|

|

市場調査レポート

商品コード

1759939

中国の自動車用半導体市場:コンポーネント別、世界の半導体輸出動向、中国の半導体輸出先別動向、戦略提言China Semiconductor Market for Automotive by Component (Microcontroller, Power Semiconductor, Sensor & MEMS Device, Memory Chip, Analog & Mixed Signal IC), Global & China Semiconductor Export, Alternate Destination - Trends and Strategic Recommendation |

||||||

カスタマイズ可能

|

|||||||

| 中国の自動車用半導体市場:コンポーネント別、世界の半導体輸出動向、中国の半導体輸出先別動向、戦略提言 |

|

出版日: 2025年06月19日

発行: MarketsandMarkets

ページ情報: 英文 104 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

2024年、中国の自動車用半導体の輸出額は、2020年の2,808億1,000万米ドルから4,191億5,000万米ドルに達し、CAGRは8.9%で、自律走行車と電気自動車の販売増加に牽引されています。

中国の自動車セクター向け半導体市場は、国内企業と世界企業の両方から多額の投資が行われています。SMIC、Huawei's HiSilicon、YMTC、BYD Semiconductor、Tsinghua Unigroupなどの大手企業が国内での取り組みを主導しており、Intel、Samsung、SK Hynixなどの国際企業は合弁事業や新しい製造工場を通じてプレゼンスを拡大しています。中国政府は、自給自足と完全なサプライチェーンの実現を目指して、国家集積回路産業投資基金(「ビッグファンド」)、地方政府基金、補助金、減税、低金利融資などで市場を支援しています。先端エレクトロニクスと自動車技術に対する世界の需要が急増する中、中国は香港を貿易ハブとして半導体を世界中に輸出しています。電気自動車やコネクテッドカーを中心とする最新の自動車の台頭により、半導体の需要が大幅に増加しています。これらの自動車には、パワートレイン制御、高度運転支援、インフォテインメント、バッテリー管理用の高度なチップが必要だからです。その結果、自動車部門は中国における半導体成長の重要な原動力となっています。

メモリーチップは中国の自動車用半導体市場で第2位にランクされています。メモリーチップは、AI、データセンター、コンシューマーエレクトロニクス、先進自動車技術に牽引され、データストレージとデータ処理の需要が急増しているため、世界の半導体産業でも第2位の地位を占めています。メモリチップは、電子機器におけるデータの保存と検索に不可欠であり、アプリケーションの実行からリアルタイムのシステム操作まで、あらゆることを可能にします。これは、インフォテインメント、ADAS、無人運転機能などのために大量のデータに依存する現代の自動車にとって不可欠な要件です。メモリーチップは、自動車のハイエンド・インフォテインメント・システム、ADAS、デジタル・インストルメント・クラスターで幅広く使用されています。電気自動車や自律走行車は、その複雑なコンピューティングやデータ処理の必要性から、さらに多くのメモリーを必要とします。中国は、成熟ノード・チップの国内生産を強化する一方で、先進メモリ技術、特にNANDとDRAMの大幅な進歩に注力しており、YMTCやCXMTのような企業がその先頭に立っています。YMTCは先進的な3D TLC NANDチップを開発し、サムスンやマイクロンのような世界リーダーと競合しています。SMICはHuaweiのMate 60 Pro用の7nmチップも製造しています。

インドは電子機器、集積回路、メモリーチップの世界第2位の輸入国です。これは主に、同国の堅調なエレクトロニクス部門、デジタル化、大規模な国内半導体製造の欠如によるものです。2024年には、中国からの電子集積回路の輸入だけで610万米ドルに達します。これらの部品は、インフォテインメント、ADAS、テレマティックス、デジタル計器クラスタなどの高度な機能を搭載する自動車分野では不可欠なもので、膨大なメモリと処理能力を必要とします。インドの高度自動車機能市場は、コネクティビティ、安全性、電動化に対する消費者需要の高まりによって急速に成長しています。ハイブリッド車と電気自動車の迅速な導入と製造(FAME)計画などの政府のイニシアティブに支えられ、EVとコネクテッドカーの導入が加速しています。インドのエレクトロニクスと半導体のエコシステムに対する投資も増加しており、国内外の企業が生産と研究開発を拡大しています。政府は、エレクトロニクス製造のための生産連動インセンティブ(PLI)スキームなどのインセンティブ・プログラムを開始し、国内供給が追いつかない中、輸入メモリーや集積回路への需要をさらに高めています。最近の例では、タタ・モーターズやマヒンドラといった自動車メーカーが最新モデルに高度なエレクトロニクスを組み込んでおり、インドの自動車・エレクトロニクス部門における技術主導の成長という幅広い動向を反映しています。

当レポートでは、マイクロコントローラ、パワー半導体、センサー&MEMSデバイス、メモリーチップ、アナログ&ミックスドシグナル集積回路など様々な種類に焦点を当て、中国の自動車用半導体市場を詳細に分析しています。輸出動向、貿易政策や規制の影響、中国からの半導体産業の多様化についても検証しています。また、代替生産地についても調査し、移行に伴う課題や戦略とともに、これらの場所の比較分析も行っています。

さらに、世界の自動車セクターが半導体市場に与える影響を評価し、将来の展望を提示しています。中国の半導体市場の成長を促進する主な要因に関する詳細情報も掲載しています。主要業界参入企業の徹底的な分析により、事業概要、製品提供、主要戦略、契約、パートナーシップ、協定、新製品発表、合併、買収に関する洞察を提供しています。

当レポートは、中国の自動車用半導体市場全体とそのサブセグメント両方の市場収益推計に関して、市場リーダーと新規参入者に貴重な情報を提供します。利害関係者が競合情勢を理解し、事業をより効果的に位置づけ、適切な市場参入戦略を計画する上で役立つものと思われます。さらに、当レポートは現在の市場状況に関する洞察を提供し、業界内の主な促進要因・抑制要因・課題・機会をハイライトしています。

目次

第1章 イントロダクション

第2章 中国の自動車用半導体産業

- 中国の自動車用半導体の現状

- マイクロコントローラ

- パワー半導体

- センサーとMEMS

- メモリチップ

- アナログおよびミックスドシグナル集積回路

- 市場価値評価

第3章 中国の自動車用半導体産業の主要参入企業

- 国内メーカー

- SMIC

- GIGADEVICE

- NOVOSENSE MICROELECTRONICS

- SILAN MICROELECTRONICS

- HISILICON

- HUA HONG SEMICONDUCTOR LIMITED

- BYD SEMICONDUCTOR

- NEXPERIA

- CHANGXIN MEMORY TECHNOLOGIES

- YANGTZE MEMORY TECHNOLOGIES CORP

- GOERTEK MICROELECTRONICS INC.

- CHINA RESOURCES MICROELECTRONICS LIMITED

- HESAI TECHNOLOGY

- その他

- 中国における世界的メーカー

- NXP SEMICONDUCTORS

- INFINEON TECHNOLOGIES

- STMICROELECTRONICS

- TEXAS INSTRUMENTS

- RENESAS ELECTRONICS CORPORATION

- 合弁事業と戦略的パートナーシップ

第4章 中国の自動車用半導体の輸出分析

- 主要輸出製品カテゴリー

- 世界の半導体輸出

- 中国からの輸出

第5章 中国の自動車用半導体産業の多様化

- 地政学的要因

- サプライチェーンレジリエンス戦略

- 経済的要因

- 世界の自動車産業への影響

第6章 代替製造拠点

- 概要

- 代替製造拠点の比較分析

- 国/地域別の技術優位性

- 東南アジア

- マレーシア

- ベトナム

- タイ

- シンガポール

- 韓国

- 台湾

- 北米

- 欧州

- インド

第7章 将来の展望と提言

- 2025年~2030年の予測産業シフト

- 技術ロードマップ

- 業界利害関係者への戦略的提言

List of Tables

- TABLE 1 AUTOMOTIVE SEMICONDUCTOR COMPONENTS DOMINATED BY CHINA

- TABLE 2 US EXPORT CONTROLS AND SANCTIONS

- TABLE 3 SEMICONDUCTOR SUPPORT PROGRAMS

- TABLE 4 PRICE HIKES OF SEMICONDUCTOR-RELATED MATERIALS BEFORE AND AFTER RUSSIA-UKRAINE WAR

- TABLE 5 TECHNOLOGY ALLIANCES AND THEIR IMPACT ON CHINA AUTOMOTIVE SEMICONDUCTOR INDUSTRY

- TABLE 6 COUNTRY-WISE INCENTIVES ON SEMICONDUCTOR COMPONENTS

- TABLE 7 EQUIPMENT AND KEY FOREIGN SUPPLIERS

- TABLE 8 MICROCONTROLLERS: KEY MANUFACTURERS, CORE COMPETENCIES, AND PRODUCTION CAPACITIES

- TABLE 9 POWER SEMICONDUCTORS: KEY MANUFACTURERS, CORE COMPETENCIES, AND PRODUCTION CAPACITIES

- TABLE 10 SENSORS & MEMS: KEY MANUFACTURERS, CORE COMPETENCIES, AND PRODUCTION CAPACITIES

- TABLE 11 LIDAR: KEY MANUFACTURERS, CORE COMPETENCIES, AND PRODUCTION CAPACITIES

- TABLE 12 MEMORY CHIPS: KEY MANUFACTURERS, CORE COMPETENCIES, AND PRODUCTION CAPACITIES

- TABLE 13 ANALOG & MIXED-SIGNAL INTEGRATED CIRCUITS: KEY MANUFACTURERS, CORE COMPETENCIES, AND PRODUCTION CAPACITIES

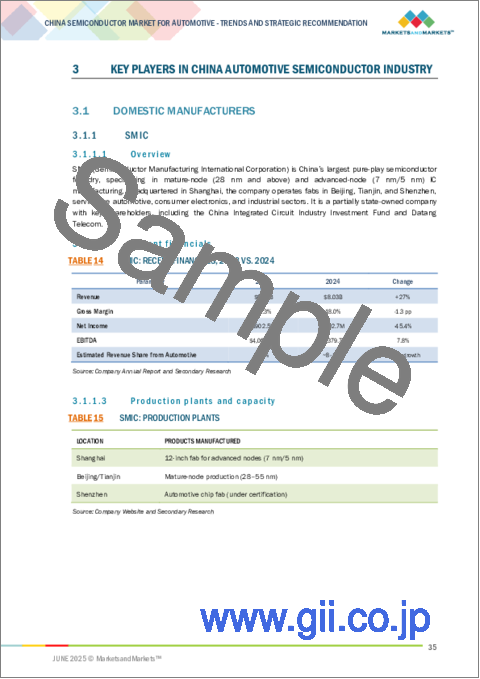

- TABLE 14 SMIC: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 15 SMIC: PRODUCTION PLANTS

- TABLE 16 SMIC: PRODUCTION CAPACITY

- TABLE 17 GIGADEVICE: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 18 GIGADEVICE: PRODUCTION PLANTS

- TABLE 19 NOVOSENSE MICROELECTRONICS: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 20 NOVOSENSE MICROELECTRONICS: PRODUCTION PLANTS

- TABLE 21 NOVOSENSE MICROELECTRONICS: PRODUCTION CAPACITY

- TABLE 22 SILEN MICROELECTRONICS: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 23 SILEN MICROELECTRONICS: PRODUCTION PLANTS

- TABLE 24 SILEN MICROELECTRONICS: PRODUCTION CAPACITY

- TABLE 25 HISILICON: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 26 HISILICON: RECENT FINANCIALS, BY REGION, 2023 VS. 2024

- TABLE 27 HISILICON: RECENT FINANCIALS, BY BUSINESS SEGMENT, 2023 VS. 2024

- TABLE 28 HISILICON: PRODUCTION PLANTS

- TABLE 29 HUA HONG SEMICONDUCTOR LIMITED: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 30 HUA HONG SEMICONDUCTOR LIMITED: RECENT FINANCIALS, BY SERVICE, 2023 VS. 2024

- TABLE 31 HUA HONG SEMICONDUCTOR LIMITED: RECENT FINANCIALS, BY END MARKET, 2023 VS. 2024

- TABLE 32 HUA HONG SEMICONDUCTOR LIMITED: PRODUCTION PLANTS

- TABLE 33 HUA HONG SEMICONDUCTOR LIMITED: PRODUCTION CAPACITY

- TABLE 34 BYD SEMICONDUCTOR: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 35 BYD SEMICONDUCTOR: PRODUCTION PLANTS

- TABLE 36 BYD SEMICONDUCTOR: PRODUCTION CAPACITY

- TABLE 37 NEXPERIA: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 38 NEXPERIA: PRODUCTION PLANTS

- TABLE 39 NEXPERIA: PRODUCTION CAPACITY

- TABLE 40 CHANGXIN MEMORY TECHNOLOGIES: PRODUCTION PLANTS

- TABLE 41 CHANGXIN MEMORY TECHNOLOGIES: PRODUCTION CAPACITY

- TABLE 42 YANGTZE MEMORY TECHNOLOGIES CORP: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 43 YANGTZE MEMORY TECHNOLOGIES CORP: PRODUCTION PLANTS

- TABLE 44 YANGTZE MEMORY TECHNOLOGIES CORP: PRODUCTION CAPACITY

- TABLE 45 GOERTEK MICROELECTRONICS INC.: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 46 GOERTEK MICROELECTRONICS INC.: PRODUCTION PLANTS

- TABLE 47 CHINA RESOURCES MICROELECTRONICS LIMITED: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 48 CHINA RESOURCES MICROELECTRONICS LIMITED: PRODUCTION PLANTS

- TABLE 49 CHINA RESOURCES MICROELECTRONICS LIMITED: PRODUCTION CAPACITY

- TABLE 50 HESAI TECHNOLOGY: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 51 HESAI TECHNOLOGY: PRODUCTION PLANTS

- TABLE 52 HESAI TECHNOLOGY: PRODUCTION CAPACITY

- TABLE 53 OTHER CHINESE AUTOMOTIVE SEMICONDUCTOR MANUFACTURERS: RECENT FINANCIALS AND PRODUCTS MANUFACTURED

- TABLE 54 NXP SEMICONDUCTORS: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 55 NXP SEMICONDUCTORS: PRODUCTION PLANTS

- TABLE 56 INFINEON TECHNOLOGIES: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 57 INFINEON TECHNOLOGIES: PRODUCTION PLANTS

- TABLE 58 STMICROELECTRONICS: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 59 STMICROELECTRONICS: PRODUCTION PLANTS

- TABLE 60 TEXAS INSTRUMENTS: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 61 TEXAS INSTRUMENTS: PRODUCTION PLANTS

- TABLE 62 RENESAS ELECTRONICS CORPORATION: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 63 RENESAS ELECTRONICS CORPORATION: PRODUCTION PLANTS

- TABLE 64 STRATEGIC PARTNERSHIPS BETWEEN SEMICONDUCTOR MANUFACTURERS IN CHINA

- TABLE 65 GLOBAL SEMICONDUCTOR EXPORTS, BY PRODUCT, 2020-2024 (USD BILLION)

- TABLE 66 CHINA SEMICONDUCTOR EXPORTS, BY PRODUCT, 2020-2024 (USD BILLION)

- TABLE 67 EXPORTS OF ELECTRONICS INTEGRATED CIRCUITS, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 68 EXPORTS OF ELECTRONICS INTEGRATED CIRCUITS AS MEMORIES, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 69 EXPORTS OF ELECTRONICS INTEGRATED CIRCUITS AS MEMORIES, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 70 EXPORTS OF ELECTRONIC INTEGRATED CIRCUITS (EXCL. PROCESSORS, CONTROLLERS, MEMORIES, AND AMPLIFIERS), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 71 EXPORTS OF PARTS OF ELECTRONIC INTEGRATED CIRCUITS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 72 CHINA: EXPORTS OF ELECTRONICS INTEGRATED CIRCUITS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 73 HONG KONG, CHINA: EXPORTS OF ELECTRONICS INTEGRATED CIRCUITS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 74 CHINA: EXPORTS OF ELECTRONICS INTEGRATED CIRCUITS AS MEMORIES, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 75 HONG KONG, CHINA: EXPORTS OF ELECTRONICS INTEGRATED CIRCUITS AS MEMORIES, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 76 CHINA: EXPORTS OF ELECTRONICS INTEGRATED CIRCUITS AS AMPLIFIERS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 77 HONG KONG, CHINA: EXPORTS OF ELECTRONICS INTEGRATED CIRCUITS AS AMPLIFIERS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 78 CHINA: EXPORTS OF ELECTRONIC INTEGRATED CIRCUITS (EXCL. PROCESSORS, CONTROLLERS, MEMORIES, AND AMPLIFIERS), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 79 TAIPEI, CHINA: EXPORTS OF ELECTRONIC INTEGRATED CIRCUITS (EXCL. PROCESSORS, CONTROLLERS, MEMORIES, AND AMPLIFIERS), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 80 HONG KONG, CHINA: EXPORTS OF ELECTRONIC INTEGRATED CIRCUITS (EXCL. PROCESSORS, CONTROLLERS, MEMORIES, AND AMPLIFIERS), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 81 US-CHINA TARIFFS, 2023-2025

- TABLE 82 US TARIFFS ON KEY CHINESE PRODUCTS/COMPONENTS

- TABLE 83 CHINESE SEMICONDUCTOR MANUFACTURERS' DIVERSIFICATION STRATEGIES

- TABLE 84 US TECHNOLOGY EXPORT CONTROLS AND IMPACT ON CHINA AUTOMOTIVE SEMICONDUCTOR INDUSTRY

- TABLE 85 CHINESE TECHNOLOGY EXPORT CONTROLS AND IMPACT ON US AUTOMOTIVE SEMICONDUCTOR INDUSTRY

- TABLE 86 CHINA'S ALLEGATIONS OF CYBERSECURITY AND ESPIONAGE

- TABLE 87 GLOBAL SUPPLY CHAIN RECALIBRATION: KEY EXAMPLES

- TABLE 88 COST COMPARISON OF AUTOMOTIVE SEMICONDUCTORS, 2020-2021 VS. 2024-2025

- TABLE 89 BILL OF MATERIALS OF AUTOMOTIVE SEMICONDUCTORS, 2023 VS. 2024

- TABLE 90 INCENTIVES/SUBSIDIES FOR AUTOMOTIVE SEMICONDUCTOR MANUFACTURING OUTSIDE CHINA

- TABLE 91 COMPARATIVE ANALYSIS OF ALTERNATIVE MANUFACTURING LOCATIONS

- TABLE 92 TECHNOLOGY DOMINANCE, BY COUNTRY/REGION

- TABLE 93 PLAYERS DIVERSIFYING TO MALAYSIA AND THEIR AUTOMOTIVE FOCUS

- TABLE 94 PLAYERS DIVERSIFYING TO VIETNAM AND THEIR AUTOMOTIVE FOCUS

- TABLE 95 PLAYERS DIVERSIFYING TO THAILAND AND THEIR AUTOMOTIVE FOCUS

- TABLE 96 PLAYERS DIVERSIFYING TO SINGAPORE AND THEIR AUTOMOTIVE FOCUS

- TABLE 97 PLAYERS DIVERSIFYING TO SOUTH KOREA AND THEIR AUTOMOTIVE FOCUS

- TABLE 98 PLAYERS DIVERSIFYING TO TAIWAN AND THEIR AUTOMOTIVE FOCUS

- TABLE 99 PLAYERS DIVERSIFYING TO US AND THEIR AUTOMOTIVE FOCUS

- TABLE 100 PLAYERS DIVERSIFYING TO MEXICO AND THEIR AUTOMOTIVE FOCUS

- TABLE 101 INCENTIVES FOR AUTOMOTIVE SEMICONDUCTOR INDUSTRY BY EUROPEAN COUNTRIES

- TABLE 102 EUROPEAN SEMICONDUCTOR MANUFACTURING HUBS

- TABLE 103 PLAYERS DIVERSIFYING TO INDIA AND THEIR AUTOMOTIVE FOCUS

- TABLE 104 AUTOMOTIVE SEMICONDUCTOR TECHNOLOGY ROADMAP, 2024-2030

- TABLE 105 STRATEGY FOR COUNTRY SELECTION

- TABLE 106 STRATEGY FOR TECHNOLOGY SELECTION

- TABLE 107 STRATEGY FOR COLLABORATIVE MODELS

List of Figures

- FIGURE 1 SEMICONDUCTOR TECHNOLOGY TREND, 1987-2023

- FIGURE 2 GLOBAL SEMICONDUCTOR EXPORTS, 2020 VS. 2024

- FIGURE 3 CHINA AND HONG KONG SEMICONDUCTOR EXPORTS, 2020 VS. 2024

In 2024, China's exports of automotive semiconductors reached USD 419.15 billion in 2024, from USD 280.81 billion in 2020, with a CAGR of 8.9%, driven by increased sales of autonomous and electric vehicles.

China's semiconductor market for the automotive sector is experiencing substantial investment from both domestic and global companies. Major players such as SMIC, Huawei's HiSilicon, YMTC, BYD Semiconductor, and Tsinghua Unigroup are leading domestic efforts, while international firms like Intel, Samsung, and SK Hynix are expanding their presence through joint ventures and new fabrication plants. The Chinese government supports the market with the National Integrated Circuit Industry Investment Fund ("Big Fund"), local government funds, subsidies, tax breaks, and low-interest loans, all aimed at achieving self-sufficiency and a complete supply chain. As global demand for advanced electronics and automotive technologies surges, China exports semiconductors worldwide, often using Hong Kong as a trade hub. The rise of modern vehicles, primarily electric and connected cars, has significantly increased the demand for semiconductors, as these vehicles require advanced chips for powertrain control, advanced driver assistance, infotainment, and battery management. Consequently, the automotive sector has become a key driver of semiconductor growth in China.

Memory chips are the second-largest segment in China's automotive semiconductor market.

Memory chips rank second in the Chinese automotive semiconductor market. These chips also hold the second-largest position in the global semiconductor industry due to soaring demand for data storage and processing, driven by AI, data centers, consumer electronics, and advanced automotive technologies. Memory chips are vital for storing and retrieving data in electronic devices, enabling everything from application execution to real-time system operations-an essential requirement for modern vehicles that rely on significant amounts of data for infotainment, ADAS, and autonomous driving features. Memory chips are extensively used in high-end infotainment systems, ADAS, and digital instrument clusters in cars. Electric and autonomous vehicles demand even more memory due to their complex computing and data processing needs. China is focusing on boosting domestic production of mature-node chips while also making significant advancements in advanced memory technology, particularly in NAND and DRAM, with companies like YMTC and CXMT leading the way. YMTC has developed advanced 3D TLC NAND chips that compete with global leaders like Samsung and Micron, while CXMT has produced and released G4 DDR5 DRAM. SMIC has also manufactured 7 nm chips for Huawei's Mate 60 Pro.

India is the second-largest importer of semiconductors from China.

India is the second-largest importer of electronics, integrated circuits, and memory chips worldwide. This is primarily due to the country's robust electronics sector, digitalization, and the lack of large-scale domestic semiconductor manufacturing. In 2024, imports of electronic integrated circuits from China alone reached USD 6.1 million. These components are essential in the automotive sector for advanced features such as infotainment, ADAS, telematics, and digital instrument clusters, which require significant memory and processing power. The Indian market for advanced automotive features is rapidly growing, driven by rising consumer demand for connectivity, safety, and electrification. The adoption of EVs and connected cars is accelerating, supported by government initiatives like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme. Investment in India's electronics and semiconductor ecosystem is also on the rise, with both domestic and international companies expanding production and R&D. The government has launched incentive programs such as the Production-Linked Incentive (PLI) scheme for electronics manufacturing, further increasing demand for imported memory and integrated circuits as local supply struggles to keep pace. Recent examples include automakers like Tata Motors and Mahindra integrating more sophisticated electronics into their latest models, reflecting the broader trend of technology-driven growth in India's automotive and electronics sectors.

Research Coverage:

The report provides an in-depth analysis of the China semiconductor market for automotive, focusing on various types, including microcontrollers, power semiconductors, sensors & MEMS devices, memory chips, and analog & mixed-signal integrated circuits. It examines export trends, the impact of trade policies and restrictions, and the diversification of the semiconductor industry away from China. The report also explores alternative manufacturing destinations, offering a comparative analysis of these locations, along with the challenges and strategies associated with the transition.

Additionally, the report assesses the effects of the global automotive sector on the semiconductor market and presents a future outlook. It includes detailed information about the major factors driving growth in China's semiconductor market. A thorough analysis of key industry players provides insights into their business overviews, product offerings, key strategies, contracts, partnerships, agreements, new product launches, mergers, and acquisitions.

Key Benefits of Buying this Report:

The report provides valuable information for market leaders and new entrants regarding revenue estimates for both the overall automotive semiconductor market in China and its sub-segments. It will assist stakeholders in understanding the competitive landscape, positioning their businesses more effectively, and planning appropriate go-to-market strategies. Additionally, the report offers insights into the current market conditions and highlights key drivers, restraints, challenges, and opportunities within the industry.

The report provides insights into the following points:

- Analysis of critical drivers (increased domestic investments in semiconductors), restraints (shortage of manufacturing facilities for 12 mm machines), opportunities (substantial investments by <12-inch wafer manufacturers), and challenges (technological gap) influencing the growth of the China semiconductor market for automotive

- Product Development/Innovation: Detailed insights into upcoming technologies and new products launched in the China semiconductor market for automotive

- Market Development: Comprehensive market information - the report analyses the authentication and brand protection market across Chinese countries

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the China semiconductor market for automotive

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as SMIC, GigaDevice Semiconductor Inc., Novosense Microelectronics, Silan Microelectronics, and HiSilicon

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 GLOBAL AUTOMOTIVE SEMICONDUCTOR INDUSTRY OVERVIEW

- 1.2 HISTORICAL DEVELOPMENT OF CHINA AUTOMOTIVE SEMICONDUCTOR INDUSTRY

- 1.2.1 2010-2014

- 1.2.2 2015-2020

- 1.2.3 2021-2025

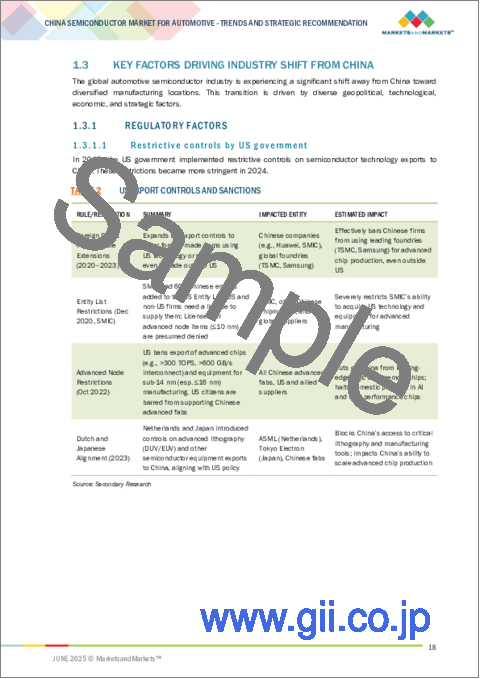

- 1.3 KEY FACTORS DRIVING INDUSTRY SHIFT FROM CHINA

- 1.3.1 REGULATORY FACTORS

- 1.3.1.1 Restrictive controls by US government

- 1.3.1.2 Chips Act and other global legislation

- 1.3.1.3 National security concerns

- 1.3.2 GEOPOLITICAL FACTORS

- 1.3.2.1 Taiwan Strait tensions

- 1.3.2.2 Russia-Ukraine war

- 1.3.2.3 Technology alliances

- 1.3.2.4 Technology limitations

- 1.3.3 ECONOMIC AND SUPPLY CHAIN FACTORS

- 1.3.3.1 Rising manufacturing costs in China

- 1.3.3.2 Incentives from alternative locations

- 1.3.4 CHALLENGES

- 1.3.4.1 Dependency on foreign IP & architecture and gaps in certification

- 1.3.4.2 Heavy reliance on imported semiconductor manufacturing equipment

- 1.3.1 REGULATORY FACTORS

2 CHINA AUTOMOTIVE SEMICONDUCTOR INDUSTRY

- 2.1 CURRENT STATE OF CHINA'S AUTOMOTIVE SEMICONDUCTORS

- 2.1.1 MICROCONTROLLERS

- 2.1.1.1 Key manufacturers, core competencies, and production capacities

- 2.1.1.2 Future roadmap

- 2.1.2 POWER SEMICONDUCTORS

- 2.1.2.1 Key manufacturers, core competencies, and production capacities

- 2.1.2.2 Future roadmap

- 2.1.3 SENSORS & MEMS

- 2.1.3.1 Key manufacturers, core competencies, and production capacities

- 2.1.3.2 Future roadmap

- 2.1.4 MEMORY CHIPS

- 2.1.4.1 Key manufacturers, core competencies, and production capacities

- 2.1.4.2 Future roadmap

- 2.1.5 ANALOG & MIXED-SIGNAL INTEGRATED CIRCUITS

- 2.1.5.1 Key manufacturers, core competencies, and production capacities

- 2.1.5.2 Future roadmap

- 2.1.1 MICROCONTROLLERS

- 2.2 MARKET VALUE ASSESSMENT

3 KEY PLAYERS IN CHINA AUTOMOTIVE SEMICONDUCTOR INDUSTRY

- 3.1 DOMESTIC MANUFACTURERS

- 3.1.1 SMIC

- 3.1.1.1 Overview

- 3.1.1.2 Recent financials

- 3.1.1.3 Production plants and capacity

- 3.1.1.4 Future strategy

- 3.1.2 GIGADEVICE

- 3.1.2.1 Overview

- 3.1.2.2 Recent financials

- 3.1.2.3 Production plants and capacity

- 3.1.2.4 Future strategy

- 3.1.3 NOVOSENSE MICROELECTRONICS

- 3.1.3.1 Overview

- 3.1.3.2 Recent financials

- 3.1.3.3 Production plants and capacity

- 3.1.3.4 Future strategy

- 3.1.4 SILAN MICROELECTRONICS

- 3.1.4.1 Overview

- 3.1.4.2 Recent financials

- 3.1.4.3 Production plants and capacity

- 3.1.4.4 Future strategy

- 3.1.5 HISILICON

- 3.1.5.1 Overview

- 3.1.5.2 Recent financials

- 3.1.5.3 Production plants and capacity

- 3.1.5.4 Future strategy

- 3.1.6 HUA HONG SEMICONDUCTOR LIMITED

- 3.1.6.1 Overview

- 3.1.6.2 Recent financials

- 3.1.6.3 Production plants and capacity

- 3.1.6.4 Future strategy

- 3.1.7 BYD SEMICONDUCTOR

- 3.1.7.1 Overview

- 3.1.7.2 Recent financials

- 3.1.7.3 Production plants and capacity

- 3.1.7.4 Future strategy

- 3.1.8 NEXPERIA

- 3.1.8.1 Overview

- 3.1.8.2 Recent financials

- 3.1.8.3 Production plants and capacity

- 3.1.8.4 Future strategy

- 3.1.9 CHANGXIN MEMORY TECHNOLOGIES

- 3.1.9.1 Overview

- 3.1.9.2 Recent financials

- 3.1.9.3 Production plants and capacity

- 3.1.9.4 Future strategy

- 3.1.10 YANGTZE MEMORY TECHNOLOGIES CORP

- 3.1.10.1 Overview

- 3.1.10.2 Recent financials

- 3.1.10.3 Production plants and capacity

- 3.1.10.4 Future strategy

- 3.1.11 GOERTEK MICROELECTRONICS INC.

- 3.1.11.1 Overview

- 3.1.11.2 Recent Financials

- 3.1.11.3 Production plants and capacity

- 3.1.11.4 Future strategy

- 3.1.12 CHINA RESOURCES MICROELECTRONICS LIMITED

- 3.1.12.1 Overview

- 3.1.12.2 Recent financials

- 3.1.12.3 Production plants and capacity

- 3.1.12.4 Future strategy

- 3.1.13 HESAI TECHNOLOGY

- 3.1.13.1 Overview

- 3.1.13.2 Recent financials

- 3.1.13.3 Production plants and capacity

- 3.1.13.4 Future strategy

- 3.1.14 OTHERS

- 3.1.1 SMIC

- 3.2 GLOBAL MANUFACTURERS IN CHINA

- 3.2.1 NXP SEMICONDUCTORS

- 3.2.1.1 Overview

- 3.2.1.2 Recent financials

- 3.2.1.3 Production plants and capacity

- 3.2.1.4 Future strategy

- 3.2.2 INFINEON TECHNOLOGIES

- 3.2.2.1 Overview

- 3.2.2.2 Recent financials

- 3.2.2.3 Production plants and capacity

- 3.2.2.4 Future strategy

- 3.2.3 STMICROELECTRONICS

- 3.2.3.1 Overview

- 3.2.3.2 Recent financials

- 3.2.3.3 Production plants and capacity

- 3.2.3.4 Future strategy

- 3.2.4 TEXAS INSTRUMENTS

- 3.2.4.1 Overview

- 3.2.4.2 Recent financials

- 3.2.4.3 Production plants and capacity

- 3.2.4.4 Future strategy

- 3.2.5 RENESAS ELECTRONICS CORPORATION

- 3.2.5.1 Overview

- 3.2.5.2 Recent financials

- 3.2.5.3 Production plants and capacity

- 3.2.5.4 Future strategy

- 3.2.1 NXP SEMICONDUCTORS

- 3.3 JOINT VENTURES AND STRATEGIC PARTNERSHIPS

4 EXPORT ANALYSIS OF CHINA'S AUTOMOTIVE SEMICONDUCTORS

- 4.1 KEY EXPORT PRODUCT CATEGORIES

- 4.2 GLOBAL SEMICONDUCTOR EXPORTS

- 4.2.1 ELECTRONIC INTEGRATED CIRCUITS (HS CODE 854231)

- 4.2.2 ELECTRONIC INTEGRATED CIRCUITS AS MEMORIES (HS CODE 854232)

- 4.2.3 ELECTRONIC INTEGRATED CIRCUITS AS AMPLIFIERS (HS CODE 854233)

- 4.2.4 ELECTRONIC INTEGRATED CIRCUITS (EXCL. PROCESSORS, CONTROLLERS, MEMORIES, AND AMPLIFIERS) (HS CODE 854239)

- 4.2.5 PARTS OF ELECTRONIC INTEGRATED CIRCUITS (HS CODE 854290)

- 4.3 EXPORTS FROM CHINA

- 4.3.1 ELECTRONIC INTEGRATED CIRCUITS (HS CODE 854231)

- 4.3.1.1 China

- 4.3.1.2 Hong Kong, China

- 4.3.2 ELECTRONIC INTEGRATED CIRCUITS AS MEMORIES (HS CODE 854232)

- 4.3.2.1 China

- 4.3.2.2 Hong Kong, China

- 4.3.3 ELECTRONIC INTEGRATED CIRCUITS AS AMPLIFIERS (HS CODE 854233)

- 4.3.3.1 China

- 4.3.3.2 Hong Kong, China

- 4.3.4 ELECTRONIC INTEGRATED CIRCUITS (EXCL. PROCESSORS, CONTROLLERS, MEMORIES, AND AMPLIFIERS) (HS CODE 854239)

- 4.3.4.1 China

- 4.3.4.2 Taipei, China

- 4.3.4.3 Hong Kong, China

- 4.3.1 ELECTRONIC INTEGRATED CIRCUITS (HS CODE 854231)

5 DIVERSIFICATION OF CHINA AUTOMOTIVE SEMICONDUCTOR INDUSTRY

- 5.1 GEOPOLITICAL FACTORS

- 5.1.1 US-CHINA TRADE TENSIONS

- 5.1.1.1 US-China tariffs

- 5.1.1.2 Diversification strategies

- 5.1.2 TECHNOLOGY EXPORT CONTROLS

- 5.1.2.1 US & Chinese technology export controls

- 5.1.2.2 Impact of export controls

- 5.1.3 NATIONAL SECURITY CONCERNS

- 5.1.1 US-CHINA TRADE TENSIONS

- 5.2 SUPPLY CHAIN RESILIENCE STRATEGIES

- 5.2.1 KNOWLEDGE GAINED FROM COVID-19 PANDEMIC

- 5.2.1.1 Realization by China after Covid-19

- 5.2.1.2 Impact on global players

- 5.2.1.3 Shift from JIT to strategic resilience

- 5.2.1 KNOWLEDGE GAINED FROM COVID-19 PANDEMIC

- 5.3 ECONOMIC FACTORS

- 5.3.1 RISING MANUFACTURING COSTS IN CHINA

- 5.3.1.1 Cost comparison

- 5.3.1.2 Bill of Materials

- 5.3.2 INCENTIVE PROGRAMS IN ALTERNATIVE LOCATIONS

- 5.3.1 RISING MANUFACTURING COSTS IN CHINA

- 5.4 IMPACT ON GLOBAL AUTOMOTIVE INDUSTRY

- 5.4.1 EFFECTS ON AUTOMOTIVE PRODUCTION COSTS

- 5.4.2 SUPPLY CHAIN RELIABILITY AND RESILIENCE

- 5.4.3 REGIONAL MANUFACTURING CLUSTERS

- 5.4.4 TECHNOLOGY DEVELOPMENT AND INNOVATION PATTERNS

6 ALTERNATIVE MANUFACTURING DESTINATIONS

- 6.1 OVERVIEW

- 6.2 COMPARATIVE ANALYSIS OF ALTERNATIVE MANUFACTURING LOCATIONS

- 6.2.1 RANKING AS ALTERNATIVES TO CHINA

- 6.3 TECHNOLOGY DOMINANCE, BY COUNTRY/REGION

- 6.4 SOUTHEAST ASIA

- 6.4.1 MALAYSIA

- 6.4.1.1 Government incentives and support

- 6.4.1.2 Key diversifications

- 6.4.1.3 Challenges

- 6.4.2 VIETNAM

- 6.4.2.1 Government incentives and support

- 6.4.2.2 Key diversifications

- 6.4.2.3 Challenges

- 6.4.3 THAILAND

- 6.4.3.1 Government incentives and support

- 6.4.3.2 Key diversifications

- 6.4.3.3 Challenges

- 6.4.4 SINGAPORE

- 6.4.4.1 Government incentives and support

- 6.4.4.2 Key diversifications

- 6.4.4.3 Challenges

- 6.4.5 SOUTH KOREA

- 6.4.5.1 Government incentives and support

- 6.4.5.2 Key diversifications

- 6.4.5.3 Impact of key players

- 6.4.5.3.1 Samsung

- 6.4.5.3.2 SK Hynix

- 6.4.5.4 Challenges

- 6.4.6 TAIWAN

- 6.4.6.1 Government incentives and support

- 6.4.6.2 Key diversifications

- 6.4.6.3 Impact of key players

- 6.4.6.3.1 TSMC

- 6.4.6.4 Challenges

- 6.4.1 MALAYSIA

- 6.5 NORTH AMERICA

- 6.5.1 GOVERNMENT INCENTIVES AND SUPPORT

- 6.5.2 KEY DIVERSIFICATIONS

- 6.5.2.1 US

- 6.5.2.2 Mexico

- 6.5.3 CHALLENGES

- 6.6 EUROPE

- 6.6.1 INCENTIVES BY EUROPEAN COUNTRIES

- 6.6.1.1 Germany

- 6.6.1.2 France

- 6.6.1.3 Italy

- 6.6.2 EUROPEAN MANUFACTURING HUBS

- 6.6.1 INCENTIVES BY EUROPEAN COUNTRIES

- 6.7 INDIA

- 6.7.1 GOVERNMENT INCENTIVES AND SUPPORT

- 6.7.2 KEY DIVERSIFICATIONS

- 6.7.3 CHALLENGES

7 FUTURE OUTLOOK AND RECOMMENDATIONS

- 7.1 PROJECTED INDUSTRY SHIFTS, 2025-2030

- 7.2 TECHNOLOGY ROADMAP

- 7.3 STRATEGIC RECOMMENDATIONS FOR INDUSTRY STAKEHOLDERS

- 7.3.1 DIVERSIFICATION

- 7.3.2 TECHNOLOGY

- 7.3.3 SUPPLY CHAIN