|

|

市場調査レポート

商品コード

1758241

精密農業の世界市場:オファリング別、技術別、用途別、地域別 - 2032年までの予測Precision Farming Market by Automation & Control Systems, Cloud-based Software, System Integration & Consulting Services, Guidance Technology, Variable Rate Technology, Yield Monitoring, Field Mapping, Variable Rate Application - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 精密農業の世界市場:オファリング別、技術別、用途別、地域別 - 2032年までの予測 |

|

出版日: 2025年06月24日

発行: MarketsandMarkets

ページ情報: 英文 294 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

精密農業の市場規模は、9.5%のCAGRで拡大し、2025年の113億8,000万米ドルから2032年には214億5,000万米ドルに成長すると予測されています。

持続可能な農業を重視する傾向が強まっており、資源の効率的な利用を促進し、環境への影響を低減することで、精密農業市場の成長が加速しています。IoTセンサー、ドローン、AI主導の分析などの精密農業技術により、農家は水、肥料、農薬の使用量を最適化し、廃棄物や土壌の劣化を最小限に抑えることができます。これは、世界の持続可能性の目標や、農業における二酸化炭素排出量の削減を求める規制の圧力と一致します。さらに、環境に優しい有機農産物に対する消費者の需要は、生態系を保全しながら収量を向上させるこうした技術の採用を農家に促しています。その結果、持続可能なソリューションへのニーズが広範な採用を促し、精密農業市場の各地域での拡大に拍車をかけています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | オファリング別、技術別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

ガイダンス技術は、作業効率の向上と人件費の削減に重要な役割を果たすため、2024年の精密農業市場で最大のシェアを占めました。GPS、自動操舵システム、GNSSなどの技術は、正確なナビゲーションと圃場マッピングを可能にし、農家が重複や無駄を最小限に抑えて植え付け、収穫、圃場作業を最適化できるようにします。主な促進要因には、自動化機械の導入の増加、農場規模の拡大、労働力不足の中での生産性向上の必要性などがあります。さらに、スマート農業に対する政府の補助金と持続可能な実践の推進が需要をさらに押し上げています。

可変施肥は、資源利用を最適化し、作物収量を向上させる能力により、予測期間中、精密農業市場で2番目に高いCAGRを記録しました。VRAにより、農家は肥料、農薬、水を圃場全体に様々な割合で散布することができ、特定の土壌と作物のニーズに合わせて投入を調整することができます。主な促進要因としては、リアルタイムの圃場モニタリングのためのデータ分析とIoTの採用の高まり、持続可能な農法への需要の高まり、施肥精度を高めるセンサー技術の進歩などが挙げられます。さらに、食糧需要を満たしながら投入コストと環境への影響を削減する必要性が、精密農業におけるVRAの急速な普及を後押ししています。

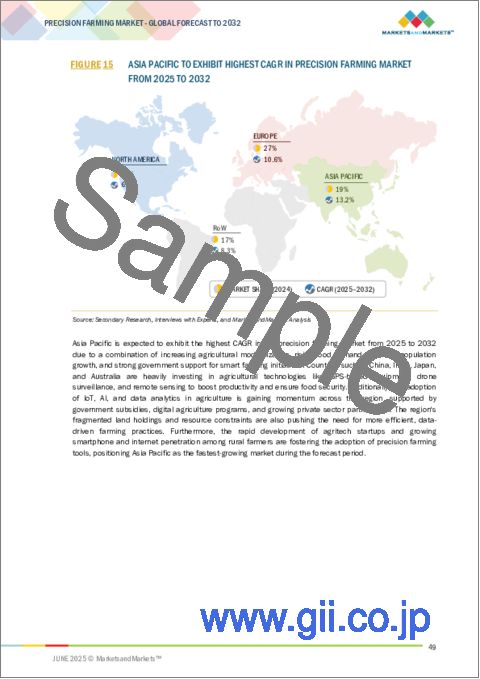

中国は、膨大な人口に対する食糧安全保障を確保するための補助金やスマート農業を推進する政策など、政府の強力な支援により、アジア太平洋精密農業市場の成長をリードすることになります。急速な都市化と食糧需要の増加が効率的な農業の必要性を後押しし、農家はより良い作物管理のためにIoT、AI、ドローンなどの先進技術を採用するようになっています。さらに、農業研究開発への多額の投資に支えられた中国の技術革新への注力は、精密農業ツールの統合を加速させています。政府の取り組み、差し迫った食糧安全保障のニーズ、広範な技術導入の組み合わせにより、中国はこの地域の精密農業市場成長のフロントランナーとして位置づけられています。

当レポートでは、世界の精密農業市場について調査し、オファリング別、技術別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 生成AI/AIが精密農業市場に与える影響

- 2025年の米国関税が精密農業市場に与える影響

第6章 精密農業市場、オファリング別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第7章 精密農業市場、技術別

- イントロダクション

- ガイダンステクノロジー

- リモートセンシング技術

- 可変作業技術

第8章 精密農業市場、用途別

- イントロダクション

- 収量監視

- 作物スカウティング

- フィールドマッピング

- 可変施肥

- 気象追跡と予報

- 在庫管理

- 農場労働管理

- 財務管理

- その他

第9章 地域別精密農業市場

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2024年~2025年

- 収益分析、2022年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標、2025年

- 製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- イントロダクション

- 主要参入企業

- DEERE & COMPANY

- AGCO CORPORATION

- CNH INDUSTRIAL N.V.

- AG LEADER TECHNOLOGY

- AGEAGLE AERIAL SYSTEMS INC.

- TOPCON CORPORATION

- BAYER AG(CLIMATE LLC)

- TEEJET TECHNOLOGIES

- HEXAGON AB

- KUBOTA CORPORATION

- その他の企業

- TRIMBLE INC.

- ABACO S.P.A.

- CROPX INC.

- FARMERS EDGE INC.

- GROWNETICS

- CROPIN TECHNOLOGY SOLUTIONS PRIVATE LIMITED

- GAMAYA

- DICKEY-JOHN

- TELUS

- HARXON CORPORATION

- AGRICOLUS

- ESRI

- FARMDOK GMBH

- YARA

- CLAAS KGAA MBH

第12章 付録

List of Tables

- TABLE 1 PRECISION FARMING MARKET: RISK ANALYSIS

- TABLE 2 AVERAGE SELLING PRICE TREND OF PRECISION FARMING DRONES, BY REGION, 2021-2024 (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF PRECISION FARMING COMPONENTS OFFERED BY KEY PLAYERS, BY HARDWARE, 2020-2024 (USD)

- TABLE 4 PRECISION FARMING MARKET: ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 5 LIST OF KEY PATENTS IN PRECISION FARMING MARKET, 2023-2025

- TABLE 6 IMPORT DATA FOR HS CODE 8433-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 7 EXPORT DATA FOR HS CODE 8433-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 PRECISION FARMING MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 9 MFN TARIFF FOR HS CODE 8433-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2025

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 PRECISION FARMING MARKET: REGULATORY LANDSCAPE

- TABLE 15 PRECISION FARMING MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 17 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 18 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 19 PRECISION FARMING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 20 PRECISION FARMING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 21 PRECISION FARMING MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 22 PRECISION FARMING MARKET, BY HARDWARE, 2025-2032 (USD MILLION)

- TABLE 23 HARDWARE: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 24 HARDWARE: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 25 HARDWARE: PRECISION FARMING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 26 HARDWARE: PRECISION FARMING MARKET, BY TECHNOLOGY, 2025-2032 (USD MILLION)

- TABLE 27 AUTOMATION & CONTROL SYSTEMS: PRECISION FARMING MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 28 AUTOMATION & CONTROL SYSTEMS: PRECISION FARMING MARKET, BY DEVICE TYPE, 2025-2032 (USD MILLION)

- TABLE 29 AUTOMATION & CONTROL SYSTEMS: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 AUTOMATION & CONTROL SYSTEMS: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 31 DRONES/UAVS: PRECISION FARMING MARKET, BY VOLUME, 2021-2024 (THOUSAND UNITS)

- TABLE 32 DRONES/UAVS: PRECISION FARMING MARKET, BY VOLUME, 2025-2032 (THOUSAND UNITS)

- TABLE 33 SENSING & MONITORING DEVICES: PRECISION FARMING MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 34 SENSING & MONITORING DEVICES: PRECISION FARMING MARKET, BY DEVICE TYPE, 2025-2032 (USD MILLION)

- TABLE 35 SENSING & MONITORING DEVICES: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 SENSING & MONITORING DEVICES: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 37 SOIL SENSORS: PRECISION FARMING MARKET, BY SENSOR TYPE, 2021-2024 (USD MILLION)

- TABLE 38 SOIL SENSORS: PRECISION FARMING MARKET, BY SENSOR TYPE, 2025-2032 (USD MILLION)

- TABLE 39 SOFTWARE: PRECISION FARMING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 40 SOFTWARE: PRECISION FARMING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 41 SOFTWARE: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 SOFTWARE: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 43 SOFTWARE: PRECISION FARMING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 44 SOFTWARE: PRECISION FARMING MARKET, BY TECHNOLOGY, 2025-2032 (USD MILLION)

- TABLE 45 LOCAL/WEB-BASED SOFTWARE: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 LOCAL/WEB-BASED SOFTWARE: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 47 CLOUD-BASED SOFTWARE: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 CLOUD-BASED SOFTWARE: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 49 SERVICES: PRECISION FARMING MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 50 SERVICES: PRECISION FARMING MARKET, BY SERVICE TYPE, 2025-2032 (USD MILLION)

- TABLE 51 SERVICES: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 SERVICES: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 53 SERVICES: PRECISION FARMING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 54 SERVICES: PRECISION FARMING MARKET, BY TECHNOLOGY, 2025-2032 (USD MILLION)

- TABLE 55 SYSTEM INTEGRATION & CONSULTING SERVICES: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 SYSTEM INTEGRATION & CONSULTING SERVICES: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 57 MANAGED SERVICES: PRECISION FARMING MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 58 MANAGED SERVICES: PRECISION FARMING MARKET, BY SERVICE TYPE, 2025-2032 (USD MILLION)

- TABLE 59 MANAGED SERVICES: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 MANAGED SERVICES: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 61 CONNECTIVITY SERVICES: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 CONNECTIVITY SERVICES: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 63 ASSISTED PROFESSIONAL SERVICES: PRECISION FARMING MARKET, BY REGION, 2021-2024(USD MILLION)

- TABLE 64 ASSISTED PROFESSIONAL SERVICES: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 65 MAINTENANCE & SUPPORT SERVICES: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 MAINTENANCE & SUPPORT SERVICES: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 67 PRECISION FARMING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 68 PRECISION FARMING MARKET, BY TECHNOLOGY, 2025-2032 (USD MILLION)

- TABLE 69 GUIDANCE TECHNOLOGY: PRECISION FARMING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 70 GUIDANCE TECHNOLOGY: PRECISION FARMING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 71 GUIDANCE TECHNOLOGY: PRECISION FARMING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 72 GUIDANCE TECHNOLOGY: PRECISION FARMING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 73 REMOTE SENSING TECHNOLOGY: PRECISION FARMING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 74 REMOTE SENSING TECHNOLOGY: PRECISION FARMING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 75 REMOTE SENSING TECHNOLOGY: PRECISION FARMING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 76 REMOTE SENSING TECHNOLOGY: PRECISION FARMING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 77 VARIABLE RATE TECHNOLOGY: PRECISION FARMING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 78 VARIABLE RATE TECHNOLOGY: PRECISION FARMING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 79 VARIABLE RATE TECHNOLOGY: PRECISION FARMING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 80 VARIABLE RATE TECHNOLOGY: PRECISION FARMING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 81 PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 82 PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 83 BENEFITS OF YIELD MONITORING

- TABLE 84 YIELD MONITORING: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 YIELD MONITORING: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 86 YIELD MONITORING: PRECISION FARMING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 87 YIELD MONITORING: PRECISION FARMING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 88 CROP SCOUTING: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 CROP SCOUTING: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 90 FIELD MAPPING: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 FIELD MAPPING: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 92 FIELD MAPPING: PRECISION FARMING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 93 FIELD MAPPING: PRECISION FARMING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 94 VARIABLE RATE APPLICATION: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 VARIABLE RATE APPLICATION: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 96 VARIABLE RATE APPLICATION: PRECISION FARMING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 97 VARIABLE RATE APPLICATION: PRECISION FARMING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 98 WEATHER TRACKING & FORECASTING: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 WEATHER TRACKING & FORECASTING: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 100 INVENTORY MANAGEMENT: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 INVENTORY MANAGEMENT: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 102 FARM LABOR MANAGEMENT: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 FARM LABOR MANAGEMENT: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 104 FINANCIAL MANAGEMENT: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 105 FINANCIAL MANAGEMENT: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 106 OTHER APPLICATIONS: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 OTHER APPLICATIONS: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 108 PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 109 PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 110 NORTH AMERICA: PRECISION FARMING MARKET, 2021-2024 (USD MILLION)

- TABLE 111 NORTH AMERICA: PRECISION FARMING MARKET, 2025-2032 (USD MILLION)

- TABLE 112 NORTH AMERICA: PRECISION FARMING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 113 NORTH AMERICA: PRECISION FARMING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 114 NORTH AMERICA: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 115 NORTH AMERICA: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 116 US: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 117 US: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 118 CANADA: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 119 CANADA: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 120 MEXICO: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 121 MEXICO: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 122 EUROPE: PRECISION FARMING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 123 EUROPE: PRECISION FARMING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 124 EUROPE: PRECISION FARMING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 125 EUROPE: PRECISION FARMING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 126 EUROPE: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 127 EUROPE: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 128 GERMANY: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 129 GERMANY: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 130 UK: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 131 UK: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 132 FRANCE: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 133 FRANCE: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 134 SPAIN: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 135 SPAIN: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 136 ITALY: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 137 ITALY: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 138 POLAND: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 POLAND: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 140 NORDICS: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 141 NORDICS: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 142 REST OF EUROPE: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 143 REST OF EUROPE: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 144 ASIA PACIFIC: PRECISION FARMING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 145 ASIA PACIFIC: PRECISION FARMING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 146 ASIA PACIFIC: PRECISION FARMING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 147 ASIA PACIFIC: PRECISION FARMING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 148 ASIA PACIFIC: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 149 ASIA PACIFIC: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 150 CHINA: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 151 CHINA: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 152 JAPAN: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 153 JAPAN: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 154 SOUTH KOREA: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 155 SOUTH KOREA: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 156 INDIA: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 157 INDIA: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 158 AUSTRALIA: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 159 AUSTRALIA: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 160 INDONESIA: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 161 INDONESIA: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 162 MALAYSIA: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 163 MALAYSIA: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 164 THAILAND: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 165 THAILAND: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 166 VIETNAM: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 167 VIETNAM: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 170 REST OF THE WORLD: PRECISION FARMING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 171 REST OF THE WORLD: PRECISION FARMING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 172 REST OF THE WORLD: PRECISION FARMING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 173 REST OF THE WORLD: PRECISION FARMING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 174 REST OF THE WORLD: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 175 REST OF THE WORLD: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 176 MIDDLE EAST: PRECISION FARMING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 177 MIDDLE EAST: PRECISION FARMING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 178 MIDDLE EAST: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 179 MIDDLE EAST: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 180 AFRICA: PRECISION FARMING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 181 AFRICA: PRECISION FARMING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 182 AFRICA: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 183 AFRICA: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 184 SOUTH AMERICA: PRECISION FARMING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 185 SOUTH AMERICA: PRECISION FARMING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 186 SOUTH AMERICA: PRECISION FARMING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 187 SOUTH AMERICA: PRECISION FARMING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 188 PRECISION FARMING MARKET: KEY PLAYERS' STRATEGIES/RIGHT TO WIN, 2024-2025

- TABLE 189 PRECISION FARMING MARKET: DEGREE OF COMPETITION

- TABLE 190 PRECISION FARMING MARKET: REGION FOOTPRINT

- TABLE 191 PRECISION FARMING MARKET: OFFERING FOOTPRINT

- TABLE 192 PRECISION FARMING MARKET: TECHNOLOGY FOOTPRINT

- TABLE 193 PRECISION FARMING MARKET: APPLICATION FOOTPRINT

- TABLE 194 PRECISION FARMING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 195 PRECISION FARMING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 196 PRECISION FARMING MARKET: PRODUCT LAUNCHES, MARCH 2024-MAY 2025

- TABLE 197 PRECISION FARMING MARKET: DEALS, MARCH 2024-MAY 2025

- TABLE 198 DEERE & COMPANY: COMPANY OVERVIEW

- TABLE 199 DEERE & COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 DEERE & COMPANY: PRODUCT LAUNCHES

- TABLE 201 DEERE & COMPANY: DEALS

- TABLE 202 DEERE & COMPANY: OTHER DEVELOPMENTS

- TABLE 203 AGCO CORPORATION: COMPANY OVERVIEW

- TABLE 204 AGCO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 AGCO CORPORATION: PRODUCT LAUNCHES

- TABLE 206 AGCO CORPORATION: DEALS

- TABLE 207 CNH INDUSTRIAL N.V.: COMPANY OVERVIEW

- TABLE 208 CNH INDUSTRIAL N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 CNH INDUSTRIAL N.V.: DEALS

- TABLE 210 AG LEADER TECHNOLOGY: COMPANY OVERVIEW

- TABLE 211 AG LEADER TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 AG LEADER TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 213 AGEAGLE AERIAL SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 214 AGEAGLE AERIAL SYSTEMS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 TOPCON CORPORATION: COMPANY OVERVIEW

- TABLE 216 TOPCON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 TOPCON CORPORATION: DEALS

- TABLE 218 BAYER AG (CLIMATE LLC): COMPANY OVERVIEW

- TABLE 219 BAYER AG (CLIMATE LLC): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 BAYER AG (CLIMATE LLC): PRODUCT LAUNCHES

- TABLE 221 BAYER AG (CLIMATE LLC): DEALS

- TABLE 222 TEEJET TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 223 TEEJET TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 HEXAGON AB: COMPANY OVERVIEW

- TABLE 225 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 HEXAGON AB: PRODUCT LAUNCHES

- TABLE 227 KUBOTA CORPORATION: COMPANY OVERVIEW

- TABLE 228 KUBOTA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 KUBOTA CORPORATION: DEALS

- TABLE 230 TRIMBLE INC.: COMPANY OVERVIEW

- TABLE 231 ABACO S.P.A.: COMPANY OVERVIEW

- TABLE 232 CROPX INC.: COMPANY OVERVIEW

- TABLE 233 FARMERS EDGE INC.: COMPANY OVERVIEW

- TABLE 234 GROWNETICS: COMPANY OVERVIEW

- TABLE 235 CROPIN TECHNOLOGY SOLUTIONS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 236 GAMAYA: COMPANY OVERVIEW

- TABLE 237 DICKEY-JOHN: COMPANY OVERVIEW

- TABLE 238 TELUS: COMPANY OVERVIEW

- TABLE 239 HARXON CORPORATION: COMPANY OVERVIEW

- TABLE 240 AGRICOLUS: COMPANY OVERVIEW

- TABLE 241 ESRI: COMPANY OVERVIEW

- TABLE 242 FARMDOK GMBH: COMPANY OVERVIEW

- TABLE 243 YARA: COMPANY OVERVIEW

- TABLE 244 CLAAS KGAA MBH: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PRECISION FARMING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 PRECISION FARMING MARKET: RESEARCH DESIGN

- FIGURE 3 PRECISION FARMING MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE)

- FIGURE 4 PRECISION FARMING MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (SUPPLY SIDE)

- FIGURE 5 PRECISION FARMING MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3 (DEMAND SIDE)

- FIGURE 6 PRECISION FARMING MARKET: BOTTOM-UP APPROACH

- FIGURE 7 PRECISION FARMING MARKET: TOP-DOWN APPROACH

- FIGURE 8 PRECISION FARMING MARKET: DATA TRIANGULATION

- FIGURE 9 PRECISION FARMING MARKET: RESEARCH ASSUMPTIONS

- FIGURE 10 PRECISION FARMING MARKET: RESEARCH LIMITATIONS

- FIGURE 11 PRECISION FARMING MARKET SIZE, 2021-2032 (USD MILLION)

- FIGURE 12 HARDWARE SEGMENT TO DOMINATE PRECISION FARMING MARKET BETWEEN 2025 AND 2032

- FIGURE 13 AUTOMATION & CONTROL SYSTEMS TO ACCOUNT FOR DOMINANT SHARE OF HARDWARE IN PRECISION FARMING MARKET IN 2025

- FIGURE 14 REMOTE SENSING TECHNOLOGY TO ACCOUNT FOR LARGEST SHARE OF PRECISION FARMING MARKET IN 2032

- FIGURE 15 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN PRECISION FARMING MARKET FROM 2025 TO 2032

- FIGURE 16 INCREASING AUTOMATION TREND TO PROVIDE LUCRATIVE OPPORTUNITIES FOR PLAYERS IN PRECISION FARMING MARKET

- FIGURE 17 DRONES/UAVS TO ACCOUNT FOR LARGEST SHARE OF PRECISION FARMING MARKET DURING FORECAST PERIOD

- FIGURE 18 YIELD MONITORING TO BE LARGEST APPLICATION IN PRECISION FARMING MARKET FROM 2025 TO 2032

- FIGURE 19 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF PRECISION FARMING MARKET FROM 2025 TO 2032

- FIGURE 20 PRECISION FARMING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 PRECISION FARMING MARKET DRIVERS: IMPACT ANALYSIS

- FIGURE 22 PRECISION FARMING MARKET RESTRAINTS: IMPACT ANALYSIS

- FIGURE 23 PRECISION FARMING MARKET OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 24 PRECISION FARMING MARKET CHALLENGES: IMPACT ANALYSIS

- FIGURE 25 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN PRECISION FARMING MARKET

- FIGURE 26 AVERAGE SELLING PRICE TREND OF PRECISION FARMING DRONES, BY REGION, 2021-2024

- FIGURE 27 AVERAGE SELLING PRICE OF PRECISION FARMING HARDWARE COMPONENTS OFFERED BY KEY PLAYERS IN 2024

- FIGURE 28 PRECISION FARMING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 KEY PLAYERS IN PRECISION FARMING ECOSYSTEM

- FIGURE 30 NUMBER OF PATENTS GRANTED IN PRECISION FARMING MARKET, 2015-2024

- FIGURE 31 IMPORT SCENARIO FOR HS CODE 8433-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 32 EXPORT SCENARIO FOR HS CODE 8433-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 34 PRECISION FARMING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 37 IMPACT OF GEN AI/AI ON PRECISION FARMING MARKET

- FIGURE 38 SOFTWARE SEGMENT TO RECORD HIGHEST CAGR IN PRECISION FARMING MARKET DURING FORECAST PERIOD

- FIGURE 39 VARIABLE RATE TECHNOLOGY TO EXHIBIT HIGHEST CAGR IN PRECISION FARMING MARKET DURING FORECAST PERIOD

- FIGURE 40 YIELD MONITORING APPLICATION TO ACCOUNT FOR LARGEST MARKET SHARE FROM 2025 TO 2032

- FIGURE 41 PRECISION FARMING MARKET, BY REGION

- FIGURE 42 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: PRECISION FARMING MARKET SNAPSHOT

- FIGURE 44 EUROPE: PRECISION FARMING MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: PRECISION FARMING MARKET SNAPSHOT

- FIGURE 46 SOUTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN REST OF THE WORLD DURING FORECAST PERIOD

- FIGURE 47 PRECISION FARMING MARKET: REVENUE ANALYSIS OF FOUR KEY PLAYERS, 2022-2024

- FIGURE 48 MARKET SHARE ANALYSIS OF COMPANIES OFFERING PRECISION FARMING SOLUTIONS, 2024

- FIGURE 49 COMPANY VALUATION, 2025

- FIGURE 50 FINANCIAL METRICS, 2025

- FIGURE 51 PRODUCT COMPARISON

- FIGURE 52 PRECISION FARMING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 53 PRECISION FARMING MARKET: COMPANY FOOTPRINT

- FIGURE 54 PRECISION FARMING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 55 DEERE & COMPANY: COMPANY SNAPSHOT

- FIGURE 56 AGCO CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 CNH INDUSTRIAL N.V.: COMPANY SNAPSHOT

- FIGURE 58 AGEAGLE AERIAL SYSTEMS INC.: COMPANY SNAPSHOT

- FIGURE 59 TOPCON CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 BAYER AG (CLIMATE LLC): COMPANY SNAPSHOT

- FIGURE 61 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 62 KUBOTA CORPORATION: COMPANY SNAPSHOT

The precision farming market is expected to grow from USD 11.38 billion in 2025 to USD 21.45 billion by 2032, at a CAGR of 9.5%. The growing emphasis on sustainable agricultural practices is accelerating the precision farming market's growth by promoting efficient resource use and reducing environmental impact. Precision farming technologies, such as IoT sensors, drones, and AI-driven analytics, enable farmers to optimize water, fertilizer, and pesticide usage, minimizing waste and soil degradation. This aligns with global sustainability goals and regulatory pressures to lower carbon footprints in agriculture. Additionally, consumer demand for eco-friendly and organic produce encourages farmers to adopt these technologies, enhancing yields while preserving ecosystems. As a result, the need for sustainable solutions drives widespread adoption, fueling the precision farming market's expansion across regions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By offering, technology, application, and region |

| Regions covered | North America, Europe, APAC, RoW |

"Guidance technology accounted for the largest market share in 2024"

Guidance technology accounted for the largest share of the precision farming market in 2024 due to its critical role in enhancing operational efficiency and reducing labor costs. Technologies like GPS, auto-steering systems, and GNSS enable precise navigation and field mapping, allowing farmers to optimize planting, harvesting, and field operations with minimal overlap or waste. Key drivers include the rising adoption of automated machinery, increasing farm sizes, and the need for higher productivity amid labor shortages. Additionally, government subsidies for smart agriculture and the push for sustainable practices further boost demand.

"Variable rate application is projected to register the second-highest CAGR during the forecast period"

Variable rate application (VRA) recorded the second-highest CAGR in the precision farming market during the forecast period due to its ability to optimize resource use and boost crop yields. VRA allows farmers to apply fertilizers, pesticides, and water at varying rates across a field, tailoring inputs to specific soil and crop needs. Key drivers include the rising adoption of data analytics and IoT for real-time field monitoring, increasing demand for sustainable farming practices, and advancements in sensor technology that enhance application precision. Additionally, the need to reduce input costs and environmental impact while meeting food demand fuels the rapid adoption of VRAin precision agriculture.

"China is estimated to lead growth in Asia Pacific precision farming market during the forecast period"

China is set to lead growth in the Asia Pacific precision farming market due to its robust government support, including subsidies and policies promoting smart agriculture to ensure food security for its massive population. Rapid urbanization and rising food demand drive the need for efficient farming, pushing farmers to adopt advanced technologies like IoT, AI, and drones for better crop management. Additionally, China's focus on technological innovation, supported by heavy investments in agricultural R&D, accelerates the integration of precision farming tools. The combination of government initiatives, pressing food security needs, and widespread tech adoption position China as a frontrunner in the region's precision farming market growth.

Breakdown of Primaries

A variety of executives from key organizations operating in the precision farming market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1-35%, Tier 2- 40%, and Tier 3-25%

- By Designation: C-level Executives-30%, Directors-40%, and Others-30%

- By Region: North America-40%, Asia Pacific-32%, Europe-23%, and RoW-5%

The precision farming market is dominated by globally established players such as Deere & Company (US), AGCO Corporation (US), CNH Industrial N.V. (Netherlands), Ag Leader Technology (US), AgEagle Aerial Systems Inc (US), Topcon Corporation (Japan), Bayer AG (Climate LLC.) (Germany), TeeJet Technologies (US), Hexagon AB (Sweden), Kubota Corporation (Japan), Trimble Inc. (US), Abaco S.p.A. (Italy), Cropx Inc. (Israel), Farmers Edge Inc. (Canada), Grownetics (US), Cropin Technology Solutions Private Limited (India), Gamaya (Switzerland), Dickey-John (US), Telus (Canada), Harxon Corporation (China), Aeris (US), Esri (US), Farmdok GmbH (Austria), Yara (Norway), and Claas KGaA mbH (Germany). The study includes an in-depth competitive analysis of these key players in the precision farming market, with their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the precision farming market and forecasts its size by offering, technology, application, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. A supply chain analysis has been included in the report, along with the key players and their competitive analysis of the precision farming ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (technological advancements fueling data-driven and efficient farming, Growing emphasis on sustainable agricultural practices, and Government support and subsidies for smart agriculture), restraints (High initial investment and technology costs, and Lack of technical knowledge and skilled workforce), opportunities (Growth potential of variable rate application (VRA) in precision farming, Adoption of data analytics in the agriculture sector, and Advancements in nanotechnology for precision agriculture), and challenge (Lack of standardized policies and regulations, Data privacy issues and security concerns, and Limited digital infrastructure in rural areas) influencing the growth of the precision farming market

- Products/Solution/Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product/solution/service launches in the precision farming market

- Market Development: Comprehensive information about lucrative markets-the report analyses the precision farming market across varied regions.

- Market Diversification: Exhaustive information about new products/solutions/services, untapped geographies, recent developments, and investments in the precision farming market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Deere & Company (US), AGCO Corporation (US), CNH Industrial N.V. (UK), Kubota Corporation (Japan), and Topcon Corporation (Japan), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RISK ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRECISION FARMING MARKET

- 4.2 PRECISION FARMING MARKET FOR AUTOMATION & CONTROL SYSTEM, BY DEVICE TYPE

- 4.3 PRECISION FARMING MARKET, BY APPLICATION

- 4.4 PRECISION FARMING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements fueling data-driven and efficient farming

- 5.2.1.2 Growing emphasis on sustainable agricultural practices

- 5.2.1.3 Government support and incentives for smart agriculture

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment and technology costs

- 5.2.2.2 Lack of technical knowledge and skilled workforce

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of variable rate application (VRA) in precision farming

- 5.2.3.2 Increasing use of data analytics to optimize farming operations

- 5.2.3.3 Advancement in nanotechnology for precision agriculture

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardized policies and regulations

- 5.2.4.2 Data privacy issues and security concerns

- 5.2.4.3 Limited digital infrastructure in rural areas

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.4.2 AVERAGE SELLING PRICE OF PRECISION FARMING HARDWARE COMPONENTS, BY KEY PLAYERS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Global Positioning System (GPS)/Global Navigation Satellite System (GNSS)

- 5.7.1.2 Remote sensing (Satellite and UAV/drones)

- 5.7.1.3 Geographic Information System (GIS)

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Internet of Things (IoT)

- 5.7.2.2 Artificial intelligence (AI) and machine learning (ML)

- 5.7.2.3 Telematics and wireless communication (e.g., LoRa, NB-IoT, 5G)

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Augmented reality (AR) and virtual reality (VR)

- 5.7.3.2 Digital twin and simulation models

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT DATA

- 5.9.2 EXPORT DATA

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 SYNGENTA ADVANCES PRECISION FARMING WITH SATELLITE INSIGHTS VIA PLANET LABS PBC PARTNERSHIP

- 5.11.2 TELNYX DEPLOYS AUTONOMOUS SENSORS TO ENHANCE COTTON YIELDS IN PARBHANI THROUGH DIGITAL INNOVATION

- 5.11.3 FARMONAUT TECHNOLOGIES PVT. LTD. EMPOWERS CALIFORNIA AGRICULTURE WITH DRONE-ENABLED PRECISION FARMING FOR ENHANCED CROP HEALTH AND EFFICIENCY

- 5.11.4 PRECISION AGRICULTURE ENHANCES COTTON YIELDS IN PARBHANI THROUGH DIGITAL INNOVATION

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 KEY REGULATIONS

- 5.14 PORTER'S FIVE FORCE ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 BARGAINING POWER OF SUPPLIERS

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF GEN AI/AI ON PRECISION FARMING MARKET

- 5.16.1 INTRODUCTION

- 5.17 IMPACT OF 2025 US TARIFF ON PRECISION FARMING MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON APPLICATIONS

6 PRECISION FARMING MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 AUTOMATION & CONTROL SYSTEMS

- 6.2.1.1 Displays

- 6.2.1.1.1 Enhancing efficiency with real-time display hardware integration

- 6.2.1.2 Guidance & steering systems

- 6.2.1.2.1 Increasing use of GPS-based guidance and automated steering solutions to drive market

- 6.2.1.3 GPS/GNSS devices

- 6.2.1.3.1 Need for better resource allocation and increasing yield to increase demand

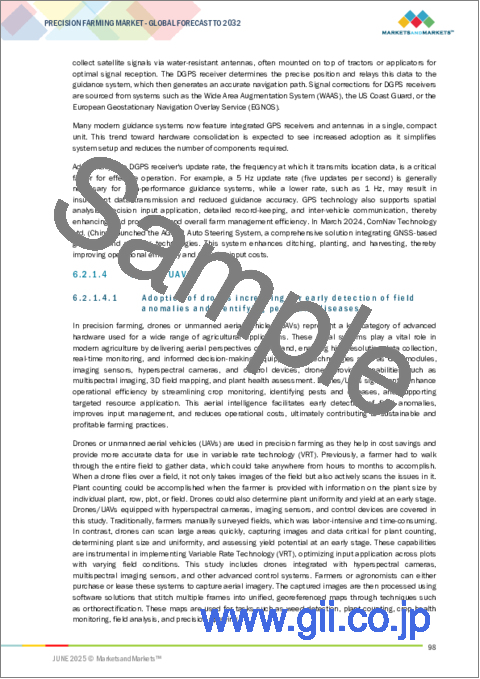

- 6.2.1.4 Drones/UAVs

- 6.2.1.4.1 Adoption of drones increasing for early detection of field anomalies and identifying pests and diseases

- 6.2.1.5 Irrigation controllers

- 6.2.1.5.1 Adoption of irrigation controllers minimizing water waste, enhancing distribution efficiency, and supporting optimal crop hydration

- 6.2.1.6 Handheld mobile devices/handheld computers

- 6.2.1.6.1 Offers flexibility and real-time connectivity for managing agricultural data and processes

- 6.2.1.7 Flow & application control devices

- 6.2.1.7.1 Increasing adoption for optimized input delivery to drive market

- 6.2.1.8 Others

- 6.2.1.1 Displays

- 6.2.2 SENSING & MONITORING DEVICES

- 6.2.2.1 Yield monitors

- 6.2.2.1.1 Offers insights into field variability and enables data-driven decision-making

- 6.2.2.2 Soil sensors

- 6.2.2.2.1 Need for real-time information on soil moisture, pH, and conductivity to drive demand

- 6.2.2.2.2 Moisture sensors

- 6.2.2.2.3 Temperature sensors

- 6.2.2.2.4 Nutrient sensors

- 6.2.2.3 Water sensors

- 6.2.2.3.1 Offers real-time data on water availability, quality, and usage

- 6.2.2.4 Climate sensors

- 6.2.2.4.1 Supports informed decision-making related to planting schedules, irrigation planning, and pest control

- 6.2.2.1 Yield monitors

- 6.2.1 AUTOMATION & CONTROL SYSTEMS

- 6.3 SOFTWARE

- 6.3.1 LOCAL/WEB-BASED SOFTWARE

- 6.3.1.1 Adoption in remote farms to drive market growth

- 6.3.2 CLOUD-BASED SOFTWARE

- 6.3.2.1 Ability to share data seamlessly and access platforms to drive adoption

- 6.3.1 LOCAL/WEB-BASED SOFTWARE

- 6.4 SERVICES

- 6.4.1 SYSTEM INTEGRATION & CONSULTING SERVICES

- 6.4.1.1 Adoption of new hardware driving system integration services

- 6.4.2 MANAGED SERVICES

- 6.4.2.1 Demand for cloud-driven managed services and expert farm operations growing

- 6.4.2.2 Farm operation services

- 6.4.2.3 Data services

- 6.4.2.4 Analytics services

- 6.4.3 CONNECTIVITY SERVICES

- 6.4.3.1 Need for maintaining reliable data transmission to fuel demand

- 6.4.4 ASSISTED PROFESSIONAL SERVICES

- 6.4.4.1 Offers expert guidance on implementation and management of farming technologies

- 6.4.4.2 Supply chain management services

- 6.4.4.3 Climate information services

- 6.4.4.4 Other assisted professional services

- 6.4.5 MAINTENANCE & SUPPORT SERVICES

- 6.4.5.1 Need for improving operation efficiency to drive segmental growth

- 6.4.1 SYSTEM INTEGRATION & CONSULTING SERVICES

7 PRECISION FARMING MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 GUIDANCE TECHNOLOGY

- 7.2.1 ABILITY TO ENHANCE FIELD ACCURACY, INPUT EFFICIENCY, AND DATA-DRIVEN DECISION-MAKING TO DRIVE ADOPTION

- 7.2.2 GPS/GNSS-BASED GUIDANCE TECHNOLOGY

- 7.2.2.1 Ability to enhance site-specific operations, input accuracy, and sustainable resource management to facilitate market growth

- 7.2.3 GIS-BASED GUIDANCE TECHNOLOGY

- 7.2.3.1 Advancing spatial data management, resource optimization, and site-specific decision support to drive market

- 7.3 REMOTE SENSING TECHNOLOGY

- 7.3.1 INCREASING ADOPTION FOR OBSERVATION OF VARIOUS AGRICULTURAL PARAMETERS TO DRIVE DEMAND

- 7.3.2 HANDHELD OR GROUND-BASED SENSING

- 7.3.2.1 Need for cost-effective field monitoring and yield assessment solutions to fuel demand

- 7.3.3 SATELLITE OR AERIAL SENSING

- 7.3.3.1 Adoption of advanced crop monitoring and yield technologies to drive market

- 7.4 VARIABLE RATE TECHNOLOGY

- 7.4.1 NEED FOR ENHANCING FARMING WITH REAL-TIME DATA, SITE-SPECIFIC MANAGEMENT, AND SUSTAINABLE INPUT TO DRIVE MARKET

- 7.4.2 MAP-BASED

- 7.4.2.1 Offers advanced spatial data and site-specific input management

- 7.4.3 SENSOR-BASED

- 7.4.3.1 Adoption of sensor-driven VRT for optimized input application and sustainable crop management to drive growth

8 PRECISION FARMING MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 YIELD MONITORING

- 8.2.1 NECESSITY FOR REAL-TIME YIELD MONITORING TO OPTIMIZE CROP PERFORMANCE AND INPUT MANAGEMENT DRIVING DEMAND

- 8.2.2 ON-FARM YIELD MONITORING

- 8.2.3 OFF-FARM YIELD MONITORING

- 8.3 CROP SCOUTING

- 8.3.1 ADVANCED CROP SCOUTING WITH GPS AND UAV TECHNOLOGIES TO OPTIMIZE INPUT USE AND ENHANCE CROP HEALTH TO DRIVE MARKET GROWTH

- 8.3.2 PRE-SEEDING CROP SCOUTING

- 8.3.3 POST-SEEDING CROP SCOUTING

- 8.3.4 CROP MONITORING

- 8.4 FIELD MAPPING

- 8.4.1 ENHANCING FARM EFFICIENCY WITH ADVANCED MANAGEMENT APPLICATIONS TO SUPPORT MARKET GROWTH

- 8.4.2 BOUNDARY MAPPING

- 8.4.3 DRAINAGE MAPPING

- 8.5 VARIABLE RATE APPLICATION

- 8.5.1 ADOPTION OF VRA INCREASING TO ENSURE EFFICIENT RESOURCE UTILIZATION

- 8.5.2 PRECISION IRRIGATION

- 8.5.3 PRECISION SEEDING

- 8.5.4 PRECISION FERTILIZATION

- 8.5.4.1 Nitrogen VRA

- 8.5.4.2 Phosphorous VRA

- 8.5.4.3 Lime VRA

- 8.5.5 OTHER VARIABLE RATE APPLICATIONS

- 8.6 WEATHER TRACKING & FORECASTING

- 8.6.1 NEED FOR ENHANCING FARM EFFICIENCY THROUGH ADVANCED WEATHER MONITORING AND FORECASTING TO DRIVE DEMAND

- 8.7 INVENTORY MANAGEMENT

- 8.7.1 NEED FOR OPTIMIZING RESOURCE EFFICIENCY TO DRIVE ADOPTION OF STRATEGIC FARM INVENTORY MANAGEMENT

- 8.8 FARM LABOR MANAGEMENT

- 8.8.1 ENABLES REDUCTION OF LABOR COSTS AND BOOSTS CROP YIELD VIA EFFECTIVE WORKFORCE COORDINATION

- 8.9 FINANCIAL MANAGEMENT

- 8.9.1 NEED FOR IMPROVING PROFITABILITY AND MITIGATING FINANCIAL RISKS TO DRIVE MARKET

- 8.10 OTHER APPLICATIONS

9 PRECISION FARMING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Presence of major market players to fuel market growth

- 9.2.3 CANADA

- 9.2.3.1 Digital innovation and sustainable practices strengthening precision agriculture

- 9.2.4 MEXICO

- 9.2.4.1 Growing advancements in digital tools and smart farming technologies to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Digitalization and strategic investments in agriculture sector driving market growth

- 9.3.3 UK

- 9.3.3.1 Technological advancements and strong research fueling adoption

- 9.3.4 FRANCE

- 9.3.4.1 Data-driven startups and smart environmental insights supporting market growth

- 9.3.5 SPAIN

- 9.3.5.1 Technological modernization, sustainable practices, and EU support advancing precision farming

- 9.3.6 ITALY

- 9.3.6.1 Adoption of smart irrigation, agricultural drones, and GPS-enabled resource optimization driving market

- 9.3.7 POLAND

- 9.3.7.1 Gradual adoption of smart farming supported by EU funding and modernization efforts to drive market

- 9.3.8 NORDICS

- 9.3.8.1 Strong digital infrastructure and environmental goals driving market growth

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Government investments, advanced technologies, and global collaborations driving growth

- 9.4.3 JAPAN

- 9.4.3.1 Precision farming advancing through robotics, research institutions, and technological innovation

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Advancement and adoption of smart technologies driving precision farming in South Korea

- 9.4.5 INDIA

- 9.4.5.1 Digital innovation and adoption of smart equipment accelerating market growth

- 9.4.6 AUSTRALIA

- 9.4.6.1 Large-scale mechanization, soil-specific applications, and institutional support boosting precision farming

- 9.4.7 INDONESIA

- 9.4.7.1 Digital transformation and public-private collaboration enabling market growth

- 9.4.8 MALAYSIA

- 9.4.8.1 Smart farming initiatives advancing precision agriculture in Malaysia

- 9.4.9 THAILAND

- 9.4.9.1 Large-scale mechanization, soil-specific applications, and institutional support to drive market

- 9.4.10 VIETNAM

- 9.4.10.1 Technology integration and policy support accelerating precision farming

- 9.4.11 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Bahrain

- 9.5.2.1.1 Sustainable agri-tech collaborations advancing precision farming

- 9.5.2.2 Kuwait

- 9.5.2.2.1 Adoption of technologies like smart water management and vertical farming driving market

- 9.5.2.3 Oman

- 9.5.2.3.1 Implementation of smart agriculture and food security initiatives driving precision farming

- 9.5.2.4 Qatar

- 9.5.2.4.1 Strategic advancements and agricultural digitization for sustainable food security to drive market

- 9.5.2.5 Saudi Arabia

- 9.5.2.5.1 Innovation and strategic initiatives transforming agriculture sector

- 9.5.2.6 UAE

- 9.5.2.6.1 Strategic collaborations enabling advancement of precision farming

- 9.5.2.7 Rest of Middle East

- 9.5.2.7.1 Evolving agricultural practices leading to emerging precision farming trends

- 9.5.2.1 Bahrain

- 9.5.3 AFRICA

- 9.5.3.1 South Africa

- 9.5.3.1.1 Advancement in precision agriculture through satellite IoT and AI-driven solutions

- 9.5.3.2 Other African countries

- 9.5.3.1 South Africa

- 9.5.4 SOUTH AMERICA

- 9.5.4.1 Advancing digital connectivity and technological integration driving demand for precision farming

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2024-2025

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 10.6 PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Offering footprint

- 10.7.5.4 Technology footprint

- 10.7.5.5 Application footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS

- 11.2.1 DEERE & COMPANY

- 11.2.1.1 Business overview

- 11.2.1.2 Products/Solutions/Services offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Product launches

- 11.2.1.3.2 Deals

- 11.2.1.3.3 Other developments

- 11.2.1.4 MnM view

- 11.2.1.4.1 Key strengths

- 11.2.1.4.2 Strategic choices

- 11.2.1.4.3 Weaknesses and competitive threats

- 11.2.2 AGCO CORPORATION

- 11.2.2.1 Business overview

- 11.2.2.2 Products/Solutions/Services offered

- 11.2.2.3 Recent developments

- 11.2.2.3.1 Product launches

- 11.2.2.3.2 Deals

- 11.2.2.4 MnM view

- 11.2.2.4.1 Key strengths

- 11.2.2.4.2 Strategic choices

- 11.2.2.4.3 Weaknesses and competitive threats

- 11.2.3 CNH INDUSTRIAL N.V.

- 11.2.3.1 Business overview

- 11.2.3.2 Products/Solutions/Services offered

- 11.2.3.3 Recent developments

- 11.2.3.3.1 Deals

- 11.2.3.4 MnM view

- 11.2.3.4.1 Key strengths

- 11.2.3.4.2 Strategic choices

- 11.2.3.4.3 Weaknesses and competitive threats

- 11.2.4 AG LEADER TECHNOLOGY

- 11.2.4.1 Business overview

- 11.2.4.2 Products/Solutions/Services offered

- 11.2.4.3 Recent developments

- 11.2.4.3.1 Product launches

- 11.2.4.4 MnM view

- 11.2.4.4.1 Key strengths

- 11.2.4.4.2 Strategic choices

- 11.2.4.4.3 Weaknesses and competitive threats

- 11.2.5 AGEAGLE AERIAL SYSTEMS INC.

- 11.2.5.1 Business overview

- 11.2.5.2 Products/Solutions/Services offered

- 11.2.5.3 MnM view

- 11.2.5.3.1 Key strengths

- 11.2.5.3.2 Strategic choices

- 11.2.5.3.3 Weaknesses and competitive threats

- 11.2.6 TOPCON CORPORATION

- 11.2.6.1 Business overview

- 11.2.6.2 Products/Solutions/Services offered

- 11.2.6.3 Recent developments

- 11.2.6.3.1 Deals

- 11.2.7 BAYER AG (CLIMATE LLC)

- 11.2.7.1 Business overview

- 11.2.7.2 Products/Solutions/Services offered

- 11.2.7.3 Recent developments

- 11.2.7.3.1 Product launches

- 11.2.7.3.2 Deals

- 11.2.8 TEEJET TECHNOLOGIES

- 11.2.8.1 Business overview

- 11.2.8.2 Products/Solutions/Services offered

- 11.2.9 HEXAGON AB

- 11.2.9.1 Business overview

- 11.2.9.2 Products/Solutions/Services offered

- 11.2.9.3 Recent developments

- 11.2.9.3.1 Product launches

- 11.2.10 KUBOTA CORPORATION

- 11.2.10.1 Business overview

- 11.2.10.2 Products/Solutions/Services offered

- 11.2.10.3 Recent development

- 11.2.10.3.1 Deals

- 11.2.1 DEERE & COMPANY

- 11.3 OTHER PLAYERS

- 11.3.1 TRIMBLE INC.

- 11.3.2 ABACO S.P.A.

- 11.3.3 CROPX INC.

- 11.3.4 FARMERS EDGE INC.

- 11.3.5 GROWNETICS

- 11.3.6 CROPIN TECHNOLOGY SOLUTIONS PRIVATE LIMITED

- 11.3.7 GAMAYA

- 11.3.8 DICKEY-JOHN

- 11.3.9 TELUS

- 11.3.10 HARXON CORPORATION

- 11.3.11 AGRICOLUS

- 11.3.12 ESRI

- 11.3.13 FARMDOK GMBH

- 11.3.14 YARA

- 11.3.15 CLAAS KGAA MBH

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS