|

|

市場調査レポート

商品コード

1734005

業務用リールの世界市場:タイプ別、巻き取りタイプ別、材質別、用途別、業界別、地域別 - 2030年までの予測Industrial Reels Market by Hose Reel, Cable Reel, Static Grounding Reel, Rewind Type (Manual Crank, Electric, Hydraulic, Pneumatic), Power Supply Management, DEF Dispensing, Construction & Infrastructure, Refuelling Stations - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 業務用リールの世界市場:タイプ別、巻き取りタイプ別、材質別、用途別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月09日

発行: MarketsandMarkets

ページ情報: 英文 170 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の業務用リールの市場規模は、4.4%のCAGRで拡大し、2025年の5億米ドルから2030年には6億2,000万米ドルに達すると予測されています。

建設、公共事業、運輸、製造業では、ケーブル、ホース、ワイヤを効果的に管理する必要性が高まっているため、業務用リールの需要が高まっています。作業が自動化され、安全規制が厳しくなる中、業務用リールを使用することで絡まりを防ぎ、摩耗を最小限に抑え、職場の安全性を高めることができます。インフラ開発の急増と再生可能エネルギー発電プロジェクトの拡大により、信頼性の高いエネルギーと堅牢な送電システムに対するかつてない需要が生じています。さらに、業務用リールを使用することで、機器の機動性が向上し、メンテナンスが簡素化されるため、この需要拡大にさらに拍車がかかります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント別 | タイプ別、巻き取りタイプ別、材質別、用途別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

スチールは、石油・ガス、建設、製造、輸送などの要求の厳しい用途に最適であり、その優れた強度と耐久性、高い耐摩耗性により、業務用リール市場を独占しています。スチール製リールは、卓越した耐荷重能力を発揮し、極端な温度変化や厳しい環境条件にも耐えられるように設計されています。これらの特性により、屋内外の用途で信頼性の高い性能が保証されます。スチールは、アルミニウムやプラスチックのような軽量な選択肢よりも、はるかに優れた引張強度と長寿命を提供することで、メンテナンスや交換コストを抑えることができます。亜鉛メッキやステンレス鋼など、最新の耐腐食性コーティング材料の進歩が市場成長に寄与しています。

建設・インフラセグメントは、都市開拓の拡大、交通システムの強化、エネルギー関連プロジェクトの推進を目的とした世界の投資の増加により、業務用リール市場において予測期間中に急速なCAGRの成長が見込まれています。業務用リールは、建設現場で電気ケーブル、ホース、流体を管理し、溶接、給油、潤滑、工具操作などの用途をサポートするために使用されます。さらに、これらのリールは、安全衛生を大幅に改善し、ダウンタイムを最小限に抑え、作業効率を最大化します。巨大プロジェクトが政府の資金援助によって重工業地域や新興国市場にますます拡大するにつれて、より強力で柔軟なリールへの要求が高まり、市場は高い成長を遂げると思われます。

中国は、製造、近代化、産業自動化への積極的な推進により、業務用リールのアジア太平洋市場を独占すると予想されます。メイド・イン・チャイナ2025や先進機械への投資といったプロジェクトが、産業用パワー、流体、ケーブル管理リールの需要を押し上げています。政府の財政政策やデジタル化政策も、スマート製造システムの使用を刺激します。業務用リールは、こうしたシステム内で効率性と安全性を最適化するための中心的な鍵となります。中国の強固な製造業基盤は、インフラ整備の上昇と相まって、この地域の経済拡大の最前線に位置しています。グリーン・テクノロジーとハイテク産業がますます重視されるようになり、主要な成長エンジンとしての中国の役割が強化されています。

当レポートでは、世界の業務用リール市場について調査し、タイプ別、巻き取りタイプ別、材質別、用途別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 価格分析

- 技術分析

第6章 業務用リール市場(タイプ別)

- イントロダクション

- ホースリール

- ケーブルリール

第7章 業務用リール市場(巻き取りタイプ別)

- イントロダクション

- 手動クランク

- 電動式

- 油圧式

- 空気圧式

第8章 業務用リール市場(材質別)

- イントロダクション

- 鋼鉄

- アルミニウム

- 複合材料

- プラスチック

第9章 業務用リール市場(用途別)

- イントロダクション

- 電源管理

- DEFディスペンシング

- 溶接作業

- 建設・インフラ

- 給油ステーション

第10章 業務用リール市場(業界別)

- イントロダクション

- 輸送

- ユーティリティ・電気

- 建設

- 鉱業

- 海事

- 軍と政府

- 空港

- その他

第11章 業務用リール市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- その他

- その他の地域

- 南米

- 中東

- アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場ランキング分析、2024年

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

第13章 企業プロファイル

- 主要参入企業

- HANNAY REELS INC.

- REELCRAFT INDUSTRIES

- CAVOTEC SA

- COXREELS

- NEDERMAN HOLDING AB

- UNITED EQUIPMENT ACCESSORIES, INC.

- CEJN AB

- HUBBELL

- WINKEL GMBH

- SANKYO REELS, INC.

- その他の企業

- THE ERICSON MANUFACTURING CO.

- CONDUCTIX-WAMPFLER GMBH

- PAUL VAHLE GMBH & CO. KG

- MOLEX

- HARTMANN & KONIG STROMZUFUHRUNGS AG

- ZECA S.P.A.

- GARTEC LTD.

- DEMAC S.R.L.

- RAASM S.P.A.

- PRINCETEL, INC.

- HOSE TECH USA

- DURO MANUFACTURING, LLC, LLC

- REELTEC

- UNIQUE WELDING & FABRICATING LIMITED

- SCHNEIDER ELECTRIC

第14章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE OF INDUSTRIAL REELS, BY KEY PLAYER, 2024 (USD)

- TABLE 2 INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 3 INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 4 INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 5 INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 6 HOSE REELS: INDUSTRIAL REELS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 7 HOSE REELS: INDUSTRIAL REELS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 8 HOSE REELS: INDUSTRIAL REELS MARKET, BY REWIND TYPE, 2021-2024 (USD MILLION)

- TABLE 9 HOSE REELS: INDUSTRIAL REELS MARKET, BY REWIND TYPE, 2025-2030 (USD MILLION)

- TABLE 10 CABLE REELS: INDUSTRIAL REELS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 11 CABLE REELS: INDUSTRIAL REELS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 12 CABLE REELS: INDUSTRIAL REELS MARKET, BY REWIND TYPE, 2021-2024 (USD MILLION)

- TABLE 13 CABLE REELS: INDUSTRIAL REELS MARKET, BY REWIND TYPE, 2025-2030 (USD MILLION)

- TABLE 14 STATIC GROUNDING REELS: INDUSTRIAL REELS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 15 STATIC GROUNDING REELS: INDUSTRIAL REELS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 16 STATIC GROUNDING REELS: INDUSTRIAL REELS MARKET, BY REWIND TYPE, 2021-2024 (USD MILLION)

- TABLE 17 STATIC GROUNDING REELS: INDUSTRIAL REELS MARKET, BY REWIND TYPE, 2025-2030 (USD MILLION)

- TABLE 18 INDUSTRIAL REELS MARKET, BY REWIND TYPE, 2021-2024 (USD MILLION)

- TABLE 19 INDUSTRIAL REELS MARKET, BY REWIND TYPE, 2025-2030 (USD MILLION)

- TABLE 20 INDUSTRIAL REELS MARKET: COMPARISON OF REWIND MECHANISMS

- TABLE 21 MANUAL CRANK: INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 22 MANUAL CRANK: INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (USD MILLION)

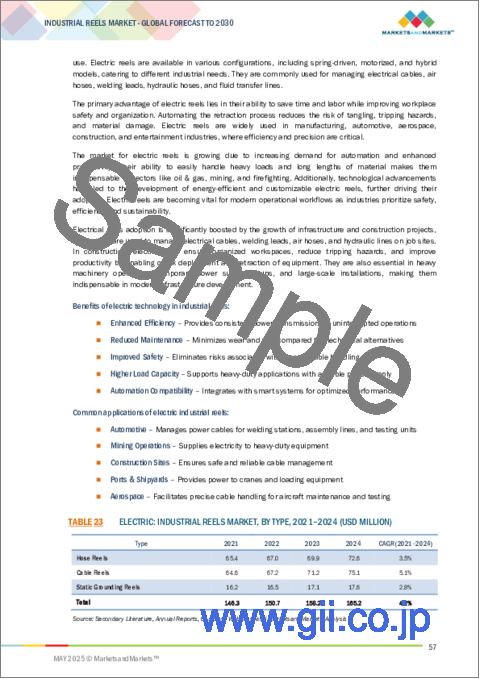

- TABLE 23 ELECTRIC: INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 24 ELECTRIC: INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 25 HYRAULIC: INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 26 HYDRAULIC: INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 27 PNEUMATIC: INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 28 PNEUMATIC: INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 INDUSTRIAL REELS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 30 INDUSTRIAL REELS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 31 INDUSTRIAL REELS MARKET: COMPARISON OF MATERIALS

- TABLE 32 STEEL INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 33 STEEL INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 34 INDUSTRIAL REELS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 35 INDUSTRIAL REELS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 36 INDUSTRIAL REELS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 37 INDUSTRIAL REELS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 38 TRANSPORTATION: INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 39 TRANSPORTATION: INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 40 TRANSPORTATION: INDUSTRIAL REELS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 TRANSPORTATION: INDUSTRIAL REELS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 UTILTIY & ELECTRICITY: INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 43 UTILTIY & ELECTRICITY: INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 44 UTILTIY & ELECTRICITY: INDUSTRIAL REELS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 UTILTIY & ELECTRICITY: INDUSTRIAL REELS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 CONSTRUCTION: INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 47 CONSTRUCTION: INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 48 CONSTRUCTION: INDUSTRIAL REELS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 CONSTRUCTION: INDUSTRIAL REELS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 MINING: INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 51 MINING: INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 52 MINING: INDUSTRIAL REELS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 MINING: INDUSTRIAL REELS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 MARITIME: INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 55 MARITIME: INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 56 MARITIME: INDUSTRIAL REELS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 MARITIME: INDUSTRIAL REELS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 MILITARY & GOVERNMENT: INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 59 MILITARY & GOVERNMENT: INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 60 MILITARY & GOVERNMENT: INDUSTRIAL REELS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 MILITARY & GOVERNMENT: INDUSTRIAL REELS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 AIRPORT: INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 63 AIRPORT: INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 64 AIRPORT: INDUSTRIAL REELS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 AIRPORT: INDUSTRIAL REELS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 OTHER INDUSTRIES: INDUSTRIAL REELS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 OTHER INDUSTRIES: INDUSTRIAL REELS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 68 OTHER INDUSTRIES: INDUSTRIAL REELS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 OTHER INDUSTRIES: INDUSTRIAL REELS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 INDUSTRIAL REELS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 INDUSTRIAL REELS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: INDUSTRIAL REELS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: INDUSTRIAL REELS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: INDUSTRIAL REELS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 75 NORTH AMERICA: INDUSTRIAL REELS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 76 EUROPE: INDUSTRIAL REELS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 77 EUROPE: INDUSTRIAL REELS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 78 EUROPE: INDUSTRIAL REELS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 79 EUROPE: INDUSTRIAL REELS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 ASIA PACIFIC: INDUSTRIAL REELS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 81 ASIA PACIFIC: INDUSTRIAL REELS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 82 ASIA PACIFIC: INDUSTRIAL REELS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 83 ASIA PACIFIC: INDUSTRIAL REELS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 REST OF THE WORLD: INDUSTRIAL REELS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 85 REST OF THE WORLD: INDUSTRIAL REELS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 86 REST OF THE WORLD: INDUSTRIAL REELS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 REST OF THE WORLD: INDUSTRIAL REELS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MANUFACTURERS, JANUARY 2021-FEBRUARY 2025

- TABLE 89 INDUSTRIAL REELS MARKET: MARKET RANKING, 2024

- TABLE 90 HANNAY REELS INC.: COMPANY OVERVIEW

- TABLE 91 HANNAY REELS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 92 HANNAY REELS INC.: PRODUCT LAUNCHES, JANUARY 2021-FEBRUARY 2025

- TABLE 93 REELCRAFT INDUSTRIES: COMPANY OVERVIEW

- TABLE 94 REELCRAFT INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 95 CAVOTEC SA: COMPANY OVERVIEW

- TABLE 96 CAVOTEC SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 97 CAVOTEC SA: DEALS, JANUARY 2021-FEBRUARY 2025

- TABLE 98 CAVOTEC SA: EXPANSIONS, JANUARY 2021-FEBRUARY 2025

- TABLE 99 CAVOTEC SA: OTHER DEVELOPMENTS

- TABLE 100 COXREELS: COMPANY OVERVIEW

- TABLE 101 COXREELS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 102 NEDERMAN HOLDING AB: COMPANY OVERVIEW

- TABLE 103 NEDERMAN HOLDING AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 104 UNITED EQUIPMENT ACCESSORIES, INC.: COMPANY OVERVIEW

- TABLE 105 UNITED EQUIPMENT ACCESSORIES, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 106 UNITED EQUIPMENT ACCESSORIES, INC.: DEALS, JANUARY 2021-FEBRUARY 2025

- TABLE 107 CEJN AB: COMPANY OVERVIEW

- TABLE 108 CEJN AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 109 HUBBELL: COMPANY OVERVIEW

- TABLE 110 HUBBELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 111 WINKEL GMBH: COMPANY OVERVIEW

- TABLE 112 WINKEL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 113 WINKEL GMBH: EXPANSION, JANUARY 2021-FEBRUARY 2025

- TABLE 114 SANKYO REELS, INC.: COMPANY OVERVIEW

- TABLE 115 SANKYO REELS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 116 SANKYO REELS, INC.: PRODUCT LAUNCHES, JANUARY 2021-FEBRUARY 2025

- TABLE 117 SANKYO REELS, INC.: DEALS, JANUARY 2021-FEBRUARY 2025

- TABLE 118 THE ERICSON MANUFACTURING CO.: COMPANY OVERVIEW

- TABLE 119 CONDUCTIX-WAMPFLER GMBH: COMPANY OVERVIEW

- TABLE 120 PAUL VAHLE GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 121 MOLEX: COMPANY OVERVIEW

- TABLE 122 HARTMANN & KONIG STROMZUFUHRUNGS AG: COMPANY OVERVIEW

- TABLE 123 ZECA S.P.A.: COMPANY OVERVIEW

- TABLE 124 GARTEC LTD.: COMPANY OVERVIEW

- TABLE 125 DEMAC S.R.L.: COMPANY OVERVIEW

- TABLE 126 RAASM S.P.A.: COMPANY OVERVIEW

- TABLE 127 PRINCETEL, INC.: COMPANY OVERVIEW

- TABLE 128 HOSE TECH USA: COMPANY OVERVIEW

- TABLE 129 DURO MANUFACTURING, LLC, LLC: COMPANY OVERVIEW

- TABLE 130 REELTEC: COMPANY OVERVIEW

- TABLE 131 UNIQUE WELDING & FABRICATING LIMITED: COMPANY OVERVIEW

- TABLE 132 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

List of Figures

- FIGURE 1 INDUSTRIAL REELS MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY-SIDE)-IDENTIFICATION OF REVENUE GENERATED BY COMPANIES FROM INDUSTRIAL REELS MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 CABLE REELS TO GROW AT HIGHEST RATE FROM 2025 TO 2030

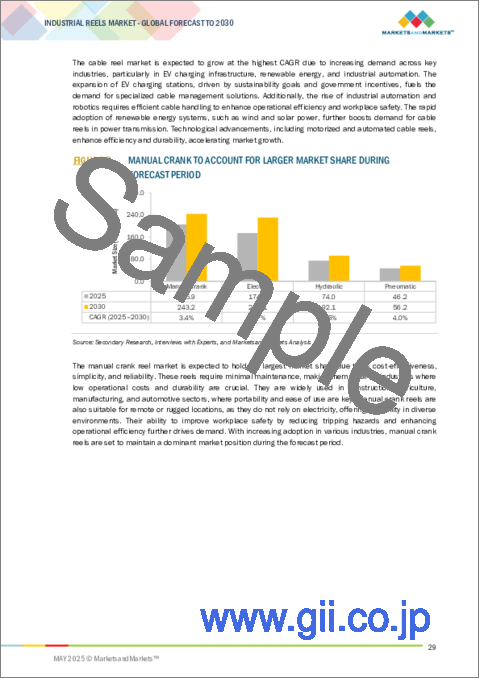

- FIGURE 8 MANUAL CRANK TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 CONSTRUCTION TO LEAD INDUSTRIAL REELS MARKET BETWEEN 2025 AND 2030

- FIGURE 10 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL REELS MARKET IN 2025

- FIGURE 11 INCREASED ADOPTION OF RENEWABLE ENERGY AND ADVANCEMENTS IN MANUFACTURING TECHNOLOGIES TO BOOST INDUSTRIAL REELS ADOPTION

- FIGURE 12 US TO DOMINATE NORTH AMERICAN INDUSTRIAL REELS MARKET IN 2025

- FIGURE 13 CONSTRUCTION TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL REELS MARKET IN ASIA PACIFIC

- FIGURE 14 CHINA TO REGISTER HIGHEST CAGR IN INDUSTRIAL REELS MARKET FROM 2025 TO 2030

- FIGURE 15 INDUSTRIAL REELS MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 DRIVERS AND THEIR IMPACT ON INDUSTRIAL REELS MARKET

- FIGURE 17 RESTRAINTS AND THEIR IMPACT ON THE INDUSTRIAL REELS MARKET

- FIGURE 18 OPPORTUNITIES AND THEIR IMPACT ON INDUSTRIAL REELS MARKET

- FIGURE 19 CHALLENGES AND THEIR IMPACT ON INDUSTRIAL REELS MARKET

- FIGURE 20 VALUE CHAIN ANALYSIS: INDUSTRIAL REELS MARKET

- FIGURE 21 AVERAGE SELLING PRICE OF INDUSTRIAL REELS, BY KEY PLAYER, 2024 (USD)

- FIGURE 22 AVERAGE SELLING PRICE TREND OF INDUSTRIAL REELS, BY TYPE, 2022-2024

- FIGURE 23 CABLE REELS TO HOLD LARGEST SHARE OF INDUSTRIAL REELS MARKET IN 2030

- FIGURE 24 MANUAL CRANK SEGMENT TO HOLD LARGEST SHARE OF INDUSTRIAL REELS MARKET DURING FORECAST PERIOD

- FIGURE 25 ALUMINUM TO GROW AT HIGHEST RATE OVER FORECAST PERIOD

- FIGURE 26 POWER SUPPLY MANAGEMENT TO HOLD LARGEST SHARE OF INDUSTRIAL REELS MARKET IN 2030

- FIGURE 27 CONSTRUCTION TO CAPTURE LARGER SHARE OF INDUSTRIAL REELS DURING FORECAST PERIOD

- FIGURE 28 INDUSTRIAL REELS MARKET, BY REGION

- FIGURE 29 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN GLOBAL INDUSTRIAL REELS MARKET DURING FORECAST PERIOD

- FIGURE 30 NORTH AMERICA: INDUSTRIAL REELS MARKET SNAPSHOT

- FIGURE 31 EUROPE: INDUSTRIAL REELS MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: INDUSTRIAL REELS MARKET SNAPSHOT

- FIGURE 33 MIDDLE EAST TO EXHIBIT HIGHEST CAGR IN REST OF THE WORLD

- FIGURE 34 INDUSTRIAL REELS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 35 INDUSTRIAL REELS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 36 INDUSTRIAL REELS MARKET: COMPANY FOOTPRINT

- FIGURE 37 CAVOTEC SA: COMPANY SNAPSHOT

- FIGURE 38 NEDERMAN HOLDING AB: COMPANY SNAPSHOT

- FIGURE 39 HUBBELL: COMPANY SNAPSHOT

The global industrial reels market is projected to reach USD 0.62 billion by 2030 from USD 0.50 billion in 2025, at a CAGR of 4.4%. Industrial reels are in higher demand as there is a rise in the need for effective cable, hose, and wire management in construction, utilities, transportation, and manufacturing industries. With operations becoming more automated and safety regulations more stringent, using industrial reels prevents tangling, minimizes wear, and enhances workplace safety. The surge in infrastructure development and the expansion of renewable energy projects are generating an unprecedented demand for reliable energy and robust transmission systems. Additionally, using industrial reels enhances equipment mobility and simplifies maintenance, further fueling this growing demand.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | by type, by rewind type, by material, by application, by industry, and by region |

| Regions covered | North America, Europe, APAC, RoW |

"Steel segment to hold largest market share during forecast period"

Steel dominates the industrial reel market due to its superior strength and durability and high resistance to wear, as it is best suited for demanding applications in oil & gas, construction, manufacturing, and transport. Steel reels demonstrate exceptional load-bearing capacities and are engineered to endure extreme temperature fluctuations and challenging environmental conditions. These properties guarantee their reliable performance in both indoor and outdoor applications. Steel is a vastly superior alternative to lighter options such as aluminum and plastic by providing much greater tensile strength and longer life to keep maintenance and replacement costs down. Advancements in modern corrosion-resistant coating materials, such as galvanized and stainless steel, contribute to market growth.

"Construction & infrastructure segment is expected to grow at highest CAGR in industrial reels market."

The construction & infrastructure segment is expected to exhibit a rapidly growing CAGR during the forecast period in the industrial reels market due to increasing global investments to expand urban development, enhance transportation systems, and advance energy-related projects. Industrial reels are used in construction sites to manage electrical cables, hoses, and fluids and support applications such as welding, fueling, lubrication, and tool operation. Moreover, these reels provide significant health and safety improvements, minimizing downtime and maximizing operational efficiency. As megaprojects increasingly expand into heavy and developing regions through government funding initiatives, increased requirements for stronger, more flexible reels will result in high market growth.

"China to dominate industrial reels market in Asia Pacific"

China is expected to dominate the Asia Pacific market for industrial reels due to its active drive toward manufacturing, modernization, and industrial automation. Projects such as Made in China 2025 and investment in advanced machinery boost the demand for industrial power, fluid, and cable management reels. Government fiscal and digitalization policies also stimulate the use of smart manufacturing systems. Industrial reels become a central key to optimizing efficiency and safety within such systems. China's robust manufacturing foundation, coupled with an upswing in infrastructure development, positions the nation at the forefront of economic expansion in the region. The emphasis is increasingly on green technologies and high-tech industries, reinforcing China's role as the primary growth engine.

- By Company Type: Tier 1 - 25%, Tier 2 - 40%, and Tier 3 - 35%

- By Designation: Directors - 30%, C-level Executives - 28%, and Others - 42%

- By Region: North America - 43%, Europe - 15%, Asia Pacific - 37%, and RoW - 05%

Hannay Reels Inc. (US), Reelcraft Industries (US), Coxreels (US), Nederman Holding AB (Sweden), Caxotec SA (Switzerland), United Equipment Accessories, Inc. (US), Cejn, Ab (Sweden), Hubbell (US), Winkel GmbH (Germany), SANKYO REELS (Japan), The Ericson Manufacturing Co (US), Conductix-Wampfler GmbH (Germany), Paul Vahle GmbH & Co. KG (Germany), Molex (US), Hartmann & Konig Stromzufuhrungs AG (Germany) are some major players in the industrial reels market.

The study includes an in-depth competitive analysis of these key players in the industrial reels market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the industrial reels market, by type (hose reels, cable reels, and static grounding reels), rewind type (manual crank, electric, hydraulic, pneumatic), material (steel, aluminium, composite material, and plastic), appication (power supply management, DEF dispensing, welding operations, construction & infrastructure, refuiling stations), industry (transportation, utility & electricity, construction, mining, maritime, military & government, airport, and other industries), and region (North America, Europe, Asia Pacific, South America, and Middle East & Africa). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the industrial reels market. A thorough analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements; new product launches; mergers and acquisitions; and recent developments associated with the industrial reels market. This report covers the competitive analysis of the upcoming industrial reels market ecosystem startups.

Reasons to Buy This Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall industrial reels market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (growth in construction and infrastructure projects, increasing investments in microgrid projects), restraints (high initial costs and maintenance expenses), opportunities (growing focus on expanding electric vehicles charging infrastructure, rising demand for fire safety and emergency response equipment), and challenges (corrosion challenges in harsh environments) influencing the growth of the industrial reels market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product and service launches in the industrial reels market

- Market Development: Comprehensive information about lucrative markets - the report analyses the industrial reels market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the industrial reels market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Hannay Reels Inc. (US), Reelcraft Industries (US), Coxreels (US), Nederman Holding AB (Sweden), Caxotec SA (Switzerland), United Equipment Accessories, Inc. (US), Cejn, Ab (Sweden), Hubbell (US), Winkel GmbH (Germany), SANKYO REELS (Japan), The Ericson Manufacturing Co (US), Conductix-Wampfler GmbH (Germany), Paul Vahle GmbH & Co. KG (Germany), Molex (US), and Hartmann & Konig Stromzufuhrungs AG (Germany) in the industrial reels market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for arriving at market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for arriving at market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL REELS MARKET

- 4.2 INDUSTRIAL REELS MARKET IN NORTH AMERICA, BY COUNTRY AND INDUSTRY

- 4.3 INDUSTRIAL REELS MARKET IN ASIA PACIFIC, BY INDUSTRY

- 4.4 INDUSTRIAL REELS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in construction and infrastructure projects

- 5.2.1.2 Increasing investments in microgrid projects

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial costs and maintenance expenses

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise of EV charging infrastructure

- 5.2.3.2 Rising demand for fire safety and emergency response equipment

- 5.2.4 CHALLENGES

- 5.2.4.1 Corrosion challenges in harsh environments

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.4.2 AVERAGE SELLING PRICE TREND, BY TYPE

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.1.1 Spring retraction technology

- 5.5.1.2 Integration of IoT sensors

- 5.5.1 KEY TECHNOLOGIES

6 INDUSTRIAL REELS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 HOSE REELS

- 6.2.1 INCREASING DEMAND FOR EFFICIENCY AND SAFETY IN INDUSTRIAL OPERATIONS FUELING GROWTH OF HOSE REELS

- 6.3 CABLE REELS

- 6.3.1 RISING RENEWABLE ENERGY PROJECTS TO DRIVE MARKET GROWTH

- 6.4 STATIC GROUNDING REELS

- 6.4.1 SAFETY OFFSETS AND HAZARD PREVENTION TO FUEL MARKET GROWTH

7 INDUSTRIAL REELS MARKET, BY REWIND TYPE

- 7.1 INTRODUCTION

- 7.2 MANUAL CRANK

- 7.2.1 COST-EFFECTIVENESS, DURABILITY, AND LOW MAINTENANCE TO DRIVE GROWTH

- 7.3 ELECTRIC

- 7.3.1 GROWTH OF INFRASTRUCTURE AND CONSTRUCTION PROJECTS BOOSTING ELECTRIC REEL ADOPTION

- 7.4 HYDRAULIC

- 7.4.1 INCREASING INFRASTRUCTURAL INVESTMENT BOOSTS MARKET DEMAND

- 7.5 PNEUMATIC

- 7.5.1 DEMAND FOR PNEUMATIC REWIND TECHNOLOGY IN LARGE-SCALE CONSTRUCTION AND LOGISTICS TO PROPEL MARKET

8 INDUSTRIAL REELS MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 STEEL

- 8.2.1 HIGH LOAD CAPACITY AND LONGEVITY TO INCREASE DEMAND FOR STEEL INDUSTRIAL REELS

- 8.2.2 MILD STEEL

- 8.2.3 STAINLESS STEEL

- 8.3 ALUMINUM

- 8.3.1 RISING ADOPTION OF CORROSION-RESISTANT MATERIALS IN HARSH ENVIRONMENTS TO PROPEL DEMAND

- 8.4 COMPOSITES

- 8.4.1 SUPERIOR DURABILITY AND LIGHTWEIGHT NATURE OF COMPOSITE MATERIALS TO FUEL MARKET GROWTH

- 8.5 PLASTIC

- 8.5.1 AFFORDABILITY AND VERSATILITY TO FUEL MARKET GROWTH

9 INDUSTRIAL REELS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 POWER SUPPLY MANAGEMENT

- 9.2.1 RISING DEMAND FOR RENEWABLE ENERGY SOLUTIONS TO DRIVE GROWTH

- 9.3 DEF DISPENSING

- 9.3.1 STRICTER EMISSION REGULATIONS IN DIESEL ENGINES TO PROPEL MARKET GROWTH

- 9.4 WELDING OPERATIONS

- 9.4.1 EXPANSION OF CONSTRUCTION AND MANUFACTURING INDUSTRIES TO PROPEL MARKET

- 9.5 CONSTRUCTION & INFRASTRUCTURE

- 9.5.1 RISING INFRASTRUCTURE INVESTMENTS TO DRIVE MARKET

- 9.6 REFUELING STATIONS

- 9.6.1 GOVERNMENT INVESTMENT IN REFUELING INFRASTRUCTURE TO BOOST MARKET GROWTH

10 INDUSTRIAL REELS MARKET, BY INDUSTRY

- 10.1 INTRODUCTION

- 10.2 TRANSPORTATION

- 10.2.1 GOVERNMENT FUNDING FOR HEAVY TRUCK VEHICLE UPGRADES TO FUEL SEGMENT GROWTH

- 10.3 UTILITY & ELECTRICITY

- 10.3.1 RISING ADOPTION OF SMART GRID TECHNOLOGIES TO SUPPORT MARKET GROWTH

- 10.4 CONSTRUCTION

- 10.4.1 GOVERNMENT INFRASTRUCTURE INITIATIVES TO FUEL MARKET GROWTH

- 10.5 MINING

- 10.5.1 RISING DEMAND FOR ENERGY-EFFICIENT AND AUTOMATED MINING OPERATIONS TO BOOST MARKET GROWTH

- 10.6 MARITIME

- 10.6.1 GROWING PORT INFRASTRUCTURE INVESTMENTS TO DRIVE MARKET GROWTH

- 10.7 MILITARY & GOVERNMENT

- 10.7.1 PROCUREMENT OF MILITARY VEHICLES TO FUEL MARKET FOR INDUSTRIAL REELS

- 10.8 AIRPORT

- 10.8.1 INVESTMENT IN SUSTAINABLE AVIATION FUELS TO COMPLEMENT GROWTH OF INDUSTRIAL REELS

- 10.8.2 AIRCRAFT REFUEING

- 10.9 OTHER INDUSTRIES

11 INDUSTRIAL REELS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Federal incentives for expanding solar & wind energy to drive market

- 11.2.2 CANADA

- 11.2.2.1 Rising need for efficient energy management in industrial settings to support growth

- 11.2.3 MEXICO

- 11.2.3.1 Expansion of trade and industrial hubs to fuel market growth

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 UK

- 11.3.1.1 Government-backed support for zero-emission vehicles to support growth

- 11.3.2 GERMANY

- 11.3.2.1 Germany's commitment to industry 4.0 to fuel market growth

- 11.3.3 FRANCE

- 11.3.3.1 Decarbonization and industrial growth to drive demand for industrial reels

- 11.3.4 ITALY

- 11.3.4.1 Rise in production site projects boosting industrial reels market

- 11.3.5 REST OF EUROPE

- 11.3.1 UK

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Investments in modern industrial equipment to propel market growth

- 11.4.2 JAPAN

- 11.4.2.1 Financial incentives for green energy and advanced technologies to drive market

- 11.4.3 SOUTH KOREA

- 11.4.3.1 Emphasis on digital and green transformation to drive adoption of industrial reels in smart factories

- 11.4.4 INDIA

- 11.4.4.1 Expansion of renewable energy projects, particularly in wind and solar power, to fuel market growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 REST OF THE WORLD

- 11.5.1 SOUTH AMERICA

- 11.5.1.1 Growing demand for heavy-duty reels in mining operations to fuel market growth

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Rising investments in infrastructure and industrial automation to drive market growth

- 11.5.2.2 GCC Countries

- 11.5.2.3 Rest of the Middle East

- 11.5.3 AFRICA

- 11.5.3.1 Rising investments in energy, mining, and logistics sectors to drive market

- 11.5.1 SOUTH AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY MAJOR PLAYERS IN THE INDUSTRIAL REELS MARKET

- 12.3 MARKET RANKING ANALYSIS, 2024

- 12.4 BRAND/PRODUCT COMPARISON

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 HANNAY REELS INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 REELCRAFT INDUSTRIES

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths/Right to win

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses/Competitive threats

- 13.1.3 CAVOTEC SA

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 COXREELS

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths/Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses/Competitive threats

- 13.1.5 NEDERMAN HOLDING AB

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths/Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses/Competitive threats

- 13.1.6 UNITED EQUIPMENT ACCESSORIES, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 CEJN AB

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 HUBBELL

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 WINKEL GMBH

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Expansions

- 13.1.10 SANKYO REELS, INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.1 HANNAY REELS INC.

- 13.2 OTHER PLAYERS

- 13.2.1 THE ERICSON MANUFACTURING CO.

- 13.2.2 CONDUCTIX-WAMPFLER GMBH

- 13.2.3 PAUL VAHLE GMBH & CO. KG

- 13.2.4 MOLEX

- 13.2.5 HARTMANN & KONIG STROMZUFUHRUNGS AG

- 13.2.6 ZECA S.P.A.

- 13.2.7 GARTEC LTD.

- 13.2.8 DEMAC S.R.L.

- 13.2.9 RAASM S.P.A.

- 13.2.10 PRINCETEL, INC.

- 13.2.11 HOSE TECH USA

- 13.2.12 DURO MANUFACTURING, LLC, LLC

- 13.2.13 REELTEC

- 13.2.14 UNIQUE WELDING & FABRICATING LIMITED

- 13.2.15 SCHNEIDER ELECTRIC

14 APPENDIX

- 14.1 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.2 CUSTOMIZATION OPTIONS

- 14.3 RELATED REPORTS

- 14.4 AUTHOR DETAILS