|

|

市場調査レポート

商品コード

1740254

VNA・PACSの世界市場:製品タイプ別、モダリティ別、用途別、エンドユーザー別、地域別 - 予測(~2030年)Vendor Neutral Archive & PACS Market by Product Type, Modality, Application, End User & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| VNA・PACSの世界市場:製品タイプ別、モダリティ別、用途別、エンドユーザー別、地域別 - 予測(~2030年) |

|

出版日: 2025年05月15日

発行: MarketsandMarkets

ページ情報: 英文 289 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のVNA・PACSの市場規模は、2025年の51億米ドルから2030年までに79億2,000万米ドルに達すると予測され、予測期間にCAGRで9.2%の成長が見込まれます。

市場の拡大の主な促進要因は、医用画像データの急増、全社的な相互運用性への移行、イメージングワークフローの最適化を目的としたベンダーニュートラルな集中型プラットフォームに対する需要の高まりです。さらに、医療のデジタル化を目指した取り組みや、医療情報交換を促進する規制枠組みが、市場成長をさらに促進しています。しかし、実装に伴う高いコストやデータ移行に伴う複雑性は、特に中小規模の医療機関にとって、依然として先進のVNA・PACSの採用への大きな障壁となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 製品タイプ、モダリティ、展開、ベンダータイプ、用途、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

製品タイプ別では、マルチサイトVNAセグメントが予測期間にもっとも高い成長率を示す見込みです。

医用画像ソリューションに対する需要の高まりの主因は、医療システムが、多様な地理的位置でのイメージングワークフローを最適化するために、相互運用性と施設横断的なデータ統合を重視するようになったことです。病院や医療システムが統合ネットワークに集約されるにつれて、シームレスなデータアクセスや共同診断作業を促進するために、包括的なイメージングレポジトリの確立が不可欠となっています。さらに、COVID-19パンデミックによって激化した遠隔診断、遠隔診察、バーチャルケアのフレームワークへの移行は、いつでもどこでも医用画像へ安全にアクセスできる、スケーラブルなマルチサイトVNAの必要性を強調しています。このような先進のソリューションは、データのサイロ化を解消し、画像の重複を最小化するだけでなく、さまざまな診療科や施設間でのケアコーディネーションを強化するのに役立ちます。

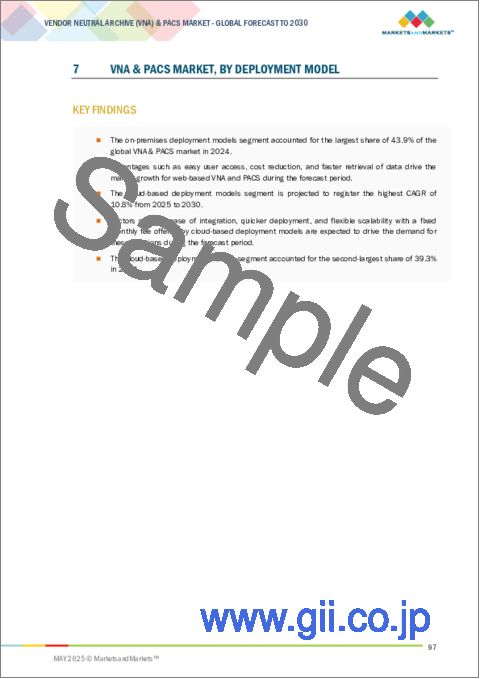

展開別では、オンプレミス展開セグメントが2024年に最大の市場シェアを占めました。

医療機関は、監視を維持し、長期的なコスト予測可能性を実現するために、インフラのオンプレミス展開を好むようになっています。このような機関は、セキュリティと性能の安定性を優先しており、これは資本予算編成の慣行とも合致しています。ストレージを社内で管理することで、厳格なデータガバナンス基準へのコンプライアンスを確保すると同時に、信頼性の高いイメージング性能を一貫して提供します。この分野における重大な考慮事項は、総所有コスト(TCO)です。クラウドベースソリューションは一般的に俊敏性が高く初期投資も少なく済みますが、オンプレミス展開は、特に既存のITチームと一定のイメージング数の要件を備えた機関にとって、長期的な投資収益率(ROI)に優れていることが多いです。さらに、ハードウェアの効率化が進んだことで、ローカル展開の経済性と信頼性が高まっています。

地域別では、アジア太平洋が2025年~2030年にもっとも高いCAGRを示すと予測されます。

アジア太平洋市場は、医用画像インフラへの投資の増加、医療アクセスの拡大、新興経済圏全体での病院システムの急速なデジタル化により、もっとも高いCAGRが見込まれています。インド、中国、東南アジア諸国などの国々では、画像診断機能の強化が進んでおり、医療機関は臨床画像と関連データの管理に用いる集中化された相互運用可能なソリューションを模索しています。同時に、技術の進歩とクラウドコンピューティングの採用の拡大により、企業向けイメージングソリューション、特にVNAとPACSは、さまざまな規模の医療機関で拡張性とコスト効率を高めています。デジタルヘルス戦略が国家的な必須事項として浮上するにつれて、イメージングワークフローの最適化、放射線データへのリモートアクセスの促進、施設間のデータ相互運用性の促進にますます注目が集まっています。これらの方針は、画像情報の統合的でシームレスな管理をサポートするVNA・PACSプラットフォームが提供する固有の利点とよく一致しています。

当レポートでは、世界のVNA・PACS市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- VNA・PACS市場の概要

- アジア太平洋のVNA・PACS市場:製品タイプ別、国別

- VNA・PACS市場:地理的成長機会

- VNA・PACS市場:地域構成

- VNA・PACS市場:先進国市場と新興国市場

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 産業動向

- クラウド採用

- AIとMLの統合

- バリューベースケアモデル

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 顧客のビジネスに影響を与える動向/混乱

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 主な会議とイベント(2025年~2026年)

- 価格分析

- VNA・PACSソリューションの平均販売価格:製品タイプ別(2024年)

- VNA・PACSソリューションの平均販売価格:地域別(定性)

- 規制分析

- 規制機関、政府機関、その他の組織

- 規制枠組み

- 特許分析

- 考察:管轄と主要申請者の分析

- 主要特許のリスト(2020年~2024年)

- ケーススタディ分析

- アンメットニーズとエンドユーザーの期待

- ビジネスモデル

- エンタープライズライセンシングモデル

- SaaSモデル

- 従量課金モデル

- ハイブリッドモデル

- VNA・PACS市場に対する米国関税の影響(2025年)

- イントロダクション

- 主要関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

- 結論

第6章 VNA・PACS市場:モダリティ別

- イントロダクション

- CT

- マンモグラフィ

- 超音波

- MRI

- X線

- PET

第7章 VNA・PACS市場:展開モデル別

- イントロダクション

- オンプレミス展開モデル

- クラウドベース展開モデル

- ハイブリッド展開モデル

第8章 VNA・PACS市場:製品タイプ別

- イントロダクション

- VNA

- 部門VNA

- 複数部門VNA

- マルチサイトVNA

- PACS

- 部門PACS

- 複数部門PACS

- マルチサイトPACS

第9章 VNA・PACS市場:ベンダータイプ別

- イントロダクション

- 独立系ベンダー

- サードパーティベンダー

第10章 VNA・PACS市場:用途別

- イントロダクション

- 心臓

- 整形外科

- 腫瘍

- 神経

- 産婦人科

- その他の用途

第11章 VNA・PACS市場:エンドユーザー別

- イントロダクション

- 病院・診療所

- 診断センター

- 外来手術センター

- その他のエンドユーザー

第12章 VNA・PACS市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 日本

- 中国

- インド

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- 中東・アフリカのマクロ経済の見通し

- GCC諸国

- その他の中東・アフリカ

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 企業の評価と財務指標

- 財務指標

- 企業の評価

- ブランド/ソフトウェアの比較

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- AGFA-GEVAERT GROUP

- FUJIFILM HOLDINGS CORPORATION

- SECTRA AB

- GE HEALTHCARE

- MERATIVE

- KONINKLIJKE PHILIPS N.V.

- CANON MEDICAL SYSTEMS CORPORATION

- INTELERAD. INTELERAD.

- PAXERAHEALTH

- NOVARAD CORPORATION

- HYLAND SOFTWARE, INC.

- SIEMENS HEALTHINEERS AG

- BRIDGEHEAD SOFTWARE LTD.

- CANOPY PARTNERS

- CRELIOHEALTH INC.

- ASPYRA, LLC

- POSTDICOM

- MEDICASOFT

- ESAOTE S.P.A.

- VISUS HEALTH IT GMBH

- その他の企業

- ADVAHEALTH SOLUTIONS

- SOFTTEAM SOLUTIONS PVT. LTD.

- ARO SYSTEMS

- CENTRAL DATA NETWORKS

- ONEPACS

- DEDALUS S.P.A.

第15章 付録

List of Tables

- TABLE 1 VNA & PACS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 VNA & PACS MARKET: FACTOR ANALYSIS

- TABLE 3 VNA & PACS MARKET: STUDY ASSUMPTIONS

- TABLE 4 VNA & PACS MARKET: RISK ANALYSIS

- TABLE 5 VNA & PACS MARKET: ROLE IN ECOSYSTEM

- TABLE 6 VNA & PACS MARKET: PORTER'S FIVE FORCES

- TABLE 7 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR MAJOR END USERS

- TABLE 8 KEY BUYING CRITERIA FOR MAJOR END USERS

- TABLE 9 VNA & PACS MARKET: LIST OF KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 10 AVERAGE SELLING PRICE OF PACS SOLUTIONS, BY PRODUCT TYPE, 2024

- TABLE 11 AVERAGE SELLING PRICE OF VNA SOLUTIONS, BY PRODUCT TYPE, 2024

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES FOR VNA & PACS SOLUTIONS

- TABLE 17 VNA & PACS MARKET: LIST OF PATENTS/PATENT APPLICATIONS, 2020-2024

- TABLE 18 CASE STUDY 1: AMBRA HEALTH UTILIZED AWS CLOUD SERVICES TO PROPEL MEDICAL IMAGING PLATFORM GROWTH

- TABLE 19 CASE STUDY 2: NHS TRUST ADOPTED INSTANT DATA ACCESS TO ESTABLISH UNIFIED PLATFORM FOR DICOM IMAGE DATA STORAGE AND MANAGEMENT

- TABLE 20 VNA & PACS MARKET: UNMET NEEDS

- TABLE 21 VNA & PACS MARKET: END-USER EXPECTATIONS

- TABLE 22 VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 23 VNA & PACS MARKET FOR CT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 24 VNA & PACS MARKET FOR MAMMOGRAPHY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 25 VNA & PACS MARKET FOR ULTRASOUND, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 VNA & PACS MARKET FOR MRI, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 27 VNA & PACS MARKET FOR X-RAY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 VNA & PACS MARKET FOR PET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 30 VNA & PACS MARKET FOR ON-PREMISES DEPLOYMENT MODELS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 VNA & PACS MARKET FOR CLOUD-BASED DEPLOYMENT MODELS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 VNA & PACS MARKET FOR HYBRID DEPLOYMENT MODELS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 34 VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 35 VNA MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 DEPARTMENT VNA MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 MULTI-DEPARTMENT VNA MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 MULTI-SITE VNA MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 40 PACS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 DEPARTMENT PACS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 MULTI-DEPARTMENT PACS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 MULTI-SITE PACS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 45 KEY INDEPENDENT VENDORS OPERATING IN MARKET

- TABLE 46 VNA & PACS MARKET FOR INDEPENDENT VENDORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 KEY THIRD-PARTY VENDORS OPERATING IN MARKET

- TABLE 48 VNA & PACS MARKET FOR THIRD-PARTY VENDORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 50 VNA & PACS MARKET FOR CARDIOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 VNA & PACS MARKET FOR ORTHOPEDIC, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 VNA & PACS MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 VNA & PACS MARKET FOR NEUROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 VNA & PACS MARKET FOR OBSTETRICS & GYNECOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 VNA & PACS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 57 VNA & PACS MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 VNA & PACS MARKET FOR DIAGNOSTIC CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 VNA & PACS MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 VNA & PACS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 VNA & PACS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: VNA & PACS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 71 US: KEY MACROINDICATORS

- TABLE 72 US: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 73 US: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 74 US: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 75 US: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 76 US: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 77 US: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 78 US: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 79 US: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 80 CANADA: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 81 CANADA: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 82 CANADA: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 83 CANADA: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 84 CANADA: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 85 CANADA: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 86 CANADA: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 87 CANADA: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: VNA & PACS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 EUROPE: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 90 EUROPE: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 EUROPE: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 92 EUROPE: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 93 EUROPE: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 94 EUROPE: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 95 EUROPE: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 96 EUROPE: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 97 GERMANY: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 98 GERMANY: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 GERMANY: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 GERMANY: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 101 GERMANY: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 102 GERMANY: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 103 GERMANY: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 104 GERMANY: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 105 UK: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 106 UK: VNA MARKET, BY TYPE 2023-2030 (USD MILLION)

- TABLE 107 UK: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 UK: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 109 UK: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 110 UK: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 111 UK: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 112 UK: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 113 FRANCE: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 114 FRANCE: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 FRANCE: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 FRANCE: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 117 FRANCE: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 118 FRANCE: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 119 FRANCE: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 120 FRANCE: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 121 ITALY: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 122 ITALY: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 ITALY: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 ITALY: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 125 ITALY: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 126 ITALY: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 127 ITALY: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 128 ITALY: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 129 SPAIN: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 130 SPAIN: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 SPAIN: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 SPAIN: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 133 SPAIN: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 134 SPAIN: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 135 SPAIN: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 136 SPAIN: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 137 REST OF EUROPE: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 138 REST OF EUROPE: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 REST OF EUROPE: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 REST OF EUROPE: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 141 REST OF EUROPE: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 142 REST OF EUROPE: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 143 REST OF EUROPE: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 144 REST OF EUROPE: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: VNA & PACS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 153 ASIA PACIFIC: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 154 JAPAN: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 155 JAPAN: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 JAPAN: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 JAPAN: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 158 JAPAN: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 159 JAPAN: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 160 JAPAN: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 161 JAPAN: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 162 CHINA: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 163 CHINA: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 CHINA: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 CHINA: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 166 CHINA: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 167 CHINA: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 168 CHINA: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 169 CHINA: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 170 INDIA: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 171 INDIA: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 INDIA: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 INDIA: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 174 INDIA: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 175 INDIA: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 176 INDIA: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 177 INDIA: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 179 REST OF ASIA PACIFIC: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 REST OF ASIA PACIFIC: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 183 REST OF ASIA PACIFIC: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 186 LATIN AMERICA: VNA & PACS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 187 LATIN AMERICA: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 188 LATIN AMERICA: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 LATIN AMERICA: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 LATIN AMERICA: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 191 LATIN AMERICA: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 192 LATIN AMERICA: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 193 LATIN AMERICA: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 194 LATIN AMERICA: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 195 BRAZIL: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 196 BRAZIL: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 BRAZIL: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 BRAZIL: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 199 BRAZIL: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 200 BRAZIL: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 201 BRAZIL: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 202 BRAZIL: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 203 MEXICO: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 204 MEXICO: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 MEXICO: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 MEXICO: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 207 MEXICO: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 208 MEXICO: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 209 MEXICO: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 210 MEXICO: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 211 REST OF LATIN AMERICA: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 212 REST OF LATIN AMERICA: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 REST OF LATIN AMERICA: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 REST OF LATIN AMERICA: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 215 REST OF LATIN AMERICA: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 216 REST OF LATIN AMERICA: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 217 REST OF LATIN AMERICA: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 218 REST OF LATIN AMERICA: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: VNA & PACS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 228 GCC COUNTRIES: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 229 GCC COUNTRIES: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 GCC COUNTRIES: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 GCC COUNTRIES: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 232 GCC COUNTRIES: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 233 GCC COUNTRIES: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 234 GCC COUNTRIES: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 235 GCC COUNTRIES: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 236 REST OF MIDDLE EAST & AFRICA: VNA & PACS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 237 REST OF MIDDLE EAST & AFRICA: VNA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 238 REST OF MIDDLE EAST & AFRICA: PACS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 239 REST OF MIDDLE EAST & AFRICA: VNA & PACS MARKET, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 240 REST OF MIDDLE EAST & AFRICA: VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 241 REST OF MIDDLE EAST & AFRICA: VNA & PACS MARKET, BY VENDOR TYPE, 2023-2030 (USD MILLION)

- TABLE 242 REST OF MIDDLE EAST & AFRICA: VNA & PACS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 243 REST OF MIDDLE EAST & AFRICA: VNA & PACS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 244 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN VNA & PACS MARKET, JANUARY 2022-MAY 2025

- TABLE 245 VNA & PACS MARKET: DEGREE OF COMPETITION

- TABLE 246 VNA & PACS MARKET: REGION FOOTPRINT

- TABLE 247 VNA & PACS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 248 VNA & PACS MARKET: DEPLOYMENT MODEL FOOTPRINT

- TABLE 249 VNA & PACS MARKET: END-USER FOOTPRINT

- TABLE 250 VNA & PACS MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 251 VNA & PACS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SME PLAYERS

- TABLE 252 VNA & PACS MARKET: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 253 VNA & PACS MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 254 VNA & PACS MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 255 AGFA-GEVAERT GROUP: COMPANY OVERVIEW

- TABLE 256 AGFA-GEVAERT GROUP: SOLUTIONS OFFERED

- TABLE 257 AGFA-GEVAERT GROUP: DEALS, JANUARY 2022-MAY 2025

- TABLE 258 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 259 FUJIFILM HOLDINGS CORPORATION: SOLUTIONS OFFERED

- TABLE 260 FUJIFILM HOLDINGS CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 261 FUJIFILM HOLDINGS CORPORATION: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 262 SECTRA AB: COMPANY OVERVIEW

- TABLE 263 SECTRA AB: SOLUTIONS OFFERED

- TABLE 264 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 265 GE HEALTHCARE: SOLUTIONS OFFERED

- TABLE 266 GE HEALTHCARE: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 267 GE HEALTHCARE: DEALS, JANUARY 2022-MAY 2025

- TABLE 268 MERATIVE: COMPANY OVERVIEW

- TABLE 269 MERATIVE: SOLUTIONS OFFERED

- TABLE 270 MERATIVE: DEALS, JANUARY 2022-MAY 2025

- TABLE 271 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 272 KONINKLIJKE PHILIPS N.V.: SOLUTIONS OFFERED

- TABLE 273 KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 274 KONINKLIJKE PHILIPS N.V.: DEALS, JANUARY 2022-MAY 2025

- TABLE 275 CANON MEDICAL SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 276 CANON MEDICAL SYSTEMS CORPORATION: SOLUTIONS OFFERED

- TABLE 277 CANON MEDICAL SYSTEMS CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 278 CANON MEDICAL SYSTEMS CORPORATION: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 279 INTELERAD. INTELERAD.: COMPANY OVERVIEW

- TABLE 280 INTELERAD. INTELERAD.: SOLUTIONS OFFERED

- TABLE 281 INTELERAD. INTELERAD.: DEALS, JANUARY 2022-MAY 2025

- TABLE 282 INTELERAD. INTELERAD.: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 283 PAXERAHEALTH: COMPANY OVERVIEW

- TABLE 284 PAXERAHEALTH: SOLUTIONS OFFERED

- TABLE 285 NOVARAD CORPORATION: COMPANY OVERVIEW

- TABLE 286 NOVARAD CORPORATION: SOLUTIONS OFFERED

- TABLE 287 HYLAND SOFTWARE, INC.: COMPANY OVERVIEW

- TABLE 288 HYLAND SOFTWARE, INC.: SOLUTIONS OFFERED

- TABLE 289 HYLAND SOFTWARE, INC.:DEALS, JANUARY 2022-MAY 2025

- TABLE 290 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- TABLE 291 SIEMENS HEALTHINEERS AG: SOLUTIONS OFFERED

- TABLE 292 SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2022-MAY 2025

- TABLE 293 BRIDGEHEAD SOFTWARE LTD.: COMPANY OVERVIEW

- TABLE 294 BRIDGEHEAD SOFTWARE LTD.: SOLUTIONS OFFERED

- TABLE 295 BRIDGEHEAD SOFTWARE LTD.: DEALS, JANUARY 2022-MAY 2025

- TABLE 296 CANOPY PARTNERS: COMPANY OVERVIEW

- TABLE 297 CANOPY PARTNERS: SOLUTIONS OFFERED

- TABLE 298 CRELIOHEALTH INC.: COMPANY OVERVIEW

- TABLE 299 CRELIOHEALTH INC.: SOLUTIONS OFFERED

- TABLE 300 ASPYRA, LLC: COMPANY OVERVIEW

- TABLE 301 ASPYRA, LLC: SOLUTIONS OFFERED

- TABLE 302 POSTDICOM: COMPANY OVERVIEW

- TABLE 303 POSTDICOM: SOLUTIONS OFFERED

- TABLE 304 MEDICASOFT: COMPANY OVERVIEW

- TABLE 305 MEDICASOFT: SOLUTIONS OFFERED

- TABLE 306 ESAOTE S.P.A.: COMPANY OVERVIEW

- TABLE 307 ESAOTE S.P.A.: SOLUTIONS OFFERED

- TABLE 308 ESAOTE S.P.A.: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 309 VISUS HEALTH IT GMBH: COMPANY OVERVIEW

- TABLE 310 VISUS HEALTH IT GMBH: SOLUTIONS OFFERED

- TABLE 311 ADVAHEALTH SOLUTIONS: COMPANY OVERVIEW

- TABLE 312 SOFTTEAM SOLUTIONS PVT. LTD.: COMPANY OVERVIEW

- TABLE 313 ARO SYSTEMS: COMPANY OVERVIEW

- TABLE 314 CENTRA DATA NETWORKS: COMPANY OVERVIEW

- TABLE 315 ONEPACS: COMPANY OVERVIEW

- TABLE 316 DEDALUS S.P.A.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 VNA & PACS MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 VNA & PACS MARKET: YEARS CONSIDERED

- FIGURE 3 VNA & PACS MARKET: RESEARCH DESIGN

- FIGURE 4 VNA & PACS MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 VNA & PACS MARKET: PRIMARY SOURCES

- FIGURE 6 VNA & PACS MARKET: KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 VNA & PACS MARKET: KEY INSIGHTS FROM PRIMARIES

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 9 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 10 SUPPLY-SIDE MARKET ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 11 VNA & PACS MARKET: BOTTOM-UP APPROACH

- FIGURE 12 VNA & PACS MARKET: TOP-DOWN APPROACH

- FIGURE 13 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN VNA & PACS MARKET

- FIGURE 14 VNA & PACS MARKET: CAGR PROJECTIONS (SUPPLY-SIDE ANALYSIS)

- FIGURE 15 VNA & PACS MARKET: DATA TRIANGULATION

- FIGURE 16 VNA & PACS MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

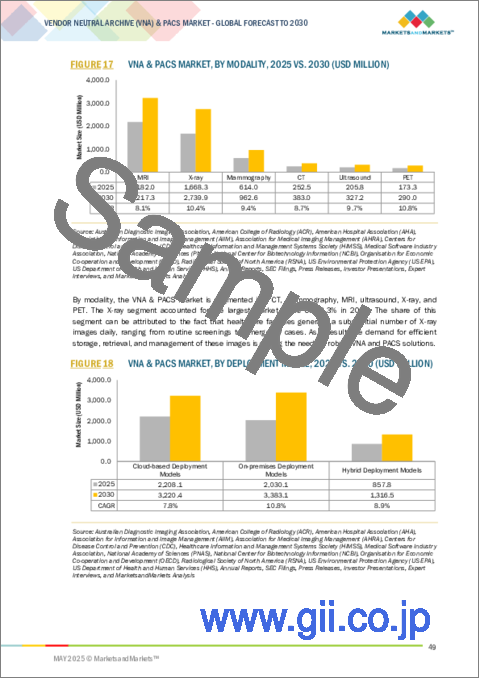

- FIGURE 17 VNA & PACS MARKET, BY MODALITY, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 VNA & PACS MARKET, BY DEPLOYMENT MODEL, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 VNA & PACS MARKET, BY VENDOR TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 VNA & PACS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 21 VNA & PACS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 22 VNA & PACS MARKET: REGIONAL SNAPSHOT

- FIGURE 23 NEED TO HANDLE GROWING DATA VOLUME TO FUEL DEMAND FOR VNA AND PACS SOLUTIONS

- FIGURE 24 JAPAN AND VNA ACCOUNTED FOR SIGNIFICANT MARKET SHARE IN 2024

- FIGURE 25 CHINA TO REGISTER HIGHEST GROWTH RATE FROM 2025 TO 2030

- FIGURE 26 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 27 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATES DURING STUDY PERIOD

- FIGURE 28 VNA & PACS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 29 VNA & PACS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 30 VNA & PACS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 31 VNA & PACS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 32 VNA & PACS MARKET: FUNDING AND NUMBER OF DEALS, 2021-2024

- FIGURE 33 VNA & PACS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR END USERS

- FIGURE 35 KEY BUYING CRITERIA FOR MAJOR END USERS

- FIGURE 36 JURISDICTION AND TOP APPLICANT ANALYSIS IN VNA & PACS MARKET, JANUARY 2022-MAY 2025

- FIGURE 37 TOP PATENT APPLICANTS/OWNERS (COMPANIES/INSTITUTIONS) FOR VNA & PACS SOLUTIONS (JANUARY 2015-MAY 2025)

- FIGURE 38 NORTH AMERICA: VNA & PACS MARKET SNAPSHOT

- FIGURE 39 UK: NUMBER OF MEDICAL IMAGING UNDER NATIONAL HEALTH SERVICE (NHS), JANUARY 2022-JANUARY 2023

- FIGURE 40 ASIA PACIFIC: VNA & PACS MARKET SNAPSHOT

- FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS IN VNA & PACS MARKET, 2020-2024 (USD MILLION)

- FIGURE 42 MARKET SHARE ANALYSIS OF KEY PLAYERS IN VNA & PACS MARKET (2024)

- FIGURE 43 VNA & PACS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 VNA & PACS MARKET: COMPANY FOOTPRINT

- FIGURE 45 VNA & PACS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 EV/EBITDA OF KEY VENDORS

- FIGURE 47 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF VNA AND PACS VENDORS

- FIGURE 48 VNA & PACS MARKET: BRAND/SOFTWARE COMPARATIVE ANALYSIS

- FIGURE 49 AGFA-GEVAERT GROUP: COMPANY SNAPSHOT

- FIGURE 50 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 SECTRA AB: COMPANY SNAPSHOT

- FIGURE 52 GE HEALTHCARE: COMPANY SNAPSHOT

- FIGURE 53 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

- FIGURE 54 CANON MEDICAL SYSTEMS CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT

The global VNA & PACS market is projected to reach USD 7.92 billion by 2030 from USD 5.10 billion in 2025, at a CAGR of 9.2% during the forecast period. Market expansion is largely fueled by the surging volume of medical imaging data, the transition towards enterprise-wide interoperability, and the increasing demand for centralized, vendor-neutral platforms designed to optimize imaging workflows. Additionally, initiatives aimed at healthcare digitization and regulatory frameworks promoting health information exchange are further catalyzing market growth. However, the high costs associated with implementation and the complexities related to data migration remain significant barriers to the adoption of advanced VNA and PACS, particularly for small to mid-sized healthcare organizations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product Type, Modality, Deployment, Vendor Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

On the basis of product type, the multi-site VNA segment is expected to witness the highest growth rate during the forecast period.

Based on product type, the VNA & PACS market is segmented into VNA (further subsegmented into department, multi-department, and multi-site VNA) and PACS (further subsegmented into department, multi-department, and multi-site PACS). The multi-site VNA subsegment is expected to witness the fastest CAGR during the forecast period. The escalating demand for medical imaging solutions is primarily driven by the increasing emphasis of healthcare systems on interoperability and cross-institutional data integration to optimize imaging workflows across diverse geographical locations. As hospitals and health systems consolidate into integrated networks, the establishment of a comprehensive imaging repository has become essential for facilitating seamless data access and collaborative diagnostic efforts. Additionally, the transition towards remote diagnostics, teleconsultations, and virtual care frameworks-exacerbated by the COVID-19 pandemic-has underscored the imperative for scalable, multi-site VNAs that enable secure and anytime-anywhere access to medical imaging. These advanced solutions not only help dismantle data silos and minimize image duplication but also enhance care coordination across various departments and facilities.

On the basis of deployment, the on-premises deployment segment held the largest market share in 2024.

On the basis of deployment, the VNA & PACS market has been segmented into on-premises, cloud-based, and hybrid deployment. The on-premises deployment segment held the largest market share in 2024. Healthcare institutions are increasingly favoring on-premises deployment in infrastructure to maintain oversight and achieve long-term cost predictability, particularly those with substantial resources or large-scale operations. These organizations prioritize security and performance stability, which aligns well with capital budgeting practices. By managing storage internally, they ensure compliance with stringent data governance standards while consistently delivering reliable imaging performance. A critical consideration in this area is the total cost of ownership (TCO). Although cloud-based solutions typically offer greater agility and require a lower upfront investment, on-premises deployment often provides superior long-term return on investment (ROI), especially for institutions equipped with established IT teams and fixed imaging volume requirements. Furthermore, advancements in hardware efficiencies are making local deployments increasingly economical and dependable.

On the basis of region, the Asia Pacific is expected to witness the highest CAGR from 2025 to 2030.

On the basis of region, the VNA & PACS market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Among these, the Asia Pacific market is expected to witness the highest CAGR due to an increased investment in medical imaging infrastructure, expanding healthcare access, and the rapid digitization of hospital systems across emerging economies. Countries such as India, China, and various Southeast Asian nations are enhancing their diagnostic imaging capabilities, leading healthcare organizations to explore centralized and interoperable solutions for the management of clinical images and associated data. Concurrently, technological advancements and the increasing adoption of cloud computing are rendering enterprise imaging solutions-specifically VNA and PACS-more scalable and cost-efficient across institutions of varying sizes. As digital health strategies emerge as national imperatives, there is an intensified focus on optimizing imaging workflows, facilitating remote access to radiological data, and promoting cross-facility data interoperability. These objectives are well-aligned with the inherent advantages offered by VNA and PACS platforms, which support integrated and seamless management of imaging information.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 45%, Tier 2: 30%, and Tier 3: 25%

- By Designation - C-level: 42%, Director-level: 31%, and Others: 27%

- By Region - North America: 32%, Europe: 30%, Asia Pacific: 25%, Middle East & Africa: 5%, Latin America: 5%

Key Players

The key players functioning in the VNA & PACS market include Hyland Software, Inc. (US), Agfa-Gevaert Group (Belgium), Intelerad Medical Systems Inc. (Canada), Canon Medical Systems Corporation (Japan), FUJIFILM Holdings Corporation (Japan), GE Healthcare (US), Merative (US), Sectra AB (Sweden), Siemens Healthcare Limited (Germany), BridgeHead Software Ltd. (UK), Canopy Partners. (US), Novarad Corporation (US), POSTDICOM (Netherlands), AdvaHealth Solutions Pte Ltd. (Singapore), CrelioHealth (India), Medicasoft (US), Esaote S.p.A. (Italy), PaxeraHealth (US), VISUS Health IT GmbH (Germany), ASPYRA, LLC (US), Dedalus S.p.A. (Italy), SoftTeam Solutions Pvt. Ltd. (India), ARO Systems (Australia), Central Data Networks (Australia), and ONEPACS (US).

Research Coverage:

The report analyses the VNA & PACS market to estimate the market size and future growth potential of various market segments based on product type, modality, deployment, vendor type, application, end user, and region. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report provides valuable insights for both established firms and emerging or smaller players, enabling them to accurately assess market dynamics. By leveraging the information presented, organizations can adopt various strategies outlined below to enhance their competitive positioning and increase market share..

This report provides insights on:

- Analysis of DROCs: Drivers [increasing investments in medical imaging technologies, growing demand for streamlined healthcare data management solutions, Integration of PACS/VNA with electronic medical records (EMRs)], restraints [increasing data security and privacy concerns, high initial investment, lack of standardized protocols and interoperability frameworks], opportunities [government initiatives to increase penetration of AI in medical imaging, Increasing medical imaging procedures and large imaging data silos, rapid uptake of big data in healthcare], and challenges [rising security concerns related to cloud-based image processing and analytics, data security issues] influencing the growth of the VNA & PACS market.

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and new product & service launches in the VNA & PACS market

- Market Development: Comprehensive information on the lucrative emerging markets, product type, modality, deployment, vendor type, application, end user, and region.

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the VNA & PACS market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the VNA & PACS market, such as Agfa-Gevaert Group (Belgium), FUJIFILM Holdings Corporation (Japan), Sectra AB (Sweden), Merative (US), and GE Healthcare (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key primary insights

- 2.1.1 SECONDARY DATA

- 2.2 RESEARCH DESIGN

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 SUPPLY-SIDE ANALYSIS (REVENUE SHARE ANALYSIS)

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.3 TOP-DOWN APPROACH

- 2.3.4 TOP-DOWN APPROACH FOR PARENT MARKET ASSESSMENT

- 2.3.5 COMPANY PRESENTATIONS AND PRIMARY INTERVIEWS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RESEARCH LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF VNA & PACS MARKET

- 4.2 ASIA PACIFIC: VNA & PACS MARKET, BY PRODUCT TYPE AND COUNTRY

- 4.3 VNA & PACS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 VNA & PACS MARKET: REGIONAL MIX

- 4.5 VNA & PACS MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Heightened investments in medical imaging technologies

- 5.2.1.2 Growing demand for streamlined healthcare data management solutions

- 5.2.1.3 Integration of PACS/VNA with electronic medical records

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment for implementing VNA and PACS solutions

- 5.2.2.2 Lack of standardized protocols and interoperability frameworks

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Favorable government initiatives for better penetration of AI in medical imaging

- 5.2.3.2 Increasing medical imaging procedures and large imaging data silos

- 5.2.3.3 Rapid uptake of big data in healthcare

- 5.2.4 CHALLENGES

- 5.2.4.1 Rising security concerns related to cloud-based image processing and analytics

- 5.2.4.2 Data security issues in healthcare settings

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 CLOUD ADOPTION

- 5.3.2 AI AND ML INTEGRATION

- 5.3.3 VALUE-BASED CARE MODELS

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Digital imaging and communications in medicine (DICOM)

- 5.4.1.2 Enterprise imaging solutions

- 5.4.1.3 Cloud-based storage and services

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Image exchange networks

- 5.4.2.2 Data analytics and business intelligence

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Health information exchange (HIE)

- 5.4.1 KEY TECHNOLOGIES

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.7.1 ROLE IN ECOSYSTEM

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF NEW ENTRANTS

- 5.9.5 THREAT OF SUBSTITUTES

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 KEY BUYING CRITERIA

- 5.11 KEY CONFERENCES & EVENTS, 2025-2026

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE OF VNA & PACS SOLUTIONS, BY PRODUCT TYPE, 2024

- 5.12.2 AVERAGE SELLING PRICE OF VNA & PACS SOLUTIONS, BY REGION (QUALITATIVE)

- 5.13 REGULATORY ANALYSIS

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 REGULATORY FRAMEWORK

- 5.13.2.1 North America

- 5.13.2.1.1 US

- 5.13.2.2 Europe

- 5.13.2.3 Asia Pacific

- 5.13.2.3.1 China

- 5.13.2.3.2 Japan

- 5.13.2.3.3 India

- 5.13.2.1 North America

- 5.14 PATENT ANALYSIS

- 5.14.1 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.14.2 LIST OF MAJOR PATENTS, 2020-2024

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 AMBRA HEALTH UTILIZED AWS CLOUD SERVICES TO PROPEL MEDICAL IMAGING PLATFORM GROWTH

- 5.15.2 NHS TRUST ADOPTED INSTANT DATA ACCESS VNA TO ESTABLISH UNIFIED PLATFORM FOR DICOM IMAGE DATA STORAGE AND MANAGEMENT

- 5.16 UNMET NEEDS & END-USER EXPECTATIONS

- 5.16.1 UNMET NEEDS

- 5.16.2 END-USER EXPECTATIONS

- 5.17 BUSINESS MODELS

- 5.17.1 ENTERPRISE LICENSING MODELS

- 5.17.2 SOFTWARE-AS-A-SERVICE (SAAS) MODELS

- 5.17.3 PAY-PER-USE MODELS

- 5.17.4 HYBRID MODELS

- 5.18 IMPACT OF 2025 US TARIFF ON VNA & PACS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 North America

- 5.18.4.1.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.4.1 North America

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.18.5.1 Hospitals & clinics

- 5.18.5.2 Diagnostics centers

- 5.18.5.3 Ambulatory surgery centers

- 5.18.5.4 Other end users

- 5.18.6 CONCLUSION

6 VNA & PACS MARKET, BY MODALITY

- 6.1 INTRODUCTION

- 6.2 CT

- 6.2.1 GROWING NEED FOR IMAGING MODALITIES IN MEDICAL FIELDS TO SUPPORT MARKET GROWTH

- 6.3 MAMMOGRAPHY

- 6.3.1 RISING INCIDENCE OF BREAST CANCER TO PROPEL MARKET GROWTH

- 6.4 ULTRASOUND

- 6.4.1 TECHNOLOGICAL ADVANCEMENTS IN ULTRASOUND DEVICES TO AID MARKET GROWTH

- 6.5 MRI

- 6.5.1 COST-EFFECTIVENESS AND EASY AVAILABILITY IN SMALL HEALTHCARE FACILITIES TO FUEL MARKET ADOPTION

- 6.6 X-RAY

- 6.6.1 DEVELOPMENTS IN X-RAY IMAGING TO BOOST ADOPTION OF VNA AND PACS SOLUTIONS

- 6.7 PET

- 6.7.1 NEED FOR BETTER MANAGEMENT AND STORAGE OF LARGE DATA VOLUMES TO FAVOR MARKET GROWTH

7 VNA & PACS MARKET, BY DEPLOYMENT MODEL

- 7.1 INTRODUCTION

- 7.2 ON-PREMISES DEPLOYMENT MODELS

- 7.2.1 BETTER CONTROL AND SECURITY FOR SENSITIVE PATIENT DATA TO AUGMENT MARKET GROWTH

- 7.3 CLOUD-BASED DEPLOYMENT MODELS

- 7.3.1 TECHNOLOGICAL ADVANCEMENTS IN DIAGNOSTIC IMAGING MODALITIES TO DRIVE MARKET

- 7.4 HYBRID DEPLOYMENT MODELS

- 7.4.1 GREATER FLEXIBILITY, SCALABILITY, AND CONTROL OVER DATA MANAGEMENT STRATEGIES TO PROPEL MARKET GROWTH

8 VNA & PACS MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 VNA

- 8.2.1 DEPARTMENT VNA

- 8.2.1.1 Limitations in addressing scalability and interoperability across diverse departments to hinder market growth

- 8.2.2 MULTI-DEPARTMENT VNA

- 8.2.2.1 Multi-department VNA to streamline data management processes and reduce redundancies

- 8.2.3 MULTI-SITE VNA

- 8.2.3.1 Multi-site VNA to provide centralized repository for managing medical data and standardizing medical records

- 8.2.1 DEPARTMENT VNA

- 8.3 PACS

- 8.3.1 DEPARTMENT PACS

- 8.3.1.1 Need for better medical imaging data storage to aid market growth

- 8.3.2 MULTI-DEPARTMENT PACS

- 8.3.2.1 Technological advancements in multi-department PACS to improve image retrieval speed and ensure data integrity

- 8.3.3 MULTI-SITE PACS

- 8.3.3.1 Advancements in cloud-based PACS solutions to propel market growth

- 8.3.1 DEPARTMENT PACS

9 VNA & PACS MARKET, BY VENDOR TYPE

- 9.1 INTRODUCTION

- 9.2 INDEPENDENT VENDORS

- 9.2.1 INCREASED FLEXIBILITY, BETTER INTEROPERABILITY, AND IMPROVED SOLUTIONS TO DRIVE MARKET

- 9.3 THIRD-PARTY VENDORS

- 9.3.1 NEED FOR INNOVATIVE SOLUTIONS TO DRIVE THIRD-PARTY VENDOR PRESENCE

10 VNA & PACS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 CARDIOLOGY

- 10.2.1 RISING CASES OF CARDIOVASCULAR DISEASES TO DRIVE MARKET

- 10.3 ORTHOPEDIC

- 10.3.1 GROWING VOLUME AND COMPLEXITY OF ORTHOPEDIC MEDICAL IMAGING SCANS TO PROPEL MARKET GROWTH

- 10.4 ONCOLOGY

- 10.4.1 RISING NUMBER OF CANCER CASES TO DRIVE USE OF VNA AND PACS SOLUTIONS FOR ONCOLOGY

- 10.5 NEUROLOGY

- 10.5.1 INCREASING DEMAND FOR ADVANCED NEUROLOGICAL IMAGING TECHNOLOGIES TO SPUR GROWTH

- 10.6 OBSTETRICS & GYNECOLOGY

- 10.6.1 USE OF 3D AND 4D IMAGING FOR MONITORING FETUS GROWTH AND DIAGNOSING HIGH-RISK PREGNANCIES TO DRIVE MARKET

- 10.7 OTHER APPLICATIONS

11 VNA & PACS MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 HOSPITALS & CLINICS

- 11.2.1 NEED TO IMPROVE PROFITABILITY OF HEALTHCARE SERVICES TO DRIVE USE OF HCIT IN HOSPITALS

- 11.3 DIAGNOSTIC CENTERS

- 11.3.1 LACK OF ADVANCED IMAGING MODALITIES IN SMALL AND MID-SCALE HOSPITALS TO AUGMENT MARKET GROWTH

- 11.4 AMBULATORY SURGERY CENTERS

- 11.4.1 INCREASING NUMBER OF INTERVENTIONAL IMAGING PROCEDURES TO SUPPORT MARKET GROWTH

- 11.5 OTHER END USERS

12 VNA & PACS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 US to dominate global VNA & PACS market during study period

- 12.2.3 CANADA

- 12.2.3.1 Rising cases of end-stage kidney diseases to propel market growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Increasing number of MRI units and diagnostic imaging centers to drive market

- 12.3.3 UK

- 12.3.3.1 Rising funding and investments in diagnostic imaging to support market growth

- 12.3.4 FRANCE

- 12.3.4.1 Rising target patient population and increasing government-funded investments to fuel uptake of VNA and PACS solutions

- 12.3.5 ITALY

- 12.3.5.1 Established healthcare infrastructure to aid market growth

- 12.3.6 SPAIN

- 12.3.6.1 Growing access to advanced cancer diagnostics to propel market

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 JAPAN

- 12.4.2.1 Presence of universal healthcare coverage to fuel market

- 12.4.3 CHINA

- 12.4.3.1 Strong government support for healthcare reforms and increased number of medical imaging procedures to drive market

- 12.4.4 INDIA

- 12.4.4.1 Improving healthcare infrastructure and increasing private-public partnerships to support market growth

- 12.4.5 REST OF ASIA PACIFIC

- 12.5 LATIN AMERICA

- 12.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 12.5.2 BRAZIL

- 12.5.2.1 Presence of free and universal healthcare system to propel market growth

- 12.5.3 MEXICO

- 12.5.3.1 Rapid technological advancements in imaging solutions to support market growth

- 12.5.4 REST OF LATIN AMERICA

- 12.6 MIDDLE EAST & AFRICA

- 12.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 12.6.2 GCC COUNTRIES

- 12.6.2.1 Technological integration to spur inclusivity, accessibility, affordability, and growth in healthcare sector

- 12.6.3 REST OF MIDDLE EAST & AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN VNA & PACS MARKET

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Product type footprint

- 13.5.5.4 Deployment model footprint

- 13.5.5.5 End-user footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.6.5.1 Detailed list of key startups/SME players

- 13.6.5.2 Competitive benchmarking of startups/SME players

- 13.7 COMPANY VALUATION & FINANCIAL METRICS

- 13.7.1 FINANCIAL METRICS

- 13.7.2 COMPANY VALUATION

- 13.8 BRAND/SOFTWARE COMPARISON

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY COMPANIES

- 14.1.1 AGFA-GEVAERT GROUP

- 14.1.1.1 Business overview

- 14.1.1.2 Solutions offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 FUJIFILM HOLDINGS CORPORATION

- 14.1.2.1 Business overview

- 14.1.2.2 Solutions offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses & competitive threats

- 14.1.3 SECTRA AB

- 14.1.3.1 Business overview

- 14.1.3.2 Solutions offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Right to win

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses & competitive threats

- 14.1.4 GE HEALTHCARE

- 14.1.4.1 Business overview

- 14.1.4.2 Solutions offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses & competitive threats

- 14.1.5 MERATIVE

- 14.1.5.1 Business overview

- 14.1.5.2 Solutions offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses & competitive threats

- 14.1.6 KONINKLIJKE PHILIPS N.V.

- 14.1.6.1 Business overview

- 14.1.6.2 Solutions offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.7 CANON MEDICAL SYSTEMS CORPORATION

- 14.1.7.1 Business overview

- 14.1.7.2 Solutions offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.7.3.2 Expansions

- 14.1.8 INTELERAD. INTELERAD.

- 14.1.8.1 Business overview

- 14.1.8.2 Solutions offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.3.2 Other developments

- 14.1.9 PAXERAHEALTH

- 14.1.9.1 Business overview

- 14.1.9.2 Solutions offered

- 14.1.10 NOVARAD CORPORATION

- 14.1.10.1 Business overview

- 14.1.10.2 Solutions offered

- 14.1.11 HYLAND SOFTWARE, INC.

- 14.1.11.1 Business overview

- 14.1.11.2 Solutions offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.12 SIEMENS HEALTHINEERS AG

- 14.1.12.1 Business overview

- 14.1.12.2 Solutions offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.13 BRIDGEHEAD SOFTWARE LTD.

- 14.1.13.1 Business overview

- 14.1.13.2 Solutions offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.14 CANOPY PARTNERS

- 14.1.14.1 Business overview

- 14.1.14.2 Solutions offered

- 14.1.15 CRELIOHEALTH INC.

- 14.1.15.1 Business overview

- 14.1.15.2 Solutions offered

- 14.1.16 ASPYRA, LLC

- 14.1.16.1 Business overview

- 14.1.16.2 Solutions offered

- 14.1.17 POSTDICOM

- 14.1.17.1 Business overview

- 14.1.17.2 Solutions offered

- 14.1.18 MEDICASOFT

- 14.1.18.1 Business overview

- 14.1.18.2 Solutions offered

- 14.1.19 ESAOTE S.P.A.

- 14.1.19.1 Business overview

- 14.1.19.2 Solutions offered

- 14.1.19.3 Recent developments

- 14.1.19.3.1 Product launches

- 14.1.20 VISUS HEALTH IT GMBH

- 14.1.20.1 Business overview

- 14.1.20.2 Solutions offered

- 14.1.1 AGFA-GEVAERT GROUP

- 14.2 OTHER PLAYERS

- 14.2.1 ADVAHEALTH SOLUTIONS

- 14.2.2 SOFTTEAM SOLUTIONS PVT. LTD.

- 14.2.3 ARO SYSTEMS

- 14.2.4 CENTRAL DATA NETWORKS

- 14.2.5 ONEPACS

- 14.2.6 DEDALUS S.P.A.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS