|

|

市場調査レポート

商品コード

1746465

サージ保護デバイスの世界市場:製品別、技術別、公称放電電流別、エンドユーザー別、地域別 - 2030年までの予測Surge Protection Devices Market by Product (Hard-wired, Plug-in, Line Cord, Power Control Devices), by Technology (Type 1, Type 2, Type 3), by Nominal Discharge Current (Below 10kA, 10-25kA, Above 25kA), End-User, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| サージ保護デバイスの世界市場:製品別、技術別、公称放電電流別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月04日

発行: MarketsandMarkets

ページ情報: 英文 317 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

サージ保護デバイスの市場規模は、2025年の29億8,000万米ドルから2030年には39億5,000万米ドルに成長すると予測され、予測期間中のCAGRは5.8%になるとみられています。

同市場は、主に電力サージから繊細な電子機器を保護し、動作の継続性を確保し、機器の損傷を最小限に抑える必要性によって牽引されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象ユニット | 金額(100万米ドル/10億米ドル)、数量(1,000台) |

| セグメント別 | 製品別、技術別、公称放電電流別、エンドユーザー別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、南米、中東・アフリカ |

公称放電電流別では、10kA未満セグメントが2025年から2030年にかけて第2位の市場になると予測されています。これは主に、低サージ保護定格で十分な住宅および軽商業用途の急成長によるものです。これらのSPDはコスト効率が高く、設置が容易で、家庭用電子機器、スマート家電、オフィス機器を、内部スイッチングイベントや近隣の妨害によって引き起こされる軽微な電圧スパイクから保護するのに適しています。コネクテッドデバイスやスマートホームシステムの導入が世界的に、特に新興経済圏で加速するにつれて、手頃な価格のプラグイン型、ポイントオブユース型のサージ保護に対する需要が高まっており、市場全体におけるこのセグメントの確固たる地位を築いています。

製品別では、プラグインセグメントは、設置の容易さと柔軟性が重要な住宅、商業、小規模オフィス環境で広く使用されているため、2025年から2030年にかけて第2位の市場になると予測されます。これらのデバイスは通常、標準的な電源コンセントに直接挿入され、コンピューター、テレビ、家電製品などの接続機器に即時保護を提供します。手頃な価格、携帯性、最新のスマート・デバイスとの互換性の向上により、消費者の間で人気が高まっています。また、日常的な電力サージによる被害に対する意識の高まりや、世界的に家庭への電子機器の普及が進んでいることも、プラグイン・サージ保護ソリューションの需要を持続的に高める主な要因となっています。

北米は、高度な電気インフラの広範な展開、スマートグリッドシステムへの投資の増加、データセンターと産業オートメーションの高集中が原動力となり、2025年から2030年にかけてサージ保護デバイス市場で2番目に急成長する地域になると予想されます。この地域は、頻繁な落雷、悪天候、グリッドインフラの老朽化によって引き起こされる電気障害の影響を受けやすいため、信頼性の高いサージ保護の必要性がさらに高まっています。また、厳格な安全規制、住宅および商業用ユーザーの意識の高まり、スマートホームおよびオフィス技術の採用増加により、米国、カナダ、メキシコ全域でサージ保護ソリューションに対する一貫した需要が高まっています。

当レポートでは、世界のサージ保護デバイス市場について調査し、製品別、技術別、公称放電電流別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- サプライチェーン分析

- 技術分析

- 価格分析

- 2025年~2026年の主な会議とイベント

- 関税と規制状況

- 貿易分析

- 特許分析

- 投資と資金調達のシナリオ

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 生成AI/AIがサージ保護デバイス市場に与える影響

- サージ保護デバイス市場のマクロ経済見通し

- 2025年の米国関税の影響- サージ保護デバイス市場

- エンドユーザーへの影響

第6章 サージ保護デバイス市場(製品別)

- イントロダクション

- ハードワイヤード

- プラグイン

- ラインコード

- 電力制御装置

第7章 サージ保護デバイス市場(技術別)

- イントロダクション

- タイプ1

- タイプ2

- タイプ3

- その他

第8章 サージ保護デバイス市場(公称放電電流別)

- イントロダクション

- 10 KA以下

- 10年~25 KA

- 25KA以上

第9章 サージ保護デバイス市場(エンドユーザー別)

- イントロダクション

- 工業

- 商業

- 住宅

- データセンター

- ユーティリティ

第10章 サージ保護デバイス市場(地域別)

- イントロダクション

- 北米

- 米国

- デジタル技術、スマートホーム、産業オートメーションへの依存度の高まりが市場を牽引

- カナダ

- スマートビルディングとネットゼロ商業スペースへの注目が高まり、市場の成長を促進

- メキシコ

- 需要拡大に向けた製造業と産業基盤の拡大

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- イタリア

- オランダ

- その他

- アジア太平洋

- 中国

- 日本

- オーストラリア

- インド

- その他

- 中東・アフリカ

- GCC

- エジプト

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- チリ

- コロンビア

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価と財務指標、2024年

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- SIEMENS

- ABB

- EATON

- SCHNEIDER ELECTRIC

- EMERSON ELECTRIC CO.

- LITTELFUSE, INC.

- LEGRAND

- PROSURGE, INC.

- PHOENIX CONTACT

- SHENZHEN TECHWIN LIGHTNING TECHNOLOGIES CO., LTD.

- CITEL

- HUBBELL

- BOURNS, INC.

- RAYCAP

- LEVITON MANUFACTURING CO., INC.

- MERSEN

- DITEK, INC.

- HAVELLS INDIA LTD.

- BELKIN

- OBO BETTERMANN HOLDING GMBH & CO. KG

- その他の企業

- ALLTEC

- MAXIVOLT

- SOCOMEC

- DEHN SE

- SUNPEACE

第13章 付録

List of Tables

- TABLE 1 SURGE PROTECTION DEVICES MARKET SIZE ESTIMATION METHODOLOGY (DEMAND-SIDE)

- TABLE 2 SURGE PROTECTION DEVICES MARKET: RISK ANALYSIS

- TABLE 3 SURGE PROTECTION DEVICES MARKET SNAPSHOT

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 INDICATIVE PRICING OF SURGE PROTECTION DEVICES, BY PRODUCT, 2024

- TABLE 6 AVERAGE SELLING PRICE TREND OF SURGE PROTECTION DEVICES, BY REGION (2021-2024)

- TABLE 7 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 8 MFN TARIFF FOR HS 853540 CODE-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 9 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 SURGE PROTECTION DEVICES MARKET: STANDARDS

- TABLE 16 IMPORT DATA FOR HS CODE 853540-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 17 EXPORT DATA FOR HS CODE 853540-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 18 LIST OF PATENTS, 2021-2025

- TABLE 19 SURGE PROTECTION DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 22 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR SURGE PROTECTION DEVICES

- TABLE 24 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END USER MARKET DUE TO TARIFF IMPACT

- TABLE 25 SURGE PROTECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 26 SURGE PROTECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 27 HARD-WIRED: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 HARD-WIRED: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 PLUG-IN: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 PLUG-IN: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 LINE CORD: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

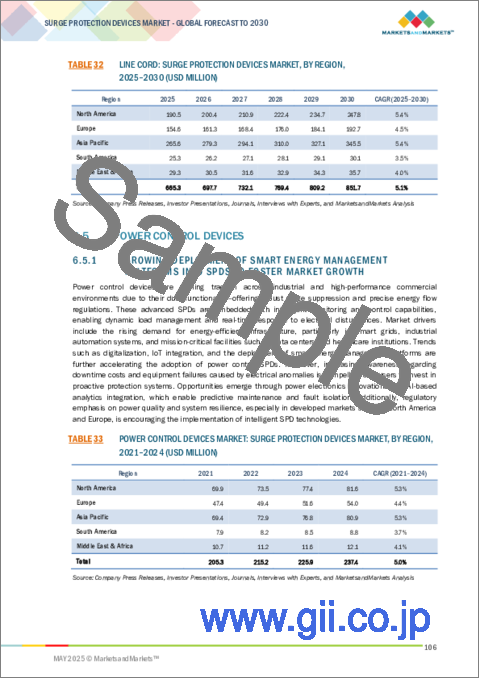

- TABLE 32 LINE CORD: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 POWER CONTROL DEVICES MARKET: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 POWER CONTROL DEVICES MARKET: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 SURGE PROTECTION DEVICES MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 36 SURGE PROTECTION DEVICES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 37 TYPE 1: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 TYPE 1: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 TYPE 2: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 TYPE 2: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 TYPE 3: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 TYPE 3: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 OTHER TECHNOLOGIES: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 OTHER TECHNOLOGIES: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 SURGE PROTECTION DEVICES MARKET, BY NOMINAL DISCHARGE CURRENT, 2021-2024 (USD MILLION)

- TABLE 46 SURGE PROTECTION DEVICES MARKET, BY NOMINAL DISCHARGE CURRENT, 2025-2030 (USD MILLION)

- TABLE 47 BELOW 10 KA: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 BELOW 10 KA: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 10-25 KA: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 10-25 KA: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 ABOVE 25 KA: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 ABOVE 25 KA: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 54 SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 55 INDUSTRIAL: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 INDUSTRIAL: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 COMMERCIAL: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 COMMERCIAL: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 RESIDENTIAL: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 RESIDENTIAL: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 DATA CENTERS: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 DATA CENTERS: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 UTILITIES: SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 UTILITIES: SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 SURGE PROTECTION DEVICES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 68 SURGE PROTECTION DEVICES MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 69 NORTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 70 NORTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY NOMINAL DISCHARGE CURRENT, 2021-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY NOMINAL DISCHARGE CURRENT, 2025-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 74 NORTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 US: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 80 US: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 81 CANADA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 82 CANADA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 83 MEXICO: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 84 MEXICO: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 85 EUROPE: SURGE PROTECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 86 EUROPE: SURGE PROTECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 87 EUROPE: SURGE PROTECTION DEVICES MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 88 EUROPE: SURGE PROTECTION DEVICES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: SURGE PROTECTION DEVICES MARKET, BY NOMINAL DISCHARGE CURRENT, 2021-2024 (USD MILLION)

- TABLE 90 EUROPE: SURGE PROTECTION DEVICES MARKET, BY NOMINAL DISCHARGE CURRENT, 2025-2030 (USD MILLION)

- TABLE 91 EUROPE: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 92 EUROPE: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: SURGE PROTECTION DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 EUROPE: SURGE PROTECTION DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 GERMANY: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 96 GERMANY: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 97 UK: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 98 UK: SURGE PROTECTION DEIVCES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 99 FRANCE: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 100 FRANCE: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 101 RUSSIA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 102 RUSSIA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 103 ITALY: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 104 ITALY: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 105 NETHERLANDS: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 106 NETHERLANDS: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 107 REST OF EUROPE: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 108 REST OF EUROPE: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 110 ASIA PACIFIC: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: SURGE PROTECTION DEVICES MARKET, BY NOMINAL DISCHARGE CURRENT, 2021-2024 (USD MILLION)

- TABLE 112 ASIA PACIFIC: SURGE PROTECTION DEVICES MARKET, BY NOMINAL DISCHARGE CURRENT, 2025-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: SURGE PROTECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 114 ASIA PACIFIC: SURGE PROTECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: SURGE PROTECTION DEVICES MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 116 ASIA PACIFIC: SURGE PROTECTION DEVICES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: SURGE PROTECTION DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 ASIA PACIFIC: SURGE PROTECTION DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 CHINA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 120 CHINA: SURGE PROTECTION DEIVCES, BY END USER, 2025-2030 (USD MILLION)

- TABLE 121 JAPAN: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 122 JAPAN: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 123 AUSTRALIA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 124 AUSTRALIA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 125 INDIA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 126 INDIA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 127 REST OF ASIA PACIFIC: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: SURGE PROTECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: SURGE PROTECTION DEVICES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: SURGE PROTECTION DEVICES MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: SURGE PROTECTION DEVICES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: SURGE PROTECTION DEVICES MARKET, BY NOMINAL DISCHARGE CURRENT, 2021-2024 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: SURGE PROTECTION DEVICES MARKET, BY NOMINAL DISCHARGE CURRENT, 2025-2030 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: SURGE PROTECTION DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: SURGE PROTECTION DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 GCC: SURGE PROTECTION DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 GCC: SURGE PROTECTION DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 GCC: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 142 GCC: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 143 UAE: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 144 UAE: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 145 SAUDI ARABIA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 146 SAUDI ARABIA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 147 KUWAIT: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 148 KUWAIT: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 149 REST OF GCC: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 150 REST OF GCC: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 151 EGYPT: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 152 EGYPT: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 153 SOUTH AFRICA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 154 SOUTH AFRICA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 155 REST OF MIDDLE EAST & AFRICA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST & AFRICA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 157 SOUTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 158 SOUTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 159 SOUTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY NOMINAL DISCHARGE CURRENT, 2021-2024 (USD MILLION)

- TABLE 160 SOUTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY NOMINAL DISCHARGE CURRENT, 2025-2030 (USD MILLION)

- TABLE 161 SOUTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 162 SOUTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 163 SOUTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 164 SOUTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 165 SOUTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 166 SOUTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 167 BRAZIL: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 168 BRAZIL: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 169 ARGENTINA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 170 ARGENTINA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 171 CHILE: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 172 CHILE: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 173 COLOMBIA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 174 COLOMBIA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 175 REST OF SOUTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 176 REST OF SOUTH AMERICA: SURGE PROTECTION DEVICES MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 177 SURGE PROTECTION DEVICES MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2025

- TABLE 178 SURGE PROTECTION DEVICES MARKET: DEGREE OF COMPETITION, 2024

- TABLE 179 SURGE PROTECTION DEVICES MARKET: REGION FOOTPRINT

- TABLE 180 SURGE PROTECTION DEVICES MARKET: PRODUCT FOOTPRINT

- TABLE 181 SURGE PROTECTION DEVICES MARKET: TECHNOLOGY FOOTPRINT

- TABLE 182 SURGE PROTECTION DEVICES MARKET: NOMINAL DISCHARGE CURRENT FOOTPRINT

- TABLE 183 SURGE PROTECTION DEVICES MARKET: END USER FOOTPRINT

- TABLE 184 SURGE PROTECTION DEVICES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 185 SURGE PROTECTION DEVICES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 186 SURGE PROTECTION DEVICES MARKET: PRODUCT LAUNCHES, JANUARY 2021-FEBRUARY 2025

- TABLE 187 SURGE PROTECTION DEVICES MARKET: DEALS, MARCH 2021-APRIL 2025

- TABLE 188 SURGE PROTECTION DEVICES MARKET: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 189 SURGE PROTECTION DEVICES MARKET: OTHER DEVELOPMENTS, JANUARY 2021-APRIL 2025

- TABLE 190 SIEMENS: COMPANY OVERVIEW

- TABLE 191 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 SIEMENS: DEALS

- TABLE 193 SIEMENS: OTHER DEVELOPMENTS

- TABLE 194 ABB: COMPANY OVERVIEW

- TABLE 195 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 ABB: DEALS

- TABLE 197 ABB: EXPANSIONS

- TABLE 198 ABB: OTHER DEVELOPMENTS

- TABLE 199 EATON: COMPANY OVERVIEW

- TABLE 200 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 EATON: DEALS

- TABLE 202 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 203 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 SCHNEIDER ELECTRIC: DEVELOPMENTS

- TABLE 205 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 206 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 EMERSON ELECTRIC CO.: DEALS

- TABLE 208 LITTELFUSE, INC.: COMPANY OVERVIEW

- TABLE 209 LITTELFUSE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 LITTLEFUSE, INC: PRODUCT LAUNCHES

- TABLE 211 LEGRAND: COMPANY OVERVIEW

- TABLE 212 LEGRAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 LEGRAND: DEALS

- TABLE 214 PROSURGE, INC: COMPANY OVERVIEW

- TABLE 215 PROSURGE, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 PHOENIX CONTACT: COMPANY OVERVIEW

- TABLE 217 PHOENIX CONTACT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 SHENZHEN TECHWIN LIGHTNING TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 219 SHENZHEN TECHWIN LIGHTNING TECHNOLOGIES CO., LTD.:PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 CITEL: COMPANY OVERVIEW

- TABLE 221 CITEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 HUBBELL: COMPANY OVERVIEW

- TABLE 223 HUBBELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 BOURNS, INC.: COMPANY OVERVIEW

- TABLE 225 BOURNS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 BOURNS, INC.: PRODUCT LAUNCHES

- TABLE 227 RAYCAP: COMPANY OVERVIEW

- TABLE 228 RAYCAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 LEVITON MANUFACTURING CO., INC.: COMPANY OVERVIEW

- TABLE 230 LEVITON MANUFACTURING CO., INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 MERSEN: COMPANY OVERVIEW

- TABLE 232 MERSEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 DITEK, INC.: COMPANY OVERVIEW

- TABLE 234 DITEK, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 HAVELLS INDIA LTD.: COMPANY OVERVIEW

- TABLE 236 HAVELLS INDIA LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 BELKIN: COMPANY OVERVIEW

- TABLE 238 BELKIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 OBO BETTERMANN HOLDING GMBH & CO. KG : COMPANY OVERVIEW

- TABLE 240 OBO BETTERMANN HOLDING GMBH & CO. KG PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 SURGE PROTECTION DEVICES MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SURGE PROTECTION DEVICES MARKET: RESEARCH DESIGN

- FIGURE 3 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR SURGE PROTECTION DEVICES

- FIGURE 4 SURGE PROTECTION DEVICES MARKET: BOTTOM-UP APPROACH

- FIGURE 5 SURGE PROTECTION DEVICES MARKET: TOP-DOWN APPROACH

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF SURGE PROTECTION DEVICES

- FIGURE 7 SURGE PROTECTION DEVICES MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 8 SURGE PROTECTION DEVICES MARKET: DATA TRIANGULATION

- FIGURE 9 TYPE 2 SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 10 HARD-WIRED SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 11 10-25 KA SEGMENT TO SECURE LARGEST MARKET SHARE IN 2030

- FIGURE 12 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 13 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 RAPID INDUSTRIALIZATION AND GROWING SMART INFRASTRUCTURE INVESTMENTS TO FUEL MARKET GROWTH

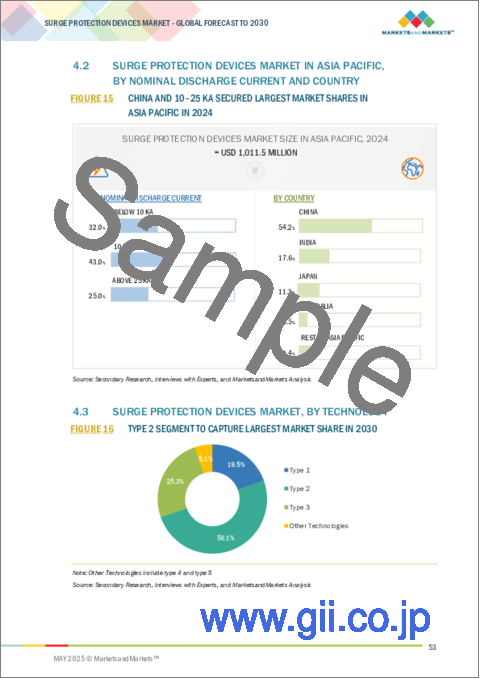

- FIGURE 15 CHINA AND 10-25 KA SECURED LARGEST MARKET SHARES IN ASIA PACIFIC IN 2024

- FIGURE 16 TYPE 2 SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 17 HARD-WIRED SEGMENT TO GARNER LARGEST MARKET SHARE IN 2030

- FIGURE 18 10-25 KA SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 19 INDUSTRIAL SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 20 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN SURGE PROTECTION DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 21 SURGE PROTECTION DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 TOTAL ELECTRICITY GENERATION, BY REGION, 2010-2050

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 SURGE PROTECTION DEVICES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 SUPPLY CHAIN ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE TREND OF SURGE PROTECTION DEVICES, BY REGION, 2021-2024

- FIGURE 27 IMPORT DATA FOR HS CODE 853540-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 28 EXPORT DATA FOR HS CODE 853540-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 29 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2024

- FIGURE 31 SURGE PROTECTION DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 34 IMPACT OF GEN AI/AI ON SURGE PROTECTION DEVICES MARKET, BY REGION

- FIGURE 35 SURGE PROTECTION DEVICES MARKET SHARE, BY PRODUCT

- FIGURE 36 SURGE PROTECTION DEVICES MARKET SHARE, BY TECHNOLOGY

- FIGURE 37 SURGE PROTECTION DEVICES MARKET SHARE, BY NOMINAL DISCHARGE CURRENT

- FIGURE 38 SURGE PROTECTION DEVICES MARKET SHARE, BY END USER

- FIGURE 39 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 SURGE PROTECTION DEVICES MARKET SHARE, BY REGION

- FIGURE 41 NORTH AMERICA: SURGE PROTECTION DEVICES MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC SURGE PROTECTION DEVICES MARKET SNAPSHOT

- FIGURE 43 MARKET SHARE ANALYSIS OF COMPANIES OFFERING SURGE PROTECTION DEVICES, 2024

- FIGURE 44 SURGE PROTECTION DEVICES MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 45 COMPANY VALUATION, 2024

- FIGURE 46 FINANCIAL METRICS, 2024

- FIGURE 47 BRAND/PRODUCT COMPARISON

- FIGURE 48 SURGE PROTECTION DEVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 SURGE PROTECTION DEVICES MARKET: COMPANY FOOTPRINT

- FIGURE 50 SURGE PROTECTION DEVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 51 SIEMENS: COMPANY SNAPSHOT

- FIGURE 52 ABB: COMPANY SNAPSHOT

- FIGURE 53 EATON: COMPANY SNAPSHOT

- FIGURE 54 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 55 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 56 LITTELFUSE, INC.: COMPANY SNAPSHOT

- FIGURE 57 LEGRAND: COMPANY SNAPSHOT

- FIGURE 58 HUBBELL: COMPANY SNAPSHOT

- FIGURE 59 MERSEN: COMPANY SNAPSHOT

- FIGURE 60 HAVELLS INDIA LTD.: COMPANY SNAPSHOT

The surge protection devices market is estimated to grow from USD 2.98 billion in 2025 to USD 3.95 billion by 2030, at a CAGR of 5.8% during the forecast period. The market is primarily driven by the need to safeguard sensitive electronic equipment from power surges, ensuring operational continuity and minimizing equipment damage.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Segments | By Product, By Technology, By Nominal Discharge Current, and By End User |

| Regions covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa. |

"By nominal discharge current, below 10 kA is expected to be the second-largest market during the forecast period.

By nominal discharge current, the below 10 kA segment is expected to be the second-largest market from 2025 to 2030, primarily due to the rapid growth in residential and light commercial applications where lower surge protection ratings are sufficient. These SPDs are cost-effective, easy to install, and well-suited for protecting household electronics, smart appliances, and office equipment from minor voltage spikes caused by internal switching events or nearby disturbances. As the adoption of connected devices and smart home systems accelerates globally, especially in emerging economies, the demand for affordable, plug-in, and point-of-use surge protection is rising, solidifying this segment's strong position in the overall market.

By product, plug-in is projected to be the second-largest market during the forecast period.

The plug-in segment, by product, is expected to be the second-largest market from 2025 to 2030 due to its widespread use in residential, commercial, and small office environments where ease of installation and flexibility are critical. These devices are typically inserted directly into standard power outlets and offer immediate protection for connected equipment such as computers, TVs, and home appliances. Their affordability, portability, and growing compatibility with modern smart devices make them popular among consumers. Also, rising awareness about the damage caused by everyday power surges and the increasing penetration of electronic devices in households worldwide are key factors driving sustained demand for plug-in surge protection solutions.

"North America is expected to be the second-fastest market during the forecast period."

North America is expected to be the second-fastest growing region in the surge protection devices market from 2025 to 2030, driven by the widespread deployment of advanced electrical infrastructure, increasing investments in smart grid systems, and the high concentration of data centers and industrial automation. The region's susceptibility to electrical disturbances caused by frequent lightning strikes, severe weather events, and aging grid infrastructure further underscores the need for reliable surge protection. Also, stringent safety regulations, rising awareness among residential and commercial users, and increased adoption of smart home and office technologies are fueling consistent demand for surge protection solutions across the US, Canada, and Mexico.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

- By Company Type: Tier 1 - 25%, Tier 2 - 35%, and Tier 3 - 35%

- By Designation: C-level Executives - 35%, Directors - 25%, and Others - 40%

- By Region: North America- 25%, Europe - 40%, Asia Pacific- 25% and RoW- 10%

Note: Other designations include sales managers, marketing managers, product managers, and product engineers.

The tier of the companies is defined based on their total revenue as of 2024. Tier 1: USD 1 billion and above, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: <USD 500 million.

A few major players with a wide regional presence dominate the surge protection device market. The leading players in the surge protection device market are ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Eaton (Ireland) and Emerson Electric Co. (US).

Study Coverage:

The report defines, describes, and forecasts the surge protection devices market by product, technology, nominal discharge current, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market, which include the analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the surge protection devices market.

Key Benefits of Buying the Report

- Product Development/ Innovation: In June 2023, Littelfuse, Inc. launched the NEMA-style SPDN Series to safeguard equipment from transient overvoltage events lasting microseconds and help mitigate costly damage and downtime.

- Market Development: In June 2024, ABB announced a USD 35 million investment in a new manufacturing and R&D facility in Nottingham, UK, dedicated to producing Furse earthing and lightning protection solutions. This facility aims to meet the growing demand for electrical protection systems across various sectors, including buildings, wind turbines, and data centers.

- Market Diversification: In March 2025, Schneider Electric announced a landmark investment of over USD700 million in its US operations, marking the company's largest-ever capital commitment in the region. This investment, set to be deployed through 2027, will support the expansion and modernization of eight manufacturing sites across states, including Texas, Tennessee, Ohio, North Carolina, Massachusetts, and Missouri. The initiative is aimed at meeting the surging demand for data centers, energy infrastructure, and automation solutions, driven largely by the rapid growth of artificial intelligence and digitalization.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Eaton (Ireland), and Emerson Electric Co. (US), among others in the surge protection device market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Intended participants and key opinion leaders

- 2.1.2.2 Key industry insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Regional analysis

- 2.2.1.2 Country-level analysis

- 2.2.1.3 Demand-side assumptions

- 2.2.1.4 Demand-side calculations

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Supply-side assumptions

- 2.2.2.2 Supply-side calculations

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SURGE PROTECTION DEVICES MARKET

- 4.2 SURGE PROTECTION DEVICES MARKET IN ASIA PACIFIC, BY NOMINAL DISCHARGE CURRENT AND COUNTRY

- 4.3 SURGE PROTECTION DEVICES MARKET, BY TECHNOLOGY

- 4.4 SURGE PROTECTION DEVICES MARKET, BY PRODUCT

- 4.5 SURGE PROTECTION DEVICES MARKET, BY NOMINAL DISCHARGE CURRENT

- 4.6 SURGE PROTECTION DEVICES MARKET, BY END USER

- 4.7 SURGE PROTECTION DEVICES MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Integration of sensitive electronic equipment into residential, commercial, and industrial sectors

- 5.2.1.2 Expanding renewable energy infrastructure

- 5.2.1.3 Rapid urbanization in emerging economies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial cost of installation

- 5.2.2.2 Transition toward DC-based electrical systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of SPDs with smart monitoring systems

- 5.2.3.2 Rapid expansion of data centers and cloud infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Short lifespan in harsh environments

- 5.2.4.2 Complexities associated with switching operations and internal disturbances

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Metal oxide varistor

- 5.6.1.2 Gas discharge tube

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Building management systems

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Uninterruptible power supply systems

- 5.6.3.2 Energy storage systems

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 INDICATIVE PRICING OF SURGE PROTECTION DEVICES, BY PRODUCT, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND OF SURGE PROTECTION DEVICES BY REGION, 2021-2024

- 5.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.9 TARIFF AND REGULATORY LANDSCAPE

- 5.9.1 TARIFF ANALYSIS

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.3 STANDARDS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 853540)

- 5.10.2 EXPORT SCENARIO (HS CODE 853540)

- 5.11 PATENT ANALYSIS

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 EATON ASSISTS DRILL PIPE MANUFACTURER IN TEXAS WITH SPDS THAT PREVENT FAILURES AND BOOST OPERATIONAL EFFICIENCY

- 5.15.1.1 Problem statement

- 5.15.1.2 Solution

- 5.15.2 ELION TECHNOLOGIES HELPS FOOD PROCESSING UNIT IN INDORE REDUCE ADVERSE IMPACTS OF LIGHTNING-RELATED INCIDENTS

- 5.15.2.1 Problem statement

- 5.15.2.2 Solution

- 5.15.3 ZERO DOWNTIME ASSISTS MANUFACTURING FACILITY IN TEXAS WITH NECESSARY FUSES AND TERMINAL BLOCKS THAT FACILITATE EASY INSTALLATION AT AC POWER INPUT OF EACH MILLING MACHINE

- 5.15.3.1 Problem statement

- 5.15.3.2 Solution

- 5.15.1 EATON ASSISTS DRILL PIPE MANUFACTURER IN TEXAS WITH SPDS THAT PREVENT FAILURES AND BOOST OPERATIONAL EFFICIENCY

- 5.16 IMPACT OF GEN AI/AI ON SURGE PROTECTION DEVICES MARKET

- 5.16.1 ADOPTION OF GEN AI/AI IN SURGE PROTECTION DEVICES

- 5.16.2 IMPACT OF GEN AI/AI ON SURGE PROTECTION DEVICES MARKET, BY REGION

- 5.17 MACROECONOMIC OUTLOOK FOR SURGE PROTECTION DEVICES MARKET

- 5.18 IMPACT OF 2025 US TARIFF - SURGE PROTECTION DEVICES MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.19 IMPACT ON END USERS

6 SURGE PROTECTION DEVICES MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 HARD-WIRED

- 6.2.1 INCREASING INTEGRATION OF HARD-WIRED SURGE PROTECTION DEVICES INTO SMART BUILDING SYSTEMS AND INDUSTRIAL AUTOMATION FRAMEWORKS TO FUEL MARKET GROWTH

- 6.3 PLUG-IN

- 6.3.1 EXPANDING ELECTRIFICATION AND URBAN HOUSING TO DRIVE MARKET

- 6.4 LINE CORD

- 6.4.1 RISING DEMAND FOR MOBILE AND TEMPORARY POWER PROTECTION SOLUTIONS TO SUPPORT MARKET GROWTH

- 6.5 POWER CONTROL DEVICES

- 6.5.1 GROWING DEPLOYMENT OF SMART ENERGY MANAGEMENT PLATFORMS INTO SPDS TO FOSTER MARKET GROWTH

7 SURGE PROTECTION DEVICES MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 TYPE 1

- 7.2.1 INCREASING INTEGRATION INTO WIND AND SOLAR FARMS TO FUEL MARKET GROWTH

- 7.3 TYPE 2

- 7.3.1 RISING EMPHASIS ON DEVELOPING EV INFRASTRUCTURE AND SOLAR ROOFTOPS TO DRIVE MARKET

- 7.4 TYPE 3

- 7.4.1 GROWING EMPHASIS ON SAFEGUARDING SENSITIVE ELECTRONICS WITHIN RESIDENTIAL, OFFICE, AND COMMERCIAL ENVIRONMENTS TO BOOST DEMAND

- 7.5 OTHER TECHNOLOGIES

8 SURGE PROTECTION DEVICES MARKET, BY NOMINAL DISCHARGE CURRENT

- 8.1 INTRODUCTION

- 8.2 BELOW 10 KA

- 8.2.1 PROLIFERATION OF CONSUMER ELECTRONICS AND INCREASING RELIANCE ON SMART HOME TECHNOLOGIES TO FUEL MARKET GROWTH

- 8.3 10-25 KA

- 8.3.1 COMPATIBILITY WITH ENERGY MANAGEMENT SYSTEMS AND PREDICTIVE MAINTENANCE FEATURES TO BOOST DEMAND

- 8.4 ABOVE 25 KA

- 8.4.1 GROWING GLOBAL INVESTMENTS IN INDUSTRIAL AUTOMATION, SMART GRIDS, AND HIGH-RELIABILITY POWER SYSTEMS TO SUPPORT MARKET GROWTH

9 SURGE PROTECTION DEVICES MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 INDUSTRIAL

- 9.2.1 RAPID INDUSTRIAL AUTOMATION, EXPANSION OF MANUFACTURING AND ENERGY INFRASTRUCTURE TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 9.3 COMMERCIAL

- 9.3.1 RISING ADOPTION OF SMART BUILDING TECHNOLOGIES TO DRIVE MARKET

- 9.4 RESIDENTIAL

- 9.4.1 INCREASING ADOPTION OF CONSUMER ELECTRONICS AND SMART HOME TECHNOLOGIES TO SUPPORT MARKET GROWTH

- 9.5 DATA CENTERS

- 9.5.1 GROWING DEMAND FOR UNINTERRUPTED POWER SUPPLY AND ROBUST PROTECTION FOR MISSION-CRITICAL INFRASTRUCTURE TO FUEL MARKET GROWTH

- 9.6 UTILITIES

- 9.6.1 SURGING ADOPTION OF SMART GRID TECHNOLOGIES TO DRIVE MARKET

10 SURGE PROTECTION DEVICES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.2 GROWING RELIANCE ON DIGITAL TECHNOLOGIES, SMART HOMES, AND INDUSTRIAL AUTOMATION TO DRIVE MARKET

- 10.2.3 CANADA

- 10.2.4 RISING EMPHASIS ON SMART BUILDINGS AND NET-ZERO COMMERCIAL SPACES TO FUEL MARKET GROWTH

- 10.2.5 MEXICO

- 10.2.6 INCREASING MANUFACTURING AND INDUSTRIAL BASE TO BOOST DEMAND

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Presence of advanced industrial sector to fuel market growth

- 10.3.2 UK

- 10.3.2.1 Rapid expansion of data center industry to foster market growth

- 10.3.3 FRANCE

- 10.3.3.1 Emphasis on electrification and decarbonization to drive market

- 10.3.4 RUSSIA

- 10.3.4.1 Growing modernization of industrial and energy infrastructure to support market growth

- 10.3.5 ITALY

- 10.3.5.1 Increasing investments in commercial and residential electrification to boost demand

- 10.3.6 NETHERLANDS

- 10.3.6.1 Growing adoption of smart grids to fuel market growth

- 10.3.7 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Rapid electrification of urban and rural regions to drive market

- 10.4.2 JAPAN

- 10.4.2.1 Frequent exposure to natural hazards to boost demand

- 10.4.3 AUSTRALIA

- 10.4.3.1 Deployment of solar energy systems across residential and commercial properties to fuel market growth

- 10.4.4 INDIA

- 10.4.4.1 Rapid urbanization and grid modernization to foster market growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC

- 10.5.1.1 UAE

- 10.5.1.1.1 Rising emphasis on smart infrastructure and digital transformation to drive market

- 10.5.1.2 Saudi Arabia

- 10.5.1.2.1 Growing implementation in telecommunication towers, government buildings, and airports to boost demand

- 10.5.1.3 Kuwait

- 10.5.1.3.1 Growing focus on energy diversification and digitization to drive market

- 10.5.1.4 Rest of GCC

- 10.5.1.1 UAE

- 10.5.2 EGYPT

- 10.5.2.1 Rising investments in power infrastructure, renewable energy, and smart grids to foster market growth

- 10.5.3 SOUTH AFRICA

- 10.5.3.1 Pressing need to tackle power outages, load shedding, and voltage instabilities to support market growth

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Rising emphasis on advancing smart grid transformation to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Growing industrial digitization and increasing deployment of renewable energy projects to fuel market growth

- 10.6.3 CHILE

- 10.6.3.1 Growing investments in renewable energy, mission-critical infrastructure, and smart urban development to offer lucrative growth opportunities

- 10.6.4 COLOMBIA

- 10.6.4.1 Rising emphasis on digital transformation to fuel market growth

- 10.6.5 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2020-2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.6 COMPANY FOOTPRINT

- 11.7.7 REGION FOOTPRINT

- 11.7.8 PRODUCT FOOTPRINT

- 11.7.9 TECHNOLOGY FOOTPRINT

- 11.7.10 NOMINAL DISCHARGE CURRENT FOOTPRINT

- 11.7.11 END USER FOOTPRINT

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.6 DETAILED LIST OF KEY STARTUPS/SMES

- 11.8.7 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SIEMENS

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 ABB

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.3.3 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 EATON

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 SCHNEIDER ELECTRIC

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 EMERSON ELECTRIC CO.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 LITTELFUSE, INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.7 LEGRAND

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 PROSURGE, INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.9 PHOENIX CONTACT

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 SHENZHEN TECHWIN LIGHTNING TECHNOLOGIES CO., LTD.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.11 CITEL

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.12 HUBBELL

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.13 BOURNS, INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches

- 12.1.14 RAYCAP

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.15 LEVITON MANUFACTURING CO., INC.

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.16 MERSEN

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Solutions/Services offered

- 12.1.17 DITEK, INC.

- 12.1.17.1 Business overview

- 12.1.17.2 Products/Solutions/Services offered

- 12.1.18 HAVELLS INDIA LTD.

- 12.1.18.1 Business overview

- 12.1.18.2 Products/Solutions/Services offered

- 12.1.19 BELKIN

- 12.1.19.1 Business overview

- 12.1.19.2 Products/Solutions/Services offered

- 12.1.20 OBO BETTERMANN HOLDING GMBH & CO. KG

- 12.1.20.1 Business overview

- 12.1.20.2 Products/Solutions/Services offered

- 12.1.1 SIEMENS

- 12.2 OTHER PLAYERS

- 12.2.1 ALLTEC

- 12.2.2 MAXIVOLT

- 12.2.3 SOCOMEC

- 12.2.4 DEHN SE

- 12.2.5 SUNPEACE

13 APPENDIX

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS