|

|

市場調査レポート

商品コード

1756519

医療用コネクタの世界市場:製品別、用途別、エンドユーザー別、地域別 - 2030年までの予測Medical Connectors Market by Product (Radiofrequency, Push-Pull, Optical, Non-magnetic), Application (Patient Monitoring, Cardiology, Neurology, Diagnostic Imaging, Respiratory, Dental), End User (Hospitals, Clinics) & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 医療用コネクタの世界市場:製品別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月20日

発行: MarketsandMarkets

ページ情報: 英文 300 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の医療用コネクタの市場規模は、2025年の17億4,000万米ドルから2030年には24億5,000万米ドルに達すると予測され、予測期間中のCAGRは7.1%になるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

医療機器市場の成長は、在宅ヘルスケア分野の拡大と相まって、コンパクトでユーザーフレンドリーな医療機器の開発を可能にする小型化コネクタの需要増加を牽引しています。しかし、無線接続ソリューションへの嗜好の高まりや、機器の製造と性能を管理する厳しい規制基準の賦課が、市場成長の妨げになる可能性があります。

患者モニタリング機器セグメントは医療用コネクタ市場を独占し、最大の応用カテゴリを代表します。この市場は、患者モニタリング機器、電気外科機器、画像診断機器、心臓病学機器、分析・処理機器、呼吸器機器、歯科機器、内視鏡機器、神経学機器など、さまざまな用途にセグメント化されています。2024年には、患者モニタリング機器が最も高い市場シェアを維持すると予測されています。これらの機器は、特に重症患者の心拍、呼吸数、神経活動、血糖値などの重要な健康指標を評価するために不可欠です。医療用コネクタはこのエコシステムに不可欠で、患者に取り付けられたセンサーや電極から外部モニタリングシステムへの信号伝送を容易にし、データ処理を可能にします。高齢化という世界の動向は、継続的な健康モニタリング・ソリューションの需要増加に大きく寄与しています。その結果、患者モニタリング分野のこの成長は、これらの高度な機器の信頼性の高い効率的な操作に不可欠な医療用コネクタの需要増加に対応しています。

医療用コネクタ市場は、病院、外来手術センター(ASC)、クリニック、診断研究所、画像診断センター、その他のヘルスケア施設などのエンドユーザーセグメントによって区分されます。この動向は、堅牢で効率的な接続ソリューションを必要とする高度な医療機器や設備に対する需要の高まりに後押しされています。これらのヘルスケア環境は、常に高度な診断、モニタリング、治療技術への投資を優先しており、そのすべてがシームレスな動作を保証する信頼性の高いコネクタシステムに決定的に依存しています。さらに、患者の安全性と厳格な感染制御プロトコルがますます重視される中、滅菌可能で生体適合性のある医療用コネクタの採用が増加しています。このような環境では医療処置の回転率が高いことに加え、機器のアップグレードの必要性が続いているため、医療用コネクタ市場における支配的な地位がさらに強化されています。

世界の医療用コネクタ市場は5つの主要地域(北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ)に分類されます。北米は、強固なヘルスケアインフラ、大規模なヘルスケア投資、大手医療機器メーカーの存在感に支えられ、現在市場をリードしています。同地域では、技術的進歩が重視されるとともに、様々なヘルスケア環境において高度な診断・治療機器が広く統合されているため、高信頼性医療用コネクタの需要が大幅に高まっています。加えて、人口の高齢化、慢性疾患の負担増、低侵襲手術へのシフトといった人口動向も、北米市場の拡大を後押ししています。この地域は、予測期間を通じて卓越した地位を維持すると予測されています。

当レポートでは、世界の医療用コネクタ市場について調査し、製品別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 医療用コネクタ市場におけるAIの影響

- 米国関税規制が医療用コネクタ市場に与える影響

第6章 医療用コネクタ市場(製品別)

- イントロダクション

- フラットシリコンサージカルケーブル

- 埋め込み型電子コネクタ

- 無線周波数コネクタ

- 使い捨てプラスチックコネクタ

- ハイブリッド円形コネクタおよびレセプタクルシステム

- 保持システム付き電源コード

- 病院グレードの照明付きコード

- 磁気医療用コネクタ

- プッシュプルコネクタ

- 非接触コネクタ

- 非磁性コネクタ

第7章 医療用コネクタ市場(用途別)

- イントロダクション

- 患者モニタリング装置

- 電気外科装置

- 診断用画像装置

- 心臓病学機器

- 分析装置および処理装置

- 呼吸器系機器

- 歯科器具

- 内視鏡装置

- 神経学的デバイス

- 経腸栄養器具

- その他

第8章 医療用コネクタ市場(エンドユーザー別)

- イントロダクション

- 病院、ASCS、クリニック

- 診断検査室

- 在宅ヘルスケア環境

- その他

第9章 医療用コネクタ市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- AMPHENOL CORPORATION

- ITT INTERCONNECT SOLUTIONS(A SUBSIDIARY OF ITT CORPORATION)

- SMITHS INTERCONNECT

- TE CONNECTIVITY LTD.

- ISCHER CONNECTORS

- MOLEX(A SUBSIDIARY OF KOCH INDUSTRIES)

- ESTERLINE TECHNOLOGIES CORPORATION

- HIROSE ELECTRIC CO., LTD.

- CINCH CONNECTIVITY(BEL FUSE INC.)

- LEMO S.A

- SAMTEC

- ODU GMBH & CO. KG

- その他の企業

- OMNETICS CONNECTOR CORPORATION

- NEXTRONICS ENGINEERING CORP.

- CFE CORPORATION CO., LTD.

- IRISO ELECTRONICS CO., LTD.

- KEL CORPORATION

- KYOCERA AVX COMPONENTS CORPORATION

- JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.(JAE)

- BINDER GMBH & CO.

- NICOMATIC

- RADIALL

- ROSENBERGER GROUP

- IEH CORPORATION

- STAUBLI

- NORCOMP

第12章 付録

List of Tables

- TABLE 1 MEDICAL CONNECTORS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MEDICAL CONNECTORS MARKET: KEY DATA FROM PRIMARY SOURCES

- TABLE 3 MEDICAL CONNECTORS MARKET: PARAMETRIC ASSUMPTIONS

- TABLE 4 MEDICAL CONNECTORS MARKET: RISK ASSESSMENT

- TABLE 5 ESTIMATED NUMBER OF NEW CASES IN 2022, 2025, AND 2030 (MALE/FEMALE, AGE [0-85+]), ALL CANCERS

- TABLE 6 PEOPLE WITH DIABETES (20-79 YEARS), BY COUNTRY, 2021 VS. 2045 (IN 1,000 S)

- TABLE 7 TOTAL DIABETES-RELATED HEALTH EXPENDITURE, 2024 AND 2050, ID MILLION

- TABLE 8 INDICATIVE PRICING ANALYSIS OF MEDICAL CONNECTOR PRODUCTS, 2023-2025

- TABLE 9 INDICATIVE PRICING ANALYSIS OF APPLICATION, BY KEY PLAYER, 2023-2025

- TABLE 10 INDICATIVE PRICING ANALYSIS OF MEDICAL CONNECTOR PRODUCTS, BY REGION, 2023-2025

- TABLE 11 MEDICAL CONNECTORS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 12 MEDICAL CONNECTORS MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2023-2025

- TABLE 13 IMPORT DATA (HS CODE 853670), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 EXPORT DATA (HS CODE 853670), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 15 MEDICAL CONNECTORS MARKET: KEY CONFERENCES AND EVENTS, JUNE 2025-DECEMBER 2026

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 MEDICAL CONNECTORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF MEDICAL CONNECTORS, BY END USER (%)

- TABLE 23 KEY BUYING CRITERIA FOR MEDICAL CONNECTORS MARKET, BY END USER

- TABLE 24 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 26 FLAT SILICON SURGICAL CABLES OFFERED BY MARKET PLAYERS

- TABLE 27 MEDICAL CONNECTORS MARKET FOR FLAT SILICON SURGICAL CABLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR FLAT SILICON SURGICAL CABLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 EUROPE: MEDICAL CONNECTORS MARKET FOR FLAT SILICON SURGICAL CABLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR FLAT SILICON SURGICAL CABLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR FLAT SILICON SURGICAL CABLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 EMBEDDED ELECTRONIC CONNECTORS OFFERED BY MARKET PLAYERS

- TABLE 33 MEDICAL CONNECTORS MARKET FOR EMBEDDED ELECTRONIC CONNECTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR EMBEDDED ELECTRONIC CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 EUROPE: MEDICAL CONNECTORS MARKET FOR EMBEDDED ELECTRONIC CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR EMBEDDED ELECTRONIC CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR EMBEDDED ELECTRONIC CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 RADIOFREQUENCY CONNECTORS OFFERED BY MARKET PLAYERS

- TABLE 39 MEDICAL CONNECTORS MARKET FOR RADIOFREQUENCY CONNECTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR RADIOFREQUENCY CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 EUROPE: MEDICAL CONNECTORS MARKET FOR RADIOFREQUENCY CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR RADIOFREQUENCY CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR RADIOFREQUENCY CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 DISPOSABLE PLASTIC CONNECTORS OFFERED BY MARKET PLAYERS

- TABLE 45 MEDICAL CONNECTORS MARKET FOR DISPOSABLE PLASTIC CONNECTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR DISPOSABLE PLASTIC CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 EUROPE: MEDICAL CONNECTORS MARKET FOR DISPOSABLE PLASTIC CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR DISPOSABLE PLASTIC CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR DISPOSABLE PLASTIC CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

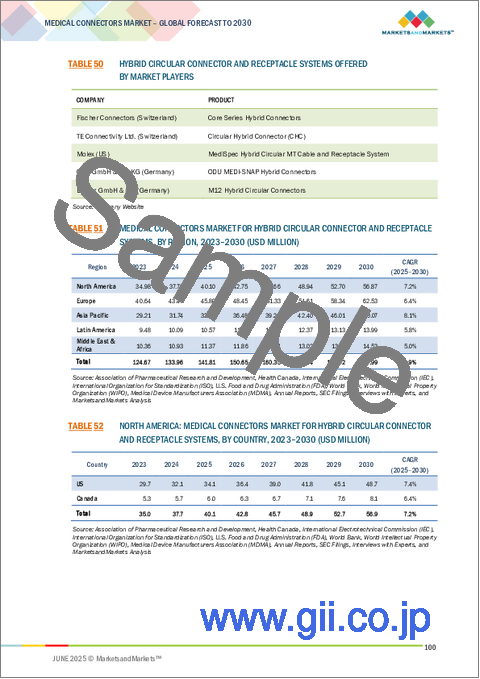

- TABLE 50 HYBRID CIRCULAR CONNECTOR AND RECEPTACLE SYSTEMS OFFERED BY MARKET PLAYERS

- TABLE 51 MEDICAL CONNECTORS MARKET FOR HYBRID CIRCULAR CONNECTOR AND RECEPTACLE SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR HYBRID CIRCULAR CONNECTOR AND RECEPTACLE SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 EUROPE: MEDICAL CONNECTORS MARKET FOR HYBRID CIRCULAR CONNECTOR AND RECEPTACLE SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR HYBRID CIRCULAR CONNECTOR AND RECEPTACLE SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR HYBRID CIRCULAR CONNECTOR AND RECEPTACLE SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 POWER CORDS WITH RETENTION SYSTEMS OFFERED BY MARKET PLAYERS

- TABLE 57 MEDICAL CONNECTORS MARKET FOR POWER CORDS WITH RETENTION SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR POWER CORDS WITH RETENTION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 EUROPE: MEDICAL CONNECTORS MARKET FOR POWER CORDS WITH RETENTION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR POWER CORDS WITH RETENTION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR POWER CORDS WITH RETENTION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 LIGHTED HOSPITAL-GRADE CORDS OFFERED BY MARKET PLAYERS

- TABLE 63 MEDICAL CONNECTORS MARKET FOR LIGHTED HOSPITAL-GRADE CORDS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR LIGHTED HOSPITAL-GRADE CORDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 EUROPE: MEDICAL CONNECTORS MARKET FOR LIGHTED HOSPITAL-GRADE CORDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR LIGHTED HOSPITAL-GRADE CORDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR LIGHTED HOSPITAL-GRADE CORDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 MAGNETIC MEDICAL CONNECTORS OFFERED BY MARKET PLAYERS

- TABLE 69 MEDICAL CONNECTORS MARKET FOR MAGNETIC MEDICAL CONNECTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR MAGNETIC MEDICAL CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 EUROPE: MEDICAL CONNECTORS MARKET FOR MAGNETIC MEDICAL CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR MAGNETIC MEDICAL CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR MAGNETIC MEDICAL CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 PUSH-PULL CONNECTORS OFFERED BY MARKET PLAYERS

- TABLE 75 MEDICAL CONNECTORS MARKET FOR PUSH-PULL CONNECTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR PUSH-PULL CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 EUROPE: MEDICAL CONNECTORS MARKET FOR PUSH-PULL CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR PUSH-PULL CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR PUSH-PULL CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 NON-CONTACT CONNECTORS OFFERED BY MARKET PLAYERS

- TABLE 81 MEDICAL CONNECTORS MARKET FOR NON-CONTACT CONNECTORS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 82 MEDICAL CONNECTORS MARKET FOR NON-CONTACT CONNECTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR NON-CONTACT CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: MEDICAL CONNECTORS MARKET FOR NON-CONTACT CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR NON-CONTACT CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR NON-CONTACT CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 MEDICAL CONNECTORS MARKET FOR WIRELESS POWER TRANSMISSION CONNECTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR WIRELESS POWER TRANSMISSION CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 EUROPE: MEDICAL CONNECTORS MARKET FOR WIRELESS POWER TRANSMISSION CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR WIRELESS POWER TRANSMISSION CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR WIRELESS POWER TRANSMISSION CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 MEDICAL CONNECTORS MARKET FOR OPTICAL CONNECTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR OPTICAL CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 EUROPE: MEDICAL CONNECTORS MARKET FOR OPTICAL CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR OPTICAL CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR OPTICAL CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 NON-MAGNETIC CONNECTORS OFFERED BY MARKET PLAYERS

- TABLE 98 MEDICAL CONNECTORS MARKET FOR NON-MAGNETIC CONNECTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR NON-MAGNETIC CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 100 EUROPE: MEDICAL CONNECTORS MARKET FOR NON-MAGNETIC CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR NON-MAGNETIC CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR NON-MAGNETIC CONNECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 104 CONNECTORS FOR PATIENT MONITORING DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 105 MEDICAL CONNECTORS MARKET FOR PATIENT MONITORING DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR PATIENT MONITORING DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 107 EUROPE: MEDICAL CONNECTORS MARKET FOR PATIENT MONITORING DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR PATIENT MONITORING DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR PATIENT MONITORING DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 110 CONNECTORS FOR ELECTROSURGICAL DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 111 MEDICAL CONNECTORS MARKET FOR ELECTROSURGICAL DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR ELECTROSURGICAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 EUROPE: MEDICAL CONNECTORS MARKET FOR ELECTROSURGICAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR ELECTROSURGICAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 115 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR ELECTROSURGICAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 116 CONNECTORS FOR DIAGNOSTIC IMAGING DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 117 MEDICAL CONNECTORS MARKET FOR DIAGNOSTIC IMAGING DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 118 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR DIAGNOSTIC IMAGING DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 119 EUROPE: MEDICAL CONNECTORS MARKET FOR DIAGNOSTIC IMAGING DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR DIAGNOSTIC IMAGING DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 121 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR DIAGNOSTIC IMAGING DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 122 CONNECTORS FOR CARDIOLOGY DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 123 MEDICAL CONNECTORS MARKET FOR CARDIOLOGY DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR CARDIOLOGY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 125 EUROPE: MEDICAL CONNECTORS MARKET FOR CARDIOLOGY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR CARDIOLOGY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 127 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR CARDIOLOGY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 CONNECTORS FOR ANALYZERS AND PROCESSING EQUIPMENT OFFERED BY KEY MARKET PLAYERS

- TABLE 129 MEDICAL CONNECTORS MARKET FOR ANALYZERS AND PROCESSING EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR ANALYZERS AND PROCESSING EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 131 EUROPE: MEDICAL CONNECTORS MARKET FOR ANALYZERS AND PROCESSING EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR ANALYZERS AND PROCESSING EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 133 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR ANALYZERS AND PROCESSING EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 134 CONNECTORS FOR RESPIRATORY DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 135 MEDICAL CONNECTORS MARKET FOR RESPIRATORY DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR RESPIRATORY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 137 EUROPE: MEDICAL CONNECTORS MARKET FOR RESPIRATORY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR RESPIRATORY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 139 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR RESPIRATORY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 140 CONNECTORS FOR DENTAL INSTRUMENTS OFFERED BY KEY MARKET PLAYERS

- TABLE 141 MEDICAL CONNECTORS MARKET FOR DENTAL INSTRUMENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 142 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR DENTAL INSTRUMENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 143 EUROPE: MEDICAL CONNECTORS MARKET FOR DENTAL INSTRUMENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR DENTAL INSTRUMENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 145 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR DENTAL INSTRUMENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 146 CONNECTORS FOR ENDOSCOPY DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 147 MEDICAL CONNECTORS MARKET FOR ENDOSCOPY DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 148 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR ENDOSCOPY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 149 EUROPE: MEDICAL CONNECTORS MARKET FOR ENDOSCOPY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR ENDOSCOPY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 151 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR ENDOSCOPY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 152 MEDICAL CONNECTORS MARKET FOR NEUROLOGICAL DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR NEUROLOGICAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 154 EUROPE: MEDICAL CONNECTORS MARKET FOR NEUROLOGICAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR NEUROLOGICAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 156 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR NEUROLOGICAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 157 MEDICAL CONNECTORS MARKET FOR ENTERAL DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 158 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR ENTERAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 159 EUROPE: MEDICAL CONNECTORS MARKET FOR ENTERAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 160 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR ENTERAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 161 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR ENTERAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 162 MEDICAL CONNECTORS MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 163 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 164 EUROPE: MEDICAL CONNECTORS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 165 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 166 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 167 MEDICAL CONNECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 168 MEDICAL CONNECTORS MARKET: HOSPITALS, ASCS, & CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 169 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR HOSPITALS, ASCS, & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 170 EUROPE: MEDICAL CONNECTORS MARKET FOR HOSPITALS, ASCS, & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR HOSPITALS, ASCS, & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 172 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR HOSPITALS, ASCS, & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 173 MEDICAL CONNECTORS MARKET FOR DIAGNOSTIC LABORATORIES & IMAGING CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 174 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR DIAGNOSTIC LABORATORIES & IMAGING CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 175 EUROPE: MEDICAL CONNECTORS MARKET FOR DIAGNOSTIC LABORATORIES & IMAGING CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 176 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR DIAGNOSTIC LABORATORIES & IMAGING CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 177 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR DIAGNOSTIC LABORATORIES & IMAGING CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 178 MEDICAL CONNECTORS MARKET FOR HOME HEALTHCARE SETTINGS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 179 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR HOME HEALTHCARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 180 EUROPE: MEDICAL CONNECTORS MARKET FOR HOME HEALTHCARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR HOME HEALTHCARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 182 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR HOME HEALTHCARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 183 MEDICAL CONNECTORS MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 184 NORTH AMERICA: MEDICAL CONNECTORS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 185 EUROPE: MEDICAL CONNECTORS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 186 ASIA PACIFIC: MEDICAL CONNECTORS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 187 LATIN AMERICA: MEDICAL CONNECTORS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 188 MEDICAL CONNECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 189 NUMBER OF MEDICAL CONNECTORS SOLD, BY COUNTRY, 2023-2030 (MILLION UNITS)

- TABLE 190 NORTH AMERICA: MACROECONOMIC INDICATORS

- TABLE 191 NORTH AMERICA: MEDICAL CONNECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 192 NORTH AMERICA: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 193 NORTH AMERICA: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 194 NORTH AMERICA: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 195 NORTH AMERICA: MEDICAL CONNECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 196 US: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 197 US: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 198 US: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 199 US: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 200 CANADA: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 201 CANADA: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 202 CANADA: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 203 CANADA: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 204 EUROPE: MACROECONOMIC INDICATORS

- TABLE 205 EUROPE: MEDICAL CONNECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 206 EUROPE: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 207 EUROPE: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 208 EUROPE: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 209 EUROPE: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 210 GERMANY: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 211 GERMANY: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 212 GERMANY: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 213 GERMANY: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 214 UK: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 215 UK: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 216 UK: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 217 UK: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 218 FRANCE: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 219 FRANCE: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 220 FRANCE: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 221 FRANCE: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 222 ITALY: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 223 ITALY: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 224 ITALY: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 225 ITALY: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 226 SPAIN: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 227 SPAIN: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 228 SPAIN: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 229 SPAIN: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 230 REST OF EUROPE: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 231 REST OF EUROPE: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 232 REST OF EUROPE: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 233 REST OF EUROPE: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 234 ASIA PACIFIC: KEY MACROECONOMIC INDICATORS

- TABLE 235 ASIA PACIFIC: MEDICAL CONNECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 236 ASIA PACIFIC: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 237 ASIA PACIFIC: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 238 ASIA PACIFIC: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 239 ASIA PACIFIC: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 240 CHINA: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 241 CHINA: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 242 CHINA: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 243 CHINA: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 244 JAPAN: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 245 JAPAN: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 246 JAPAN: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 247 JAPAN: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 248 INDIA: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 249 INDIA: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 250 INDIA: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 251 INDIA: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 252 REST OF ASIA PACIFIC: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 253 REST OF ASIA PACIFIC: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 254 REST OF ASIA PACIFIC: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 255 REST OF ASIA PACIFIC: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 256 LATIN AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 257 LATIN AMERICA: MEDICAL CONNECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 258 LATIN AMERICA: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 259 LATIN AMERICA: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 260 LATIN AMERICA: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 261 LATIN AMERICA: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 262 BRAZIL: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 263 BRAZIL: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 264 BRAZIL: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 265 BRAZIL: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 266 MEXICO: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 267 MEXICO: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 268 MEXICO: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 269 MEXICO: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 270 REST OF LATIN AMERICA: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 271 REST OF LATIN AMERICA: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 272 REST OF LATIN AMERICA: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 273 REST OF LATIN AMERICA: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: KEY MACROECONOMIC INDICATORS

- TABLE 275 MIDDLE EAST & AFRICA: MEDICAL CONNECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 276 MIDDLE EAST & AFRICA: MEDICAL CONNECTORS MARKET, BY NON-CONTACT CONNECTORS TYPE, 2023-2030 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: MEDICAL CONNECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: MEDICAL CONNECTORS MARKET, END USER, 2023-2030 (USD MILLION)

- TABLE 279 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MEDICAL CONNECTORS MARKET

- TABLE 280 MEDICAL CONNECTORS MARKET: DEGREE OF COMPETITION

- TABLE 281 MEDICAL CONNECTORS MARKET: REGION FOOTPRINT

- TABLE 282 MEDICAL CONNECTORS MARKET: PRODUCT FOOTPRINT

- TABLE 283 MEDICAL CONNECTORS MARKET: APPLICATION FOOTPRINT

- TABLE 284 MEDICAL CONNECTORS MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 285 MEDICAL CONNECTORS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 286 MEDICAL CONNECTORS MARKET: PRODUCT LAUNCHES, JANUARY 2022-APRIL 2025

- TABLE 287 MEDICAL CONNECTORS MARKET: DEALS, JANUARY 2022- APRIL 2025

- TABLE 288 MEDICAL CONNECTORS MARKET: EXPANSIONS, JANUARY 2022- APRIL 2025

- TABLE 289 AMPHENOL CORPORATION: COMPANY OVERVIEW

- TABLE 290 AMPHENOL CORPORATION: PRODUCTS OFFERED

- TABLE 291 AMPHENOL CORPORATION: DEALS, JANUARY 2022-APRIL 2025

- TABLE 292 ITT CORPORATION: COMPANY OVERVIEW

- TABLE 293 ITT CORPORATION: PRODUCTS OFFERED

- TABLE 294 ITT CORPORATION: PRODUCT LAUNCHES, JANUARY 2022-APRIL 2025

- TABLE 295 SMITHS INTERCONNECT: COMPANY OVERVIEW

- TABLE 296 SMITHS INTERCONNECT: PRODUCTS OFFERED

- TABLE 297 SMITHS INTERCONNECT: PRODUCT LAUNCHES, JANUARY 2022-APRIL 2025

- TABLE 298 TE CONNECTIVITY LTD.: COMPANY OVERVIEW

- TABLE 299 TE CONNECTIVITY LTD.: PRODUCTS OFFERED

- TABLE 300 TE CONNECTIVITY LTD.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 301 TE CONNECTIVITY LTD.: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 302 FISCHER CONNECTORS: COMPANY OVERVIEW

- TABLE 303 FISCHER CONNECTORS: PRODUCTS OFFERED

- TABLE 304 FISCHER CONNECTORS: PRODUCT LAUNCHES, JANUARY 2022-APRIL 2025

- TABLE 305 FISCHER CONNECTORS: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 306 MOLEX: COMPANY OVERVIEW

- TABLE 307 MOLEX: PRODUCTS OFFERED

- TABLE 308 MOLEX: DEALS, JANUARY 2022-APRIL 2025

- TABLE 309 MOLEX: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 310 ESTERLINE TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 311 ESTERLINE TECHNOLOGIES CORPORATION: PRODUCTS OFFERED

- TABLE 312 HIROSE ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 313 HIROSE ELECTRIC CO., LTD.: PRODUCTS OFFERED

- TABLE 314 HIROSE ELECTRIC CO., LTD.: PRODUCT LAUNCHES, JANUARY 2022- FEBRUARY 2025

- TABLE 315 CINCH CONNECTIVITY: COMPANY OVERVIEW

- TABLE 316 CINCH CONNECTIVITY: PRODUCTS OFFERED

- TABLE 317 CINCH CONNECTIVITY: PRODUCT LAUNCHES, JANUARY 2022-APRIL 2025

- TABLE 318 LEMO S.A: COMPANY OVERVIEW

- TABLE 319 LEMO S.A: PRODUCTS OFFERED

- TABLE 320 LEMO S.A: PRODUCT LAUNCHES, JANUARY 2022-FEBRUARY 2025

- TABLE 321 SAMTEC: COMPANY OVERVIEW

- TABLE 322 SAMTEC: PRODUCTS OFFERED

- TABLE 323 SAMTEC: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 324 ODU GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 325 ODU GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 326 ODU GMBH & CO. KG: PRODUCT LAUNCHES, JANUARY 2022-FEBRUARY 2025

- TABLE 327 OMNETICS CONNECTOR CORPORATION: COMPANY OVERVIEW

- TABLE 328 NEXTRONICS ENGINEERING CORP.: COMPANY OVERVIEW

- TABLE 329 CFE CORPORATION CO., LTD.: COMPANY OVERVIEW

- TABLE 330 IRISO ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 331 KEL CORPORATION: COMPANY OVERVIEW

- TABLE 332 KYOCERA AVX COMPONENTS CORPORATION: COMPANY OVERVIEW

- TABLE 333 JAPAN AVIATION ELECTRONICS INDUSTRY, LTD. (JAE): COMPANY OVERVIEW

- TABLE 334 BINDER GMBH & CO.: COMPANY OVERVIEW

- TABLE 335 NICOMATIC: COMPANY OVERVIEW

- TABLE 336 RADIALL: COMPANY OVERVIEW

- TABLE 337 ROSENBERGER GROUP: COMPANY OVERVIEW

- TABLE 338 IEH CORPORATION: COMPANY OVERVIEW

- TABLE 339 STAUBLI: COMPANY OVERVIEW

- TABLE 340 NORCOMP: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MEDICAL CONNECTORS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MEDICAL CONNECTORS MARKET: RESEARCH DESIGN

- FIGURE 3 MEDICAL CONNECTORS MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 MEDICAL CONNECTORS MARKET: KEY PRIMARY SOURCES

- FIGURE 5 MEDICAL CONNECTORS MARKET: KEY INDUSTRY INSIGHTS

- FIGURE 6 SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 MEDICAL CONNECTORS MARKET: REVENUE SHARE ANALYSIS

- FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 10 MEDICAL CONNECTORS MARKET: TOP-DOWN APPROACH

- FIGURE 11 MEDICAL CONNECTORS MARKET: DATA TRIANGULATION

- FIGURE 12 MEDICAL CONNECTORS MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 MEDICAL CONNECTORS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 MEDICAL CONNECTORS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 GEOGRAPHICAL SNAPSHOT OF MEDICAL CONNECTORS MARKET

- FIGURE 16 EXPANDING HOSPITAL NETWORKS TO DRIVE MARKET

- FIGURE 17 FLAT SILICONE SURGICAL CABLES AND CHINA LED ASIA PACIFIC MARKET IN 2024

- FIGURE 18 CHINA TO RECORD HIGHEST GROWTH RATE FROM 2025 TO 2030

- FIGURE 19 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 21 MEDICAL CONNECTORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 MEDICAL CONNECTORS MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

- FIGURE 24 MEDICAL CONNECTORS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 MEDICAL CONNECTORS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 MEDICAL CONNECTORS MARKET: INVESTMENT AND FUNDING SCENARIO, 2019-2025

- FIGURE 27 MEDICAL CONNECTORS MARKET: PATENT ANALYSIS, JANUARY 2015- DECEMBER 2024

- FIGURE 28 MEDICAL CONNECTORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF MEDICAL CONNECTOR PRODUCTS

- FIGURE 30 KEY BUYING CRITERIA FOR MEDICAL CONNECTORS MARKET, BY END USER

- FIGURE 31 AI USE CASES

- FIGURE 32 NORTH AMERICA: MEDICAL CONNECTORS MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: MEDICAL CONNECTORS MARKET SNAPSHOT

- FIGURE 34 REVENUE ANALYSIS OF KEY PLAYERS IN MEDICAL CONNECTORS MARKET, 2020-2024

- FIGURE 35 MARKET SHARE ANALYSIS OF KEY PLAYERS IN MEDICAL CONNECTORS MARKET (2024)

- FIGURE 36 COMPANY VALUATION OF KEY VENDORS, 2025

- FIGURE 37 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS, 2025

- FIGURE 38 MEDICAL CONNECTORS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 39 MEDICAL CONNECTORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 MEDICAL CONNECTORS MARKET: COMPANY FOOTPRINT

- FIGURE 41 MEDICAL CONNECTORS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 42 AMPHENOL CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 43 ITT CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 44 SMITHS INTERCONNECT: COMPANY SNAPSHOT (2024)

- FIGURE 45 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT (2024)

- FIGURE 46 HIROSE ELECTRIC CO., LTD.: COMPANY SNAPSHOT (2024)

- FIGURE 47 CINCH CONNECTIVITY: COMPANY SNAPSHOT (2024)

The global medical connectors market is projected to reach USD 2.45 billion by 2030 from USD 1.74 billion in 2025, at a CAGR of 7.1% during the forecast period."

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

The growth of the medical devices market, coupled with the expanding home healthcare sector, is driving an increased demand for miniaturized connectors that enable the development of compact and user-friendly medical equipment. However, the market growth may be hindered by the rising preference for wireless connectivity solutions and the imposition of stringent regulatory standards that govern device manufacturing and performance.

"The patient monitoring devices segment of the medical connectors market, by application, is expected to hold the largest position during the forecast period."

The patient monitoring devices segment dominates the medical connectors market, representing the largest application category. This market is segmented into various applications, including patient monitoring devices, electrosurgical instruments, diagnostic imaging devices, cardiology devices, analyzers and processing equipment, respiratory devices, dental instruments, endoscopy devices, and neurology devices, among others. In 2024, patient monitoring devices are projected to maintain the highest market share. These devices are critical for assessing vital health indicators-such as heart rhythm, respiratory rate, neural activity, and blood glucose levels-particularly in critically ill patients. Medical connectors are integral to this ecosystem, facilitating the transmission of signals from sensors or electrodes affixed to the patient to external monitoring systems, thereby enabling data processing. The ongoing global trend of an aging population is a significant factor contributing to the increased demand for continuous health monitoring solutions. Consequently, this growth in the patient monitoring sector is driving a corresponding rise in the demand for medical connectors, essential for the reliable and efficient operation of these advanced devices.

"The hospitals, ambulatory surgery centers, and clinics segment accounted for the largest market share in the medical connectors end user market."

The medical connectors market is delineated by end-user segments, which include hospitals, ambulatory surgery centers (ASCs), clinics, diagnostic laboratories, imaging centers, and additional healthcare facilities. In 2024, hospitals, ASCs, and clinics commanded the largest share of the market, a trend driven by the escalating demand for sophisticated medical devices and equipment that necessitate robust and efficient connectivity solutions. These healthcare settings consistently prioritize investments in advanced diagnostic, monitoring, and therapeutic technologies, all of which are critically dependent on reliable connector systems to ensure seamless operation. Moreover, with an increasing emphasis on patient safety and stringent infection control protocols, there is a growing adoption of sterilizable and biocompatible medical connectors. The ongoing need for equipment upgrades, alongside the high turnover of medical procedures in these environments, further reinforces their dominant position within the medical connectors market.

"North America is expected to hold the largest position in the medical connectors market, by region, during the forecast period."

The global medical connectors market is categorized into five primary regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America currently leads the market, underpinned by its robust healthcare infrastructure, substantial healthcare investments, and a strong presence of leading medical device manufacturers. The region's emphasis on technological advancement, along with the widespread integration of sophisticated diagnostic and therapeutic devices across various healthcare settings, has significantly fueled the demand for high-reliability medical connectors. Additionally, demographic trends such as an aging population, combined with a rising burden of chronic diseases and a shift towards minimally invasive surgical techniques, further catalyze market expansion in North America. This region is anticipated to sustain its preeminent position throughout the forecast period.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1: 50%, Tier 2: 40%, and Tier 3: 10%

- By Designation: C Level: 27%, Director Level: 18%, and Others: 55%

- By Region: North America: 50%, Europe: 20%, Asia Pacific: 20%, Latin America: 7%, and Middle East & Africa: 3%

Note 1: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The major players operating in the medical connectors market are Amphenol Corporation (US), ITT Interconnect Solutions (US), Smiths Interconnect (UK), TE Connectivity Ltd. (Switzerland), Fischer Connectors (Switzerland), Molex (US), Esterline Technologies Corporation (US), Hirose Electric Co., Ltd. (Japan), Cinch Connectivity (US), LEMO S.A. (Switzerland), Samtec (US), and ODU GmbH & Co. KG (Germany).

Research Coverage

This report studies the medical connectors market based on product, application, end user, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends. It forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the strategies mentioned below to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (advancements in medical devices market and developing home healthcare market and increased demand for miniaturized connectors), restraints (rising demand for wireless connectivity and stringent regulatory standards), opportunities (high growth potential in untapped emerging markets), challenges (supply chain volatility and compatibility and standardization challenges due to heterogeneous landscape of medical equipment).

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the medical connectors market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the medical connectors market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the medical connectors market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources for secondary data

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Key primary participants

- 2.1.2.5 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation approach

- 2.2.1.1.1 Presentations of companies and primary interviews

- 2.2.1.1.2 Primary interviews

- 2.2.1.1 Company revenue estimation approach

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 PARAMETRIC ASSUMPTIONS

- 2.5.2 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MEDICAL CONNECTORS MARKET

- 4.2 ASIA PACIFIC MEDICAL CONNECTORS MARKET, BY PRODUCT AND COUNTRY

- 4.3 MEDICAL CONNECTORS MARKET, BY COUNTRY

- 4.4 MEDICAL CONNECTORS MARKET, REGIONAL MIX, 2025 VS. 2030

- 4.5 MEDICAL CONNECTORS MARKET: EMERGING ECONOMIES VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for medical equipment

- 5.2.1.1.1 Surge in aging population

- 5.2.1.1.2 Increasing prevalence of chronic conditions and trauma injuries

- 5.2.1.1.3 Rising preference for minimally invasive surgeries

- 5.2.1.1.4 Surging demand for diagnostic imaging

- 5.2.1.2 Increasing demand for home-based care

- 5.2.1.1 Rising demand for medical equipment

- 5.2.2 RESTRAINTS

- 5.2.2.1 Growing demand for wireless connectivity in medical devices

- 5.2.2.2 Stringent regulatory standards governing medical connectors

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of medical device sector in Central & Eastern Europe and Asia Pacific

- 5.2.3.2 Wide adoption of telemedicine and remote patient monitoring

- 5.2.3.3 Integration of advanced medical technologies via international partnerships

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled technicians and biomedical engineers

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICING ANALYSIS, BY PRODUCT, 2023-2025

- 5.4.2 INDICATIVE PRICING ANALYSIS OF APPLICATION, BY KEY PLAYER, 2023-2025

- 5.4.3 INDICATIVE PRICING ANALYSIS, BY REGION, 2023-2025

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Embedded electronic connectors

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Radiofrequency connectors

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA (HS CODE 853670)

- 5.11.2 EXPORT DATA (HS CODE 853670)

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 REGULATORY SCENARIO

- 5.13.2.1 North America

- 5.13.2.1.1 US

- 5.13.2.2 Europe

- 5.13.2.1 North America

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI ON MEDICAL CONNECTORS MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 MARKET POTENTIAL OF AI IN MEDICAL CONNECTORS MARKET

- 5.16.3 AI USE CASES

- 5.16.4 KEY COMPANIES IMPLEMENTING AI

- 5.16.5 FUTURE OF AI IN MEDICAL CONNECTORS MARKET

- 5.17 IMPACT OF US TARIFF REGULATION ON MEDICAL CONNECTORS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 KEY IMPACTS ON COUNTRY/REGION

- 5.17.4.1 North America

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.17.5.1 Hospitals, ASCs, & clinics

- 5.17.5.2 Diagnostics laboratories & imaging centers

- 5.17.5.3 Home healthcare settings

- 5.17.5.4 Other end users

6 MEDICAL CONNECTORS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 FLAT SILICON SURGICAL CABLES

- 6.2.1 FLEXIBILITY AND GREATER CURRENT CARRYING CAPACITY TO BOOST DEMAND

- 6.3 EMBEDDED ELECTRONIC CONNECTORS

- 6.3.1 MINIATURIZATION AND INTEGRATION TO BOOST MARKET TRACTION

- 6.4 RADIOFREQUENCY CONNECTORS

- 6.4.1 DEMAND FOR HIGH-SPEED DATA AND IMAGING TO DRIVE ADOPTION

- 6.5 DISPOSABLE PLASTIC CONNECTORS

- 6.5.1 INFECTION CONTROL AND COST-EFFICIENCY TO DRIVE ADOPTION

- 6.6 HYBRID CIRCULAR CONNECTOR AND RECEPTACLE SYSTEMS

- 6.6.1 INTEGRATION OF MULTIPLE FUNCTIONALITIES TO DRIVE MARKET

- 6.7 POWER CORDS WITH RETENTION SYSTEMS

- 6.7.1 ENHANCING SAFETY AND RELIABILITY IN CRITICAL MEDICAL APPLICATIONS TO DRIVE MARKET

- 6.8 LIGHTED HOSPITAL-GRADE CORDS

- 6.8.1 SOLID BRASS BLADES AND ROBUST INSULATION TO ENSURE DURABILITY AND COMPLIANCE IN MEDICAL ENVIRONMENTS

- 6.9 MAGNETIC MEDICAL CONNECTORS

- 6.9.1 IMPROVING SAFETY AND EASE OF USE IN MEDICAL APPLICATIONS TO BOOST ADOPTION

- 6.10 PUSH-PULL CONNECTORS

- 6.10.1 ENHANCING SAFETY AND EFFICIENCY IN MEDICAL APPLICATIONS TO DRIVE MARKET

- 6.11 NON-CONTACT CONNECTORS

- 6.11.1 WIRELESS POWER TRANSMISSION CONNECTORS

- 6.11.1.1 Revolutionizing medical device power delivery through non-contact solutions to drive market

- 6.11.2 OPTICAL CONNECTORS

- 6.11.2.1 Facilitating high-speed, contactless data transmission in medical settings to drive market

- 6.11.1 WIRELESS POWER TRANSMISSION CONNECTORS

- 6.12 NON-MAGNETIC CONNECTORS

- 6.12.1 ENSURING COMPATIBILITY AND SAFETY IN MAGNETIC-SENSITIVE MEDICAL ENVIRONMENTS TO BOOST DEMAND

7 MEDICAL CONNECTORS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 PATIENT MONITORING DEVICES

- 7.2.1 RISING DIABETES INCIDENCES AND AGING POPULATION FUEL DEMAND FOR PATIENT MONITORING DEVICES

- 7.3 ELECTROSURGICAL DEVICES

- 7.3.1 RISING SURGICAL VOLUMES AND SHIFT TO MINIMALLY INVASIVE PROCEDURES FUEL DEMAND FOR ELECTROSURGICAL DEVICES

- 7.4 DIAGNOSTIC IMAGING DEVICES

- 7.4.1 SURGE IN CHRONIC DISEASES AND DEMAND FOR EARLY DIAGNOSIS TO DRIVE ADOPTION OF DIAGNOSTIC IMAGING SYSTEMS

- 7.5 CARDIOLOGY DEVICES

- 7.5.1 RISING CARDIOVASCULAR DISEASE BURDEN AND TECHNOLOGICAL ADVANCEMENTS TO BOOST ADOPTION

- 7.6 ANALYZERS AND PROCESSING EQUIPMENT

- 7.6.1 ADVANCEMENTS IN MEDICAL DIAGNOSTICS TO DRIVE DEMAND FOR HIGH-RELIABILITY CONNECTORS IN HEALTHCARE SETTINGS

- 7.7 RESPIRATORY DEVICES

- 7.7.1 INCREASING PREVALENCE OF RESPIRATORY CONDITIONS TO DRIVE MARKET

- 7.8 DENTAL INSTRUMENTS

- 7.8.1 ADVANCEMENTS IN DENTAL TECHNOLOGY AND INCREASED DEMAND FOR HIGH-RELIABILITY CONNECTORS TO DRIVE MARKET

- 7.9 ENDOSCOPY DEVICES

- 7.9.1 ADVANCEMENTS IN ENDOSCOPIC TECHNOLOGY AND CRITICAL ROLE OF HIGH-RELIABILITY CONNECTORS TO BOOST DEMAND

- 7.10 NEUROLOGICAL DEVICES

- 7.10.1 GROWING PREVALENCE OF NEUROLOGICAL DISORDERS TO DRIVE MARKET

- 7.11 ENTERAL DEVICES

- 7.11.1 STANDARDIZING ENTERAL DEVICE CONNECTIONS TO IMPROVE PATIENT OUTCOMES

- 7.12 OTHER APPLICATIONS

8 MEDICAL CONNECTORS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS, ASCS, & CLINICS

- 8.2.1 POWERING DEMAND FOR MEDICAL CONNECTORS THROUGH TECHNOLOGY AND CARE INTEGRATION

- 8.3 DIAGNOSTIC LABORATORIES

- 8.3.1 GROWING ADOPTION OF CONNECTORS IN MODERN DIAGNOSTIC SETTINGS

- 8.4 HOME HEALTHCARE SETTINGS

- 8.4.1 HOME-BASED MEDICAL DEVICES DRIVING CONNECTOR INNOVATION

- 8.5 OTHER END USERS

9 MEDICAL CONNECTORS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Surge in aging population to drive market

- 9.2.3 CANADA

- 9.2.3.1 Rising healthcare spending to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Expanding healthcare infrastructure and rising demand for advanced medical devices to drive market

- 9.3.3 UK

- 9.3.3.1 Surge in public-private partnerships to boost demand for connectors

- 9.3.4 FRANCE

- 9.3.4.1 Rising healthcare expenditure to drive market

- 9.3.5 ITALY

- 9.3.5.1 Rising demand for disease management solutions to drive market

- 9.3.6 SPAIN

- 9.3.6.1 Rise in aging population to fuel market growth

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Rapid demographic and healthcare shifts to boost market

- 9.4.3 JAPAN

- 9.4.3.1 Strategic initiatives aimed at transforming healthcare system to boost demand for medical connectors

- 9.4.4 INDIA

- 9.4.4.1 Need for enhanced medical infrastructure and devices to drive market

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Increasing demand for diagnostic and therapeutic procedures to drive market

- 9.5.3 MEXICO

- 9.5.3.1 Aging population and healthcare investment to drive market

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MEDICAL CONNECTORS MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Product footprint

- 10.7.5.4 Application footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 AMPHENOL CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 ITT INTERCONNECT SOLUTIONS (A SUBSIDIARY OF ITT CORPORATION)

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 SMITHS INTERCONNECT

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 TE CONNECTIVITY LTD.

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.3.2 Expansions

- 11.1.5 ISCHER CONNECTORS

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Expansions

- 11.1.6 MOLEX (A SUBSIDIARY OF KOCH INDUSTRIES)

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.3.2 Expansions

- 11.1.7 ESTERLINE TECHNOLOGIES CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 HIROSE ELECTRIC CO., LTD.

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.9 CINCH CONNECTIVITY (BEL FUSE INC.)

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.10 LEMO S.A

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.11 SAMTEC

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Expansions

- 11.1.12 ODU GMBH & CO. KG

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches

- 11.1.1 AMPHENOL CORPORATION

- 11.2 OTHER PLAYERS

- 11.2.1 OMNETICS CONNECTOR CORPORATION

- 11.2.2 NEXTRONICS ENGINEERING CORP.

- 11.2.3 CFE CORPORATION CO., LTD.

- 11.2.4 IRISO ELECTRONICS CO., LTD.

- 11.2.5 KEL CORPORATION

- 11.2.6 KYOCERA AVX COMPONENTS CORPORATION

- 11.2.7 JAPAN AVIATION ELECTRONICS INDUSTRY, LTD. (JAE)

- 11.2.8 BINDER GMBH & CO.

- 11.2.9 NICOMATIC

- 11.2.10 RADIALL

- 11.2.11 ROSENBERGER GROUP

- 11.2.12 IEH CORPORATION

- 11.2.13 STAUBLI

- 11.2.14 NORCOMP

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS