|

|

市場調査レポート

商品コード

1734004

温度データロガーの世界市場:タイプ別、使用法別、構成別、用途別、地域別 - 2030年までの予測Temperature Data Logger Market by Type (USB, Bluetooth, Wireless (Web-based, Cloud-based, IoT-based, Battery-operated)), Configuration (Standalone, Connected), Utility (Single-use, Reusable) and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 温度データロガーの世界市場:タイプ別、使用法別、構成別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月08日

発行: MarketsandMarkets

ページ情報: 英文 159 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の温度データロガーの市場規模は、予測期間中に5.8%のCAGRで拡大し、2025年の5億2,900万米ドルから2030年には7億110万米ドルに成長すると予測されています。

温度データロガー市場は、医薬品、食品・飲料、化学、物流などの主要産業において、リアルタイムの正確な温度測定に対するニーズが高まっているため、著しい成長を遂げています。FDA、WHO、EU適正流通規範(GDP)などの組織による厳格な規制は、特にワクチンや生物製剤などのデリケートな商品の温度監視を要求しており、コールドチェーン要件も厳しいです。このような規制の勢いは、輸送や保管の用途で温度データロガーが広く受け入れられる一因となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100米ドル) |

| セグメント別 | タイプ別、使用法別、構成別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

スタンドアロン温度データロガーは、リアルタイムモニタリングよりもシンプルさ、携帯性、費用対効果が優先される用途に必要です。環境モニタリングでは、測候所、農地、生態学的調査など、遠隔地の温度動向を追跡します。また、ビルや施設の管理では、HVACシステム、倉庫、データセンターの効率性と安全性を監視するために利用されます。工業プロセスでは、オーブン、キルン、冷凍庫の温度を追跡し、品質管理を確実にするためにスタンドアロン・ロガーが採用されています。さらに、実験、サンプル保管、臨床試験をモニターするための研究・実験室や、レストランや小売店での保管状況を確認するための食品安全コンプライアンスにおいても重要です。バッテリー駆動の設計、耐久性、使いやすさは、リアルタイム接続なしで信頼できる温度追跡を必要とするシナリオに不可欠です。

食品・飲料業界では、乳製品、食肉、魚介類、冷凍食品、食品・飲料などの生鮮品の品質、安全性、鮮度を保つために、適切な温度管理が極めて重要です。食品の安全性に関する消費者の意識の高まりや、危害分析重要管理点(HACCP)や食品安全近代化法(FSMA)などの厳しい食品安全規制の実施により、温度データロガーは必需品となっています。保管や輸送の状況を監視し、製品が指定された温度範囲内にあることを確認することで、腐敗や汚染を防ぐために極めて重要です。温度ロギング技術は、Bluetoothやその他の技術を含むまでに進歩し、食品サプライチェーンにおけるトレーサビリティとリアルタイムのモニタリングを向上させています。適切な監視によって腐敗を大幅に減らすことができるため、これは世界の食品廃棄の懸念に対処する上で極めて重要になっています。T&D CorporationやDeltaTrakのような企業は、特に食品・飲料業界向けに温度データロガーを開発し、冷蔵輸送や低温貯蔵のためのソリューションを提供しています。さらに、食料品のオンラインショッピングや食事の宅配サービスの動向は、温度管理されたロジスティクスの需要を高めており、その結果、この分野でのデータロガーの採用が増加しています。食品・飲料業界は、世界の食品貿易の増加と高品質製品に対する消費者の期待により、温度データロガーの主要市場であり続けると思われます。

米国は、強力な産業インフラ、規制施行、技術的リーダーシップにより、世界の温度データロガー市場を独占する態勢を整えています。主な促進要因の1つは、特に製薬、ヘルスケア、食品分野での厳しい規制環境です。FDAやCDCなどの機関は、温度に敏感な製品に厳しいガイドラインを課しており、継続的なモニタリングと文書化を義務付けています。さらに、米国は世界の製薬・バイオテクノロジー研究と製造の中心地です。生物製剤、ワクチン、温度に敏感な治療薬への需要が高まる中、生産、保管、流通の各チェーンにおいて信頼性の高い温度追跡の必要性が高まっています。また、同国はコールドチェーン物流網が高度に発達しており、データロガー・ソリューションの需要を押し上げています。技術革新も重要な要素です。米国には大手データロガーメーカーやIoT開発企業があり、ワイヤレス、AI、クラウドベースの技術をモニタリングシステムに継続的に統合しています。これらの進歩はリアルタイムの分析とリモートアクセスをサポートし、業務効率とコンプライアンスを強化します。さらに、食品と医薬品の安全性に関する消費者の意識の高まり、eコマースと医療機器ロジスティクスの拡大により、米国は温度データロガー市場の支配的勢力として位置づけられています。

当レポートでは、世界の温度データロガー市場について調査し、タイプ別、使用法別、構成別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン分析

- 顧客ビジネスに影響を与える動向/混乱

- 2025年の主な会議とイベント

第6章 温度データロガー市場(タイプ別)

- イントロダクション

- USB

- 無線

- Bluetooth

- その他

第7章 温度データロガー市場(使用法別)

- イントロダクション

- 単回使用型

- 再利用型

第8章 温度データロガー市場(構成別)

- イントロダクション

- スタンドアロン

- 接続型

第9章 温度データロガー市場(用途別)

- イントロダクション

- 医薬品・ライフサイエンス

- 食品・飲料

- 医療機器

- エレクトロニクスおよび半導体

- 工業製造業

- コールドチェーン物流

- 環境モニタリング

第10章 温度データロガー市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- 北欧

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- インド

- その他

- 行

- 南米

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2023年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- ONSET COMPUTER CORPORATION

- HIOKI E.E. CORPORATION

- TESTO SE & CO. KGAA

- ELPRO-BUCHS AG

- DICKSON

- SENSITECH INC.

- VAISALA

- SIGNATROL

- GEMINI DATA LOGGERS

- EBRO ELECTRONIC

- その他の企業

- CAS DATALOGGERS

- KIMO ELECTRONIC PVTLTD.

- DELTATRAK INC.

- OMEGA ENGINEERING INC.

- GAO TEK & GAO GROUP INC.

第13章 付録

List of Tables

- TABLE 1 TEMPERATURE DATA LOGGER MARKET: LIST OF KEY CONFERENCES AND EVENTS

- TABLE 2 TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 3 TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 4 TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 5 TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 6 USB: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 7 USB: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 8 WIRELESS: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 9 WIRELESS: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 10 BLUETOOTH: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 11 BLUETOOTH: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 12 OTHER TYPES: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 13 OTHER TYPES: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 14 TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2021-2024 (USD MILLION)

- TABLE 15 TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 16 SINGLE-USE: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 17 SINGLE-USE: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 18 REUSABLE: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 19 REUSABLE: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 20 TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 21 TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2025-2030 (USD MILLION)

- TABLE 22 STANDALONE: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 23 STANDALONE: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 24 CONNECTED: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 25 CONNECTED: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 26 TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 27 TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 28 PHARMACEUTICAL & LIFE SCIENCES: TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 29 PHARMACEUTICAL & LIFE SCIENCES: TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 30 PHARMACEUTICAL & LIFE SCIENCES: TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 31 PHARMACEUTICAL & LIFE SCIENCES: TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2025-2030 (USD MILLION)

- TABLE 32 PHARMACEUTICAL & LIFE SCIENCES: TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2021-2024 (USD MILLION)

- TABLE 33 PHARMACEUTICAL & LIFE SCIENCES: TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 34 PHARMACEUTICAL & LIFE SCIENCES: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 PHARMACEUTICAL & LIFE SCIENCES: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 FOOD & BEVERAGE: TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 37 FOOD & BEVERAGE: TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 38 FOOD & BEVERAGE: TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 39 FOOD & BEVERAGE: TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2025-2030 (USD MILLION)

- TABLE 40 FOOD & BEVERAGE: TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2021-2024 (USD MILLION)

- TABLE 41 FOOD & BEVERAGE: TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 42 FOOD & BEVERAGE: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 FOOD & BEVERAGE: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 MEDICAL DEVICES: TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 45 MEDICAL DEVICES: TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 46 MEDICAL DEVICES: TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 47 MEDICAL DEVICES: TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2025-2030 (USD MILLION)

- TABLE 48 MEDICAL DEVICES: TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2021-2024 (USD MILLION)

- TABLE 49 MEDICAL DEVICES: TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 50 MEDICAL DEVICES: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 MEDICAL DEVICES: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 ELECTRONICS & SEMICONDUCTOR: TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 53 ELECTRONICS & SEMICONDUCTOR: TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 54 ELECTRONICS & SEMICONDUCTOR: TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 55 ELECTRONICS & SEMICONDUCTOR: TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2025-2030 (USD MILLION)

- TABLE 56 ELECTRONICS & SEMICONDUCTOR: TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2021-2024 (USD MILLION)

- TABLE 57 ELECTRONICS & SEMICONDUCTOR: TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 58 ELECTRONICS & SEMICONDUCTOR: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 ELECTRONICS & SEMICONDUCTOR: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 INDUSTRIAL MANUFACTURING: TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 61 INDUSTRIAL MANUFACTURING: TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 62 INDUSTRIAL MANUFACTURING: TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 63 INDUSTRIAL MANUFACTURING: TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2025-2030 (USD MILLION)

- TABLE 64 INDUSTRIAL MANUFACTURING: TEMPERATURE DATA LOGGER MARKET, BY UTILITY 2021-2024 (USD MILLION)

- TABLE 65 INDUSTRIAL MANUFACTURING: TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 66 INDUSTRIAL MANUFACTURING: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 INDUSTRIAL MANUFACTURING: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 COLD CHAIN LOGISTICS: TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 69 COLD CHAIN LOGISTICS: TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 70 COLD CHAIN LOGISTICS: TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 71 COLD CHAIN LOGISTICS: TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2025-2030 (USD MILLION)

- TABLE 72 COLD CHAIN LOGISTICS: TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2021-2024 (USD MILLION)

- TABLE 73 COLD CHAIN LOGISTICS: TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 74 COLD CHAIN LOGISTICS: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 COLD CHAIN LOGISTICS: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 ENVIRONMENTAL MONITORING: TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 77 ENVIRONMENTAL MONITORING: TEMPERATURE DATA LOGGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 78 ENVIRONMENTAL MONITORING: TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 79 ENVIRONMENTAL MONITORING: TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION, 2025-2030 (USD MILLION)

- TABLE 80 ENVIRONMENTAL MONITORING: TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2021-2024 (USD MILLION)

- TABLE 81 ENVIRONMENTAL MONITORING: TEMPERATURE DATA LOGGER MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 82 ENVIRONMENTAL MONITORING: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 ENVIRONMENTAL MONITORING: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 TEMPERATURE DATA LOGGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 TEMPERATURE DATA LOGGER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: TEMPERATURE DATA LOGGER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: TEMPERATURE DATA LOGGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 90 EUROPE: TEMPERATURE DATA LOGGER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 91 EUROPE: TEMPERATURE DATA LOGGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 93 EUROPE: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: TEMPERATURE DATA LOGGER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 95 ASIA PACIFIC: TEMPERATURE DATA LOGGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 ASIA PACIFIC: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 97 ASIA PACIFIC: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 98 ROW: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 ROW: TEMPERATURE DATA LOGGER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 ROW: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 101 ROW: TEMPERATURE DATA LOGGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 102 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2023-2025

- TABLE 103 TEMPERATURE DATA LOGGER MARKET: DEGREE OF COMPETITION, 2024

- TABLE 104 TEMPERATURE DATA LOGGER MARKET: PRODUCT LAUNCHES, JANUARY 2023 TO JANUARY 2025

- TABLE 105 TEMPERATURE DATA LOGGER MARKET: OTHER DEVELOPMENTS, JANUARY 2023 TO JANUARY 2025

- TABLE 106 ONSET COMPUTER CORPORATION: COMPANY OVERVIEW

- TABLE 107 ONSET COMPUTER CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 108 HIOKI E.E. CORPORATION: COMPANY OVERVIEW

- TABLE 109 HIOKI E.E. CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 110 HIOKI E.E. CORPORATION: PRODUCT LAUNCHES

- TABLE 111 TESTO SE & CO. KGAA: COMPANY OVERVIEW

- TABLE 112 TESTO SE & CO. KGAA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 113 ELPRO-BUCHS AG: COMPANY OVERVIEW

- TABLE 114 ELPRO-BUCHS AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 115 DICKSON: COMPANY OVERVIEW

- TABLE 116 DICKSON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 117 SENSITECH INC.: COMPANY OVERVIEW

- TABLE 118 SENSITECH INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 119 VAISALA: COMPANY OVERVIEW

- TABLE 120 VAISALA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 121 VAISALA: PRODUCT LAUNCHES

- TABLE 122 VAISALA: OTHER DEVELOPMENTS

- TABLE 123 SIGNATROL: COMPANY OVERVIEW

- TABLE 124 SIGNATROL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 125 SIGNATROL: PRODUCT LAUNCHES

- TABLE 126 GEMINI DATA LOGGERS: COMPANY OVERVIEW

- TABLE 127 GEMINI DATA LOGGERS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 128 EBRO ELECTRONIC: COMPANY OVERVIEW

- TABLE 129 EBRO ELECTRONICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 130 CAS DATALOGGERS: COMPANY OVERVIEW

- TABLE 131 KIMO ELECTRONIC PVTLTD.: COMPANY OVERVIEW

- TABLE 132 DELTATRAK INC.: COMPANY OVERVIEW

- TABLE 133 OMEGA ENGINEERING INC.: COMPANY OVERVIEW

- TABLE 134 GAO TEK & GAO GROUP INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 TEMPERATURE DATA LOGGER: MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 TEMPERATURE DATA LOGGER MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 3 TEMPERATURE DATA LOGGER MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS FROM SALES OF TEMPERATURE DATA LOGGERS

- FIGURE 7 DATA TRIANGULATION: TEMPERATURE DATA LOGGER MARKET

- FIGURE 8 CONNECTED SEGMENT TO HOLD MAJORITY OF MARKET SHARE IN 2030

- FIGURE 9 SINGLE-USE SEGMENT TO COMMAND TEMPERATURE DATA LOGGER MARKET IN 2030

- FIGURE 10 PHARMACEUTICAL & LIFE SCIENCES TO BE DOMINANT APPLICATION IN 2030

- FIGURE 11 ASIA PACIFIC TO RECORD HIGHEST CAGR IN TEMPERATURE DATA LOGGER MARKET DURING FORECAST PERIOD

- FIGURE 12 RISING NEED FOR REAL-TIME TEMPERATURE MONITORING IN COLD CHAIN LOGISTICS TO DRIVE MARKET

- FIGURE 13 WIRELESS SEGMENT TO CAPTURE LARGEST SHARE OF DATA LOGGER MARKET, BY TYPE, IN 2025

- FIGURE 14 CONNECTED SEGMENT TO DOMINATE DATA LOGGER MARKET, BY CONFIGURATION, IN 2025

- FIGURE 15 SINGLE-USE SEGMENT TO LEAD TEMPERATURE DATA LOGGER MARKET, BY UTILITY, IN 2025

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL TEMPERATURE DATA LOGGER MARKET DURING FORECAST PERIOD

- FIGURE 17 TEMPERATURE DATA LOGGER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 TEMPERATURE DATA LOGGER MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 19 TEMPERATURE DATA LOGGER MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 20 TEMPERATURE DATA LOGGER MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 21 TEMPERATURE DATA LOGGER MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 22 TEMPERATURE DATA LOGGER SUPPLY CHAIN ANALYSIS

- FIGURE 23 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 24 TEMPERATURE DATA LOGGER MARKET, BY TYPE

- FIGURE 25 WIRELESS TEMPERATURE DATA LOGGERS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 26 TEMPERATURE DATA LOGGER MARKET, BY UTILITY

- FIGURE 27 SINGLE-USE TEMPERATURE DATA LOGGERS TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 28 TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION

- FIGURE 29 CONNECTED TEMPERATURE DATA LOGGERS TO HOLD PROMINENT MARKET SHARE IN 2025

- FIGURE 30 TEMPERATURE DATA LOGGER MARKET, BY APPLICATION

- FIGURE 31 PHARMACEUTICAL & LIFE SCIENCES SEGMENT TO HOLD LARGEST SHARE OF TEMPERATURE DATA LOGGER MARKET IN 2025

- FIGURE 32 TEMPERATURE DATA LOGGER MARKET, BY REGION

- FIGURE 33 NORTH AMERICA: TEMPERATURE DATA LOGGER MARKET SNAPSHOT

- FIGURE 34 EUROPE: TEMPERATURE DATA LOGGER MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: TEMPERATURE DATA LOGGER MARKET SNAPSHOT

- FIGURE 36 TEMPERATURE DATA LOGGER MARKET: REVENUE ANALYSIS, 2020-2024

- FIGURE 37 TEMPERATURE DATA LOGGER MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 38 HIOKI E.E. CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 VAISALA: COMPANY SNAPSHOT

The global temperature data logger market is projected to grow from USD 529.0 million in 2025 to USD 701.1 million in 2030 at a CAGR of 5.8% during the forecast period. The temperature data logger market is experiencing tremendous growth due to the growing need for real-time, precise temperature measurement in key industries such as pharmaceuticals, food & beverage, chemicals, and logistics. Strict regulations by organizations such as the FDA, WHO, and EU Good Distribution Practices (GDP) require temperature monitoring of sensitive commodities, particularly vaccines and biologics, with stringent cold chain requirements. This regulatory momentum has contributed to the broad acceptance of temperature data loggers across transportation and storage uses.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Type, Wireless, Configuration and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Standalone segment to contribute a significant share to the temperature data logger market."

Standalone temperature data loggers are necessary for applications where simplicity, portability, and cost-effectiveness are prioritized over real-time monitoring. In environmental monitoring, they track temperature trends in remote locations, including weather stations, agricultural fields, and ecological studies. They are also utilized in building and facility management to monitor HVAC systems, warehouses, and data centers for efficiency and safety. In industrial processes, standalone loggers are employed to track temperature in ovens, kilns, and freezers to ensure quality control. Additionally, they are crucial in research and laboratory settings for monitoring experiments, sample storage, and clinical trials, as well as in food safety compliance for verifying storage conditions in restaurants and retail outlets. Their battery-operated design, durability, and ease of use make them indispensable for scenarios requiring reliable temperature tracking without real-time connectivity.

"Adoption of temperature data loggers in the food & beverage industry to grow significantly."

In the food & beverage industry, proper temperature control is crucial in preserving the quality, safety, and freshness of perishable goods such as dairy, meat, seafood, frozen foods, and beverages. Due to increasing consumer awareness regarding food safety and the implementation of strict food safety regulations such as Hazard Analysis Critical Control Point (HACCP) and Food Safety Modernization Act (FSMA), temperature data loggers have become a necessity. They are crucial for monitoring storage and transportation conditions to ensure products are within specified temperature ranges, thus preventing spoilage and contamination. Temperature logging technology has advanced to include Bluetooth and other technologies, improving traceability and real-time monitoring in food supply chains. This has become crucial in dealing with global food waste concerns because proper monitoring can significantly reduce spoilage. Companies such as T&D Corporation and DeltaTrak have developed temperature data loggers specifically for the food & beverage industry, providing solutions for refrigerated transportation and cold storage. Moreover, the trend of online grocery shopping and meal delivery services has increased the demand for temperature-controlled logistics, which in turn is increasing the adoption of data loggers in this sector. The food & beverage industry will remain a key market for temperature data loggers with the increase in global food trade and consumer expectations for high-quality products.

"The US is projected to dominate the temperature data logger market."

The US is poised to dominate the global temperature data logger market due to strong industrial infrastructure, regulatory enforcement, and technological leadership. One of the primary drivers is the country's stringent regulatory environment, particularly in the pharmaceutical, healthcare, and food sectors. Agencies such as the FDA and CDC impose strict guidelines on temperature-sensitive products, requiring continuous monitoring and documentation, which fuels the widespread adoption of advanced data loggers. Moreover, the US is a global pharmaceutical and biotechnology research and manufacturing hub. With increasing demand for biologics, vaccines, and temperature-sensitive therapies, there is a growing need for reliable temperature tracking across production, storage, and distribution chains. The nation also has a highly developed cold chain logistics network, boosting demand for data logger solutions. Technological innovation is another critical factor. The US is home to leading data logger manufacturers and IoT developers, continuously integrating wireless, AI, and cloud-based technologies into monitoring systems. These advancements support real-time analytics and remote access, enhancing operational efficiency and compliance. In addition, rising consumer awareness about food and drug safety and the expansion of e-commerce and medical device logistics position the US as a dominant force in the temperature data logger market.

In-depth interviews have been conducted with Chief Executive Officers (CEOs), Directors, and other executives from various key organizations operating in the temperature data logger market.

- By Company Type: Tier 1 - 42%, Tier 2 - 37%, and Tier 3 - 21%

- By Designation: C-level Executives - 48%, Directors - 33%, and Others - 19%

- By Region: North America - 35%, Europe - 18%, Asia Pacific - 40%, and RoW - 7%

The study includes an in-depth competitive analysis of key players in the temperature data logger market, with their company profiles, recent developments, and key market strategies. Players include Onset Computer Corporation (US), HIOKI E.E. Corporation (Japan), Testo SE & Co. KGaA (Germany), ELPRO-BUCHS AG (Switzerland), Dickson (US), Sensitech Inc(US), Vaisala (Finland), Signatrol (UK), Gemini Data Loggers (UK), Ebro Electronics (Germany), CAS Dataloggers (US), KIMO Electronics Pvt (India), DeltaTrak (US), Omega Engineering Inc (US), and GAO TEK & GAO GROUP INC. (US).

Research Coverage

This research report categorizes the temperature data logger market by type, utility, configuration, industry, and region (North America, Europe, and Asia Pacific). The report scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the temperature data logger market. A detailed analysis of the key industry players has provided insights into their business overview, solutions and services, and key strategies, such as contracts, partnerships, agreements, new product and service launches, acquisitions, and other recent developments associated with the temperature data logger market. This report covers a competitive analysis of upcoming temperature data logger market startups.

Reasons To Buy This Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the temperature data logger market and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing penetration of temperature data loggers in pharmaceutical and medical device industries, stringent monitoring requirements in the food & beverage and cold chain logistics sector, increasing adoption of Industry 4.0, wireless connectivity, and IoT, demand for environmental monitoring applications), restraints (high initial cost involved in advanced data loggers, complexities in deployment and integration), opportunities (incorporation of temperature control systems in food safety management, Supportive government initiatives & funding for IoT projects that require temperature measuring devices), and challenges (stringent performance requirements for advanced applications, data security concerns) influencing the growth of the temperature data logger market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the temperature data logger market

- Market Development: Comprehensive information about lucrative markets-the report analyses the temperature data logger market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the temperature data logger market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the temperature data logger market, such as Onset Computer Corporation (US), HIOKI E.E. Corporation (Japan), Testo SE & Co. KGaA (Germany), ELPRO-BUCHS AG (Switzerland), and Dickson (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Intended participants in primary interviews

- 2.1.2.2 Key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.2.5 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Bottom-up approach for estimating market size

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Top-down approach for estimating market size

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TEMPERATURE DATA LOGGER MARKET

- 4.2 TEMPERATURE DATA LOGGER MARKET, BY TYPE

- 4.3 TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION

- 4.4 TEMPERATURE DATA LOGGER MARKET, BY UTILITY

- 4.5 TEMPERATURE DATA LOGGER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand from pharmaceuticals & medical devices industries

- 5.2.1.2 Growing adoption in food & beverages and cold chain logistics sectors

- 5.2.1.3 Increasing use of Industry 5.0, wireless connectivity, and IoT technologies

- 5.2.1.4 Surging deployment of temperature data loggers in environmental monitoring applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 High deployment and maintenance costs

- 5.2.2.2 Complexity in deployment and integration

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Stringent food safety regulations with elevating demand for packaged food

- 5.2.3.2 Increasing government funding toward IoT projects

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent performance requirements for advanced applications

- 5.2.4.2 Data security concerns

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 KEY CONFERENCES AND EVENTS, 2025

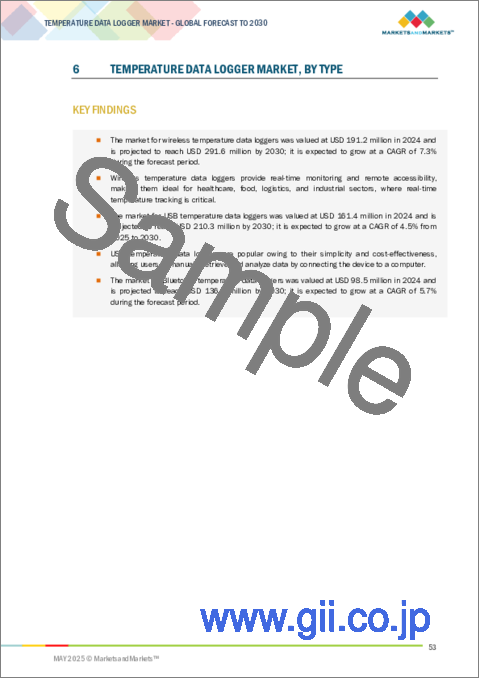

6 TEMPERATURE DATA LOGGER MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 USB

- 6.2.1 EASE OF DATA RETRIEVAL VIA USB CONNECTIONS TO BOOST DEMAND

- 6.3 WIRELESS

- 6.3.1 NEED FOR REAL-TIME DATA ACCESS TO FUEL SEGMENTAL GROWTH

- 6.4 BLUETOOTH

- 6.4.1 ABILITY TO OFFER HASSLE-FREE AND REAL-TIME DATA ACCESS TO DRIVE MARKET

- 6.5 OTHER TYPES

7 TEMPERATURE DATA LOGGER MARKET, BY UTILITY

- 7.1 INTRODUCTION

- 7.2 SINGLE-USE

- 7.2.1 RISING NEED TO MONITOR TEMPERATURE-SENSITIVE PRODUCTS IN LARGE-SCALE DISTRIBUTION NETWORKS TO ACCELERATE DEMAND

- 7.3 REUSABLE

- 7.3.1 ESCALATED DEMAND FOR CONTINUOUS TEMPERATURE MONITORING IN COLD CHAIN LOGISTICS AND FOOD INDUSTRIES TO FOSTER MARKET GROWTH

8 TEMPERATURE DATA LOGGER MARKET, BY CONFIGURATION

- 8.1 INTRODUCTION

- 8.2 STANDALONE

- 8.2.1 REQUIREMENT FOR PERIODIC TEMPERATURE RECORDING FOR REMOTE LOCATIONS TO STIMULATE SEGMENTAL GROWTH

- 8.3 CONNECTED

- 8.3.1 ABILITY TO PROVIDE IMMEDIATE ALERTS IN CASE OF TEMPERATURE DEVIATIONS TO BOOST DEMAND

9 TEMPERATURE DATA LOGGER MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 PHARMACEUTICAL & LIFE SCIENCES

- 9.2.1 NECESSITY TO MAINTAIN ACCURATE TEMPERATURE DURING DRUG MANUFACTURING PROCESSES TO SPIKE DEMAND

- 9.2.2 DRUG MANUFACTURING

- 9.2.3 CLINICAL TRIALS & STERILIZATION

- 9.2.4 VACCINE STORAGE MONITORING

- 9.3 FOOD & BEVERAGE

- 9.3.1 EMPHASIS ON PRESERVING FRESHNESS, TASTE, TEXTURE, AND NUTRITIONAL VALUE OF PERISHABLE PRODUCTS TO BOOST DEMAND

- 9.3.2 PRODUCTION PROCESS MONITORING

- 9.3.3 COMPLIANCE WITH FOOD SAFETY REGULATIONS

- 9.3.4 COLD CHAIN MONITORING

- 9.3.5 REFRIGERATION MONITORING

- 9.4 MEDICAL DEVICES

- 9.4.1 STRINGENT TEMPERATURE AND HUMIDITY CONTROL STANDARDS FOR CLEANROOMS TO SUPPORT SEGMENTAL GROWTH

- 9.4.2 INCUBATOR MONITORING

- 9.4.3 CHAMBER MONITORING

- 9.4.4 LABORATORY APPLICATIONS

- 9.5 ELECTRONICS & SEMICONDUCTORS

- 9.5.1 NECESSITY TO MONITOR HIGH-TEMPERATURE ENVIRONMENTS DURING CHIP PRODUCTION TO DRIVE MARKET

- 9.5.2 SENSITIVE EQUIPMENT STORAGE

- 9.5.3 MANUFACTURING PROCESS CONTROL

- 9.6 INDUSTRIAL MANUFACTURING

- 9.6.1 HIGH EMPHASIS ON PREVENTIVE MAINTENANCE TO FACILITATE ADOPTION OF DATA LOGGERS

- 9.6.2 MACHINE CONDITION MONITORING

- 9.6.3 QUALITY CONTROL

- 9.7 COLD CHAIN LOGISTICS

- 9.7.1 NEED TO ENSURE SAFE AND EFFECTIVE TRANSPORTATION AND STORAGE OF TEMPERATURE-SENSITIVE PRODUCTS TO BOOST DEMAND

- 9.7.2 REAL-TIME MONITORING

- 9.7.3 TRANSPORTATION & DELIVERY

- 9.8 ENVIRONMENTAL MONITORING

- 9.8.1 RISING FOCUS ON BUILDING SMART OFFICES AND GREENHOUSES TO FOSTER MARKET GROWTH

10 TEMPERATURE DATA LOGGER MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.2.1 Increasing adoption of data loggers in food & beverage and industrial manufacturing applications to drive market

- 10.2.3 CANADA

- 10.2.3.1 Expansion of cold chain logistics to create market growth opportunities

- 10.2.4 MEXICO

- 10.2.4.1 Thriving electronics & semiconductor industry to support market growth

- 10.3 EUROPE

- 10.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.2 UK

- 10.3.2.1 Elevating demand for high-end electronic products to stimulate market growth

- 10.3.3 GERMANY

- 10.3.3.1 Constant technological advancements in automotive sector to foster market growth

- 10.3.4 FRANCE

- 10.3.4.1 Booming aerospace industry to contribute to market growth

- 10.3.5 NORDICS

- 10.3.5.1 Strong focus on adoption of renewable energy to create market growth opportunities

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Rapid industrialization to accelerate market growth

- 10.4.3 JAPAN

- 10.4.3.1 Stringent food safety and pharmaceutical regulations to support market growth

- 10.4.4 INDIA

- 10.4.4.1 Automotive and consumer electronics industries to contribute to market growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 Presence of large electronics manufacturing plants to propel market

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Strong focus on strengthening healthcare supply chain to create opportunities

- 10.5.2.2 GCC

- 10.5.2.3 Rest of Middle East

- 10.5.3 AFRICA

- 10.5.3.1 Existence of giant pharma companies to support market growth

- 10.5.1 SOUTH AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPETITIVE SCENARIO

- 11.5.1 PRODUCT LAUNCHES

- 11.5.2 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 ONSET COMPUTER CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Services/Solutions offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Key strengths/Right to win

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses/Competitive threats

- 12.1.2 HIOKI E.E. CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Services/Solutions offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 TESTO SE & CO. KGAA

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Services/Solutions offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Key strengths/Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses/Competitive threats

- 12.1.4 ELPRO-BUCHS AG

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Services/Solutions offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Key strengths/Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses/Competitive threats

- 12.1.5 DICKSON

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Services/Solutions offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths/Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses/Competitive threats

- 12.1.6 SENSITECH INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Services/Solutions offered

- 12.1.7 VAISALA

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Services/Solutions offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Other developments

- 12.1.8 SIGNATROL

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Services/Solutions offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.9 GEMINI DATA LOGGERS

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Services/Solutions offered

- 12.1.10 EBRO ELECTRONIC

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Services/Solutions offered

- 12.1.1 ONSET COMPUTER CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 CAS DATALOGGERS

- 12.2.2 KIMO ELECTRONIC PVTLTD.

- 12.2.3 DELTATRAK INC.

- 12.2.4 OMEGA ENGINEERING INC.

- 12.2.5 GAO TEK & GAO GROUP INC.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS