|

|

市場調査レポート

商品コード

1755998

航空機用電気機械アクチュエータの世界市場:プラットフォーム別、機構タイプ別、用途別、モータートルク別、地域別 - 2030年までの予測Electromechanical Actuators in Aircraft Market by Application, Mechanism Type, Motor Torque, Platform, Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 航空機用電気機械アクチュエータの世界市場:プラットフォーム別、機構タイプ別、用途別、モータートルク別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月20日

発行: MarketsandMarkets

ページ情報: 英文 265 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

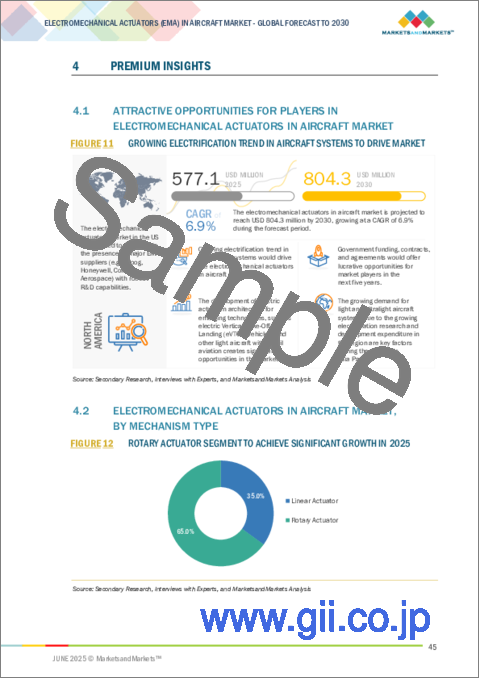

航空機用電気機械アクチュエータの市場規模は、2025年の5億7,710万米ドルから6.9%のCAGRで拡大し、2030年には8億430万米ドルに達すると予測されています。

同市場は、航空宇宙システムの電動化への世界のシフトに牽引され、2030年までに堅調に拡大するとみられます。航空機メーカーが油圧ラインや流体ベースのシステムを排除することを優先する中、軽量・コンパクトでエネルギー効率の高い特性を持つEMAの採用が増加しています。この動向は、排出量の削減、メンテナンスの簡素化、システム統合の改善に焦点を当てた最新の民間航空機および防衛航空機プログラムにおいて特に顕著です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | プラットフォーム別、機構タイプ別、用途別、モータートルク別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

ロータリーアクチュエータは、すべての重要な航空機システムで広く使用され、小型モーションコントロールで顕著な性能特性を示すため、ロータリーアクチュエータ分野は、航空機の電気機械アクチュエータ市場を独占する可能性が高いです。ロータリーアクチュエータは、スロットル制御、バルブ操作、フラップ駆動、スラストリバーサ、ブレーキシステムなど、正確な角度運動と高トルク密度が要求される用途で極めて重要です。小型で、滑らかで制御された回転運動を提供できることから、スペースに制約のある民間機や軍用機の用途に特に適しています。また、ロータリーEMAは、リニアEMAよりも信頼性が向上し、応答速度が速く、電子飛行制御システムへの統合が簡単であるという利点があります。新世代の航空機プラットフォームがモジュール式の電動アーキテクチャーに移行するにつれて、メンテナンスが容易で汎用性の高い回転アクチュエーターへのニーズが高まっています。これらのアクチュエータは、eVTOLやUAVのような、制御面を効率的に駆動するために軽量で高性能なシステムが必要とされる新しいプラットフォームにも適しています。さらに、デジタル・フィードバック・システム、組込みセンサー、熱管理の改善により、診断能力とともに耐障害性が大幅に向上しています。

ナローボディ航空機セグメントは、特に短距離から中距離のセグメントにおいて、世界の航空機の成長において主要な役割を果たしているため、航空機の電気機械アクチュエータ市場を独占する態勢を整えています。新興諸国における航空需要の増加、格安航空会社の開発、ポイント・ツー・ポイントの接続性の上昇に伴い、世界的に多くの納入が行われています。航空会社は、燃費効率、運航性能、ライフサイクルコストの低減に重点を置いた次世代ナローボディ・プラットフォームへの投資を増やしており、この目標はまさにEMAの利点と一致しています。電気機械式アクチュエータは、軽量化、メンテナンスの容易さ、デジタル飛行制御システムとの互換性という点で、従来の油圧式システムに対して圧倒的な優位性を持っています。これらの条件は、座席マイルあたりのコストが重要な性能指標であるナローボディフリートにとって最も重要です。さらに、航空機メーカーは、規制や環境上の要求に対応し、EMA技術の成長を加速させるため、より多くの電気システムを新型のナローボディ機に組み込もうとしています。

ラテンアメリカは、地域的な航空旅行ニーズの高まり、航空機のアップグレードイニシアチブ、航空宇宙インフラへの投資増加により、予測期間中、航空機用電気機械アクチュエータ市場で最も高い成長を遂げると予測されます。ブラジル、メキシコ、コロンビアは、国内および地域内の航空輸送ブームに見舞われており、地元の航空会社は、高度なアクチュエーション・システムを装備した、より新しく燃費効率の高い航空機を調達しています。さらに、地域政府は、固定翼機や回転式軍用機のアップグレードなど、国防近代化構想に投資しており、メンテナンス要件が少なく信頼性が高いことから、油圧式代替システムよりも電気機械式システムを好む傾向が強まっています。

ラテンアメリカでは、特にブラジルで航空機の製造とMROが盛んに行われています。このため、EMA技術の現地採用や統合が促進されています。ハイブリッド機や電気航空機への関心など、持続可能な航空への移行も、EMAのような軽量で電動式の部品への需要を高めています。この地域が世界の航空市場に占める絶対的な割合は依然として小さいですが、変化のペースが速く、規制の変更が可能であり、航空宇宙エコシステムが拡大していることから、ラテンアメリカは民間航空および防衛航空市場における電気機械アクチュエータの高成長地域となっています。

当レポートでは、世界の航空機用電気機械アクチュエータ市場について調査し、プラットフォーム別、機構タイプ別、用途別、モータートルク別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 貿易分析

- 価格分析

- 運用データ

- ボリュームデータ(プラットフォームに配備された電気機械アクチュエータの数)

- エコシステム分析

- バリューチェーン分析

- 主要な利害関係者と購入基準

- 2024年~2025年の主な会議とイベント

- 関税と規制状況

- 投資と資金調達のシナリオ

- 技術動向

- 電気機械アクチュエータの基本コンポーネント

- 技術分析

- ケーススタディ分析

- 技術ロードマップ

- 特許分析

- 生成AI/AIの影響

- マクロ経済見通し

- 米国の2025年関税

第6章 航空機用電気機械アクチュエータ市場(プラットフォーム別)

- イントロダクション

- ナローボディ機

- ワイドボディ機

- 地域輸送航空機

- ビジネスジェット

- 民間ヘリコプター

- 軽量・超軽量航空機

第7章 航空機用電気機械アクチュエータ市場(機構タイプ別)

- イントロダクション

- リニアアクチュエータ

- ロータリーアクチュエータ

第8章 航空機用電気機械アクチュエータ市場(用途別)

- イントロダクション

- 飛行制御面

- 燃料分配

- キャビンアクチュエーション

- ドア

- 着陸装置

- その他

第9章 航空機用電気機械アクチュエータ市場(モータートルク別)

- イントロダクション

- 25NM未満

- 25~100NM

- 100~300NM

- 300NM超

第10章 航空機用電気機械アクチュエータ市場(地域別)

- イントロダクション

- 北米

- イントロダクション

- PESTLE分析

- 米国

- カナダ

- 欧州

- イントロダクション

- PESTLE分析

- 英国

- フランス

- ドイツ

- イタリア

- その他

- アジア太平洋

- イントロダクション

- PESTLE分析

- 中国

- インド

- 日本

- その他

- 中東・アフリカ

- イントロダクション

- PESTLE分析

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他

- ラテンアメリカ

- イントロダクション

- PESTLE分析

- ブラジル

- メキシコ

- その他

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- ブランド比較

- 財務指標と企業評価

- 収益分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- イントロダクション

- 主要参入企業

- HONEYWELL INTERNATIONAL INC.

- WOODARD INC.

- AMETEK, INC.

- CURTISS-WRIGHT CORPORATION

- LIEBHERR GROUP

- MOOG INC.

- EATON

- SAAB

- PARKER HANNIFIN CORP

- ITT INC.

- HANWHA GROUP

- FAULHABER GROUP

- TRANSDIGM GROUP INC.

- TAMAGAWA SEIKI CO.,LTD.

- TEXTRON INC.

- その他の企業

- HFE INTERNATIONAL, LLC

- HITEC GROUP USA, INC.

- KYNTRONICS

- PEGASUS ACTUATORS GMBH

- ULTRA MOTION

- UMBRAGROUP

- VOLZ SERVOS GMBH & CO. KG

- ZIMM GMBH

- MECAER AVIATION GROUP

- ISPSYSTEM

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 R&D PROJECTS ON ACTUATION SYSTEM DEVELOPMENTS FUNDED WITHIN PROGRAM "HORIZON 2020"

- TABLE 3 IMPORT DATA FOR HS CODE 88-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 4 EXPORT DATA FOR HS CODE 88-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 5 INDICATIVE PRICING ANALYSIS FOR ELECTROMECHANICAL ACTUATOR APPLICATIONS, BY MECHANISM TYPE, 2024 (USD MILLION)

- TABLE 6 INDICATIVE PRICING ANALYSIS FOR ELECTROMECHANICAL ACTUATOR APPLICATIONS, BY MOTOR TORQUE, 2024 (USD MILLION)

- TABLE 7 INDICATIVE PRICING ANALYSIS FOR NORTH AMERICA, 2024 (USD)

- TABLE 8 INDICATIVE PRICING ANALYSIS FOR EUROPE, 2024 (USD)

- TABLE 9 INDICATIVE PRICING ANALYSIS FOR ASIA PACIFIC, 2024 (USD)

- TABLE 10 INDICATIVE PRICING ANALYSIS FOR MIDDLE EAST & AFRICA, 2024 (USD)

- TABLE 11 INDICATIVE PRICING ANALYSIS FOR LATIN AMERICA, 2024 (USD)

- TABLE 12 INDICATIVE PRICING ANALYSIS: CONVENTIONAL VS. SMART ELECTROMECHANICAL ACTUATORS

- TABLE 13 GLOBAL VOLUME DATA FOR AIRCRAFT, BY PLATFORM, 2020-2030

- TABLE 14 NORTH AMERICA: VOLUME DATA FOR AIRCRAFT, BY PLATFORM, 2020-2030

- TABLE 15 EUROPE: VOLUME DATA FOR AIRCRAFT, BY PLATFORM, 2020-2030

- TABLE 16 ASIA PACIFIC: VOLUME DATA FOR AIRCRAFT, BY PLATFORM, 2020-2030

- TABLE 17 MIDDLE EAST: VOLUME DATA FOR AIRCRAFT, BY PLATFORM, 2020-2030

- TABLE 18 LATIN AMERICA: VOLUME DATA FOR AIRCRAFT, BY PLATFORM, 2020-2030

- TABLE 19 NUMBER OF ELECTROMECHANICAL ACTUATORS DEPLOYED IN PLATFORMS, 2019-2024

- TABLE 20 NUMBER OF ELECTROMECHANICAL ACTUATORS DEPLOYED IN PLATFORMS, 2025-2030

- TABLE 21 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 24 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 25 TARIFFS FOR AIRCRAFT, SPACECRAFT, AND PARTS THEREOF, 2024

- TABLE 26 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 CONTRIBUTION OF DIFFERENT COMPONENTS TO ELECTROMECHANICAL ACTUATOR MASS

- TABLE 32 KEY CHARACTERISTICS OF ELECTRIC MOTORS USED IN AVIATION

- TABLE 33 KEY PATENTS GRANTED, 2020-2024

- TABLE 34 RECIPROCAL TARIFF RATES ADJUSTED BY US

- TABLE 35 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 36 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 37 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 38 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 39 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MECHANISM TYPE, 2021-2024 (USD MILLION)

- TABLE 40 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MECHANISM TYPE, 2025-2030 (USD MILLION)

- TABLE 41 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 42 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 43 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MOTOR TORQUE, 2021-2024 (USD MILLION)

- TABLE 44 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MOTOR TORQUE, 2025-2030 (USD MILLION)

- TABLE 45 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 NORTH AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 50 NORTH AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 52 NORTH AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MECHANISM TYPE, 2021-2024 (USD MILLION)

- TABLE 54 NORTH AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MECHANISM TYPE, 2025-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 56 NORTH AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 57 US: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 58 US: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 59 US: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 60 US: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 61 US: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 62 US: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 CANADA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 64 CANADA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 65 CANADA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 66 CANADA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 67 CANADA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 68 CANADA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 69 EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 72 EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 74 EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 75 EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MECHANISM TYPE, 2021-2024 (USD MILLION)

- TABLE 76 EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MECHANISM TYPE, 2025-2030 (USD MILLION)

- TABLE 77 EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 78 EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 79 UK: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 80 UK: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 81 UK: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 82 UK: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 83 UK: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 84 UK: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 FRANCE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 86 FRANCE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 87 FRANCE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 88 FRANCE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 89 FRANCE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 90 FRANCE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91 GERMANY: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 92 GERMANY: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 93 GERMANY: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 94 GERMANY: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 95 GERMANY: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 96 GERMANY: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 97 ITALY: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 98 ITALY: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 99 ITALY: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 100 ITALY: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 101 ITALY: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 102 ITALY: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 103 REST OF EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 104 REST OF EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 105 REST OF EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 106 REST OF EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 107 REST OF EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 108 REST OF EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MECHANISM TYPE, 2021-2024 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MECHANISM TYPE, 2025-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 118 ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 CHINA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 120 CHINA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 121 CHINA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 122 CHINA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 123 CHINA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 124 CHINA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 125 INDIA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 126 INDIA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 127 INDIA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 128 INDIA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 129 INDIA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 130 INDIA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 JAPAN: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 132 JAPAN: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 133 JAPAN: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 134 JAPAN: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 135 JAPAN: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 136 JAPAN: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MECHANISM TYPE, 2021-2024 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MECHANISM TYPE, 2025-2030 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 SAUDI ARABIA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 154 SAUDI ARABIA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 155 SAUDI ARABIA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 156 SAUDI ARABIA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 157 SAUDI ARABIA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 158 SAUDI ARABIA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 159 UAE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 160 UAE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 161 UAE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 162 UAE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 163 UAE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 164 UAE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165 SOUTH AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 166 SOUTH AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 167 SOUTH AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 168 SOUTH AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 169 SOUTH AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 170 SOUTH AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 174 REST OF MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 175 REST OF MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 176 REST OF MIDDLE EAST & AFRICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 177 LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 178 LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 179 LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 180 LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 181 LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 182 LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 183 LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MECHANISM TYPE, 2021-2024 (USD MILLION)

- TABLE 184 LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MECHANISM TYPE, 2025-2030 (USD MILLION)

- TABLE 185 LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 186 LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 187 BRAZIL: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 188 BRAZIL: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 189 BRAZIL: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 190 BRAZIL: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 191 BRAZIL: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 192 BRAZIL: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 193 MEXICO: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 194 MEXICO: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 195 MEXICO: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 196 MEXICO: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 197 MEXICO: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 198 MEXICO: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 199 REST OF LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 200 REST OF LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 201 REST OF LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2021-2024 (USD MILLION)

- TABLE 202 REST OF LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT, 2025-2030 (USD MILLION)

- TABLE 203 REST OF LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 204 REST OF LATIN AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 205 KEY PLAYER STRATEGIES, 2020-2024

- TABLE 206 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET: DEGREE OF COMPETITION

- TABLE 207 PLATFORM FOOTPRINT

- TABLE 208 APPLICATION FOOTPRINT

- TABLE 209 REGION FOOTPRINT

- TABLE 210 LIST OF KEY STARTUPS/SMES

- TABLE 211 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 212 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET: PRODUCT LAUNCHES, JANUARY 2020-MAY 2025

- TABLE 213 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET: DEALS, JANUARY 2020-MAY 2025

- TABLE 214 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET: OTHER DEVELOPMENTS, JANUARY 2020-MAY 2025

- TABLE 215 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 216 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 218 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 219 WOODWARD INC.: COMPANY OVERVIEW

- TABLE 220 WOODWARD INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 WOODWARD INC.: DEALS

- TABLE 222 AMETEK, INC.: COMPANY OVERVIEW

- TABLE 223 AMETEK, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 AMETEK, INC.: EXPANSIONS

- TABLE 225 CURTISS-WRIGHT CORPORATION: COMPANY OVERVIEW

- TABLE 226 CURTISS-WRIGHT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 CURTISS-WRIGHT CORPORATION: DEALS

- TABLE 228 CURTISS-WRIGHT CORPORATION: OTHER DEVELOPMENTS

- TABLE 229 LIEBHERR GROUP: COMPANY OVERVIEW

- TABLE 230 LIEBHERR GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 LIEBHERR GROUP: DEALS

- TABLE 232 MOOG INC.: COMPANY OVERVIEW

- TABLE 233 MOOG INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 MOOG INC.: DEALS

- TABLE 235 EATON: COMPANY OVERVIEW

- TABLE 236 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 EATON: OTHER DEVELOPMENTS

- TABLE 238 SAAB: COMPANY OVERVIEW

- TABLE 239 SAAB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 241 PARKER HANNIFIN CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 ITT INC.: BUSINESS OVERVIEW

- TABLE 243 ITT INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 ITT INC.: EXPANSIONS

- TABLE 245 HANWHA GROUP: COMPANY OVERVIEW

- TABLE 246 HANWHA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 HANWHA GROUP: OTHER DEVELOPMENTS

- TABLE 248 FAULHABER GROUP: COMPANY OVERVIEW

- TABLE 249 FAULHABER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 TRANSDIGM GROUP INC.: COMPANY OVERVIEW

- TABLE 251 TRANSDIGM GROUP INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 TAMAGAWA SEIKI CO.,LTD.: COMPANY OVERVIEW

- TABLE 253 TAMAGAWA SEIKI CO.,LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 TEXTRON INC.: COMPANY OVERVIEW

- TABLE 255 TEXTRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 TEXTRON INC.: DEALS

- TABLE 257 HFE INTERNATIONAL, LLC: COMPANY OVERVIEW

- TABLE 258 HITEC GROUP USA, INC.: COMPANY OVERVIEW

- TABLE 259 KYNTRONICS: COMPANY OVERVIEW

- TABLE 260 PEGASUS ACTUATORS GMBH: COMPANY OVERVIEW

- TABLE 261 ULTRA MOTION LLC: COMPANY OVERVIEW

- TABLE 262 UMBRAGROUP: COMPANY OVERVIEW

- TABLE 263 VOLZ SERVOS GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 264 ZIMM GMBH: COMPANY OVERVIEW

- TABLE 265 MECAER AVIATION GROUP: COMPANY OVERVIEW

- TABLE 266 ISPSYSTEM: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 EVTOL SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 ROTARY ACTUATOR SEGMENT TO LEAD MARKET BY 2030

- FIGURE 9 FLIGHT CONTROL SURFACE SEGMENT TO LEAD MARKET IN 2025

- FIGURE 10 LATIN AMERICA TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 GROWING ELECTRIFICATION TREND IN AIRCRAFT SYSTEMS TO DRIVE MARKET

- FIGURE 12 ROTARY ACTUATOR SEGMENT TO ACHIEVE SIGNIFICANT GROWTH IN 2025

- FIGURE 13 EVTOL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 FLIGHT CONTROL SURFACE SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 15 BRAZIL TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 16 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 NUMBER OF AIRCRAFT ELECTRIFICATION PROGRAMS LAUNCHED, 2009-2018

- FIGURE 18 FUNDING IN DRONE INDUSTRY, 2013-2022 (USD MILLION)

- FIGURE 19 REVENUE SHIFT IN ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET

- FIGURE 20 IMPORT DATA FOR HS CODE 88-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 21 EXPORT DATA FOR HS CODE 88-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 22 INDICATIVE PRICING ANALYSIS, BY REGION, 2024

- FIGURE 23 ECOSYSTEM MAP

- FIGURE 24 VALUE CHAIN ANALYSIS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 27 TOTAL FUNDING AND NUMBER OF DEALS, 2020-2024 (YTD)

- FIGURE 28 EVOLUTION OF TECHNOLOGY IN ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET

- FIGURE 29 EVOLUTION OF ELECTROMECHANICAL ACTUATORS

- FIGURE 30 PATENTS GRANTED, 2014-2025

- FIGURE 31 IMPACT OF GEN AI/AI

- FIGURE 32 NARROW-BODY AIRCRAFT SEGMENT TO LEAD MARKET IN 2025

- FIGURE 34 FLIGHT CONTROL SURFACE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 35 < 25 NM SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 36 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 37 NORTH AMERICA: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET SNAPSHOT

- FIGURE 38 EUROPE: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET SNAPSHOT

- FIGURE 40 MARKET SHARE ANALYSIS OF KEY COMPANIES, 2024

- FIGURE 41 BRAND COMPARISON

- FIGURE 42 FINANCIAL METRICS, 2025

- FIGURE 43 COMPANY VALUATION, 2025

- FIGURE 44 REVENUE ANALYSIS OF KEY PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 45 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 COMPANY FOOTPRINT

- FIGURE 47 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 49 WOODWARD INC.: COMPANY SNAPSHOT

- FIGURE 50 AMETEK, INC.: COMPANY SNAPSHOT

- FIGURE 51 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 LIEBHERR GROUP: COMPANY SNAPSHOT

- FIGURE 53 MOOG INC.: COMPANY SNAPSHOT

- FIGURE 54 EATON: COMPANY SNAPSHOT

- FIGURE 55 SAAB: COMPANY SNAPSHOT

- FIGURE 56 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- FIGURE 57 ITT INC.: COMPANY SNAPSHOT

- FIGURE 58 HANWHA GROUP: COMPANY SNAPSHOT

- FIGURE 59 TRANSDIGM GROUP INC.: COMPANY SNAPSHOT

- FIGURE 60 TEXTRON INC.: COMPANY SNAPSHOT

The electromechanical actuators in aircraft market is projected to reach USD 804.3 million by 2030, growing from USD 577.1 million in 2025 at a CAGR of 6.9%. The market is set to expand steadily by 2030, driven by the global shift toward electrification in aerospace systems. As aircraft manufacturers prioritize eliminating hydraulic lines and fluid-based systems, EMAs are increasingly adopted for their lightweight, compact, and energy-efficient characteristics. The trend is particularly strong in modern commercial and defense aircraft programs focused on reducing emissions, simplifying maintenance, and improving system integration.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By mechanism type, motor torque, application, platform, and region |

| Regions covered | North America, Europe, APAC, RoW |

"By mechanism type, the rotary actuator segment is estimated to grow at a higher rate than the linear actuator segment in 2025."

The rotary actuator segment is likely to dominate the electromechanical actuators in aircraft market because rotary actuators are extensively used in all-critical aircraft systems and exhibit remarkable performance characteristics in small motion control. Rotary actuators are crucial in applications like throttle control, valve operation, flap driving, thrust reversers, and brake systems-all requiring accurate angular motion and high torque density. Their small size and capability of delivering smooth, controlled rotary motion make them especially well-suited to space-constrained commercial and military aircraft applications. Also, rotary EMAs benefit from improved reliability, faster response rates, and simpler integration into electronic flight control systems than linear EMAs. As new-generation aircraft platforms shift toward modular, electric architectures, there is a growing need for low-maintenance, versatile rotary actuators. These actuators are also preferable in newer platforms like eVTOLs and UAVs, where lightweight high-performance systems are needed to drive the control surfaces efficiently. Furthermore, improvements in digital feedback systems, embedded sensors, and thermal management have seen substantial improvements in fault tolerance along with diagnostic capability.

"By platform, the narrow-body aircraft segment is estimated to account for the largest share in 2025."

The narrow-body aircraft segment is poised to dominate the electromechanical actuators in aircraft market as they play a leading role in global fleet growth, especially in short-to-medium range segments. They are witnessing many deliveries globally, with the growing demand for air travel in emerging countries, the development of low-cost carriers, and rising point-to-point connectivity. Air carriers are investing increasingly in next-generation narrow-body platforms focusing on fuel efficiency, operation performance, and lower lifecycle cost-objectives that coincide precisely with the advantages of EMAs. Electromechanical actuators have a tremendous edge over legacy hydraulic systems in terms of weight reduction, easier maintenance, and compatibility with digital flight control systems. These conditions are paramount for narrow-body fleets where cost-per-seat-mile is the key performance indicator. In addition, aircraft makers are incorporating more electric systems in newer narrow-body aircraft to address regulatory and environmental demands and drive the growth of EMA technologies more quickly.

"Latin America is projected to grow at the highest CAGR during the forecast period."

Latin America is projected to experience the highest growth in the electromechanical actuators in aircraft market during the forecast period due to growing regional air travel needs, fleet upgrading initiatives, and rising investment in aerospace infrastructure. Brazil, Mexico, and Colombia are experiencing a domestic and intra-regional air traffic boom, with local carriers procuring newer, more fuel-efficient aircraft fitted with advanced actuation systems. Additionally, regional governments are investing in defense modernization initiatives, such as upgrading fixed-wing and rotary military fleets, which increasingly prefer electromechanical systems over hydraulic alternatives because of their reduced maintenance requirements and greater reliability.

Latin America witnesses major aircraft manufacturing and MRO activities-especially in Brazil. This facilitates local adoption and integration of EMA technologies. The transition to sustainable aviation, such as the interest in hybrid and electric aircraft, also increases the demand for lightweight, electrically-powered parts, such as EMAs. Although the region continues to represent a smaller percentage of the global aviation market in absolute terms, its rapid pace of change, enabling regulatory changes and expanding aerospace ecosystem make Latin America a high-growth region for electromechanical actuators in the commercial aviation and defense aviation markets.

The break-up of primary participants in the electromechanical actuators in aircraft market is given below:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Middle East - 10%, and Rest of the World (RoW) - 5%

Major companies profiled in the report include Curtiss-Wright Corporation (US), Moog (US), Honeywell (US), Liebherr (Switzerland), and Ametek Inc. (US), among others.

Research Coverage:

This market study covers the electromechanical actuators in aircraft market across various segments and subsegments. It aims to estimate this market size and growth potential across different parts based on region. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall electromechanical actuators in aircraft market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities. The electromechanical actuators in aircraft market experiences growth and evolution driven by various factors. Some of these factors are provided below:

- Market Drivers (Growing demand for more electric aircraft (MEA), rising demand for electromechanical actuators in the drone industry, technological issues with traditional hydraulic systems and pneumatic actuators), restraints (Stringent government regulations), opportunities ( Development of electric actuation architecture for urban air mobility (UAM), and challenges (Technological complexities)

- Market Penetration: Comprehensive information on electromechanical actuators in aircraft offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the electromechanical actuators in aircraft market

- Market Development: Comprehensive information about lucrative markets. The report analyses the electromechanical actuators in aircraft market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the electromechanical actuators in aircraft market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the electromechanical actuators in aircraft market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary insights

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation and methodology

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS OF RESEARCH

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET

- 4.2 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MECHANISM TYPE

- 4.3 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY LIGHT AND ULTRALIGHT AIRCRAFT

- 4.4 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION

- 4.5 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing electrification of aircraft and R&D in more electric aircraft (MEA)

- 5.2.1.2 Rising demand for electromechanical actuators in drone industry

- 5.2.1.3 Technological issues with traditional hydraulic and pneumatic actuators

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent government regulations

- 5.2.2.2 Design integration challenges with legacy airframe architecture

- 5.2.2.3 High certification costs and lengthy qualification timelines

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of electric actuation architecture for urban air mobility (UAM)

- 5.2.3.2 Electrification of future aircraft platforms

- 5.2.4 CHALLENGES

- 5.2.4.1 Technological complexities

- 5.2.4.2 Thermal management and power density constraints in compact airframe spaces

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ELECTROMECHANICAL ACTUATOR MANUFACTURERS

- 5.4 TRADE ANALYSIS

- 5.4.1 IMPORT SCENARIO

- 5.4.2 EXPORT SCENARIO

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING ANALYSIS

- 5.5.2 INDICATIVE PRICING ANALYSIS, BY REGION, 2024

- 5.5.3 FACTORS AFFECTING PRICING OF ELECTROMECHANICAL ACTUATORS

- 5.5.4 INDICATIVE PRICING ANALYSIS: CONVENTIONAL VS. SMART ELECTROMECHANICAL ACTUATORS

- 5.6 OPERATIONAL DATA

- 5.6.1 GLOBAL OPERATIONAL DATA, BY PLATFORM

- 5.6.2 NORTH AMERICA: OPERATIONAL DATA, BY PLATFORM

- 5.6.3 EUROPE: OPERATIONAL DATA, BY PLATFORM

- 5.6.4 ASIA PACIFIC: OPERATIONAL DATA, BY PLATFORM

- 5.6.5 MIDDLE EAST & AFRICA: OPERATIONAL DATA, BY PLATFORM

- 5.6.6 LATIN AMERICA: OPERATIONAL DATA, BY PLATFORM

- 5.7 VOLUME DATA (NUMBER OF ELECTROMECHANICAL ACTUATORS DEPLOYED IN PLATFORMS)

- 5.8 ECOSYSTEM ANALYSIS

- 5.8.1 MANUFACTURERS

- 5.8.2 SERVICE PROVIDERS

- 5.8.3 END USERS

- 5.9 VALUE CHAIN ANALYSIS

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFFS

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 INVESTMENT & FUNDING SCENARIO

- 5.14 TECHNOLOGY TRENDS

- 5.14.1 BRUSHLESS DC MOTORS

- 5.14.2 SIMPLEX ELECTROMECHANICAL ACTUATORS

- 5.14.3 NO-BLEED SYSTEM AIRCRAFT ARCHITECTURE

- 5.14.4 FAULT DIAGNOSIS AND CONDITION MONITORING SYSTEM

- 5.14.5 RARE EARTH MAGNETS

- 5.15 BASIC COMPONENTS OF ELECTROMECHANICAL ACTUATORS

- 5.15.1 ELECTRIC MOTORS

- 5.15.2 POWER AND CONTROL ELECTRONICS

- 5.15.3 MECHANICAL TRANSMISSION

- 5.16 TECHNOLOGY ANALYSIS

- 5.16.1 KEY TECHNOLOGIES

- 5.16.1.1 Brushless DC (BLDC) and Permanent Magnet Synchronous Motors (PMSMs)

- 5.16.1.2 Harmonic Drive and Cycloidal Gear Systems

- 5.16.1.3 Fail-safe Devices

- 5.16.1.4 3D Printing

- 5.16.2 ADJACENT TECHNOLOGIES

- 5.16.2.1 Embedded Sensor Architecture (Resolvers, Encoders, Hall Sensors)

- 5.16.2.2 Electrical Power Distribution System (EPDS)

- 5.16.3 COMPLEMENTARY TECHNOLOGIES

- 5.16.3.1 Structural Health Monitoring (SHM) Technologies

- 5.16.3.2 Robotics

- 5.16.3.3 AI-/ML-based predictive control algorithms

- 5.16.1 KEY TECHNOLOGIES

- 5.17 CASE STUDY ANALYSIS

- 5.17.1 ELECTROMECHANICAL ACTUATORS IN SUSTAINABLE AVIATION

- 5.17.2 WHIPPANY ACTUATION SYSTEMS' INTEGRATION OF COLLABORATIVE ROBOTICS FOR INCREASED PRODUCTIVITY

- 5.17.3 INTEGRATION OF LIEBHERR'S ACTUATORS IN AW189 HELICOPTER

- 5.17.4 MOOG INC. (US) DEVELOPED MULTIPLE ELECTROMECHANICAL ACTUATORS WITH ENHANCED RELIABILITY FOR BOEING 787 DREAMLINER

- 5.18 TECHNOLOGY ROADMAP

- 5.19 PATENT ANALYSIS

- 5.20 IMPACT OF GEN AI/AI

- 5.21 MACROECONOMIC OUTLOOK

- 5.21.1 INTRODUCTION

- 5.21.2 NORTH AMERICA

- 5.21.3 EUROPE

- 5.21.4 ASIA PACIFIC

- 5.21.5 MIDDLE EAST

- 5.21.6 LATIN AMERICA

- 5.21.7 AFRICA

- 5.22 US 2025 TARIFF

- 5.22.1 INTRODUCTION

- 5.22.2 KEY TARIFF RATES

- 5.22.3 PRICE IMPACT ANALYSIS

- 5.22.4 IMPACT ON END-USE INDUSTRIES

6 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY PLATFORM

- 6.1 INTRODUCTION

- 6.2 NARROW-BODY AIRCRAFT

- 6.2.1 FLEET MODERNIZATION AND EFFICIENCY TARGETS TO DRIVE INTEGRATION OF ELECTROMECHANICAL ACTUATORS WITH AIRCRAFT

- 6.3 WIDE-BODY AIRCRAFT

- 6.3.1 TRANSITION TO ELECTRIC ARCHITECTURE IN LONG-HAUL FLEETS TO STIMULATE DEMAND

- 6.4 REGIONAL TRANSPORT AIRCRAFT

- 6.4.1 FOCUS OF OPERATORS ON ENHANCING SYSTEM RELIABILITY AND REDUCING LIFECYCLE COST TO ACCELERATE GROWTH

- 6.5 BUSINESS JET

- 6.5.1 USE OF ELECTROMECHANICAL ACTUATORS IN CABIN SYSTEMS TO DRIVE MARKET

- 6.6 COMMERCIAL HELICOPTER

- 6.6.1 USE OF ACTUATORS IN CONTROLLING ROTOR BLADES TO DRIVE MARKET

- 6.7 LIGHT AND ULTRALIGHT AIRCRAFT

- 6.7.1 MORE USE OF SINGLE-ENGINE AIRCRAFT THAN LARGE COMMERCIAL AIRCRAFT TO DRIVE MARKET

- 6.7.2 GENERAL AVIATION

- 6.7.3 UNMANNED AERIAL VEHICLE

- 6.7.4 EVTOL

7 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MECHANISM TYPE

- 7.1 INTRODUCTION

- 7.2 LINEAR ACTUATOR

- 7.2.1 NEED FOR HIGH PRECISION AND FAST RESPONSE TIME TO DRIVE MARKET

- 7.2.1.1 Use case 1: Deployment of Moog LA3000 Linear Actuator in flight control systems of fixed-wing aircraft

- 7.2.1.2 Use case 2: Deployment of Collins Aerospace's RFLA-5000 Linear Actuator in commercial aircraft flap system

- 7.2.1 NEED FOR HIGH PRECISION AND FAST RESPONSE TIME TO DRIVE MARKET

- 7.3 ROTARY ACTUATOR

- 7.3.1 NEED FOR SMOOTH OPERATIONS AND REDUCED BACKLASH TO DRIVE MARKET

- 7.3.1.1 Use case 1: Deployment of Moog RHD Series Rotary Actuator in jet engine thrust vectoring systems

- 7.3.1.2 Use case 2: Use of Curtiss-Wright EMA-R Actuator in aircraft spoiler drive systems

- 7.3.1 NEED FOR SMOOTH OPERATIONS AND REDUCED BACKLASH TO DRIVE MARKET

8 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 FLIGHT CONTROL SURFACE

- 8.2.1 ADVANCEMENTS IN MODERN ACTUATORS TO DRIVE MARKET

- 8.3 FUEL DISTRIBUTION

- 8.3.1 ADOPTION OF MORE ELECTRIC AIRCRAFT (MEA) TECHNOLOGY TO DRIVE MARKET

- 8.4 CABIN ACTUATION

- 8.4.1 FOCUS ON REDUCING DOWNTIME AND OPERATIONAL COSTS TO DRIVE MARKET

- 8.5 DOOR

- 8.5.1 NEED FOR ENHANCEMENTS IN AIRCRAFT DOOR OPERATIONS TO DRIVE MARKET

- 8.6 LANDING GEAR

- 8.6.1 DEMAND FOR ENHANCED SAFETY TO DRIVE ADOPTION OF ELECTROMECHANICAL ACTUATORS

- 8.7 OTHER APPLICATIONS

9 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY MOTOR TORQUE

- 9.1 INTRODUCTION

- 9.2 < 25 NM

- 9.2.1 SHIFT TOWARD COMPACT ACTUATION TO SUPPORT LIGHTWEIGHT CONTROL SYSTEMS TO DRIVE MARKET

- 9.3 25-100 NM

- 9.3.1 INCREASED ADOPTION OF ELECTROMECHANICAL ACTUATORS IN UNMANNED AND REGIONAL PLATFORMS TO BOOST DEMAND

- 9.4 100-300 NM

- 9.4.1 ELECTRIFICATION OF HIGH-DUTY FLIGHT SURFACES TO ACCELERATE ACTUATOR INTEGRATION

- 9.5 > 300 NM

- 9.5.1 RISING REPLACEMENT OF HYDRAULIC SYSTEMS IN HEAVY-LOAD APPLICATIONS TO FUEL GROWTH

10 ELECTROMECHANICAL ACTUATORS IN AIRCRAFT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 INTRODUCTION

- 10.2.2 PESTLE ANALYSIS

- 10.2.3 US

- 10.2.3.1 Increasing investments in electric-powered aircraft to drive market

- 10.2.4 CANADA

- 10.2.4.1 Continuous R&D activities in aviation industry to drive market

- 10.3 EUROPE

- 10.3.1 INTRODUCTION

- 10.3.2 PESTLE ANALYSIS

- 10.3.3 UK

- 10.3.3.1 Increasing adoption of UAVs to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Focus of key players on sustainable aviation to drive market

- 10.3.5 GERMANY

- 10.3.5.1 International partnership for development and supply of actuation systems to drive market

- 10.3.6 ITALY

- 10.3.6.1 Increasing competition among homegrown and global companies to affect market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 INTRODUCTION

- 10.4.2 PESTLE ANALYSIS

- 10.4.3 CHINA

- 10.4.3.1 Investment in R&D for high-quality actuators to drive market

- 10.4.4 INDIA

- 10.4.4.1 Growing demand for indigenous helicopters to drive market

- 10.4.5 JAPAN

- 10.4.5.1 International exports by domestic players to drive market

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 INTRODUCTION

- 10.5.2 PESTLE ANALYSIS

- 10.5.3 SAUDI ARABIA

- 10.5.3.1 Aviation industry's modernization program, 'Vision 2030' to drive market

- 10.5.4 UAE

- 10.5.4.1 Demand for drone-powered logistics and delivery services to drive market

- 10.5.5 SOUTH AFRICA

- 10.5.5.1 Rising demand for commercial aircraft to drive market

- 10.5.6 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 INTRODUCTION

- 10.6.2 PESTLE ANALYSIS

- 10.6.3 BRAZIL

- 10.6.3.1 Development of advanced actuation systems to drive market

- 10.6.4 MEXICO

- 10.6.4.1 Popularity of Safran Landing Systems to set trend for market growth

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 BRAND COMPARISON

- 11.5 FINANCIAL METRICS AND COMPANY VALUATION

- 11.6 REVENUE ANALYSIS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING

- 11.8.5.1 Details list of startups/SMES

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 HONEYWELL INTERNATIONAL INC.

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches

- 12.2.1.3.2 Deals

- 12.2.2 WOODARD INC.

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Deals

- 12.2.3 AMETEK, INC.

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Expansions

- 12.2.4 CURTISS-WRIGHT CORPORATION

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Deals

- 12.2.4.3.2 Other developments

- 12.2.5 LIEBHERR GROUP

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 Recent developments

- 12.2.5.3.1 Deals

- 12.2.6 MOOG INC.

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Deals

- 12.2.7 EATON

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.7.3 Recent developments

- 12.2.7.3.1 Other developments

- 12.2.8 SAAB

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.9 PARKER HANNIFIN CORP

- 12.2.9.1 Business overview

- 12.2.9.2 Products/Solutions/Services offered

- 12.2.10 ITT INC.

- 12.2.10.1 Business overview

- 12.2.10.2 Products/Solutions/Services offered

- 12.2.10.3 Recent developments

- 12.2.10.3.1 Expansions

- 12.2.11 HANWHA GROUP

- 12.2.11.1 Business overview

- 12.2.11.2 Products/Solutions/Services offered

- 12.2.11.3 Recent developments

- 12.2.11.3.1 Other developments

- 12.2.12 FAULHABER GROUP

- 12.2.12.1 Business overview

- 12.2.12.2 Products/Solutions/Services offered

- 12.2.13 TRANSDIGM GROUP INC.

- 12.2.13.1 Business overview

- 12.2.13.2 Products/Solutions/Services offered

- 12.2.14 TAMAGAWA SEIKI CO.,LTD.

- 12.2.14.1 Business overview

- 12.2.14.2 Products/Solutions/Services offered

- 12.2.15 TEXTRON INC.

- 12.2.15.1 Business overview

- 12.2.15.2 Products/Solutions/Services offered

- 12.2.15.3 Recent developments

- 12.2.15.3.1 Deals

- 12.2.1 HONEYWELL INTERNATIONAL INC.

- 12.3 OTHER PLAYERS

- 12.3.1 HFE INTERNATIONAL, LLC

- 12.3.2 HITEC GROUP USA, INC.

- 12.3.3 KYNTRONICS

- 12.3.4 PEGASUS ACTUATORS GMBH

- 12.3.5 ULTRA MOTION

- 12.3.6 UMBRAGROUP

- 12.3.7 VOLZ SERVOS GMBH & CO. KG

- 12.3.8 ZIMM GMBH

- 12.3.9 MECAER AVIATION GROUP

- 12.3.10 ISPSYSTEM

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS