|

|

市場調査レポート

商品コード

1734980

個人用保護具(PPE)の世界市場:タイプ別、最終用途産業別、地域別 - 予測(~2030年)Personal Protective Equipment Market by Type (Hand & Arm Protection, Protective Clothing, Foot & Leg Protection), End-use Industry (Manufacturing, Construction, Oil & Gas, Healthcare, Transportation, Firefighting), & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 個人用保護具(PPE)の世界市場:タイプ別、最終用途産業別、地域別 - 予測(~2030年) |

|

出版日: 2025年05月21日

発行: MarketsandMarkets

ページ情報: 英文 277 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の個人用保護具(PPE)の市場規模は、2024年の566億4,000万米ドルから2030年までに776億6,000万米ドルに達すると予測され、CAGRで5.49%の成長が見込まれます。

個人用保護具(PPE)は、製造、建設、石油・ガス、医療、輸送などの最終用途産業で広く使用されています。個人用保護具(PPE)の主な機能は、怪我や疾患につながる職場の危険にさらされる機会を減らし、従業員の健康を守り、業務の継続性を維持することです。厳しい環境・安全規制の遵守や、職場の安全性向上に対する需要の高まりが、採用を加速させています。ビジネスの観点からは、PPEの適切な利用は時間を節約し、法的責任を回避し、OSHA、ISO、または特定地域の同等の規格などの規制要件への準拠を保証します。PPE技術の進歩は、性能と持続可能性のレベルを引き上げ、市場の拡大をさらに後押ししています。世界レベルでの急速な産業化も、個人用保護具(PPE)需要の拡大を後押ししています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル |

| セグメント | タイプ、最終用途産業、地域 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

「保護衣が2024年の個人用保護具(PPE)市場において第2位の市場規模を占めました。」

世界の個人用保護具(PPE)市場において、保護衣セグメントが2024年に金額ベースで第2位のシェアを占めました。過酷な作業条件下での性能の優位性がこれを後押ししています。難燃性衣服、化学保護衣、高視認性衣服などの保護衣は、リスクの高い環境への曝露を減らす上で重要な役割を果たしています。労働安全規制が厳しく、労働者の安全コンプライアンスへの投資が増加している地域では、保護衣の需要が強いです。製造、医療、石油・ガスなどの産業でこうした衣服の使用が増加しているのは、高性能で安全性を重視したPPEソリューションへのはっきりとしたシフトを反映しています。手・腕の保護が依然として首位のセグメントでしたが、世界のインフラ開発の進行と労働災害防止に対する意識の高まりにより、保護衣は大きな支持を得ました。

「石油・ガス産業が2024年の個人用保護具(PPE)市場において金額ベースで第3位の最終用途産業でした。」

石油・ガス産業は、2024年の世界の個人用保護具(PPE)市場において金額ベースで第3位の最終用途産業でした。この優位性は、同産業のリスクの高い作業条件と厳しい規制基準に支えられています。探査、掘削、精製、輸送の各作業では、作業員を保護するために、保護衣、呼吸用保護具、フェイスマスクなど、幅広い個人用保護具(PPE)が必要とされます。上流と下流のプロジェクトへの継続的な投資が、着実なPPE需要を支え、この産業は市場全体への主要な寄与者となっています。

「欧州が2024年の個人用保護具(PPE)市場において金額ベースで第2位の地域でした。」

世界の個人用保護具(PPE)市場における欧州の優位性は、その確立された生産基盤、厳格な環境・安全基準、製造、建設、石油・ガス、輸送、医療などの主要な最終使用産業の支配的なプレゼンスによるものです。この地域では、リスク管理と職場の安全性を重視する規制により、特にドイツ、フランス、英国で、先進の保護具処方の導入が推進されています。安定した成長が続いている一方、西欧における市場の飽和と、新興経済国に比べて産業の拡大が緩やかであったことから、欧州は北米に次ぐ第2位となりましたが、市場金額ではアジア太平洋を上回っています。

当レポートでは、世界の個人用保護具(PPE)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 個人用保護具(PPE)市場の企業にとって魅力的な機会

- 個人用保護具(PPE)市場:地域別

- 北米の個人用保護具(PPE)市場:タイプ別・国別

- 地域の分析:個人用保護具(PPE)市場、最終用途産業別

- 個人用保護具(PPE)市場の魅力

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済指標

第6章 産業動向

- サプライチェーン分析

- 原材料サプライヤー

- メーカー

- 販売業者

- 最終用途産業

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- ケーススタディ分析

- 3Mの統合型PPEによる溶接生産性の向上

- 大手石油掘削企業への手袋調達の合理化

- 貿易分析

- 輸入シナリオ(HSコード621010)

- 輸出シナリオ(HSコード621010)

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制枠組み

- 主な会議とイベント

- 投資と資金調達のシナリオ

- 特許分析

- アプローチ

- 文書のタイプ

- 主な出願者

- 管轄分析

- 米国関税の影響 - 個人用保護具(PPE)市場(2025年)

- イントロダクション

- 主要関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

- 個人用保護具(PPE)市場に対するAI/生成AIの影響

第7章 個人用保護具(PPE)市場:タイプ別

- イントロダクション

- 手・腕用保護具

- 保護衣

- 足・脚用保護具

- 呼吸用保護具

- 目・顔用保護具

- 頭部保護具

- その他のタイプ

第8章 個人用保護具(PPE)市場:最終用途産業別

- イントロダクション

- 製造

- 建設

- 石油・ガス

- 医療

- 輸送

- 消防

- 食品

- その他の最終用途産業

第9章 個人用保護具(PPE)市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- インドネシア

- オーストラリア

- タイ

- マレーシア

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 中東・アフリカ

- GCC諸国

- イラン

- エジプト

- 南アフリカ

- 南米

- ブラジル

- アルゼンチン

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- ブランド/製品の比較分析

- 企業の評価と財務指標

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- HONEYWELL INTERNATIONAL INC.

- DUPONT DE NEMOURS, INC.

- 3M COMPANY

- ANSELL LIMITED

- MSA SAFETY INCORPORATED

- LAKELAND INDUSTRIES, INC.

- ALPHA PRO TECH, LTD.

- SIOEN INDUSTRIES NV

- RADIANS, INC.

- DELTA PLUS GROUP

- PROTECTIVE INDUSTRIAL PRODUCTS, INC.

- その他の企業

- MOLDEX-METRIC

- KLEIN TOOLS, INC.

- MALLCOM INDIA LIMITED

- NATIONAL SAFETY APPAREL

- UVEX GROUP

- GATEWAY SAFETY

- SAF-T-GARD INTERNATIONAL, INC.

- LINDSTROM GROUP

- DRAGERWERK AG & CO. KGAA

- AVON TECHNOLOGIES PLC

- POLISON CORPORATION

- PAN TAIWAN ENTERPRISE CO., LTD.

- COFRA S.R.L.

- JSP LTD.

第12章 隣接市場と関連市場

- イントロダクション

- 制限事項

- フェイスシールド市場

- 市場の定義

- 市場の概要

- フェイスシールド市場:地域別

第13章 付録

List of Tables

- TABLE 1 PERSONAL PROTECTIVE EQUIPMENT MARKET: RISK ASSESSMENT

- TABLE 2 DIRECT AND HIDDEN COSTS OF WORKPLACE ACCIDENTS

- TABLE 3 PERSONAL PROTECTIVE EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 IMPACT OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE END-USE INDUSTRIES (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 6 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021-2030 (USD BILLION)

- TABLE 7 INDICATIVE SELLING PRICE OF PERSONAL PROTECTIVE EQUIPMENT, BY REGION, 2022-2030 (USD/UNIT)

- TABLE 8 ROLES OF COMPANIES IN PERSONAL PROTECTIVE EQUIPMENT ECOSYSTEM

- TABLE 9 BENEFITS OF SENSOR TECHNOLOGY

- TABLE 10 IMPORT DATA RELATED TO PERSONAL PROTECTIVE EQUIPMENT, BY REGION, 2019-2024 (USD MILLION)

- TABLE 11 EXPORT DATA RELATED TO PERSONAL PROTECTIVE EQUIPMENT, BY REGION, 2019-2024 (USD MILLION)

- TABLE 12 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 PERSONAL PROTECTIVE EQUIPMENT MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 PERSONAL PROTECTIVE EQUIPMENT MARKET: INVESTMENT AND FUNDING SCENARIO, 2022-2025

- TABLE 19 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS, 2014-2024

- TABLE 20 LIST OF MAJOR PATENTS RELATED TO PERSONAL PROTECTIVE EQUIPMENT, 2014-2024

- TABLE 21 PATENTS BY 3M INNOVATIVE PROPERTIES COMPANY

- TABLE 22 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 24 SAFETY STANDARDS IN DIFFERENT INDUSTRIES

- TABLE 25 PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 26 HAND & ARM PROTECTION: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 27 HAND & ARM PROTECTION: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 PROTECTIVE CLOTHING: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 29 PROTECTIVE CLOTHING: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 FOOT & LEG PROTECTION: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

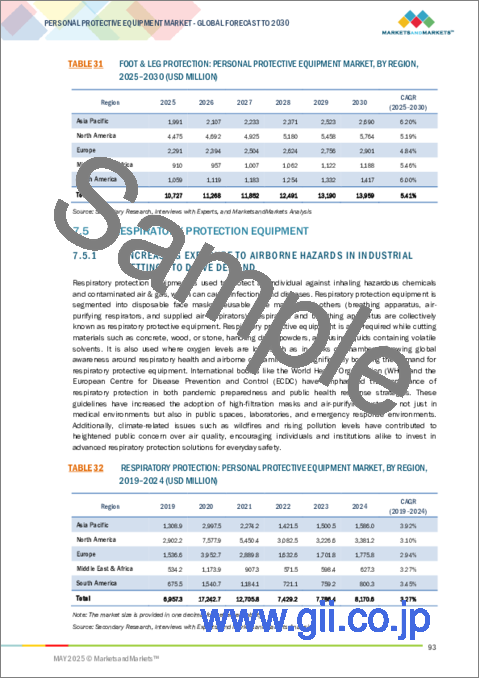

- TABLE 31 FOOT & LEG PROTECTION: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 RESPIRATORY PROTECTION: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 33 RESPIRATORY PROTECTION: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 EYE & FACE PROTECTION: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 35 EYE & FACE PROTECTION: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 HEAD PROTECTION: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 37 HEAD PROTECTION: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 OTHER TYPES: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 39 OTHER TYPES: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 41 PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 42 MANUFACTURING: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 43 MANUFACTURING: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 CONSTRUCTION: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 45 CONSTRUCTION: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 OIL & GAS: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 47 OIL & GAS: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 HEALTHCARE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 49 HEALTHCARE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 TRANSPORTATION: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 51 TRANSPORTATION: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 FIREFIGHTING: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 53 FIREFIGHTING: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 FOOD: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 55 FOOD: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 OTHER END-USE INDUSTRIES: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 57 OTHER END-USE INDUSTRIES: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 59 PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 ASIA PACIFIC: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 61 ASIA PACIFIC: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 62 ASIA PACIFIC: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 63 ASIA PACIFIC: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 64 ASIA PACIFIC: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 65 ASIA PACIFIC: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 66 CHINA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 67 CHINA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 68 CHINA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 69 CHINA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 70 JAPAN: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 71 JAPAN: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 72 JAPAN: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 73 JAPAN: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 74 INDIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 75 INDIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 76 INDIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 77 INDIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 78 SOUTH KOREA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 79 SOUTH KOREA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 80 SOUTH KOREA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 81 SOUTH KOREA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 82 INDONESIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 83 INDONESIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 84 INDONESIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 85 INDONESIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 86 AUSTRALIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 87 AUSTRALIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 88 AUSTRALIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 89 AUSTRALIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 90 THAILAND: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 91 THAILAND: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 92 THAILAND: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 93 THAILAND: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 94 MALAYSIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 95 MALAYSIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 96 MALAYSIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 97 MALAYSIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 103 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 104 US: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 105 US: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 106 US: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 107 US: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 108 CANADA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 109 CANADA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 110 CANADA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 111 CANADA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 112 MEXICO: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 113 MEXICO: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 114 MEXICO: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 115 MEXICO: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 117 EUROPE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 119 EUROPE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 120 EUROPE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 121 EUROPE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 122 GERMANY: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 123 GERMANY: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 124 GERMANY: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 125 GERMANY: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 126 UK: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 127 UK: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 128 UK: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 129 UK: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 130 FRANCE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 131 FRANCE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 132 FRANCE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 133 FRANCE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 134 ITALY: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 135 ITALY: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 136 ITALY: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 137 ITALY: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 138 SPAIN: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 139 SPAIN: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 140 SPAIN: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 141 SPAIN: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 148 SAUDI ARABIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 149 SAUDI ARABIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 150 SAUDI ARABIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 151 SAUDI ARABIA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 152 UAE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 153 UAE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 154 UAE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 155 UAE: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 156 IRAN: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 157 IRAN: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 158 IRAN: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 159 IRAN: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 160 EGYPT: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 161 EGYPT: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 162 EGYPT: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 163 EGYPT: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 164 SOUTH AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 165 SOUTH AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 166 SOUTH AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 167 SOUTH AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 168 SOUTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 169 SOUTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 170 SOUTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 171 SOUTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 172 SOUTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 173 SOUTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 174 BRAZIL: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 175 BRAZIL: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 176 BRAZIL: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 177 BRAZIL: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 178 ARGENTINA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 179 ARGENTINA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 180 ARGENTINA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 181 ARGENTINA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 182 STRATEGIES ADOPTED BY KEY PERSONAL PROTECTIVE EQUIPMENT MANUFACTURERS, JANUARY 2019-APRIL 2025

- TABLE 183 PERSONAL PROTECTIVE EQUIPMENT MARKET: DEGREE OF COMPETITION

- TABLE 184 PERSONAL PROTECTIVE EQUIPMENT MARKET: REGION FOOTPRINT

- TABLE 185 PERSONAL PROTECTIVE EQUIPMENT MARKET: TYPE FOOTPRINT

- TABLE 186 PERSONAL PROTECTIVE EQUIPMENT MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 187 PERSONAL PROTECTIVE EQUIPMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 188 PERSONAL PROTECTIVE EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 189 PERSONAL PROTECTIVE EQUIPMENT MARKET: PRODUCT LAUNCHES, JANUARY 2019-APRIL 2025

- TABLE 190 PERSONAL PROTECTIVE EQUIPMENT MARKET: DEALS, JANUARY 2019-APRIL 2025

- TABLE 191 PERSONAL PROTECTIVE EQUIPMENT MARKET: EXPANSIONS, JANUARY 2019-APRIL 2025

- TABLE 192 PERSONAL PROTECTIVE EQUIPMENT MARKET: OTHER DEVELOPMENTS, JANUARY 2019-APRIL 2025

- TABLE 193 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 194 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 195 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 196 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 197 HONEYWELL INTERNATIONAL INC.: EXPANSIONS

- TABLE 198 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

- TABLE 199 DUPONT DE NEMOURS, INC.: PRODUCTS OFFERED

- TABLE 200 DUPONT DE NEMOURS, INC.: DEALS

- TABLE 201 DUPONT DE NEMOURS, INC.: EXPANSIONS

- TABLE 202 DUPONT DE NEMOURS, INC.: OTHER DEVELOPMENTS

- TABLE 203 3M COMPANY: COMPANY OVERVIEW

- TABLE 204 3M COMPANY: PRODUCTS OFFERED

- TABLE 205 3M COMPANY: EXPANSIONS

- TABLE 206 ANSELL LIMITED: COMPANY OVERVIEW

- TABLE 207 ANSELL LIMITED: PRODUCTS OFFERED

- TABLE 208 ANSELL LIMITED: PRODUCT LAUNCHES

- TABLE 209 ANSELL LIMITED: DEALS

- TABLE 210 ANSELL LIMITED: EXPANSIONS

- TABLE 211 ANSELL LIMITED: OTHER DEVELOPMENTS

- TABLE 212 MSA SAFETY INCORPORATED: COMPANY OVERVIEW

- TABLE 213 MSA SAFETY INCORPORATED: PRODUCTS OFFERED

- TABLE 214 MSA SAFETY INCORPORATED: PRODUCT LAUNCHES

- TABLE 215 MSA SAFETY INC.: DEALS

- TABLE 216 LAKELAND INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 217 LAKELAND INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 218 LAKELAND INDUSTRIES, INC.: DEALS

- TABLE 219 LAKELAND INDUSTRIES, INC.: EXPANSIONS

- TABLE 220 ALPHA PRO TECH, LTD.: COMPANY OVERVIEW

- TABLE 221 ALPHA PRO TECH, LTD.: PRODUCTS OFFERED

- TABLE 222 SIOEN INDUSTRIES NV: COMPANY OVERVIEW

- TABLE 223 SIOEN INDUSTRIES NV: PRODUCTS OFFERED

- TABLE 224 SIOEN INDUSTRIES NV: PRODUCT LAUNCHES

- TABLE 225 RADIANS, INC.: COMPANY OVERVIEW

- TABLE 226 RADIANS, INC.: PRODUCTS OFFERED

- TABLE 227 RADIANS, INC.: PRODUCT LAUNCHES

- TABLE 228 DELTA PLUS GROUP: COMPANY OVERVIEW

- TABLE 229 DELTA PLUS GROUP: PRODUCTS OFFERED

- TABLE 230 DELTA PLUS GROUP: OTHER DEVELOPMENTS

- TABLE 231 PROTECTIVE INDUSTRIAL PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 232 PROTECTIVE INDUSTRIAL PRODUCTS, INC.: PRODUCTS OFFERED

- TABLE 233 PROTECTIVE INDUSTRIAL PRODUCTS, INC.: DEALS

- TABLE 234 MOLDEX-METRIC: COMPANY OVERVIEW

- TABLE 235 KLEIN TOOLS, INC.: COMPANY OVERVIEW

- TABLE 236 MALLCOM INDIA LIMITED: COMPANY OVERVIEW

- TABLE 237 NATIONAL SAFETY APPAREL: COMPANY OVERVIEW

- TABLE 238 UVEX GROUP: COMPANY OVERVIEW

- TABLE 239 GATEWAY SAFETY: COMPANY OVERVIEW

- TABLE 240 SAF-T-GARD INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 241 LINDSTROM GROUP: COMPANY OVERVIEW

- TABLE 242 DRAGERWERK AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 243 AVON PROTECTION PLC: COMPANY OVERVIEW

- TABLE 244 POLISON CORPORATION: COMPANY OVERVIEW

- TABLE 245 PAN TAIWAN ENTERPRISE CO., LTD.: COMPANY OVERVIEW

- TABLE 246 COFRA S.R.L.: COMPANY OVERVIEW

- TABLE 247 JSP LTD.: COMPANY OVERVIEW

- TABLE 248 EUROPE: FACE SHIELD MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

- TABLE 249 EUROPE: FACE SHIELD MARKET, BY COUNTRY, 2018-2025 (MILLION UNIT)

- TABLE 250 NORTH AMERICA: FACE SHIELD MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

- TABLE 251 NORTH AMERICA: FACE SHIELD MARKET, BY COUNTRY, 2018-2025 (MILLION UNIT)

- TABLE 252 ASIA PACIFIC: FACE SHIELD MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

- TABLE 253 ASIA PACIFIC: FACE SHIELD MARKET, BY COUNTRY, 2018-2025 (MILLION UNIT)

- TABLE 254 MIDDLE EAST & AFRICA: FACE SHIELD MARKET, BY REGION, 2018-2025 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: FACE SHIELD MARKET, BY REGION, 2018-2025 (MILLION UNIT)

- TABLE 256 SOUTH AMERICA: FACE SHIELD MARKET, BY REGION, 2018-2025 (USD MILLION)

- TABLE 257 SOUTH AMERICA: FACE SHIELD MARKET, BY REGION, 2018-2025 (MILLION UNIT)

List of Figures

- FIGURE 1 PERSONAL PROTECTIVE EQUIPMENT MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 PERSONAL PROTECTIVE EQUIPMENT MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE MARKET SHARE OF KEY PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM-UP (DEMAND SIDE)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - TOP-DOWN

- FIGURE 7 PERSONAL PROTECTIVE EQUIPMENT MARKET: DATA TRIANGULATION

- FIGURE 8 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 10 HAND & ARM PROTECTION SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 MANUFACTURING INDUSTRY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 13 RISING AWARENESS ABOUT WORKPLACE SAFETY TO DRIVE MARKET GROWTH

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 HAND & ARM PROTECTION SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2024

- FIGURE 16 MANUFACTURING INDUSTRY LED PERSONAL PROTECTIVE EQUIPMENT MARKET IN MOST REGIONS

- FIGURE 17 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 18 PERSONAL PROTECTIVE EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 PERSONAL PROTECTIVE EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 22 PERSONAL PROTECTIVE EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 INDICATIVE SELLING PRICE TREND OF PERSONAL PROTECTIVE EQUIPMENT, BY REGION, 2022-2030 (USD/UNIT)

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 PERSONAL PROTECTIVE EQUIPMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 IMPORT DATA FOR PERSONAL PROTECTIVE EQUIPMENT, BY KEY COUNTRY, 2019-2024 (USD MILLION)

- FIGURE 27 EXPORT DATA FOR PERSONAL PROTECTIVE EQUIPMENT, BY KEY COUNTRY, 2019-2024 (USD MILLION)

- FIGURE 28 PATENTS REGISTERED FOR PERSONAL PROTECTIVE EQUIPMENT, 2014-2024

- FIGURE 29 MAJOR PATENTS RELATED TO PERSONAL PROTECTIVE EQUIPMENT, 2014-2024

- FIGURE 30 LEGAL STATUS OF PATENTS FILED RELATED TO PERSONAL PROTECTIVE EQUIPMENT, 2014-2024

- FIGURE 31 MAXIMUM PATENTS FILED IN JURISDICTION OF US FROM 2014 TO 2024

- FIGURE 32 IMPACT OF AI/GEN AI ON PERSONAL PROTECTIVE EQUIPMENT MARKET

- FIGURE 33 HAND & ARM PROTECTION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 34 MANUFACTURING SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC TO BE FASTEST-GROWING MARKET BETWEEN 2025 AND 2030

- FIGURE 36 ASIA PACIFIC: PERSONAL PROTECTIVE EQUIPMENT MARKET SNAPSHOT

- FIGURE 37 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SNAPSHOT

- FIGURE 38 EUROPE: PERSONAL PROTECTIVE EQUIPMENT MARKET SNAPSHOT

- FIGURE 39 PERSONAL PROTECTIVE EQUIPMENT MARKET SHARE ANALYSIS, 2024

- FIGURE 40 PERSONAL PROTECTIVE EQUIPMENT MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 41 PERSONAL PROTECTIVE EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 PERSONAL PROTECTIVE EQUIPMENT MARKET: COMPANY FOOTPRINT

- FIGURE 43 PERSONAL PROTECTIVE EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 PERSONAL PROTECTIVE EQUIPMENT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 45 PERSONAL PROTECTIVE EQUIPMENT MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 46 PERSONAL PROTECTIVE EQUIPMENT MARKET: ENTERPRISE VALUATION OF KEY PLAYERS

- FIGURE 47 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 48 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

- FIGURE 49 3M COMPANY: COMPANY SNAPSHOT

- FIGURE 50 ANSELL LIMITED: COMPANY SNAPSHOT

- FIGURE 51 MSA SAFETY INCORPORATED: COMPANY SNAPSHOT

- FIGURE 52 LAKELAND INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 53 ALPHA PRO TECH, LTD.: COMPANY SNAPSHOT

- FIGURE 54 DELTA PLUS GROUP: COMPANY SNAPSHOT

The global personal protective equipment market is projected to reach USD 77.66 billion by 2030 from USD 56.64 billion in 2024, at a CAGR of 5.49%. Personal protective equipment is widely used in manufacturing, construction, oil & gas, healthcare, transportation, and other end-use industries. The primary function of personal protective equipment is to reduce exposure to workplace hazards that lead to injury or illness, thus protecting the well-being of employees and maintaining continuity of operations. Growing demand for improved workplace safety, along with adherence to strict environmental and safety regulations, is driving adoption at a faster pace. From a business perspective, proper utilization of PPE saves time, avoids liability, and ensures compliance with regulatory requirements like OSHA, ISO, or equivalent standards in a particular region. Advances in PPE technologies are raising performance and sustainability levels, further supporting market expansion. Rapid industrialization at a global level is also driving a growing demand for personal protective equipment.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | Type, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

"Protective clothing accounted for the second-largest market of the personal protective equipment market in 2024."

The protective clothing segment held the second-largest share of the global personal protective equipment market, in terms of value, in 2024. This is fueled by their performance superiority under harsh operating conditions. Protective clothing, such as flame-resistant apparel, chemical protective clothing, and high-visibility clothing, plays a crucial role in reducing exposure to high-risk environments. The demand for protective clothing is strong in regions with stringent occupational safety regulations and increased investment in worker safety compliance. The increasing usage of this clothing in industries like manufacturing, healthcare, oil & gas, and others reflects a clear shift toward high-performance, safety-focused PPE solutions. Although hand & arm protection remained the top segment, protective clothing gained significant traction due to ongoing global infrastructure development and rising awareness of workplace injury prevention.

"The oil & gas industry was the third-largest end-use industry of the personal protective equipment market, in terms of value, in 2024."

The oil & gas industry was the third-largest end-use industry in the global personal protective equipment market, in terms of value, in 2024. This dominance is supported by the high-risk operating conditions and stringent regulatory standards of the sector. Exploration, drilling, refining, and transportation operations require a broad range of personal protective equipment, such as protective clothing, respiratory protective equipment, and face masks, to provide worker protection. Ongoing investments in upstream and downstream projects supported consistent PPE demand, turning the industry into a leading contributor to the overall market.

"Europe was the second-largest region in the personal protective equipment market, in terms of value, in 2024."

This dominance of Europe in the global personal protective equipment market is driven by its established production base, rigorous environmental and safety standards, and dominant presence of major end-use industries like manufacturing, construction, oil & gas, transportation, and healthcare. The regulatory focus in the region on risk management and workplace safety has driven the implementation of advanced protective equipment formulations, especially in Germany, France, and the UK. While growth remained steady, it was moderated by market saturation in Western Europe and slower industrial expansion compared to emerging economies, which placed Europe second to North America but ahead of Asia Pacific in terms of market value.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, and the Rest of the World - 5%

The key players profiled in the report include Honeywell International Inc. (US), 3M Company (US), DuPont de Nemours, Inc. (US), Ansell Limited (Australia), MSA Safety Incorporated (US), Lakeland Industries, Inc. (US), Delta Plus Group (France), Alpha Pro Tech, Ltd. (Canada), Sioen Industries NV (Belgium), Radians, Inc. (US), and Protective Industrial Products, Inc. (US).

Research Coverage

This report segments the market for personal protective equipment based on type, end-use industry, and region and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the market for personal protective equipment.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the personal protective equipment market, high-growth regions, and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on personal protective equipment offered by top players in the global market.

- Analysis of Key Drivers (Rising awareness about the importance of workplace safety, stringent regulations in developed countries, and industrial growth in Asia Pacific and Middle East & Africa), Restraints (increased automation in end-use industries and lack of awareness in developing countries), Opportunities (growing healthcare industry in emerging economies and development of new materials and technologies), and Challenges (need for increased comfort and multi-functionality) influencing the growth of the personal protective equipment market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the personal protective equipment market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for personal protective equipment across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global personal protective equipment market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the personal protective equipment market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.3.4 MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- 1.3.5 YEARS CONSIDERED

- 1.3.6 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PERSONAL PROTECTIVE EQUIPMENT MARKET

- 4.2 PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION

- 4.3 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE AND COUNTRY

- 4.4 REGIONAL ANALYSIS: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY

- 4.5 PERSONAL PROTECTIVE EQUIPMENT MARKET ATTRACTIVENESS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising awareness about importance of workplace safety

- 5.2.1.2 Stringent regulations in developed countries

- 5.2.1.3 Industrial growth in Asia Pacific and Middle East & Africa

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increased automation in end-use industries

- 5.2.2.2 Lack of awareness in developing countries

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing healthcare industry in emerging economies

- 5.2.3.2 Development of new materials and technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Need for increased comfort and multi-functionality

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTORS

- 6.1.4 END-USE INDUSTRIES

- 6.2 PRICING ANALYSIS

- 6.2.1 INDICATIVE SELLING PRICE TREND OF PERSONAL PROTECTIVE EQUIPMENT, BY REGION, 2022-2030

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Sensor technology

- 6.5.1.2 Nanotechnology

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Wearable technology platforms

- 6.5.1 KEY TECHNOLOGIES

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 BOOSTING WELDING PRODUCTIVITY WITH 3M'S INTEGRATED PPE

- 6.6.2 STREAMLINING GLOVE PROCUREMENT FOR OIL DRILLING GIANT

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 621010)

- 6.7.2 EXPORT SCENARIO (HS CODE 621010)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 OSHA Personal Protective Equipment Standard (29 CFR 1910)

- 6.8.2.2 ISO 21420:2020

- 6.9 KEY CONFERENCES AND EVENTS

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF - PERSONAL PROTECTIVE EQUIPMENT MARKET

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

- 6.13 IMPACT OF AI/GEN AI ON PERSONAL PROTECTIVE EQUIPMENT MARKET

7 PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 HAND & ARM PROTECTION EQUIPMENT

- 7.2.1 RISING WORKPLACE SAFETY REGULATIONS TO PROPEL GROWTH

- 7.2.2 DISPOSABLE GLOVES

- 7.2.3 REUSABLE GLOVES

- 7.2.4 OTHER HAND & ARM PROTECTION EQUIPMENT

- 7.2.4.1 Wrist cuffs & armlets

- 7.2.4.2 Elbow protectors

- 7.2.4.3 Mitts

- 7.2.4.4 Barrier creams

- 7.3 PROTECTIVE CLOTHING

- 7.3.1 INCREASING DEMAND FROM HEALTHCARE INDUSTRY TO FUEL DEMAND

- 7.3.2 DISPOSABLE PROTECTIVE CLOTHING

- 7.3.3 REUSABLE PROTECTIVE CLOTHING

- 7.4 FOOT & LEG PROTECTION EQUIPMENT

- 7.4.1 EXPANSION OF HIGH-RISK INDUSTRIES TO DRIVE DEMAND

- 7.5 RESPIRATORY PROTECTION EQUIPMENT

- 7.5.1 INCREASING EXPOSURE TO AIRBORNE HAZARDS IN INDUSTRIAL SETTINGS TO DRIVE DEMAND

- 7.5.2 DISPOSABLE FACE MASKS

- 7.5.3 REUSABLE FACE MASKS

- 7.5.4 OTHER RESPIRATORY PROTECTION EQUIPMENT

- 7.6 EYE & FACE PROTECTION EQUIPMENT

- 7.6.1 ADOPTION OF ADVANCED VISORS AND GOGGLES TO FUEL GROWTH

- 7.6.2 SAFETY SPECTACLES

- 7.6.3 WELDING SHIELDS

- 7.6.4 OTHER EYE & FACE PROTECTION EQUIPMENT

- 7.6.4.1 Safety goggles

- 7.6.4.2 Face shields

- 7.7 HEAD PROTECTION EQUIPMENT

- 7.7.1 RISING ADOPTION OF SAFETY HELMETS IN WORKPLACE AND RECREATIONAL ACTIVITIES TO SUPPORT MARKET EXPANSION

- 7.8 OTHER TYPES

- 7.8.1 FALL PROTECTION

- 7.8.1.1 Full body harnesses

- 7.8.1.2 Other fall protection equipment

- 7.8.2 HEARING PROTECTION

- 7.8.2.1 Earplugs

- 7.8.2.2 Other hearing protection equipment

- 7.8.1 FALL PROTECTION

8 PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 MANUFACTURING

- 8.2.1 INCREASING INDUSTRIAL ACTIVITIES TO FUEL DEMAND

- 8.3 CONSTRUCTION

- 8.3.1 INCREASING INVESTMENTS IN INFRASTRUCTURE DEVELOPMENT TO DRIVE MARKET

- 8.4 OIL & GAS

- 8.4.1 RISING WORKFORCE SAFETY CONCERNS IN OIL & GAS SECTOR TO DRIVE MARKET GROWTH

- 8.5 HEALTHCARE

- 8.5.1 RISING PREVALENCE OF HARMFUL DISEASES & INCREASING HEALTHCARE EXPENDITURE TO DRIVE MARKET

- 8.6 TRANSPORTATION

- 8.6.1 GROWING AUTOMOTIVE INDUSTRY TO DRIVE DEMAND

- 8.7 FIREFIGHTING

- 8.7.1 HIGH DEMAND FOR ADVANCED SAFETY EQUIPMENT TO DRIVE MARKET

- 8.8 FOOD

- 8.8.1 STRINGENT FOOD SAFETY REGULATIONS AND HYGIENE STANDARDS TO DRIVE DEMAND

- 8.9 OTHER END-USE INDUSTRIES

9 PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Low-cost labor and raw material availability to drive market

- 9.2.2 JAPAN

- 9.2.2.1 Growth in food, healthcare, construction, and automotive industries to fuel demand

- 9.2.3 INDIA

- 9.2.3.1 Entry of global auto manufacturers & increasing infrastructure activities to drive demand

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Rapid industrialization and technological advancement to support market growth

- 9.2.5 INDONESIA

- 9.2.5.1 Growth in oil & gas and industrial sectors to drive market

- 9.2.6 AUSTRALIA

- 9.2.6.1 Growth of healthcare and mining industries to fuel demand

- 9.2.7 THAILAND

- 9.2.7.1 Social and economic development to fuel demand during forecast period

- 9.2.8 MALAYSIA

- 9.2.8.1 Large industrial sector to propel demand for personal protective equipment

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Presence of key players to drive market

- 9.3.2 CANADA

- 9.3.2.1 Increasing number of surgeries to drive market

- 9.3.3 MEXICO

- 9.3.3.1 Low labor cost and free trade agreements to drive growth

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Government emphasis on safety of industrial workers to fuel demand

- 9.4.2 UK

- 9.4.2.1 Economic growth and increase in consumer spending to support market growth

- 9.4.3 FRANCE

- 9.4.3.1 Developments in end-use industries to fuel market growth

- 9.4.4 ITALY

- 9.4.4.1 Economic recovery to support market growth

- 9.4.5 SPAIN

- 9.4.5.1 Increasing construction activities and foreign investments to fuel demand

- 9.4.1 GERMANY

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Growth of oil & gas and healthcare industries to fuel market growth

- 9.5.1.2 UAE

- 9.5.1.2.1 Increased investments in construction industry to drive demand

- 9.5.1.1 Saudi Arabia

- 9.5.2 IRAN

- 9.5.2.1 Rising government expenditure on infrastructure development to drive market

- 9.5.3 EGYPT

- 9.5.3.1 Economic growth and infrastructure development to support market growth

- 9.5.4 SOUTH AFRICA

- 9.5.4.1 Growing manufacturing sector and workplace safety regulations to fuel demand

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Economic growth to drive market

- 9.6.2 ARGENTINA

- 9.6.2.1 Regulatory mandates on use of personal protective equipment to drive market

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Type footprint

- 10.5.5.4 End-use Industry footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMES

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 BRAND/PRODUCT COMPARISON ANALYSIS

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 HONEYWELL INTERNATIONAL INC.

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 DUPONT DE NEMOURS, INC.

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 3M COMPANY

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 ANSELL LIMITED

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.3.4 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 MSA SAFETY INCORPORATED

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 LAKELAND INDUSTRIES, INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.3.2 Expansions

- 11.1.7 ALPHA PRO TECH, LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 SIOEN INDUSTRIES NV

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.9 RADIANS, INC.

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.10 DELTA PLUS GROUP

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Other developments

- 11.1.11 PROTECTIVE INDUSTRIAL PRODUCTS, INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.1 HONEYWELL INTERNATIONAL INC.

- 11.2 OTHER PLAYERS

- 11.2.1 MOLDEX-METRIC

- 11.2.2 KLEIN TOOLS, INC.

- 11.2.3 MALLCOM INDIA LIMITED

- 11.2.4 NATIONAL SAFETY APPAREL

- 11.2.5 UVEX GROUP

- 11.2.6 GATEWAY SAFETY

- 11.2.7 SAF-T-GARD INTERNATIONAL, INC.

- 11.2.8 LINDSTROM GROUP

- 11.2.9 DRAGERWERK AG & CO. KGAA

- 11.2.10 AVON TECHNOLOGIES PLC

- 11.2.11 POLISON CORPORATION

- 11.2.12 PAN TAIWAN ENTERPRISE CO., LTD.

- 11.2.13 COFRA S.R.L.

- 11.2.14 JSP LTD.

12 ADJACENT & RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 FACE SHIELD MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 FACE SHIELD MARKET, BY REGION

- 12.3.3.1 Europe

- 12.3.3.2 North America

- 12.3.3.3 Asia Pacific

- 12.3.3.4 Middle East & Africa

- 12.3.3.5 South America

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS