|

|

市場調査レポート

商品コード

1747197

エクソソーム研究の世界市場:提供別、適応症別、用途別、製造サービス別 - 予測(~2030年)Exosome Research Market by Offering (Kits, Reagents (Antibodies, Isolation, Purification), Instruments, Services), Indication (Cancer, Infectious Diseases), Application (Biomarkers, Vaccines), Manufacturing Services (Stem Cell) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| エクソソーム研究の世界市場:提供別、適応症別、用途別、製造サービス別 - 予測(~2030年) |

|

出版日: 2025年06月10日

発行: MarketsandMarkets

ページ情報: 英文 325 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のエクソソーム研究の市場規模は、2025年の2億1,440万米ドルから2030年までに4億8,060万米ドルに達すると予測され、予測期間にCAGRで17.5%の成長が見込まれます。

市場の拡大は主に、がん、神経変性疾患、CVDを含む慢性疾患の罹患率の上昇によるものです。この動向は、新たな診断・治療戦略への差し迫ったニーズを強く示しています。エクソソームは、その潜在的なバイオマーカーとしての特性と、標的治療のデリバリーを促進する能力により、先進の疾患診断と治療法に対する需要の増加に対応できる独自の地位にあります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 100万米ドル |

| セグメント | 提供、用途、製造サービス、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

「キット・試薬セグメントが調査期間にもっとも高いCAGRで成長する見込みです。」

学術機関、バイオテクノロジー企業、診断開発業者が疾患診断や治療介入におけるエクソソームの多面的な役割を深く掘り下げるにつれて、標準化された使いやすいキット・試薬への需要が顕著に増加しています。これらの専用ツールは、エクソソームの単離、精製、標識、下流分析に関連するワークフローを簡素化し迅速化する上で重要な役割を果たしています。細胞から分泌されるナノサイズの小胞であるエクソソームは、さまざまな疾患における重要なバイオマーカーとして浮上しており、正確な取り扱いと分析が必要とされています。市販のキットによって提供される標準化は、研究者が一貫性と信頼性をもってこれらの作業を実行できるようにするのに役立ち、これはトランスレーショナルリサーチと前臨床開発の両方において不可欠です。特に再現性は科学研究において重大であり、認証されたキットを利用することで、一貫したプロトコルが保証され、ばらつきを最小化し、全体的な研究成果を高めることができます。この信頼性は、正確なバイオマーカーの同定が疾患の早期発見とモニタリングにとってもっとも重要な、バイオマーカー探索とリキッドバイオプシー研究において特に適正です。エクソソームに基づく診断、特にがん検出のための腫瘍学やアルツハイマー病やパーキンソン病のような神経変性疾患への関心が高まるにつれて、研究室はすぐに使用できる試薬システムを選ぶようになってきています。これらのシステムは、サンプル調製、RNAやDNAの抽出、包括的なカーゴプロファイリングを容易にし、それによってさまざまな下流の分子用途を支援します。このような標準化されたツールの統合は、研究方法を合理化するだけでなく、生成されるデータの質を高め、最終的には臨床現場におけるエクソソーム研究の進行に寄与します。診断が進化し続ける中、このような信頼性が高く効率的なキットの役割はさらに顕著になり、個別化医療や標的治療におけるブレークスルーへの道が開かれるとみられます。

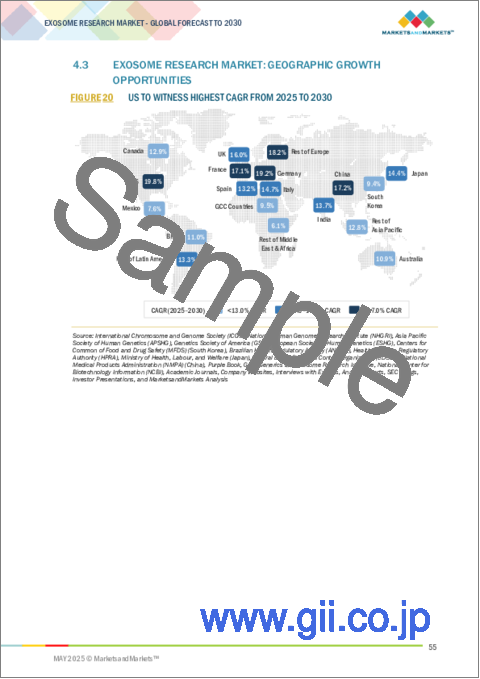

「北米が2025年~2030年に世界のエクソソーム研究市場でもっとも高いCAGRで成長すると予測されます。」

北米が世界のエクソソーム研究市場における主導的地位を維持しています。これは主に政府による多額の投資と支援機構によるものです。米国のNational Institutes of Health(NIH)のような主要機関は極めて重要であり、特にエクソソームを中心としたプロジェクトを対象とする生物医学研究に多額の資金を提供しています。この資金援助により、研究者たちは診断と治療の両面におけるエクソソームの新たな用途を探求することができます。

当レポートでは、世界のエクソソーム研究市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- エクソソーム研究市場の概要

- 北米のエクソソーム研究市場:用途別、国別

- エクソソーム研究市場:地理的成長機会

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- エクソソーム研究製品の参考価格:主要企業別(2024年)

- エクソソーム研究製品の参考価格:地域別(2024年)

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 特許出願件数:書類種別(2014年~2024年)

- 主要特許リスト(2023年~2024年)

- 主な会議とイベント(2025年~2026年)

- 規制分析

- 規制機関、政府機関、その他の組織

- 規制枠組み

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 投資と資金調達のシナリオ

- 貿易データの分析

- HSコード3822の輸入データ(2020年~2024年)

- HSコード3822の輸出データ(2020年~2024年)

- エクソソーム研究市場に対するAI/生成AIの影響

- エクソソーム研究市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

第6章 エクソソーム研究市場:提供別

- イントロダクション

- キット・試薬

- 抗体

- 単離、精製、定量キット・試薬

- その他のキット・試薬

- 器具

- サービス

第7章 エクソソーム研究市場:適応症別

- イントロダクション

- がん

- 肺がん

- 乳がん

- 前立腺がん

- 大腸がん

- その他のがん

- 神経変性疾患

- 心血管疾患

- 感染症

- その他の適応症

第8章 エクソソーム研究市場:用途別

- イントロダクション

- バイオマーカー

- ワクチン開発

- 組織再生

- その他の用途

第9章 エクソソーム研究市場:製造サービス別

- イントロダクション

- 幹細胞由来エクソソームの製造

- 樹状細胞由来エクソソームの製造

- その他の製造サービス

第10章 エクソソーム研究市場:エンドユーザー別

- イントロダクション

- 学術・研究機関

- 製薬・バイオテクノロジー企業

- 病院・臨床検査機関

第11章 エクソソーム研究市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済分析

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済分析

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済分析

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済分析

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- 中東・アフリカのマクロ経済分析

- GCC諸国

- その他の中東・アフリカ

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 企業の評価と財務指標

- 財務指標

- 企業の評価

- ブランド/製品の比較

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- THERMO FISHER SCIENTIFIC INC.

- QIAGEN

- LONZA

- DANAHER

- BIO-TECHNE

- SYSTEM BIOSCIENCES, LLC

- AMSBIO

- ROOSTERBIO, INC.

- MILTENYI BIOTEC

- NORGEN BIOTEK CORP.

- AETHLON MEDICAL, INC.

- CREATIVE MEDICAL TECHNOLOGIES HOLDINGS, INC.

- SPECTRIS

- NANOFCM, INC.

- IZON SCIENCE LIMITED

- CAPRICOR THERAPEUTICS, INC.

- その他の企業

- ANJARIUM BIOSCIENCES AG

- CILOA

- INNOVAPREP

- ILIAS BIOLOGICS INC.

- UNCHAINED LABS

- RION INC.

- CELL GUIDANCE SYSTEM LLC

- INOVIQ

- NX PHARMAGEN

- EXOPHARM

- EVERZOM

- NANOSOMIX

- CREATIVE BIOLABS

第14章 付録

List of Tables

- TABLE 1 EXOSOME RESEARCH MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 IMPACT ANALYSIS OF SUPPLY- AND DEMAND-SIDE FACTORS

- TABLE 3 EXOSOME RESEARCH MARKET: RISK ANALYSIS

- TABLE 4 EXOSOME RESEARCH MARKET: IMPACT ANALYSIS

- TABLE 5 GLOBAL CANCER INCIDENCE, BY REGION, 2022 VS. 2025

- TABLE 6 INDICATIVE PRICE OF EXOSOME RESEARCH PRODUCTS, BY KEY PLAYER, 2024

- TABLE 7 INDICATIVE PRICE OF EXOSOME RESEARCH PRODUCTS, BY REGION, 2024 (USD)

- TABLE 8 EXOSOME RESEARCH MARKET: ROLE IN ECOSYSTEM

- TABLE 9 EXOSOME RESEARCH MARKET: NUMBER OF PATENTS FILED, 2014-2024

- TABLE 10 EXOSOME RESEARCH MARKET: DETAILED ANALYSIS OF KEY PATENTS, 2023-2024

- TABLE 11 EXOSOME RESEARCH MARKET: LIST OF KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EXOSOME RESEARCH MARKET: PORTER'S FIVE FORCES

- TABLE 17 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY OFFERING

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 19 IMPORT DATA FOR HS CODE 3822, 2020-2024 (USD THOUSAND)

- TABLE 20 EXPORT DATA FOR HS CODE 3822, 2020-2024 (USD THOUSAND)

- TABLE 21 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 22 EXOSOME RESEARCH PRODUCTS-RELATED TARIFF REVISION

- TABLE 23 EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 24 EXOSOME RESEARCH KITS & REAGENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 25 NORTH AMERICA: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 EUROPE: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 27 ASIA PACIFIC: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 LATIN AMERICA: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 MIDDLE EAST & AFRICA: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 31 ANTIBODIES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 NORTH AMERICA: ANTIBODIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 EUROPE: ANTIBODIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 ASIA PACIFIC: ANTIBODIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 LATIN AMERICA: ANTIBODIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 MIDDLE EAST & AFRICA: ANTIBODIES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 ISOLATION, PURIFICATION, AND QUANTITATION KITS & REAGENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 NORTH AMERICA: ISOLATION, PURIFICATION, AND QUANTITATION KITS & REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

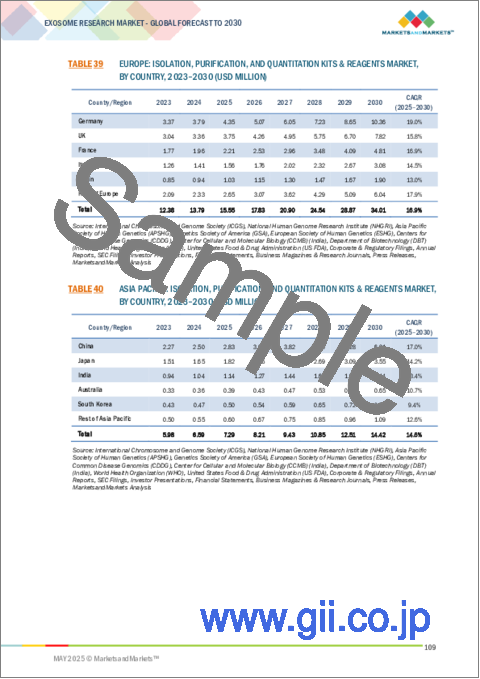

- TABLE 39 EUROPE: ISOLATION, PURIFICATION, AND QUANTITATION KITS & REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 ASIA PACIFIC: ISOLATION, PURIFICATION, AND QUANTITATION KITS & REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 LATIN AMERICA: ISOLATION, PURIFICATION, AND QUANTITATION KITS & REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 MIDDLE EAST & AFRICA: ISOLATION, PURIFICATION, AND QUANTITATION KITS & REAGENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 OTHER KITS & REAGENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: OTHER KITS & REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 EUROPE: OTHER KITS & REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 ASIA PACIFIC: OTHER KITS & REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 LATIN AMERICA: OTHER KITS & REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 MIDDLE EAST & AFRICA: OTHER KITS & REAGENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 EXOSOME RESEARCH INSTRUMENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: EXOSOME RESEARCH INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 EUROPE: EXOSOME RESEARCH INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 ASIA PACIFIC: EXOSOME RESEARCH INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 LATIN AMERICA: EXOSOME RESEARCH INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 MIDDLE EAST & AFRICA: EXOSOME RESEARCH INSTRUMENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 EXOSOME RESEARCH SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: EXOSOME RESEARCH SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 EUROPE: EXOSOME RESEARCH SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 ASIA PACIFIC: EXOSOME RESEARCH SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 LATIN AMERICA: EXOSOME RESEARCH SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 MIDDLE EAST & AFRICA: EXOSOME RESEARCH SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 62 EXOSOME RESEARCH MARKET FOR CANCER, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: EXOSOME RESEARCH MARKET FOR CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 EUROPE: EXOSOME RESEARCH MARKET FOR CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: EXOSOME RESEARCH MARKET FOR CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 LATIN AMERICA: EXOSOME RESEARCH MARKET FOR CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET FOR CANCER, BY REGION, 2023-2030 (USD MILLION)

- TABLE 68 EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 69 LUNG CANCER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: LUNG CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 EUROPE: LUNG CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 ASIA PACIFIC: LUNG CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 LATIN AMERICA: LUNG CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 MIDDLE EAST & AFRICA: LUNG CANCER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 75 BREAST CANCER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: BREAST CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 EUROPE: BREAST CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 ASIA PACIFIC: BREAST CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 LATIN AMERICA: BREAST CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 MIDDLE EAST & AFRICA: BREAST CANCER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 81 PROSTATE CANCER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: PROSTATE CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: PROSTATE CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 ASIA PACIFIC: PROSTATE CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 LATIN AMERICA: PROSTATE CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 MIDDLE EAST & AFRICA: PROSTATE CANCER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 87 COLORECTAL CANCER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: COLORECTAL CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 EUROPE: COLORECTAL CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: COLORECTAL CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 LATIN AMERICA: COLORECTAL CANCER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 MIDDLE EAST & AFRICA: COLORECTAL CANCER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 93 OTHER CANCERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: OTHER CANCERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 EUROPE: OTHER CANCERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 ASIA PACIFIC: OTHER CANCERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 LATIN AMERICA: OTHER CANCERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: OTHER CANCERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 99 EXOSOME RESEARCH MARKET FOR NEURODEGENERATIVE DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: EXOSOME RESEARCH MARKET FOR NEURODEGENERATIVE DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 EUROPE: EXOSOME RESEARCH MARKET FOR NEURODEGENERATIVE DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: EXOSOME RESEARCH MARKET FOR NEURODEGENERATIVE DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 LATIN AMERICA: EXOSOME RESEARCH MARKET FOR NEURODEGENERATIVE DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET FOR NEURODEGENERATIVE DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 105 EXOSOME RESEARCH MARKET FOR CARDIOVASCULAR DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: EXOSOME RESEARCH MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2023-2030(USD MILLION)

- TABLE 107 EUROPE: EXOSOME RESEARCH MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2023-2030(USD MILLION)

- TABLE 108 ASIA PACIFIC: EXOSOME RESEARCH MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2023-2030(USD MILLION)

- TABLE 109 LATIN AMERICA: EXOSOME RESEARCH MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2023-2030(USD MILLION))

- TABLE 110 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET FOR CARDIOVASCULAR DISEASES, BY REGION, 2023-2030(USD MILLION)

- TABLE 111 EXOSOME RESEARCH MARKET FOR INFECTIOUS DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: EXOSOME RESEARCH MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 EUROPE: EXOSOME RESEARCH MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: EXOSOME RESEARCH MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 115 LATIN AMERICA: EXOSOME RESEARCH MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET FOR INFECTIOUS DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 117 EXOSOME RESEARCH MARKET FOR OTHER INDICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 118 NORTH AMERICA: EXOSOME RESEARCH MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 119 EUROPE: EXOSOME RESEARCH MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: EXOSOME RESEARCH MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 121 LATIN AMERICA: EXOSOME RESEARCH MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET FOR OTHER INDICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 123 EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 124 EXOSOME RESEARCH MARKET FOR BIOMARKERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: EXOSOME RESEARCH MARKET FOR BIOMARKERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 126 EUROPE: EXOSOME RESEARCH MARKET FOR BIOMARKERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: EXOSOME RESEARCH MARKET FOR BIOMARKERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 LATIN AMERICA: EXOSOME RESEARCH MARKET FOR BIOMARKERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA & AFRICA: EXOSOME RESEARCH MARKET FOR BIOMARKERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 130 EXOSOME RESEARCH MARKET FOR VACCINE DEVELOPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: EXOSOME RESEARCH MARKET FOR VACCINE DEVELOPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 132 EUROPE: EXOSOME RESEARCH MARKET FOR VACCINE DEVELOPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: EXOSOME RESEARCH MARKET FOR VACCINE DEVELOPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 134 LATIN AMERICA: EXOSOME RESEARCH MARKET FOR VACCINE DEVELOPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET FOR VACCINE DEVELOPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 136 EXOSOME RESEARCH MARKET FOR TISSUE REGENERATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 137 NORTH AMERICA: EXOSOME RESEARCH MARKET FOR TISSUE REGENERATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 EUROPE: EXOSOME RESEARCH MARKET FOR TISSUE REGENERATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: EXOSOME RESEARCH MARKET FOR TISSUE REGENERATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 140 LATIN AMERICA: EXOSOME RESEARCH MARKET FOR TISSUE REGENERATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET FOR TISSUE REGENERATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 142 EXOSOME RESEARCH MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 143 NORTH AMERICA: EXOSOME RESEARCH MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 144 EUROPE: EXOSOME RESEARCH MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: EXOSOME RESEARCH MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 146 LATIN AMERICA: EXOSOME RESEARCH MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 148 EXOSOME RESEARCH MARKET, BY MANUFACTURING SERVICE, 2023-2030 (USD MILLION)

- TABLE 149 EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 150 EXOSOME RESEARCH MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 151 NORTH AMERICA: EXOSOME RESEARCH MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 152 EUROPE: EXOSOME RESEARCH MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 153 ASIA PACIFIC: EXOSOME RESEARCH MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 154 LATIN AMERICA: EXOSOME RESEARCH MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 156 EXOSOME RESEARCH MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 157 NORTH AMERICA: EXOSOME RESEARCH MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 158 EUROPE: EXOSOME RESEARCH MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 159 ASIA PACIFIC: EXOSOME RESEARCH MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 160 LATIN AMERICA: EXOSOME RESEARCH MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 162 EXOSOME RESEARCH MARKET FOR HOSPITALS & CLINICAL TESTING LABORATORIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 163 NORTH AMERICA: EXOSOME RESEARCH MARKET FOR HOSPITALS & CLINICAL TESTING LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 164 EUROPE: EXOSOME RESEARCH MARKET FOR HOSPITALS & CLINICAL TESTING LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 165 ASIA PACIFIC: EXOSOME RESEARCH MARKET FOR HOSPITALS & CLINICAL TESTING LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 166 LATIN AMERICA: EXOSOME RESEARCH MARKET FOR HOSPITALS & CLINICAL TESTING LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET FOR HOSPITALS & CLINICAL TESTING LABORATORIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 168 EXOSOME RESEARCH MARKET: KEYWORD RELEVANCE, TREND, AND PRIMARY FOCUS, 2015-2024

- TABLE 169 EXOSOME RESEARCH MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 170 NORTH AMERICA: KEY MACROINDICATORS

- TABLE 171 NORTH AMERICA: EXOSOME RESEARCH MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 172 NORTH AMERICA: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 173 NORTH AMERICA: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 NORTH AMERICA: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 175 NORTH AMERICA: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 NORTH AMERICA: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 177 NORTH AMERICA: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 178 US: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 179 US: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 US: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 181 US: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 US: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 183 US: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 184 CANADA: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 185 CANADA: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 CANADA: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 187 CANADA: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 CANADA: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 189 CANADA: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 190 EUROPE: KEY MACROINDICATORS

- TABLE 191 EUROPE: EXOSOME RESEARCH MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 192 EUROPE: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 193 EUROPE: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 EUROPE: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 195 EUROPE: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 EUROPE: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 197 EUROPE: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 198 GERMANY: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 199 GERMANY: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 GERMANY: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 201 GERMANY: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 GERMANY: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 203 GERMANY: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 204 UK: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 205 UK: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 UK: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 207 UK: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 UK: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 209 UK: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 210 FRANCE: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 211 FRANCE: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 FRANCE: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 213 FRANCE: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 FRANCE: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 215 FRANCE: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 216 ITALY: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 217 ITALY: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 ITALY: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 219 ITALY: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 ITALY: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 221 ITALY: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 222 SPAIN: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 223 SPAIN: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 SPAIN: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 225 SPAIN: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 SPAIN: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 227 SPAIN: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 228 REST OF EUROPE: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 229 REST OF EUROPE: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 REST OF EUROPE: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 231 REST OF EUROPE: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 REST OF EUROPE: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 233 REST OF EUROPE: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 234 ASIA PACIFIC: KEY MACROINDICATORS

- TABLE 235 ASIA PACIFIC: EXOSOME RESEARCH MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 236 ASIA PACIFIC: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 237 ASIA PACIFIC: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 238 ASIA PACIFIC: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 239 ASIA PACIFIC: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 ASIA PACIFIC: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 241 ASIA PACIFIC: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 242 CHINA: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 243 CHINA: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 244 CHINA: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 245 CHINA: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 246 CHINA: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 247 CHINA: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 248 JAPAN: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 249 JAPAN: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 JAPAN: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 251 JAPAN: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 252 JAPAN: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 253 JAPAN: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 254 INDIA: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 255 INDIA: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 INDIA: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 257 INDIA: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 258 INDIA: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 259 INDIA: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 260 AUSTRALIA: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 261 AUSTRALIA: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 262 AUSTRALIA: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 263 AUSTRALIA: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 264 AUSTRALIA: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 265 AUSTRALIA: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 266 SOUTH KOREA: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 267 SOUTH KOREA: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 268 SOUTH KOREA: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 269 SOUTH KOREA: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 270 SOUTH KOREA: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 271 SOUTH KOREA: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 272 REST OF ASIA PACIFIC: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 273 REST OF ASIA PACIFIC: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 274 REST OF ASIA PACIFIC: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 275 REST OF ASIA PACIFIC: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 276 REST OF ASIA PACIFIC: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 277 REST OF ASIA PACIFIC: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 278 LATIN AMERICA: KEY MACROINDICATORS

- TABLE 279 LATIN AMERICA: EXOSOME RESEARCH MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 280 LATIN AMERICA: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 281 LATIN AMERICA: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 282 LATIN AMERICA: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 283 LATIN AMERICA: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 284 LATIN AMERICA: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 285 LATIN AMERICA: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 286 BRAZIL: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 287 BRAZIL: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 288 BRAZIL: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 289 BRAZIL: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 290 BRAZIL: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 291 BRAZIL: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 292 MEXICO: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 293 MEXICO: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 294 MEXICO: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 295 MEXICO: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 296 MEXICO: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 297 MEXICO: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 298 REST OF LATIN AMERICA: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 299 REST OF LATIN AMERICA: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 300 REST OF LATIN AMERICA: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 301 REST OF LATIN AMERICA: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 302 REST OF LATIN AMERICA: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 303 REST OF LATIN AMERICA: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 304 MIDDLE EAST & AFRICA: KEY MACROINDICATORS

- TABLE 305 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 306 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 307 MIDDLE EAST & AFRICA: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 308 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 309 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 310 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 312 GCC COUNTRIES: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 313 GCC COUNTRIES: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 314 GCC COUNTRIES: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 315 GCC COUNTRIES: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 316 GCC COUNTRIES: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 317 GCC COUNTRIES: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 318 REST OF MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 319 REST OF MIDDLE EAST & AFRICA: EXOSOME RESEARCH KITS & REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 320 REST OF MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 321 REST OF MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET FOR CANCER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 322 REST OF MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 323 REST OF MIDDLE EAST & AFRICA: EXOSOME RESEARCH MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 324 OVERVIEW OF MAJOR STRATEGIES DEPLOYED BY KEY PLAYERS IN EXOSOME RESEARCH MARKET, JANUARY 2022-MAY 2025

- TABLE 325 EXOSOME RESEARCH MARKET: DEGREE OF COMPETITION

- TABLE 326 EXOSOME RESEARCH MARKET: REGION FOOTPRINT

- TABLE 327 EXOSOME RESEARCH MARKET: OFFERING FOOTPRINT

- TABLE 328 EXOSOME RESEARCH MARKET: INDICATION FOOTPRINT

- TABLE 329 EXOSOME RESEARCH MARKET: APPLICATION FOOTPRINT

- TABLE 330 EXOSOME RESEARCH MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 331 EXOSOME RESEARCH MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SME PLAYERS, BY OFFERING AND REGION, 2024

- TABLE 332 EXOSOME RESEARCH MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 333 EXOSOME RESEARCH MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 334 EXOSOME RESEARCH MARKET: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 335 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 336 THERMO FISHER SCIENTIFIC INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 337 THERMO FISHER SCIENTIFIC INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 338 QIAGEN: COMPANY OVERVIEW

- TABLE 339 QIAGEN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 340 QIAGEN: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 341 LONZA: COMPANY OVERVIEW

- TABLE 342 LONZA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 343 LONZA: DEALS, JANUARY 2022-MAY 2025

- TABLE 344 LONZA: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 345 DANAHER: COMPANY OVERVIEW

- TABLE 346 DANAHER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 347 DANAHER: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 348 DANAHER: DEALS, JANUARY 2022-MAY 2025

- TABLE 349 BIO-TECHNE: COMPANY OVERVIEW

- TABLE 350 BIO-TECHNE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 351 BIO-TECHNE: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 352 SYSTEM BIOSCIENCES, LLC: COMPANY OVERVIEW

- TABLE 353 SYSTEM BIOSCIENCES, LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 354 AMSBIO: COMPANY OVERVIEW

- TABLE 355 AMSBIO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 356 ROOSTERBIO, INC.: COMPANY OVERVIEW

- TABLE 357 ROOSTERBIO, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 358 ROOSTERBIO, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 359 MILTENYI BIOTEC: COMPANY OVERVIEW

- TABLE 360 MILTENYI BIOTEC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 361 MILTENYI BIOTEC: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 362 NORGEN BIOTEK CORP.: COMPANY OVERVIEW

- TABLE 363 NORGEN BIOTEK CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 364 AETHLON MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 365 AETHLON MEDICAL, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 366 AETHLON MEDICAL, INC.: PRODUCT APPROVALS, JANUARY 2022-MAY 2025

- TABLE 367 CREATIVE MEDICAL TECHNOLOGIES HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 368 CREATIVE MEDICAL TECHNOLOGIES HOLDINGS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 369 SPECTRIS: COMPANY OVERVIEW

- TABLE 370 SPECTRIS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 371 SPECTRIS: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 372 SPECTRIS: DEALS, JANUARY 2022-MAY 2025

- TABLE 373 NANOFCM, INC.: COMPANY OVERVIEW

- TABLE 374 NANOFCM, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 375 IZON SCIENCE LIMITED: COMPANY OVERVIEW

- TABLE 376 IZON SCIENCE LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 377 CAPRICOR THERAPEUTICS, INC.: COMPANY OVERVIEW

- TABLE 378 CAPRICOR THERAPEUTICS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 379 ANJARIUM BIOSCIENCES AG: COMPANY OVERVIEW

- TABLE 380 CILOA: COMPANY OVERVIEW

- TABLE 381 INNOVAPREP: COMPANY OVERVIEW

- TABLE 382 ILIAS BIOLOGICS INC.: COMPANY OVERVIEW

- TABLE 383 UNCHAINED LABS: COMPANY OVERVIEW

- TABLE 384 RION INC.: COMPANY OVERVIEW

- TABLE 385 CELL GUIDANCE SYSTEM LLC: COMPANY OVERVIEW

- TABLE 386 INOVIQ: COMPANY OVERVIEW

- TABLE 387 NX PHARMAGEN: COMPANY OVERVIEW

- TABLE 388 EXOPHARM: COMPANY OVERVIEW

- TABLE 389 EVERZOM: COMPANY OVERVIEW

- TABLE 390 NANOSOMIX: COMPANY OVERVIEW

- TABLE 391 CREATIVE BIOLABS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 EXOSOME RESEARCH MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 EXOSOME RESEARCH MARKET: YEARS CONSIDERED

- FIGURE 3 EXOSOME RESEARCH MARKET: RESEARCH DESIGN

- FIGURE 4 EXOSOME RESEARCH MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 EXOSOME RESEARCH MARKET: BREAKDOWN OF PRIMARIES (SUPPLY- AND DEMAND-SIDE PARTICIPANTS)

- FIGURE 6 EXOSOME RESEARCH MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2024

- FIGURE 7 COMPANY REVENUE ANALYSIS-BASED ESTIMATION: BOTTOM-UP APPROACH (2024)

- FIGURE 8 REVENUE SHARE ANALYSIS OF THERMO FISHER SCIENTIFIC INC. (2024)

- FIGURE 9 EXOSOME RESEARCH MARKET: KEY INSIGHTS FROM PRIMARIES

- FIGURE 10 EXOSOME RESEARCH MARKET: TOP-DOWN APPROACH

- FIGURE 11 EXOSOME RESEARCH MARKET: CAGR PROJECTIONS

- FIGURE 12 EXOSOME RESEARCH MARKET: DATA TRIANGULATION

- FIGURE 13 EXOSOME RESEARCH MARKET, BY OFFERING, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 EXOSOME RESEARCH MARKET, BY INDICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 EXOSOME RESEARCH MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 EXOSOME RESEARCH MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 REGIONAL SNAPSHOT OF EXOSOME RESEARCH MARKET

- FIGURE 18 HIGH DEMAND FOR PRECISION MEDICINES AND STRONG PHARMACEUTICAL R&D INFRASTRUCTURE TO DRIVE MARKET

- FIGURE 19 US AND BIOMARKERS COMMANDED LARGEST SHARE OF NORTH AMERICAN EXOSOME RESEARCH MARKET IN 2024

- FIGURE 20 US TO WITNESS HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 21 EXOSOME RESEARCH MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 EXOSOME RESEARCH MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 23 INDICATIVE PRICE OF EXOSOME KITS & REAGENTS, BY KEY PLAYER (2024)

- FIGURE 24 INDICATIVE PRICE OF EXOSOME RESEARCH PRODUCTS, BY REGION (2024)

- FIGURE 25 EXOSOME RESEARCH MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 EXOSOME RESEARCH MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 EXOSOME RESEARCH MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 EXOSOME RESEARCH MARKET: TOP PATENT APPLICANTS/OWNERS AND NUMBER OF PATENTS GRANTED, JANUARY 2014-DECEMBER 2024

- FIGURE 29 EXOSOME RESEARCH MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY OFFERING

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 32 EXOSOME RESEARCH MARKET: FUNDING AND NUMBER OF DEALS, 2020-2024

- FIGURE 33 EXOSOME RESEARCH MARKET: IMPACT OF AI/GEN AI

- FIGURE 34 NORTH AMERICA: EXOSOME RESEARCH MARKET SNAPSHOT

- FIGURE 35 EUROPE: EXOSOME RESEARCH MARKET SNAPSHOT

- FIGURE 36 REVENUE ANALYSIS OF KEY PLAYERS IN EXOSOME RESEARCH MARKET, 2020-2024 (USD MILLION)

- FIGURE 37 MARKET SHARE ANALYSIS OF KEY PLAYERS IN EXOSOME RESEARCH MARKET (2024)

- FIGURE 38 EXOSOME RESEARCH MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 39 EXOSOME RESEARCH MARKET: COMPANY FOOTPRINT

- FIGURE 40 EXOSOME RESEARCH MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 41 EV/EBITDA OF KEY VENDORS

- FIGURE 42 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 43 EXOSOME RESEARCH MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 44 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 45 QIAGEN: COMPANY SNAPSHOT

- FIGURE 46 LONZA: COMPANY SNAPSHOT

- FIGURE 47 DANAHER: COMPANY SNAPSHOT

- FIGURE 48 BIO-TECHNE: COMPANY SNAPSHOT

- FIGURE 49 AETHLON MEDICAL, INC.: COMPANY SNAPSHOT

- FIGURE 50 CREATIVE MEDICAL TECHNOLOGIES HOLDINGS, INC.: COMPANY SNAPSHOT

- FIGURE 51 SPECTRIS: COMPANY SNAPSHOT

- FIGURE 52 CAPRICOR THERAPEUTICS, INC.: COMPANY SNAPSHOT

The global exosome research market is projected to reach USD 480.6 million by 2030 from USD 214.4 million in 2025, at a CAGR of 17.5% during the forecast period. The expansion of the exosome research market is primarily fueled by the escalating incidence of chronic diseases, including cancer, neurodegenerative disorders, and CVDs; this trend underscores the urgent need for novel diagnostic and therapeutic strategies. Exosomes, due to their properties as potential biomarkers and their capacity to facilitate targeted therapeutic delivery, are uniquely positioned to address the increasing demand for advanced disease diagnostics and treatment modalities.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD million) |

| Segments | Offerings, Application, Manufacturing Service, End User, Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

"The kits & reagents segment is expected to grow at the highest CAGR during the study period."

As academic institutions, biotechnology companies, and diagnostic developers delve deeper into the multifaceted roles of exosomes in disease diagnostics and therapeutic interventions, there has been a notable increase in the demand for standardized, user-friendly kits & reagents. These specialized tools play a crucial role in simplifying and expediting the workflows associated with exosome isolation, purification, labeling, and downstream analysis. Exosomes, nano-sized vesicles secreted by cells, have emerged as significant biomarkers in various diseases, necessitating precise handling and analysis. The standardization offered by commercially available kits helps ensure that researchers can perform these tasks with consistency and reliability, which is vital in both translational research and preclinical development. In particular, reproducibility is critical in scientific research; utilizing validated kits ensures consistent protocols that minimize variability and enhance overall research outcomes. This reliability is particularly pertinent in biomarker discovery and liquid biopsy research, where the identification of accurate biomarkers is paramount for early disease detection and monitoring. With the growing interest in exosome-based diagnostics-especially within oncology for cancer detection and neurodegenerative diseases like Alzheimer's and Parkinson's-laboratories are increasingly opting for ready-to-use reagent systems. These systems facilitate sample preparation, RNA and DNA extraction, and comprehensive cargo profiling, thereby supporting a range of downstream molecular applications. The integration of such standardized tools not only streamlines the research process but also enhances the quality of data generated, ultimately contributing to the advancement of exosome research in clinical settings. As the landscape of diagnostics continues to evolve, the role of such reliable and efficient kits will become even more pronounced, paving the way for breakthroughs in personalized medicine and targeted therapies.

"North America is expected to grow at the highest CAGR in the global exosome research market from 2025 to 2030."

North America maintains its leading position in the global exosome research market, primarily due to substantial government investment and support mechanisms. Key organizations such as the National Institutes of Health (NIH) in the United States are pivotal, channeling significant funding into biomedical research, specifically targeting projects centered on exosomes. This financial endorsement empowers researchers to explore novel applications of exosomes in both diagnostics and therapeutics. For example, in June 2024, the National Heart, Lung, and Blood Institute (NHLBI) renewed a USD 12 million Program Project Grant (PPG) to support researchers at the Lewis Katz School of Medicine at Temple University. Their investigation focuses on heart cell-derived exosomes and their involvement in cardiac injury and repair processes. This funding facilitates a deeper understanding of the mechanisms by which exosomes contribute to myocardial tissue regeneration, potentially leading to groundbreaking therapeutic strategies. Likewise, in August 2023, the National Cancer Institute (NCI) allocated USD 2.5 million to the Sylvester Comprehensive Cancer Center to advance research on exosome-based biomarkers for prostate cancer detection through urine and blood assays. Such robust government backing not only propels scientific exploration but also fosters collaboration between academic institutions and industry, thereby cultivating a dynamic research ecosystem. This well-capitalized environment accelerates innovation and reinforces North America's status as a frontrunner in exosome research. As a result, the region continues to draw in investments and talent, driving ongoing growth within the exosome research sector.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the authentication and brand protection marketplace.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side-70% and Demand Side-30%

- By Designation: Managers-45%, CXO and Directors-30%, and Executives-25%

- By Region: North America-40%, Europe-25%, the Asia Pacific-25%, Latin America-5%, and the Middle East & Africa-5%

List of Key Companies Profiled in the Report:

Key players in the exosome research market include Thermo Fisher Scientific, Inc. (US), Bio-Techne (US), Danaher Corporation (US), Capricor Therapeutics(US), Lonza (Switzerland), QIAGEN (Germany), Creative Medical Technologies Holdings, Inc. (US), System Biosciences, LLC (US), NX Pharmagen (US), NanoSomiX (US), Miltenyi Biotech (Germany), Norgen Biotek Corp. (Canada), AMSBio (UK), Aethlon Medical, Inc. (US), Anjarium Biosciences AG (UK), Ciloa (France), InnovaPrep LLC (US), ILIAS Biologics, Inc. (South Korea), Unchained Labs (US), Rion, Inc. (US), Cell Guidance System, LLC (UK), INOVIQ (Australia), Exopharm (Australia), Everzom (France), RoosterBio, Inc. (US), Creative Biolabs (US), Nanofcm (UK), Izon Science (UK), and Malvern Panalytical (UK).

Research Coverage:

This research report categorizes the exosome research market by offering [kits & reagents (antibodies, isolation, purification, quantitation kits, reagents, and other kits & reagents), instruments, and services], indication [cancer indication (lung cancer, breast cancer, prostate cancer, colorectal cancer, other cancers), neurodegenerative diseases, cardiovascular diseases, infectious diseases, and other indications], by application [biomarkers, vaccine development, tissue regeneration, and other applications], by manufacturing services [stem cell-derived exosome manufacturing services, dendritic cell-derived exosome manufacturing services, and other manufacturing services] by end user [academic & research institutes, pharmaceutical & biotechnological companies, and hospitals & clinical laboratories] and by region [North America, Europe, Asia Pacific, Latin America, Middle East & Africa].

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the exosome research market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, solutions, key strategies, collaborations, partnerships, and agreements. New approvals/launches, collaborations, acquisitions, and recent developments associated with the Exosome Research market.

Key Benefits of Buying the Report:

The report will help market leaders and new entrants by providing them with the closest approximations of the revenue numbers for the overall exosome research market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their businesses and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing investment in pharmaceutical & life sciences research, rising cancer prevalence, and increasing interest in exosome-based procedures), restraints (technical complexity of exosome isolation, and regulatory uncertainty in exosome research), opportunities (rising investments in emerging countries for exosome research, growing interest in exosome-based therapeutics, and increasing demand for personalized medicines), and Challenges (lack of gold standard protocols for exosome development and production and limited understanding of cargo loading).

- Product Development/Innovation: Detailed insights on upcoming products, research and development activities, and new product approvals/launches in the exosome research market.

- Market Development: Comprehensive information about lucrative markets; the report analyses the market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the exosome research market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players. A detailed analysis of the key industry players has been done to provide insights into their key strategies, product launches/ approvals, acquisitions, partnerships, agreements, collaborations, other recent developments, investment and funding activities, brand/product comparative analysis, and vendor valuation and financial metrics of the exosome research market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Objectives of secondary research

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key objective of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.2.1.1 Company revenue analysis (bottom-up approach)

- 2.2.1.2 Revenue share analysis of Thermo Fisher Scientific Inc.

- 2.2.1.3 MnM repository analysis

- 2.2.1.4 Primary interviews

- 2.2.2 INSIGHTS FROM PRIMARY EXPERTS

- 2.2.3 SEGMENTAL MARKET SIZE ESTIMATION (TOP-DOWN APPROACH)

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.3 MARKET GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 EXOSOME RESEARCH MARKET OVERVIEW

- 4.2 NORTH AMERICA: EXOSOME RESEARCH MARKET, BY APPLICATION AND COUNTRY

- 4.3 EXOSOME RESEARCH MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing investment in pharmaceutical and life sciences R&D

- 5.2.1.2 Rising focus on development of cancer therapeutics and diagnostics

- 5.2.1.3 Growing interest in exosome-based procedures

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technical complexity of exosome isolation and characterization

- 5.2.2.2 Regulatory complications and uncertainty in exosome research

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High investments in emerging economies

- 5.2.3.2 Growing interest in exosome-based therapeutics

- 5.2.3.3 Rising demand for personalized medicines

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standard protocols for exosome manufacturing and development

- 5.2.4.2 Limited understanding of cargo loading capacity

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICE OF EXOSOME RESEARCH PRODUCTS, BY KEY PLAYER, 2024

- 5.4.2 INDICATIVE PRICE OF EXOSOME RESEARCH PRODUCTS, BY REGION, 2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.7.1 ROLE IN ECOSYSTEM

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Ultracentrifugation

- 5.8.1.2 Nanoparticle tracking analysis (NTA)

- 5.8.2 COMPLIMENTARY TECHNOLOGIES

- 5.8.2.1 Microfluidics

- 5.8.2.2 Western blotting/ELISA

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Next-generation sequencing

- 5.8.3.2 Mass spectrometry

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.9.1 NUMBER OF PATENTS FILED, BY DOCUMENT TYPE, 2014-2024

- 5.9.2 LIST OF KEY PATENTS, 2023-2024

- 5.10 KEY CONFERENCES & EVENTS, 2025-2026

- 5.11 REGULATORY ANALYSIS

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATORY FRAMEWORK

- 5.11.2.1 North America

- 5.11.2.1.1 US

- 5.11.2.1.2 Canada

- 5.11.2.2 Europe

- 5.11.2.2.1 Germany

- 5.11.2.2.2 France

- 5.11.2.2.3 UK

- 5.11.2.3 Asia Pacific

- 5.11.2.3.1 China

- 5.11.2.3.2 Japan

- 5.11.2.3.3 India

- 5.11.2.4 Rest of the World

- 5.11.2.4.1 Brazil

- 5.11.2.4.2 Argentina

- 5.11.2.4.3 Saudi Arabia

- 5.11.2.1 North America

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 KEY BUYING CRITERIA

- 5.14 INVESTMENT & FUNDING SCENARIO

- 5.15 TRADE DATA ANALYSIS

- 5.15.1 IMPORT DATA FOR HS CODE 3822, 2020-2024

- 5.15.2 EXPORT DATA FOR HS CODE 3822, 2020-2024

- 5.16 IMPACT OF AI/GEN AI ON EXOSOME RESEARCH MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON EXOSOME RESEARCH MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACTS ON COUNTRY/REGION

- 5.17.4.1 North America

- 5.17.4.1.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.4.1 North America

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.17.5.1 Academic & research institutes

- 5.17.5.2 Pharmaceutical & biotechnology companies

- 5.17.5.3 Hospitals & clinical laboratories

6 EXOSOME RESEARCH MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 KITS & REAGENTS

- 6.2.1 ANTIBODIES

- 6.2.1.1 High demand for exosome-based markers for disease detection to propel market growth

- 6.2.2 ISOLATION, PURIFICATION, AND QUANTITATION KITS & REAGENTS

- 6.2.2.1 Availability of rapid and easy-to-use kits & reagents to ensure sustained demand

- 6.2.3 OTHER KITS & REAGENTS

- 6.2.1 ANTIBODIES

- 6.3 INSTRUMENTS

- 6.3.1 DEMAND FOR SCALABLE EXOSOME DEVELOPMENT THROUGH HIGH-THROUGHPUT SYSTEMS TO DRIVE GROWTH

- 6.4 SERVICES

- 6.4.1 LACK OF IN-HOUSE RESOURCES TO SUPPORT MARKET GROWTH

7 EXOSOME RESEARCH MARKET, BY INDICATION

- 7.1 INTRODUCTION

- 7.2 CANCER

- 7.2.1 LUNG CANCER

- 7.2.1.1 Increasing demand for advanced diagnostics for lung cancer to propel market growth

- 7.2.2 BREAST CANCER

- 7.2.2.1 Increased awareness and focus on better non-invasive diagnosis to aid market growth

- 7.2.3 PROSTATE CANCER

- 7.2.3.1 Effectiveness of liquid biopsy in detecting prostate cancer before surgery to support market growth

- 7.2.4 COLORECTAL CANCER

- 7.2.4.1 Rising focus on exosome-based research on tumor initiation, progression, chemoresistance, and metastasis to drive market

- 7.2.5 OTHER CANCERS

- 7.2.1 LUNG CANCER

- 7.3 NEURODEGENERATIVE DISEASES

- 7.3.1 INCREASED APPLICATION OF SALIVARY EXOSOMAL CARGO CONTENT IN DISEASE TREATMENT TO PROPEL MARKET GROWTH

- 7.4 CARDIOVASCULAR DISEASES

- 7.4.1 GREATER RESEARCH FOCUS ON EXTRACELLULAR VESICLES TO AUGMENT MARKET GROWTH

- 7.5 INFECTIOUS DISEASES

- 7.5.1 POTENTIAL FOR EXOSOMES IN DEVELOPING NOVEL INFECTIOUS DISEASE TREATMENTS TO AID ADOPTION

- 7.6 OTHER INDICATIONS

8 EXOSOME RESEARCH MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 BIOMARKERS

- 8.2.1 ABILITY TO MODULATE CELL SIGNALING AND REDUCE NEUROINFLAMMATION TO DRIVE ADOPTION

- 8.3 VACCINE DEVELOPMENT

- 8.3.1 NEED FOR COMBATING INFECTIOUS DISEASES TO SPUR ADOPTION OF EXOSOME-BASED VACCINES

- 8.4 TISSUE REGENERATION

- 8.4.1 MINIMAL SIDE EFFECTS AND HIGH EFFICACY OF EXOSOMES IN TISSUE REGENERATION TO SUPPORT ADOPTION

- 8.5 OTHER APPLICATIONS

9 EXOSOME RESEARCH MARKET, BY MANUFACTURING SERVICE

- 9.1 INTRODUCTION

- 9.2 STEM CELL-DERIVED EXOSOME MANUFACTURING

- 9.2.1 INCREASE IN DEMAND FOR MESENCHYMAL STEM CELLS-BASED EXOSOMES IN THERAPEUTICS TO AUGMENT MARKET GROWTH

- 9.3 DENDRITIC CELL-DERIVED EXOSOME MANUFACTURING

- 9.3.1 SIGNIFICANT DEVELOPMENTS IN DENDRITIC CELL-BASED EXOSOME IMMUNOTHERAPY TO DRIVE MARKET

- 9.4 OTHER MANUFACTURING SERVICES

10 EXOSOME RESEARCH MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 ACADEMIC & RESEARCH INSTITUTES

- 10.2.1 INCREASING NUMBER OF CANCER AND STEM CELL RESEARCH PROJECTS GLOBALLY TO AUGMENT MARKET GROWTH

- 10.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 10.3.1 HIGH INVESTMENTS AND RAPID INNOVATIONS IN EXOSOME-BASED DIAGNOSTICS TO AID MARKET GROWTH

- 10.4 HOSPITALS & CLINICAL TESTING LABORATORIES

- 10.4.1 RISING ADOPTION OF EXOSOME-BASED ONCOLOGY RESEARCH SOLUTIONS TO PROPEL MARKET GROWTH

11 EXOSOME RESEARCH MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC ANALYSIS FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 US to dominate North American exosome research market during study period

- 11.2.3 CANADA

- 11.2.3.1 Increasing funding for genome-based medical treatments to support market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC ANALYSIS FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Advanced biotechnology sector and developed research facilities to favor market growth

- 11.3.3 UK

- 11.3.3.1 Favorable R&D initiatives and advanced life science industry to drive market

- 11.3.4 FRANCE

- 11.3.4.1 Increasing collaborations between biotechnology firms and research institutes to propel market growth

- 11.3.5 ITALY

- 11.3.5.1 Favorable government policies to propel growth of exosome research

- 11.3.6 SPAIN

- 11.3.6.1 Increased focus on pharmaceutical R&D to aid market growth

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC ANALYSIS FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Favorable government initiatives for development of biotechnology industry to drive market

- 11.4.3 JAPAN

- 11.4.3.1 High prevalence of cancer and increased healthcare expenditure to aid market growth

- 11.4.4 INDIA

- 11.4.4.1 Increasing number of institutional alliances and growing focus on clinical innovation to support market growth

- 11.4.5 AUSTRALIA

- 11.4.5.1 Substantial government funding and innovative applications in regenerative medicines to augment market growth

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Favorable government initiatives and routine clinical trials to support market growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC ANALYSIS FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Increased government investments in pharmaceutical R&D to drive market

- 11.5.3 MEXICO

- 11.5.3.1 Advancements in regenerative medicines and exosome-based therapies to support market growth

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC ANALYSIS FOR MIDDLE EAST & AFRICA

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Strong focus on local pharmaceutical R&D to fuel market growth

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN EXOSOME RESEARCH MARKET

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Offering footprint

- 12.5.5.4 Indication footprint

- 12.5.5.5 Application footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SME players, by offering and region

- 12.7 COMPANY VALUATION & FINANCIAL METRICS

- 12.7.1 FINANCIAL METRICS

- 12.7.2 COMPANY VALUATION

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES & APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 THERMO FISHER SCIENTIFIC INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 QIAGEN

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 LONZA

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 DANAHER

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services/Solutions offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 BIO-TECHNE

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Services/Solutions offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 SYSTEM BIOSCIENCES, LLC

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Services/Solutions offered

- 13.1.7 AMSBIO

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Services/Solutions offered

- 13.1.8 ROOSTERBIO, INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Services/Solutions offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 MILTENYI BIOTEC

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Services/Solutions offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.10 NORGEN BIOTEK CORP.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Services/Solutions offered

- 13.1.11 AETHLON MEDICAL, INC.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Services/Solutions offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product approvals

- 13.1.12 CREATIVE MEDICAL TECHNOLOGIES HOLDINGS, INC.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Services/Solutions offered

- 13.1.13 SPECTRIS

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Services/Solutions offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product launches

- 13.1.13.3.2 Deals

- 13.1.14 NANOFCM, INC.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Services/Solutions offered

- 13.1.15 IZON SCIENCE LIMITED

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Services/Solutions offered

- 13.1.16 CAPRICOR THERAPEUTICS, INC.

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Services/Solutions offered

- 13.1.1 THERMO FISHER SCIENTIFIC INC.

- 13.2 OTHER PLAYERS

- 13.2.1 ANJARIUM BIOSCIENCES AG

- 13.2.2 CILOA

- 13.2.3 INNOVAPREP

- 13.2.4 ILIAS BIOLOGICS INC.

- 13.2.5 UNCHAINED LABS

- 13.2.6 RION INC.

- 13.2.7 CELL GUIDANCE SYSTEM LLC

- 13.2.8 INOVIQ

- 13.2.9 NX PHARMAGEN

- 13.2.10 EXOPHARM

- 13.2.11 EVERZOM

- 13.2.12 NANOSOMIX

- 13.2.13 CREATIVE BIOLABS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS