|

|

市場調査レポート

商品コード

1769081

収益サイクル管理の世界市場:ソリューションタイプ別、オファリング別、デリバリーモード別、エンドユーザー別、地域別 - 2030年までの予測Revenue Cycle Management Market by Offering, Delivery, End User, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 収益サイクル管理の世界市場:ソリューションタイプ別、オファリング別、デリバリーモード別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月07日

発行: MarketsandMarkets

ページ情報: 英文 382 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の収益サイクル管理の市場規模は、2025年の611億1,000万米ドルから2030年には1,053億5,000万米ドルに達すると予測され、予測期間中のCAGRは11.5%になるとみられています。

RCM市場は、進化するコーディング規制と分類基準の影響を大きく受け続けています。例えば、CMSは2024年10月1日から、診断と手技全体で395の新規コード、252の削除、13の改訂を含む2025年度ICD-10の大規模な更新を実施しました。このような頻繁で大規模な更新は、コーディングの複雑さを管理し、請求の正確性を維持するために、自動化されたRCMプラットフォームへの依存度を高めています。しかし、新興地域では、訓練を受けたHCITの人材がかなり不足しており、レガシーシステムのアップグレードに財政的な制約があるため、大きな課題が残っています。このようなスキルやインフラのギャップがRCMソリューションの展開を妨げ、市場全体の成長をやや抑制する可能性があります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | ソリューションタイプ別、オファリング別、デリバリーモード別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

収益サイクル管理市場は、オファリング別に、製品提供とアウトソーシングサービスに分けられます。2024年の収益サイクル管理市場では、アウトソーシングサービスが大きなシェアを占めています。このセグメントの市場シェアが大きく、急成長しているのは、主にITインフラの需要と熟練したヘルスケアIT人材の不足によるものです。さらに、医療費請求の監査やコンプライアンス報告の量が増加しているため、社内のチームでは追いつくことが難しくなっており、多くの医療機関が専門のベンダーと提携するようになっています。アウトソーシングはまた、医療機関が一般登録やインフルエンザのシーズンなど、請求量の季節的変動に対応する上でも役立ちます。さらに、サービスプロバイダーは現在、コーディング、売掛金管理、分析を統合した収益サイクル管理ソリューションを提供するようになってきています。このアプローチは、業務の分断を減らし、収益プロセスに対する包括的な可視性を提供します。

製品別では、収益サイクル管理市場は患者アクセスソリューション、中間収益サイクルソリューション、バックエンド収益サイクルソリューションに区分されます。バックエンド収益サイクルソリューション分野は、支払者の償還モデルが複雑化し、高度な解決戦略を必要とする否認請求の量が増加しているため、2024年に最大のシェアを占めると予想されます。回収、支払計上、不服申し立て処理における自動化の利用が増加しているため、この分野での採用が拡大しています。さらに、売掛金管理に予測分析を取り入れることで、プロバイダーはリスクの高い口座を優先し、収益創出を迅速化することができます。

世界の収益サイクル管理市場は5つの主要地域(北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ)に区分されます。アジア太平洋は予測期間中に最も高い成長を記録すると予想されています。ヘルスケアにおける収益サイクル管理(RCM)システムの成長を後押ししている要因はいくつかあります。病院請求システムの急速なデジタル変革や、民間ヘルスケアプロバイダーによるクラウドベースのRCMツールへの投資の増加は、大きな貢献要因となっています。また、インドのAyushman Bharat Digital Missionのような政府主導のヘルスケアデジタル化プログラムは、RCMプラットフォームの採用を促進しています。さらに、フィリピンやマレーシアのような地域にRCMのアウトソーシング拠点が出現していることも、市場の拡大を後押ししています。

当レポートでは、世界の収益サイクル管理市場について調査し、ソリューションタイプ別、オファリング別、デリバリーモード別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- 業界動向

- 技術分析

- エコシステム分析

- バリューチェーン分析

- ポーターのファイブフォース分析

- 規制分析

- 特許分析

- ケーススタディ分析

- 主要な利害関係者と購入基準

- 2025年~2026年の主な会議とイベント

- 価格分析

- 2025年の米国関税が収益サイクル管理市場に与える影響

第6章 収益サイクル管理市場(ソリューションタイプ別)

- イントロダクション

- エンドツーエンドソリューション

- ニッチ/ポイントソリューション

第7章 収益サイクル管理市場(オファリング別)

- イントロダクション

- 製品

- アウトソーシングサービス

第8章 収益サイクル管理市場(デリバリーモード別)

- イントロダクション

- オンプレミスソリューション

- クラウドベースのソリューション

第9章 収益サイクル管理市場(エンドユーザー別)

- イントロダクション

- 医療機関

- ヘルスケア支払者

第10章 収益サイクル管理市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 日本

- 中国

- インド

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 市場ランキング分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/ソフトウェア比較

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- OPTUM, INC.

- ORACLE

- MCKESSON CORPORATION

- EPIC SYSTEMS CORPORATION

- SOLVENTUM

- R1 RCM INC.

- EXPERIAN INFORMATION SOLUTIONS, INC.

- CONIFER HEALTH SOLUTIONS

- VERADIGM LLC

- ECLINICALWORKS

- COGNIZANT

- ATHENAHEALTH, INC.

- THE SSI GROUP, LLC

- HURON CONSULTING GROUP INC.

- ADVANCEDMD, INC.

- GEBBS

- TRUBRIDGE

- CARECLOUD, INC.

- MEDICAL INFORMATION TECHNOLOGY, INC.

- MEDHOST

- その他の企業

- ADVANTEDGE HEALTHCARE SOLUTIONS(HEALTH PRIME INTERNATIONAL)

- FINTHRIVE

- PLUTUS HEALTH

- OMEGA HEALTHCARE MANAGEMENT SERVICES

- VEE HEALTHTEK, INC.

第13章 付録

List of Tables

- TABLE 1 RISK ASSESSMENT: REVENUE CYCLE MANAGEMENT MARKET

- TABLE 2 REVENUE CYCLE MANAGEMENT MARKET: IMPACT ANALYSIS

- TABLE 3 TOP 30 HEALTHCARE DATA BREACHES IN US (2011-2024)

- TABLE 4 REVENUE CYCLE MANAGEMENT MARKET: ROLE IN ECOSYSTEM

- TABLE 5 REVENUE CYCLE MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REVENUE CYCLE MANAGEMENT MARKET: REGULATORY STANDARDS

- TABLE 11 JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES FOR REVENUE CYCLE MANAGEMENT

- TABLE 12 REVENUE CYCLE MANAGEMENT MARKET: LIST OF PATENTS/PATENT APPLICATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 14 KEY BUYING CRITERIA FOR REVENUE CYCLE MANAGEMENT COMPONENTS

- TABLE 15 REVENUE CYCLE MANAGEMENT MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 18 REVENUE CYCLE MANAGEMENT MARKET FOR END-TO-END SOLUTIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 19 REVENUE CYCLE MANAGEMENT MARKET FOR NICHE/POINT SOLUTIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 20 REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 21 PRODUCTS OFFERED BY KEY MARKET PLAYERS

- TABLE 22 REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 23 PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 24 PATIENT ACCESS SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 25 ELIGIBILITY VERIFICATION SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 26 ELIGIBILITY VERIFICATION SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 27 PRE-CERTIFICATION & AUTHORIZATION SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 28 PRE-CERTIFICATION & AUTHORIZATION SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 OTHER PATIENT ACCESS SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 30 OTHER PATIENT ACCESS SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 32 MID-REVENUE CYCLE SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 CLINICAL CODING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 34 CLINICAL CODING SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 CLINICAL DOCUMENTATION IMPROVEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 36 CLINICAL DOCUMENTATION IMPROVEMENT SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 OTHER MID-REVENUE CYCLE SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 38 OTHER MID-REVENUE CYCLE SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 40 BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 CLAIMS PROCESSING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 42 CLAIMS PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 DENIAL MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 44 DENIAL MANAGEMENT SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 OTHER BACK-END REVENUE CYCLE SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 46 OTHER BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 48 REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 PATIENT ACCESS OUTSOURCING SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 50 PATIENT ACCESS OUTSOURCING SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 MID-REVENUE CYCLE OUTSOURCING SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 52 MID-REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 BACK-END REVENUE CYCLE OUTSOURCING SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 54 BACK-END REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 56 REVENUE CYCLE MANAGEMENT MARKET FOR ON-PREMISE SOLUTIONS, BY REGION, 2023-2030 (USD MILLION)

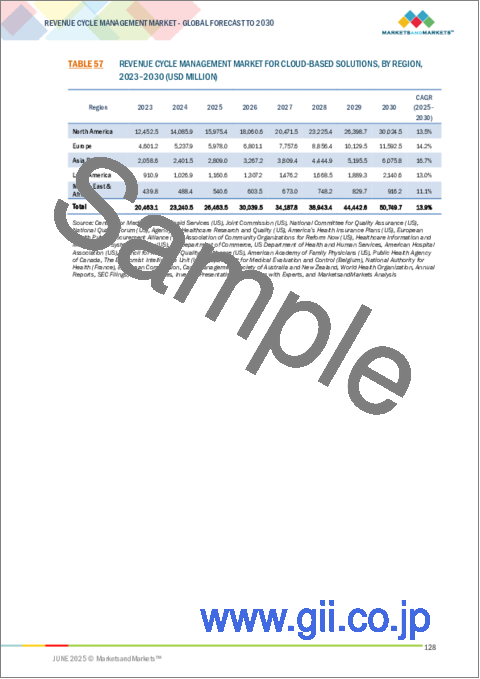

- TABLE 57 REVENUE CYCLE MANAGEMENT MARKET FOR CLOUD-BASED SOLUTIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 59 REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 60 REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 62 REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 REVENUE CYCLE MANAGEMENT MARKET FOR HOSPITALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 REVENUE CYCLE MANAGEMENT MARKET FOR OTHER INPATIENT FACILITIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 66 REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 67 REVENUE CYCLE MANAGEMENT MARKET FOR PHYSICIANS' PRACTICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 68 REVENUE CYCLE MANAGEMENT MARKET FOR AMBULATORY SURGICAL CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 69 REVENUE CYCLE MANAGEMENT MARKET FOR HOSPITAL OUTPATIENT FACILITIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 70 REVENUE CYCLE MANAGEMENT MARKET FOR DIAGNOSTIC & IMAGING CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 71 REVENUE CYCLE MANAGEMENT MARKET FOR OTHER OUTPATIENT FACILITIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 72 REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PAYERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 73 REVENUE CYCLE MANAGEMENT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 87 US: KEY MACROINDICATORS

- TABLE 88 US: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 89 US: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 90 US: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 US: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 92 US: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 93 US: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 94 US: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 US: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 96 US: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 97 US: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 US: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 US: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 CANADA: KEY MACROINDICATORS

- TABLE 101 CANADA: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 102 CANADA: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 103 CANADA: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 CANADA: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 CANADA: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 CANADA: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 CANADA: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 CANADA: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 109 CANADA: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 110 CANADA: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 CANADA: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 CANADA: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 115 EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 116 EUROPE: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 EUROPE: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 EUROPE: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 EUROPE: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 EUROPE: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 122 EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 123 EUROPE: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 EUROPE: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 EUROPE: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 GERMANY: KEY MACROINDICATORS

- TABLE 127 GERMANY: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 128 GERMANY: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 129 GERMANY: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 GERMANY: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 GERMANY: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 GERMANY: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 GERMANY: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 GERMANY: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 135 GERMANY: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 136 GERMANY: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 137 GERMANY: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 GERMANY: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 FRANCE: KEY MACROINDICATORS

- TABLE 140 FRANCE: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 141 FRANCE: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 142 FRANCE: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 143 FRANCE: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 FRANCE: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 FRANCE: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 FRANCE: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 FRANCE: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 148 FRANCE: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 149 FRANCE: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 FRANCE: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 FRANCE: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 UK: KEY MACROINDICATORS

- TABLE 153 UK: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 154 UK: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 155 UK: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 UK: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 UK: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 UK: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 UK: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 UK: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 161 UK: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 162 UK: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 UK: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 UK: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 ITALY: KEY MACROINDICATORS

- TABLE 166 ITALY: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 167 ITALY: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 168 ITALY: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 ITALY: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 ITALY: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 ITALY: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 ITALY: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 ITALY: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 174 ITALY: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 175 ITALY: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 ITALY: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 ITALY: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 SPAIN: KEY MACROINDICATORS

- TABLE 179 SPAIN: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 180 SPAIN: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 181 SPAIN: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 SPAIN: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 SPAIN: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 SPAIN: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 SPAIN: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 SPAIN: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 187 SPAIN: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 188 SPAIN: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 SPAIN: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 SPAIN: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 REST OF EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 192 REST OF EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 193 REST OF EUROPE: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 REST OF EUROPE: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 REST OF EUROPE: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 REST OF EUROPE: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 REST OF EUROPE: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 REST OF EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 199 REST OF EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 200 REST OF EUROPE: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 REST OF EUROPE: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 REST OF EUROPE: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 204 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 205 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 206 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 ASIA PACIFIC: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 ASIA PACIFIC: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 212 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 213 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 JAPAN: KEY MACROINDICATORS

- TABLE 217 JAPAN: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 218 JAPAN: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 219 JAPAN: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 JAPAN: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 JAPAN: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 JAPAN: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 JAPAN: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 JAPAN: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 225 JAPAN: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 226 JAPAN: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 227 JAPAN: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 228 JAPAN: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 229 CHINA: KEY MACROINDICATORS

- TABLE 230 CHINA: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 231 CHINA: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 232 CHINA: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 233 CHINA: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 CHINA: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 235 CHINA: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 236 CHINA: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 237 CHINA: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 238 CHINA: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 239 CHINA: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 CHINA: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 241 CHINA: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 242 INDIA: KEY MACROINDICATORS

- TABLE 243 INDIA: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 244 INDIA: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 245 INDIA: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 246 INDIA: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 247 INDIA: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 248 INDIA: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 249 INDIA: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 INDIA: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 251 INDIA: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 252 INDIA: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 253 INDIA: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 254 INDIA: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 255 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 256 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 257 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 258 REST OF ASIA PACIFIC: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 259 REST OF ASIA PACIFIC: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 260 REST OF ASIA PACIFIC: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 261 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 262 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 263 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 264 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 265 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 266 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 267 LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 268 LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 269 LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 270 LATIN AMERICA: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 271 LATIN AMERICA: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 272 LATIN AMERICA: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 273 LATIN AMERICA: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 274 LATIN AMERICA: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 275 LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 276 LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 277 LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 278 LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 279 LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 280 BRAZIL: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 281 BRAZIL: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 282 BRAZIL: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 283 BRAZIL: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 284 BRAZIL: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 285 BRAZIL: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 286 BRAZIL: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 287 BRAZIL: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 288 BRAZIL: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 289 BRAZIL: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 290 BRAZIL: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 291 BRAZIL: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 292 MEXICO: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 293 MEXICO: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 294 MEXICO: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 295 MEXICO: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 296 MEXICO: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 297 MEXICO: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 298 MEXICO: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 299 MEXICO: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 300 MEXICO: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 301 MEXICO: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 302 MEXICO: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 303 MEXICO: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 304 REST OF LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 305 REST OF LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 306 REST OF LATIN AMERICA: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 307 REST OF LATIN AMERICA: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 308 REST OF LATIN AMERICA: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 309 REST OF LATIN AMERICA: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 310 REST OF LATIN AMERICA: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 311 REST OF LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 312 REST OF LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 313 REST OF LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 314 REST OF LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 315 REST OF LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 316 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 317 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 318 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 319 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 320 MIDDLE EAST & AFRICA: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 321 MIDDLE EAST & AFRICA: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 322 MIDDLE EAST & AFRICA: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 323 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 324 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 325 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 326 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 327 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 328 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 329 GCC COUNTRIES: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 330 GCC COUNTRIES: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 331 GCC COUNTRIES: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 332 GCC COUNTRIES: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 333 GCC COUNTRIES: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 334 GCC COUNTRIES: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 335 GCC COUNTRIES: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 336 GCC COUNTRIES: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 337 GCC COUNTRIES: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 338 GCC COUNTRIES: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 339 GCC COUNTRIES: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 340 GCC COUNTRIES: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 341 REST OF MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2023-2030 (USD MILLION)

- TABLE 342 REST OF MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 343 REST OF MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 344 REST OF MIDDLE EAST & AFRICA: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 345 REST OF MIDDLE EAST & AFRICA: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 346 REST OF MIDDLE EAST & AFRICA: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 347 REST OF MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT OUTSOURCING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 348 REST OF MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 349 REST OF MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 350 REST OF MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 351 REST OF MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 352 REST OF MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 353 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN REVENUE CYCLE MANAGEMENT MARKET, JANUARY 2022-MAY 2025

- TABLE 354 REVENUE CYCLE MANAGEMENT MARKET: DEGREE OF COMPETITION

- TABLE 355 REVENUE CYCLE MANAGEMENT MARKET: REGION FOOTPRINT

- TABLE 356 REVENUE CYCLE MANAGEMENT MARKET: SOLUTION TYPE FOOTPRINT

- TABLE 357 REVENUE CYCLE MANAGEMENT MARKET: OFFERING FOOTPRINT

- TABLE 358 REVENUE CYCLE MANAGEMENT MARKET: END-USER FOOTPRINT

- TABLE 359 REVENUE CYCLE MANAGEMENT MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 360 REVENUE CYCLE MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF SMES/STARTUPS, BY REGION

- TABLE 361 REVENUE CYCLE MANAGEMENT MARKET: PRODUCT/SERVICE LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 362 REVENUE CYCLE MANAGEMENT MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 363 REVENUE CYCLE MANAGEMENT MARKET: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 364 REVENUE CYCLE MANAGEMENT MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 365 OPTUM, INC.: COMPANY OVERVIEW

- TABLE 366 OPTUM, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 367 OPTUM, INC.: PRODUCT/SERVICE LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 368 OPTUM, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 369 ORACLE: COMPANY OVERVIEW

- TABLE 370 ORACLE: PRODUCTS & SERVICES OFFERED

- TABLE 371 ORACLE: PRODUCT/SERVICE LAUNCHES & UPGRADES, JANUARY 2022-MAY 2025

- TABLE 372 ORACLE: DEALS, JANUARY 2022-MAY 2025

- TABLE 373 MCKESSON CORPORATION: COMPANY OVERVIEW

- TABLE 374 MCKESSON CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 375 MCKESSON CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 376 EPIC SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 377 EPIC SYSTEMS CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 378 EPIC SYSTEMS CORPORATION: PRODUCT/SERVICE LAUNCHES & UPGRADES, JANUARY 2022-MAY 2025

- TABLE 379 EPIC SYSTEMS CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 380 SOLVENTUM: COMPANY OVERVIEW

- TABLE 381 SOLVENTUM: PRODUCTS & SERVICES OFFERED

- TABLE 382 SOLVENTUM: DEALS, JANUARY 2022-MAY 2025

- TABLE 383 R1 RCM INC.: COMPANY OVERVIEW

- TABLE 384 R1 RCM INC.: PRODUCTS & SERVICES OFFERED

- TABLE 385 R1 RCM INC.: PRODUCT/SERVICE LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 386 R1 RCM INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 387 R1 RCM INC.: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 388 EXPERIAN INFORMATION SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 389 EXPERIAN INFORMATION SOLUTIONS, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 390 EXPERIAN INFORMATION SOLUTIONS, INC.: PRODUCT/SERVICE LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 391 EXPERIAN INFORMATION SOLUTIONS, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 392 CONIFER HEALTH SOLUTIONS: COMPANY OVERVIEW

- TABLE 393 CONIFER HEALTH SOLUTIONS: PRODUCTS & SERVICES OFFERED

- TABLE 394 CONIFER HEALTH SOLUTIONS: DEALS, JANUARY 2022-MAY 2025

- TABLE 395 VERADIGM LLC: COMPANY OVERVIEW

- TABLE 396 VERADIGM LLC: PRODUCTS & SERVICES OFFERED

- TABLE 397 VERADIGM LLC: PRODUCT/SERVICE LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 398 VERADIGM LLC: DEALS, JANUARY 2022-MAY 2025

- TABLE 399 ECLINICALWORKS: COMPANY OVERVIEW

- TABLE 400 ECLINICALWORKS: PRODUCTS & SERVICES OFFERED

- TABLE 401 ECLINICALWORKS: DEALS, JANUARY 2021-FEBRUARY 2025

- TABLE 402 COGNIZANT: COMPANY OVERVIEW

- TABLE 403 COGNIZANT: PRODUCTS & SERVICES OFFERED

- TABLE 404 COGNIZANT: PRODUCT/SERVICE LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 405 COGNIZANT: DEALS, JANUARY 2022-MAY 2025

- TABLE 406 ATHENAHEALTH, INC.: COMPANY OVERVIEW

- TABLE 407 ATHENAHEALTH, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 408 ATHENAHEALTH, INC.: PRODUCT/SERVICE LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 409 ATHENAHEALTH, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 410 ATHENAHEALTH, INC.: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 411 THE SSI GROUP, LLC: COMPANY OVERVIEW

- TABLE 412 THE SSI GROUP, LLC: PRODUCTS & SERVICES OFFERED

- TABLE 413 THE SSI GROUP, LLC: PRODUCT/SERVICE LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 414 HURON CONSULTING GROUP INC.: COMPANY OVERVIEW

- TABLE 415 HURON CONSULTING GROUP INC.: PRODUCTS & SERVICES OFFERED

- TABLE 416 ADVANCEDMD, INC.: COMPANY OVERVIEW

- TABLE 417 ADVANCEDMD, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 418 ADVANCEDMD, INC.: PRODUCT/SERVICE UPGRADES, JANUARY 2022-MAY 2025

- TABLE 419 ADVANCEDMD, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 420 GEBBS: COMPANY OVERVIEW

- TABLE 421 GEBBS: PRODUCTS & SERVICES OFFERED

- TABLE 422 GEBBS: DEALS, JANUARY 2022-MAY 2025

- TABLE 423 TRUBRIDGE: COMPANY OVERVIEW

- TABLE 424 TRUBRIDGE: PRODUCTS & SERVICES OFFERED

- TABLE 425 TRUBRIDGE: DEALS, JANUARY 2022-MAY 2025

- TABLE 426 CARECLOUD, INC.: COMPANY OVERVIEW

- TABLE 427 CARECLOUD, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 428 CARECLOUD, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 429 MEDICAL INFORMATION TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 430 MEDICAL INFORMATION TECHNOLOGY, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 431 MEDICAL INFORMATION TECHNOLOGY, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 432 MEDHOST: COMPANY OVERVIEW

- TABLE 433 MEDHOST: PRODUCTS & SERVICES OFFERED

- TABLE 434 MEDHOST: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 435 MEDHOST: DEALS, JANUARY 2022-MAY 2025

- TABLE 436 MEDHOST.: EXPANSIONS, JANUARY 2021-FEBRUARY 2025

List of Figures

- FIGURE 1 REVENUE CYCLE MANAGEMENT MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 REGIONAL SNAPSHOT

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 PRIMARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 MARKET SIZE ESTIMATION

- FIGURE 7 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 8 CAGR PROJECTIONS: OVERALL REVENUE CYCLE MANAGEMENT MARKET

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 REVENUE CYCLE MANAGEMENT MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 15 GROWING REGULATORY REQUIREMENTS AND GOVERNMENT INITIATIVES TO DRIVE MARKET

- FIGURE 16 INDIA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 18 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 19 REVENUE CYCLE MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 HEALTHCARE SECURITY BREACHES OF 500+ RECORDS IN US, 2009-2024

- FIGURE 21 MEDIAN HEALTHCARE DATA BREACH SIZE BY YEAR IN US, 2009-2024

- FIGURE 22 INDIVIDUALS AFFECTED BY HEALTHCARE SECURITY BREACHES IN US, 2009-2023

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 REVENUE CYCLE MANAGEMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 REVENUE CYCLE MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 REVENUE CYCLE MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR REVENUE CYCLE MANAGEMENT PATENTS (JANUARY 2015-MAY 2025)

- FIGURE 28 MAJOR PATENTS IN REVENUE CYCLE MANAGEMENT MARKET (JANUARY 2015-MAY 2025)

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 30 KEY BUYING CRITERIA FOR REVENUE CYCLE MANAGEMENT COMPONENTS

- FIGURE 31 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET SNAPSHOT

- FIGURE 33 REVENUE ANALYSIS OF KEY PLAYERS IN REVENUE CYCLE MANAGEMENT MARKET, 2020-2024

- FIGURE 34 MARKET SHARE ANALYSIS OF KEY PLAYERS IN REVENUE CYCLE MANAGEMENT MARKET, 2024

- FIGURE 35 REVENUE CYCLE MANAGEMENT: KEY PLAYERS, 2024

- FIGURE 36 REVENUE CYCLE MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 37 REVENUE CYCLE MANAGEMENT MARKET: COMPANY FOOTPRINT

- FIGURE 38 REVENUE CYCLE MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 39 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS, 2025

- FIGURE 40 EV/EBITDA OF KEY VENDORS, 2025

- FIGURE 41 REVENUE CYCLE MANAGEMENT MARKET: BRAND/SOFTWARE COMPARISON

- FIGURE 42 OPTUM, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 43 ORACLE: COMPANY SNAPSHOT (2023)

- FIGURE 44 MCKESSON CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 45 SOLVENTUM: COMPANY SNAPSHOT (2024)

- FIGURE 46 EXPERIAN INFORMATION SOLUTIONS, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 47 VERADIGM LLC: COMPANY SNAPSHOT (2022)

- FIGURE 48 COGNIZANT: COMPANY SNAPSHOT (2024)

- FIGURE 49 HURON CONSULTING GROUP INC.: COMPANY SNAPSHOT (2024)

- FIGURE 50 TRUBRIDGE: COMPANY SNAPSHOT (2024)

- FIGURE 51 CARECLOUD, INC.: COMPANY SNAPSHOT (2024)

The global revenue cycle management market is projected to reach USD 105.35 billion by 2030 from USD 61.11 billion in 2025, at a CAGR of 11.5% during the forecast period. The RCM market continues to be heavily influenced by evolving coding regulations and classification standards. For instance, CMS implemented major FY 2025 ICD-10 updates, including 395 new codes, 252 deletions, and 13 revisions, effective October 1, 2024, across diagnoses and procedures. These frequent, large-scale updates are driving greater reliance on automated RCM platforms to manage coding complexity and maintain billing accuracy. However, a significant challenge persists in emerging regions, where there is a considerable shortage of trained HCIT personnel and financial limitations on upgrading legacy systems. This gap in skills and infrastructure may hinder the deployment of RCM solutions, which could slightly temper overall market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Offering, Solution Type, Delivery Mode, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"The outsourcing services segment is expected to be the fastest-growing segment in the revenue cycle management market during the forecast period."

Based on offering, the revenue cycle management market has been divided into product offerings and outsourcing services. Outsourcing services commanded the larger share of the revenue cycle management market in 2024. This segment's significant market share and rapid growth are primarily due to the demand for IT infrastructure and the shortage of skilled healthcare IT personnel. Additionally, the increasing volume of medical billing audits and compliance reporting has made it challenging for in-house teams to keep up, leading many providers to partner with specialized vendors. Outsourcing also assists healthcare organizations in managing seasonal fluctuations in billing volumes, such as during open enrollment or flu season. Moreover, service providers are now increasingly offering bundled revenue cycle management solutions that integrate coding, accounts receivable management, and analytics. This approach reduces operational fragmentation and provides comprehensive visibility into revenue processes.

"The back-end revenue cycle segment is estimated to hold the largest share of the revenue cycle management market in 2024."

Based on product, the revenue cycle management market is segmented into patient access solutions, mid-revenue cycle solutions, and back-end revenue cycle solutions. The back-end revenue cycle solutions segment is expected to hold the largest share in 2024 due to the growing complexity of payer reimbursement models and the increasing volume of denied claims requiring advanced resolution strategies. The increased use of automation in collections, payment posting, and appeals processing has led to greater adoption in this area. Furthermore, the incorporation of predictive analytics into accounts receivable management allows providers to prioritize high-risk accounts and expedite revenue generation.

"The Asia Pacific region is expected to register the highest growth rate in the revenue cycle management market during the forecast period."

The global revenue cycle management market is segmented into five major regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific is expected to register the highest growth during the forecast period. Several factors are driving the growth of revenue cycle management (RCM) systems in healthcare. The rapid digital transformation of hospital billing systems and increasing investments by private healthcare providers in cloud-based RCM tools are significant contributors. Additionally, government-led healthcare digitization programs, such as India's Ayushman Bharat Digital Mission, are promoting the adoption of RCM platforms. Furthermore, the emergence of regional RCM outsourcing hubs in countries like the Philippines and Malaysia also fuels market expansion.

The breakdown of primary participants is as mentioned below:

- By Company Type: Tier 1 (41%), Tier 2 (31%), and Tier 3 (28%)

- By Designation: C-level Executives (44%), Directors (31%), and Others (25%)

- By Region: North America (45%), Europe (28%), Asia Pacific (20%), Latin America (4%), and the Middle East & Africa (3%)

Key Players

The prominent players in this market are Optum, Inc. (US), R1 RCM Inc. (US), Oracle (US), Medical Information Technology, Inc. (US), McKesson Corporation (US), Solventum (US), Experian Information Solutions, Inc. (Ireland), Conifer Health Solutions. (US), Veradigm LLC (US), eClinicalWorks (US), Cognizant (US), athenahealth, Inc. (US), The SSI Group, LLC (US), Huron Consulting Group Inc. (US), AdvancedMD, Inc. (US), GeBBS (US), Epic Systems Corporation (US), TruBridge (US), CareCloud, Inc. (US), MEDHOST (US), AdvantEdge Healthcare Solutions (US), FinThrive (US), Plutus Health (US), Omega Healthcare Management Services (India), and Vee Healthtek, Inc. (US). Players adopted organic as well as inorganic growth strategies such as product launches and enhancements, investments, partnerships, collaborations, joint ventures, funding, acquisitions, expansions, agreements, contracts, and alliances to increase their offerings, cater to the unmet needs of customers, increase their profitability, and expand their presence in the global market.

Research Coverage

- The report studies the revenue cycle management market based on offering, solution type, delivery mode, end user, and region.

- The report analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting the market growth.

- The report evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders.

- The report studies micromarkets with respect to their growth trends, prospects, and contributions to the total revenue cycle management market.

- The report forecasts the revenue of market segments with respect to five major regions.

Reasons to Buy the Report

The report can help established firms, as well as new entrants/smaller firms, gauge the pulse of the market, which, in turn, would help them garner a greater share. Firms purchasing the report could use one or a combination of the five strategies mentioned below.

This report provides insights into the following pointers:

- Analysis of key drivers (growing regulatory requirements and government initiatives, increasing patient volume and subsequent growth in health insurance, loss of revenue due to billing errors and declining reimbursements, growing need to manage unstructured healthcare data, and rising demand for robust process improvements in the healthcare sector), restraints (high deployment costs and IT infrastructural constraints in emerging economies), opportunities (increasing outsourcing services in emerging economies and growing demand for AI and cloud-based deployment), and challenges (issues related to data security and confidentiality and reluctance to switch from conventional methods) influencing the growth of the revenue cycle management market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the revenue cycle management market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of revenue cycle management solutions across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the revenue cycle management market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the revenue cycle management market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 KEY STAKEHOLDERS

- 1.6 LIMITATIONS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Insights from primary experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION: REVENUE CYCLE MANAGEMENT MARKET

- 2.2.1 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET RANKING ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES IN REVENUE CYCLE MANAGEMENT MARKET

- 4.2 REVENUE CYCLE MANAGEMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.3 REVENUE CYCLE MANAGEMENT MARKET: REGIONAL MIX (2023-2030)

- 4.4 REVENUE CYCLE MANAGEMENT MARKET: DEVELOPED VS. EMERGING ECONOMIES, 2025 VS. 2030

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing regulatory requirements and government initiatives

- 5.2.1.2 Increasing patient volume and subsequent growth in health insurance

- 5.2.1.3 Loss of revenue due to billing errors and declining reimbursements

- 5.2.1.4 Growing need to manage unstructured healthcare data

- 5.2.1.5 Rising demand for robust process improvements in healthcare sector

- 5.2.2 RESTRAINTS

- 5.2.2.1 High deployment costs

- 5.2.2.2 IT infrastructural constraints in emerging economies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing outsourcing services in emerging economies

- 5.2.3.2 Growing demand for AI and cloud-based deployment

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues related to data security and confidentiality

- 5.2.4.2 Reluctance to switch from conventional methods

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 INDUSTRY TRENDS

- 5.4.1 GREATER FOCUS ON PATIENT FINANCIAL EXPERIENCE

- 5.4.2 USE OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 5.4.3 PIVOTAL ROLE OF DATA ANALYSIS IN MANAGING HEALTHCARE REVENUE CYCLES

- 5.4.4 INCREASING NUMBER OF PARTNERSHIPS AND COLLABORATIONS TO DRIVE INNOVATION

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.1.1 AI platforms

- 5.5.1.2 Cloud computing

- 5.5.2 COMPLEMENTARY TECHNOLOGIES

- 5.5.2.1 Electronic health records (EHRs)

- 5.5.2.2 Telehealth platforms

- 5.5.1 KEY TECHNOLOGIES

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 BARGAINING POWER OF SUPPLIERS

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 THREAT OF NEW ENTRANTS

- 5.8.5 THREAT OF SUBSTITUTES

- 5.9 REGULATORY ANALYSIS

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATORY LANDSCAPE

- 5.10 PATENT ANALYSIS

- 5.10.1 PATENT PUBLICATION TRENDS FOR REVENUE CYCLE MANAGEMENT MARKET

- 5.10.2 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR REVENUE CYCLE MANAGEMENT

- 5.10.3 MAJOR PATENTS IN REVENUE CYCLE MANAGEMENT MARKET

- 5.11 CASE STUDY ANALYSIS

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 KEY CONFERENCES & EVENTS IN 2025-2026

- 5.14 PRICING ANALYSIS

- 5.15 IMPACT OF 2025 US TARIFFS ON REVENUE CYCLE MANAGEMENT MARKET

- 5.15.1 KEY TARIFF RATES

- 5.15.2 PRICE IMPACT ANALYSIS

- 5.15.3 IMPACT ON COUNTRY/REGION

- 5.15.3.1 US

- 5.15.3.2 Europe

- 5.15.3.3 APAC

- 5.15.4 IMPACT ON END-USE INDUSTRIES

6 REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE

- 6.1 INTRODUCTION

- 6.2 END-TO-END SOLUTIONS

- 6.2.1 ABILITY OF INTEGRATED RCM PLATFORMS TO DRIVE OPERATIONAL EFFICIENCY AND FINANCIAL PERFORMANCE TO BOOST ADOPTION

- 6.3 NICHE/POINT SOLUTIONS

- 6.3.1 SPECIALIZED RCM TOOLS TO GAIN MOMENTUM AMID DEMAND FOR TARGETED, HIGH-ROI SOLUTIONS

7 REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING

- 7.1 INTRODUCTION

- 7.2 PRODUCTS

- 7.2.1 PATIENT ACCESS SOLUTIONS

- 7.2.1.1 Eligibility verification solutions

- 7.2.1.1.1 Eligibility verification solutions segment to account for largest share of patient access solutions market

- 7.2.1.2 Pre-certification & authorization solutions

- 7.2.1.2.1 Ability of electronic pre-certification and authorization solutions to help reduce error risks to drive growth

- 7.2.1.3 Other patient access solutions

- 7.2.1.1 Eligibility verification solutions

- 7.2.2 MID-REVENUE CYCLE SOLUTIONS

- 7.2.2.1 Clinical coding solutions

- 7.2.2.1.1 Increasing complexity of medical codes to drive market

- 7.2.2.2 Clinical documentation improvement solutions

- 7.2.2.2.1 Automated feedback and guidance by CDI solutions to help physicians improve accuracy of patient records

- 7.2.2.3 Other mid-revenue cycle solutions

- 7.2.2.1 Clinical coding solutions

- 7.2.3 BACK-END REVENUE CYCLE SOLUTIONS

- 7.2.3.1 Claims processing solutions

- 7.2.3.1.1 Ability of claims processing solutions to help reduce false claims and manual effort to boost demand

- 7.2.3.2 Denial management solutions

- 7.2.3.2.1 Ability to help healthcare payers and providers with effective claims management to drive market

- 7.2.3.3 Other back-end revenue cycle solutions

- 7.2.3.1 Claims processing solutions

- 7.2.1 PATIENT ACCESS SOLUTIONS

- 7.3 OUTSOURCING SERVICES

- 7.3.1 PATIENT ACCESS OUTSOURCING SERVICES

- 7.3.1.1 Patient access outsourcing services segment to account for largest share of outsourcing services market

- 7.3.2 MID-REVENUE CYCLE OUTSOURCING SERVICES

- 7.3.2.1 Increasing losses due to billing errors, scarcity of IT professionals, and infrastructure limitations to drive market

- 7.3.3 BACK-END REVENUE CYCLE OUTSOURCING SERVICES

- 7.3.3.1 Shortage of skilled HCIT professionals to drive market

- 7.3.1 PATIENT ACCESS OUTSOURCING SERVICES

8 REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE

- 8.1 INTRODUCTION

- 8.2 ON-PREMISE SOLUTIONS

- 8.2.1 ABILITY TO REUSE EXISTING SERVERS AND STORAGE HARDWARE TO DRIVE DEMAND FOR ON-PREMISE SOLUTIONS

- 8.3 CLOUD-BASED SOLUTIONS

- 8.3.1 DEMAND FOR AFFORDABLE CLOUD-BASED SOLUTIONS FROM SMALL AND MEDIUM-SIZED HEALTHCARE FACILITIES TO DRIVE MARKET

9 REVENUE CYCLE MANAGEMENT MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HEALTHCARE PROVIDERS

- 9.2.1 INPATIENT FACILITIES

- 9.2.1.1 Hospitals

- 9.2.1.1.1 Growing need to improve profitability in healthcare operations to drive adoption of RCM tools in hospitals

- 9.2.1.2 Other inpatient facilities

- 9.2.1.1 Hospitals

- 9.2.2 OUTPATIENT FACILITIES

- 9.2.2.1 Physicians' practices

- 9.2.2.1.1 High demand for integration of EHR with practice management systems to support market growth

- 9.2.2.2 Ambulatory surgical centers (ASCs)

- 9.2.2.2.1 Eroding patient volumes at hospitals due to high infection rate of COVID-19 to drive demand for ASCs

- 9.2.2.3 Hospital outpatient facilities

- 9.2.2.3.1 Need to maintain documentation for high volume of patients in hospital OPDs to drive demand for RCM solutions

- 9.2.2.4 Diagnostic & imaging centers

- 9.2.2.4.1 Growing preference for technologically advanced specialty clinics to drive demand

- 9.2.2.5 Other outpatient facilities

- 9.2.2.1 Physicians' practices

- 9.2.1 INPATIENT FACILITIES

- 9.3 HEALTHCARE PAYERS

- 9.3.1 INCREASING PRODUCTIVITY AND PROFITABILITY OF CODING OPERATIONS TO DRIVE ADOPTION OF RCM SOLUTIONS

10 REVENUE CYCLE MANAGEMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Growing focus of healthcare providers on improving care quality and reducing medical errors to drive market

- 10.2.3 CANADA

- 10.2.3.1 Need for healthcare cost containment and financial management of healthcare organizations to support market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Increasing patient volume to boost adoption of RCM solutions

- 10.3.3 FRANCE

- 10.3.3.1 Government investments to increase demand for effective RCM solutions

- 10.3.4 UK

- 10.3.4.1 Growing patient pool to boost demand for RCM solutions & services

- 10.3.5 ITALY

- 10.3.5.1 Initiatives toward digitalizing patient records to drive market

- 10.3.6 SPAIN

- 10.3.6.1 IT infrastructural improvements to boost market

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 JAPAN

- 10.4.2.1 Government mandates to boost adoption of RCM solutions

- 10.4.3 CHINA

- 10.4.3.1 Digitalization and improving infrastructure to support market growth

- 10.4.4 INDIA

- 10.4.4.1 Growing patient pool to support market growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Brazil to dominate revenue cycle management market in Latin America

- 10.5.3 MEXICO

- 10.5.3.1 Increase in focus of digital health to boost market growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Rising healthcare investments to fuel uptake

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN REVENUE CYCLE MANAGEMENT MARKET

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 MARKET RANKING ANALYSIS

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Solution type footprint

- 11.6.5.4 Offering footprint

- 11.6.5.5 End-user footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of startups/SMEs

- 11.8 COMPANY VALUATION & FINANCIAL METRICS

- 11.8.1 COMPANY VALUATION

- 11.8.2 FINANCIAL METRICS

- 11.9 BRAND/SOFTWARE COMPARISON

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT/SERVICE LAUNCHES & APPROVALS

- 11.10.2 DEALS

- 11.10.3 EXPANSIONS

- 11.10.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 OPTUM, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products & services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product/Service launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 ORACLE

- 12.1.2.1 Business overview

- 12.1.2.2 Products & services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product/Service launches & upgrades

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 MCKESSON CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products & services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 EPIC SYSTEMS CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products & services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product/Service launches & upgrades

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 SOLVENTUM

- 12.1.5.1 Business overview

- 12.1.5.2 Products & services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 R1 RCM INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products & services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product/Service launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Other developments

- 12.1.7 EXPERIAN INFORMATION SOLUTIONS, INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products & services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product/Service launches

- 12.1.7.3.2 Deals

- 12.1.8 CONIFER HEALTH SOLUTIONS

- 12.1.8.1 Business overview

- 12.1.8.2 Products & services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 VERADIGM LLC

- 12.1.9.1 Business overview

- 12.1.9.2 Products & services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product/Service launches

- 12.1.9.3.2 Deals

- 12.1.10 ECLINICALWORKS

- 12.1.10.1 Business overview

- 12.1.10.2 Products & services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.11 COGNIZANT

- 12.1.11.1 Business overview

- 12.1.11.2 Products & services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product/Service launches

- 12.1.11.3.2 Deals

- 12.1.12 ATHENAHEALTH, INC.

- 12.1.12.1 Business overview

- 12.1.12.2 Products & services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product/Service launches & approvals

- 12.1.12.3.2 Deals

- 12.1.12.3.3 Other developments

- 12.1.13 THE SSI GROUP, LLC

- 12.1.13.1 Business overview

- 12.1.13.2 Products & services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product/Service launches

- 12.1.14 HURON CONSULTING GROUP INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products & services offered

- 12.1.15 ADVANCEDMD, INC.

- 12.1.15.1 Business overview

- 12.1.15.2 Products & services offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Product/Service upgrades

- 12.1.15.3.2 Deals

- 12.1.16 GEBBS

- 12.1.16.1 Business overview

- 12.1.16.2 Products & services offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Deals

- 12.1.17 TRUBRIDGE

- 12.1.17.1 Business overview

- 12.1.17.2 Products & services offered

- 12.1.17.3 Recent developments

- 12.1.17.3.1 Deals

- 12.1.18 CARECLOUD, INC.

- 12.1.18.1 Business overview

- 12.1.18.2 Products & services offered

- 12.1.18.3 Recent developments

- 12.1.18.3.1 Deals

- 12.1.19 MEDICAL INFORMATION TECHNOLOGY, INC.

- 12.1.19.1 Business overview

- 12.1.19.2 Products & services offered

- 12.1.19.3 Recent developments

- 12.1.19.3.1 Deals

- 12.1.20 MEDHOST

- 12.1.20.1 Business overview

- 12.1.20.2 Products & services offered

- 12.1.20.3 Recent developments

- 12.1.20.3.1 Product launches

- 12.1.20.3.2 Deals

- 12.1.20.3.3 Expansions

- 12.1.1 OPTUM, INC.

- 12.2 OTHER PLAYERS

- 12.2.1 ADVANTEDGE HEALTHCARE SOLUTIONS (HEALTH PRIME INTERNATIONAL)

- 12.2.2 FINTHRIVE

- 12.2.3 PLUTUS HEALTH

- 12.2.4 OMEGA HEALTHCARE MANAGEMENT SERVICES

- 12.2.5 VEE HEALTHTEK, INC.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS:

- 13.5 AUTHOR DETAILS