|

|

市場調査レポート

商品コード

1727398

極低温バルブアセンブリの世界市場:構成材料別、システムタイプ別、タイプ別、コンポーネント別、冷却剤別、エンドユーザー業界別、用途別、地域別 - 2029年までの予測Cryogenic Valve Assembly Market by Type (Gate, Globe, Ball, Check, Butterfly), Cryogen (Nitrogen, Argon, Oxygen, LNG, Hydrogen), End-user Industry (Metallurgy, Power, Chemicals, Electronics), Component, Application, and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 極低温バルブアセンブリの世界市場:構成材料別、システムタイプ別、タイプ別、コンポーネント別、冷却剤別、エンドユーザー業界別、用途別、地域別 - 2029年までの予測 |

|

出版日: 2025年05月06日

発行: MarketsandMarkets

ページ情報: 英文 277 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

極低温バルブアセンブリの市場規模は、2024年の48億3,000万米ドルから2029年には72億1,000万米ドルに達すると予測され、予測期間中のCAGRは8.3%と見込まれています。

医療、食品保存、電子機器製造における極低温ガスへの取り組みの増加が、極低温バルブアセンブリ市場を牽引しています。よりクリーンな代替燃料としてのLNGに対する世界全体の需要の増加とLNGの輸出入の増加が市場成長を促進します。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント | 構成材料別、システムタイプ別、タイプ別、コンポーネント別、冷却剤別、エンドユーザー業界別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

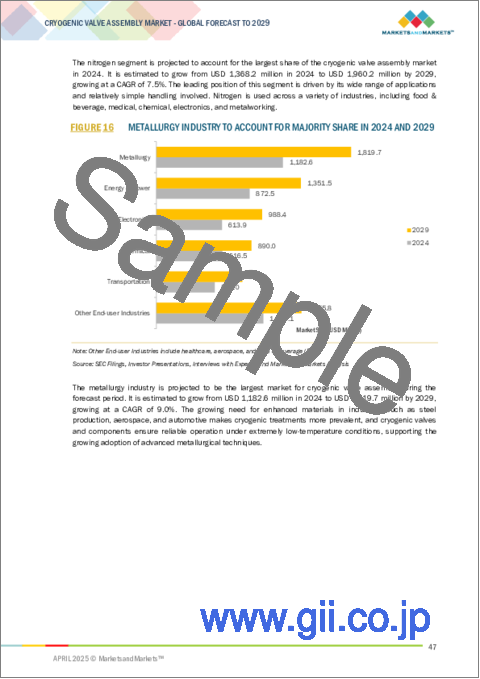

極低温バルブアセンブリ市場は、エンドユーザー産業別に、エネルギー・電力、化学、冶金、エレクトロニクス、輸送の5つのカテゴリーに分類されました。エンドユーザー別では、冶金産業が最大シェアを占めると予想されています。酸素(O2)、窒素(N2)、アルゴン(Ar)などの極低温ガスは、製鉄、溶接、加工などの冶金プロセスで広く使用されていることから、これらのガスは製品品質の向上、燃焼効率の改善、金属加工時の温度制御において重要です。建設、自動車、工業用金属製品など、高品質の金属を製造する部門からの需要が増加しているため、信頼性の高い極低温バルブアセンブリの必要性が高まっています。インフラ開発と金属のより高度な治療の大幅な増加も、セグメントの成長を増加させる。

用途別では、極低温バルブアセンブリ市場はCASUと非CASUにセグメント化されています。極低温空気分離ユニット(CASU)セグメントは、特に酸素、窒素、アルゴンなどの高純度産業ガスの生成における極低温バルブの重要性により、極低温バルブアセンブリ市場を独占すると予測されています。前述のガスは、ヘルスケアや医療用途、冶金、エレクトロニクス、化学用途など、多くの産業で使用されています。パンデミック以降、医療用酸素の需要も著しく伸びており、新興国市場における工業生産と工業化の度合いの向上とともに、CASU設備の需要をさらに高めています。極低温バルブは、極低温ガスのユニットへの流れを制御し隔離するために使用され、極低温バルブを利用するこれらの施設で使用されます。

最終用途別では、極低温バルブアセンブリ市場は、その他を除いて、ゲートバルブ、グローブバルブ、ボールバルブ、チェックバルブ、バタフライバルブにセグメント化されています。グローブバルブは、極低温用途における正確な絞り機能と効果的な流量調整機能により、極低温バルブアセンブリのタイプで2番目に大きいと推定されています。その堅牢な設計は、高圧、低温条件下での信頼性の高い性能を保証し、LNG、工業ガス、化学産業にとって理想的なものとなっています。流量制御システムに対する需要の高まりが、この製品の成長をさらに後押ししています。

北米は2024年から2029年の間に極低温バルブアセンブリ市場で2番目に急成長する地域になると予測されています。北米市場は米国、カナダ、メキシコで構成されます。北米は、強力なLNGインフラ、炭素回収や水素などのクリーンエネルギー技術への投資の増加、航空宇宙、ヘルスケア、化学の重要なプレーヤーにより、極低温バルブアセンブリ市場で2番目に急成長する地域になると予測されています。また、医療技術の継続的な改善や、手術・診断現場での極低温ガス量の増加も、極低温需要に好影響を与えると思われます。さらに、米国政府がエネルギー供給の多様化に力を入れ、天然ガスの輸出増加を認めていることも、この地域の市場ポテンシャル向上に特に役立つと思われます。主要メーカーもこの地域に立地しており、産業ガスサプライチェーンのアップグレードは、極低温バルブアセンブリの採用と受容性の両方をさらに促進するのに役立つと思われます。

当レポートでは、極低温バルブアセンブリ市場を様々な地域について、システムタイプ別、タイプ別、コンポーネント別、冷却剤別、エンドユーザー業界別、用途別、地域別に定義、記述、予測しています。また、市場の詳細な質的・量的分析も行っています。主な市場促進要因・抑制要因・機会・課題を包括的にレビューしています。また、市場の様々な重要な側面もカバーしています。これらには、競合情勢、市場力学、金額ベースの市場推定、極低温バルブアセンブリ市場の将来動向などの分析が含まれます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- サプライチェーン分析

- エコシステム分析

- 技術分析

- ケーススタディ分析

- 特許分析

- 価格分析

- 貿易分析

- 2024年~2025年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 投資と資金調達のシナリオ

- 極低温バルブアセンブリ市場のマクロ経済見通し

第6章 極低温バルブアセンブリ市場、構成材料別(定性)

- イントロダクション

- ステンレス鋼

- ニッケル合金

- ステライト

- ポリテトラフルオロエチレン(PTFE)

- ポリクロロトリフルオロエチレン(PCTFE)

- 黒鉛

第7章 極低温バルブアセンブリ市場、システムタイプ別(定性)

- イントロダクション

- ストレージシステム

- ハンドリングシステム

- 供給システム

- その他

第8章 極低温バルブアセンブリ市場、タイプ別

- イントロダクション

- ゲートバルブ

- グローブバルブ

- ボールバルブ

- チェックバルブ

- バタフライバルブ

- その他

第9章 極低温バルブアセンブリ市場、コンポーネント別

- イントロダクション

- バルブボディ

- シート

- シール

- ガスケット

- バックアップリング

- パイプスリーブ

- スペーサー

- ベアリング

- ギア

- アクチュエータ

- ボンネット

- ディスク/プラグ

- ステム

- スロットルプレート

- その他の

第10章 極低温バルブアセンブリ市場、冷却剤別

- イントロダクション

- 窒素

- アルゴン

- 酸素

- LNG

- 水素

- その他

第11章 極低温バルブアセンブリ市場、エンドユーザー業界別

- イントロダクション

- 冶金

- エネルギーと電力

- 化学薬品

- エレクトロニクス

- 輸送

- その他

第12章 極低温バルブアセンブリ市場、用途別

- イントロダクション

- 極低温空気分離ユニット(CASU)

- 非極低温空気分離ユニット(NON-CASU)

第13章 極低温バルブアセンブリ市場、地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- オーストラリア

- 日本

- マレーシア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ロシア

- 英国

- ドイツ

- フランス

- その他

- 中東

- GCC諸国

- 中東

- アフリカ

- 南アフリカ

- ナイジェリア

- アルジェリア

- その他

- 南米

- ブラジル

- アルゼンチン

- ベネズエラ

- その他

第14章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2024年

- 2023年の市場シェア分析

- 収益分析、2020年~2024年

- ブランド/製品比較

- 企業評価と財務指標、2024年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第15章 企業プロファイル

- 主要参入企業

- PARKER HANNIFIN CORP

- EMERSON ELECTRIC CO.

- FLOWSERVE CORPORATION

- CRANE COMPANY

- VALMET

- VELAN

- BAKER HUGHES

- KITZ CORPORATION

- BRAY INTERNATIONAL

- BAC VALVES

- CRYOCOMP

- SLB

- L&T VALVES LIMITED

- POWELL VALVES

- HABONIM

- HEROSE

- その他の企業

- SAMSON AKTIENGESELLSCHAFT

- VALCO GROUP

- OSWAL INDUSTRIES LIMITED

- MAVERICK VALVES

- CRYOGENIC SPECIALTY MANUFACTURING

- ROCHELLES TECHNOMATICS INDIA PVT. LTD

- XHVAL GROUP VALVE CO., LTD.

- XINTAI VALVE

- MECA-INOX

第16章 付録

List of Tables

- TABLE 1 CRYOGENIC VALVE ASSEMBLY MARKET SNAPSHOT

- TABLE 2 ROLE OF COMPANIES IN CRYOGENIC VALVE ASSEMBLY ECOSYSTEM

- TABLE 3 LIST OF MAJOR PATENTS, 2021-2024

- TABLE 4 AVERAGE SELLING PRICE TREND OF CRYOGENIC VALVE ASSEMBLY MARKET, BY TYPE, 2023-2029 (USD)

- TABLE 5 INDICATIVE PRICING TREND OF CRYOGENIC VALVE ASSEMBLY, BY REGION, 2023-2029 (USD)

- TABLE 6 EXPORT DATA FOR HS CODE 280430, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 7 IMPORT DATA FOR HS CODE 280430, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 8 EXPORT DATA FOR HS CODE 280421, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 9 IMPORT DATA FOR HS CODE 280421, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 280440, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 11 IMPORT DATA FOR HS CODE 280440, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR HS CODE 271111, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 13 IMPORT DATA FOR HS CODE 271111, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR HS CODE 280410, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 15 IMPORT DATA FOR HS CODE 280410, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 16 CRYOGENIC VALVE ASSEMBLY MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 CRYOGENIC VALVE ASSEMBLY MARKET: REGULATORY FRAMEWORKS

- TABLE 23 CRYOGENIC VALVE ASSEMBLY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USER INDUSTRIES

- TABLE 25 KEY BUYING CRITERIA FOR KEY END-USER INDUSTRIES

- TABLE 26 CRYOGENIC VALVE ASSEMBLY MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 27 GATE VALVE ASSEMBLY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 28 GLOBE VALVE ASSEMBLY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 29 BALL VALVE ASSEMBLY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 30 CHECK VALVE ASSEMBLY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 31 BUTTERFLY VALVE ASSEMBLY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 32 OTHER CRYOGENIC VALVE ASSEMBLY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 33 CRYOGENIC VALVE ASSEMBLY MARKET, BY COMPONENT, 2022-2029 (USD MILLION)

- TABLE 34 CRYOGENIC VALVE ASSEMBLY MARKET, BY CRYOGEN, 2022-2029 (USD MILLION)

- TABLE 35 CRYOGENIC VALVE ASSEMBLY MARKET FOR NITROGEN, BY REGION, 2022-2029 (USD MILLION)

- TABLE 36 CRYOGENIC VALVE ASSEMBLY MARKET FOR ARGON, BY REGION, 2022-2029 (USD MILLION)

- TABLE 37 CRYOGENIC VALVE ASSEMBLY MARKET FOR OXYGEN, BY REGION, 2022-2029 (USD MILLION)

- TABLE 38 CRYOGENIC VALVE ASSEMBLY MARKET FOR LNG, BY REGION, 2022-2029 (USD MILLION)

- TABLE 39 CRYOGENIC VALVE ASSEMBLY MARKET FOR HYDROGEN, BY REGION, 2022-2029 (USD MILLION)

- TABLE 40 CRYOGEN VALVE ASSEMBLY MARKET FOR OTHER CRYOGENS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 41 CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 42 CRYOGENIC VALVE ASSEMBLY MARKET IN METALLURGY, BY REGION, 2022-2029 (USD MILLION)

- TABLE 43 CRYOGENIC VALVE ASSEMBLY MARKET IN ENERGY & POWER, BY REGION, 2022-2029 (USD MILLION)

- TABLE 44 CRYOGENIC VALVE ASSEMBLY MARKET IN CHEMICALS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 45 CRYOGENIC VALVE ASSEMBLY MARKET IN ELECTRONICS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 46 CRYOGENIC VALVE ASSEMBLY MARKET IN TRANSPORTATION, BY REGION, 2022-2029 (USD MILLION)

- TABLE 47 CRYOGENIC VALVE ASSEMBLY MARKET IN OTHER END-USER INDUSTRIES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 48 CRYOGENIC VALVE ASSEMBLY MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 49 CRYOGENIC VALVE ASSEMBLY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 50 ASIA PACIFIC: CRYOGENIC VALVE ASSEMBLY MARKET, BY CRYOGEN, 2022-2029 (USD MILLION)

- TABLE 51 ASIA PACIFIC: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 52 ASIA PACIFIC: CRYOGENIC VALVE ASSEMBLY MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 53 ASIA PACIFIC: CRYOGENIC VALVE ASSEMBLY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 54 CHINA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 55 INDIA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 56 AUSTRALIA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 57 JAPAN: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 58 MALAYSIA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 59 REST OF ASIA PACIFIC: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 60 NORTH AMERICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY CRYOGEN, 2022-2029 (USD MILLION)

- TABLE 61 NORTH AMERICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 62 NORTH AMERICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 63 NORTH AMERICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 64 US: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 65 CANADA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 66 MEXICO: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 67 EUROPE: CRYOGENIC VALVE ASSEMBLY MARKET, BY CRYOGEN, 2022-2029 (USD MILLION)

- TABLE 68 EUROPE: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 69 EUROPE: CRYOGENIC VALVE ASSEMBLY MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 70 EUROPE: CRYOGENIC VALVE ASSEMBLY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 71 RUSSIA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 72 UK: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 73 GERMANY: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 74 FRANCE: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 75 REST OF EUROPE: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 76 MIDDLE EAST: CRYOGENIC VALVE ASSEMBLY MARKET, BY CRYOGEN, 2022-2029 (USD MILLION)

- TABLE 77 MIDDLE EAST: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 78 MIDDLE EAST: CRYOGENIC VALVE ASSEMBLY MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 79 MIDDLE EAST: CRYOGENIC VALVE ASSEMBLY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 80 SAUDI ARABIA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 81 UAE: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 82 QATAR: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 83 REST OF GCC: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 84 REST OF THE MIDDLE EAST: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 85 AFRICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY CRYOGEN, 2022-2029 (USD MILLION)

- TABLE 86 AFRICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 87 AFRICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 88 AFRICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 89 SOUTH AFRICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 90 NIGERIA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 91 ALGERIA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 92 REST OF AFRICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 93 SOUTH AMERICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY CRYOGEN, 2022-2029 (USD MILLION)

- TABLE 94 SOUTH AMERICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 95 SOUTH AMERICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 96 SOUTH AMERICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 97 BRAZIL: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 98 ARGENTINA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 99 VENEZUELA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 100 REST OF SOUTH AMERICA: CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 101 CRYOGENIC VALVE ASSEMBLY MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 102 CRYOGENIC VALVE ASSEMBLY MARKET: DEGREE OF COMPETITION

- TABLE 103 CRYOGENIC VALVE ASSEMBLY MARKET: REGIONAL FOOTPRINT

- TABLE 104 CRYOGENIC VALVE ASSEMBLY MARKET: TYPE FOOTPRINT, 2023

- TABLE 105 CRYOGENIC VALVE ASSEMBLY MARKET: CRYOGEN FOOTPRINT, 2023

- TABLE 106 CRYOGENIC VALVE ASSEMBLY MARKET: APPLICATION FOOTPRINT, 2023

- TABLE 107 CRYOGENIC VALVE ASSEMBLY MARKET: END USER FOOTPRINT, 2023

- TABLE 108 CRYOGENIC VALVE ASSEMBLY MARKET: COMPONENT FOOTPRINT, 2023 (1/2)

- TABLE 109 CRYOGENIC VALVE ASSEMBLY MARKET: COMPONENT FOOTPRINT, 2023 (2/2)

- TABLE 110 CRYOGENIC VALVE ASSEMBLY MARKET: LIST OF KEY STARTUPS/SMES, 2023 (1/2)

- TABLE 111 CRYOGENIC VALVE ASSEMBLY MARKET: LIST OF KEY STARTUPS/SMES, 2023 (2/2)

- TABLE 112 CRYOGENIC VALVE ASSEMBLY MARKET: PRODUCT LAUNCHES, JANUARY 2020-NOVEMBER 2024

- TABLE 113 CRYOGENIC VALVE ASSEMBLY MARKET: DEALS, JANUARY 2020-NOVEMBER 2024

- TABLE 114 CRYOGENIC VALVE ASSEMBLY MARKET: EXPANSION, JANUARY 2020-NOVEMBER 2024

- TABLE 115 CRYOGENIC VALVE ASSEMBLY MARKET: OTHER DEVELOPMENT, JANUARY 2020-NOVEMBER 2024

- TABLE 116 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 117 PARKER HANNIFIN CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 118 PARKER HANNIFIN CORP: PRODUCT LAUNCHES

- TABLE 119 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 120 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 121 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 122 FLOWSERVE CORPORATION: COMPANY OVERVIEW

- TABLE 123 FLOWSERVE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 FLOWSERVE CORPORATION: DEALS

- TABLE 125 FLOWSERVE CORPORATION: OTHER DEVELOPMENTS

- TABLE 126 CRANE COMPANY: COMPANY OVERVIEW

- TABLE 127 CRANE COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 128 CRANE COMPANY: DEALS

- TABLE 129 VALMET: COMPANY OVERVIEW

- TABLE 130 VALMET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 131 VALMET: OTHER DEVELOPMENTS

- TABLE 132 VELAN: COMPANY OVERVIEW

- TABLE 133 VELAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 BAKER HUGHES: COMPANY OVERVIEW

- TABLE 135 BAKER HUGHES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 BAKER HUGHES: PRODUCT LAUNCHES

- TABLE 137 BAKER HUGHES: EXPANSIONS

- TABLE 138 BAKER HUGHES: OTHER DEVELOPMENTS

- TABLE 139 KITZ CORPORATION: COMPANY OVERVIEW

- TABLE 140 KITZ CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 KITZ CORPORATION: DEALS

- TABLE 142 KITZ CORPORATION: EXPANSIONS

- TABLE 143 BRAY INTERNATIONAL: COMPANY OVERVIEW

- TABLE 144 BRAY INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 BAC VALVES: COMPANY OVERVIEW

- TABLE 146 BAC VALVES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 CRYOCOMP: COMPANY OVERVIEW

- TABLE 148 CRYOCOMP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 SLB: COMPANY OVERVIEW

- TABLE 150 SLB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 SLB: EXPANSIONS

- TABLE 152 L&T VALVES LIMITED: COMPANY OVERVIEW

- TABLE 153 L&T VALVES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 POWELL VALVES: COMPANY OVERVIEW

- TABLE 155 POWELL VALVES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 HABONIM: COMPANY OVERVIEW

- TABLE 157 HABONIM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 HEROSE: COMPANY OVERVIEW

- TABLE 159 HEROSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 CRYOGENIC VALVE ASSEMBLY MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 CRYOGENIC VALVE ASSEMBLY MARKET: RESEARCH DESIGN

- FIGURE 4 DATA TRIANGULATION METHODOLOGY

- FIGURE 5 KEY DATA FROM SECONDARY SOURCES

- FIGURE 6 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 7 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 CRYOGENIC VALVE ASSEMBLY MARKET: BOTTOM-UP APPROACH

- FIGURE 9 CRYOGENIC VALVE ASSEMBLY MARKET: TOP-DOWN APPROACH

- FIGURE 10 METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR CRYOGENIC VALVE ASSEMBLY

- FIGURE 11 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF CRYOGENIC VALVE ASSEMBLY

- FIGURE 12 CRYOGENIC VALVE ASSEMBLY MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 13 CRYOGENIC VALVE ASSEMBLY MARKET: MARKET SHARE ANALYSIS, 2023

- FIGURE 14 BALL VALVES TO DOMINATE CRYOGENIC VALVE ASSEMBLY MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 15 NITROGEN TO ACCOUNT FOR LARGEST SHARE OF CRYOGENIC VALVE ASSEMBLY MARKET IN 2024

- FIGURE 16 METALLURGY INDUSTRY TO ACCOUNT FOR MAJORITY SHARE IN 2024 AND 2029

- FIGURE 17 CASU APPLICATIONS TO ACCOUNT FOR LARGER SHARE OF CRYOGENIC VALVE ASSEMBLY MARKET IN 2024 AND 2029 (USD MILLION)

- FIGURE 18 VALVE BODY TO ACCOUNT FOR LEADING SHARE OF CRYOGENIC VALVE ASSEMBLY MARKET IN 2024 AND 2029

- FIGURE 19 ASIA PACIFIC DOMINATED CRYOGENIC VALVE ASSEMBLY MARKET IN 2023

- FIGURE 20 UTILIZATION OF INDUSTRIAL GASES IN METALLURGY AND ENERGY & POWER INDUSTRIES TO DRIVE MARKET

- FIGURE 21 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN CRYOGENIC VALVE ASSEMBLY MARKET DURING FORECAST PERIOD

- FIGURE 22 NITROGEN AND CHINA HELD LARGEST SHARE OF ASIA PACIFIC CRYOGENIC VALVE ASSEMBLY MARKET, BY CRYOGEN AND COUNTRY, RESPECTIVELY, IN 2023

- FIGURE 23 BALL VALVE TO CAPTURE LARGEST SHARE OF GLOBAL CRYOGENIC VALVE ASSEMBLY MARKET IN 2029

- FIGURE 24 LNG SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2029

- FIGURE 25 METALLURGY INDUSTRY TO ACCOUNT FOR LARGEST SHARE OF CRYOGENIC VALVE ASSEMBLY MARKET IN 2029

- FIGURE 26 CASU APPLICATIONS TO DOMINATE CRYOGENIC VALVE ASSEMBLY MARKET BY 2029

- FIGURE 27 VALVE BODY IS EXPECTED TO DOMINATE CRYOGENIC VALVE ASSEMBLY MARKET IN 2029

- FIGURE 28 CRYOGENIC VALVE ASSEMBLY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 29 TOP FIVE EXPORTERS OF LNG IN 2023 (MT)

- FIGURE 30 TOTAL REVENUE OF CHEMICAL INDUSTRY WORLDWIDE, 2005-2022 (USD BILLION)

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 32 SUPPLY CHAIN ANALYSIS

- FIGURE 33 ECOSYSTEM ANALYSIS

- FIGURE 34 CRYOGENIC VALVE ASSEMBLY MARKET: PATENTS APPLIED AND GRANTED, 2013-2023

- FIGURE 35 EXPORT DATA FOR HS CODE 280430, 2021-2023 (USD THOUSAND)

- FIGURE 36 IMPORT DATA FOR HS CODE 280430, 2021-2023 (USD THOUSAND)

- FIGURE 37 EXPORT DATA FOR HS CODE 280421, 2021-2023 (USD THOUSAND)

- FIGURE 38 IMPORT DATA FOR HS CODE 280421, 2021-2023 (USD THOUSAND)

- FIGURE 39 EXPORT DATA FOR HS CODE 280440, 2021-2023 (USD THOUSAND)

- FIGURE 40 IMPORT DATA FOR HS CODE 280440, 2020-2022 (USD THOUSAND)

- FIGURE 41 EXPORT DATA FOR HS CODE 271111, 2021-2023 (USD THOUSAND)

- FIGURE 42 LNG IMPORT DATA FOR TOP FIVE COUNTRIES, 2021-2023 (USD THOUSAND)

- FIGURE 43 EXPORT DATA FOR HS CODE 280410, 2021-2023 (USD THOUSAND)

- FIGURE 44 IMPORT DATA FOR HS CODE 280410, 2021-2023 (USD THOUSAND)

- FIGURE 45 PORTER'S FIVE FORCES ANALYSIS FOR CRYOGENIC VALVE ASSEMBLY MARKET

- FIGURE 46 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USER INDUSTRIES

- FIGURE 47 KEY BUYING CRITERIA FOR KEY END-USER INDUSTRIES

- FIGURE 48 INVESTMENT AND FUNDING SCENARIO, 2024 (USD MILLION)

- FIGURE 49 CRYOGENIC VALVE ASSEMBLY MARKET SHARE (VALUE), BY TYPE, 2023

- FIGURE 50 CRYOGENIC VALVE ASSEMBLY MARKET SHARE (VALUE), BY COMPONENT, 2023

- FIGURE 51 CRYOGENIC VALVE ASSEMBLY MARKET SHARE (VALUE), BY CRYOGEN, 2023

- FIGURE 52 CRYOGENIC VALVE ASSEMBLY MARKET SHARE (VALUE), BY END-USER INDUSTRY, 2023

- FIGURE 53 CRYOGENIC VALVE ASSEMBLY MARKET SHARE (VALUE), BY APPLICATION, 2023

- FIGURE 54 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN CRYOGENIC VALVE ASSEMBLY MARKET DURING FORECAST PERIOD

- FIGURE 55 CRYOGENIC VALVE ASSEMBLY MARKET SHARE (VALUE), BY REGION, 2023

- FIGURE 56 ASIA PACIFIC: CRYOGENIC VALVE ASSEMBLY MARKET SNAPSHOT

- FIGURE 57 EUROPE: CRYOGENIC VALVE ASSEMBLY MARKET SNAPSHOT

- FIGURE 58 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2023

- FIGURE 59 CRYOGENIC VALVE ASSEMBLY MARKET: SEGMENTAL REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 60 CRYOGENIC VALVE ASSEMBLY MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 61 CRYOGENIC VALVE ASSEMBLY MARKET: COMPANY EVALUATION, 2024

- FIGURE 62 CRYOGENIC VALVE ASSEMBLY MARKET: FINANCIAL METRICS, 2024

- FIGURE 63 CRYOGENIC VALVE ASSEMBLY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 64 CRYOGENIC VALVE ASSEMBLY MARKET: COMPANY FOOTPRINT, 2023

- FIGURE 65 CRYOGENIC VALVE ASSEMBLY MARKET: STARTUPS/SMES EVALUATION MATRIX, 2023

- FIGURE 66 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- FIGURE 67 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 68 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 CRANE COMPANY: COMPANY SNAPSHOT

- FIGURE 70 VALMET: COMPANY SNAPSHOT

- FIGURE 71 VELAN: COMPANY SNAPSHOT

- FIGURE 72 BAKER HUGHES: COMPANY SNAPSHOT

- FIGURE 73 KITZ CORPORATION: COMPANY SNAPSHOT

- FIGURE 74 SLB: COMPANY SNAPSHOT

The cryogenic valve assembly market is estimated to reach USD 7.21 billion by 2029 from an estimated value of USD 4.83 billion in 2024, at a CAGR of 8.3% during the forecast period. Increasing practices for cryogenic gases in medical, food preservation, and electronics manufacturing are driving the cryogenic valve assembly market. The increase in overall global demand for LNG as a cleaner fuel alternative and the increase in LNG import/export will propel market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Type, System Type, Application, Cryogen, End-user, Component, Construction Material, Region |

| Regions covered | North America, Europe, Asia Pacific, Rest of the World (RoW) |

"Metallurgy: The largest segment of the cryogenic valve assembly market, by end-user industry."

By end-user industry, the cryogenic valve assembly market was segmented into five categories: energy & power, chemical, metallurgy, electronics, and transportation, apart from others. The segment, metallurgy, is expected to capture the largest share of the market by end user. Given the widespread use of cryogenic gases such as oxygen (O2), nitrogen (N2), and argon (Ar) in metallurgical processes such as steel manufacturing, welding, and fabrication, these gases are important in improving product quality, improving combustion efficiency, and also in controlling temperatures while processing metal. The increasing demand from sectors involved in manufacturing high-quality metals, including construction, automotive, and industrial metal products, increases the need for reliable cryogenic valve assemblies. The large increase in infrastructure development and more advanced treatments of metal also increases the segment growth.

"The CASU segment is estimated to remain the larger segment in terms of application."

Based on application, the cryogenic valve assembly market has been segmented into CASU and non-CASU. The cryogenic air separation unit (CASU) segment is projected to dominate the cryogenic valve assembly market owing to the significance of cryogenic valves in generating an array of high-purity industrial gases, particularly oxygen, nitrogen, and argon. The aforementioned gases are used throughout a multitude of industries, including healthcare and medical uses, metallurgy, electronics, and chemical uses. The demand for medical-grade oxygen has also grown tremendously since the pandemic, further abating the demand for CASU installations along with improving industrial production and degree of industrialization in developing markets. The cryogenic valves are used to control and isolate the flow of extremely cold gas to the unit, which is used in these facilities that utilize cryogenic valves.

"The globe valves segment is estimated to emerge as the second-largest segment based on type."

By end use, the cryogenic valve assembly market has been segmented into gate, globe, ball, check, and butterfly valves, apart from others. Globe valves are estimated to be the second-largest cryogenic valve assembly type due to their precise throttling capabilities and effective flow regulation in cryogenic applications. Their robust design ensures reliable performance under high-pressure, low-temperature conditions, making them ideal for LNG, industrial gas, and chemical industries. Increasing demand for controlled flow systems further supports their growth.

"North America is projected to be the second-fastest-growing region in the cryogenic valve assembly market."

North America is estimated to be the second-fastest region in the cryogenic valve assembly market between 2024 and 2029. The North American market consists of the US, Canada, and Mexico. North America is projected to be the second fastest-growing region in the cryogenic valve assemblies market due to its strong LNG infrastructure, increased investment into clean energy technologies such as carbon capture and hydrogen, and important players in aerospace, healthcare, and chemicals. Continuous improvements in medical technologies and growing cryogenic gas volumes in surgical and diagnostic settings will also have a positive effect on cryogenic demand. Additionally, the US government's dedication to diversifying the energy supply and allowing for increasing exports of natural gas will especially help improve the market potential in this region. Key manufacturers are also located in this region, and upgrading industrial gas supply chains will further help drive both the adoption and acceptability of cryogenic valve assemblies, which are already increasing across North America.

Breakdown of Primaries

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 65%, Tier 2 - 24%, and Tier 3 - 11%

By Designation: C-Level Executives - 30%, Manager - 25%, and Others - 45%

By Region: North America - 27%, Europe - 20%, Asia Pacific - 33%, South America & Central America - 12%, Middle East - 4%, and Africa - 4%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The cryogenic valve assembly market is dominated by a few major players that have a wide regional presence. The leading players in the cryogenic valve assembly market are PARKER HANNIFIN CORP (US), Emerson Electric Co. (US), Flowserve Corporation (US), Bray International (US), Valmet (Finland), Crane Company (US), L&T Valves Limited (India), KITZ Corporation (Japan), Baker Hughes (US), KITZ Corporation (Japan), Baker Hughes (US), XINTAI VALVE (China), Valco Group (France), cryocomp (US), and BAC VALVES (Spain).

Research Coverage

The report defines, describes, and forecasts the cryogenic valve assembly market by construction material, type, end-user, components, cryogen, application, and system type for various regions. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the cryogenic valve assembly market.

Key Benefits of Buying the Report

- The cryogenic valve assembly market is influenced by the growing requirement for LNG infrastructure, increased focus on hydrogen-based energy solutions, and increasing utilization of cryogenic systems in the healthcare, electronics, and chemicals segments. With the rising global focus on decarbonization coupled with government initiatives aimed at the adoption of clean energy solutions, the market growth is gaining momentum. The increase in production of industrial gas, development in valve design for extreme conditions, and greater safety requirements across all segments have also increased the demand for reliable cryogenic valve assemblies.

- Product Development/Innovation: The cryogenic valve assembly market is seeing substantial product development and innovation, driven by stringent safety and regulatory standards. Companies are investing in improved materials and technology to manufacture advanced cryogenic valve assemblies.

- Market Development: Emerson has launched the Fisher 63EGLP-16 Pilot Operated Relief Valve to meet the safety needs of storage tank applications, improving installation, maintenance, and operation for pressurized tanks. This new product extends Emerson's safety valve portfolio with enhanced features to support the specific needs of liquid propane and ammonia storage systems. This will be beneficial for cryogenic valve application, ensuring the safety of operation.

- Market Diversification: Flowserve acquired LNG submerged pump technology and R&D from NexGen Cryogenic Solutions to enhance its LNG product portfolio. This aligns with Flowserve's decarbonization goals, which are improving efficiency and reliability in the LNG market.

- Competitive Assessment: Assessment of rankings some of the key players, including PARKER HANNIFIN CORP (US), Emerson Electric Co. (US), Flowserve Corporation (US), Bray International (US), Valmet (Finland), Crane Company (US), L&T Valves Limited (India), KITZ Corporation (Japan), Baker Hughes (US), KITZ Corporation (Japan), Baker Hughes (US), XINTAI VALVE (China), and Valco Group (France).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS AND GEOGRAPHICAL SEGMENTATION COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 RESEARCH LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 DATA TRIANGULATION

- 2.3 PRIMARY AND SECONDARY RESEARCH

- 2.3.1 SECONDARY DATA

- 2.3.1.1 Key data from secondary sources

- 2.3.2 PRIMARY DATA

- 2.3.2.1 Key data from primary sources

- 2.3.2.2 Breakdown of primaries

- 2.3.1 SECONDARY DATA

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Demand-side metrics

- 2.4.3.2 Assumptions for demand-side analysis

- 2.4.3.3 Calculations for demand-side analysis

- 2.4.4 SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Calculations for supply side

- 2.4.4.2 Assumptions for supply-side analysis

- 2.5 MARKET SIZE FORECAST

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CRYOGENIC VALVE ASSEMBLY MARKET

- 4.2 CRYOGENIC VALVE ASSEMBLY MARKET, BY REGION

- 4.3 ASIA PACIFIC: CRYOGENIC VALVE ASSEMBLY MARKET, BY CRYOGEN AND COUNTRY

- 4.4 CRYOGENIC VALVE ASSEMBLY MARKET, BY TYPE

- 4.5 CRYOGENIC VALVE ASSEMBLY MARKET, BY CRYOGEN

- 4.6 CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY

- 4.7 CRYOGENIC VALVE ASSEMBLY MARKET, BY APPLICATION

- 4.8 CRYOGENIC VALVE ASSEMBLY MARKET, BY COMPONENT

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in demand for liquefied natural gas as clean and efficient energy source

- 5.2.1.2 Rising in investment in chemical industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatile raw material and metal prices and significant competition from gray market players

- 5.2.2.2 Hazards and greenhouse gas emissions resulting from leak of cryogenic fluids

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of industrial gas market

- 5.2.3.2 Growth of space, healthcare, and hydrogen industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Compliance with stringent regulations and safety standards

- 5.2.4.2 High maintenance and cost challenges

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 SMART VALVE TECHNOLOGY

- 5.6.2 ADVANCED MATERIALS AND DESIGN

- 5.6.3 BI-DIRECTIONAL FLOW CAPABILITY

- 5.6.4 LOW-LEAKAGE CRYOGENIC VALVE TECHNOLOGY BY NASA

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 ENHANCING CRYOGENIC VALVE RELIABILITY WITH UNILION SEALS TO REDUCE FAILURES AND IMPROVE PERFORMANCE

- 5.7.2 PREVENTING HUMAN ERROR IN CRYOGENIC VALVE OPERATIONS WITH ALCATRAZ INTERLOCKS

- 5.8 PATENT ANALYSIS

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND, BY TYPE, 2023-2029

- 5.9.2 INDICATIVE PRICING TREND, BY REGION, 2023-2029

- 5.10 TRADE ANALYSIS

- 5.10.1 HS CODE 280430

- 5.10.1.1 Nitrogen export scenario

- 5.10.1.2 Nitrogen import scenario

- 5.10.2 HS CODE 280421

- 5.10.2.1 Argon export scenario

- 5.10.2.2 Argon import scenario

- 5.10.3 HS CODE 280440

- 5.10.3.1 Oxygen export scenario

- 5.10.3.2 Oxygen import scenario

- 5.10.4 HS CODE 271111

- 5.10.4.1 LNG export scenario

- 5.10.4.2 LNG import scenario

- 5.10.5 HS CODE 280410

- 5.10.5.1 Hydrogen export scenario

- 5.10.5.2 Hydrogen import scenario

- 5.10.1 HS CODE 280430

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY FRAMEWORKS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 MACROECONOMIC OUTLOOK FOR CRYOGENIC VALVE ASSEMBLY MARKET

6 CRYOGENIC VALVE ASSEMBLY MARKET, BY CONSTRUCTION MATERIALS (QUALITATIVE)

- 6.1 INTRODUCTION

- 6.2 STAINLESS STEEL

- 6.3 NICKEL ALLOYS

- 6.4 STELLITE

- 6.5 POLYTETRAFLUOROETHYLENE (PTFE)

- 6.6 POLYCHLOROTRIFLUOROETHYLENE (PCTFE)

- 6.7 GRAPHITE

7 CRYOGENIC VALVE ASSEMBLY MARKET, BY SYSTEM TYPE (QUALITATIVE)

- 7.1 INTRODUCTION

- 7.2 STORAGE SYSTEMS

- 7.3 HANDLING SYSTEMS

- 7.4 SUPPLY SYSTEMS

- 7.5 OTHER SYSTEMS

8 CRYOGENIC VALVE ASSEMBLY MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 GATE VALVES

- 8.2.1 ENABLING SAFE AND PRECISE ISOLATION IN CRYOGENIC APPLICATIONS

- 8.3 GLOBE VALVES

- 8.3.1 OFFERING ENERGY EFFICIENCY BY OPTIMIZING FLUID FLOW IN CRYOGENIC SYSTEMS APPLICATIONS

- 8.4 BALL VALVES

- 8.4.1 NEED FOR FAST OPERATION IN EMERGENCY SHUT-OFF SITUATIONS

- 8.5 CHECK VALVES

- 8.5.1 NEED FOR SAFE AND EFFICIENT OPERATION IN TRANSPORTATION AND STORAGE OF LIQUEFIED GASES

- 8.6 BUTTERFLY VALVES

- 8.6.1 PROVIDING LOW-PRESSURE DROPS MAKES THEM SUITABLE FOR HIGH-FLOW CRYOGENIC APPLICATIONS

- 8.7 OTHER VALVES

9 CRYOGENIC VALVE ASSEMBLY MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 VALVE BODY

- 9.2.1 RISING FOCUS ON MEETING STRINGENT SAFETY AND REGULATORY STANDARDS IN CRYOGENIC APPLICATIONS

- 9.3 SEATS

- 9.3.1 DEMAND FOR HIGH-PERFORMANCE SEATS TO ENSURE ZERO-LEAK OPERATION IN CRITICAL CRYOGENIC APPLICATIONS

- 9.4 SEALS

- 9.4.1 RISE IN REQUIREMENT FOR SEALS CAPABLE OF WITHSTANDING HARSH CHEMICALS AND CORROSIVE MEDIA

- 9.5 GASKETS

- 9.5.1 ESSENTIAL FOR ENSURING LEAK-PROOF SEALS IN CRYOGENIC SYSTEMS, PREVENTING FLUID OR GAS LEAKAGE

- 9.6 BACK-UP RINGS

- 9.6.1 OFFERING INCREASED LONGEVITY OF SEALS, REDUCING FREQUENCY OF REPLACEMENTS AND MAINTENANCE COSTS

- 9.7 PIPE SLEEVES

- 9.7.1 ADDITIONAL STRENGTH IMPROVES ABILITY TO WITHSTAND HIGH-PRESSURE CONDITIONS IN CRYOGENIC SYSTEMS

- 9.8 SPACERS

- 9.8.1 ENSURING PRECISE ALIGNMENT BETWEEN COMPONENTS, IMPROVING OVERALL PERFORMANCE AND EFFICIENCY OF CRYOGENIC SYSTEMS

- 9.9 BEARINGS

- 9.9.1 MINIMIZING FRICTION BETWEEN MOVING PARTS, ENHANCING EFFICIENCY IN VALVE OPERATIONS

- 9.10 GEARS

- 9.10.1 INCREASED NEED FOR GEARS TO ENABLE ACCURATE VALVE ACTUATION AND FLOW REGULATION

- 9.11 ACTUATORS

- 9.11.1 RISE IN DEMAND FOR PRECISE CONTROL OF VALVE MOVEMENT IN CRYOGENIC APPLICATIONS

- 9.12 BONNET

- 9.12.1 EXTENDED BONNET PREVENTS FREEZING BETWEEN PACKING AND STEM, ENSURING BETTER SEALING IN EXTREME TEMPERATURES

- 9.13 DISCS/PLUGS

- 9.13.1 MAINTAINING PRESSURE AND PREVENTING LEAKAGE TO ENSURE SAFE TRANSPORT AND STORAGE OF CRYOGENIC LIQUIDS

- 9.14 STEM

- 9.14.1 MADE FROM DURABLE MATERIALS TO WITHSTAND PHYSICAL STRESSES AND CORROSIVE EFFECTS OF CRYOGENIC LIQUIDS

- 9.15 THROTTLE PLATES

- 9.15.1 ENSURING ACCURATE CONTROL OF GAS OR FLUID FLOW AT VARYING TEMPERATURES

- 9.16 OTHER COMPONENTS

10 CRYOGENIC VALVE ASSEMBLY MARKET, BY CRYOGEN

- 10.1 INTRODUCTION

- 10.2 NITROGEN

- 10.2.1 HIGH ADOPTION OF NITROGEN IN ENERGY & POWER SECTOR

- 10.3 ARGON

- 10.3.1 RISE IN DEMAND FOR ELECTRONICS TO DRIVE REQUIREMENTS FOR ARGON-HANDLING CRYOGENIC VALVE ASSEMBLY

- 10.4 OXYGEN

- 10.4.1 INCREASE IN STEEL AND IRON PRODUCTION TO CREATE HIGH DEMAND FOR OXYGEN-RELATED CRYOGENIC EQUIPMENT

- 10.5 LNG

- 10.5.1 EFFICIENCY AND SAFETY TO BE VITAL FOR LNG STORAGE, TRANSPORTATION, AND REGASIFICATION PROCESSES

- 10.6 HYDROGEN

- 10.6.1 INCREASE IN PRODUCTION OF HYDROGEN-POWERED VEHICLES TO NECESSITATE ADVANCED CRYOGENIC VALVES FOR SECURE HYDROGEN HANDLING

- 10.7 OTHER CRYOGENS

11 CRYOGENIC VALVE ASSEMBLY MARKET, BY END-USER INDUSTRY

- 11.1 INTRODUCTION

- 11.2 METALLURGY

- 11.2.1 NEED FOR PRECISE REGULATION OF EXTREMELY LOW-TEMPERATURE LIQUIDS AND GASES IN METAL PROCESSING

- 11.3 ENERGY & POWER

- 11.3.1 INCREASED DEMAND FOR LIQUEFIED NATURAL GAS (LNG) FOR POWER GENERATION AND TRANSPORTATION

- 11.4 CHEMICALS

- 11.4.1 PRODUCTION OF SPECIALTY CHEMICALS, OFTEN INVOLVING LOW-TEMPERATURE PROCESSES, TO SUPPORT ADOPTION OF VALVES FOR PRECISE CONTROL

- 11.5 ELECTRONICS

- 11.5.1 GROWING SEMICONDUCTOR INDUSTRY TO REQUIRE ULTRA-PURE CRYOGENIC GASES SUCH AS NITROGEN AND HELIUM

- 11.6 TRANSPORTATION

- 11.6.1 GLOBAL INCREASE IN BUILDING LNG AND HYDROGEN REFUELING STATIONS

- 11.7 OTHER END-USER INDUSTRIES

12 CRYOGENIC VALVE ASSEMBLY MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 CRYOGENIC AIR SEPARATION UNIT (CASU)

- 12.2.1 NEED FOR OXYGEN AND NITROGEN IN POWER GENERATION, NATURAL GAS PROCESSING, AND LNG PRODUCTION

- 12.3 NON-CRYOGENIC AIR SEPARATION UNIT (NON-CASU)

- 12.3.1 BEING SMALLER AND MORE COMPACT TO ALLOW FOR EASIER INSTALLATION IN LIMITED SPACES

13 CRYOGENIC VALVE ASSEMBLY MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 CHINA

- 13.2.1.1 Increase in LNG infrastructure to meet rising energy demand

- 13.2.2 INDIA

- 13.2.2.1 Increase in investments in space missions

- 13.2.3 AUSTRALIA

- 13.2.3.1 Australia's LNG export leadership to fuel demand for cryogenic valves in storage and transport

- 13.2.4 JAPAN

- 13.2.4.1 Initiatives to become global leader in hydrogen technology and infrastructure

- 13.2.5 MALAYSIA

- 13.2.5.1 Government's push for cleaner energy sources to necessitate efficient valve systems with expanding natural gas networks for transportation and distribution

- 13.2.6 REST OF ASIA PACIFIC

- 13.2.1 CHINA

- 13.3 NORTH AMERICA

- 13.3.1 US

- 13.3.1.1 US leadership in LNG exports, supported by expanding terminal capacities, to drive demand in storage and transportation

- 13.3.2 CANADA

- 13.3.2.1 Construction of LNG export facilities to generate significant demand for cryogenic equipment

- 13.3.3 MEXICO

- 13.3.3.1 Pioneering energy transformation with robust LNG and hydrogen infrastructure advancements

- 13.3.1 US

- 13.4 EUROPE

- 13.4.1 RUSSIA

- 13.4.1.1 Investments in LNG by energy giants

- 13.4.2 UK

- 13.4.2.1 Government's commitment to net-zero carbon emissions

- 13.4.3 GERMANY

- 13.4.3.1 Germany's hydrogen economy to drive demand for cryogenic valves for liquid hydrogen storage and transport

- 13.4.4 FRANCE

- 13.4.4.1 National low-carbon strategy with five-year carbon budgets and multiannual plan for energy investments

- 13.4.5 REST OF EUROPE

- 13.4.1 RUSSIA

- 13.5 MIDDLE EAST

- 13.5.1 GCC COUNTRIES

- 13.5.1.1 Saudi Arabia

- 13.5.1.1.1 Initiation of LNG projects to diversify its energy portfolio and strengthen its position in global energy market

- 13.5.1.2 UAE

- 13.5.1.2.1 Investments in natural gas infrastructure, including LNG production and storage

- 13.5.1.3 Qatar

- 13.5.1.3.1 Qatar's ongoing investments in LNG terminals, export facilities, and storage tanks require advanced cryogenic valves

- 13.5.1.4 Rest of GCC

- 13.5.1.1 Saudi Arabia

- 13.5.2 REST OF THE MIDDLE EAST

- 13.5.1 GCC COUNTRIES

- 13.6 AFRICA

- 13.6.1 SOUTH AFRICA

- 13.6.1.1 Growth in metallurgy, chemicals, and healthcare to drive demand for industrial gases

- 13.6.2 NIGERIA

- 13.6.2.1 Increase in demand for LNG and nitrogen from oil & gas and shipping industries

- 13.6.3 ALGERIA

- 13.6.3.1 Upcoming offshore projects, increasing LNG export volumes, and ongoing enhancements in liquefaction and storage facilities

- 13.6.4 REST OF AFRICA

- 13.6.1 SOUTH AFRICA

- 13.7 SOUTH AMERICA

- 13.7.1 BRAZIL

- 13.7.1.1 Energy transition and oil production from offshore sources

- 13.7.2 ARGENTINA

- 13.7.2.1 Reviving oil & gas sector to bring opportunities for cryogenic valves and component providers

- 13.7.3 VENEZUELA

- 13.7.3.1 Vast natural gas reserves, including Orinoco Belt, drive LNG production and export

- 13.7.4 REST OF SOUTH AMERICA

- 13.7.1 BRAZIL

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 14.3 MARKET SHARE ANALYSIS, 2023

- 14.4 REVENUE ANALYSIS, 2020-2024

- 14.5 BRAND/PRODUCT COMPARISON

- 14.6 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 14.7.5.1 Company footprint

- 14.7.5.2 Regional footprint

- 14.7.5.3 Type footprint

- 14.7.5.4 Cryogen footprint

- 14.7.5.5 Application footprint

- 14.7.5.6 End User Footprint

- 14.7.5.7 Component footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING

- 14.8.5.1 List of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 PARKER HANNIFIN CORP

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 EMERSON ELECTRIC CO.

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 FLOWSERVE CORPORATION

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.3.2 Other developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 CRANE COMPANY

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 VALMET

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Other developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 VELAN

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.7 BAKER HUGHES

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.7.3.2 Expansion

- 15.1.7.3.3 Other developments

- 15.1.8 KITZ CORPORATION

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.8.3.2 Expansion

- 15.1.9 BRAY INTERNATIONAL

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.10 BAC VALVES

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.11 CRYOCOMP

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.12 SLB

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Expansion

- 15.1.13 L&T VALVES LIMITED

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.14 POWELL VALVES

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.15 HABONIM

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.16 HEROSE

- 15.1.16.1 Business overview

- 15.1.16.2 Products/Solutions/Services offered

- 15.1.1 PARKER HANNIFIN CORP

- 15.2 OTHER PLAYERS

- 15.2.1 SAMSON AKTIENGESELLSCHAFT

- 15.2.2 VALCO GROUP

- 15.2.3 OSWAL INDUSTRIES LIMITED

- 15.2.4 MAVERICK VALVES

- 15.2.5 CRYOGENIC SPECIALTY MANUFACTURING

- 15.2.6 ROCHELLES TECHNOMATICS INDIA PVT. LTD

- 15.2.7 XHVAL GROUP VALVE CO., LTD.

- 15.2.8 XINTAI VALVE

- 15.2.9 MECA-INOX

16 APPENDIX

- 16.1 INSIGHTS OF INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS