|

|

市場調査レポート

商品コード

1762817

スマート灌漑の世界市場:コンポーネント別、システムタイプ別、用途別、地域別 - 2030年までの予測Smart Irrigation Market by System Type (Weather-based, Sensor-based), Controllers, Sensors (Soil Moisture Sensors, Temperature Sensors, Rain/Freeze Sensors, Fertigation Sensors), Water Flow Meters, Greenhouses, Open Fields - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| スマート灌漑の世界市場:コンポーネント別、システムタイプ別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月01日

発行: MarketsandMarkets

ページ情報: 英文 250 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のスマート灌漑の市場規模は、2025年に15億9,000万米ドルと評価され、予測期間中のCAGRは10.8%と見込まれており、2030年には26億5,000万米ドルに達すると予測されています。

水不足に対する世界の懸念が高まり、持続可能な農法に対する需要が高まる中、スマート灌漑システムが大きな支持を得ています。これらのシステムは、水の使用を自動化・最適化し、リアルタイムの環境データに基づいて作物や景観に適切な量の水が供給されるように設計されています。農家、政府機関、造園サービス・プロバイダーは、水効率と作物収量を向上させるため、天候ベースのコントローラー、土壌水分センサー、クラウドベースの灌漑管理プラットフォームなど、高度な灌漑技術を徐々に採用しています。これらの技術は、正確な水の供給、無駄の削減、運用コストの削減を可能にすると同時に、環境保全の目標もサポートします。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | コンポーネント別、システムタイプ別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

天候ベースのセグメントは、優れた節水能力、設置の簡便さ、気候対応技術との互換性により、予測期間中最大の市場シェアを占めると予想されます。優れた節水能力により、これらのシステムは水不足地域において非常に魅力的であり、その結果、環境に優しい灌漑ソリューションを求める消費者による大きな採用が見込まれます。さらに、IoTセンサー、衛星気象予測、自動制御システムとの互換性により、極めて高効率でインテリジェントな灌漑制御が容易になります。これにより、水の浪費、電力、運用コストが節約され、技術に経済的実現性が加わる。さらに、気候変動に関する懸念の高まり、節水に関する厳しい規制要件、環境に優しい灌漑ソリューションに対する財政的インセンティブや補助金の利用可能性の増加が市場を牽引しています。世界的に環境に対する懸念が高まる中、天候ベースのスマート灌漑システムは、実際の気候のニーズに基づいて水の使用量を最適化し、農業生産性と生態系の健全性を確保しながら最適な資源効率をサポートする能力で、高い人気を集めています。

センサー分野は、データ駆動型灌漑の実現、水使用効率の最適化、精密農業のサポートにおいて重要な役割を果たすため、スマート灌漑市場において予測期間中に最も高いCAGRで成長すると予測されています。データ駆動型灌漑は正確な散水を可能にするため、より少ない労力でより多くのことを達成し、作物収量の向上を達成しようとする農家を魅了します。水利用効率の最適化は、水の浪費を防ぐだけでなく、運用コストの削減にもつながります。加えて、土地固有の性質を持つ精密農業の採用が増加しているため、情報に基づいたリアルタイムの意思決定を可能にする統合センサーシステムの需要が高まっています。

アジア太平洋は、予測期間中にスマート灌漑市場で最も高いCAGRを記録すると予測されています。農業需要の増加は、より高い作物収量と資源の節約を余儀なくさせ、それによってスマート灌漑ソリューションの採用を促進しています。一方、水不足問題の増加により、水の保全が優先事項として位置づけられ、精密灌漑ソリューションの需要が大幅に増加しています。さらに、政府の補助金や特別プログラムが、これらのシステムの採用をさらに促進しています。急速な技術導入とデジタルインフラの改善により、この地域ではスマート灌漑システムの迅速かつ広範な展開が可能になっています。さらに、IoT、AI、センサー技術の進歩と、世界的および地域的なアグリテックプレーヤーの存在が、スマート灌漑システムの急速な展開の原因となっています。これらすべての要因がアジア太平洋におけるスマート灌漑市場の成長を後押ししています。

当レポートでは、世界のスマート灌漑市場について調査し、コンポーネント別、システムタイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- AI/生成AIがスマート灌漑市場に与える影響

- 2025年の米国関税がスマート灌漑市場に与える影響

第6章 スマート灌漑システムにおけるさまざまな技術の統合

- イントロダクション

- IoT

- AI/機械学習

- GIS/GPS

第7章 スマート灌漑市場(コンポーネント別)

- イントロダクション

- コントローラー

- センサー

- 水流量計

- その他

第8章 スマート灌漑市場(システムタイプ別)

- イントロダクション

- 天候ベース

- センサーベース

第9章 スマート灌漑市場(用途別)

- イントロダクション

- 農業

- 農業以外

第10章 スマート灌漑市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2024年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競争シナリオ

第12章 企業プロファイル

- イントロダクション

- 主要参入企業

- THE TORO COMPANY

- RAIN BIRD CORPORATION

- NETAFIM

- HUNTER INDUSTRIES INC.

- HYDROPOINT

- MANNA IRRIGATION LTD.

- STEVENS WATER MONITORING SYSTEMS INC.

- GALCON

- RACHIO INC.

- WEATHERMATIC

- その他の企業

- IRRIGREEN

- BANYAN WATER, INC.

- DELTA-T DEVICES LTD

- CALSENSE

- AQUASPY

- SOIL SCOUT OY.

- ACCLIMA, INC.

- RAINMACHINE-GREEN ELECTRONICS LLC

- WISECONN ENGINEERING

- VALMONT INDUSTRIES, INC.

- GROGURU

- ORBIT

- HORTAU

- AKOA SYSTEM

- CYBER-RAIN

第13章 付録

List of Tables

- TABLE 1 MAJOR SECONDARY SOURCES

- TABLE 2 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 3 KEY DATA FROM PRIMARY SOURCES

- TABLE 4 SMART IRRIGATION MARKET: RISK ANALYSIS

- TABLE 5 AVERAGE SELLING PRICE TREND OF SENSORS, BY REGION, 2021-2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF CONTROLLERS, BY REGION, 2021-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE OF SENSORS, BY KEY PLAYER, 2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE OF CONTROLLERS, BY KEY PLAYER, 2024 (USD)

- TABLE 9 ROLE OF COMPANIES IN SMART IRRIGATION ECOSYSTEM

- TABLE 10 LIST OF KEY PATENTS, 2023-2024

- TABLE 11 IMPORT DATA FOR HS CODE 842482-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 EXPORT DATA FOR HS CODE 842482-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 MFN IMPORT TARIFFS FOR HS CODE 842482-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TWO APPLICATIONS (%)

- TABLE 21 KEY BUYING CRITERIA FOR TWO APPLICATIONS

- TABLE 22 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 EXPECTED CHANGE IN PRICES AND IMPACT ON APPLICATION MARKET DUE TO TARIFF

- TABLE 24 SMART IRRIGATION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 25 SMART IRRIGATION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 26 SMART IRRIGATION MARKET, BY COMPONENT, 2021-2024 (MILLION UNITS)

- TABLE 27 SMART IRRIGATION MARKET, BY COMPONENT, 2025-2030 (MILLION UNITS)

- TABLE 28 CONTROLLERS: SMART IRRIGATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 CONTROLLERS: SMART IRRIGATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 CONTROLLERS: SMART IRRIGATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 31 CONTROLLERS: SMART IRRIGATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 32 SENSORS: SMART IRRIGATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 SENSORS: SMART IRRIGATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 SENSORS: SMART IRRIGATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 35 SENSORS: SMART IRRIGATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 36 FERTIGATION SENSORS: SMART IRRIGATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 37 FERTIGATION SENSORS: SMART IRRIGATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 38 WATER FLOW METERS: SMART IRRIGATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 WATER FLOW METERS: SMART IRRIGATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 OTHER COMPONENTS: SMART IRRIGATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 OTHER COMPONENTS: SMART IRRIGATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 43 SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 44 WEATHER-BASED: SMART IRRIGATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 WEATHER-BASED: SMART IRRIGATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 WEATHER-BASED: SMART IRRIGATION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 47 WEATHER-BASED: SMART IRRIGATION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 48 WEATHER-BASED: SMART IRRIGATION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 49 WEATHER-BASED: SMART IRRIGATION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 50 WEATHER-BASED: SMART IRRIGATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 51 WEATHER-BASED: SMART IRRIGATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 52 WEATHER-BASED: SMART IRRIGATION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 WEATHER-BASED: SMART IRRIGATION MARKET IN ROW, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 54 SENSOR-BASED: SMART IRRIGATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 SENSOR-BASED: SMART IRRIGATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 SENSOR-BASED: SMART IRRIGATION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 57 SENSOR-BASED: SMART IRRIGATION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 58 SENSOR-BASED: SMART IRRIGATION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 59 SENSOR-BASED: SMART IRRIGATION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 60 SENSOR-BASED: SMART IRRIGATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 61 SENSOR-BASED: SMART IRRIGATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 62 SENSOR-BASED: SMART IRRIGATION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 SENSOR-BASED: SMART IRRIGATION MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 SMART IRRIGATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 65 SMART IRRIGATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 66 AGRICULTURAL: SMART IRRIGATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 AGRICULTURAL: SMART IRRIGATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 AGRICULTURAL: SMART IRRIGATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 69 AGRICULTURAL: SMART IRRIGATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 70 NON-AGRICULTURAL: SMART IRRIGATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 NON-AGRICULTURAL: SMART IRRIGATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 NON-AGRICULTURAL: SMART IRRIGATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 73 NON-AGRICULTURAL: SMART IRRIGATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 74 SMART IRRIGATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 SMART IRRIGATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: SMART IRRIGATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 77 NORTH AMERICA: SMART IRRIGATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: SMART IRRIGATION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: SMART IRRIGATION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: SMART IRRIGATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: SMART IRRIGATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 84 US: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 85 US: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 86 CANADA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 87 CANADA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 88 MEXICO: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 89 MEXICO: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 90 EUROPE: SMART IRRIGATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 91 EUROPE: SMART IRRIGATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: SMART IRRIGATION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 93 EUROPE: SMART IRRIGATION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: SMART IRRIGATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 95 EUROPE: SMART IRRIGATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 96 EUROPE: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 97 EUROPE: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 98 UK: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 99 UK: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 100 GERMANY: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 101 GERMANY: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 102 FRANCE: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 103 FRANCE: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 104 ITALY: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 105 ITALY: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 106 SPAIN: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 107 SPAIN: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 108 POLAND: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 109 POLAND: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 110 NORDICS: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 111 NORDICS: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 112 REST OF EUROPE: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 113 REST OF EUROPE: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: SMART IRRIGATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 115 ASIA PACIFIC: SMART IRRIGATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: SMART IRRIGATION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 117 ASIA PACIFIC: SMART IRRIGATION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: SMART IRRIGATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 119 ASIA PACIFIC: SMART IRRIGATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 121 ASIA PACIFIC: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 122 CHINA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 123 CHINA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 124 JAPAN: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 125 JAPAN: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 126 SOUTH KOREA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 127 SOUTH KOREA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 128 INDIA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 129 INDIA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 130 AUSTRALIA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 131 AUSTRALIA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 132 INDONESIA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 133 INDONESIA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 134 MALAYSIA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 135 MALAYSIA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 136 THAILAND: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 137 THAILAND: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 138 VIETNAM: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 139 VIETNAM: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 142 ROW: SMART IRRIGATION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 143 ROW: SMART IRRIGATION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 144 ROW: SMART IRRIGATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 145 ROW: SMART IRRIGATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 146 ROW: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 147 ROW: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 148 ROW: SMART IRRIGATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 149 ROW: SMART IRRIGATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 150 MIDDLE EAST: SMART IRRIGATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 151 MIDDLE EAST: SMART IRRIGATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 153 MIDDLE EAST: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 154 BAHRAIN: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 155 BAHRAIN: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 156 KUWAIT: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 157 KUWAIT: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 158 OMAN: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 159 OMAN: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 160 QATAR: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 161 QATAR: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 162 SAUDI ARABIA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 163 SAUDI ARABIA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 164 UAE: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 165 UAE: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 166 REST OF MIDDLE EAST: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 167 REST OF MIDDLE EAST: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 168 AFRICA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 169 AFRICA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 170 SOUTH AMERICA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 171 SOUTH AMERICA: SMART IRRIGATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 172 SMART IRRIGATION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 173 SMART IRRIGATION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 174 SMART IRRIGATION MARKET: REGION FOOTPRINT

- TABLE 175 SMART IRRIGATION MARKET: COMPONENT FOOTPRINT

- TABLE 176 SMART IRRIGATION MARKET: SYSTEM TYPE FOOTPRINT

- TABLE 177 SMART IRRIGATION MARKET: APPLICATION FOOTPRINT

- TABLE 178 SMART IRRIGATION MARKET: DETAILED LIST OF STARTUPS/SMES

- TABLE 179 SMART IRRIGATION MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 180 SMART IRRIGATION MARKET: PRODUCT LAUNCHES, FEBRUARY 2021-NOVEMBER 2024

- TABLE 181 SMART IRRIGATION MARKET: DEALS, FEBRUARY 2021-NOVEMBER 2024

- TABLE 182 THE TORO COMPANY: COMPANY OVERVIEW

- TABLE 183 THE TORO COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 THE TORO COMPANY: PRODUCT LAUNCHES

- TABLE 185 THE TORO COMPANY: DEALS

- TABLE 186 RAIN BIRD CORPORATION: COMPANY OVERVIEW

- TABLE 187 RAIN BIRD CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 RAIN BIRD CORPORATION: PRODUCT LAUNCHES

- TABLE 189 RAIN BIRD CORPORATION: DEALS

- TABLE 190 NETAFIM: COMPANY OVERVIEW

- TABLE 191 NETAFIM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 NETAFIM: PRODUCT LAUNCHES

- TABLE 193 NETAFIM: DEALS

- TABLE 194 HUNTER INDUSTRIES INC.: COMPANY OVERVIEW

- TABLE 195 HUNTER INDUSTRIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 HUNTER INDUSTRIES INC.: PRODUCT LAUNCHES

- TABLE 197 HYDROPOINT: COMPANY OVERVIEW

- TABLE 198 HYDROPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 HYDROPOINT: PRODUCT LAUNCHES

- TABLE 200 HYDROPOINT: DEALS

- TABLE 201 MANNA IRRIGATION LTD.: COMPANY OVERVIEW

- TABLE 202 MANNA IRRIGATION LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 MANNA IRRIGATION LTD.: DEALS

- TABLE 204 STEVENS WATER MONITORING SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 205 STEVENS WATER MONITORING SYSTEMS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 STEVENS WATER MONITORING SYSTEMS INC.: DEALS

- TABLE 207 GALCON: COMPANY OVERVIEW

- TABLE 208 GALCON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 RACHIO INC.: COMPANY OVERVIEW

- TABLE 210 RACHIO INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 WEATHERMATIC: COMPANY OVERVIEW

- TABLE 212 WEATHERMATIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 SMART IRRIGATION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SMART IRRIGATION MARKET: RESEARCH DESIGN

- FIGURE 3 SMART IRRIGATION MARKET: BOTTOM-UP APPROACH

- FIGURE 4 SMART IRRIGATION MARKET: TOP-DOWN APPROACH

- FIGURE 5 SMART IRRIGATION MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- FIGURE 6 SMART IRRIGATION MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 7 SMART IRRIGATION MARKET: DATA TRIANGULATION

- FIGURE 8 SMART IRRIGATION MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 SMART IRRIGATION MARKET SNAPSHOT, 2021-2030

- FIGURE 10 CONTROLLERS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 11 WEATHER-BASED SYSTEM TYPE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 12 NON-AGRICULTURAL SEGMENT TO SECURE LARGER MARKET SHARE IN 2025

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 14 DEPLOYMENT OF IOT SENSORS IN AGRICULTURAL FARMS TO FUEL MARKET GROWTH

- FIGURE 15 CONTROLLERS SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 16 WEATHER-BASED SEGMENT TO SECURE LARGER MARKET SHARE IN 2030

- FIGURE 17 NON-AGRICULTURAL SEGMENT TO HOLD LARGER MARKET SHARE IN 2025

- FIGURE 18 NORTH AMERICA TO SECURE LARGEST MARKET SHARE IN 2030

- FIGURE 19 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 20 MARKET DYNAMICS: SMART IRRIGATION MARKET

- FIGURE 21 SMART IRRIGATION MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 22 SMART IRRIGATION MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 23 SMART IRRIGATION MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 24 SMART IRRIGATION MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 AVERAGE SELLING PRICE TREND OF SENSORS, BY REGION, 2021-2024

- FIGURE 27 AVERAGE SELLING PRICE TREND OF CONTROLLERS, BY REGION, 2021-2024

- FIGURE 28 AVERAGE SELLING PRICE OF SENSORS, BY KEY PLAYER, 2024

- FIGURE 29 AVERAGE SELLING PRICE OF CONTROLLERS, BY KEY PLAYER, 2024

- FIGURE 30 VALUE CHAIN ANALYSIS

- FIGURE 31 SMART IRRIGATION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 32 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 33 IMPORT SCENARIO FOR HS CODE 842482-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 34 EXPORT DATA FOR HS CODE 842482-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 36 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 IMPACT OF PORTER'S FIVE FORCES

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TWO APPLICATIONS

- FIGURE 39 KEY BUYING CRITERIA FOR TWO APPLICATIONS

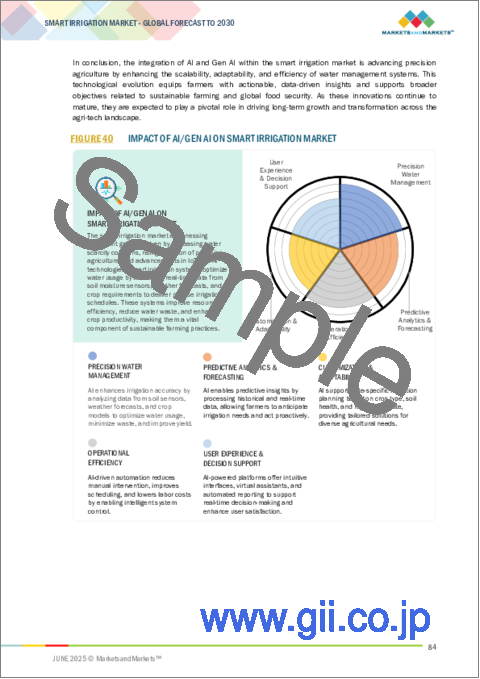

- FIGURE 40 IMPACT OF AI/GEN AI ON SMART IRRIGATION MARKET

- FIGURE 41 CONTROLLERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 42 SENSOR-BASED SYSTEMS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 43 NON-AGRICULTURAL SEGMENT TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 44 ASIA PACIFIC TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA: SMART IRRIGATION MARKET SNAPSHOT

- FIGURE 46 EUROPE: SMART IRRIGATION MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: SMART IRRIGATION MARKET SNAPSHOT

- FIGURE 48 SMART IRRIGATION MARKET SHARE ANALYSIS, 2024

- FIGURE 49 SMART IRRIGATION MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 50 SMART IRRIGATION MARKET: COMPANY VALUATION

- FIGURE 51 SMART IRRIGATION MARKET: FINANCIAL METRICS, 2025 (USD BILLION)

- FIGURE 52 SMART IRRIGATION MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 53 SMART IRRIGATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 SMART IRRIGATION MARKET: COMPANY FOOTPRINT

- FIGURE 55 SMART IRRIGATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 56 THE TORO COMPANY: COMPANY SNAPSHOT

The global smart irrigation market was valued at USD 1.59 billion in 2025 and is projected to reach USD 2.65 billion by 2030, at a CAGR of 10.8% during the forecast period. With the increasing global concern over water scarcity and the rising demand for sustainable agricultural practices, smart irrigation systems are gaining significant traction. These systems are designed to automate and optimize water usage, ensuring that crops and landscapes receive the appropriate amount of water based on real-time environmental data. Farmers, government agencies, and landscaping service providers are progressively adopting advanced irrigation technologies, including weather-based controllers, soil moisture sensors, and cloud-based irrigation management platforms to improve water efficiency and crop yields. These technologies enable precise water delivery, reduce wastage, and lower operational costs while also supporting environmental conservation goals.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, System Type, Technology, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Weather-based segment is expected to hold the largest market share during the forecast period."

The weather-based segment is anticipated to have the largest market share during the forecast period due to its superior water-saving capacity, simplicity in installation, and compatibility with climate-responsive technologies. Superior water-saving capacity makes these systems highly appealing in water-scarce regions, resulting in huge adoption by consumers seeking environmentally friendly irrigation solutions. In addition, compatibility with IoT sensors, satellite weather forecasting, and automatic control systems facilitates extremely high-efficiency and intelligent irrigation control. This saves water wastage, electricity, and operational costs and adds economic feasibility to the technology. Additionally, growing concerns regarding climate change, strict regulatory requirements for water conservation, and increased availability of financial incentives and subsidies for environment-friendly irrigation solutions are driving the market. With increasing environmental concerns globally, weather-based smart irrigation systems are becoming highly sought after for their ability to optimize water usage based on actual climatic needs, supporting optimum resource efficiency while ensuring agricultural productivity and ecosystem health.

"Sensor segment is projected to grow at the highest CAGR during the forecast period."

The sensor segment is expected to grow at the highest CAGR during the forecast period in the smart irrigation market due to its critical role in enabling data-driven irrigation, optimized water-use efficiency, and supporting precision agriculture. Data-driven irrigation enables accurate water application, which attracts farmers seeking to accomplish more with less and attain improved crop yield. Optimized water-use efficiency not only prevents water wastage but also reduces operational costs. In addition, the growing adoption of precision agriculture of a site-specific nature is leading to growing demand for integrated sensor systems that enable informed real-time decision-making.

"Asia Pacific is anticipated to register the highest CAGR during the forecast period."

The Asia Pacific region is expected to register the highest CAGR in the smart irrigation market during the forecast period. Rising agricultural demand forces higher crop yield, and resource savings, thereby driving the adoption of smart irrigation solutions. Meanwhile, increasing water scarcity issues position water conservation as a priority, which significantly increases the demand for precision irrigation solutions. In addition, government subsidies and special programs further promote the adoption of these systems. Rapid technological adoption, and improved digital infrastructure enable quicker and broader rollout of smart irrigation systems in the region. Moreover, advancements in IoT, AI, and sensor technology, coupled with the presence of global and regional agritech players, are responsible for the rapid rollout of smart irrigation systems. All these factors drive the growth of the smart irrigation market in Asia Pacific.

Extensive primary interviews were conducted with key industry experts in the smart irrigation market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation -Directors - 50%, Managers - 30%, and Others - 20%

- By Region - Asia Pacific - 45%, Europe - 30%, North America - 20%, and RoW - 5%

The smart irrigation market is dominated by a few globally established players, such as The Toro Company (US), Rain Bird Corporation (US), HUNTER INDUSTRIES INC. (US), NETAFIM (Israel), HydroPoint (US), Manna Irrigation Ltd. (Israel), Stevens Water Monitoring Systems Inc. (US), Galcon (Israel), Rachio Inc. (US), Weathermatic (US), Irrigreen (US), Banyan Water, Inc. (US), Delta-T Devices Ltd (UK), CALSENSE (US), and AquaSpy (US).

The study includes an in-depth competitive analysis of these key players in the smart irrigation market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the smart irrigation market and forecasts its size by system type (weather-based, sensor-based), component (controllers, sensors, water flow meters, others), and application (agricultural, non-agricultural). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes a value chain analysis of the key players and their competitive analysis in the smart irrigation ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Growing deployment of automated monitoring systems in farming sector, Advancement in sensor technology & connectivity, Government initiatives to promote water conservation), restraints (Lack of training and education among farmers, Interoperability issues due to lack of standardization in communication interfaces and protocols), opportunities (Declining costs of smart irrigation components, Constant advancements in irrigation technologies and farming practices, Growing demand for 5G network for remote monitoring), challenges (Connectivity issues in rural areas, Data security and privacy concerns)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the smart irrigation market

- Market Development: Comprehensive information about lucrative markets - the report analyses the smart irrigation market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the smart irrigation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as The Toro Company (US), Rain Bird Corporation (US), HUNTER INDUSTRIES INC. (US), NETAFIM (Israel), HydroPoint (US), Manna Irrigation Ltd. (Israel), Stevens Water Monitoring Systems Inc. (US), Galcon (Israel), Rachio Inc. (US), Weathermatic (US), Irrigreen (US), Banyan Water, Inc. (US), Delta-T Devices Ltd (UK), CALSENSE (US), and AquaSpy (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMART IRRIGATION MARKET

- 4.2 SMART IRRIGATION MARKET, BY COMPONENT

- 4.3 SMART IRRIGATION MARKET, BY SYSTEM TYPE

- 4.4 SMART IRRIGATION MARKET, BY APPLICATION

- 4.5 SMART IRRIGATION MARKET, BY REGION

- 4.6 SMART IRRIGATION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Deployment of automated monitoring systems in farming sector

- 5.2.1.2 Advancements in sensor technology & connectivity

- 5.2.1.3 Government-led initiatives to promote water conservation

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of training and education among farmers

- 5.2.2.2 Interoperability issues due to lack of standardization in communication interfaces and protocols

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Declining costs of smart irrigation components

- 5.2.3.2 Ongoing developments in irrigation technologies and farming practices

- 5.2.3.3 Growing demand for 5G network for remote monitoring

- 5.2.4 CHALLENGES

- 5.2.4.1 Connectivity issues in rural areas

- 5.2.4.2 Data security and privacy concerns

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF SENSORS, BY REGION, 2021-2024

- 5.4.2 AVERAGE SELLING PRICE OF COMPONENTS, BY KEY PLAYER, 2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Smart valves and pumps

- 5.7.1.2 Mobile and cloud-based applications

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Digital image processing

- 5.7.2.2 Remote sensing

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Precision agriculture

- 5.7.3.2 Blockchain

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 842482)

- 5.9.2 EXPORT DATA (HS CODE 842482)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 HUNTER INDUSTRIES HELPS SOUTHERN CALIFORNIA SCHOOL DISTRICT REDUCE WATER WASTE

- 5.11.2 NETAFIM DELIVERS WATER-EFFICIENT FARMING TO KENYAN SMALLHOLDERS

- 5.11.3 TORO COMPANY ENABLES EFFICIENT LANDSCAPE MANAGEMENT FOR LUXURY RESORT IN DUBAI

- 5.11.4 JAIN IRRIGATION MODERNIZES SUGARCANE CULTIVATION IN MAHARASHTRA WITH AUTOMATED IRRIGATION

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREATS OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON SMART IRRIGATION MARKET

- 5.16.1 INTRODUCTION

- 5.17 IMPACT OF 2025 US TARIFF ON SMART IRRIGATION MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON APPLICATIONS

6 INTEGRATION OF DIFFERENT TECHNOLOGIES IN SMART IRRIGATION SYSTEM

- 6.1 INTRODUCTION

- 6.2 IOT

- 6.3 AI/ML

- 6.4 GIS/GPS

7 SMART IRRIGATION MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 CONTROLLERS

- 7.2.1 EVAPOTRANSPIRATION

- 7.2.1.1 Integration with smart controllers and weather-based systems to fuel market growth

- 7.2.2 SOIL SENSORS

- 7.2.2.1 Increasing emphasis on sustainability and water conservation to support market growth

- 7.2.1 EVAPOTRANSPIRATION

- 7.3 SENSORS

- 7.3.1 SOIL MOISTURE SENSORS

- 7.3.1.1 Rising demand for precision agriculture solutions and smart farming techniques to drive market

- 7.3.2 RAIN/FREEZE SENSORS

- 7.3.2.1 Integration with IoT-enabled platforms and weather-based predictive algorithms to foster market growth

- 7.3.3 TEMPERATURE SENSORS

- 7.3.3.1 Ability to deliver actionable insights and support intelligent automation to boost demand

- 7.3.4 FERTIGATION SENSORS

- 7.3.4.1 Growing application for maintaining appropriate acidity or alkalinity in irrigation water to drive market

- 7.3.4.2 pH sensors

- 7.3.4.2.1 Need to maintain optimal pH levels for different crop types to boost demand

- 7.3.4.3 EC sensors

- 7.3.4.3.1 Rising demand for precision agriculture and sustainable farming practices to fuel market growth

- 7.3.4.4 Other sensors

- 7.3.1 SOIL MOISTURE SENSORS

- 7.4 WATER FLOW METERS

- 7.4.1 STRINGENT WATER CONSERVATION REGULATIONS AND INCREASING AWARENESS OF SUSTAINABLE IRRIGATION PRACTICES TO FOSTER MARKET GROWTH

- 7.5 OTHER COMPONENTS

8 SMART IRRIGATION MARKET, BY SYSTEM TYPE

- 8.1 INTRODUCTION

- 8.2 WEATHER-BASED

- 8.2.1 INTEGRATION OF AI AND ML INTO WEATHER-BASED SYSTEMS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 8.3 SENSOR-BASED

- 8.3.1 ONGOING ADVANCEMENTS IN SOIL-BASED SYSTEMS TO DRIVE MARKET

9 SMART IRRIGATION MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 AGRICULTURAL

- 9.2.1 GREENHOUSES

- 9.2.1.1 Growing demand for controlled-environment agriculture and high-value crop production to support market growth

- 9.2.2 OPEN FIELDS

- 9.2.2.1 Susceptibility to water scarcity, inefficient irrigation, and inconsistent crop yields to boost demand

- 9.2.1 GREENHOUSES

- 9.3 NON-AGRICULTURAL

- 9.3.1 RESIDENTIAL

- 9.3.1.1 Increasing adoption of home automation systems to offer lucrative growth opportunities

- 9.3.2 TURF & LANDSCAPE

- 9.3.2.1 Growing need for water conservation and efficient resource management to fuel market growth

- 9.3.3 GOLF COURSES

- 9.3.3.1 Rising need for data-driven water management solutions to drive market

- 9.3.4 OTHER NON-AGRICULTURAL APPLICATIONS

- 9.3.1 RESIDENTIAL

10 SMART IRRIGATION MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Rebates and subsidies for water-efficient technologies to drive market

- 10.2.3 CANADA

- 10.2.3.1 Expanding smart city initiatives in urban centers to boost demand

- 10.2.4 MEXICO

- 10.2.4.1 Rising investments in modernizing irrigation infrastructure to fuel market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 UK

- 10.3.2.1 Emphasis on achieving sustainability goals and climate resilience to foster market growth

- 10.3.3 GERMANY

- 10.3.3.1 Adoption of advanced irrigation solutions to offer lucrative growth opportunities

- 10.3.4 FRANCE

- 10.3.4.1 Government-led initiatives to boost digital transformation of agriculture to spur market growth

- 10.3.5 ITALY

- 10.3.5.1 Pressing need to manage water resources efficiently in drought-prone regions to augment market growth

- 10.3.6 SPAIN

- 10.3.6.1 Convergence of digital innovation, environmental urgency, and favorable funding mechanisms to boost demand

- 10.3.7 POLAND

- 10.3.7.1 Modernization of agricultural infrastructure through precision irrigation technologies to drive market

- 10.3.8 NORDICS

- 10.3.8.1 Rising investment in agri-tech and digital infrastructure to fuel market growth

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Growing focus on agricultural modernization and sustainable resource management to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Increasing investment in smart farming technologies to fuel market growth

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Government-led initiatives to promote smart farming to propel market growth

- 10.4.5 INDIA

- 10.4.5.1 Rising adoption of agri-tech solutions to spur market growth

- 10.4.6 AUSTRALIA

- 10.4.6.1 Increasing awareness of sustainable farming to drive market

- 10.4.7 INDONESIA

- 10.4.7.1 Favorable programs under Agricultural 4.0 to offer lucrative growth opportunities

- 10.4.8 MALAYSIA

- 10.4.8.1 Improved water management and digital transformation across agri-food sector to fuel market growth

- 10.4.9 THAILAND

- 10.4.9.1 Rising water scarcity concerns to drive market

- 10.4.10 VIETNAM

- 10.4.10.1 Adoption of water-saving technologies and improved water storage methods to drive market

- 10.4.11 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Bahrain

- 10.5.2.1.1 Rising environmental concerns to drive market

- 10.5.2.2 Kuwait

- 10.5.2.2.1 Adoption of advanced irrigation technologies to support market growth

- 10.5.2.3 Oman

- 10.5.2.3.1 Increasing government support and technological advancements to boost demand

- 10.5.2.4 Qatar

- 10.5.2.4.1 Emphasis on minimizing water usage while maximizing agricultural output to boost demand

- 10.5.2.5 Saudi Arabia

- 10.5.2.5.1 Shift toward sustainable agriculture and efficient water resource management to boost demand

- 10.5.2.6 UAE

- 10.5.2.6.1 Promotion of sustainable agricultural practices to drive market

- 10.5.2.7 Rest of Middle East

- 10.5.2.1 Bahrain

- 10.5.3 AFRICA

- 10.5.3.1 Increasing popularity of digital farming platforms to fuel market growth

- 10.5.4 SOUTH AMERICA

- 10.5.4.1 Increasing water scarcity to boost demand

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2020-2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Component footprint

- 11.7.5.4 System type footprint

- 11.7.5.5 Application footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of startups/SMEs

- 11.8.5.2 Competitive benchmarking of startups/SMEs

- 11.9 COMPETITIVE SCENARIOS

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 THE TORO COMPANY

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches

- 12.2.1.3.2 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths/Right to win

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses/Competitive threats

- 12.2.2 RAIN BIRD CORPORATION

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Product launches

- 12.2.2.3.2 Deals

- 12.2.2.4 MnM view

- 12.2.2.4.1 Key strengths/Right to win

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses/Competitive threats

- 12.2.3 NETAFIM

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Product launches

- 12.2.3.3.2 Deals

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths/Right to win

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses/Competitive threats

- 12.2.4 HUNTER INDUSTRIES INC.

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Product launches

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths/Right to win

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses/Competitive threats

- 12.2.5 HYDROPOINT

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 Recent developments

- 12.2.5.3.1 Product launches

- 12.2.5.3.2 Deals

- 12.2.5.4 MnM view

- 12.2.5.4.1 Key strengths/Right to win

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses/Competitive threats

- 12.2.6 MANNA IRRIGATION LTD.

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Deals

- 12.2.7 STEVENS WATER MONITORING SYSTEMS INC.

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.7.3 Recent developments

- 12.2.7.3.1 Deals

- 12.2.8 GALCON

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.9 RACHIO INC.

- 12.2.9.1 Business overview

- 12.2.9.2 Products/Solutions/Services offered

- 12.2.10 WEATHERMATIC

- 12.2.10.1 Business overview

- 12.2.10.2 Products/Solutions/Services offered

- 12.2.1 THE TORO COMPANY

- 12.3 OTHER PLAYERS

- 12.3.1 IRRIGREEN

- 12.3.2 BANYAN WATER, INC.

- 12.3.3 DELTA-T DEVICES LTD

- 12.3.4 CALSENSE

- 12.3.5 AQUASPY

- 12.3.6 SOIL SCOUT OY.

- 12.3.7 ACCLIMA, INC.

- 12.3.8 RAINMACHINE - GREEN ELECTRONICS LLC

- 12.3.9 WISECONN ENGINEERING

- 12.3.10 VALMONT INDUSTRIES, INC.

- 12.3.11 GROGURU

- 12.3.12 ORBIT

- 12.3.13 HORTAU

- 12.3.14 AKOA SYSTEM

- 12.3.15 CYBER-RAIN

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS