|

|

市場調査レポート

商品コード

1727400

歯科麻酔薬の世界市場:薬剤タイプ別、投与経路別、エンドユーザー別、地域別 - 2030年までの予測Dental Anesthetics Market by Drug Type (Lidocaine, Mepivacaine, Articaine, Bupivacaine, Mepivacaine, Prilocaine), Route of Administration (Topical, Injectable, Syringes, Needles), End User (Hospitals, Clinics, Others), Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 歯科麻酔薬の世界市場:薬剤タイプ別、投与経路別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月13日

発行: MarketsandMarkets

ページ情報: 英文 245 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の歯科麻酔薬の市場規模は、2025年の14億8,000万米ドルから2030年には18億米ドルに達すると予測され、予測期間中のCAGRは4.0%と見込まれています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 薬剤タイプ別、投与経路別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

世界の歯科麻酔薬市場は、歯科疾患の罹患率が上昇し、歯科処置の増加に伴って拡大しています。さらに、口腔の健康や審美歯科の重要性に対する認識が高まり、歯科治療を受ける人が増えています。多くの地域で所得水準が向上し、ヘルスケアのインフラが整備されたことで、歯科治療がより身近なものとなっています。さらに、高齢者人口の増加により、これらのサービスに対する需要が高まると予想されます。しかし、予測期間中には、歯科開業医の不足や歯科治療に対する保険適用の制限といった課題が、市場の成長をある程度妨げる可能性があります。

アルチカインは、他のタイプの麻酔薬と比較して多くの利点があるため、予測期間中に最高のCAGRを経験すると予測されています。ベンゼン環を含む他のアミド系麻酔薬とは異なり、アルチカインはチオフェン環を有しているため、脂質溶解性が向上し、組織や神経膜への浸透性が改善されます。このように硬組織と軟組織の両方への拡散性が向上しているため、他の麻酔薬では神経ブロックが必要となることが多い下顎への浸潤に、アルチカインは特に効果的です。その結果、歯科医師はアルチカインが骨密度の高い部位でより優れた効果を発揮します。さらに、様々な研究により、高齢者や小児の患者集団においても、適切に使用された場合の安全性が確認されています。これらの利点は、アルチカインの人気の高まりに貢献し、市場の拡大を支えています。

局所麻酔薬市場は、歯科麻酔薬市場において最も高い成長を遂げると予測され、その原動力は、標準的な処置における広範な使用、適用の容易さ、非侵襲性、迅速な表面麻酔を提供する能力です。歯科医はジェル、定量スプレー、パッチなどの新技術をますます利用するようになっています。さらに、針を使用しない麻酔の導入や、様々なフレーバーの局所麻酔薬の入手が可能になったことも、導入の増加に寄与しています。局所麻酔薬は作用時間が短いという制約があるもの、その信頼性と幅広い用途が引き続き市場の成長を後押ししています。

歯科麻酔薬の需要は、主にラテンアメリカとアジア太平洋の発展途上地域における歯科クリニックの成長によって牽引されています。ベトナム、インドネシア、インドなどの国々で歯科サービスがより利用しやすくなるにつれ、効果的な疼痛管理を必要とする手術を希望する患者が増加しています。歯科クリニックの拡大に寄与する主な要因としては、中間所得層の所得増加、都市化、口腔衛生に対する意識の高まりなどが挙げられます。その結果、信頼性の高い局所麻酔薬や局部麻酔薬に対するニーズが高まっています。

アジア太平洋の歯科麻酔薬市場は、ヘルスケアの変化を反映するいくつかの要因により、最高のCAGRで成長すると予想されています。歯科感染症の有病率の上昇と口腔の健康に対する意識の高まりが、歯科処置の需要を促進しています。さらに、同地域の人口の多さと高齢化は、ヘルスケア支出の増加に大きく寄与しており、容易にアクセス可能で患者に優しい治療オプションの必要性を高めています。ヘルスケアインフラの改善、可処分所得の増加、歯科用麻酔薬の進歩もアジア太平洋の歯科用麻酔薬市場の成長を促進すると思われます。

当レポートでは、世界の歯科麻酔薬市場について調査し、薬剤タイプ別、投与経路別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 規制分析

- 業界動向

- 償還シナリオ

- 技術分析

- 2025年~2026年の主な会議とイベント

- 価格分析

- 貿易分析

- 特許分析

- バリューチェーン分析

- エコシステム分析

- サプライチェーン分析

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

- 隣接市場分析

- アンメットニーズ/エンドユーザーの期待

- AI/生成AIが歯科麻酔市場に与える影響

- 2025年の米国関税の影響- 概要

第6章 歯科麻酔薬市場(薬剤タイプ別)

- イントロダクション

- リドカイン

- メピバカイン

- アルティカイン

- ブピバカイン

- プリロカイン

- その他

第7章 歯科麻酔薬市場(投与経路別)

- イントロダクション

- 局所麻酔薬

- 注射麻酔薬

- 注射器

- 針

第8章 歯科麻酔薬市場(エンドユーザー別)

- イントロダクション

- 病院

- 歯科医院

- その他

第9章 歯科麻酔薬市場(地域別)

- イントロダクション

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- イタリア

- スペイン

- フランス

- 英国

- その他

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 韓国

- 日本

- 中国

- インド

- オーストラリア

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- アルゼンチン

- メキシコ

- その他

- 中東・アフリカ

- 市場拡大のため、サービスが行き届いていない地域への注目が高まる

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- 市場を活性化させるための公共キャンペーンや教育プログラムの増加

- GCC諸国のマクロ経済見通し

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- SEPTODONT HOLDING

- DENTSPLY SIRONA

- PIERREL

- HUONS GLOBAL

- NORMON

- DFL INDUSTRIA E COMERCIO S/A

- ULTRADENT PRODUCTS INC.

- PRIMEX PHARMACEUTICALS

- KEYSTONE INDUSTRIES

- CLARBEN LABORATORIES

- HIKMA PHARMACEUTICALS PLC

- ZEYCO

- NEW STETIC S.A.

- CETYLITE, INC.

- ICPA HEALTH PRODUCTS LIMITED

- その他の企業

- CENTRIX, INC.

- ZYMETH PHARMACEUTICAL

- DMG AMERICA LLC

- GC SHOWAYAKUHIN CORPORATION

- YOUNG INNOVATIONS, INC.

- CROSSTEX INTERNATIONAL, INC.

- MARK3(CARGUS INTERNATIONAL, INC.)

- J. MORITA CORP.

- KULZER GMBH

- INTEGRA LIFESCIENCES CORPORATION

第12章 付録

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 DENTAL ANESTHETICS MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 3 PROJECTED INCREASE IN NUMBER OF PEOPLE AGED OVER 65 YEARS, BY REGION, 2019 VS. 2050 (MILLION)

- TABLE 4 US: AVERAGE SPENDING BY PATIENTS ON COSMETIC DENTISTRY SERVICES, 2021 VS. 2022

- TABLE 5 US: RECENT DEALS BACKED BY PRIVATE EQUITY, 2020-2024

- TABLE 6 AVERAGE PROCEDURAL COST IN TOP TEN DENTAL TOURISM DESTINATIONS (USD)

- TABLE 7 DENTAL ANESTHETICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 DENTAL ANESTHETICS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 14 AVERAGE SELLING PRICE TREND OF INJECTABLE ANESTHETICS, BY REGION, 2023-2025 (USD)

- TABLE 15 INDICATIVE SELLING PRICE OF DENTAL ANESTHETICS, BY KEY PLAYER, 2024

- TABLE 16 IMPORT DATA FOR DENTAL ANESTHETICS (HS CODE: 300390), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 17 EXPORT DATA FOR DENTAL ANESTHETICS (HS CODE: 300390), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 18 LIST OF PATENTS IN DENTAL ANESTHETICS MARKET (2022-2024)

- TABLE 19 DENTAL ANESTHETICS MARKET: ROLE IN ECOSYSTEM

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF END USERS

- TABLE 21 KEY BUYING CRITERIA FOR END USERS

- TABLE 22 DENTAL ANESTHETICS MARKET: UNMET NEEDS

- TABLE 23 DENTAL ANESTHETICS MARKET: END-USER EXPECTATIONS

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR DENTAL PRODUCTS

- TABLE 26 DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 27 DENTAL ANESTHETICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 DENTAL ANESTHETICS MARKET FOR LIDOCAINE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 DENTAL ANESTHETICS MARKET FOR MEPIVACAINE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 DENTAL ANESTHETICS MARKET FOR ARTICAINE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 DENTAL ANESTHETICS MARKET FOR BUPIVACAINE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 DENTAL ANESTHETICS MARKET FOR PRILOCAINE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 DENTAL ANESTHETICS MARKET FOR OTHER DRUG TYPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 35 DENTAL ANESTHETICS MARKET FOR ROUTE OF ADMINISTRATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 TOPICAL ANESTHETICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 INJECTABLE ANESTHETICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 INJECTABLE ANESTHETICS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 39 SYRINGES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 NEEDLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 42 DENTAL ANESTHETICS MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 DENTAL ANESTHETICS MARKET FOR DENTAL CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 DENTAL ANESTHETICS MARKET FOR OTHER END USERS, BY COUNTRY 2023-2030 (USD MILLION)

- TABLE 45 DENTAL ANESTHETICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 EUROPE: DENTAL ANESTHETICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 EUROPE: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 48 EUROPE: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 49 EUROPE: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 50 GERMANY: DENTIST POPULATION, 2019-2022

- TABLE 51 GERMANY: KEY MACROECONOMIC INDICATORS FOR DENTAL ANESTHETICS MARKET

- TABLE 52 GERMANY: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 53 GERMANY: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 54 GERMANY: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 55 ITALY: KEY MACROECONOMIC INDICATORS FOR DENTAL ANESTHETICS MARKET

- TABLE 56 ITALY: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 57 ITALY: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 58 ITALY: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 59 SPAIN: KEY MACROECONOMIC INDICATORS FOR DENTAL ANESTHETICS MARKET

- TABLE 60 SPAIN: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 61 SPAIN: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 62 SPAIN: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 63 FRANCE: KEY MACROECONOMIC INDICATORS FOR DENTAL ANESTHETICS MARKET

- TABLE 64 FRANCE: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 65 FRANCE: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 66 FRANCE: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 67 UK: KEY MACROECONOMIC INDICATORS FOR DENTAL ANESTHETICS MARKET

- TABLE 68 UK: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 69 UK: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 70 UK: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 71 REST OF EUROPE: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 72 REST OF EUROPE: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 73 REST OF EUROPE: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 74 US: DENTAL EXPENDITURE, 2014-2023 (USD BILLION)

- TABLE 75 NORTH AMERICA: DENTAL ANESTHETICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 79 US: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 80 US: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 81 US: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 82 CANADA: KEY MACROECONOMIC INDICATORS FOR DENTAL ANESTHETICS MARKET

- TABLE 83 CANADA: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 84 CANADA: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 85 CANADA: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 86 ASIA PACIFIC: DENTAL ANESTHETICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 ASIA PACIFIC: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 90 SOUTH KOREA: FOREIGN PATIENTS VISITING DENTAL FACILITIES, 2017-2021

- TABLE 91 SOUTH KOREA: KEY MACROECONOMIC INDICATORS FOR DENTAL ANESTHETICS MARKET

- TABLE 92 SOUTH KOREA: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 93 SOUTH KOREA: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 94 SOUTH KOREA: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 95 JAPAN: KEY MACROECONOMIC INDICATORS FOR DENTAL ANESTHETICS MARKET

- TABLE 96 JAPAN: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 97 JAPAN: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 98 JAPAN: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 99 CHINA: KEY MACROECONOMIC INDICATORS FOR DENTAL ANESTHETICS MARKET

- TABLE 100 CHINA: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 101 CHINA: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 102 CHINA: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 103 INDIA: KEY MACROECONOMIC INDICATORS FOR DENTAL ANESTHETICS MARKET

- TABLE 104 INDIA: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 105 INDIA: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 106 INDIA: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 107 AUSTRALIA: MACROECONOMIC INDICATORS FOR DENTAL ANESTHETICS MARKET

- TABLE 108 AUSTRALIA: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 109 AUSTRALIA: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 110 AUSTRALIA: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 114 LATIN AMERICA: DENTAL ANESTHETICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 115 LATIN AMERICA: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 116 LATIN AMERICA: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 117 LATIN AMERICA: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 118 BRAZIL: KEY MACROECONOMIC INDICATORS FOR DENTAL ANESTHETICS MARKET

- TABLE 119 BRAZIL: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 120 BRAZIL: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 121 BRAZIL: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 122 ARGENTINA: KEY MACROECONOMIC INDICATORS FOR DENTAL ANESTHETICS MARKET

- TABLE 123 ARGENTINA: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 124 ARGENTINA: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 125 ARGENTINA: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 126 MEXICO: KEY MACROECONOMIC INDICATORS FOR DENTAL ANESTHETICS MARKET

- TABLE 127 MEXICO: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 128 MEXICO: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 129 MEXICO: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 130 REST OF LATIN AMERICA: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 131 REST OF LATIN AMERICA: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 132 REST OF LATIN AMERICA: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 136 GCC COUNTRIES: DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2023- 2030 (USD MILLION)

- TABLE 137 GCC COUNTRIES: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

- TABLE 138 GCC COUNTRIES: DENTAL ANESTHETICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 139 STRATEGIES ADOPTED BY KEY PLAYERS IN DENTAL ANESTHETICS MARKET, JANUARY 2021-MARCH 2025

- TABLE 140 DENTAL ANESTHETICS MARKET: DEGREE OF COMPETITION

- TABLE 141 DENTAL ANESTHETICS MARKET: REGION FOOTPRINT

- TABLE 142 DENTAL ANESTHETICS MARKET: DRUG TYPE FOOTPRINT

- TABLE 143 DENTAL ANESTHETICS MARKET: ROUTE OF ADMINISTRATION FOOTPRINT

- TABLE 144 DENTAL ANESTHETICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 145 DENTAL ANESTHETICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 146 DENTAL ANESTHETICS MARKET: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 147 DENTAL ANESTHETICS MARKET: DEALS, JANUARY 2021-MARCH 2025

- TABLE 148 DENTAL ANESTHETICS MARKET: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 149 DENTAL ANESTHETICS MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 150 SEPTODONT HOLDING: COMPANY OVERVIEW

- TABLE 151 SEPTODONT HOLDING: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 152 SEPTODONT HOLDING: PRODUCTS LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 153 SEPTODONT HOLDING: DEALS, JANUARY 2021-MARCH 2025

- TABLE 154 SEPTODONT HOLDING: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 155 DENTSPLY SIRONA: COMPANY OVERVIEW

- TABLE 156 DENTSPLY SIRONA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 157 DENTSPLY SIRONA: DEALS, JANUARY 2021-MARCH 2025

- TABLE 158 PIERREL: COMPANY OVERVIEW

- TABLE 159 PIERREL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 160 PIERREL: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 161 PIERREL: DEALS, JANUARY 2021-MARCH 2025

- TABLE 162 HUONS GLOBAL: COMPANY OVERVIEW

- TABLE 163 HUONS GLOBAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 164 HUONS GLOBAL: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 165 HUONS GLOBAL: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 166 NORMON: COMPANY OVERVIEW

- TABLE 167 NORMON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 168 DFL INDUSTRIA E COMERCIO S/A: COMPANY OVERVIEW

- TABLE 169 DFL INDUSTRIA E COMERCIO S/A: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 170 ULTRADENT PRODUCTS INC.: COMPANY OVERVIEW

- TABLE 171 ULTRADENT PRODUCTS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 172 ULTRADENT PRODUCTS INC.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 173 ULTRADENT PRODUCTS INC.: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 174 ULTRADENT PRODUCTS INC.: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 175 PRIMEX PHARMACEUTICALS: COMPANY OVERVIEW

- TABLE 176 PRIMEX PHARMACEUTICALS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 177 KEYSTONE INDUSTRIES: COMPANY OVERVIEW

- TABLE 178 KEYSTONE INDUSTRIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 179 CLARBEN LABORATORIES: COMPANY OVERVIEW

- TABLE 180 CLARBEN LABORATORIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 181 HIKMA PHARMACEUTICALS PLC: COMPANY OVERVIEW

- TABLE 182 HIKMA PHARMACEUTICALS PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 183 ZEYCO: COMPANY OVERVIEW

- TABLE 184 ZEYCO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 185 NEW STETIC S.A.: COMPANY OVERVIEW

- TABLE 186 NEW STETIC S.A.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 187 CETYLITE, INC.: COMPANY OVERVIEW

- TABLE 188 CETYLITE, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 189 ICPA HEALTH PRODUCTS LIMITED: COMPANY OVERVIEW

- TABLE 190 ICPA HEALTH PRODUCTS LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 191 CENTRIX, INC.: COMPANY OVERVIEW

- TABLE 192 ZYMETH PHARMACEUTICAL: COMPANY OVERVIEW

- TABLE 193 DMG AMERICA LLC: COMPANY OVERVIEW

- TABLE 194 GC SHOWAYAKUHIN CORPORATION: COMPANY OVERVIEW

- TABLE 195 YOUNG INNOVATIONS, INC.: COMPANY OVERVIEW

- TABLE 196 CROSSTEX INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 197 MARK3 (CARGUS INTERNATIONAL, INC.): COMPANY OVERVIEW

- TABLE 198 J. MORITA CORP.: COMPANY OVERVIEW

- TABLE 199 KULZER GMBH: COMPANY OVERVIEW

- TABLE 200 INTEGRA LIFESCIENCES CORPORATION: COMPANY OVERVIEW

List of Figures

- FIGURE 1 DENTAL ANESTHETICS MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: SEPTODONT HOLDING

- FIGURE 9 SUPPLY-SIDE MARKET SIZE ESTIMATION: DENTAL ANESTHETICS MARKET (2024)

- FIGURE 10 BOTTOM-UP APPROACH

- FIGURE 11 TOP-DOWN APPROACH

- FIGURE 12 CAGR PROJECTIONS FROM DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES ANALYSIS (2025-2030)

- FIGURE 13 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 14 DATA TRIANGULATION METHODOLOGY

- FIGURE 15 DENTAL ANESTHETICS MARKET, BY DRUG TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 DENTAL ANESTHETICS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 GEOGRAPHIC SNAPSHOT OF DENTAL ANESTHETICS MARKET

- FIGURE 19 RISING INCIDENCE OF DENTAL DISEASES TO DRIVE MARKET

- FIGURE 20 INJECTABLE ANESTHETICS SEGMENT IN SOUTH KOREA LED ASIA PACIFIC MARKET IN 2024

- FIGURE 21 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 ASIA PACIFIC REGION TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 23 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 24 DENTAL ANESTHETICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 UK: PROJECTED NUMBER OF ADULTS (16 YEARS AND OLDER) WITH DENTAL CARIES, 2020-2050 (MILLION)

- FIGURE 26 DENTAL ANESTHETICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR DENTAL ANESTHETICS MARKET (JANUARY 2014-DECEMBER 2024)

- FIGURE 28 TOP PATENT APPLICANT COUNTRIES FOR DENTAL ANESTHETICS (JANUARY 2014-DECEMBER 2024)

- FIGURE 29 DENTAL ANESTHETICS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 DENTAL ANESTHETICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 DENTAL ANESTHETICS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 32 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES IN DENTAL ANESTHETICS MARKET

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF END USERS

- FIGURE 34 KEY BUYING CRITERIA FOR END USERS

- FIGURE 35 DENTAL ANESTHETICS MARKET: ADJACENT MARKET ANALYSIS

- FIGURE 36 DENTAL ANESTHETICS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 37 EUROPE: DENTAL ANESTHETICS MARKET SNAPSHOT

- FIGURE 38 NORTH AMERICA: DENTAL ANESTHETICS MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: DENTAL ANESTHETICS MARKET SNAPSHOT

- FIGURE 40 MARKET SHARE ANALYSIS OF KEY PLAYERS IN DENTAL ANESTHETICS MARKET (2024)

- FIGURE 41 DENTAL ANESTHETICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 DENTAL ANESTHETICS MARKET: COMPANY FOOTPRINT

- FIGURE 43 DENTAL ANESTHETICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 EV/EBITDA OF KEY VENDORS

- FIGURE 45 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 46 DENTAL ANESTHETICS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 47 DENTSPLY SIRONA: COMPANY SNAPSHOT

- FIGURE 48 HUONS GLOBAL: COMPANY SNAPSHOT

- FIGURE 49 HIKMA PHARMACEUTICALS PLC: COMPANY SNAPSHOT

The global dental anesthetics market is projected to reach USD 1.80 billion by 2030 from USD 1.48 billion in 2025, at a CAGR of 4.0% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Drug Type, Route of Administration, End User, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The global market for dental anesthetics is expanding due to a rising incidence of dental issues, which has led to an increase in dental procedures. Furthermore, there is greater awareness of the importance of oral health and cosmetic dentistry, prompting more individuals to seek dental treatments. Improved income levels and enhanced healthcare infrastructure in many regions make dental care more accessible. Additionally, the growing elderly population is expected to drive up demand for these services. However, during the projected period, challenges such as a shortage of dental practitioners and limited insurance coverage for dental procedures may hinder market growth to some extent.

"Articaine is expected to grow at the highest CAGR during the forecast period."

Articaine is projected to experience the highest CAGR during the forecast period due to its numerous advantages over other types of anesthetics. Unlike other amide anesthetics that contain a benzene ring, articaine features a thiophene ring, which leads to increased lipid solubility and improved penetration into tissues and nerve membranes. This enhanced diffusion through both hard and soft tissues makes articaine particularly effective for mandibular infiltrations, where nerve blocks are often required with other anesthetics. Consequently, dentists find that articaine performs better in areas with dense bone structures. Additionally, various studies have confirmed its safety profile when used appropriately, even among elderly and pediatric patient populations. These advantages contribute to the growing popularity of articaine and support its market expansion.

"The topical anesthetics segment is expected to grow at the highest CAGR in the dental anesthetics market, by route of administration."

The topical anesthetics market is projected to experience the highest growth in the dental anesthetics market, driven by their widespread use in standard procedures, ease of application, non-invasiveness, and ability to provide quick surface anesthesia. Dentists increasingly utilize new technologies such as gels, metered-dose sprays, and patches. Additionally, the introduction of needle-free anesthesia and the availability of topical anesthetics in various flavors contribute to their increased adoption. Although topical anesthetics are limited by their short duration of action, their reliability and broad range of applications continue to fuel market growth.

"Based on end users, the dental clinics segment is expected to dominate the dental anesthetics market during the forecast period."

The demand for dental anesthetics is primarily driven by the growth of dental clinics in developing regions of Latin America and the Asia Pacific. As dental services become more accessible in countries such as Vietnam, Indonesia, and India, a greater number of patients are seeking surgeries that require effective pain management. Key factors contributing to the expansion of dental clinics include rising incomes among the middle class, urbanization, and an increasing awareness of oral health. Consequently, there is a growing need for reliable topical and local anesthetics, as more dental clinics now offer restorative and cosmetic procedures.

"The Asia Pacific is expected to register the highest CAGR in the dental anesthetics market during the forecast period."

The dental anesthetics market in the Asia Pacific region is expected to grow at the highest CAGR due to several factors that reflect the changing landscape of healthcare. The rising prevalence of dental infections and greater awareness of oral health drive the demand for dental procedures. Additionally, the region's large and aging population significantly contributes to increased healthcare spending, which boosts the need for easily accessible and patient-friendly treatment options. Improvements in healthcare infrastructure, higher disposable incomes, and advancements in dental anesthetics will also likely fuel growth in the Asia Pacific dental anesthetics market.

A summary of the main supply-side participants in the dental anesthetics market is provided below for this report:

- By Company Type: Tier 1 (35%), Tier 2 (40%), and Tier 3 (25%)

- By Designation: C-level Executives (20%), D-level Executives (35%), and Others (45%)

- By Region: North America (25%), Europe (23%), Asia Pacific (28%), Latin America (17%), Middle East & Africa (7%)

The prominent players in the global dental anesthetics market are Septodont Holding (France), DENTSPLY SIRONA (US), Pierrel (Italy), Huons Global (South Korea), Normon (Spain), DFL Industria e Comercio S/A (Brazil), Ultradent Products Inc. (US), Hikma Pharmaceuticals Plc (UK), Clarben Laboratories (Spain), New Stetic S.A (Colombia), Primex Pharmaceuticals (Switzerland), Keystone Industries (US), Centrix, Inc. (US), GC SHOWAYAKUHIN CORPORATION (Japan), DMG America LLC (US), Zeyco (Mexico), Zymeth Pharmaceutical (India), Cetylite, Inc. (US), ICPA Health Products Limited (India), Crosstex International, Inc. (US), Young Innovations, Inc. (US), Mark3 (Cargus International, Inc.) (US), J.Morita Corp. (Japan), Kulzer GmbH (Germany), and Integra Lifesciences Corporation (US).

Research Coverage

The market study focuses on the dental anesthetics market across various segments. Its purpose is to estimate the market size and growth potential across different categories, including drug type, route of administration, end user, and geographic region. Additionally, the study includes a comprehensive competitive analysis of the key players in the market, along with their company profiles. This analysis features important observations regarding their product offerings, recent developments, and key strategies in the market.

Reasons to Buy the Report

The report provides valuable information for market leaders and new entrants in the dental anesthetics market, offering approximate revenue figures for both the overall market and its subsegments. It enables stakeholders to understand the competitive landscape, which can help them better position their businesses and develop effective go-to-market strategies. Additionally, the report offers insights into the current state of the market, including critical drivers, restraints, challenges, and opportunities.

This report provides insights on the following pointers:

- Analysis of key drivers (increasing patient pool for dental treatments, increasing demand for advanced cosmetic dental procedures, and technological advancements in anesthetic delivery), restraints (potential adverse effects), opportunities (rising number of DSOs and growing private equity investments, emerging markets, and growing dental tourism) and challenges (dearth of trained dental practitioners and needle phobia).

- Market Penetration: Comprehensive information on product portfolios offered by the top players in the global dental anesthetics market. The report analyzes this market by drug type, route of administration, end user, and region.

- Product Enhancement/Innovation: Detailed insights on upcoming trends and product launches in the global dental anesthetics market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by drug type, route of administration, end user, and region.

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of leading players in the global dental anesthetics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 DENTAL ANESTHETICS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION AND COUNTRY (2024)

- 4.3 DENTAL ANESTHETICS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 DENTAL ANESTHETICS MARKET: REGIONAL MIX

- 4.5 DENTAL ANESTHETICS MARKET: EMERGING ECONOMIES VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing patient pool for dental treatments

- 5.2.1.1.1 Dental caries and other dental disorders

- 5.2.1.1.2 Geriatric population and edentulism

- 5.2.1.1.3 Periodontal diseases

- 5.2.1.1.4 Changing lifestyles and unhealthy food habits

- 5.2.1.2 Increasing demand for advanced cosmetic dental procedures

- 5.2.1.3 Technological advancements in anesthetic delivery

- 5.2.1.1 Increasing patient pool for dental treatments

- 5.2.2 RESTRAINTS

- 5.2.2.1 Potential adverse effects

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising number of DSOs and growing private equity investments

- 5.2.3.2 Emerging markets

- 5.2.3.3 Growing dental tourism

- 5.2.4 CHALLENGES

- 5.2.4.1 Dearth of trained dental practitioners

- 5.2.4.2 Needle phobia

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 THREAT OF NEW ENTRANTS

- 5.4 REGULATORY ANALYSIS

- 5.4.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4.2 REGULATORY LANDSCAPE

- 5.5 INDUSTRY TRENDS

- 5.5.1 METERED SPRAY SYSTEMS

- 5.5.2 JET INJECTION SYSTEMS

- 5.6 REIMBURSEMENT SCENARIO

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Vasoconstrictors

- 5.7.1.2 Buffering agents

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Computer-controlled local anesthetic delivery (CCLAD) systems

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Reversal agents

- 5.7.1 KEY TECHNOLOGIES

- 5.8 KEY CONFERENCES & EVENTS, 2025-2026

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND OF INJECTABLE ANESTHETICS, BY REGION

- 5.9.2 INDICATIVE SELLING PRICE OF DENTAL ANESTHETICS, BY KEY PLAYER

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA FOR DENTAL ANESTHETICS (HS CODE: 300390), 2020-2024

- 5.10.2 EXPORT DATA FOR DENTAL ANESTHETICS (HS CODE: 300390), 2020-2024

- 5.11 PATENT ANALYSIS

- 5.11.1 PATENT PUBLICATION TRENDS FOR DENTAL ANESTHETICS

- 5.11.2 JURISDICTION ANALYSIS: TOP APPLICANTS FOR PATENTS IN DENTAL ANESTHETICS MARKET

- 5.12 VALUE CHAIN ANALYSIS

- 5.13 ECOSYSTEM ANALYSIS

- 5.14 SUPPLY CHAIN ANALYSIS

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 CASE STUDY 1: ORAQIX TOPICAL ANESTHETIC SIGNIFICANTLY REDUCED PAIN DURING SRP, ENHANCING COMFORT AND PATIENT ACCEPTANCE OF PERIODONTAL THERAPY

- 5.15.2 CASE STUDY 2: PROCAINE HYDROCHLORIDE PROVIDES SAFE DENTAL ANESTHESIA FOR PATIENT WITH LIDOCAINE ALLERGIES AND SEVERE PHOBIA

- 5.15.3 CASE STUDY 3: COMPUTERIZED ANESTHESIA SYSTEM AND PATIENT EDUCATION REDUCE DENTAL ANXIETY IN EXTRACTION PROCEDURES

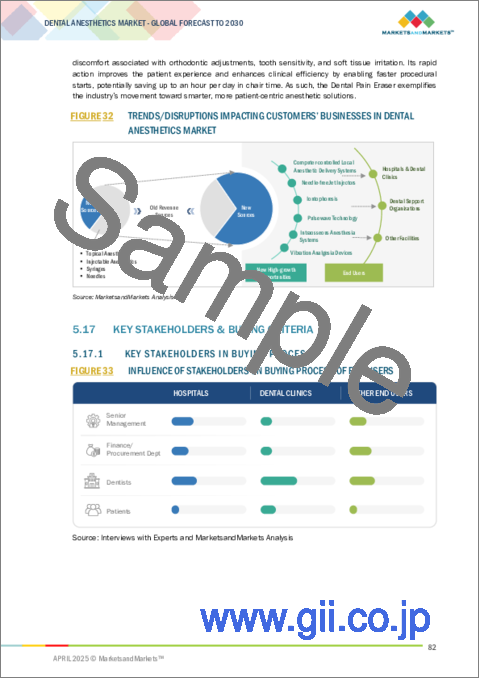

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 ADJACENT MARKET ANALYSIS

- 5.19 UNMET NEEDS/END-USER EXPECTATIONS

- 5.20 IMPACT OF AI/GENERATIVE AI ON DENTAL ANESTHETICS MARKET

- 5.21 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON END-USER INDUSTRIES

6 DENTAL ANESTHETICS MARKET, BY DRUG TYPE

- 6.1 INTRODUCTION

- 6.2 LIDOCAINE

- 6.2.1 RAPID ONSET AND VERSATILE FORMULATIONS TO DRIVE MARKET

- 6.3 MEPIVACAINE

- 6.3.1 UPTAKE IN PEDIATRIC & GERIATRIC POPULATIONS TO FUEL MARKET

- 6.4 ARTICAINE

- 6.4.1 IDEAL CHOICE FOR EXTENDED SURGICAL PROCEDURES TO PROPEL MARKET

- 6.5 BUPIVACAINE

- 6.5.1 PROVISION OF EFFECTIVE POST-OPERATIVE PAIN RELIEF TO SUPPORT MARKET GROWTH

- 6.6 PRILOCAINE

- 6.6.1 LOWER TOXICITY PROFILE TO FUEL UPTAKE

- 6.7 OTHER DRUG TYPES

7 DENTAL ANESTHETICS MARKET, BY ROUTE OF ADMINISTRATION

- 7.1 INTRODUCTION

- 7.2 TOPICAL ANESTHETICS

- 7.2.1 GROWING PATIENT PREFERENCE FOR NEEDLE-FREE ALTERNATIVES TO BOOST DEMAND

- 7.3 INJECTABLE ANESTHETICS

- 7.3.1 HIGH PRECISION AND EFFECTIVENESS TO PROPEL MARKET

- 7.4 SYRINGES

- 7.4.1 ADVANCEMENTS IN SYRINGE DESIGN TO FUEL MARKET

- 7.5 NEEDLES

- 7.5.1 RISING FOCUS ON INFECTION CONTROL AND PATIENT COMFORT TO SUPPORT MARKET GROWTH

8 DENTAL ANESTHETICS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 ABILITY TO PURCHASE ADVANCED DENTISTRY EQUIPMENT TO DRIVE MARKET

- 8.3 DENTAL CLINICS

- 8.3.1 RISING DEMAND FOR COSMETIC & RESTORATIVE DENTAL PROCEDURES TO PROPEL MARKET

- 8.4 OTHER END USERS

9 DENTAL ANESTHETICS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 EUROPE

- 9.2.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.2.2 GERMANY

- 9.2.2.1 Favorable government policies for reimbursement to expedite growth

- 9.2.3 ITALY

- 9.2.3.1 Rising adoption of digital dentistry techniques to augment growth

- 9.2.4 SPAIN

- 9.2.4.1 Presence of well-established dental healthcare infrastructure to foster growth

- 9.2.5 FRANCE

- 9.2.5.1 Favorable distribution network and reimbursement scenario to aid growth

- 9.2.6 UK

- 9.2.6.1 Booming geriatric population to stimulate growth

- 9.2.7 REST OF EUROPE

- 9.3 NORTH AMERICA

- 9.3.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.3.2 US

- 9.3.2.1 High per capita income and quality of treatment to support growth

- 9.3.3 CANADA

- 9.3.3.1 Rising healthcare expenditure to sustain growth

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 SOUTH KOREA

- 9.4.2.1 Growing elderly population to fuel market

- 9.4.3 JAPAN

- 9.4.3.1 Surge in age-related dental issues to promote growth

- 9.4.4 CHINA

- 9.4.4.1 Shift in demographic trend to accelerate growth

- 9.4.5 INDIA

- 9.4.5.1 Growing cosmetic dentistry sector to fuel market

- 9.4.6 AUSTRALIA

- 9.4.6.1 Increasing access to dental services to favor growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Booming dental tourism to contribute to growth

- 9.5.3 ARGENTINA

- 9.5.3.1 Growing focus on oral health to propel market

- 9.5.4 MEXICO

- 9.5.4.1 Affordable dental care costs to amplify growth

- 9.5.5 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GROWING FOCUS ON UNDERSERVED AREAS TO BOOST MARKET

- 9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 INCREASING NUMBER OF PUBLIC CAMPAIGNS AND EDUCATION PROGRAMS TO DRIVE MARKET

- 9.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN DENTAL ANESTHETICS MARKET

- 10.3 MARKET SHARE ANALYSIS

- 10.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.4.1 STARS

- 10.4.2 EMERGING LEADERS

- 10.4.3 PERVASIVE PLAYERS

- 10.4.4 PARTICIPANTS

- 10.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.4.5.1 Company footprint

- 10.4.5.2 Region footprint

- 10.4.5.3 Drug type footprint

- 10.4.5.4 Route of administration footprint

- 10.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 RESPONSIVE COMPANIES

- 10.5.3 DYNAMIC COMPANIES

- 10.5.4 STARTING BLOCKS

- 10.5.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.5.5.1 Detailed list of key startups/SMEs

- 10.5.5.2 Competitive benchmarking of key startups/SMEs

- 10.6 COMPANY VALUATION & FINANCIAL METRICS

- 10.6.1 FINANCIAL METRICS

- 10.6.2 COMPANY VALUATION

- 10.7 BRAND/PRODUCT COMPARISON

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 PRODUCT LAUNCHES

- 10.8.2 DEALS

- 10.8.3 EXPANSIONS

- 10.8.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SEPTODONT HOLDING

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Services/Solutions offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 DENTSPLY SIRONA

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Services/Solutions offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 PIERREL

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Services/Solutions offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 HUONS GLOBAL

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Services/Solutions offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Expansions

- 11.1.4.3.2 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 NORMON

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Services/Solutions offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses & competitive threats

- 11.1.6 DFL INDUSTRIA E COMERCIO S/A

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Services/Solutions offered

- 11.1.7 ULTRADENT PRODUCTS INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Services/Solutions offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.3.2 Expansions

- 11.1.7.3.3 Other developments

- 11.1.8 PRIMEX PHARMACEUTICALS

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Services/Solutions offered

- 11.1.9 KEYSTONE INDUSTRIES

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Services/Solutions offered

- 11.1.10 CLARBEN LABORATORIES

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Services/Solutions offered

- 11.1.11 HIKMA PHARMACEUTICALS PLC

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Services/Solutions offered

- 11.1.12 ZEYCO

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Services/Solutions offered

- 11.1.13 NEW STETIC S.A.

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Services/Solutions offered

- 11.1.14 CETYLITE, INC.

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Services/Solutions offered

- 11.1.15 ICPA HEALTH PRODUCTS LIMITED

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Services/Solutions offered

- 11.1.1 SEPTODONT HOLDING

- 11.2 OTHER PLAYERS

- 11.2.1 CENTRIX, INC.

- 11.2.2 ZYMETH PHARMACEUTICAL

- 11.2.3 DMG AMERICA LLC

- 11.2.4 GC SHOWAYAKUHIN CORPORATION

- 11.2.5 YOUNG INNOVATIONS, INC.

- 11.2.6 CROSSTEX INTERNATIONAL, INC.

- 11.2.7 MARK3 (CARGUS INTERNATIONAL, INC.)

- 11.2.8 J. MORITA CORP.

- 11.2.9 KULZER GMBH

- 11.2.10 INTEGRA LIFESCIENCES CORPORATION

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS