|

|

市場調査レポート

商品コード

1766387

単回使用手術器具の世界市場:製品タイプ別、用途別、医療環境別、地域別 - 2030年までの予測Single Use Surgical Instruments Market by Product(Handheld Surgical Instrument, Electrosurgical Instrument, Endoscopic Instrument), Application(General Surgery, Orthopedic Surgery), Care Setting(Hospitals & Specialty Clinics)-Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 単回使用手術器具の世界市場:製品タイプ別、用途別、医療環境別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月03日

発行: MarketsandMarkets

ページ情報: 英文 289 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

単回使用手術器具の市場規模は、5.7%のCAGRで拡大し、2025年の59億2,000万米ドルから2030年には78億米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品タイプ別、用途別、医療環境別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ、GCC諸国 |

外来手術センター(ASC)の増加により、単回使用手術器具の需要が大きく伸びています。これらの施設は、効率的で費用対効果の高い無菌ソリューションを必要とする即日手術用に設計されています。従来の病院とは異なり、ASCでは滅菌インフラやスタッフが限られていることが多く、再利用可能な器具は実用的ではありません。

単回使用手器具は、再処理の必要性をなくし、手技間のターンアラウンドタイムを短縮し、交差汚染のリスクを最小限に抑えるため、便利な代替手段を提供します。さらに、高価な滅菌装置や滅菌工程を省くことによるコスト削減も、使い捨て器具をこれらのセンターにとって特に魅力的なものにしています。

ヘルスケア産業が価値ベースのケアと低侵襲処置にシフトするにつれ、ASCは患者数の増加を経験しています。この動向は、業務上のニーズを満たす、すぐに使える滅菌済み手術器具の採用を直接的に後押ししています。その結果、単回使用手術器具メーカーは、的を絞った技術革新と流通戦略を通じて、この拡大する市場に対応する機会が増えています。

ハンドヘルド手術器具部門が世界市場をリードしている主な理由は、再利用可能な代替品よりもコスト効率が高いからです。再利用可能な器具は当初安く見えるかもしれませんが、人件費、滅菌機器、光熱費、化学薬品、厳格な品質管理プロトコールなど、再処理に関連する隠れた経常コストが全体の費用を大幅に増加させます。

対照的に、単回使用手の器具は、これらのコストを完全に排除し、より予測可能で、多くの場合、手技あたりの総コストをより低く抑えることができます。また、再処理ミスや機器の故障による処置遅延のリスクも最小限に抑えることができます。このような金銭的・業務的効率性により、世界中の病院や手術センターで単回使用手器具の普及が進んでいます。

一般外科分野は、世界の単回使用手術器具市場の主要分野であり、新興市場におけるヘルスケアアクセスの拡大が主な要因となっています。政府および民間セクターは医療インフラの改善に投資しており、その結果、以前は十分な医療サービスが受けられなかった地域に、より多くの病院や診療所が設立されています。一般外科手術は、しばしば最初に提供されるサービスのひとつであり、幅広い種類の器具を必要とします。

単回使用手の器具は、複雑で高価な滅菌工程を必要としないため、こうした環境にとって理想的なソリューションとなります。手ごろな価格、使いやすさ、信頼性により、資源が限られている施設や新設の施設に特に適しており、これが採用の拡大に寄与し、これらの地域における市場成長を後押ししています。

北米のメーカーは、人間工学的に設計されているだけでなく、性能効率も最適化された高品質の使い捨て手術器具の開発に先駆的に取り組んでいます。これらの革新的なツールは、近代ヘルスケアの厳格な基準を満たすように設計されており、外科医にとっての快適性と患者にとっての安全性の両方を提供しています。

この地域は、最先端の医療技術を取り入れることで、際立った存在感を示してきました。この技術は、患者ケアの向上と手術環境における安全プロトコルの強化に重要な役割を果たしています。このような技術革新へのコミットメントは、手術器具の継続的な改良に反映されており、より良い結果をもたらし、手技を合理化しています。

当レポートでは、世界の単回使用手術器具市場について調査し、製品タイプ別、用途別、医療環境別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 業界動向

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 規制分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- アンメットニーズ/エンドユーザーの期待

- 2025年の米国関税が使い捨て手術器具市場に与える影響

- 隣接市場分析

第6章 単回使用手術器具市場(製品タイプ別)

- イントロダクション

- ハンドヘルド手術器具

- 電気外科器具

- 内視鏡器具

- その他

第7章 単回使用手術器具市場(用途別)

- イントロダクション

- 一般外科

- 整形外科

- 心臓血管外科

- 婦人科・産科外科

- 耳鼻咽喉科手術

- 眼科手術

- その他

第8章 単回使用手術器具市場(医療環境別)

- イントロダクション

- 病院・専門クリニック

- 外来手術センター

- 在宅ケア

第9章 単回使用手術器具市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- ヘルスケアの増加が市場を牽引

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- 市場を推進するための健康インフラの改善

- GCC諸国のマクロ経済見通し

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- JOHNSON & JOHNSON SERVICES, INC.(ETHICON, INC.)

- MEDTRONIC

- BD

- B. BRAUN SE

- SMITH+NEPHEW

- COOPERSURGICAL, INC.

- STRYKER

- ALCON LABORATORIES, INC.

- STERIS

- PAUL HARTMANN AG

- ERBE ELEKTROMEDIZIN GMBH

- KIRWAN SURGICAL PRODUCTS, LLC

- ASPEN SURGICAL PRODUCTS, INC.

- SRR SURGICAL CO.

- TATA SURGICAL

- その他の企業

- DTR MEDICAL LTD.

- FUHRMANN GMBH

- HEINZ HERENZ

- SWANN-MORTON LIMITED

- PURPLE SURGICAL

- SURGAID MEDICAL(XIAMEN)CO., LTD.

- HANGZHOU TONGLU SHIKONGHOU MEDICAL INSTRUMENT CO., LTD.

- TAKTVOLL

- TIANJIN ZHICHAO MEDICAL TECHNOLOGY CO., LTD.

- HANGZHOU SCONOR MEDICAL TECHNOLOGY CO., LTD.

第12章 付録

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 SINGLE-USE SURGICAL INSTRUMENTS MARKET: IMPACT OF ANALYSIS OF MARKET DYNAMICS

- TABLE 3 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT TYPE, 2024 (USD)

- TABLE 4 AVERAGE SELLING PRICE TREND OF FORCEPS, BY REGION, 2022-2024 (USD)

- TABLE 5 SINGLE-USE SURGICAL INSTRUMENTS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 SINGLE-USE SURGICAL INSTRUMENTS MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2022-2025

- TABLE 7 IMPORT DATA FOR HS CODE 901890- COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 EXPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 SINGLE-USE SURGICAL INSTRUMENTS MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 SINGLE-USE SURGICAL INSTRUMENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 18 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 19 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR SINGLE-USE SURGICAL INSTRUMENTS

- TABLE 20 SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 21 HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 22 HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 23 LEADING MANUFACTURERS OF SINGLE-USE SURGICAL SCALPELS

- TABLE 24 SINGLE-USE SURGICAL INSTRUMENTS MARKET FOR SCALPELS, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 25 SINGLE-USE SURGICAL SCALPELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 LEADING MANUFACTURERS OF SINGLE-USE SURGICAL FORCEPS

- TABLE 27 SINGLE-USE SURGICAL INSTRUMENTS MARKET FOR FORCEPS, BY REGION, 2023-2030 (THOUSAND UNITS)

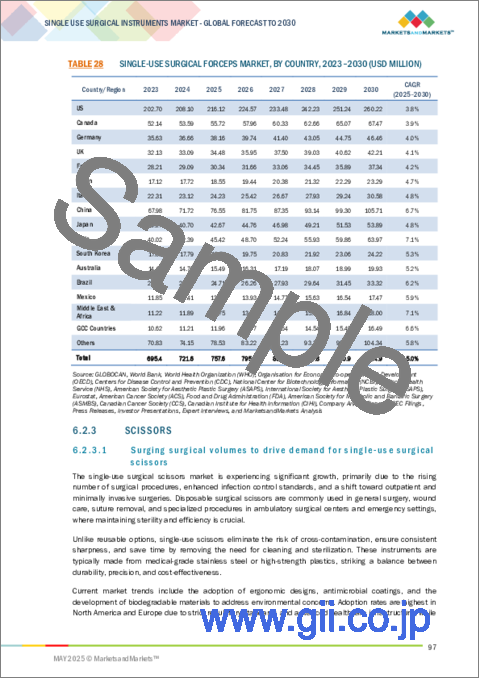

- TABLE 28 SINGLE-USE SURGICAL FORCEPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 LEADING MANUFACTURERS OF SINGLE-USE SURGICAL SCISSORS

- TABLE 30 SINGLE-USE SURGICAL INSTRUMENTS MARKET FOR SCISSORS, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 31 SINGLE-USE SURGICAL SCISSORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 OTHER HANDHELD SURGICAL INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 34 SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 LEADING MANUFACTURERS OF SINGLE-USE SURGICAL CAUTERY DEVICES

- TABLE 36 SINGLE-USE SURGICAL CAUTERY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 SINGLE-USE SURGICAL BIPOLAR FORCEPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 OTHER ELECTROSURGICAL INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 40 SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 LEADING MANUFACTURERS OF SINGLE-USE SURGICAL TROCARS

- TABLE 42 SINGLE-USE SURGICAL TROCARS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 LEADING MANUFACTURERS OF SINGLE-USE SURGICAL GRASPERS

- TABLE 44 SINGLE-USE SURGICAL GRASPERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 OTHER ENDOSCOPIC INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 OTHER SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 48 SINGLE-USE SURGICAL INSTRUMENTS MARKET FOR GENERAL SURGERY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 SINGLE-USE SURGICAL INSTRUMENTS MARKET FOR ORTHOPEDIC SURGERY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 SINGLE-USE SURGICAL INSTRUMENTS MARKET FOR CARDIOVASCULAR SURGERY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 SINGLE-USE SURGICAL INSTRUMENTS MARKET FOR GYNECOLOGY & OBSTETRICS SURGERY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 SINGLE-USE SURGICAL INSTRUMENTS MARKET FOR ENT SURGERY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 SINGLE-USE SURGICAL INSTRUMENTS MARKET FOR OPHTHALMIC SURGERY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 SINGLE-USE SURGICAL INSTRUMENTS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 56 SINGLE-USE SURGICAL INSTRUMENTS MARKET FOR HOSPITALS & SPECIALTY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 SINGLE-USE SURGICAL INSTRUMENTS MARKET FOR AMBULATORY SURGICAL CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 SINGLE-USE SURGICAL INSTRUMENTS MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 67 US: KEY MACROINDICATORS

- TABLE 68 US: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 69 US: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 70 US: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 71 US: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 72 US: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 73 US: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 74 CANADA: KEY MACROINDICATORS

- TABLE 75 CANADA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 76 CANADA: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 77 CANADA: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 78 CANADA: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 CANADA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 80 CANADA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 81 EUROPE: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 87 EUROPE: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 88 GERMANY: KEY MACROINDICATORS

- TABLE 89 GERMANY: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 90 GERMANY: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 GERMANY: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 92 GERMANY: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 93 GERMANY: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 94 GERMANY: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 95 UK: KEY MACROINDICATORS

- TABLE 96 UK: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 97 UK: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 UK: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 UK: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 UK: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 101 UK: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 102 FRANCE: KEY MACROINDICATORS

- TABLE 103 FRANCE: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 104 FRANCE: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 FRANCE: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 FRANCE: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 FRANCE: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 108 FRANCE: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 109 ITALY: KEY MACROINDICATORS

- TABLE 110 ITALY: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 111 ITALY: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 ITALY: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 ITALY: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 ITALY: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 115 ITALY: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 116 SPAIN: KEY MACROINDICATORS

- TABLE 117 SPAIN: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 118 SPAIN: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 SPAIN: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 SPAIN: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 SPAIN: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 122 SPAIN: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 123 REST OF EUROPE: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 124 REST OF EUROPE: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 REST OF EUROPE: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 REST OF EUROPE: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 REST OF EUROPE: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 128 REST OF EUROPE: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 130 ASIA PACIFIC: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 136 CHINA: KEY MACROINDICATORS

- TABLE 137 CHINA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 138 CHINA: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 CHINA: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 CHINA: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 CHINA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 142 CHINA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 143 JAPAN: KEY MACROINDICATORS

- TABLE 144 JAPAN: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 145 JAPAN: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 JAPAN: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 JAPAN: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 JAPAN: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 149 JAPAN: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 150 INDIA: KEY MACROINDICATORS

- TABLE 151 INDIA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 152 INDIA: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 INDIA: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 INDIA: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 INDIA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 156 INDIA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 157 AUSTRALIA: KEY MACROINDICATORS

- TABLE 158 AUSTRALIA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 159 AUSTRALIA: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 AUSTRALIA: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 AUSTRALIA: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 AUSTRALIA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 163 AUSTRALIA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 164 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 165 SOUTH KOREA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 166 SOUTH KOREA: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 SOUTH KOREA: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 SOUTH KOREA: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 SOUTH KOREA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 170 SOUTH KOREA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 177 LATIN AMERICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 178 LATIN AMERICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 179 LATIN AMERICA: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 LATIN AMERICA: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 LATIN AMERICA: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 LATIN AMERICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 183 LATIN AMERICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 184 BRAZIL: KEY MACROINDICATORS

- TABLE 185 BRAZIL: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 186 BRAZIL: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 BRAZIL: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 BRAZIL: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 BRAZIL: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 190 BRAZIL: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 191 MEXICO: MACROECONOMIC INDICATORS

- TABLE 192 MEXICO: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 193 MEXICO: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 MEXICO: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 MEXICO: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 MEXICO: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 197 MEXICO: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 198 REST OF LATIN AMERICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 199 REST OF LATIN AMERICA: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 REST OF LATIN AMERICA: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 REST OF LATIN AMERICA: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 REST OF LATIN AMERICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 203 REST OF LATIN AMERICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 210 GCC COUNTRIES: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 211 GCC COUNTRIES: HANDHELD SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 GCC COUNTRIES: SINGLE-USE ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 GCC COUNTRIES: SINGLE-USE ENDOSCOPIC INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 GCC COUNTRIES: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 215 GCC COUNTRIES: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 216 OVERVIEW OF STRATEGIES ADOPTED BY MAJOR PLAYERS IN SINGLE-USE SURGICAL INSTRUMENTS MARKET

- TABLE 217 SINGLE-USE SURGICAL INSTRUMENTS MARKET: DEGREE OF COMPETITION

- TABLE 218 SINGLE-USE SURGICAL INSTRUMENTS MARKET: REGION FOOTPRINT

- TABLE 219 SINGLE-USE SURGICAL INSTRUMENTS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 220 SINGLE-USE SURGICAL INSTRUMENTS MARKET: APPLICATION FOOTPRINT

- TABLE 221 SINGLE-USE SURGICAL INSTRUMENTS MARKET: CARE SETTING FOOTPRINT

- TABLE 222 SINGLE-USE SURGICAL INSTRUMENTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 223 SINGLE-USE SURGICAL INSTRUMENTS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 224 SINGLE-USE SURGICAL INSTRUMENTS MARKET: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 225 SINGLE-USE SURGICAL INSTRUMENTS MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 226 SINGLE-USE SURGICAL INSTRUMENTS MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 227 SINGLE-USE SURGICAL INSTRUMENTS MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 228 JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.): COMPANY OVERVIEW

- TABLE 229 JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.): PRODUCTS OFFERED

- TABLE 230 MEDTRONIC: COMPANY OVERVIEW

- TABLE 231 MEDTRONIC: PRODUCTS OFFERED

- TABLE 232 BD: COMPANY OVERVIEW

- TABLE 233 BD: PRODUCTS OFFERED

- TABLE 234 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 235 B. BRAUN SE: PRODUCTS OFFERED

- TABLE 236 SMITH+NEPHEW: COMPANY OVERVIEW

- TABLE 237 SMITH+NEPHEW: PRODUCTS OFFERED

- TABLE 238 SMITH+NEPHEW: EXPANSIONS

- TABLE 239 SMITH+NEPHEW: OTHER DEVELOPMENTS

- TABLE 240 COOPERSURGICAL, INC.: COMPANY OVERVIEW

- TABLE 241 COOPERSURGICAL, INC.: PRODUCTS OFFERED

- TABLE 242 STRYKER: COMPANY OVERVIEW

- TABLE 243 STRYKER: PRODUCTS OFFERED

- TABLE 244 ALCON LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 245 ALCON LABORATORIES, INC.: PRODUCTS OFFERED

- TABLE 246 STERIS: COMPANY OVERVIEW

- TABLE 247 STERIS: PRODUCTS OFFERED

- TABLE 248 STERIS: DEALS

- TABLE 249 PAUL HARTMANN AG: COMPANY OVERVIEW

- TABLE 250 PAUL HARTMANN AG: PRODUCTS OFFERED

- TABLE 251 PAUL HARTMANN AG: DEALS

- TABLE 252 ERBE ELEKTROMEDIZIN GMBH: COMPANY OVERVIEW

- TABLE 253 ERBE ELEKTROMEDIZIN GMBH: PRODUCTS OFFERED

- TABLE 254 ERBE ELEKTROMEDIZIN GMBH: PRODUCT LAUNCHES

- TABLE 255 ERBE ELEKTROMEDIZIN GMBH: EXPANSIONS

- TABLE 256 KIRWAN SURGICAL PRODUCTS, LLC: COMPANY OVERVIEW

- TABLE 257 KIRWAN SURGICAL PRODUCTS, LLC: PRODUCTS OFFERED

- TABLE 258 ASPEN SURGICAL PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 259 ASPEN SURGICAL PRODUCTS, INC.: PRODUCTS OFFERED

- TABLE 260 ASPEN SURGICAL PRODUCTS, INC.: DEALS

- TABLE 261 SRR SURGICAL CO.: COMPANY OVERVIEW

- TABLE 262 SRR SURGICAL CO.: PRODUCTS OFFERED

- TABLE 263 TATA SURGICAL: COMPANY OVERVIEW

- TABLE 264 TATA SURGICAL: PRODUCTS OFFERED

- TABLE 265 DTR MEDICAL LTD.: COMPANY OVERVIEW

- TABLE 266 FUHRMANN GMBH: COMPANY OVERVIEW

- TABLE 267 HEINZ HERENZ: COMPANY OVERVIEW

- TABLE 268 SWANN-MORTON LIMITED: COMPANY OVERVIEW

- TABLE 269 PURPLE SURGICAL: COMPANY OVERVIEW

- TABLE 270 SURGAID MEDICAL (XIAMEN) CO., LTD.: COMPANY OVERVIEW

- TABLE 271 HANGZHOU TONGLU SHIKONGHOU MEDICAL INSTRUMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 272 TAKTVOLL: COMPANY OVERVIEW

- TABLE 273 TIANJIN ZHICHAO MEDICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 274 HANGZHOU SCONOR MEDICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SINGLE-USE SURGICAL INSTRUMENTS MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 SINGLE-USE SURGICAL INSTRUMENTS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION: MEDTRONIC (2024)

- FIGURE 8 SINGLE-USE SURGICAL INSTRUMENTS MARKET SIZE ESTIMATION: COMPANY REVENUE ESTIMATION

- FIGURE 9 DEMAND-SIDE MARKET SIZE ESTIMATION

- FIGURE 10 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR SINGLE-USE SURGICAL INSTRUMENTS MARKET (2025-2030)

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 DATA TRIANGULATION

- FIGURE 13 SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 GEOGRAPHICAL SNAPSHOT OF SINGLE-USE SURGICAL INSTRUMENTS MARKET

- FIGURE 17 GLOBAL INCREASE IN NUMBER OF SURGERIES TO DRIVE MARKET

- FIGURE 18 HANDHELD SURGICAL INSTRUMENTS SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2024

- FIGURE 19 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 ASIA PACIFIC WILL CONTINUE TO DOMINATE MARKET IN 2030

- FIGURE 21 DEVELOPING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 22 SINGLE-USE SURGICAL INSTRUMENTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 AVERAGE SELLING PRICE TREND OF FORCEPS, BY REGION, 2022-2024 (USD)

- FIGURE 25 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND DISTRIBUTION PHASES

- FIGURE 26 SINGLE-USE SURGICAL INSTRUMENTS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 SINGLE-USE SURGICAL INSTRUMENTS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 SINGLE-USE SURGICAL INSTRUMENTS MARKET: INVESTMENT & FUNDING SCENARIO, 2019-2023

- FIGURE 29 SINGLE-USE SURGICAL INSTRUMENTS MARKET: VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 30 SINGLE-USE SURGICAL INSTRUMENTS MARKET: NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 31 SINGLE-USE SURGICAL INSTRUMENTS MARKET: PATENT ANALYSIS, JANUARY 2015-MAY 2025

- FIGURE 32 IMPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 33 EXPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 34 SINGLE-USE SURGICAL INSTRUMENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 37 SINGLE-USE SURGICAL INSTRUMENTS MARKET: ADJACENT MARKETS

- FIGURE 38 NORTH AMERICA: SINGLE-USE SURGICAL INSTRUMENTS MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: SINGLE-USE SURGICAL INSTRUMENTS MARKET SNAPSHOT

- FIGURE 40 REVENUE ANALYSIS OF TOP PLAYERS IN SINGLE-USE SURGICAL INSTRUMENTS MARKET, 2020-2024 (USD MILLION)

- FIGURE 41 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 42 SINGLE-USE SURGICAL INSTRUMENTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 SINGLE-USE SURGICAL INSTRUMENTS MARKET: COMPANY FOOTPRINT

- FIGURE 44 SINGLE-USE SURGICAL INSTRUMENTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 EV/EBITDA OF KEY VENDORS

- FIGURE 46 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 47 SINGLE-USE SURGICAL INSTRUMENTS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 48 JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.): COMPANY SNAPSHOT

- FIGURE 49 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 50 BD: COMPANY SNAPSHOT

- FIGURE 51 B. BRAUN SE: COMPANY SNAPSHOT

- FIGURE 52 SMITH+NEPHEW: COMPANY SNAPSHOT

- FIGURE 53 COOPERSURGICAL, INC.: COMPANY SNAPSHOT

- FIGURE 54 STRYKER: COMPANY SNAPSHOT

- FIGURE 55 ALCON LABORATORIES, INC.: COMPANY SNAPSHOT

- FIGURE 56 STERIS: COMPANY SNAPSHOT

- FIGURE 57 PAUL HARTMANN AG: COMPANY SNAPSHOT

The single-use surgical instruments market is projected to reach USD 7.80 billion by 2030 from USD 5.92 billion in 2025, at a CAGR of 5.7%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Product Type, Application, Care Setting, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries |

The increasing number of outpatient and ambulatory surgical centers (ASCs) is driving a significant demand for single-use surgical instruments. These facilities are designed for same-day surgeries that require efficient, cost-effective, and sterile solutions. Unlike traditional hospitals, ASCs often have limited sterilization infrastructure and staff, making reusable instruments less practical.

Single-use instruments provide a convenient alternative, as they eliminate the need for reprocessing, reduce turnaround times between procedures, and minimize the risk of cross-contamination. Additionally, the cost savings associated with avoiding expensive sterilization equipment and processes make disposable tools particularly appealing to these centers.

As the healthcare industry shifts toward value-based care and minimally invasive procedures, ASCs are experiencing increased patient volumes. This trend directly supports the adoption of ready-to-use, sterile surgical tools that meet their operational needs. Consequently, manufacturers of single-use surgical instruments have a growing opportunity to cater to this expanding market through targeted innovation and distribution strategies.

By product type, the handheld surgical instruments segment held the largest share of the global single-use surgical instruments market in 2024.

The handheld surgical instruments segment leads the global market primarily because they are more cost-effective than reusable alternatives. While reusable instruments may seem cheaper initially, the hidden and recurring costs associated with reprocessing, including labor, sterilization equipment, utilities, chemical agents, and strict quality control protocols, significantly increase the overall expense.

In contrast, single-use instruments eliminate these costs entirely, providing a more predictable and often lower total cost per procedure. They also minimize the risk of procedural delays resulting from reprocessing errors or equipment failure. This financial and operational efficiency is driving the widespread adoption of single-use instruments in hospitals and surgical centers around the world.

By application, the general surgery segment held the largest market share in 2024.

The general surgery segment is the leading sector in the global single-use surgical instruments market, largely driven by increased healthcare access in emerging markets. Governments and private sectors are investing in the improvement of medical infrastructure, resulting in the establishment of more hospitals and clinics in previously underserved areas. General surgeries, which are often among the first services offered, require a wide range of instruments.

Single-use tools provide an ideal solution for these settings, as they eliminate the need for complex and expensive sterilization processes. Their affordability, ease of use, and reliability make them particularly suitable for resource-limited or newly established facilities, which contributes to their growing adoption and boosts market growth in these regions.

North America accounted for the largest share of the SUSI market in 2024.

North American manufacturers are pioneering the development of high-quality disposable surgical tools that are not only ergonomically designed but also optimized for performance efficiency. These innovative tools are engineered to meet the rigorous standards of modern healthcare, ensuring they provide both comfort for the surgeon and safety for the patient.

The region has distinguished itself by embracing cutting-edge medical technologies, which play a crucial role in advancing patient care and enhancing safety protocols in surgical environments. This commitment to innovation is reflected in the continuous improvement of surgical instruments, which facilitate better outcomes and streamline procedures.

A breakdown of the primary participants (supply side) for the single-use surgical instruments market referred to in this report is provided below:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level Executives (55%), D-level Executives (27%), and Others (18%)

- By Region: North America (35%), Europe (32%), Asia Pacific (25%), Latin America (5%), the Middle East & Africa (1%), and GCC Countries (2%)

Prominent players in the single-use surgical instruments market are Ethicon, Inc. (US), Medtronic (Ireland), BD (US), B. Braun SE (Germany), Smith+Nephew (UK), CooperSurgical, Inc. (US), and Stryker (US).

Research Coverage

The report assesses the market for single-use surgical instruments and estimates its size and future growth potential across various segments, including product type, application, care setting, and region. Additionally, the report features a competitive analysis of the key players in this market, along with company profiles, descriptions of their product offerings, recent developments, and important market strategies.

Reasons to Buy the Report

The report will help both market leaders and new entrants by providing data on estimated revenue figures for the overall single-use surgical instruments market and its subsegments. It will assist stakeholders in understanding the competitive landscape, enabling them to position their businesses effectively and develop appropriate go-to-market strategies. Additionally, the report provides insights into market trends and offers data on key drivers, challenges, obstacles, and opportunities within the market.

This report provides insights into the following points:

- Analysis of key drivers (increasing prevalence of chronic diseases and growing number of surgical procedures), restraints (high cost associated with single-use instruments and regulatory and quality control challenges), opportunities (expansion of healthcare infrastructure in emerging markets), and challenges (environmental sustainability and waste management)

- Product Enhancement/Innovation: Comprehensive details about product launches and anticipated trends in the global SUSI market

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product type, application, care setting, and region

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global SUSI market

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings, and capacities of the major competitors in the global SUSI market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY USED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 LIMITATIONS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH DESIGN

- 2.2.1 SECONDARY RESEARCH

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY RESEARCH

- 2.2.2.1 Primary sources

- 2.2.2.2 Key industry insights

- 2.2.2.3 Breakdown of primary interviews

- 2.2.1 SECONDARY RESEARCH

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 SUPPLY-SIDE ANALYSIS (REVENUE SHARE ANALYSIS)

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.2.1 Company revenue estimation approach

- 2.3.2.2 Customer-based market estimation

- 2.3.2.3 Demand-side analysis

- 2.3.2.4 Growth forecast approach

- 2.4 DATA TRIANGULATION

- 2.5 MARKET SHARE ASSESSMENT

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SINGLE-USE SURGICAL INSTRUMENTS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE AND COUNTRY (2024)

- 4.3 SINGLE-USE SURGICAL INSTRUMENTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 SINGLE-USE SURGICAL INSTRUMENTS MARKET: REGIONAL MIX

- 4.5 SINGLE-USE SURGICAL INSTRUMENTS MARKET: DEVELOPED VS. DEVELOPING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of chronic diseases

- 5.2.1.2 Growing number of surgical procedures

- 5.2.1.3 Increased focus on safety and infection control

- 5.2.1.4 Technological advancements

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost associated with single-use instruments

- 5.2.2.2 Regulatory and quality control challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of healthcare infrastructure in emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental sustainability and waste management

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT TYPE, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF FORCEPS, BY REGION, 2022-2024 (USD)

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Injection molding of medical-grade polymers

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Ergonomic design software to optimize instrument shape

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Robotic-assisted surgical tools

- 5.9.1 KEY TECHNOLOGIES

- 5.10 INDUSTRY TRENDS

- 5.10.1 INTEGRATION OF ADVANCED MATERIALS AND SUSTAINABILITY INITIATIVES

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA (HS CODE 901890)

- 5.12.2 EXPORT DATA (HS CODE 901890)

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 CASE STUDY 1: ADOPTION OF SINGLE-USE SURGICAL INSTRUMENTS IN OPHTHALMIC SURGERIES

- 5.14.2 CASE STUDY 2: SSI REDUCTION IN ORTHOPEDIC SURGERY THROUGH THE USE OF SINGLE-USE IMPLANTS

- 5.14.3 CASE STUDY 3: REDUCED SSI RATES IN CESAREAN SECTIONS USING SINGLE-USE INSTRUMENTS IN LOW-RESOURCE SETTINGS

- 5.15 REGULATORY ANALYSIS

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 REGULATORY LANDSCAPE

- 5.15.2.1 North America

- 5.15.2.1.1 US

- 5.15.2.1.2 Canada

- 5.15.2.2 Europe

- 5.15.2.3 Asia Pacific

- 5.15.2.3.1 China

- 5.15.2.3.2 Japan

- 5.15.2.3.3 India

- 5.15.2.4 Latin America

- 5.15.2.4.1 Brazil

- 5.15.2.4.2 Mexico

- 5.15.2.5 Middle East

- 5.15.2.6 Africa

- 5.15.2.1 North America

- 5.16 PORTER'S FIVE FORCES ANALYSIS

- 5.16.1 BARGAINING POWER OF SUPPLIERS

- 5.16.2 BARGAINING POWER OF BUYERS

- 5.16.3 THREAT OF NEW ENTRANTS

- 5.16.4 THREAT OF SUBSTITUTES

- 5.16.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 UNMET NEEDS/END-USER EXPECTATIONS

- 5.19 IMPACT OF 2025 US TARIFF ON SINGLE-USE SURGICAL INSTRUMENTS MARKET

- 5.19.1 KEY TARIFF RATES

- 5.19.2 PRICE IMPACT ANALYSIS

- 5.19.3 IMPACT ON END-USER INDUSTRIES

- 5.20 ADJACENT MARKET ANALYSIS

6 SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 HANDHELD SURGICAL INSTRUMENTS

- 6.2.1 SCALPELS

- 6.2.1.1 Infection control priorities and outpatient surgery growth to drive demand for single-use surgical scalpels

- 6.2.2 FORCEPS

- 6.2.2.1 Shift to minimally invasive surgeries to accelerate adoption of single-use surgical forceps

- 6.2.3 SCISSORS

- 6.2.3.1 Surging surgical volumes to drive demand for single-use surgical scissors

- 6.2.4 OTHER HANDHELD SURGICAL INSTRUMENTS

- 6.2.1 SCALPELS

- 6.3 ELECTROSURGICAL INSTRUMENTS

- 6.3.1 CAUTERY DEVICES

- 6.3.1.1 Sterility requirements to fuel growth in single-use cautery devices market

- 6.3.2 BIPOLAR FORCEPS

- 6.3.2.1 Growing preference for minimally invasive and robotic-assisted surgeries to boost market growth

- 6.3.3 OTHER ELECTROSURGICAL INSTRUMENTS

- 6.3.1 CAUTERY DEVICES

- 6.4 ENDOSCOPIC INSTRUMENTS

- 6.4.1 SINGLE-USE TROCARS

- 6.4.1.1 Rising adoption of minimally invasive surgeries and infection prevention imperatives to fuel growth

- 6.4.2 GRASPERS

- 6.4.2.1 Increasing demand for sterile, efficient solutions in minimally invasive surgeries to boost growth

- 6.4.3 OTHER ENDOSCOPIC INSTRUMENTS

- 6.4.1 SINGLE-USE TROCARS

- 6.5 OTHER SINGLE-USE SURGICAL INSTRUMENTS

7 SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 GENERAL SURGERY

- 7.2.1 GROWING NEED FOR ENHANCED INFECTION CONTROL TO BOOST ADOPTION OF SINGLE-USE INSTRUMENTS IN GENERAL SURGERY

- 7.3 ORTHOPEDIC SURGERY

- 7.3.1 GROWING PREVALENCE OF OSTEOARTHRITIS AND SPORTS INJURIES TO BOOST MARKET GROWTH

- 7.4 CARDIOVASCULAR SURGERY

- 7.4.1 INCREASING INCIDENCE OF CARDIOVASCULAR DISEASES TO INCREASE NEED FOR CARDIAC INTERVENTION

- 7.5 GYNECOLOGY & OBSTETRICS SURGERY

- 7.5.1 INCREASING USE OF SUSI IN GYNECOLOGIC AND OBSTETRIC PROCEDURES TO ENSURE STERILITY TO DRIVE GROWTH

- 7.6 ENT SURGERY

- 7.6.1 INCREASING CASES OF ENT-RELATED DISORDERS TO BOOST DEMAND FOR SINGLE-USE SURGICAL INSTRUMENTS

- 7.7 OPHTHALMIC SURGERY

- 7.7.1 INNOVATIONS IN MICRO-INSTRUMENTATION TO BOLSTER MARKET

- 7.8 OTHER APPLICATIONS

8 SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY CARE SETTING

- 8.1 INTRODUCTION

- 8.2 HOSPITALS & SPECIALTY CLINICS

- 8.2.1 HIGH VOLUME AND COMPLEXITY OF SURGERIES PERFORMED IN HOSPITALS TO DRIVE MARKET GROWTH

- 8.3 AMBULATORY SURGICAL CENTERS

- 8.3.1 SHIFT TOWARD OUTPATIENT SURGERIES TO CONTRIBUTE TO MARKET GROWTH

- 8.4 HOME CARE SETTINGS

- 8.4.1 GROWING PREFERENCE FOR HOME-BASED CARE TO BOOST DEMAND FOR SINGLE-USE SURGICAL INSTRUMENTS

9 SINGLE-USE SURGICAL INSTRUMENTS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Favorable infrastructure network to drive market

- 9.2.3 CANADA

- 9.2.3.1 Growing surgical volumes to fuel market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Rising healthcare spending to increase demand for single-use surgical instruments

- 9.3.3 UK

- 9.3.3.1 Growing focus on high-quality care at licensed fertility clinics to propel market

- 9.3.4 FRANCE

- 9.3.4.1 Rising elderly population to boost market

- 9.3.5 ITALY

- 9.3.5.1 Regulatory guidelines to govern market

- 9.3.6 SPAIN

- 9.3.6.1 Booming medical tourism to drive market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Increasing medical benefits to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Higher adoption of minimally invasive procedures to support market growth

- 9.4.4 INDIA

- 9.4.4.1 Affordable treatment options to fuel market

- 9.4.5 AUSTRALIA

- 9.4.5.1 Rise in chronic diseases to propel market

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Growing focus on reversing low population trend to stimulate growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Increasing volume of surgical procedures to stimulate growth

- 9.5.3 MEXICO

- 9.5.3.1 Expansion of healthcare infrastructure to aid market growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 RISING HEALTHCARE SPENDING TO DRIVE MARKET

- 9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 IMPROVING HEALTH INFRASTRUCTURE TO PROPEL MARKET

- 9.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product type footprint

- 10.5.5.4 Application footprint

- 10.5.5.5 Care setting footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.)

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 MnM view

- 11.1.1.3.1 Right to win

- 11.1.1.3.2 Strategic choices

- 11.1.1.3.3 Weaknesses and competitive threats

- 11.1.2 MEDTRONIC

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Right to win

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses and competitive threats

- 11.1.3 BD

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Right to win

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses and competitive threats

- 11.1.4 B. BRAUN SE

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 SMITH+NEPHEW

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Expansions

- 11.1.5.3.2 Other developments

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 COOPERSURGICAL, INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.7 STRYKER

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 ALCON LABORATORIES, INC.

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 STERIS

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 PAUL HARTMANN AG

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 ERBE ELEKTROMEDIZIN GMBH

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches

- 11.1.11.3.2 Expansions

- 11.1.12 KIRWAN SURGICAL PRODUCTS, LLC

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.13 ASPEN SURGICAL PRODUCTS, INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Deals

- 11.1.14 SRR SURGICAL CO.

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.15 TATA SURGICAL

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.1 JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.)

- 11.2 OTHER COMPANIES

- 11.2.1 DTR MEDICAL LTD.

- 11.2.2 FUHRMANN GMBH

- 11.2.3 HEINZ HERENZ

- 11.2.4 SWANN-MORTON LIMITED

- 11.2.5 PURPLE SURGICAL

- 11.2.6 SURGAID MEDICAL (XIAMEN) CO., LTD.

- 11.2.7 HANGZHOU TONGLU SHIKONGHOU MEDICAL INSTRUMENT CO., LTD.

- 11.2.8 TAKTVOLL

- 11.2.9 TIANJIN ZHICHAO MEDICAL TECHNOLOGY CO., LTD.

- 11.2.10 HANGZHOU SCONOR MEDICAL TECHNOLOGY CO., LTD.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS