|

|

市場調査レポート

商品コード

1758243

液浸冷却の世界市場:タイプ別、用途別、コンポーネント別、冷却液別、地域別 - 2032年までの予測Immersion Cooling Market by Type (Single Phase, Two Phase), Application (High-performance Computing, Edge Computing, Cryptocurrency Mining), Cooling Fluid, Component (Solutions, Services), and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 液浸冷却の世界市場:タイプ別、用途別、コンポーネント別、冷却液別、地域別 - 2032年までの予測 |

|

出版日: 2025年06月25日

発行: MarketsandMarkets

ページ情報: 英文 236 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

液浸冷却の市場規模は、2025年の5億7,000万米ドルから2032年には26億米ドルに成長し、CAGRは24.2%を記録すると予測されています。

システム性能の向上と熱負荷の低減は、最適な運用効率を確保する上で重要な要素です。液浸冷却技術の進歩により、この2つの目的を同時に達成することがますます現実的になっており、このアプローチは従来の冷却方法に代わる優れた選択肢と位置付けられています。その結果、熱管理、エネルギー効率、信頼性の向上を実現する次世代液浸冷却ソリューションの開発により、市場は力強い成長を遂げています。これらの技術は、電子部品の効率的な冷却が不可欠な幅広い産業や用途で採用されています。特に、熱密度と性能に対する要求が非常に高いハイパフォーマンス・コンピューティング(HPC)環境では、その傾向が顕著です。システムの安定性を維持し、ハードウェアの寿命を延ばし、より高い計算密度をサポートする液浸冷却の能力は、計算集約的なインフラストラクチャの進化において説得力のあるソリューションとなっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 対象ユニット | 金額(100万米ドル/10億米ドル)および数量(MW) |

| セグメント | タイプ別、用途別、コンポーネント別、冷却液別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

世界の液浸冷却市場では、単相液浸冷却がより大きなセグメントになると予測されています。この優位性は、主に放熱効率の実証済みと操作の簡便さに起因します。単相システムで使用される誘電体流体は、高い熱容量と強い熱伝導率を有しており、相変化を起こすことなく電子部品から効果的に熱を吸収・移動させることができます。この安定した熱性能は、最適な動作温度を維持することで、ハイパフォーマンス・コンピューティング(HPC)システムの安定動作をサポートします。その結果、単相液浸冷却はシステムの効率と信頼性を高めるだけでなく、ハードウェアの寿命延長にも貢献します。このような利点は、メンテナンスの複雑さを軽減し、既存のインフラストラクチャへの統合を容易にすることと相まって、データセンターや計算集約型環境で広く採用され続けています。

ハイパフォーマンス・コンピューティング(HPC)の採用拡大が、液浸冷却技術の需要増加の主なきっかけとなっています。より広範なデータセンターの冷却エコシステムにおける重要なソリューションとして、液浸冷却は、極端な放熱、エネルギー効率要件、環境の持続可能性、継続的な技術進歩をサポートする必要性など、HPCワークロードに関連する主要な課題に対応しています。従来の空冷システムは熱的・空間的な限界に近づいており、液浸冷却はより実行可能でスケーラブルな代替手段として台頭してきています。人工知能、気候モデリング、ゲノミクス、複雑なシミュレーションなどの用途に後押しされ、HPCシステムの処理密度が高まっているため、従来の方法では実現が困難な堅牢な熱管理ソリューションが求められています。液浸冷却は優れた熱効率を提供するため、サーバーの高密度化、スペースの有効活用、より負荷の高いプロセッサーのサポートが可能になります。パフォーマンスと持続可能性の目標に合致することで、HPC全体における次世代冷却技術への投資とイノベーションが加速されます。

合成流体は、その優れた熱性能とエネルギー効率向上への貢献により、液浸冷却市場を独占すると予想されます。これらの人工誘電性流体は、従来の冷却媒体と比較して熱伝達特性が大幅に優れているため、高密度コンピューティング環境に適しています。電子部品からの熱を効果的に吸収・放散することで、合成流体はデータセンターの冷却効率の最適化、エネルギー消費の削減、全体的な運用コストの削減を可能にします。一貫した熱安定性、長寿命、デリケートなITハードウェアとの互換性により、次世代液浸冷却システムで推奨される選択肢としての地位がさらに強化されます。エネルギー効率と持続可能性がデータセンター事業者にとって重要な優先事項となるにつれ、合成流体の採用が加速し、世界の液浸冷却市場の成長と革新が促進されると予想されます。

北米は、持続可能性、エネルギー効率、技術革新への強いコミットメントが原動力となり、予測期間を通じて無液浸冷却の最も重要な地域市場であり続けると予測されます。同地域のデータセンターは、環境フットプリントの削減とエネルギー使用の最適化というプレッシャーに直面しており、液浸冷却は魅力的なソリューションです。ITハードウェアを熱伝導性の誘電流体に直接浸すことで、液浸システムは従来の空冷への依存を排除し、エネルギー消費と運用コストを大幅に削減します。このような効率性の向上は、グリーンデータセンターの実践や二酸化炭素削減目標に関する北米の広範なイニシアティブと密接に連携しています。この地域の先進的なデジタルインフラ、ハイパフォーマンスコンピューティングの早期導入、有利な規制状況は、液浸冷却導入の最前線としての地位をさらに強固なものにしています。

当レポートでは、世界の液浸冷却市場について調査し、タイプ別、用途別、コンポーネント別、冷却液別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 購入基準

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- エコシステム/市場マップ

- 技術分析

- 特許分析

- 投資と資金調達のシナリオ

- 貿易データ

- AI/生成AIがデータセンター液体冷却市場に与える影響

- 2025年~2026年の主な会議とイベント

- 規制状況

- 液浸冷却ソリューションプロバイダーが使用するマーケティングチャネル:比較分析

- 液浸冷却会社のパートナー

- 総所有コスト

- ケーススタディ分析

- 世界マクロ経済見通し

- 2025年の米国関税の影響- 液浸冷却市場

第6章 液浸冷却市場(タイプ別)

- イントロダクション

- 単相液浸冷却

- 二相液浸冷却

第7章 液浸冷却市場(用途別)

- イントロダクション

- 高性能コンピューティング

- エッジコンピューティング

- 人工知能

- 暗号通貨マイニング

- その他

第8章 液浸冷却市場(コンポーネント別)

- イントロダクション

- ソリューション

- サービス

第9章 液浸冷却市場(冷却液別)

- イントロダクション

- 合成流体

- ミネラルオイル

- フッ素系流体

- その他

第10章 液浸冷却市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- タイ

- マレーシア

- その他

- 欧州

- ドイツ

- フランス

- オランダ

- 英国

- ロシア

- スペイン

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- その他のGCC諸国

- その他

- 南米

第11章 競合情勢

- イントロダクション

- 収益分析

- 市場シェア分析、2024年

- ブランド製品比較

- 企業評価マトリックス、2024年

- スタートアップ/中小企業評価マトリックス、2024年

- 企業評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- GREEN REVOLUTION COOLING INC.

- SUBMER

- ASPERITAS

- LIQUIDSTACK HOLDING B. V.

- MIDAS IMMERSION COOLING

- VERTIV GROUP CORP.

- ICEOTOPE PRECISION LIQUID COOLING

- LIQUIDCOOL SOLUTIONS

- DUG TECHNOLOGY

- DCX LIQUID COOLING SYSTEMS

- STULZ GMBH

- MODINE

- GIGA-BYTE TECHNOLOGY CO., LTD.

- WIWYNN CORPORATION

- KAORI HEAT TREATMENT CO., LTD.

- DELTA POWER SOLUTIONS

- BOYD

- その他の企業

- HYPERTEC GROUP INC.

- PEZY COMPUTING

- TAS

- RSI K.K.

- TEIMMERS

第13章 隣接市場と関連市場

第14章 付録

List of Tables

- TABLE 1 IMMERSION COOLING MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

- TABLE 2 IMMERSION COOLING MARKET, BY COOLING FLUID: INCLUSIONS AND EXCLUSIONS

- TABLE 3 IMMERSION COOLING MARKET, BY COMPONENT: INCLUSIONS AND EXCLUSIONS

- TABLE 4 IMMERSION COOLING MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

- TABLE 5 IMMERSION COOLING MARKET, BY REGION: INCLUSIONS AND EXCLUSIONS

- TABLE 6 FACTOR ANALYSIS

- TABLE 7 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 8 IMMERSION COOLING MARKET SNAPSHOT: 2025 VS. 2032

- TABLE 9 CARBON FOOTPRINT OF AIR-COOLING VERSUS IMMERSION-COOLING FOR DATA CENTERS

- TABLE 10 AIR-COOLING VERSUS IMMERSION COOLING FOR DATA CENTERS

- TABLE 11 COMPARATIVE NOISE LEVEL

- TABLE 12 WATER CONSUMPTION IN AIR-COOLING VERSUS IMMERSION-COOLING FOR DATA CENTERS

- TABLE 13 IMMERSION COOLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 15 KEY BUYING CRITERIA

- TABLE 16 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 17 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2024 (USD/L)

- TABLE 18 AVERAGE SELLING PRICE TREND OF IMMERSION COOLING FLUIDS, BY REGION, 2020-2030 (USD/L)

- TABLE 19 IMMERSION COOLING MARKET: ROLE IN ECOSYSTEM

- TABLE 20 MAJOR PATENTS RELATED TO DATA CENTER LIQUID COOLING SOLUTIONS

- TABLE 21 DATA CENTER IMMERSION COOLING MARKET: TOP USE CASES AND MARKET POTENTIAL

- TABLE 22 DATA CENTER IMMERSION COOLING MARKET: BEST PRACTICES

- TABLE 23 DATA CENTER IMMERSION COOLING MARKET: LIST OF CONFERENCES AND EVENTS, 2025-2026

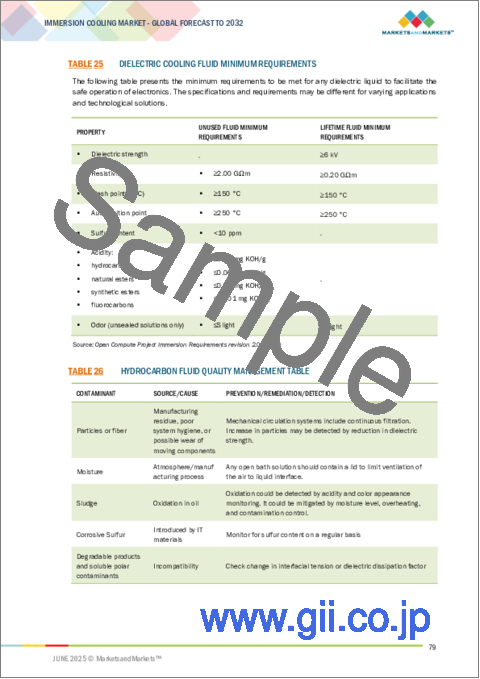

- TABLE 24 DIELECTRIC COOLING FLUID SPECIFICATIONS

- TABLE 25 DIELECTRIC COOLING FLUID MINIMUM REQUIREMENTS

- TABLE 26 HYDROCARBON FLUID QUALITY MANAGEMENT TABLE 79 TABLE 27 FLUOROCARBON FLUID QUALITY MANAGEMENT TABLE 80 TABLE 28 APPROACHES IN INDIAN CONTEXT

- TABLE 29 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 DETAILS OF DIFFERENT DISTRIBUTION CHANNELS

- TABLE 32 LIST OF PARTNER COMPANIES OF MAJOR IMMERSION COOLING SOLUTION PROVIDERS

- TABLE 33 AVERAGE PRICE OF COOLING FLUID (USD/LITER)

- TABLE 34 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY COUNTRY, 2021-2024

- TABLE 35 UNEMPLOYMENT RATE, BY COUNTRY, 2021-2024

- TABLE 36 INFLATION RATE (AVERAGE CONSUMER PRICES), BY COUNTRY, 2021-2024

- TABLE 37 FOREIGN DIRECT INVESTMENT, 2022-2023

- TABLE 38 TABLE 1: US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 39 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR IMMERSION COOLING

- TABLE 40 IMMERSION COOLING MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 41 IMMERSION COOLING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 42 SINGLE-PHASE IMMERSION COOLING: IMMERSION COOLING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 SINGLE-PHASE IMMERSION COOLING: IMMERSION COOLING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 44 TWO-PHASE IMMERSION COOLING: IMMERSION COOLING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 TWO-PHASE IMMERSION COOLING: IMMERSION COOLING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 46 IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 47 IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 48 HIGH-PERFORMANCE COMPUTING: IMMERSION COOLING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 HIGH-PERFORMANCE COMPUTING: IMMERSION COOLING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 50 EDGE COMPUTING: IMMERSION COOLING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 EDGE COMPUTING: IMMERSION COOLING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 52 ARTIFICIAL INTELLIGENCE: IMMERSION COOLING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 ARTIFICIAL INTELLIGENCE: IMMERSION COOLING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 54 CRYPTOCURRENCY MINING: IMMERSION COOLING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 CRYPTOCURRENCY MINING: IMMERSION COOLING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 56 OTHER APPLICATIONS: IMMERSION COOLING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 OTHER APPLICATIONS: IMMERSION COOLING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 58 IMMERSION COOLING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 59 IMMERSION COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 60 SOLUTIONS: IMMERSION COOLING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 SOLUTIONS: IMMERSION COOLING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 62 SERVICES: IMMERSION COOLING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 SERVICES: IMMERSION COOLING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 64 IMMERSION COOLING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 IMMERSION COOLING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 66 IMMERSION COOLING MARKET, BY REGION, 2020-2024 (MW)

- TABLE 67 IMMERSION COOLING MARKET, BY REGION, 2025-2032 (MW)

- TABLE 68 IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 69 IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 70 IMMERSION COOLING MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 71 IMMERSION COOLING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 72 ASIA PACIFIC: IMMERSION COOLING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 73 ASIA PACIFIC: IMMERSION COOLING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 74 ASIA PACIFIC: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 75 ASIA PACIFIC: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 76 ASIA PACIFIC: IMMERSION COOLING MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 77 ASIA PACIFIC: IMMERSION COOLING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 78 CHINA: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 79 CHINA: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 80 INDIA: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 81 INDIA: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 82 JAPAN: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 83 JAPAN: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 84 SOUTH KOREA: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 85 SOUTH KOREA: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 86 THAILAND: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 87 THAILAND: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 88 MALAYSIA: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 89 MALAYSIA: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 92 EUROPE: IMMERSION COOLING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 93 EUROPE: IMMERSION COOLING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 94 EUROPE: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 95 EUROPE: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 96 EUROPE: IMMERSION COOLING MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 97 EUROPE: IMMERSION COOLING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 98 GERMANY: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 99 GERMANY: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 100 FRANCE: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 101 FRANCE: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 102 NETHERLANDS: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 103 NETHERLANDS: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 104 UK: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 105 UK: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 106 RUSSIA: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 107 RUSSIA: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 108 SPAIN: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 109 SPAIN: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 110 REST OF EUROPE: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 111 REST OF EUROPE: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 112 NORTH AMERICA: IMMERSION COOLING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 113 NORTH AMERICA: IMMERSION COOLING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 114 NORTH AMERICA: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 115 NORTH AMERICA: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 116 NORTH AMERICA: IMMERSION COOLING MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 117 NORTH AMERICA: IMMERSION COOLING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 118 US: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 119 US: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 120 CANADA: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 121 CANADA: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 122 MEXICO: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 123 MEXICO: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: IMMERSION COOLING MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: IMMERSION COOLING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 128 SOUTH AMERICA: IMMERSION COOLING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 129 SOUTH AMERICA: IMMERSION COOLING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 130 SOUTH AMERICA: IMMERSION COOLING MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 131 SOUTH AMERICA: IMMERSION COOLING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 132 STRATEGIES ADOPTED BY KEY IMMERSION COOLING TECHNOLOGY MANUFACTURERS, 2019-2025

- TABLE 133 IMMERSION COOLING MARKET: DEGREE OF COMPETITION

- TABLE 134 IMMERSION COOLING MARKET: DEGREE OF COMPETITION, 2024

- TABLE 135 IMMERSION COOLING MARKET: REGION FOOTPRINT, 2024

- TABLE 136 IMMERSION COOLING MARKET: TYPE FOOTPRINT, 2024

- TABLE 137 IMMERSION COOLING MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 138 IMMERSION COOLING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 139 IMMERSION COOLING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 140 IMMERSION COOLING MARKET: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 141 IMMERSION COOLING MARKET: DEALS, JANUARY 2019-MAY 2025

- TABLE 142 IMMERSION COOLING MARKET: EXPANSIONS, JANUARY 2019-MAY 2025

- TABLE 143 GREEN REVOLUTION COOLING INC.: COMPANY OVERVIEW

- TABLE 144 GREEN REVOLUTION COOLING, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 GREEN REVOLUTION COOLING, INC.: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 146 GREEN REVOLUTION COOLING, INC.: DEALS, JANUARY 2019-MAY 2025

- TABLE 147 SUBMER: COMPANY OVERVIEW

- TABLE 148 SUBMER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 SUBMER: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 150 SUBMER: DEALS, JANUARY 2019-MAY 2025

- TABLE 151 SUBMER: EXPANSIONS, JANUARY 2019-MAY 2025

- TABLE 152 SUBMER: OTHERS, JANUARY 2019-MAY 2025

- TABLE 153 ASPERITAS: COMPANY OVERVIEW

- TABLE 154 ASPERITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 ASPERITAS: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 156 ASPERITAS: DEALS, JANUARY 2019-MAY 2025

- TABLE 157 LIQUIDSTACK HOLDING B.V.: COMPANY OVERVIEW

- TABLE 158 LIQUIDSTACK HOLDING B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 LIQUIDSTACK HOLDING B.V.: DEALS, JANUARY 2019-MAY 2025

- TABLE 160 LIQUIDSTACK HOLDING B.V.: OTHERS, JANUARY 2019-MAY 2025

- TABLE 161 MIDAS IMMERSION COOLING: COMPANY OVERVIEW

- TABLE 162 MIDAS IMMERSION COOLING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 MIDAS IMMERSION COOLING: DEALS, JANUARY 2019-MAY 2025

- TABLE 164 VERTIV GROUP CORP.: COMPANY OVERVIEW

- TABLE 165 VERTIV GROUP CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 VERTIV GROUP CORP.: DEALS, JANUARY 2019-MAY 2025

- TABLE 167 ICEOTOPE PRECISION LIQUID COOLING: COMPANY OVERVIEW

- TABLE 168 ICEOTOPE PRECISION LIQUID COOLING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 ICEOTOPE PRECISION LIQUID COOLING: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 170 ICEOTOPE PRECISION LIQUID COOLING: DEALS, JANUARY 2019-MAY 2025

- TABLE 171 LIQUIDCOOL SOLUTIONS: COMPANY OVERVIEW

- TABLE 172 LIQUIDCOOL SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 LIQUIDCOOL SOLUTIONS: DEALS, JANUARY 2019-MAY 2025

- TABLE 174 DUG TECHNOLOGY: COMPANY OVERVIEW

- TABLE 175 DUG TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 DUG TECHNOLOGY: DEALS, JANUARY 2019-MAY 2025

- TABLE 177 DCX LIQUID COOLING SYSTEMS: COMPANY OVERVIEW

- TABLE 178 DCX LIQUID COOLING SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 DCX LIQUID COOLING SYSTEMS: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 180 DCX LIQUID COOLING SYSTEMS: OTHERS, JANUARY 2019-MAY 2025

- TABLE 181 STULZ GMBH: COMPANY OVERVIEW

- TABLE 182 STULZ GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 STULZ GMBH: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 184 MODINE: COMPANY OVERVIEW

- TABLE 185 MODINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 MODINE: PRODUCT LAUNCHES

- TABLE 187 MODINE: DEALS

- TABLE 188 MODINE: EXPANSIONS

- TABLE 189 GIGA-BYTE TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 190 GIGA-BYTE TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 WIWYNN CORPORATION: COMPANY OVERVIEW

- TABLE 192 WIWYNN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 KAORI HEAT TREATMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 194 KAORI HEAT TREATMENT CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 DELTA POWER SOLUTIONS: COMPANY OVERVIEW

- TABLE 196 DELTA POWER SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 BOYD: COMPANY OVERVIEW

- TABLE 198 BOYD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 HYPERTEC GROUP INC.: COMPANY OVERVIEW

- TABLE 200 PEZY COMPUTING.: COMPANY OVERVIEW

- TABLE 201 TAS: COMPANY OVERVIEW

- TABLE 202 RSI K. K.: COMPANY OVERVIEW

- TABLE 203 TEIMMERS: COMPANY OVERVIEW

- TABLE 204 DATA CENTER LIQUID COOLING MARKET, BY TYPE OF COOLING, 2017-2024 (USD MILLION)

- TABLE 205 DATA CENTER LIQUID COOLING MARKET, BY TYPE OF COOLING, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 IMMERSION COOLING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 IMMERSION COOLING MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2-BOTTOM-UP (DEMAND SIDE)

- FIGURE 7 IMMERSION COOLING MARKET: DATA TRIANGULATION

- FIGURE 8 HIGH-PERFORMANCE COMPUTING TO ACCOUNT FOR LARGEST SHARE OF IMMERSION COOLING MARKET

- FIGURE 9 SINGLE-PHASE IMMERSION COOLING SEGMENT TO LEAD IMMERSION COOLING MARKET

- FIGURE 10 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER SHARE OF OVERALL IMMERSION COOLING MARKET

- FIGURE 11 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF IMMERSION COOLING MARKET

- FIGURE 12 ADOPTION IN CRYPTOCURRENCY MINING AND GROWING SERVER DENSITY DRIVING GROWTH

- FIGURE 13 ASIA PACIFIC IMMERSION COOLING MARKET PROJECTED TO WITNESS HIGHEST CAGR BETWEEN 2025 AND 2032

- FIGURE 14 CRYPTOCURRENCY MINING ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICA IMMERSION COOLING MARKET IN 2024

- FIGURE 15 IMMERSION COOLING MARKET IN CHINA PROJECTED TO WITNESS HIGHEST CAGR BETWEEN 2025 AND 2032

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN IMMERSION COOLING MARKET

- FIGURE 17 AVERAGE SERVER RACK DENSITY, 2020-2024

- FIGURE 18 IMMERSION COOLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 20 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 21 REVENUE SHIFTS AND NEW REVENUE POCKETS IN IMMERSION COOLING MARKET

- FIGURE 22 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2024

- FIGURE 23 AVERAGE SELLING PRICE OF IMMERSION COOLING FLUIDS, BY REGION, 2020-2030

- FIGURE 24 IMMERSION COOLING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 IMMERSION COOLING MARKET: ECOSYSTEM MAPPING

- FIGURE 26 TYPES OF IMMERSION COOLING SOLUTIONS

- FIGURE 27 LIST OF MAJOR PATENTS RELATED TO DATA CENTER IMMERSION COOLING SOLUTIONS

- FIGURE 28 DATA CENTER IMMERSION COOLING MARKET: INVESTMENT AND FUNDING RELATED TO STARTUPS/SMES, 2019-2024 (USD MILLION)

- FIGURE 29 IMPORT DATA FOR HS CODE 271019-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018-2022 (USD BILLION)

- FIGURE 30 EXPORT DATA FOR HS CODE 271019-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018-2022 (USD BILLION)

- FIGURE 31 SINGLE-PHASE IMMERSION COOLING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 32 HIGH-PERFORMANCE COOLING APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 33 SOLUTIONS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 34 IMMERSION COOLING MARKET IN CHINA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC: IMMERSION COOLING MARKET SNAPSHOT

- FIGURE 36 EUROPE: IMMERSION COOLING MARKET SNAPSHOT

- FIGURE 37 NORTH AMERICA: IMMERSION COOLING MARKET SNAPSHOT

- FIGURE 38 REVENUE ANALYSIS OF KEY COMPANIES (2021-2024)

- FIGURE 39 LEADING PLAYERS IN IMMERSION COOLING MARKET, 2024

- FIGURE 40 BRAND PRODUCT COMPARISON

- FIGURE 41 COMPANY EVALUATION MATRIX FOR IMMERSION COOLING MARKET, 2024

- FIGURE 42 IMMERSION COOLING MARKET: COMPANY FOOTPRINT

- FIGURE 43 STARTUP/SME EVALUATION MATRIX FOR IMMERSION COOLING MARKET, 2024

- FIGURE 44 EV/REVENUE

- FIGURE 45 EV/EBITDA

- FIGURE 46 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 47 VERTIV GROUP CORP.: COMPANY SNAPSHOT

- FIGURE 48 DUG TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 49 MODINE: COMPANY SNAPSHOT

- FIGURE 50 GIGA-BYTE TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 51 WIWYNN CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 KAORI HEAT TREATMENT CO., LTD: COMPANY SNAPSHOT

- FIGURE 53 DELTA POWER SOLUTIONS: COMPANY SNAPSHOT

The immersion cooling market is projected to grow from USD 0.57 billion in 2025 to USD 2.60 billion by 2032, registering a CAGR of 24.2%. Enhanced system performance and reduced thermal loads are critical factors in ensuring optimal operational efficiency. Advancements in immersion cooling technologies are making it increasingly feasible to achieve both objectives simultaneously, positioning this approach as a superior alternative to conventional cooling methods. As a result, the market is witnessing strong growth, driven by the development of next-generation immersion cooling solutions that offer improved thermal management, energy efficiency, and reliability. These technologies are being adopted across a wide range of industries and applications where efficient cooling of electronic components is essential-particularly in high-performance computing (HPC) environments, where heat density and performance demands are exceptionally high. The ability of immersion cooling to maintain system stability, extend hardware lifespan, and support higher compute densities makes it a compelling solution in the evolving landscape of compute-intensive infrastructure.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/USD Billion) and Volume (MW) |

| Segments | Type, Component, Cooling Fluid, Application, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"By type, single-phase to be larger segment of immersion cooling market between 2025 and 2032"

Single-phase immersion cooling is projected to be a larger segment of the global immersion cooling market. This dominance is primarily attributed to its proven efficiency in heat dissipation and operational simplicity. The dielectric fluids used in single-phase systems possess high heat capacity and strong thermal conductivity, enabling them to effectively absorb and transfer heat away from electronic components without undergoing a phase change. This consistent thermal performance supports the stable operation of high-performance computing (HPC) systems by maintaining optimal operating temperatures. As a result, single-phase immersion cooling not only enhances system efficiency and reliability but also contributes to extended hardware lifespan. These advantages, coupled with lower maintenance complexity and easier integration into existing infrastructure, continue to drive its widespread adoption across data centers and compute-intensive environments.

"By application, high-performance computing to be largest segment of immersion cooling market from 2025 to 2032"

The growing adoption of high-performance computing (HPC) is a major catalyst for the rising demand for immersion cooling technologies. As a critical solution within the broader data center cooling ecosystem, immersion cooling addresses the key challenges associated with HPC workloads, including extreme heat dissipation, energy efficiency requirements, environmental sustainability, and the need to support ongoing technological advancements. With traditional air cooling systems approaching their thermal and spatial limitations, immersion cooling is emerging as a more viable and scalable alternative. The increasing processing density of HPC systems-driven by applications in artificial intelligence, climate modeling, genomics, and complex simulations-demands robust thermal management solutions that conventional methods struggle to deliver. Immersion cooling offers superior thermal efficiency, enabling higher server density, better space utilization, and support for more intensive processor loads. This alignment with performance and sustainability goals accelerates investment and innovation in next-generation cooling technologies across the HPC landscape.

"By cooling fluid, synthetic fluids to be largest segment of immersion cooling market from 2025 to 2032"

Synthetic fluids are expected to dominate the immersion cooling market due to their superior thermal performance and contribution to enhanced energy efficiency. These engineered dielectric fluids typically offer significantly better heat transfer properties compared to traditional cooling media, making them well-suited for high-density computing environments. By effectively absorbing and dissipating heat from electronic components, synthetic fluids enable data centers to optimize cooling efficiency, reduce energy consumption, and lower overall operational costs. Their consistent thermal stability, extended service life, and compatibility with sensitive IT hardware further strengthen their position as the preferred choice in next-generation immersion cooling systems. As energy efficiency and sustainability become critical priorities for data center operators, the adoption of synthetic fluids is anticipated to accelerate, driving growth and innovation across the global immersion cooling landscape.

"North America immersion cooling market to exhibit highest growth during forecast period"

North America is projected to remain the most significant regional market for immersion cooling throughout the forecast period, driven by strong commitments to sustainability, energy efficiency, and technological innovation. As data centers across the region face increasing pressure to reduce their environmental footprint and optimize energy use, immersion cooling presents a compelling solution. By submerging IT hardware directly in thermally conductive dielectric fluids, immersion systems eliminate reliance on traditional air-based cooling, significantly lowering energy consumption and operational costs. These efficiency gains align closely with North America's broader initiatives around green data center practices and carbon reduction goals. The region's advanced digital infrastructure, early adoption of high-performance computing, and favorable regulatory landscape further reinforce its position at the forefront of immersion cooling adoption.

Profile break-up of primary participants for report:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level Executives - 60%, Directors - 20%, and Others - 20%

- By Region: North America - 30%, Europe - 30%, Asia Pacific - 30%, South America - 5%, and Middle East & Africa - 5%

The immersion cooling market report is dominated by LiquidStack (Netherlands), Green Revolution Cooling Inc (US), Submer (Spain), Asperitas (Netherlands), Midas Green Technologies (US), Iceotope Technologies Ltd (US), LiquidCool Solutions (US), DUG Technology (Australia), DCX Liquid Cooling Systems (Poland), Vertiv Group Corp (US), Kaori Heat Treatment Co., Ltd (Taiwan), BOYD (US), and GIGA-BYTE Technology Co., Ltd. (Taiwan).

Research Coverage

The report defines, segments, and projects the size of the immersion cooling market based on application, type, cooling fluid, component, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments such as expansions, product launches, partnerships, collaborations, agreements, and joint ventures they undertake in the market.

The report also comprehensively reviews market drivers, restraints, opportunities, and challenges in the immersion cooling market. It covers qualitative aspects in addition to the quantitative aspects of these markets.

Reasons to Buy Report

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the immersion cooling market and its segments. This report is also expected to help stakeholders understand the market's competitive landscape better, gain insights to improve the position of their businesses and make suitable go-to-market strategies. It will enable stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

Report provides insights into following points:

- Analysis of key drivers (Adoption in cryptocurrency mining and blockchain technology, Growing density of servers, rising need for eco-friendly data center cooling solutions, and increasing demand for compact and noise-free cooling solutions), restraints (Susceptibility to leakage and preference for air cooling technology), opportunities (Adoption in low-density data servers, emergence of AI, high-performance electronics, telecom, and other technologies, development of cooling solutions for deployment in harsh environments, high-density cooling requirements), and challenges (High investment in existing infrastructure and retrofitting immersion cooling solutions in large- and medium-scale data centers) influencing the growth of the immersion cooling market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the immersion cooling market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the immersion cooling market across several regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the immersion cooling market.

- Competitive Assessment: In-depth assessment of the market shares, growth strategies, and service offerings of leading and other players in the immersion cooling market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE AND SEGMENTATION

- 1.3.1 IMMERSION COOLING MARKET, INCLUSIONS AND EXCLUSIONS

- 1.3.2 IMMERSION COOLING MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 CALCULATION OF BASE MARKET SIZE

- 2.3.1 SUPPLY-SIDE APPROACH

- 2.3.2 DEMAND-SIDE APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN IMMERSION COOLING MARKET

- 4.2 IMMERSION COOLING MARKET, BY REGION

- 4.3 NORTH AMERICA IMMERSION COOLING MARKET, BY APPLICATION AND COUNTRY

- 4.4 IMMERSION COOLING MARKET, BY MAJOR COUNTRIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Adoption in cryptocurrency mining and blockchain

- 5.2.1.2 Growing density of servers

- 5.2.1.3 Increasing need for eco-friendly data center cooling solutions

- 5.2.1.4 Rising need for cost-effective cooling solutions

- 5.2.1.5 Increasing demand for compact and noise-free solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Susceptibility to leakage

- 5.2.2.2 Dominance of air cooling technology

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption in low-density data centers

- 5.2.3.2 Emergence of AI, high-performance electronics, telecom, and other technologies

- 5.2.3.3 Development of cooling solutions for deployment in harsh environments

- 5.2.3.4 High-density cooling requirements

- 5.2.4 CHALLENGES

- 5.2.4.1 Significant investments in existing infrastructure

- 5.2.4.2 Retrofitting immersion cooling solutions in large and medium-scale data centers

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA FOR CRYPTOCURRENCY MINING

- 5.5 BUYING CRITERIA

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2030

- 5.8 SUPPLY CHAIN ANALYSIS

- 5.9 ECOSYSTEM/MARKET MAP

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 SINGLE-PHASE

- 5.10.1.1 IT chassis

- 5.10.1.2 Single-phase tub/open bath

- 5.10.2 TWO-PHASE

- 5.10.2.1 Two-phase tub/open bath

- 5.10.3 HYBRID

- 5.10.1 SINGLE-PHASE

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TRADE DATA

- 5.13.1 IMPORT SCENARIO (HS CODE 271019)

- 5.13.2 EXPORT SCENARIO (HS CODE 271019)

- 5.14 IMPACT OF AI/GEN AI ON DATA CENTER LIQUID COOLING MARKET

- 5.14.1 TOP USE CASES AND MARKET POTENTIAL

- 5.14.2 BEST MARKET PRACTICES

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 OPEN COMPUTE PROJECT (OCP) - QUALITY & SAFETY REQUIREMENTS FOR IMMERSION COOLING TECHNOLOGY

- 5.16.2 OPEN COMPUTE PROJECT (OCP) - DIELECTRIC COOLING FLUID REQUIREMENTS FOR DATA CENTER APPLICATIONS

- 5.16.3 IMMERSION COOLING TECHNOLOGY - COUNTRY/REGIONAL REGULATIONS

- 5.16.3.1 US

- 5.16.3.2 Europe

- 5.16.3.2.1 China

- 5.16.3.2.2 Japan

- 5.16.3.2.3 India

- 5.16.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.17 MARKETING CHANNELS USED BY IMMERSION COOLING SOLUTION PROVIDERS: COMPARATIVE ANALYSIS

- 5.17.1 B2B MARKETING CHANNELS - COMPARATIVE ANALYSIS

- 5.18 PARTNERS OF IMMERSION COOLING COMPANIES

- 5.18.1 PARTNERSHIPS

- 5.19 TOTAL COST OF OWNERSHIP

- 5.20 CASE STUDY ANALYSIS

- 5.20.1 ASPERITAS AND ITRENEW PARTNER TO BRING SUSTAINABLE, PLUG-AND-PLAY DATA CENTER SOLUTION FULL CIRCLE

- 5.20.2 DUG REDUCED ENERGY SPENDING IN DATA CENTER BY ADOPTING GRC'S IMMERSION COOLING TECHNOLOGY

- 5.20.3 MICROSOFT CHOSE IMMERSION COOLING TECHNOLOGY BY LIQUIDSTACK FOR ITS CLOUD SERVERS

- 5.20.4 BITFURY GROUP ENHANCES DATA CENTER COOLING EFFICIENCY USING 3M'S ENGINEERED FLUIDS

- 5.20.5 MACQUARIE TELECOM GROUP TO DEPLOY SUBMER'S IMMERSION COOLING SOLUTIONS AT ITS DATA CENTERS

- 5.20.6 NTT DATA CORPORATION TO ADOPT LIQUIDSTACK'S TWO-PHASE IMMERSION COOLING SOLUTIONS AT ITS DATA CENTERS

- 5.21 GLOBAL MACROECONOMIC OUTLOOK

- 5.21.1 GDP

- 5.22 IMPACT OF 2025 US TARIFF- IMMERSION COOLING MARKET

- 5.22.1 INTRODUCTION

- 5.22.2 KEY TARIFF RATES IMPACTING MARKET

- 5.22.3 PRICE IMPACT ANALYSIS

- 5.22.4 KEY IMPACT ON VARIOUS REGIONS/COUNTRIES

- 5.22.4.1 US

- 5.22.4.2 Europe

- 5.22.4.3 Asia Pacific

- 5.22.5 IMPACT ON APPLICATIONS

6 IMMERSION COOLING MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 SINGLE-PHASE IMMERSION COOLING

- 6.2.1 DEMAND FOR EFFICIENT COOLING AND LOW MAINTENANCE TO DRIVE MARKET

- 6.3 TWO-PHASE IMMERSION COOLING

- 6.3.1 FLUID LOSS TO BE PRIMARY CONCERN

7 IMMERSION COOLING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 HIGH-PERFORMANCE COMPUTING

- 7.2.1 DEMAND FOR SOLVING COMPLEX COMPUTE-INTENSIVE PROBLEMS TO DRIVE MARKET

- 7.3 EDGE COMPUTING

- 7.3.1 SIGNIFICANT INCREASE IN NUMBER OF INTELLIGENT APPLICATIONS TO BOOST MARKET

- 7.4 ARTIFICIAL INTELLIGENCE

- 7.4.1 DIGITAL TRANSFORMATION OF COMPANIES TO PROPEL MARKET

- 7.5 CRYPTOCURRENCY MINING

- 7.5.1 HIGH POTENTIAL FOR GROWTH TO FUEL DEMAND

- 7.6 OTHER APPLICATIONS

8 IMMERSION COOLING MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 SOLUTIONS

- 8.2.1 GROWING DEMAND FOR HIGH-DENSITY SERVER COOLING TO DRIVE MARKET

- 8.3 SERVICES

- 8.3.1 INCREASING ADOPTION OF CUSTOMIZED SERVICES TO BOOST MARKET

9 IMMERSION COOLING MARKET, BY COOLING FLUID

- 9.1 INTRODUCTION

- 9.2 SYNTHETIC FLUIDS

- 9.2.1 LOW CORROSION AND FLAMMABILITY TO FUEL DEMAND

- 9.3 MINERAL OIL

- 9.3.1 INEXPENSIVE, NON-TOXIC, AND LOW CORROSION TO DRIVE GROWTH

- 9.4 FLUOROCARBON-BASED FLUIDS

- 9.4.1 INCREASING DEMAND IN HIGH-PERFORMANCE LIQUID COOLING APPLICATIONS TO BOOST GROWTH

- 9.5 OTHER COOLING FLUIDS

10 IMMERSION COOLING MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Rise in number of data centers to drive market

- 10.2.2 INDIA

- 10.2.2.1 Surging demand from data centers to boost market

- 10.2.3 JAPAN

- 10.2.3.1 Redesigning existing data center facilities to drive market

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Advancements in AI and cryptocurrency mining to drive market

- 10.2.5 THAILAND

- 10.2.5.1 Expansion of digital hardware infrastructure to fuel market

- 10.2.6 MALAYSIA

- 10.2.6.1 Rapid cloud service adoption to fuel market

- 10.2.7 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Attractive investments and growth of data centers to boost market

- 10.3.2 FRANCE

- 10.3.2.1 Rising demand for immersion cooling from cloud providers to drive market

- 10.3.3 NETHERLANDS

- 10.3.3.1 Use of green energy for data centers to propel market

- 10.3.4 UK

- 10.3.4.1 New eco-design requirements set by European parliament for servers and data centers to drive market

- 10.3.5 RUSSIA

- 10.3.5.1 Growing demand for computing resources and data storage systems to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Innovations in cloud computing to boost demand for data center solutions

- 10.3.7 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Surging demand from cryptocurrency providers to drive market

- 10.4.2 CANADA

- 10.4.2.1 Increasing digitalization and massive data generation to boost market

- 10.4.3 MEXICO

- 10.4.3.1 Big data and automation technologies to fuel growth

- 10.4.1 US

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 SAUDI ARABIA

- 10.5.1.1 Harsh climatic conditions and government-backed digital transformation initiatives to drive market

- 10.5.2 UAE

- 10.5.2.1 Sustainability and hyperscale growth to boost market

- 10.5.3 REST OF GCC

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- 10.5.1 SAUDI ARABIA

- 10.6 SOUTH AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.1.1 STRATEGIES ADOPTED BY KEY MARKET PLAYERS, 2019-2025

- 11.2 REVENUE ANALYSIS

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.3.1 MARKET SHARE OF KEY PLAYERS

- 11.4 BRAND PRODUCT COMPARISON

- 11.5 COMPANY EVALUATION MATRIX, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 Application footprint

- 11.6 STARTUP/SME EVALUATION MATRIX, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 DYNAMIC COMPANIES

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES

- 11.8.2 DEALS

- 11.8.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 GREEN REVOLUTION COOLING INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 SUBMER

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.3.4 Others

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 ASPERITAS

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 LIQUIDSTACK HOLDING B. V.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Others

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 MIDAS IMMERSION COOLING

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 VERTIV GROUP CORP.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.4 MnM view

- 12.1.6.4.1 Right to win

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses and competitive threats

- 12.1.7 ICEOTOPE PRECISION LIQUID COOLING

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.8 LIQUIDCOOL SOLUTIONS

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 DUG TECHNOLOGY

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 DCX LIQUID COOLING SYSTEMS

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Others

- 12.1.11 STULZ GMBH

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.12 MODINE

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches

- 12.1.12.3.2 Deals

- 12.1.12.3.3 Expansions

- 12.1.13 GIGA-BYTE TECHNOLOGY CO., LTD.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.14 WIWYNN CORPORATION

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.15 KAORI HEAT TREATMENT CO., LTD.

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.16 DELTA POWER SOLUTIONS

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Solutions/Services offered

- 12.1.17 BOYD

- 12.1.17.1 Business overview

- 12.1.17.2 Products/Solutions/Services offered

- 12.1.1 GREEN REVOLUTION COOLING INC.

- 12.2 OTHER PLAYERS

- 12.2.1 HYPERTEC GROUP INC.

- 12.2.2 PEZY COMPUTING

- 12.2.3 TAS

- 12.2.4 RSI K.K.

- 12.2.5 TEIMMERS

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 IMMERSION COOLING INTERCONNECTED MARKETS

- 13.3.1 DATA CENTER LIQUID COOLING MARKET

- 13.3.1.1 Market definition

- 13.3.1.2 Market overview

- 13.3.1.3 Data center liquid cooling market, by type of cooling

- 13.3.1.3.1 Cold plate liquid cooling

- 13.3.1.3.1.1 high-density data center installation TO drive demand

- 13.3.1.3.1 Cold plate liquid cooling

- 13.3.1.4 Immersed liquid cooling

- 13.3.1.4.1 low carbon footprint through immersion liquid cooling to drive segment

- 13.3.1 DATA CENTER LIQUID COOLING MARKET

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS