|

|

市場調査レポート

商品コード

1748392

電子実験ノートの世界市場:製品タイプ別、コンポーネント別、展開別、ライセンス別、組織規模別、エンドユーザー別、地域別 - 2030年までの予測Electronic Lab Notebook Market by Deployment [Cloud (SaaS, PaaS, IaaS)], License (Proprietary, Open source), Component (Software, Services), Organization Size (SME, Large), End User (Pharma & Biotech, NGS, Biobank, Academia) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 電子実験ノートの世界市場:製品タイプ別、コンポーネント別、展開別、ライセンス別、組織規模別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月29日

発行: MarketsandMarkets

ページ情報: 英文 316 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

技術的進歩の高まりと、電子実験ノート(ELN)の継続的な進歩のための研究開発努力は、予測期間中の市場成長を促進すると予想されます。

科学研究におけるより高い効率性、精度、信頼性への要求の高まりが、デジタルツールや革新的なソリューションの普及につながっています。さらに、規制当局がデータの完全性と正確性をより重視する中、電子実験ノート(ELN)を採用することで、組織は業界のコンプライアンス基準を満たす上で戦略的優位性を得ることができます。複数の組織が信頼性の高い標準化された記録管理の利点を認識し始めているため、このような電子文書への移行はELN市場の大きな成長を促進すると予想されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品タイプ別、コンポーネント別、展開別、ライセンス別、組織規模別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

製品別では、電子実験ノート市場は分野横断型と特定ELNに区分されます。2024年には、分野横断型ELNセグメントが市場の最大シェアを占めました。分野横断型電子実験ノートの広範な利用が、特に多様な研究ニーズに対応する柔軟性を必要とする研究開発ラボでの採用を促進しています。こうした研究室では、使いやすさと複数の科学分野をサポートする能力から、ELNが好まれています。その他の特典としては、ITコストの削減、組織全体の標準化、安全なデータ保存、データ収集プロセスにおける共同作業の強化などが挙げられます。

電子実験ノート市場は、ライセンス別にプロプライエタリELNとオープンソースELNに区分されます。2024年には、プロプライエタリELNセグメントが市場を独占しました。プロプライエタリ・ライセンスは、組織独自のワークフローや規制要件に合わせたカスタマイズや統合機能を強化するもので、企業は堅牢なデータ保護やコンプライアンスを確保することで競争力を高める必要があります。

電子実験ノート市場は、地域別に北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカに区分されます。北米が2024年に最大の市場シェアを占めたのは、ラボラトリーオートメーションに対する需要の高まり、先端技術プラットフォームに対するニーズの高まり、同地域の主要市場参入企業が実施する数多くの戦略的イニシアチブのおかげです。

当レポートでは、世界の電子実験ノート市場について調査し、製品タイプ別、コンポーネント別、展開別、ライセンス別、組織規模別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 業界動向

- エコシステム分析

- バリューチェーン分析

- 規制状況

- 価格分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 投資と資金調達のシナリオ

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- エンドユーザー分析

- 電子実験ノート市場:ビジネスモデル

- AI/生成AIが電子実験ノート市場に与える影響

- 2025年の米国関税の影響- 電子実験ノート市場

第6章 電子実験ノート市場(製品タイプ別)

- イントロダクション

- 固有ELNS

- 学際的ELNS

第7章 電子実験ノート市場(コンポーネント別)

- イントロダクション

- ソフトウェア

- サービス

第8章 電子実験ノート市場(展開別)

- イントロダクション

- オンプレミスモデル

- クラウドベースモデル

- ハイブリッドモデル

第9章 電子実験ノート市場(ライセンス別)

- イントロダクション

- 専用ELN

- オープンソースELN

第10章 電子実験ノート市場(組織規模別)

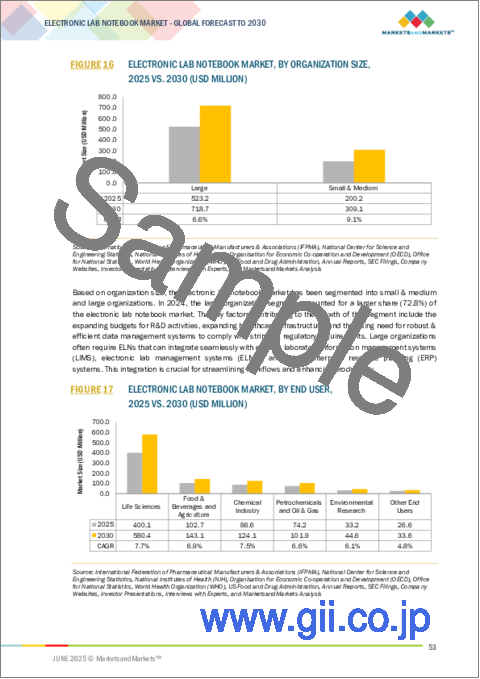

- イントロダクション

- 大規模組織

- 中小組織

第11章 電子実験ノート市場(エンドユーザー別)

- イントロダクション

- ライフサイエンス

- 食品・飲料・農業

- 石油化学製品、石油・ガス

- 化学産業

- 環境調査

- その他

第12章 電子実験ノート市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 日本

- 中国

- インド

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年~2024年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- 製品比較

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- REVVITY, INC.

- DASSAULT SYSTEMES

- BENCHLING

- THERMO FISHER SCIENTIFIC INC.

- WATERS CORPORATION

- IDBS

- STARLIMS CORPORATION

- LABLYNX, INC.

- LABVANTAGE SOLUTIONS INC.

- AGILENT TECHNOLOGIES, INC.

- LABWARE

- EPPENDORF SE

- DOTMATICS

- LAB-ALLY

- LABFORWARD GMBH

- LABII INC.

- BRUKER CORPORATION

- SAPIO SCIENCES

- BIODATA INC.(LABGURU)

- AGILEBIO

- その他の企業

- CODON SOFTWARE PVT. LTD.

- LABTRACK

- AGARAM TECHNOLOGIES PVT. LTD.

- SCINOTE LLC

- ELABNEXT

第15章 付録

List of Tables

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 ELECTRONIC LAB NOTEBOOK MARKET: RISK ASSESSMENT

- TABLE 3 ELECTRONIC LAB NOTEBOOK MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 INDICATIVE PRICING OF ELECTRONIC LAB NOTEBOOKS OFFERED BY KEY PLAYERS, BY DEPLOYMENT MODE, 2024

- TABLE 11 INDICATIVE PRICING OF CLOUD-BASED ELECTRONIC LAB NOTEBOOKS, BY REGION, 2024

- TABLE 12 KEY PATENTS IN ELECTRONIC LAB NOTEBOOK MARKET, 2020-2024

- TABLE 13 ELECTRONIC LAB NOTEBOOK MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 ELECTRONIC LAB NOTEBOOK MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 17 UNMET NEEDS IN ELECTRONIC LAB NOTEBOOK MARKET

- TABLE 18 END-USER EXPECTATIONS IN ELECTRONIC LAB NOTEBOOK MARKET

- TABLE 19 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 21 SPECIFIC ELECTRONIC LAB NOTEBOOK MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 22 CROSS-DISCIPLINARY ELECTRONIC LAB NOTEBOOK MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 23 ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 24 SOFTWARE ELECTRONIC LAB NOTEBOOK MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 25 SERVICES ELECTRONIC LAB NOTEBOOK MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 26 ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 27 ON-PREMISES MODEL MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 CLOUD-BASED MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 29 CLOUD-BASED MODEL MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 SAAS ELECTRONIC LAB NOTEBOOK MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 IAAS ELECTRONIC LAB NOTEBOOK MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 PAAS ELECTRONIC LAB NOTEBOOK MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 HYBRID MODEL MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 35 PROPRIETARY ELECTRONIC LAB NOTEBOOK MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 OPEN-SOURCE ELECTRONIC LAB NOTEBOOK MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 38 ELECTRONIC LAB NOTEBOOK MARKET FOR LARGE ORGANIZATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 ELECTRONIC LAB NOTEBOOK MARKET FOR SMALL & MEDIUM ORGANIZATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 41 ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 42 ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 ELECTRONIC LAB NOTEBOOK MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 ELECTRONIC LAB NOTEBOOK MARKET FOR CONTRACT SERVICE ORGANIZATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 ELECTRONIC LAB NOTEBOOK MARKET FOR BIOBANKS & BIOREPOSITORIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 ELECTRONIC LAB NOTEBOOK MARKET FOR CLINICAL RESEARCH LABORATORIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 ELECTRONIC LAB NOTEBOOK MARKET FOR ACADEMIC RESEARCH INSTITUTES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 ELECTRONIC LAB NOTEBOOK MARKET FOR NGS LABORATORIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 ELECTRONIC LAB NOTEBOOK MARKET FOR TOXICOLOGY LABORATORIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 ELECTRONIC LAB NOTEBOOK MARKET FOR OTHER LIFE SCIENCES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 ELECTRONIC LAB NOTEBOOK MARKET FOR FOOD & BEVERAGES AND AGRICULTURE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 ELECTRONIC LAB NOTEBOOK MARKET FOR PETROCHEMICALS AND OIL & GAS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 ELECTRONIC LAB NOTEBOOK MARKET FOR CHEMICAL INDUSTRY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 ELECTRONIC LAB NOTEBOOK MARKET FOR ENVIRONMENTAL RESEARCH, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 ELECTRONIC LAB NOTEBOOK MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 ELECTRONIC LAB NOTEBOOK MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 66 US: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 67 US: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 68 US: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 69 US: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 70 US: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 71 US: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 72 US: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 73 US: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 74 CANADA: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 75 CANADA: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 76 CANADA: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 77 CANADA: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 78 CANADA: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 79 CANADA: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 80 CANADA: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 81 CANADA: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: ELECTRONIC LAB NOTEBOOK MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 87 EUROPE: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 89 EUROPE: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 90 EUROPE: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 GERMANY: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 92 GERMANY: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 93 GERMANY: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 94 GERMANY: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 GERMANY: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 96 GERMANY: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 97 GERMANY: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 98 GERMANY: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 FRANCE: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 100 FRANCE: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 101 FRANCE: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 102 FRANCE: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 FRANCE: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 104 FRANCE: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 105 FRANCE: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 106 FRANCE: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 UK: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 108 UK: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 109 UK: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 110 UK: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 UK: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 112 UK: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 113 UK: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 114 UK: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 ITALY: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 116 ITALY: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 117 ITALY: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 118 ITALY: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 ITALY: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 120 ITALY: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 121 ITALY: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 122 ITALY: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 SPAIN: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 124 SPAIN: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 125 SPAIN: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 126 SPAIN: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 SPAIN: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 128 SPAIN: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 129 SPAIN: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 130 SPAIN: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 REST OF EUROPE: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 132 REST OF EUROPE: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 133 REST OF EUROPE: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 134 REST OF EUROPE: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 REST OF EUROPE: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 136 REST OF EUROPE: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 137 REST OF EUROPE: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 138 REST OF EUROPE: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 JAPAN: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 149 JAPAN: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 150 JAPAN: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 151 JAPAN: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 JAPAN: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 153 JAPAN: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 154 JAPAN: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 155 JAPAN: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 CHINA: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 157 CHINA: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 158 CHINA: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 159 CHINA: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 CHINA: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 161 CHINA: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 162 CHINA: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 163 CHINA: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 INDIA: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 165 INDIA: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 166 INDIA: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 167 INDIA: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 INDIA: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 169 INDIA: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 170 INDIA: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 171 INDIA: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 179 REST OF ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 181 LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 182 LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 183 LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 184 LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 186 LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 187 LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 188 LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 BRAZIL: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 190 BRAZIL: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 191 BRAZIL: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 192 BRAZIL: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 BRAZIL: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 194 BRAZIL: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 195 BRAZIL: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 196 BRAZIL: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 MEXICO: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 198 MEXICO: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 199 MEXICO: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 200 MEXICO: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 MEXICO: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 202 MEXICO: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 203 MEXICO: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 204 MEXICO: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 REST OF LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 206 REST OF LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 207 REST OF LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 208 REST OF LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 REST OF LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 210 REST OF LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 211 REST OF LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 212 REST OF LATIN AMERICA: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 GCC COUNTRIES: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 223 GCC COUNTRIES: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 224 GCC COUNTRIES: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 225 GCC COUNTRIES: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 GCC COUNTRIES: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 227 GCC COUNTRIES: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 228 GCC COUNTRIES: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 229 GCC COUNTRIES: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 REST OF MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 231 REST OF MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 232 REST OF MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

- TABLE 233 REST OF MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET FOR DEPLOYMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 REST OF MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2023-2030 (USD MILLION)

- TABLE 235 REST OF MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

- TABLE 236 REST OF MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 237 REST OF MIDDLE EAST & AFRICA: ELECTRONIC LAB NOTEBOOK MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 238 ELECTRONIC LAB NOTEBOOK MARKET: OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES, 2021-2024

- TABLE 239 ELECTRONIC LAB NOTEBOOK MARKET: DEGREE OF COMPETITION

- TABLE 240 ELECTRONIC LAB NOTEBOOK MARKET: REGION FOOTPRINT

- TABLE 241 ELECTRONIC LAB NOTEBOOK MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 242 ELECTRONIC LAB NOTEBOOK MARKET: COMPONENT FOOTPRINT

- TABLE 243 ELECTRONIC LAB NOTEBOOK MARKET: DEPLOYMENT FOOTPRINT

- TABLE 244 ELECTRONIC LAB NOTEBOOK MARKET: END USER FOOTPRINT

- TABLE 245 ELECTRONIC LAB NOTEBOOK MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 246 ELECTRONIC LAB NOTEBOOK MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 247 ELECTRONIC LAB NOTEBOOK MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-MAY 2025

- TABLE 248 ELECTRONIC LAB NOTEBOOK MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 249 ELECTRONIC LAB NOTEBOOK MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 250 REVVITY, INC.: COMPANY OVERVIEW

- TABLE 251 REVVITY, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 252 REVVITY, INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 253 REVVITY, INC.: DEALS

- TABLE 254 DASSAULT SYSTEMES: COMPANY OVERVIEW

- TABLE 255 DASSAULT SYSTEMES: PRODUCTS/SERVICES OFFERED

- TABLE 256 DASSAULT SYSTEMES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 257 BENCHLING: COMPANY OVERVIEW

- TABLE 258 BENCHLING: PRODUCTS/SERVICES OFFERED

- TABLE 259 BENCHLING: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 260 BENCHLING: DEALS

- TABLE 261 BENCHLING: OTHER DEVELOPMENTS

- TABLE 262 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 263 THERMO FISHER SCIENTIFIC INC.: PRODUCTS/SERVICES OFFERED

- TABLE 264 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 265 THERMO FISHER SCIENTIFIC INC.: DEALS

- TABLE 266 WATERS CORPORATION: COMPANY OVERVIEW

- TABLE 267 WATERS CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 268 WATERS CORPORATION: DEALS

- TABLE 269 WATERS CORPORATION: EXPANSIONS

- TABLE 270 IDBS: COMPANY OVERVIEW

- TABLE 271 IDBS: PRODUCTS/SERVICES OFFERED

- TABLE 272 IDBS: DEALS

- TABLE 273 STARLIMS CORPORATION: COMPANY OVERVIEW

- TABLE 274 STARLIMS CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 275 STARLIMS CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 276 STARLIMS CORPORATION: DEALS

- TABLE 277 LABLYNX, INC.: COMPANY OVERVIEW

- TABLE 278 LABLYNX, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 279 LABVANTAGE SOLUTIONS INC.: COMPANY OVERVIEW

- TABLE 280 LABVANTAGE SOLUTIONS INC.: PRODUCTS/SERVICES OFFERED

- TABLE 281 LABVANTAGE SOLUTIONS INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 282 LABVANTAGE SOLUTIONS INC.: DEALS

- TABLE 283 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 284 AGILENT TECHNOLOGIES, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 285 AGILENT TECHNOLOGIES, INC.: DEALS

- TABLE 286 LABWARE: COMPANY OVERVIEW

- TABLE 287 LABWARE: PRODUCTS/SERVICES OFFERED

- TABLE 288 LABWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 289 LABWARE: DEALS

- TABLE 290 LABWARE: EXPANSIONS

- TABLE 291 LABWARE: OTHER DEVELOPMENTS

- TABLE 292 EPPENDORF SE: COMPANY OVERVIEW

- TABLE 293 EPPENDORF SE: PRODUCTS/SERVICES OFFERED

- TABLE 294 DOTMATICS: COMPANY OVERVIEW

- TABLE 295 DOTMATICS: PRODUCTS/SERVICES OFFERED

- TABLE 296 DOTMATICS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 297 DOTMATICS: DEALS

- TABLE 298 DOTMATICS: OTHER DEVELOPMENTS

- TABLE 299 LAB-ALLY: COMPANY OVERVIEW

- TABLE 300 LAB-ALLY: PRODUCTS/SERVICES OFFERED

- TABLE 301 LABFORWARD GMBH: COMPANY OVERVIEW

- TABLE 302 LABFORWARD GMBH: PRODUCTS/SERVICES OFFERED

- TABLE 303 LABFORWARD GMBH: OTHER DEVELOPMENTS

- TABLE 304 LABII INC.: COMPANY OVERVIEW

- TABLE 305 LABII INC.: PRODUCTS/SERVICES OFFERED

- TABLE 306 LABII INC.: DEALS

- TABLE 307 BRUKER CORPORATION: COMPANY OVERVIEW

- TABLE 308 BRUKER CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 309 BRUKER CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 310 BRUKER: DEALS

- TABLE 311 SAPIO SCIENCES: COMPANY OVERVIEW

- TABLE 312 SAPIO SCIENCES: PRODUCTS/SERVICES OFFERED

- TABLE 313 SAPIO SCIENCES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 314 SAPIO SCIENCES: DEALS

- TABLE 315 BIODATA INC.: COMPANY OVERVIEW

- TABLE 316 BIODATA INC.: PRODUCTS/SERVICES OFFERED

- TABLE 317 BIODATA INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 318 BIODATA INC.: DEALS

- TABLE 319 AGILEBIO: COMPANY OVERVIEW

- TABLE 320 AGILEBIO: PRODUCTS/SERVICES OFFERED

List of Figures

- FIGURE 1 ELECTRONIC LAB NOTEBOOK MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY INDUSTRY AND REGION

- FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 BOTTOM-UP APPROACH: END-USER ADOPTION

- FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DYNAMICS, 2025-2030

- FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 10 TOP-DOWN APPROACH

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 ELECTRONIC LAB NOTEBOOK MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 ELECTRONIC LAB NOTEBOOK MARKET: REGIONAL SNAPSHOT

- FIGURE 19 INCREASING FOCUS ON DIGITIZATION IN LABORATORIES TO DRIVE MARKET

- FIGURE 20 SERVICES SEGMENT AND CHINA ACCOUNTED FOR LARGEST MARKET SHARES IN 2024

- FIGURE 21 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 22 NORTH AMERICA TO LEAD ELECTRONIC LAB NOTEBOOK MARKET DURING FORECAST PERIOD

- FIGURE 23 EMERGING COUNTRIES TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 24 ELECTRONIC LAB NOTEBOOK MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 DATA BREACHES IN HEALTHCARE SECTOR, 2019-2023

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 ELECTRONIC LAB NOTEBOOK MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 ELECTRONIC LAB NOTEBOOK MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 GLOBAL PATENT PUBLICATION TRENDS IN ELECTRONIC LAB NOTEBOOK MARKET, 2017-2024

- FIGURE 30 PATENTS APPLIED AND GRANTED, 2017-2024

- FIGURE 31 TOP APPLICANTS FOR ELECTRONIC LAB NOTEBOOK PATENTS, BY COUNTRY/REGION, 2017-2024

- FIGURE 32 ELECTRONIC LAB NOTEBOOK MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 33 ELECTRONIC LAB NOTEBOOK MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 36 GEN AI USE CASES IN ELECTRONIC LAB NOTEBOOK

- FIGURE 37 NORTH AMERICA: ELECTRONIC LAB NOTEBOOK MARKET SNAPSHOT

- FIGURE 38 EUROPE: ELECTRONIC LAB NOTEBOOK MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET SNAPSHOT

- FIGURE 40 ELECTRONIC LAB NOTEBOOK MARKET: REVENUE ANALYSIS OF 5 KEY PLAYERS, 2020-2024

- FIGURE 41 ELECTRONIC LAB NOTEBOOK MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 42 ELECTRONIC LAB NOTEBOOK MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 ELECTRONIC LAB NOTEBOOK MARKET: COMPANY FOOTPRINT

- FIGURE 44 ELECTRONIC LAB NOTEBOOK MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF ELECTRONIC LAB NOTEBOOK VENDORS

- FIGURE 46 EV/EBITDA OF KEY VENDORS

- FIGURE 47 ELECTRONIC LAB NOTEBOOK MARKET: PRODUCT COMPARISON

- FIGURE 48 REVVITY, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 49 DASSAULT SYSTEMES: COMPANY SNAPSHOT (2024)

- FIGURE 50 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2024)

- FIGURE 51 WATERS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 52 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 53 EPPENDORF SE: COMPANY SNAPSHOT (2023)

The rising technological advancements and R&D efforts for continuous advancements in ELNs are expected to fuel market growth during the forecast period. The increasing demand for higher efficiency, precision, and reliability in scientific research has led to the widespread use of digital tools and innovative solutions. Additionally, as regulatory agencies focus more on data integrity and accuracy, adopting electronic lab notebooks (ELNs) provides organizations with a strategic advantage in meeting industry compliance standards. This transition to electronic documentation is expected to drive significant growth in the ELN market, as several organizations have begun recognizing the benefits of reliable & standardized record-keeping.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Component, Deployment Mode, License, Organization Size, and End User |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. |

By product, the cross-disciplinary segment accounted for the largest share of the market in 2024.

By product, the electronic lab notebook market is segmented into cross-disciplinary and specific ELNs. In 2024, the cross-disciplinary ELN segment accounted for the largest share of the market. The extensive use of cross-disciplinary electronic lab notebooks is fueling adoption, particularly in R&D laboratories that involve flexibility to accommodate diverse research needs. These labs favor ELNs for ease of use & ability to support multiple scientific disciplines. Additionally, ELNs offer several benefits, such as lower IT costs, standardized practices across the organization, secure data storage, and enhanced collaboration in data collection processes.

By license, the proprietary ELN segment accounted for the largest share of the ELN market in 2024.

The electronic lab notebook market is segmented by license into proprietary ELN and open-source ELN. In 2024, the proprietary ELN segment dominated the market. Proprietary licenses provide enhanced customization and integration capabilities that align with unique organizational workflows and regulatory requirements, requiring companies to have a competitive edge by ensuring robust data protection and compliance.

By region, North America accounted for the largest share of the market in 2024.

The electronic lab notebook market is segmented by region into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest market share in 2024, owing to the growing demand for laboratory automation, the rising need for advanced technology platforms, and the numerous strategic initiatives implemented by key market players in the region.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 32%, Tier 2: 44%, and Tier 3: 24%

- By Designation - Directors: 30%, Manager: 34%, and Others: 36%

- By Region - North America: 40%, Europe: 28%, Asia Pacific: 20%, Latin America: 7%, and the Middle East & Africa: 5%

Key Players

The prominent players operating in the electronic lab notebook market include Revvity, Inc. (US), Dassault Systemes (France), Benchling (US), Thermo Fisher Scientific, Inc. (US), Waters Corporation (US), IDBS (US), STARLIMS Corporation (US), LabVantage Solutions Inc. (US), LabLynx (US), Agilent Technologies, Inc. (US), LabWare (US), Eppendorf SE (Germany), Dotmatics (US), Lab-Ally (US), Labforward GmbH (Germany), and Labii Inc. (US), among others. These companies adopted product/service launches, expansions, agreements, partnerships, collaborations, and acquisitions to strengthen their market presence in the electronic lab notebook market.

Research Coverage:

The report analyzes the electronic lab notebook market. It aims to estimate the market size and future growth potential of various market segments based on product, component, deployment mode, license, organization size, end user, and region. The report also analyses factors affecting market growth (drivers, restraints, opportunities, and challenges). It evaluates the opportunities and challenges for stakeholders in the market. The report also studies micromarkets in terms of their growth trends, prospects, and contributions to the overall electronic lab notebook market. The report forecasts the revenue of the market segments in five regions. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will benefit established and new or smaller firms by providing valuable insights into market trends. This information can help them gain a larger share of the market. Organizations that purchase the report can use one or a combination of the strategies outlined below to enhance their market positions.

This report provides insights based on the following:

- Analysis of key drivers (increasing focus on digitization in laboratories, technological advancements advantages of ELN over conventional notebooks, growing research activities), restraints (high initial costs for installation of ELN, data security & privacy concerns), opportunities (rising adoption of cloud-based solutions and the growing adoption of ELNs in emerging markets), challenges (integration with existing systems and shortage of trained professionals) are factors contributing the growth of the electronic lab notebook market.

- Product Development/Innovation: Detailed insights on upcoming trends, research & development activities, and new software launches in the electronic lab notebook market.

- Market Development: Comprehensive information on lucrative emerging markets by product, component, deployment mode, license, organization size, end user, and region.

- Market Diversification: Exhaustive information about software portfolios, lucrative growth geographies, recent developments, and investments in the electronic lab notebook market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, company evaluation quadrant, and capabilities of leading players in the global electronic lab notebook market, such as Revvity, Inc. (US), Dassault Systemes (France), Benchling (US), Thermo Fisher Scientific, Inc. (US), Waters Corporation (US), IDBS (US), STARLIMS Corporation (US), and LabVantage Solutions Inc., among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.5.1 METHODOLOGY-RELATED LIMITATIONS

- 2.5.2 SCOPE-RELATED LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 GROWTH OPPORTUNITIES FOR PLAYERS IN ELECTRONIC LAB NOTEBOOK MARKET

- 4.2 ASIA PACIFIC: ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT AND COUNTRY

- 4.3 ELECTRONIC LAB NOTEBOOK MARKET: REGIONAL GROWTH OPPORTUNITIES

- 4.4 REGIONAL MIX: ELECTRONIC LAB NOTEBOOK MARKET

- 4.5 ELECTRONIC LAB NOTEBOOK MARKET: EMERGING VS. DEVELOPED ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing focus on digitization in laboratories

- 5.2.1.2 Advantages of electronic lab notebooks over conventional notebooks

- 5.2.1.3 Growing R&D expenditure of pharmaceutical & biotechnology companies

- 5.2.1.4 Technological advancements

- 5.2.1.5 Need for data integrity & compliance

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial installation cost of electronic lab notebooks

- 5.2.2.2 Data security & privacy concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption in emerging markets

- 5.2.3.2 Rising popularity of cloud-based solutions

- 5.2.3.3 Integration of artificial intelligence and machine learning

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration with existing systems

- 5.2.4.2 Dearth of trained professionals

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Cloud computing

- 5.4.1.2 Voice-enabled digital lab assistants

- 5.4.1.3 Data analytics

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Internet of Things

- 5.4.2.2 Artificial intelligence & machine learning

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Blockchain

- 5.4.1 KEY TECHNOLOGIES

- 5.5 INDUSTRY TRENDS

- 5.5.1 GROWING DEMAND FOR ELECTRONIC LAB NOTEBOOKS IN BIOLOGICS DEVELOPMENT

- 5.5.2 SHIFT TOWARD MORE COLLABORATIVE AND INTEGRATED SYSTEMS

- 5.5.3 INCREASING CUSTOMIZATION AND FLEXIBILITY OF ELNS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 REGULATORY ANALYSIS

- 5.8.2.1 North America

- 5.8.2.2 Europe

- 5.8.2.3 Asia Pacific

- 5.8.2.4 Middle East & Africa

- 5.8.2.5 Latin America

- 5.9 PRICING ANALYSIS

- 5.9.1 INDICATIVE PRICING OF ELECTRONIC LAB NOTEBOOKS OFFERED KEY PLAYERS, BY DEPLOYMENT MODE, 2024

- 5.9.2 INDICATIVE PRICING OF CLOUD-BASED ELECTRONIC LAB NOTEBOOKS, BY REGION, 2024

- 5.10 PATENT ANALYSIS

- 5.10.1 PATENT PUBLICATION TRENDS FOR ELECTRONIC LAB NOTEBOOK SOLUTIONS

- 5.10.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 IMPLEMENTING DOTMATICS ELN INTO CHARLES RIVER LABORATORIES LAB OF THE FUTURE

- 5.12.2 USING SCINOTE ELN TO FACILITATE EFFICIENT COLLABORATION

- 5.12.3 INCREASING RESEARCH THROUGHPUT WITH ELN FOR CHEMISTS AND BIOLOGISTS

- 5.13 INVESTMENT AND FUNDING SCENARIO

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 END-USER ANALYSIS

- 5.16.1 UNMET NEEDS

- 5.16.2 END-USER EXPECTATIONS

- 5.17 ELECTRONIC LAB NOTEBOOK MARKET: BUSINESS MODELS

- 5.18 IMPACT OF AI/GEN AI ON ELECTRONIC LAB NOTEBOOK MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 MARKET POTENTIAL OF GEN AI IN ELECTRONIC LAB NOTEBOOK

- 5.18.2.1 Key use cases of Gen AI

- 5.18.3 CASE STUDIES OF AI/GENERATIVE AI IMPLEMENTATION

- 5.18.3.1 Scispot leveraging AI-driven automation and analytics in ELNs

- 5.18.4 INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.18.4.1 Laboratory information management systems (LIMS)

- 5.18.4.2 Supply chain & inventory management

- 5.18.4.3 AI-driven drug discovery platforms

- 5.18.4.4 Educational platforms

- 5.18.4.5 Clinical & translational research platforms

- 5.18.5 USER READINESS AND IMPACT ASSESSMENT

- 5.18.5.1 User readiness

- 5.18.5.1.1 Life sciences

- 5.18.5.1.2 Food & beverage and agriculture

- 5.18.5.1.3 Petrochemical and oil & gas

- 5.18.5.2 Impact assessment

- 5.18.5.2.1 User A: Life sciences

- 5.18.5.2.1.1 Implementation

- 5.18.5.2.1.2 Impact

- 5.18.5.2.2 User B: Food & beverage and agriculture

- 5.18.5.2.2.1 Implementation

- 5.18.5.2.2.2 Impact

- 5.18.5.2.3 User C: Petrochemical and oil & gas

- 5.18.5.2.3.1 Implementation

- 5.18.5.2.3.2 Impact

- 5.18.5.2.1 User A: Life sciences

- 5.18.5.1 User readiness

- 5.19 IMPACT OF 2025 US TARIFF - ELECTRONIC LAB NOTEBOOK MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 ELECTRONIC LAB NOTEBOOK MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 SPECIFIC ELNS

- 6.2.1 ADVANCING SPECIALIZED RESEARCH WITH SPECIFIC ELNS

- 6.3 CROSS-DISCIPLINARY ELNS

- 6.3.1 DRIVING SCIENTIFIC COLLABORATION AND INNOVATION WITH CROSS-DISCIPLINARY ELNS

7 ELECTRONIC LAB NOTEBOOK MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 SOFTWARE

- 7.2.1 DRIVING INNOVATION IN RESEARCH WITH INTELLIGENT ELN SOFTWARE SOLUTIONS

- 7.3 SERVICES

- 7.3.1 MAXIMIZING RESEARCH PRODUCTIVITY WITH SERVICE-DRIVEN ELN PLATFORMS

8 ELECTRONIC LAB NOTEBOOK MARKET, BY DEPLOYMENT

- 8.1 INTRODUCTION

- 8.2 ON-PREMISES MODEL

- 8.2.1 ROBUST DATA CONTROL WITH ON-PREMISE ELECTRONIC LAB NOTEBOOKS

- 8.3 CLOUD-BASED MODEL

- 8.3.1 SOFTWARE-AS-A-SERVICE

- 8.3.1.1 Empowering research with Software-as-a-Service ELN solutions

- 8.3.2 INFRASTRUCTURE-AS-A-SERVICE

- 8.3.2.1 Enhancing research flexibility with Infrastructure-as-a-Service ELN solutions

- 8.3.3 PLATFORM-AS-A-SERVICE

- 8.3.3.1 Accelerating innovation with Platform-as-a-Service ELN solutions

- 8.3.1 SOFTWARE-AS-A-SERVICE

- 8.4 HYBRID MODEL

- 8.4.1 FLEXIBLE RESEARCH SOLUTIONS WITH HYBRID ELECTRONIC LAB NOTEBOOKS

9 ELECTRONIC LAB NOTEBOOK MARKET, BY LICENSE

- 9.1 INTRODUCTION

- 9.2 PROPRIETARY ELN

- 9.2.1 OPTIMIZING RESEARCH OPERATIONS WITH INTEGRATED PROPRIETARY ELN ECOSYSTEMS

- 9.3 OPEN-SOURCE ELN

- 9.3.1 CUSTOMIZABLE SOFTWARE FOR MANAGING AND SHARING EXPERIMENTAL DATA

10 ELECTRONIC LAB NOTEBOOK MARKET, BY ORGANIZATION SIZE

- 10.1 INTRODUCTION

- 10.2 LARGE ORGANIZATION

- 10.2.1 NEED FOR STANDARDIZED GLOBAL OPERATIONS AND ADVANCED ANALYTICS TO ACCELERATE GROWTH

- 10.3 SMALL & MEDIUM ORGANIZATION

- 10.3.1 NEED FOR IMPROVED OPERATIONAL EFFICIENCY AND REDUCED ERRORS TO STIMULATE GROWTH

11 ELECTRONIC LAB NOTEBOOK MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 LIFE SCIENCES

- 11.2.1 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 11.2.1.1 Increasing R&D expenditure to encourage growth

- 11.2.2 CONTRACT SERVICE ORGANIZATIONS

- 11.2.2.1 Increasing outsourcing of research activities to speed up growth

- 11.2.3 BIOBANKS & BIOREPOSITORIES

- 11.2.3.1 Demand for high-quality specimens to amplify growth

- 11.2.4 CLINICAL RESEARCH LABORATORIES

- 11.2.4.1 Growing use of ELNs in clinical research for improved quality and enhanced productivity to boost market

- 11.2.5 ACADEMIC RESEARCH INSTITUTES

- 11.2.5.1 Increasing advancements in cancer, genomics, and proteomics research to assist growth

- 11.2.6 NGS LABORATORIES

- 11.2.6.1 Need for managing and interpreting sequencing data to intensify growth

- 11.2.7 TOXICOLOGY LABORATORIES

- 11.2.7.1 Need to eliminate human errors and ensure easy information accessibility to spur growth

- 11.2.8 OTHER LIFE SCIENCES

- 11.2.1 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 11.3 FOOD & BEVERAGES AND AGRICULTURE

- 11.3.1 GROWING FOCUS ON FOOD SAFETY, QUALITY, AND SUPPLY CHAIN TO FUEL MARKET

- 11.4 PETROCHEMICALS AND OIL & GAS

- 11.4.1 RISING FOCUS ON IMPROVED OPERATIONAL EFFICIENCY & REGULATORY COMPLIANCE TO BOLSTER GROWTH

- 11.5 CHEMICAL INDUSTRY

- 11.5.1 NEED FOR CHEMICAL COMPANIES TO ABIDE BY STRINGENT REGULATORY GUIDELINES TO ADVANCE GROWTH

- 11.6 ENVIRONMENTAL RESEARCH

- 11.6.1 INCREASING REGULATORY REQUIREMENTS IN ENVIRONMENTAL AND WATER TESTING LABORATORIES TO AID GROWTH

- 11.7 OTHER END USERS

12 ELECTRONIC LAB NOTEBOOK MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Robust R&D funding and regulatory compliance fuel ELN adoption

- 12.2.3 CANADA

- 12.2.3.1 Strategic R&D investments and automation need to propel market

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Growing emphasis on laboratory automation, R&D, and digital transformation to drive market

- 12.3.3 FRANCE

- 12.3.3.1 Innovation-driven industrial strategy to fuel ELN adoption in diverse research sectors

- 12.3.4 UK

- 12.3.4.1 Rising R&D investment and cross-sector digital transformation to propel market

- 12.3.5 ITALY

- 12.3.5.1 Government funding and regulatory modernization to drive market

- 12.3.6 SPAIN

- 12.3.6.1 Rising demand for digital compliance and automation in food, pharma, and research sectors to accelerate ELN adoption

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 JAPAN

- 12.4.2.1 Academic digitization and stringent regulatory compliance to drive market

- 12.4.3 CHINA

- 12.4.3.1 Cloud infrastructure and government-led R&D investments to fuel market

- 12.4.4 INDIA

- 12.4.4.1 Growing contract research and manufacturing services, digital initiatives, and startup ecosystem to fuel uptake

- 12.4.5 REST OF ASIA PACIFIC

- 12.5 LATIN AMERICA

- 12.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 12.5.2 BRAZIL

- 12.5.2.1 Robust healthcare investment and digital strategy to propel ELN adoption in clinical and research labs

- 12.5.3 MEXICO

- 12.5.3.1 Increasing cloud adoption, AI integration, and research digitization to drive market

- 12.5.4 REST OF LATIN AMERICA

- 12.6 MIDDLE EAST & AFRICA

- 12.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 12.6.2 GCC COUNTRIES

- 12.6.2.1 Healthcare sector expansion and strategic investments to drive ELN adoption

- 12.6.3 REST OF MIDDLE EAST & AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 13.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN ELECTRONIC LAB NOTEBOOK MARKET

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Product type footprint

- 13.5.5.4 Component footprint

- 13.5.5.5 Deployment footprint

- 13.5.5.6 End user footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.6.5.1 Detailed list of key startups/SMEs

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- 13.7.1 COMPANY VALUATION

- 13.7.2 FINANCIAL METRICS

- 13.8 PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 13.9.2 DEALS

- 13.9.3 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 REVVITY, INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches and enhancements

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 DASSAULT SYSTEMES

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches and enhancements

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses & competitive threats

- 14.1.3 BENCHLING

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches and enhancements

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Other developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses & competitive threats

- 14.1.4 THERMO FISHER SCIENTIFIC INC.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches and enhancements

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses & competitive threats

- 14.1.5 WATERS CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.3.2 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses & competitive threats

- 14.1.6 IDBS

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.7 STARLIMS CORPORATION

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches and enhancements

- 14.1.7.3.2 Deals

- 14.1.8 LABLYNX, INC.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Services offered

- 14.1.9 LABVANTAGE SOLUTIONS INC.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches and enhancements

- 14.1.9.3.2 Deals

- 14.1.10 AGILENT TECHNOLOGIES, INC.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Deals

- 14.1.11 LABWARE

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches and enhancements

- 14.1.11.3.2 Deals

- 14.1.11.3.3 Expansions

- 14.1.11.3.4 Other developments

- 14.1.12 EPPENDORF SE

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Services offered

- 14.1.13 DOTMATICS

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Product launches and enhancements

- 14.1.13.3.2 Deals

- 14.1.13.3.3 Other developments

- 14.1.14 LAB-ALLY

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Services offered

- 14.1.15 LABFORWARD GMBH

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Other developments

- 14.1.16 LABII INC.

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Services offered

- 14.1.16.3 Recent developments

- 14.1.16.3.1 Deals

- 14.1.17 BRUKER CORPORATION

- 14.1.17.1 Business overview

- 14.1.17.2 Products/Services offered

- 14.1.17.3 Recent developments

- 14.1.17.3.1 Product launches and enhancements

- 14.1.17.3.2 Deals

- 14.1.18 SAPIO SCIENCES

- 14.1.18.1 Business overview

- 14.1.18.2 Products/Services offered

- 14.1.18.3 Recent developments

- 14.1.18.3.1 Product launches and enhancements

- 14.1.18.3.2 Deals

- 14.1.19 BIODATA INC. (LABGURU)

- 14.1.19.1 Business overview

- 14.1.19.2 Products/Services offered

- 14.1.19.3 Recent developments

- 14.1.19.3.1 Product launches and enhancements

- 14.1.19.3.2 Deals

- 14.1.20 AGILEBIO

- 14.1.20.1 Business overview

- 14.1.20.2 Products/Services offered

- 14.1.1 REVVITY, INC.

- 14.2 OTHER PLAYERS

- 14.2.1 CODON SOFTWARE PVT. LTD.

- 14.2.2 LABTRACK

- 14.2.3 AGARAM TECHNOLOGIES PVT. LTD.

- 14.2.4 SCINOTE LLC

- 14.2.5 ELABNEXT

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS