|

|

市場調査レポート

商品コード

1761503

医療用ディスプレイの世界市場:技術別、パネルサイズ別、解像度別、色別、用途別、地域別 - 2030年までの予測Medical Display Market by Technology, Panel Size, Resolution, Display Color, Application - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 医療用ディスプレイの世界市場:技術別、パネルサイズ別、解像度別、色別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月30日

発行: MarketsandMarkets

ページ情報: 英文 310 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

医療用ディスプレイの市場規模は、予測期間中に5.5%のCAGRで拡大し、2025年の26億4,000万米ドルから2030年には34億5,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 技術別、パネルサイズ別、解像度別、色別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

医療用ディスプレイ市場は、イメージング技術の進歩、正確な診断に対する需要の増加、慢性疾患の有病率の上昇など、いくつかの主な要因の影響を受けています。さらに、特に新興経済圏におけるヘルスケア投資の拡大、デジタルヘルスケアシステムへのシフトが市場成長の原動力となっています。画質に関する規制基準、放射線科や外科における高解像度ディスプレイの必要性、遠隔医療の拡大も需要に影響を与えています。しかし、過疎地ではコストが高く、アクセスが限られているため、市場拡大の妨げになる可能性があります。

4.1~8メガピクセルの解像度を持つ医療用ディスプレイは、特に放射線学と外科用途において、正確な診断に不可欠な高い画像の鮮明度を提供する能力により、最大の市場シェアを占めています。これらのディスプレイは、複雑な解剖学的構造を詳細に視覚化できるため、診断の信頼性が高まる。その性能と費用対効果の組み合わせにより、病院や診断センターで広く好まれています。

ディスプレイの色別では、カラーディスプレイが医療用ディスプレイ市場を独占しています。なぜなら、カラーディスプレイは、正確な診断や外科手術のガイダンスに不可欠な、詳細で多次元的な画像を提供するからです。カラーディスプレイは、MRIやCTのような高度な画像診断技術に対応しており、色の識別が解釈を向上させる。汎用性が高く、様々な専門分野で一般的に使用されているため、現代のヘルスケア現場で好まれています。

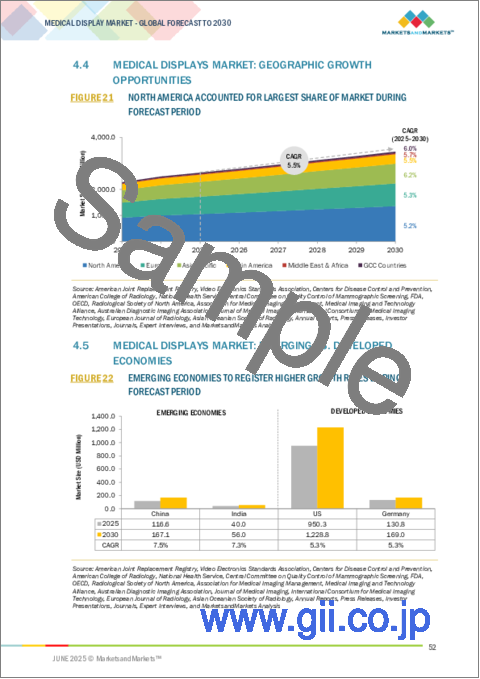

アジア太平洋は、医療用ディスプレイ市場で最も高い成長率を経験すると予測されています。この成長の背景には、ヘルスケアへの投資の増加、先進画像技術の急速な導入、ヘルスケアインフラの拡大など、いくつかの要因があります。さらに、病気の早期診断に対する意識の高まり、高齢者人口の増加、慢性疾患の有病率の増加が需要を促進しています。さらに、政府のイニシアチブの改善や有利な政策、中国やインドなどの新興経済国の存在が、予測期間中にこの地域の市場拡大を加速させる要因となっています。

当レポートでは、世界の医療用ディスプレイ市場について調査し、技術別、パネルサイズ別、解像度別、色別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 規制分析

- ポーターのファイブフォース分析

- バリューチェーン分析

- 技術分析

- エコシステム分析

- 特許分析

- 貿易分析

- 価格分析

- 2025年~2026年の主な会議とイベント

- 主要な利害関係者と購入基準

- サプライチェーン分析

- 医療用ディスプレイの定性データ(ビデオ入力ポートタイプ別)

- 2025年の米国関税が医療用ディスプレイ市場に与える影響

- 医療用ディスプレイ市場におけるGEN AIの影響

- アンメットニーズ/エンドユーザーの期待

- 隣接市場分析

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向/混乱

- 償還シナリオ

- 投資と資金調達のシナリオ

第6章 医療用ディスプレイ市場(技術別)

- イントロダクション

- LEDバックライト付きLCD

- CCFLバックライトLCD

- 有機EL

第7章 医療用ディスプレイ市場(パネルサイズ別)

- イントロダクション

- 22.9インチ以下

- 23.0~26.9インチ

- 27.0~41.9インチ

- 42インチ以上

第8章 医療用ディスプレイ市場(解像度別)

- イントロダクション

- 2MP未満

- 2.1~4MP

- 4.1~8MP

- 8MP以上

第9章 医療用ディスプレイ市場(色別)

- イントロダクション

- カラーディスプレイ

- モノクロおよびグレースケールディスプレイ

第10章 医療用ディスプレイ市場(用途別)

- イントロダクション

- 診断

- 外科/介入

- 歯科

- その他

第11章 医療用ディスプレイ市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 日本

- 中国

- インド

- 韓国

- オーストラリア

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- GCC諸国

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 主要プレーヤーのR&D評価

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- BARCO NV

- EIZO INC.

- SONY ELECTRONICS INC.

- NOVANTA INC.

- SHENZHEN BEACON DISPLAY TECHNOLOGY CO., LTD.

- LG ELECTRONICS

- FSN MEDICAL TECHNOLOGIES

- ADVANTECH CO., LTD.

- QUEST INTERNATIONAL

- STERIS

- JUSHA MEDICAL

- SIEMENS HEALTHINEERS

- DOUBLE BLACK IMAGING

- HP DEVELOPMENT COMPANY, L.P.

- STRYKER

- その他の企業

- COJE DISPLAYS

- AXIOMTEK

- BENQ AMERICA CORPORATION

- JVCKENWOOD USA CORPORATION

- AMERICAN PORTWELL TECHNOLOGY, INC.

- AUO DISPLAY PLUS

- CANVYS-VISUAL TECHNOLOGY SOLUTIONS

- QINGDAO HISENSE MEDICAL EQUIPMENT CO., LTD.

- KORTEK CORPORATION

- D&T INC.

第14章 付録

List of Tables

- TABLE 1 MEDICAL DISPLAYS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES, 2021-2024

- TABLE 3 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 4 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 5 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 6 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 7 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 MEDICAL DISPLAYS MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2023-2025

- TABLE 15 IMPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 16 EXPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 17 AVERAGE SELLING PRICE TREND OF MEDICAL DISPLAY PRODUCTS, BY TECHNOLOGY, 2022-2024

- TABLE 18 AVERAGE SELLING PRICE TREND OF MEDICAL DISPLAY PRODUCTS, BY KEY PLAYER, 2022-2024

- TABLE 19 AVERAGE SELLING TREND OF LED-BACKLIT LCD DISPLAYS, BY REGION, 2022-2024

- TABLE 20 MEDICAL DISPLAYS MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TECHNOLOGIES

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE TECHNOLOGIES

- TABLE 23 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 24 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR MEDICAL DISPLAYS

- TABLE 25 KEY COMPANIES IMPLEMENTING AI

- TABLE 26 MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 27 LED DISPLAY, BY SIZE AND AREA OF USE

- TABLE 28 LED-BACKLIT LCD DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 LED-BACKLIT LCD DISPLAYS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 30 CCFL-BACKLIT LCD DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 CCFL-BACKLIT LCD DISPLAYS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 32 OLED DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 OLED DISPLAYS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 34 MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 35 MEDICAL DISPLAYS MARKET FOR PANELS UNDER 22.9 INCHES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 MEDICAL DISPLAYS MARKET FOR PANELS UNDER 22.9 INCHES, BY REGION, 2023-2030 (UNITS)

- TABLE 37 MEDICAL DISPLAYS MARKET FOR 23.0-26.9-INCH PANELS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 MEDICAL DISPLAYS MARKET FOR 23.0-26.9-INCH PANELS, BY REGION, 2023-2030 (UNITS)

- TABLE 39 MEDICAL DISPLAYS MARKET FOR 27.0-41.9-INCH PANELS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 MEDICAL DISPLAYS MARKET FOR 27.0-41.9-INCH PANELS, BY REGION, 2023-2030 (UNITS)

- TABLE 41 MEDICAL DISPLAYS MARKET FOR PANELS ABOVE 42 INCHES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 MEDICAL DISPLAYS MARKET FOR PANELS ABOVE 42 INCHES, BY COUNTRY, 2023-2030 (UNITS)

- TABLE 43 MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 44 UP TO 2MP RESOLUTION MEDICAL DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 UP TO 2MP RESOLUTION MEDICAL DISPLAYS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 46 2.1-4MP RESOLUTION MEDICAL DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 2.1-4MP RESOLUTION MEDICAL DISPLAYS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 48 4.1-8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 4.1-8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 50 ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 51 ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 4K RESOLUTION MEDICAL DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 4K RESOLUTION MEDICAL DISPLAYS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 54 8K RESOLUTION MEDICAL DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 8K RESOLUTION MEDICAL DISPLAYS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 56 MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 57 COLOR MEDICAL DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 COLOR MEDICAL DISPLAYS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 59 MONOCHROME & GRAYSCALE MEDICAL DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 MONOCHROME & GRAYSCALE MEDICAL DISPLAYS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 61 MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 62 MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 63 MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 GENERAL RADIOLOGY DISPLAYS AVAILABLE IN MARKET

- TABLE 65 MEDICAL DISPLAYS MARKET FOR GENERAL RADIOLOGY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 MAMMOGRAPHY DISPLAYS AVAILABLE IN MARKET

- TABLE 67 MEDICAL DISPLAYS MARKET FOR MAMMOGRAPHY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 DIGITAL PATHOLOGY DISPLAYS AVAILABLE IN MARKET

- TABLE 69 MEDICAL DISPLAYS MARKET FOR DIGITAL PATHOLOGY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 MULTIMODALITY DISPLAYS AVAILABLE IN MARKET

- TABLE 71 MEDICAL DISPLAYS MARKET FOR MULTIMODALITY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 SURGICAL DISPLAYS AVAILABLE IN MARKET

- TABLE 73 MEDICAL DISPLAYS MARKET FOR SURGICAL/INTERVENTIONAL APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 DENTISTRY DISPLAYS AVAILABLE IN MARKET

- TABLE 75 MEDICAL DISPLAYS MARKET FOR DENTISTRY APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 MAJOR PRODUCTS AVAILABLE IN MARKET

- TABLE 77 MEDICAL DISPLAYS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 MEDICAL DISPLAYS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: MEDICAL DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 87 US: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 88 US: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 89 US: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 90 US: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 US: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 92 US: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 93 US: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 94 CANADA: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 95 CANADA: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 96 CANADA: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 97 CANADA: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 CANADA: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 99 CANADA: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 100 CANADA: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 EUROPE: MEDICAL DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 EUROPE: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 103 EUROPE: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 104 EUROPE: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 105 EUROPE: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 EUROPE: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 107 EUROPE: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 108 EUROPE: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 GERMANY: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 110 GERMANY: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 111 GERMANY: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 112 GERMANY: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 GERMANY: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 114 GERMANY: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 115 GERMANY: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 UK: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 117 UK: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 118 UK: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 119 UK: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 UK: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 121 UK: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 122 UK: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 FRANCE: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 124 FRANCE: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 125 FRANCE: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 126 FRANCE: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 FRANCE: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 128 FRANCE: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 129 FRANCE: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 SPAIN: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 131 SPAIN: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 132 SPAIN: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 133 SPAIN: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 SPAIN: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 135 SPAIN: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 136 SPAIN: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 137 ITALY: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 138 ITALY: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 139 ITALY: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 140 ITALY: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 ITALY: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 142 ITALY: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 143 ITALY: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 REST OF EUROPE: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 145 REST OF EUROPE: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 146 REST OF EUROPE: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 147 REST OF EUROPE: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 REST OF EUROPE: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 149 REST OF EUROPE: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 150 REST OF EUROPE: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: MEDICAL DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION

- TABLE 152 ASIA PACIFIC: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 153 ASIA PACIFIC: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 154 ASIA PACIFIC: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 157 ASIA PACIFIC: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 158 ASIA PACIFIC: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 JAPAN: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 160 JAPAN: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 161 JAPAN: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 162 JAPAN: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 JAPAN: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 164 JAPAN: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 165 JAPAN: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 CHINA: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 167 CHINA: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 168 CHINA: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 169 CHINA: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 CHINA: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 171 CHINA: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 172 CHINA: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 INDIA: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 174 INDIA: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 175 INDIA: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 176 INDIA: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 INDIA: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 178 INDIA: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 179 INDIA: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 SOUTH KOREA: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 181 SOUTH KOREA: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 182 SOUTH KOREA: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 183 SOUTH KOREA: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 SOUTH KOREA: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 185 SOUTH KOREA: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 186 SOUTH KOREA: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 AUSTRALIA: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 188 AUSTRALIA: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 189 AUSTRALIA: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 190 AUSTRALIA: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 AUSTRALIA: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 192 AUSTRALIA: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 193 AUSTRALIA: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 REST OF ASIA PACIFIC: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 195 REST OF ASIA PACIFIC: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 LATIN AMERICA: MEDICAL DISPLAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 202 LATIN AMERICA: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 203 LATIN AMERICA: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 204 LATIN AMERICA: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 205 LATIN AMERICA: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 LATIN AMERICA: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 207 LATIN AMERICA: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 208 LATIN AMERICA: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 BRAZIL: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 210 BRAZIL: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 211 BRAZIL: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 212 BRAZIL: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 BRAZIL: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 214 BRAZIL: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 215 BRAZIL: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 MEXICO: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 217 MEXICO: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 218 MEXICO: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 219 MEXICO: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 MEXICO: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 221 MEXICO: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 222 MEXICO: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 REST OF LATIN AMERICA: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 224 REST OF LATIN AMERICA: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 225 REST OF LATIN AMERICA: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 226 REST OF LATIN AMERICA: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 227 REST OF LATIN AMERICA: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 228 REST OF LATIN AMERICA: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 229 REST OF LATIN AMERICA: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 237 GCC COUNTRIES: MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 238 GCC COUNTRIES: MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2023-2030 (USD MILLION)

- TABLE 239 GCC COUNTRIES: MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2023-2030 (USD MILLION)

- TABLE 240 GCC COUNTRIES: ABOVE 8MP RESOLUTION MEDICAL DISPLAYS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 241 GCC COUNTRIES: MEDICAL DISPLAYS MARKET, BY COLOR, 2023-2030 (USD MILLION)

- TABLE 242 GCC COUNTRIES: MEDICAL DISPLAYS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 243 GCC COUNTRIES: MEDICAL DISPLAYS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 244 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MEDICAL DISPLAYS MARKET, JANUARY 2022-MAY 2025

- TABLE 245 MEDICAL DISPLAYS MARKET: DEGREE OF COMPETITION

- TABLE 246 MEDICAL DISPLAYS MARKET: REGION FOOTPRINT

- TABLE 247 MEDICAL DISPLAYS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 248 MEDICAL DISPLAYS MARKET: PANEL SIZE FOOTPRINT

- TABLE 249 MEDICAL DISPLAY MARKET: RESOLUTION FOOTPRINT

- TABLE 250 MEDICAL DISPLAYS MARKET: DISPLAY COLOR FOOTPRINT

- TABLE 251 MEDICAL DISPLAYS MARKET: APPLICATION FOOTPRINT

- TABLE 252 MEDICAL DISPLAYS MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 253 MEDICAL DISPLAYS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 254 MEDICAL DISPLAYS MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 255 MEDICAL DISPLAYS MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 256 MEDICAL DISPLAYS MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 257 BARCO NV: COMPANY OVERVIEW

- TABLE 258 BARCO NV: PRODUCTS OFFERED

- TABLE 259 BARCO NV: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 260 BARCO NV: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 261 EIZO INC.: COMPANY OVERVIEW

- TABLE 262 EIZO INC.: PRODUCTS OFFERED

- TABLE 263 EIZO INC.: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 264 SONY ELECTRONICS INC.: COMPANY OVERVIEW

- TABLE 265 SONY ELECTRONICS INC.: PRODUCTS OFFERED

- TABLE 266 SONY ELECTRONICS INC.: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 267 NOVANTA INC.: COMPANY OVERVIEW

- TABLE 268 NOVANTA INC.: PRODUCTS OFFERED

- TABLE 269 SHENZHEN BEACON DISPLAY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 270 SHENZHEN BEACON DISPLAY TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 271 LG ELECTRONICS: COMPANY OVERVIEW

- TABLE 272 LG ELECTRONICS: PRODUCTS OFFERED

- TABLE 273 LG ELECTRONICS: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 274 FSN MEDICAL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 275 FSN MEDICAL TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 276 FSN MEDICAL TECHNOLOGIES: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 277 ADVANTECH CO., LTD.: COMPANY OVERVIEW

- TABLE 278 ADVANTECH CO., LTD.: PRODUCTS OFFERED

- TABLE 279 ADVANTECH CO., LTD.: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 280 QUEST INTERNATIONAL: COMPANY OVERVIEW

- TABLE 281 QUEST INTERNATIONAL: PRODUCTS OFFERED

- TABLE 282 QUEST INTERNATIONAL: DEALS, JANUARY 2022-MAY 2025

- TABLE 283 STERIS: COMPANY OVERVIEW

- TABLE 284 STERIS: PRODUCTS OFFERED

- TABLE 285 JUSHA MEDICAL: COMPANY OVERVIEW

- TABLE 286 JUSHA MEDICAL: PRODUCTS OFFERED

- TABLE 287 JUSHA MEDICAL: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 288 JUSHA MEDICAL: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 289 SIEMENS HEALTHINEERS: COMPANY OVERVIEW

- TABLE 290 SIEMENS HEALTHINEERS: PRODUCTS OFFERED

- TABLE 291 DOUBLE BLACK IMAGING: COMPANY OVERVIEW

- TABLE 292 DOUBLE BLACK IMAGING: PRODUCTS OFFERED

- TABLE 293 DOUBLE BLACK IMAGING: DEALS, JANUARY 2022-MAY 2025

- TABLE 294 HP DEVELOPMENT COMPANY, L.P.: COMPANY OVERVIEW

- TABLE 295 HP DEVELOPMENT COMPANY, L.P.: PRODUCTS OFFERED

- TABLE 296 STRYKER: COMPANY OVERVIEW

- TABLE 297 STRYKER: PRODUCTS OFFERED

- TABLE 298 STRYKER: DEALS, JANUARY 2022-MAY 2025

List of Figures

- FIGURE 1 MEDICAL DISPLAYS MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 MEDICAL DISPLAYS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 REVENUE SHARE ANALYSIS FOR BARCO, 2024

- FIGURE 8 MEDICAL DISPLAYS MARKET: SUPPLY-SIDE MARKET SIZE ESTIMATION

- FIGURE 9 MARKET SIZE ESTIMATION: END-USER ASSESSMENT APPROACH

- FIGURE 10 MARKET SIZE ESTIMATION: SYSTEM BASE ASSESSMENT APPROACH

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 MEDICAL DISPLAYS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 MEDICAL DISPLAYS MARKET, BY PANEL SIZE, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 MEDICAL DISPLAYS MARKET, BY RESOLUTION, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 MEDICAL DISPLAYS MARKET, BY COLOR, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 MEDICAL DISPLAYS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 GEOGRAPHICAL SNAPSHOT OF MEDICAL DISPLAYS MARKET

- FIGURE 18 GROWING ADOPTION OF HYBRID OPERATING ROOMS TO DRIVE MARKET

- FIGURE 19 COLOR DISPLAYS ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2024

- FIGURE 20 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 21 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 22 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 23 MEDICAL DISPLAYS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 PORTER FIVE FORCES ANALYSIS

- FIGURE 25 MEDICAL DISPLAYS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 MEDICAL DISPLAYS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 MEDICAL DISPLAYS MARKET: PATENT ANALYSIS, JANUARY 2015-MAY 2025

- FIGURE 28 IMPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 29 EXPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 30 AVERAGE SELLING PRICE TREND OF MEDICAL DISPLAY PRODUCTS, BY TECHNOLOGY, 2022-2024

- FIGURE 31 AVERAGE SELLING PRICE OF MEDICAL DISPLAY PRODUCTS, BY KEY PLAYER, 2022-2024 (USD)

- FIGURE 32 AVERAGE SELLING PRICE OF LED-BACKLIT LCD DISPLAYS, BY REGION, 2022-2024 (USD)

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TECHNOLOGIES

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE TECHNOLOGIES

- FIGURE 35 MEDICAL DISPLAYS MARKET: SUPPLY CHAIN ANALYSIS (DIAGNOSTIC APPLICATIONS)

- FIGURE 36 MEDICAL DISPLAYS MARKET: SUPPLY CHAIN ANALYSIS (SURGICAL/INTERVENTIONAL APPLICATIONS)

- FIGURE 37 MEDICAL DISPLAYS MARKET: SUPPLY CHAIN ANALYSIS (DENTISTRY APPLICATIONS)

- FIGURE 38 AI USE CASES

- FIGURE 39 MEDICAL DISPLAYS MARKET: ADJACENT MARKET ANALYSIS

- FIGURE 40 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 41 INVESTMENT & FUNDING SCENARIO, 2019-2023

- FIGURE 42 VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 43 NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 44 NORTH AMERICA: MEDICAL DISPLAYS MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: MEDICAL DISPLAYS MARKET SNAPSHOT

- FIGURE 46 KEY PLAYERS IN MEDICAL DISPLAYS MARKET

- FIGURE 47 REVENUE ANALYSIS FOR KEY PLAYERS IN MEDICAL DISPLAYS MARKET, 2020-2024

- FIGURE 48 MARKET SHARE ANALYSIS OF OEM PLAYERS IN MEDICAL DISPLAYS MARKET, 2024

- FIGURE 49 MARKET SHARE ANALYSIS FOR NON-OEM PLAYERS IN MEDICAL DISPLAYS MARKET, 2024

- FIGURE 50 MEDICAL DISPLAYS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 51 MEDICAL DISPLAYS MARKET: COMPANY FOOTPRINT

- FIGURE 52 MEDICAL DISPLAYS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 53 R&D EXPENDITURE OF KEY PLAYERS IN MEDICAL DISPLAYS MARKET, 2023 VS. 2024

- FIGURE 54 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS, 2025

- FIGURE 55 EV/EBITDA OF KEY VENDORS

- FIGURE 56 MEDICAL DISPLAYS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 57 BARCO NV: COMPANY SNAPSHOT (2024)

- FIGURE 58 EIZO INC.: COMPANY SNAPSHOT (2023)

- FIGURE 59 SONY ELECTRONICS INC.: COMPANY SNAPSHOT (2023)

- FIGURE 60 NOVANTA INC.: COMPANY SNAPSHOT (2024)

- FIGURE 61 LG ELECTRONICS: COMPANY SNAPSHOT (2024)

- FIGURE 62 ADVANTECH CO., LTD.: COMPANY SNAPSHOT (2023)

- FIGURE 63 STERIS: COMPANY SNAPSHOT (2024)

- FIGURE 64 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2024)

- FIGURE 65 HP DEVELOPMENT COMPANY, L.P.: COMPANY SNAPSHOT (2024)

- FIGURE 66 STRYKER: COMPANY SNAPSHOT (2024)

The medical displays market is projected to reach USD 3.45 billion by 2030 from USD 2.64 billion in 2025, at a CAGR of 5.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Technology, Panel Size, Resolution, Display Color, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

The medical displays market is influenced by several key factors, including advancements in imaging technologies, an increasing demand for accurate diagnostics, and the rising prevalence of chronic diseases. Additionally, growing healthcare investments, particularly in emerging economies, and the shift toward digital healthcare systems are driving market growth. Regulatory standards for image quality, the need for high-resolution displays in radiology and surgery, and the expansion of telemedicine also affect demand. However, high costs and limited access in underdeveloped regions may hinder market expansion.

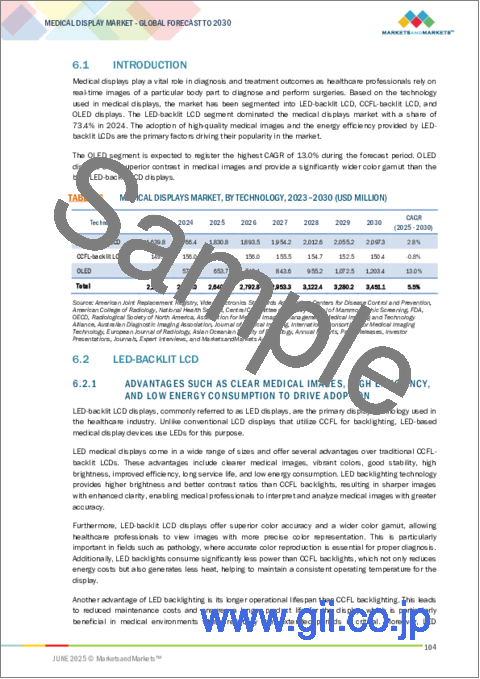

Medical displays with a resolution of 4.1 to 8 megapixels hold the largest market share due to their ability to provide high image clarity, which is crucial for accurate diagnosis, particularly in radiology and surgical applications. These displays allow for detailed visualization of complex anatomical structures, thereby enhancing diagnostic confidence. Their combination of performance and cost-effectiveness makes them widely preferred in hospitals and diagnostic centers.

By display color, color displays dominate the medical displays market because they offer detailed, multidimensional imaging that is crucial for accurate diagnosis and surgical guidance. They are compatible with advanced imaging techniques such as MRI and CT, where color differentiation improves interpretation. Their versatility and common use across various specialties make them the preferred choice in modern healthcare settings.

The Asia Pacific region is forecasted to experience the highest growth rate in the medical displays market. This growth is driven by several factors, including increased investments in healthcare, the rapid adoption of advanced imaging technologies, and the expansion of healthcare infrastructure. Additionally, rising awareness of early disease diagnosis, a growing geriatric population, and the increasing prevalence of chronic diseases are fueling demand. Furthermore, improving government initiatives and favorable policies, along with the presence of emerging economies such as China and India, are contributing to the region's accelerated market expansion during the forecast period.

A detailed overview of the main supply-side participants in the medical displays market is provided below for this report:

- By Company Type: Tier 1 (42%), Tier 2 (37%), and Tier 3 (21%)

- By Designation: C-level Executives (39%), Director-level Executives (33%), and Others (28%)

- By Region: North America (64%), Europe (17%), Asia Pacific (7%), Latin America 96%), and the Middle East & Africa (6%)

Prominent players in the medical displays market are Barco NV (Belgium), EIZO (Japan), Sony Electronics Inc. (Japan), LG Electronics (South Korea), Novanta (US), FSN Medical Technologies (South Korea), Advantech (Taiwan), Quest International (US), STERIS (UK), Jusha Medical (China), Siemens Healthineers AG (Germany), Double Black Imaging (US), HP Development Co. Ltd. (US), Stryker (US), and COJE Displays (South Korea).

Research Coverage

The report assesses the medical displays market, estimating its size and future growth potential across various segments, including technology, panel size, resolution, application, and region. Additionally, it features a competitive analysis of key players in the market, providing insights into their company profiles, product offerings, recent developments, and major market strategies.

Reasons to Buy the Report

The report is designed to help both market leaders and new entrants by providing data on revenue estimates for the overall medical displays market and its subsegments. It will also assist stakeholders in understanding the competitive landscape, allowing them to gain valuable insights for positioning their businesses and developing effective go-to-market strategies. Additionally, the report offers stakeholders a clear understanding of market trends and provides information on key drivers, challenges, obstacles, and opportunities within the market.

This report provides insights into the following points:

- Analysis of key drivers (growing adoption of hybrid operating rooms, short replacement cycles of medical displays, increasing preference for minimally invasive treatments, and rising number of diagnostic imaging centers), restraints (market saturation in developed countries, increasing adoption of refurbished medical displays, and excise tax on medical devices in US), opportunities (increasing investments from government bodies and private players in healthcare sectors in emerging economies and development of healthcare infrastructure in emerging markets), and challenges (adoption of consumer-grade displays, high cost associated with new display technologies, and hospital budget cuts)

- Product Enhancement/Innovation: Comprehensive details about product launches and anticipated trends in the global medical displays market

- Market Development: Thorough knowledge and analysis of the profitable rising markets by technology, panel size, resolution, display color, application, and region

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global medical displays market

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings, and capacities of the major competitors in the global medical displays market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY SOURCES

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY SOURCES

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY SOURCES

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DEMAND-SIDE ANALYSIS

- 2.3.1 END-USER BASE

- 2.3.2 SYSTEM BASE

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 MEDICAL DISPLAYS MARKET OVERVIEW

- 4.2 NORTH AMERICA: MEDICAL DISPLAYS MARKET, BY COLOR AND COUNTRY (2024)

- 4.3 MEDICAL DISPLAYS MARKET: REGIONAL MIX

- 4.4 MEDICAL DISPLAYS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.5 MEDICAL DISPLAYS MARKET: EMERGING VS. DEVELOPED ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 MARKET DRIVERS

- 5.2.1.1 Growing adoption of hybrid operating rooms

- 5.2.1.2 Short replacement cycles of medical displays

- 5.2.1.3 Increasing preference for minimally invasive treatments

- 5.2.1.4 Rising number of diagnostic imaging centers

- 5.2.2 MARKET RESTRAINTS

- 5.2.2.1 Market saturation in developed countries

- 5.2.2.2 Increasing adoption of refurbished medical displays

- 5.2.2.3 Excise tax on medical devices in US

- 5.2.3 MARKET OPPORTUNITIES

- 5.2.3.1 Increasing investments from government bodies and private players in emerging economies

- 5.2.3.2 Development of healthcare infrastructure in emerging markets

- 5.2.3.3 Technological advancements

- 5.2.4 MARKET CHALLENGES

- 5.2.4.1 Adoption of consumer-grade displays

- 5.2.4.2 High cost associated with new display technologies

- 5.2.4.3 Hospital budget cuts

- 5.2.1 MARKET DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 GROWING CONSOLIDATION IN MEDICAL DISPLAYS MARKET

- 5.3.2 SHIFT TOWARD HIGH-RESOLUTION & MULTIMODALITY IMAGING (4K, 8K, AND HDR)

- 5.4 REGULATORY ANALYSIS

- 5.4.1 REGULATORY LANDSCAPE

- 5.4.1.1 North America

- 5.4.1.1.1 US

- 5.4.1.1.2 Canada

- 5.4.1.2 Europe

- 5.4.1.3 Asia Pacific

- 5.4.1.3.1 Japan

- 5.4.1.3.2 China

- 5.4.1.4 India

- 5.4.1.1 North America

- 5.4.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4.1 REGULATORY LANDSCAPE

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 VALUE CHAIN ANALYSIS

- 5.6.1 RESEARCH & PRODUCT DEVELOPMENT

- 5.6.2 RAW MATERIAL PROCUREMENT

- 5.6.3 COMPONENT & PRODUCT MANUFACTURING

- 5.6.4 SYSTEM MANUFACTURING

- 5.6.5 DISTRIBUTION

- 5.6.6 MARKETING & SALES

- 5.6.7 POST-SALES SERVICES

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGY

- 5.7.1.1 High-resolution imaging (4K/8K, UHD)

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 PACS integration & workflow software

- 5.7.2.2 AI-based image enhancement algorithms

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Augmented reality (AR) & mixed reality (MR)

- 5.7.3.2 Handheld imaging & point-of-care visualization devices

- 5.7.1 KEY TECHNOLOGY

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA

- 5.10.2 EXPORT DATA

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND, BY TECHNOLOGY

- 5.11.2 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.11.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.11.4 AVERAGE SELLING PRICE OF LED-BACKLIT LCD DISPLAYS, BY REGION, 2022-2024 (USD)

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 SUPPLY CHAIN ANALYSIS

- 5.14.1 DIAGNOSTIC APPLICATIONS

- 5.14.1.1 Prominent companies

- 5.14.1.2 Small & medium-sized enterprises

- 5.14.1.3 End users

- 5.14.2 SURGICAL/INTERVENTIONAL APPLICATIONS

- 5.14.2.1 Prominent companies

- 5.14.2.2 Small & medium-sized enterprises

- 5.14.2.3 End users

- 5.14.3 DENTISTRY APPLICATIONS

- 5.14.3.1 Prominent companies

- 5.14.3.2 Small & medium-sized enterprises

- 5.14.3.3 End users

- 5.14.1 DIAGNOSTIC APPLICATIONS

- 5.15 QUALITATIVE DATA ON MEDICAL DISPLAYS, BY VIDEO INPUT PORT TYPE

- 5.15.1 HDMI

- 5.15.2 DVI

- 5.15.3 DISPLAYPORT

- 5.15.4 USB-C

- 5.15.5 VGA

- 5.15.6 THUNDERBOLT

- 5.16 IMPACT OF 2025 US TARIFF ON MEDICAL DISPLAYS MARKET

- 5.16.1 KEY TARIFF RATES

- 5.16.2 PRICE IMPACT ANALYSIS

- 5.16.3 IMPACT ON END-USER INDUSTRIES

- 5.17 IMPACT OF GEN AI ON MEDICAL DISPLAYS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 MARKET POTENTIAL OF AI IN MEDICAL DISPLAYS MARKET

- 5.17.3 AI USE CASES

- 5.17.4 KEY COMPANIES IMPLEMENTING AI

- 5.17.5 FUTURE OF GENERATIVE AI IN MEDICAL DISPLAYS MARKET

- 5.18 UNMET NEEDS/END-USER EXPECTATIONS

- 5.19 ADJACENT MARKET ANALYSIS

- 5.20 CASE STUDY ANALYSIS

- 5.20.1 CASE STUDY 1: REVOLUTIONIZING DIGITAL PATHOLOGY IMAGING

- 5.20.2 CASE STUDY 2: 3D VISUALIZATION FOR COMPLEX MEDICAL CASES

- 5.20.3 CASE STUDY 3: ENHANCING DIAGNOSTIC ACCURACY IN RADIOLOGY

- 5.21 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.22 REIMBURSEMENT SCENARIO

- 5.22.1 US

- 5.22.2 EUROPE

- 5.22.3 ASIA PACIFIC

- 5.22.4 OTHER REGIONS

- 5.23 INVESTMENT & FUNDING SCENARIO

6 MEDICAL DISPLAYS MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 LED-BACKLIT LCD

- 6.2.1 ADVANTAGES SUCH AS CLEAR MEDICAL IMAGES, HIGH EFFICIENCY, AND LOW ENERGY CONSUMPTION TO DRIVE ADOPTION

- 6.3 CCFL-BACKLIT LCD

- 6.3.1 FALLING PRICES OF LED-BACKLIT TECHNOLOGY TO HAMPER MARKET GROWTH

- 6.4 OLED

- 6.4.1 ABILITY TO INTERPRET COMPLEX MEDICAL IMAGES TO SUPPORT MARKET GROWTH

7 MEDICAL DISPLAYS MARKET, BY PANEL SIZE

- 7.1 INTRODUCTION

- 7.2 UNDER 22.9 INCHES

- 7.2.1 LOWER ASP COMPARED TO LARGER DISPLAYS TO DRIVE MARKET

- 7.3 23.0-26.9 INCHES

- 7.3.1 ACCURATE IMAGE INTERPRETATION TO PROPEL MARKET

- 7.4 27.0-41.9 INCHES

- 7.4.1 ADVANCEMENTS IN PANEL TECHNOLOGIES TO SUPPORT MARKET GROWTH

- 7.5 ABOVE 42 INCHES

- 7.5.1 INCREASED DEMAND FOR SURGICAL PROCEDURES TO DRIVE MARKET

8 MEDICAL DISPLAYS MARKET, BY RESOLUTION

- 8.1 INTRODUCTION

- 8.2 UP TO 2MP

- 8.2.1 LOW PRICES COMPARED TO HIGHER-RESOLUTION DISPLAYS TO BOOST ADOPTION

- 8.3 2.1-4MP

- 8.3.1 HIGHER BRIGHTNESS AND COMPATIBILITY WITH HIGH-RESOLUTION MODALITIES TO DRIVE ADOPTION

- 8.4 4.1-8MP

- 8.4.1 GROWING VOLUME OF SURGICAL PROCEDURES TO SUPPORT MARKET GROWTH

- 8.5 ABOVE 8MP

- 8.5.1 4K

- 8.5.1.1 High-resolution image visualization for pathologists to support market

- 8.5.2 8K

- 8.5.2.1 Rising number of remote surgeries to drive market

- 8.5.1 4K

9 MEDICAL DISPLAYS MARKET, BY COLOR

- 9.1 INTRODUCTION

- 9.2 COLOR DISPLAYS

- 9.2.1 GROWING DEMAND FOR MORE PRECISE AND DETAILED IMAGES TO DRIVE MARKET

- 9.3 MONOCHROME & GRAYSCALE DISPLAYS

- 9.3.1 WIDER AVAILABILITY OF COLOR DISPLAYS AT LOWER COST TO HAMPER MARKET GROWTH

10 MEDICAL DISPLAYS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 DIAGNOSTIC

- 10.2.1 GENERAL RADIOLOGY

- 10.2.1.1 Technological advancements to support market growth

- 10.2.2 MAMMOGRAPHY

- 10.2.2.1 High volume of mammography tests performed to propel market

- 10.2.3 DIGITAL PATHOLOGY

- 10.2.3.1 Rising prevalence of cancer to support market growth

- 10.2.4 MULTIMODALITY

- 10.2.4.1 Ability to display images from different modalities on single screen to boost demand

- 10.2.1 GENERAL RADIOLOGY

- 10.3 SURGICAL/INTERVENTIONAL

- 10.3.1 GROWING NUMBER OF SURGICAL PROCEDURES TO DRIVE DEMAND

- 10.4 DENTISTRY

- 10.4.1 IMPORTANCE OF MEDICAL DISPLAYS IN DIAGNOSTIC IMAGING AND TREATMENT PLANNING TO SUPPORT MARKET

- 10.5 OTHER APPLICATIONS

11 MEDICAL DISPLAYS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Increasing volume of medical screening procedures to drive market

- 11.2.3 CANADA

- 11.2.3.1 Need for replacement of medical displays to drive market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Increasing number of ambulatory healthcare facilities and ambulatory surgical centers to boost adoption

- 11.3.3 UK

- 11.3.3.1 Large number of diagnostic imaging centers to propel market

- 11.3.4 FRANCE

- 11.3.4.1 Higher adoption of multimodality displays in hospitals to support market growth

- 11.3.5 SPAIN

- 11.3.5.1 Growing adoption of advanced imaging modalities to drive market

- 11.3.6 ITALY

- 11.3.6.1 Growing number of CT scans to drive adoption

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Large geriatric population and high healthcare expenditure to propel market

- 11.4.3 CHINA

- 11.4.3.1 China to be fastest-growing market for medical displays

- 11.4.4 INDIA

- 11.4.4.1 Improving healthcare infrastructure to drive market

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Improving technological innovation to drive market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Government investment in smart hospitals to further accelerate market growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Brazil to be largest and fastest-growing market in Latin America

- 11.5.3 MEXICO

- 11.5.3.1 Need for technologically advanced medical displays to drive market

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GOVERNMENT INITIATIVES TO IMPROVE HEALTHCARE INFRASTRUCTURE TO PROPEL MARKET

- 11.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.7 GCC COUNTRIES

- 11.7.1 GROWING BURDEN OF NON-COMMUNICABLE DISEASES (NCDS) TO PROPEL MARKET

- 11.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.4.1 MARKET SHARE ANALYSIS FOR OEM PLAYERS

- 12.4.2 MARKET SHARE ANALYSIS FOR NON-OEM PLAYERS

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 PERVASIVE PLAYERS

- 12.5.3 EMERGING LEADERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Technology footprint

- 12.5.5.4 Panel size footprint

- 12.5.5.5 Resolution footprint

- 12.5.5.6 Display color footprint

- 12.5.5.7 Application footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 R&D ASSESSMENT OF KEY PLAYERS

- 12.8 COMPANY VALUATION & FINANCIAL METRICS

- 12.9 BRAND/PRODUCT COMPARISON

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT LAUNCHES & APPROVALS

- 12.10.2 DEALS

- 12.10.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 BARCO NV

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 EIZO INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 SONY ELECTRONICS INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 NOVANTA INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses & competitive threats

- 13.1.5 SHENZHEN BEACON DISPLAY TECHNOLOGY CO., LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses & competitive threats

- 13.1.6 LG ELECTRONICS

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches & approvals

- 13.1.7 FSN MEDICAL TECHNOLOGIES

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 ADVANTECH CO., LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.9 QUEST INTERNATIONAL

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 STERIS

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 JUSHA MEDICAL

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.11.3.2 Other developments

- 13.1.12 SIEMENS HEALTHINEERS

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 DOUBLE BLACK IMAGING

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Deals

- 13.1.14 HP DEVELOPMENT COMPANY, L.P.

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 STRYKER

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Deals

- 13.1.1 BARCO NV

- 13.2 OTHER PLAYERS

- 13.2.1 COJE DISPLAYS

- 13.2.2 AXIOMTEK

- 13.2.3 BENQ AMERICA CORPORATION

- 13.2.4 JVCKENWOOD USA CORPORATION

- 13.2.5 AMERICAN PORTWELL TECHNOLOGY, INC.

- 13.2.6 AUO DISPLAY PLUS

- 13.2.7 CANVYS - VISUAL TECHNOLOGY SOLUTIONS

- 13.2.8 QINGDAO HISENSE MEDICAL EQUIPMENT CO., LTD.

- 13.2.9 KORTEK CORPORATION

- 13.2.10 D&T INC.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 RELATED REPORTS

- 14.4 AUTHOR DETAILS