing surface roughness, adhesion properties, and thin film uniformity.

"Material science & nanotechnology segment to hold second-largest share of atomic force microscopy market"

The material science & nanotechnology segment is projected to account for the second-largest share of the atomic force microscopy market. Atomic force microscopes are extensively utilized to study surface morphology, roughness, mechanical properties, and molecular interactions at the atomic level, which is critical in developing next-generation materials. The growing interest in nanostructured materials, composite materials, and two-dimensional materials such as graphene and transition metal dichalcogenides has increased the adoption of AFM in academic and industrial research settings. Additionally, rising investments in nanotechnology initiatives by government agencies and private organizations, coupled with increased collaboration between research institutes and commercial enterprises, are propelling the segment's growth. Advancements in AFM technology, such as the integration of high-speed scanning, multiparametric measurement modes, and integration with spectroscopy techniques, are enhancing its utility and precision in material characterization.

"Asia Pacific to witness highest CAGR in atomic force microscopy market during forecast period"

The increasing focus on nanotechnology research, semiconductor innovation, and materials science development primarily drives the atomic force microscopy market in the Asia Pacific region. Countries such as China, Japan, South Korea, and Taiwan are investing heavily in research and development infrastructure to strengthen their position in advanced manufacturing and electronics. The rapid expansion of the semiconductor industry, supported by favorable government policies and public-private partnerships, is creating substantial demand for high-resolution surface characterization tools such as AFMs. Academic institutions and research organizations are also adopting AFMs to support breakthroughs in nanoscience and biotechnology.

Breakdown of Primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 40%, Tier 2 - 35%, Tier 3 - 25%

- By Designation - C-level Executives - 48%, Directors - 33%, Others - 19%

- By Region - North America - 35%, Europe - 18%, Asia Pacific - 40%, RoW - 7%

The atomic force microscopy market is dominated by a few globally established players, such as Park Systems (South Korea), Bruker (US), Hitachi High-Tech Corporation (Japan), Oxford Instruments (UK), and Semilab Inc. (Hungary). The study includes an in-depth competitive analysis of these key players, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the atomic force microscopy market and forecasts its size by offering, grade, application, and region. It also discusses the market's drivers, restraints, opportunities, and challenges and gives a detailed view of the market across four main regions: North America, Europe, Asia Pacific, and RoW.

Key Benefits of Buying the Report:

- Analysis of key drivers (expansion of life sciences and healthcare applications, rising investments in nanotechnology research, growing semiconductor & electronics industry). restraints (high equipment cost), opportunities (technological advancements and emerging applications), challenges (lack of skilled professionals for handling atomic force microscopy tools)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches/developments in the atomic force microscopy market

- Market Development: Comprehensive information about lucrative markets by providing an analysis of the atomic force microscopy market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the atomic force microscopy market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, Park Systems (South Korea), Bruker (US), Hitachi High-Tech Corporation (Japan), Oxford Instruments (UK), and Semilab Inc. (Hungary), among others, in the atomic force microscopy market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESMANET

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN ATOMIC FORCE MICROSCOPY MARKET

- 4.2 ATOMIC FORCE MICROSCOPY MARKET, BY OFFERING

- 4.3 ATOMIC FORCE MICROSCOPY MARKET, BY GRADE

- 4.4 ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION

- 4.5 ATOMIC FORCE MICROSCOPY MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Need for nanoscale precision in semiconductor manufacturing

- 5.2.1.2 High investments in nanotechnology

- 5.2.1.3 Expansion of atomic force microscopy applications in life sciences and healthcare sectors

- 5.2.2 RESTRAINTS

- 5.2.2.1 Damage to samples due to contact-mode atomic force microscopy

- 5.2.2.2 Critical sample preparation requirements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing investments in OLED panel production globally

- 5.2.3.2 Expanding applications of atomic force microscopy from drug delivery to protein dynamics

- 5.2.3.3 Emerging applications from basic imaging to multi-modal analysis due to technological advancements

- 5.2.4 CHALLENGES

- 5.2.4.1 High-throughput challenges due to surface coverage and speed limitations

- 5.2.1 DRIVERS

- 5.3 TRADE ANALYSIS

- 5.3.1 IMPORT SCENARIO (HS CODE 901210)

- 5.3.2 EXPORT SCENARIO (HS CODE 901210)

- 5.4 PATENTS ANALYSIS

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.1.1 Closed-loop feedback control

- 5.5.2 ADJACENT TECHNOLOGIES

- 5.5.2.1 Nanoimprint lithography (NIL)

- 5.5.2.2 Optical interferometry

- 5.5.3 COMPLEMENTARY TECHNOLOGIES

- 5.5.3.1 Machine learning

- 5.5.1 KEY TECHNOLOGIES

- 5.6 IMPACT OF AI/GEN AI ON ATOMIC FORCE MICROSCOPY MARKET

- 5.7 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.7.1 INTRODUCTION

- 5.7.2 KEY TARIFF RATES

- 5.7.3 PRICE IMPACT ANALYSIS

- 5.7.4 IMPACT ON COUNTRY/REGION

- 5.7.4.1 US

- 5.7.4.2 Europe

- 5.7.4.3 Asia Pacific

- 5.7.5 IMPACT ON APPLICATIONS

6 ATOMIC FORCE MICROSCOPY MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 ATOMIC FORCE MICROSCOPES

- 6.2.1 EXCELLENCE IN EVALUATING MULTIMODAL SURFACES AT NANOSCALE LEVEL TO ACCELERATE ADOPTION

- 6.2.2 CONTACT MODE

- 6.2.3 NON-CONTACT MODE

- 6.2.4 TAPPING MODE

- 6.3 PROBES

- 6.3.1 ABILITY TO OPTIMIZE AFM PERFORMANCE TO BOOST DEMAND

- 6.4 SOFTWARE

- 6.4.1 RISING DEMAND FOR SYSTEMATIC AFM PROBE SCANNING AND DATA ANALYSIS TO FOSTER SEGMENTAL GROWTH

7 ATOMIC FORCE MICROSCOPY MARKET, BY GRADE

- 7.1 INTRODUCTION

- 7.2 INDUSTRIAL

- 7.2.1 THRIVING SEMICONDUCTOR INDUSTRY AND INCREASING PRECISION MANUFACTURING TREND TO SUPPORT SEGMENTAL GROWTH

- 7.3 RESEARCH

- 7.3.1 INCREASING GLOBAL NANOSCIENCE INVESTMENTS TO CONTRIBUTE TO SEGMENTAL GROWTH

8 ATOMIC FORCE MICROSCOPY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 SEMICONDUCTORS & ELECTRONICS

- 8.2.1 RISING COMPLEXITY IN CHIP DESIGN TO ACCELERATE AFM ADOPTION

- 8.2.2 DATA STORAGE

- 8.2.3 3D-INTEGRATED CIRCUITS AND FIN FIELD-EFFECT TRANSISTORS

- 8.2.4 DISPLAYS

- 8.2.5 CARBON NANOTUBES

- 8.3 MATERIAL SCIENCE & NANOTECHNOLOGY

- 8.3.1 SIGNIFICANT ADVANCEMENTS IN NANOTECHNOLOGY AND MATERIAL SCIENCE THROUGH GOVERNMENT-SUPPORTED INITIATIVES TO BOOST DEMAND

- 8.4 CHEMICAL & POLYMER RESEARCH

- 8.4.1 NEED FOR QUALITY ASSURANCE AND PRECISION IN CHEMICAL MANUFACTURING TO SPIKE DEMAND

- 8.5 LIFE SCIENCES & BIOMEDICAL

- 8.5.1 EXCELLENCE IN PRECISELY ANALYZING BIOLOGICAL STRUCTURES AND CELL MECHANICS TO FACILITATE ADOPTION

- 8.5.2 CELL BIOLOGY

- 8.5.3 BIOTECHNOLOGY

- 8.5.4 PHARMACEUTICALS

- 8.6 OTHER APPLICATIONS

- 8.6.1 SOLAR CELLS

- 8.6.2 GEOSCIENCE

- 8.6.3 FORENSIC SCIENCE

- 8.6.4 FOOD TECHNOLOGY

9 ATOMIC FORCE MICROSCOPY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Government's strategic push toward advanced nanotechnology to accelerate market growth

- 9.2.2 CANADA

- 9.2.2.1 Expanding federal funding for nanotechnology research centers to support market growth

- 9.2.3 MEXICO

- 9.2.3.1 Increasing focus on developing nanomaterials and advanced composites to stimulate market growth

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Growing biotechnology industry to create growth opportunities

- 9.3.2 UK

- 9.3.2.1 Sharp rise in biotechnology investments to surge demand

- 9.3.3 FRANCE

- 9.3.3.1 Significant emphasis on sustainable manufacturing to facilitate market growth

- 9.3.4 ITALY

- 9.3.4.1 Rising demand for precision medicine, regenerative therapies, and bio-nanotechnology to create growth opportunities

- 9.3.5 SPAIN

- 9.3.5.1 Government funding in nanotechnology, biotechnology, and materials science fields to foster market growth

- 9.3.6 NETHERLANDS

- 9.3.6.1 Public-private collaborations aiming at scientific advancements to spike demand

- 9.3.7 RUSSIA

- 9.3.7.1 Strategic push toward scientific and technological leadership to support market growth

- 9.3.8 SWITZERLAND

- 9.3.8.1 Commitment to science-led economic advancement to contribute to market growth

- 9.3.9 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 ASIA PACIFIC

- 9.4.1 CHINA

- 9.4.1.1 High-tech roadmap and semiconductor resilience to boost demand

- 9.4.2 JAPAN

- 9.4.2.1 Ongoing R&D efforts across automotive sector to spur demand

- 9.4.3 SOUTH KOREA

- 9.4.3.1 Emphasis on semiconductor fabrication to facilitate requirement

- 9.4.4 INDIA

- 9.4.4.1 Increasing investment in biotech innovation to fuel market expansion

- 9.4.5 TAIWAN

- 9.4.5.1 Government funding for applied scientific development to propel market

- 9.4.6 AUSTRALIA

- 9.4.6.1 Tax credits and incentives offered to improve R&D effectiveness to stimulate market growth

- 9.4.7 SINGAPORE

- 9.4.7.1 Thriving semiconductor industry to enhance market momentum

- 9.4.8 MALAYSIA

- 9.4.8.1 Rising focus on enhancing industrial sector to support market progression

- 9.4.9 THAILAND

- 9.4.9.1 Transition toward high-value industries through Thailand 4.0 vision to expedite market growth

- 9.4.10 REST OF ASIA PACIFIC

- 9.4.1 CHINA

- 9.5 ROW

- 9.5.1 MIDDLE EAST

- 9.5.1.1 Innovation-led industrial growth to drive adoption

- 9.5.2 AFRICA

- 9.5.2.1 Expanding food & beverages and automotive industries to create growth opportunities

- 9.5.3 SOUTH AMERICA

- 9.5.3.1 Collaborative research networks and R&D investments in medicine & biology field to stimulate deployment

- 9.5.1 MIDDLE EAST

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.4.1 STARS

- 10.4.2 EMERGING LEADERS

- 10.4.3 PERVASIVE PLAYERS

- 10.4.4 PARTICIPANTS

- 10.5 COMPETITIVE SCENARIO

- 10.5.1 PRODUCT LAUNCHES

- 10.5.2 DEALS

- 10.5.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 BRUKER

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 HITACHI HIGH-TECH CORPORATION

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Key strengths/Right to win

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses/Competitive threats

- 11.1.3 OXFORD INSTRUMENTS

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 PARK SYSTEMS

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses/Competitive threats

- 11.1.5 SEMILAB INC.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses/Competitive threats

- 11.1.6 AFM WORKSHOP

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.7 ANTON PAAR GMBH

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Expansions

- 11.1.8 ATTOCUBE SYSTEMS GMBH

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.9 HORIBA, LTD.

- 11.1.9.1 Business overview

- 11.1.9.2 Products/solutions/services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.10 NANOSURF

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Expansions

- 11.1.11 NT-MDT SI

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.1 BRUKER

- 11.2 OTHER PLAYERS

- 11.2.1 ANFATEC INSTRUMENTS AG

- 11.2.2 A.P.E. RESEARCH

- 11.2.3 CREATEC FISCHER & CO. GMBH

- 11.2.4 CSINSTRUMENTS

- 11.2.5 DME SCANNING PROBE MICROSCOPES

- 11.2.6 GETEC MICROSCOPY GMBH

- 11.2.7 ICSPI

- 11.2.8 LABMATE SCIENTIFIC LLC

- 11.2.9 LABTRON EQUIPMENT LTD.

- 11.2.10 MAD CITY LABS INC.

- 11.2.11 MOLECULAR VISTA

- 11.2.12 NANOMAGNETICS INSTRUMENTS

- 11.2.13 OME TECHNOLOGY CO., LTD.

- 11.2.14 RHK TECHNOLOGY

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS