|

|

市場調査レポート

商品コード

1762814

ドローン用バッテリーの世界市場:技術別、コンポーネント別、販売拠点別、プラットフォーム別、容量別、地域別 - 2030年までの予測Drone Battery Market by Technology (Lithium-based, Nickel-based, Fuel Cell, Sodium-ion), Platform (Commercial, Government & Law Enforcement, Military), Capacity (<5, 5-20, 20-50, >50), Point of Sale (OEM, Aftermarket) and Region - Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ドローン用バッテリーの世界市場:技術別、コンポーネント別、販売拠点別、プラットフォーム別、容量別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月27日

発行: MarketsandMarkets

ページ情報: 英文 288 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ドローン用バッテリーの市場規模は、2025年の15億9,000万米ドルから2030年には24億1,000万米ドルに達し、CAGRは8.7%になると予測されています。

農業、宅配サービス、防衛などの分野でドローン技術を採用する企業が増え、市場は拡大しています。これらのドローンには、長寿命、急速充電、安全運用が可能な強力で信頼性の高いバッテリーが必要です。リチウムベースのバッテリーや水素燃料電池などの新しいバッテリー技術は、ドローンの性能を向上させ、現代産業の要求に応えています。しかし、先進的なバッテリーは高価であり、リチウムのような材料は調達が困難です。さらに、リチウム電池の輸送には厳しい規制があります。こうしたハードルにもかかわらず、より優れたドローン用バッテリーの需要は高まり続けており、市場の成長を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 技術別、コンポーネント別、販売拠点別、プラットフォーム別、容量別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

セルは、ドローンに電力を貯蔵し供給する主要コンポーネントであるため、ドローン用バッテリー市場で最大のセグメントです。ドローンの飛行時間と全体的な性能は、セルの強度と軽量性に大きく依存します。ドローンの配送、農業、防衛への活用が進むにつれ、企業は軽量でありながらより多くのエネルギーを蓄えることができるバッテリーセルを必要としています。バッテリーメーカーは、ドローンがより長く飛行し、より効果的にタスクを実行できるように、これらのセルの品質を高めています。セルは、ドローン用バッテリーで最も重要かつ広く使用されている部品と考えられています。

ドローン用バッテリー市場の商業セグメントは急速な成長を遂げています。多くの企業が現在、配達、農業、検査、撮影、地図作成など様々な作業にドローンを活用しています。これらのドローンは、より長い飛行時間を提供し、より重い機器をサポートできる強力なバッテリーを必要とします。時間を節約し、コストを削減し、効率を高めるために、ドローンを採用する企業が増えています。eコマース、スマート農業、建設、エネルギー検査などの産業が拡大するにつれ、ドローンの需要は増加の一途をたどっています。そのため、これらの用途をサポートできる高度なバッテリーの必要性が高まっています。複数の産業でドローンが急速に採用されていることから、ドローン用バッテリー市場の商業セグメントは大きく成長しています。

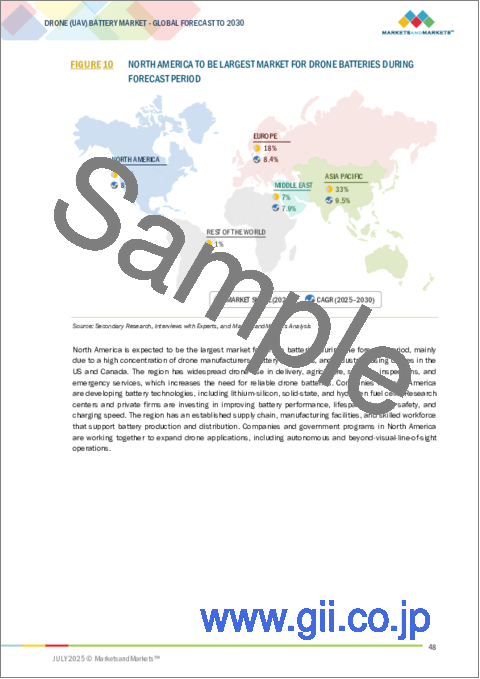

北米はドローン用バッテリー市場の主要地域ですが、これは主にドローンとバッテリーのトップ企業が多く立地しているためです。同地域は新技術の導入が早く、ドローンは配送、農業、建設、警備など様々な産業で活用されています。北米の企業は、ドローンの飛行時間や性能を向上させるために、リチウムベースのバッテリーや水素燃料電池などの新しいタイプのバッテリーも開発しています。ドローンは商業目的でも防衛目的でも広く使用されているため、強力で信頼性の高いバッテリーに対する需要は高いです。この旺盛な需要により、北米がドローン用バッテリー市場でトップの地位を固めています。

当レポートでは、世界のドローン用バッテリー市場について調査し、技術別、コンポーネント別、販売拠点別、プラットフォーム別、容量別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 価格分析

- 運用データ

- 関税と規制状況

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向と混乱

- エコシステム分析

- 技術分析

- 貿易分析

- 使用事例分析

- 投資と資金調達のシナリオ

- 主要な利害関係者と購入基準

- 2025年~2026年の主な会議とイベント

- 部品表

- 総所有コスト

- AIの影響

- マクロ経済見通し

- ビジネスモデル

- 米国の2025年関税

- 技術ロードマップ

第6章 ドローンバッテリー市場(技術別)

- イントロダクション

- リチウムベース

- ニッケルベース

- 燃料電池

- ナトリウムイオン

第7章 ドローン用バッテリー市場(コンポーネント別)

- イントロダクション

- セル

- バッテリー管理システム

- エンクロージャー

- コネクタ

第8章 ドローンバッテリー市場(販売拠点別)

- イントロダクション

- OEM

- アフターマーケット

第9章 ドローンバッテリー市場(プラットフォーム別)

- イントロダクション

- 消費者

- 商業

- 政府と法執行機関

- 軍隊

第10章 ドローン用バッテリー市場(容量別)

- イントロダクション

- 5 AH未満

- 5年~20 AH

- 20~50 AH

- 50 AH超

第11章 ドローンバッテリー市場(地域別)

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- フランス

- ドイツ

- イタリア

- ロシア

- スウェーデン

- その他

- アジア太平洋

- PESTLE分析

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他

- 中東

- PESTLE分析

- GCC

- イスラエル

- トルコ

- その他

- その他の地域

- PESTLE分析

- ラテンアメリカ

- アフリカ

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年~2024年

- 収益分析、2021年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- ブランド/製品比較

- 企業評価と財務指標

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- DJI

- EAGLEPICHER TECHNOLOGIES

- RRC POWER SOLUTIONS GMBH

- SHENZHEN GREPOW BATTERY CO., LTD.

- EPSILOR-ELECTRIC FUEL LTD.

- TADIRAN BATTERIES

- PLUG POWER INC.

- SES AI CORPORATION

- SION POWER CORPORATION

- INTELLIGENT ENERGY LIMITED

- H3 DYNAMICS HOLDINGS PTE. LTD.

- HONEYWELL INTERNATIONAL INC.

- INVENTUS POWER

- MMC

- DOOSAN MOBILITY INNOVATION

- その他の企業

- KOKAM BATTERY

- DENCHI GROUP

- TROOWIN POWER SYSTEM TECHNOLOGY

- AMPEREX TECHNOLOGY LIMITED

- AMICELL

- CUSTOM POWER

- AMPRIUS TECHNOLOGIES

- GUANGZHOU SUNLAND NEW ENERGY TECHNOLOGY CO., LTD.

- ALEXANDER BATTERY TECHNOLOGIES

- EV BATTERY SOLUTIONS

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATE

- TABLE 2 AVERAGE SELLING PRICE OF DRONE BATTERIES, BY PLATFORM, 2024 (USD)

- TABLE 3 AVERAGE SELLING PRICE OF DRONE BATTERIES, BY REGION, 2024 (USD)

- TABLE 4 REGIONAL PROCUREMENT OF DRONES, 2021-2024 (UNITS)

- TABLE 5 TARIFFS FOR LITHIUM CELLS AND BATTERIES (HS CODE: 850650)

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 9 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 11 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 12 IMPORT DATA FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 EXPORT DATA OF HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TECHNOLOGY (%)

- TABLE 15 KEY BUYING CRITERIA, BY PLATFORM

- TABLE 16 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 TOTAL COST OF OWNERSHIP OF DRONE BATTERIES

- TABLE 18 U-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 19 KEY PRODUCT-RELATED TARIFF FOR DRONE BATTERIES

- TABLE 20 ANTICPATED CHANGES IN PRICES AND POTENTIAL IMPACT ON END-USE MARKET

- TABLE 22 DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 23 DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 24 LITHIUM-BASED: DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 25 LITHIUM-BASED: DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 26 NICKEL-BASED: DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 27 NICKEL-BASED: DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 28 DRONE BATTERY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 29 DRONE BATTERY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 30 DRONE BATTERY MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 31 DRONE BATTERY MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- TABLE 32 DRONE BATTERY OEM MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 33 DRONE BATTERY OEM MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 34 DRONE BATTERY AFTERMARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 35 DRONE BATTERY AFTERMARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 36 DRONE BATTERY AFTERMARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 37 DRONE BATTERY AFTERMARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 38 DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 39 DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 40 CONSUMER: DRONE BATTERY MARKET, BY WEIGHT, 2021-2024 (USD MILLION)

- TABLE 41 CONSUMER: DRONE BATTERY MARKET, BY WEIGHT, 2025-2030 (USD MILLION)

- TABLE 42 COMMERCIAL: DRONE BATTERY MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 43 COMMERCIAL: DRONE BATTERY MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 44 MILITARY: DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 45 MILITARY: DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 46 SPECIFICATIONS OF SMALL DRONES

- TABLE 47 SMALL MILITARY DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 48 SMALL MILITARY DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 49 TACTICAL MILITARY DRONE BATTERY MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 50 TACTICAL MILITARY DRONE BATTERY MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 51 STRATEGIC MILITARY DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 52 STRATEGIC MILITARY DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 53 DRONE BATTERY MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 54 DRONE BATTERY MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 55 DRONE BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 DRONE BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: DRONE BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 NORTH AMERICA: DRONE BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 60 NORTH AMERICA: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: CONSUMER DRONE BATTERY MARKET, BY WEIGHT, 2021-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: CONSUMER DRONE BATTERY MARKET, BY WEIGHT, 2025-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: COMMERCIAL DRONE BATTERY MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 64 NORTH AMERICA: COMMERCIAL DRONE BATTERY MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: MILITARY DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 66 NORTH AMERICA: MILITARY DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 68 NORTH AMERICA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 70 NORTH AMERICA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: DRONE BATTERY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 74 NORTH AMERICA: DRONE BATTERY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: DRONE BATTERY MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: DRONE BATTERY MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- TABLE 77 US: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 78 US: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 79 US: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 80 US: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 81 US: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 82 US: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 83 US: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 84 US: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 85 CANADA: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 86 CANADA: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 87 CANADA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 88 CANADA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 89 CANADA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 90 CANADA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 91 CANADA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 92 CANADA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: DRONE BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 EUROPE: DRONE BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 EUROPE: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 96 EUROPE: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: CONSUMER DRONE BATTERY MARKET, BY WEIGHT, 2021-2024 (USD MILLION)

- TABLE 98 EUROPE: CONSUMER DRONE BATTERY MARKET, BY WEIGHT, 2025-2030 (USD MILLION)

- TABLE 99 EUROPE: COMMERCIAL DRONE BATTERY MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 100 EUROPE: COMMERCIAL DRONE BATTERY MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 101 EUROPE: MILITARY DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 102 EUROPE: MILITARY DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 104 EUROPE: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 106 EUROPE: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 108 EUROPE: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: DRONE BATTERY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 110 EUROPE: DRONE BATTERY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: DRONE BATTERY MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 112 EUROPE: DRONE BATTERY MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- TABLE 113 UK: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 114 UK: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 115 UK: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 116 UK: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 117 UK: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 118 UK: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 119 UK: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 120 UK: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 121 FRANCE: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 122 FRANCE: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 123 FRANCE: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 124 FRANCE: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 125 FRANCE: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 126 FRANCE: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 127 FRANCE: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 128 FRANCE: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 129 GERMANY: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 130 GERMANY: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 131 GERMANY: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 132 GERMANY: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 133 GERMANY: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 134 GERMANY: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 135 GERMANY: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 136 GERMANY: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 137 ITALY: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 138 ITALY: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 139 ITALY: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 140 ITALY: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 141 ITALY: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 142 ITALY: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 143 ITALY: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 144 ITALY: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 145 RUSSIA: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 146 RUSSIA: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 147 RUSSIA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 148 RUSSIA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 149 RUSSIA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 150 RUSSIA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 151 RUSSIA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 152 RUSSIA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 153 SWEDEN: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 154 SWEDEN: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 155 SWEDEN: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 156 SWEDEN: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 157 SWEDEN: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 158 SWEDEN: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 159 SWEDEN: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 160 SWEDEN: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 161 REST OF EUROPE: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 162 REST OF EUROPE: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 163 REST OF EUROPE: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 164 REST OF EUROPE: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 165 REST OF EUROPE: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 166 REST OF EUROPE: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 REST OF EUROPE: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 168 REST OF EUROPE: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: DRONE BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 170 ASIA PACIFIC: DRONE BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 172 ASIA PACIFIC: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: CONSUMER DRONE BATTERY MARKET, BY WEIGHT, 2021-2024 (USD MILLION)

- TABLE 174 ASIA PACIFIC: CONSUMER DRONE BATTERY MARKET, BY WEIGHT, 2025-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: COMMERCIAL DRONE BATTERY MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 176 ASIA PACIFIC: COMMERCIAL DRONE BATTERY MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 177 ASIA PACIFIC: MILITARY DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 178 ASIA PACIFIC: MILITARY DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 179 ASIA PACIFIC: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 180 ASIA PACIFIC: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 182 ASIA PACIFIC: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 183 ASIA PACIFIC: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 184 ASIA PACIFIC: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 185 ASIA PACIFIC: DRONE BATTERY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 186 ASIA PACIFIC: DRONE BATTERY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 187 ASIA PACIFIC: DRONE BATTERY MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 188 ASIA PACIFIC: DRONE BATTERY MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- TABLE 189 CHINA: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 190 CHINA: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 191 CHINA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 192 CHINA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 193 CHINA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 194 CHINA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 195 CHINA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 196 CHINA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 197 INDIA: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 198 INDIA: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 199 INDIA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 200 INDIA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 201 INDIA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 202 INDIA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 203 INDIA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 204 INDIA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 205 JAPAN: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 206 JAPAN: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 207 JAPAN: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 208 JAPAN: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 209 JAPAN: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 210 JAPAN: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 211 JAPAN: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 212 JAPAN: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 213 AUSTRALIA: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 214 AUSTRALIA: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 215 AUSTRALIA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 216 AUSTRALIA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 217 AUSTRALIA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 218 AUSTRALIA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 219 AUSTRALIA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 220 AUSTRALIA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 221 SOUTH KOREA: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 222 SOUTH KOREA: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 223 SOUTH KOREA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 224 SOUTH KOREA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 225 SOUTH KOREA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 226 SOUTH KOREA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 227 SOUTH KOREA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 228 SOUTH KOREA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 229 REST OF ASIA PACIFIC: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 230 REST OF ASIA PACIFIC: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 231 REST OF ASIA PACIFIC: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 232 REST OF ASIA PACIFIC: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 233 REST OF ASIA PACIFIC: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 234 REST OF ASIA PACIFIC: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 235 REST OF ASIA PACIFIC: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 236 REST OF ASIA PACIFIC: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 237 MIDDLE EAST: DRONE BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 238 MIDDLE EAST: DRONE BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 239 MIDDLE EAST: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 240 MIDDLE EAST: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 241 MIDDLE EAST: CONSUMER DRONE BATTERY MARKET, BY WEIGHT, 2021-2024 (USD MILLION)

- TABLE 242 MIDDLE EAST: CONSUMER DRONE BATTERY MARKET, BY WEIGHT, 2025-2030 (USD MILLION)

- TABLE 243 MIDDLE EAST: COMMERCIAL DRONE BATTERY MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 244 MIDDLE EAST: COMMERCIAL DRONE BATTERY MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 245 MIDDLE EAST: MILITARY DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 246 MIDDLE EAST: MILITARY DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 247 MIDDLE EAST: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 248 MIDDLE EAST: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 249 MIDDLE EAST: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 250 MIDDLE EAST: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 251 MIDDLE EAST: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 252 MIDDLE EAST: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 253 MIDDLE EAST: DRONE BATTERY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 254 MIDDLE EAST: DRONE BATTERY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 255 MIDDLE EAST: DRONE BATTERY MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 256 MIDDLE EAST: DRONE BATTERY MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- TABLE 257 SAUDI ARABIA: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 258 SAUDI ARABIA: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 259 SAUDI ARABIA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 260 SAUDI ARABIA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 261 SAUDI ARABIA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 262 SAUDI ARABIA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 263 SAUDI ARABIA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 264 SAUDI ARABIA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 265 UAE: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 266 UAE: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 267 UAE: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 268 UAE: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 269 UAE: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 270 UAE: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 271 UAE: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 272 UAE: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 273 ISRAEL: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 274 ISRAEL: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 275 ISRAEL: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 276 ISRAEL: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 277 ISRAEL: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 278 ISRAEL: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 279 ISRAEL: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 280 ISRAEL: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 281 TURKEY: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 282 TURKEY: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 283 TURKEY: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 284 TURKEY: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 285 TURKEY: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 286 TURKEY: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 287 TURKEY: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 288 TURKEY: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 289 REST OF MIDDLE EAST: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 290 REST OF MIDDLE EAST: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 291 REST OF MIDDLE EAST: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 292 REST OF MIDDLE EAST: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 293 REST OF MIDDLE EAST: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 294 REST OF MIDDLE EAST: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 295 REST OF MIDDLE EAST: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 296 REST OF MIDDLE EAST: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 297 REST OF THE WORLD: DRONE BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 298 REST OF THE WORLD: DRONE BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 299 REST OF THE WORLD: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 300 REST OF THE WORLD: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 301 REST OF THE WORLD: CONSUMER DRONE BATTERY MARKET, BY WEIGHT, 2021-2024 (USD MILLION)

- TABLE 302 REST OF THE WORLD: CONSUMER DRONE BATTERY MARKET, BY WEIGHT, 2025-2030 (USD MILLION)

- TABLE 303 REST OF THE WORLD: COMMERCIAL DRONE BATTERY MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 304 REST OF THE WORLD: COMMERCIAL DRONE BATTERY MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 305 REST OF THE WORLD: MILITARY DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 306 REST OF THE WORLD: MILITARY DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 307 REST OF THE WORLD: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 308 REST OF THE WORLD: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 309 REST OF THE WORLD: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 310 REST OF THE WORLD: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 311 REST OF THE WORLD: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 312 REST OF THE WORLD: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 313 REST OF THE WORLD: DRONE BATTERY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 314 REST OF THE WORLD: DRONE BATTERY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 315 REST OF THE WORLD: DRONE BATTERY MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 316 REST OF THE WORLD: DRONE BATTERY MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- TABLE 317 LATIN AMERICA: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 318 LATIN AMERICA: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 319 LATIN AMERICA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 320 LATIN AMERICA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 321 LATIN AMERICA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 322 LATIN AMERICA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 323 LATIN AMERICA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 324 LATIN AMERICA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 325 AFRICA: DRONE BATTERY MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 326 AFRICA: DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 327 AFRICA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 328 AFRICA: DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 329 AFRICA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 330 AFRICA: LITHIUM-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 331 AFRICA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 332 AFRICA: NICKEL-BASED DRONE BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 333 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 334 DRONE BATTERY MARKET: DEGREE OF COMPETITION

- TABLE 335 REGION FOOTPRINT

- TABLE 336 PLATFORM FOOTPRINT

- TABLE 337 TECHNOLOGY FOOTPRINT

- TABLE 338 POINT OF SALE FOOTPRINT

- TABLE 339 LIST OF START-UPS/SMES

- TABLE 340 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 341 DRONE BATTERY MARKET: PRODUCT LAUNCHES, 2020-2025

- TABLE 342 DRONE BATTERY MARKET: DEALS, 2020-2025

- TABLE 343 DRONE BATTERY MARKET: OTHERS, 2020-2025

- TABLE 344 DJI: COMPANY OVERVIEW

- TABLE 345 DJI: PRODUCTS OFFERED

- TABLE 346 DJI: DEALS

- TABLE 347 EAGLEPICHER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 348 EAGLEPICHER TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 349 RRC POWER SOLUTIONS GMBH: COMPANY OVERVIEW

- TABLE 350 RRC POWER SOLUTIONS GMBH: PRODUCTS OFFERED

- TABLE 351 RRC POWER SOLUTIONS GMBH: PRODUCT LAUNCHES

- TABLE 352 SHENZHEN GREPOW BATTERY CO., LTD.: COMPANY OVERVIEW

- TABLE 353 SHENZHEN GREPOW BATTERY CO., LTD.: PRODUCTS OFFERED

- TABLE 354 SHENZHEN GREPOW BATTERY CO., LTD.: PRODUCT LAUNCHES

- TABLE 355 EPSILOR-ELECTRIC FUEL LTD.: COMPANY OVERVIEW

- TABLE 356 EPSILOR-ELECTRIC FUEL LTD.: PRODUCTS OFFERED

- TABLE 357 EPSILOR-ELECTRIC FUEL LTD.: OTHER DEVELOPMENTS

- TABLE 358 TADIRAN BATTERIES: COMPANY OVERVIEW

- TABLE 359 TADIRAN BATTERIES: PRODUCTS OFFERED

- TABLE 360 PLUG POWER INC.: COMPANY OVERVIEW

- TABLE 361 PLUG POWER INC.: PRODUCTS OFFERED

- TABLE 362 PLUG POWER INC.: DEALS

- TABLE 363 SES AI CORPORATION: COMPANY OVERVIEW

- TABLE 364 SES AI CORPORATION: PRODUCTS OFFERED

- TABLE 365 SES AI CORPORATION: PRODUCT LAUNCHES

- TABLE 366 SION POWER CORPORATION: COMPANY OVERVIEW

- TABLE 367 SION POWER CORPORATION: PRODUCTS OFFERED

- TABLE 368 SION POWER CORPORATION: OTHER DEVELOPMENTS

- TABLE 369 INTELLIGENT ENERGY LIMITED: COMPANY OVERVIEW

- TABLE 370 INTELLIGENT ENERGY LIMITED: PRODUCTS OFFERED

- TABLE 371 INTELLIGENT ENERGY LIMITED: PRODUCT LAUNCHES

- TABLE 372 INTELLIGENT ENERGY LIMITED: DEALS

- TABLE 373 H3 DYNAMICS HOLDINGS PTE. LTD.: COMPANY OVERVIEW

- TABLE 374 H3 DYNAMICS HOLDINGS PTE. LTD.: PRODUCTS OFFERED

- TABLE 375 H3 DYNAMICS HOLDINGS PTE. LTD.: DEALS

- TABLE 376 H3 DYNAMICS HOLDINGS PTE. LTD.: OTHER DEVELOPMENTS

- TABLE 377 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 378 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 379 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 380 HONEYWELL INTERNATIONAL INC.: OTHER DEVELOPMENTS

- TABLE 381 INVENTUS POWER: COMPANY OVERVIEW

- TABLE 382 INVENTUS POWER: PRODUCTS OFFERED

- TABLE 383 MMC: COMPANY OVERVIEW

- TABLE 384 MMC: PRODUCTS OFFERED

- TABLE 385 DOOSAN MOBILITY INNOVATION: COMPANY OVERVIEW

- TABLE 386 DOOSAN MOBILITY INNOVATION: PRODUCTS OFFERED

- TABLE 387 DOOSAN MOBILITY INNOVATION: PRODUCT LAUNCHES

- TABLE 388 DOOSAN MOBILITY INNOVATION: DEALS

- TABLE 389 KOKAM BATTERY: COMPANY OVERVIEW

- TABLE 390 DENCHI GROUP: COMPANY OVERVIEW

- TABLE 391 TROOWIN POWER SYSTEM TECHNOLOGY: COMPANY OVERVIEW

- TABLE 392 AMPEREX TECHNOLOGY LIMITED: COMPANY OVERVIEW

- TABLE 393 AMICELL: COMPANY OVERVIEW

- TABLE 394 CUSTOM POWER: COMPANY OVERVIEW

- TABLE 395 AMPRIUS TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 396 GUANGZHOU SUNLAND NEW ENERGY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 397 ALEXANDER BATTERY TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 398 EV BATTERY SOLUTIONS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 DRONE BATTERY MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 COMMERCIAL TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 9 CELLS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO BE LARGEST MARKET FOR DRONE BATTERIES DURING FORECAST PERIOD

- FIGURE 11 GROWING USE OF ADVANCED BATTERY TECHNOLOGIES TO DRIVE MARKET

- FIGURE 12 LITHIUM-ION TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 13 OEM TO HOLD HIGHER SHARE THAN AFTERMARKET IN 2025

- FIGURE 14 MILITARY TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 15 5-20 AH SEGMENT TO BE DOMINANT IN 2025

- FIGURE 16 CONNECTORS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 17 CHINA TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 18 DRONE BATTERY MARKET DYNAMICS

- FIGURE 19 UNIT SHIPMENTS OF DRONE, BY PLATFORM, 2020-2024

- FIGURE 20 SPECIFIC ENERGIES OF DIFFERENT BATTERY CHEMISTRIES

- FIGURE 21 VALUE CHAIN ANALYSIS

- FIGURE 22 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 ECOSYSTEM ANALYSIS

- FIGURE 24 IMPORT DATA FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 25 EXPORT DATA FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TECHNOLOGY

- FIGURE 28 KEY BUYING CRITERIA, BY PLATFORM

- FIGURE 29 BILL OF MATERIALS FOR DRONE BATTERIES

- FIGURE 30 IMPACT OF AI ON DRONE BATTERY MARKET

- FIGURE 31 BUSINESS MODELS IN DRONE BATTERY MARKET

- FIGURE 32 EVOLUTION OF DRONE BATTERY TECHNOLOGY

- FIGURE 33 DRONE BATTERY TECHNOLOGY ROADMAP

- FIGURE 34 PATENT ANALYSIS

- FIGURE 35 DRONE BATTERY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- FIGURE 36 DRONE BATTERY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- FIGURE 37 DRONE BATTERY MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- FIGURE 38 DRONE BATTERY MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- FIGURE 39 DRONE BATTERY MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- FIGURE 40 DRONE BATTERY MARKET, BY REGION, 2025-2030

- FIGURE 41 NORTH AMERICA: DRONE BATTERY MARKET SNAPSHOT

- FIGURE 42 EUROPE: DRONE BATTERY MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: DRONE BATTERY MARKET SNAPSHOT

- FIGURE 44 MIDDLE EAST: DRONE BATTERY MARKET SNAPSHOT

- FIGURE 45 REST OF THE WORLD: DRONE BATTERY MARKET SNAPSHOT

- FIGURE 46 REVENUE ANALYSIS OF KEY PLAYERS, 2021-2024

- FIGURE 47 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 48 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 COMPANY FOOTPRINT

- FIGURE 50 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 51 BRAND/PRODUCT COMPARISON

- FIGURE 52 FINANCIAL METRICS OF PROMINENT PLAYERS

- FIGURE 53 VALUATION OF PROMINENT PLAYERS

- FIGURE 54 PLUG POWER INC.: COMPANY SNAPSHOT

- FIGURE 55 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

The drone battery market is expected to reach USD 2.41 billion by 2030, from USD 1.59 billion in 2025, with a CAGR of 8.7%. The market is expanding as more businesses in agriculture, delivery services, and defense adopt drone technology. These drones require strong and reliable batteries that can last longer, charge quickly, and operate safely. New battery technologies, such as Lithium-based batteries and hydrogen fuel cells, are enhancing drone performance and meeting the demands of modern industries. However, advanced batteries can be expensive, and materials like Lithium are difficult to source. Additionally, strict regulations govern the transportation of Lithium batteries. Despite these hurdles, the demand for better drone batteries continues to rise, driving growth in the market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Platform, Technology, Component, Point Of Sale, and Capacity and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Cell to be largest segment during forecast period"

The cell is the largest segment in the drone battery market because it is the primary component that stores and provides power to the drone. A drone's flight time and overall performance largely depend on the strength and lightweight nature of the cell. As drones are increasingly utilized for delivery, agriculture, and defense, businesses require battery cells that can store more energy while remaining lightweight. Battery manufacturers are enhancing the quality of these cells to enable drones to fly longer and perform their tasks more effectively. The cell is considered the most important and widely used component in drone batteries.

"Commercial segment to exhibit fastest growth during forecast period"

The commercial segment of the drone battery market is experiencing rapid growth. Many businesses are now utilizing drones for various tasks such as delivery, farming, inspections, filming, and mapping. These drones require powerful batteries that can provide longer flight times and support heavier equipment. Companies are increasingly adopting drones to save time, reduce costs, and enhance efficiency. As industries like e-commerce, smart farming, construction, and energy inspection expand, the demand for drones continues to rise. This, in turn, drives the need for advanced batteries capable of supporting these applications. Given the swift adoption of drones across multiple industries, the commercial segment of the drone battery market is growing significantly.

"North America to be leading market for drone batteries during forecast period"

North America is the leading region in the drone battery market, primarily because many top drone and battery companies are located there. The region is quick to adopt new technologies, and drones are utilized across various industries, including delivery, agriculture, construction, and security. Companies in North America are also developing new types of batteries, such as lithium-based batteries and hydrogen fuel cells, to enhance drone flight duration and performance. As drones are widely used for both commercial and defense purposes, there is a high demand for powerful and reliable batteries. This strong demand solidifies North America's position as the top region in the drone battery market.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier-1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%; Tier 2 - 45%; and Tier 3 - 20%

- By Designation: C Level - 35%; Directors - 25%; and Others - 40%

- By Region: North America - 21%; Europe - 18%; Asia Pacific - 42%; Rest of the World - 19%

Epsilor-Electric Fuel Ltd. (Israel), EaglePicher Technologies (US), RRC Power Solutions GmbH (Germany), Shenzhen Grepow Battery Co., Ltd. (China), and Tadiran Batteries (US) are the leading players in the drone battery market.

Research coverage

The study addresses the drone battery market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on technology, components, capacity, platform, point of sale, and region. This study also includes a comprehensive competitive analysis of the key players in the market, along with their company profiles, significant observations related to their solutions and business offerings, recent developments undertaken by them, and major market strategies they have adopted.

Key benefits of buying this report:

This report will assist market leaders and new entrants by providing information on the closest approximations of revenue figures for the drone battery market and its subsegments. The report encompasses the entire ecosystem of the drone battery market. It will enable stakeholders to understand the competitive landscape, gain deeper insights to better position their businesses, and plan effective go-to-market strategies. The report will also help stakeholders gauge the market dynamics and offer them information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers, such as the growing use of drones across industries, the need for longer flight time and faster charging, advancements in smart battery systems, rapid adoption of autonomous technologies, and the shift toward cleaner, electric-powered drone operations

- Product Development: In-depth analysis of product innovation/development by companies across various regions

- Market Development: Comprehensive information about lucrative markets - the report analyses the drone battery market across varied regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the drone battery market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Epsilor-Electric Fuel Ltd. (Israel), EaglePicher Technologies (US), RRC Power Solutions GmbH (Germany), Shenzhen Grepow Battery Co., Ltd. (China), and Tadiran Batteries (US), among others, in the drone battery market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Market size estimation methodology

- 2.2.1.2 Regional split of drone battery market

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DRONE BATTERY MARKET

- 4.2 DRONE BATTERY MARKET, BY TECHNOLOGY

- 4.3 DRONE BATTERY MARKET, BY POINT OF SALE

- 4.4 DRONE BATTERY MARKET, BY PLATFORM

- 4.5 DRONE BATTERY MARKET, BY CAPACITY

- 4.6 DRONE BATTERY MARKET, BY COMPONENT

- 4.7 DRONE BATTERY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of drones across diverse applications

- 5.2.1.2 Increasing demand for longer flight times, faster charging, and safer battery performance

- 5.2.1.3 Advancements in autonomous drone technology

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of energy-dense batteries

- 5.2.2.2 Restrictions on transport of lithium batteries

- 5.2.2.3 Limited battery lifespan and flight time

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in material sciences and battery technology

- 5.2.3.2 Innovations in hydrogen fuel cell technology

- 5.2.3.3 Introduction of smart battery technology

- 5.2.3.4 Public and private sector investments in drone battery R&D and local manufacturing

- 5.2.4 CHALLENGES

- 5.2.4.1 Inadequate charging infrastructure

- 5.2.4.2 Lack of safety standards

- 5.2.4.3 Poor quality of grey market products

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE, PLATFORM

- 5.3.2 AVERAGE SELLING PRICE, BY REGION

- 5.4 OPERATIONAL DATA

- 5.5 TARIFF AND REGULATORY LANDSCAPE

- 5.5.1 TARIFF DATA

- 5.5.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Lithium-based batteries

- 5.9.1.2 Nickel-based batteries

- 5.9.1.3 Fuel cells

- 5.9.1.4 Solid-state batteries

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Thermal management systems

- 5.9.2.2 Charging infrastructure

- 5.9.2.3 Battery swapping systems

- 5.9.2.4 Remote monitoring software

- 5.9.2.5 Power management algorithms

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Electric propulsion systems

- 5.9.3.2 Lightweight composite materials

- 5.9.3.3 VTOL and hybrid drones

- 5.9.1 KEY TECHNOLOGIES

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 850650)

- 5.10.2 EXPORT SCENARIO (HS CODE 850650)

- 5.11 USE CASE ANALYSIS

- 5.11.1 ISS AEROSPACE'S SENSUS EMPLOYED HYDROGEN FUEL CELLS TO ENHANCE RANGE AND FLIGHT TIME

- 5.11.2 THALES' STRATOBUS LEVERAGED LICERION-HE BATTERIES TO ENHANCE OPERATIONS

- 5.11.3 STOREDOT DEVELOPED UFC FLASHBETTERY TO REDUCE CHARGING TIME

- 5.11.4 MAXELL AND NILEWORKS DEVELOPED INTELLIGENT BATTERIES FOR AGRICULTURAL DRONES

- 5.11.5 DANENERGY DESIGNED CUSTOM LITHIUM BATTERY PACKS TO ENHANCE PERFORMANCE

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 BILL OF MATERIALS

- 5.16 TOTAL COST OF OWNERSHIP

- 5.17 IMPACT OF AI

- 5.17.1 AI-ENABLED SMART BATTERY MANAGEMENT SYSTEMS

- 5.17.2 PREDICTIVE MAINTENANCE AND BATTERY LIFECYCLE OPTIMIZATION

- 5.17.3 ADAPTIVE POWER OPTIMIZATION BASED ON MISSION PROFILES

- 5.17.4 AUTONOMOUS CHARGING AND BATTERY SWAPPING

- 5.17.5 THERMAL AND RISK MANAGEMENT

- 5.17.6 DATA-DRIVEN BATTERY DESIGN AND CUSTOMIZATION

- 5.17.7 AI IN BATTERY-AS-A-SERVICE MODELS

- 5.18 MACRO ECONOMIC OUTLOOK

- 5.18.1 NORTH AMERICA

- 5.18.2 EUROPE

- 5.18.3 ASIA PACIFIC

- 5.18.4 MIDDLE EAST

- 5.18.5 LATIN AMERICA

- 5.18.6 AFRICA

- 5.19 BUSINESS MODELS

- 5.19.1 BATTERY MANUFACTURING MODEL

- 5.19.2 IN-HOUSE BATTERY MANUFACTURING MODEL

- 5.19.3 CUSTOM BATTERY SALES MODEL

- 5.19.4 AFTERMARKET MODEL

- 5.20 US 2025 TARIFF

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.5 IMPACT ON END-USE INDUSTRIES

- 5.20.5.1 Commercial

- 5.20.5.2 Defense

- 5.20.5.3 Industrial

- 5.20.5.4 Law enforcement

- 5.21 TECHNOLOGY ROADMAP

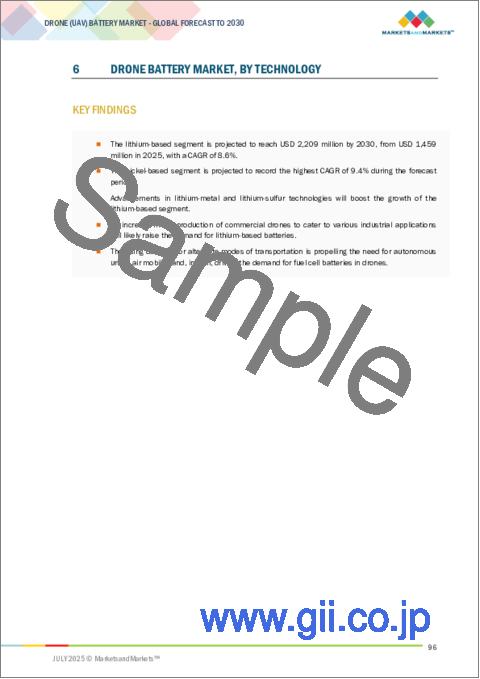

6 DRONE BATTERY MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 LITHIUM-BASED

- 6.2.1 LITHIUM-ION SEGMENT TO BE PREVALENT

- 6.2.2 LITHIUM-ION

- 6.2.2.1 Use case: LP 30794 by EaglePicher

- 6.2.3 LITHIUM-POLYMER

- 6.2.3.1 Use case: Tattu 6S LiPo by Grepow

- 6.2.4 LITHIUM-METAL

- 6.2.4.1 Use case: Licerion by Sion Power

- 6.2.5 LITHIUM-SULFUR

- 6.2.5.1 Use case: Gelion 395 Wh/kg Lithium-Sulfur 9.5 Ah

- 6.3 NICKEL-BASED

- 6.3.1 NICKEL-METAL HYDRIDE SEGMENT TO EXHIBIT FASTEST GROWTH

- 6.3.2 NICKEL-CADMIUM

- 6.3.2.1 Use case: KEBILSHOP 1.2V 5000mAh D-size Ni-Cd battery

- 6.3.3 NICKEL-METAL HYDRIDE

- 6.3.3.1 Use case: NiMH battery packs by Alexander Technologies

- 6.4 FUEL CELL

- 6.4.1 COMPLIANCE WITH LOW-EMISSION OPERATIONAL GOALS

- 6.4.2 USE CASE: TRI-HYBRID POWER SYSTEM BY H3 DYNAMICS AND XSUN

- 6.5 SODIUM-ION

- 6.5.1 COST-EFFECTIVE SOLUTION FOR LIGHTWEIGHT, SHORT-RANGE DRONES

- 6.5.2 USE CASE: SODIUM-ION BATTERIES BY INDI ENERGY

7 DRONE BATTERY MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 CELLS

- 7.2.1 KEY COMPONENT OF DRONE BATTERIES

- 7.3 BATTERY MANAGEMENT SYSTEMS

- 7.3.1 INSTRUMENTAL IN MONITORING BATTERY FUNCTIONS

- 7.4 ENCLOSURES

- 7.4.1 SAFEGUARD BATTERIES FROM DUST, DIRT, WATER, OIL, AND OTHER PARTICLES

- 7.5 CONNECTORS

- 7.5.1 ENSURE SMOOTH OPERATIONS OF ELECTRIC CIRCUITS

8 DRONE BATTERY MARKET, BY POINT OF SALE

- 8.1 INTRODUCTION

- 8.2 OEM

- 8.2.1 FEASIBILITY OF ASSEMBLY AND MODIFICATION FOR DRONE OPERATORS

- 8.3 AFTERMARKET

- 8.3.1 SPARE PARTS SEGMENT TO SECURE LEADING POSITION

- 8.3.2 PRODUCT INTEGRATION

- 8.3.3 SPARE PARTS

- 8.3.4 UPGRADE

9 DRONE BATTERY MARKET, BY PLATFORM

- 9.1 INTRODUCTION

- 9.2 CONSUMER

- 9.2.1 <250 G TO BE LARGEST SEGMENT

- 9.2.2 <250 G

- 9.2.3 >250 G

- 9.3 COMMERCIAL

- 9.3.1 SMALL SEGMENT TO BE DOMINANT

- 9.3.2 SMALL

- 9.3.3 MEDIUM

- 9.3.4 LARGE

- 9.4 GOVERNMENT & LAW ENFORCEMENT

- 9.4.1 DEVELOPMENT OF NEWER, LIGHTER BATTERIES

- 9.5 MILITARY

- 9.5.1 STRATEGIC SEGMENT TO SURPASS OTHERS

- 9.5.2 SMALL

- 9.5.2.1 Nano

- 9.5.2.2 Micro

- 9.5.2.3 Mini

- 9.5.3 TACTICAL

- 9.5.3.1 Close range

- 9.5.3.2 Short range

- 9.5.3.3 Medium range medium endurance

- 9.5.3.4 Low altitude long endurance

- 9.5.4 STRATEGIC

- 9.5.4.1 MALE

- 9.5.4.2 HALE

10 DRONE BATTERY MARKET, BY CAPACITY

- 10.1 INTRODUCTION

- 10.2 >5 AH

- 10.2.1 EXTENSIVE USE IN SMALL CONSUMER DRONES

- 10.3 5-20 AH

- 10.3.1 SUITABLE FOR COMMERCIAL APPLICATIONS SUCH AS AGRICULTURE AND MAPPING

- 10.4 20-50 AH

- 10.4.1 PREFERRED IN LONG-ENDURANCE AND PAYLOAD-HEAVY DRONE OPERATIONS

- 10.5 >50 AH

- 10.5.1 PREDOMINANCE IN STRATEGIC AND HEAVY-LIFT DRONE APPLICATIONS

11 DRONE BATTERY MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 PESTLE ANALYSIS

- 11.2.2 US

- 11.2.2.1 Substantial investments in development of drone batteries

- 11.2.3 CANADA

- 11.2.3.1 Focus on performance due to extreme weather conditions

- 11.3 EUROPE

- 11.3.1 PESTLE ANALYSIS

- 11.3.2 UK

- 11.3.2.1 Technological advancements and changing regulatory policies

- 11.3.3 FRANCE

- 11.3.3.1 Robust defense-industrial base and extensive use of commercial drones

- 11.3.4 GERMANY

- 11.3.4.1 Defense modernization and green battery initiatives

- 11.3.5 ITALY

- 11.3.5.1 Increasing adoption in military and smart agriculture applications

- 11.3.6 RUSSIA

- 11.3.6.1 Localization of drone battery development due to wartime demand

- 11.3.7 SWEDEN

- 11.3.7.1 Defense upgrades and robust clean-tech ecosystem

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 PESTLE ANALYSIS

- 11.4.2 CHINA

- 11.4.2.1 Significant presence of major drone battery manufacturers

- 11.4.3 INDIA

- 11.4.3.1 Indigenous development of drone batteries

- 11.4.4 JAPAN

- 11.4.4.1 Extensive use of drones in monitoring, spraying, and surveying applications

- 11.4.5 AUSTRALIA

- 11.4.5.1 Rising use of drones for delivery of food and medical supplies

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Strong government funding and defense modernization programs

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST

- 11.5.1 PESTLE ANALYSIS

- 11.5.2 GCC

- 11.5.2.1 Saudi Arabia

- 11.5.2.1.1 Rising procurement of drones for ISR activities

- 11.5.2.2 UAE

- 11.5.2.2.1 Favorable initiatives for drone operations

- 11.5.2.1 Saudi Arabia

- 11.5.3 ISRAEL

- 11.5.3.1 Increased investments in R&D of drone batteries

- 11.5.4 TURKEY

- 11.5.4.1 Expanding use of drones in military and commercial sectors

- 11.5.5 REST OF MIDDLE EAST

- 11.6 REST OF THE WORLD

- 11.6.1 PESTLE ANALYSIS

- 11.6.2 LATIN AMERICA

- 11.6.2.1 Growing adoption of drones in agriculture, border surveillance, and disaster response

- 11.6.3 AFRICA

- 11.6.3.1 Rise in commercial drone applications

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 12.3 REVENUE ANALYSIS, 2021-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Platform footprint

- 12.5.5.4 Technology footprint

- 12.5.5.5 Point of sale footprint

- 12.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING

- 12.6.5.1 List of start-ups/SMEs

- 12.6.5.2 Competitive benchmarking of start-ups/SMEs

- 12.7 BRAND/PRODUCT COMPARISON

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 OTHERS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 DJI

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 EAGLEPICHER TECHNOLOGIES

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Right to win

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses and competitive threats

- 13.1.3 RRC POWER SOLUTIONS GMBH

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 SHENZHEN GREPOW BATTERY CO., LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 EPSILOR-ELECTRIC FUEL LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 TADIRAN BATTERIES

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.7 PLUG POWER INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 SES AI CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.9 SION POWER CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Other developments

- 13.1.10 INTELLIGENT ENERGY LIMITED

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.11 H3 DYNAMICS HOLDINGS PTE. LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.3.2 Other developments

- 13.1.12 HONEYWELL INTERNATIONAL INC.

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.12.3.2 Other developments

- 13.1.13 INVENTUS POWER

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.14 MMC

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 DOOSAN MOBILITY INNOVATION

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches

- 13.1.15.3.2 Deals

- 13.1.1 DJI

- 13.2 OTHER PLAYERS

- 13.2.1 KOKAM BATTERY

- 13.2.2 DENCHI GROUP

- 13.2.3 TROOWIN POWER SYSTEM TECHNOLOGY

- 13.2.4 AMPEREX TECHNOLOGY LIMITED

- 13.2.5 AMICELL

- 13.2.6 CUSTOM POWER

- 13.2.7 AMPRIUS TECHNOLOGIES

- 13.2.8 GUANGZHOU SUNLAND NEW ENERGY TECHNOLOGY CO., LTD.

- 13.2.9 ALEXANDER BATTERY TECHNOLOGIES

- 13.2.10 EV BATTERY SOLUTIONS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 ANNEXURE: LAUNDRY LIST OF COMPANIES:

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS