|

|

市場調査レポート

商品コード

1752399

デジタル鉄道の世界市場:ソリューション別、サービス別、用途別、地域別 - 2030年までの予測Digital Railway Market by Offering (Solutions (Remote Monitoring, Network Management, Security, Analytics) and Services), Application (Rail Operations Management, Passenger Information System, and Asset Management) and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| デジタル鉄道の世界市場:ソリューション別、サービス別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月16日

発行: MarketsandMarkets

ページ情報: 英文 264 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

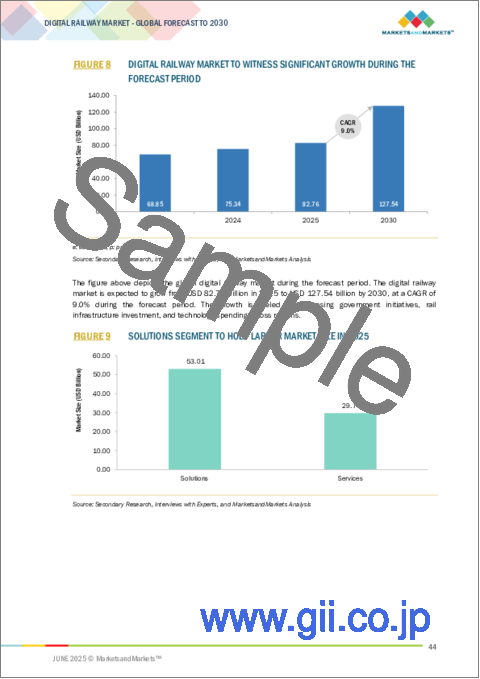

デジタル鉄道の市場規模は、2025年に827億6,000万米ドルと推定され、9.0%のCAGRで拡大し、2030年には1,275億4,000万米ドルに達すると予測されています。

IoTの採用へのシフトは、鉄道ネットワークの管理において革命的です。鉄道におけるIoTは、列車インフラの信頼性と安全性も向上させます。IoTセンサーによって生成されたデータは、以前はできなかった状況の分析と解釈を可能にします。IoTの導入により、鉄道の効率化にとって2つの重大な課題である列車ダイヤの最適化と設備の保守に、多くのデータを利用できるようになっています。アナリティクスと組み合わせることで、IoTは鉄道運行を効率化することができます。ベンダーやサードパーティプロバイダーは、サプライチェーン管理やロジスティクス活動にデジタル化されたシステムを採用するようになってきています。IoT対応テクノロジーは、ロジスティクス・ビジネスの状況を一変させつつあります。組織はますます、IoTとクラウド技術の巨大な力を利用したビジネスの再構築に力を入れるようになっています。RFID、GSM-R(Global System for Mobile Communications-Railway)、コラボレーション・プラットフォームの助けを借りて、物流ベンダーは経済的課題に立ち向かう方法を見出しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント | ソリューション別、サービス別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

システム統合・展開サービスは、鉄道ITインフラをアップグレードし、既存システム内でデジタル鉄道ソフトウェアをサポートする上で重要な役割を果たします。これらのサービスは、配備を強化し、時間とコストを節約し、効率的な運用を促進し、導入に関連する混乱を最小限に抑えます。そのプロセスは、顧客の要求事項を収集することから始まり、ソリューションの展開、統合、テスト、展開へと続きます。最終的に、これらのサービスはベンダーに依存しないソリューションの展開を可能にし、高度に最適化されたデジタル鉄道の開発に貢献します。

「鉄道交通管理分野は、予測期間中に最大の市場規模を持つ見込みです。鉄道運行管理システムは、鉄道網全体の集中監視と運行管理を可能にします。すべての鉄道運行は、中央管理システムによって規則化することができます。この中央管理システムは、列車や鉄道インフラを横断する高速通信リンクを介したリアルタイム・データを利用して、交通を自動化します。鉄道交通管理には、信号、交通制御、ルーティング、列車スケジューリングが含まれます。このシステムは、ネットワークの容量と時間効率を高め、交通の流れを調整し、運行遅延のリスクを減らし、ネットワークの災害管理を改善するための柔軟なソリューションを提供します。鉄道交通管理システムの機能には、交通計画、運行管理システム、旅客向け運行情報、保守サポート、運転士のみの運転、運転士なしの運転が含まれます。

アジア太平洋は、新技術の採用の増加、デジタルトランスフォーメーションへの投資の増加、アジア太平洋諸国のGDPの成長により、デジタル鉄道の市場が最も急成長すると推定されます。同地域の主要経済圏には、オーストラリア、シンガポール、中国、韓国、香港、インドが含まれ、いずれも技術変革への投資を急速に進めています。未開拓の市場ポテンシャル、先端技術の高い普及率、さまざまな産業での貨物利用の増加、進行中の経済開拓、政府の支援的規制により、デジタル鉄道市場は予測期間中、アジア太平洋地域で大きな成長を遂げると予想されます。国連アジア太平洋経済社会委員会(UNESCAP)は、アジア横断鉄道(TAR)ネットワークの開発とデジタル化を積極的に推進しています。TARは域内・域外貿易と輸送の促進に大きく寄与しており、28カ国を横断する約12万8000キロメートルをカバーしています。2023年9月、TAR作業部会は鉄道輸送の競争力を高めるため、「アジア太平洋における鉄道デジタルトランスフォーメーションの加速に関する戦略2030」を採択しました。

当レポートでは、世界のデジタル鉄道市場について調査し、ソリューション別、サービス別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- デジタル鉄道の簡単な歴史

- デジタル鉄道市場:エコシステム分析

- ケーススタディ分析

- バリューチェーン分析

- 規制状況

- 価格モデル分析

- 顧客のビジネスに影響を与える動向と混乱

- 技術分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- デジタル鉄道市場におけるベストプラクティス

- デジタル鉄道市場向け技術ロードマップ

- 投資と資金調達のシナリオ

- デジタル鉄道のビジネスモデル

- AI/生成AIがデジタル鉄道市場に与える影響

- 2025年の米国関税の影響- デジタル鉄道市場

第6章 デジタル鉄道市場(ソリューション別)

- イントロダクション

- リモートモニタリング

- ルート最適化とスケジュール

- 分析

- ネットワーク管理

- 予測保守

- 安全

- その他

第7章 デジタル鉄道市場(サービス別)

- イントロダクション

- 専門サービス

- マネージドサービス

第8章 デジタル鉄道市場(用途別)

- イントロダクション

- 鉄道運行管理

- 旅客情報システム

- 資産運用管理

- その他

第9章 デジタル鉄道市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 北米:デジタル鉄道市場促進要因

- 米国

- カナダ

- 欧州

- 欧州:マクロ経済見通し

- 欧州:市場促進要因

- 欧州:規制の影響

- 英国

- ドイツ

- フランス

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- アジア太平洋:デジタル鉄道市場促進要因

- 中国

- インド

- 日本

- その他

- 中東・アフリカ

- 中東・アフリカ:マクロ経済見通し

- 中東・アフリカ:デジタル鉄道市場促進要因

- ナイジェリア

- アラブ首長国連邦

- 南アフリカ

- その他

- ラテンアメリカ

- ラテンアメリカ:デジタル鉄道市場促進要因

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2022年~2025年

- 市場シェア分析、2024年

- 主要企業の収益分析(2020年~2024年)

- ブランド/製品比較

- 企業評価と財務指標

- 企業評価クアドラント、2025年

- スタートアップ/中小企業評価クアドラント

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- SIEMENS

- CISCO

- HITACHI

- WABTEC

- ALSTOM

- IBM

- ABB

- HUAWEI

- FUJITSU

- DXC

- HONEYWELL

- INDRA

- NOKIA

- ATKINS

- TOSHIBA

- TELEVIC

- ADVANTECH

- スタートアップ/中小企業

- ZEDAS

- R2P

- SIMPLEWAY

- TEGO

- ASSETIC

- PASSIO TECHNOLOGIES

- DELPHISONIC

- UPTAKE

- KONUX

- MACHINES WITH VISION

- EKE-ELECTRONICS

- AITEK S.P.A.

- CLOUDMOYO

- RAILTEL

第12章 隣接市場/関連市場

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 RISK ASSESSMENT

- TABLE 3 DIGITAL RAILWAY MARKET: ECOSYSTEM

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 INDICATIVE PRICING ANALYSIS OF DIGITAL RAILWAY SOLUTIONS, BY KEY PLAYER, 2024

- TABLE 9 DIGITAL RAILWAY MARKET: LIST OF TOP PATENTS, 2024

- TABLE 10 DIGITAL RAILWAY MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 IMPACT OF PORTER'S FIVE FORCES ON DIGITAL RAILWAY MARKET

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 14 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 15 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 16 DIGITAL RAILWAY MARKET, BY SOLUTION, 2019-2024 (USD BILLION)

- TABLE 17 DIGITAL RAILWAY MARKET, BY SOLUTION, 2025-2030 (USD BILLION)

- TABLE 18 REMOTE MONITORING: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 19 REMOTE MONITORING: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 20 ROUTE OPTIMIZATION & SCHEDULING: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 21 ROUTE OPTIMIZATION & SCHEDULING: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 22 ANALYTICS: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 23 DIGITAL RAILWAY ANALYTICS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 24 NETWORK MANAGEMENT: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 25 NETWORK MANAGEMENT: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 26 PREDICTIVE MAINTENANCE: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 27 PREDICTIVE MAINTENANCE: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 28 SECURITY: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 29 SECURITY: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 30 OTHER SOLUTIONS: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 31 OTHER SOLUTIONS: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 32 DIGITAL RAILWAY MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 33 DIGITAL RAILWAY MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 34 PROFESSIONAL SERVICES: DIGITAL RAILWAY MARKET, BY TYPE, 2019-2024 (USD BILLION)

- TABLE 35 PROFESSIONAL SERVICES: DIGITAL RAILWAY MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 36 PROFESSIONAL SERVICES: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 37 PROFESSIONAL SERVICES: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 38 CONSULTING SERVICES: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 39 CONSULTING SERVICES: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 40 SYSTEM INTEGRATION & DEPLOYMENT: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 41 SYSTEM INTEGRATION & DEPLOYMENT: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 42 SUPPORT & MAINTENANCE: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 43 SUPPORT & MAINTENANCE: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 44 MANAGED SERVICES: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 45 MANAGED SERVICES: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 46 DIGITAL RAILWAY MARKET, BY APPLICATION, 2019-2024 (USD BILLION)

- TABLE 47 DIGITAL RAILWAY MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 48 RAIL OPERATIONS MANAGEMENT: DIGITAL RAILWAYS MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 49 RAIL OPERATIONS MANAGEMENT: DIGITAL RAILWAYS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 50 RAIL OPERATIONS MANAGEMENT: DIGITAL RAILWAY MARKET, BY TYPE, 2019-2024 (USD BILLION)

- TABLE 51 DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 52 RAIL AUTOMATION MANAGEMENT: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 53 RAIL AUTOMATION MANAGEMENT: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 54 RAIL CONTROL: DIGITAL RAILWAY MARKET, BY TYPE, 2019-2024 (USD BILLION)

- TABLE 55 RAIL CONTROL: DIGITAL RAILWAY MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 56 SIGNALING SOLUTIONS: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 57 SIGNALING SOLUTIONS: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 58 RAIL TRAFFIC MANAGEMENT: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 59 RAIL TRAFFIC MANAGEMENT: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 60 FREIGHT MANAGEMENT: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 61 FREIGHT MANAGEMENT: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 62 SMART TICKETING: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 63 SMART TICKETING: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 64 WORKFORCE MANAGEMENT: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 65 WORKFORCE MANAGEMENT: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 66 PASSENGER INFORMATION SYSTEM: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 67 PASSENGER INFORMATION SYSTEM: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 68 ASSET MANAGEMENT: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 69 ASSET MANAGEMENT: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 70 OTHER APPLICATIONS: DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 71 OTHER APPLICATIONS: DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 72 DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 73 DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 74 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 75 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY SOLUTION, 2019-2024 (USD BILLION)

- TABLE 77 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY SOLUTION, 2025-2030 (USD BILLION)

- TABLE 78 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 79 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 80 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 81 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 82 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY APPLICATION, 2019-2024 (USD BILLION)

- TABLE 83 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 84 NORTH AMERICA: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2019-2024 (USD BILLION)

- TABLE 85 NORTH AMERICA: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 86 NORTH AMERICA: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2019-2024 (USD BILLION)

- TABLE 87 NORTH AMERICA: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 88 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY COUNTRY, 2019-2024 (USD BILLION)

- TABLE 89 NORTH AMERICA: DIGITAL RAILWAY MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 90 EUROPE: DIGITAL RAILWAY MARKET, BY OFFERING, 2019-2024 (USD BILLION)

- TABLE 91 EUROPE: DIGITAL RAILWAY MARKET, BY OFFERING, 2025-2030 (USD BILLION)

- TABLE 92 EUROPE: DIGITAL RAILWAY MARKET, BY SOLUTION, 2019-2024 (USD BILLION)

- TABLE 93 EUROPE: DIGITAL RAILWAY MARKET, BY SOLUTION, 2025-2030 (USD BILLION)

- TABLE 94 EUROPE: DIGITAL RAILWAY MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 95 EUROPE: DIGITAL RAILWAY MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 96 EUROPE: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 97 EUROPE: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 98 EUROPE: DIGITAL RAILWAY MARKET, BY APPLICATION, 2019-2024 (USD BILLION)

- TABLE 99 EUROPE: DIGITAL RAILWAY MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 100 EUROPE: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2019-2024 (USD BILLION)

- TABLE 101 EUROPE: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 102 EUROPE: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2019-2024 (USD BILLION)

- TABLE 103 EUROPE: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 104 EUROPE: DIGITAL RAILWAY MARKET, BY COUNTRY, 2019-2024 (USD BILLION)

- TABLE 105 EUROPE: DIGITAL RAILWAY MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 106 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY OFFERING, 2019-2024 (USD BILLION)

- TABLE 107 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY OFFERING, 2025-2030 (USD BILLION)

- TABLE 108 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY SOLUTION, 2019-2024 (USD BILLION)

- TABLE 109 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY SOLUTION, 2025-2030 (USD BILLION)

- TABLE 110 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 111 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 112 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 113 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 114 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY APPLICATION, 2019-2024 (USD BILLION)

- TABLE 115 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 116 ASIA PACIFIC: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2019-2024 (USD BILLION)

- TABLE 117 ASIA PACIFIC: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 118 ASIA PACIFIC: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2019-2024 (USD BILLION)

- TABLE 119 ASIA PACIFIC: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 120 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY COUNTRY, 2019-2024 (USD BILLION)

- TABLE 121 ASIA PACIFIC: DIGITAL RAILWAY MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 122 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY OFFERING, 2019-2024 (USD BILLION)

- TABLE 123 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY OFFERING, 2025-2030 (USD BILLION)

- TABLE 124 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY SOLUTION, 2019-2024 (USD BILLION)

- TABLE 125 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY SOLUTION, 2025-2030 (USD BILLION)

- TABLE 126 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 127 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 128 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 129 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 130 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY APPLICATION, 2019-2024 (USD BILLION)

- TABLE 131 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 132 MIDDLE EAST & AFRICA: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2019-2024 (USD BILLION)

- TABLE 133 MIDDLE EAST & AFRICA: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 134 MIDDLE EAST & AFRICA: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2019-2024 (USD BILLION)

- TABLE 135 MIDDLE EAST & AFRICA: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 136 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY COUNTRY, 2019-2024 (USD BILLION)

- TABLE 137 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 138 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY OFFERING, 2019-2024 (USD BILLION)

- TABLE 139 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY OFFERING, 2025-2030 (USD BILLION)

- TABLE 140 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY SOLUTION, 2019-2024 (USD BILLION)

- TABLE 141 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY SOLUTION, 2025-2030 (USD BILLION)

- TABLE 142 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 143 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 144 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 145 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 146 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY APPLICATION, 2019-2024 (USD BILLION)

- TABLE 147 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 148 LATIN AMERICA: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2019-2024 (USD BILLION)

- TABLE 149 LATIN AMERICA: DIGITAL RAIL OPERATIONS MANAGEMENT APPLICATION MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 150 LATIN AMERICA: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2019-2024 (USD BILLION)

- TABLE 151 LATIN AMERICA: DIGITAL RAIL CONTROL APPLICATION MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 152 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY COUNTRY, 2019-2024 (USD BILLION)

- TABLE 153 LATIN AMERICA: DIGITAL RAILWAY MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 154 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS, 2022-2025

- TABLE 155 DIGITAL RAILWAY MARKET: DEGREE OF COMPETITION

- TABLE 156 DIGITAL RAILWAY MARKET: REGION FOOTPRINT

- TABLE 157 DIGITAL RAILWAY MARKET: PRODUCT FOOTPRINT

- TABLE 158 DIGITAL RAILWAY MARKET: APPLICATION FOOTPRINT

- TABLE 159 DIGITAL RAILWAYS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 160 DIGITAL RAILWAYS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 161 PRODUCT LAUNCHES, JUNE 2019-MAY 2025

- TABLE 162 DEALS, JANUARY 2019-MAY 2025

- TABLE 163 SIEMENS: COMPANY OVERVIEW

- TABLE 164 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 SIEMENS: PRODUCT LAUNCHES

- TABLE 166 SIEMENS: DEALS

- TABLE 167 SIEMENS: OTHER DEVELOPMENTS

- TABLE 168 CISCO: COMPANY OVERVIEW

- TABLE 169 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 CISCO: DEALS

- TABLE 171 HITACHI: COMPANY OVERVIEW

- TABLE 172 HITACHI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 HITACHI: PRODUCT LAUNCHES

- TABLE 174 HITACHI: DEALS

- TABLE 175 HITACHI: OTHER DEVELOPMENTS

- TABLE 176 WABTEC: COMPANY OVERVIEW

- TABLE 177 WABTEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 WABTEC: PRODUCT LAUNCHES

- TABLE 179 WABTEC: DEALS

- TABLE 180 ALSTOM: COMPANY OVERVIEW

- TABLE 181 ALSTOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 ALSTOM: DEALS

- TABLE 183 ALSTOM: OTHER DEVELOPMENTS

- TABLE 184 IBM: COMPANY OVERVIEW

- TABLE 185 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 ABB: COMPANY OVERVIEW

- TABLE 187 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 ABB: PRODUCT LAUNCHES

- TABLE 189 ABB: DEALS

- TABLE 190 HUAWEI: COMPANY OVERVIEW

- TABLE 191 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 HUAWEI: PRODUCT LAUNCHES

- TABLE 193 HUAWEI: DEALS

- TABLE 194 FUJITSU: COMPANY OVERVIEW

- TABLE 195 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 FUJITSU: DEALS

- TABLE 197 DXC: COMPANY OVERVIEW

- TABLE 198 DXC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 DXC: OTHER DEVELOPMENTS

- TABLE 200 HONEYWELL: COMPANY OVERVIEW

- TABLE 201 HONEYWELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 HONEYWELL: DEALS

- TABLE 203 SMART RAILWAYS MARKET SIZE, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 204 SMART RAILWAYS MARKET SIZE, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 205 SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 206 SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 207 SERVICES: SMART RAILWAYS MARKET SIZE, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 208 SERVICES: SMART RAILWAYS MARKET SIZE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 209 PROFESSIONAL SERVICES: SMART RAILWAYS MARKET SIZE, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 210 PROFESSIONAL SERVICES: SMART RAILWAYS MARKET SIZE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 211 SMART RAILWAYS MARKET SIZE, BY REGION, 2019-2024 (USD MILLION)

- TABLE 212 SMART RAILWAYS MARKET SIZE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 213 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016-2019 (USD MILLION)

- TABLE 214 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2025 (USD MILLION)

- TABLE 215 RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2016-2019 (USD MILLION)

- TABLE 216 RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2025 (USD MILLION)

- TABLE 217 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 218 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2025 (USD MILLION)

List of Figures

- FIGURE 1 DIGITAL RAILWAY MARKET: RESEARCH DESIGN

- FIGURE 2 DIGITAL RAILWAY MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM DIGITAL RAILWAY SOLUTIONS/SERVICES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL DIGITAL RAILWAY SOLUTIONS/SERVICES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - DEMAND-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 DIGITAL RAILWAY MARKET TO WITNESS SIGNIFICANT GROWTH DURING THE FORECAST PERIOD

- FIGURE 9 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE IN 2025

- FIGURE 10 REMOTE MONITORING SEGMENT TO HOLD LARGEST MARKET SIZE IN 2025

- FIGURE 11 PROFESSIONAL SERVICES SEGMENT TO HOLD HIGHEST MARKET SHARE IN 2025

- FIGURE 12 SYSTEM INTEGRATION & DEPLOYMENT SEGMENT TO HOLD HIGHEST MARKET SHARE IN 2025

- FIGURE 13 RAIL OPERATIONS MANAGEMENT SEGMENT TO HOLD LARGEST MARKET SIZE IN 2025

- FIGURE 14 DIGITAL RAILWAY MARKET, BY REGION (2025)

- FIGURE 15 RISING ADOPTION OF AUTOMATION TECHNOLOGIES TO DRIVE MARKET

- FIGURE 16 REMOTE MONITORING SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD (2025-2030)

- FIGURE 17 REMOTE MONITORING SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD (2025-2030)

- FIGURE 18 PROFESSIONAL SERVICE AND RAIL OPERATIONS MANAGEMENT SEGMENTS TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2025

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DIGITAL RAILWAY MARKET

- FIGURE 20 BRIEF HISTORY OF DIGITAL RAILWAYS

- FIGURE 21 DIGITAL RAILWAY MARKET: ECOSYSTEM

- FIGURE 22 DIGITAL RAILWAY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE OF DIGITAL RAILWAY SOLUTIONS, BY KEY PLAYER, 2024

- FIGURE 24 REVENUE SHIFT FOR DIGITAL RAILWAY MARKET

- FIGURE 25 DIGITAL RAILWAY MARKET: PATENTS APPLIED AND GRANTED, 2015-2025

- FIGURE 26 DIGITAL RAILWAY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 29 INVESTMENT IN LEADING GLOBAL DIGITAL RAILWAYS, BY NUMBER OF DEALS AND FUNDING (USD MILLION)

- FIGURE 30 USE CASES OF GENERATIVE AI IN DIGITAL RAILWAYS

- FIGURE 31 PREDICTIVE MAINTENANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 MANAGED SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 PASSENGER INFORMATION SYSTEMS TO BE FASTEST-GROWING APPLICATION SEGMENT

- FIGURE 34 EUROPE TO BE LARGEST REGIONAL DIGITAL RAILWAY MARKET IN 2025

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 37 SHARES OF LEADING COMPANIES IN DIGITAL RAILWAY MARKET, 2024

- FIGURE 38 REVENUE ANALYSIS FOR LEADING PLAYERS, 2020-2024

- FIGURE 39 DIGITAL RAILWAY MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 40 COMPANY VALUATION: 2025

- FIGURE 41 FINANCIAL METRICS OF KEY VENDORS: 2025

- FIGURE 42 KEY DIGITAL RAILWAY MARKET PLAYER EVALUATION MATRIX, 2024

- FIGURE 43 DIGITAL RAILWAY MARKET: COMPANY FOOTPRINT

- FIGURE 44 DIGITAL RAILWAY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 SIEMENS: COMPANY SNAPSHOT

- FIGURE 46 CISCO: COMPANY SNAPSHOT

- FIGURE 47 HITACHI: COMPANY SNAPSHOT

- FIGURE 48 WABTEC: COMPANY SNAPSHOT

- FIGURE 49 ALSTOM: COMPANY SNAPSHOT

- FIGURE 50 IBM: COMPANY SNAPSHOT

- FIGURE 51 ABB: COMPANY SNAPSHOT

- FIGURE 52 HUAWEI: COMPANY SNAPSHOT

- FIGURE 53 FUJITSU: COMPANY SNAPSHOT

- FIGURE 54 DXC: COMPANY SNAPSHOT

- FIGURE 55 HONEYWELL: COMPANY SNAPSHOT

The digital railway market is estimated to be USD 82.76 billion in 2025 and is projected to reach USD 127.54 billion by 2030 at a CAGR of 9.0%. The shift toward the adoption of IoT is revolutionary in the management of railway networks. IoT in railways also improves the reliability and safety of the train infrastructure. The data generated by IoT sensors enables the analysis and interpretation of conditions that could not be done earlier. With the deployment of IoT, a lot of data could now be used to optimize train schedules and maintain equipment, two serious challenges for railway efficiency. When combined with analytics, IoT can streamline railway operations for better efficiency. Vendors and third-party providers are increasingly adopting digitized systems for supply chain management and logistics activities. IoT-enabled technologies are transforming the landscape of the logistics business. Organizations are increasingly focusing on re-engineering businesses with the immense power of IoT and cloud technologies. With the help of RFID, Global System for Mobile Communications-Railway (GSM-R), and collaboration platforms, logistics vendors find ways to face economic challenges.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Billion) |

| Segments | Offering, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"System integration and deployment services segment will witness the highest growth during the forecast period." System integration and deployment services play a crucial role in upgrading railway IT infrastructure to support digital railway software within existing systems. These services enhance deployment, save time and costs, promote efficient operations, and minimize disruptions related to implementation. The process begins with gathering customer requirements, followed by deploying, integrating, testing, and rolling out solutions. Ultimately, these services enable the deployment of vendor-independent solutions, contributing to the development of a highly optimized digital railway.

"Rail traffic management segment is expected to have the largest market size during the forecast period." The rail traffic management system enables centralized supervision and traffic control of the entire rail network. All rail operations can be regularized by a central control system. This central administration system uses real-time data over high-speed communication links across trains and rail infrastructures to automate the traffic. Rail traffic management involves signaling, traffic control, routing, and train scheduling. The system offers a flexible solution to increase network capacity and time efficiency, regulate traffic flow, reduce the risk of operational delays, and improve network disaster management. The rail traffic management system features include traffic planning, operation management system, operation information for passengers, maintenance support, and driver-only and driverless operation.

"Asia Pacific is expected to record the highest growth rate during the forecast period."

Asia Pacific is estimated to be the fastest-growing market for digital railways due to the increasing adoption of new technologies, higher investments in digital transformation, and the growth in GDPs of Asia Pacific countries. The key economies in the region include Australia, Singapore, China, South Korea, Hong Kong, and India, all of which are rapidly investing in technological transformation. With untapped market potential, high penetration of advanced technologies, increasing freight usage across various industries, ongoing economic developments, and supportive government regulations, the digital railway market is anticipated to experience significant growth in the Asia Pacific region during the forecast period. The United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) is actively driving the development and digital transformation of the Trans-Asian Railway (TAR) network. The TAR contributes greatly to facilitating both intra- and inter-regional trade and transport, which covers approximately 128,000 kilometers across 28 countries. In September 2023, the TAR Working Group adopted the "Strategy 2030 on Accelerating Rail Digital Transformation in Asia-Pacific" to boost the competitiveness of rail transport.

Breakdown of Primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 34%, Tier 2 - 43%, and Tier 3 - 23%

- By Designation: C-level -50%, D-level - 30%, and Others - 20%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 30%, Rest of the World - 15%

The major players in the digital railway market include Alstom (France), Cisco (US), Wabtec (US), ABB (Switzerland), IBM (US), Hitachi (Japan), Huawei (China), Indra Sistemas (Spain), Siemens (Germany), Honeywell (US), Fujitsu (Japan), Toshiba (Japan), DXC (US), Nokia (Finland), Advantech (Taiwan), Televic (Belgium), Uptake (US), Tego (US), KONUX (Germany), Aitek S.p.A (Italy), Assetic (Australia), Machines With Vision (UK), Delphisonic (US), Passio Technologies (US), Atkins (UK), CloudMoyo (US), RailTel (India), ZEDAS (Germany), Simpleway (US), EKE Electronics (Finland), and r2p (Germany). These players have adopted various growth strategies, such as partnerships, agreements, collaborations, product launches/enhancements, and acquisitions, to expand their market footprint.

Research Coverage

This study covers the digital railway market and its growth potential across different segments, including offerings, applications, and regions. The offerings are sub-segmented into solutions and services. The solutions studied under the digital railway market include remote monitoring, route optimization & scheduling, analytics, network management, predictive maintenance, security, and other solutions (location analytics, content management for infotainment, and preventive maintenance). The services studied include professional services (consulting, system integration and deployment, support, and maintenance) and managed services. The application segment includes rail operations management (rail automation management, rail control (signaling solutions, rail traffic management, and freight management), smart ticketing, and workforce management), passenger information systems, asset management, and other applications (connectivity and communication). The regional analysis of the digital railway market covers North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global digital railway market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape, gain insights, and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides the following insights.

1. Analysis of key drivers (surge in passenger numbers over the past few years, rising adoption of IoT in railways, advancement in communication technology), restraints (lack of robust railway infrastructure in underdeveloped countries, high initial cost of deployment), opportunities (rising need for advanced transportation infrastructure, autonomous train to be significant opportunity for digital railway solution providers, emerging trend of smart cities), and challenges (increased threat of cyberattacks as railway system becomes digital, lack of IT infrastructure and skilled personnel) influencing the growth of the digital railway market.

2. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the digital railway market.

3. Market Development: The report provides comprehensive information about lucrative markets, analyzing the digital railway market across various regions.

4. Market Diversification: Comprehensive information about new products and services, untapped geographies, recent developments, and investments in the digital railway market.

5. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players: Alstom (France), Cisco (US), Wabtec (US), ABB (Switzerland), IBM (US), Hitachi (Japan), Huawei (China), Indra Sistemas (Spain), Siemens (Germany), Honeywell (US), Fujitsu (Japan), Toshiba (Japan), DXC (US), Nokia (Finland), Advantech (Taiwan), Televic (Belgium), Uptake (US), Tego (US), KONUX (Germany), Aitek S.p.A (Italy), Assetic (Australia), Machines With Vision (UK), Delphisonic (US), Passio Technologies (US), Atkins (UK), CloudMoyo (US), RailTel (India), ZEDAS (Germany), Simpleway (US), EKE Electronics (Finland), and r2p (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 DIGITAL RAILWAY MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 MARKET BREAKUP AND DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE MARKET OPPORTUNITIES IN DIGITAL RAILWAY MARKET

- 4.2 DIGITAL RAILWAY MARKET, BY TOP THREE SOLUTIONS

- 4.3 DIGITAL RAILWAY MARKET, BY APPLICATIONS

- 4.4 NORTH AMERICA: DIGITAL RAILWAY MARKET: SERVICE AND TOP THREE APPLICATIONS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in passenger numbers over the past few years

- 5.2.1.2 Rising adoption of IoT in railways

- 5.2.1.3 Advancements in communication technology

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of robust railway infrastructure in underdeveloped countries

- 5.2.2.2 High initial cost of deployment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising need for advanced transportation infrastructure

- 5.2.3.2 Autonomous train to be significant opportunity for digital railway solution providers

- 5.2.3.3 Emerging trend of smart cities

- 5.2.4 CHALLENGES

- 5.2.4.1 Increased threat of cyberattacks as railway system becomes digital

- 5.2.4.2 Lack of IT infrastructure and skilled personnel

- 5.2.1 DRIVERS

- 5.3 BRIEF HISTORY OF DIGITAL RAILWAYS

- 5.3.1 1980S-1990S: FOUNDATION LAYING

- 5.3.2 2000S: RISE OF INTELLIGENT INFRASTRUCTURE

- 5.3.3 2010S: DIGITAL TRANSFORMATION AND CONNECTIVITY

- 5.3.4 2020S-PRESENT: AI-DRIVEN AND AUTONOMOUS RAILWAYS

- 5.4 DIGITAL RAILWAY MARKET: ECOSYSTEM ANALYSIS

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 USE CASES

- 5.5.1.1 Case study 1: Siemens provides maintenance services to Govia Thameslink Railway

- 5.5.1.2 Case study 2: Thales provided Bane (NOR) with next-generation traffic management system

- 5.5.1.3 Case study 3: Assetic helped Sydney Trains visualize rail assets for optimized asset management

- 5.5.1.4 Case study 4: Thales provided train-to-ground broadband data communication solution to Brescia Metro

- 5.5.1.5 Case study 5: Taiwan High Speed Rail Corporation selected IBM Maximo to build an advanced maintenance management solution

- 5.5.1.6 Case study 6: VTG Rail Europe collaborated with Siemens to innovate rail freight transport

- 5.5.1.7 Case study 7: Uptake's automated maintenance work order of North American freight railway company

- 5.5.1 USE CASES

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.2 KEY REGULATIONS

- 5.7.2.1 North America

- 5.7.2.1.1 SCR 17: Artificial Intelligence Bill (California)

- 5.7.2.1.2 S1103: Artificial Intelligence Automated Decision Bill (Connecticut)

- 5.7.2.1.3 National Artificial Intelligence Initiative Act (NAIIA)

- 5.7.2.1.4 Artificial Intelligence and Data Act (AIDA) - Canada

- 5.7.2.2 Europe

- 5.7.2.2.1 European Union (EU) - Artificial Intelligence Act (AIA)

- 5.7.2.2.2 General Data Protection Regulation (Europe)

- 5.7.2.3 Asia Pacific

- 5.7.2.3.1 Interim Administrative Measures for Generative Artificial Intelligence Services (China)

- 5.7.2.3.2 National AI Strategy (Singapore)

- 5.7.2.3.3 Hiroshima AI Process Comprehensive Policy Framework (Japan)

- 5.7.2.4 Middle East & Africa

- 5.7.2.4.1 National Strategy for Artificial Intelligence (UAE)

- 5.7.2.4.2 National Artificial Intelligence Strategy (Qatar)

- 5.7.2.4.3 AI Ethics Principles and Guidelines (Dubai)

- 5.7.2.5 Latin America

- 5.7.2.5.1 Santiago Declaration (Chile)

- 5.7.2.5.2 Brazilian Artificial Intelligence Strategy (EBIA)

- 5.7.2.1 North America

- 5.7.3 ISO/IEC

- 5.7.3.1 ISO/IEC JTC 1

- 5.7.3.2 ISO/IEC 27001

- 5.7.3.3 ISO/IEC 19770-1

- 5.7.3.4 ISO/IEC JTC 1/SWG 5

- 5.7.3.5 ISO/IEC JTC 1/SC 31

- 5.7.3.6 ISO/IEC JTC 1/SC 27

- 5.7.3.7 ISO/IEC JTC 1/WG 7 sensors

- 5.7.4 GDPR

- 5.7.5 FMCSA

- 5.7.6 FHWA

- 5.7.7 MARAD

- 5.7.8 FAA

- 5.7.9 FRA

- 5.7.10 IEEE-SA

- 5.7.11 CEN/ISO

- 5.7.12 CEN/CENELEC

- 5.7.13 ETSI

- 5.7.14 ITU-T

- 5.8 PRICING MODEL ANALYSIS

- 5.8.1 INDICATIVE PRICING ANALYSIS OF DIGITAL RAILWAY SERVICES, 2024

- 5.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Internet of Things (IoT)

- 5.10.1.2 Big data analytics and cloud computing

- 5.10.1.3 Artificial intelligence (AI) & machine learning (ML)

- 5.10.1.4 Advanced signaling systems

- 5.10.1.5 Communication-based train control (CBTC)

- 5.10.2 ADJACENT TECHNOLOGIES

- 5.10.2.1 Augmented reality (AR) & virtual reality (VR)

- 5.10.2.2 Blockchain

- 5.10.2.3 Drones

- 5.10.3 COMPLEMENTARY TECHNOLOGIES

- 5.10.3.1 Edge computing

- 5.10.3.2 Digital twin

- 5.10.3.3 Cybersecurity

- 5.10.3.4 5G and wireless communication networks

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 BEST PRACTICES IN DIGITAL RAILWAY MARKET

- 5.16 TECHNOLOGY ROADMAP FOR DIGITAL RAILWAY MARKET

- 5.16.1 SHORT-TERM ROADMAP (2023-2025)

- 5.16.2 MID-TERM ROADMAP (2026-2028)

- 5.16.3 LONG-TERM ROADMAP (2029-2030)

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 BUSINESS MODELS OF DIGITAL RAILWAYS

- 5.18.1 CURRENT BUSINESS MODELS

- 5.18.2 EMERGING BUSINESS MODELS

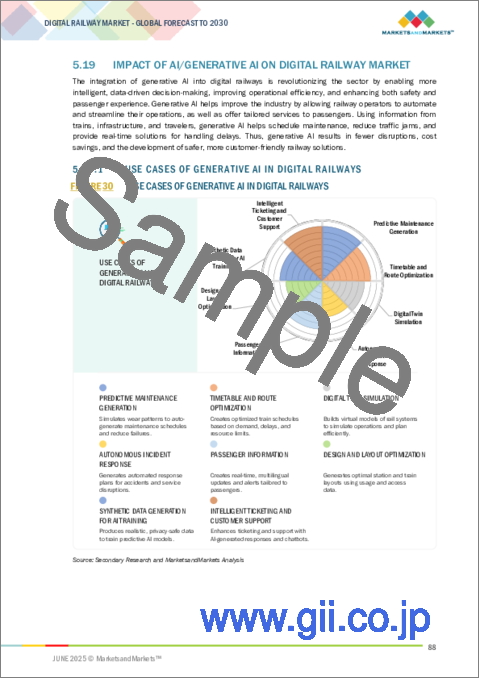

- 5.19 IMPACT OF AI/GENERATIVE AI ON DIGITAL RAILWAY MARKET

- 5.19.1 USE CASES OF GENERATIVE AI IN DIGITAL RAILWAYS

- 5.20 IMPACT OF 2025 US TARIFF - DIGITAL RAILWAY MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.5 IMPACT ON DIGITAL RAILWAY MARKET SEGMENTS

6 DIGITAL RAILWAY MARKET, BY SOLUTION

- 6.1 INTRODUCTION

- 6.1.1 SOLUTION: MARKET DRIVERS

- 6.2 REMOTE MONITORING

- 6.2.1 REMOTE MONITORING SOLUTIONS TO IMPROVE RELIABILITY OF RAILWAY INFRASTRUCTURE

- 6.3 ROUTE OPTIMIZATION & SCHEDULING

- 6.3.1 ROUTE OPTIMIZATION & SCHEDULING SOLUTIONS TO ENABLE EFFICIENT MANAGEMENT OF ROUTINE OPERATIONS FOR TRAINS

- 6.4 ANALYTICS

- 6.4.1 RAIL ANALYTICS SYSTEMS TO HELP IN DEMAND PLANNING, REVENUE AND WORKFORCE MANAGEMENT, TRANSIT ANALYSIS, AND PRICING ANALYSIS

- 6.5 NETWORK MANAGEMENT

- 6.5.1 NETWORK MANAGEMENT SOLUTIONS PLAY AN IMPORTANT ROLE IN DISASTER MANAGEMENT AND MINIMIZING LOSS

- 6.6 PREDICTIVE MAINTENANCE

- 6.6.1 PREDICTIVE MAINTENANCE SOLUTIONS TO INCREASE ASSET LIFE AND IMPROVE RAIL OPERATIONS AND SAFETY

- 6.7 SECURITY

- 6.7.1 RAIL SECURITY SOLUTIONS TO BE ADOPTED INCREASINGLY WITH HIGHER DEPLOYMENT OF DIGITAL SOLUTIONS

- 6.8 OTHER SOLUTIONS

7 DIGITAL RAILWAY MARKET, BY SERVICE

- 7.1 INTRODUCTION

- 7.1.1 SERVICE: MARKET DRIVERS

- 7.2 PROFESSIONAL SERVICES

- 7.2.1 CONSULTING

- 7.2.1.1 Consulting service vendors to offer recommendations on implementing new technologies

- 7.2.2 SYSTEM INTEGRATION & DEPLOYMENT

- 7.2.2.1 System integration & deployment service providers to help integrate smart solutions with their existing infrastructure

- 7.2.3 SUPPORT & MAINTENANCE

- 7.2.3.1 Support & maintenance services to assist in installing freight management system solutions

- 7.2.1 CONSULTING

- 7.3 MANAGED SERVICES

8 DIGITAL RAILWAY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 APPLICATION: MARKET DRIVERS

- 8.2 RAIL OPERATIONS MANAGEMENT

- 8.2.1 RAIL AUTOMATION MANAGEMENT

- 8.2.1.1 Rail automation system comprises traffic monitoring and protection systems to ensure safety and better experience

- 8.2.2 RAIL CONTROL

- 8.2.2.1 Signaling Solutions

- 8.2.2.1.1 Signaling solutions to ensure communication between trains, stations, and workforce

- 8.2.2.2 Rail Traffic Management

- 8.2.2.2.1 Rail traffic management to offer flexible solutions to increase railway network capacity and efficiency

- 8.2.2.3 Freight Management

- 8.2.2.3.1 Freight management systems to help freight operators in infrastructure and planning decisions

- 8.2.2.1 Signaling Solutions

- 8.2.3 SMART TICKETING

- 8.2.3.1 Smart ticketing to help contribute to overall improvement of railway transport network

- 8.2.4 WORKFORCE MANAGEMENT

- 8.2.4.1 Workforce management to ensure significant cost reduction and effective employee engagement

- 8.2.1 RAIL AUTOMATION MANAGEMENT

- 8.3 PASSENGER INFORMATION SYSTEMS

- 8.3.1 PASSENGER INFORMATION SYSTEMS TO BE KEY COMMUNICATION LINK BETWEEN TRANSPORTATION OPERATORS AND PASSENGER CONNECTIVITY

- 8.4 ASSET MANAGEMENT

- 8.4.1 RAIL ASSET MANAGEMENT TO OPTIMIZE PERFORMANCE AND RAIL INFRASTRUCTURE

- 8.5 OTHER APPLICATIONS

9 DIGITAL RAILWAY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 NORTH AMERICA: DIGITAL RAILWAY MARKET DRIVERS

- 9.2.3 US

- 9.2.3.1 Government initiatives to drive market in US

- 9.2.4 CANADA

- 9.2.4.1 Increase in number of passengers and higher freight traffic to drive market in Canada

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 EUROPE: MARKET DRIVERS

- 9.3.3 EUROPE: REGULATORY IMPLICATIONS

- 9.3.4 UK

- 9.3.4.1 Need to improve efficiency of existing railway infrastructure to boost market in UK

- 9.3.5 GERMANY

- 9.3.5.1 Greater adoption of IoT and analytics to boost market in Germany

- 9.3.6 FRANCE

- 9.3.6.1 High investment by railway operators to drive market in France

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 ASIA PACIFIC: DIGITAL RAILWAY MARKET DRIVERS

- 9.4.3 CHINA

- 9.4.3.1 High government investments in railway infrastructure and rapid growth in railways to drive market in China

- 9.4.4 INDIA

- 9.4.4.1 Higher railway profits and government initiatives for smart cities to drive market in India

- 9.4.5 JAPAN

- 9.4.5.1 Increase in adoption of railway technologies to boost market in Japan

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 MIDDLE EAST & AFRICA: DIGITAL RAILWAY MARKET DRIVERS

- 9.5.3 NIGERIA

- 9.5.3.1 Government initiatives combined with cooperation with other countries to boost market in Nigeria

- 9.5.4 UAE

- 9.5.4.1 Government initiatives to drive market in UAE

- 9.5.5 SOUTH AFRICA

- 9.5.5.1 Increased demand for transportation services to match regional trade requirements to drive market in South Africa

- 9.5.6 REST OF THE MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: DIGITAL RAILWAY MARKET DRIVERS

- 9.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.3 BRAZIL

- 9.6.3.1 Large scope for further development of railway infrastructure to boost opportunity in Brazil

- 9.6.4 MEXICO

- 9.6.4.1 Strategic location in North America to play key role in development of railway infrastructure in Mexico

- 9.6.5 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.4 REVENUE ANALYSIS OF LEADING PLAYERS, 2020-2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7 COMPANY EVALUATION QUADRANT, 2025

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Product footprint

- 10.7.5.4 Application footprint

- 10.8 STARTUP/SME EVALUATION QUADRANT

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- 11.1.1 SIEMENS

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 CISCO

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 HITACHI

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product Launches

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Other developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 WABTEC

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices made

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 ALSTOM

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Other developments

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 IBM

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 MnM view

- 11.1.6.3.1 Right to win

- 11.1.6.3.2 Strategic choices

- 11.1.6.3.3 Weaknesses and competitive threats

- 11.1.7 ABB

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product Launches

- 11.1.8 HUAWEI

- 11.1.8.1 Business Overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.8.3.2 Deals

- 11.1.9 FUJITSU

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.10 DXC

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Other developments

- 11.1.11 HONEYWELL

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.12 INDRA

- 11.1.13 NOKIA

- 11.1.14 ATKINS

- 11.1.15 TOSHIBA

- 11.1.16 TELEVIC

- 11.1.17 ADVANTECH

- 11.1.1 SIEMENS

- 11.2 STARTUPS/SMES

- 11.2.1 ZEDAS

- 11.2.2 R2P

- 11.2.3 SIMPLEWAY

- 11.2.4 TEGO

- 11.2.5 ASSETIC

- 11.2.6 PASSIO TECHNOLOGIES

- 11.2.7 DELPHISONIC

- 11.2.8 UPTAKE

- 11.2.9 KONUX

- 11.2.10 MACHINES WITH VISION

- 11.2.11 EKE-ELECTRONICS

- 11.2.12 AITEK S.P.A.

- 11.2.13 CLOUDMOYO

- 11.2.14 RAILTEL

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.1.1 LIMITATIONS

- 12.2 SMART RAILWAYS MARKET - GLOBAL FORECAST TO 2030

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 SMART RAILWAYS MARKET, BY OFFERING

- 12.2.4 SMART RAILWAYS MARKET, BY SOLUTION

- 12.2.5 SMART RAILWAYS MARKET, BY SERVICE

- 12.2.6 SMART RAILWAYS MARKET, BY PROFESSIONAL SERVICE

- 12.2.7 SMART RAILWAYS MARKET, BY REGION

- 12.3 RAILWAY MANAGEMENT SYSTEM MARKET - GLOBAL FORECAST TO 2025

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING

- 12.3.4 RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION

- 12.3.5 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATIONS OFFERED

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS