|

|

市場調査レポート

商品コード

1766386

エンボディドAIの世界市場:製品タイプ別、具現化レベル別、業界別、地域別 - 2030年までの予測Embodied AI Market by Product Type [Robots (Humanoid Robots, Mobile Robots, Industrial Robots, Service Robots, Cobots), Exoskeletons, Autonomous Systems, Smart Appliances], Level of Embodiment (Level 1, Level 2, Level 3) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| エンボディドAIの世界市場:製品タイプ別、具現化レベル別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月02日

発行: MarketsandMarkets

ページ情報: 英文 291 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

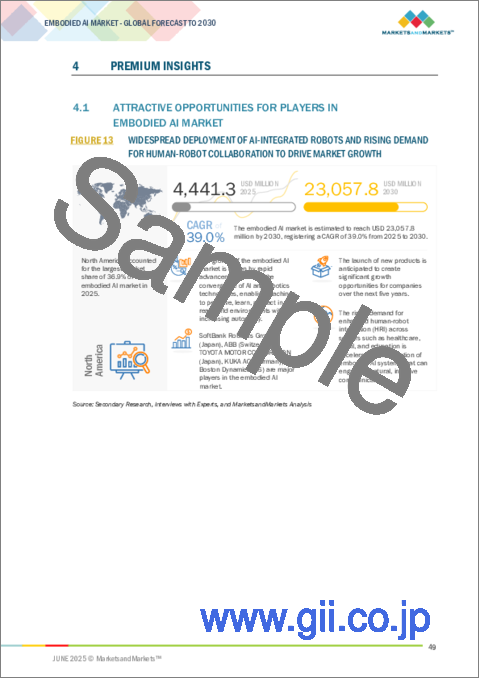

エンボディドAIの市場規模は、2025年の44億4,000万米ドルから2030年には230億6,000万米ドルに拡大し、CAGR39.0%を達成すると予測されています。

この成長は、機械がより自律的に機能し、文脈を認識できるようにするロボット工学とAIの進歩によってもたらされます。消費者市場におけるスマート・アシスタントやサービス・ロボットの存在感の高まりがこの動向をさらに後押しし、AIを搭載したデバイスが家庭で掃除、警備、介護の仕事をするのが当たり前になります。さらに、エンボディドAIは、実世界のモビリティを向上させることで自律システムの改善に貢献し、ロボットや車両に複雑な周囲の環境を理解し、ナビゲートする力を与えます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 製品タイプ別、具現化レベル別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

モバイルロボット分野は、複雑な環境をナビゲートできる自律的で柔軟なソリューションに対する需要が産業界全体で高まっており、高い成長が見込まれています。体現型AIを搭載したモバイルロボットは、リアルタイムで周囲の環境を感知、処理、対応できるため、倉庫、病院、小売店、公共スペースに最適です。モバイルロボットは、マテリアルハンドリング、在庫追跡、屋内配送、施設監視などのタスクに導入されています。自由に移動し、インテリジェントな判断を下すその能力は、ワークフローの自動化と生産性を大幅に向上させ、市場の成長を促進しています。

複雑な反復作業や危険な作業を正確にこなすインテリジェントなロボットシステムに対する需要の高まりにより、エンボディドAI市場では産業オートメーション垂直市場が最大の市場シェアを占めています。エンボディドAIは、機械が文脈を理解し、動的な工場設定をナビゲートし、自律検査、柔軟な組み立て、共同処理などのタスクに不可欠なリアルタイムの操作上の意思決定を行うことを可能にします。ABB、ファナック、安川電機、KUKA AGなどの企業は、自律性、安全性、人間と機械のコラボレーションを強化するために、産業用ロボットにAIを統合し、完全に自律的で相互接続された製造エコシステムをサポートしています。

北米におけるエンボディドAI市場の成長は、テクノロジー企業、新興企業、学術機関の活気あるエコシステムに支えられたAIとロボット工学への旺盛な投資によって後押しされています。Boston Dynamics、Tesla、Apptronik、Agility Robotics、Sanctuary Cognitive Systems Corporationなどの大手企業は、ヒューマノイドロボットから自律型モバイルプラットフォームまで、高度なエンボディドAIシステムの開発を主導しています。さらに、この地域は早期の技術導入と高度に発達したデジタルインフラから恩恵を受けており、ヘルスケア、ロジスティクス、防衛、スマート製造などの分野にわたってエンボディドAIのシームレスな統合を可能にしています。

当レポートでは、世界のエンボディドAI市場について調査し、製品タイプ別、具現化レベル別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達シナリオ、2021年~2025年

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 特許分析

- 規制状況

- 貿易分析

- 価格分析

- 技術分析

- ケーススタディ分析

- 2025年~2026年の主な会議とイベント

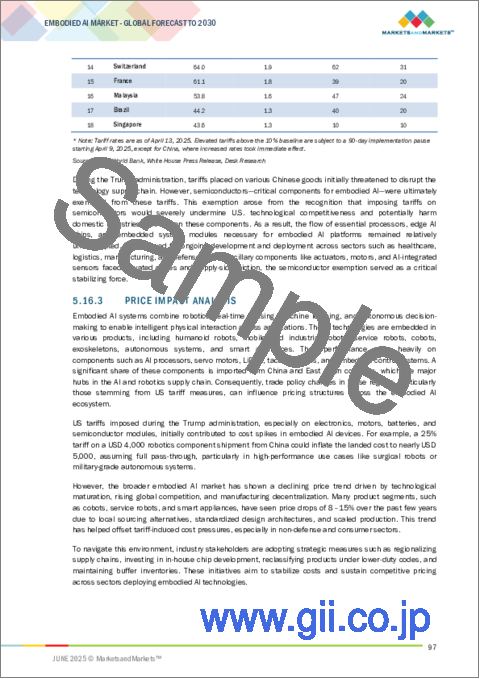

- 2025年の米国関税を具現化したAI市場への影響

第6章 エンボディドAI市場(製品タイプ別)

- イントロダクション

- ロボット

- 外骨格

- 自律システム

- スマート家電

第7章 エンボディドAI市場(具現化レベル別)

- イントロダクション

- レベル1:基本

- レベル2:中級

- レベル3:高度

第8章 エンボディドAI市場(業界別)

- イントロダクション

- ヘルスケア

- 産業オートメーション

- 自動車

- 物流とサプライチェーン

- 防衛と安全保障

- 小売

- 教育

- その他

第9章 エンボディドI市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 韓国

- 日本

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 南米

- アフリカ

- 中東

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2022年~2025年

- 収益分析、2021年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- エンボディドAIの企業評価マトリックス:主要参入企業、2024年

- エンボディドAIに関する企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- SOFTBANK ROBOTICS GROUP

- ABB

- TOYOTA MOTOR CORPORATION

- KUKA AG

- BOSTON DYNAMICS

- ROBOTIS CO., LTD.

- YASKAWA ELECTRIC CORPORATION

- FANUC CORPORATION

- TESLA

- AGILITY ROBOTICS

- その他の企業

- HANSON ROBOTICS LTD.

- 1X TECHNOLOGIES

- ENGINEAI

- SHANGHAI AGIBOT INNOVATION TECHNOLOGY CO., LTD.

- ANYBOTICS

- GHOSTROBOTICS

- UNIVERSAL ROBOTS A/S

- BEAR ROBOTICS, INC.

- APPTRONIK

- NURO, INC.

- UNITREE ROBOTICS

- WAYVE

- FOURIER

第12章 付録

List of Tables

- TABLE 1 EMBODIED AI MARKET: RISK ANALYSIS

- TABLE 2 ROLE OF PLAYERS IN EMBODIED AI ECOSYSTEM

- TABLE 3 EMBODIED AI MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- TABLE 6 LIST OF APPLIED/GRANTED PATENTS RELATED TO EMBODIED AI, APRIL 2024-MAY 2025

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EMBODIED AI MARKET: STANDARDS GOVERNING/RELEVANT TO AI

- TABLE 12 IMPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 EXPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 AVERAGE SELLING PRICE OF EMBODIED AI ROBOT TYPES OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 15 PRICING RANGE OF EMBODIED AI ROBOT TYPES, BY KEY PLAYER, 2024

- TABLE 16 PRICING RANGE OF HUMANOID ROBOTS, BY REGION, 2021-2024 (USD)

- TABLE 17 PRICING RANGE OF MOBILE ROBOTS, BY REGION, 2021-2024 (USD)

- TABLE 18 PRICING RANGE OF INDUSTRIAL ROBOTS, BY REGION, 2021-2024 (USD)

- TABLE 19 PRICING RANGE OF SERVICE ROBOTS, BY REGION, 2021-2024 (USD)

- TABLE 20 PRICING RANGE OF COBOTS, BY REGION, 2021-2024 (USD)

- TABLE 21 EMBODIED AI MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 22 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 EMBODIED AI MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 24 EMBODIED AI MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 25 EMBODIED AI MARKET FOR ROBOTS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 26 EMBODIED AI MARKET FOR ROBOTS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 27 EMBODIED AI MARKET FOR ROBOTS, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 28 EMBODIED AI MARKET FOR ROBOTS, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 29 EMBODIED AI MARKET FOR ROBOTS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 EMBODIED AI MARKET FOR ROBOTS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 HUMANOID ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 HUMANOID ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 INDUSTRIAL ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 INDUSTRIAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 SERVICE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 SERVICE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 COBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 COBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 EMBODIED AI MARKET FOR EXOSKELETONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 EMBODIED AI MARKET FOR EXOSKELETONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 EMBODIED AI MARKET FOR AUTONOMOUS SYSTEMS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 EMBODIED AI MARKET FOR AUTONOMOUS SYSTEMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 EMBODIED AI MARKET FOR SMART APPLIANCES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 EMBODIED AI MARKET FOR SMART APPLIANCES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 48 EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 49 EMBODIED AI MARKET FOR LEVEL 1: BASIC EMBODIMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 EMBODIED AI MARKET FOR LEVEL 1: BASIC EMBODIMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: EMBODIED AI MARKET FOR LEVEL 1: BASIC EMBODIMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 52 NORTH AMERICA: EMBODIED AI MARKET FOR LEVEL 1: BASIC EMBODIMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 53 EUROPE: EMBODIED AI MARKET FOR LEVEL 1: BASIC EMBODIMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 54 EUROPE: EMBODIED AI MARKET FOR LEVEL 1: BASIC EMBODIMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 55 ASIA PACIFIC: EMBODIED AI MARKET FOR LEVEL 1: BASIC EMBODIMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 ASIA PACIFIC: EMBODIED AI MARKET FOR LEVEL 1: BASIC EMBODIMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 REST OF THE WORLD: EMBODIED AI MARKET FOR LEVEL 1: BASIC EMBODIMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 REST OF THE WORLD: EMBODIED AI MARKET FOR LEVEL 1: BASIC EMBODIMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 EMBODIED AI MARKET FOR LEVEL 2: INTERMEDIATE EMBODIMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 EMBODIED AI MARKET FOR LEVEL 2: INTERMEDIATE EMBODIMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: EMBODIED AI MARKET FOR LEVEL 2: INTERMEDIATE EMBODIMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: EMBODIED AI MARKET FOR LEVEL 2: INTERMEDIATE EMBODIMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 EUROPE: EMBODIED AI MARKET FOR LEVEL 2: INTERMEDIATE EMBODIMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 EUROPE: EMBODIED AI MARKET FOR LEVEL 2: INTERMEDIATE EMBODIMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: EMBODIED AI MARKET FOR LEVEL 2: INTERMEDIATE EMBODIMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 ASIA PACIFIC: EMBODIED AI MARKET FOR LEVEL 2: INTERMEDIATE EMBODIMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 REST OF THE WORLD: EMBODIED AI MARKET FOR LEVEL 2: INTERMEDIATE EMBODIMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 REST OF THE WORLD: EMBODIED AI MARKET FOR LEVEL 2: INTERMEDIATE EMBODIMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 EMBODIED AI MARKET FOR LEVEL 3: ADVANCED EMBODIMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 EMBODIED AI MARKET FOR LEVEL 3: ADVANCED EMBODIMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: EMBODIED AI MARKET FOR LEVEL 3: ADVANCED EMBODIMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: EMBODIED AI MARKET FOR LEVEL 3: ADVANCED EMBODIMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: EMBODIED AI MARKET FOR LEVEL 3: ADVANCED EMBODIMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 74 EUROPE: EMBODIED AI MARKET FOR LEVEL 3: ADVANCED EMBODIMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 75 ASIA PACIFIC: EMBODIED AI MARKET FOR LEVEL 3: ADVANCED EMBODIMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 76 ASIA PACIFIC: EMBODIED AI MARKET FOR LEVEL 3: ADVANCED EMBODIMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 77 REST OF THE WORLD: EMBODIED AI MARKET FOR LEVEL 3: ADVANCED EMBODIMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 REST OF THE WORLD: EMBODIED AI MARKET FOR LEVEL 3: ADVANCED EMBODIMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 EMBODIED AI MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 80 EMBODIED AI MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 81 HEALTHCARE: EMBODIED AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 HEALTHCARE: EMBODIED AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 INDUSTRIAL AUTOMATION: EMBODIED AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 INDUSTRIAL AUTOMATION: EMBODIED AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 AUTOMOTIVE: EMBODIED AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 AUTOMOTIVE: EMBODIED AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 LOGISTICS & SUPPLY CHAIN: EMBODIED AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 LOGISTICS & SUPPLY CHAIN: EMBODIED AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 DEFENSE & SECURITY: EMBODIED AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 DEFENSE & SECURITY: EMBODIED AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 RETAIL: EMBODIED AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 RETAIL: EMBODIED AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 EDUCATION: EMBODIED AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 EDUCATION: EMBODIED AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 OTHER VERTICALS: EMBODIED AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 OTHER VERTICALS: EMBODIED AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 EMBODIED AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 EMBODIED AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: EMBODIED AI MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: EMBODIED AI MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: EMBODIED AI MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: EMBODIED AI MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: EMBODIED AI MARKET FOR ROBOTS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: EMBODIED AI MARKET FOR ROBOTS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: EMBODIED AI MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: EMBODIED AI MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 109 US: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 110 US: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 111 CANADA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 112 CANADA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 113 MEXICO: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 114 MEXICO: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: EMBODIED AI MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 EUROPE: EMBODIED AI MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: EMBODIED AI MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 118 EUROPE: EMBODIED AI MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: EMBODIED AI MARKET FOR ROBOTS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 120 EUROPE: EMBODIED AI MARKET FOR ROBOTS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: EMBODIED AI MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: EMBODIED AI MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 125 GERMANY: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 126 GERMANY: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 127 UK: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 128 UK: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 129 FRANCE: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 130 FRANCE: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 131 ITALY: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 132 ITALY: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 133 SPAIN: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 134 SPAIN: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 135 POLAND: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 136 POLAND: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 137 NORDICS: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 138 NORDICS: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 139 REST OF EUROPE: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 140 REST OF EUROPE: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: EMBODIED AI MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: EMBODIED AI MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: EMBODIED AI MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: EMBODIED AI MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: EMBODIED AI MARKET FOR ROBOTS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: EMBODIED AI MARKET FOR ROBOTS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: EMBODIED AI MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 150 ASIA PACIFIC: EMBODIED AI MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 151 CHINA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 152 CHINA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 153 SOUTH KOREA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 154 SOUTH KOREA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 155 JAPAN: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 156 JAPAN: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 157 INDIA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 158 INDIA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 159 AUSTRALIA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 160 AUSTRALIA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 161 INDONESIA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 162 INDONESIA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 163 MALAYSIA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 164 MALAYSIA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 165 THAILAND: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 166 THAILAND: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 167 VIETNAM: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 168 VIETNAM: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 171 REST OF THE WORLD: EMBODIED AI MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 172 REST OF THE WORLD: EMBODIED AI MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 173 REST OF THE WORLD: EMBODIED AI MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 174 REST OF THE WORLD: EMBODIED AI MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 175 REST OF THE WORLD: EMBODIED AI MARKET FOR ROBOTS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 176 REST OF THE WORLD: EMBODIED AI MARKET FOR ROBOTS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 177 REST OF THE WORLD: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 178 REST OF THE WORLD: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 179 REST OF THE WORLD: EMBODIED AI MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 180 REST OF THE WORLD: EMBODIED AI MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 181 SOUTH AMERICA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 182 SOUTH AMERICA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 183 AFRICA: EMBODIED AI MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 184 AFRICA: EMBODIED AI MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 185 AFRICA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 186 AFRICA: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 187 MIDDLE EAST: EMBODIED AI MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 188 MIDDLE EAST: EMBODIED AI MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 189 MIDDLE EAST: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2021-2024 (USD MILLION)

- TABLE 190 MIDDLE EAST: EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT, 2025-2030 (USD MILLION)

- TABLE 191 OVERVIEW OF STRATEGIES ADOPTED BY EMBODIED AI MANUFACTURERS AND PROVIDERS

- TABLE 192 EMBODIED AI MARKET SHARE ANALYSIS, 2024

- TABLE 193 EMBODIED AI MARKET: REGION FOOTPRINT, 2024

- TABLE 194 EMBODIED AI MARKET: PRODUCT TYPE FOOTPRINT, 2024

- TABLE 195 EMBODIED AI MARKET: LEVEL OF EMBODIMENT FOOTPRINT, 2024

- TABLE 196 EMBODIED AI MARKET: VERTICAL FOOTPRINT, 2024

- TABLE 197 EMBODIED AI MARKET: LIST OF KEY STARTUPS/SMES, 2024

- TABLE 198 EMBODIED AI MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 199 EMBODIED AI MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, APRIL 2022-MAY 2025

- TABLE 200 EMBODIED AI MARKET: DEALS, APRIL 2022-MAY 2025

- TABLE 201 SOFTBANK ROBOTICS GROUP: COMPANY OVERVIEW

- TABLE 202 SOFTBANK ROBOTICS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 SOFTBANK ROBOTICS GROUP: PRODUCT LAUNCHES, APRIL 2022-MAY 2025

- TABLE 204 SOFTBANK ROBOTICS GROUP: DEALS, APRIL 2022-MAY 2025

- TABLE 205 ABB: COMPANY OVERVIEW

- TABLE 206 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 ABB: PRODUCT LAUNCHES, APRIL 2022-MAY 2025

- TABLE 208 ABB: DEALS, APRIL 2022-MAY 2025

- TABLE 209 TOYOTA MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 210 TOYOTA MOTOR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 TOYOTA MOTOR CORPORATION: DEALS, APRIL 2022-MAY 2025

- TABLE 212 KUKA AG: COMPANY OVERVIEW

- TABLE 213 KUKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 KUKA AG: DEALS, APRIL 2022-MAY 2025

- TABLE 215 BOSTON DYNAMICS: COMPANY OVERVIEW

- TABLE 216 BOSTON DYNAMICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 BOSTON DYNAMICS: PRODUCT LAUNCHES, APRIL 2022-MAY 2025

- TABLE 218 BOSTON DYNAMICS: DEALS, APRIL 2022-MAY 2025

- TABLE 219 ROBOTIS CO., LTD.: COMPANY OVERVIEW

- TABLE 220 ROBOTIS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 ROBOTIS CO., LTD.: PRODUCT LAUNCHES, APRIL 2022-MAY 2025

- TABLE 222 ROBOTIS CO., LTD.: DEALS, APRIL 2022-MAY 2025

- TABLE 223 YASKAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 224 YASKAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 YASKAWA ELECTRIC CORPORATION: DEALS, APRIL 2022-MAY 2025

- TABLE 226 FANUC CORPORATION: COMPANY OVERVIEW

- TABLE 227 FANUC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 FANUC CORPORATION: DEALS, APRIL 2022-MAY 2025

- TABLE 229 TESLA: COMPANY OVERVIEW

- TABLE 230 TESLA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 AGILITY ROBOTICS: COMPANY OVERVIEW

- TABLE 232 AGILITY ROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 AGILITY ROBOTICS: PRODUCT ENHANCEMENTS, APRIL 2022-MAY 2025

- TABLE 234 AGILITY ROBOTICS: DEALS, APRIL 2022-MAY 2025

- TABLE 235 FIGURE: COMPANY OVERVIEW

- TABLE 236 SANCTUARY COGNITIVE SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 237 HANSON ROBOTICS LTD.: COMPANY OVERVIEW

- TABLE 238 1X TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 239 ENGINEAI: COMPANY OVERVIEW

- TABLE 240 SHANGHAI AGIBOT INNOVATION TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 241 ANYBOTICS: COMPANY OVERVIEW

- TABLE 242 GHOSTROBOTICS: COMPANY OVERVIEW

- TABLE 243 UNIVERSAL ROBOTS A/S: COMPANY OVERVIEW

- TABLE 244 BEAR ROBOTICS, INC.: COMPANY OVERVIEW

- TABLE 245 APPTRONIK: COMPANY OVERVIEW

- TABLE 246 NURO, INC.: COMPANY OVERVIEW

- TABLE 247 UNITREE ROBOTICS: COMPANY OVERVIEW

- TABLE 248 WAYVE: COMPANY OVERVIEW

- TABLE 249 FOURIER: COMPANY OVERVIEW

List of Figures

- FIGURE 1 EMBODIED AI MARKET SEGMENTATION AND REGIONS CONSIDERED

- FIGURE 2 EMBODIED AI MARKET: RESEARCH DESIGN

- FIGURE 3 EMBODIED AI MARKET: RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 EMBODIED AI MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 5 EMBODIED AI MARKET: BOTTOM-UP APPROACH

- FIGURE 6 EMBODIED AI MARKET: TOP-DOWN APPROACH

- FIGURE 7 EMBODIED AI MARKET: DATA TRIANGULATION

- FIGURE 8 ROBOTS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 9 LEVEL 3: ADVANCED EMBODIMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 INDUSTRIAL AUTOMATION VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 11 ASIA PACIFIC TO LEAD MARKET IN 2030

- FIGURE 12 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 WIDESPREAD DEPLOYMENT OF AI-INTEGRATED ROBOTS AND RISING DEMAND FOR HUMAN-ROBOT COLLABORATION TO DRIVE MARKET GROWTH

- FIGURE 14 ROBOTS AND LEVEL 2: INTERMEDIATE EMBODIMENT SEGMENT TO HOLD LARGE MARKET SHARE IN 2025

- FIGURE 15 HEALTHCARE VERTICAL TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 16 CHINA TO WITNESS HIGHEST CAGR IN EMBODIED AI MARKET DURING FORECAST PERIOD

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN EMBODIED AI MARKET

- FIGURE 18 IMPACT ANALYSIS: DRIVERS

- FIGURE 19 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 20 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 21 IMPACT ANALYSIS: CHALLENGES

- FIGURE 22 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 23 EMBODIED AI MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 EMBODIED AI MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 EMBODIED AI MARKET: INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 26 EMBODIED AI MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- FIGURE 29 EMBODIED AI MARKET: PATENT ANALYSIS, 2014-2024

- FIGURE 30 IMPORT SCENARIO FOR HS CODE 847950-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 31 EXPORT SCENARIO FOR HS CODE 847950-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 32 AVERAGE SELLING PRICE OF HUMANOID ROBOTS, BY REGION, 2021-2024 (USD)

- FIGURE 33 AVERAGE SELLING PRICE OF MOBILE ROBOTS, BY REGION, 2021-2024 (USD)

- FIGURE 34 AVERAGE SELLING PRICE OF INDUSTRIAL ROBOTS, BY REGION, 2021-2024 (USD)

- FIGURE 35 AVERAGE SELLING PRICE OF SERVICE ROBOTS, BY REGION, 2021-2024 (USD)

- FIGURE 36 AVERAGE SELLING PRICE OF COBOTS, BY REGION, 2021-2024 (USD)

- FIGURE 37 ROBOTS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 LEVEL 3: ADVANCED EMBODIMENT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 39 HEALTHCARE VERTICAL TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: EMBODIED AI MARKET SNAPSHOT

- FIGURE 42 US TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 43 EUROPE: EMBODIED AI MARKET SNAPSHOT

- FIGURE 44 UK TO BE FASTEST-GROWING MARKET IN EUROPE DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC: EMBODIED AI MARKET SNAPSHOT

- FIGURE 46 CHINA TO LEAD EMBODIED AI MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 47 REST OF THE WORLD: EMBODIED AI MARKET SNAPSHOT

- FIGURE 48 MIDDLE EAST TO LEAD EMBODIED AI MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 49 REVENUE ANALYSIS OF FIVE KEY PLAYERS IN EMBODIED AI MARKET, 2021-2024 (USD MILLION)

- FIGURE 50 SHARE OF KEY PLAYERS IN EMBODIED AI MARKET, 2024

- FIGURE 51 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 52 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 53 EMBODIED AI MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 54 EMBODIED AI MARKET: COMPETITIVE EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 55 EMBODIED AI MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 56 EMBODIED AI MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 57 SOFTBANK ROBOTICS GROUP: COMPANY SNAPSHOT

- FIGURE 58 ABB: COMPANY SNAPSHOT

- FIGURE 59 TOYOTA MOTOR CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 KUKA AG: COMPANY SNAPSHOT

- FIGURE 61 ROBOTIS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 FANUC CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 TESLA: COMPANY SNAPSHOT

The embodied AI market is projected to expand from USD 4.44 billion in 2025 to USD 23.06 billion by 2030, achieving a CAGR of 39.0%. This growth is driven by advancements in robotics and AI, which enable machines to function more autonomously and to be contextually aware. The increasing presence of smart assistants and service robots in consumer markets further bolsters this trend, making AI-powered devices commonplace in homes for cleaning, security, and caregiving tasks. Moreover, embodied AI contributes to improving autonomous systems by enhancing real-world mobility, empowering robots and vehicles to understand and navigate intricate surroundings.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Product Type, Level of Embodiment, Vertical, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Mobile robots are projected to record the highest CAGR during the forecast period"

The mobile robots segment is expected to grow at a high rate with increasing demand across industries for autonomous and flexible solutions that can navigate complex environments. Mobile robots, powered by embodied AI, can sense, process, and respond to their surroundings in real time, making them ideal for warehouses, hospitals, retail stores, and public spaces. Mobile robots are being deployed for tasks like material handling, inventory tracking, indoor delivery, and facility monitoring. Their ability to move freely and make intelligent decisions significantly enhances workflow automation and productivity, driving market growth.

"Industrial automation vertical to hold largest market share in 2025"

The industrial automation vertical holds the largest market share in the embodied AI market driven by the increasing demand for intelligent robotic systems that can perform complex, repetitive, and hazardous tasks with precision. Embodied AI enables machines to understand context, navigate dynamic factory settings, and make real-time operational decisions, which is vital for tasks such as autonomous inspection, flexible assembly, and collaborative handling. Companies including ABB, FANUC, Yaskawa Electric, and KUKA AG have integrated AI into their industrial robots to enhance autonomy, safety, and human-machine collaboration to support fully autonomous and interconnected manufacturing ecosystems.

"North America to hold largest market share in embodied AI market in 2025"

The growth of the embodied AI market in North America is being fueled by robust investment in AI and robotics, supported by a vibrant ecosystem of technology companies, startups, and academic institutions. Major players such as Boston Dynamics, Tesla, Apptronik, Agility Robotics, and Sanctuary Cognitive Systems Corporation are leading the development of advanced embodied AI systems ranging from humanoid robots to autonomous mobile platforms. Moreover, the region benefits from early technology adoption and a highly developed digital infrastructure, which allows for seamless integration of embodied AI across sectors such as healthcare, logistics, defense, and smart manufacturing.

Extensive primary interviews were conducted with key industry experts in the embodied AI market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

- By Company Type: Tier 1-40%, Tier 2-20%, and Tier 3-40%

- By Designation: C-level Executives-10%, Directors-30%, and Others-60%

- By Region: Asia Pacific-40%, Europe-20%, North America-30%, and RoW-10%

The embodied AI market is dominated by a few globally established players, such as SoftBank Robotics Group (Japan), ABB (Switzerland), TOYOTA MOTOR CORPORATION (Japan), KUKA AG (Germany), Boston Dynamics (US), ROBOTIS Co., Ltd. (South Korea), YASKAWA ELECTRIC CORPORATION (Japan), FANUC CORPORATION (Japan), Tesla (US), Agility Robotics (US), Figure (US), Sanctuary Cognitive Systems Corporation (Canada), Hanson Robotics Ltd. (China), 1X Technologies (Norway), EngineAI (China), Shanghai AgiBot Innovation Technology Co., Ltd (China), ANYbotics (Switzerland), Ghostrobotics (US), Universal Robots A/S (Denmark), Bear Robotics, Inc. (US), Apptronik (US), Nuro, Inc. (US), Unitree Robotics (China), Wayve (UK), and Fourier (China).

The study includes an in-depth competitive analysis of these key players in the embodied AI market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the embodied AI market based on product type (robots, exoskeletons, autonomous systems, smart appliances), level of embodiment (level 1: basic embodiment, level 2: intermediate embodiment, level 3: advanced embodiment), and vertical (healthcare, industrial automation, automotive, logistics & supply chain, defense & security, retail, education, and others). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes an ecosystem analysis of key players.

Reasons to buy this report:

This report will provide market leaders/new entrants with information on the closest approximations of revenues for the overall embodied AI market and its subsegments. The report will help stakeholders understand the competitive landscape and gain insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and offers information on the key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report:

- Analysis of key drivers (advancements in robotics and AI integration to enhance machine autonomy, increasing demand for human-robot interaction, growth of smart assistants and service robots in consumer markets, real-world mobility with embodied AI in autonomous systems), restraints (ethical dilemmas in human-robot interactions, privacy concerns in public and private environments), opportunities (expanding embodied AI applications in healthcare and elderly care, transforming industrial automation with embodied AI and collaborative robots, learning and well-being through educational and social robots, advancements in military capabilities using embodied AI in tactical operations), challenges (data scarcity in collecting real-world training sets, fragmentation in standardized platforms and protocols)

- Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the embodied AI market

- Market Development: Comprehensive information about lucrative markets through the analysis of the embodied AI market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the embodied AI market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as SoftBank Robotics Group (Japan), ABB (Switzerland), TOYOTA MOTOR CORPORATION (Japan), KUKA AG (Germany), Boston Dynamics (US), ROBOTIS Co., Ltd. (South Korea), YASKAWA ELECTRIC CORPORATION (Japan), FANUC CORPORATION (Japan), Tesla (US), Agility Robotics (US), Figure (US), Sanctuary Cognitive Systems Corporation (Canada), Hanson Robotics Ltd. (China), 1X Technologies (Norway), and EngineAI (China), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EMBODIED AI MARKET

- 4.2 EMBODIED AI MARKET, BY PRODUCT TYPE AND LEVEL OF EMBODIMENT

- 4.3 EMBODIED AI MARKET, BY VERTICAL

- 4.4 EMBODIED AI MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Advancements in robotics and AI integration to enhance machine autonomy

- 5.2.1.2 Increasing demand for human-robot interaction

- 5.2.1.3 Growth of smart assistants and service robots in consumer markets

- 5.2.1.4 Real-world mobility with embodied AI in autonomous systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Ethical dilemmas in human-robot interactions

- 5.2.2.2 Privacy concerns in public and private environments

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expanding applications in healthcare and elderly care

- 5.2.3.2 Transforming industrial automation with embodied AI and collaborative robots

- 5.2.3.3 Learning and well-being through educational and social robots

- 5.2.3.4 Advancements in military capabilities using embodied AI in tactical operations

- 5.2.4 CHALLENGES

- 5.2.4.1 Data scarcity in collecting real-world training sets

- 5.2.4.2 Fragmentation in standardized platforms and protocols

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.7.2 BARGAINING POWER OF SUPPLIERS

- 5.7.3 BARGAINING POWER OF BUYERS

- 5.7.4 THREAT OF SUBSTITUTES

- 5.7.5 THREAT OF NEW ENTRANTS

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 PATENT ANALYSIS

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 STANDARDS

- 5.10.3 REGULATIONS

- 5.10.3.1 North America

- 5.10.3.1.1 US

- 5.10.3.1.2 Canada

- 5.10.3.2 Europe

- 5.10.3.2.1 Germany

- 5.10.3.2.2 France

- 5.10.3.3 Asia Pacific

- 5.10.3.3.1 Japan

- 5.10.3.3.2 South Korea

- 5.10.3.4 Rest of the World

- 5.10.3.4.1 Saudi Arabia

- 5.10.3.4.2 Brazil

- 5.10.3.1 North America

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA (HS CODE 847950)

- 5.11.2 EXPORT SCENARIO (HS CODE 847950)

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE OF EMBODIED AI ROBOT TYPES, BY KEY PLAYER, 2024 (USD)

- 5.12.2 PRICING RANGE OF EMBODIED AI ROBOT TYPES, BY KEY PLAYER, 2024

- 5.12.3 AVERAGE SELLING PRICE OF EMBODIED AI ROBOT TYPES, BY REGION, 2021-2024 (USD)

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.1.1 Simultaneous Localization and Mapping (SLAM)

- 5.13.1.2 Reinforcement Learning (RL)

- 5.13.1.3 Sensor Fusion

- 5.13.1.4 Computer Vision

- 5.13.1.5 Natural Language Processing (NLP)

- 5.13.2 COMPLEMENTARY TECHNOLOGIES

- 5.13.2.1 Cloud Robotics Platforms

- 5.13.2.2 Human-Machine Interfaces (HMIs)

- 5.13.2.3 Simulation & Digital Twins

- 5.13.3 ADJACENT TECHNOLOGIES

- 5.13.3.1 Neuromorphic Computing

- 5.13.3.2 AR/VR (Augmented & Virtual Reality)

- 5.13.1 KEY TECHNOLOGIES

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 CASE STUDY 1: STELLANTIS NV-TRANSFORMING INFOTAINMENT TESTING WITH COMAU'S AI-POWERED COLLABORATIVE ROBOTICS

- 5.14.2 CASE STUDY 2: LOVEMARK-AI-POWERED 3D VISION TRANSFORMS HALOGEN LEAK DETECTION FOR AIR CONDITIONER PRODUCTION

- 5.14.3 CASE STUDY 3: NEXLAM S.R.L.-EMBRACING SMART WELDING AUTOMATION WITH ROBOTECO-ITALARGON'S TAWERS AND GWP

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 IMPACT OF 2025 US TARIFFS-EMBODIED AI MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRIES/REGIONS

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON END-USE INDUSTRIES

- 5.16.5.1 Healthcare

- 5.16.5.2 Automation & manufacturing

- 5.16.5.3 Automotive

- 5.16.5.4 Logistics & supply chain

- 5.16.5.5 Defense & security

- 5.16.6 RETAIL

- 5.16.7 EDUCATION

6 EMBODIED AI MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 ROBOTS

- 6.2.1 HUMANOID ROBOTS

- 6.2.1.1 Expanding human-robot interaction capabilities to meet rising demand in service sectors

- 6.2.2 MOBILE ROBOTS

- 6.2.2.1 Growing deployment of AI-powered mobile robots for efficient material handling and warehouse automation to drive growth

- 6.2.3 INDUSTRIAL ROBOTS

- 6.2.3.1 Focus on smart factory transformation by integrating AI-powered industrial robots with IoT and cloud systems

- 6.2.4 SERVICE ROBOTS

- 6.2.4.1 Need for automation in healthcare and eldercare to support growth

- 6.2.5 COBOTS

- 6.2.5.1 Boosting assembly and packaging efficiency through AI-enhanced pick-and-place cobots to propel market growth

- 6.2.1 HUMANOID ROBOTS

- 6.3 EXOSKELETONS

- 6.3.1 RISING USE OF EXOSKELETONS IN HEALTHCARE FOR REHABILITATION TO BOOST MARKET GROWTH

- 6.4 AUTONOMOUS SYSTEMS

- 6.4.1 ENABLING ADAPTIVE NAVIGATION TO SUPPORT DYNAMIC ENVIRONMENTS TO DRIVE MARKET FOR AUTONOMOUS SYSTEMS

- 6.5 SMART APPLIANCES

- 6.5.1 RISING DEMAND FOR INTELLIGENT HOME DEVICES AND CLEANING ROBOTS TO FUEL MARKET GROWTH

7 EMBODIED AI MARKET, BY LEVEL OF EMBODIMENT

- 7.1 INTRODUCTION

- 7.2 LEVEL 1: BASIC EMBODIMENT

- 7.2.1 RISING CONSUMER DEMAND FOR AFFORDABLE AUTOMATION TO DRIVE MARKET GROWTH FOR LEVEL 1 EMBODIMENT

- 7.3 LEVEL 2: INTERMEDIATE EMBODIMENT

- 7.3.1 RISING ADOPTION OF ROBOTS IN WAREHOUSES AND AUTONOMOUS DELIVERY TO PROPEL MARKET GROWTH

- 7.4 LEVEL 3: ADVANCED EMBODIMENT

- 7.4.1 CONVERGENCE OF LLMS AND PHYSICAL INTELLIGENCE TO DRIVE GROWTH IN ADVANCED EMBODIMENT MARKET

8 EMBODIED AI MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.2 HEALTHCARE

- 8.2.1 ROBOTIC SURGERY & ASSISTANCE

- 8.2.1.1 Increasing adoption of surgical robots for enhanced precision and control to drive the growth of the market

- 8.2.2 PATIENT CARE & REHABILITATION

- 8.2.2.1 Rising demand for elderly and chronic care solutions to drive market growth

- 8.2.3 MEDICAL IMAGING & DIAGNOSTICS

- 8.2.3.1 Accelerated diagnostic efficiency through AI-enhanced image acquisition and interpretation to boost market growth

- 8.2.1 ROBOTIC SURGERY & ASSISTANCE

- 8.3 INDUSTRIAL AUTOMATION

- 8.3.1 FACTORY AUTOMATION

- 8.3.1.1 Growing need to replace manual labor with high-yield, self-adaptive robotic systems to drive adoption in factories

- 8.3.2 QUALITY CONTROL & INSPECTION

- 8.3.2.1 Growing demand for zero-defect production to drive adoption of intelligent quality assurance robots

- 8.3.1 FACTORY AUTOMATION

- 8.4 AUTOMOTIVE

- 8.4.1 AUTONOMOUS VEHICLES

- 8.4.1.1 Increasing demand for contactless and autonomous mobility solutions to boost market for embodied AI in autonomous vehicles

- 8.4.2 ADVANCED DRIVER ASSISTANCE SYSTEMS (ADAS)

- 8.4.2.1 OEM investments in L2+ and L3 automation to fuel embodied AI innovation in driver assistance systems

- 8.4.1 AUTONOMOUS VEHICLES

- 8.5 LOGISTICS & SUPPLY CHAIN

- 8.5.1 AUTONOMOUS DELIVERY SYSTEMS

- 8.5.1.1 Integration of embodied AI with warehouse automation and smart logistics infrastructure to boost adoption

- 8.5.2 WAREHOUSE AUTOMATION

- 8.5.2.1 Advancements in physical AI-powered digital twins to boost market for embodied AI in warehouse automation

- 8.5.1 AUTONOMOUS DELIVERY SYSTEMS

- 8.6 DEFENSE & SECURITY

- 8.6.1 AUTONOMOUS SURVEILLANCE DRONES

- 8.6.1.1 Advancements in AI perception, navigation, and communication technologies to propel adoption of autonomous surveillance drones

- 8.6.2 SEARCH & RESCUE OPERATIONS

- 8.6.2.1 Increasing challenges in GPS-denied and complex environments to propel demand for embodied AI in SAR operations

- 8.6.3 AUTONOMOUS COMBAT SYSTEMS

- 8.6.3.1 Need to reduce human exposure in high-risk operations to increase demand for embodied AI in autonomous combat systems

- 8.6.1 AUTONOMOUS SURVEILLANCE DRONES

- 8.7 RETAIL

- 8.7.1 CUSTOMER SERVICE ROBOTS

- 8.7.1.1 Labor shortages in customer-facing roles to accelerate adoption of embodied AI robots for retail and hospitality services

- 8.7.2 IN-STORE ROBOTICS FOR INVENTORY MANAGEMENT

- 8.7.2.1 Growing deployment of intelligent mobile robots in high-traffic retail environments to drive market

- 8.7.3 PERSONALIZED SHOPPING ASSISTANTS

- 8.7.3.1 Rising consumer expectations for personalized in-store experiences to boost demand

- 8.7.1 CUSTOMER SERVICE ROBOTS

- 8.8 EDUCATION

- 8.8.1 TEACHING ROBOTS

- 8.8.1.1 Integration of intelligent robotics in classrooms to propel growth of embodied AI for teaching applications

- 8.8.2 INTERACTIVE LEARNING SYSTEMS

- 8.8.2.1 Integration of AI with multisensory interfaces to drive adoption of interactive learning systems in education

- 8.8.3 AI TUTORS

- 8.8.3.1 Advancements in NLP and emotion-aware AI are set to drive adoption of AI tutors

- 8.8.1 TEACHING ROBOTS

- 8.9 OTHER VERTICALS

9 EMBODIED AI MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Advancements of humanoids and mobile robots in the region to drive market growth

- 9.2.3 CANADA

- 9.2.3.1 Major investments in robotics, healthcare automation, and AI talent to boost embodied AI in Canada

- 9.2.4 MEXICO

- 9.2.4.1 Automation in Mexico's automotive sector to drive demand for embodied AI solutions

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Strategic R&D and government support accelerate Germany's embodied AI innovation

- 9.3.3 UK

- 9.3.3.1 Advancements in automation and human-machine collaboration to propel UK embodied AI market

- 9.3.4 FRANCE

- 9.3.4.1 Accelerated adoption of embodied AI across France's industrial and healthcare sectors to drive market growth

- 9.3.5 ITALY

- 9.3.5.1 Digital transformation in logistics and advanced robotics research accelerating embodied AI adoption in Italy

- 9.3.6 SPAIN

- 9.3.6.1 National AI strategies and industrial digitization fuel embodied AI adoption

- 9.3.7 POLAND

- 9.3.7.1 Government-backed AI factories and industrial robotics adoption accelerate Poland's embodied AI market

- 9.3.8 NORDICS

- 9.3.8.1 High robot density and AI-driven production advancing embodied AI adoption in Nordic smart factories

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Government-backed innovation and growing production fuels China's dominance in embodied AI

- 9.4.3 SOUTH KOREA

- 9.4.3.1 Strategic alliances and industrial partnerships to accelerate market growth

- 9.4.4 JAPAN

- 9.4.4.1 Innovations in automotive technology to drive market

- 9.4.5 INDIA

- 9.4.5.1 Smart manufacturing and digital transformation accelerating embodied AI adoption across industries

- 9.4.6 AUSTRALIA

- 9.4.6.1 Agriculture and mining sector adoption to drive market for embodied AI

- 9.4.7 INDONESIA

- 9.4.7.1 Digital sector expansion to propel embodied AI adoption in Indonesia

- 9.4.8 MALAYSIA

- 9.4.8.1 Malaysia's AI policy framework and innovation ecosystem to fuel market growth

- 9.4.9 THAILAND

- 9.4.9.1 AI-powered public safety initiatives and smart city infrastructure to fuel Thailand's embodied AI market expansion

- 9.4.10 VIETNAM

- 9.4.10.1 Strategic investments in AI infrastructure to accelerate embodied AI market growth in Vietnam

- 9.4.11 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD

- 9.5.1 MACROECONOMIC OUTLOOK FOR REST OF THE WORLD

- 9.5.2 SOUTH AMERICA

- 9.5.2.1 Rising digital transformation and funding to fuel market growth

- 9.5.3 AFRICA

- 9.5.3.1 South Africa

- 9.5.3.1.1 Industrial strength and AI investment position South Africa at forefront of embodied AI in Africa

- 9.5.3.2 Other African countries

- 9.5.3.1 South Africa

- 9.5.4 MIDDLE EAST

- 9.5.4.1 GCC

- 9.5.4.1.1 Bahrain

- 9.5.4.1.1.1 Innovation and talent development to drive market growth

- 9.5.4.1.2 Kuwait

- 9.5.4.1.2.1 Expanding embodied AI capabilities via research and talent development through educational initiatives

- 9.5.4.1.3 Oman

- 9.5.4.1.3.1 Strategic policies and sectoral innovations to propel market growth

- 9.5.4.1.4 Qatar

- 9.5.4.1.4.1 Strategic AI investments to accelerate the market growth for embodied AI

- 9.5.4.1.5 Saudi Arabia

- 9.5.4.1.5.1 Increasing adoption of robotics and AI-driven automation to boost embodied AI market growth

- 9.5.4.1.6 United Arab Emirates

- 9.5.4.1.6.1 UAE's investment in intelligent automation set to boost embodied AI market

- 9.5.4.1.1 Bahrain

- 9.5.4.2 Rest of Middle East

- 9.5.4.1 GCC

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 REVENUE ANALYSIS, 2021-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX FOR EMBODIED AI: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Product type footprint

- 10.7.5.4 Level of embodiment footprint

- 10.7.5.5 Vertical footprint

- 10.8 COMPANY EVALUATION MATRIX FOR EMBODIED AI: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SOFTBANK ROBOTICS GROUP

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 ABB

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 TOYOTA MOTOR CORPORATION

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 KUKA AG

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 BOSTON DYNAMICS

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 ROBOTIS CO., LTD.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.7 YASKAWA ELECTRIC CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 FANUC CORPORATION

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.9 TESLA

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.10 AGILITY ROBOTICS

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product enhancements

- 11.1.10.3.2 Deals

- 11.1.1 SOFTBANK ROBOTICS GROUP

- 11.2 OTHER PLAYERS

- 11.2.1 FIGURE 269 11.2.2 SANCTUARY COGNITIVE SYSTEMS CORPORATION

- 11.2.3 HANSON ROBOTICS LTD.

- 11.2.4 1X TECHNOLOGIES

- 11.2.5 ENGINEAI

- 11.2.6 SHANGHAI AGIBOT INNOVATION TECHNOLOGY CO., LTD.

- 11.2.7 ANYBOTICS

- 11.2.8 GHOSTROBOTICS

- 11.2.9 UNIVERSAL ROBOTS A/S

- 11.2.10 BEAR ROBOTICS, INC.

- 11.2.11 APPTRONIK

- 11.2.12 NURO, INC.

- 11.2.13 UNITREE ROBOTICS

- 11.2.14 WAYVE

- 11.2.15 FOURIER

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS