|

|

市場調査レポート

商品コード

1763332

水性バリアコーティングの世界市場 (~2930年):成分 (水・充填剤・バインダー・添加剤)・バリアタイプ (水蒸気・オイル/グリース)・基材 (紙&段ボール)・エンドユーザー産業 (食品&飲料包装)・地域別Water-based Barrier Coatings Market by Component (Water, Filler, Binder, Additives), Barrier Type (Water Vapor, Oil/Grease), Substrate (Paper & Cardboard), End-use Industry (Food & Beverage Packaging), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 水性バリアコーティングの世界市場 (~2930年):成分 (水・充填剤・バインダー・添加剤)・バリアタイプ (水蒸気・オイル/グリース)・基材 (紙&段ボール)・エンドユーザー産業 (食品&飲料包装)・地域別 |

|

出版日: 2025年07月03日

発行: MarketsandMarkets

ページ情報: 英文 277 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の水性バリアコーティングの市場規模は、2024年の12億8,000万米ドルから、2030年には18億5,000万米ドルに達し、2025年から2030年のCAGRは6.3%になると予測されています。

水性バリアコーティングは、包装分野、特に食品容器、飲料用カートン、包装紙、産業用包装フィルムなどでますます活用されています。これらのコーティングは、水分、油分、グリース、ガスからの保護機能を提供し、包装材の持続可能性や廃棄のしやすさを向上させます。これらは頻繁な使用や湿度・温度の変化にも耐えられるよう設計されており、長期間にわたってその効果を維持します。安全で環境にやさしい包装への関心の高まりや、食品安全および環境への影響に関する厳しい規制の存在が、さまざまな業界における導入を後押ししています。最近のコーティング技術の進歩により、防護性能と持続可能性の両面が大幅に強化されており、市場の拡大をさらに支えています。加えて、世界的な急速な工業化や、食品加工およびeコマース分野における需要の増加も、水性バリアコーティングの需要拡大に貢献しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) ・数量 (キロトン) |

| セグメント | バリアタイプ、コンポーネント、基板、エンドユーザー産業、地域 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

"バリアタイプ別では、水蒸気の部門が予測期間中に最大のCAGRを記録する見込み"

水蒸気に対するバリア性を持つコーティング製品の需要は、湿気に敏感な製品を保護する上で重要な役割を果たすことから、今後大きく増加すると予測されています。包装食品、医薬品、パーソナルケア製品の世界的な消費拡大に伴い、製品の品質を保持し、安全性を確保するために、効果的な耐湿包装ソリューションの必要性が高まっています。水蒸気バリア機能を備えた水性コーティングは、従来のプラスチックラミネートやアルミ箔と比較して環境負荷が少ない持続可能な代替手段を提供し、規制要件や市場の期待に適合します。PFAS (有機フッ素化合物) を含まない堆肥化・リサイクル可能な材料が重視される中、こうした水蒸気バリアコーティングの重要性は、包装業界でますます高まっています。

さらに、ナノコーティングやバイオベース技術の進展により、持続可能性を損なうことなくパッケージ性能を向上させることが可能となっています。産業界が機能性と環境配慮の両立を重視するなか、水蒸気バリアコーティング製品は急速に人気と導入率を高めていくとみられています。

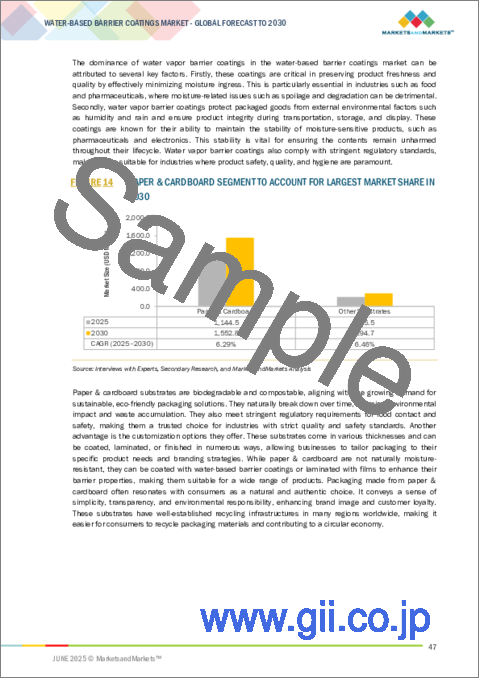

”基材別では、紙・段ボールの部門が2030年に最大のシェアを示す見通し”

この背景には、持続可能でリサイクル可能な包装材料の採用が急増していることがあります。環境問題への関心や規制圧力の高まりを受けて、多くの食品・飲料、パーソナルケア、消費財メーカーが、環境負荷の少ない水性バリアコーティングを施した紙製包装へと移行しつつあります。水性コーティングは、紙や段ボールに対して水分、油分、ガスからの保護機能を与えながらも、リサイクル性や堆肥化性を確保します。カップ、トレイ、折りたたみ式カートン、テイクアウト用容器など、紙ボードの用途が広がる中、こうした分野の急成長も需要拡大を後押ししています。

また、水性コーティング技術の進化により、繊維系包装材に対する密着性、印刷適性、バリア性能が向上しており、今後も持続可能な包装ソリューションとして最も有望な選択肢となることが期待されています。

当レポートでは、世界の水性バリアコーティングの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- マクロ経済指標

第6章 業界動向

- サプライチェーン分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 貿易分析

- 価格分析

- 技術分析

- ケーススタディ分析

- 規制状況

- 主な会議とイベント

- 投資と資金調達のシナリオ

- 特許分析

- AI/生成AIが水性バリアコーティング市場に与える影響

- 米国関税が水性バリアコーティング市場に与える影響

第7章 水性バリアコーティング市場:樹脂タイプ別

- アクリル

- ポリエチレン (PE)

- ポリウレタン (PU)

- バイオポリマー

- エポキシ

- その他

第8章 水性バリアコーティング市場:成分別

- 水

- 充填剤

- バインダー

- 添加剤

第9章 水性バリアコーティング市場:バリアタイプ別

- 水蒸気

- オイル/グリース

- その他

第10章 水性バリアコーティング市場:基材別

- 紙・段ボール

- その他

第11章 水性バリアコーティング市場:エンドユーザー産業別

- 食品・飲料包装

- その他

第12章 水性バリアコーティング市場:地域別

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリアとニュージーランド

- インドネシア

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- トルコ

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- 南米

- ブラジル

- アルゼンチン

第13章 競合情勢

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- ブランド/製品比較分析

- 企業評価と財務指標

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- ALTANA AG

- BASF SE

- H.B. FULLER COMPANY

- KURARAY CO., LTD.

- SONOCO PRODUCTS COMPANY

- MICHELMAN, INC.

- IMERYS

- SOLENIS

- DOW INC.

- ARCHROMA

- OMYA AG

- その他の企業

- SIEGWERK DRUCKFARBEN AG & CO. KGAA

- HUBER GROUP

- MELODEA LTD

- CH-POLYMERS OY

- MICA CORPORATION

- PARAMELT B.V.

- AQUASPERSIONS LIMITED

- KEMIRA OYJ

- STORA ENSO OYJ

- MONDI PLC

- FOLLMANN GMBH & CO. KG

- QUIMOVIL S.A.

- EMPOWERA TECHNORGANICS PVT LTD

- STAHL HOLDINGS B.V.

第15章 隣接市場と関連市場

第16章 付録

List of Tables

- TABLE 1 WATER-BASED BARRIER COATINGS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 WATER-BASED BARRIER COATINGS MARKET: DEFINITION AND INCLUSIONS, BY COMPONENT

- TABLE 3 WATER-BASED BARRIER COATINGS MARKET: DEFINITION AND INCLUSIONS, BY RESIN TYPE

- TABLE 4 WATER-BASED BARRIER COATINGS MARKET: DEFINITION AND INCLUSIONS, BY BARRIER TYPE

- TABLE 5 WATER-BASED BARRIER COATINGS MARKET: DEFINITION AND INCLUSIONS, BY SUBSTRATE

- TABLE 6 WATER-BASED BARRIER COATINGS MARKET: DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- TABLE 7 WATER-BASED BARRIER COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN END-USE INDUSTRIES (%)

- TABLE 9 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 10 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021-2030 (USD BILLION)

- TABLE 11 ROLES OF COMPANIES IN WATER-BASED BARRIER COATINGS ECOSYSTEM

- TABLE 12 IMPORT DATA RELATED TO HS CODE 4819-COMPLIANT PRODUCTS, BY REGION, 2019-2024 (USD MILLION)

- TABLE 13 EXPORT DATA RELATED TO HS CODE 4819-COMPLIANT PRODUCTS, BY REGION, 2019-2024 (USD MILLION)

- TABLE 14 AVERAGE SELLING PRICE TREND OF WATER-BASED BARRIER COATINGS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- TABLE 15 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 WATER-BASED BARRIER COATINGS: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 22 WATER-BASED BARRIER COATINGS MARKET: FUNDING/INVESTMENT SCENARIO

- TABLE 23 WATER-BASED BARRIER COATINGS MARKET: PATENT STATUS, 2014-2024

- TABLE 24 WATER-BASED BARRIER COATINGS MARKET: LIST OF MAJOR PATENTS, 2014-2024

- TABLE 25 PATENTS BY STORA ENSO OYJ, 2024

- TABLE 26 PATENTS BY FORD GLOBAL TECHNOLOGIES, LLC, 2021-2024

- TABLE 27 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 28 WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2021-2024 (USD MILLION)

- TABLE 29 WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2025-2030 (USD MILLION)

- TABLE 30 WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2021-2024 (KILOTON)

- TABLE 31 WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2025-2030 (KILOTON)

- TABLE 32 WATER VAPOR: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 WATER VAPOR: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 WATER VAPOR: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 35 WATER VAPOR: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 36 OIL/GREASE: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 OIL/GREASE: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 OIL/GREASE: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 39 OIL/GREASE: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 40 OTHER BARRIER TYPES: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 OTHER BARRIER TYPES: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 OTHER BARRIER TYPES: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 43 OTHER BARRIER TYPES: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 44 WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 45 WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 46 WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 47 WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 48 PAPER AND CARDBOARD: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 PAPER AND CARDBOARD: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 PAPER AND CARDBOARD: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 51 PAPER AND CARDBOARD: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 52 OTHER SUBSTRATES: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 OTHER SUBSTRATES: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 OTHER SUBSTRATES: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 55 OTHER SUBSTRATES: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 56 WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 57 WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 58 WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 59 WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 60 FOOD AND BEVERAGE PACKAGING: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 FOOD AND BEVERAGE PACKAGING: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 FOOD AND BEVERAGE PACKAGING: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 63 FOOD AND BEVERAGE PACKAGING: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 64 OTHER END-USE INDUSTRIES: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 OTHER END-USE INDUSTRIES: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 OTHER END-USE INDUSTRIES: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 67 OTHER END-USE INDUSTRIES: WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 68 WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 71 WATER-BASED BARRIER COATINGS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 72 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, 2025-2030 (USD MILLION)

- TABLE 74 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 75 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 76 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2021-2024 (USD MILLION)

- TABLE 77 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2025-2030 (USD MILLION)

- TABLE 78 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2021-2024 (KILOTON)

- TABLE 79 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2025-2030 (KILOTON)

- TABLE 80 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 81 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 82 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 83 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 84 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 85 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 86 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 87 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 88 CHINA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 89 CHINA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 90 CHINA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 91 CHINA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 92 INDIA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 93 INDIA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 94 INDIA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 95 INDIA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 96 JAPAN: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 97 JAPAN: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 98 JAPAN: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 99 JAPAN: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 100 SOUTH KOREA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 101 SOUTH KOREA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 102 SOUTH KOREA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 103 SOUTH KOREA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 104 AUSTRALIA AND NEW ZEALAND: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 105 AUSTRALIA AND NEW ZEALAND: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 106 AUSTRALIA AND NEW ZEALAND: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 107 AUSTRALIA AND NEW ZEALAND: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 108 INDONESIA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 109 INDONESIA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 110 INDONESIA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 111 INDONESIA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 112 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 113 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 115 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 116 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2021-2024 (USD MILLION)

- TABLE 117 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2021-2024 (KILOTON)

- TABLE 119 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2025-2030 (KILOTON)

- TABLE 120 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 121 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 123 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 124 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 125 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 126 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 127 EUROPE: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 128 GERMANY: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 129 GERMANY: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 130 GERMANY: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 131 GERMANY: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 132 UK: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 133 UK: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 134 UK: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 135 UK: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 136 FRANCE: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 137 FRANCE: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 138 FRANCE: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 139 FRANCE: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 140 ITALY: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 141 ITALY: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 142 ITALY: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 143 ITALY: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 144 TURKEY: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 145 TURKEY: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 146 TURKEY: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 147 TURKEY: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 148 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 149 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 151 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 152 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2021-2024 (USD MILLION)

- TABLE 153 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2025-2030 (USD MILLION)

- TABLE 154 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2021-2024 (KILOTON)

- TABLE 155 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2025-2030 (KILOTON)

- TABLE 156 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 157 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 158 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 159 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 160 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 161 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 162 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 163 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 164 US: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 165 US: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 166 US: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 167 US: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 168 CANADA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 169 CANADA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 170 CANADA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 171 CANADA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 172 MEXICO: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 173 MEXICO: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 174 MEXICO: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 175 MEXICO: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 176 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 179 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 180 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2021-2024 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2025-2030 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2021-2024 (KILOTON)

- TABLE 183 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2025-2030 (KILOTON)

- TABLE 184 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 187 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 188 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 191 MIDDLE EAST & AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 192 GCC COUNTRIES: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 193 GCC COUNTRIES: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 194 GCC COUNTRIES: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 195 GCC COUNTRIES: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 196 SOUTH AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 197 SOUTH AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 198 SOUTH AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 199 SOUTH AFRICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 200 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 201 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 202 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 203 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 204 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2021-2024 (USD MILLION)

- TABLE 205 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2025-2030 (USD MILLION)

- TABLE 206 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2021-2024 (KILOTON)

- TABLE 207 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE, 2025-2030 (KILOTON)

- TABLE 208 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 209 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 210 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 211 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 212 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 213 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 214 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 215 SOUTH AMERICA: WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 216 BRAZIL: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 217 BRAZIL: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 218 BRAZIL: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 219 BRAZIL: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 220 ARGENTINA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (USD MILLION)

- TABLE 221 ARGENTINA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 222 ARGENTINA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2021-2024 (KILOTON)

- TABLE 223 ARGENTINA: WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE, 2025-2030 (KILOTON)

- TABLE 224 WATER-BASED BARRIER COATINGS MARKET: KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 225 WATER-BASED BARRIER COATINGS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 226 WATER-BASED BARRIER COATINGS MARKET: REGION FOOTPRINT

- TABLE 227 WATER-BASED BARRIER COATINGS MARKET: BARRIER TYPE FOOTPRINT

- TABLE 228 WATER-BASED BARRIER COATINGS MARKET: SUBSTRATE FOOTPRINT

- TABLE 229 WATER-BASED BARRIER COATINGS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 230 WATER-BASED BARRIER COATINGS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 231 WATER-BASED BARRIER COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 232 WATER-BASED BARRIER COATINGS MARKET: PRODUCT LAUNCHES, JANUARY 2019-APRIL 2025

- TABLE 233 WATER-BASED BARRIER COATINGS MARKET: DEALS, JANUARY 2019-APRIL 2025

- TABLE 234 WATER-BASED BARRIER COATINGS MARKET: EXPANSIONS, JANUARY 2019-APRIL 2025

- TABLE 235 ALTANA AG: COMPANY OVERVIEW

- TABLE 236 ALTANA AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 237 ALTANA AG: PRODUCT LAUNCHES

- TABLE 238 ALTANA AG: DEALS

- TABLE 239 BASF SE: COMPANY OVERVIEW

- TABLE 240 BASF SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 241 BASF SE: PRODUCT LAUNCHES

- TABLE 242 BASF SE: DEALS

- TABLE 243 H.B. FULLER COMPANY: COMPANY OVERVIEW

- TABLE 244 H.B. FULLER COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 245 H.B. FULLER COMPANY: PRODUCT LAUNCHES

- TABLE 246 KURARAY CO., LTD: COMPANY OVERVIEW

- TABLE 247 KURARAY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 248 KURARAY CO., LTD.: PRODUCT LAUNCHES

- TABLE 249 SONOCO PRODUCTS COMPANY: COMPANY OVERVIEW

- TABLE 250 SONOCO PRODUCTS COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 251 SONOCO PRODUCTS COMPANY: EXPANSIONS

- TABLE 252 MICHELMAN, INC.: COMPANY OVERVIEW

- TABLE 253 MICHELMAN, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 254 IMERYS: COMPANY OVERVIEW

- TABLE 255 IMERYS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 256 SOLENIS: COMPANY OVERVIEW

- TABLE 257 SOLENIS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 258 SOLENIS: DEALS

- TABLE 259 SOLENIS: EXPANSIONS

- TABLE 260 DOW INC.: COMPANY OVERVIEW

- TABLE 261 DOW INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 262 ARCHROMA: COMPANY OVERVIEW

- TABLE 263 ARCHROMA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 264 ARCHROMA: PRODUCT LAUNCHES

- TABLE 265 OMYA AG: COMPANY OVERVIEW

- TABLE 266 OMYA AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 267 SIEGWERK DRUCKFARBEN AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 268 HUBER GROUP: COMPANY OVERVIEW

- TABLE 269 MELODEA LTD: COMPANY OVERVIEW

- TABLE 270 CH-POLYMERS OY: COMPANY OVERVIEW

- TABLE 271 MICA CORPORATION: COMPANY OVERVIEW

- TABLE 272 PARAMELT B.V.: COMPANY OVERVIEW

- TABLE 273 AQUASPERSIONS LIMITED: COMPANY OVERVIEW

- TABLE 274 KEMIRA OYJ: COMPANY OVERVIEW

- TABLE 275 STORA ENSO OYJ: COMPANY OVERVIEW

- TABLE 276 MONDI PLC: COMPANY OVERVIEW

- TABLE 277 FOLLMANN GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 278 QUIMOVIL S.A: COMPANY OVERVIEW

- TABLE 279 EMPOWERA TECHNORGANICS PVT LTD: COMPANY OVERVIEW

- TABLE 280 STAHL HOLDINGS B.V.: COMPANY OVERVIEW

- TABLE 281 COATING ADDITIVES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 282 COATING ADDITIVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 283 COATING ADDITIVES MARKET, BY REGION, 2018-2023 (KILOTON)

- TABLE 284 COATING ADDITIVES MARKET, BY REGION, 2024-2029 (KILOTON)

List of Figures

- FIGURE 1 WATER-BASED BARRIER COATINGS MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 WATER-BASED BARRIER COATINGS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): COMBINED REVENUE OF MAJOR PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE AND SHARE OF MAJOR PLAYERS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3 BOTTOM-UP (DEMAND SIDE): PRODUCTS SOLD

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4: TOP-DOWN

- FIGURE 7 WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE

- FIGURE 8 WATER-BASED BARRIER COATINGS ESTIMATION, BY REGION

- FIGURE 9 WATER-BASED BARRIER COATINGS MARKET: DATA TRIANGULATION

- FIGURE 10 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 11 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 12 FOOD & BEVERAGE PACKAGING SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2024

- FIGURE 13 WATER VAPOR SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 PAPER & CARDBOARD SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 15 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 16 DEVELOPED ECONOMIES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 17 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 PAPER & CARDBOARD SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES OF ASIA PACIFIC WATER-BASED BARRIER COATINGS MARKET IN 2024

- FIGURE 19 PAPER & CARDBOARD SEGMENT LED WATER-BASED BARRIER COATINGS MARKET ACROSS ALL REGIONS IN 2024

- FIGURE 20 INDIA TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 21 WATER-BASED BARRIER COATINGS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 WATER-BASED BARRIER COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN END-USE INDUSTRIES

- FIGURE 24 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 25 WATER-BASED BARRIER COATINGS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 WATER-BASED BARRIER COATINGS MARKET: KEY PLAYERS IN ECOSYSTEM

- FIGURE 28 IMPORT DATA FOR HS CODE 4819-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2019-2024 (USD MILLION)

- FIGURE 29 EXPORT DATA FOR HS CODE 4819-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2019-2024 (USD MILLION)

- FIGURE 30 AVERAGE SELLING PRICE TREND OF WATER-BASED BARRIER COATINGS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- FIGURE 31 AVERAGE SELLING PRICE TREND OF WATER-BASED BARRIER COATINGS, BY REGION, 2022-2030 (USD/KG)

- FIGURE 32 PATENTS REGISTERED RELATED TO WATER-BASED BARRIER COATINGS, 2014-2024

- FIGURE 33 TOP PATENT OWNERS, 2014-2024

- FIGURE 34 LEGAL STATUS OF PATENTS FILED FOR WATER-BASED BARRIER COATINGS, 2014-2024

- FIGURE 35 MAJOR PATENTS FILED IN US JURISDICTION, 2014-2024

- FIGURE 36 WATER-BASED BARRIER COATINGS MARKET: IMPACT OF AI/GEN AI

- FIGURE 37 WATER VAPOR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 38 PAPER AND CARDBOARD SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 39 FOOD AND BEVERAGE PACKAGING END-USE INDUSTRY TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO REGISTER HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 41 ASIA PACIFIC: WATER-BASED BARRIER COATINGS MARKET SNAPSHOT

- FIGURE 42 EUROPE: WATER-BASED BARRIER COATINGS MARKET SNAPSHOT

- FIGURE 43 NORTH AMERICA: WATER-BASED BARRIER COATINGS MARKET SNAPSHOT

- FIGURE 44 WATER-BASED BARRIER COATINGS MARKET SHARE ANALYSIS, 2024

- FIGURE 45 WATER-BASED BARRIER COATINGS MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2021-2024 (USD MILLION)

- FIGURE 46 WATER-BASED BARRIER COATINGS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 WATER-BASED BARRIER COATINGS MARKET: COMPANY FOOTPRINT

- FIGURE 48 WATER-BASED BARRIER COATINGS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 WATER-BASED BARRIER COATINGS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 50 WATER-BASED BARRIER COATINGS MARKET: EV/EBITDA OF KEY COMPANIES

- FIGURE 51 WATER-BASED BARRIER COATINGS MARKET: ENTERPRISE VALUATION (EV) OF KEY PLAYERS (USD BILLION)

- FIGURE 52 ALTANA AG: COMPANY SNAPSHOT

- FIGURE 53 BASF SE: COMPANY SNAPSHOT

- FIGURE 54 H.B. FULLER COMPANY: COMPANY SNAPSHOT

- FIGURE 55 KURARAY CO., LTD: COMPANY SNAPSHOT

- FIGURE 56 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

- FIGURE 57 IMERYS: COMPANY SNAPSHOT

- FIGURE 58 DOW INC.: COMPANY SNAPSHOT

- FIGURE 59 ARCHROMA: COMPANY SNAPSHOT

The global water-based barrier coatings market size is projected to reach USD 1.85 billion by 2030 from USD 1.28 billion in 2024, at a CAGR of 6.3% between 2025 and 2030. Water-based barrier coatings are increasingly utilized in the packaging sector, specifically for food containers, beverage cartons, wrappers, and industrial packaging films. These coatings provide essential protection against moisture, oil, grease, and gases, enhancing the sustainability and ease of disposal of packaging materials. Engineered to withstand frequent use, fluctuations in humidity, and temperature variations, these coatings maintain their effectiveness over time. The growing emphasis on safe, environmentally friendly packaging and stringent regulations concerning food safety and environmental impact is driving adoption across various industries. Recent advancements in coating technology are significantly enhancing both these products' protective capabilities and sustainability, further supporting market expansion. Additionally, the rapid industrialization and rising demand in food processing and e-commerce sectors worldwide are contributing to the increasing demand for water-based barrier coatings.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Barrier Type, Component, Substrate, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

"Water vapor barrier type segment to register highest CAGR in water-based barrier coatings market during forecast period"

The demand for water vapor barrier coating products is expected to increase significantly over the forecast period, driven by their critical role in protecting moisture-sensitive products. As global consumption of packaged food, pharmaceuticals, and personal care products rises, the need for effective moisture-resistant packaging solutions is paramount to preserving product integrity and ensuring safety. Water-based coatings that offer water vapor barriers present a more environmentally sustainable alternative compared to traditional plastic laminates and aluminum foils, aligning with regulatory requirements and market expectations. The emphasis on compostable, recyclable materials devoid of PFAS (per- and polyfluoroalkyl substances) further underscores the growing importance of water vapor barrier coatings in the packaging industry.

Additionally, nano-coating and bio-based technologies enhance packaging performance without compromising sustainability. As industries shift their focus toward utility and eco-friendly solutions, water vapor barrier coating products are poised for rapid growth in popularity and adoption.

"Paper and cardboard substrate segment to account for largest share of water-based barrier coatings market in 2030"

The paper and cardboard segment is projected to dominate the global water-based barrier coatings market by 2030, primarily driven by the increasing adoption of sustainable and recyclable packaging materials. As environmental concerns and regulatory pressures intensify, many food and beverage, personal care, and consumer goods companies are transitioning to paper-based packaging incorporating eco-friendly barrier coatings. Water-based coatings enhance the performance of paper and cardboard by providing protection against moisture, grease, and gases while still ensuring recyclability and compostability. The rising popularity of paperboard for applications such as cups, trays, folding cartons, and takeaway containers is further fueled by the rapid expansion of these services.

Advancements in water-based coating technologies are leading to improved adhesion, printability, and barrier properties for fiber-based packaging, positioning them as the preferred choice for sustainable packaging solutions in the years ahead.

"Europe to register third-highest CAGR during forecast period"

During the forecast period, water-based barrier coatings in Europe are anticipated to experience significant growth, ranking third in terms of value. This upward trend can be attributed to stringent environmental regulations, initiatives aimed at achieving a circular economy and increasing demand for sustainable packaging solutions. The influence of European Union legislation, such as the Single-Use Plastics Directive and the Packaging and Packaging Waste Regulation (PPWR), is prompting various industries to adopt more recyclable and compostable materials, thereby driving the demand for water-based barrier coatings. The European market, characterized by its advanced development, continues to progress steadily, supported by ongoing innovations in bio-based and fluorochemical-free coatings. Meanwhile, similar trends are emerging in the food and beverage, personal care, and pharmaceutical sectors in the United States, where there is a growing preference for fiber-based and sustainable packaging options. Despite the momentum in these regions, the advancement of these industries is occurring at a somewhat slower pace compared to developments in the Asia Pacific and Latin America, largely due to the influence of key packaging converters and governmental support for environmentally friendly practices.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of World - 5%

Key players profiled in the report include ALTANA AG (Germany), BASF SE (Germany), H.B. Fuller Company (US), Kuraray Co., Ltd. (Japan), Michelman, Inc. (US), Imerys (France), Dow Inc. (US), Sonoco Products Company (US), Omya AG (Switzerland), and Archroma (Switzerland).

Research Coverage

This report segments the water-based barrier coatings market based on component, barrier type, substrate, end-use industry, and region and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the market for water-based barrier coatings.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the water-based barrier coatings market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on water-based barrier coatings offered by top players in the global market

- Analysis of key drivers: (Increasing demand for bio-degradable and sustainable products in packaging industry, longer shelf life of products, and high growth of food & beverage packaging industry) restraints (Performance limitations in harsh environments and high costs and equipment investment) opportunities (Developments in coating technologies, mounting demand for sustainable packaging, expansion into developing markets, and advancements of bio-based and high-barrier coatings), and challenges (Volatile raw material prices and market awareness) influencing the growth of water-based barrier coatings market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product & service launches in the water-based barrier coatings market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for water-based barrier coatings across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent global water-based barrier coatings market developments.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the water-based barrier coatings market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WATER- BASED BARRIER COATINGS MARKET

- 4.2 WATER-BASED BARRIER COATINGS MARKET, BY REGION

- 4.3 ASIA PACIFIC WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE AND COUNTRY

- 4.4 WATER-BASED BARRIER COATINGS MARKET, BY TYPE

- 4.5 WATER-BASED BARRIER COATINGS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for sustainable and biodegradable products in packaging industry

- 5.2.1.2 Longer shelf life of products, oil and grease-free packaging, and moisture resistance

- 5.2.1.3 Tremendous growth of food & beverage packaging industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Performance limitations in harsh environments

- 5.2.2.2 High initial costs and equipment investment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for sustainable packaging

- 5.2.3.2 Advancements in coating technologies

- 5.2.3.3 Expansion into emerging markets

- 5.2.3.4 Development of bio-based and high-barrier coatings

- 5.2.4 CHALLENGES

- 5.2.4.1 Fluctuating raw material prices and limited consumer awareness

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS AND BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO (HS CODE 4819)

- 6.4.2 EXPORT SCENARIO (HS CODE 4819)

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 6.5.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Polymer dispersion technology

- 6.6.1.2 Barrier enhancer additives

- 6.6.1.3 Renewable/Bio-based material integration

- 6.6.2 COMPLEMENTARY TECHNOLOGIES

- 6.6.2.1 Advanced drying and curing systems

- 6.6.2.2 Substrate surface treatment

- 6.6.2.3 Recyclability enhancement technologies

- 6.6.1 KEY TECHNOLOGIES

- 6.7 CASE STUDY ANALYSIS

- 6.7.1 MICHELMAN INDIA - ENHANCING RECYCLABILITY IN EDIBLE OIL PACKAGING

- 6.7.2 SIEGWERK - SUSTAINABLE COATING FOR SINGLE-USE PAPER PLATES

- 6.7.3 H.B. FULLER COMPANY - IMPROVING RECYCLABILITY OF PAPER-BASED FOOD PACKAGING

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATIONS

- 6.8.2.1 REACH Regulations

- 6.8.2.2 Safety Data Sheets (SDS)

- 6.8.2.3 ISO Standards

- 6.8.2.4 GMP Standards

- 6.8.2.5 FDA Regulations

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 PATENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF AI/GEN AI ON WATER-BASED BARRIER COATINGS MARKET

- 6.13 IMPACT OF 2025 US TARIFF ON WATER-BASED BARRIER COATINGS MARKET

- 6.13.1 INTRODUCTION

- 6.13.2 KEY TARIFF RATES

- 6.13.3 PRICE IMPACT ANALYSIS

- 6.13.4 IMPACT ON COUNTRY/REGION

- 6.13.4.1 US

- 6.13.4.2 Europe

- 6.13.4.3 Asia Pacific

- 6.13.5 IMPACT ON PAPER PACKAGING INDUSTRY

7 WATER-BASED BARRIER COATINGS MARKET, BY RESIN TYPE

- 7.1 INTRODUCTION

- 7.2 ACRYLIC

- 7.3 POLYETHYLENE (PE)

- 7.4 POLYURETHANE (PU)

- 7.5 BIOPOLYMERS

- 7.6 EPOXY

- 7.7 OTHER RESIN TYPES

8 WATER-BASED BARRIER COATINGS MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 WATER

- 8.3 FILLERS

- 8.4 BINDERS

- 8.5 ADDITIVES

9 WATER-BASED BARRIER COATINGS MARKET, BY BARRIER TYPE

- 9.1 INTRODUCTION

- 9.2 WATER VAPOR

- 9.2.1 EFFECTIVE PROTECTION IN VARIOUS APPLICATIONS TO DRIVE MARKET

- 9.3 OIL/GREASE

- 9.3.1 EXCEPTIONAL PROTECTION PROPERTIES TO FUEL MARKET GROWTH

- 9.4 OTHER BARRIER TYPES

10 WATER-BASED BARRIER COATINGS MARKET, BY SUBSTRATE

- 10.1 INTRODUCTION

- 10.2 PAPER AND CARDBOARD

- 10.2.1 RESISTANCE TO MOISTURE AND WEATHERING TO FUEL DEMAND

- 10.3 OTHER SUBSTRATES

11 WATER-BASED BARRIER COATINGS MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 FOOD AND BEVERAGE PACKAGING

- 11.2.1 HIGH DEMAND FOR SUSTAINABLE PACKAGING TO BOOST MARKET

- 11.3 OTHER END-USE INDUSTRIES

12 WATER-BASED BARRIER COATINGS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Growing demand for processed and semi-processed foods to drive market

- 12.2.2 INDIA

- 12.2.2.1 Emerging economy and rising FDI investments to drive market

- 12.2.3 JAPAN

- 12.2.3.1 High demand from food & beverage packaging and agriculture industries to boost market

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Increasing demand for packaged food and blister packaging in food industry to drive demand

- 12.2.5 AUSTRALIA AND NEW ZEALAND

- 12.2.5.1 Increasing FDI investments in packaged food industry to propel market

- 12.2.6 INDONESIA

- 12.2.6.1 Rising consumer spending and growing food & beverage industry to boost market

- 12.2.1 CHINA

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Growth of manufacturing and food retail sectors to drive demand

- 12.3.2 UK

- 12.3.2.1 Changing consumer preferences to fuel market growth

- 12.3.3 FRANCE

- 12.3.3.1 Technological innovations in packaging industry to drive demand

- 12.3.4 ITALY

- 12.3.4.1 Rising foreign institutional investments to propel market

- 12.3.5 TURKEY

- 12.3.5.1 Stable financial sector and high public spending to drive market

- 12.3.1 GERMANY

- 12.4 NORTH AMERICA

- 12.4.1 US

- 12.4.1.1 Rising disposable income to boost market

- 12.4.2 CANADA

- 12.4.2.1 Growth of food & beverage industry to drive market

- 12.4.3 MEXICO

- 12.4.3.1 Demand for packaging to propel market

- 12.4.1 US

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 Saudi Arabia

- 12.5.1.1.1 Increased investments in various sectors to propel demand

- 12.5.1.2 UAE

- 12.5.1.2.1 Growth of food & beverage industry to drive market

- 12.5.1.1 Saudi Arabia

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Innovations and technological advancements to drive market

- 12.5.1 GCC COUNTRIES

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Government-led investments and FDI exposure in domestic industries to drive market

- 12.6.2 ARGENTINA

- 12.6.2.1 Increased population and improved economic conditions to drive demand

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS

- 13.4 REVENUE ANALYSIS

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Barrier type footprint

- 13.5.5.4 Substrate footprint

- 13.5.5.5 End-use industry footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.6.5.1 Detailed list of key startups/SMEs

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 BRAND/PRODUCT COMPARISON ANALYSIS

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 ALTANA AG

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 BASF SE

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 H.B. FULLER COMPANY

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 KURARAY CO., LTD.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 SONOCO PRODUCTS COMPANY

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 MICHELMAN, INC.

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.7 IMERYS

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 SOLENIS

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.3.2 Expansions

- 14.1.9 DOW INC.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 ARCHROMA

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Services/Solutions offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.11 OMYA AG

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.1 ALTANA AG

- 14.2 OTHER PLAYERS

- 14.2.1 SIEGWERK DRUCKFARBEN AG & CO. KGAA

- 14.2.2 HUBER GROUP

- 14.2.3 MELODEA LTD

- 14.2.4 CH-POLYMERS OY

- 14.2.5 MICA CORPORATION

- 14.2.6 PARAMELT B.V.

- 14.2.7 AQUASPERSIONS LIMITED

- 14.2.8 KEMIRA OYJ

- 14.2.9 STORA ENSO OYJ

- 14.2.10 MONDI PLC

- 14.2.11 FOLLMANN GMBH & CO. KG

- 14.2.12 QUIMOVIL S.A.

- 14.2.13 EMPOWERA TECHNORGANICS PVT LTD

- 14.2.14 STAHL HOLDINGS B.V.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 COATINGS ADDITIVES MARKET

- 15.2.1 MARKET DEFINITION

- 15.2.2 MARKET OVERVIEW

- 15.3 COATINGS ADDITIVES MARKET, BY REGION

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS