|

|

市場調査レポート

商品コード

1754851

産業用エバポレーターの世界市場:タイプ別、機能性別、最終用途産業別、地域別 - 2030年までの予測Industrial Evaporators Market by Construction Type (Shell & Tube Evaporators, Plate Evaporators), Functionality (Falling Film, Rising Film), End-use Industry (Food & Beverage, Pharmaceutical, Automotive), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 産業用エバポレーターの世界市場:タイプ別、機能性別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月11日

発行: MarketsandMarkets

ページ情報: 英文 251 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の産業用エバポレーターの市場規模は、2025年の221億米ドルから2030年には281億4,000万米ドルに成長すると予測され、予測期間中のCAGRは5.0%になるとみられています。

効率的な熱分離プロセスに対する需要の高まりは、食品・飲料、製薬、化学、廃水処理など複数の産業で顕著です。工業化の進展は、効果的な濃縮、精製、溶媒回収方法の必要性と相まって、高度なエバポレーターシステムの採用を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象ユニット | 金額(100万米ドル/10億米ドル)および数量(台数) |

| セグメント | タイプ別、機能性別、最終用途産業別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

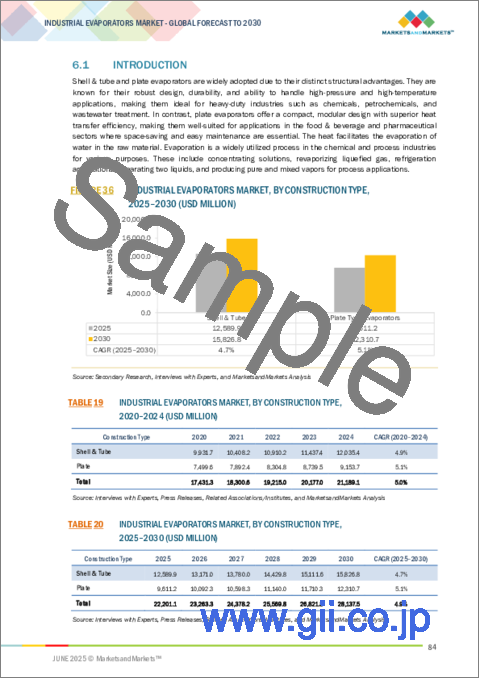

プレート式エバポレーターは、その構造タイプによって分類され、予測期間中に第2位の市場シェアを獲得すると予想されています。この成長が期待される理由は、コンパクトな設計、卓越した熱効率、メンテナンスの容易さであり、食品・飲料、医薬品、化学処理などの多様な産業で高い人気を集めています。これらのエバポレーターのモジュラー・アーキテクチャーは拡張性とカスタマイズを容易にし、スペースとエネルギー効率が最重要視される用途での魅力を高めています。産業界がコスト効率とエネルギー効率の高いソリューションをますます追求するようになるにつれて、プレート式エバポレーターの需要は一貫した成長を遂げ、市場での地位を確固たるものにすると予想されます。

食品・飲料産業は、産業用エバポレーター市場において、予測期間中に最も大きな成長を遂げると予測されます。加工・包装食品に対する世界の需要の増加と、食品製造における効率的な濃縮・脱水プロセスに対する要求の高まりが、この拡大を大きく後押ししています。産業用エバポレーターは、ジュース濃縮、乳製品加工、フレーバー抽出など、製品品質の維持とエネルギー消費の最適化が重要な用途に不可欠です。さらに、厳しい食品安全規制と持続可能な製造方法の重視が、高度なエバポレーター技術の採用を促進し、この業界の成長に寄与しています。

当レポートでは、世界の産業用エバポレーター市場について調査し、タイプ別、機能性別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- バリューチェーン分析

- 価格分析

- 産業用エバポレーター市場のエコシステム

- 特許分析

- ケーススタディ分析

- 貿易分析

- 主要な利害関係者と購入基準

- 2025年~2026年の主な会議とイベント

- 規制状況

- 技術分析

- 隣接技術

- 補完的技術

- 動向/破壊的変化の影響

- 世界マクロ経済見通し

- 2025年の米国関税の影響- 産業用エバポレーター市場

- 産業用エバポレーター市場における人工知能(AI)の影響

- 投資と資金調達のシナリオ

第6章 産業用エバポレーター市場(タイプ別)

- イントロダクション

- シェル&チューブ式エバポレーター

- プレート式エバポレーター

第7章 産業用エバポレーター市場(機能別)

- イントロダクション

- 流下膜式エバポレーター

- ライジングフィルムエバポレーター

- 強制循環式エバポレーター

- 撹拌薄膜エバポレーター

- 機械式蒸気再圧縮エバポレーター

- その他

第8章 産業用エバポレーター市場(最終用途産業別)

- イントロダクション

- 医薬品

- 化学製品・石油化学製品

- エレクトロニクス・半導体

- パルプ・紙

- 食品・飲料

- 自動車

- その他

第9章 産業用エバポレーター市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- 韓国

- 日本

- インド

- マレーシア

- オーストラリア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- ロシア

- フランス

- イタリア

- スペイン

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- アルゼンチン

- ブラジル

- その他

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- VEOLIA WATER TECHNOLOGIES(VEOLIA GROUP)

- SUMITOMO HEAVY INDUSTRIES, LTD.

- SPX FLOW, INC.

- JEOL LTD.

- CONDORCHEM ENVIRO SOLUTIONS

- ECO-TECHNO SRL

- GEA GROUP AKTIENGESELLSCHAFT

- H2O GMBH

- DE DIETRICH

- BUCHER UNIPEKTIN

- ALFA LAVAL

- SASAKURA ENGINEERING CO, LTD.

- PRAJ INDUSTRIES

- SANSHIN MFG. CO., LTD.

- EQUIPMENT MANUFACTURING COMPANY

- SALTWORKS TECHNOLOGIES INC.

- ZHEJIANG TAIKANG EVAPORATOR CO., LTD

- BELMAR TECHNOLOGIES

- HEBEI LEHENG ENERGY SAVING EQUIPMENT CO. LTD.

- UNITOP AQUACARE LIMITED

- その他の企業

- 3V TECH S.P.A.

- SAMSCO

- 3R TECHNOLOGY

- ENCON EVAPORATORS

- S.A.I.T.A SRL

- RELCO LLC

- SMI EVAPORATIVE SOLUTIONS

- COLMAC COIL MANUFACTURING, INC.

- TETRA PAK INTERNATIONAL S.A.

- ARTISAN INDUSTRIES INC.

第12章 隣接市場と関連市場

第13章 付録

List of Tables

- TABLE 1 INDUSTRIAL EVAPORATORS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 INDUSTRIAL EVAPORATORS MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 3 INDUSTRIAL EVAPORATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE TREND OF INDUSTRIAL EVAPORATORS, BY KEY PLAYER (USD/UNIT)

- TABLE 5 AVERAGE SELLING PRICE TREND OF INDUSTRIAL EVAPORATORS, BY TYPE (USD/UNIT)

- TABLE 6 AVERAGE SELLING PRICE TREND OF INDUSTRIAL EVAPORATORS, BY END-USE INDUSTRY (USD/UNIT)

- TABLE 7 AVERAGE SELLING PRICE TREND OF INDUSTRIAL EVAPORATOR, BY REGION (USD/UNIT)

- TABLE 8 INDUSTRIAL EVAPORATORS MARKET: ECOSYSTEM

- TABLE 9 INDUSTRIAL EVAPORATORS MARKET: LIST OF MAJOR PATENTS

- TABLE 10 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 11 KEY BUYING CRITERIA, BY TOP THREE END-USE INDUSTRIES

- TABLE 12 INDUSTRIAL EVAPORATORS MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 13 STANDARDS FOR INDUSTRIAL EVAPORATORS

- TABLE 14 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY COUNTRY, 2021-2024

- TABLE 15 UNEMPLOYMENT RATE, BY COUNTRY, 2021-2024

- TABLE 16 INFLATION RATE (AVERAGE CONSUMER PRICES), BY COUNTRY, 2021-2024

- TABLE 17 FOREIGN DIRECT INVESTMENT, 2022 VS. 2023

- TABLE 18 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 19 INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 20 INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 21 INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (UNITS)

- TABLE 22 INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (UNITS)

- TABLE 23 SHELL & TUBE EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 24 SHELL & TUBE EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 PLATE EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 PLATE EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 INDUSTRIAL EVAPORATORS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 28 INDUSTRIAL EVAPORATORS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 29 FALLING FILM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 FALLING FILM EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 RISING FILM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 RISING FILM EVAPORATORS , BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 FORCED CIRCULATION EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 FORCED CIRCULATION EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 AGITATED THIN FILM EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 AGITATED THIN FILM EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 MECHANICAL VAPOR RECOMPRESSION EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 MECHANICAL VAPOR RECOMPRESSION EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 OTHER EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 OTHER EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 42 INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 43 PHARMACEUTICALS: INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 PHARMACEUTICALS: INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 CHEMICALS & PETROCHEMICALS: INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 CHEMICALS & PETROCHEMICALS: INDUSTRIAL EVAPORATORS MARKET, 2025-2030 (USD MILLION)

- TABLE 47 ELECTRONICS & SEMICONDUCTOR: INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 ELECTRONICS & SEMICONDUCTOR: INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 PULP & PAPER: INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 PULP & PAPER: INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 FOOD & BEVERAGES: INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 FOOD & BEVERAGES: INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 AUTOMOTIVE: INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 AUTOMOTIVE: INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 OTHER END-USE INDUSTRIES: INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 OTHER END-USE INDUSTRIES: INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 INDUSTRIAL EVAPORATORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 ASIA PACIFIC: INDUSTRIAL EVAPORATORS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 60 ASIA PACIFIC: INDUSTRIAL EVAPORATORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 ASIA PACIFIC: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 62 ASIA PACIFIC: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 63 ASIA PACIFIC: INDUSTRIAL EVAPORATORS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 64 ASIA PACIFIC: INDUSTRIAL EVAPORATORS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 66 ASIA PACIFIC: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 67 CHINA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 68 CHINA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 69 CHINA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 70 CHINA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 71 SOUTH KOREA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 72 SOUTH KOREA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 73 SOUTH KOREA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 74 SOUTH KOREA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 75 JAPAN: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 76 JAPAN: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 77 JAPAN: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 78 JAPAN: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 79 INDIA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 80 INDIA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 81 INDIA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 82 INDIA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 83 MALAYSIA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 84 MALAYSIA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 85 MALAYSIA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 86 MALAYSIA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 87 AUSTRALIA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 88 AUSTRALIA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 89 AUSTRALIA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 90 AUSTRALIA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 96 NORTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 103 US: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 104 US: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 105 US: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 106 US: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 107 CANADA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 108 CANADA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 109 CANADA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 110 CANADA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 111 MEXICO: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 112 MEXICO: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 113 MEXICO: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 114 MEXICO: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: INDUSTRIAL EVAPORATORS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 116 EUROPE: INDUSTRIAL EVAPORATORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 118 EUROPE: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: INDUSTRIAL EVAPORATORS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 120 EUROPE: INDUSTRIAL EVAPORATORS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 122 EUROPE: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 123 GERMANY: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 124 GERMANY: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 125 GERMANY: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 126 GERMANY: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127 UK: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 128 UK: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 129 UK: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 130 UK: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 131 RUSSIA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 132 RUSSIA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 133 RUSSIA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 134 RUSSIA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 FRANCE: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 136 FRANCE: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 137 FRANCE: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 138 FRANCE: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 ITALY: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 140 ITALY: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 141 ITALY: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 142 ITALY: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 SPAIN: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 144 SPAIN: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 145 SPAIN: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 146 SPAIN: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 147 REST OF EUROPE: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 148 REST OF EUROPE: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 149 REST OF EUROPE: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 150 REST OF EUROPE: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 159 SAUDI ARABIA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 160 SAUDI ARABIA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 161 SAUDI ARABIA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 162 SAUDI ARABIA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 163 UAE: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 164 UAE: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 165 UAE: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 166 UAE: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 167 OTHER GCC COUNTRIES: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 168 OTHER GCC COUNTRIES: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 169 OTHER GCC COUNTRIES: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 170 OTHER GCC COUNTRIES: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 171 SOUTH AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 172 SOUTH AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 173 SOUTH AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 174 SOUTH AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 175 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 176 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 179 SOUTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 180 SOUTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 181 SOUTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 182 SOUTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 183 SOUTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 184 SOUTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 185 SOUTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 186 SOUTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 187 ARGENTINA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 188 ARGENTINA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 189 ARGENTINA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 190 ARGENTINA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 191 BRAZIL: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 192 BRAZIL: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 193 BRAZIL: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 194 BRAZIL: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 195 REST OF SOUTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2020-2024 (USD MILLION)

- TABLE 196 REST OF SOUTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- TABLE 197 REST OF SOUTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 198 REST OF SOUTH AMERICA: INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 199 INDUSTRIAL EVAPORATORS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025)

- TABLE 200 INDUSTRIAL EVAPORATORS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 201 INDUSTRIAL EVAPORATORS MARKET: REGION FOOTPRINT (20 COMPANIES)

- TABLE 202 INDUSTRIAL EVAPORATORS MARKET: CONSTRUCTION TYPE FOOTPRINT (20 COMPANIES)

- TABLE 203 INDUSTRIAL EVAPORATORS MARKET: FUNCTIONALITY FOOTPRINT (20 COMPANIES)

- TABLE 204 INDUSTRIAL EVAPORATORS MARKET: END-USE INDUSTRY FOOTPRINT (20 COMPANIES)

- TABLE 205 INDUSTRIAL EVAPORATORS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 206 INDUSTRIAL EVAPORATORS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 207 INDUSTRIAL EVAPORATORS MARKET: PRODUCT LAUNCHES, JANUARY 2020-APRIL 2025

- TABLE 208 INDUSTRIAL EVAPORATORS MARKET: DEALS, JANUARY 2020-APRIL 2025

- TABLE 209 INDUSTRIAL EVAPORATORS MARKET: EXPANSIONS, JANUARY 2020-APRIL 2025

- TABLE 210 VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP): COMPANY OVERVIEW

- TABLE 211 VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP): DEALS

- TABLE 213 VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP): EXPANSIONS

- TABLE 214 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 215 SUMITOMO HEAVY INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 SPX FLOW, INC.: COMPANY OVERVIEW

- TABLE 217 SPX FLOW, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 JEOL LTD.: COMPANY OVERVIEW

- TABLE 219 JEOL LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 CONDORCHEM ENVIRO SOLUTIONS: COMPANY OVERVIEW

- TABLE 221 CONDORCHEM ENVIRO SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 ECO-TECHNO SRL: COMPANY OVERVIEW

- TABLE 223 ECO-TECHNO SRL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 GEA GROUP AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- TABLE 225 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES

- TABLE 227 GEA GROUP AKTIENGESELLSCHAFT: EXPANSIONS

- TABLE 228 H2O GMBH: COMPANY OVERVIEW

- TABLE 229 H2O GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 H2O GMBH: PRODUCT LAUNCHES

- TABLE 231 DE DIETRICH: COMPANY OVERVIEW

- TABLE 232 DE DIETRICH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 DE DIETRICH: PRODUCT LAUNCHES

- TABLE 234 BUCHER UNIPEKTIN: COMPANY OVERVIEW

- TABLE 235 BUCHER UNIPEKTIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 237 ALFA LAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 SASAKURA ENGINEERING CO, LTD.: COMPANY OVERVIEW

- TABLE 239 SASAKURA ENGINEERING CO, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 PRAJ INDUSTRIES: COMPANY OVERVIEW

- TABLE 241 PRAJ INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 SANSHIN MFG. CO., LTD.: COMPANY OVERVIEW

- TABLE 243 SANSHIN MFG. CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 EQUIPMENT MANUFACTURING COMPANY: COMPANY OVERVIEW

- TABLE 245 EQUIPMENT MANUFACTURING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 SALTWORKS TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 247 SALTWORKS TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 ZHEJIANG TAIKANG EVAPORATOR CO., LTD: COMPANY OVERVIEW

- TABLE 249 ZHEJIANG TAIKANG EVAPORATOR CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 BELMAR TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 251 BELMAR TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 HEBEI LEHENG ENERGY SAVING EQUIPMENT CO. LTD.: COMPANY OVERVIEW

- TABLE 253 HEBEI LEHENG ENERGY SAVING EQUIPMENT CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 UNITOP AQUACARE LIMITED: COMPANY OVERVIEW

- TABLE 255 UNITOP AQUACARE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 3V TECH S.P.A.: COMPANY OVERVIEW

- TABLE 257 SAMSCO: COMPANY OVERVIEW

- TABLE 258 3R TECHNOLOGY: COMPANY OVERVIEW

- TABLE 259 ENCON EVAPORATORS: COMPANY OVERVIEW

- TABLE 260 S.A.I.T.A SRL: COMPANY OVERVIEW

- TABLE 261 RELCO LLC: COMPANY OVERVIEW

- TABLE 262 SMI EVAPORATIVE SOLUTIONS: COMPANY OVERVIEW

- TABLE 263 COLMAC COIL MANUFACTURING, INC.: COMPANY OVERVIEW

- TABLE 264 TETRA PAK INTERNATIONAL S.A.: COMPANY OVERVIEW

- TABLE 265 ARTISAN INDUSTRIES INC.: COMPANY OVERVIEW

- TABLE 266 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (USD MILLION)

- TABLE 267 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 268 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (UNITS)

- TABLE 269 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (UNITS)

List of Figures

- FIGURE 1 INDUSTRIAL EVAPORATORS MARKET SEGMENTATION

- FIGURE 2 INDUSTRIAL EVAPORATORS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)

- FIGURE 7 INDUSTRIAL EVAPORATORS MARKET: DATA TRIANGULATION

- FIGURE 8 FACTOR ANALYSIS

- FIGURE 9 SHELL & TUBE EVAPORATORS ACCOUNTED FOR LARGER SHARE OF INDUSTRIAL EVAPORATORS MARKET IN 2024

- FIGURE 10 FALLING FILM EVAPORATORS HELD LARGEST MARKET SHARE IN 2024

- FIGURE 11 FOOD & BEVERAGES ACCOUNTED FOR MAJOR SHARE IN 2024

- FIGURE 12 ASIA PACIFIC TO LEAD INDUSTRIAL EVAPORATORS MARKET DURING FORECAST PERIOD

- FIGURE 13 RISING DEMAND FROM VARIOUS MANUFACTURING INDUSTRIES TO DRIVE MARKET GROWTH

- FIGURE 14 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 15 SHELL & TUBE EVAPORATORS AND CHINA TO LEAD ASIA PACIFIC INDUSTRIAL EVAPORATORS MARKET

- FIGURE 16 CHINA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN INDUSTRIAL EVAPORATORS MARKET

- FIGURE 18 KEY FIGURES: GLOBAL FOOD & BEVERAGES

- FIGURE 19 CHEMICAL INDUSTRY OUTLOOK

- FIGURE 20 NUMBER OF DESALINATION PLANTS, BY REGION, 2023

- FIGURE 21 PORTER'S FIVE FORCES ANALYSIS: INDUSTRIAL EVAPORATORS MARKET

- FIGURE 22 INDUSTRIAL EVAPORATORS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF INDUSTRIAL EVAPORATORS, BY KEY PLAYER

- FIGURE 24 AVERAGE SELLING PRICE TREND OF INDUSTRIAL EVAPORATORS, BY CONSTRUCTION TYPE (USD/UNIT)

- FIGURE 25 EVAPORATORS MARKET: AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY

- FIGURE 26 EVAPORATORS MARKET: AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 27 INDUSTRIAL EVAPORATORS MARKET: ECOSYSTEM

- FIGURE 28 NUMBER OF PATENTS YEAR-WISE DURING LAST 10 YEARS

- FIGURE 29 CHINA ACCOUNTED FOR HIGHEST NUMBER OF PATENTS

- FIGURE 30 IMPORT DATA FOR HS CODE 3920-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 31 EXPORT DATA FOR HS CODE 3920-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 32 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 33 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 34 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR INDUSTRIAL EVAPORATORS MARKET

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO

- FIGURE 36 INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE, 2025-2030 (USD MILLION)

- FIGURE 37 INDUSTRIAL EVAPORATORS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- FIGURE 38 INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- FIGURE 39 INDUSTRIAL EVAPORATORS MARKET, BY REGION (USD MILLION)

- FIGURE 40 ASIA PACIFIC: INDUSTRIAL EVAPORATORS MARKET SNAPSHOT

- FIGURE 41 NORTH AMERICA: INDUSTRIAL EVAPORATORS MARKET SNAPSHOT

- FIGURE 42 EUROPE: INDUSTRIAL EVAPORATORS MARKET SNAPSHOT

- FIGURE 43 INDUSTRIAL EVAPORATORS MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2019-2024 (USD BILLION)

- FIGURE 44 INDUSTRIAL EVAPORATORS MARKET SHARE ANALYSIS, 2024

- FIGURE 45 INDUSTRIAL EVAPORATORS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 46 INDUSTRIAL EVAPORATORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 INDUSTRIAL EVAPORATORS MARKET: COMPANY FOOTPRINT

- FIGURE 48 INDUSTRIAL EVAPORATORS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 INDUSTRIAL EVAPORATORS MARKET: EV/EBITDA

- FIGURE 50 INDUSTRIAL EVAPORATORS MARKET: ENTERPRISE VALUE (USD BILLION)

- FIGURE 51 INDUSTRIAL EVAPORATORS MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 52 VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP): COMPANY SNAPSHOT

- FIGURE 53 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 54 JEOL LTD.: COMPANY SNAPSHOT

- FIGURE 55 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 56 BUCHER UNIPEKTIN: COMPANY SNAPSHOT

- FIGURE 57 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 58 SASAKURA ENGINEERING CO, LTD.: COMPANY SNAPSHOT

- FIGURE 59 PRAJ INDUSTRIES: COMPANY SNAPSHOT

The global industrial evaporators market is projected to grow from USD 22.10 billion in 2025 to USD 28.14 billion by 2030, at a CAGR of 5.0% during the forecast period. The escalating demand for efficient thermal separation processes is evident across multiple industries, including food & beverage, pharmaceuticals, chemicals, and wastewater treatment. The rise in industrialization, coupled with the imperative for effective concentration, purification, and solvent recovery methods, is driving the adoption of advanced evaporator systems.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) and Volume (No. of Units) |

| Segments | Construction Type, Functionality, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

Plate evaporators segment, by construction type, to account for second-largest market share during forecast period

Plate evaporators, classified by their construction type, are anticipated to capture the second-largest market share during the forecast period. This expected growth stems from their compact design, exceptional thermal efficiency, and ease of maintenance, making them highly sought after in diverse industries such as food & beverage, pharmaceuticals, and chemical processing. The modular architecture of these evaporators facilitates scalability and customization, enhancing their attractiveness for applications where space and energy efficiency are paramount. As industries increasingly pursue cost-effective and energy-efficient solutions, the demand for plate evaporators is expected to experience consistent growth, solidifying their prominent market position.

Food & beverage segment, by end-use industry, to register fastest growth during forecast period

The food & beverage industry is forecasted to experience the most significant growth in the industrial evaporators market during the upcoming period. The increasing global demand for processed and packaged foods and a rising requirement for efficient concentration and dehydration processes in food manufacturing largely fuel this expansion. Industrial evaporators are essential in applications such as juice concentration, dairy processing, and flavor extraction, where maintaining product quality and optimizing energy consumption is critical. Furthermore, stringent food safety regulations and a heightened emphasis on sustainable manufacturing practices are driving the adoption of advanced evaporator technologies, thereby contributing to the growth of this industry.

Profile break-up of primary participants:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: C-level- 30%, Director Level- 25%, and Others - 45%

- By Region: North America - 30%, Europe - 20%, Asia Pacific - 40%, Middle East & Africa - 7%, and South America - 3%

Veolia Water Technologies (France), Sumitomo Heavy Industries, Ltd. (Japan), SPX Flow Inc. (US), Alfa Laval. (Sweden), and GEA Group AG (Germany) are some of the major players operating in the industrial evaporators market. These companies have adopted acquisitions, expansions, partnerships, and agreements to increase their market share business revenue.

Research Coverage

The report defines, segments, and projects the industrial evaporators market based on construction type, functionality, end-use industry, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles industrial evaporator manufacturers, comprehensively analyses their market shares and core competencies, and tracks and analyzes competitive developments undertaken by them in the market, such as expansions, partnerships, and product launches.

Reasons to Buy Report

The report is expected to provide the market leaders/new entrants with the closest approximations of numbers of the industrial evaporators market and its segments. This report is also expected to help stakeholders understand the market's competitive landscape, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Expanding food & beverage industry, rapid adoption of ZLD and MLD in manufacturing sector), restraints (High manufacturing and maintenance costs), opportunities (Rise in demand for desalination due to water crises), and challenges (Shortage of skilled workforce) influencing the growth of the industrial evaporators market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities in the industrial evaporators market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the industrial evaporators market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the industrial market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players such as Veolia Water Technologies (France), Sumitomo Heavy Industries, Ltd. (Japan), SPX Flow, Inc. (US), JEOL Ltd. (Japan), Condorchem Enviro Solutions (Spain), Eco-Techno Srl (Italy), GEA Group Aktiengesellschaft (Germany), H2O GmbH (Germany), De Dietrich (US), Bucher Unipektin (Switzerland), Alfa Laval (Sweden), Sasakura Engineering Co, Ltd. (Japan), Praj Industries (India), Sanshin Mfg. Co., Ltd. (Japan), Equipment Manufacturing Corporation (US), Saltworks Technologies Inc. (Canada), Zhejiang Taikang Evaporator Co., Ltd. (China), Belmar Technologies (England), Hebei Leheng Energy Saving Equipment Co. Ltd. (China), and Unitop Aquacare Limited (India) in the industrial evaporators market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.4 CURRENCY

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 List of participating companies for primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.6 ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.7.1 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL EVAPORATORS MARKET

- 4.2 INDUSTRIAL EVAPORATORS MARKET, BY REGION

- 4.3 ASIA PACIFIC INDUSTRIAL EVAPORATORS MARKET, BY CONSTRUCTION TYPE AND COUNTRY

- 4.4 INDUSTRIAL EVAPORATORS MARKET: MAJOR COUNTRIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in food & beverage industry

- 5.2.1.2 Rapid adoption of ZLD and MLD in manufacturing industry

- 5.2.1.3 Chemical & pharmaceutical industry expansion

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment cost

- 5.2.2.2 Energy-intensive operation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Industrialization in developing countries

- 5.2.3.2 Rise in demand for desalination

- 5.2.3.3 Integration of renewable energy

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled workforce

- 5.2.4.2 Corrosion and fouling issues

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF INDUSTRIAL EVAPORATORS BY KEY PLAYERS

- 5.5.2 AVERAGE SELLING PRICE TREND, BY TYPE

- 5.5.3 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY

- 5.5.4 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 INDUSTRIAL EVAPORATORS MARKET ECOSYSTEM

- 5.7 PATENT ANALYSIS

- 5.7.1 METHODOLOGY

- 5.7.2 PATENT PUBLICATION TRENDS

- 5.7.3 INSIGHTS

- 5.7.4 JURISDICTION ANALYSIS

- 5.7.5 INDUSTRIAL EVAPORATORS MARKET: LIST OF MAJOR PATENTS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 MULTIPLE-EFFECT EVAPORATORS: ENERGY INTEGRATION STUDY

- 5.8.1.1 Objective

- 5.8.1.2 Solution statement

- 5.8.2 EFFECT OF FOULING ON FALLING FILM EVAPORATOR

- 5.8.2.1 Objective

- 5.8.2.2 Solution statement

- 5.8.1 MULTIPLE-EFFECT EVAPORATORS: ENERGY INTEGRATION STUDY

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO

- 5.9.2 EXPORT SCENARIO

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 KEY CONFERENCES & EVENTS IN 2025-2026

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.1.1 Evaporator technology

- 5.13.1.2 Falling film evaporates

- 5.13.1.3 Rising film evaporators

- 5.13.1.4 Forced circulation evaporators

- 5.13.1.5 Agitated thin film evaporations

- 5.13.1.6 Mechanical vapor recompression

- 5.13.1 KEY TECHNOLOGIES

- 5.14 ADJACENT TECHNOLOGIES

- 5.14.1 CRYSTALLIZERS

- 5.14.2 DRYERS

- 5.15 COMPLEMENTARY TECHNOLOGIES

- 5.15.1 MECHANICAL VAPOR RECOMPRESSION

- 5.15.2 WASTE HEAT RECOVERY UNITS

- 5.16 TRENDS/DISRUPTION IMPACT

- 5.17 GLOBAL MACROECONOMIC OUTLOOK

- 5.17.1 GDP

- 5.18 IMPACT OF 2025 US TARIFF - INDUSTRIAL EVAPORATORS MARKET

- 5.18.1 KEY TARIFF RATES

- 5.18.2 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR INDUSTRIAL EVAPORATORS

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON APPLICATIONS

- 5.18.5.1 Pharmaceutical

- 5.18.5.2 Chemical & petrochemical

- 5.18.5.3 Electronics & semiconductor

- 5.18.5.4 Pulp & paper

- 5.18.5.5 Food & beverage

- 5.18.5.6 Automotive

- 5.18.5.7 Other applications

- 5.19 IMPACT OF ARTIFICIAL INTELLIGENCE (AI) ON INDUSTRIAL EVAPORATORS MARKET

- 5.20 INVESTMENT AND FUNDING SCENARIO

6 INDUSTRIAL EVAPORATORS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 SHELL & TUBE EVAPORATORS

- 6.2.1 SEGMENT TO CONTINUE DOMINANCE IN EVAPORATORS MARKET

- 6.3 PLATE EVAPORATORS

- 6.3.1 HIGH DEMAND FROM FOOD & BEVERAGE INDUSTRY TO DRIVE MARKET

7 INDUSTRIAL EVAPORATORS MARKET, BY FUNCTIONALITY

- 7.1 INTRODUCTION

- 7.2 FALLING FILM EVAPORATORS

- 7.2.1 HIGH DEMAND FROM SEVERAL MAJOR INDUSTRIES

- 7.3 RISING FILM EVAPORATORS

- 7.3.1 IDEAL FOR LOW-SCALING FEEDS

- 7.4 FORCED CIRCULATION EVAPORATORS

- 7.4.1 SUITABLE FOR CRYSTALLIZATION OF SOLUTIONS AND SLURRIES

- 7.5 AGITATED THIN FILM EVAPORATORS

- 7.5.1 OVERCOME PROBLEMS OF DIFFICULT-TO-HANDLE PRODUCTS

- 7.6 MECHANICAL VAPOR RECOMPRESSION EVAPORATORS

- 7.6.1 MECHANICAL VAPOR EVAPORATORS CAN BE USED FOR HEAT-SENSITIVE MATERIALS

- 7.7 OTHERS

8 INDUSTRIAL EVAPORATORS MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 PHARMACEUTICALS

- 8.2.1 EXTENSIVE USE OF THIN FILM EVAPORATORS TO DRIVE SEGMENT GROWTH

- 8.3 CHEMICALS & PETROCHEMICALS

- 8.3.1 WIDE USE OF VARIOUS EVAPORATION PROCESSES

- 8.4 ELECTRONICS & SEMICONDUCTOR

- 8.4.1 PRIMARY APPLICATION OF EVAPORATORS FOR METAL DEPOSITION

- 8.5 PULP & PAPER

- 8.5.1 USE OF EVAPORATORS TO CONCENTRATE BLACK LIQUOR

- 8.6 FOOD & BEVERAGES

- 8.6.1 KEY INDUSTRY FOR EVAPORATOR USAGE

- 8.7 AUTOMOTIVE

- 8.7.1 USE OF MULTIPLE-EFFECT EVAPORATORS FOR INDUSTRIAL PROCESSES

- 8.8 OTHER END-USE INDUSTRIES

9 INDUSTRIAL EVAPORATORS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Position as manufacturing hub to drive demand for industrial evaporators

- 9.2.2 SOUTH KOREA

- 9.2.2.1 Growing electronics and automotive sectors to create opportunities for market growth

- 9.2.3 JAPAN

- 9.2.3.1 Leading end-use industries to create demand for industrial evaporators

- 9.2.4 INDIA

- 9.2.4.1 Government initiatives in food & beverage sector to generate demand for industrial evaporators

- 9.2.5 MALAYSIA

- 9.2.5.1 Expanding manufacturing sector to create opportunities

- 9.2.6 AUSTRALIA

- 9.2.6.1 High demand for industrial evaporators in food & beverage sector

- 9.2.7 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Pharmaceutical sector growth to create demand

- 9.3.2 CANADA

- 9.3.2.1 Rising demand for industrial evaporators in automotive industry

- 9.3.3 MEXICO

- 9.3.3.1 Electronics industry to create demand for pure industrial water

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Pharmaceutical production and automotive industry to support market growth

- 9.4.2 UK

- 9.4.2.1 Rising demand for industrial evaporators in electrical and electronics industry

- 9.4.3 RUSSIA

- 9.4.3.1 Growth in food & beverage industry to increase demand

- 9.4.4 FRANCE

- 9.4.4.1 Water treatment infrastructure to drive demand for industrial evaporators

- 9.4.5 ITALY

- 9.4.5.1 Growth in pharmaceutical and automotive industries to increase demand for industrial evaporators

- 9.4.6 SPAIN

- 9.4.6.1 Growth in food & beverage industry to support market

- 9.4.7 REST OF EUROPE

- 9.4.1 GERMANY

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Growth in chemical industry to create demand for industrial evaporators

- 9.5.1.2 UAE

- 9.5.1.2.1 Growing demand from manufacturing sector to boost demand

- 9.5.1.3 Other GCC Countries

- 9.5.1.1 Saudi Arabia

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Thriving industrial sector to create demand for industrial evaporators

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 ARGENTINA

- 9.6.1.1 Growing food & beverage and electronics industries to boost market growth

- 9.6.2 BRAZIL

- 9.6.2.1 Automobile industry to create demand for industrial evaporators

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.1 ARGENTINA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.3.1 REVENUE ANALYSIS: TOP FIVE PLAYERS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 BRAND/PRODUCT COMPARISON

- 10.5.1 VEOLIA

- 10.5.2 SUMITOMO HEAVY INDUSTRIES, LTD.

- 10.5.3 SPX FLOW, INC.

- 10.5.4 JEOL LTD

- 10.5.5 CONDORCHEM ENVIRO SOLUTIONS

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.6.5.2 Region footprint

- 10.6.5.3 Construction type footprint

- 10.6.5.4 Functionality footprint

- 10.6.5.5 End-use industry footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.7.5.1 Detailed list of key startups/SMES

- 10.7.5.2 Competitive benchmarking of key startups/SMEs

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- 11.1.1 VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP)

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 SUMITOMO HEAVY INDUSTRIES, LTD.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Right to win

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses and competitive threats

- 11.1.3 SPX FLOW, INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Right to win

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses and competitive threats

- 11.1.4 JEOL LTD.

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 CONDORCHEM ENVIRO SOLUTIONS

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 ECO-TECHNO SRL

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.7 GEA GROUP AKTIENGESELLSCHAFT

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Expansion

- 11.1.8 H2O GMBH

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.2.1 Product launches

- 11.1.9 DE DIETRICH

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.10 BUCHER UNIPEKTIN

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.11 ALFA LAVAL

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.12 SASAKURA ENGINEERING CO, LTD.

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.13 PRAJ INDUSTRIES

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.14 SANSHIN MFG. CO., LTD.

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.15 EQUIPMENT MANUFACTURING COMPANY

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.16 SALTWORKS TECHNOLOGIES INC.

- 11.1.16.1 Business overview

- 11.1.16.2 Products/Solutions/Services offered

- 11.1.17 ZHEJIANG TAIKANG EVAPORATOR CO., LTD

- 11.1.17.1 Business overview

- 11.1.17.2 Products/Solutions/Services offered

- 11.1.18 BELMAR TECHNOLOGIES

- 11.1.18.1 Business overview

- 11.1.18.2 Products/Solutions/Services offered

- 11.1.19 HEBEI LEHENG ENERGY SAVING EQUIPMENT CO. LTD.

- 11.1.19.1 Business overview

- 11.1.19.2 Products/Solutions/Services offered

- 11.1.20 UNITOP AQUACARE LIMITED

- 11.1.20.1 Business overview

- 11.1.20.2 Products/Solutions/Services offered

- 11.1.1 VEOLIA WATER TECHNOLOGIES (VEOLIA GROUP)

- 11.2 OTHER PLAYERS

- 11.2.1 3V TECH S.P.A.

- 11.2.2 SAMSCO

- 11.2.3 3R TECHNOLOGY

- 11.2.4 ENCON EVAPORATORS

- 11.2.5 S.A.I.T.A SRL

- 11.2.6 RELCO LLC

- 11.2.7 SMI EVAPORATIVE SOLUTIONS

- 11.2.8 COLMAC COIL MANUFACTURING, INC.

- 11.2.9 TETRA PAK INTERNATIONAL S.A.

- 11.2.10 ARTISAN INDUSTRIES INC.

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 INTERCONNECTED MARKETS

- 12.3.1 ZERO LIQUID DISCHARGE SYSTEMS MARKET

- 12.3.1.1 Market definition

- 12.3.1.2 Market overview

- 12.3.1 ZERO LIQUID DISCHARGE SYSTEMS MARKET

- 12.4 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM

- 12.4.1 CONVENTIONAL

- 12.4.1.1 Requirement in small and medium capacity plants to drive market

- 12.4.2 HYBRID

- 12.4.2.1 High water recovery rate to promote use

- 12.4.1 CONVENTIONAL

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS