|

|

市場調査レポート

商品コード

1769082

バイオセンサーの世界市場:コンポーネント別、タイプ別、製品別、技術別、用途別、地域別 - 2030年までの予測Biosensors Market by Type (Sensor Patch, Embedded Device), Product (Wearable, Non-Wearable), Wearable (Wristwear, Bodywear), Technology (Electrochemical, Optical, Piezoelectric, Thermal, Nanomechanical), Application and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| バイオセンサーの世界市場:コンポーネント別、タイプ別、製品別、技術別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月08日

発行: MarketsandMarkets

ページ情報: 英文 228 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のバイオセンサーの市場規模は、2025年の345億1,000万米ドルから2030年までに543億7,000万米ドルに達すると予測され、この間のCAGRは9.5%と見込まれています。

市場開拓の原動力となっているのは、新興国における感染症の増加、迅速な診断と効率的なモニタリングソリューションに対する需要の増加、小型化、ナノテクノロジー、マイクロ流体工学、新製品イノベーションなどの技術進歩です。さらに、都市部における需要の高まりは、診断装置が簡単に入手でき、使用も簡単であることから、市場の成長をさらに後押ししています。世界各国の政府は、患者の自己負担を減らしつつ、診断検査への可用性とアクセスを確保することを目的として、診断と医薬品サービスを改善するイニシアチブを開始しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | コンポーネント別、タイプ別、製品別、技術別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

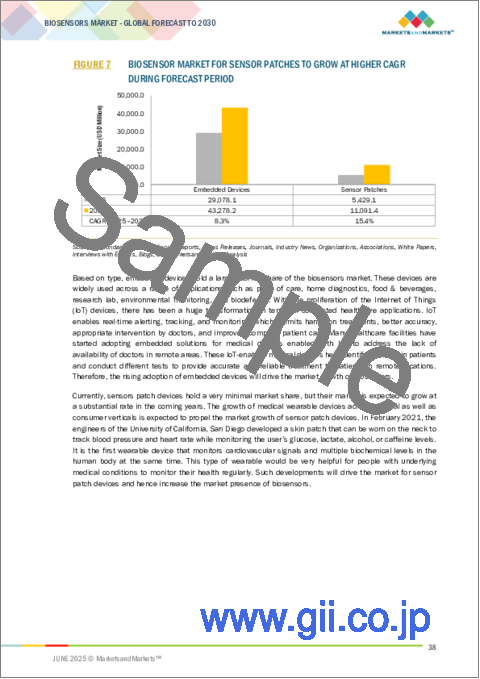

組み込みデバイスは、ポイントオブケア、家庭診断、飲食品、研究所、環境モニタリング、バイオディフェンスなど様々な用途一般的に使用されています。モノのインターネット(IoT)デバイスの成長に伴い、接続されたヘルスケアに大きな変化が生じています。IoTはリアルタイムの警告、追跡、監視を可能にし、手による治療、精度の向上、医師によるタイムリーな介入、全体的な患者ケアの向上を可能にします。多くのヘルスケア施設では、遠隔地の医師不足に対処するため、IoT機能を備えた医療機器の組み込みソリューションを採用し始めています。これらのIoT対応医療機器は、遠隔地の患者に正確で信頼性の高い治療を提供するため、病気の特定や各種検査の実施を支援します。その結果、組み込み型デバイスの使用が増加し、バイオセンサーの市場成長を後押しします。

ノンウェアラブルバイオセンサー市場は、ハンドヘルドツールからラボシステムやポイントオブケア診断に至るまで、ヘルスケア、環境モニタリング、食品安全に不可欠な多様な用途に牽引される活気ある成長分野です。病院、調査、食品、環境分野で使用されるこれらのバイオセンサーは、リアルタイムの現場監視を可能にし、食品の品質課題への対応と安全基準の達成を支援します。市場成長の原動力となっているのは、環境監視に対する意識の高まりと、生体防御、食品管理、病原体検出のための迅速な装置の必要性です。

中国のバイオセンサー市場を牽引する要因には、急速な経済成長と高齢化、ヘルスケアサービス向上のための政府の取り組みなどがあります。中国で事業を展開する多くの多国籍輸出業者やメーカーは、信頼性の高い国内流通やサービスインフラを支える買収や戦略的提携などの戦略を採用しています。対照的に、多くの国内メーカー、特に中国国外への輸出市場に重点を置くメーカーは、国内での強力な流通・サービス網を欠いています。中国は世界で最も人口の多い国であり、一人っ子政策により、将来的に高齢者人口の増加が予想されます。高齢化に伴い、心臓病をはじめとするさまざまな疾患の発生率が大幅に上昇する可能性が高いです。

当レポートでは、世界のバイオセンサー市場について調査し、コンポーネント別、タイプ別、製品別、技術別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 技術分析

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 生成AI/AIがバイオセンサー市場に与える影響

- 特許分析

- 貿易分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 2025年~2026年の主な会議とイベント

- 規制状況と基準

- 2025年の米国関税の影響- バイオセンサー市場

第6章 バイオセンサー市場(コンポーネント別)

- イントロダクション

- バイオレセプター分子

- 生物学的要素

- トランスデューサー

第7章 バイオセンサー市場(タイプ別)

- イントロダクション

- センサーパッチ

- 組み込みデバイス

第8章 バイオセンサー市場(製品別)

- イントロダクション

- ウェアラブルバイオセンサー

- 非ウェアラブル(POC)バイオセンサー

第9章 バイオセンサー市場(技術別)

- イントロダクション

- 電気化学バイオセンサー

- 光学バイオセンサー

- 圧電バイオセンサー

- 熱バイオセンサー

- ナノメカニカルバイオセンサー

第10章 バイオセンサー市場(用途別)

- イントロダクション

- POC

- 在宅診断

- 研究室

- 環境モニタリング

- 食品・飲料

- バイオディフェンス

第11章 バイオセンサー市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- その他

- その他の地域

- 南米

- 中東

- アフリカ

第12章 競合情勢

- 概要

- 主要参入企業が採用する戦略(2021年~2024年)

- 収益分析、2022年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- ABBOTT LABORATORIES

- F. HOFFMANN-LA ROCHE LTD

- MEDTRONIC

- BIO-RAD LABORATORIES, INC.

- DUPONT

- BIOSENSORS INTERNATIONAL GROUP, LTD.

- CYTIVA

- DEXCOM, INC.

- LIFESCAN IP HOLDINGS, LLC

- MASIMO

- NOVA BIOMEDICAL

- UNIVERSAL BIOSENSORS

- その他の企業

- ACON LABORATORIES

- CONDUCTIVE TECHNOLOGIES

- EASTPRINT INCORPORATED

- IST AG

- LIFESIGNALS

- NEUROSKY

- PINNACLE TECHNOLOGY

- SD BIOSENSOR, INC.

- VITALCONNECT

- XSENSIO

- ZIMMER AND PEACOCK

- PARAGRAF LIMITED

- DYNAMIC BIOSENSORS

- LINEXENS

- BIOLINQ INCORPORATED

第14章 付録

List of Tables

- TABLE 1 BIOSENSORS MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 ROLE OF COMPANIES IN BIOSENSOR ECOSYSTEM

- TABLE 3 INDICATIVE SELLING PRICE TREND OF GLUCOSE MONITORING SYSTEMS, BY PRODUCT TYPE (USD), 2025

- TABLE 4 INDICATIVE SELLING PRICE OF GLUCOSE MONITORING SYSTEMS, BY COMPANY (USD), 2025

- TABLE 5 INDICATIVE SELLING PRICE TREND OF GLUCOSE MONITORING SYSTEM, BY REGION, 2021-2024 (USD)

- TABLE 6 BIOSENSORS MARKET: LIST OF MAJOR PATENTS

- TABLE 7 IMPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 EXPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 BIOSENSORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 BIOSENSORS MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 11 BIOSENSORS MARKET: KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 12 BIOSENSORS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: SAFETY STANDARDS FOR BIOSENSORS

- TABLE 18 EUROPE: SAFETY STANDARDS FOR BIOSENSORS

- TABLE 19 ASIA PACIFIC: SAFETY STANDARDS FOR BIOSENSORS

- TABLE 20 REST OF THE WORLD: SAFETY STANDARDS FOR BIOSENSORS

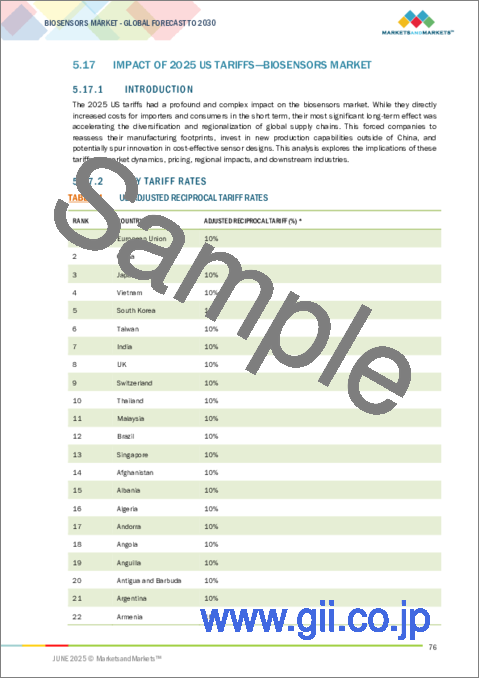

- TABLE 21 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 22 BIOSENSORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 23 BIOSENSORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 24 BIOSENSORS MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 25 BIOSENSORS MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 26 BIOSENSORS MARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 27 BIOSENSORS MARKET, BY PRODUCT, 2025-2030 (MILLION UNITS)

- TABLE 28 WEARABLE BIOSENSORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 29 WEARABLE BIOSENSORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 30 WEARABLE BIOSENSORS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 31 WEARABLE BIOSENSORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 32 WEARABLE BIOSENSORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 33 WEARABLE BIOSENSORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 34 NON-WEARABLE BIOSENSORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 35 NON-WEARABLE BIOSENSORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 36 NON-WEARABLE BIOSENSORS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 37 NON-WEARABLE BIOSENSORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 38 BIOSENSORS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 39 BIOSENSORS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 40 ELECTROCHEMICAL BIOSENSORS MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 41 ELECTROCHEMICAL BIOSENSORS MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 42 OPTICAL BIOSENSORS MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 43 OPTICAL BIOSENSORS MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 44 PIEZOELECTRIC BIOSENSORS MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 45 PIEZOELECTRIC BIOSENSORS MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 46 THERMAL BIOSENSORS MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 47 THERMAL BIOSENSORS MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 48 NANOMECHANICAL BIOSENSORS MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 49 NANOMECHANICAL BIOSENSORS MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 50 BIOSENSORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 51 BIOSENSORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 52 BIOSENSORS MARKET FOR POC APPLICATIONS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 53 BIOSENSORS MARKET FOR POC APPLICATIONS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 54 BIOSENSORS MARKET FOR POC APPLICATIONS, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 55 BIOSENSORS MARKET FOR POC APPLICATIONS, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 56 BIOSENSORS MARKET FOR POC APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 BIOSENSORS MARKET FOR POC APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: BIOSENSORS MARKET FOR POC APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 59 NORTH AMERICA: BIOSENSORS MARKET FOR POC APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 60 EUROPE: BIOSENSORS MARKET FOR POC APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 61 EUROPE: BIOSENSORS MARKET FOR POC APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 62 ASIA PACIFIC: BIOSENSORS MARKET FOR POC APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 63 ASIA PACIFIC: BIOSENSORS MARKET FOR POC APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 64 REST OF THE WORLD: BIOSENSORS MARKET FOR POC APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 REST OF THE WORLD: BIOSENSORS MARKET FOR POC APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 BIOSENSORS MARKET FOR HOME DIAGNOSTICS APPLICATIONS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 BIOSENSORS MARKET FOR HOME DIAGNOSTICS APPLICATIONS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 68 BIOSENSORS MARKET FOR HOME DIAGNOSTICS APPLICATIONS, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 69 BIOSENSORS MARKET FOR HOME DIAGNOSTICS APPLICATIONS, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 70 BIOSENSORS MARKET FOR HOME DIAGNOSTICS APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 BIOSENSORS MARKET FOR HOME DIAGNOSTICS APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: BIOSENSORS MARKET FOR HOME DIAGNOSTICS APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: BIOSENSORS MARKET FOR HOME DIAGNOSTICS APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 74 EUROPE: BIOSENSORS MARKET FOR HOME DIAGNOSTICS APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 75 EUROPE: BIOSENSORS MARKET FOR HOME DIAGNOSTICS APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 76 ASIA PACIFIC: BIOSENSORS MARKET FOR HOME DIAGNOSTICS APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 77 ASIA PACIFIC: BIOSENSORS MARKET FOR HOME DIAGNOSTICS APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 78 REST OF THE WORLD: BIOSENSORS MARKET FOR HOME DIAGNOSTICS APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 REST OF THE WORLD: BIOSENSORS MARKET FOR HOME DIAGNOSTICS APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 BIOSENSORS MARKET FOR RESEARCH LAB APPLICATIONS, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 81 BIOSENSORS MARKET FOR RESEARCH LAB APPLICATIONS, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 82 BIOSENSORS MARKET FOR RESEARCH LAB APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 BIOSENSORS MARKET FOR RESEARCH LAB APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: BIOSENSORS MARKET FOR RESEARCH LAB APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: BIOSENSORS MARKET FOR RESEARCH LAB APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 86 EUROPE: BIOSENSORS MARKET FOR RESEARCH LAB APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 87 EUROPE: BIOSENSORS MARKET FOR RESEARCH LAB APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: BIOSENSORS MARKET FOR RESEARCH LAB APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 89 ASIA PACIFIC: BIOSENSORS MARKET FOR RESEARCH LAB APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 REST OF THE WORLD: BIOSENSORS MARKET FOR RESEARCH LAB APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 REST OF THE WORLD: BIOSENSORS MARKET FOR RESEARCH LAB APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 BIOSENSORS MARKET FOR ENVIRONMENTAL MONITORING APPLICATIONS, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 93 BIOSENSORS MARKET FOR ENVIRONMENTAL MONITORING APPLICATIONS, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 94 BIOSENSORS MARKET FOR ENVIRONMENTAL MONITORING APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 BIOSENSORS MARKET FOR ENVIRONMENTAL MONITORING APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: BIOSENSORS MARKET FOR ENVIRONMENTAL MONITORING APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: BIOSENSORS MARKET FOR ENVIRONMENTAL MONITORING APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 98 EUROPE: BIOSENSORS MARKET FOR ENVIRONMENTAL MONITORING APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 99 EUROPE: BIOSENSORS MARKET FOR ENVIRONMENTAL MONITORING APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: BIOSENSORS MARKET FOR ENVIRONMENTAL MONITORING APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 101 ASIA PACIFIC: BIOSENSORS MARKET FOR ENVIRONMENTAL MONITORING APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 102 REST OF THE WORLD: BIOSENSORS MARKET FOR ENVIRONMENTAL MONITORING APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 REST OF THE WORLD: BIOSENSORS MARKET FOR ENVIRONMENTAL MONITORING APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 BIOSENSORS MARKET FOR FOOD & BEVERAGE APPLICATIONS, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 105 BIOSENSORS MARKET FOR FOOD & BEVERAGE APPLICATIONS, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 106 BIOSENSORS MARKET FOR FOOD & BEVERAGE APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 BIOSENSORS MARKET FOR FOOD & BEVERAGE APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: BIOSENSORS MARKET FOR FOOD & BEVERAGE APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 109 NORTH AMERICA: BIOSENSORS MARKET FOR FOOD & BEVERAGE APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 110 EUROPE: BIOSENSORS MARKET FOR FOOD & BEVERAGE APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 111 EUROPE: BIOSENSORS MARKET FOR FOOD & BEVERAGE APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: BIOSENSORS MARKET FOR FOOD & BEVERAGE APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 113 ASIA PACIFIC: BIOSENSORS MARKET FOR FOOD & BEVERAGE APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 114 REST OF THE WORLD: BIOSENSORS MARKET FOR FOOD & BEVERAGE APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 REST OF THE WORLD: BIOSENSORS MARKET FOR FOOD & BEVERAGE APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 BIOSENSORS MARKET FOR BIODEFENSE APPLICATIONS, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 117 BIOSENSORS MARKET FOR BIODEFENSE APPLICATIONS, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 118 BIOSENSORS MARKET FOR BIODEFENSE APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 BIOSENSORS MARKET FOR BIODEFENSE APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: BIOSENSORS MARKET FOR BIODEFENSE APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 121 NORTH AMERICA: BIOSENSORS MARKET FOR BIODEFENSE APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: BIOSENSORS MARKET FOR BIODEFENSE APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 123 EUROPE: BIOSENSORS MARKET FOR BIODEFENSE APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: BIOSENSORS MARKET FOR BIODEFENSE APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 125 ASIA PACIFIC: BIOSENSORS MARKET FOR BIODEFENSE APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 126 REST OF THE WORLD: BIOSENSORS MARKET FOR BIODEFENSE APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 REST OF THE WORLD: BIOSENSORS MARKET FOR BIODEFENSE APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 128 BIOSENSORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 129 BIOSENSORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: BIOSENSORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: BIOSENSORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: BIOSENSORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: BIOSENSORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: BIOSENSORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 135 EUROPE: BIOSENSORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: BIOSENSORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 137 EUROPE: BIOSENSORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: BIOSENSORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 ASIA PACIFIC: BIOSENSORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: BIOSENSORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: BIOSENSORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 142 REST OF THE WORLD: BIOSENSORS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 143 REST OF THE WORLD: BIOSENSORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 REST OF THE WORLD: BIOSENSORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 REST OF THE WORLD: BIOSENSORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST: BIOSENSORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 147 MIDDLE EAST: BIOSENSORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 148 GCC COUNTRIES: BIOSENSORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 149 GCC COUNTRIES: BIOSENSORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 BIOSENSORS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 151 BIOSENSORS MARKET SHARE ANALYSIS, 2024

- TABLE 152 BIOSENSORS MARKET: REGION FOOTPRINT

- TABLE 153 BIOSENSORS MARKET: PRODUCT FOOTPRINT

- TABLE 154 BIOSENSORS MARKET: TYPE FOOTPRINT

- TABLE 155 BIOSENSORS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 156 BIOSENSORS MARKET: APPLICATION FOOTPRINT

- TABLE 157 BIOSENSORS MARKET: LIST OF KEY START-UPS/SMES

- TABLE 158 BIOSENSORS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 159 BIOSENSORS MARKET: PRODUCT LAUNCHES, APPROVALS, AND ENHANCEMENTS, JANUARY 2021-MAY 2025

- TABLE 160 BIOSENSORS MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 161 BIOSENSORS MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 162 ABBOTT LABORATORIES: COMPANY OVERVIEW

- TABLE 163 ABBOTT LABORATORIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 ABBOTT LABORATORIES: PRODUCT ENHANCEMENTS, JANUARY 2021-MAY 2025

- TABLE 165 ABBOTT LABORATORIES: DEALS, JANUARY 2021-MAY 2025

- TABLE 166 F. HOFFMANN-LA ROCHE LTD: COMPANY OVERVIEW

- TABLE 167 F. HOFFMANN-LA ROCHE LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 F. HOFFMANN-LA ROCHE LTD: DEALS, JANUARY 2021-MAY 2025

- TABLE 169 MEDTRONIC: COMPANY OVERVIEW

- TABLE 170 MEDTRONIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 MEDTRONIC: PRODUCT APPROVALS, JANUARY 2021-MAY 2025

- TABLE 172 MEDTRONIC: DEALS, JANUARY 2021-MAY 2025

- TABLE 173 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 174 BIO-RAD LABORATORIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 DUPONT: COMPANY OVERVIEW

- TABLE 176 DUPONT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 DUPONT: DEALS, JANUARY 2021-MAY 2025

- TABLE 178 DUPONT: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 179 BIOSENSORS INTERNATIONAL GROUP, LTD.: COMPANY OVERVIEW

- TABLE 180 BIOSENSORS INTERNATIONAL GROUP, LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 181 BIOSENSORS INTERNATIONAL GROUP, LTD.: PRODUCT APPROVALS, JANUARY 2021-MAY 2025

- TABLE 182 CYTIVA: COMPANY OVERVIEW

- TABLE 183 CYTIVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 CYTIVA: DEALS, JANUARY 2021-MAY 2025

- TABLE 185 DEXCOM, INC.: COMPANY OVERVIEW

- TABLE 186 DEXCOM, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 DEXCOM, INC.: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 188 LIFESCAN IP HOLDINGS, LLC: COMPANY OVERVIEW

- TABLE 189 LIFESCAN IP HOLDINGS, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 MASIMO: COMPANY OVERVIEW

- TABLE 191 MASIMO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 MASIMO: DEALS, JANUARY 2021-MAY 2025

- TABLE 193 NOVA BIOMEDICAL: COMPANY OVERVIEW

- TABLE 194 NOVA BIOMEDICAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 NOVA BIOMEDICAL: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 196 NOVA BIOMEDICAL: DEALS, JANUARY 2021-MAY 2025

- TABLE 197 UNIVERSAL BIOSENSORS: COMPANY OVERVIEW

- TABLE 198 UNIVERSAL BIOSENSORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 BIOSENSORS MARKET SEGMENTATION

- FIGURE 2 BIOSENSORS MARKET: RESEARCH DESIGN

- FIGURE 3 BIOSENSORS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 BIOSENSORS MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 5 BIOSENSORS MARKET: TOP-DOWN APPROACH

- FIGURE 6 BIOSENSORS MARKET: DATA TRIANGULATION

- FIGURE 7 BIOSENSOR MARKET FOR SENSOR PATCHES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 8 WEARABLE BIOSENSORS TO GROW AT HIGHER RATE DURING FORECAST PERIOD

- FIGURE 9 ELECTROCHEMICAL TECHNOLOGY TO HOLD LARGEST SHARE IN 2030

- FIGURE 10 POC APPLICATIONS TO HOLD LARGEST SHARE OF BIOSENSORS MARKET

- FIGURE 11 BIOSENSORS MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 12 RISING DEMAND FOR WEARABLE DEVICES TO DRIVE USE OF BIOSENSORS IN POC AND HOME DIAGNOSTIC APPLICATIONS

- FIGURE 13 WRISTWEAR APPLICATION TO HOLD LARGEST SHARE OF WEARABLE BIOSENSORS MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 14 US AND NON-WEARABLE DEVICES TO HOLD LARGEST SHARE OF NORTH AMERICAN BIOSENSORS MARKET IN 2025

- FIGURE 15 BIOSENSORS MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 16 BIOSENSORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 BIOSENSORS MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 18 BIOSENSORS MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 19 BIOSENSORS MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 20 BIOSENSORS MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 21 BIOSENSORS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 BIOSENSORS MARKET: ECOSYSTEM

- FIGURE 23 BIOSENSORS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 AVERAGE SELLING PRICE OF GLUCOSE MONITORING SYSTEMS, BY COMPANY, 2025 (USD)

- FIGURE 25 INDICATIVE SELLING PRICE TREND OF GLUCOSE MONITORING SYSTEM, BY REGION, 2021-2024

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2023-2025

- FIGURE 27 IMPACT OF GEN AI/AI ON BIOSENSORS MARKET

- FIGURE 28 BIOSENSORS MARKET: PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 29 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 901890, BY COUNTRY, 2020-2025 (USD THOUSAND)

- FIGURE 30 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 901890, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 31 BIOSENSORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 BIOSENSORS MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 33 BIOSENSORS MARKET: KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 34 SENSOR PATCHES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 MARKET FOR WEARABLE BIOSENSORS TO GROW AT HIGHER RATE DURING FORECAST PERIOD

- FIGURE 36 BIOSENSORS MARKET FOR ELECTROCHEMICAL TECHNOLOGY TO HOLD LARGEST SHARE IN 2030

- FIGURE 37 POC APPLICATIONS HELD LARGEST MARKET SHARE OF BIOSENSORS MARKET IN 2025

- FIGURE 38 NORTH AMERICA HOLDS LARGEST SHARE OF BIOSENSORS MARKET

- FIGURE 39 NORTH AMERICA: BIOSENSORS MARKET SNAPSHOT

- FIGURE 40 EUROPE: BIOSENSORS MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: BIOSENSORS MARKET SNAPSHOT

- FIGURE 42 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2022-2024

- FIGURE 43 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2024

- FIGURE 44 COMPANY VALUATION

- FIGURE 45 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 46 BIOSENSORS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 47 BIOSENSORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 BIOSENSORS MARKET: COMPANY FOOTPRINT

- FIGURE 49 BIOSENSORS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 ABBOTT LABORATORIES: COMPANY SNAPSHOT

- FIGURE 51 F. HOFFMANN-LA ROCHE LTD: COMPANY SNAPSHOT

- FIGURE 52 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 53 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT

- FIGURE 54 DUPONT: COMPANY SNAPSHOT

- FIGURE 55 DEXCOM, INC.: COMPANY SNAPSHOT

- FIGURE 56 MASIMO: COMPANY SNAPSHOT

- FIGURE 57 UNIVERSAL BIOSENSORS: COMPANY SNAPSHOT

The global biosensors market is expected to reach USD 34.51 billion in 2025 from USD 54.37 billion by 2030, growing at a CAGR of 9.5% during this period. Market growth is driven by the rising number of infectious diseases in developing countries, increasing demand for rapid diagnosis and efficient monitoring solutions, and technological advancements such as miniaturization, nanotechnology, microfluidics, and new product innovations. Additionally, the growing demand in urban areas, where diagnostic devices are easily accessible and simple to use, is further boosting market growth. Governments worldwide are launching initiatives to improve diagnostics and drug services, aiming to ensure availability and access to diagnostic testing while reducing patients' out-of-pocket expenses.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Type, Technology, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Embedded devices to account for the larger market share in 2030"

Embedded devices are commonly used in various applications such as point of care, home diagnostics, food and beverages, research labs, environmental monitoring, and biodefense. With the growth of the Internet of Things (IoT) devices, there has been a significant shift in connected healthcare applications. IoT enables real-time alerts, tracking, and monitoring, which allows for hands-on treatments, improved accuracy, timely interventions by doctors, and overall better patient care. Many healthcare facilities are beginning to adopt embedded solutions for medical devices with IoT capabilities to address the shortage of doctors in remote areas. These IoT-enabled medical devices help identify diseases and perform various tests to deliver accurate and reliable treatment to patients in remote locations. Consequently, the increasing use of embedded devices will boost the market growth of biosensors.

"Non-wearable (POC) biosensors to capture the largest share of the biosensors market throughout the forecast period"

The non-wearable biosensors market is a vibrant growth area driven by diverse applications, from handheld tools to lab systems and point-of-care diagnostics, vital in healthcare, environmental monitoring, and food safety. These biosensors, used in hospitals, research, food, and environmental sectors, enable real-time, on-site monitoring, helping address food quality challenges and meet safety standards. Market growth is fueled by increased awareness of environmental surveillance and the need for rapid devices for biodefense, food control, and pathogen detection.

"China to hold largest share in Asia Pacific of biosensors market in 2030"

The factors driving the biosensors market in China include rapid economic growth and an aging population, along with government efforts to improve healthcare services. Many multinational exporters and producers operating in China have adopted strategies such as acquisitions or strategic partnerships that support reliable domestic distribution and service infrastructure. In contrast, many domestic manufacturers, particularly those focused on export markets outside of China, lack strong distribution and service networks within the country. China is the most populous country in the world, and with the one-child policy, the elderly population is expected to increase in the future. As the population ages, there will likely be a significant rise in the incidence of various disorders, including heart diseases.

Extensive primary interviews were conducted with key industry experts in the biosensors market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below: The study includes insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The breakdown of the primary participants is as follows:

- By Company Type: Tier 1-40%, Tier 2-35%, and Tier 3-25%

- By Designation: C-level Executives-45%, Directors-35%, and Others-20%

- By Region: North America-30%, Europe-22%, Asia Pacific-40%, and RoW-8%

Abbott Laboratories (US), F. Hoffmann-La Roche Ltd (Switzerland), Medtronic (Ireland), Bio-Rad Laboratories, Inc. (US), DuPont (US), Biosensors International Group, Ltd. (Singapore), Dexcom, Inc. (US), Masimo (US), Nova Biomedical (US), Universal Biosensors (Australia), and ACON Laboratories (US) are some key players in the biosensors market.

The study includes an in-depth competitive analysis of these key players in the biosensors market, with their company profiles, recent developments, and key market strategies.

Study Coverage: This research report categorizes the biosensors market based on type (sensor patches, embedded devices), product (wearable, non-wearable), technology (electrochemical, optical, piezoelectric, thermal, nanomechanical), component (bioreceptor molecules, biological elements, transducers), application (POC, home diagnostics, research labs, environmental monitoring, food & beverages, biodefense), and region (North America, Europe, Asia Pacific and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the biosensors market and forecasts the same till 2030. The report also consists of leadership mapping and analysis of all the companies included in the biosensor ecosystem.

Key Benefits of Buying the Report The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall biosensors market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (emergence of nanotechnology-based biosensors, technological advancements, increasing use of biosensors to monitor glucose levels in individuals with diabetes, government initiatives to support diagnostics) restraints (reluctance to adopt new treatment practices, high costs of R&D), opportunities (emerging markets in developing countries, food & environmental monitoring applications, growth opportunities in wearables) and challenges (regulatory barriers and long certification & approval cycles) influencing the growth of the biosensors market

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the biosensors market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the biosensors market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the biosensors market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Abbott Laboratories (US), F. Hoffmann-La Roche Ltd (Switzerland), Medtronic (Ireland), Bio-Rad Laboratories, Inc. (US), DuPont (US), Biosensors International Group, Ltd. (Singapore), Dexcom, Inc. (US), Masimo (US), Nova Biomedical (US), Universal Biosensors (Australia), and ACON Laboratories (US) in the biosensors market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS & REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.3.4 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size (supply side)

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN BIOSENSORS MARKET

- 4.2 BIOSENSORS MARKET FOR WEARABLE DEVICES, BY TYPE

- 4.3 BIOSENSORS MARKET IN NORTH AMERICA, BY COUNTRY AND BY PRODUCT

- 4.4 BIOSENSORS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Emergence of nanotechnology-based biosensors

- 5.2.1.2 Technological advancements in recent years

- 5.2.1.3 Increasing use of biosensors to monitor glucose levels in individuals with diabetes

- 5.2.1.4 Supportive government initiatives for diagnostics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Reluctance to adopt new treatment practices

- 5.2.2.2 High cost of biosensor R&D

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging markets in developing countries

- 5.2.3.2 Rising food and environmental monitoring applications

- 5.2.3.3 Growth opportunities in wearables

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory barriers and long certification & approval cycles

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.6 PRICING ANALYSIS

- 5.6.1 INDICATIVE SELLING PRICE TREND OF GLUCOSE MONITORING SYSTEMS, BY PRODUCT TYPE, 2025

- 5.6.2 INDICATIVE SELLING PRICE OF GLUCOSE MONITORING SYSTEMS, BY COMPANY, 2025

- 5.6.3 INDICATIVE SELLING PRICE TREND OF GLUCOSE MONITORING SYSTEMS, BY REGION

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Multiplexed Biosensors

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 AI-Integrated Biosensing Platforms

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Drug Delivery Systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CASE STUDY 1: I-STAT SYSTEM HELPS PATIENTS AT ROCHDALE URGENT CARE CENTER

- 5.8.2 CASE STUDY 2: INTEGRATED HEALTH SOLUTION PROVIDED COST SAVINGS AND INCREASED EFFICIENCY

- 5.8.3 CASE STUDY 3: IMPROVING MOBILITY FOR PATIENTS AND REDUCING FALSE ALARMS FOR STAFF AT SUB-ACUTE CHILDREN'S HOSPITAL

- 5.8.4 CASE STUDY 4: ENABLING SEAMLESS DATA TRANSMISSION FROM PATIENT'S HOME

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 IMPACT OF GEN AI/AI ON BIOSENSORS MARKET

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 BARGAINING POWER OF SUPPLIERS

- 5.13.5 THREAT OF NEW ENTRANTS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 REGULATORY LANDSCAPE AND STANDARDS

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 STANDARDS

- 5.17 IMPACT OF 2025 US TARIFFS-BIOSENSORS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON APPLICATIONS

- 5.17.5.1 Point of Care (PoC)

- 5.17.5.2 Home Diagnostics

6 BIOSENSORS MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 BIORECEPTOR MOLECULES

- 6.2.1 ANTIBODIES AND PROTEINS ARE ALSO USED AS BIORECEPTOR MOLECULES IN BIOSENSORS

- 6.3 BIOLOGICAL ELEMENTS

- 6.3.1 BIOLOGICAL ELEMENTS ARE MATERIALS RELATED TO BIOMOLECULES

- 6.4 TRANSDUCERS

- 6.4.1 TRANSDUCER CONVERTS BIOCHEMICAL ACTIVITIES INTO ELECTRICAL SIGNALS

7 BIOSENSORS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 SENSOR PATCHES

- 7.2.1 WIDE-RANGE MONITORING OF VITAL SIGNS AND OTHER REQUIRED PARAMETERS

- 7.3 EMBEDDED DEVICES

- 7.3.1 BROAD-SPECTRUM DETECTION OF BIOLOGICAL ANALYTES, HIGH SUCCESS RATES IN MEDICAL LABS AND FOOD BIOANALYSES

8 BIOSENSORS MARKET, BY PRODUCT

- 8.1 INTRODUCTION

- 8.2 WEARABLE BIOSENSORS

- 8.2.1 WRISTWEAR

- 8.2.1.1 Real-time health and fitness tracking and monitoring

- 8.2.2 EYEWEAR

- 8.2.2.1 Smart glasses and smart lenses to have significant presence in market in coming years

- 8.2.3 FOOTWEAR

- 8.2.3.1 Help in monitoring kilometers run, calories burned, workout hours, blood pressure, and other fitness & health-related data

- 8.2.4 NECKWEAR

- 8.2.4.1 Trendy devices that can help monitor fitness and health

- 8.2.5 BODYWEAR

- 8.2.5.1 Have potential to equip clothes used for daily wear with smart capabilities, making detection of body movements possible

- 8.2.6 OTHER WEARABLE BIOSENSORS

- 8.2.1 WRISTWEAR

- 8.3 NON-WEARABLE (POC) BIOSENSORS

- 8.3.1 REAL-TIME ON-SITE MONITORING OF PRODUCTION PROCESSES

9 BIOSENSORS MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 ELECTROCHEMICAL BIOSENSORS

- 9.2.1 AMPEROMETRIC SENSORS

- 9.2.1.1 Blood glucose sensors

- 9.2.1.1.1 Suitable for medical devices for monitoring blood glucose

- 9.2.1.1 Blood glucose sensors

- 9.2.2 POTENTIOMETRIC SENSORS

- 9.2.2.1 Immunosensors

- 9.2.2.1.1 Label-free detection and quantification of immune complex

- 9.2.2.1 Immunosensors

- 9.2.3 CONDUCTOMETRIC SENSORS

- 9.2.3.1 Studies in enzymatic reactions and practical applications such as drug and pollutant detection to propel market

- 9.2.1 AMPEROMETRIC SENSORS

- 9.3 OPTICAL BIOSENSORS

- 9.3.1 SPR BIOSENSORS

- 9.3.1.1 Measure interactions in real-time with high sensitivity and without needing labels

- 9.3.2 COLORIMETRIC BIOSENSORS

- 9.3.2.1 Used in various applications, such as detection and identification of virulence activities

- 9.3.3 FLUORESCENCE BIOSENSORS

- 9.3.3.1 Provide better sensitivities and specificities, as well as ease of labeling, while detection

- 9.3.1 SPR BIOSENSORS

- 9.4 PIEZOELECTRIC BIOSENSORS

- 9.4.1 ACOUSTIC BIOSENSORS

- 9.4.1.1 Monitor changes in physical properties of acoustic waves in response to measurand

- 9.4.2 MICROCANTILEVER BIOSENSORS

- 9.4.2.1 Promising tool for detecting biomolecular interactions with improved accuracy

- 9.4.1 ACOUSTIC BIOSENSORS

- 9.5 THERMAL BIOSENSORS

- 9.5.1 STABILITY, NO NEED FOR FREQUENT RECALIBRATION, AND INSENSITIVITY TO OPTICAL AND ELECTROCHEMICAL PROPERTIES SUPPORT ADOPTION

- 9.6 NANOMECHANICAL BIOSENSORS

- 9.6.1 RAPID, SENSITIVE, AND SELECTIVE DETECTION OF BIOLOGICAL AND BIOCHEMICAL ENTITIES

10 BIOSENSORS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 POC

- 10.2.1 GLUCOSE MONITORING

- 10.2.1.1 Rising prevalence of diabetes, advancements in self-monitoring, and growing awareness about PoC testing

- 10.2.2 CARDIAC MARKER DETECTION

- 10.2.2.1 Sedentary urban lifestyles driving prevalence of cardiovascular diseases

- 10.2.3 INFECTIOUS DISEASE DETECTION

- 10.2.3.1 Detection of toxins, bacteria, and viruses in physiological and environmental matrices

- 10.2.4 COAGULATION MONITORING

- 10.2.4.1 Growing use of anticoagulant therapy, coupled with adoption of self-testing kits for use at home

- 10.2.5 PREGNANCY TESTING

- 10.2.5.1 Growing preference of women for confidentiality and accessibility of test results

- 10.2.6 BLOOD GAS & ELECTROLYTE DETECTION

- 10.2.6.1 Growing global aging population to drive market

- 10.2.7 TUMOR/CANCER MARKER DETECTION

- 10.2.7.1 Increasing number of people suffering from cancer and growth in investments in cancer research

- 10.2.8 URINALYSIS TESTING

- 10.2.8.1 Rising number of urinary tract infections among individuals

- 10.2.9 CHOLESTEROL TESTING

- 10.2.9.1 Increasing prevalence of CVDs due to aging and obese population

- 10.2.1 GLUCOSE MONITORING

- 10.3 HOME DIAGNOSTICS

- 10.3.1 GLUCOSE MONITORING

- 10.3.1.1 Growing preference for self-monitoring blood glucose devices

- 10.3.2 PREGNANCY TESTING

- 10.3.2.1 Need for portable and user-friendly pregnancy testing devices

- 10.3.3 CHOLESTEROL TESTING

- 10.3.3.1 Growth of diseases due to increased cholesterol levels in individuals

- 10.3.1 GLUCOSE MONITORING

- 10.4 RESEARCH LABS

- 10.4.1 NEED FOR BIOSENSOR-BASED PRODUCT DEVELOPMENT FOR EARLY MONITORING OF DISEASES

- 10.5 ENVIRONMENTAL MONITORING

- 10.5.1 DETECTION OF CONTAMINANTS IN COMPLEX MATRICES WITH SEVERAL ADVANTAGES TO ENHANCE MARKET GROWTH

- 10.6 FOOD & BEVERAGES

- 10.6.1 BIOSENSORS USED FOR PATHOGEN DETECTION TO HELP MEET STRINGENT FOOD STANDARDS

- 10.7 BIODEFENSE

- 10.7.1 USE OF BIOSENSORS TO DETECT MICROBIAL PATHOGENS DURING BIOLOGICAL WARFARE

11 BIOSENSORS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Availability of and interest in biosensor-based POC to drive market

- 11.2.2 CANADA

- 11.2.2.1 Increasing government support to propel market growth

- 11.2.3 MEXICO

- 11.2.3.1 Use of biosensors for detecting cardiovascular disorders to propel market growth in Mexico

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Monitoring chronic diseases to escalate biosensors market growth

- 11.3.2 FRANCE

- 11.3.2.1 Technological advancements in healthcare systems to drive growth

- 11.3.3 UK

- 11.3.3.1 Rising cardiac diseases and aging population to drive market

- 11.3.4 ITALY

- 11.3.4.1 Growing private sector results in increasing demand for biosensors for various applications

- 11.3.5 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Government initiatives for enhancing healthcare products and services to propel market growth

- 11.4.2 JAPAN

- 11.4.2.1 Increase in standard of living, rising health awareness, and surge in aging population to support market growth

- 11.4.3 INDIA

- 11.4.3.1 Growing population in India to escalate demand for biosensors in healthcare

- 11.4.4 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 REST OF THE WORLD

- 11.5.1 SOUTH AMERICA

- 11.5.1.1 Growing environment-related concerns have boosted adoption of biosensors for environmental monitoring

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Government and private support to drive adoption of POC testing kits will favor demand for biosensors

- 11.5.2.2 GCC Countries

- 11.5.2.2.1 Saudi Arabia

- 11.5.2.2.2 UAE

- 11.5.2.2.3 Rest of GCC Countries

- 11.5.2.3 Rest of Middle East

- 11.5.3 AFRICA

- 11.5.3.1 Increasing penetration in consumer electronics and medical devices

- 11.5.1 SOUTH AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Product footprint

- 12.7.5.4 Type footprint

- 12.7.5.5 Technology footprint

- 12.7.5.6 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES, APPROVALS, AND ENHANCEMENTS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ABBOTT LABORATORIES

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product enhancements

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 F. HOFFMANN-LA ROCHE LTD

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 MEDTRONIC

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product approvals

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 BIO-RAD LABORATORIES, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths/Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses/Competitive threats

- 13.1.5 DUPONT

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Expansion

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 BIOSENSORS INTERNATIONAL GROUP, LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product approvals

- 13.1.7 CYTIVA

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 DEXCOM, INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.9 LIFESCAN IP HOLDINGS, LLC

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 MASIMO

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.11 NOVA BIOMEDICAL

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.12 UNIVERSAL BIOSENSORS

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.1 ABBOTT LABORATORIES

- 13.2 OTHER PLAYERS

- 13.2.1 ACON LABORATORIES

- 13.2.2 CONDUCTIVE TECHNOLOGIES

- 13.2.3 EASTPRINT INCORPORATED

- 13.2.4 IST AG

- 13.2.5 LIFESIGNALS

- 13.2.6 NEUROSKY

- 13.2.7 PINNACLE TECHNOLOGY

- 13.2.8 SD BIOSENSOR, INC.

- 13.2.9 VITALCONNECT

- 13.2.10 XSENSIO

- 13.2.11 ZIMMER AND PEACOCK

- 13.2.12 PARAGRAF LIMITED

- 13.2.13 DYNAMIC BIOSENSORS

- 13.2.14 LINEXENS

- 13.2.15 BIOLINQ INCORPORATED

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS