|

|

市場調査レポート

商品コード

1756515

診断用心電計/ECGの世界市場:製品別、リードタイプ別、タイプ別、展開/接続別、エンドユーザー別、地域別 - 2032年までの予測Diagnostic Electrocardiograph/ECG Market by Product (Resting ECG, Stress ECG, Mobile Cardiac Telemetry), Lead Type (Single-lead, 3, 5, 6 & 12-lead ECG Device), Type (Portable ECG Device, Wearable ECG Device), Connectivity - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 診断用心電計/ECGの世界市場:製品別、リードタイプ別、タイプ別、展開/接続別、エンドユーザー別、地域別 - 2032年までの予測 |

|

出版日: 2025年06月13日

発行: MarketsandMarkets

ページ情報: 英文 374 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の診断用心電計/ECGの市場規模は、2025年の91億9,000万米ドルから2032年には151億8,000万米ドルに達すると予測され、予測期間中のCAGRは7.4%になるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2032年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品別、リードタイプ別、タイプ別、展開/接続別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

糖尿病やCVDなどの慢性疾患の有病率の上昇と相まって、世界の高齢者人口の大幅な拡大が診断用ECG市場の需要を牽引する見通しです。さらに、予防医療への注目の高まり、医療費の増加、各地域のヘルスケアインフラの改善も市場成長を促進します。診断用ECG機器の技術的進歩、革新的な製品の導入、有利な償還の枠組み、政府の支援政策などが、市場のダイナミクスをさらに高めると予想されます。ヘルスケアインフラへの投資や、診断用ECGソリューションの入手しやすさと買いやすさを向上させる取り組みも、市場拡大を後押しするとみられます。

診断用ECG市場は主にデバイスが牽引しており、2024年には最大の市場シェアを占めました。この急成長の主な要因は、冠動脈疾患、脳卒中、末梢動脈疾患などのCVD発症率の上昇にあります。さらに、高齢者集団における早期かつ継続的な心臓モニタリングの需要や、遠隔患者管理の増加傾向が、この成長動向を大きく後押ししています。小型化やワイヤレス接続の強化など、機器技術における最近の進歩は、これらの機器をより効率的で、ユーザー中心で、利用しやすいものにしています。この進化により、従来の臨床環境でも遠隔地でも心臓ケアを提供できるようになり、患者の転帰が改善され、ヘルスケア提供が最適化されます。

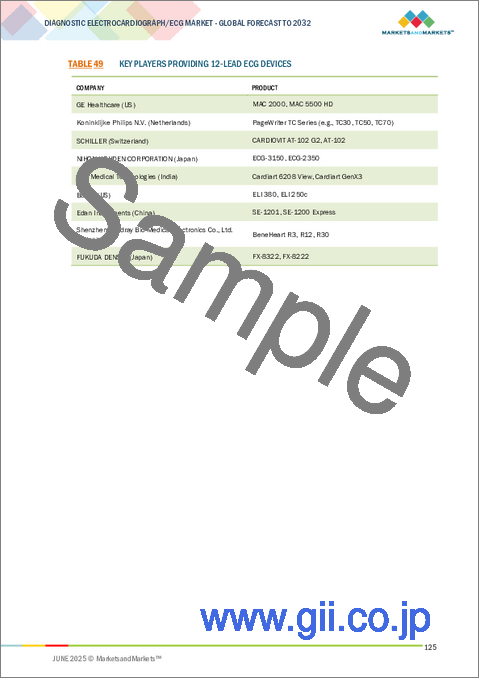

リードタイプ別では、診断用ECG市場は12リード、5リード、3リード、6リード、シングルリードECG機器に区分されます。12誘導ECGシステムは、12か所の電極配置を通じて心臓の電気的活動を包括的に分析し、多面的に見ることができるため、市場を独占しています。この機能により、心筋梗塞、複雑な不整脈、虚血性心疾患など、さまざまなCVDの正確な診断が容易になります。臨床医、特に救急部、ICU、および心臓病専門クリニックでは、重要な臨床的意思決定とタイムリーな治療介入を行うために、12誘導心電図が提供する豊富なデータに大きく依存しています。さらに、ワイヤレス接続や遠隔医療プラットフォームとのシームレスな統合を特徴とするポータブルデジタル12誘導心電図装置など、最近の技術的進歩は、診断心電図の展望におけるこれらのシステムの重要な役割をさらに強固なものにしています。

展開/接続別では、診断ECG市場はスタンドアロン、PCベース、クラウドベースのECG機器に区分されます。スタンドアロン型ECG機器が市場シェアを占め、よりアクセスしやすく継続的なモニタリングが必要なCVDsの世界の有病率の上昇がその要因となっています。技術の進歩は、遠隔患者モニタリングや在宅医療への注目の高まりと相まって、小型で高精度の使いやすい機器の開発につながっています。この動向はまた、予防的健康管理を強化し、従来の臨床環境以外での心臓の健康状態の自己モニタリングを容易にします。これらの機器は不整脈やその他の心疾患の早期発見に役立つため、病院を受診する頻度を減らすことができます。これらの機器は、予防的な心臓の健康管理のための費用対効果の高い選択肢として機能し、診断能力を強化するために遠隔医療プラットフォームや人工知能とシームレスに統合することができます。

世界の診断用ECG市場は5つの主要地域(北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ)に区分されます。北米は診断用ECGの最大地域市場であり、アジア太平洋市場は予測期間中に最も高いCAGRで成長すると予測されています。

北米市場の優位性は、相互に関連するいくつかの要因によるところが大きいです。まず、CVDの罹患率が上昇しており、これは公衆衛生上の差し迫った問題になっているため、関連ヘルスケアサービスや製品に対する需要が高まっています。この増加はさらに、こうした健康課題に対処するための医療とリソースを効率的に提供する、強固で確立されたヘルスケア・インフラによって支えられています。さらに、北米の国民は可処分所得が高く、予防医療や高度な治療オプションなど、健康関連の投資に優先的に支出することができます。このような経済力も、革新的な医療技術やソリューションの採用を後押ししており、同地域全域で広く利用可能です。診断ツール、治療方法、患者管理システムなど、ヘルスケアにおける最先端技術の進歩が幅広く利用できるようになったことで、治療全体の質が向上し、CVD患者の健康転帰が改善されます。これらの要因が相まって、北米における市場の成長とヘルスケアソリューションの継続的な進化に向けた強力な環境が構築されています。さらに、GEヘルスケア、バクスター、OSIシステムズといった業界をリードする企業の影響力が、同地域における診断用ECG市場の成長を促進すると期待されています。

当レポートでは、世界の診断用心電計/ECG市場について調査し、製品別、リードタイプ別、タイプ別、展開/接続別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 技術分析

- ポーターのファイブフォース分析

- 規制状況

- 特許分析

- 貿易分析

- 価格分析

- 償還シナリオ

- 2025年~2026年の主な会議とイベント

- 主要な利害関係者と購入基準

- アンメットニーズ/エンドユーザーの期待

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- AI/生成AIが診断用心電図市場に与える影響

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向/混乱

- 2025年の米国関税の影響

- 投資と資金調達のシナリオ

第6章 診断用心電計/ECG市場(製品別)

- イントロダクション

- デバイス

- ソフトウェアとサービス

第7章 診断用心電計/ECG市場(リードタイプ別)

- イントロダクション

- 12リード

- 5リード

- 3リード

- 6リード

- シングルリード

- その他

第8章 診断用心電計/ECG市場(タイプ別)

- イントロダクション

- ポータブル

- ウェアラブル

- 埋め込み型

第9章 診断用心電計/ECG市場(展開/接続別)

- イントロダクション

- スタンドアロン心電計

- PCベースの心電計

- クラウドベースの心電計

第10章 診断用心電計/ECG市場(エンドユーザー別)

- イントロダクション

- 病院

- プライマリケアセンター

- 心臓センター

- 外来手術センター

- 在宅ケア

- 緊急治療室

- その他

第11章 診断用心電計/ECG市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- マレーシア

- タイ

- インドネシア

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益シェア分析(2022年~2024年)

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- スタートアップ/中小企業向け企業評価マトリックス、2024年

- ブランド/製品比較

- 診断用心電図市場:企業評価と財務指標

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- KONINKLIJKE PHILIPS N.V.

- GE HEALTHCARE

- MEDTRONIC

- BOSTON SCIENTIFIC CORPORATION

- ABBOTT LABORATORIES

- BAXTER(HILL-ROM HOLDINGS, INC.)

- FUKUDA DENSHI

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- NIHON KOHDEN CORPORATION

- OSI SYSTEMS, INC.

- BITTIUM

- IRHYTHM TECHNOLOGIES, INC.

- LEPU MEDICAL TECHNOLOGY(BEIJING)CO., LTD.

- MIDMARK CORPORATION

- BPL MEDICAL TECHNOLOGIES

- SCHILLER

- ACS DIAGNOSTICS

- ALLENGERS

- BIONET CO., LTD.

- その他の企業

- EDAN INSTRUMENTS, INC.

- QINGDAO MEDITECH EQUIPMENT CO., LTD.

- CARDIAC INSIGHT, INC.

- ALIVECOR, INC.

- VITALCONNECT

- BTL

- BORSAM MEDICAL

- NASIFF ASSOCIATES, INC.

- VECTRACOR, INC.

- BIOMEDICAL INSTRUMENTS CO., LTD.

- LIFESIGNALS

第14章 付録

List of Tables

- TABLE 1 DIAGNOSTIC ECG MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 3 DIAGNOSTIC ECG MARKET: STUDY ASSUMPTIONS

- TABLE 4 DIAGNOSTIC ECG MARKET: RISK ANALYSIS

- TABLE 5 DIAGNOSTIC ECG MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 DIAGNOSTIC ECG MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2023-2025

- TABLE 12 IMPORT DATA FOR HS CODE 901811 (ELECTRO-CARDIOGRAPHS), BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR HS CODE 901811 (ELECTRO-CARDIOGRAPHS), BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 14 AVERAGE SELLING PRICE TREND OF RESTING ECG, BY REGION, 2022-2024

- TABLE 15 AVERAGE SELLING PRICE TREND OF STRESS ECG, BY REGION, 2022-2024

- TABLE 16 AVERAGE SELLING PRICE TREND OF HOLTER MONITORS, BY REGION, 2022-2024

- TABLE 17 COMMON CPT CODES AND AVERAGE REIMBURSEMENT RATES

- TABLE 18 DIAGNOSTIC ECG MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT

- TABLE 20 KEY BUYING CRITERIA FOR DIAGNOSTIC ECG PRODUCTS

- TABLE 21 DIAGNOSTIC ECG MARKET: CURRENT UNMET NEEDS

- TABLE 22 DIAGNOSTIC ECG PROVIDERS: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 23 KEY COMPANIES IMPLEMENTING AI IN DIAGNOSTIC ECG DEVICES

- TABLE 24 CASE STUDY 1: ARRHYTHMIA DETECTION IN SINGLE-LEAD ECG CHEST STRAP

- TABLE 25 CASE STUDY 2: CARDIOSOFT ECG - BICESTER HEALTH CENTRE

- TABLE 26 CASE STUDY 3: ENHANCING POST-STROKE ATRIAL FIBRILLATION DETECTION WITH PHILIPS BIOTEL HEART MCOT

- TABLE 27 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 28 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR DIAGNOSTIC ELECTROCARDIOGRAPHS

- TABLE 29 NORTH AMERICA: IMPACT ON CANADA DUE TO US TARIFFS

- TABLE 30 ASIA PACIFIC: IMPACT ON CHINA, JAPAN, AND INDIA DUE TO US TARIFFS

- TABLE 31 EUROPE: IMPACT ON GERMANY AND UK DUE TO US TARIFFS

- TABLE 32 LATIN AMERICA: IMPACT ON MEXICO DUE TO US TARIFFS

- TABLE 33 DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 34 KEY PLAYERS PROVIDING DIAGNOSTIC ECG DEVICES

- TABLE 35 DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 36 KEY PLAYERS PROVIDING RESTING ECG DEVICES

- TABLE 37 RESTING ECG DEVICES MARKET, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 38 KEY PLAYERS PROVIDING STRESS ECG DEVICES

- TABLE 39 STRESS ECG DEVICES MARKET, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 40 KEY PLAYERS PROVIDING HOLTER MONITORS

- TABLE 41 HOLTER MONITORS MARKET, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 42 KEY PLAYERS PROVIDING EVENT MONITORS

- TABLE 43 EVENT MONITORS MARKET, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 44 IMPLANTABLE LOOP RECORDERS MARKET, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 45 MOBILE CARDIAC TELEMETRY DEVICES MARKET, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 46 SMART ECG MONITORS MARKET, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 47 DIAGNOSTIC ECG SOFTWARE & SERVICES MARKET, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 48 DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 49 KEY PLAYERS PROVIDING 12-LEAD ECG DEVICES

- TABLE 50 12-LEAD ECG DEVICES MARKET, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 51 5-LEAD ECG DEVICES MARKET, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 52 3-LEAD ECG DEVICES MARKET, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 53 6-LEAD ECG DEVICES MARKET, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 54 SINGLE-LEAD ECG DEVICES MARKET, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 55 OTHER ECG LEAD DEVICES MARKET, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 56 DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 57 KEY PLAYERS PROVIDING PORTABLE ECG DEVICES

- TABLE 58 DIAGNOSTIC ECG DEVICES MARKET FOR PORTABLE ECG DEVICES, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 59 KEY PLAYERS PROVIDING WEARABLE DIAGNOSTIC ECG DEVICES

- TABLE 60 DIAGNOSTIC ECG DEVICES MARKET FOR WEARABLE ECG DEVICES, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 61 DIAGNOSTIC ECG DEVICES MARKET FOR IMPLANTABLE ECG DEVICES, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 62 DIAGNOSTIC ECG MARKET, BY DEPLOYMENT/CONNECTIVITY, 2023-2032 (USD MILLION)

- TABLE 63 DIAGNOSTIC ECG DEVICES MARKET FOR STANDALONE ECG, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 64 DIAGNOSTIC ECG DEVICES MARKET FOR PC-BASED ECG DEVICES, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 65 DIAGNOSTIC ECG DEVICES MARKET FOR CLOUD-BASED ECG DEVICES, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 66 DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 67 DIAGNOSTIC ECG MARKET FOR HOSPITALS, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 68 DIAGNOSTIC ECG MARKET FOR PRIMARY CARE CENTERS, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 69 DIAGNOSTIC ECG MARKET FOR CARDIAC CENTERS, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 70 DIAGNOSTIC ECG MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 71 DIAGNOSTIC ECG MARKET FOR HOME CARE SETTINGS, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 72 DIAGNOSTIC ECG MARKET FOR URGENT CARE SETTINGS, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 73 DIAGNOSTIC ECG MARKET FOR OTHER END USERS, BY COUNTRY/REGION, 2023-2032 (USD MILLION)

- TABLE 74 DIAGNOSTIC ECG MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 75 NORTH AMERICA: DIAGNOSTIC ECG MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 76 NORTH AMERICA: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 77 NORTH AMERICA: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 78 NORTH AMERICA: DIAGNOSTIC ECG DEVICES MARKET VOLUME, BY DEVICE TYPE, 2023-2032 (THOUSAND UNITS)

- TABLE 79 NORTH AMERICA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 80 NORTH AMERICA: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 81 NORTH AMERICA: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 82 NORTH AMERICA: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 83 US: KEY MACROINDICATORS

- TABLE 84 US: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 85 US: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 86 US: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 87 US: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 88 US: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 89 US: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 90 CANADA: KEY MACROINDICATORS

- TABLE 91 CANADA: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 92 CANADA: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 93 CANADA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 94 CANADA: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 95 CANADA: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 96 CANADA: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 97 EUROPE: DIAGNOSTIC ECG MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 98 EUROPE: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 99 EUROPE: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 100 EUROPE: DIAGNOSTIC ECG DEVICES MARKET VOLUME, BY DEVICE TYPE, 2023-2032 (THOUSAND UNITS)

- TABLE 101 EUROPE: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 102 EUROPE: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 103 EUROPE: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 104 EUROPE: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 105 GERMANY: KEY MACROINDICATORS

- TABLE 106 GERMANY: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 107 GERMANY: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 108 GERMANY: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 109 GERMANY: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 110 GERMANY: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 111 GERMANY: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 112 FRANCE: KEY MACROINDICATORS

- TABLE 113 FRANCE: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 114 FRANCE: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 115 FRANCE: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 116 FRANCE: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 117 FRANCE: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 118 FRANCE: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 119 UK: KEY MACROINDICATORS

- TABLE 120 UK: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 121 UK: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 122 UK: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 123 UK: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 124 UK: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 125 UK: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 126 ITALY: KEY MACROINDICATORS

- TABLE 127 ITALY: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 128 ITALY: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 129 ITALY: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 130 ITALY: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 131 ITALY: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 132 ITALY: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 133 SPAIN: KEY MACROINDICATORS

- TABLE 134 SPAIN: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 135 SPAIN: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 136 SPAIN: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 137 SPAIN: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 138 SPAIN: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 139 SPAIN: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 140 REST OF EUROPE: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 141 REST OF EUROPE: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 142 REST OF EUROPE: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 143 REST OF EUROPE: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 144 REST OF EUROPE: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 145 REST OF EUROPE: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 146 ASIA PACIFIC: DIAGNOSTIC ECG MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 147 ASIA PACIFIC: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 148 ASIA PACIFIC: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 149 ASIA PACIFIC: DIAGNOSTIC ECG DEVICES MARKET VOLUME, BY DEVICE TYPE, 2023-2032 (THOUSAND UNITS)

- TABLE 150 ASIA PACIFIC: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 151 ASIA PACIFIC: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 152 ASIA PACIFIC: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 153 ASIA PACIFIC: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 154 JAPAN: MACROECONOMIC INDICATORS

- TABLE 155 JAPAN: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 156 JAPAN: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 157 JAPAN: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 158 JAPAN: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 159 JAPAN: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 160 JAPAN: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 161 CHINA: MACROECONOMIC INDICATORS

- TABLE 162 CHINA: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 163 CHINA: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 164 CHINA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 165 CHINA: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 166 CHINA: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 167 CHINA: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 168 INDIA: MACROECONOMIC INDICATORS

- TABLE 169 INDIA: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 170 INDIA: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 171 INDIA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 172 INDIA: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 173 INDIA: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 174 INDIA: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 175 AUSTRALIA: KEY MACROINDICATORS

- TABLE 176 AUSTRALIA: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 177 AUSTRALIA: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 178 AUSTRALIA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 179 AUSTRALIA: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 180 AUSTRALIA: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 181 AUSTRALIA: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 182 SOUTH KOREA: MACROECONOMIC INDICATORS

- TABLE 183 SOUTH KOREA: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 184 SOUTH KOREA: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 185 SOUTH KOREA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 186 SOUTH KOREA: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 187 SOUTH KOREA: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 188 SOUTH KOREA: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 189 MALAYSIA: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 190 MALAYSIA: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 191 MALAYSIA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 192 MALAYSIA: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 193 MALAYSIA: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 194 MALAYSIA: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 195 THAILAND: MACROECONOMIC INDICATORS

- TABLE 196 THAILAND: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 197 THAILAND: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 198 THAILAND: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 199 THAILAND: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 200 THAILAND: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 201 THAILAND: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 202 INDONESIA: MACROECONOMIC INDICATORS

- TABLE 203 INDONESIA: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 204 INDONESIA: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 205 INDONESIA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 206 INDONESIA: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 207 INDONESIA: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 208 INDONESIA: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 215 LATIN AMERICA: DIAGNOSTIC ECG MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 216 LATIN AMERICA: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 217 LATIN AMERICA: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 218 LATIN AMERICA: DIAGNOSTIC ECG DEVICES MARKET VOLUME, BY DEVICE TYPE, 2023-2032 (THOUSAND UNITS)

- TABLE 219 LATIN AMERICA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 220 LATIN AMERICA: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 221 LATIN AMERICA: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 222 LATIN AMERICA: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 223 BRAZIL: MACROECONOMIC INDICATORS

- TABLE 224 BRAZIL: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 225 BRAZIL: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 226 BRAZIL: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 227 BRAZIL: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 228 BRAZIL: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 229 BRAZIL: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 230 MEXICO: MACROECONOMIC INDICATORS

- TABLE 231 MEXICO: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 232 MEXICO: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 233 MEXICO: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 234 MEXICO: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 235 MEXICO: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 236 MEXICO: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 237 REST OF LATIN AMERICA: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 238 REST OF LATIN AMERICA: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 239 REST OF LATIN AMERICA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 240 REST OF LATIN AMERICA: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 241 REST OF LATIN AMERICA: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 242 REST OF LATIN AMERICA: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: DIAGNOSTIC ECG MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 246 MIDDLE EAST AND AFRICA : DIAGNOSTIC ECG DEVICES MARKET VOLUME, BY DEVICE TYPE, 2023-2032 (THOUSAND UNITS)

- TABLE 247 MIDDLE EAST & AFRICA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 251 GCC COUNTRIES: DIAGNOSTIC ECG MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 252 GCC COUNTRIES: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 253 GCC COUNTRIES: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 254 GCC COUNTRIES: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 255 GCC COUNTRIES: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 256 GCC COUNTRIES: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 257 GCC COUNTRIES: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 258 KSA: KEY MACROINDICATORS

- TABLE 259 KINGDOM OF SAUDI ARABIA (KSA): DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 260 KINGDOM OF SAUDI ARABIA (KSA): DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 261 KINGDOM OF SAUDI ARABIA (KSA): DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 262 KINGDOM OF SAUDI ARABIA (KSA): DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 263 KINGDOM OF SAUDI ARABIA (KSA): DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 264 KINGDOM OF SAUDI ARABIA (KSA): DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 265 UAE: KEY MACROINDICATORS

- TABLE 266 UNITED ARAB EMIRATES (UAE): DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 267 UNITED ARAB EMIRATES (UAE): DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 268 UNITED ARAB EMIRATES (UAE): DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 269 UNITED ARAB EMIRATES (UAE): DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 270 UNITED ARAB EMIRATES (UAE): DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 271 UNITED ARAB EMIRATES (UAE): DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 272 REST OF GCC COUNTRIES: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 273 REST OF GCC COUNTRIES: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 274 REST OF GCC COUNTRIES: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 275 REST OF GCC COUNTRIES: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 276 REST OF GCC COUNTRIES: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 277 REST OF GCC COUNTRIES: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 278 REST OF MIDDLE EAST & AFRICA: DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

- TABLE 279 REST OF MIDDLE EAST & AFRICA: DIAGNOSTIC ECG DEVICES MARKET, BY DEVICE TYPE, 2023-2032 (USD MILLION)

- TABLE 280 REST OF MIDDLE EAST & AFRICA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023-2032 (USD MILLION)

- TABLE 281 REST OF MIDDLE EAST & AFRICA: DIAGNOSTIC ECG MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 282 REST OF MIDDLE EAST & AFRICA: DIAGNOSTIC ECG MARKET, BY CONNECTIVITY/DEPLOYMENT, 2023-2032 (USD MILLION)

- TABLE 283 REST OF MIDDLE EAST & AFRICA: DIAGNOSTIC ECG MARKET, BY END USER, 2023-2032 (USD MILLION)

- TABLE 284 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN DIAGNOSTIC ECG MARKET

- TABLE 285 DIAGNOSTIC ECG MARKET: DEGREE OF COMPETITION, 2024

- TABLE 286 DIAGNOSTIC ECG MARKET: REGION FOOTPRINT

- TABLE 287 DIAGNOSTIC ECG MARKET: PRODUCT FOOTPRINT

- TABLE 288 DIAGNOSTIC ECG MARKET: LEAD TYPE FOOTPRINT

- TABLE 289 DIAGNOSTIC ECG MARKET: TYPE FOOTPRINT

- TABLE 290 DIAGNOSTIC ECG MARKET: DEPLOYMENT/CONNECTIVITY FOOTPRINT

- TABLE 291 DIAGNOSTIC ECG MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 292 DIAGNOSTIC ECG MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME PLAYERS

- TABLE 293 DIAGNOSTIC ECG MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 294 DIAGNOSTIC ECG MARKET: DEALS, JANUARY 2022-MARCH 2025

- TABLE 295 DIAGNOSTIC ECG MARKET: EXPANSIONS, JANUARY 2022-MARCH 2025

- TABLE 296 DIAGNOSTIC ECG MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MARCH 2025

- TABLE 297 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 298 KONINKLIJKE PHILIPS N. V.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 299 KONINKLIJKE PHILIPS N. V.: PRODUCT/SERVICE LAUNCHES, JANUARY 2022-APRIL 2025

- TABLE 300 KONINKLIJKE PHILIPS N. V.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 301 KONINKLIJKE PHILIPS N. V.: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 302 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 303 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 304 GE HEALTHCARE: DEALS, JANUARY 2022-APRIL 2025

- TABLE 305 GE HEALTHCARE: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 306 MEDTRONIC: COMPANY OVERVIEW

- TABLE 307 MEDTRONIC: PRODUCTS OFFERED

- TABLE 308 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

- TABLE 309 BOSTON SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- TABLE 310 ABBOTT LABORATORIES: COMPANY OVERVIEW

- TABLE 311 ABBOTT: PRODUCTS OFFERED

- TABLE 312 ABBOTT: PRODUCT LAUNCHES, JANUARY 2022-APRIL 2025

- TABLE 313 BAXTER: COMPANY OVERVIEW

- TABLE 314 BAXTER: PRODUCTS OFFERED

- TABLE 315 FUKUDA DENSHI: COMPANY OVERVIEW

- TABLE 316 FUKUDA DENSHI: PRODUCTS OFFERED

- TABLE 317 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 318 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: PRODUCTS OFFERED

- TABLE 319 NIHON KOHDEN CORPORATION: COMPANY OVERVIEW

- TABLE 320 NIHON KOHDEN CORPORATION: PRODUCTS OFFERED

- TABLE 321 OSI SYSTEMS, INC: COMPANY OVERVIEW

- TABLE 322 OSI SYSTEMS, INC.: PRODUCTS OFFERED

- TABLE 323 OSI SYSTEMS, INC.: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 324 BITTIUM: COMPANY OVERVIEW

- TABLE 325 BITTIUM: PRODUCTS OFFERED

- TABLE 326 BITTIUM: DEALS, JANUARY 2022-APRIL 2025

- TABLE 327 IRHYTHM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 328 IRHYTHM TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 329 IRHYTHM TECHNOLOGIES, INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 330 IRHYTHM TECHNOLOGIES, INC.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 331 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.: COMPANY OVERVIEW

- TABLE 332 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.: PRODUCTS OFFERED

- TABLE 333 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-APRIL 2025

- TABLE 334 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 335 MIDMARK CORPORATION: COMPANY OVERVIEW

- TABLE 336 MIDMARK CORPORATION: PRODUCTS OFFERED

- TABLE 337 MIDMARK CORPORATION: PRODUCT LAUNCH, JANUARY 2022-APRIL 2025

- TABLE 338 BPL MEDICAL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 339 BPL MEDICAL TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 340 BPL MEDICAL TECHNOLOGIES: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 341 BPL MEDICAL TECHNOLOGIES: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 342 SCHILLER: COMPANY OVERVIEW

- TABLE 343 SCHILLER: PRODUCTS OFFERED

- TABLE 344 SCHILLER: PRODUCT LAUNCH, JANUARY 2022-APRIL 2025

- TABLE 345 SCHILLER: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 346 ACS DIAGNOSTICS: COMPANY OVERVIEW

- TABLE 347 ACS DIAGNOSTICS: PRODUCTS OFFERED

- TABLE 348 ALLENGERS: COMPANY OVERVIEW

- TABLE 349 ALLENGERS: PRODUCTS OFFERED

- TABLE 350 BIONET CO., LTD.: COMPANY OVERVIEW

- TABLE 351 BIONET CO., LTD.: PRODUCTS OFFERED

- TABLE 352 BIONET CO., LTD.: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

List of Figures

- FIGURE 1 DIAGNOSTIC ECG MARKET: SEGMENTS CONSIDERED & GEOGRAPHICAL SCOPE

- FIGURE 2 DIAGNOSTIC ECG MARKET: YEARS CONSIDERED

- FIGURE 3 DIAGNOSTIC ECG MARKET: RESEARCH DESIGN

- FIGURE 4 DIAGNOSTIC ECG MARKET: KEY PRIMARY SOURCES

- FIGURE 5 DIAGNOSTIC ECG MARKET: INSIGHTS FROM PRIMARIES

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 7 BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 DIAGNOSTIC ECG MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS (2024)

- FIGURE 9 DIAGNOSTIC ECG: MARKET SIZE ESTIMATION

- FIGURE 10 TOP-DOWN APPROACH

- FIGURE 11 BOTTOM-UP APPROACH

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 DIAGNOSTIC ECG MARKET, BY PRODUCT, 2025 VS. 2032 (USD MILLION)

- FIGURE 14 DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 15 DIAGNOSTIC ECG MARKET, BY TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 16 DIAGNOSTIC ECG MARKET, BY DEPLOYMENT/CONNECTIVITY, 2025 VS. 2032 (USD MILLION)

- FIGURE 17 DIAGNOSTIC ECG MARKET, BY END USER, 2025 VS. 2032 (USD MILLION)

- FIGURE 18 GEOGRAPHICAL SNAPSHOT OF DIAGNOSTIC ECG MARKET

- FIGURE 19 INCREASING PREVALENCE OF CARDIOVASCULAR DISEASES GLOBALLY TO DRIVE MARKET GROWTH

- FIGURE 20 DEVICES SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN DIAGNOSTIC ECG MARKET IN 2024

- FIGURE 21 RESTING ECG DEVICES TO CAPTURE LARGEST SHARE OF DIAGNOSTIC ECG DEVICES MARKET IN 2025

- FIGURE 22 12-LEAD ECG DEVICES SEGMENT TO CONTINUE TO DOMINATE MARKET IN 2032

- FIGURE 23 HOSPITALS, CLINICS, AND CARDIAC CENTERS SEGMENT TO DOMINATE MARKET IN 2032

- FIGURE 24 CHINA TO REGISTER HIGHEST GROWTH IN DIAGNOSTIC ECG MARKET FROM 2025 TO 2032

- FIGURE 25 DIAGNOSTIC ECG MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 DIAGNOSTIC ECG MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 DIAGNOSTIC ECG MARKET: NUMBER OF GRANTED PATENT APPLICATIONS (JANUARY 2014-MAY 2025)

- FIGURE 28 TOP APPLICANT COUNTRIES/REGIONS FOR DIAGNOSTIC ECG PATENTS (JANUARY 2014-MAY 2025)

- FIGURE 29 AVERAGE SELLING PRICE FOR RESTING ECG, BY KEY PLAYER, 2024

- FIGURE 30 AVERAGE SELLING PRICE FOR STRESS ECG, BY KEY PLAYER, 2024

- FIGURE 31 AVERAGE SELLING PRICE OF HOLTER MONITORS, BY KEY PLAYER, 2024

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR DIAGNOSTIC ECG PRODUCTS

- FIGURE 33 KEY BUYING CRITERIA FOR DIAGNOSTIC ECG PRODUCTS

- FIGURE 34 DIAGNOSTIC ECG MARKET: VALUE CHAIN ANALYSIS

- FIGURE 35 DIAGNOSTIC ECG MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 36 DIAGNOSTIC ECG MARKET: ECOSYSTEM ANALYSIS

- FIGURE 37 AI USE CASES

- FIGURE 38 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 39 DIAGNOSTIC ECG MARKET: INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 40 DIAGNOSTIC ECG MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 41 NORTH AMERICA: DIAGNOSTIC ECG MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: DIAGNOSTIC ECG MARKET SNAPSHOT

- FIGURE 43 REVENUE SHARE ANALYSIS OF TOP FIVE PLAYERS IN DIAGNOSTIC ECG MARKET (2022-2024)

- FIGURE 44 DIAGNOSTIC ECG MARKET SHARE ANALYSIS, 2024

- FIGURE 45 RANKING OF KEY PLAYERS IN DIAGNOSTIC ECG MARKET, 2024

- FIGURE 46 DIAGNOSTIC ECG MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 DIAGNOSTIC ECG MARKET: COMPANY FOOTPRINT

- FIGURE 48 DIAGNOSTIC ECG MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 DIAGNOSTIC ECG MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 50 EV/EBITDA OF KEY VENDORS

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 52 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT, 2024

- FIGURE 53 GE HEALTHCARE: COMPANY SNAPSHOT, 2024

- FIGURE 54 MEDTRONIC: COMPANY SNAPSHOT (2024)

- FIGURE 55 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 56 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2024)

- FIGURE 57 BAXTER: COMPANY SNAPSHOT, 2024

- FIGURE 58 FUKUDA DENSHI: COMPANY SNAPSHOT, 2024

- FIGURE 59 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: COMPANY SNAPSHOT, 2024

- FIGURE 60 NIHON KOHDEN CORPORATION: COMPANY SNAPSHOT, 2024

- FIGURE 61 OSI SYSTEMS, INC.: COMPANY SNAPSHOT, 2024

- FIGURE 62 BITTIUM: COMPANY SNAPSHOT, 2024

- FIGURE 63 IRHYTHM TECHNOLOGIES, INC.: COMPANY SNAPSHOT, 2024

- FIGURE 64 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.: COMPANY SNAPSHOT, 2024

The global diagnostic electrocardiograph/ECG market is projected to reach USD 15.18 billion by 2032 from USD 9.19 billion in 2025, at a CAGR of 7.4% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2032 |

| Base Year | 2024 |

| Forecast Period | 2024-2032 |

| Units Considered | Value (USD billion) |

| Segments | Product, lead type, type, deployment/ connectivity, end user, and region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

The significant expansion of the geriatric demographic worldwide, coupled with the escalating prevalence of chronic conditions such as diabetes and CVDs, is poised to drive the demand for the diagnostic ECG market. Additionally, the increasing focus on preventive healthcare, coupled with rising healthcare expenditures and improvements in healthcare infrastructure across various regions, also facilitates market growth. Technological advancements in diagnostic ECG devices, the introduction of innovative products, and favorable reimbursement frameworks, along with supportive government policies, are further expected to enhance market dynamics. Investments in healthcare infrastructure and initiatives to improve the accessibility and affordability of diagnostic ECG solutions are also likely to bolster market progression.

The diagnostic ECG devices segment is to grow at the highest CAGR during the forecast period.

The diagnostic ECG market is predominantly driven by devices, which command the largest market share in 2024. This surge is primarily attributed to the rising incidence of CVDs, including coronary artery disease, stroke, and peripheral artery disease. Furthermore, the demand for early and continuous cardiac monitoring among geriatric populations, along with the increasing trend toward remote patient management, significantly underpins this growth trajectory. Recent advancements in device technology, such as miniaturization and enhanced wireless connectivity, are rendering these instruments more efficient, user-centric, and accessible. This evolution enables the provision of cardiac care in both conventional clinical environments and remote settings, thereby improving patient outcomes and optimizing healthcare delivery.

The 12-lead ECG devices segment captured the largest market share, by lead type, in 2024.

Based on lead type, the diagnostic ECG market is segmented into 12, 5, 3, 6, and single lead ECG devices. The 12-lead ECG systems dominate the market due to their ability to deliver comprehensive analysis and a multi-faceted view of cardiac electrical activity through twelve electrode placements-this capability facilitates accurate diagnosis of a range of CVDs, including myocardial infarctions, complex arrhythmias, and ischemic heart disease. Clinicians, particularly in emergency departments, ICUs, and specialized cardiology clinics, heavily depend on the rich data provided by 12-lead ECGs for critical clinical decision-making and timely therapeutic interventions. Furthermore, recent technological advancements, such as portable digital 12-lead ECG devices featuring wireless connectivity and seamless integration with telemedicine platforms, have further solidified the essential role of these systems in the landscape of diagnostic ECG.

The standalone ECG devices segment commanded the largest market share, by deployment/connectivity in 2024.

Based on deployment/ connectivity, the diagnostic ECG market is segmented into standalone, PC-based, and cloud-based ECG devices. Standalone ECG devices accounted for the market share, driven by the rising global prevalence of CVDs that necessitate more accessible and continuous monitoring. The technological advancements have led to the development of compact, precise, and user-friendly devices, coupled with an increasing focus on remote patient monitoring and home-based care. This trend also enhances preventive health management and facilitates self-monitoring of cardiac health outside traditional clinical environments. These devices are instrumental in the early detection of arrhythmias and other cardiac conditions, thus reducing the frequency of hospital visits. They serve as cost-effective alternatives for proactive cardiac health management and can be seamlessly integrated with telemedicine platforms and artificial intelligence for enhanced diagnostic capabilities.

North America accounted for the largest regional share of the diagnostic ECG market in 2024.

The global diagnostic ECG market is segmented into five major regions: North America, Europe, the Asia Pacific, Latin America, and Middle East & Africa. North America is the largest regional market for diagnostic ECG, whereas the Asia Pacific market is estimated to grow at the highest CAGR during the forecast period.

The significant predominance of the North American market can largely be attributed to several interrelated factors. Firstly, there is a rising incidence of CVDs, which has become a pressing public health concern and is driving demand for related healthcare services and products. This increase is further supported by a robust and well-established healthcare infrastructure that efficiently provides medical care and resources to address these health challenges. Additionally, the population in North America enjoys elevated disposable incomes, which allows individuals to prioritize spending on health-related investments, including preventive care and advanced treatment options. This financial capability also supports the adoption of innovative medical technologies and solutions, which are widely accessible throughout the region. The extensive availability of cutting-edge technological advancements in healthcare, including diagnostic tools, treatment modalities, and patient management systems, enhances the overall quality of care and improves health outcomes for patients with CVDs. Together, these factors create a strong environment for market growth and the ongoing evolution of healthcare solutions in North America. Furthermore, the influence of leading industry players such as GE Healthcare, Baxter, and OSI Systems, Inc. is expected to catalyze growth in the diagnostic ECG market within the region.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-35%, Tier 2-40%, and Tier 3- 25%

- By Designation: C-level-30%, Director-level-23%, and Other Designations-47%

- By Region: North America-35%, Europe-20%, Asia Pacific-25%, Latin America-13%, and Middle East & Africa-7%

The major players operating in the diagnostic ECG market are GE HealthCare (US), Koninklijke Philips N.V. (Netherlands), Baxter (US), FUKUDA DENSHI (Japan), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), NIHON KOHDEN CORPORATION (Japan), OSI Systems, Inc. (US), Bittium (Finland), iRhythm Technologies, Inc. (US), Lepu Medical Technology (Beijing) Co., Ltd. (China), Midmark Corporation (US), BPL Medical Technologies (India), SCHILLER (Switzerland), ACS Diagnostics (US), Allengers (India), and Bionet Co., Ltd. (South Korea).

Research Coverage

This report studies the diagnostic ECG market based on product, lead type, type, deployment/ connectivity, end user, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to gain a larger market share. Firms purchasing the report could use one or a combination of the following strategies to strengthen their market presence.

This report provides insights on the following points:

- Analysis of Key divers (increasing incidence of lifestyle and cardiovascular diseases, expanding global geriatric population and subsequent surge in heart conditions, development of wireless monitoring and wearable cardiac devices, and growing need for cost-containment across healthcare facilities), restraints (stringent regulatory requirements delaying cardiac device approval and technological limitations of diagnostic ECG devices & software), Opportunities (High growth opportunities in emerging economies and expanding access to advanced cardiac diagnostics with AI and CMS support), Challenges (Limited integration of ECG Systems with electronic health records and accuracy challenges in next-generation ECG monitoring)

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the diagnostic ECG market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the diagnostic ECG market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the diagnostic ECG market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 SEGMENTS CONSIDERED & GEOGRAPHICAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION OF DIAGNOSTIC ECG PRODUCTS

- 2.2.1 REVENUE SHARE ANALYSIS (BOTTOM-UP APPROACH)

- 2.2.2 MNM REPOSITORY ANALYSIS

- 2.2.3 COMPANY INVESTOR PRESENTATIONS AND PRIMARY INTERVIEWS

- 2.2.4 TOP-DOWN APPROACH

- 2.2.5 BOTTOM-UP APPROACH

- 2.2.6 PRIMARY INTERVIEWS

- 2.2.7 DEMAND-SIDE APPROACH

- 2.2.8 VOLUME DATA ANALYSIS

- 2.3 MARKET GROWTH RATE PROJECTION

- 2.4 DATA TRIANGULATION

- 2.4.1 STUDY ASSUMPTIONS

- 2.4.2 RESEARCH LIMITATIONS

- 2.5 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 DIAGNOSTIC ECG MARKET OVERVIEW

- 4.2 NORTH AMERICA: DIAGNOSTIC ECG MARKET SHARE, BY TYPE AND COUNTRY (2024)

- 4.3 DIAGNOSTIC ECG DEVICES MARKET SHARE, BY DEVICE TYPE, 2025 VS. 2032

- 4.4 DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2025 VS. 2032 (USD MILLION)

- 4.5 DIAGNOSTIC ECG MARKET, BY END USER, 2025 VS. 2032 (USD MILLION)

- 4.6 DIAGNOSTIC ECG MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing incidence of lifestyle and cardiovascular diseases

- 5.2.1.2 Rapidly expanding global geriatric population and subsequent surge in heart conditions

- 5.2.1.3 Development of wireless monitoring and wearable cardiac devices

- 5.2.1.4 Growing need for cost-containment across healthcare facilities

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulatory requirements delaying approval of cardiac devices

- 5.2.2.2 Technological limitations of diagnostic ECG devices and software

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging markets to offer high-growth opportunities

- 5.2.3.2 Expanding access to advanced cardiac diagnostics with AI and CMS support

- 5.2.4 CHALLENGES

- 5.2.4.1 Challenges in integrating ECG systems with Electronic Health Records (EHRs)

- 5.2.4.2 Accuracy challenges in next-generation ECG monitoring

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 MINIATURIZATION AND WEARABLE ECG DEVICES

- 5.3.2 REMOTE AND HOME-BASED DIAGNOSTICS

- 5.3.3 HIGH-FIDELITY AND MULTI-LEAD PORTABLE ECGS

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Wearable devices and sensors

- 5.4.1.2 Integration of Artificial Intelligence (AI)

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Wireless ECG devices

- 5.4.2.2 Mobile apps integration

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Vital sign monitors

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 BARGAINING POWER OF SUPPLIERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY ANALYSIS

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.3 REGULATORY FRAMEWORK

- 5.6.3.1 North America

- 5.6.3.1.1 US

- 5.6.3.1.2 Canada

- 5.6.3.2 Europe

- 5.6.3.3 Asia Pacific

- 5.6.3.3.1 China

- 5.6.3.3.2 Japan

- 5.6.3.3.3 India

- 5.6.3.4 Latin America

- 5.6.3.4.1 Brazil

- 5.6.3.4.2 Mexico

- 5.6.3.5 Middle East

- 5.6.3.6 Africa

- 5.6.3.1 North America

- 5.7 PATENT ANALYSIS

- 5.7.1 PATENT PUBLICATION TRENDS FOR DIAGNOSTIC ECG

- 5.7.2 JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 TRADE ANALYSIS FOR DIAGNOSTIC ECG PRODUCTS

- 5.8.2 TRADE DATA FOR HS CODE 901811

- 5.8.2.1 Import data for HS Code 901811

- 5.8.2.2 Export data for HS Code 901811

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.9.1.1 Average selling price of resting ECG, by key player

- 5.9.1.2 Average selling price for stress ECG, by key player

- 5.9.1.3 Average selling price of Holter monitors, by key player

- 5.9.2 AVERAGE SELLING PRICE, BY REGION

- 5.9.2.1 Average selling price of resting ECG, stress ECG, and Holter monitors, by region

- 5.9.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.10 REIMBURSEMENT SCENARIO

- 5.11 KEY CONFERENCES & EVENTS, 2025-2026

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 KEY BUYING CRITERIA

- 5.13 UNMET NEEDS/END-USER EXPECTATIONS

- 5.14 VALUE CHAIN ANALYSIS

- 5.15 SUPPLY CHAIN ANALYSIS

- 5.16 ECOSYSTEM ANALYSIS

- 5.17 IMPACT OF AI/GEN AI ON DIAGNOSTIC ECG MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 MARKET POTENTIAL IN DIAGNOSTIC ECG ECOSYSTEM

- 5.17.3 AI USE CASES

- 5.17.4 KEY COMPANIES IMPLEMENTING AI IN DIAGNOSTIC ECG DEVICES

- 5.17.5 FUTURE OF GEN AI IN DIAGNOSTIC ECG ECOSYSTEM

- 5.18 CASE STUDY ANALYSIS

- 5.19 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.20 IMPACT OF 2025 US TARIFF

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.5 IMPACT ON END-USER INDUSTRIES

- 5.21 INVESTMENT AND FUNDING SCENARIO

6 DIAGNOSTIC ECG MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 DEVICES

- 6.2.1 RESTING ECG DEVICES

- 6.2.1.1 Wide availability of resting ECG devices to support market growth

- 6.2.2 STRESS ECG DEVICES

- 6.2.2.1 High cost of stress ECG devices to limit adoption

- 6.2.3 HOLTER MONITORS

- 6.2.3.1 Growing demand for continuous monitoring to fuel growth

- 6.2.4 EVENT MONITORS

- 6.2.4.1 Increasing outsourcing of monitoring devices to propel market growth

- 6.2.5 IMPLANTABLE LOOP RECORDERS

- 6.2.5.1 Introduction of technologically advanced implantable loop recorders to support market growth

- 6.2.6 MOBILE CARDIAC TELEMETRY DEVICES

- 6.2.6.1 Increasing demand for cardiac monitoring solutions in home care settings to propel market

- 6.2.7 SMART ECG MONITORS

- 6.2.7.1 Rising adoption of smart/wearable ECG monitors

- 6.2.1 RESTING ECG DEVICES

- 6.3 SOFTWARE & SERVICES

- 6.3.1 SHIFT TOWARD AI-ENABLED ECG SOFTWARE TO SUPPORT GROWTH

7 DIAGNOSTIC ECG MARKET, BY LEAD TYPE

- 7.1 INTRODUCTION

- 7.2 12-LEAD ECG DEVICES

- 7.2.1 GROWING USE IN PRE-HOSPITAL AND CLINIC SETTINGS TO DRIVE MARKET GROWTH

- 7.3 5-LEAD ECG DEVICES

- 7.3.1 GROWING IMPORTANCE OF PATIENT MONITORING TO BOOST ADOPTION

- 7.4 3-LEAD ECG DEVICES

- 7.4.1 VITAL TOOL FOR RHYTHM MONITORING TO SUPPORT MARKET GROWTH

- 7.5 6-LEAD ECG DEVICES

- 7.5.1 GROWING USE OF 6-LEAD ECG DEVICES IN REMOTE PATIENT MONITORING TO FAVOR MARKET GROWTH

- 7.6 SINGLE-LEAD ECG DEVICES

- 7.6.1 EASE OF USE FOR DIAGNOSIS AND QUICK RESULTS TO INCREASE USE OF SINGLE-LEAD ECG DEVICES

- 7.7 OTHER ECG LEAD DEVICES

8 DIAGNOSTIC ECG MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 PORTABLE 138 8.2.1 CONVENIENCE AND ACCESSIBILITY OF PORTABLE ECG DEVICES TO ENHANCE EARLY CARDIAC SCREENING

- 8.3 WEARABLE

- 8.3.1 RISING DEMAND FOR CONTINUOUS HEART MONITORING IN FITNESS AND CHRONIC DISEASE MANAGEMENT

- 8.4 IMPLANTABLE 142 8.4.1 HIGH DIAGNOSTIC YIELD FOR ELUSIVE CARDIAC CONDITIONS WITH LONG-TERM MONITORING

9 DIAGNOSTIC ECG MARKET, BY DEPLOYMENT/CONNECTIVITY

- 9.1 INTRODUCTION

- 9.2 STANDALONE ECG DEVICES

- 9.2.1 WIDESPREAD ADOPTION OF STANDALONE ECG DEVICES DUE TO OPERATIONAL SIMPLICITY

- 9.3 PC-BASED ECG DEVICES

- 9.3.1 GROWING USE FOR ADVANCED ECG DIAGNOSTICS AND INTEGRATION TO SUPPORT REMOTE CARDIAC CARE

- 9.4 CLOUD-BASED ECG DEVICES

- 9.4.1 ACCELERATED GROWTH OF CLOUD-BASED ECG SOLUTIONS TO SUPPORT REMOTE CARDIAC CARE

10 DIAGNOSTIC ECG MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOSPITALS

- 10.2.1 INCREASING UTILIZATION OF ECG DEVICES IN HOSPITALS TO ACCELERATE MARKET GROWTH

- 10.3 PRIMARY CARE CENTERS

- 10.3.1 WIDENING ACCESS TO ECG DIAGNOSTICS IN PRIMARY CARE CENTERS TO BOOST MARKET PENETRATION

- 10.4 CARDIAC CENTERS

- 10.4.1 SPECIALIZED ECG APPLICATIONS IN CARDIAC CENTERS TO DRIVE DEMAND FOR ADVANCED DEVICES

- 10.5 AMBULATORY SURGICAL CENTERS

- 10.5.1 GROWING NEED FOR PRE-OPERATIVE CARDIAC SCREENING IN ASCS TO INFLUENCE MARKET DEMAND

- 10.6 HOME CARE SETTINGS

- 10.6.1 RISING PREFERENCE FOR REMOTE MONITORING FUELS ECG DEVICE USAGE IN HOME CARE

- 10.7 URGENT CARE SETTINGS

- 10.7.1 INTEGRATION OF DIAGNOSTIC ECG IN URGENT CARE SETTINGS FOR TIMELY CARDIAC EVALUATIONS TO FUEL MARKET DEMAND

- 10.8 OTHER END USERS

- 10.8.1 DIVERSE ECG APPLICATIONS ACROSS NURSING HOMES, RETAIL CLINICS, SPORTS MEDICINE & RESEARCH TO INFLUENCE MARKET DEMAND

11 DIAGNOSTIC ECG MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 US to command largest share in diagnostic ECG market

- 11.2.3 CANADA

- 11.2.3.1 Growing adoption of digital diagnostic ECG systems to drive market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 High healthcare spending to propel market growth

- 11.3.3 FRANCE

- 11.3.3.1 Government support for e-Health to propel market

- 11.3.4 UK

- 11.3.4.1 Rising demand for home-based smart ECG devices to support market growth

- 11.3.5 ITALY

- 11.3.5.1 Growing focus on improvements in patient care to drive market

- 11.3.6 SPAIN

- 11.3.6.1 Rising geriatric population to support market growth in Spain

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 High healthcare expenditure and favorable reimbursement and insurance coverage to support market growth in Japan

- 11.4.3 CHINA

- 11.4.3.1 Government support for infrastructural improvement to drive market growth

- 11.4.4 INDIA

- 11.4.4.1 Increasing cardiac disease burden intensifies demand for ECG diagnostics

- 11.4.5 AUSTRALIA

- 11.4.5.1 Increased patient volume and favorable government initiatives to drive market

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Rising geriatric population to propel market growth

- 11.4.7 MALAYSIA

- 11.4.7.1 Increasing CVD burden and national digital health initiatives driving ECG adoption

- 11.4.8 THAILAND

- 11.4.8.1 National cardiac screening programs and smart hospital investments driving ECG adoption in Thailand

- 11.4.9 INDONESIA

- 11.4.9.1 Rising cardiac disease burden and public health digitalization efforts to drive ECG device uptake in Indonesia

- 11.4.10 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Improving access to diagnostic services to drive growth

- 11.5.3 MEXICO

- 11.5.3.1 Rising heart disease to drive market growth

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Kingdom of Saudi Arabia (KSA)

- 11.6.2.1.1 Prevalence of CVDs boosting ECG adoption in Saudi Arabia

- 11.6.2.2 United Arab Emirates (UAE)

- 11.6.2.2.1 National CVD screening programs and digital health strategies driving market

- 11.6.2.3 Rest of GCC Countries

- 11.6.2.1 Kingdom of Saudi Arabia (KSA)

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DIAGNOSTIC ECG MARKET

- 12.3 REVENUE SHARE ANALYSIS (2022-2024)

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.4.1 RANKING OF KEY PLAYERS

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY PRODUCT FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Product footprint

- 12.5.5.4 Lead type footprint

- 12.5.5.5 Type footprint

- 12.5.5.6 Deployment/Connectivity footprint

- 12.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SME players

- 12.6.5.2 Competitive benchmarking of key startups/SME players

- 12.7 BRAND/PRODUCT COMPARISON

- 12.8 DIAGNOSTIC ECG MARKET: COMPANY VALUATION & FINANCIAL METRICS

- 12.8.1 FINANCIAL METRICS

- 12.8.2 COMPANY VALUATION

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES & APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 KONINKLIJKE PHILIPS N.V.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product/Service launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 GE HEALTHCARE

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choice

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 MEDTRONIC

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Right to win

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses and competitive threats

- 13.1.4 BOSTON SCIENTIFIC CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses and competitive threats

- 13.1.5 ABBOTT LABORATORIES

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 BAXTER (HILL-ROM HOLDINGS, INC.)

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 MnM view

- 13.1.6.3.1 Key strengths/Right to win

- 13.1.6.3.2 Strategic choices

- 13.1.6.3.3 Weaknesses & competitive threats

- 13.1.7 FUKUDA DENSHI

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 MnM view

- 13.1.7.3.1 Key strengths

- 13.1.7.3.2 Strategic choices

- 13.1.7.3.3 Weaknesses & competitive threats

- 13.1.8 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 MnM view

- 13.1.8.3.1 Key strengths

- 13.1.8.3.2 Strategic choices

- 13.1.8.3.3 Weaknesses & competitive threats

- 13.1.9 NIHON KOHDEN CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 OSI SYSTEMS, INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Expansions

- 13.1.11 BITTIUM

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.12 IRHYTHM TECHNOLOGIES, INC.

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches and approvals

- 13.1.12.3.2 Deals

- 13.1.13 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product launches and approvals

- 13.1.13.3.2 Other developments

- 13.1.14 MIDMARK CORPORATION

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Product launches

- 13.1.15 BPL MEDICAL TECHNOLOGIES

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Expansions

- 13.1.15.3.2 Other developments

- 13.1.16 SCHILLER

- 13.1.16.1 Business overview

- 13.1.16.2 Products offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Product launches

- 13.1.16.3.2 Other developments

- 13.1.17 ACS DIAGNOSTICS

- 13.1.17.1 Business overview

- 13.1.17.2 Products offered

- 13.1.18 ALLENGERS

- 13.1.18.1 Business overview

- 13.1.18.2 Products offered

- 13.1.19 BIONET CO., LTD.

- 13.1.19.1 Business overview

- 13.1.19.2 Products offered

- 13.1.19.3 Recent developments

- 13.1.19.3.1 Other developments

- 13.1.1 KONINKLIJKE PHILIPS N.V.

- 13.2 OTHER PLAYERS

- 13.2.1 EDAN INSTRUMENTS, INC.

- 13.2.2 QINGDAO MEDITECH EQUIPMENT CO., LTD.

- 13.2.3 CARDIAC INSIGHT, INC.

- 13.2.4 ALIVECOR, INC.

- 13.2.5 VITALCONNECT

- 13.2.6 BTL

- 13.2.7 BORSAM MEDICAL

- 13.2.8 NASIFF ASSOCIATES, INC.

- 13.2.9 VECTRACOR, INC.

- 13.2.10 BIOMEDICAL INSTRUMENTS CO., LTD.

- 13.2.11 LIFESIGNALS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS