|

|

市場調査レポート

商品コード

1766388

デジタル聴診器の世界市場:設計タイプ別、接続性別、用途別、エンドユーザー別、地域別 - 予測(~2032年)Digital Stethoscopes Market by Design Type (Tube-based, Tubeless), Connectivity (Wireless, Wired), Application (Cardiology, Pulmonary), End User (Hospitals, Urgent Care Centers, Ambulatory Care Centers, Home Care), and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| デジタル聴診器の世界市場:設計タイプ別、接続性別、用途別、エンドユーザー別、地域別 - 予測(~2032年) |

|

出版日: 2025年07月04日

発行: MarketsandMarkets

ページ情報: 英文 241 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のデジタル聴診器の市場規模は、2025年の4億9,000万米ドルから2032年までに7億1,000万米ドルに達すると予測され、予測期間にCAGRで5.5%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 10億米ドル |

| セグメント | 設計タイプ、接続性、用途、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ、GCC諸国 |

世界のデジタル聴診器市場は、遠隔医療、遠隔患者モニタリングの成長、慢性疾患の有病率の増加によって牽引されています。AIとIoTの統合により、診断の精度と接続性が強化され、これらの機器は臨床現場と遠隔地の両方でより価値が高まっています。

医療インフラの拡大とデジタルヘルスへの投資の増加が成長を支えている新興市場には大きな機会があります。手頃な価格とAIによる機能に焦点を当てた戦略的パートナーシップとイノベーションが、さらに幅広い採用と市場拡大の機会を生み出します。

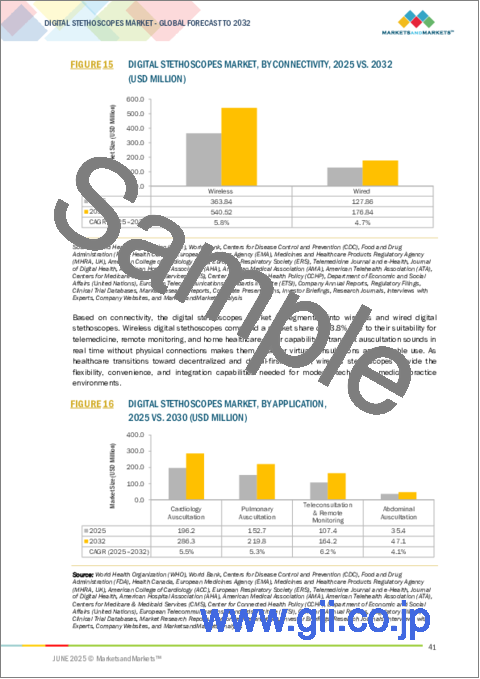

「無線デジタル聴診器セグメントが、予測期間にもっとも高いCAGRで成長する見込みです。」

無線デジタル聴診器は、柔軟なコネクテッドソリューションに対する需要の高まりにより、医療市場でますます人気のセグメントとなっています。リアルタイムのデータ共有や遠隔診断が可能な無線デジタル聴診器は、遠隔医療や在宅医療の普及に完全に合致しています。

特にBluetooth接続、クラウド統合、モバイルヘルスアプリケーションなどの技術的進歩により、これらの機器はより信頼性が高くユーザーフレンドリーな、既存のデジタルエコシステムとの互換性が高いものとなっています。さらに、医療提供者はワークフローの効率化と患者エンゲージメントの向上を求めており、無線モデルの機動性と利便性がその採用を後押ししています。

この成長は、デジタルヘルスインフラへの投資の増加や、特にサービスが行き届いていない地域や遠隔地でのケアへのアクセスを強化する、拡張可能で相互運用可能なツールの推進によってさらに支えられています。

「遠隔診察・遠隔モニタリングセグメントは、予測期間にもっとも高い成長率が見込まれます。」

デジタル聴診器市場は、用途によって心臓聴診、肺聴診、腹部聴診、遠隔診察・遠隔モニタリングの4つに区分されます。このうち、遠隔聴診・遠隔モニタリングセグメントがもっとも高い成長を示しています。この成長の促進要因は世界的なバーチャル医療へのシフトであり、このシフトは安全で非接触の診察と効果的な慢性疾患管理への需要によって加速しています。

デジタル聴診器は、遠隔診察時にリアルタイムの高品質な聴診を可能にし、遠隔地からの診断精度を高めるという重要な役割を担っています。遠隔モニタリングプラットフォームとの統合により、継続的な患者評価が可能になるため、通院の必要性が減り、早期介入が容易になります。医療制度がますます在宅ケアとデジタルヘルスソリューションを優先するようになるにつれて、このセグメントは接続性、AI、患者にやさしい技術の進歩に支えられて急速に拡大し続けています。

「北米が2024年にデジタル聴診器市場で最大のシェアを占めました。」

北米は現在、デジタル聴診器の最大の地域市場であり、アジア太平洋市場が予測期間にもっとも高いCAGRとなる見込みです。北米の市場シェアが大きいのは、心血管疾患などの慢性疾患の有病率が高く、デジタル聴診器のような診断ツールを必要とする患者層が厚いためと考えられます。さらに、この地域には複数の主要市場企業が存在するため、北米のデジタル聴診器市場の成長はさらに高まる可能性が高いです。

当レポートでは、世界のデジタル聴診器市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- デジタル聴診器市場の概要

- アジア太平洋のデジタル聴診器市場:用途別、国別(2024年)

- デジタル聴診器市場:地域の成長機会

第5章 市場の概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 産業動向

- AI搭載デジタル聴診器、遠隔医療

- ウェアラブルヘルスモニタリング

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- ポーターのファイブフォース分析

- 規制情勢

- 規制枠組み

- 規制機関、政府機関、その他の組織

- 特許分析

- 貿易分析

- HSコード901890の輸入データ

- HSコード901890の輸出データ

- 償還シナリオ

- 主な会議とイベント(2025年~2026年)

- 主なステークホルダーと購入基準

- デジタル聴診器市場におけるアンメットニーズ/エンドユーザーの期待

- サプライチェーン分析

- バリューチェーン分析

- デジタル聴診器市場に対する生成AIの影響

- 価格分析

- 市場エコシステム

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- 2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途部門に対する影響

第6章 デジタル聴診器市場:用途別

- イントロダクション

- 心臓聴診

- 肺聴診

- 腹部聴診

- 遠隔診察・遠隔モニタリング

第7章 デジタル聴診器市場:接続性別

- イントロダクション

- 無線デジタル聴診器

- 有線デジタル聴診器

第8章 デジタル聴診器市場:設計タイプ別

- イントロダクション

- チューブ式デジタル聴診器

- チューブレスデジタル聴診器

第9章 デジタル聴診器市場:エンドユーザー別

- イントロダクション

- 病院・診療所

- プライマリケアセンター

- 外来診療センター

- 救急診療センター

- 在宅ケア環境

- その他のエンドユーザー

第10章 デジタル聴診器市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- 中東・アフリカのマクロ経済の見通し

- GCC諸国

- その他の中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- SOLVENTUM

- EKO HEALTH, INC.

- THINKLABS

- TAIDOC TECHNOLOGY CORPORATION

- HD MEDICAL, INC.

- LINKTOP

- GS TECHNOLOGY

- AMD GLOBAL TELEMEDICINE

- GUANGDONG HANHONG MEDICAL TECHNOLOGY CO., LTD.

- QINGDAO MEDITECH EQUIPMENT CO., LTD

- その他の企業

- AYU DEVICES PVT LTD.

- VISIONFLEX PTY LIMITED

- CARDIONICS INC.

- AI HEALTH HIGHWAY INDIA PVT LTD.

- M3DICINE PTY LTD.

- MEDAICA

- TYTOCARE LTD.

- IMEDI PLUS

- AEVICE HEALTH PTE LTD.

- STRADOS LABS

- SAINTIANT TECHNOLOGIES

- HEROIC-FAITH

- SONAVI LABS HQ

- GV CONCEPTS, INC.

- STETHOME SP. Z O.O.

- EKUORE MEDICAL DEVICES

第13章 付録

List of Tables

- TABLE 1 DIGITAL STETHOSCOPES MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES FOR CONVERSION

- TABLE 3 DIGITAL STETHOSCOPES MARKET: STUDY ASSUMPTIONS

- TABLE 4 DIGITAL STETHOSCOPES MARKET: RISK ANALYSIS

- TABLE 5 DIGITAL STETHOSCOPES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 DIGITAL STETHOSCOPES MARKET: KEY PATENTS, 2022-2024

- TABLE 12 IMPORT DATA FOR INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, OR VETERINARY SCIENCES (HS CODE 901890), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, OR VETERINARY SCIENCES (HS CODE 901890), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 DIGITAL STETHOSCOPES MARKET: MAJOR CONFERENCES & EVENTS IN 2025-2026

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF DIGITAL STETHOSCOPES

- TABLE 16 KEY BUYING CRITERIA FOR DIGITAL STETHOSCOPES PRODUCTS

- TABLE 17 INDICATIVE PRICING OF DIGITAL STETHOSCOPES, BY KEY PLAYER, 2024 (USD)

- TABLE 18 INDICATIVE PRICING OF DIGITAL STETHOSCOPES, BY KEY REGION, 2022-2024 (USD)

- TABLE 19 CASE STUDY 1: TELEHEALTH INTEGRATION INTO DIGITAL STETHOSCOPE

- TABLE 20 CASE STUDY 2: DIGIBEAT - AI AND AR-ENHANCED REMOTE EXAMS

- TABLE 21 CASE STUDY 3: EKO CORE 500(TM) IN ACUTE CARE AND TRAUMA

- TABLE 22 US ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 23 KEY PRODUCT-RELATED TARIFF EFFECTIVE ON DIGITAL STETHOSCOPES

- TABLE 24 NORTH AMERICA: IMPACT OF US TARIFF ON CANADA

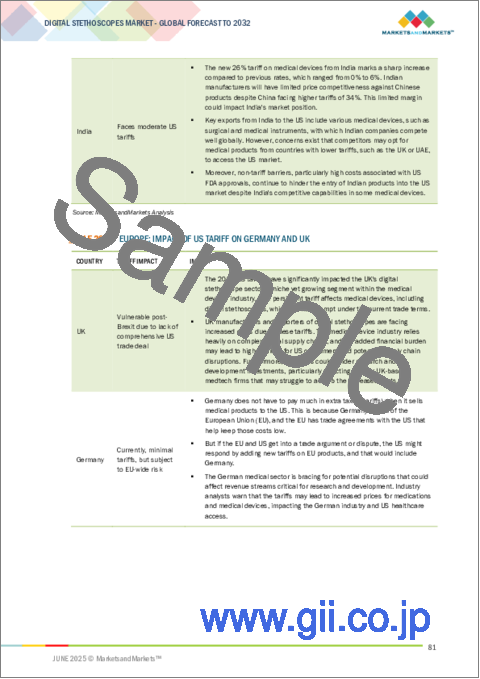

- TABLE 25 ASIA PACIFIC: IMPACT OF US TARIFF ON CHINA, JAPAN, AND INDIA

- TABLE 26 EUROPE: IMPACT OF US TARIFF ON GERMANY AND UK

- TABLE 27 LATIN AMERICA: IMPACT OF US TARIFF ON MEXICO

- TABLE 28 DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 29 COMMERCIALLY AVAILABLE DIGITAL STETHOSCOPES USED FOR CARDIOLOGY AUSCULTATION

- TABLE 30 CARDIOLOGY AUSCULTATION: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 31 COMMERCIALLY AVAILABLE DIGITAL STETHOSCOPES USED FOR PULMONARY AUSCULTATION

- TABLE 32 PULMONARY AUSCULTATION: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 33 COMMERCIALLY AVAILABLE DIGITAL STETHOSCOPES USED FOR ABDOMINAL AUSCULTATION

- TABLE 34 ABDOMINAL AUSCULTATION: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 35 COMMERCIALLY AVAILABLE DIGITAL STETHOSCOPES USED FOR TELECONSULTATION & REMOTE MONITORING

- TABLE 36 TELECONSULTATION & REMOTE MONITORING: DIGITAL STETHOSCOPES, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 37 DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 38 COMMERCIALLY AVAILABLE WIRELESS DIGITAL STETHOSCOPES

- TABLE 39 WIRELESS DIGITAL STETHOSCOPES, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 40 COMMERCIALLY AVAILABLE WIRED DIGITAL STETHOSCOPES

- TABLE 41 DIGITAL STETHOSCOPES MARKET FOR WIRED DIGITAL STETHOSCOPES, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 42 DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 43 COMMERCIALLY AVAILABLE TUBE-BASED DIGITAL STETHOSCOPES

- TABLE 44 TUBE-BASED DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 45 COMMERCIALLY AVAILABLE TUBELESS DIGITAL STETHOSCOPES

- TABLE 46 TUBELESS DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 47 DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 48 HOSPITALS & CLINICS: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 49 PRIMARY CARE CENTERS: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 50 AMBULATORY CARE CENTERS: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 51 URGENT CARE CENTERS: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 52 HOME CARE SETTINGS: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 53 OTHER END USERS: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 54 DIGITAL STETHOSCOPES MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 55 NORTH AMERICA: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY 2023-2032 (THOUSAND UNITS)

- TABLE 56 EUROPE: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY 2023-2032 (THOUSAND UNITS)

- TABLE 57 ASIA PACIFIC: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY 2023-2032 (THOUSAND UNITS)

- TABLE 58 LATIN AMERICA: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY 2023-2032 (THOUSAND UNITS)

- TABLE 59 MIDDLE EAST & AFRICA: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY 2023-2032 (THOUSAND UNITS)

- TABLE 60 NORTH AMERICA: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 61 NORTH AMERICA: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 62 NORTH AMERICA: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 63 NORTH AMERICA: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 64 NORTH AMERICA: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 65 US: KEY MACROINDICATORS

- TABLE 66 US: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 67 US: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 68 US: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 69 US: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 70 CANADA: KEY MACROINDICATORS

- TABLE 71 CANADA: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 72 CANADA: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 73 CANADA: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 74 CANADA: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 75 EUROPE: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 76 EUROPE: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 77 EUROPE: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 78 EUROPE: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 79 EUROPE: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 80 GERMANY: KEY MACROINDICATORS

- TABLE 81 GERMANY: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 82 GERMANY: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 83 GERMANY: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 84 GERMANY: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 85 UK: KEY MACROINDICATORS

- TABLE 86 UK: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 87 UK: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 88 UK: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 89 UK: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 90 FRANCE: KEY MACROINDICATORS

- TABLE 91 FRANCE: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 92 FRANCE: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 93 FRANCE: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 94 FRANCE: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 95 ITALY: KEY MACROINDICATORS

- TABLE 96 ITALY: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 97 ITALY: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 98 ITALY: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 99 ITALY: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 100 SPAIN: KEY MACROINDICATORS

- TABLE 101 SPAIN: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 102 SPAIN: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 103 SPAIN: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 104 SPAIN: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 105 REST OF EUROPE: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 106 REST OF EUROPE: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 107 REST OF EUROPE: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 108 REST OF EUROPE: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 109 ASIA PACIFIC: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 110 ASIA PACIFIC: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 111 ASIA PACIFIC: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 112 ASIA PACIFIC: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 113 ASIA PACIFIC: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 114 CHINA: MACROECONOMIC INDICATORS

- TABLE 115 CHINA: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 116 CHINA: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 117 CHINA: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 118 CHINA: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 119 JAPAN: MACROECONOMIC INDICATORS

- TABLE 120 JAPAN: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 121 JAPAN: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 122 JAPAN: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 123 JAPAN: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 124 INDIA: MACROECONOMIC INDICATORS

- TABLE 125 INDIA: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 126 INDIA: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 127 INDIA: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 128 INDIA: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 129 AUSTRALIA: KEY MACROINDICATORS

- TABLE 130 AUSTRALIA: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 131 AUSTRALIA: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 132 AUSTRALIA: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 133 AUSTRALIA: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 134 SOUTH KOREA: MACROECONOMIC INDICATORS

- TABLE 135 SOUTH KOREA: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 136 SOUTH KOREA: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 137 SOUTH KOREA: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 138 SOUTH KOREA: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 143 LATIN AMERICA: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 144 LATIN AMERICA: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 145 LATIN AMERICA: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 146 LATIN AMERICA: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 147 LATIN AMERICA: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 148 BRAZIL: MACROECONOMIC INDICATORS

- TABLE 149 BRAZIL: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 150 BRAZIL: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 151 BRAZIL: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 152 BRAZIL: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 153 MEXICO: MACROECONOMIC INDICATORS

- TABLE 154 MEXICO: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 155 MEXICO: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 156 MEXICO: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 157 MEXICO: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 158 REST OF LATIN AMERICA: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 159 REST OF LATIN AMERICA: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 160 REST OF LATIN AMERICA: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 161 REST OF LATIN AMERICA: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 167 GCC COUNTRIES: DIGITAL STETHOSCOPES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 168 GCC COUNTRIES: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 169 GCC COUNTRIES: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 170 GCC COUNTRIES: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 171 GCC COUNTRIES: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 172 SAUDI ARABIA: KEY MACROINDICATORS

- TABLE 173 SAUDI ARABIA: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 174 SAUDI ARABIA: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 175 SAUDI ARABIA: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 176 SAUDI ARABIA: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 177 UAE: KEY MACROINDICATORS

- TABLE 178 UAE: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 179 UAE: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 180 UAE: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 181 UAE: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 182 OTHER GCC COUNTRIES: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 183 OTHER GCC COUNTRIES: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 184 OTHER GCC COUNTRIES: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 185 OTHER GCC COUNTRIES: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2023-2032 (USD MILLION)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 188 REST OF MIDDLE EAST & AFRICA: DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 189 REST OF MIDDLE EAST & AFRICA: DIGITAL STETHOSCOPES MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 190 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE DIGITAL STETHOSCOPES MARKET

- TABLE 191 DIGITAL STETHOSCOPES MARKET: DEGREE OF COMPETITION

- TABLE 192 DIGITAL STETHOSCOPES MARKET: REGION FOOTPRINT

- TABLE 193 DIGITAL STETHOSCOPES MARKET: DESIGN TYPE FOOTPRINT

- TABLE 194 DIGITAL STETHOSCOPES MARKET: CONNECTIVITY FOOTPRINT

- TABLE 195 DIGITAL STETHOSCOPES MARKET: APPLICATION FOOTPRINT

- TABLE 196 DIGITAL STETHOSCOPES MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 197 DIGITAL STETHOSCOPES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME PLAYERS

- TABLE 198 DIGITAL STETHOSCOPES MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 199 DIGITAL STETHOSCOPES MARKET: DEALS, JANUARY 2022-APRIL 2025

- TABLE 200 DIGITAL STETHOSCOPES MARKET: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 201 SOLVENTUM: COMPANY OVERVIEW

- TABLE 202 SOLVENTUM: PRODUCTS OFFERED

- TABLE 203 SOLVENTUM: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 204 EKO HEALTH, INC.: COMPANY OVERVIEW

- TABLE 205 EKO HEALTH, INC: PRODUCTS OFFERED

- TABLE 206 EKO HEALTH, INC: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 207 EKO HEALTH, INC.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 208 THINKLABS: COMPANY OVERVIEW

- TABLE 209 THINKLABS: PRODUCTS OFFERED

- TABLE 210 THINKLABS: DEALS, JANUARY 2022-APRIL 2025

- TABLE 211 TAIDOC TECHNOLOGY CORPORATION: COMPANY OVERVIEW

- TABLE 212 TAIDOC TECHNOLOGY CORPORATION: PRODUCTS OFFERED

- TABLE 213 HD MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 214 HD MEDICAL, INC.: PRODUCTS OFFERED

- TABLE 215 LINKTOP: COMPANY OVERVIEW

- TABLE 216 LINKTOP: PRODUCTS OFFERED

- TABLE 217 GS TECHNOLOGY: COMPANY OVERVIEW

- TABLE 218 GS TECHNOLOGY: PRODUCTS OFFERED

- TABLE 219 AMD GLOBAL TELEMEDICINE: COMPANY OVERVIEW

- TABLE 220 AMD GLOBAL TELEMEDICINE: PRODUCTS OFFERED

- TABLE 221 AMD GLOBAL TELEMEDICINE: DEALS

- TABLE 222 GUANGDONG HANHONG MEDICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 223 GUANGDONG HANHONG MEDICAL TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 224 QINGDAO MEDITECH EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 225 QINGDAO MEDITECH EQUIPMENT CO., LTD.: PRODUCTS OFFERED

- TABLE 226 AYU DEVICES PVT LTD.: COMPANY OVERVIEW

- TABLE 227 VISIONFLEX PTY LIMITED: COMPANY OVERVIEW

- TABLE 228 CARDIONICS INC.: COMPANY OVERVIEW

- TABLE 229 AI HEALTH HIGHWAY INDIA PVT LTD.: COMPANY OVERVIEW

- TABLE 230 M3DICINE PTY LTD.: COMPANY OVERVIEW

- TABLE 231 MEDAICA: COMPANY OVERVIEW

- TABLE 232 TYTOCARE LTD.: COMPANY OVERVIEW

- TABLE 233 IMEDI PLUS: COMPANY OVERVIEW

- TABLE 234 AEVICE HEALTH PTE LTD.: COMPANY OVERVIEW

- TABLE 235 STRADOS LABS: COMPANY OVERVIEW

- TABLE 236 SAINTIANT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 237 HEROIC-FAITH: COMPANY OVERVIEW

- TABLE 238 SONAVI LABS HQ: COMPANY OVERVIEW

- TABLE 239 GV CONCEPTS, INC.: COMPANY OVERVIEW

- TABLE 240 STETHOME SP. Z O.O.: COMPANY OVERVIEW

- TABLE 241 EKUORE MEDICAL DEVICES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 DIGITAL STETHOSCOPES MARKET: SEGMENTS CONSIDERED & REGIONAL SCOPE

- FIGURE 2 DIGITAL STETHOSCOPES MARKET: YEARS CONSIDERED

- FIGURE 3 DIGITAL STETHOSCOPES MARKET: RESEARCH DESIGN

- FIGURE 4 DIGITAL STETHOSCOPES MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 DIGITAL STETHOSCOPES MARKET: KEY PRIMARY SOURCES

- FIGURE 6 DIGITAL STETHOSCOPES MARKET: INSIGHTS FROM PRIMARIES

- FIGURE 7 DIGITAL STETHOSCOPES MARKET: BREAKDOWN OF PRIMARIES (BY COMPANY TYPE, DESIGNATION, AND REGION)

- FIGURE 8 DIGITAL STETHOSCOPES MARKET: BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY- AND DEMAND-SIDE PARTICIPANTS)

- FIGURE 9 DIGITAL STETHOSCOPES MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS (2024)

- FIGURE 10 DIGITAL STETHOSCOPES MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (BOTTOM-UP APPROACH)

- FIGURE 11 DIGITAL STETHOSCOPES MARKET: TOP-DOWN APPROACH

- FIGURE 12 DIGITAL STETHOSCOPES MARKET: CAGR PROJECTIONS (SUPPLY SIDE)

- FIGURE 13 DIGITAL STETHOSCOPES MARKET: DATA TRIANGULATION

- FIGURE 14 DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 15 DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY, 2025 VS. 2032 (USD MILLION)

- FIGURE 16 DIGITAL STETHOSCOPES MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 DIGITAL STETHOSCOPES MARKET, BY END USER, 2025 VS. 2032 (USD MILLION)

- FIGURE 18 REGIONAL SNAPSHOT OF DIGITAL STETHOSCOPES MARKET

- FIGURE 19 GROWING PREVALENCE OF CHRONIC DISEASES AND INCREASING PREFERENCE FOR REMOTE MONITORING TO DRIVE MARKET GROWTH

- FIGURE 20 CARDIOLOGY AUSCULTATION ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC DIGITAL STETHOSCOPES MARKET IN 2024

- FIGURE 21 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 22 DIGITAL STETHOSCOPES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 DIGITAL STETHOSCOPES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 TOP APPLICANTS/OWNERS (COMPANIES/INSTITUTIONS) FOR DIGITAL STETHOSCOPE PATENTS (JANUARY 2014-MAY 2025)

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF DIGITAL STETHOSCOPES

- FIGURE 26 KEY BUYING CRITERIA FOR DIGITAL STETHOSCOPES

- FIGURE 27 DIGITAL STETHOSCOPES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 DIGITAL STETHOSCOPES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 DIGITAL STETHOSCOPES MARKET: IMPACT OF AI

- FIGURE 30 DIGITAL STETHOSCOPES MARKET ECOSYSTEM

- FIGURE 31 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DIGITAL STETHOSCOPES MARKET

- FIGURE 32 NORTH AMERICA: DIGITAL STETHOSCOPES MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: DIGITAL STETHOSCOPES MARKET SNAPSHOT

- FIGURE 34 REVENUE ANALYSIS OF KEY PLAYERS IN DIGITAL STETHOSCOPES MARKET (2020-2024)

- FIGURE 35 MARKET SHARE ANALYSIS OF KEY PLAYERS IN DIGITAL STETHOSCOPES MARKET (2024)

- FIGURE 36 RANKING OF KEY PLAYERS IN DIGITAL STETHOSCOPES MARKET, 2024

- FIGURE 37 DIGITAL STETHOSCOPES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 38 DIGITAL STETHOSCOPES MARKET: COMPANY FOOTPRINT

- FIGURE 39 DIGITAL STETHOSCOPES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 40 EV/EBITDA OF KEY VENDORS

- FIGURE 41 YEAR-TO-DATE PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 42 DIGITAL STETHOSCOPES MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 43 SOLVENTUM: COMPANY SNAPSHOT (2024)

- FIGURE 44 TAIDOC TECHNOLOGY CORPORATION: COMPANY SNAPSHOT (2024)

The global digital stethoscopes market is projected to reach USD 0.71 billion by 2032 from USD 0.49 billion in 2025, at a CAGR of 5.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | Design Type, Connectivity, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries |

The global digital stethoscopes market is driven by the growth of telemedicine, remote patient monitoring, and the increasing prevalence of chronic diseases. The integration of artificial intelligence (AI) and the Internet of Things (IoT) is enhancing diagnostic accuracy and connectivity, making these devices more valuable in both clinical and remote settings.

There are significant opportunities in emerging markets, where expanding healthcare infrastructure and increasing investments in digital health support growth. Strategic partnerships and innovations that focus on affordability and AI-driven features further create opportunities for wider adoption and market expansion.

"The wireless digital stethoscopes segment is expected to grow at the highest CAGR during the forecast period."

Wireless digital stethoscopes are becoming an increasingly popular segment of the healthcare market due to the rising demand for flexible and connected solutions. Their ability to enable real-time data sharing and remote diagnostics aligns perfectly with the growing use of telemedicine and home-based care.

Technological advancements-especially in Bluetooth connectivity, cloud integration, and mobile health applications-make these devices more reliable, user-friendly, and compatible with existing digital ecosystems. Additionally, healthcare providers are looking to improve workflow efficiency and patient engagement, and the mobility and convenience of wireless models are driving their adoption.

This growth is further supported by increased investments in digital health infrastructure and a push for scalable, interoperable tools that enhance access to care, particularly in underserved or remote areas.

"The teleconsultation & remote monitoring segment is expected to grow at the highest rate during the forecast period."

The digital stethoscopes market is segmented by application into four categories: cardiology auscultation, pulmonary auscultation, abdominal auscultation, and teleconsultation & remote monitoring. Among these, the teleconsultation & remote monitoring segment is experiencing the highest growth. This increase is driven by a global shift toward virtual healthcare, which has been accelerated by the demand for safe, contactless consultations and effective chronic disease management.

Digital stethoscopes play a vital role in enabling real-time, high-quality auscultation during teleconsultations, thereby enhancing diagnostic accuracy from a distance. Their integration with remote monitoring platforms allows for continuous patient assessments, which reduces the need for hospital visits and facilitates early intervention. As healthcare systems increasingly prioritize home-based care and digital health solutions, this segment continues to expand rapidly, supported by advancements in connectivity, artificial intelligence, and patient-friendly technologies.

"North America accounted for the largest share of the digital stethoscopes market in 2024."

The global market for digital stethoscopes is divided into five major regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America is currently the largest regional market for digital stethoscopes, while the Asia Pacific market is expected to experience the highest CAGR during the forecast period. The significant market share in North America can be attributed to the high prevalence of chronic diseases, such as cardiovascular conditions, which creates a larger patient base in need of diagnostic tools like digital stethoscopes. Additionally, the presence of several key market players in the region is likely to further enhance the growth of the digital stethoscopes market in North America.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (35%), Tier 2 (40%), and Tier 3 (25%)

- By Designation: C-level Executives (30%), D-level Executives (23%), and Others (47%)

- By Region: North America (35%), Europe (20%), Asia Pacific (25%), Latin America (13%), and the Middle East & Africa (7%)

The major players operating in the digital stethoscopes market are Solventum (US), Eko Health, Inc. (US), Thinklabs (US), HD Medical, Inc. (US), Linktop (China), TaiDoc Technology Corporation (Taiwan), GS Technology (South Korea), AMD Global Telemedicine (US), Guangdong Hanhong Medical Technology Co., Ltd. (China), and Qingdao Meditech Equipment Co., Ltd. (China).

Research Coverage

This report examines the digital stethoscopes market by analyzing various factors, including design type, connectivity, application, and region. It also evaluates elements that influence market growth, such as drivers, restraints, opportunities, and challenges. Additionally, the report provides insights into the competitive landscape, highlighting the leading players in the market. Furthermore, it explores micromarkets to understand their individual growth trends and offers revenue forecasts for different market segments across five major regions, along with the specific countries within those regions.

Reasons to Buy the Report

The report will allow both established companies and smaller entrants to understand the current state of the market, which will help them increase their market share. Firms that purchase the report can implement one or a combination of the strategies mentioned below to enhance their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers [surge in telemedicine and remote patient monitoring and integration of artificial intelligence (Al) and internet of things (loT)], restraints (high cost and affordability issues and resistance from traditional practitioners), opportunities (untapped growth potential in emerging markets and product innovations and strategic partnerships), and challenges (limited technical training and user familiarity and battery life and device reliability issues)

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the digital stethoscopes market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the digital stethoscopes market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the digital stethoscopes market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 SEGMENTS CONSIDERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary research

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key objectives of primary research

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION OF DIGITAL STETHOSCOPES

- 2.2.1 REVENUE SHARE ANALYSIS (BOTTOM-UP APPROACH)

- 2.2.2 COMPANY INVESTOR PRESENTATIONS AND PRIMARY INTERVIEWS

- 2.3 TOP-DOWN APPROACH

- 2.4 MARKET GROWTH RATE PROJECTION

- 2.5 DATA TRIANGULATION

- 2.5.1 STUDY ASSUMPTIONS

- 2.5.2 RESEARCH LIMITATIONS

- 2.5.3 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 DIGITAL STETHOSCOPES MARKET OVERVIEW

- 4.2 ASIA PACIFIC: DIGITAL STETHOSCOPES MARKET, BY APPLICATION AND COUNTRY (2024)

- 4.3 DIGITAL STETHOSCOPES MARKET: REGIONAL GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 Surge in telemedicine and remote patient monitoring

- 5.1.1.2 Growing incidence of cardiovascular and respiratory diseases

- 5.1.1.3 Integration of artificial intelligence and Internet of Things

- 5.1.2 RESTRAINTS

- 5.1.2.1 High cost and affordability issues

- 5.1.2.2 Resistance from traditional practitioners

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Untapped growth potential in emerging markets

- 5.1.3.2 Product innovation and strategic partnerships

- 5.1.4 CHALLENGES

- 5.1.4.1 Limited technical training and user familiarity

- 5.1.4.2 Battery life and device reliability issues

- 5.1.1 DRIVERS

- 5.2 INDUSTRY TRENDS

- 5.2.1 AI-POWERED DIGITAL STETHOSCOPES AND TELEHEALTH

- 5.2.2 WEARABLE HEALTH MONITORING

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 AI-powered auscultation

- 5.3.1.2 Noise cancellation and sound amplification

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 Integration with mobile applications

- 5.3.2.2 Multi-functionality and sensor integration

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 Wearable health monitors

- 5.3.1 KEY TECHNOLOGIES

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.4.2 BARGAINING POWER OF SUPPLIERS

- 5.4.3 BARGAINING POWER OF BUYERS

- 5.4.4 THREAT OF SUBSTITUTES

- 5.4.5 THREAT OF NEW ENTRANTS

- 5.5 REGULATORY LANDSCAPE

- 5.5.1 REGULATORY FRAMEWORK

- 5.5.1.1 North America

- 5.5.1.2 Europe

- 5.5.1.3 Asia Pacific

- 5.5.1.4 Latin America

- 5.5.1.5 Middle East & Africa

- 5.5.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5.1 REGULATORY FRAMEWORK

- 5.6 PATENT ANALYSIS

- 5.6.1 JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT DATA FOR HS CODE 901890

- 5.7.2 EXPORT DATA FOR HS CODE 901890

- 5.8 REIMBURSEMENT SCENARIO

- 5.9 KEY CONFERENCES & EVENTS (2025-2026)

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 UNMET NEEDS/END USER EXPECTATIONS IN DIGITAL STETHOSCOPES MARKET

- 5.12 SUPPLY CHAIN ANALYSIS

- 5.13 VALUE CHAIN ANALYSIS

- 5.14 IMPACT OF GEN AI ON DIGITAL STETHOSCOPES MARKET

- 5.15 PRICING ANALYSIS

- 5.16 MARKET ECOSYSTEM

- 5.16.1 ROLE IN ECOSYSTEM

- 5.17 CASE STUDY ANALYSIS

- 5.18 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.19 INVESTMENT & FUNDING SCENARIO

- 5.20 IMPACT OF 2025 US TARIFF

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.5 IMPACT ON END-USE SEGMENTS

6 DIGITAL STETHOSCOPES MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 CARDIOLOGY AUSCULTATION

- 6.2.1 AI-ENHANCED DIAGNOSTICS DRIVE SEGMENT GROWTH

- 6.3 PULMONARY AUSCULTATION

- 6.3.1 ADVANCEMENTS IN LUNG SOUND ANALYSIS IMPROVE PULMONARY DIAGNOSTICS

- 6.4 ABDOMINAL AUSCULTATION

- 6.4.1 ENHANCES GASTROINTESTINAL SOUND DETECTION TO DRIVE SEGMENT

- 6.5 TELECONSULTATION & REMOTE MONITORING

- 6.5.1 INTEGRATION OF TELEHEALTH IN HEALTHCARE TO BOOST SEGMENT

7 DIGITAL STETHOSCOPES MARKET, BY CONNECTIVITY

- 7.1 INTRODUCTION

- 7.2 WIRELESS DIGITAL STETHOSCOPES

- 7.2.1 EXPANDING REMOTE CARE AND ADVANCED TECHNOLOGY FUEL SEGMENT GROWTH

- 7.3 WIRED DIGITAL STETHOSCOPES

- 7.3.1 CLINICAL DEPENDABILITY AND RISING RESPIRATORY BURDEN DRIVE ADOPTION

8 DIGITAL STETHOSCOPES MARKET, BY DESIGN TYPE

- 8.1 INTRODUCTION

- 8.2 TUBE-BASED DIGITAL STETHOSCOPES

- 8.2.1 GROWING TELEHEALTH ECOSYSTEM AND AI INTEGRATION TO BOOST ADOPTION

- 8.3 TUBELESS DIGITAL STETHOSCOPES

- 8.3.1 ADVANCE CARDIAC AND RESPIRATORY MONITORING IN REMOTE CARE TO DRIVE SEGMENT

9 DIGITAL STETHOSCOPES MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS & CLINICS

- 9.2.1 AI-POWERED DIAGNOSTICS IN HOSPITAL SETTINGS DRIVE ADOPTION

- 9.3 PRIMARY CARE CENTERS

- 9.3.1 POINT-OF-CARE DIAGNOSIS IN PRIMARY SETTINGS ACCELERATES UPTAKE

- 9.4 AMBULATORY CARE CENTERS

- 9.4.1 DEMAND FOR MULTIFUNCTIONAL DIAGNOSTICS WITH SMART STETHOSCOPES TO FUEL SEGMENT

- 9.5 URGENT CARE CENTERS

- 9.5.1 QUICKER PATIENT CHECKS AND HIGH-QUALITY CARE WITH AI-BASED STETHOSCOPES TO FUEL SEGMENT

- 9.6 HOME CARE SETTINGS

- 9.6.1 REMOTE PATIENT MONITORING IN HOMES BOOSTS DEMAND

- 9.7 OTHER END USERS

10 DIGITAL STETHOSCOPES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Dominant North American digital stethoscopes market during forecast period

- 10.2.3 CANADA

- 10.2.3.1 Telehealth and rural healthcare focus to propel market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Market growth accelerated with AI integration into digital stethoscopes

- 10.3.3 UK

- 10.3.3.1 Government digital health initiatives to drive market growth

- 10.3.4 FRANCE

- 10.3.4.1 AI adoption and telehealth bolster growth of market

- 10.3.5 ITALY

- 10.3.5.1 Strategic Integration of AI in public healthcare to drive market growth

- 10.3.6 SPAIN

- 10.3.6.1 Growing aging population and remote care to augment market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Increasing aging population and digital health integration to support market growth

- 10.4.3 JAPAN

- 10.4.3.1 Technology-driven healthcare and increasing aging population to drive market

- 10.4.4 INDIA

- 10.4.4.1 Government initiatives and innovative digital solutions to boost market

- 10.4.5 AUSTRALIA

- 10.4.5.1 Increased geriatric patient pool and government support to fuel growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Rising geriatric population to drive market

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Expanding healthcare access in Brazil fuels market growth

- 10.5.3 MEXICO

- 10.5.3.1 Growing chronic disease burden and digital health adoption to drive market

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Saudi Arabia

- 10.6.2.1.1 Surge in prevalence of CVDs to boost adoption

- 10.6.2.2 UAE

- 10.6.2.2.1 Government initiatives in healthcare infrastructure to drive market

- 10.6.2.3 Other GCC Countries

- 10.6.2.1 Saudi Arabia

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DIGITAL STETHOSCOPES MARKET

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 RANKING OF KEY PLAYERS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Design type footprint

- 11.5.5.4 Connectivity footprint

- 11.5.5.5 Application footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startup/SME players

- 11.6.5.2 Competitive benchmarking of key startups/SME players

- 11.7 COMPANY VALUATION & FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES & APPROVALS

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SOLVENTUM

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 EKO HEALTH, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Recent developments

- 12.1.2.2.1 Product launches and approvals

- 12.1.2.2.2 Deals

- 12.1.2.3 MnM view

- 12.1.2.3.1 Right to win

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses & competitive threats

- 12.1.3 THINKLABS

- 12.1.3.1 Business overview

- 12.1.3.2 Recent developments

- 12.1.3.2.1 Deals

- 12.1.3.3 MnM view

- 12.1.3.3.1 Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses & competitive threats

- 12.1.4 TAIDOC TECHNOLOGY CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 MnM view

- 12.1.4.2.1 Right to win

- 12.1.4.2.2 Strategic choices

- 12.1.4.2.3 Weaknesses & competitive threats

- 12.1.5 HD MEDICAL, INC.

- 12.1.5.1 Business overview

- 12.1.5.2 MnM view

- 12.1.5.2.1 Right to win

- 12.1.5.2.2 Strategic choices

- 12.1.5.2.3 Weaknesses & competitive threats

- 12.1.6 LINKTOP

- 12.1.6.1 Business overview

- 12.1.7 GS TECHNOLOGY

- 12.1.7.1 Business overview

- 12.1.8 AMD GLOBAL TELEMEDICINE

- 12.1.8.1 Business overview

- 12.1.8.2 Recent developments

- 12.1.8.2.1 Deals

- 12.1.9 GUANGDONG HANHONG MEDICAL TECHNOLOGY CO., LTD.

- 12.1.9.1 Business overview

- 12.1.10 QINGDAO MEDITECH EQUIPMENT CO., LTD

- 12.1.10.1 Business overview

- 12.1.1 SOLVENTUM

- 12.2 OTHER PLAYERS

- 12.2.1 AYU DEVICES PVT LTD.

- 12.2.2 VISIONFLEX PTY LIMITED

- 12.2.3 CARDIONICS INC.

- 12.2.4 AI HEALTH HIGHWAY INDIA PVT LTD.

- 12.2.5 M3DICINE PTY LTD.

- 12.2.6 MEDAICA

- 12.2.7 TYTOCARE LTD.

- 12.2.8 IMEDI PLUS

- 12.2.9 AEVICE HEALTH PTE LTD.

- 12.2.10 STRADOS LABS

- 12.2.11 SAINTIANT TECHNOLOGIES

- 12.2.12 HEROIC-FAITH

- 12.2.13 SONAVI LABS HQ

- 12.2.14 GV CONCEPTS, INC.

- 12.2.15 STETHOME SP. Z O.O.

- 12.2.16 EKUORE MEDICAL DEVICES

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS