|

|

市場調査レポート

商品コード

1735891

精密誘導弾の世界市場:製品別、システム別、発射プラットフォーム別、運用形態別、速度別、射程距離別、地域別 - 2030年までの予測Precision-Guided Munition Market by Product (Tactical Missile, Interceptor Missile, Torpedoes, Rockets, Loitering Munition), System (Guidance & Navigation, Target Acquisition), Launch Platform, Speed, Mode of Operation, Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 精密誘導弾の世界市場:製品別、システム別、発射プラットフォーム別、運用形態別、速度別、射程距離別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月21日

発行: MarketsandMarkets

ページ情報: 英文 375 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

精密誘導弾の市場規模は2025年に372億4,000万米ドルと推定され、CAGRは5.9%と見込まれており、2030年には497億1,000万米ドルに達すると予測されています。

精密誘導弾の進化は、次世代防衛ソリューションに沿った複数の戦略的・作戦的要請によって推進されています。世界の軍隊は、より高い運用効率、物流負担の軽減、任務の信頼性向上を提供するシステムを優先しています。このシフトは、消費エネルギーが少なく、メンテナンスが最小限で済み、スリムで機敏な部隊構造に貢献する軍需品に対する需要の高まりを反映しています。さらに、量よりも精度を重視する傾向の高まりや、持続可能でインテリジェントな戦争の推進は、より広範な防衛近代化の動向と一致しています。PGMは、巻き添え被害と資源消費を最小限に抑えながら、正確な任務を遂行するために不可欠なものとなっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | 製品別、システム別、発射プラットフォーム別、運用形態別、速度別、射程距離別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

電気光学/赤外線(EO/IR)誘導システムは、非常に複雑な作戦環境であっても、リアルタイムで忠実度の高い目標捕捉と終末誘導を実現できるため、精密誘導弾市場を独占することになります。これらのシステムにより、PGMは静止目標や移動目標をピンポイントで視覚的に探知、追跡、交戦することが可能となり、交戦規則で目標を正確に識別し、巻き添え被害を少なくすることが頻繁に要求される今日の精密打撃任務には不可欠です。

EO/IRシーカーは、低シグネチャ、パッシブ誘導能力を提供し、検出不可能な信号を放射しながら目標に向かって弾薬を原点復帰させる。夜間の明るい照明条件や、煙や塵のような不明瞭な場所でも機能する可能性があるため、あらゆる種類の任務や地形に柔軟に対応できます。

このようなシステムは、空対地爆弾、浮遊弾、自律型ミサイルに多く見られ、可視または熱赤外領域の画像が目標識別、照準点決定、最終コース修正に使用されます。また、オンボード・プロセッサや人工知能アルゴリズムとの統合により、自動目標認識(ATR)、画像に基づくコース中間更新、飛行中の再ターゲッティングなどの高度な機能も可能になります。

慣性航法システム(INS)は、ほぼすべての種類の精密兵器に正確な自律航法と誘導を提供する基礎を形成するため、精密誘導弾市場を独占する立場にあります。INS技術は、ジャイロスコープや加速度計などの内部センサーを利用して、外部入力なしに弾薬の位置、向き、速度をモニターすることで誘導するもので、スタンドアロン型誘導システムでもハイブリッド型誘導システムでも中心的な要素となっています。

INSの長所の1つは、紛争環境における耐障害性です。電子戦システムによって妨害されたりなりすまされたりするGPSとは対照的に、INSはGPSが劣化したり妨害されたりする環境でも確実に作動します。そのため、将来のPGM、特に電子的対抗手段が支配的な脅威の高い環境では、INSは頼りになるナビゲーション・システムとなります。さらに、INSはGPS、レーザーシーカー、レーダー、画像システムなどと組み合わせたマルチモード誘導システムの重要な部分でもあります。INSは、正確なミッドコース・ナビゲーションと終末誘導の安定化を提供し、外部からの合図が断続的であったり欠落していたりする場合でも、精密な交戦を支援します。

INSコンポーネントの小型化、特に微小電気機械システム(MEMS)の進化により、INSは戦術ミサイルや誘導爆弾、砲弾、浮遊弾など幅広い種類の弾薬に統合されています。また、その柔軟性と比較的低いシグネチャーは、プラットフォームにとらわれない展開を容易にし、空、陸、海の各領域で有用なものとなっています。

地対地誘導ロケットは、精度、射程距離、応答性、手頃な価格という独自の組み合わせにより、精密誘導弾(PGM)市場を独占します。これらの兵器は、費用対効果の高い無誘導砲と高価な戦術ミサイルの間の重要な能力ギャップを埋めるものであり、大規模な軍事力と新興防衛力の両方にとって魅力的な代替手段を提供します。この兵器の最も強力な特長のひとつは、制空権を必要とせず、地表に設置された移動式発射装置から遠距離に高精度の射撃を行えることです。誘導多連装ロケットシステム(GMLRS)のようなシステムや、世界中にある同様のシステムは、短時間の通告で静止した標的や移動可能な標的を攻撃することが可能であり、敵の防空(SEAD)の制圧、対砲台任務、精密阻止に優れています。

HIMARSやトラックに搭載されたMLRSのような極めて機動性の高い発射プラットフォームから発射できるため、戦場での生存性が高く、戦術的対応能力が高いです。ネットワークに接続されているため、センサー・トゥ・シューター、迅速で正確な反応、敏感な時間帯の標的への対応に適しています。

米国は、比類のない国防予算、成熟した産業基盤、精密でネットワーク化された戦争に対する戦略的優先順位により、世界の精密誘導弾市場で最大の保有国になるであろう。米国軍のドクトリンは、世界な打撃能力を維持しながら、巻き添え被害を減らすことを優先しており、PGMを戦術的・戦略的戦力投射の中核としています。

米国は、空対地爆弾から誘導ロケット弾、浮遊爆弾、長距離戦術ミサイル、精密砲弾に至るまで、最も先進的で多様なPGMを保有しています。JDAM、ストームブレイカー、エクスカリバー、GMLRS、JAGMは、軍の全分野で広く採用されており、モジュール式の強化やソフトウェア主導の改訂によって定期的に更新されています。

さらに米国国防総省は、長距離精密射撃(LRPF)、統合全領域指揮統制(JADC2)、次世代制空権(NGAD)といった近代化計画の下、多領域精密射撃にも高い価値を与えています。このプログラムは、ネットワーク対応、AI統合の相互運用可能なPGMへの持続的な投資を保証するものです。国家的ニーズに加えて、米国はPGMの対外軍事販売で圧倒的なシェアを占めており、これはNATO同盟国やインド太平洋地域のパートナーの間で高い需要があります。Lockheed Martin、RTX、Boeing、Northrop Grummanを含む元請企業の確立されたネットワークが、その主導的地位を確固たるものにしています。

精密誘導弾市場で著名な企業は、Northrop Grumman(米国)、RTX(米国)、General Dynamics Corporation(米国)、BAE Systems(英国)、Lockheed Martin Corporation(米国)、MBDA(フランス)、Israel Aerospace Industries(イスラエル)、QinetiQ(英国)、Boeing(米国)、Aselsan AS(トルコ)などです。

この調査レポートは、各セグメントにわたる精密誘導弾市場を対象としています。システム、発射プラットフォーム、製品、動作モード、速度、射程距離、地域など、さまざまなセグメントにわたる市場規模および市場の成長可能性を推計することを目的としています。また、主要企業プロファイル、製品・事業に関する主な見解、最近の動向、主要市場戦略とともに、市場競争に関する詳細な競合分析も掲載しています。当レポートを購入する主な利点当レポートは、精密誘導弾市場全体とそのサブセグメントの収益数の最も近い近似値に関する情報を提供し、この市場の市場リーダー/新規参入者に役立ちます。当レポートは、精密誘導弾産業のエコシステム全体をカバーしており、利害関係者が競合情勢を理解し、自社の事業をより良く位置付け、適切な市場参入戦略を計画するためのより多くの考察を得るのに役立ちます。また、利害関係者が市場の鼓動を理解し、主要市場促進要因・抑制要因・課題・機会に関する情報を提供するのにも役立ちます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向と混乱

- バリューチェーン分析

- エコシステム分析

- 技術分析

- ケーススタディ分析

- 貿易データ

- 主要な利害関係者と購入基準

- 米国の2025年関税

- 規制状況

- 2025年~2026年の主な会議とイベント

- 投資と資金調達のシナリオ

- 価格分析

- 運用データ

- AIの影響

- マクロ経済見通し

- 部品表

- 総所有コスト

- ビジネスモデル

- 技術ロードマップ

第6章 業界動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- サプライチェーン分析

- 特許分析

第7章 精密誘導兵器市場(製品別)

- イントロダクション

- 戦術ミサイル

- 迎撃ミサイル

- 誘導ロケット

- 誘導弾

- 魚雷

- 徘徊兵器

第8章 精密誘導兵器市場(システム別)

- イントロダクション

- 誘導・航法システム

- ターゲット捕捉システム

- 推進システム

- 弾頭

- 電源システム

第9章 精密誘導兵器市場(発射プラットフォーム別)

- イントロダクション

- 陸

- 空

- 海

第10章 精密誘導兵器市場(運用形態別)

- イントロダクション

- 自律型

- 半自律型

第11章 精密誘導兵器市場(速度別)

- イントロダクション

- サブソニック

- スーパーソニック

- ハイパーソニック

第12章 精密誘導兵器市場(射程距離別)

- イントロダクション

- 短距離

- 中距離

- 長距離

- 拡張範囲

第13章 精密誘導兵器市場(地域別)

- イントロダクション

- 北米

- PESTLE分析

- 防衛プログラム

- 米国

- カナダ

- 欧州

- PESTLE分析

- 防衛プログラム

- 英国

- フランス

- ドイツ

- イタリア

- ロシア

- その他

- アジア太平洋

- PESTLE分析

- 防衛プログラム

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他

- 中東

- PESTLE分析

- 防衛プログラム

- サウジアラビア

- イスラエル

- トルコ

- その他

- その他の地域

- PESTLE分析

- 防衛プログラム

- ラテンアメリカ

- アフリカ

第14章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 市場シェア分析、2024年

- 収益分析、2021年~2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第15章 企業プロファイル

- 主要参入企業

- NORTHROP GRUMMAN

- LOCKHEED MARTIN CORPORATION

- RTX

- BOEING

- GENERAL DYNAMICS CORPORATION

- BAE SYSTEMS

- ASELSAN A.S.

- MBDA

- ISRAEL AEROSPACE INDUSTRIES LTD.

- THALES

- RHEINMETALL AG

- LEONARDO S.P.A.

- KONGSBERG

- SAAB AB

- ELBIT SYSTEMS LTD.

- RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

- LEIDOS

- GENERAL ATOMICS

- DENEL DYNAMICS

- HANWHA GROUP

- POLSKA GRUPA ZBROJENIOWA

- ROSTEC

- その他の企業

- ROKETSAN

- BHARAT DYNAMICS LIMITED

- LIG NEX1

- DRDO

第16章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 US PRECISION-GUIDED MUNITION PROCUREMENT, 2024

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 IMPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 5 EXPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PRODUCTS (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- TABLE 8 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 9 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR PRECISION-GUIDED MUNITION MARKET

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 AVERAGE SELLING PRICE OF PRECISION-GUIDED MUNITIONS, BY PRODUCT, 2024 (USD MILLION)

- TABLE 17 AVERAGE SELLING PRICE OF PRECISION-GUIDED MUNITIONS, BY REGION, 2024 (USD MILLION)

- TABLE 18 OPERATIONAL DATA FOR PRECISION-GUIDED MUNITION PRODUCTS, 2021-2024 (UNITS)

- TABLE 19 OPERATIONAL DATA FOR PRECISION-GUIDED MUNITION PRODUCTS, 2025-2030 (UNITS)

- TABLE 20 BILL OF MATERIALS FOR JOINT DIRECT ATTACK MUNITIONS

- TABLE 21 BILL OF MATERIALS FOR GUIDED MULTIPLE LAUNCH ROCKET SYSTEMS

- TABLE 22 TOTAL COST OF OWNERSHIP FOR JOINT DIRECT ATTACK MUNITIONS

- TABLE 23 TOTAL COST OF OWNERSHIP FOR GUIDED MULTIPLE LAUNCH ROCKET SYSTEMS

- TABLE 24 BUSINESS MODELS IN PRECISION-GUIDED MUNITION MARKET

- TABLE 25 PATENT ANALYSIS

- TABLE 26 PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 27 PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 28 TACTICAL MISSILES: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 29 TACTICAL MISSILES: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 30 INTERCEPTOR MISSILES: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 31 INTERCEPTOR MISSILES: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 32 GUIDED ROCKETS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 33 GUIDED ROCKETS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 34 GUIDED AMMUNITION: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 35 GUIDED AMMUNITION: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025-2030 (USD MILLION)

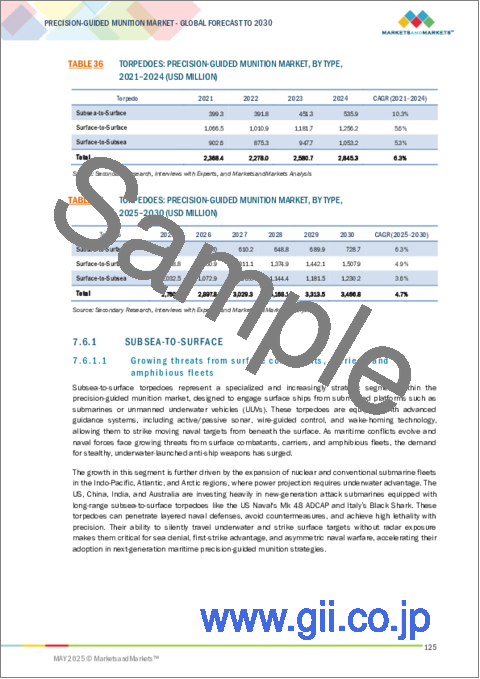

- TABLE 36 TORPEDOES: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 37 TORPEDOES: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 38 LOITERING MUNITIONS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 39 LOITERING MUNITIONS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 40 PRECISION-GUIDED MUNITION MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 41 PRECISION-GUIDED MUNITION MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 42 GUIDANCE & NAVIGATION SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 43 GUIDANCE & NAVIGATION SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 44 TARGET ACQUISITION SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 45 TARGET ACQUISITION SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 46 PROPULSION SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 47 PROPULSION SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 48 WARHEADS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 49 WARHEADS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 50 POWER SUPPLY SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 51 POWER SUPPLY SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 52 PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 53 PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 54 PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 55 PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 56 PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 57 PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 58 HYPERSONIC MISSILES, BY COUNTRY

- TABLE 59 PRECISION-GUIDED MUNITION MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 60 PRECISION-GUIDED MUNITION MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 61 PRECISION-GUIDED MUNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 PRECISION-GUIDED MUNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 64 NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 66 NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 68 NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 70 NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 US: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 74 US: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 75 US: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 76 US: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 77 US: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 78 US: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 79 US: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 80 US: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 81 CANADA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 82 CANADA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 83 CANADA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 84 CANADA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 85 CANADA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 86 CANADA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 87 CANADA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 88 CANADA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 90 EUROPE: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 91 EUROPE: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 92 EUROPE: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 94 EUROPE: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 95 EUROPE: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 96 EUROPE: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 EUROPE: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 UK: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 100 UK: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 101 UK: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 102 UK: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 103 UK: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 104 UK: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 105 UK: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 106 UK: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 107 FRANCE: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 108 FRANCE: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 109 FRANCE: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 110 FRANCE: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 111 FRANCE: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 112 FRANCE: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 113 FRANCE: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 114 FRANCE: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 115 GERMANY: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 116 GERMANY: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 117 GERMANY: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 118 GERMANY: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 119 GERMANY: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 120 GERMANY: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 121 GERMANY: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 122 GERMANY: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 123 ITALY: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 124 ITALY: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 125 ITALY: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 126 ITALY: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 127 ITALY: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 128 ITALY: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 129 ITALY: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 130 ITALY: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 131 RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 132 RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 133 RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 134 RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 135 RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 136 RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 137 RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 138 RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 139 REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 140 REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 141 REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 142 REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 143 REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 144 REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 145 REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 146 REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 150 ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 152 ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 153 ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 154 ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 156 ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 157 CHINA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 158 CHINA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 159 CHINA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 160 CHINA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 161 CHINA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 162 CHINA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 163 CHINA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 164 CHINA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 165 INDIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 166 INDIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 167 INDIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 168 INDIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 169 INDIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 170 INDIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 171 INDIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 172 INDIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 173 JAPAN: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 174 JAPAN: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 175 JAPAN: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 176 JAPAN: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 177 JAPAN: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 178 JAPAN: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 179 JAPAN: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 180 JAPAN: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 181 SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 182 SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 183 SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 184 SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 185 SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 186 SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 187 SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 188 SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 189 AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 190 AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 191 AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 192 AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 193 AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 194 AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 195 AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 196 AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 205 MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 206 MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 207 MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 208 MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 210 MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 212 MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 214 MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 215 SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 216 SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 217 SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 218 SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 219 SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 220 SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 221 SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 222 SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 223 ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 224 ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 225 ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 226 ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 227 ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 228 ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 229 ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 230 ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 231 TURKEY: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 232 TURKEY: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 233 TURKEY: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 234 TURKEY: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 235 TURKEY: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 236 TURKEY: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 237 TURKEY: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 238 TURKEY: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 239 REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 240 REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 241 REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 242 REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 243 REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 244 REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 245 REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 246 REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 247 REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 248 REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 249 REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 250 REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 251 REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 252 REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 253 REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 254 REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 255 REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 256 REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 257 LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 258 LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 259 LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 260 LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 261 LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 262 LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 263 LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 264 LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 265 AFRICA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 266 AFRICA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 267 AFRICA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 268 AFRICA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 269 AFRICA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 270 AFRICA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 271 AFRICA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021-2024 (USD MILLION)

- TABLE 272 AFRICA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- TABLE 273 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 274 PRECISION-GUIDED MUNITION MARKET: DEGREE OF COMPETITION

- TABLE 275 REGION FOOTPRINT

- TABLE 276 PRODUCT FOOTPRINT

- TABLE 277 SPEED FOOTPRINT

- TABLE 278 LIST OF START-UPS/SMES

- TABLE 279 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 280 PRECISION-GUIDED MUNITION MARKET: PRODUCT LAUNCHES/ DEVELOPMENTS, 2021-2025

- TABLE 281 PRECISION-GUIDED MUNITION MARKET: DEALS, 2021-2025

- TABLE 282 PRECISION-GUIDED MUNITION MARKET: OTHERS, 2021-2025

- TABLE 283 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 284 NORTHROP GRUMMAN: PRODUCTS OFFERED

- TABLE 285 NORTHROP GRUMMAN: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 286 NORTHROP GRUMMAN: DEALS

- TABLE 287 NORTHROP GRUMMAN: OTHERS

- TABLE 288 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 289 LOCKHEED MARTIN CORPORATION: PRODUCTS OFFERED

- TABLE 290 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 291 LOCKHEED MARTIN CORPORATION: OTHERS

- TABLE 292 RTX: COMPANY OVERVIEW

- TABLE 293 RTX: PRODUCTS OFFERED

- TABLE 294 RTX: OTHERS

- TABLE 295 BOEING: COMPANY OVERVIEW

- TABLE 296 BOEING: PRODUCTS OFFERED

- TABLE 297 BOEING: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 298 BOEING: DEALS

- TABLE 299 BOEING: OTHERS

- TABLE 300 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 301 GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

- TABLE 302 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 303 GENERAL DYNAMICS CORPORATION: OTHERS

- TABLE 304 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 305 BAE SYSTEMS: PRODUCTS OFFERED

- TABLE 306 BAE SYSTEMS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 307 BAE SYSTEMS: OTHERS

- TABLE 308 ASELSAN A.S.: COMPANY OVERVIEW

- TABLE 309 ASELSAN A.S.: PRODUCTS OFFERED

- TABLE 310 ASELSAN A.S.: DEALS

- TABLE 311 ASELSAN A.S.: OTHERS

- TABLE 312 MBDA: COMPANY OVERVIEW

- TABLE 313 MBDA: PRODUCTS OFFERED

- TABLE 314 MBDA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 315 MBDA: DEALS

- TABLE 316 MBDA: OTHERS

- TABLE 317 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 318 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 319 ISRAEL AEROSPACE INDUSTRIES LTD.: DEALS

- TABLE 320 ISRAEL AEROSPACE INDUSTRIES LTD.: OTHERS

- TABLE 321 THALES: COMPANY OVERVIEW

- TABLE 322 THALES: PRODUCTS OFFERED

- TABLE 323 THALES: DEALS

- TABLE 324 THALES: OTHERS

- TABLE 325 RHEINMETALL AG: COMPANY OVERVIEW

- TABLE 326 RHEINMETALL AG: PRODUCTS OFFERED

- TABLE 327 RHEINMETALL AG: DEALS

- TABLE 328 RHEINMETALL AG: OTHERS

- TABLE 329 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 330 LEONARDO S.P.A.: PRODUCTS OFFERED

- TABLE 331 LEONARDO S.P.A.: DEALS

- TABLE 332 LEONARDO S.P.A.: OTHERS

- TABLE 333 KONGSBERG: COMPANY OVERVIEW

- TABLE 334 KONGSBERG: PRODUCTS OFFERED

- TABLE 335 KONGSBERG: DEALS

- TABLE 336 KONGSBERG: OTHERS

- TABLE 337 SAAB AB: COMPANY OVERVIEW

- TABLE 338 SAAB AB: PRODUCTS OFFERED

- TABLE 339 SAAB AB: DEALS

- TABLE 340 SAAB AB: OTHERS

- TABLE 341 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 342 ELBIT SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 343 ELBIT SYSTEMS LTD.: OTHERS

- TABLE 344 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 345 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 346 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: DEALS

- TABLE 347 LEIDOS: COMPANY OVERVIEW

- TABLE 348 LEIDOS: PRODUCTS OFFERED

- TABLE 349 LEIDOS: OTHERS

- TABLE 350 GENERAL ATOMICS: COMPANY OVERVIEW

- TABLE 351 GENERAL ATOMICS: PRODUCTS OFFERED

- TABLE 352 GENERAL ATOMICS: DEALS

- TABLE 353 GENERAL ATOMICS: OTHERS

- TABLE 354 DENEL DYNAMICS: COMPANY OVERVIEW

- TABLE 355 DENEL DYNAMICS: PRODUCTS OFFERED

- TABLE 356 HANWHA GROUP: COMPANY OVERVIEW

- TABLE 357 HANWHA GROUP: PRODUCTS OFFERED

- TABLE 358 HANWHA GROUP: DEALS

- TABLE 359 HANWHA GROUP: OTHERS

- TABLE 360 POLSKA GRUPA ZBROJENIOWA: COMPANY OVERVIEW

- TABLE 361 POLSKA GRUPA ZBROJENIOWA: PRODUCTS OFFERED

- TABLE 362 POLSKA GRUPA ZBROJENIOWA: DEALS

- TABLE 363 POLSKA GRUPA ZBROJENIOWA: OTHERS

- TABLE 364 ROSTEC: COMPANY OVERVIEW

- TABLE 365 ROSTEC: PRODUCTS OFFERED

- TABLE 366 ROSTEC: OTHERS

List of Figures

- FIGURE 1 PRECISION-GUIDED MUNITION MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 LOITERING MUNITIONS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 8 AIRBORNE SEGMENT TO BE DOMINANT IN 2025

- FIGURE 9 GUIDANCE & NAVIGATION SYSTEMS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 10 SUPERSONIC SEGMENT TO ACCOUNT FOR HIGHEST SHARE IN 2030

- FIGURE 11 NORTH AMERICA TO BE LARGEST MARKET FOR PRECISION-GUIDED MUNITIONS DURING FORECAST PERIOD

- FIGURE 12 SUBSTANTIAL INVESTMENTS, MILITARY MODERNIZATION PROGRAMS, AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

- FIGURE 13 SUPERSONIC TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 14 AUTONOMOUS TO HOLD HIGHER SHARE THAN SEMI-AUTONOMOUS DURING FORECAST PERIOD

- FIGURE 15 AIRBORNE SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 16 INDIA TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 PRECISION-GUIDED MUNITION MARKET DYNAMICS

- FIGURE 18 ADVANTAGES OF MINIATURIZATION

- FIGURE 19 ADVANTAGES OF HYBRID MISSILES

- FIGURE 20 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 VALUE CHAIN ANALYSIS

- FIGURE 22 ECOSYSTEM ANALYSIS

- FIGURE 23 IMPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 24 EXPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PRODUCTS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 28 AI LANDSCAPE

- FIGURE 29 IMPACT OF AI ON DEFENSE SECTOR

- FIGURE 30 ADOPTION OF AI IN MILITARY BY TOP COUNTRIES

- FIGURE 31 IMPACT OF AI ON PRECISION-GUIDED MUNITION MARKET

- FIGURE 32 MACROECONOMIC OUTLOOK FOR NORTH AMERICA, EUROPE, ASIA PACIFIC, AND MIDDLE EAST

- FIGURE 33 MACROECONOMIC OUTLOOK FOR REST OF THE WORLD

- FIGURE 34 BILL OF MATERIALS FOR JOINT DIRECT ATTACK MUNITIONS

- FIGURE 35 BILL OF MATERIALS FOR GUIDED MULTIPLE LAUNCH ROCKET SYSTEMS

- FIGURE 36 TOTAL COST OF OWNERSHIP FOR PRECISION-GUIDED MUNITIONS

- FIGURE 37 BUSINESS MODELS IN PRECISION-GUIDED MUNITION MARKET

- FIGURE 38 TECHNOLOGY ROADMAP OF PRECISION-GUIDED MUNITIONS

- FIGURE 39 EVOLUTION OF PRECISION-GUIDED MUNITION TECHNOLOGY

- FIGURE 40 SUPPLY CHAIN ANALYSIS

- FIGURE 41 PATENT ANALYSIS

- FIGURE 42 PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- FIGURE 43 PRECISION-GUIDED MUNITION MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- FIGURE 44 PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025-2030 (USD MILLION)

- FIGURE 45 PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- FIGURE 46 PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025-2030 (USD MILLION)

- FIGURE 47 PRECISION-GUIDED MUNITION MARKET, BY RANGE, 2025-2030 (USD MILLION)

- FIGURE 48 PRECISION-GUIDED MUNITION MARKET, BY REGION, 2025-2030

- FIGURE 49 NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET SNAPSHOT

- FIGURE 50 EUROPE: PRECISION-GUIDED MUNITION MARKET SNAPSHOT

- FIGURE 51 ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET SNAPSHOT

- FIGURE 52 MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET SNAPSHOT

- FIGURE 53 REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET SNAPSHOT

- FIGURE 54 MARKET SHARE OF KEY PLAYERS, 2024

- FIGURE 55 REVENUE ANALYSIS OF KEY PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 56 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 57 COMPANY FOOTPRINT

- FIGURE 58 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 59 VALUATION OF PROMINENT PLAYERS

- FIGURE 60 FINANCIAL METRICS OF PROMINENT PLAYERS

- FIGURE 61 BRAND/PRODUCT COMPARISON

- FIGURE 62 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 63 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 RTX: COMPANY SNAPSHOT

- FIGURE 65 BOEING: COMPANY SNAPSHOT

- FIGURE 66 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 68 ASELSAN A.S.: COMPANY SNAPSHOT

- FIGURE 69 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 70 THALES: COMPANY SNAPSHOT

- FIGURE 71 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 72 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 73 KONGSBERG: COMPANY SNAPSHOT

- FIGURE 74 SAAB AB: COMPANY SNAPSHOT

- FIGURE 75 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 76 RAFAEL ADVANCED DEFENSE SYSTEMS LTD: COMPANY SNAPSHOT

- FIGURE 77 LEIDOS: COMPANY SNAPSHOT

- FIGURE 78 HANWHA GROUP: COMPANY SNAPSHOT

The precision-guided munitions market is estimated to be USD 37.24 billion in 2025 and is projected to reach USD 49.71 billion by 2030, at a CAGR of 5.9%. The evolution of precision-guided munitions is being driven by multiple strategic and operational imperatives that align with next-generation defense solutions. Military forces globally are prioritizing systems that offer higher operational efficiency, reduced logistical burden, and enhanced mission reliability. This shift reflects a growing demand for munitions that consume less energy, require minimal maintenance, and contribute to leaner, more agile force structures. Furthermore, the increasing emphasis on precision over volume, as well as the push for sustainable and intelligent warfare, aligns with broader defense modernization trends. PGMs are becoming essential for executing missions with accuracy while minimizing collateral damage and resource consumption.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Product, System, Launch Platform, Speed, Mode of Operation, Region |

| Regions covered | North America, Europe, APAC, RoW |

"EO/IR: The largest segment by targeting system during the forecast period" Electro-Optical/Infrared (EO/IR) guidance systems are poised to dominate the precision-guided munitions market because they can deliver real-time, high-fidelity target acquisition and terminal guidance even in highly complex operational environments. These systems allow PGMs to visually detect, track, and engage static and moving targets with pinpoint accuracy-vital for today's precision strike missions where rules of engagement frequently require positive target identification and low collateral damage.

EO/IR seekers provide a low-signature, passive guidance capacity that permits the munitions to home toward the target while radiating non-detectable signals, making the platforms very survivable against defenses predicated upon radars. The capability to provide function in bright lighting conditions at nighttime, as well as potentially in obscurant-filled areas like smoke or dust, facilitates more flexibility across all types of missions and terrains.

These systems are found more in air-to-ground bombs, loitering munitions, and autonomous missiles, where imagery in the visible or thermal infrared is employed for target identification, aim point determination, and final-course correction. Integration with onboard processors and artificial intelligence algorithms also enables sophisticated features like automatic target recognition (ATR), mid-course image-based updates, and in-flight retargeting.

"Inertial Navigation System: The fastest-growing segment by guidance & navigation system during the forecast period" Inertial Navigation Systems (INS) are positioned to dominate the precision-guided munitions market because they form the basis for providing accurate, autonomous navigation and guidance for nearly all types of precision weapons. INS technology guides by employing internal sensors-gyroscopes and accelerometers-to monitor the position, orientation, and speed of a munition without any external inputs, which makes it a central element in both standalone and hybrid guidance systems.

One of the strongest points of INS is its fault tolerance in contested environments. As opposed to GPS, which is subject to being denied or spoofed by electronic warfare systems, INS will operate reliably even when in GPS-degraded or denied environments. It is therefore the go-to navigation system for future PGMs, especially for high-threat environments where electronic countermeasures dominate. In addition, INS is a crucial part of multi-mode guidance systems, wherein it is coupled with GPS, laser seekers, radar, or imaging systems. It provides precise midcourse navigation and terminal guidance stabilization and aids precision engagement even when external cues are intermittent or missing.

Miniaturization of INS components, particularly through the evolution of microelectromechanical systems (MEMS), has seen its integration into a broad spectrum of munitions-tactical missiles and guided bombs, artillery shells, and loitering munitions. Its flexibility and comparatively low signature also facilitate platform-agnostic deployment, rendering it useful in air, land, and sea domains.

"Surface-to-Surface: The fastest-growing segment by guided rockets during the forecast period"

Surface-to-surface guided rockets will dominate the precision-guided munitions (PGM) market due to their unique combination of accuracy, range, responsiveness, and affordability. These weapons close a critical capability gap between cost-effective unguided artillery and costly tactical missiles, and they offer an attractive alternative to both large-scale military forces and emerging defense forces. One of their strongest assets is that they can perform highly precise fires at distant ranges from mobile, surface-based launchers without the requirement of air superiority. Systems like the guided multiple launch rocket system (GMLRS) and similar systems across the globe are capable of striking static and relocatable targets with short notice, and they excel at suppression of enemy air defenses (SEAD), counter-battery missions, and precision interdiction.

They compare differently to air-launched PGMs as they are rapidly deployable, salvaged-in-mass, and can be fired from extremely mobile launcher platforms such as HIMARS or MLRS mounted on trucks, thus providing them greater battlefield survivability and tactical response capability. Being network-connected allows them to suit sensor-to-shooter, speedily precise response, and response engagements of sensitive time targets.

"The US to account for the highest market share in the precision-guided munitions market during the forecasted year"

The US will be the largest holder in the global precision-guided munitions market due to its unmatched defense budget, mature industrial base, and strategic priority on precision, networked warfare. The doctrine of the US military prioritizes the reduction of collateral damage while it sustains global strike capabilities, rendering PGMs core to both tactical and strategic force projection.

The US possesses the most advanced and diverse set of PGMs, ranging from air-to-ground bombs to guided rockets, loitering bombs, and long-range tactical missiles to precision artillery rounds. JDAM, StormBreaker, Excalibur, GMLRS, and JAGM are widely employed in all branches of the armed forces and are regularly updated through modular enhancements and software-driven revisions.

Further, the U.S. Department of Defense also gives high value to multi-domain precision fires under its modernization plans, like Long-Range Precision Fires (LRPF), Joint All-Domain Command and Control (JADC2), and Next-Generation Air Dominance (NGAD). The programs guarantee sustained investment in network-enabled, AI-integrated interoperable PGMs. On top of national needs, the US holds a dominant share in foreign military sales of PGMs, which are in high demand among NATO allies as well as Indo-Pacific partners. Its well-established network of prime contractors, including Lockheed Martin, RTX, Boeing, and Northrop Grumman, solidifies its leadership position.

Break-up of profiles of primary participants in the precision-guided munitions market: By Company Type: Tier 1 - 49%, Tier 2 - 37%, and Tier 3 - 14% By Designation: C-Level Executives - 55%, Director level - 27%, and Others - 18% By Region: North America - 32%, Europe - 32%, Asia Pacific - 16%, Middle East-10%, Rest of the world - 10%

Prominent companies in the precision-guided munitions market are Northrop Grumman (US), RTX (US), General Dynamics Corporation (US), BAE Systems (UK), Lockheed Martin Corporation (US), MBDA (France), Israel Aerospace Industries (Israel), QinetiQ (UK), Boeing (US), and Aselsan AS (Turkey), among others.

Research Coverage: The market study covers the precision-guided munitions market across segments. It aims to estimate the market size and the growth potential of this market across different segments, such as system, launch platform, product, mode of operation, speed, range, and region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies. Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall precision-guided munitions market and its subsegments. The report covers the entire ecosystem of the precision-guided munitions industry and will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of Key Drivers (Increased demand for precision guided munition to minimize collateral damage, reduction in logistics burden, growing military modernization programs, change in nature of warfare) Restraints (Regulations to arms transfer, high manufacturing costs) Opportunities (Miniaturization of munitions, development of hybrid precision guided munitions), and Challenges (Storage and lifecycle challenges) that impact the growth of the precision guided munitions market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the precision-guided munitions market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the precision-guided munitions market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the precision-guided munitions market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players, such as Northrop Grumman (US), RTX (US), General Dynamics Corporation (US), BAE Systems (UK), Lockheed Martin Corporation (US), MBDA (France), Israel Aerospace Industries (Israel), QinetiQ (UK), Boeing (US), Aselsan AS (Turkey), among others, in the precision-guided munitions market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Precision-guided munition market, by system

- 2.2.1.2 Precision-guided munition market, by product

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRECISION-GUIDED MUNITION MARKET

- 4.2 PRECISION-GUIDED MUNITION MARKET, BY SPEED

- 4.3 PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION

- 4.4 PRECISION-GUIDED MUNITION MARKET, BY PLATFORM

- 4.5 PRECISION-GUIDED MUNITION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Elevated demand for precision-guided munitions to minimize collateral damage

- 5.2.1.2 Reduced logistical burden of modern warfare

- 5.2.1.3 Surge in military modernization programs

- 5.2.1.4 Evolving nature of warfare

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent arms transfer regulations and export control frameworks

- 5.2.2.2 High manufacturing costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Miniaturization of munitions

- 5.2.3.2 Development of hybrid precision-guided munitions

- 5.2.3.3 Advent of recoverable and multi-mission munitions

- 5.2.3.4 Integration of AI and autonomous capabilities

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration constraints associated with larger precision-guided munitions

- 5.2.4.2 Storage and shelf life limitations

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 MANUFACTURERS

- 5.5.2 SYSTEM INTEGRATORS

- 5.5.3 SOLUTION PROVIDERS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Millimeter-wave radar seekers

- 5.6.1.2 Image-aided INS/GPS technology

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 AI-powered mission planning

- 5.6.2.2 Swarming protocols

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Electro-optical targeting systems

- 5.6.3.2 Automatic target recognition algorithms

- 5.6.1 KEY TECHNOLOGIES

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 GMLRS-ER BY LOCKHEED MARTIN

- 5.7.2 STORM SHADOW BY MBDA

- 5.7.3 SPICE 250 BY RAFAEL

- 5.7.4 GBU-39 SMALL DIAMETER BOMB (SDB II) BY BOEING

- 5.8 TRADE DATA

- 5.8.1 IMPORT SCENARIO (HS CODE 9306)

- 5.8.2 EXPORT SCENARIO (HS CODE 9306)

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 US 2025 TARIFF

- 5.10.1 INTRODUCTION

- 5.10.2 KEY TARIFF RATES

- 5.10.3 PRICE IMPACT ANALYSIS

- 5.10.4 IMPACT ON COUNTRY/REGION

- 5.10.4.1 US

- 5.10.4.2 Europe

- 5.10.4.3 Asia Pacific

- 5.10.5 IMPACT ON END USERS

- 5.11 REGULATORY LANDSCAPE

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 INVESTMENT AND FUNDING SCENARIO

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE, BY PRODUCT

- 5.14.2 AVERAGE SELLING PRICE, BY REGION

- 5.15 OPERATIONAL DATA

- 5.16 IMPACT OF AI

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT OF AI ON DEFENSE SECTOR

- 5.16.3 ADOPTION OF AI IN MILITARY BY TOP COUNTRIES

- 5.16.4 IMPACT OF AI ON PRECISION-GUIDED MUNITION MARKET

- 5.17 MACROECONOMIC OUTLOOK

- 5.17.1 INTRODUCTION

- 5.17.2 NORTH AMERICA

- 5.17.3 EUROPE

- 5.17.4 ASIA PACIFIC

- 5.17.5 MIDDLE EAST

- 5.17.6 REST OF THE WORLD

- 5.18 BILL OF MATERIALS

- 5.19 TOTAL COST OF OWNERSHIP

- 5.20 BUSINESS MODELS

- 5.21 TECHNOLOGY ROADMAP

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 MULTI-MODE SEEKERS

- 6.2.2 SWARMING MUNITIONS

- 6.2.3 MODULAR MUNITIONS

- 6.2.4 LOW-COST PRECISION STRIKE KITS

- 6.2.5 REAL-TIME IN-FLIGHT RETARGETING

- 6.2.6 DUAL-USE ISR AND STRIKE INTEGRATION

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 AI-ENABLED TARGET RECOGNITION

- 6.3.2 CYBER-RESILIENT GUIDANCE AND CONTROL SYSTEMS

- 6.3.3 INTEGRATION OF SPACE-BASED ASSETS INTO PRECISION STRIKE

- 6.3.4 BATTLEFIELD DIGITIZATION AND NETWORK-CENTRIC WARFARE

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 PATENT ANALYSIS

7 PRECISION-GUIDED MUNITION MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 TACTICAL MISSILES

- 7.2.1 SURFACE-TO-SURFACE

- 7.2.1.1 Emphasis on long-range precision fires and rapid response capabilities

- 7.2.1.2 Use case: Brimstone by MBDA

- 7.2.2 AIR-TO-SURFACE

- 7.2.2.1 Emerging threat environments and evolving platform strategies

- 7.2.2.2 Use case: OpFires by DARPA-Lockheed Martin

- 7.2.1 SURFACE-TO-SURFACE

- 7.3 INTERCEPTOR MISSILES

- 7.3.1 MOBILE AIR DEFENSE INTERCEPTORS

- 7.3.1.1 Rise of mobile, multi-vector aerial threats

- 7.3.1.2 Use case: Barak 8 by IAI, Rafael, and DRDO

- 7.3.2 MANPAD INTERCEPTORS

- 7.3.2.1 Heightened air threat landscape and elevated demand for mobile air defense solutions

- 7.3.2.2 Use case: Mistral 3 by MBDA

- 7.3.1 MOBILE AIR DEFENSE INTERCEPTORS

- 7.4 GUIDED ROCKETS

- 7.4.1 SURFACE-TO-SURFACE

- 7.4.1.1 Increased adoption due to long-range and rapidly deployable firepower

- 7.4.1.2 Use case: HIMARS by Lockheed Martin

- 7.4.2 AIR-TO-SURFACE

- 7.4.2.1 Need for low-cost, lightweight precision strike options

- 7.4.2.2 Use case: FZ275 LGR by Thales

- 7.4.1 SURFACE-TO-SURFACE

- 7.5 GUIDED AMMUNITION

- 7.5.1 GUIDED MORTARS

- 7.5.1.1 Growing traction due to improved accuracy and operational effectiveness

- 7.5.1.2 Use case: XM395 by Northrop Grumman

- 7.5.2 GUIDED ARTILLERY SHELLS

- 7.5.2.1 Transformation of conventional artillery into high-precision, long-range strike systems

- 7.5.2.2 Use case: M982 Excalibur by RTX and BAE Systems

- 7.5.3 GLIDE BOMBS

- 7.5.3.1 Compatibility with fourth- and fifth-generation aircraft and UAVs

- 7.5.3.2 Use case: GBU-39/B SDB I by Boeing

- 7.5.1 GUIDED MORTARS

- 7.6 TORPEDOES

- 7.6.1 SUBSEA-TO-SURFACE

- 7.6.1.1 Growing threats from surface combatants, carriers, and amphibious fleets

- 7.6.1.2 Use case: Black Shark by Leonardo

- 7.6.2 SURFACE-TO-SUBSEA

- 7.6.2.1 Rising proliferation of stealthy, long-endurance submarines in modern naval fleets

- 7.6.2.2 Use case: MU90 Impact by Thales and Naval Group

- 7.6.3 SURFACE-TO-SURFACE

- 7.6.3.1 Increasing threat of naval confrontations in coastal and enclosed sea regions

- 7.6.3.2 Use case: MILAS by MBDA

- 7.6.1 SUBSEA-TO-SURFACE

- 7.7 LOITERING MUNITIONS

- 7.7.1 RECOVERABLE

- 7.7.1.1 Excellent surveillance and precision strike capabilities in multiple-use operations

- 7.7.1.2 Use case: SkyStriker by Elbit Systems

- 7.7.2 EXPENDABLE

- 7.7.2.1 Extensive use in contested environments due to low cost and real-time target acquisition

- 7.7.2.2 Use case: Harop by IAI

- 7.7.1 RECOVERABLE

8 PRECISION-GUIDED MUNITION MARKET, BY SYSTEM

- 8.1 INTRODUCTION

- 8.2 GUIDANCE & NAVIGATION SYSTEMS

- 8.2.1 INERTIAL NAVIGATION SYSTEMS

- 8.2.1.1 Prevalence of electronic warfare, spoofing, and satellite denial in contested environments

- 8.2.1.2 Use case: Excalibur M982 by RTX and BAE Systems

- 8.2.2 GLOBAL POSITIONING SYSTEMS

- 8.2.2.1 Need for high-precision navigation over long distances

- 8.2.2.2 Use case: JDAM by Boeing

- 8.2.3 TERRAIN CONTOUR MATCHING RADAR

- 8.2.3.1 Resurgence of electronic warfare and GNSS spoofing

- 8.2.3.2 Use case: Tomahawk by RTX

- 8.2.1 INERTIAL NAVIGATION SYSTEMS

- 8.3 TARGET ACQUISITION SYSTEMS

- 8.3.1 EO/IR

- 8.3.1.1 Development of smaller and more efficient infrared systems for precision-guided munitions

- 8.3.1.2 Use case: Brimstone II by MBDA

- 8.3.1.3 IIR homing

- 8.3.1.4 IR homing

- 8.3.2 RADAR

- 8.3.2.1 Superior performance in all-weather, beyond-visual-range, and high-speed engagement scenarios

- 8.3.2.2 Use case: Aster 30 by MBDA

- 8.3.2.3 Active homing

- 8.3.2.4 Semi-active homing

- 8.3.2.5 Passive homing

- 8.3.3 LASER/LIDAR

- 8.3.3.1 Emphasis on low-collateral-damage strikes in modern warfare

- 8.3.3.2 Use case: GBU-53/B StormBreaker by RTX

- 8.3.3.3 Active

- 8.3.3.4 Semi-active

- 8.3.4 MULTI-MODE

- 8.3.4.1 Operational versatility and enhanced strike accuracy

- 8.3.4.2 GBU-53/B StormBreaker by RTX

- 8.3.1 EO/IR

- 8.4 PROPULSION SYSTEMS

- 8.4.1 SOLID

- 8.4.1.1 Wide acceptance in short-range ballistic missiles and loitering munitions

- 8.4.1.2 Use case: AGM-114 Hellfire by Lockheed Martin

- 8.4.2 LIQUID

- 8.4.2.1 Shift toward longer-range, high-agility, and precision strike capabilities

- 8.4.2.2 Use case: R-27 (AA-10 Alamo) by Soviet Union

- 8.4.3 HYBRID

- 8.4.3.1 Growing complexity of mission profiles and increasing demand for agile munitions

- 8.4.3.2 Use case: HSTDV by DRDO

- 8.4.4 RAMJET

- 8.4.4.1 Ability to deliver sustained high-speed flight over extended ranges

- 8.4.4.2 Use case: Meteor by MBDA

- 8.4.5 SCRAMJET

- 8.4.5.1 Defense initiatives aimed at accelerating research and development

- 8.4.5.2 Use case: HAWC by DARPA

- 8.4.6 TURBOJET

- 8.4.6.1 High demand for compact, cost-effective, and extended-range strike capabilities from militaries

- 8.4.6.2 Use case: AGM-86B ALCM by RTX

- 8.4.7 ELECTRIC

- 8.4.7.1 Innovations in defense programs

- 8.4.7.2 Use case: SkyStriker by Elbit Systems and Switchblade 300 by AeroVironment

- 8.4.1 SOLID

- 8.5 WARHEADS

- 8.5.1 BLAST WARHEADS

- 8.5.1.1 Suitable for urban operations, airfield denial, and missions requiring controlled destruction

- 8.5.1.2 Use case: Tomahawk Block IV by RTX

- 8.5.2 CONTINUOUS ROD WARHEADS

- 8.5.2.1 Effectiveness against fast-moving airborne targets

- 8.5.2.2 Use case: AIM-120 AMRAAM D by RTX

- 8.5.3 FRAGMENTATION WARHEADS

- 8.5.3.1 Deployment in urban combat, counter-insurgency missions, and air defense operations

- 8.5.3.2 Use case: NASAMS by RTX

- 8.5.4 KINETIC ENERGY PERPETRATORS

- 8.5.4.1 Increasing concerns about deeply buried targets and hardened enemy assets

- 8.5.4.2 Use case: CHAMP

- 8.5.5 THERMOBARIC/SHAPED CHARGE WARHEADS

- 8.5.5.1 Rising strategic importance due to effectiveness in engaging fortified, enclosed, and armored targets

- 8.5.5.2 Use case: Brimstone by MBDA

- 8.5.6 SMART SUBMUNITIONS

- 8.5.6.1 Replacement of traditional cluster munitions

- 8.5.6.2 Use case: CBU-105 by Textron

- 8.5.1 BLAST WARHEADS

- 8.6 POWER SUPPLY SYSTEMS

- 8.6.1 ALTERNATORS

- 8.6.1.1 Focus on reducing reliance on heavy or limited-life onboard batteries

- 8.6.1.2 Use case: AGM-86 ALCM by Boeing

- 8.6.2 BATTERIES

- 8.6.2.1 Elevated demand for compact, high-energy, and reliable power solutions

- 8.6.2.2 Use case: IM-92 Stinger by RTX

- 8.6.1 ALTERNATORS

9 PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM

- 9.1 INTRODUCTION

- 9.2 LAND

- 9.2.1 RAPID DEPLOYMENT AND REPOSITIONING CAPABILITIES IN DYNAMIC COMBAT ENVIRONMENTS

- 9.3 AIRBORNE

- 9.3.1 EXTENSIVE USE IN HIGH-PRIORITY MISSIONS

- 9.4 NAVAL

- 9.4.1 ABILITY TO MAINTAIN STRONG DEFENSE POSTURE

10 PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION

- 10.1 INTRODUCTION

- 10.2 AUTONOMOUS

- 10.2.1 FASTER RESPONSE TIMES AND HIGHER OPERATIONAL FLEXIBILITY

- 10.3 SEMI-AUTONOMOUS

- 10.3.1 REDUCED OPERATIONAL RESPONSE TIMES AND INCREASED TARGETING ACCURACY

11 PRECISION-GUIDED MUNITION MARKET, BY SPEED

- 11.1 INTRODUCTION

- 11.2 SUBSONIC

- 11.2.1 EXTENDED RANGE AND PRECISE TARGETING CAPABILITIES

- 11.3 SUPERSONIC

- 11.3.1 RAPID RESPONSE AND DEEP-STRIKE VERSATILITY

- 11.4 HYPERSONIC

- 11.4.1 UNMATCHED SPEED, PRECISION, AND STRATEGIC DISRUPTION

12 PRECISION-GUIDED MUNITION MARKET, BY RANGE

- 12.1 INTRODUCTION

- 12.2 SHORT RANGE

- 12.2.1 DEPLOYMENT OF AGILE DEFENSE SYSTEMS FOR CLOSE-RANGE THREAT NEUTRALIZATION

- 12.3 MEDIUM RANGE

- 12.3.1 GLOBAL TREND TOWARD SELF-RELIANT MISSILE MANUFACTURING

- 12.4 LONG RANGE

- 12.4.1 IMPROVED TACTICAL AND STRATEGIC OPERATIONS WITH LONG-RANGE CAPABILITIES

- 12.5 EXTENDED RANGE

- 12.5.1 ENHANCED NATIONAL DETERRENCE THROUGH DEEP-STRIKE MISSILE TECHNOLOGIES

13 PRECISION-GUIDED MUNITION MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 PESTLE ANALYSIS

- 13.2.2 DEFENSE PROGRAMS

- 13.2.3 US

- 13.2.3.1 Robust military-industrial infrastructure and strategic imperatives to drive market

- 13.2.4 CANADA

- 13.2.4.1 Emphasis on defense modernization to drive market

- 13.3 EUROPE

- 13.3.1 PESTLE ANALYSIS

- 13.3.2 DEFENSE PROGRAMS

- 13.3.3 UK

- 13.3.3.1 Strategic Indo-Pacific realignment to drive market

- 13.3.4 FRANCE

- 13.3.4.1 Defense industrial sovereignty and multinational collaborations to drive market

- 13.3.5 GERMANY

- 13.3.5.1 Commitment to precision-focused deterrence to drive market

- 13.3.6 ITALY

- 13.3.6.1 Expanding defense manufacturing capabilities to drive market

- 13.3.7 RUSSIA

- 13.3.7.1 Robust domestic R&D capacity to drive market

- 13.3.8 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 PESTLE ANALYSIS

- 13.4.2 DEFENSE PROGRAMS

- 13.4.3 CHINA

- 13.4.3.1 Military modernization efforts and increased defense budget to drive market

- 13.4.4 INDIA

- 13.4.4.1 Evolving defense policies and regional security concerns to drive market

- 13.4.5 JAPAN

- 13.4.5.1 Strategic defense investments and focus on military self-sufficiency to drive market

- 13.4.6 SOUTH KOREA

- 13.4.6.1 Emphasis on strengthening defense capabilities amid growing security threats to drive market

- 13.4.7 AUSTRALIA

- 13.4.7.1 Substantial increase in defense spending to drive market

- 13.4.8 REST OF ASIA PACIFIC

- 13.5 MIDDLE EAST

- 13.5.1 PESTLE ANALYSIS

- 13.5.2 DEFENSE PROGRAMS

- 13.5.3 SAUDI ARABIA

- 13.5.3.1 Vision 2030 agenda and strategic partnerships to drive market

- 13.5.4 ISRAEL

- 13.5.4.1 Persistent asymmetric threats to drive market

- 13.5.5 TURKEY

- 13.5.5.1 Focus on indigenous innovation and robust export-oriented defense industry to drive market

- 13.5.6 REST OF MIDDLE EAST

- 13.6 REST OF THE WORLD

- 13.6.1 PESTLE ANALYSIS

- 13.6.2 DEFENSE PROGRAMS

- 13.6.3 LATIN AMERICA

- 13.6.3.1 Increasing investments in counter-insurgency and border control technologies to drive market

- 13.6.4 AFRICA

- 13.6.4.1 Increased defense modernization initiatives to drive market

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2021-2024

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Product footprint

- 14.5.5.4 Speed footprint

- 14.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING

- 14.6.5.1 List of start-ups/SMEs

- 14.6.5.2 Competitive benchmarking of start-ups/SMEs

- 14.7 COMPANY VALUATION AND FINANCIAL METRICS

- 14.8 BRAND/PRODUCT COMPARISON

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 14.9.2 DEALS

- 14.9.3 OTHERS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 NORTHROP GRUMMAN

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches/developments

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Others

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 LOCKHEED MARTIN CORPORATION

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Deals

- 15.1.2.3.2 Others

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 RTX

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Others

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 BOEING

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches/developments

- 15.1.4.3.2 Deals

- 15.1.4.3.3 Others

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 GENERAL DYNAMICS CORPORATION

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Deals

- 15.1.5.3.2 Others

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 BAE SYSTEMS

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches/developments

- 15.1.6.3.2 Others

- 15.1.7 ASELSAN A.S.

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.7.3.2 Others

- 15.1.8 MBDA

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches/developments

- 15.1.8.3.2 Deals

- 15.1.8.3.3 Others

- 15.1.9 ISRAEL AEROSPACE INDUSTRIES LTD.

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.9.3.2 Others

- 15.1.10 THALES

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.10.3.2 Others

- 15.1.11 RHEINMETALL AG

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.11.3.2 Others

- 15.1.12 LEONARDO S.P.A.

- 15.1.12.1 Business overview

- 15.1.12.2 Products offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Deals

- 15.1.12.3.2 Others

- 15.1.13 KONGSBERG

- 15.1.13.1 Business overview

- 15.1.13.2 Products offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Deals

- 15.1.13.3.2 Others

- 15.1.14 SAAB AB

- 15.1.14.1 Business overview

- 15.1.14.2 Products offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Deals

- 15.1.14.3.2 Others

- 15.1.15 ELBIT SYSTEMS LTD.

- 15.1.15.1 Business overview

- 15.1.15.2 Products offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Others

- 15.1.16 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

- 15.1.16.1 Business overview

- 15.1.16.2 Products offered

- 15.1.16.3 Recent developments

- 15.1.16.3.1 Deals

- 15.1.17 LEIDOS

- 15.1.17.1 Business overview

- 15.1.17.2 Products offered

- 15.1.17.3 Recent developments

- 15.1.17.3.1 Others

- 15.1.18 GENERAL ATOMICS

- 15.1.18.1 Business overview

- 15.1.18.2 Products offered

- 15.1.18.3 Recent developments

- 15.1.18.3.1 Deals

- 15.1.18.3.2 Others

- 15.1.19 DENEL DYNAMICS

- 15.1.19.1 Business overview

- 15.1.19.2 Products offered

- 15.1.20 HANWHA GROUP

- 15.1.20.1 Business overview

- 15.1.20.2 Products offered

- 15.1.20.3 Recent developments

- 15.1.20.3.1 Deals

- 15.1.20.3.2 Others

- 15.1.21 POLSKA GRUPA ZBROJENIOWA

- 15.1.21.1 Business overview

- 15.1.21.2 Products offered

- 15.1.21.3 Recent developments

- 15.1.21.3.1 Deals

- 15.1.21.3.2 Others

- 15.1.22 ROSTEC

- 15.1.22.1 Business overview

- 15.1.22.2 Products offered

- 15.1.22.3 Recent developments

- 15.1.22.3.1 Others

- 15.1.1 NORTHROP GRUMMAN

- 15.2 OTHER PLAYERS

- 15.2.1 ROKETSAN

- 15.2.2 BHARAT DYNAMICS LIMITED

- 15.2.3 LIG NEX1

- 15.2.4 DRDO

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS