|

|

市場調査レポート

商品コード

1752398

IoT医療機器の世界市場:製品別、タイプ別、接続技術別、エンドユーザー別、地域別 - 2030年までの予測IoT Medical Devices Market by Product(Wearable (Vital Sign (BP, Glucose, ECG, Oximeter), Resp., Fetal), Implant(Neuro, Cardiac-Defib, Pacemaker) Pumps), Connectivity(Bluetooth, WiFi), End User(Hospital, Nursing Home) & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| IoT医療機器の世界市場:製品別、タイプ別、接続技術別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月13日

発行: MarketsandMarkets

ページ情報: 英文 330 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のIoT医療機器の市場規模は、2025年の650億8,000万米ドルから2030年には1,547億4,000万米ドルに達すると予測され、この間のCAGRは18.9%になるとみられています。

同市場は、特に遠隔医療の普及に伴い、患者の継続的かつリアルタイムなモニタリングに対する需要が高まっていることから急成長しています。低エネルギーセンサー、5Gネットワーク、エッジコンピューティングにおける最近の技術革新により、ウェアラブルデバイスや埋め込み型デバイスからヘルスケアシステムへの効率的なデータ収集と伝送が可能になっています。これらの進歩により、より積極的で分散化されたケアが可能になり、病院での再入院の減少につながります。さらに、慢性疾患の罹患率の上昇と世界の高齢化により、家庭と臨床の両方の環境でこれらの技術の利用が拡大しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品別、タイプ別、接続技術別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

しかし、市場は、レガシー医療ITインフラとの統合の複雑さ、HIPAAやGDPRなどのデータプライバシー規制への対応、接続が進むエコシステムで患者情報を保護するための強固なサイバーセキュリティの維持の必要性などの課題に直面しています。

2024年、病院&診療所セグメントは、IoT医療機器市場における主要なエンドユーザーセグメントとして浮上し、その地位は今後数年間も維持されると予想されます。このリーダーシップは主に、ヘルスケア施設内での高度な診断、モニタリング、治療ツールに対する需要の増加によるものです。IoT対応技術を採用することで、これらの施設はリアルタイムのデータモニタリング、リモートケア機能、合理化された臨床業務を通じて患者の転帰を向上させることができます。患者のバイタルサインや慢性的な健康状態を継続的に追跡できるため、迅速な介入とより効果的なケアの提供が可能になります。さらに、IoTを電子カルテ(EHR)や臨床意思決定プラットフォームと統合することで、データの精度が向上し、ケアチーム間の連携が強化されます。この動向を後押しする主な要因には、効率化の推進、患者数の増加、厳しい規制基準や品質基準を満たす必要性などがあります。その結果、病院や診療所は、パフォーマンスを向上させ、コンプライアンスを確保し、より迅速で個別化された患者ケアを提供するために、IoTテクノロジーに多額の投資を行っています。

Bluetooth対応IoT技術は、IoT医療機器市場で最も急成長している接続オプションとして急速に台頭しています。この成長は主に、エネルギー効率、容易な統合、スマートフォン、タブレット、ウェアラブルヘルスケア機器との幅広い互換性によってもたらされています。継続的なモニタリングや患者との対話のためにコネクテッド・ソリューションを採用する医療機関が増えるなか、Bluetoothは短距離データ交換のための信頼性が高くコスト効率の高い方法となっています。フィットネストラッカー、モバイル診断機器、ホームヘルスモニタリングツールなど、低消費電力と安定したデータ転送が重要な機器において、Bluetoothは重要な役割を果たしています。

アジア太平洋は、予測期間中にIoT医療機器市場で最も速い成長を遂げると予想されます。この成長の主な要因は、IoTや人工知能を含むデジタルヘルスケア技術の急速な導入です。ヘルスケア・インフラの改善を目指した政府の取り組みが、スマート病院やデジタル・ヘルス・プラットフォームへの多額の投資と相まって、コネクテッド医療機器の導入拡大につながっています。さらに、高齢者人口の増加や慢性的な健康状態の増加を背景とした遠隔モニタリング・ソリューションに対する需要の高まりが、この動向をさらに後押ししています。さらに、強化された通信ネットワークとデジタル医療サービスに対する支持的な規制枠組みが、IoTベースのソリューションの導入を促進しています。その結果、アジア太平洋は、IoT医療機器産業の世界的拡大における主要地域として台頭しつつあります。

当レポートでは、世界のIoT医療機器市場について調査し、製品別、タイプ別、接続技術別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界考察

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 規制分析

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 特許分析

- ケーススタディ分析

- 2025年~2026年の主な会議とイベント

- 顧客のビジネスに影響を与える動向/混乱

- 2025年の米国関税の影響-IoT医療機器市場

第6章 IoT医療機器市場(製品別)

- イントロダクション

- バイタルサインモニタリング装置

- イメージングシステム

- 埋込型心臓デバイス

- 患者モニター

- 呼吸器系機器

- 輸液ポンプ

- 胎児モニタリング装置

- 神経学的デバイス

- 人工呼吸器

- 麻酔器

- 補聴器

- その他

第7章 IoT医療機器市場(タイプ別)

- イントロダクション

- 据置型デバイス

- 埋込型デバイス

- ウェアラブルデバイス

- その他

第8章 IoT医療機器市場(接続技術別)

- イントロダクション

- WI-FI

- Bluetooth

- ZIGBEE

- その他

第9章 IoT医療機器市場(エンドユーザー別)

- イントロダクション

- 病院・クリニック

- 老人ホーム、介護付き高齢者用住宅、長期ケアセンター、在宅ケア施設

- その他

第10章 IoT医療機器市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 評価と財務指標

- ブランド/ソフトウェア比較

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- MEDTRONIC

- GE HEALTHCARE

- KONINKLIJKE PHILIPS N.V.

- ABBOTT

- BOSTON SCIENTIFIC CORPORATION

- OMRON CORPORATION

- BAXTER INTERNATIONAL, INC.

- BIOTRONIK

- JOHNSON & JOHNSON

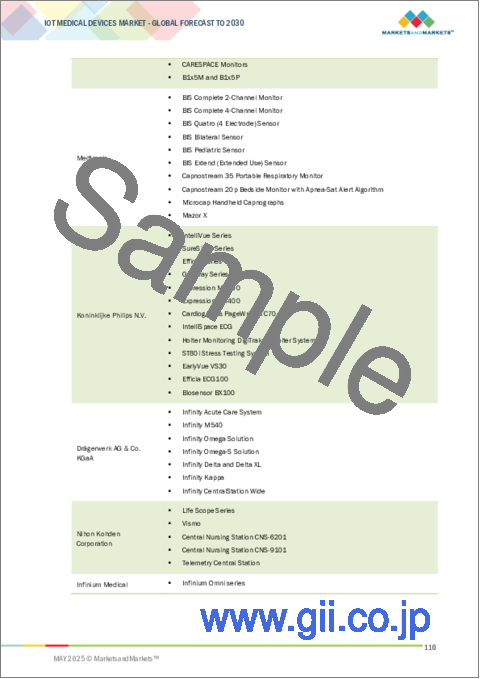

- NIHON KOHDEN CORPORATION

- SIEMENS HEALTHINEERS AG

- HONEYWELL INTERNATIONAL, INC.

- ALIVECOR, INC.

- DRAGERWERK AG & CO. KGAA

- NONIN

- RESMED

- MASIMO

- I-SENS, INC.

- ICU MEDICAL, INC.

- その他の企業

- AMD GLOBAL TELEMEDICINE

- IHEALTH LABS

- AEROTEL MEDICAL SYSTEMS

- HUNTLEIGH HEALTHCARE LIMITED

- INFINIUM MEDICAL

- HAMILTON MEDICAL

第13章 付録

List of Tables

- TABLE 1 IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES ON IOT MEDICAL DEVICES MARKET

- TABLE 2 MAJOR US HEALTHCARE DATA BREACHES

- TABLE 3 IOT MEDICAL DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 5 KEY BUYING CRITERIA FOR IOT MEDICAL DEVICES

- TABLE 6 TESTS AND CERTIFICATION REQUIREMENTS FOR WIRELESSLY CONNECTED MEDICAL DEVICES

- TABLE 7 REGULATIONS AND STANDARDS GOVERNING CONNECTED MEDICAL DEVICES

- TABLE 8 CLASSIFICATION OF MEDICAL DEVICES IN JAPAN

- TABLE 9 CLASSIFICATION OF MEDICAL DEVICES IN CHINA

- TABLE 10 AVERAGE COST OF IOT MEDICAL DEVICES, BY PRODUCT

- TABLE 11 KEY PATENTS IN IOT MEDICAL DEVICES MARKET

- TABLE 12 IOT MEDICAL DEVICES MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 13 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 14 IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 15 VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 16 VITAL SIGNS MONITORING DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 17 BLOOD GLUCOSE MONITORS OFFERED BY KEY MARKET PLAYERS

- TABLE 18 BLOOD GLUCOSE MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 19 ECG/HEART RATE MONITORS OFFERED BY KEY MARKET PLAYERS

- TABLE 20 ECG/HEART RATE MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 21 BLOOD PRESSURE MONITORS OFFERED BY KEY MARKET PLAYERS

- TABLE 22 BLOOD PRESSURE MONITORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 23 MULTIPARAMETER MONITORS OFFERED BY KEY MARKET PLAYERS

- TABLE 24 MULTIPARAMETER MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 25 OXIMETERS OFFERED BY KEY MARKET PLAYERS

- TABLE 26 OXIMETERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 27 IMAGING SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 28 IMAGING SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 30 IMPLANTABLE CARDIAC DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 IMPLANTABLE CARDIOVERTER-DEFIBRILLATORS OFFERED BY KEY MARKET PLAYERS

- TABLE 32 IMPLANTABLE CARDIOVERTER-DEFIBRILLATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 PACEMAKERS OFFERED BY KEY MARKET PLAYERS

- TABLE 34 PACEMAKERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 IMPLANTABLE CARDIAC MONITORS OFFERED BY KEY MARKET PLAYERS

- TABLE 36 IMPLANTABLE CARDIAC MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 PATIENT MONITORS OFFERED BY KEY MARKET PLAYERS

- TABLE 38 PATIENT MONITORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 RESPIRATORY DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 40 RESPIRATORY DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 INFUSION PUMPS OFFERED BY KEY MARKET PLAYERS

- TABLE 42 INFUSION PUMPS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 FETAL MONITORING DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 44 FETAL MONITORING DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 NEUROLOGICAL DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 46 NEUROLOGICAL DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 VENTILATORS OFFERED BY KEY MARKET PLAYERS

- TABLE 48 VENTILATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 ANESTHESIA MACHINES OFFERED BY KEY MARKET PLAYERS

- TABLE 50 ANESTHESIA MACHINES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 HEARING DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 52 HEARING DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 OTHER IOT MEDICAL DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 54 OTHER IOT MEDICAL DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 56 STATIONARY IOT MEDICAL DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 57 STATIONARY IOT MEDICAL DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 IMPLANTABLE IOT MEDICAL DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 59 IMPLANTABLE IOT MEDICAL DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 WEARABLE IOT MEDICAL DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 61 WEARABLE IOT MEDICAL DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 OTHER DEVICE TYPES OFFERED BY KEY MARKET PLAYERS

- TABLE 63 OTHER IOT MEDICAL DEVICE TYPES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 65 WI-FI-ENABLED IOT MEDICAL DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 BLUETOOTH-ENABLED IOT MEDICAL DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 67 ZIGBEE-ENABLED IOT MEDICAL DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 68 OTHER IOT MEDICAL DEVICE CONNECTIVITY TECHNOLOGIES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 69 IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 70 IOT MEDICAL DEVICES MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 IOT MEDICAL DEVICES MARKET FOR NURSING HOMES, ASSISTED LIVING FACILITIES, LONG-TERM CARE CENTERS, AND HOME CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 IOT MEDICAL DEVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 IOT MEDICAL DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: IOT MEDICAL DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 81 US: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 82 US: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 83 US: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 US: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 US: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 86 US: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 87 CANADA: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 88 CANADA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 89 CANADA: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 CANADA: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 CANADA: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 92 CANADA: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 93 EUROPE: IOT MEDICAL DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 EUROPE: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 95 EUROPE: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 EUROPE: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 EUROPE: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 EUROPE: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 99 EUROPE: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 100 GERMANY: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 101 GERMANY: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 GERMANY: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 GERMANY: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 GERMANY: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 105 GERMANY: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 106 UK: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 107 UK: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 UK: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 UK: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 110 UK: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 111 UK: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 112 FRANCE: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 113 FRANCE: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 FRANCE: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 FRANCE: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 FRANCE: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 117 FRANCE: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 118 ITALY: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 119 ITALY: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 ITALY: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 ITALY: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 ITALY: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 123 ITALY: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 124 SPAIN: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 125 SPAIN: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 SPAIN: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 SPAIN: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 SPAIN: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 129 SPAIN: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 130 REST OF EUROPE: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 131 REST OF EUROPE: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 REST OF EUROPE: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 REST OF EUROPE: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 REST OF EUROPE: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 135 REST OF EUROPE: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: IOT MEDICAL DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 143 CHINA: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 144 CHINA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 CHINA: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 CHINA: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 CHINA: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 148 CHINA: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 149 JAPAN: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 150 JAPAN: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 JAPAN: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 JAPAN: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 JAPAN: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 154 JAPAN: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 155 INDIA: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 156 INDIA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 INDIA: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 INDIA: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 INDIA: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 160 INDIA: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 167 LATIN AMERICA: IOT MEDICAL DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 168 LATIN AMERICA: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 169 LATIN AMERICA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 LATIN AMERICA: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 LATIN AMERICA: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 LATIN AMERICA: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 173 LATIN AMERICA: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 174 BRAZIL: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 175 BRAZIL: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 BRAZIL: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 BRAZIL: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 BRAZIL: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 179 BRAZIL: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 180 MEXICO: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 181 MEXICO: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 MEXICO: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 MEXICO: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 MEXICO: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 185 MEXICO: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 186 REST OF LATIN AMERICA: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 187 REST OF LATIN AMERICA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 REST OF LATIN AMERICA: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 REST OF LATIN AMERICA: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 REST OF LATIN AMERICA: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 191 REST OF LATIN AMERICA: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: IOT MEDICAL DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 199 GCC COUNTRIES: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 200 GCC COUNTRIES: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 GCC COUNTRIES: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 GCC COUNTRIES: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 GCC COUNTRIES: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 204 GCC COUNTRIES: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 205 REST OF MIDDLE EAST & AFRICA: IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 206 REST OF MIDDLE EAST & AFRICA: VITAL SIGNS MONITORING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 REST OF MIDDLE EAST & AFRICA: IMPLANTABLE CARDIAC DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: IOT MEDICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: IOT MEDICAL DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 211 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN IOT MEDICAL DEVICES MARKET, JANUARY 2022-MAY 2025

- TABLE 212 IOT MEDICAL DEVICES MARKET: DEGREE OF COMPETITION

- TABLE 213 IOT MEDICAL DEVICES MARKET: REGION FOOTPRINT

- TABLE 214 IOT MEDICAL DEVICES MARKET: PRODUCT FOOTPRINT

- TABLE 215 IOT MEDICAL DEVICES MARKET: TYPE FOOTPRINT

- TABLE 216 IOT MEDICAL DEVICES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 217 IOT MEDICAL DEVICES MARKET: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 218 IOT MEDICAL DEVICES MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 219 IOT MEDICAL DEVICES MARKET: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 220 MEDTRONIC: BUSINESS OVERVIEW

- TABLE 221 MEDTRONIC: PRODUCTS OFFERED

- TABLE 222 MEDTRONIC: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 223 MEDTRONIC: DEALS, JANUARY 2022-MAY 2025

- TABLE 224 MEDTRONIC: OTHER DEVELOPMENTS, JANUARY 2023-MAY 2025

- TABLE 225 GE HEALTHCARE: BUSINESS OVERVIEW

- TABLE 226 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 227 GE HEALTHCARE: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 228 GE HEALTHCARE DEALS, JANUARY 2022-MAY 2025

- TABLE 229 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- TABLE 230 KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED

- TABLE 231 KONINKLIJKE PHILIPS N.V: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 232 KONINKLIJKE PHILIPS N.V: DEALS, JANUARY 2022-MAY 2025

- TABLE 233 KONINKLIJKE PHILIPS N.V.: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 234 ABBOTT: BUSINESS OVERVIEW

- TABLE 235 ABBOTT: PRODUCTS OFFERED

- TABLE 236 ABBOTT: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 237 ABBOTT: DEALS, JANUARY 2022-MAY 2025

- TABLE 238 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

- TABLE 239 BOSTON SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- TABLE 240 BOSTON SCIENTIFIC CORPORATION: PRODUCT LAUNCHES, ENHANCEMENTS, AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 241 BOSTON SCIENTIFIC: DEALS, JANUARY 2022-MAY 2025

- TABLE 242 OMRON CORPORATION: BUSINESS OVERVIEW

- TABLE 243 OMRON CORPORATION: PRODUCTS OFFERED

- TABLE 244 OMRON CORPORATION: PRODUCT & SERVICE LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 245 OMRON CORPORATION: DEALS, OMRON CORPORATION

- TABLE 246 OMRON CORPORATION: EXPANSIONS, OMRON CORPORATION

- TABLE 247 BAXTER INTERNATIONAL, INC.: BUSINESS OVERVIEW

- TABLE 248 BAXTER INTERNATIONAL, INC.: PRODUCTS OFFERED

- TABLE 249 BAXTER INTERNATIONAL, INC.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 250 BAXTER: DEALS, JANUARY 2022-MAY 2025

- TABLE 251 BIOTRONIK: BUSINESS OVERVIEW

- TABLE 252 BIOTRONIK: PRODUCTS OFFERED

- TABLE 253 BIOTRONIK PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 254 BIOTRONIK: DEALS, JANUARY 2022-MAY 2025

- TABLE 255 JOHNSON & JOHNSON: BUSINESS OVERVIEW

- TABLE 256 JOHNSON & JOHNSON: PRODUCTS OFFERED

- TABLE 257 JOHNSON & JOHNSON: DEALS, JANUARY 2022-MAY 2025

- TABLE 258 NIHON KOHDEN CORPORATION: BUSINESS OVERVIEW

- TABLE 259 NIHON KOHDEN CORPORATION: PRODUCTS OFFERED

- TABLE 260 NIHON KOHDEN CORPORATION: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 261 NIHON KOHDEN CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 262 NIHON KOHDEN CORPORATION: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 263 SIEMENS HEALTHINEERS AG: BUSINESS OVERVIEW

- TABLE 264 SIEMENS HEALTHINEERS AG: PRODUCTS OFFERED

- TABLE 265 SIEMENS HEALTHINEERS AG: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 266 SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2022-MAY 2025

- TABLE 267 HONEYWELL INTERNATIONAL, INC.: BUSINESS OVERVIEW

- TABLE 268 HONEYWELL INTERNATIONAL, INC.: PRODUCTS OFFERED

- TABLE 269 ALIVECOR, INC.: BUSINESS OVERVIEW

- TABLE 270 ALIVECOR, INC.: PRODUCTS OFFERED

- TABLE 271 ALIVECOR, INC.: PRODUCT & SERVICE LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 272 ALIVECOR, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 273 DRAGERWERK AG & CO. KGAA: BUSINESS OVERVIEW

- TABLE 274 DRAGERWERK AG & CO. KGAA: PRODUCTS OFFERED

- TABLE 275 DRAGERWERK AG & CO. KGAA: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 276 DRAGERWERK AG & CO. KGAA: DEALS, JANUARY 2022-MAY 2025

- TABLE 277 NONIN: BUSINESS OVERVIEW

- TABLE 278 NONIN: PRODUCTS OFFERED

- TABLE 279 NONIN: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 280 NONIN: DEALS, JANUARY 2022-MAY 2025

- TABLE 281 RESMED: COMPANY OVERVIEW

- TABLE 282 RESMED: PRODUCTS OFFERED

- TABLE 283 RESMED: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 284 RESMED: DEALS, JANUARY 2022-MAY 2025

- TABLE 285 RESMED: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 286 RESMED: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 287 MASIMO: COMPANY OVERVIEW

- TABLE 288 MASIMO: PRODUCTS OFFERED

- TABLE 289 MASIMO: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 290 MASIMO: DEALS, JANUARY 2022-MAY 2025

- TABLE 291 I-SENS, INC.: COMPANY OVERVIEW

- TABLE 292 I-SENS, INC.: PRODUCTS OFFERED

- TABLE 293 I-SENS, INC.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 294 I-SENS, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 295 I-SENS, INC.: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 296 ICU MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 297 ICU MEDICAL, INC.: PRODUCTS OFFERED

- TABLE 298 ICU MEDICAL, INC.: PRODUCT APPROVALS, JANUARY 2022-MAY 2025

- TABLE 299 ICU MEDICAL, INC.: DEALS, JANUARY 2022-MAY 2025

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS DEMAND SIDE AND SUPPLY SIDE: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 6 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 7 BOTTOM-UP APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 IOT MEDICAL DEVICES MARKET, BY PRODUCT, 2025 VS. 2030(USD MILLION)

- FIGURE 11 IOT MEDICAL DEVICES MARKET, BY TYPE, 2025 VS. 2030(USD MILLION)

- FIGURE 12 IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 IOT MEDICAL DEVICES MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF IOT MEDICAL DEVICES MARKET

- FIGURE 15 RISING GLOBAL DEMAND FOR REMOTE PATIENT MONITORING TO DRIVE MARKET GROWTH

- FIGURE 16 STATIONARY MEDICAL DEVICES TO COMMAND LARGEST SHARE OF ASIA PACIFIC MARKET IN 2024

- FIGURE 17 CHINA TO RECORD HIGHEST CAGR IN GLOBAL MARKET

- FIGURE 18 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES

- FIGURE 20 IOT MEDICAL DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 HEALTHCARE SPENDING, BY COUNTRY, 2023 (% OF GDP)

- FIGURE 22 NUMBER OF SMARTPHONE USERS, BY COUNTRY, 2022

- FIGURE 23 IOT MEDICAL DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 25 KEY BUYING CRITERIA FOR IOT MEDICAL DEVICES

- FIGURE 26 VALUE CHAIN ANALYSIS, 2024

- FIGURE 27 IOT MEDICAL DEVICES MARKET: ECOSYSTEM

- FIGURE 28 PATENT PUBLICATION TRENDS (JANUARY 2015-MAY 2025)

- FIGURE 29 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) OF IOT MEDICAL DEVICES (JANUARY 2015-MAY 2025)

- FIGURE 30 TOP APPLICANT COUNTRIES/REGIONS FOR IOT MEDICAL DEVICE PATENTS (JANUARY 2015-MAY 2025)

- FIGURE 31 IOT MEDICAL DEVICES MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 32 NORTH AMERICA: IOT MEDICAL DEVICES MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: IOT MEDICAL DEVICES MARKET SNAPSHOT

- FIGURE 34 REVENUE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 35 IOT MEDICAL DEVICES MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 36 IOT MEDICAL DEVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 37 IOT MEDICAL DEVICES MARKET: COMPANY FOOTPRINT

- FIGURE 38 IOT MEDICAL DEVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 39 EV/EBITDA OF KEY VENDORS

- FIGURE 40 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 41 IOT MEDICAL DEVICES MARKET: BRAND/SOFTWARE COMPARATIVE ANALYSIS

- FIGURE 42 MEDTRONIC: COMPANY SNAPSHOT (2023)

- FIGURE 43 GE HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 44 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 45 ABBOTT: COMPANY SNAPSHOT (2024)

- FIGURE 46 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 47 OMRON CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 48 BAXTER INTERNATIONAL, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 49 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2024)

- FIGURE 50 NIHON KOHDEN CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 51 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2024)

- FIGURE 52 HONEYWELL INTERNATIONAL, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 53 DRAGERWERK AG & CO. KGAA: COMPANY SNAPSHOT (2024)

- FIGURE 54 RESMED: COMPANY SNAPSHOT (2024)

- FIGURE 55 MASIMO: COMPANY SNAPSHOT (2024)

- FIGURE 56 I-SENS, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 57 ICU MEDICAL, INC.: COMPANY SNAPSHOT (2024)

The global IoT medical devices market is projected to reach USD 154.74 billion by 2030, up from USD 65.08 billion in 2025, reflecting a CAGR of 18.9% during this period. The market is growing rapidly due to an increasing demand for continuous and real-time patient monitoring, particularly with the wider adoption of telehealth. Recent innovations in low-energy sensors, 5G networks, and edge computing have made it possible to efficiently collect and transmit data from wearable and implantable devices to healthcare systems. These advancements enable more proactive and decentralized care, leading to fewer hospital readmissions. Furthermore, the rising incidence of chronic conditions and an aging global population are driving the greater use of these technologies in both home and clinical settings.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, type, connectivity technology, end user, region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

However, the market faces challenges, such as the complexity of integrating with legacy health IT infrastructure, compliance with data privacy regulations like HIPAA and GDPR, and the need to maintain strong cybersecurity to protect patient information in an increasingly connected ecosystem.

"The hospitals & clinics segment, under the IoT medical devices market, is expected to register the fastest growth during the forecast period."

In 2024, the hospitals & clinics segment emerged as the leading end user segment in the IoT medical devices market, a position it is expected to maintain in the coming years. This leadership is primarily due to the increasing demand for advanced diagnostic, monitoring, and treatment tools within healthcare facilities. By adopting IoT-enabled technologies, these institutions can enhance patient outcomes through real-time data monitoring, remote care capabilities, and streamlined clinical operations. The ability to continuously track patient vital signs and chronic health conditions allows for quicker interventions and more effective care delivery. Additionally, the integration of IoT with electronic health records (EHRs) and clinical decision-making platforms improves data accuracy and fosters better coordination among care teams. Key factors driving this trend include the push for higher efficiency, rising patient volumes, and the necessity to meet stringent regulatory and quality standards. As a result, hospitals and clinics are making substantial investments in IoT technologies to improve performance, ensure compliance, and provide more responsive, personalized patient care.

"Bluetooth-enabled IoT technology is projected to dominate the IoT medical devices market during the forecast period."

Bluetooth-enabled IoT technology is rapidly emerging as the fastest-growing connectivity option in the IoT medical devices market. This growth is primarily driven by its energy efficiency, easy integration, and wide compatibility with smartphones, tablets, and wearable healthcare devices. As more healthcare organizations adopt connected solutions for continuous monitoring and patient interaction, Bluetooth has become a reliable and cost-effective method for short-range data exchange. It plays a vital role in devices such as fitness trackers, mobile diagnostic equipment, and home health monitoring tools, where low power consumption and consistent data transfer are crucial.

"Asia Pacific is expected to register fastest market growth during the forecast period."

The Asia Pacific region is expected to experience the fastest growth in the IoT medical devices market during the forecast period. This growth is primarily driven by the rapid adoption of digital healthcare technologies, including IoT and artificial intelligence. Government initiatives aimed at improving healthcare infrastructure, combined with significant investments in smart hospitals and digital health platforms, are leading to the increased deployment of connected medical devices. Additionally, the rising demand for remote monitoring solutions, fueled by a growing elderly population and an increase in chronic health conditions, is further propelling this trend. Furthermore, enhanced telecommunications networks and supportive regulatory frameworks for digital health services are facilitating the implementation of IoT-based solutions. As a result, Asia-Pacific is emerging as a key player in the global expansion of the IoT medical device industry.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 45%, Tier 2: 30%, and Tier 3: 25%

- By Designation - C-level: 42%, Director-level: 31%, and Others: 27%

- By Region - North America: 32%, Asia Pacific: 32%, Europe: 26%, Latin America: 5% and Middle East & Africa: 5%

Key Players in the IoT Medical Devices Market

The key players functioning in the IoT medical devices market include Medtronic (Ireland), GE Healthcare (US), Koninklijke Philips N.V. (Netherlands), Abbott (US), Boston Scientific Corporation (US), OMRON Corporation (Japan), Baxter International Inc. (US), BIOTRONIK (Germany), Johnson & Johnson Private Limited (US), NIHON KOHDEN CORPORATION (Japan), Siemens Healthineers AG (Germany), Honeywell International Inc. (US), AliveCor, Inc. (US), Dragerwerk AG & Co. KGaA (Germany), Nonin (US), AMD Global Telemedicine (US), iHealth Labs Inc (US), Aerotel Medical Systems (1998) Ltd. (Israel), i-SENS, Inc. (Korea), Huntleigh Healthcare Limited (UK), ResMed (US), Masimo (US), Infinium Medical (US), ICU Medical, Inc. (US), and Hamilton Medical (Switzerland).

Research Coverage

The report analyzes the IoT medical devices market and aims to estimate the market size and future growth potential of various market segments based on product, type, connectivity technology, end user, and region. The report also provides a competitive analysis of the key players operating in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will provide valuable insights for both, established companies and new or smaller firms, helping them understand market trends and dynamics. By doing so, they can increase their market share. Companies that purchase this report can employ one or more of the strategies outlined below to enhance their positions in the market.

This report provides insights on:

- Analysis of key drivers: Drivers (government initiatives to promote digital health), restraints (high deployment cost of connected medical devices), opportunities (low doctor-to-patient ratio in several countries), and challenges (data security issues) are key factors influencing the growth of the IoT medical devices market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the IoT medical devices market

- Market Development: Comprehensive information on the lucrative emerging markets, product, type, connectivity technology, end user, and region

- Market Diversification: Exhaustive information about the software portfolios, growing geographies, recent developments, and investments in the IoT medical devices market

- Competitive Assessment: In-depth assessment of market ranking, growth strategies, product offerings, and capabilities of the leading players in the IoT medical devices market like Medtronic (Ireland), GE Healthcare (US), Koninklijke Philips N.V. (Netherlands), Abbott (US), and Boston Scientific Corporation (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DESIGN

- 2.1.1 RESEARCH DATA

- 2.1.2 SECONDARY SOURCES

- 2.1.2.1 Key data from secondary sources

- 2.1.3 PRIMARY SOURCES

- 2.1.3.1 Key data from primary sources

- 2.1.3.2 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 LIMITATIONS

- 2.5 MARKET SHARE ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 IOT MEDICAL DEVICES MARKET OVERVIEW

- 4.2 ASIA PACIFIC: IOT MEDICAL DEVICES MARKET, BY TYPE AND COUNTRY

- 4.3 GEOGRAPHIC GROWTH OPPORTUNITIES IN IOT MEDICAL DEVICES MARKET

- 4.4 REGIONAL MIX: IOT MEDICAL DEVICES MARKET

- 4.5 IOT MEDICAL DEVICES MARKET: DEVELOPED MARKETS VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Government initiatives to promote digital health

- 5.2.1.2 Growing need for cost-containment in healthcare delivery

- 5.2.1.3 Rising focus on patient engagement and patient-centric healthcare

- 5.2.1.4 Evolution of high-speed networking technologies

- 5.2.1.5 Growing focus on patient safety

- 5.2.2 RESTRAINTS

- 5.2.2.1 High deployment costs of connected medical devices

- 5.2.2.2 Lack of skilled IT personnel across healthcare organizations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Low doctor-to-patient ratio in several countries

- 5.2.4 CHALLENGES

- 5.2.4.1 Data security issues

- 5.2.4.2 Data management and interoperability concerns

- 5.2.1 DRIVERS

- 5.3 INDUSTRY INSIGHTS

- 5.3.1 INCREASING NUMBER OF PRODUCT LAUNCHES

- 5.3.2 GROWING INTEGRATION OF CLOUD PLATFORMS AND SAAS IN HEALTHCARE ECOSYSTEM

- 5.3.3 INCREASING NUMBER OF COLLABORATIONS TO DRIVE INNOVATION

- 5.4 TECHNOLOGY ANALYSIS

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.5.2 BARGAINING POWER OF SUPPLIERS

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 THREAT OF NEW ENTRANTS

- 5.5.5 THREAT OF SUBSTITUTES

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 BUYING CRITERIA

- 5.7 REGULATORY ANALYSIS

- 5.7.1 NORTH AMERICA

- 5.7.1.1 US

- 5.7.1.2 Canada

- 5.7.2 EUROPE

- 5.7.3 ASIA PACIFIC

- 5.7.3.1 Japan

- 5.7.3.2 China

- 5.7.3.3 India

- 5.7.1 NORTH AMERICA

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 PRICING ANALYSIS

- 5.11 PATENT ANALYSIS

- 5.11.1 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.11.2 LIST OF MAJOR PATENTS

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 CASE STUDY 1: ADVANCING WOUND MEASUREMENT ACCURACY IN HEALTHCARE WITH IOT TECHNOLOGY

- 5.12.2 CASE STUDY 2: EMPOWERING PATIENT-CONTROLLED PAIN MEDICATION ADMINISTRATION WITH IOT TECHNOLOGY

- 5.12.3 CASE STUDY 3: IMPROVING MATERNAL AND FETAL CARE WITH IOT-DRIVEN MONITORING SOLUTIONS

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15 IMPACT OF 2025 US TARIFFS-IOT MEDICAL DEVICES MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 PRICE IMPACT ANALYSIS

- 5.15.4 IMPACT ON COUNTRY/REGION

- 5.15.4.1 US

- 5.15.4.2 Europe

- 5.15.4.3 Asia Pacific

- 5.15.5 IMPACT ON END-USE INDUSTRIES

6 IOT MEDICAL DEVICES MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 VITAL SIGNS MONITORING DEVICES

- 6.2.1 BLOOD GLUCOSE MONITORS

- 6.2.1.1 Preference for continuous glucose monitoring to drive market

- 6.2.2 ECG/HEART RATE MONITORS

- 6.2.2.1 Rising incidence of CVD to drive market growth

- 6.2.3 BLOOD PRESSURE MONITORS

- 6.2.3.1 Growing prevalence of hypertension and obesity to fuel market

- 6.2.4 MULTIPARAMETER MONITORS

- 6.2.4.1 Rising preference for home care to drive demand

- 6.2.5 OXIMETERS

- 6.2.5.1 Increasing focus on self-monitoring to drive market

- 6.2.1 BLOOD GLUCOSE MONITORS

- 6.3 IMAGING SYSTEMS

- 6.3.1 NEED TO TRANSMIT DATA FOR REMOTE VIEWING TO SUPPORT MARKET GROWTH

- 6.4 IMPLANTABLE CARDIAC DEVICES

- 6.4.1 IMPLANTABLE CARDIOVERTER-DEFIBRILLATORS

- 6.4.1.1 Growing geriatric population to boost demand

- 6.4.2 PACEMAKERS

- 6.4.2.1 Rising number of cardiac patients to drive demand

- 6.4.3 IMPLANTABLE CARDIAC MONITORS

- 6.4.3.1 Ease of remote monitoring to drive demand

- 6.4.1 IMPLANTABLE CARDIOVERTER-DEFIBRILLATORS

- 6.5 PATIENT MONITORS

- 6.5.1 GROWING ADOPTION TO BOOST MARKET

- 6.6 RESPIRATORY DEVICES

- 6.6.1 RISING PREVALENCE OF RESPIRATORY DISORDERS TO DRIVE DEMAND

- 6.7 INFUSION PUMPS

- 6.7.1 RISK OF SECURITY BREACHES TO IMPACT MARKET GROWTH

- 6.8 FETAL MONITORING DEVICES

- 6.8.1 GROWING EMPHASIS ON FETAL HEALTH TO DRIVE MARKET GROWTH

- 6.9 NEUROLOGICAL DEVICES

- 6.9.1 TECHNOLOGICAL ADVANCEMENTS TO BOOST MARKET

- 6.10 VENTILATORS

- 6.10.1 HIGH DEMAND FOR INTENSIVE CARE TO DRIVE MARKET GROWTH

- 6.11 ANESTHESIA MACHINES

- 6.11.1 INCREASING NUMBER OF SURGICAL PROCEDURES TO DRIVE MARKET

- 6.12 HEARING DEVICES

- 6.12.1 RISING ADOPTION OF ADVANCED AIDS TO BOOST MARKET

- 6.13 OTHER IOT MEDICAL DEVICES

7 IOT MEDICAL DEVICES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 STATIONARY DEVICES

- 7.2.1 IMPROVED DATA ACCESSIBILITY TO DRIVE DEMAND

- 7.3 IMPLANTABLE DEVICES

- 7.3.1 INCREASING INCIDENCE OF CVD AND NEUROLOGICAL DISEASES TO DRIVE DEMAND

- 7.4 WEARABLE DEVICES

- 7.4.1 RISING USE IN HOME CARE SETTINGS TO PROPEL MARKET

- 7.5 OTHER DEVICE TYPES

8 IOT MEDICAL DEVICES MARKET, BY CONNECTIVITY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 WI-FI

- 8.2.1 ABILITY TO PROVIDE GREATER FLEXIBILITY TO CAREGIVERS TO SUPPORT MARKET GROWTH

- 8.3 BLUETOOTH

- 8.3.1 SEAMLESS CONNECTION BETWEEN WIRELESS DEVICES TO FOSTER ADOPTION

- 8.4 ZIGBEE

- 8.4.1 SECURITY CONCERNS TO LIMIT ADOPTION

- 8.5 OTHER CONNECTIVITY TECHNOLOGIES

9 IOT MEDICAL DEVICES MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS & CLINICS

- 9.2.1 NEED TO REDUCE HEALTHCARE COSTS TO DRIVE MARKET

- 9.3 NURSING HOMES, ASSISTED LIVING FACILITIES, LONG-TERM CARE CENTERS, AND HOME CARE SETTINGS

- 9.3.1 INCREASING GERIATRIC POPULATION TO CONTRIBUTE TO SEGMENT GROWTH

- 9.4 OTHER END USERS

10 IOT MEDICAL DEVICES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 High adoption of connected devices to drive market

- 10.2.3 CANADA

- 10.2.3.1 Government investments in health-related technologies to boost market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Government initiatives to boost market

- 10.3.3 UK

- 10.3.3.1 High penetration of wearables to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Government support for e-Health to drive market

- 10.3.5 ITALY

- 10.3.5.1 Widespread use of mobile devices to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Growing geriatric population to propel demand

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 High burden of chronic disorders to drive demand

- 10.4.3 JAPAN

- 10.4.3.1 Demand from large geriatric population to boost market

- 10.4.4 INDIA

- 10.4.4.1 Growing adoption of telemedicine to boost market

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Increasing government initiatives to drive market

- 10.5.3 MEXICO

- 10.5.3.1 Focus on digitalization of healthcare to support market

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN IOT MEDICAL DEVICES MARKET

- 11.3 REVENUE ANALYSIS, 2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product footprint

- 11.5.5.4 Type footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.7 VALUATION & FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.8 BRAND/SOFTWARE COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY COMPANIES

- 12.1.1 MEDTRONIC

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches & approvals

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 GE HEALTHCARE

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches & approvals

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 KONINKLIJKE PHILIPS N.V.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches & enhancements

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 ABBOTT

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches & approvals

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 BOSTON SCIENTIFIC CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches, enhancements, and approvals

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 OMRON CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product & service launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Expansions

- 12.1.7 BAXTER INTERNATIONAL, INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches & approvals

- 12.1.7.3.2 Deals

- 12.1.8 BIOTRONIK

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches & enhancements

- 12.1.8.3.2 Deals

- 12.1.9 JOHNSON & JOHNSON

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 NIHON KOHDEN CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches & approvals

- 12.1.10.3.2 Deals

- 12.1.10.3.3 Expansions

- 12.1.11 SIEMENS HEALTHINEERS AG

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.11.3.2 Deals

- 12.1.12 HONEYWELL INTERNATIONAL, INC.

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.13 ALIVECOR, INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product & service launches

- 12.1.13.3.2 Deals

- 12.1.14 DRAGERWERK AG & CO. KGAA

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches

- 12.1.14.3.2 Deals

- 12.1.15 NONIN

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Product launches

- 12.1.15.3.2 Deals

- 12.1.16 RESMED

- 12.1.16.1 Business overview

- 12.1.16.2 Products offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Product launches

- 12.1.16.3.2 Deals

- 12.1.16.3.3 Expansions

- 12.1.16.3.4 Other developments

- 12.1.17 MASIMO

- 12.1.17.1 Business overview

- 12.1.17.2 Products offered

- 12.1.17.3 Recent developments

- 12.1.17.3.1 Product launches & approvals

- 12.1.17.3.2 Deals

- 12.1.18 I-SENS, INC.

- 12.1.18.1 Business overview

- 12.1.18.2 Products offered

- 12.1.18.3 Recent developments

- 12.1.18.3.1 Product launches & approvals

- 12.1.18.3.2 Deals

- 12.1.18.3.3 Expansions

- 12.1.19 ICU MEDICAL, INC.

- 12.1.19.1 Business overview

- 12.1.19.2 Products offered

- 12.1.19.3 Recent developments

- 12.1.19.3.1 Product approvals

- 12.1.19.3.2 Deals

- 12.1.1 MEDTRONIC

- 12.2 OTHER PLAYERS

- 12.2.1 AMD GLOBAL TELEMEDICINE

- 12.2.2 IHEALTH LABS

- 12.2.3 AEROTEL MEDICAL SYSTEMS

- 12.2.4 HUNTLEIGH HEALTHCARE LIMITED

- 12.2.5 INFINIUM MEDICAL

- 12.2.6 HAMILTON MEDICAL

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS