|

|

市場調査レポート

商品コード

1762821

スマートガスメーターの世界市場:技術別、タイプ別、コンポーネント別、エンドユーザー別、地域別 - 2030年までの予測Smart Gas Meter Market by Technology (AMR and AMI), Type (Smart Ultrasonic Gas Meter and Smart Diaphragm Gas Meter), Component (Hardware and Software), End User (Residential, Commercial, and Industrial), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| スマートガスメーターの世界市場:技術別、タイプ別、コンポーネント別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月02日

発行: MarketsandMarkets

ページ情報: 英文 207 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のスマートガスメーターの市場規模は、2024年の24億9,000万米ドルから2030年には40億4,000万米ドルに達し、予測期間のCAGRは8.5%を記録すると予測されています。

スマートガスメーターは、現代のエネルギー・ネットワークに不可欠なものとなりつつあり、デジタル技術を利用して公益事業者と家庭をリアルタイムで接続しています。この双方向通信により、ガス使用量の追跡と把握が容易になり、企業や消費者がエネルギーをより効率的に管理し、さらには家庭での貯蔵や発電といった新しいエネルギー・ソリューションに参加するのに役立っています。モノのインターネット(IoT)を通じてより多くのスマートデバイスがネットワークに加わるにつれ、強固で安全かつ高速な通信システムの必要性が高まっています。スマート・ガス・メーターを含むスマート・グリッド技術の利用は、世界中の政府の政策と規制によって推進されています。これらのイニシアチブは、省エネルギーを促進し、グリッドの信頼性を向上させることを目的としています。最近、米国エネルギー省は、エネルギー・インフラの近代化を目的とした高度計測および自動化プロジェクトに200万米ドルの資金提供を発表し、この分野への重要な投資が注目されています。これらの要因は、産業、商業、家庭における需要の増加とともに、ガスネットワークを更新し、よりスマートで回復力のあるエネルギーシステムを構築するための不可欠なツールとして、スマートガスメーターの使用を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | 技術別、タイプ別、コンポーネント別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

自動検針(AMR)は、今後数年間、スマートガスメーター市場で際立った特徴となることが予想されます。この成長は、自動的に検針を行い、手作業によるチェックの必要性をなくすことができる、手頃な価格のスマート・ガス・メーターに対する需要の高まりに後押しされています。アジア太平洋が市場の最大シェアを占め、僅差で欧州がこれに続くとみられます。この成長は主に、これらの地域の住宅、商業、工業地域におけるスマート・ガス・メーターの広範な展開によるものです。これは、効率改善とコスト削減の方法として、スマートエネルギー技術とグリッドの近代化に対する関心と共鳴しています。

ハードウェアセグメントは、世界のスマートガスメーター市場において最大であり、2024年には総収益の50%以上を占め、予測期間中も支配的であり続ける。このリーダーシップは、正確な測定とリアルタイムのデータ機能を提供する高度な計測インフラに対する需要の高まりによる。スマートメーター、センサー、通信機器などのハードウェア・デバイスは、正確な消費量測定と自動データ収集を促進するスマート・ガス・メータリング・ソリューションの基盤です。ハードウェア技術の絶え間ない革新により、性能と寿命が強化され、スマート・ガス・メーターが電力会社やエンドユーザーにとってますます魅力的なものとなり、市場の健全な成長を促進しています。

スマートガスメーター市場の成長率が最も速いのはアジア太平洋で、欧州が2位です。中国、日本、マレーシア、オーストラリア、インドネシア、シンガポール、その他のアジア太平洋諸国がこの地域を構成する国々です。この地域で最大かつ最も急成長している市場は中国です。現在、中国はスマートグリッド技術への新規投資の最前線にいます。国のエネルギー部門に大きな変化が起きているため、中国はスマートグリッド技術の主要ユーザーとして台頭してきました。国の野心的な再生可能エネルギー計画の結果、スマートグリッド技術の必要性はますます高まると思われます。中国がエネルギー効率を重視していることも、スマート・グリッド産業の必要性を支える要因のひとつであり、スマート・ガス・メーターの需要を押し上げています。

Apator S.A.(ポーランド)、Diehl Stiftung &Co.KG(ドイツ)、Honeywell International Inc.(米国)、Itron Inc.(米国)、Landis+Gyr(スイス)、Sensus(Xylem)(米国)、EDMI Limited(シンガポール)、Chongqing Shancheng Gas Equipment(中国)、Dongfa(Group)(中国)、Raychem RPG(インド)、CHINT Group(中国)、ZENNER International GmbH &Co.KG(ドイツ)、Master Meter(米国)、Aclara Technologies(米国)などがスマートガスメーター市場の主要参入企業です。本調査では、スマートガスメーター市場におけるこれら主要企業の企業プロファイル、最近の動向、主な市場戦略など、詳細な競合分析を掲載しています。

当レポートでは、スマートガスメーター市場をタイプ別(スマート超音波ガスメーター、スマートダイアフラムガスメーター)、技術別(自動検針(AMR)、高度計測インフラ(AMI))、コンポーネント別(ハードウェア、ソフトウェア)、エンドユーザー別(住宅、商業、産業)、地域別(北米、欧州、アジア太平洋、中東・アフリカ、南米)に定義、記述、予測しています。本レポートの調査範囲は、スマートガスメーター市場の成長に影響を与える促進要因・市場抑制要因・課題・機会などの主な要因に関する詳細情報を網羅しています。主な業界プレイヤーを詳細に分析し、事業概要、ソリューション、サービス、主要戦略、開発、提携、合意、M&A、スマートガスメーター市場に関連する最近の動向などに関する洞察を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 価格分析

- 貿易分析

- バリューチェーン分析

- 技術分析

- 関税と規制状況

- 特許分析

- ケーススタディ分析

- ポーターのファイブフォース分析

- AI/生成AIがスマートガスメーター市場に与える影響

- 世界のマクロ経済見通し

- 2025年の米国関税の影響- 概要

- 価格影響分析

第6章 スマートガスメーター市場(技術別)

- イントロダクション

- 高度計量インフラ(AMI)

- 自動検針(AMR)

第7章 スマートガスメーター市場(タイプ別)

- イントロダクション

- スマート超音波ガスメーター

- スマートダイヤフラムガスメーター

第8章 スマートガスメーター市場(コンポーネント別)

- イントロダクション

- ソフトウェア

第9章 スマートガスメーター市場(エンドユーザー別)

- イントロダクション

- 住宅

- 商業

- 工業

第10章 スマートガスメーター市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- ポーランド

- その他

- アジア太平洋

- 中国

- オーストラリア

- 日本

- インド

- 韓国

- その他

- 中東・アフリカ

- GCC

- イスラエル

- 南アフリカ

- トルコ

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2016年~2025年

- 市場シェア分析、2024年

- 市場評価フレームワーク

- 収益分析、2020年~2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 競争力評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- APATOR S.A.

- DIEHL STIFTUNG & CO. KG

- HONEYWELL INTERNATIONAL INC.

- ITRON INC.

- LANDIS+GYR

- SENSUS(XYLEM)

- EDMI LIMITED

- CHONGQING SHANCHENG GAS EQUIPMENT CO., LTD

- DONGFA(GROUP)

- RAYCHEM RPG PRIVATE LIMITED

- CHINT GROUP

- ZENNER INTERNATIONAL GMBH & CO. KG

- MASTER METER INC.

- ACLARA TECHNOLOGIES

- WASION HOLDINGS INTERNATIONAL

- その他の企業

- AICHITOKEIDENKI CORPORATION

- PIETRO FIORENTINI S.P.A.

- SECURE METERS LTD.

- FUJITSU

- SAGEMCOM

- ADYA SMART METERING

- ULTAN TECHNOLOGIES

- POWERCOM

- DISCOVERGY GMBH

- SNS TECHNOSYS

第13章 付録

List of Tables

- TABLE 1 SNAPSHOT OF SMART GAS METER MARKET

- TABLE 2 EXPORT DATA FOR HS CODE 902810-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 3 IMPORT DATA FOR HS CODE 902810-COMPLIANT PRODUCTS, 2022-2024 (USD THOUSAND)

- TABLE 4 ROLES OF COMPANIES IN SMART GAS METER ECOSYSTEM

- TABLE 5 IMPORT TARIFF FOR HS 902810-COMPLIANT PRODUCTS, 2024

- TABLE 6 REGULATIONS

- TABLE 7 LIST OF PATENTS APPLIED AND GRANTED, 2022-2024

- TABLE 8 SMART GAS METER MARKET: PORTER'S FIVE FORCE ANALYSIS

- TABLE 9 WORLD GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 10 INFLATION RATE, AVERAGE CONSUMER PRICES, ANNUAL PERCENT CHANGE (2024%)

- TABLE 11 MANUFACTURING VALUE ADDED (% OF GDP), 2023

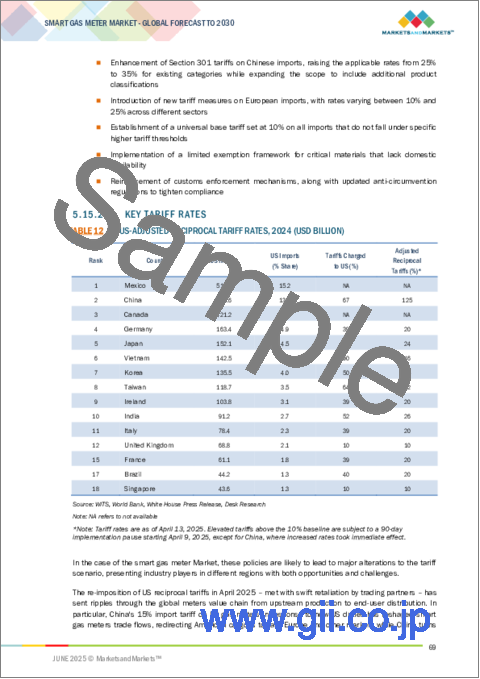

- TABLE 12 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 13 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON SMART GAS METER COMPONENTS DUE TO TARIFF IMPACT

- TABLE 14 SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 15 SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 16 ADVANCED METERING INFRASTRUCTURE (AMI): SMART GAS METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 17 ADVANCED METERING INFRASTRUCTURE (AMI): SMART GAS METER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 18 AUTOMATED METER READING (AMR): SMART GAS METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 19 AUTOMATED METER READING (AMR): SMART GAS METER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 20 SMART GAS METER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 21 SMART GAS METER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 22 SMART ULTRASONIC GAS METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 23 SMART ULTRASONIC GAS METER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 SMART DIAPHRAGM GAS METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 25 SMART DIAPHRAGM GAS METER MARKET: BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 SMART GAS METER MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 27 SMART GAS METER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 28 HARDWARE: SMART GAS METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 HARDWARE: SMART GAS METER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 SOFTWARE: SMART GAS METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 SOFTWARE: SMART GAS METER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 33 SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 34 RESIDENTIAL: SMART GAS METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 RESIDENTIAL: SMART GAS METER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 COMMERCIAL: SMART GAS METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 COMMERCIAL: SMART GAS METER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 INDUSTRIAL: SMART GAS METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 INDUSTRIAL: SMART GAS METER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 SMART GAS METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 SMART GAS METER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 43 NORTH AMERICA: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: SMART GAS METER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 45 NORTH AMERICA: SMART GAS METER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: SMART GAS METER MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 47 NORTH AMERICA: SMART GAS METER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 49 NORTH AMERICA: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: SMART GAS METER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 51 NORTH AMERICA: SMART GAS METER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 52 US: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 53 US: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 54 US: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 55 US: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 56 CANADA: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 57 CANADA: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 58 CANADA: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 59 CANADA: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 60 MEXICA: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 61 MEXICO: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 62 MEXICO: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 63 MEXICO: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 64 EUROPE: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 65 EUROPE : SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 66 EUROPE: SMART GAS METER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 EUROPE : SMART GAS METER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 68 EUROPE: SMART GAS METER MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 69 EUROPE: SMART GAS METER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 70 EUROPE: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 71 EUROPE: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 72 EUROPE: SMART GAS METER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 EUROPE: SMART GAS METER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 74 GERMANY: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 75 GERMANY: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 76 GERMANY: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 77 GERMANY: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 78 FRANCE: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 79 FRANCE: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 80 FRANCE: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 81 FRANCE: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 82 UK: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 83 UK: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 84 UK: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 85 UK: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 86 SPAIN: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 87 SPAIN: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 88 SPAIN: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 89 SPAIN: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 90 ITALY: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 91 ITALY: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 92 ITALY: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 93 ITALY: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 94 POLAND: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 95 POLAND: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 96 POLAND: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 97 POLAND: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 98 REST OF EUROPE: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 99 REST OF EUROPE: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 100 REST OF EUROPE: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 101 REST OF EUROPE: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: SMART GAS METER MARKET, BY TECHNOLOGY TYPE, 2021-2024 (USD MILLION)

- TABLE 103 ASIA PACIFIC: SMART GAS METER MARKET, BY TECHNOLOGY TYPE, 2025-2030 (USD MILLION)

- TABLE 104 ASIA PACIFIC: SMART GAS METER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 105 ASIA PACIFIC: SMART GAS METER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC : SMART GAS METER MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 107 ASIA PACIFIC : SMART GAS METER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 109 ASIA PACIFIC: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: SMART GAS METER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 111 ASIA PACIFIC: SMART METER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 112 CHINA: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 113 CHINA: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 114 CHINA: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 115 CHINA: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 116 AUSTRALIA: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 117 AUSTRALIA: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 118 AUSTRALIA: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 119 AUSTRALIA: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 120 JAPAN: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 121 JAPAN: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 122 JAPAN: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 123 JAPAN: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 124 INDIA: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 125 INDIA: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 126 INDIA: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 127 INDIA: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 128 SOUTH KOREA: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 129 SOUTH KOREA: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 130 SOUTH KOREA: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 131 SOUTH KOREA: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: SMART GAS METER MARKET, BY TECHNOLOGY , 2021-2024 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: SMART GAS METER MARKET, BY TECHNOLOGY , 2025-2030 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: SMART GAS METER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: SMART GAS METER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: SMART GAS METER MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: SMART GAS METER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: SMART GAS METER MARKET, BY BY END USER, 2025-2030 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: SMART GAS METER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: SMART GAS METER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 146 GCC: SMART METER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 147 GCC: SMART METER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 148 SAUDI ARABIA: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 149 SAUDI ARABIA: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 150 SAUDI ARABIA: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 151 SAUDI ARABIA: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 152 UAE: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 153 UAE: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 154 UAE: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 155 UAE: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 156 ISRAEL: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 157 ISRAEL: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 158 ISRAEL: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 159 ISRAEL: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 160 SOUTH AFRICA: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 161 SOUTH AFRICA: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 162 SOUTH AFRICA: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 163 SOUTH AFRICA: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 164 TURKEY: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 165 TURKEY: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 166 TURKEY: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 167 TURKEY: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 168 REST OF MIDDLE EAST & AFRICA: SMART GAS METER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 169 REST OF MIDDLE EAST & AFRICA: SMART GAS METER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 170 REST OF MIDDLE EAST & AFRICA: SMART GAS METER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: SMART GAS METER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 172 SMART GAS METER: KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2016-APRIL 2025

- TABLE 173 SMART GAS METER MARKET: DEGREE OF COMPETITION, 2024

- TABLE 174 MARKET EVALUATION FRAMEWORK

- TABLE 175 SMART GAS METER MARKET: REGION FOOTPRINT

- TABLE 176 SMART GAS METER MARKET: TECHNOLOGY FOOTPRINT

- TABLE 177 SMART GAS METER MARKET: TYPE FOOTPRINT

- TABLE 178 SMART GAS METER MARKET: END USER FOOTPRINT

- TABLE 179 SMART GAS METER MARKET: PRODUCT LAUNCHES, JANUARY 2016-APRIL 2025

- TABLE 180 SMART GAS METER MARKET: DEALS, JANUARY 2016- APRIL 2025

- TABLE 181 APATOR S.A.: COMPANY OVERVIEW

- TABLE 182 APATOR S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 APATOR S.A.: DEALS

- TABLE 184 APATOR S.A.: OTHER DEVELOPMENTS

- TABLE 185 DIEHL STIFTUNG & CO. KG: COMPANY OVERVIEW

- TABLE 186 DIEHL STIFTUNG & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 DIEHL STIFTUNG & CO. KG: DEALS

- TABLE 188 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 189 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 191 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 192 HONEYWELL INTERNATIONAL INC.: OTHER DEVELOPMENTS

- TABLE 193 ITRON INC.: COMPANY OVERVIEW

- TABLE 194 ITRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ITRON INC.: OTHER DEVELOPMENTS

- TABLE 196 LANDIS+GYR: COMPANY OVERVIEW

- TABLE 197 LANDIS+GYR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 LANDIS+GYR: PRODUCT LAUNCHES

- TABLE 199 LANDIS+GYR: DEALS

- TABLE 200 LANDIS+GYR: OTHER DEVELOPMENTS

- TABLE 201 SENSUS(XYLEM): COMPANY OVERVIEW

- TABLE 202 SENSUS (XYLEM): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 SENSUS (XYLEM): PRODUCT LAUNCHES

- TABLE 204 EDMI LIMITED: COMPANY OVERVIEW

- TABLE 205 EDMI LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 EDMI LIMITED: DEALS

- TABLE 207 CHONGQING SHANCHENG GAS EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 208 CHONGQING SHANCHENG GAS EQUIPMENT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 DONGFA (GROUP): COMPANY OVERVIEW

- TABLE 210 DONGFA (GROUP): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 RAYCHEM RPG PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 212 RAYCHEM RPG PRIVATE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 CHINT GROUP: COMPANY OVERVIEW

- TABLE 214 CHINT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 ZENNER INTERNATIONAL GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 216 ZENNER INTERNATIONAL GMBH & CO. KG: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 217 ZENNER INTERNATIONAL GMBH & CO. KG: DEALS

- TABLE 218 MASTER METER INC.: COMPANY OVERVIEW

- TABLE 219 MASTER METER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 ACLARA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 221 ACLARA TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 ACLARA TECHNOLOGIES: DEALS

- TABLE 223 WASION HOLDINGS INTERNATIONAL: COMPANY OVERVIEW

- TABLE 224 WASION HOLDINGS INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 WASION HOLDINGS INTERNATIONAL: DEALS

List of Figures

- FIGURE 1 SMART GAS METER MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 MAIN METRICS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR SMART GAS METERS

- FIGURE 4 SMART GAS METER MARKET: INDUSTRY-REGION/COUNTRY-WISE ANALYSIS

- FIGURE 5 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF SMART GAS METERS

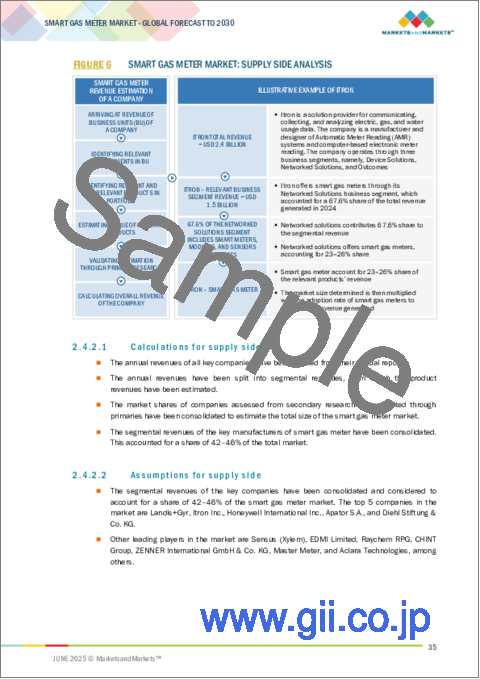

- FIGURE 6 SMART GAS METER MARKET: SUPPLY SIDE ANALYSIS

- FIGURE 7 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF SMART GAS METER MARKET IN 2024

- FIGURE 8 AUTOMATIC METER READING (AMI) SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 9 SMART DIAPHRAGM GAS METER SEGMENT TO CLAIM LARGER MARKET SHARE IN 2025

- FIGURE 10 HARDWARE SEGMENT TO SECURE LARGER MARKET SHARE IN 2030

- FIGURE 11 RESIDENTIAL SEGMENT TO LEAD MARKET IN 2030

- FIGURE 12 INCREASING INVESTMENTS IN SMART GRID TECHNOLOGIES TO FUEL MARKET GROWTH

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 CHINA ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC SMART GAS METER MARKET IN 2024

- FIGURE 15 ADVANCED METERING INFRASTRUCTURE (AMI) SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 16 HARDWARE SEGMENT TO SECURE LARGER MARKET SHARE IN 2030

- FIGURE 17 SMART DIAPHRAGM SEGMENT TO GARNER LARGER MARKET SHARE IN 2030

- FIGURE 18 RESIDENTIAL SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 19 SMART GAS METER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 GLOBAL INVESTMENTS, BY TECHNOLOGY, 2017-2023 (USD BILLION)

- FIGURE 21 GLOBAL ELECTRICITY PRODUCTION, BY SOURCE, 2021-2023

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 ECOSYSTEM ANALYSIS

- FIGURE 24 AVERAGE SELLING PRICE TREND OF SMART GAS METERS, BY REGION, 2021-2024

- FIGURE 25 EXPORT DATA FOR HS CODE 902810-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 26 IMPORT DATA FOR HS CODE 902810-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 27 VALUE CHAIN ANALYSIS

- FIGURE 28 PORTER'S FIVE FORCES ANALYSIS: SMART GAS METER MARKET

- FIGURE 29 IMPACT OF GENERATIVE AI/AI ON END USER, BY REGION

- FIGURE 30 SMART GAS METER MARKET, BY TECHNOLOGY

- FIGURE 31 SMART GAS METER MARKET, BY TYPE

- FIGURE 32 SMART GAS METER MARKET, BY COMPONENT

- FIGURE 33 SMART GAS METER MARKET, BY END USER, 2024

- FIGURE 34 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 SMART GAS METER MARKET SHARE, BY REGION, 2024

- FIGURE 36 NORTH AMERICA: SMART GAS METER MARKET SNAPSHOT

- FIGURE 37 EUROPE: SMART GAS METER MARKET SNAPSHOT

- FIGURE 38 SMART GAS METER MARKET SHARE ANALYSIS, 2024

- FIGURE 39 SMART GAS METER MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 40 COMPANY VALUATION

- FIGURE 41 FINANCIAL METRICS

- FIGURE 42 BRAND/PRODUCT COMPARISON

- FIGURE 43 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 SMART GAS METER MARKET: COMPETITIVE EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 APATOR S.A.: COMPANY SNAPSHOT

- FIGURE 47 DIEHL STIFTUNG & CO. KG: COMPANY SNAPSHOT

- FIGURE 48 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 49 ITRON INC.: COMPANY SNAPSHOT

- FIGURE 50 LANDIS+GYR: COMPANY SNAPSHOT

- FIGURE 51 SENSUS (XYLEM): COMPANY SNAPSHOT

- FIGURE 52 WASION HOLDINGS INTERNATIONAL: COMPANY SNAPSHOT

The global smart gas meter market is projected to reach USD 4.04 billion by 2030, up from USD 2.49 billion in 2024, registering a CAGR of 8.5% over the forecast period. Smart gas meters are becoming vital to modern energy networks, using digital technology to connect utilities and households in real time. This two-way communication makes tracking and understanding gas usage easier, helping companies and consumers manage energy more efficiently and even participate in new energy solutions like home-based storage and generation. As more smart devices join the network through the Internet of Things (IoT), the need for strong, secure, and fast communication systems grows-ensuring everything runs smoothly and safely, even as the number of connected devices skyrockets. Supportive government policies and regulations across the world are pushing for the use of smart grid technologies, including smart gas meters. These initiatives aim to promote energy conservation and improve grid reliability. Recently, the US Department of Energy announced USD 2 million in funding for advanced metering and automation projects that aim to modernize energy infrastructure and have highlighted significant investments in this area. These factors, along with rising demand in industry, commerce, and homes, are driving the use of smart gas meters as essential tools for updating gas networks and creating smarter, more resilient energy systems.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Technology, type, Component, end user |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

By technology, the automated meter reading (AMR) segment is expected to hold a larger share of the smart gas meter market during the forecast period.

Automated meter reading (AMR) is expected to be the standout feature in the smart gas meter market in the coming years. This growth is fueled by the rising demand for affordable smart gas meters, which can automatically collect readings and eliminate the need for manual checks. The Asia Pacific region is likely to command the maximum share of the market, followed closely by Europe. The growth is mainly due to the extensive rollout of smart gas meters in these geographies' residential, commercial, and industrial areas. This resonates with your interest in smart energy technology and grid modernization as a way to improve efficiency and save costs.

By component, the hardware segment is expected to be the largest segment during the forecast period."

The hardware segment is the largest in the global smart gas meter market, accounting for more than 50% of total revenue in 2024 and continuing to dominate through the forecast period. This leadership is driven by the rising demand for advanced metering infrastructure that delivers precise measurement and real-time data capabilities. Hardware devices, such as smart meters, sensors, and communication devices, are the foundation of smart gas metering solutions, which facilitate precise consumption measurement and automatic data collection. Constant innovation in hardware technology has enhanced performance and longevity, aligning with smart gas meters becoming increasingly appealing to utility companies and end-users and driving the market's healthy growth.

By region, Asia Pacific is anticipated to be the fastest-growing market for smart gas meters during the forecast period.

The smart gas meter market with the quickest rate of growth is Asia Pacific, with Europe coming in second. China, Japan, Malaysia, Australia, Indonesia, Singapore, and the Rest of Asia Pacific are the countries that make up this region. The region's biggest and fastest-growing market is China. Currently, China is at the forefront of new investments in smart grid technologies. Due to the significant changes occurring in the nation's energy sector, China has emerged as the primary user of smart grid technology. Smart grid technologies will become increasingly necessary as a result of the nation's ambitious renewable energy program. China's emphasis on adopting energy efficiency is another factor supporting the need for the smart grid industry, which in turn is driving up demand for smart gas meters.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 57%, Tier 2- 29%, and Tier 3- 14%

By Designation: C-Level- 35%, Managers- 20%, and Others- 45%

By Region: North Americas- 20%, Europe- 15%, Asia Pacific- 30%, and the Middle East & Africa- 25% and South America- 10%

Note: The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

Apator S.A. (Poland), Diehl Stiftung & Co. KG (Germany), Honeywell International Inc. (United States), Itron Inc. (US), Landis+Gyr (Switzerland), Sensus (Xylem) (US), EDMI Limited (Singapore), Chongqing Shancheng Gas Equipment Co., Ltd. (China), Dongfa (Group) (China), Raychem RPG (India), CHINT Group (China), ZENNER International GmbH & Co. KG (Germany), Master Meter (US), Aclara Technologies (US) are some of the key players in the smart gas meter market. The study includes an in-depth competitive analysis of these key players in the smart gas meter market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report defines, describes, and forecasts the smart gas meter market by type (Smart Ultrasonic Gas Meter, Smart Diaphragm Gas Meter), technology (Automatic Meter Reading (AMR), Advanced Metering Infrastructure (AMI)), component (Hardware, Software), end user (Residential, Commercial, Industrial), and by region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the smart gas meter market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements, mergers and acquisitions; and recent developments associated with the smart gas meter market.

Key Benefits of Buying the Report

- Analysis of key drivers (Modernizing Gas Networks technologies and asset management of advanced metering infrastructure (AMI)), restraints (Concerns pertaining to data privacy & security and consumer health, high upfront cost), opportunities (Growing emphasis on smart grid initiatives and modernization of gas networks, Integration of artificial intelligence (AI) into smart gas meter operations) and challenges (Delayed realization of return on investment (ROI) due to complexity in integration of devices) influences the growth of the smart gas meter market.

- Product Development/ Innovation: New technology is redefining the market for smart gas meters and will eventually be designed to use superior digital tools enabled by automation, reliability, and economic viability. AI predictive maintenance systems and big data analytics, for example, will monitor large streams of sensor data to attempt to predict failures, which will allow condition-based interventions to avert costly downtime and preserve the life of the meter.

- Market Development: In April 2025, Landis+Gyr and Centrica Smart Meter Assets (a subsidiary of Centrica plc, which includes British Gas) signed a new three-year agreement to supply smart electricity and gas meters. This extends a collaboration that has spanned more than a decade. The partnership aims to further advance the UK's smart energy transition, ensuring households and businesses benefit from improved energy management.

- Market Diversification: In September 2024, Honeywell announced the completion of its acquisition of Air Products' liquefied natural gas (LNG) process technology and equipment business for USD 1.81. This further expands the comprehensive suite of top-tier solutions Honeywell offers its customers to manage their energy transformation journey.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Apator S.A. (Poland), Diehl Stiftung & Co. KG (Germany), Honeywell International Inc. (United States), Itron Inc. (United States), Landis+Gyr (Switzerland), Sensus (Xylem) (United States), EDMI Limited (Singapore), Chongqing Shancheng Gas Equipment Co., Ltd. (China), Dongfa (Group) (China), Raychem RPG (India), CHINT Group (China), ZENNER International GmbH & Co. KG (Germany), Master Meter (United States), Aclara Technologies (United States) among others in the smart gas meter market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 DEFINITION

- 1.2.1 BY TECHNOLOGY: INCLUSIONS & EXCLUSIONS

- 1.2.2 BY COMPONENT: INCLUSIONS & EXCLUSIONS

- 1.2.3 BY END USER: INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- 2.2.1 SECONDARY DATA

- 2.3 DEMAND SIDE METRICS

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 DEMAND SIDE ANALYSIS: BOTTOM-UP APPROACH

- 2.4.1.1 Calculation for demand side

- 2.4.1.2 Assumptions for demand side

- 2.4.2 SUPPLY SIDE ANALYSIS

- 2.4.2.1 Calculations for supply side

- 2.4.2.2 Assumptions for supply side

- 2.4.3 FORECAST

- 2.4.1 DEMAND SIDE ANALYSIS: BOTTOM-UP APPROACH

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMART GAS METER MARKET

- 4.2 SMART GAS METER MARKET, BY REGION

- 4.3 ASIA PACIFIC SMART GAS METER MARKET, BY END USER AND COUNTRY

- 4.4 SMART GAS METER MARKET, BY TECHNOLOGY

- 4.5 SMART GAS METER MARKET, BY COMPONENT

- 4.6 SMART GAS METER MARKET, BY TYPE

- 4.7 SMART GAS METER MARKET, BY END USER

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Digitalization of distribution grids and optimization of network operations

- 5.2.1.2 Benefits of deploying AMI

- 5.2.1.3 Increasing investments in smart grid technologies to measure and analyze data

- 5.2.2 RESTRAINTS

- 5.2.2.1 Concerns pertaining to data privacy & security and consumer health

- 5.2.2.2 High upfront cost for smart gas infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emphasis on smart grid initiatives and modernization of gas networks

- 5.2.3.2 Integration of AI into smart gas meter operations

- 5.2.4 CHALLENGES

- 5.2.4.1 Complications associated with integration of devices

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.6 TRADE ANALYSIS

- 5.6.1 HS CODE 902810

- 5.6.1.1 Export scenario

- 5.6.1.2 Import scenario

- 5.6.1 HS CODE 902810

- 5.7 VALUE CHAIN ANALYSIS

- 5.7.1 HARDWARE & SOFTWARE PROVIDERS/SUPPLIERS

- 5.7.2 CHIPSET & COMMUNICATION MODULE

- 5.7.3 MANUFACTURERS/ASSEMBLERS

- 5.7.4 DISTRIBUTORS AND BUYERS

- 5.7.5 END USERS AND POST-SALES SERVICES

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 IoT and AI

- 5.8.1 KEY TECHNOLOGIES

- 5.9 TARIFF AND REGULATORY LANDSCAPE

- 5.9.1 TARIFF ANALYSIS

- 5.10 PATENT ANALYSIS

- 5.10.1 LIST OF PATENTS APPLIED AND GRANTED, 2022-2024

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 E.ON BAYERN LAUNCHES SMART METER PILOT TO OPTIMIZE POWER AND GAS MONITORING

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 IMPACT OF AI/GEN AI ON SMART GAS METER MARKET

- 5.13.1 ADOPTION OF GENERATIVE AI/AI APPLICATIONS IN SMART GAS METERS

- 5.13.2 IMPACT OF GENERATIVE AI/AI APPLICATIONS, BY REGION

- 5.13.3 IMPACT OF AI IN MARKET, BY REGION

- 5.14 GLOBAL MACROECONOMIC OUTLOOK

- 5.14.1 INTRODUCTION

- 5.14.2 GDP TRENDS AND FORECAST

- 5.14.3 INFLATION

- 5.14.4 MANUFACTURING VALUE ADDED (% OF GDP)

- 5.15 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.16 PRICE IMPACT ANALYSIS

- 5.16.1 IMPACT ON COUNTRY/REGION

- 5.16.1.1 North America

- 5.16.1.2 Europe

- 5.16.1.3 Asia Pacific

- 5.16.1.4 RoW

- 5.16.2 IMPACT ON COMPONENTS

- 5.16.1 IMPACT ON COUNTRY/REGION

6 SMART GAS METER MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 ADVANCED METERING INFRASTRUCTURE (AMI)

- 6.2.1 GROWING NEED FOR ACCURATE METER READING AND INCREASING SPENDING ON SMART GRID PROJECTS TO BOOST DEMAND

- 6.3 AUTOMATED METER READING (AMR)

- 6.3.1 INCREASING DEMAND FOR COST-EFFECTIVE SMART GAS METERS TO FUEL MARKET GROWTH

7 SMART GAS METER MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 SMART ULTRASONIC GAS METER

- 7.2.1 RISING NEED FOR COMPACT-SIZED AND DURABLE SMART GAS METERS TO BOOST DEMAND

- 7.3 SMART DIAPHRAGM GAS METER

- 7.3.1 INCREASING NUMBER OF RESIDENTIAL & LIGHT COMMERCIAL BUILDINGS TO FUEL MARKET GROWTH

8 SMART GAS METER MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.1.1 INCREASING DEMAND FOR PRECISE SMART GAS METER OPERATIONS TO SUPPORT MARKET GROWTH

- 8.2 SOFTWARE

- 8.2.1 ADVANCING UTILITY OPERATIONS AND GROWING NEED FOR SMART GAS METER OPERATIONAL MANAGEMENT TO SUPPORT MARKET GROWTH

9 SMART GAS METER MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 RESIDENTIAL

- 9.2.1 INCREASING FOCUS ON ENERGY EFFICIENCY TO FOSTER MARKET GROWTH

- 9.3 COMMERCIAL

- 9.3.1 INCREASING DIGITALIZATION AND URBANIZATION TO SPUR MARKET GROWTH

- 9.4 INDUSTRIAL

- 9.4.1 INCREASING DEMAND FOR ENERGY-EFFICIENT OPERATIONS IN SEVERAL INDUSTRIES TO FOSTER MARKET GROWTH

10 SMART GAS METER MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Investments in development of smart metering infrastructure to drive market

- 10.2.2 CANADA

- 10.2.2.1 Robust expansion fueled by supportive government initiatives to spur market growth

- 10.2.3 MEXICO

- 10.2.3.1 Government-led infrastructure modernization initiatives to offer lucrative growth opportunities

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Digitalization of energy infrastructure to fuel market growth

- 10.3.2 FRANCE

- 10.3.2.1 Need to modernize aging infrastructure to spur market growth

- 10.3.3 UK

- 10.3.3.1 IoT and communication technologies advancements to offer lucrative growth opportunities

- 10.3.4 SPAIN

- 10.3.4.1 Initiatives to modernize energy infrastructure to support market growth

- 10.3.5 ITALY

- 10.3.5.1 Renewable hydrogen initiatives to offer lucrative growth opportunities

- 10.3.6 POLAND

- 10.3.6.1 Rising consumer awareness about energy efficiency to spur market growth

- 10.3.7 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 High investments in IoT to drive market growth

- 10.4.2 AUSTRALIA

- 10.4.2.1 Rising emphasis on achieving net-zero emissions target to spur market growth

- 10.4.3 JAPAN

- 10.4.3.1 Shifting focus toward renewable energy and electric vehicles to foster market growth

- 10.4.4 INDIA

- 10.4.4.1 Focus on enhancing renewable energy capacity to boost demand

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Rising emphasis on achieving carbon neutrality in power generation to fuel market growth

- 10.4.6 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Increasing focus on grid modernization to spur market growth

- 10.5.1.2 UAE

- 10.5.1.2.1 Smart Dubai initiatives to offer lucrative growth opportunities

- 10.5.1.1 Saudi Arabia

- 10.5.2 ISRAEL

- 10.5.2.1 Favorable government subsidies to boost demand

- 10.5.3 SOUTH AFRICA

- 10.5.3.1 Rapid advances in smart utility infrastructure to accelerate demand

- 10.5.4 TURKEY

- 10.5.4.1 Developing power metering infrastructure to fuel market growth

- 10.5.5 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2016-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 MARKET EVALUATION FRAMEWORK

- 11.5 REVENUE ANALYSIS, 2020-2024

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- 11.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.8.5.1 Company footprint

- 11.8.5.2 Region footprint

- 11.8.5.3 Technology footprint

- 11.8.5.4 Type footprint

- 11.8.5.5 End user footprint

- 11.9 COMPETITIVE EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 STARTING BLOCKS

- 11.9.4 DYNAMIC COMPANIES

- 11.10 COMPETITIVE SCENARIO

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- 12.1.1 APATOR S.A.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 DIEHL STIFTUNG & CO. KG

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 HONEYWELL INTERNATIONAL INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 ITRON INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 LANDIS+GYR

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 SENSUS (XYLEM)

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.7 EDMI LIMITED

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 CHONGQING SHANCHENG GAS EQUIPMENT CO., LTD

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.9 DONGFA (GROUP)

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 RAYCHEM RPG PRIVATE LIMITED

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.11 CHINT GROUP

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.12 ZENNER INTERNATIONAL GMBH & CO. KG

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.13 MASTER METER INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.14 ACLARA TECHNOLOGIES

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.15 WASION HOLDINGS INTERNATIONAL

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.1 APATOR S.A.

- 12.2 OTHER PLAYERS

- 12.2.1 AICHITOKEIDENKI CORPORATION

- 12.2.2 PIETRO FIORENTINI S.P.A.

- 12.2.3 SECURE METERS LTD.

- 12.2.4 FUJITSU

- 12.2.5 SAGEMCOM

- 12.2.6 ADYA SMART METERING

- 12.2.7 ULTAN TECHNOLOGIES

- 12.2.8 POWERCOM

- 12.2.9 DISCOVERGY GMBH

- 12.2.10 SNS TECHNOSYS

13 APPENDIX

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS