|

|

市場調査レポート

商品コード

1752397

合板の世界市場:タイプ別、使用タイプ別、用途別、地域別 - 2030年までの予測Plywood Market by Type (Softwood, Hardwood), Application (Construction, Industrial), Use Type (New Construction, Rehabilitation), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 合板の世界市場:タイプ別、使用タイプ別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月13日

発行: MarketsandMarkets

ページ情報: 英文 228 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の合板の市場規模は、4.21%のCAGRで拡大し、2024年の473億9,000万米ドルから2030年には603億1,000万米ドルに達すると予測されています。

合板は家具、包装、農業、建築・建設、内装、屋根材、床材などに広く使用されています。合板は、材料の内部と外部の両方に構造的な支えを提供することで、幅広い産業に貢献しています。合板の耐候性と耐久性を高めることで、メーカーは製品の品質を維持し、メンテナンス・コストを削減し、厳しい規制や世界・スタンダードに準拠することができます。使用される合板の種類は、広葉樹か針葉樹かにかかわらず、すべて消費者の使用目的によって決まる。世界の急速な都市化も、合板の需要拡大を後押ししています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)および数量(100万立方メートル) |

| セグメント | タイプ別、使用タイプ別、用途別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

家具、キャビネット、インテリアデザインにおいて、高品質で長持ちし、見た目にも美しい素材への需要が高まっていることから、合板市場における広葉樹の採用が増加しています。これは主に、その強度、洗練された仕上げ、魅力的な模様によるものです。アジア太平洋を中心に世界の中産階級が拡大するにつれ、人々は高級で、カスタマイズされた、美しい家具を求めるようになり、広葉樹のニーズが高まっています。持続可能性も重要な要素です。環境に優しい建材に対する意識の高まりと規制の厳格化により、製造業者と消費者の双方がこの種の合板を求めるようになっています。

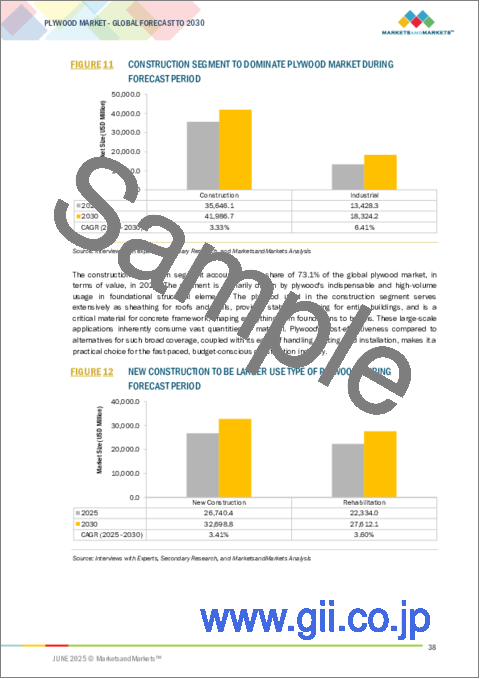

産業用セグメントは、予測期間中、世界の合板市場で最も急成長する用途と予測されます。この成長は、マテリアルハンドリング製品、輸送機器、壁や屋根のブレースのような構造用途の増加によるところが大きいです。しかし、主に世界の建築およびインフラ・プロジェクトの需要が大きいため、建設が合板市場の最大シェアを維持し続けています。産業用合板は、耐久性に優れ、コスト効率に優れ、柔軟性のある材料を求める産業界の特殊なニーズに応えるため、急速に用途が拡大しています。この成長は、物流、製造、技術における需要によって後押しされ、世界の合板市場において産業用途はダイナミックかつ急速に拡大するセグメントとして位置づけられています。

世界の合板市場における欧州の優位性は、その確立された生産基盤、厳格な環境・安全基準、家具、包装、建築・建設などの主要な最終用途産業の圧倒的な存在によってもたらされます。同地域の規制当局は、製品の耐久性と環境の持続可能性に関して厳しい基準を課しているため、メーカーは耐久性と持続可能性を保証する合板技術への投資を余儀なくされています。技術革新と研究開発に重点を置く国々の増加、および主要世界企業の存在は、市場動向と製品性能の推進におけるこの地域の役割をさらに後押ししています。

当レポートでは、世界の合板市場について調査し、タイプ別、使用タイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標

第6章 業界動向

- サプライチェーン分析

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- ケーススタディ分析

- 技術分析

- 貿易分析

- 規制状況

- 2025年~2026年の主な会議とイベント

- 投資と資金調達のシナリオ

- 特許分析

- AI/生成AIが合板市場に与える影響

- 2025年の米国関税が合板市場に与える影響

第7章 合板市場(タイプ別)

- イントロダクション

- 針葉樹

- 広葉樹

第8章 合板市場(使用タイプ別)

- イントロダクション

- 新築

- 改修

第9章 合板市場(用途別)

- イントロダクション

- 建設

- 工業

第10章 合板市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- インドネシア

- マレーシア

- タイ

- ベトナム

- フィリピン

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- トルコ

- フィンランド

- オランダ

- その他

- 南米

- ブラジル

- アルゼンチン

- チリ

- その他

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- イラン

- その他

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析、2024年

- 2020~2024年におけるトップ5社の収益分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 製品比較分析

- 企業評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- GEORGIA-PACIFIC

- BOISE CASCADE COMPANY

- WEYERHAEUSER COMPANY

- UPM

- SVEZA GROUP

- AUSTRAL PLYWOODS

- POTLATCHDELTIC CORPORATION

- GREENPLY INDUSTRIES LIMITED

- METSA GROUP

- CENTURYPLY

- スタートアップ/中小企業

- AUSTIN PLYWOOD

- LATVIJAS FINIERIS AS

- KITPLY INDUSTRIES LIMITED

- KAJARIA PLYWOOD PVT. LTD.

- MERINO INDUSTRIES LIMITED

- GLOBE PANEL INDUSTRIES(I)PVT. LTD.

- DUROPLY INDUSTRIES LIMITED

- UNIPLY LTD.

- UFP INDUSTRIES, INC.

- MURPHY

- WEST FRASER

- ROYOMARTIN

- FORMWOOD INDUSTRIES

- ARCHELA CONTRACHAPADOS, S.L.

- MIRALUZ

第13章 付録

List of Tables

- TABLE 1 PLYWOOD MARKET: RISK ASSESSMENT

- TABLE 2 PLYWOOD MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 4 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 5 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021-2030 (USD BILLION)

- TABLE 6 AVERAGE SELLING PRICE OF PLYWOOD OFFERED BY KEY PLAYERS, BY APPLICATION, 2024 (USD/CBM)

- TABLE 7 AVERAGE SELLING PRICE TREND OF PLYWOOD, BY REGION, 2022-2030 (USD/CBM)

- TABLE 8 ROLES OF COMPANIES IN PLYWOOD ECOSYSTEM

- TABLE 9 IMPORT DATA RELATED TO PLYWOOD, BY REGION, 2018-2023 (USD MILLION)

- TABLE 10 EXPORT DATA RELATED TO PLYWOOD, BY REGION, 2018-2023 (USD MILLION)

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 PLYWOOD MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 PLYWOOD MARKET: FUNDING/INVESTMENT, 2023-2025

- TABLE 18 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS, 2014-2024

- TABLE 19 LIST OF MAJOR PATENTS RELATED TO PLYWOOD, 2014-2024

- TABLE 20 PATENTS BY VALINGE INNOVATION AB

- TABLE 21 US ADJUSTED RECIPROCAL TARIFF RATES

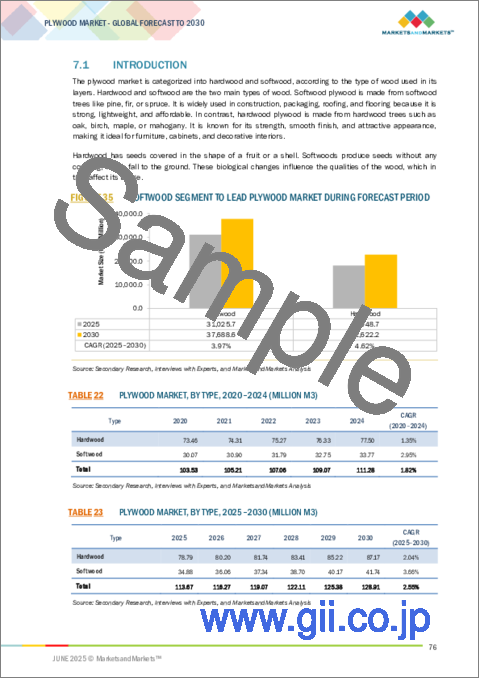

- TABLE 22 PLYWOOD MARKET, BY TYPE, 2020-2024 (MILLION M3)

- TABLE 23 PLYWOOD MARKET, BY TYPE, 2025-2030 (MILLION M3)

- TABLE 24 PLYWOOD MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 25 PLYWOOD MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 26 SOFTWOOD: PLYWOOD MARKET, BY REGION, 2020-2024 (MILLION M3)

- TABLE 27 SOFTWOOD: PLYWOOD MARKET, BY REGION, 2025-2030 (MILLION M3)

- TABLE 28 SOFTWOOD: PLYWOOD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 SOFTWOOD: PLYWOOD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 HARDWOOD: PLYWOOD MARKET, BY REGION, 2020-2024 (MILLION M3)

- TABLE 31 HARDWOOD: PLYWOOD MARKET, BY REGION, 2025-2030 (MILLION M3)

- TABLE 32 HARDWOOD: PLYWOOD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 HARDWOOD: PLYWOOD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 PLYWOOD MARKET, BY USE TYPE, 2020-2024 (MILLION M3)

- TABLE 35 PLYWOOD MARKET, BY USE TYPE, 2025-2030 (MILLION M3)

- TABLE 36 PLYWOOD MARKET, BY USE TYPE, 2020-2024 (USD MILLION)

- TABLE 37 PLYWOOD MARKET, BY USE TYPE, 2025-2030 (USD MILLION)

- TABLE 38 NEW CONSTRUCTION: PLYWOOD MARKET, BY REGION, 2020-2024 (MILLION M3)

- TABLE 39 NEW CONSTRUCTION: PLYWOOD MARKET, BY REGION, 2025-2030 (MILLION M3)

- TABLE 40 NEW CONSTRUCTION: PLYWOOD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 NEW CONSTRUCTION: PLYWOOD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 REHABILITATION: PLYWOOD MARKET, BY REGION, 2020-2024 (MILLION M3)

- TABLE 43 REHABILITATION: PLYWOOD MARKET, BY REGION, 2025-2030 (MILLION M3)

- TABLE 44 REHABILITATION: PLYWOOD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 REHABILITATION: PLYWOOD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 PLYWOOD MARKET, BY APPLICATION, 2020-2024 (MILLION M3)

- TABLE 47 PLYWOOD MARKET, BY APPLICATION, 2025-2030 (MILLION M3)

- TABLE 48 PLYWOOD MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 49 PLYWOOD MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 50 CONSTRUCTION: PLYWOOD MARKET, BY REGION, 2020-2024 (MILLION M3)

- TABLE 51 CONSTRUCTION: PLYWOOD MARKET, BY REGION, 2025-2030 (MILLION M3)

- TABLE 52 CONSTRUCTION: PLYWOOD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 CONSTRUCTION: PLYWOOD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 CONSTRUCTION: PLYWOOD MARKET IN ROOFING, BY REGION, 2020-2024 (MILLION M3)

- TABLE 55 CONSTRUCTION: PLYWOOD MARKET IN ROOFING, BY REGION, 2025-2030 (MILLION M3)

- TABLE 56 CONSTRUCTION: PLYWOOD MARKET IN ROOFING, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 CONSTRUCTION: PLYWOOD MARKET IN ROOFING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 CONSTRUCTION: PLYWOOD MARKET IN SUBFLOORING, BY REGION, 2020-2024 (MILLION M3)

- TABLE 59 CONSTRUCTION: PLYWOOD MARKET IN SUBFLOORING, BY REGION, 2025-2030 (MILLION M3)

- TABLE 60 CONSTRUCTION: PLYWOOD MARKET IN SUBFLOORING, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 CONSTRUCTION: PLYWOOD MARKET IN SUBFLOORING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 CONSTRUCTION: PLYWOOD MARKET IN WALL SHEATHING, BY REGION, 2020-2024 (MILLION M3)

- TABLE 63 CONSTRUCTION: PLYWOOD MARKET IN WALL SHEATHING, BY REGION, 2025-2030 (MILLION M3)

- TABLE 64 CONSTRUCTION: PLYWOOD MARKET IN WALL SHEATHING, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 CONSTRUCTION: PLYWOOD MARKET IN WALL SHEATHING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 CONSTRUCTION: PLYWOOD MARKET IN FINISH FLOORING, BY REGION, 2020-2024 (MILLION M3)

- TABLE 67 CONSTRUCTION: PLYWOOD MARKET IN FINISH FLOORING, BY REGION, 2025-2030 (MILLION M3)

- TABLE 68 CONSTRUCTION: PLYWOOD MARKET IN FINISH FLOORING, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 CONSTRUCTION: PLYWOOD MARKET IN FINISH FLOORING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 CONSTRUCTION: PLYWOOD MARKET IN SLIDING, BY REGION, 2020-2024 (MILLION M3)

- TABLE 71 CONSTRUCTION: PLYWOOD MARKET IN SLIDING, BY REGION, 2025-2030 (MILLION M3)

- TABLE 72 CONSTRUCTION: PLYWOOD MARKET IN SLIDING, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 CONSTRUCTION: PLYWOOD MARKET IN SLIDING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 CONSTRUCTION: PLYWOOD MARKET IN OTHER APPLICATIONS, BY REGION, 2020-2024 (MILLION M3)

- TABLE 75 CONSTRUCTION: PLYWOOD MARKET IN OTHER APPLICATIONS, BY REGION, 2025-2030 (MILLION M3)

- TABLE 76 CONSTRUCTION: PLYWOOD MARKET IN OTHER APPLICATIONS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 CONSTRUCTION: PLYWOOD MARKET IN OTHER APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 INDUSTRIAL: PLYWOOD MARKET, BY REGION, 2020-2024 (MILLION M3)

- TABLE 79 INDUSTRIAL: PLYWOOD MARKET, BY REGION, 2025-2030 (MILLION M3)

- TABLE 80 INDUSTRIAL: PLYWOOD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 INDUSTRIAL: PLYWOOD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 INDUSTRIAL: PLYWOOD MARKET IN MATERIAL HANDLING PRODUCTS, BY REGION, 2020-2024 (MILLION M3)

- TABLE 83 INDUSTRIAL: PLYWOOD MARKET IN MATERIAL HANDLING PRODUCTS, BY REGION, 2025-2030 (MILLION M3)

- TABLE 84 INDUSTRIAL: PLYWOOD MARKET IN MATERIAL HANDLING PRODUCTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 INDUSTRIAL: PLYWOOD MARKET IN MATERIAL HANDLING PRODUCTS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 INDUSTRIAL: PLYWOOD MARKET IN TRANSPORT EQUIPMENT, BY REGION, 2020-2024 (MILLION M3)

- TABLE 87 INDUSTRIAL: PLYWOOD MARKET IN TRANSPORT EQUIPMENT, BY REGION, 2025-2030 (MILLION M3)

- TABLE 88 INDUSTRIAL: PLYWOOD MARKET IN TRANSPORT EQUIPMENT, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 INDUSTRIAL: PLYWOOD MARKET IN TRANSPORT EQUIPMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 INDUSTRIAL: PLYWOOD MARKET IN OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2020-2024 (MILLION M3)

- TABLE 91 INDUSTRIAL: PLYWOOD MARKET IN OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2025-2030 (MILLION M3)

- TABLE 92 INDUSTRIAL: PLYWOOD MARKET IN OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 93 INDUSTRIAL: PLYWOOD MARKET IN OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 PLYWOOD MARKET, BY REGION, 2020-2024 (MILLION M3)

- TABLE 95 PLYWOOD MARKET, BY REGION, 2025-2030 (MILLION M3)

- TABLE 96 PLYWOOD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 97 PLYWOOD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 ASIA PACIFIC: PLYWOOD MARKET, BY TYPE, 2020-2024 (MILLION M3)

- TABLE 99 ASIA PACIFIC: PLYWOOD MARKET, BY TYPE, 2025-2030 (MILLION M3)

- TABLE 100 ASIA PACIFIC: PLYWOOD MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 101 ASIA PACIFIC: PLYWOOD MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: PLYWOOD MARKET, BY APPLICATION, 2020-2024 (MILLION M3)

- TABLE 103 ASIA PACIFIC: PLYWOOD MARKET, BY APPLICATION, 2025-2030 (MILLION M3)

- TABLE 104 ASIA PACIFIC: PLYWOOD MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 105 ASIA PACIFIC: PLYWOOD MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: PLYWOOD MARKET, BY USE TYPE, 2020-2024 (MILLION M3)

- TABLE 107 ASIA PACIFIC: PLYWOOD MARKET, BY USE TYPE, 2025-2030 (MILLION M3)

- TABLE 108 ASIA PACIFIC: PLYWOOD MARKET, BY USE TYPE, 2020-2024 (USD MILLION)

- TABLE 109 ASIA PACIFIC: PLYWOOD MARKET, BY USE TYPE, 2025-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: PLYWOOD MARKET, BY COUNTRY, 2020-2024 (MILLION M3)

- TABLE 111 ASIA PACIFIC: PLYWOOD MARKET, BY COUNTRY, 2025-2030 (MILLION M3)

- TABLE 112 ASIA PACIFIC: PLYWOOD MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 113 ASIA PACIFIC: PLYWOOD MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: PLYWOOD MARKET, BY TYPE, 2020-2024 (MILLION M3)

- TABLE 115 NORTH AMERICA: PLYWOOD MARKET, BY TYPE, 2025-2030 (MILLION M3)

- TABLE 116 NORTH AMERICA: PLYWOOD MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 117 NORTH AMERICA: PLYWOOD MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 118 NORTH AMERICA: PLYWOOD MARKET, BY APPLICATION, 2020-2024 (MILLION M3)

- TABLE 119 NORTH AMERICA: PLYWOOD MARKET, BY APPLICATION, 2025-2030 (MILLION M3)

- TABLE 120 NORTH AMERICA: PLYWOOD MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 121 NORTH AMERICA: PLYWOOD MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: PLYWOOD MARKET, BY USE TYPE, 2020-2024 (MILLION M3)

- TABLE 123 NORTH AMERICA: PLYWOOD MARKET, BY USE TYPE, 2025-2030 (MILLION M3)

- TABLE 124 NORTH AMERICA: PLYWOOD MARKET, BY USE TYPE, 2020-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: PLYWOOD MARKET, BY USE TYPE, 2025-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: PLYWOOD MARKET, BY COUNTRY, 2020-2024 (MILLION M3)

- TABLE 127 NORTH AMERICA: PLYWOOD MARKET, BY COUNTRY, 2025-2030 (MILLION M3)

- TABLE 128 NORTH AMERICA: PLYWOOD MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 129 NORTH AMERICA: PLYWOOD MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: PLYWOOD MARKET, BY TYPE, 2020-2024 (MILLION M3)

- TABLE 131 EUROPE: PLYWOOD MARKET, BY TYPE, 2025-2030 (MILLION M3)

- TABLE 132 EUROPE: PLYWOOD MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 133 EUROPE: PLYWOOD MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: PLYWOOD MARKET, BY APPLICATION, 2020-2024 (MILLION M3)

- TABLE 135 EUROPE: PLYWOOD MARKET, BY APPLICATION, 2025-2030 (MILLION M3)

- TABLE 136 EUROPE: PLYWOOD MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 137 EUROPE: PLYWOOD MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 EUROPE: PLYWOOD MARKET, BY USE TYPE, 2020-2024 (MILLION M3)

- TABLE 139 EUROPE: PLYWOOD MARKET, BY USE TYPE, 2025-2030 (MILLION M3)

- TABLE 140 EUROPE: PLYWOOD MARKET, BY USE TYPE, 2020-2024 (USD MILLION)

- TABLE 141 EUROPE: PLYWOOD MARKET, BY USE TYPE, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: PLYWOOD MARKET, BY COUNTRY, 2020-2024 (MILLION M3)

- TABLE 143 EUROPE: PLYWOOD MARKET, BY COUNTRY, 2025-2030 (MILLION M3)

- TABLE 144 EUROPE: PLYWOOD MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 145 EUROPE: PLYWOOD MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 146 SOUTH AMERICA: PLYWOOD MARKET, BY TYPE, 2020-2024 (MILLION M3)

- TABLE 147 SOUTH AMERICA: PLYWOOD MARKET, BY TYPE, 2025-2030 (MILLION M3)

- TABLE 148 SOUTH AMERICA: PLYWOOD MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 149 SOUTH AMERICA: PLYWOOD MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 150 SOUTH AMERICA: PLYWOOD MARKET, BY APPLICATION, 2020-2024 (MILLION M3)

- TABLE 151 SOUTH AMERICA: PLYWOOD MARKET, BY APPLICATION, 2025-2030 (MILLION M3)

- TABLE 152 SOUTH AMERICA: PLYWOOD MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 153 SOUTH AMERICA: PLYWOOD MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 154 SOUTH AMERICA: PLYWOOD MARKET, BY USE TYPE, 2020-2024 (MILLION M3)

- TABLE 155 SOUTH AMERICA: PLYWOOD MARKET, BY USE TYPE, 2025-2030 (MILLION M3)

- TABLE 156 SOUTH AMERICA: PLYWOOD MARKET, BY USE TYPE, 2020-2024 (USD MILLION)

- TABLE 157 SOUTH AMERICA: PLYWOOD MARKET, BY USE TYPE, 2025-2030 (USD MILLION)

- TABLE 158 SOUTH AMERICA: PLYWOOD MARKET, BY COUNTRY, 2020-2024 (MILLION M3)

- TABLE 159 SOUTH AMERICA: PLYWOOD MARKET, BY COUNTRY, 2025-2030 (MILLION M3)

- TABLE 160 SOUTH AMERICA: PLYWOOD MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 161 SOUTH AMERICA: PLYWOOD MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY TYPE, 2020-2024 (MILLION M3)

- TABLE 163 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY TYPE, 2025-2030 (MILLION M3)

- TABLE 164 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY APPLICATION, 2020-2024 (MILLION M3)

- TABLE 167 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY APPLICATION, 2025-2030 (MILLION M3)

- TABLE 168 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY USE TYPE, 2020-2024 (MILLION M3)

- TABLE 171 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY USE TYPE, 2025-2030 (MILLION M3)

- TABLE 172 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY USE TYPE, 2020-2024 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY USE TYPE, 2025-2030 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY COUNTRY, 2020-2024 (MILLION M3)

- TABLE 175 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY COUNTRY, 2025-2030 (MILLION M3)

- TABLE 176 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: PLYWOOD MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 178 STRATEGIES ADOPTED BY KEY PLYWOOD MANUFACTURERS

- TABLE 179 PLYWOOD MARKET: DEGREE OF COMPETITION

- TABLE 180 PLYWOOD MARKET: REGION FOOTPRINT

- TABLE 181 PLYWOOD MARKET: TYPE FOOTPRINT

- TABLE 182 PLYWOOD MARKET: APPLICATION FOOTPRINT

- TABLE 183 PLYWOOD MARKET: USE TYPE FOOTPRINT

- TABLE 184 PLYWOOD MARKET: KEY STARTUPS/SMES

- TABLE 185 PLYWOOD MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 186 PLYWOOD MARKET: PRODUCT LAUNCHES, JANUARY 2019-JANUARY 2025

- TABLE 187 PLYWOOD MARKET: DEALS, JANUARY 2019-JANUARY 2025

- TABLE 188 PLYWOOD MARKET: EXPANSIONS, JANUARY 2019-JANUARY 2025

- TABLE 189 PLYWOOD MARKET: OTHER DEVELOPMENTS, JANUARY 2019-JANUARY 2025

- TABLE 190 GEORGIA-PACIFIC: COMPANY OVERVIEW

- TABLE 191 GEORGIA-PACIFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 GEORGIA-PACIFIC: OTHER DEVELOPMENT, JANUARY 2019 - MARCH 2025

- TABLE 193 BOISE CASCADE COMPANY: COMPANY OVERVIEW

- TABLE 194 BOISE CASCADE COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 BOISE CASCADE COMPANY: DEALS, JANUARY 2019 - MARCH 2025

- TABLE 196 WEYERHAEUSER COMPANY: COMPANY OVERVIEW

- TABLE 197 WEYERHAEUSER COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 WEYERHAEUSER COMPANY: DEALS, JANUARY 2019 - MARCH 2025

- TABLE 199 UPM: COMPANY OVERVIEW

- TABLE 200 UPM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 SVEZA GROUP: COMPANY OVERVIEW

- TABLE 202 SVEZA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 AUSTRAL PLYWOODS: COMPANY OVERVIEW

- TABLE 204 AUSTRAL PLYWOODS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 POTLATCHDELTIC CORPORATION: COMPANY OVERVIEW

- TABLE 206 POTLATCHDELTIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 GREENPLY INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 208 GREENPLY INDUSTRIES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 GREENPLY INDUSTRIES LIMITED: PRODUCT LAUNCHES

- TABLE 210 GREENPLY INDUSTRIES LIMITED: EXPANSIONS

- TABLE 211 METSA GROUP: COMPANY OVERVIEW

- TABLE 212 METSA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 CENTURYPLY: COMPANY OVERVIEW

- TABLE 214 CENTURYPLY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 AUSTIN PLYWOOD: COMPANY OVERVIEW

- TABLE 216 LATVIJAS FINIERIS AS: COMPANY OVERVIEW

- TABLE 217 KITPLY INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 218 KAJARIA PLYWOOD PVT. LTD.: COMPANY OVERVIEW

- TABLE 219 MERINO INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 220 GLOBE PANEL INDUSTRIES (I) PVT. LTD.: COMPANY OVERVIEW

- TABLE 221 DUROPLY INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 222 UNIPLY LTD.: COMPANY OVERVIEW

- TABLE 223 UFP INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 224 MURPHY: COMPANY OVERVIEW

- TABLE 225 WEST FRASER: COMPANY OVERVIEW

- TABLE 226 ROYOMARTIN: COMPANY OVERVIEW

- TABLE 227 FORMWOOD INDUSTRIES: COMPANY OVERVIEW

- TABLE 228 ARCHELA CONTRACHAPADOS, S.L.: COMPANY OVERVIEW

- TABLE 229 MIRALUZ: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PLYWOOD MARKET SEGMENTATION AND REGIONAL SPREAD

- FIGURE 2 PLYWOOD MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE MARKET SHARE OF KEY PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3- BOTTOM UP (DEMAND SIDE)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3-TOP DOWN

- FIGURE 7 PLYWOOD MARKET: DATA TRIANGULATION

- FIGURE 8 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 10 SOFTWOOD SEGMENT ACCOUNTED FOR LARGEST SHARE OF PLYWOOD MARKET IN 2024

- FIGURE 11 CONSTRUCTION SEGMENT TO DOMINATE PLYWOOD MARKET DURING FORECAST PERIOD

- FIGURE 12 NEW CONSTRUCTION TO BE LARGER USE TYPE OF PLYWOOD DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF PLYWOOD MARKET IN 2024

- FIGURE 14 RAPID INDUSTRIALIZATION TO CREATE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 15 ASIA PACIFIC TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 SOFTWOOD AND CHINA ACCOUNTED FOR LARGEST MARKET SHARE OF ASIA PACIFIC PLYWOOD MARKET IN 2024

- FIGURE 17 CONSTRUCTION SEGMENT ACCOUNTED FOR LARGEST APPLICATION OF PLYWOOD MARKET IN 2024

- FIGURE 18 PHILIPPINES TO REGISTER HIGHEST CAGR IN PLYWOOD MARKET

- FIGURE 19 PLYWOOD MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 PLYWOOD MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 22 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 23 PLYWOOD MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 AVERAGE SELLING PRICE OF PLYWOOD OFFERED BY KEY PLAYERS, BY APPLICATION, 2024 (USD/CBM)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF PLYWOOD, BY REGION, 2022-2030 (USD/CBM)

- FIGURE 26 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 27 PARTICIPANTS IN PLYWOOD ECOSYSTEM

- FIGURE 28 IMPORT DATA FOR PLYWOOD, BY KEY COUNTRY, 2018-2023 (USD MILLION)

- FIGURE 29 EXPORT DATA FOR PLYWOOD, BY KEY COUNTRY, 2018-2023 (USD MILLION)

- FIGURE 30 PATENTS REGISTERED FOR PLYWOOD, 2014-2024

- FIGURE 31 MAJOR PATENTS RELATED TO PLYWOOD, 2014-2024

- FIGURE 32 LEGAL STATUS OF PATENTS FILED RELATED TO PLYWOOD, 2014-2024

- FIGURE 33 MAXIMUM PATENTS FILED IN JURISDICTION OF US, 2014-2024

- FIGURE 34 IMPACT OF AI/GEN AI ON PLYWOOD MARKET

- FIGURE 35 SOFTWOOD SEGMENT TO LEAD PLYWOOD MARKET DURING FORECAST PERIOD

- FIGURE 36 REHABILITATION SEGMENT IS PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 CONSTRUCTION SEGMENT TO LEAD PLYWOOD MARKET DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC EMERGING AS STRATEGIC LOCATION FOR PLYWOOD MARKET

- FIGURE 39 ASIA PACIFIC: PLYWOOD MARKET SNAPSHOT

- FIGURE 40 NORTH AMERICA: PLYWOOD MARKET SNAPSHOT

- FIGURE 41 EUROPE: PLYWOOD MARKET SNAPSHOT

- FIGURE 42 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- FIGURE 43 REVENUE ANALYSIS OF KEY COMPANIES OF PLYWOOD, 2020-2024

- FIGURE 44 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 45 PLYWOOD MARKET: COMPANY FOOTPRINT

- FIGURE 46 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 47 PRODUCT COMPARISON

- FIGURE 48 PLYWOOD MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 49 PLYWOOD MARKET: ENTERPRISE VALUATION (EV) OF KEY PLAYERS

- FIGURE 50 BOISE CASCADE COMPANY: COMPANY SNAPSHOT

- FIGURE 51 WEYERHAEUSER COMPANY: COMPANY SNAPSHOT

- FIGURE 52 UPM: COMPANY SNAPSHOT

- FIGURE 53 POTLATCHDELTIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 GREENPLY INDUSTRIES LIMITED: COMPANY SNAPSHOT

- FIGURE 55 METSA GROUP: COMPANY SNAPSHOT

- FIGURE 56 CENTURYPLY: COMPANY SNAPSHOT

The global plywood market size is projected to reach USD 60.31 billion by 2030 from USD 47.39 billion in 2024, at a CAGR of 4.21%. Plywood is widely used in furniture, packaging, agriculture, building and construction, interiors, roofing, and flooring. It serves a broad range of industries by providing structural support to both the interior and exterior of materials. By enhancing the weatherability and durability of plywood, manufacturers can maintain product quality, lower maintenance costs, and comply with stringent regulations and global standards. The type of plywood used, whether hardwood or softwood, entirely depends on the consumer's intended use. Rapid urbanization worldwide is also driving the growing demand for plywood.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Million Cubic Meter) |

| Segments | Type, Application, Use Type, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

"Hardwood segment accounted for the largest market share in 2024"

The rising demand for high-quality, long-lasting, and visually appealing materials in furniture, cabinets, and interior design has increased the adoption of hardwood in the plywood market. This is primarily due to its strength, refined finish, and attractive patterns. As the global middle class expands, particularly in Asia Pacific, people are seeking premium, customized, and aesthetically pleasing furniture, which increases the need for hardwood. Sustainability is also a key factor. The growing awareness of eco-friendly construction materials and stricter regulations are driving both manufacturers and consumers toward this type of plywood, as it is often certified and proven to be more sustainable.

"Industrial segment is projected to register the fastest growth in the plywood market, in terms of value, during the forecast period."

The industrial segment is projected to be the fastest-growing application in the global plywood market during the forecast period. The growth is largely driven by the increased use of material handling products, transport equipment, and structural uses like wall and roof bracings. However, construction continues to hold the largest share of the plywood market, primarily due to substantial demand for global building and infrastructure projects. Industrial usage is rapidly increasing as industries seek durable, cost-effective, and flexible materials to meet their specialized needs. This growth is bolstered by demand in logistics, manufacturing, and technology, positioning industrial applications as a dynamic and rapidly expanding segment within the global plywood market.

"Europe accounted for the third-largest share of the plywood market, in terms of value, in 2024."

This dominance of Europe in the global plywood market is driven by its established production base, rigorous environmental and safety standards, and dominant presence of major end-use industries like furniture, packaging, and building & construction. The region's regulatory authorities impose stringent standards on product durability and environmental sustainability, leading manufacturers to invest in plywood technologies to guarantee durability and sustainability. The growing emphasis of countries on innovation and R&D, as well as the presence of major global players, further supports the regions' role in driving market trends and product performance.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, and the Rest of the World - 5%

The key players profiled in the report include Georgia-Pacific (US), Boise Cascade Company (US), Weyerhaeuser Company (US), UPM (Finland), SVEZA Group (Russia), Austral Plywoods (Australia), PotlatchDeltic Corporation (US), Greenply Industries Limited (India), Metsa Group (Finland), and CenturyPly (India).

Research Coverage

This report segments the plywood market based on type, application, use type, and region, and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the plywood market.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the plywood market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on plywood offered by top players in the global market.

- Analysis of key drivers (booming furniture industry and the rising demand for plywood in the Asia Pacific due to the growing building & construction industry), restraints (volatile raw material prices and environmental concerns), opportunities (technological advancements in manufacturing and expanding residential and commercial construction), and challenges (raw material constraints to challenge growth) influencing the growth of the plywood market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the plywood market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for plywood across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global plywood market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the plywood market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.3.4 MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.3.5 MARKET DEFINITION AND INCLUSIONS, BY USE TYPE

- 1.3.6 YEARS CONSIDERED

- 1.3.7 CURRENCY CONSIDERED

- 1.3.8 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PLYWOOD MARKET

- 4.2 PLYWOOD MARKET, BY REGION

- 4.3 ASIA PACIFIC PLYWOOD MARKET, BY TYPE AND COUNTRY

- 4.4 PLYWOOD MARKET, BY APPLICATION AND REGION

- 4.5 PLYWOOD MARKET, BY MAJOR COUNTRIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Booming furniture industry

- 5.2.1.2 Rising demand for plywood in Asia Pacific due to growing building & construction industry

- 5.2.1.3 Urbanization and infrastructure development to drive demand

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatile raw material prices

- 5.2.2.2 Environmental concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements in manufacturing

- 5.2.3.2 Expanding residential and commercial construction

- 5.2.4 CHALLENGES

- 5.2.4.1 Raw material constraints to challenge growth

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 PLYWOOD MANUFACTURERS

- 6.1.3 DISTRIBUTORS

- 6.1.4 END-USE INDUSTRIES

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF PLYWOOD OFFERED BY KEY PLAYERS, BY APPLICATION

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 CASE STUDY ANALYSIS

- 6.5.1 GEORGIA-PACIFIC'S GREEN TECH REVOLUTION: MERGING SUSTAINABILITY WITH SMART MANUFACTURING

- 6.5.2 ACHIEVING CIRCULAR ECONOMY IN PLYWOOD MANUFACTURING AT METSA GROUP

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Automated manufacturing & robotics

- 6.6.1.2 Drying technologies

- 6.6.2 COMPLEMENTARY TECHNOLOGIES

- 6.6.2.1 Wood processing & preparation

- 6.6.1 KEY TECHNOLOGIES

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO

- 6.7.2 EXPORT SCENARIO

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 FSC Certification (Forest Stewardship Council)

- 6.8.2.2 EPA TSCA (Toxic Substances Control Act)

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF AI/GEN AI ON PLYWOOD MARKET

- 6.13 IMPACT OF 2025 US TARIFF ON PLYWOOD MARKET

- 6.13.1 INTRODUCTION

- 6.13.2 KEY TARIFF RATES

- 6.13.3 PRICE IMPACT ANALYSIS

- 6.13.4 IMPACT ON COUNTRY/REGION

- 6.13.4.1 US

- 6.13.4.2 Europe

- 6.13.4.3 Asia Pacific

- 6.13.5 IMPACT ON CONSTRUCTION INDUSTRY

- 6.13.6 IMPACT ON INDUSTRIAL INDUSTRY

7 PLYWOOD MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 SOFTWOOD

- 7.2.1 STRUCTURAL APPLICATIONS IN BUILDING SECTOR

- 7.3 HARDWOOD

- 7.3.1 UTILITY FOR HIGH-TRAFFIC APPLICATIONS SUCH AS FLOORING AND FURNITURE

8 PLYWOOD MARKET, BY USE TYPE

- 8.1 INTRODUCTION

- 8.2 NEW CONSTRUCTION

- 8.2.1 ECONOMIC RECOVERY AND INFRASTRUCTURE DEVELOPMENT IN EMERGING ECONOMIES TO DRIVE SEGMENT

- 8.3 REHABILITATION

- 8.3.1 SUSTAINABILITY AND AGING INFRASTRUCTURE TO DRIVE GROWTH

9 PLYWOOD MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 CONSTRUCTION

- 9.2.1 ROOFING

- 9.2.1.1 Major component in construction

- 9.2.2 SUBFLOORING

- 9.2.2.1 Extremely stable wood material

- 9.2.3 WALL SHEATHING

- 9.2.3.1 Provides strength and rigidity

- 9.2.4 FINISH FLOORING

- 9.2.4.1 Provides an advantage over hardwood

- 9.2.5 SLIDING

- 9.2.5.1 Quick and ease of access

- 9.2.6 OTHER CONSTRUCTION APPLICATIONS

- 9.2.6.1 Interior wall coverings

- 9.2.1 ROOFING

- 9.3 INDUSTRIAL

- 9.3.1 MATERIAL HANDLING PRODUCTS

- 9.3.1.1 Optimal material handling solutions

- 9.3.2 TRANSPORT EQUIPMENT

- 9.3.2.1 Resistant to cracking, breaking, shrinkage, twisting, and warping

- 9.3.3 OTHER INDUSTRIAL APPLICATIONS

- 9.3.3.1 Additional strength and protection

- 9.3.1 MATERIAL HANDLING PRODUCTS

10 PLYWOOD MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Massive construction, infrastructure investments, and ongoing industry innovation to boost demand

- 10.2.2 JAPAN

- 10.2.2.1 Sustainable construction, advanced manufacturing, and focus on quality and resilience to drive demand for wood products

- 10.2.3 SOUTH KOREA

- 10.2.3.1 Focus on cost efficiency and steady construction demand to drive market

- 10.2.4 INDIA

- 10.2.4.1 Availability of resources, rapid economic growth, increasing disposable income, and urbanization to drive market

- 10.2.5 INDONESIA

- 10.2.5.1 Export-oriented growth leveraging abundant timber resources and cost advantages to drive market

- 10.2.6 MALAYSIA

- 10.2.6.1 Manufacture of high-durability and superior-quality wood-based panels to drive market

- 10.2.7 THAILAND

- 10.2.7.1 Premiumization and furniture manufacturing to drive growth

- 10.2.8 VIETNAM

- 10.2.8.1 Fastest-growing hub for plywood exports and furniture manufacturing to drive market

- 10.2.9 PHILIPPINES

- 10.2.9.1 Booming construction and urbanization to support market growth

- 10.2.10 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Growing packaging and furniture industries to drive market

- 10.3.2 CANADA

- 10.3.2.1 State-of-the-art manufacturing facilities to provide growth opportunities

- 10.3.3 MEXICO

- 10.3.3.1 Favorable trade agreements to attract key market players

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Presence of major distribution channels to increase demand

- 10.4.2 UK

- 10.4.2.1 Substantial growth amid major geopolitical conflicts

- 10.4.3 FRANCE

- 10.4.3.1 Government initiatives and growing industrial usage to drive market

- 10.4.4 RUSSIA

- 10.4.4.1 Investments by government to modernize infrastructure to boost market

- 10.4.5 SPAIN

- 10.4.5.1 Investments and government approach toward sustainability to drive market

- 10.4.6 ITALY

- 10.4.6.1 High disposable income and shifting trend toward wooden furniture to drive market

- 10.4.7 TURKEY

- 10.4.7.1 Growing furniture and construction industries increasing demand for plywood to boost market

- 10.4.8 FINLAND

- 10.4.8.1 Sustainable forestry and strategic production growth to drive market

- 10.4.9 NETHERLANDS

- 10.4.9.1 Adapting to supply chain disruptions and illegal imports amidst European sanctions to drive market

- 10.4.10 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Production capacity expansions and established distribution channels to propel market

- 10.5.2 ARGENTINA

- 10.5.2.1 Government initiatives to boost demand

- 10.5.3 CHILE

- 10.5.3.1 Steady growth and sustainability to drive market

- 10.5.4 REST OF SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 UAE

- 10.6.1.1 Growth of various manufacturing industries to drive market

- 10.6.2 SAUDI ARABIA

- 10.6.2.1 Large number of existing and new construction projects to boost demand

- 10.6.3 IRAN

- 10.6.3.1 Government investments and economic growth to drive wood products industry

- 10.6.4 REST OF MIDDLE EAST & AFRICA

- 10.6.1 UAE

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 Application footprint

- 11.5.5.5 Use type footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMES

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 PRODUCT COMPARISON ANALYSIS

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 GEORGIA-PACIFIC

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Other development

- 12.1.1.4 MnM View

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 BOISE CASCADE COMPANY

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 WEYERHAEUSER COMPANY

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 UPM

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Key strengths

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 SVEZA GROUP

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM View

- 12.1.5.3.1 Key strengths

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 AUSTRAL PLYWOODS

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.7 POTLATCHDELTIC CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.8 GREENPLY INDUSTRIES LIMITED

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Expansions

- 12.1.9 METSA GROUP

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 CENTURYPLY

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.1 GEORGIA-PACIFIC

- 12.2 SMES/STARTUPS

- 12.2.1 AUSTIN PLYWOOD

- 12.2.2 LATVIJAS FINIERIS AS

- 12.2.3 KITPLY INDUSTRIES LIMITED

- 12.2.4 KAJARIA PLYWOOD PVT. LTD.

- 12.2.5 MERINO INDUSTRIES LIMITED

- 12.2.6 GLOBE PANEL INDUSTRIES (I) PVT. LTD.

- 12.2.7 DUROPLY INDUSTRIES LIMITED

- 12.2.8 UNIPLY LTD.

- 12.2.9 UFP INDUSTRIES, INC.

- 12.2.10 MURPHY

- 12.2.11 WEST FRASER

- 12.2.12 ROYOMARTIN

- 12.2.13 FORMWOOD INDUSTRIES

- 12.2.14 ARCHELA CONTRACHAPADOS, S.L.

- 12.2.15 MIRALUZ

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS