|

|

市場調査レポート

商品コード

1741574

圧迫療法市場:技法別、製品別、用途別、流通チャネル別、地域別 - 2030年までの予測Compression Therapy Market by Technique, Product, Application, Distribution Channel - Global Forecasts to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 圧迫療法市場:技法別、製品別、用途別、流通チャネル別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月28日

発行: MarketsandMarkets

ページ情報: 英文 279 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

圧迫療法の市場規模は大きな成長が見込まれ、5.5%のCAGRで拡大し、2025年の45億米ドルから2030年には59億米ドルに拡大すると見込まれています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 技法別、製品別、用途別、流通チャネル別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

この市場拡大の背景には、高齢者人口の増加、慢性静脈不全の顕著な増加、がん治療に関連したリンパ浮腫の増加など、いくつかの要因があります。さらに、座りっぱなしのライフスタイルの普及や肥満率の上昇が循環障害の急増につながり、非侵襲的な治療オプションに対する需要の高まりを生み出しています。

製品の快適性の向上、目立たない装着型デザインの開発、医師の臨床意識の高まりが、外来や在宅での圧迫療法の採用にさらに貢献しています。これらの動向は、主要市場における償還範囲の拡大とともに、世界の市場成長を引き続き後押ししています。

弾性着衣は、静脈瘤、リンパ浮腫、慢性静脈不全のような症状の治療に広く使用されているため、圧迫療法市場をリードしています。ストッキング、スリーブ、ラップを含むこれらの製品は、使いやすく、さまざまな圧迫レベルがあり、臨床現場や在宅ケアに適しているため人気があります。手術後の回復や、高齢者や座りがちなライフスタイルの人などリスクの高い人々の予防ケアにおける重要性が高まっていることも、需要をさらに押し上げています。さらに、より通気性が高く快適な生地の使用など、製品設計における継続的な技術革新が、市場での継続的な優位性を支えています。

病院・診療所は、特に空気圧圧迫装置や高度治療用ストッキングなどの特殊製品において、圧迫療法市場における主要な流通経路となっています。これらの医療施設は、慢性静脈不全、リンパ浮腫、手術後の回復といった症状の治療において重要な役割を果たしています。臨床現場における医師による処方や推奨は、圧迫療法製品の需要を促進する上で不可欠です。圧迫療法が臨床的に受け入れられつつあり、その利点が確立されていることが、こうした環境で広く使用される要因となっています。その結果、病院と診療所が主要な販売チャネルとして際立っています。

この市場の成長は、静脈やリンパの問題が蔓延しつつある日本や中国の高齢化など、いくつかの要因によって牽引されています。さらに、インドのような新興国におけるヘルスケア意識の高まりと医療インフラの改善が、圧迫療法の使用増加に寄与しています。同地域の経済成長も可処分所得の上昇をもたらし、より多くの個人がこれらの治療用製品にアクセスし、購入できるようになっています。こうした動向は、予防医療や術後治療の受け入れ拡大とともに、アジア太平洋地域の市場成長を加速させています。

当レポートでは、世界の圧迫療法市場について調査し、技法別、製品別、用途別、流通チャネル別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 規制分析

- 償還シナリオ

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- バリューチェーン分析

- サプライチェーン分析

- 価格分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 顧客のビジネスに影響を与える動向と混乱

- 主要な利害関係者と購入基準

- アンメットニーズと主な問題点

- 圧迫療法市場におけるAIの影響

- 2025年の米国関税が圧迫療法市場に与える影響

第6章 圧迫療法市場(製品別)

- イントロダクション

- 弾性包帯

- 圧迫ラップ

- 弾性ストッキング

- 圧迫テープ

- 空気圧迫装置

- 弾性ブレース

- その他

第7章 圧迫療法市場(技術別)

- イントロダクション

- 静的圧迫療法

- 動的圧迫療法

第8章 圧迫療法市場(用途別)

- イントロダクション

- 静脈瘤治療

- 深部静脈血栓治療

- リンパ浮腫の治療

- 脚の潰瘍治療

- その他

第9章 圧迫療法市場(流通チャネル別)

- イントロダクション

- 薬局・小売店

- eコマースプラットフォーム

- 病院とクリニック

- 在宅ケア

第10章 圧迫療法市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- 製品/ブランド比較

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- SOLVENTUM CORPORATION(3M)

- ENOVIS CORPORATION

- BSN MEDICAL(A SUBSIDIARY OF ESSITY)

- CARDINAL HEALTH

- ARJOHUNTLEIGH

- TACTILE MEDICAL

- CONVATEC INC.

- BIO COMPRESSION SYSTEMS, INC.

- JUZO GMBH

- MEDI GMBH & CO. KG

- PAUL HARTMANN

- SANYLEG, S.R.L.

- SIGVARIS GROUP

- SMITH+NEPHEW

- MEGO AFEK, LTD.

- その他の企業

- GOTTFRIED MEDICAL, INC.

- THERMOTEK, INC.

- BAUERFEIND AG

- OFA BAMBERG GMBH

- MEDLINE INDUSTRIES

- ACI MEDICAL

- AIROS MEDICAL INC.

- BARCELCOM TEXTEIS, S.A

- CIZETA MEDICALI S.P.A

- BOSL MEDIZINTECHNIK

第13章 付録

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REIMBURSEMENT CODES FOR VARIOUS PROCEDURES

- TABLE 9 AVERAGE SELLING PRICE OF COMPRESSION STOCKINGS, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 10 AVERAGE SELLING PRICE OF COMPRESSION BRACES, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 11 AVERAGE SELLING PRICE OF COMPRESSION THERAPY PRODUCT TYPE, BY REGION, 2022-2024

- TABLE 12 COMPRESSION THERAPY MARKET: LIST OF MAJOR PATENTS

- TABLE 13 IMPORT DATA FOR HS CODE 611510, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR HS CODE 611510, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 COMPRESSION THERAPY MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 16 KEY REQUIREMENTS OF STAKEHOLDERS WHILE BUYING COMPRESSION THERAPY PRODUCTS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF COMPRESSION THERAPY PRODUCTS (%)

- TABLE 18 UNMET CUSTOMER NEEDS & KEY PAIN POINTS

- TABLE 19 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 21 COMPRESSION BANDAGES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 22 NORTH AMERICA: COMPRESSION BANDAGES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 23 EUROPE: COMPRESSION BANDAGES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 24 ASIA PACIFIC: COMPRESSION BANDAGES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 25 LATIN AMERICA: COMPRESSION BANDAGES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 MIDDLE EAST & AFRICA: COMPRESSION BANDAGES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 27 COMPRESSION BANDAGES MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 28 COMPRESSION BANDAGES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 29 COMPRESSION BANDAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 30 COMPRESSION WRAPS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 NORTH AMERICA: COMPRESSION WRAPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 EUROPE: COMPRESSION WRAPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 ASIA PACIFIC: COMPRESSION WRAPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 LATIN AMERICA: COMPRESSION WRAPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 MIDDLE EAST & AFRICA: COMPRESSION WRAPS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 COMPRESSION WRAPS MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 37 COMPRESSION WRAPS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 38 COMPRESSION WRAPS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 39 COMPRESSION STOCKINGS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 40 COMPRESSION STOCKINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: COMPRESSION STOCKINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 EUROPE: COMPRESSION STOCKINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 ASIA PACIFIC: COMPRESSION STOCKINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 LATIN AMERICA: COMPRESSION STOCKINGS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 MIDDLE EAST & AFRICA: COMPRESSION STOCKINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 COMPRESSION STOCKINGS MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 47 COMPRESSION STOCKINGS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 48 COMPRESSION STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 49 CLASS I COMPRESSION STOCKINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 CLASS II COMPRESSION STOCKINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 CLASS III COMPRESSION STOCKINGS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 COMPRESSION TAPES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: COMPRESSION TAPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 EUROPE: COMPRESSION TAPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 ASIA PACIFIC: COMPRESSION TAPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 LATIN AMERICA: COMPRESSION TAPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 MIDDLE EAST & AFRICA: COMPRESSION TAPES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 COMPRESSION TAPES MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 59 COMPRESSION TAPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 60 COMPRESSION TAPES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 61 PNEUMATIC COMPRESSION DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 62 PNEUMATIC COMPRESSION DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: PNEUMATIC COMPRESSION DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 EUROPE: PNEUMATIC COMPRESSION DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: PNEUMATIC COMPRESSION DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 LATIN AMERICA: PNEUMATIC COMPRESSION DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 MIDDLE EAST & AFRICA: PNEUMATIC COMPRESSION DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 68 PNEUMATIC COMPRESSION DEVICES MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 69 PNEUMATIC COMPRESSION DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 70 PNEUMATIC COMPRESSION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 71 INTERMITTENT COMPRESSION DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 72 SEQUENTIAL COMPRESSION DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 73 COMPRESSION BRACES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: COMPRESSION BRACES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 EUROPE: COMPRESSION BRACES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 ASIA PACIFIC:COMPRESSION BRACES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 LATIN AMERICA: COMPRESSION BRACES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 MIDDLE EAST & AFRICA: COMPRESSION BRACES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 79 COMPRESSION BRACES MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 80 COMPRESSION BRACES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 81 COMPRESSION BRACES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 82 OTHER COMPRESSION GARMENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: OTHER COMPRESSION GARMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: OTHER COMPRESSION GARMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: OTHER COMPRESSION GARMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 LATIN AMERICA: OTHER COMPRESSION GARMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 MIDDLE EAST & AFRICA: OTHER COMPRESSION GARMENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 88 OTHER COMPRESSION GARMENTS MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 89 OTHER COMPRESSION GARMENTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 90 OTHER COMPRESSION GARMENTS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 91 COMPRESSION THERAPY MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 92 STATIC COMPRESSION THERAPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 93 DYNAMIC COMPRESSION THERAPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 94 COMPRESSION THERAPY MARKET, BY APPLICATION, 2023-2030(USD MILLION)

- TABLE 95 COMPRESSION THERAPY MARKET FOR VARICOSE VEIN TREATMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 96 COMPRESSION THERAPY MARKET FOR DEEP VEIN THROMBOSIS TREATMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 97 COMPRESSION THERAPY MARKET FOR LYMPHEDEMA TREATMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 98 COMPRESSION THERAPY MARKET FOR LEG ULCER TREATMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 99 COMPRESSION THERAPY MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 100 COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 101 COMPRESSION THERAPY MARKET FOR PHARMACIES & RETAILERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 102 COMPRESSION THERAPY MARKET FOR E-COMMERCE PLATFORMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 103 COMPRESSION THERAPY MARKET FOR HOSPITALS & CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 104 COMPRESSION THERAPY MARKET FOR HOME CARE SETTINGS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 105 COMPRESSION THERAPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: MACROECONOMIC INDICATORS

- TABLE 107 NORTH AMERICA: COMPRESSION THERAPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: COMPRESSION THERAPY MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: COMPRESSION THERAPY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 112 US: KEY MACROINDICATORS

- TABLE 113 US: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 114 CANADA: KEY MACROINDICATORS

- TABLE 115 CANADA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 116 EUROPE: MACROECONOMIC INDICATORS

- TABLE 117 EUROPE: COMPRESSION THERAPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 118 EUROPE: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 119 EUROPE: COMPRESSION THERAPY MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 120 EUROPE: COMPRESSION THERAPY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 121 EUROPE: COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 122 GERMANY: KEY MACROINDICATORS

- TABLE 123 GERMANY: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 124 FRANCE: KEY MACROINDICATORS

- TABLE 125 FRANCE: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 126 UK: KEY MACROINDICATORS

- TABLE 127 UK: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 128 ITALY: KEY MACROINDICATORS

- TABLE 129 ITALY: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 130 SPAIN: KEY MACROINDICATORS

- TABLE 131 SPAIN: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 132 HIP SURGERY PROCEDURES (TOTAL PATIENTS) IN EUROPEAN COUNTRIES

- TABLE 133 REST OF EUROPE: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MACROECONOMIC INDICATORS

- TABLE 135 ASIA PACIFIC: COMPRESSION THERAPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: COMPRESSION THERAPY MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: COMPRESSION THERAPY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 140 CHINA: KEY MACROINDICATORS

- TABLE 141 CHINA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 142 JAPAN: KEY MACROINDICATORS

- TABLE 143 JAPAN: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 144 INDIA: KEY MACROINDICATORS

- TABLE 145 INDIA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 146 AUSTRALIA: KEY MACROINDICATORS

- TABLE 147 AUSTRALIA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 148 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 149 SOUTH KOREA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 151 LATIN AMERICA: MACROECONOMIC INDICATORS

- TABLE 152 LATIN AMERICA: COMPRESSION THERAPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 153 LATIN AMERICA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 154 LATIN AMERICA: COMPRESSION THERAPY MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 155 LATIN AMERICA: COMPRESSION THERAPY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 156 LATIN AMERICA: COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 157 BRAZIL: KEY MACROINDICATORS

- TABLE 158 BRAZIL: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 159 MEXICO: KEY MACROINDICATORS

- TABLE 160 MEXICO: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 161 REST OF LATIN AMERICA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: MACROECONOMIC INDICATORS

- TABLE 163 MIDDLE EAST & AFRICA: COMPRESSION THERAPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: COMPRESSION THERAPY MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: COMPRESSION THERAPY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 168 GCC COUNTRIES: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 169 REST OF MIDDLE EAST & AFRICA: COMPRESSION THERAPY MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 170 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES IN COMPRESSION THERAPY MARKET

- TABLE 171 COMPRESSION THERAPY MARKET: DEGREE OF COMPETITION

- TABLE 172 COMPRESSION THERAPY MARKET: REGION FOOTPRINT

- TABLE 173 COMPRESSION THERAPY MARKET: PRODUCT FOOTPRINT

- TABLE 174 COMPRESSION THERAPY MARKET: APPLICATION FOOTPRINT

- TABLE 175 COMPRESSION THERAPY MARKET: TECHNIQUE FOOTPRINT

- TABLE 176 COMPRESSION THERAPY MARKET: DISTRIBUTION CHANNEL FOOTPRINT

- TABLE 177 LIST OF KEY START-UPS/SMES

- TABLE 178 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 179 COMPRESSION THERAPY MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 180 COMPRESSION THERAPY MARKET: DEALS, JANUARY 2021-APRIL 2025

- TABLE 181 SOLVENTUM CORPORATION: COMPANY OVERVIEW

- TABLE 182 SOLVENTUM CORPORATION (3M): PRODUCTS OFFERED

- TABLE 183 SOLVENTUM CORPORATION (3M): PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 184 SOLVENTUM CORPORATION (3M): DEALS, JANUARY 2021-APRIL 2025

- TABLE 185 ENOVIS CORPORATION: COMPANY OVERVIEW

- TABLE 186 ENOVIS CORPORATION: PRODUCTS OFFERED

- TABLE 187 ENOVIS CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-APRIL 2025

- TABLE 188 ENOVIS CORPORATION: DEALS, JANUARY 2021-APRIL 2025

- TABLE 189 ESSITY: COMPANY OVERVIEW

- TABLE 190 ESSITY: PRODUCTS OFFERED

- TABLE 191 ESSITY: DEALS, JANUARY 2021-APRIL 2025

- TABLE 192 CARDINAL HEALTH: COMPANY OVERVIEW

- TABLE 193 CARDINAL HEALTH: PRODUCTS OFFERED

- TABLE 194 CARDINAL HEALTH: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 195 ARJOHUNTLEIGH: COMPANY OVERVIEW

- TABLE 196 ARJOHUNTLEIGH: PRODUCTS OFFERED

- TABLE 197 TACTILE MEDICAL: COMPANY OVERVIEW

- TABLE 198 TACTILE MEDICAL: PRODUCTS OFFERED

- TABLE 199 TACTILE MEDICAL: PRODUCT LAUNCHES, JANUARY 2021-APRIL 2025

- TABLE 200 CONVATEC INC.: COMPANY OVERVIEW

- TABLE 201 CONVATEC INC.: PRODUCTS OFFERED

- TABLE 202 CONVATEC INC.: DEALS, JANUARY 2021-APRIL 2025

- TABLE 203 BIO COMPRESSION SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 204 BIO COMPRESSION SYSTEMS, INC.: PRODUCTS OFFERED

- TABLE 205 JUZO GMBH: COMPANY OVERVIEW

- TABLE 206 JUZO GMBH: PRODUCTS OFFERED

- TABLE 207 JUZO GMBH: PRODUCT LAUNCHES, JANUARY 2021-APRIL 2025

- TABLE 208 MEDI GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 209 MEDI GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 210 PAUL HARTMANN: COMPANY OVERVIEW

- TABLE 211 PAUL HARTMANN: PRODUCTS OFFERED

- TABLE 212 PAUL HARTMANN: DEALS, JANUARY 2021-APRIL 2025

- TABLE 213 SANYLEG, S.R.L.: COMPANY OVERVIEW

- TABLE 214 SANYLEG, S.R.L.: PRODUCTS OFFERED

- TABLE 215 SIGVARIS GROUP: COMPANY OVERVIEW

- TABLE 216 SIGVARIS GROUP: PRODUCTS OFFERED

- TABLE 217 SIGVARIS GROUP.: DEALS, JANUARY 2021-APRIL 2025

- TABLE 218 SMITH+NEPHEW: COMPANY OVERVIEW

- TABLE 219 SMITH+NEPHEW: PRODUCTS OFFERED

- TABLE 220 SMITH+NEPHEW: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 221 MEGO AFEK, LTD.: COMPANY OVERVIEW

- TABLE 222 MEGO AFEK, LTD.: PRODUCTS OFFERED

- TABLE 223 GOTTFRIED MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 224 THERMOTEK, INC.: COMPANY OVERVIEW

- TABLE 225 BAUERFEIND AG: COMPANY OVERVIEW

- TABLE 226 OFA BAMBERG GMBH: COMPANY OVERVIEW

- TABLE 227 MEDLINE INDUSTRIES: COMPANY OVERVIEW

- TABLE 228 ACI MEDICAL: COMPANY OVERVIEW

- TABLE 229 AIROS MEDICAL INC.: COMPANY OVERVIEW

- TABLE 230 BARCELCOM TEXTEIS, S.A: COMPANY OVERVIEW

- TABLE 231 CIZETA MEDICALI S.P.A: COMPANY OVERVIEW

- TABLE 232 BOSL MEDIZINTECHNIK: COMPANY OVERVIEW

List of Figures

- FIGURE 1 COMPRESSION THERAPY MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 COMPRESSION THERAPY MARKET: RESEARCH DATA

- FIGURE 3 COMPRESSION THERAPY MARKET: RESEARCH DESIGN

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 MARKET SIZE ESTIMATION: COMPANY REVENUE ESTIMATION

- FIGURE 6 COMPRESSION THERAPY MARKET: MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 8 GROWTH PROJECTIONS ON REVENUE IMPACT OF KEY MACROINDICATORS

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 COMPRESSION THERAPY MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 COMPRESSION THERAPY MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 COMPRESSION THERAPY MARKET, BY TECHNIQUE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 COMPRESSION THERAPY MARKET: GEOGRAPHIC OUTLOOK

- FIGURE 15 GROWING INCIDENCE OF SPORTS INJURIES AND FAVORABLE CLINICAL EVIDENCE TO DRIVE MARKET GROWTH

- FIGURE 16 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR COMPRESSION THERAPY DURING FORECAST PERIOD

- FIGURE 17 HOSPITALS & CLINICS AND US WERE LARGEST SEGMENTS IN 2024

- FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 19 COMPRESSION THERAPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 GERIATRIC POPULATION, BY REGION, 2015 VS. 2030 VS. 2050

- FIGURE 21 EUROPE: ROAD DEATHS PER MILLION INHABITANTS, BY COUNTRY, 2021

- FIGURE 22 REASONS FOR NON-COMPLIANCE WITH COMPRESSION THERAPY

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 COMPRESSION THERAPY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 COMPRESSION THERAPY MARKET: INVESTMENT & FUNDING SCENARIO, 2019-2023 (USD MILLION)

- FIGURE 26 NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 27 VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 28 COMPRESSION THERAPY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 COMPRESSION THERAPY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 30 AVERAGE SELLING PRICE TREND OF COMPRESSION THERAPY PRODUCTS, BY TYPE, 2022-2024 (USD THOUSAND)

- FIGURE 31 AVERAGE SELLING PRICE TREND OF COMPRESSION THERAPY MARKET, BY PRODUCT TYPE, 2022-2024 (USD)

- FIGURE 32 AVERAGE SELLING PRICE TREND OF COMPRESSION STOCKINGS, BY KEY PLAYER, 2022-2024 (USD THOUSAND)

- FIGURE 33 AVERAGE SELLING PRICE TREND OF COMPRESSION BRACES, BY KEY PLAYER, 2022-2024 (USD THOUSAND)

- FIGURE 34 AVERAGE SELLING PRICE TREND OF COMPRESSION THERAPY PRODUCTS, BY REGION, 2022-2024 (USD THOUSAND)

- FIGURE 35 COMPRESSION THERAPY MARKET: PATENT ANALYSIS

- FIGURE 36 COMPRESSION THERAPY MARKET: IMPORT SCENARIO FOR HS CODE 611510, 2020-2024

- FIGURE 37 COMPRESSION THERAPY MARKET: EXPORT SCENARIO FOR HS CODE 611510, 2020-2024

- FIGURE 38 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF COMPRESSION THERAPY PRODUCTS

- FIGURE 40 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 41 NORTH AMERICA: COMPRESSION THERAPY MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: COMPRESSION THERAPY MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN COMPRESSION THERAPY MARKET, 2020-2024

- FIGURE 44 COMPRESSION STOCKINGS MARKET SHARE ANALYSIS, 2024

- FIGURE 45 COMPRESSION BANDAGES MARKET SHARE ANALYSIS, 2024

- FIGURE 46 PNEUMATIC COMPRESSION DEVICES MARKET SHARE ANALYSIS, 2024

- FIGURE 47 COMPRESSION THERAPY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 COMPRESSION THERAPY MARKET: COMPANY FOOTPRINT

- FIGURE 49 COMPRESSION THERAPY MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 50 EV/EBITDA OF KEY VENDORS

- FIGURE 51 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 52 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 53 SOLVENTUM CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 54 ENOVIS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 55 ESSITY: COMPANY SNAPSHOT (2024)

- FIGURE 56 CARDINAL HEALTH: COMPANY SNAPSHOT (2024)

- FIGURE 57 ARJOHUNTLEIGH: COMPANY SNAPSHOT (2024)

- FIGURE 58 TACTILE MEDICAL: COMPANY SNAPSHOT (2024)

- FIGURE 59 CONVATEC INC.: COMPANY SNAPSHOT (2024)

- FIGURE 60 PAUL HARTMANN: COMPANY SNAPSHOT (2024)

- FIGURE 61 SMITH+NEPHEW: COMPANY SNAPSHOT (2024)

The compression therapy market is expected to experience significant growth, increasing from USD 4.5 billion in 2025 to USD 5.9 billion by 2030, at a CAGR of 5.5%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Technique, Application, Distribution Channel, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

This expansion is driven by several factors, including a growing elderly population, a notable rise in chronic venous insufficiency cases, and an increase in lymphedema related to cancer treatments. Additionally, the prevalence of sedentary lifestyles and rising obesity rates has led to a surge in circulatory disorders, creating a higher demand for non-invasive treatment options.

Improvements in product comfort, the development of discreet wearable designs, and increased clinical awareness among physicians have further contributed to the adoption of compression therapy in outpatient and home settings. These trends, along with wider reimbursement coverage in key markets, continue to bolster global market growth.

"Compression garments dominated the market in 2024."

Compression garments lead the compression therapy market due to their extensive use in treating conditions like varicose veins, lymphedema, and chronic venous insufficiency. These products, including stockings, sleeves, and wraps, are popular because they are easy to use, available in various compression levels, and suitable for clinical settings and home care. Their increasing importance in post-surgical recovery and preventive care for at-risk populations, such as the elderly and those with sedentary lifestyles, has further driven demand. Additionally, ongoing innovations in product design, including the use of more breathable and comfortable fabrics, support their continued dominance in the market.

"The hospitals & clinics segment held the largest share of the compression therapy market in 2024."

Hospitals & clinics are the primary distribution channels in the compression therapy market, especially for specialty products such as pneumatic compression devices and advanced therapeutic stockings. These medical facilities play a crucial role in treating conditions like chronic venous insufficiency, lymphedema, and post-surgical recovery. The prescriptions and recommendations made by physicians in clinical settings are vital for driving demand for compression therapy products. The growing clinical acceptance and well-established benefits of compression therapy contribute to its widespread use in these environments. Consequently, hospitals & clinics stand out as the leading distribution channels.

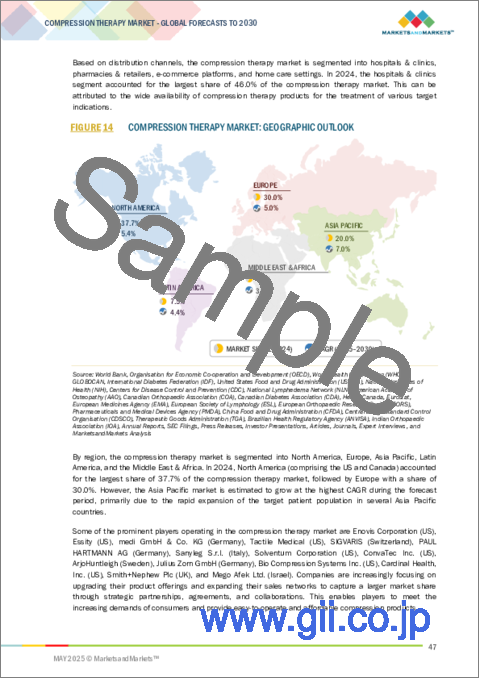

"The Asia Pacific regional segment is expected to register the highest CAGR in the compression therapy market during the forecast period."

The growth in this market is driven by several factors, including an aging population in Japan and China, where venous and lymphatic issues are becoming more prevalent. Additionally, rising healthcare awareness and improvements in medical infrastructure in emerging economies like India are contributing to the increased use of compression therapy. Economic growth in the region is also elevating disposable incomes, enabling more individuals to access and afford these therapeutic products. Together, these trends, along with a growing acceptance of preventive care and post-surgical treatment, are accelerating market growth in the Asia Pacific (APAC) region.

A breakdown of the primary participants referred to for this report is provided below:

- By Company: Tier 1 (35%), Tier 2 (45%), and Tier 3 (20%)

- By Designation: C-level Executives (35%), Director-level Executives (25%), and Others (40%)

- By Region: North America (40%), Europe (30%), Asia Pacific (20%), Latin America (5%), and the Middle East & Africa (5%)

Prominent players in the compression therapy market include 3M (US), BSN Medical (Germany), medi GmbH & Co. KG (Germany), Sigvaris AG (Switzerland), Juzo GmbH (Germany), Lohmann & Rauscher GmbH & Co. KG (Germany), DJO Global (US), JOBST (US), Therafirm (US), Bauerfeind AG (Germany), PAUL HARTMANN AG (Germany), CircAid Medical Products, Inc. (US), Tactile Medical (US), Bio Compression Systems, Inc. (US), THUASNE (France), among others.

Research Coverage

This market research analyzes the compression therapy market by segmenting it according to product, technique, application, distribution channel, and region. It provides insights into key factors influencing the market, including drivers, restraints, opportunities, and challenges. The report highlights opportunities and challenges for stakeholders and offers a detailed analysis of the competitive landscape, focusing on major market players. Additionally, it examines the micromarkets in greater detail, looking at growth patterns, opportunities, and their contributions to the overall compression therapy market. The report also includes revenue generation forecasts for various market segments and identifies growth opportunities across five key regions.

Key Benefits of Buying this Report

This report is valuable for both new and current players in the market, offering essential information to identify potential investment opportunities. It provides a comprehensive overview of both major and minor players, facilitating effective risk analysis and informed investment decisions. The report includes precise segmentation based on end users and geographical regions, offering detailed insights into niche market segments. Additionally, it highlights key trends, challenges, growth drivers, and opportunities, supporting strategic decision-making through a balanced analysis.

Through this report, readers get insightful views into the following parameters:

The compression therapy market is experiencing growth driven by several key factors, including the increasing prevalence of chronic conditions such as venous insufficiency and lymphedema, which require long-term management. Advances in automated diagnostic tools and smart compression devices are enhancing treatment efficiency and accuracy.

However, high product costs and a lack of awareness in emerging markets constrain this growth. However, there are also significant opportunities for the market, such as product innovation in areas like antimicrobials and custom-fit solutions. Market diversification through new product launches and expansions into untapped regions could further propel growth in the compression therapy market.

Product Development/Innovation: Emerging technologies, ongoing R&D activities, and recent launches of products in the market

Market Development: The report has elaborated the markets by segmenting the compression therapy market into different regions

Market Diversification: New product launches, unexploited markets, recent developments, and investments in the compression therapy market

Competitive Analysis: A comprehensive analysis of market share, product offerings, and leading strategies of major players, such as 3M (US), BSN Medical (Germany), medi GmbH & Co. KG (Germany), Sigvaris AG (Switzerland), Juzo GmbH (Germany), Lohmann & Rauscher GmbH & Co. KG (Germany), DJO Global (US), JOBST (US), Therafirm (US), Bauerfeind AG (Germany), PAUL HARTMANN AG (Germany), CircAid Medical Products, Inc. (US), Tactile Medical (US), Bio Compression Systems, Inc. (US), and THUASNE (France)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.1.3 Objectives of secondary research

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key primary sources (demand and supply sides)

- 2.1.2.2 Supply- and demand-side participants

- 2.1.2.3 Breakdown of primary interviews: By company type, designation, and region

- 2.1.2.4 Objectives of primary research

- 2.1.2.5 Insights from industry experts

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation

- 2.2.1.2 Approach 2: Customer-based market estimation

- 2.2.1.3 Approach 3: Primary interviews

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 GROWTH RATE ASSUMPTIONS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COMPRESSION THERAPY MARKET

- 4.2 COMPRESSION THERAPY MARKET, BY REGION

- 4.3 NORTH AMERICA: COMPRESSION THERAPY MARKET, BY COUNTRY AND DISTRIBUTION CHANNEL

- 4.4 COMPRESSION THERAPY MARKET: GEOGRAPHIC SNAPSHOT

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Large target patient population

- 5.2.1.2 Growing incidence of sports injuries and accidents

- 5.2.1.3 Increasing number of orthopedic procedures

- 5.2.1.4 Greater product affordability and market availability

- 5.2.1.5 Clinical evidence favoring adoption of compression therapy for management of target conditions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of universally accepted standards for compression products

- 5.2.2.2 Low patient compliance with compression garments

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth potential offered by emerging markets

- 5.2.3.2 Growing patient awareness regarding benefits of compression therapy

- 5.2.4 CHALLENGES

- 5.2.4.1 Significant adoption of alternative therapies for specific target indications

- 5.2.4.2 Increasing pricing pressure on market players

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 REGULATORY ANALYSIS

- 5.4.1 REGULATORY ANALYSIS

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Europe

- 5.4.1.4 Japan

- 5.4.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4.1 REGULATORY ANALYSIS

- 5.5 REIMBURSEMENT SCENARIO

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT & FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Pneumatic compression devices

- 5.8.1.2 Smart compression garments

- 5.8.1.3 Static compression devices

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Digital connectivity (telehealth platforms)

- 5.8.2.2 Value-added software (AI & IOT)

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Custom-fitted compression garments

- 5.8.1 KEY TECHNOLOGIES

- 5.9 VALUE CHAIN ANALYSIS

- 5.9.1 RESEARCH & DEVELOPMENT

- 5.9.2 RAW MATERIAL PROCUREMENT & PRODUCT MANUFACTURING

- 5.9.3 DISTRIBUTION, MARKETING & SALES, AND AFTER-SALES SERVICES

- 5.10 SUPPLY CHAIN ANALYSIS

- 5.10.1 PROMINENT COMPANIES

- 5.10.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 5.10.3 END USERS

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE

- 5.11.2 AVERAGE SELLING PRICE TREND OF COMPRESSION THERAPY DEVICES, BY PRODUCT TYPE, 2022-2024

- 5.11.3 AVERAGE SELLING PRICE TREND OF COMPRESSION STOCKINGS, BY KEY PLAYER, 2022-2024

- 5.11.4 AVERAGE SELLING PRICE OF COMPRESSION STOCKINGS, BY KEY PLAYER, 2022-2024

- 5.11.5 AVERAGE SELLING PRICE TREND OF COMPRESSION BRACES, BY KEY PLAYER, 2022-2024

- 5.11.6 AVERAGE SELLING PRICE OF COMPRESSION BRACES, BY KEY PLAYER, 2022-2024

- 5.11.7 AVERAGE SELLING PRICE TREND OF COMPRESSION THERAPY PRODUCTS, BY REGION, 2022-2024

- 5.11.8 AVERAGE SELLING PRICE OF COMPRESSION THERAPY PRODUCTS, BY REGION, 2022-2024

- 5.12 PATENT ANALYSIS

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 611510)

- 5.13.2 EXPORT SCENARIO (HS CODE 611510)

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.16 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 UNMET NEEDS & KEY PAIN POINTS

- 5.18 IMPACT OF AI ON COMPRESSION THERAPY MARKET

- 5.19 IMPACT OF 2025 US TARIFF ON COMPRESSION THERAPY MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 COMPRESSION THERAPY MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 COMPRESSION BANDAGES

- 6.2.1 LIMITED AVAILABILITY OF MEDICAL REIMBURSEMENTS FOR VARICOSE VEIN SURGERIES TO RESTRAIN MARKET GROWTH

- 6.3 COMPRESSION WRAPS

- 6.3.1 RISING GERIATRIC POPULATION AND INCREASING INCIDENCE OF SPORTS INJURIES TO DRIVE MARKET

- 6.4 COMPRESSION STOCKINGS

- 6.4.1 CLASS I COMPRESSION STOCKINGS

- 6.4.1.1 Advantages such as comfort and durability to drive demand for Class I stockings

- 6.4.2 CLASS II COMPRESSION STOCKINGS

- 6.4.2.1 Increasing number of lymphedema and DVT patients to fuel demand

- 6.4.3 CLASS III COMPRESSION STOCKINGS

- 6.4.3.1 High level of compression provided to boost adoption of Class III stockings

- 6.4.1 CLASS I COMPRESSION STOCKINGS

- 6.5 COMPRESSION TAPES

- 6.5.1 ABILITY TO PREVENT FURTHER MUSCLE INJURY TO DRIVE DEMAND FOR COMPRESSION TAPES

- 6.6 PNEUMATIC COMPRESSION DEVICES

- 6.6.1 INTERMITTENT COMPRESSION DEVICES

- 6.6.1.1 Availability of wide range of intermittent pumps with varying designs and complexity to boost demand

- 6.6.2 SEQUENTIAL COMPRESSION DEVICES

- 6.6.2.1 Wide usage for DVT prevention to boost growth

- 6.6.1 INTERMITTENT COMPRESSION DEVICES

- 6.7 COMPRESSION BRACES

- 6.7.1 RISING NUMBER OF JOINT REPLACEMENT SURGERIES TO SUPPORT MARKET

- 6.8 OTHER COMPRESSION GARMENTS

7 COMPRESSION THERAPY MARKET, BY TECHNIQUE

- 7.1 INTRODUCTION

- 7.2 STATIC COMPRESSION THERAPY

- 7.2.1 PROCEDURAL ADVANTAGES OF STATIC COMPRESSION THERAPY TO DRIVE GROWTH

- 7.3 DYNAMIC COMPRESSION THERAPY

- 7.3.1 RISING INCIDENCE OF TARGET CONDITIONS TO SUPPORT MARKET

8 COMPRESSION THERAPY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 VARICOSE VEIN TREATMENT

- 8.2.1 GROWING GLOBAL PREVALENCE OF VARICOSE VEINS TO DRIVE MARKET

- 8.3 DEEP VEIN THROMBOSIS TREATMENT

- 8.3.1 AVAILABILITY OF ALTERNATIVE TREATMENTS FOR DVT TO LIMIT GROWTH

- 8.4 LYMPHEDEMA TREATMENT

- 8.4.1 RISING INCIDENCE OF CANCER TO CONTRIBUTE TO GROWTH

- 8.5 LEG ULCER TREATMENT

- 8.5.1 GROWING DISEASE BURDEN ACROSS MAJOR COUNTRIES TO BOOST MARKET

- 8.6 OTHER APPLICATIONS

9 COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNEL

- 9.1 INTRODUCTION

- 9.2 PHARMACIES & RETAILERS

- 9.2.1 RISING ADOPTION OF OFF-THE-SHELF PRODUCTS TO SUPPORT MARKET GROWTH

- 9.3 E-COMMERCE PLATFORMS

- 9.3.1 E-COMMERCE PLATFORMS TO REGISTER HIGH CAGR DURING FORECAST PERIOD

- 9.4 HOSPITALS & CLINICS

- 9.4.1 HEALTHCARE INFRASTRUCTURAL IMPROVEMENTS TO BOOST GROWTH

- 9.5 HOME CARE SETTINGS

- 9.5.1 GROWING INCLINATION TOWARD HOME HEALTHCARE TO DRIVE MARKET

10 COMPRESSION THERAPY MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Rising number of sports injuries to drive market growth

- 10.2.3 CANADA

- 10.2.3.1 Increasing incidence of target diseases to support growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Inconsistent reimbursement for compression therapy products to restrain market growth

- 10.3.3 FRANCE

- 10.3.3.1 High incidence of diabetes to drive demand for compression therapy

- 10.3.4 UK

- 10.3.4.1 Rising prevalence of lymphedema and DVT to drive market

- 10.3.5 ITALY

- 10.3.5.1 Rising awareness about preventive care for musculoskeletal injuries to fuel growth

- 10.3.6 SPAIN

- 10.3.6.1 Growing presence of key manufacturers to increase access to compression therapy products

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Modernization of healthcare facilities to drive market growth

- 10.4.3 JAPAN

- 10.4.3.1 Japan to dominate Asia Pacific compression therapy market

- 10.4.4 INDIA

- 10.4.4.1 Growing number of hip & knee surgeries to support market

- 10.4.5 AUSTRALIA

- 10.4.5.1 Government subsidies related to compression garments for lymphedema patients to promote growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Increasing number of plastic surgeries to drive demand for compression garments

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Rising number of cosmetic surgeries to support market

- 10.5.3 MEXICO

- 10.5.3.1 Lack of reimbursement for bracing products to limit growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Significant investments in healthcare to boost growth

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 COMPRESSION STOCKINGS MARKET SHARE

- 11.4.2 COMPRESSION BANDAGES MARKET SHARE

- 11.4.3 PNEUMATIC COMPRESSION DEVICES MARKET SHARE

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product footprint

- 11.5.5.4 Application footprint

- 11.5.5.5 Technique footprint

- 11.5.5.6 Distribution channel footprint

- 11.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPANY BENCHMARKING: START-UPS/SMES, 2024

- 11.6.5.1 List of start-ups/SMEs

- 11.6.5.2 Competitive benchmarking of start-ups/SMEs

- 11.7 COMPANY VALUATION & FINANCIAL METRICS

- 11.8 PRODUCT/BRAND COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES & APPROVALS

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SOLVENTUM CORPORATION (3M)

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches & approvals

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 ENOVIS CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 BSN MEDICAL (A SUBSIDIARY OF ESSITY)

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 CARDINAL HEALTH

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches & approvals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 ARJOHUNTLEIGH

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses & competitive threats

- 12.1.6 TACTILE MEDICAL

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.7 CONVATEC INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 BIO COMPRESSION SYSTEMS, INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.9 JUZO GMBH

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.10 MEDI GMBH & CO. KG

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 PAUL HARTMANN

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.12 SANYLEG, S.R.L.

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.13 SIGVARIS GROUP

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.14 SMITH+NEPHEW

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Expansions

- 12.1.15 MEGO AFEK, LTD.

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.1 SOLVENTUM CORPORATION (3M)

- 12.2 OTHER PLAYERS

- 12.2.1 GOTTFRIED MEDICAL, INC.

- 12.2.2 THERMOTEK, INC.

- 12.2.3 BAUERFEIND AG

- 12.2.4 OFA BAMBERG GMBH

- 12.2.5 MEDLINE INDUSTRIES

- 12.2.6 ACI MEDICAL

- 12.2.7 AIROS MEDICAL INC.

- 12.2.8 BARCELCOM TEXTEIS, S.A

- 12.2.9 CIZETA MEDICALI S.P.A

- 12.2.10 BOSL MEDIZINTECHNIK

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS