|

|

市場調査レポート

商品コード

1752092

無水フッ化水素酸(AHF)の世界市場:グレード別、タイプ別、流通チャネル別、用途別、最終用途産業別 - 予測(~2030年)Anhydrous Hydrofluoric Acid Market by Grade, Type, Distribution Channel, Application, End-use Industry - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 無水フッ化水素酸(AHF)の世界市場:グレード別、タイプ別、流通チャネル別、用途別、最終用途産業別 - 予測(~2030年) |

|

出版日: 2025年06月10日

発行: MarketsandMarkets

ページ情報: 英文 274 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の無水フッ化水素酸(AHF)の市場規模は、2025年の69億米ドルから2030年までに84億4,000万米ドルに達すると予測され、予測期間にCAGRで4.0%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル/10億米ドル |

| セグメント | タイプ、グレード、流通チャネル、用途、最終用途産業、地域 |

| 対象地域 | 北米、アジア太平洋、欧州、中東・アフリカ、南米 |

需要の主な促進要因は、冷蔵、空調、電子などの産業で使用されるフッ素化学品へのニーズの増加です。AHFは、こうしたエネルギー効率の高い製品に使用されるフルオロカーボンやフルオロポリマーの重要な前駆体として機能し、効率化を求める世界の動向に後押しされています。ノードサイズの継続的な縮小(と3Dアーキテクチャの統合)は、半導体製造における高純度AHFの使用も増加させています。これは、特にアジア太平洋のハイテク用途で使用される、エッチングと洗浄のプロセスにとって重要であるためです。また、建設用途や自動車用途向けに大規模なアルミニウム生産が必要とされるため、インフラプロジェクトがアルミニウム製錬用途を刺激する可能性が高く、AHFの需要は持続するとみられます。

「フルオロケイ酸タイプは、金額ベースでAHF市場でもっとも急成長しているタイプです。」

フルオロケイ酸タイプは、AHF生産に用いる持続可能で安価な原料としてその使用が増加しているため、市場のもっとも高成長しているセグメントとなっています。フルオロケイ酸はリン酸肥料産業の非常に実用的な副産物であり、コストと環境にやさしい処分の面で有利なため、蛍石よりも伝統的でない手段として着実に利用が拡大しています。熱分解や硫酸処理を用いたフルオロケイ酸のAHFへの直接・間接処理は、電子、医薬品、石油精製産業における高純度AHFの需要の増加に対応する手段として、ますます実行可能性が高まっています。この予測される成長は主に、化学、環境規制、持続可能性への取り組みに対応した、環境にやさしいさまざまなフルオロケイ酸廃棄物の処分を可能にする必要性によってもたらされます。フルオロケイ酸由来のAHFは、半導体産業の電子製造において、ウエハーのエッチングや洗浄に欠かせない材料です。AHFを前駆体として必要とする製薬産業で使用されるフッ素化合物の合成の増加も、このセグメントの拡大に寄与しています。フルオロケイ酸由来のAHFを精製する電気透析のような、フルオロケイ酸由来のAHFから商業規模のAHFへの革新的な生産プロセスの開発は、従来使用されてきたAHFよりも高価で低濃度であるという制約があるにもかかわらず、生産効率を向上させるため、進行しています。

「標準グレードは、AHF市場の中で金額ベースでもっとも急成長しているグレードセグメントです。」

無水フッ化水素酸(AHF)市場のグレードセグメントでは、標準グレードがもっとも急成長していることが明らかになっています。AHFはその手頃な価格と幅広い用途のために複数の産業にわたって使用されており、直接の形で、または誘導体化された製品として使用されます。通常、標準グレードのAHFを選択することは、石油精製、化学と金属加工用途など、ほとんどの産業で十分すぎるほどであり、超高純度グレードのAHFが必須ではない中程度の純度を意味します。石油精製に用いる高オクタン価ガソリンにアップグレードするためのアルキル化プロセスでAHFが必要とされ、特にアジア太平洋など産業活動が活発化している地域では、世界中で標準AHFグレードの需要が大幅に増加しています。

当レポートでは、世界の無水フッ化水素酸(AHF)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 無水フッ化水素酸(AHF)市場の企業にとって魅力的な機会

- 無水フッ化水素酸(AHF)市場:グレード別

- 無水フッ化水素酸(AHF)市場:タイプ別

- 無水フッ化水素酸(AHF)市場:流通チャネル別

- 無水フッ化水素酸(AHF)市場:用途別

- 無水フッ化水素酸(AHF)市場:最終用途産業別

- 無水フッ化水素酸(AHF)市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 無水フッ化水素酸(AHF)市場に対する生成AIの影響

- イントロダクション

- 生成AIの影響

第6章 産業動向

- イントロダクション

- 顧客ビジネスに影響を与える動向/混乱

- サプライチェーン分析

- 原材料サプライヤー

- メーカー

- 販売業者

- エンドユーザー

- 2025年の米国関税の影響 - 無水フッ化水素酸(AHF)市場

- イントロダクション

- 主な関税率

- 価格の影響の分析

- さまざまな地域への重要な影響

- 最終用途産業に対する影響

- 価格分析

- 平均販売価格の動向:地域別(2021年~2025年)

- 無水フッ化水素酸(AHF)の平均販売価格の動向:グレード別(2021年~2025年)

- 各製品グレードの平均販売価格の動向、主要企業(2021年~2025年)

- 投資と資金調達のシナリオ

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 調査手法

- 特許取得数(2015年~2024年)

- 特許公報の動向

- 考察

- 特許の法的地位

- 管轄分析

- 主な出願者

- 主要特許のリスト

- 貿易分析

- 輸出シナリオ(HSコード281111)

- 輸入シナリオ(HSコード281111)

- 主な会議とイベント(2025年~2026年)

- 関税と規制情勢

- 関税(2023年)

- 規制機関、政府機関、その他の組織

- 無水フッ化水素酸(AHF)市場に関する規制

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済の見通し

- ケーススタディ分析

第7章 無水フッ化水素酸(AHF)市場:用途別

- イントロダクション

- エッチング剤・洗浄剤

- pH調整剤

- 発煙剤

- 材料加工・表面処理

- 化学反応中間体

第8章 無水フッ化水素酸(AHF)市場:タイプ別

- イントロダクション

- 蛍石由来

- フルオロケイ酸由来

第9章 無水フッ化水素酸(AHF)市場:流通チャネル別

- イントロダクション

- 直接販売

- オンライン小売業者

第10章 無水フッ化水素酸(AHF)市場:グレード別

- イントロダクション

- 高純度グレード

- 標準グレード

第11章 無水フッ化水素酸(AHF)市場:最終用途産業別

- イントロダクション

- フルオロカーボン

- 触媒

- 半導体・電子

- 核

- 製薬

- 化学・石油化学

- その他の最終用途産業

- 実験用試薬

- 農薬

第12章 無水フッ化水素酸(AHF)市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- その他の欧州

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- 南米

- アルゼンチン

- ブラジル

- その他の南米

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2020年1月~2025年1月)

- 市場シェア分析(2024年)

- 収益分析(2020年~2025年)

- ブランドの比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- HONEYWELL INTERNATIONAL INC.

- SOLVAY

- LANXESS

- ORBIA FLUOR & ENERGY MATERIALS

- ZHEJIANG YONGHE REFRIGERANT CO., LTD.

- SRF LIMITED

- GULF FLUOR

- BASF

- NAVIN FLUORINE INTERNATIONAL LIMITED

- STELLA CHEMIFA CORPORATION

- ARKEMA

- DONGYUE GROUP LTD.

- その他の企業

- HALOPOLYMER

- SINOCHEM LANTIAN CO., LTD.

- FUJIAN YONGJING TECHNOLOGY CO., LTD.

- LIAONING EAST SHINE CHEMICAL TECHNOLOGY CO., LTD.

- LUOYANG FENGRUI FLUORINE INDUSTRY CO., LTD.

- ZHEJIANG SANMEI CHEMICAL INDUSTRY CO., LTD.

- FORMOSA DAIKIN ADVANCED CHEMICALS CO., LTD.

- TANFAC INDUSTRIES LTD

- DERIVADOS DEL FLUOR SAU

- ULBA METALLURGICAL PLANT JSC

- FUBAO GROUP

- FOOSUNG CO., LTD.

- MORITA CHEMICAL INDUSTRIES CO., LTD.

第15章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF ANHYDROUS HYDROFLUORIC ACID, BY REGION, 2021-2024 (USD/KILOTON)

- TABLE 2 AVERAGE SELLING PRICE TREND OF ANHYDROUS HYDROFLUORIC ACID, BY GRADE, 2021-2025 (USD/KILOTON)

- TABLE 3 AVERAGE SELLING PRICE TREND OF PRODUCT GRADES, BY KEY PLAYER, 2021-2025 (USD/KILOTON)

- TABLE 4 ANHYDROUS HYDROFLUORIC ACID MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 5 KEY TECHNOLOGIES IN ANHYDROUS HYDROFLUORIC ACID

- TABLE 6 COMPLEMENTARY TECHNOLOGIES IN ANHYDROUS HYDROFLUORIC ACID

- TABLE 7 ADJACENT TECHNOLOGIES IN ANHYDROUS HYDROFLUORIC ACID

- TABLE 8 ANHYDROUS HYDROFLUORIC ACID MARKET: TOTAL NUMBER OF PATENTS

- TABLE 9 ANHYDROUS HYDROFLUORIC ACID: LIST OF MAJOR PATENT OWNERS, 2015-2024

- TABLE 10 ANHYDROUS HYDROFLUORIC ACID: LIST OF MAJOR PATENTS, 2014-2025

- TABLE 11 EXPORT DATA OF HS CODE 281111-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 12 IMPORT DATA OF HS CODE 281111-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 13 ANHYDROUS HYDROFLUORIC ACID MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 TARIFFS RELATED TO ANHYDROUS HYDROFLUORIC ACID MARKET, 2023

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REGULATIONS FOR PLAYERS IN ANHYDROUS HYDROFLUORIC ACID MARKET

- TABLE 21 ANHYDROUS HYDROGEN FLUORIDE MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 24 GDP TRENDS AND FORECASTS, BY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 25 ANHYDROUS HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 26 ANHYDROUS HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025- 2030 (USD MILLION)

- TABLE 27 ANHYDROUS HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 28 ANHYDROUS HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 29 ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 30 ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 31 ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 32 ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 33 ANHYDROUS HYDROFLUORIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2021-2024 (USD MILLION)

- TABLE 34 ANHYDROUS HYDROFLUORIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 35 ANHYDROUS HYDROFLUORIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2021-2024 (KILOTON)

- TABLE 36 ANHYDROUS HYDROFLUORIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (KILOTON)

- TABLE 37 ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 38 ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 39 ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 40 ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 41 ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 42 ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 43 ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 44 ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 45 ANHYDROUS HYDROFLUORIC ACID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 ANHYDROUS HYDROFLUORIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 ANHYDROUS HYDROFLUORIC ACID MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 48 ANHYDROUS HYDROFLUORIC ACID MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 49 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 52 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 53 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 54 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 55 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 56 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 57 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, GRADE, 2021-2024 (USD MILLION)

- TABLE 58 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 59 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, GRADE, 2021-2024 (KILOTON)

- TABLE 60 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 61 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 62 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 63 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 64 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 65 CHINA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 66 CHINA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 67 CHINA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 68 CHINA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 69 JAPAN: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 70 JAPAN: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 71 JAPAN: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 72 JAPAN: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 73 INDIA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 74 INDIA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 75 INDIA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 76 INDIA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 77 SOUTH KOREA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 78 SOUTH KOREA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 79 SOUTH KOREA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 80 SOUTH KOREA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 81 REST OF ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 82 REST OF ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 83 REST OF ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 84 REST OF ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 85 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 86 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 88 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 89 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 90 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 92 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 93 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 94 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 96 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 97 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 100 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 101 US: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 102 US: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 103 US: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 104 US: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 105 CANADA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 106 CANADA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 107 CANADA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 108 CANADA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 109 MEXICO: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 110 MEXICO: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 111 MEXICO: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 112 MEXICO: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 113 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 116 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 117 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 118 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 120 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 121 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, GRADE, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, GRADE, 2021-2024 (KILOTON)

- TABLE 124 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 125 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 126 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 128 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 129 GERMANY: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 130 GERMANY: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 131 GERMANY: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 132 GERMANY: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 133 ITALY: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 134 ITALY: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 ITALY: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 136 ITALY: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 137 FRANCE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 138 FRANCE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 FRANCE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 140 FRANCE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 141 UK: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 142 UK: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 UK: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 144 UK: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 145 SPAIN: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 146 SPAIN: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 147 SPAIN: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 148 SPAIN: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 149 REST OF EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 150 REST OF EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 REST OF EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 152 REST OF EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 153 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 156 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 157 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 160 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 161 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, GRADE, 2021-2024 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, GRADE, 2021-2024 (KILOTON)

- TABLE 164 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 165 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 168 MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 169 SAUDI ARABIA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 170 SAUDI ARABIA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 171 SAUDI ARABIA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 172 SAUDI ARABIA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 173 UAE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 174 UAE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 175 UAE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 176 UAE: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 177 REST OF GCC COUNTRIES: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 178 REST OF GCC COUNTRIES: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 179 REST OF GCC COUNTRIES: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 180 REST OF GCC COUNTRIES: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 181 SOUTH AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 182 SOUTH AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 183 SOUTH AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 184 SOUTH AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 188 REST OF MIDDLE EAST & AFRICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 189 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 190 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 191 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 192 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 193 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 194 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 195 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 196 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 197 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, GRADE, 2021-2024 (USD MILLION)

- TABLE 198 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 199 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, GRADE, 2021-2024 (KILOTON)

- TABLE 200 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 201 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 202 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 203 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 204 SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 205 ARGENTINA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 206 ARGENTINA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 207 ARGENTINA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 208 ARGENTINA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 209 BRAZIL: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 210 BRAZIL: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 211 BRAZIL: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 212 BRAZIL: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 213 REST OF SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 215 REST OF SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 216 REST OF SOUTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 217 OVERVIEW OF STRATEGIES ADOPTED BY KEY ANHYDROUS HYDROFLUORIC ACID MANUFACTURERS

- TABLE 218 ANHYDROUS HYDROFLUORIC ACID MARKET: DEGREE OF COMPETITION

- TABLE 219 ANHYDROUS HYDROFLUORIC ACID MARKET: REGION FOOTPRINT

- TABLE 220 ANHYDROUS HYDROFLUORIC ACID MARKET: GRADE FOOTPRINT

- TABLE 221 ANHYDROUS HYDROFLUORIC ACID MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 222 ANHYDROUS HYDROFLUORIC ACID MARKET: KEY STARTUPS/SMES, 2024

- TABLE 223 ANHYDROUS HYDROFLUORIC ACID MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 224 ANHYDROUS HYDROFLUORIC ACID MARKET: DEALS, JANUARY 2020- JANUARY 2025

- TABLE 225 ANHYDROUS HYDROFLUORIC ACID MARKET: EXPANSIONS, JANUARY 2020- JANUARY 2025

- TABLE 226 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 227 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 HONEYWELL INTERNATIONAL INC.: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 229 SOLVAY: COMPANY OVERVIEW

- TABLE 230 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 SOLVAY: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 232 LANXESS: COMPANY OVERVIEW

- TABLE 233 LANXESS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 ORBIA FLUOR & ENERGY MATERIALS: COMPANY OVERVIEW

- TABLE 235 ORBIA FLUOR & ENERGY MATERIALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 ORBIA FLUOR & ENERGY MATERIALS: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 237 ZHEJIANG YONGHE REFRIGERANT CO., LTD.: COMPANY OVERVIEW

- TABLE 238 ZHEJIANG YONGHE REFRIGERANT CO., LTD.: PRODUCT/SOLUTIONS/ SERVICES OFFERED

- TABLE 239 SRF LIMITED: COMPANY OVERVIEW

- TABLE 240 SRF LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 GULF FLUOR: COMPANY OVERVIEW

- TABLE 242 GULF FLUOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 BASF: COMPANY OVERVIEW

- TABLE 244 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 NAVIN FLUORINE INTERNATIONAL LIMITED.: COMPANY OVERVIEW

- TABLE 246 NAVIN FLUORINE INTERNATIONAL LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 247 NAVIN FLUORINE INTERNATIONAL LIMITED: OTHER DEVELOPMENTS, JANUARY 2020-JANUARY 2025

- TABLE 248 STELLA CHEMIFA CORPORATION: COMPANY OVERVIEW

- TABLE 249 STELLA CHEMIFA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 ARKEMA: COMPANY OVERVIEW

- TABLE 251 ARKEMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 ARKEMA: OTHER DEVELOPMENTS, JANUARY 2020-JANUARY 2025

- TABLE 253 DONGYUE GROUP LIMITED: COMPANY OVERVIEW

- TABLE 254 DONGYUE GROUP LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 HALOPOLYMER: COMPANY OVERVIEW

- TABLE 256 SINOCHEM LANTIAN CO., LTD.: COMPANY OVERVIEW

- TABLE 257 FUJIAN YONGJING TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 258 LIAONING EAST SHINE CHEMICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 259 LUOYANG FENGRUI FLUORINE INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 260 ZHEJIANG SANMEI CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 261 FORMOSA DAIKIN ADVANCED CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 262 TANFAC INDUSTRIES LTD: COMPANY OVERVIEW

- TABLE 263 DERIVADOS DEL FLUOR SAU: COMPANY OVERVIEW

- TABLE 264 ULBA METALLURGICAL PLANT JSC: COMPANY OVERVIEW

- TABLE 265 FUBAO GROUP: COMPANY OVERVIEW

- TABLE 266 FOOSUNG CO., LTD.: COMPANY OVERVIEW

- TABLE 267 MORITA CHEMICAL INDUSTRIES CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ANHYDROUS HYDROFLUORIC ACID MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 ANHYDROUS HYDROFLUORIC ACID MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS, 2024

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 ANHYDROUS HYDROFLUORIC ACID MARKET: DATA TRIANGULATION

- FIGURE 9 HIGH-PURITY GRADE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 FLUORITE-BASED SEGMENT TO BE LARGER TYPE DURING FORECAST PERIOD

- FIGURE 11 DIRECT SALES TO BE LARGER DISTRIBUTION CHANNEL DURING FORECAST PERIOD

- FIGURE 12 INTERMEDIATE IN CHEMICAL REACTION TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- FIGURE 13 CATALYST TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 GROWING USE OF ANHYDROUS HYDROFLUORIC ACID IN SEMICONDUCTOR & ELECTRONICS INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 16 HIGH-PURITY GRADE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 17 FLUORITE-BASED SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 18 DIRECT SALES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 19 ETCHING & CLEANING AGENTS APPLICATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 NUCLEAR SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 SOUTH KOREA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 22 ANHYDROUS HYDROFLUORIC ACID MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 USE OF GENERATIVE AI IN ANHYDROUS HYDROFLUORIC ACID MARKET

- FIGURE 24 ANHYDROUS HYDROFLUORIC ACID MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 ANHYDROUS HYDROGEN FLUORIDE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE TREND OF ANHYDROUS HYDROFLUORIC ACID, BY REGION, 2021-2025 (USD/KILOTON)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF PRODUCT GRADE, BY KEY PLAYER, 2021-2025

- FIGURE 28 ANHYDROUS HYDROFLUORIC ACID: INVESTMENT AND FUNDING SCENARIO

- FIGURE 29 ANHYDROUS HYDROFLUORIC ACID: ECOSYSTEM ANALYSIS

- FIGURE 30 NUMBER OF PATENTS GRANTED (2015-2024)

- FIGURE 31 ANHYDROUS HYDROFLUORIC ACID: LEGAL STATUS OF PATENTS

- FIGURE 32 PATENT ANALYSIS FOR ANHYDROUS HYDROFLUORIC ACID, BY JURISDICTION, 2015-2024

- FIGURE 33 TOP 7 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS 2015-2024

- FIGURE 34 EXPORT DATA OF HS CODE 281111-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 35 IMPORT DATA OF HS CODE 281111-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 36 ANHYDROUS HYDROGEN FLUORIDE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 38 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 39 INTERMEDIATE IN CHEMICAL REACTIONS APPLICATION TO DOMINATE ANHYDROUS HYDROFLUORIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 40 FLUORITE-BASED TO BE LARGER TYPE IN ANHYDROUS HYDROFLUORIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 41 DIRECT SALES TO BE LARGER DISTRIBUTION CHANNEL IN ANHYDROUS HYDROFLUORIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 42 HIGH-PURITY TO BE LARGER GRADE SEGMENT OF ANHYDROUS HYDROFLUORIC ACID MARKET IN 2025

- FIGURE 43 CATALYST SEGMENT TO LEAD ANHYDROUS HYDROFLUORIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC: ANHYDROUS HYDROFLUORIC ACID MARKET SNAPSHOT

- FIGURE 46 NORTH AMERICA: ANHYDROUS HYDROFLUORIC ACID MARKET SNAPSHOT

- FIGURE 47 EUROPE: ANHYDROUS HYDROFLUORIC ACID MARKET SNAPSHOT

- FIGURE 48 ANHYDROUS HYDROFLUORIC ACID MARKET: SHARE OF KEY PLAYERS (2025)

- FIGURE 49 EV/EBITDA OF KEY VENDORS, 2024

- FIGURE 50 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN, 2024

- FIGURE 51 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2025

- FIGURE 52 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY SEGMENT

- FIGURE 53 ANHYDROUS HYDROFLUORIC ACID MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 ANHYDROUS HYDROFLUORIC ACID MARKET: COMPANY FOOTPRINT

- FIGURE 55 ANHYDROUS HYDROFLUORIC ACID MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 56 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 57 SOLVAY: COMPANY SNAPSHOT

- FIGURE 58 LANXESS: COMPANY SNAPSHOT

- FIGURE 59 ORBIA FLOUR & ENERGY MATERIALS: COMPANY SNAPSHOT

- FIGURE 60 ZHEJIANG YONGHE REFRIGERANT CO., LTD.: COMPANY SNAPSHOT

- FIGURE 61 SRF LIMITED: COMPANY SNAPSHOT

- FIGURE 62 BASF: COMPANY SNAPSHOT

- FIGURE 63 NAVIN FLUORINE INTERNATIONAL LIMITED: COMPANY SNAPSHOT

- FIGURE 64 STELLA CHEMIFA CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 ARKEMA: COMPANY SNAPSHOT

- FIGURE 66 DONGYUE GROUP LIMITED: COMPANY SNAPSHOT

The anhydrous hydrofluoric acid (AHF) market size is projected to grow from USD 6.9 billion in 2025 to USD 8.44 billion by 2030, registering a CAGR of 4.0% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Type, Grade, Distribution Channel, Application, End-use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

The main driver of demand is the increasing need for fluorinated chemicals, which are used in industries such as refrigeration, air conditioning, and electronics. AHF acts as a critical precursor to fluorocarbons and fluoropolymers for these energy-efficient products and is driven by the global trend toward efficiency. The continual decrease in node size (and integration of 3D architecture) is also increasing the use of high-purity AHF in semiconductor manufacturing, as it is significant for the etching and cleaning processes used in high-tech applications, particularly in the Asia Pacific. The demand for AHF will also be sustained, with infrastructure projects likely stimulating aluminum smelting applications as large-scale aluminum production is needed for construction and automotive purposes.

" Fluorosilicic acid type accounted for the fastest growing type segment of the AHF market in terms of value."

The fluorosilicic acid type has been the highest growing segment of the market because of its increasing use as a sustainable and affordable raw material for the production of AHF. Fluorosilicic acid is a very viable by-product of the phosphate fertilizer industry, and it is steadily gaining use as a less traditional means than fluorspar because of advantages in terms of cost and environmental disposal. The direct and indirect processing of fluorosilicic acid into AHF using thermal decomposition or treatment with sulfuric acid is an increasingly viable means to meet the increased demand for high-purity AHF in the electronics, pharmaceuticals, and petroleum refining industries. This predicted growth is primarily driven by the need to enable the environmentally friendly disposal of various fluorosilicic acid wastes, which meet chemical, environmental regulations and sustainability initiatives. Fluorosilicic acid derived AHF is a critical silicone wafer etching and cleaning material in the semiconductor industry in electronic manufacturing. The increasing synthesis of fluorinated compounds used in the pharmaceutical industry that require AHF as a precursor, is an additional contributor to the expansion of this segment. The development of innovative production processes for commercial scale AHF from fluorosilicic acid-derived AHF, such as electrodialysis for purification of fluorosilicic acid-derived AHF, is ongoing as they allow for better efficiencies in production despite the limitations of being more expensive and lower concentrations than the conventionally used AHF.

"Standard grade to be the fastest-growing grade segment of the AHF market in terms of value."

The standard grade segment has proved to be the fastest-growing segment in the grade segment of the anhydrous hydrofluoric acid (AHF) market. AHF is used across several industries due to its affordability and wide range of applications, all factor into its use either in the direct form or as a derivatized product. Choosing standard grade AHF typically means moderate purities that are more than sufficient for most industries and where ultra-high purity grade AHF is not essential, including petroleum refining, chemical and metal processing applications, and more. Demands for the standard AHF grade across the world have significantly increased as AHF is required in the alkylation process to upgrade to high-octane gasoline for petroleum refining and in regions where there is increasing industrial activity, notably the Asia Pacific.

"Fuming agents accounted for the fastest-growing in application segment of the AHF market in terms of value."

The application of fuming agents is the fastest-growing application segment of the AHF market, and this segment is thriving because it is critically important for specialized industrial processes that require high reactivity. AHF and its subsequent fuming agents possess significant chemical properties, and therefore, their application is becoming increasingly important in numerous industries, such as chemical synthesis, petroleum refining, and specialty materials that constantly evolve, demand, and need AHF's chemical properties to react with compounds to develop new businesses. In the petroleum refinery, AHF can be placed in the unit to develop high-octane gasoline in alkylation units to meet the increase in demand for higher-efficiency fuel supply; however, in regions such as the Asia Pacific, we are seeing rapid growth in demand. The chemical industry provides another area for growth or expansion for fuming agents and compounds to assist in the production of fluorinated compounds, which also include agrochemicals and specialty chemicals that can benefit the agriculture and manufacturing sectors. Furthermore, in the electronics industry, for electronic parts, there is a need for AHF fuming agents for surface treatment and etching processes. AHF fuming agents are used as the industry sees rapid growth in producing high-performing components and circuit boards. In addition to the traditional AHF fuming chemical properties being utilized, the segment also offers opportunities in new or emerging segments like developing advanced materials for renewable energy technologies, such as solar panels, batteries, etc., where advanced or optimizing AHF fuming and/or chemical properties/products will quicken the overall manufacturing process.

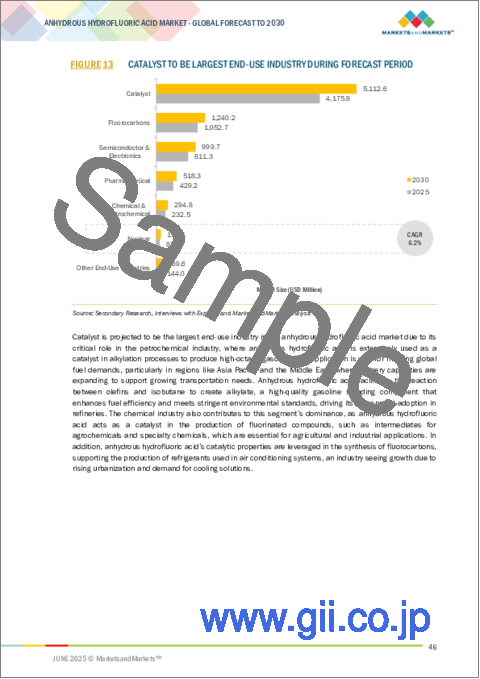

"Fluorocarbons was the fastest-growing end-use industry segment of the anhydrous hydrofluoric acid market in terms of value."

The fluorocarbon end-use segment has been the fastest-growing segment of the anhydrous hydrofluoric acid (AHF) market as it plays a vital role in producing critical fluorocarbon compounds for many end users. Fluorocarbons (fluorinated hydrocarbons), including refrigerants, propellants, and specialty gases, use AHF as a significant precursor in one or more of their synthesis processes, which creates demand in several end-use industries, including refrigeration, air conditioning, and chemical manufacturing. In emerging economies, increased urbanization and warmer climates are driving heightened global demand for energy-efficient cooling systems, which leads to the increased demand for fluorocarbon-based refrigerants. The demand for fluorocarbon-based refrigerants has also increased in the automotive and construction industries as fluorocarbons are used in air conditioning systems and insulation materials, respectively. The growth in demand for AHF across each of these segments is further enhanced through the associated infrastructure developments taking place and the desire for consumer comfort. An additional aspect of growth lies in the development and transition toward new environmentally-friendly fluorocarbons, such as hydrofluoroolefins (HFOs), which are now happening globally to meet stricter regulations phasing out high-global-warming-potential compounds. Many of these changes represent opportunities that AHF can now contribute to developing next-generation refrigerants. Fluorocarbons also are sustainable as valuable material inputs in the electronics industry to be used in the plasma etching process (a method used in semiconductor manufacturing), where the overall demand for electronic devices shows no signs of slowing down as demand for devices continues to rise. There are additional contributions for growth in the fluorocarbon end-use segment, such as new production processing efficiencies, plus other innovative processes that reduce environmental impacts with respect to the associated lifecycle.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the AHF market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 15%, Asia Pacific - 67%, Europe - 10%, Middle East & Africa - 5%, South America - 3%

The AHF market comprises major players such as Honeywell International Inc. (US), Solvay (Belgium), LANXESS (Germany), Orbia Flour & Energy Materials (Mexico), Zhejiang Yonghe Refrigerant Co.,Ltd. (China), Stella Chemifa Corporation (Japan), Donguye Group Ltd. (China), SRF Limited (India), Gulf Flour (UAE), BASF (Germany), Navin Flourine International Limited (India), and Arkema (France). The study includes in-depth competitive analysis of these key players in the AHF market, along with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for AHF on the basis of type, form, application, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the market for AHF.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the AHF market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of drivers: (Growing demand for fluorinated chemicals), restraints (Highly corrosive nature of AHF is a key operational barrier causing the increased infrastructure and safety cost), opportunities (Growing investments in clean energy solutions (e.g., Lithium-ion Batteries), and challenges (Dependency on high-quality fluorspar in the production of AHF).

- Market Penetration: Comprehensive information on the products offered by top players in the global AHF market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, product launches, expansions, and partnerships in the AHF market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for AHF across regions.

- Market Capacity: Production capacities of companies producing AHF are provided wherever available with upcoming capacities.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the AHF market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants in primary interviews

- 2.1.2.4 Breakdown of primary interviews

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 GROWTH FORECAST

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ANHYDROUS HYDROFLUORIC ACID MARKET

- 4.2 ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE

- 4.3 ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE

- 4.4 ANHYDROUS HYDROFLUORIC ACID MARKET, BY DISTRIBUTION CHANNEL

- 4.5 ANHYDROUS HYDROFLUORIC ACID MARKET, BY APPLICATION

- 4.6 ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY

- 4.7 ANHYDROUS HYDROFLUORIC ACID MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for fluorinated chemicals

- 5.2.1.2 Rising demand for high-purity anhydrous hydrofluoric acid amid 3D architecture shift

- 5.2.1.3 Large-scale infrastructure projects across major economies bolster demand in aluminum smelting

- 5.2.2 RESTRAINTS

- 5.2.2.1 High toxicity and handling risks with chemicals

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in fluoropolymer industry

- 5.2.3.2 Growing investments in clean energy solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Dependency on high-quality fluorspar in production of anhydrous hydrofluoric acid

- 5.2.4.2 Regulatory delays and permitting challenges in anhydrous hydrofluoric acid production process

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI ON ANHYDROUS HYDROFLUORIC ACID MARKET

- 5.3.1 INTRODUCTION

- 5.3.2 IMPACT OF GENERATIVE AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL SUPPLIERS

- 6.3.2 MANUFACTURERS

- 6.3.3 DISTRIBUTORS

- 6.3.4 END USERS

- 6.4 IMPACT OF 2025 US TARIFFS-ANHYDROUS HYDROFLUORIC ACID MARKET

- 6.4.1 INTRODUCTION

- 6.4.2 KEY TARIFF RATES

- 6.4.3 PRICE IMPACT ANALYSIS

- 6.4.4 KEY IMPACT ON VARIOUS REGIONS

- 6.4.4.1 US

- 6.4.4.2 Europe

- 6.4.4.3 Asia Pacific

- 6.4.5 END-USE INDUSTRY IMPACT

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2025

- 6.5.2 AVERAGE SELLING PRICE TREND OF ANHYDROUS HYDROFLUORIC ACID, BY GRADE, 2021-2025

- 6.5.3 AVERAGE SELLING PRICE TREND OF PRODUCT GRADES, KEY PLAYER, 2021-2025

- 6.6 INVESTMENT AND FUNDING SCENARIO

- 6.7 ECOSYSTEM ANALYSIS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.3 ADJACENT TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 PATENTS GRANTED, 2015-2024

- 6.9.3 PATENT PUBLICATION TRENDS

- 6.9.4 INSIGHTS

- 6.9.5 LEGAL STATUS OF PATENTS

- 6.9.6 JURISDICTION ANALYSIS

- 6.9.7 TOP APPLICANTS

- 6.9.8 LIST OF MAJOR PATENTS

- 6.10 TRADE ANALYSIS

- 6.10.1 EXPORT SCENARIO (HS CODE 281111)

- 6.10.2 IMPORT SCENARIO (HS CODE 281111)

- 6.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 TARIFFS, 2023

- 6.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.3 REGULATIONS RELATED TO ANHYDROUS HYDROFLUORIC ACID MARKET

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 THREAT OF NEW ENTRANTS

- 6.13.2 THREAT OF SUBSTITUTES

- 6.13.3 BARGAINING POWER OF SUPPLIERS

- 6.13.4 BARGAINING POWER OF BUYERS

- 6.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 MACROECONOMIC OUTLOOK

- 6.15.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.16 CASE STUDY ANALYSIS

- 6.16.1 ARKEMA AND NUTRIEN BUILD ANHYDROUS HYDROFLUORIC ACID FACILITY REDUCING SUPPLY CHAIN VULNERABILITY

- 6.16.2 ARKEMA DEVELOPED UNIVERSAL METHOD FOR FLUORINE GENERATION ENHANCING SUSTAINABILITY

7 ANHYDROUS HYDROFLUORIC ACID MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 ETCHING & CLEANING AGENTS

- 7.2.1 UNIQUE ABILITY TO SELECTIVELY DISSOLVE SILICA TO DRIVE APPLICATION IN MICROCHIP MANUFACTURING

- 7.3 PH CONTROL AGENTS

- 7.3.1 ENHANCING PROCESS EFFICIENCY IN CHEMICAL AND WATER TREATMENT APPLICATIONS TO DRIVE MARKET

- 7.4 FUMING AGENTS

- 7.4.1 ENABLING FLUORINATION FOR PHARMACEUTICAL AND AGROCHEMICAL INNOVATIONS TO DRIVE MARKET

- 7.5 MATERIAL PROCESSING & SURFACE TREATMENT

- 7.5.1 ENHANCING DURABILITY AND FUNCTIONALITY IN INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 7.6 INTERMEDIATE IN CHEMICAL REACTIONS

- 7.6.1 FACILITATING FLUOROCHEMICAL SYNTHESIS FOR DIVERSE APPLICATIONS TO DRIVE MARKET

8 ANHYDROUS HYDROFLUORIC ACID MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 FLUORITE BASED

- 8.2.1 HIGH PURITY AND RELIABILITY TO MAKE IT PREFERRED CHOICE FOR INDUSTRIES

- 8.3 FLUOROSILICIC ACID BASED

- 8.3.1 SUPPORTING COST-EFFECTIVE AND SUSTAINABLE PRODUCTION FOR INDUSTRIAL APPLICATIONS TO DRIVE MARKET

9 ANHYDROUS HYDROFLUORIC ACID MARKET, BY DISTRIBUTION CHANNEL

- 9.1 INTRODUCTION

- 9.2 DIRECT SALES

- 9.2.1 ENSURING SAFETY AND SCALE THROUGH MANUFACTURER-TO-CLIENT CHANNELS TO DRIVE MARKET

- 9.3 ONLINE RETAILERS

- 9.3.1 EXPANDING ACCESSIBILITY THROUGH DIGITAL PROCUREMENT PLATFORMS TO DRIVE MARKET

10 ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE

- 10.1 INTRODUCTION

- 10.2 HIGH PURITY GRADE

- 10.2.1 ENSURING PRECISION AND RELIABILITY IN HIGH-TECH AND SENSITIVE APPLICATIONS TO DRIVE MARKET

- 10.3 STANDARD GRADE

- 10.3.1 PROVIDING COST-EFFECTIVE SOLUTIONS FOR GENERAL INDUSTRIAL APPLICATIONS TO DRIVE MARKET

11 ANHYDROUS HYDROFLUORIC ACID MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 FLUOROCARBONS

- 11.2.1 SUPPORTING PRODUCTION OF ENVIRONMENTALLY FRIENDLY REFRIGERANTS AND PROPELLANTS TO DRIVE MARKET

- 11.3 CATALYST

- 11.3.1 ENHANCING EFFICIENCY IN ALKYLATION PROCESSES FOR HIGH-OCTANE GASOLINE PRODUCTION TO DRIVE MARKET

- 11.4 SEMICONDUCTOR & ELECTRONICS

- 11.4.1 ENABLING PRECISION ETCHING AND CLEANING IN MICROCHIP MANUFACTURING TO DRIVE MARKET

- 11.5 NUCLEAR

- 11.5.1 FACILITATING URANIUM ENRICHMENT FOR NUCLEAR FUEL PRODUCTION TO DRIVE MARKET

- 11.6 PHARMACEUTICAL

- 11.6.1 USE OF ANHYDROUS HYDROFLUORIC ACID AS A FLUORINATING AGENT IN SYNTHESIS OF ACTIVE PHARMACEUTICAL INGREDIENTS TO DRIVE MARKET

- 11.7 CHEMICAL & PETROCHEMICAL

- 11.7.1 ENABLING PRODUCTION OF FLUOROPOLYMERS AND SPECIALTY CHEMICALS TO DRIVE MARKET

- 11.8 OTHER END-USE INDUSTRIES

- 11.8.1 LABORATORY REAGENT

- 11.8.2 AGROCHEMICAL

12 ANHYDROUS HYDROFLUORIC ACID MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Advancements in semiconductor and automotive industries to drive market

- 12.2.2 JAPAN

- 12.2.2.1 Electronics and sustainability government initiatives to fuel market

- 12.2.3 INDIA

- 12.2.3.1 Industrial growth and clean energy initiatives to drive market expansion

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Semiconductor innovation and sustainable practices to propel market growth

- 12.2.5 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Increasing anhydrous hydrofluoric acid market growth through nuclear and semiconductor industries to drive market

- 12.3.2 CANADA

- 12.3.2.1 Advancing petrochemical innovation and nuclear energy initiatives to drive market

- 12.3.3 MEXICO

- 12.3.3.1 Extensive use of anhydrous hydrofluoric acid in thriving petrochemical industry to drive market

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Chemical synthesis, electronics, biotechnology, and export demand to boost market growth

- 12.4.2 ITALY

- 12.4.2.1 Electronics innovation, pharmaceutical expansion, green and chemistry advances to propel market

- 12.4.3 FRANCE

- 12.4.3.1 Nuclear energy dominance and petrochemical advancements to drive market expansion

- 12.4.4 UK

- 12.4.4.1 Pharmaceutical growth, fluorocarbon innovation, and agrochemical advances to drive market

- 12.4.5 SPAIN

- 12.4.5.1 Increasing solar energy and specialty chemical applications to catalyze market growth

- 12.4.6 REST OF EUROPE

- 12.4.1 GERMANY

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 Saudi Arabia

- 12.5.1.1.1 Petrochemical dominance and increasing use of anhydrous hydrofluoric acid in fluorinated chemicals to drive market

- 12.5.1.2 UAE

- 12.5.1.2.1 Growing aluminum smelting industry and high-tech manufacturing to fuel market expansion

- 12.5.1.3 Rest of GCC countries

- 12.5.1.1 Saudi Arabia

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Essential role of anhydrous hydrofluoric acid in mineral extraction and chemical refining to drive demand

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.6 SOUTH AMERICA

- 12.6.1 ARGENTINA

- 12.6.1.1 Increasing agrochemical and research applications to drive market growth

- 12.6.2 BRAZIL

- 12.6.2.1 Robust manufacturing and export sectors in fluorocarbons and pharmaceutical applications to drive market

- 12.6.3 REST OF SOUTH AMERICA

- 12.6.1 ARGENTINA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN (JANUARY 2020- JANUARY 2025)

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.3.1 VALUATION AND FINANCIAL METRICS OF KEY ANHYDROUS HYDROFLUORIC ACID VENDORS, 2024

- 13.4 REVENUE ANALYSIS, 2020-2025

- 13.5 BRAND COMPARISON

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS (2024)

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Grade footprint

- 13.6.5.4 End-use industry footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.7.5.1 Detailed list of startups/SMEs

- 13.7.5.2 Competitive benchmarking of key startups/SMEs

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 DEALS

- 13.8.2 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 HONEYWELL INTERNATIONAL INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 SOLVAY

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 LANXESS

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Right to win

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses and competitive threats

- 14.1.4 ORBIA FLUOR & ENERGY MATERIALS

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 ZHEJIANG YONGHE REFRIGERANT CO., LTD.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 SRF LIMITED

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.7 GULF FLUOR

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 BASF

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 NAVIN FLUORINE INTERNATIONAL LIMITED

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Other developments

- 14.1.10 STELLA CHEMIFA CORPORATION

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.11 ARKEMA

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Other developments

- 14.1.12 DONGYUE GROUP LTD.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.1 HONEYWELL INTERNATIONAL INC.

- 14.2 OTHER PLAYERS

- 14.2.1 HALOPOLYMER

- 14.2.2 SINOCHEM LANTIAN CO., LTD.

- 14.2.3 FUJIAN YONGJING TECHNOLOGY CO., LTD.

- 14.2.4 LIAONING EAST SHINE CHEMICAL TECHNOLOGY CO., LTD.,

- 14.2.5 LUOYANG FENGRUI FLUORINE INDUSTRY CO., LTD.,

- 14.2.6 ZHEJIANG SANMEI CHEMICAL INDUSTRY CO., LTD.

- 14.2.7 FORMOSA DAIKIN ADVANCED CHEMICALS CO., LTD.,

- 14.2.8 TANFAC INDUSTRIES LTD

- 14.2.9 DERIVADOS DEL FLUOR SAU

- 14.2.10 ULBA METALLURGICAL PLANT JSC

- 14.2.11 FUBAO GROUP

- 14.2.12 FOOSUNG CO., LTD.

- 14.2.13 MORITA CHEMICAL INDUSTRIES CO., LTD.,

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS