|

|

市場調査レポート

商品コード

1756521

圧力モニタリングの世界市場:製品別、手技別、治療用途別、エンドユーザー別、地域別 - 2032年までの予測Pressure Monitoring Market by Product (Oximeters, BP Cuffs, BP Monitors (Digital, Aneroid, Cuffless)), Procedure (Invasive & Non-invasive), Therapeutic Application (Respiratory and Cardiac Disorders, Glaucoma), End User - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 圧力モニタリングの世界市場:製品別、手技別、治療用途別、エンドユーザー別、地域別 - 2032年までの予測 |

|

出版日: 2025年06月23日

発行: MarketsandMarkets

ページ情報: 英文 485 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

圧力モニタリングの市場規模は、2025年の145億6,000万米ドルから2032年には254億8,000万米ドルに達すると予測され、2025年から2032年までのCAGRは8.3%になるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2032年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品別、手技別、治療用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

非侵襲的、携帯型、接続型モニタリングデバイスの開発などの技術革新により、臨床と家庭の両方の環境における圧力モニタリングのアクセシビリティと利便性が向上しています。さらに、遠隔医療サービスの成長、ヘルスケア支出の増加、予防医療に対する一般市民の意識の高まりはすべて、早期診断と定期的な健康モニタリングに貢献しています。これらの要因が様々なヘルスケア環境での圧力モニタリングシステムの採用を促進し、圧力モニタリング市場の成長を加速させています。

圧力モニタリング市場は、いくつかの重要な要因によって大きな成長を遂げています。この動向の主な要因は、高血圧、心血管障害、呼吸器疾患などの慢性疾患の世界の有病率の上昇であり、これらの疾患は効果的な管理のために継続的で正確な圧力モニタリングを必要とします。高齢者はこれらの健康問題により脆弱であるため、高齢化もこの需要に大きな役割を果たしています。

さらに、技術の進歩により、患者の快適性を高め、遠隔モニタリングを容易にする、非侵襲的で携帯可能なスマート・デバイスが開発されています。これは、遠隔医療や在宅医療の増加傾向と一致しています。さらに、ヘルスケア支出の増加、ヘルスケア・インフラの拡大、早期診断と予防医療に対する意識の高まりも、世界の市場成長の原動力となっています。

これらの要因が、継続的な健康管理を必要とする高齢者人口と相まって、さまざまなヘルスケア環境での気圧モニタリングシステムの採用を加速しています。

より広範な圧力モニタリング市場における肺圧モニタリングの成長は、特に高齢化した集団や慢性閉塞性肺疾患(COPD)または心不全の患者における肺高血圧症やその他の呼吸器関連の合併症の発生率の上昇によって牽引されています。重篤な転帰を防ぐために肺血管の異常を早期に発見することが重視されるようになっており、そのため医療システムはより正確でリアルタイムの肺圧評価ツールを採用するようになっています。低侵襲で植え込み可能なモニタリング技術へのシフトは、特にクリティカルケアや心肺環境において、この採用をさらに加速しています。さらに、治療計画の最適化における肺圧モニタリングの重要性を支持する臨床ガイドラインや調査も増えており、このニッチながら重要な市場分野への投資と技術革新を促進しています。

クリティカルケアや外科的環境におけるリアルタイムの高精度モニタリングに対する需要の高まりが、圧力モニタリング市場における侵襲的手技の成長を促進しています。動脈圧や頭蓋内圧の測定などの技術は、重篤な心血管疾患、神経疾患、外傷性疾患の患者を管理するために不可欠です。

特に高齢化した集団や複数の合併症を持つ患者の間で複雑な手術が増加しているため、術中やICUでの継続的なモニタリングの必要性が高まっています。さらに、先進国のヘルスケアシステムでは、重症治療室の高度化と専門医療従事者の充実が、侵襲的モニタリング法の幅広い採用を後押ししています。

病院や外科センターが患者の安全性と診断・治療の精度を優先する中、侵襲的圧力モニタリングは依然として高度急性期臨床環境において不可欠な要素となっています。

治療用途別では、呼吸器疾患が圧力モニタリング市場で最大のシェアを占めています。

呼吸器疾患の増加は、圧力モニタリングシステムの需要を大きく促進しており、これは環境およびライフスタイルに関連した健康課題の増加と密接に関連しています。大気汚染の増加、有害粒子への職業的曝露、喫煙、呼吸器感染症の長期的影響などの要因が、COPD、喘息、睡眠時無呼吸症候群などの慢性呼吸器疾患の急増に寄与しています。

これらの疾患では、換気や酸素療法を効果的に管理するために、胸腔内圧や気道圧を正確かつ継続的にモニタリングする必要があります。さらに、病院と在宅介護の両方で機械的換気と非侵襲的呼吸サポートの使用が増加しているため、圧力モニタリングシステムの必要性が大幅に高まっています。

ヘルスケアプロバイダーが早期介入と積極的な疾患管理に重点を置く中、正確な圧力測定ツールは臨床転帰を改善し、呼吸器疾患患者の病院再入院を減らすために不可欠となっています。

在宅ケア環境における圧力モニタリングの成長は、いくつかの重要な要因によってもたらされます。まず、高血圧や心血管障害などの慢性疾患の有病率が増加しており、継続的なモニタリングが必要で、在宅ベースのソリューションがより魅力的になっています。さらに、技術の進歩により、自己管理を容易にし、頻繁な通院の必要性を減らす、使いやすく、携帯可能で正確なモニタリング機器の開発が進んでいます。

さらに、高齢化社会は快適な自宅でケアを受けることを好むため、在宅ケアモニタリングソリューションの需要がさらに高まっています。ヘルスケア政策や償還構造の変化も在宅ケアをサポートするように進化しており、患者と医療提供者の双方にとってより現実的な選択肢となっています。これらの要因が相まって、在宅ケアにおける体圧モニタリングの役割が高まっています。

地域別では、北米が2024年の圧力モニタリング市場で最大のシェアを占めています。

北米における体圧モニタリング市場の成長は、高度なヘルスケアテクノロジーと患者中心のケアモデルが重視されていることが背景にあります。ヘルスケアITインフラへの投資の増加により、圧力モニタリング機器と電子カルテおよび遠隔医療プラットフォームとの統合が可能になり、より効率的で協調的な患者管理が実現しました。さらに、北米では厳しい規制の枠組みと品質基準が、信頼性の高い革新的なモニタリング・ソリューションの採用を促進しています。

価値観に基づく医療へのシフトは、臨床転帰を改善し、病院の再入院を減らすために持続圧モニタリングを利用するようヘルスケアプロバイダーに促しています。さらに、心臓血管の健康に焦点を当てた意識向上キャンペーンや、疾患の早期発見を目的とした政府プログラムにより、臨床と在宅ケアの両方の環境で圧力モニタリング装置の需要が増加しています。

当レポートでは、世界の圧力モニタリング市場について調査し、製品別、手技別、治療用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 技術分析

- ポーターのファイブフォース分析

- 規制状況

- 特許分析

- 貿易分析

- 価格分析

- 2025年~2026年の主な会議とイベント

- 主要な利害関係者と購入基準

- 圧力モニタリング市場における満たさアンメットニーズ/エンドユーザーの期待

- AI/生成AIが圧力モニタリング市場に与える影響

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- ケーススタディ分析

- 圧力モニタリング市場の隣接市場

- 顧客のビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- 2025年の米国関税が圧力モニタリング市場に与える影響

第6章 圧力モニタリング市場(製品別)

- イントロダクション

- デバイス

- アクセサリー

第7章 圧力モニタリング市場(手技別)

- イントロダクション

- 侵襲的処置

- 非侵襲的処置

第8章 圧力モニタリング市場(治療用途別)

- イントロダクション

- 呼吸器疾患

- 緑内障

- 心臓疾患

- 神経疾患

- 透析

- その他

第9章 圧力モニタリング市場(エンドユーザー別)

- イントロダクション

- 病院とクリニック

- 外来診療センター

- 在宅ケア

- 緊急治療室

- プライマリセンター

- その他

第10章 圧力モニタリング市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較分析

- 主要プレーヤーのR&D評価

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- MEDTRONIC

- KONINKLIJKE PHILIPS N.V.

- GE HEALTHCARE

- OMRON CORPORATION.

- DRAGERWERK AG & CO. KGAA

- ABBOTT

- BAXTER INTERNATIONAL, INC.

- TERUMO CORPORATION

- BECTON, DICKINSON AND COMPANY(BD)

- NIHON KOHDEN CORPORATION

- INTEGRA LIFESCIENCES CORPORATION

- ZEISS GROUP

- BOSTON SCIENTIFIC CORPORATION

- ICU MEDICAL, INC.

- MASIMO CORPORATION

- その他の企業

- REICHERT, INC.

- NONIN

- NATUS

- HONSUN

- ROSSMAX INTERNATIONAL LTD.

- MICROLIFE CORPORATION

- A&D COMPANY

- PAUL HARTMANN ASIA-PACIFIC LTD.

- ICARE FINLAND OY.

- IHEALTH LABS INC.

第13章 付録

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES (USD UNITS)

- TABLE 2 PRESSURE MONITORING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 US FDA: CLASSIFICATION OF MEDICAL DEVICES

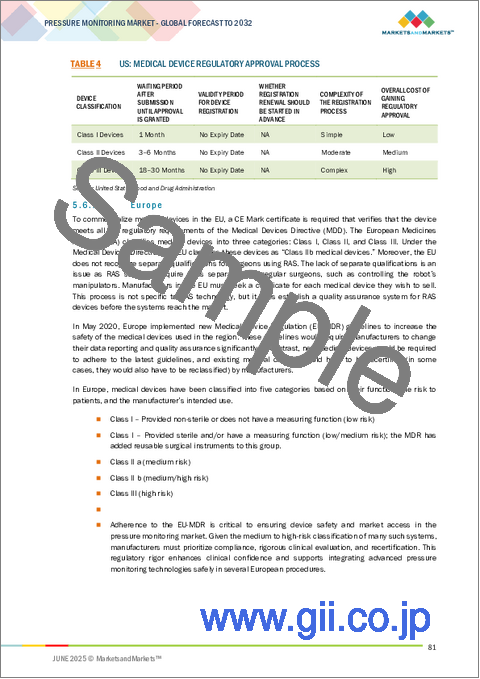

- TABLE 4 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 5 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PHARMACEUTICALS & MEDICAL DEVICES AGENCY

- TABLE 6 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 PRESSURE MONITORING MARKET: LIST OF LEADING PATENTS

- TABLE 11 IMPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2025 (USD THOUSANDS)

- TABLE 12 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2025 (USD THOUSANDS)

- TABLE 13 INDICATIVE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT

- TABLE 14 INDICATIVE SELLING PRICE TREND OF PRESSURE MONITORING PRODUCTS, BY REGION

- TABLE 15 PRESSURE MONITORING MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USERS

- TABLE 17 KEY BUYING CRITERIA FOR PRESSURE MONITORING SYSTEMS

- TABLE 18 UNMET NEEDS/END-USER EXPECTATIONS IN PRESSURE MONITORING MARKET

- TABLE 19 PRESSURE MONITORING MARKET: IMPACT OF AI/GENERATIVE AI

- TABLE 20 MEDTRONIC: PRESSURE MONITORING DEVICES (ARTERIAL PRESSURE & ICP MONITORING)

- TABLE 21 GE HEALTHCARE: IMPLEMENTATION OF ADVANCED INVASIVE PRESSURE MONITORING SOLUTIONS

- TABLE 22 OMRON HEALTHCARE: FOCUS ON ENHANCED ACCURACY IN HOME BLOOD PRESSURE MONITORING SOLUTIONS

- TABLE 23 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 24 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR DRUG DEVICE PRODUCTS

- TABLE 25 PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 26 PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 27 PRESSURE MONITORING MARKET FOR DEVICES, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 28 BLOOD PRESSURE MONITORS MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 29 BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 30 PRESSURE MONITORING MARKET FOR SPHYGMOMANOMETERS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 31 PRESSURE MONITORING MARKET FOR BLOOD PRESSURE TRANSDUCERS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 32 PRESSURE MONITORING MARKET FOR AMBULATORY BLOOD PRESSURE MONITORS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 33 PRESSURE MONITORING MARKET FOR AUTOMATED BLOOD PRESSURE MONITORS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 34 PRESSURE MONITORING MARKET FOR CUFFLESS BLOOD PRESSURE MONITORS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 35 BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION)

- TABLE 36 PRESSURE MONITORING MARKET FOR DIGITAL BLOOD PRESSURE MONITORS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 37 PRESSURE MONITORING MARKET FOR ANEROID BLOOD PRESSURE MONITORS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 38 PRESSURE MONITORING MARKET FOR WEARABLE BLOOD PRESSURE MONITORS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 39 PRESSURE MONITORING MARKET FOR WEARABLE BLOOD PRESSURE MONITORS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 40 PRESSURE MONITORING MARKET FOR CUFF-BASED BLOOD PRESSURE MONITORS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 41 PRESSURE MONITORING MARKET FOR CUFFLESS BLOOD PRESSURE MONITORS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 42 PRESSURE MONITORING MARKET FOR CUFFLESS BLOOD PRESSURE MONITORS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 43 PRESSURE MONITORING MARKET FOR WRIST-BASED MONITORS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 44 PRESSURE MONITORING MARKET FOR FINGER-BASED MONITORS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 45 PRESSURE MONITORING MARKET FOR ARM BAND-BASED MONITORS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 46 INTRAOCULAR PRESSURE MONITORS MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 47 PULMONARY PRESSURE MONITORS MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 48 PULMONARY PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 49 PRESSURE MONITORING MARKET FOR OXIMETERS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 50 PRESSURE MONITORING MARKET FOR CAPNOGRAPHY, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 51 PRESSURE MONITORING MARKET FOR SPIROMETERS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 52 INTRACRANIAL PRESSURE MONITORS MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 53 OTHER MONITORING DEVICES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 54 PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 55 PRESSURE MONITORING MARKET FOR ACCESSORIES, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 56 BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 57 BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 58 BLOOD PRESSURE CUFFS MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 59 BULBS MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 60 MANOMETERS MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 61 TUBES & VALVES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 62 INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 63 INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 64 TIP COVERS/TONOCOVERS MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 65 PRISMS MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 66 SENSORS MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 67 PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

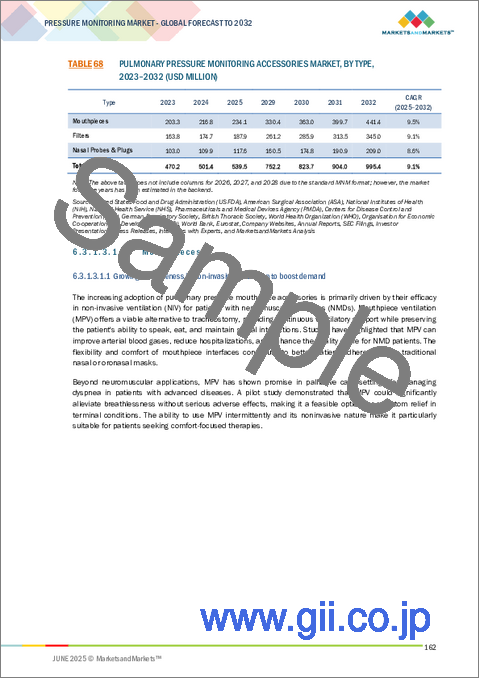

- TABLE 68 PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 69 MOUTHPIECES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 70 FILTERS MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 71 NASAL PROBES & PLUGS MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 72 OTHER PRESSURE MONITORING ACCESSORIES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 73 PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY, 2023-2032 (USD MILLION)

- TABLE 74 DISPOSABLE ACCESSORIES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 75 REUSABLE ACCESSORIES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 76 PRESSURE MONITORING MARKET, BY PROCEDURE, 2023-2032 (USD MILLION)

- TABLE 77 INVASIVE PRESSURE MONITORING PROCEDURES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 78 NON-INVASIVE PRESSURE MONITORING PROCEDURES MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 79 PRESSURE MONITORING MARKET, BY THERAPEUTIC APPLICATION, 2023-2032 (USD MILLION)

- TABLE 80 PRESSURE MONITORING MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 81 PRESSURE MONITORING MARKET FOR GLAUCOMA, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 82 PRESSURE MONITORING MARKET FOR CARDIAC DISORDERS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 83 PRESSURE MONITORING MARKET FOR NEUROLOGICAL DISORDERS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 84 PRESSURE MONITORING MARKET FOR DIALYSIS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 85 PRESSURE MONITORING MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 86 PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 87 PRESSURE MONITORING MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 88 PRESSURE MONITORING MARKET FOR AMBULATORY CARE CENTERS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 89 PRESSURE MONITORING MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 90 PRESSURE MONITORING MARKET FOR URGENT CARE SETTINGS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 91 PRESSURE MONITORING MARKET FOR PRIMARY CENTERS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 92 PRESSURE MONITORING MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 93 PRESSURE MONITORING MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 94 NORTH AMERICA: PRESSURE MONITORING MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 95 NORTH AMERICA: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 96 NORTH AMERICA: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 97 NORTH AMERICA: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 98 NORTH AMERICA: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (THOUSAND UNITS)

- TABLE 99 NORTH AMERICA: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 100 NORTH AMERICA: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 101 NORTH AMERICA: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 102 NORTH AMERICA: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 103 NORTH AMERICA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 104 NORTH AMERICA: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 105 NORTH AMERICA: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 106 NORTH AMERICA: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 107 NORTH AMERICA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 108 NORTH AMERICA: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 109 NORTH AMERICA: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 110 NORTH AMERICA: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 111 US: KEY MACROINDICATORS

- TABLE 112 US: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 113 US: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 114 US: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 115 US: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 116 US: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 117 US: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 118 US: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 119 US: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 120 US: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 121 US: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 122 US: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 123 US: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 124 US: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 125 US: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 126 US: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 127 CANADA: KEY MACROINDICATORS

- TABLE 128 CANADA: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 129 CANADA: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 130 CANADA: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 131 CANADA: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 132 CANADA: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 133 CANADA: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 134 CANADA: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 135 CANADA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 136 CANADA: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 137 CANADA: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 138 CANADA: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 139 CANADA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 140 CANADA: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 141 CANADA: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 142 CANADA: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 143 EUROPE: PRESSURE MONITORING MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 144 EUROPE: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 145 EUROPE: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 146 EUROPE: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 147 EUROPE: BLOOD PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (THOUSAND UNITS)

- TABLE 148 EUROPE: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 149 EUROPE: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 150 EUROPE: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 151 EUROPE: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 152 EUROPE PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 153 EUROPE: PRESSURE MONITORING MARKET, BY BLOOD PRESSURE/CARDIAC MONITORING TYPE, 2023-2032 (USD MILLION)

- TABLE 154 EUROPE: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 155 EUROPE: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 156 EUROPE: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 157 EUROPE: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 158 EUROPE: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 159 EUROPE: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 160 GERMANY: KEY MACROINDICATORS

- TABLE 161 GERMANY: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 162 GERMANY: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 163 GERMANY: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 164 GERMANY: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 165 GERMANY: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 166 GERMANY: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 167 GERMANY: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 168 GERMANY: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 169 GERMANY: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 170 GERMANY: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 171 GERMANY: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 172 GERMANY: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 173 GERMANY: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 174 GERMANY: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 175 GERMANY: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 176 UK: KEY MACROINDICATORS

- TABLE 177 UK: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 178 UK: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 179 UK: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 180 UK: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 181 UK: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 182 UK: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 183 UK: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 184 UK: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 185 UK: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 186 UK: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 187 UK: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 188 UK: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 189 UK: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 190 UK: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 191 UK: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 192 FRANCE: KEY MACROINDICATORS

- TABLE 193 FRANCE: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 194 FRANCE: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 195 FRANCE: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 196 FRANCE: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 197 FRANCE: WEARABLE BLOOD PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 198 FRANCE: PRESSURE MONITORING MARKET, BY CUFFLESS-BASED BLOOD PRESSURE MONITORING TYPE, 2023-2032 (USD MILLION)

- TABLE 199 FRANCE: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 200 FRANCE: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 201 FRANCE: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 202 FRANCE: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 203 FRANCE: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 204 FRANCE: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 205 FRANCE: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 206 FRANCE: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 207 FRANCE: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 208 ITALY: KEY MACROINDICATORS

- TABLE 209 ITALY: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 210 ITALY: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 211 ITALY: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 212 ITALY: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 213 ITALY: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 214 ITALY: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 215 ITALY: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 216 ITALY: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 217 ITALY: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 218 ITALY: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 219 ITALY: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 220 ITALY: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 221 ITALY: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 222 ITALY: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 223 ITALY: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 224 SPAIN: KEY MACROINDICATORS

- TABLE 225 SPAIN: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 226 SPAIN: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 227 SPAIN: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 228 SPAIN: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 229 SPAIN: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 230 SPAIN: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 231 SPAIN: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 232 SPAIN: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 233 SPAIN: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 234 SPAIN: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 235 SPAIN PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 236 SPAIN: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 237 SPAIN: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 238 SPAIN: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 239 SPAIN: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 240 REST OF EUROPE: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 241 REST OF EUROPE: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 242 REST OF EUROPE: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 243 REST OF EUROPE: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 244 REST OF EUROPE: PRESSURE MONITORING MARKET, BY WEARABLE BLOOD PRESSURE MONITORS TYPE, 2023-2032 (USD MILLION)

- TABLE 245 REST OF EUROPE: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 246 REST OF EUROPE: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 247 REST OF EUROPE: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 248 REST OF EUROPE: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 249 REST OF EUROPE: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 250 REST OF EUROPE: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 251 REST OF EUROPE: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 252 REST OF EUROPE: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 253 REST OF EUROPE: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 254 REST OF EUROPE: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 255 ASIA PACIFIC: PRESSURE MONITORING MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 256 ASIA PACIFIC: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 257 ASIA PACIFIC: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 258 ASIA PACIFIC: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 259 ASIA PACIFIC: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (THOUSAND UNITS)

- TABLE 260 ASIA PACIFIC: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 261 ASIA PACIFIC: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 262 ASIA PACIFIC: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 263 ASIA PACIFIC: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 264 ASIA PACIFIC: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 265 ASIA PACIFIC: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 266 ASIA PACIFIC: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 267 ASIA PACIFIC: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 268 ASIA PACIFIC: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 269 ASIA PACIFIC: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 270 ASIA PACIFIC: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 271 ASIA PACIFIC: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 272 CHINA: KEY MACROINDICATORS

- TABLE 273 CHINA: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 274 CHINA: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 275 CHINA: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 276 CHINA: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 277 CHINA: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 278 CHINA: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 279 CHINA: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 280 ARKET, BY ACCESSORIES TYPE, 2023-2032 (USD MILLION)

- TABLE 281 CHINA: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 282 CHINA: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 283 CHINA: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 284 CHINA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 285 CHINA: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 286 CHINA: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 287 CHINA: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 288 JAPAN: KEY MACROINDICATORS

- TABLE 289 JAPAN: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 290 JAPAN: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 291 JAPAN: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 292 JAPAN: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 293 JAPAN: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 294 JAPAN: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 295 JAPAN: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 296 JAPAN: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 297 JAPAN: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 298 JAPAN: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 299 JAPAN: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 300 JAPAN: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 301 JAPAN: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 302 JAPAN: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 303 JAPAN: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 304 INDIA: KEY MACROINDICATORS

- TABLE 305 INDIA: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 306 INDIA: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 307 INDIA: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 308 INDIA: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 309 INDIA: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 310 INDIA: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 311 INDIA: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 312 INDIA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 313 INDIA: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 314 INDIA: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 315 INDIA: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 316 INDIA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 317 INDIA: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 318 INDIA: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 319 INDIA: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 320 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 321 SOUTH KOREA: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 322 SOUTH KOREA: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 323 SOUTH KOREA: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 324 SOUTH KOREA: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 325 SOUTH KOREA: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 326 SOUTH KOREA: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 327 SOUTH KOREA: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 328 SOUTH KOREA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 329 SOUTH KOREA: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 330 SOUTH KOREA: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 331 SOUTH KOREA: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 332 SOUTH KOREA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 333 SOUTH KOREA: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 334 SOUTH KOREA: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 335 SOUTH KOREA: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 336 AUSTRALIA: KEY MACROINDICATORS

- TABLE 337 AUSTRALIA: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 338 AUSTRALIA: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 339 AUSTRALIA: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 340 AUSTRALIA: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 341 AUSTRALIA: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 342 AUSTRALIA: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 343 AUSTRALIA: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 344 AUSTRALIA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 345 AUSTRALIA: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 346 AUSTRALIA: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 347 AUSTRALIA: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 348 AUSTRALIA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 349 AUSTRALIA: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 350 AUSTRALIA: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 351 AUSTRALIA: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 352 REST OF ASIA PACIFIC: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 353 REST OF ASIA PACIFIC: PRESSURE MONITORING MARKET, BY DEVICE, 2023-2032 (USD MILLION

- TABLE 354 REST OF ASIA PACIFIC: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 355 REST OF ASIA PACIFIC: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 356 REST OF ASIA PACIFIC: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 357 REST OF ASIA PACIFIC: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 358 REST OF ASIA PACIFIC: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 359 REST OF ASIA PACIFIC: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 360 REST OF ASIA PACIFIC: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 361 REST OF ASIA PACIFIC: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 362 REST OF ASIA PACIFIC: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 363 REST OF ASIA PACIFIC: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 364 REST OF ASIA PACIFIC: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 365 REST OF ASIA PACIFIC: PRESSURE MONITORING MARKET: THERAPEUTIC APPLICATION, 2023-2032 (USD MILLION)

- TABLE 366 REST OF ASIA PACIFIC: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 367 LATIN AMERICA: PRESSURE MONITORING MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 368 LATIN AMERICA: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 369 LATIN AMERICA: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 370 LATIN AMERICA: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 371 LATIN AMERICA: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (THOUSAND UNITS)

- TABLE 372 LATIN AMERICA: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 373 LATIN AMERICA: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 374 LATIN AMERICA: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 375 LATIN AMERICA: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 376 LATIN AMERICA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 377 LATIN AMERICA: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 378 LATIN AMERICA: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 379 LATIN AMERICA: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 380 LATIN AMERICA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 381 LATIN AMERICA: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 382 LATIN AMERICA: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 383 LATIN AMERICA: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 384 BRAZIL: KEY MACROINDICATORS

- TABLE 385 BRAZIL: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION

- TABLE 386 BRAZIL: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 387 BRAZIL: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 388 BRAZIL: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 389 BRAZIL: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 390 BRAZIL: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 391 BRAZIL: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 392 BRAZIL: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 393 BRAZIL: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 394 BRAZIL: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 395 BRAZIL: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 396 BRAZIL: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 397 BRAZIL: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 398 BRAZIL: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 399 BRAZIL: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 400 MEXICO: KEY MACROINDICATORS

- TABLE 401 MEXICO: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION

- TABLE 402 MEXICO: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 403 MEXICO: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 404 MEXICO: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 405 MEXICO: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 406 MEXICO: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 407 MEXICO: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 408 PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 409 MEXICO: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 410 MEXICO: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 411 MEXICO: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 412 MEXICO: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 413 MEXICO: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 414 MEXICO: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 415 MEXICO: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 416 REST OF LATIN AMERICA: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION

- TABLE 417 REST OF LATIN AMERICA: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 418 REST OF LATIN AMERICA: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 419 REST OF LATIN AMERICA: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 420 REST OF LATIN AMERICA: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 421 REST OF LATIN AMERICA: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 422 REST OF LATIN AMERICA: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 423 REST OF LATIN AMERICA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 424 REST OF LATIN AMERICA: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 425 REST OF LATIN AMERICA: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 426 REST OF LATIN AMERICA: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 427 REST OF LATIN AMERICA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 428 REST OF LATIN AMERICA: PRESSURE MONITORING MARKET, BY PROCEDURE TYPE, 2023-2032 (USD MILLION)

- TABLE 429 REST OF LATIN AMERICA: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 430 REST OF LATIN AMERICA: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 431 MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 432 MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 433 MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 434 MIDDLE EAST & AFRICA: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 435 MIDDLE EAST & AFRICA: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (THOUSAND UNITS)

- TABLE 436 MIDDLE EAST & AFRICA: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 437 MIDDLE EAST & AFRICA: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 438 MIDDLE EAST & AFRICA: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 439 MIDDLE EAST & AFRICA: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 440 MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 441 MIDDLE EAST & AFRICA: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 442 MIDDLE EAST & AFRICA: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 443 MIDDLE EAST & AFRICA: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 444 MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 445 MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 446 MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 447 MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 448 GCC COUNTRIES: PRESSURE MONITORING MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 449 GCC COUNTRIES: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION

- TABLE 450 GCC COUNTRIES: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 451 GCC COUNTRIES: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 452 GCC COUNTRIES: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 453 GCC COUNTRIES: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 454 GCC COUNTRIES: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 455 GCC COUNTRIES: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 456 GCC COUNTRIES: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 457 GCC COUNTRIES: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 458 GCC COUNTRIES: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 459 GCC COUNTRIES: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 460 GCC COUNTRIES: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 461 GCC COUNTRIES: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 462 GCC COUNTRIES: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 463 GCC COUNTRIES: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 464 KINGDOM OF SAUDI ARABIA: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION

- TABLE 465 KINGDOM OF SAUDI ARABIA: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 466 KINGDOM OF SAUDI ARABIA: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 467 KINGDOM OF SAUDI ARABIA: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 468 KINGDOM OF SAUDI ARABIA: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 469 KINGDOM OF SAUDI ARABIA: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 470 KINGDOM OF SAUDI ARABIA: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 471 KINGDOM OF SAUDI ARABIA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 472 KINGDOM OF SAUDI ARABIA: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 473 KINGDOM OF SAUDI ARABIA: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 474 KINGDOM OF SAUDI ARABIA: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 475 KINGDOM OF SAUDI ARABIA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 476 KINGDOM OF SAUDI ARABIA: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 477 KINGDOM OF SAUDI ARABIA: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 478 KINGDOM OF SAUDI ARABIA: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 479 UNITED ARAB EMIRATES: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION

- TABLE 480 UNITED ARAB EMIRATES: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 481 UNITED ARAB EMIRATES: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 482 UNITED ARAB EMIRATES: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 483 UNITED ARAB EMIRATES: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 484 UNITED ARAB EMIRATES: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 485 UNITED ARAB EMIRATES: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 486 UNITED ARAB EMIRATES: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 487 UNITED ARAB EMIRATES: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 488 UNITED ARAB EMIRATES: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 489 UNITED ARAB EMIRATES: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 490 UNITED ARAB EMIRATES: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 491 UNITED ARAB EMIRATES: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 492 UNITED ARAB EMIRATES: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 493 UNITED ARAB EMIRATES: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 494 OTHER GCC COUNTRIES: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 495 OTHER GCC COUNTRIES: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 496 OTHER GCC COUNTRIES: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 497 OTHER GCC COUNTRIES: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 498 OTHER GCC COUNTRIES: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 499 REST OF GCC COUNTRIES: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 500 OTHER GCC COUNTRIES: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 501 OTHER GCC COUNTRIES: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 502 OTHER GCC COUNTRIES: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 503 OTHER GCC COUNTRIES: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 504 OTHER GCC COUNTRIES: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 505 OTHER GCC COUNTRIES: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 506 OTHER GCC COUNTRIES: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 507 OTHER GCC COUNTRIES: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 508 OTHER GCC COUNTRIES: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 509 REST OF MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET, BY PRODUCT, 2023-2032 (USD MILLION

- TABLE 510 REST OF MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET FOR DEVICES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 511 REST OF MIDDLE EAST & AFRICA: BLOOD PRESSURE MONITORS MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 512 REST OF MIDDLE EAST & AFRICA: BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 513 REST OF MIDDLE EAST & AFRICA: WEARABLE BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 514 REST OF MIDDLE EAST & AFRICA: CUFFLESS BLOOD PRESSURE MONITORS MARKET, BY TECHNOLOGY TYPE, 2023-2032 (USD MILLION)

- TABLE 515 REST OF MIDDLE EAST & AFRICA: PULMONARY PRESSURE MONITORING MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 516 REST OF MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 517 REST OF MIDDLE EAST & AFRICA: BLOOD PRESSURE/CARDIAC MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 518 REST OF MIDDLE EAST & AFRICA: INTRAOCULAR PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 519 REST OF MIDDLE EAST & AFRICA: PULMONARY PRESSURE MONITORING ACCESSORIES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 520 REST OF MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET FOR ACCESSORIES, BY USABILITY TYPE, 2023-2032 (USD MILLION)

- TABLE 521 REST OF MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET FOR PROCEDURES, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 522 REST OF MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 523 REST OF MIDDLE EAST & AFRICA: PRESSURE MONITORING MARKET, BY END USER, 2023-2032 (USD MILLION

- TABLE 524 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN PRESSURE MONITORING MARKET

- TABLE 525 PRESSURE MONITORING MARKET: DEGREE OF COMPETITION

- TABLE 526 PRESSURE MONITORING MARKET: REGION FOOTPRINT

- TABLE 527 PRESSURE MONITORING MARKET: PRODUCT FOOTPRINT

- TABLE 528 PRESSURE MONITORING MARKET: PROCEDURE TYPE FOOTPRINT

- TABLE 529 PRESSURE MONITORING MARKET: THERAPEUTIC APPLICATION FOOTPRINT

- TABLE 530 PRESSURE MONITORING MARKET: END-USER FOOTPRINT

- TABLE 531 PRESSURE MONITORING MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 532 PRESSURE MONITORING MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 533 PRESSURE MONITORING MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 534 PRESSURE MONITORING MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 535 PRESSURE MONITORING MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 536 MEDTRONIC: COMPANY OVERVIEW

- TABLE 537 MEDTRONIC: PRODUCTS OFFERED

- TABLE 538 MEDTRONIC: PRODUCT APPROVALS, JANUARY 2022-MAY 2025

- TABLE 539 MEDTRONIC: DEALS, JANUARY 2022-MAY 2025

- TABLE 540 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 541 KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED

- TABLE 542 KONINKLIJKE PHILIPS N.V: DEALS, JANUARY 2022-MAY 2025

- TABLE 543 KONINKLIJKE PHILIPS N.V: EXPANSIONS: JANUARY 2022-MAY 2025

- TABLE 544 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 545 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 546 GE HEALTHCARE: PRODUCT APPROVALS, JANUARY 2022-MAY 2025

- TABLE 547 GE HEALTHCARE: DEALS, JANUARY 2022-MAY 2025

- TABLE 548 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 549 OMRON CORPORATION: PRODUCTS OFFERED

- TABLE 550 OMRON CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 551 DRAGERWERK AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 552 DRAGERWERK AG & CO. KGAA: PRODUCTS OFFERED

- TABLE 553 ABBOTT: COMPANY OVERVIEW

- TABLE 554 ABBOTT: PRODUCTS OFFERED

- TABLE 555 ABBOTT: PRODUCT APPROVALS, JANUARY 2022-MAY 2025

- TABLE 556 ABBOTT: DEALS, JANUARY 2022-MAY 2025

- TABLE 557 BAXTER INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 558 BAXTER INTERNATIONAL, INC.: PRODUCTS OFFERED

- TABLE 559 BAXTER INTERNATIONAL, INC : EXPANSIONS: JANUARY 2022-MAY 2025

- TABLE 560 TERUMO CORPORATION: COMPANY OVERVIEW

- TABLE 561 TERUMO CORPORATION: PRODUCTS OFFERED

- TABLE 562 TERUMO CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 563 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 564 BECTON, DICKINSON AND COMPANY: PRODUCTS OFFERED

- TABLE 565 BECTON, DICKINSON AND COMPANY: DEALS, JANUARY 2022-MAY 2025

- TABLE 566 NIHON KOHDEN CORPORATION: COMPANY OVERVIEW

- TABLE 567 NIHON KOHDEN CORPORATION.: PRODUCTS OFFERED

- TABLE 568 INTEGRA LIFESCIENCES CORPORATION: COMPANY OVERVIEW

- TABLE 569 INTEGRA LIFESCIENCES CORPORATION: PRODUCTS OFFERED

- TABLE 570 ZEISS GROUP: COMPANY OVERVIEW

- TABLE 571 ZEISS GROUP: PRODUCTS OFFERED

- TABLE 572 BOSTON SCIENTIFIC CORPORATION: COMPANY OVERVIEW

- TABLE 573 BOSTON SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- TABLE 574 ICU MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 575 ICU MEDICAL INC: PRODUCTS OFFERED

- TABLE 576 ICU MEDICAL, INC: DEALS, JANUARY 2022-MAY 2025

- TABLE 577 MASIMO CORPORATION: COMPANY OVERVIEW

- TABLE 578 MASIMO CORPORATION: PRODUCTS OFFERED

- TABLE 579 REICHERT, INC.: COMPANY OVERVIEW

- TABLE 580 NONIN: COMPANY OVERVIEW

- TABLE 581 NATUS: COMPANY OVERVIEW

- TABLE 582 HONSUN: COMPANY OVERVIEW

- TABLE 583 ROSSMAX INTERNATIONAL LTD.: COMPANY OVERVIEW

- TABLE 584 MICROLIFE CORPORATION: COMPANY OVERVIEW

- TABLE 585 A&D COMPANY: COMPANY OVERVIEW

- TABLE 586 PAUL HARTMANN ASIA-PACIFIC LTD.: COMPANY OVERVIEW

- TABLE 587 ICARE FINLAND OY .: COMPANY OVERVIEW

- TABLE 588 IHEALTH LABS INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MARKETS COVERED

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2024)

- FIGURE 6 SUPPLY-SIDE ANALYSIS: PRESSURE MONITORING MARKET

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF PRESSURE MONITORING MARKET (2025-2032)

- FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS OF PRESSURE MONITORING MARKET (2024)

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 PRESSURE MONITORING MARKET, BY PRODUCT, 2025 VS. 2032 (USD MILLION)

- FIGURE 12 PRESSURE MONITORING MARKET, BY PROCEDURE, 2025 VS. 2032 (USD MILLION)

- FIGURE 13 PRESSURE MONITORING MARKET, BY THERAPEUTIC APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 14 PRESSURE MONITORING MARKET, BY END USER, 2025 VS. 2032 (USD MILLION)

- FIGURE 15 GEOGRAPHIC SNAPSHOT OF PRESSURE MONITORING MARKET

- FIGURE 16 RISING PREVALENCE OF CHRONIC DISEASES AND GROWING FOCUS ON PATIENT MONITORING TO PROPEL MARKET

- FIGURE 17 DEVICES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN US IN 2024

- FIGURE 18 ASIA PACIFIC REGION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 21 PRESSURE MONITORING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 PRESSURE MONITORING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR BLOOD PRESSURE MONITORING PATENTS (JANUARY 2014-APRIL 2025)

- FIGURE 24 TOP APPLICANT COUNTRIES/REGIONS FOR PRESSURE MONITORING PATENTS (JANUARY 2014-APRIL 2025)

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USERS

- FIGURE 26 KEY BUYING CRITERIA FOR PRESSURE MONITORING SYSTEMS

- FIGURE 27 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED DURING MANUFACTURING PHASE

- FIGURE 28 PRESSURE MONITORING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 29 PRESSURE MONITORING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 30 ADJACENT MARKETS FOR PRESSURE MONITORING MARKET

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES IN PRESSURE MONITORING MARKET

- FIGURE 32 INVESTMENT & FUNDING ACTIVITIES IN PRESSURE MONITORING MARKET, 2021-2024

- FIGURE 33 PRESSURE MONITORING MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 34 NORTH AMERICA: PRESSURE MONITORING MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: PRESSURE MONITORING MARKET SNAPSHOT

- FIGURE 36 REVENUE ANALYSIS OF KEY PLAYERS IN PRESSURE MONITORING MARKET (2020-2024)

- FIGURE 37 MARKET SHARE ANALYSIS OF KEY PLAYERS IN PRESSURE MONITORING MARKET. 2024

- FIGURE 38 PRESSURE MONITORING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 39 PRESSURE MONITORING MARKET: COMPANY FOOTPRINT

- FIGURE 40 COMPANY EVALUATION MATRIX: STARTUPS/SMES, (2024)

- FIGURE 41 EV/EBITDA OF KEY VENDORS

- FIGURE 42 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 43 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 44 R&D ASSESSMENT OF KEY PLAYERS IN PRESSURE MONITORING MARKET, 2022-2024

- FIGURE 45 MEDTRONIC: COMPANY SNAPSHOT (2024)

- FIGURE 46 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 47 GE HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 48 OMRON CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 49 DRAGERWERK AG & CO. KGAA: COMPANY SNAPSHOT (2024)

- FIGURE 50 ABBOTT: COMPANY SNAPSHOT (2024)

- FIGURE 51 BAXTER INTERNATIONAL, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 52 TERUMO CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 53 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2024)

- FIGURE 54 NIHON KOHDEN CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 55 INTEGRA LIFESCIENCES CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 56 ZEISS GROUP: COMPANY SNAPSHOT (2024)

- FIGURE 57 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 58 ICU MEDICAL, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 59 MASIMO CORPORATION: COMPANY SNAPSHOT (2024)

The pressure monitoring market is projected to reach USD 25.48 billion by 2032 from USD 14.56 billion in 2025, at a CAGR of 8.3% from 2025 to 2032.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2032 |

| Base Year | 2024 |

| Forecast Period | 2024-2032 |

| Units Considered | Value (USD billion) |

| Segments | Product, Procedure, Therapeutic Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Technological innovations, such as the development of non-invasive, portable, and connected monitoring devices, have improved the accessibility and convenience of pressure monitoring in both clinical and home settings. Furthermore, the growth of telehealth services, increasing healthcare expenditures, and a heightened public awareness of preventive care are all contributing to early diagnosis and regular health monitoring. These factors are driving the adoption of pressure monitoring systems across various healthcare environments, thereby accelerating the growth of the pressure monitoring market.

The pressure monitoring market is experiencing substantial growth, driven by several key factors. A major contributor to this trend is the increasing global prevalence of chronic diseases such as hypertension, cardiovascular disorders, and respiratory conditions, which require continuous and accurate pressure monitoring for effective management. The aging population also plays a significant role in this demand, as older adults are more vulnerable to these health issues.

Additionally, advancements in technology have led to the creation of non-invasive, portable, and smart devices that enhance patient comfort and facilitate remote monitoring. This aligns with the rising trend of telehealth and home-based care. Moreover, increasing healthcare expenditures, expanding healthcare infrastructure, and heightened awareness about early diagnosis and preventive care are also fueling market growth worldwide.

Together, these factors, combined with an older population that needs ongoing health management, are accelerating the adoption of pressure monitoring systems across various healthcare settings.

Based on products, pulmonary pressure monitors accounted for the second-largest share in the pressure monitoring market.

The growth of pulmonary pressure monitoring within the broader pressure monitoring market is being driven by the rising incidence of pulmonary hypertension and other respiratory-related complications, especially among aging populations and patients with chronic obstructive pulmonary disease (COPD) or heart failure. There is an increasing emphasis on the early detection of pulmonary vascular abnormalities to prevent severe outcomes, which is prompting healthcare systems to adopt more precise and real-time pulmonary pressure assessment tools. The shift towards minimally invasive and implantable monitoring technologies has further accelerated this adoption, particularly in critical care and cardiopulmonary settings. Additionally, clinical guidelines and research are increasingly supporting the importance of pulmonary pressure monitoring in optimizing treatment plans, thus driving investment and innovation in this niche yet vital segment of the market.

Based on procedures, invasive procedures registered the highest CAGR during the forecast period.

The increasing demand for real-time, high-precision monitoring in critical care and surgical settings is driving the growth of invasive procedures in the pressure monitoring market. Techniques such as arterial and intracranial pressure measurements are essential for managing patients with severe cardiovascular, neurological, or traumatic conditions, as immediate and accurate readings can significantly impact their outcomes.

The rise in complex surgeries, particularly among aging populations and patients with multiple comorbidities, has heightened the need for continuous intraoperative and ICU monitoring. Additionally, the growing sophistication of critical care units and the greater availability of specialized medical personnel in developed healthcare systems are supporting the wider adoption of invasive monitoring methods.

As hospitals and surgical centers prioritize patient safety and precision in diagnosis and treatment, invasive pressure monitoring remains a vital component in high-acuity clinical environments.

Based on therapeutic applications, respiratory disorders hold the largest share of the pressure monitoring market.

The rise in respiratory disorders is significantly driving the demand for pressure monitoring systems, which is closely linked to increasing environmental and lifestyle-related health challenges. Factors such as rising air pollution, occupational exposure to harmful particles, smoking, and the long-term effects of respiratory infections have contributed to a surge in chronic respiratory diseases like COPD, asthma, and sleep apnea.

These conditions often necessitate precise and continuous monitoring of intrathoracic and airway pressures to effectively manage ventilation and oxygen therapy. Additionally, the growing use of mechanical ventilation and non-invasive respiratory support in both hospital and home care settings has led to a substantial increase in the need for pressure monitoring systems.

As healthcare providers focus on early intervention and proactive disease management, accurate pressure measurement tools have become essential for improving clinical outcomes and reducing hospital readmissions for patients with respiratory conditions.

By end user, home care settings dominated the pressure monitoring market in 2024.

The growth of pressure monitoring in home care settings is driven by several key factors. First, there is an increasing prevalence of chronic diseases, such as hypertension and cardiovascular disorders, which require continuous monitoring and make home-based solutions more appealing. Additionally, technological advancements have led to the development of user-friendly, portable, and accurate monitoring devices that facilitate self-management and reduce the need for frequent hospital visits.

Furthermore, the aging population prefers to receive care in the comfort of their own homes, which further boosts the demand for homecare monitoring solutions. Changes in healthcare policies and reimbursement structures are also evolving to support home-based care, making it a more viable option for both patients and providers. Collectively, these factors contribute to the growing role of pressure monitoring in home care settings.

By region, North America accounted for the largest share of the pressure monitoring market in 2024.

The growth of the pressure monitoring market in North America is driven by a strong emphasis on advanced healthcare technologies and patient-centered care models. Increased investments in healthcare IT infrastructure have enabled the integration of pressure monitoring devices with electronic health records and telehealth platforms, resulting in more efficient and coordinated patient management. Moreover, strict regulatory frameworks and quality standards in North America promote the adoption of highly reliable and innovative monitoring solutions.

The shift towards value-based care is encouraging healthcare providers to utilize continuous pressure monitoring to improve clinical outcomes and reduce hospital readmissions. Additionally, awareness campaigns focused on cardiovascular health, as well as government programs aimed at early disease detection, are increasing the demand for pressure monitoring devices in both clinical and home care settings.

A breakdown of the primary participants (supply side) for the pressure monitoring market referred to in this report is provided below:

- By Company Type: Tier 1 (35%), Tier 2 (40%), and Tier 3 (25%)

- By Designation: C-level Executives (20%), D-level Executives (35%), and Others (45%)

- By Region: North America (27%), Europe (25%), Asia Pacific (30%), Latin America (8%), and the Middle East & Africa (10%)

The key players in the pressure monitoring market are Medtronic (US), Omron Corporation (Japan), Dragerwerk AG & Co. KGaA (Germany), Abbott (US), Koninklijke Philips N.V. (Netherlands), GE Healthcare (US), Baxter (US), Terumo Corporation (Japan), BD (US), Nihon Kohden Corporation (Japan), Integra LifeSciences Corporation (US), Zeiss Group (Germany), Boston Scientific Corporation (US), HONSUN (China), A&D Company (Japan), Reichert, Inc. (US), Nonin. (US), Mehra Eyetech Pvt. Ltd. (India), Rossmax International Ltd. (China), Microlife Corporation. (China), SunTech Medical, Inc. (US), PAUL HARTMANN Asia-Pacific Ltd. (Canada), Icare Finland Oy (Finland), and iHealth Labs Inc. (US).

Research Coverage

The report analyzes the pressure monitoring market and estimates its size and future growth potential based on various segments such as product, procedure, therapeutic area, end user, and region. It also includes a competitive analysis of the key players in this market, along with their company profiles, service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report is designed to assist both market leaders and new entrants by providing valuable insights into the overall pressure monitoring market, including detailed revenue estimates for its subsegments. It will help stakeholders comprehend the competitive landscape, allowing them to better position their businesses and develop effective go-to-market strategies. Additionally, the report highlights key market drivers, restraints, challenges, and opportunities, enabling stakeholders to understand current market trends and dynamics.

This report provides insights into the following pointers:

- Analysis of key drivers (growing prevalence of chronic diseases, technological advancements and integration with digital health platforms, shift towards home healthcare and remote monitoring, and aging population and increased healthcare expenditure), restraints (regulatory and compliance challenges and data privacy and security concerns), opportunities (development of non-invasive and wearable pressure monitoring devices and growth in emerging markets and telehealth infrastructure), and challenges (limited availability of skilled professionals)

- Market Penetration: It provides detailed information on products available from major players in the global pressure monitoring market. The report covers various segments, including products, procedures, therapeutic areas, end users, and regions

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global pressure monitoring market