|

|

市場調査レポート

商品コード

1725767

MRIシステムの世界市場:用途別、アーキテクチャ別、デザイン別、磁場強度別、エンドユーザー別、地域別 - 2030年までの予測MRI Systems Market by Architecture (Open, Closed), Field Strength (High Field MRI Systems & Low Field MRI Systems), Design (Portable MRI Systems, Fixed/Stationary MRI Systems), End User (Hospitals, Diagnostic Clinic), Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| MRIシステムの世界市場:用途別、アーキテクチャ別、デザイン別、磁場強度別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月07日

発行: MarketsandMarkets

ページ情報: 英文 260 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のMRIシステムの市場規模は、2025年の65億米ドルから2030年には90億米ドルに達すると予測され、2025年から2030年までのCAGRは6.5%になるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 用途別、アーキテクチャ別、デザイン別、磁場強度別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

市場の成長は、特に神経疾患と筋骨格系疾患の疾病負担の増加に起因しており、今後数年間で増加すると予測されています。高齢化人口の増加、がんなどの慢性疾患の有病率の上昇により、世界中でMRIシステムのニーズが高まると予想されます。これらすべての要因が、より広範なレベルでMRIシステム市場の成長に寄与します。

MRIシステム市場は、低~中磁場MRIシステム、高・超高磁場MRIシステム、超高磁場MRIシステムを含む磁場強度別に分類されます。高磁場および超高磁場MRIシステムは、その優れた信号対雑音比(SNR)で注目され、臨床的有用性を大幅に高めています。これらのシステムは、脳、筋骨格系構造、血管系の撮像に威力を発揮するだけでなく、精神医学、神経学、生物医学研究、多発性硬化症などの疾患の早期発見といった特殊な用途にも優れています。MRIをPETや超音波などの補完的モダリティと統合することで、操作スループットがさらに最適化され、ヘリウム使用量が減少する一方で、スキャン時間が短縮され、画像解像度が向上します。高磁場MRIシステム、特に1.5Tおよび3Tで作動するシステムは、その著しく優れた画質、撮影時間の短縮、および臨床応用の広範な範囲により、低磁場システム(1T以下)よりも好まれています。高磁場システムの高いSNRは、神経疾患、筋骨格系の損傷、心血管系の異常などの複雑な病態の診断に不可欠な、より鮮明で詳細な画像診断につながります。高速スキャン機能は、患者のスループットを向上させるだけでなく、ヘルスケア施設内の業務効率を高める。これらの要因が相まって、高磁場MRIシステムの市場導入が拡大しています。

クローズドMRIスキャナーは、小型の円筒形チャンバーを利用して体内構造の高精細画像を生成します。ほとんどの高磁場超電導MRIスキャナーはクローズド型に設計されています。クローズド型MRIは、磁場強度が高いため、効率が高く、画質が優れ、スループットが向上することから、業界標準とされています。オープン型MRIでは、同等の評価を得るために4~5回のスキャンを必要とすることがありますが、クローズド型MRIでは通常1~2回のスキャンで検査が完了します。この効率性は、検査時間を短縮するだけでなく、処置や治療の臨床的有用性を高める。クローズドMRIはスキャン時間が短いため、モーションアーチファクトを低減し、患者のスループットを向上させることができます。さらに、機能的MRI(fMRI)、拡散強調画像(DWI)、心臓MRIなど、高磁場強度が精度を左右する高度な画像診断技術にも対応しています。

MRIシステム市場は、固定型(または据置型)MRIシステムと可搬型MRIシステムの2つに大別されます。固定型MRIシステムは、いくつかの理由から、一般的にポータブル型よりも好まれています。優れた画質、全身スキャン能力、ワークフロー効率の向上、長期的な費用対効果などが挙げられます。通常、固定式MRI装置は磁場で作動します。固定式MRI装置のもう1つの大きな利点は、全身撮影が可能なことであり、これが市場の成長をさらに後押ししています。

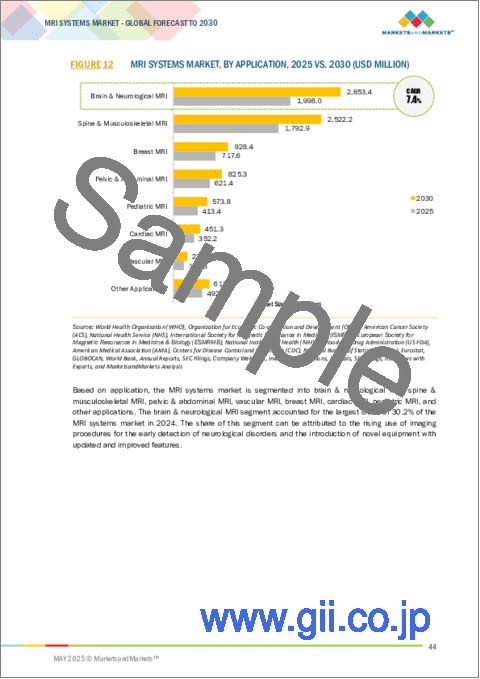

用途別では、脳・神経MRI、脊椎・筋骨格系MRI、骨盤・腹部MRI、血管MRI、乳房MRI、心臓MRI、小児MRI、その他の用途に区分されます。MRIシステム市場の用途別では、脳・神経MRI分野が予測期間中に最も高い成長率を記録すると予測されています。このセグメントの急成長に寄与している主な促進要因には、高度なAI技術の統合や、内臓の正確なターゲティングを可能にする革新的な装置の採用拡大が含まれ、これによりリアルタイムのイメージング機能が促進されます。

世界のMRIシステム市場は、エンドユーザー別に病院、画像診断センター、その他のカテゴリーに分類されます。2024年には、病院セグメントが最大の市場シェアを占めました。この優位性は主に、正確な診断を強化し、早期発見の重要性に対する認識を高める先進的なMRIシステムの病院での使用増加によるものです。その要因としては、最近の製品発売、患者ケアをサポートする機能が向上した先進的システムの採用拡大、病院で実施される画像診断件数の増加などが挙げられます。さまざまな病状を迅速かつ正確に診断する需要が高まる中、多くの病院が先進的なMRIシステムの導入を優先しています。専用の画像処理装置を持つ大規模な政府系病院は、こうした技術をいち早く導入していますが、民間病院では、時間の経過とともに高度な画像処理ソリューションの導入が進んでいます。画像処理ワークフローの近代化に向けた動向は、病院におけるMRIシステムの採用をさらに後押ししています。

MRIシステム市場は5つの主要地域(北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ)に分けられます。特にアジア太平洋には、競争力のある価格設定を維持しながら、高度な技術的特徴を備えた包括的なMRIモダリティを提供するMRIシステムメーカーが多数存在します。エンドユーザー、特にヘルスケア機関では、最近の関税制裁によって悪化した予算制約に直面するケースが増えており、これが中国メーカーが提供する費用対効果の高いMRIソリューションへのシフトを促しています。この地域の製造環境は、低い人件費と豊富な資源から恩恵を受け、MRIシステムの効率的な生産工程を促進しています。このような力学により、アジア太平洋市場は、現地の需要増加と戦略的な価格設定により、世界市場の中で最も高い成長率を示すと予想されます。

当レポートでは、世界のMRIシステム市場について調査し、用途別、アーキテクチャ別、デザイン別、磁場強度別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 規制状況

- 償還シナリオ分析

- エコシステム分析

- バリューチェーン分析

- サプライチェーン分析

- 価格分析

- 特許分析

- 貿易分析

- 技術分析

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- 2025年~2026年の主な会議とイベント

- 主要な利害関係者と購入基準

- ケーススタディ分析

- MRIスキャンの応用、2022年~2024年

- MRIシステム市場におけるAIの影響

- 米国関税:2025年

第6章 MRIシステム市場(用途別)

- イントロダクション

- 脳と神経のMRI

- 脊椎および筋骨格MRI

- 血管MRI

- 骨盤および腹部MRI

- 乳房MRI

- 心臓MRI

- 小児MRI

- その他

第7章 MRIシステム市場(アーキテクチャ別)

- イントロダクション

- 閉鎖型MRIシステム

- オープンMRIシステム

第8章 MRIシステム市場(デザイン別)

- イントロダクション

- 固定式/据置型MRIシステム

- 可動式MRIシステム

第9章 MRIシステム市場(磁場強度別)

- イントロダクション

- 高磁場~超高磁場MRIシステム

- 低~中磁場MRIシステム

- 超高磁場MRIシステム

第10章 MRIシステム市場(エンドユーザー別)

- イントロダクション

- 病院

- 診断画像センター

- その他

第11章 MRIシステム市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:マクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカ:マクロ経済見通し

- GCC諸国

- その他

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益シェア分析、2020年~2024年

- 市場シェア分析

- 2024年の主要参入企業ランキング

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- SIEMENS HEALTHINEERS

- KONINKLIJKE PHILIPS N.V.

- GE HEALTHCARE

- CANON MEDICAL SYSTEMS

- FUJIFILM CORPORATION

- FONAR CORPORATION

- ESAOTE S.P.A

- SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.

- ASPECT IMAGING LTD.

- TIME MEDICAL HOLDING

- NEUSOFT MEDICAL SYSTEMS CO., LTD.

- STERNMED GMBH

- HYPERFINE, INC.

- SHENZHEN BASDA MEDICAL APPARATUS CO., LTD.

- SHENZHEN ANKE HIGH-TECH., LTD.

- その他の企業

- MAGNETICA LTD

- AURORA HEALTHCARE US CORP

- INNERVISION MRI LTD.

- BEIJING WANDONG MEDICAL TECHNOLOGY CO., LTD.

- MEDONICA CO., LTD

- NEOSCAN SOLUTIONS GMBH

- KANGDA INTERCONTINENTAL MEDICAL EQUIPMENT CO., LTD.

- MINFOUND MEDICAL SYSTEMS CO., LTD.

- SYNAPTIVE MEDICAL

- XINGAOYI MEDICAL EQUIPMENT CO., LTD

第14章 付録

List of Tables

- TABLE 1 MARKET DYNAMICS: IMPACT ANALYSIS

- TABLE 2 IMPACT OF PORTER'S FORCES ON MRI SYSTEMS MARKET

- TABLE 3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 5 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 6 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 7 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 8 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 9 NORTH AMERICA: RELEVANT MRI REIMBURSEMENT CODE

- TABLE 10 EUROPE: RELEVANT MRI REIMBURSEMENT CODE

- TABLE 11 ASIA PACIFIC: RELEVANT MRI REIMBURSEMENT CODE

- TABLE 12 ROLE OF COMPANIES/ORGANIZATIONS IN MARKET ECOSYSTEM

- TABLE 13 AVERAGE SELLING PRICING TREND OF MRI SYSTEMS, BY KEY PLAYER, 2022-2024

- TABLE 14 AVERAGE SELLING PRICING TREND OF MRI SYSTEMS, BY REGION, 2022-2024

- TABLE 15 INNOVATIONS AND PATENT REGISTRATIONS, 2023-2024

- TABLE 16 IMPORT DATA FOR HS CODE 9018-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 17 EXPORT DATA FOR HS CODE 9018-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 18 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY FIELD STRENGTH

- TABLE 20 KEY BUYING CRITERIA, BY END USER

- TABLE 21 EXPANDING ACCESS TO MRI SYSTEMS

- TABLE 22 MRI SCAN APPLICATIONS, BY REGION, 2022 ('000 UNITS)

- TABLE 23 MRI SCAN APPLICATIONS, BY REGION, 2023 ('000 UNITS)

- TABLE 24 MRI SCAN APPLICATIONS, BY REGION, 2024 ('000 UNITS)

- TABLE 25 RECIPROCAL TARIFF RATES ADJUSTED BY US

- TABLE 26 MRI SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 27 MRI SYSTEMS MARKET FOR BRAIN & NEUROLOGICAL MRI, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 MRI SYSTEMS MARKET FOR SPINE & MUSCULOSKELETAL MRI, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 MRI SYSTEMS MARKET FOR VASCULAR MRI, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 MRI SYSTEMS MARKET FOR PELVIC & ABDOMINAL MRI, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 MRI SYSTEMS MARKET FOR BREAST MRI, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 MRI SYSTEMS MARKET FOR CARDIAC MRI, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 MRI SYSTEMS MARKET FOR PEDIATRIC MRI, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 MRI SYSTEMS MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 MRI SYSTEMS MARKET, BY ARCHITECTURE, 2023-2030 (USD MILLION)

- TABLE 36 CLOSED MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 37 CLOSED MRI SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 STANDARD BORE MRI SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 WIDE-BORE MRI SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 OPEN MRI SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 MRI SYSTEMS MARKET, BY DESIGN, 2023-2030 (USD MILLION)

- TABLE 42 FIXED/STATIONARY MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 43 FIXED/STATIONARY MRI SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 FLOOR-FIXED MRI SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 CEILING-FIXED MRI SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 PORTABLE MRI SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 48 HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY REGION, 2022-2024 (UNITS)

- TABLE 50 1.5T MRI SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 1.5T MRI SYSTEMS MARKET, BY REGION, 2022-2024 (UNITS)

- TABLE 52 3T MRI SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 3T MRI SYSTEMS MARKET, BY REGION, 2022-2024 (UNITS)

- TABLE 54 LOW-TO-MID-FIELD MRI SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 LOW-TO-MID-FIELD MRI SYSTEMS MARKET, BY REGION, 2022-2024 (UNITS)

- TABLE 56 ULTRA-HIGH-FIELD MRI SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 ULTRA-HIGH-FIELD MRI SYSTEMS MARKET, BY REGION, 2022-2024 (UNITS)

- TABLE 58 MRI SYSTEMS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 59 MRI SYSTEMS MARKET FOR HOSPITALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 MRI SYSTEMS MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 MRI SYSTEMS MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 MRI SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: MACROECONOMIC OUTLOOK

- TABLE 64 NORTH AMERICA: MRI SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2023-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: CLOSED MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: MRI SYSTEMS MARKET, BY DESIGN, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: FIXED/STATIONARY MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: MRI SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: MRI SYSTEMS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 73 US: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 74 US: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 75 CANADA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 76 CANADA: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 77 EUROPE: MACROECONOMIC OUTLOOK

- TABLE 78 EUROPE: MRI SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 EUROPE: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 80 EUROPE: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 81 EUROPE: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: CLOSED MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: MRI SYSTEMS MARKET, BY DESIGN, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: FIXED/STATIONARY MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: MRI SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: MRI SYSTEMS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 87 GERMANY: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 88 GERMANY: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 89 UK: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 90 UK: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 FRANCE: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 92 FRANCE: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 93 ITALY: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 94 ITALY: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 SPAIN: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 96 SPAIN: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 REST OF EUROPE: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 98 REST OF EUROPE: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- TABLE 100 ASIA PACIFIC: MRI SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 ASIA PACIFIC: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2023-2030 (USD MILLION)

- TABLE 104 ASIA PACIFIC: CLOSED MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: MRI SYSTEMS MARKET, BY DESIGN, 2023-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: FIXED/STATIONARY MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MRI SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MRI SYSTEMS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 109 JAPAN: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 110 JAPAN: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 CHINA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 112 CHINA: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 INDIA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 114 INDIA: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 AUSTRALIA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 116 AUSTRALIA: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 SOUTH KOREA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 118 SOUTH KOREA: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 LATIN AMERICA: MACROECONOMIC OUTLOOK

- TABLE 122 LATIN AMERICA: MRI SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 123 LATIN AMERICA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 124 LATIN AMERICA: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 LATIN AMERICA: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2023-2030 (USD MILLION)

- TABLE 126 LATIN AMERICA: CLOSED MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 LATIN AMERICA: MRI SYSTEMS MARKET, BY DESIGN, 2023-2030 (USD MILLION)

- TABLE 128 LATIN AMERICA: FIXED/STATIONARY MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 129 LATIN AMERICA: MRI SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 130 LATIN AMERICA: MRI SYSTEMS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 131 BRAZIL: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 132 BRAZIL: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 MEXICO: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 134 MEXICO: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 REST OF LATIN AMERICA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 136 REST OF LATIN AMERICA: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- TABLE 138 MIDDLE EAST & AFRICA: MRI SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MRI SYSTEMS MARKET, BY ARCHITECTURE, 2023-2030 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: CLOSED MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MRI SYSTEMS MARKET, BY DESIGN, 2023-2030 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: FIXED/STATIONARY MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: MRI SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: MRI SYSTEMS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 147 GCC COUNTRIES: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 148 GCC COUNTRIES: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 REST OF MIDDLE EAST & AFRICA: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2023-2030 (USD MILLION)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MRI SYSTEMS MARKET, 2021-2025

- TABLE 152 MRI SYSTEMS MARKET: DEGREE OF COMPETITION

- TABLE 153 MRI SYSTEMS MARKET: FIELD STRENGTH FOOTPRINT

- TABLE 154 MRI SYSTEMS MARKET: APPLICATION FOOTPRINT

- TABLE 155 MRI SYSTEMS MARKET: END USER FOOTPRINT

- TABLE 156 MRI SYSTEMS MARKET: REGION FOOTPRINT

- TABLE 157 MRI SYSTEMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 158 MRI SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 159 MRI SYSTEMS MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 160 MRI SYSTEMS MARKET: DEALS, JANUARY 2021-APRIL 2025

- TABLE 161 MRI SYSTEMS MARKET: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 162 SIEMENS HEALTHINEERS: COMPANY OVERVIEW

- TABLE 163 SIEMENS HEALTHINEERS: PRODUCTS OFFERED

- TABLE 164 SIEMENS HEALTHINEERS: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 165 SIEMENS HEALTHINEERS: DEALS, JANUARY 2021-APRIL 2025

- TABLE 166 SIEMENS HEALTHINEERS: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 167 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 168 KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED

- TABLE 169 KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 170 KONINKLIJKE PHILIPS N.V.: DEALS, JANUARY 2021-APRIL 2025

- TABLE 171 KONINKLIJKE PHILIPS N.V.: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 172 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 173 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 174 GE HEALTHCARE: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 175 GE HEALTHCARE: DEALS, JANUARY 2021-APRIL 2025

- TABLE 176 GE HEALTHCARE: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 177 CANON MEDICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 178 CANON MEDICAL SYSTEMS: PRODUCTS OFFERED

- TABLE 179 CANON MEDICAL SYSTEMS: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 180 CANON MEDICAL SYSTEMS: DEALS, JANUARY 2021-APRIL 2025

- TABLE 181 FUJIFILM CORPORATION: COMPANY OVERVIEW

- TABLE 182 FUJIFILM CORPORATION: PRODUCTS OFFERED

- TABLE 183 FUJIFILM CORPORATION: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 184 FUJIFILM CORPORATION: DEALS, JANUARY 2021-APRIL 2025

- TABLE 185 FONAR CORPORATION: COMPANY OVERVIEW

- TABLE 186 FONAR CORPORATION: PRODUCTS OFFERED

- TABLE 187 FONAR CORPORATION: DEALS, JANUARY 2021-APRIL 2025

- TABLE 188 ESAOTE SPA: COMPANY OVERVIEW

- TABLE 189 ESAOTE SPA: PRODUCTS OFFERED

- TABLE 190 ESAOTE SPA: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 191 ESAOTE SPA: DEALS, JANUARY 2021-APRIL 2025

- TABLE 192 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: COMPANY OVERVIEW

- TABLE 193 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: PRODUCTS OFFERED

- TABLE 194 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 195 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: DEALS, JANUARY 2021-APRIL 2025

- TABLE 196 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 197 ASPECT IMAGING LTD.: COMPANY OVERVIEW

- TABLE 198 ASPECT IMAGING LTD.: PRODUCTS OFFERED

- TABLE 199 TIME MEDICAL HOLDING: COMPANY OVERVIEW

- TABLE 200 TIME MEDICAL HOLDING: PRODUCTS OFFERED

- TABLE 201 TIME MEDICAL HOLDING: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 202 TIME MEDICAL HOLDING: DEALS, JANUARY 2021-APRIL 2025

- TABLE 203 TIME MEDICAL HOLDING: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 204 NEUSOFT MEDICAL SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 205 NEUSOFT MEDICAL SYSTEMS CO., LTD.: PRODUCTS OFFERED

- TABLE 206 NEUSOFT MEDICAL SYSTEMS CO., LTD.: DEALS, JANUARY 2021-APRIL 2025

- TABLE 207 STERNMED GMBH: COMPANY OVERVIEW

- TABLE 208 STERNMED GMBH: PRODUCTS OFFERED

- TABLE 209 STERNMED GMBH: DEALS, JANUARY 2021-APRIL 2025

- TABLE 210 HYPERFINE, INC.: COMPANY OVERVIEW

- TABLE 211 HYPERFINE, INC.: PRODUCTS OFFERED

- TABLE 212 HYPERFINE, INC.: DEALS, JANUARY 2021-APRIL 2025

- TABLE 213 SHENZHEN BASDA MEDICAL APPARATUS CO., LTD.: COMPANY OVERVIEW

- TABLE 214 SHENZHEN BASDA MEDICAL APPARATUS CO., LTD.: PRODUCTS OFFERED

- TABLE 215 SHENZHEN ANKE HIGH-TECH., LTD: COMPANY OVERVIEW

- TABLE 216 SHENZHEN ANKE HIGH-TECH., LTD: PRODUCTS OFFERED

- TABLE 217 MAGNETICA LTD: COMPANY OVERVIEW

- TABLE 218 AURORA HEALTHCARE US CORP: COMPANY OVERVIEW

- TABLE 219 INNERVISION MRI LTD.: COMPANY OVERVIEW

- TABLE 220 BEIJING WANDONG MEDICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 221 MEDONICA CO., LTD: COMPANY OVERVIEW

- TABLE 222 NEOSCAN SOLUTIONS GMBH: COMPANY OVERVIEW

- TABLE 223 KANGDA INTERCONTINENTAL MEDICAL EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 224 MINFOUND MEDICAL SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 225 SYNAPTIVE MEDICAL: COMPANY OVERVIEW

- TABLE 226 XINGAOYI MEDICAL EQUIPMENT CO,. LTD: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 APPROACH 1 (COMPANY REVENUE ESTIMATION)

- FIGURE 6 REVENUE SHARE ANALYSIS: ILLUSTRATIVE EXAMPLE OF SIEMENS HEALTHINEERS

- FIGURE 7 APPROACH 2: CUSTOMER-BASED MARKET ESTIMATION

- FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 MRI SYSTEMS MARKET, BY ARCHITECTURE, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 MRI SYSTEMS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 MRI SYSTEMS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 MRI SYSTEMS MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 15 RISING PREVALENCE OF CHRONIC DISEASES TO DRIVE MARKET

- FIGURE 16 HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 17 BRAIN & NEUROLOGICAL MRI SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 18 HOSPITALS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 19 CHINA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 MRI SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 ECOSYSTEM ANALYSIS

- FIGURE 23 VALUE CHAIN ANALYSIS

- FIGURE 24 SUPPLY CHAIN ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF MRI SYSTEMS, BY KEY PLAYER, 2022-2024 (USD MILLION)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF MRI SYSTEMS, BY REGION, 2022-2024 (USD MILLION)

- FIGURE 27 PATENTS GRANTED, 2014-2024

- FIGURE 28 IMPORT DATA FOR HS CODE 9018-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 29 EXPORT DATA FOR HS CODE 9018-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 30 NEW REVENUE POCKETS FOR PLAYERS IN MRI SYSTEMS MARKET

- FIGURE 31 INVESTMENT & FUNDING SCENARIO, 2019-2023 (USD MILLION)

- FIGURE 32 NUMBER OF DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 33 TOTAL VALUE OF DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY FIELD STRENGTH

- FIGURE 35 KEY BUYING CRITERIA, BY END USER

- FIGURE 36 AI-INTEGRATED MRI SYSTEMS: USE CASES

- FIGURE 37 PRICE IMPACT ANALYSIS

- FIGURE 38 NORTH AMERICA: MRI SYSTEMS MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: MRI SYSTEMS MARKET SNAPSHOT

- FIGURE 40 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 41 MARKET SHARE OF KEY PLAYERS, 2024

- FIGURE 42 RANKING OF KEY PLAYERS, 2024

- FIGURE 43 EV/EBITDA OF TOP THREE PLAYERS, 2025

- FIGURE 44 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF TOP THREE VENDORS, 2025

- FIGURE 45 BRAND/PRODUCT COMPARISON

- FIGURE 46 MRI SYSTEMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 COMPANY FOOTPRINT

- FIGURE 48 MRI SYSTEMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2024)

- FIGURE 50 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 51 GE HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 52 CANON MEDICAL SYSTEMS: COMPANY SNAPSHOT (2024)

- FIGURE 53 FUJIFILM CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 54 FONAR CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 55 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: COMPANY SNAPSHOT (2024)

- FIGURE 56 HYPERFINE, INC.: COMPANY SNAPSHOT (2024)

The global MRI systems market is projected to reach USD 9.0 billion by 2030 from USD 6.5 billion in 2025, at a CAGR of 6.5% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Field Strength, Architecture, Design, Application, End User, and Region |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa |

The market's growth can be attributed to an increase in disease burden, specifically for neurological and musculoskeletal conditions, which is projected to increase in the coming years. An increase in the aging population, with the rising prevalence of chronic diseases such as cancer, is anticipated to increase the need for MRI systems across the globe. All these factors, on a broader level, will help to grow the market for MRI systems.

By field strength, the high & very high field segment dominated the MRI systems market in 2024.

The MRI systems market is categorized by field strength, encompassing low-to-mid-field MRI systems, high and very high field MRI systems, and ultra-high-field MRI systems. High and very high field MRI systems are notable for their superior signal-to-noise ratio (SNR), which enhances clinical utility significantly. These systems are not only instrumental in imaging the brain, musculoskeletal structures, and vascular systems but also excel in specialized applications within psychiatry, neurology, biomedical research, and the early identification of conditions such as multiple sclerosis. The integration of MRI with complementary modalities such as PET and ultrasound further optimizes operational throughput and decreases helium usage while also delivering faster scan times and enhanced image resolution. High-field MRI systems, specifically those operating at 1.5T and 3T, are favored over low-field systems (below 1T) due to their markedly superior image quality, reduced acquisition times, and extensive range of clinical applications. The elevated SNR in high-field systems translates to clearer, more detailed imaging essential for diagnosing complex conditions such as neurological disorders, musculoskeletal injuries, and cardiovascular abnormalities. The rapid scan capabilities not only improve patient throughput but also enhance operational efficiency within healthcare facilities. Collectively, these factors have driven the growing adoption of high-field MRI systems within the market.

By architecture, the closed MRI systems segment accounted for the largest share of the market in 2024.

A closed MRI scanner utilizes a small cylindrical chamber to produce highly detailed images of the body's structure. Most high-field superconducting magnetic resonance imaging scanners are designed in a closed format. Due to their higher efficiency, superior image quality, and increased throughput-all resulting from greater magnetic field strengths-closed MRI systems are considered the industry standard. In contrast to open MRI systems, which may require up to four or five scans for a comparable evaluation, closed MRI systems typically complete the scanning process in just one or two scans. This efficiency not only shortens examination times but also enhances the clinical utility of procedures and therapies. Closed MRI offers faster scan times, which helps reduce motion artifacts and improves patient throughput, making it particularly suitable for high-volume hospitals and diagnostic centers. Additionally, it supports advanced imaging techniques such as functional MRI (fMRI), diffusion-weighted imaging (DWI), and cardiac MRI, all of which rely on high-field strength for precision.

By design, the fixed/stationary MRI systems segment accounted for the largest share of the market in 2024.

The market for MRI systems is divided into two main categories: fixed (or stationary) MRI systems and portable MRI systems. Fixed MRI systems are generally preferred over portable ones for several reasons. They offer superior image quality, the ability to conduct full-body scans, improved workflow efficiency, and better long-term cost-effectiveness. Typically, fixed MRI units operate at a magnetic field. Another significant advantage of fixed MRI systems is their capability for full-body imaging, which further fuels market growth.

By application, the brain & neurological MRI segment has registered the highest growth rate during the forecast period.

Based on applications, the MRI systems market is segmented into brain & neurological MRI, spine & musculoskeletal MRI, pelvic & abdominal MRI, vascular MRI, breast MRI, cardiac MRI, pediatric MRI, and other applications. The brain & neurological MRI segment of the MRI systems market by application is expected to register the highest growth rate during the forecast period. Key drivers contributing to the rapid growth of this segment include the integration of sophisticated AI technologies as well as the increasing adoption of innovative devices that enable accurate targeting of internal organs, thereby facilitating real-time imaging capabilities.

By end user, the hospitals segment accounted for the largest share of the market in 2024.

The global MRI systems market is classified by end users into hospitals, diagnostic imaging centers, and other categories. In 2024, the hospital segment held the largest market share. This dominance is primarily due to the increased use of advanced MRI systems in hospitals, which enhance accurate diagnosis and raise awareness of the importance of early detection. Contributing factors include recent product launches, the growing adoption of advanced systems with improved features that support patient care, and a rising number of imaging procedures conducted in hospitals. As the demand for rapid and precise diagnoses of various medical conditions grows, many hospitals are prioritizing the installation of advanced MRI systems. Large government hospitals with dedicated imaging units have been early adopters of these technologies, while private hospitals are increasingly embracing advanced imaging solutions over time. The trend towards modernizing imaging workflows has further driven the adoption of MRI systems in hospitals.

"The Asia Pacific market is projected to show the highest growth rate in the MRI systems market."

The MRI systems market spans five primary regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Notably, the Asia Pacific region houses a significant number of MRI systems manufacturers that deliver a comprehensive range of MRI modalities equipped with advanced technological features, all while maintaining competitive pricing. End users, particularly in healthcare institutions, are increasingly facing budget constraints exacerbated by recent tariff sanctions; this has prompted a shift towards more cost-effective MRI solutions offered by Chinese manufacturers. The region's manufacturing landscape benefits from low labor costs and abundant resources, facilitating efficient production processes for MRI systems. These dynamics position the Asia Pacific market to experience the highest growth rate within the global landscape, driven by both increased local demand and the strategic pricing of offerings.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-20%, Tier 2-45%, and Tier 3-35%

- By Designation: C-level-30%, Directors-20%, and Others-50%

- By Region: North America-36%, Europe-25%, Asia Pacific-27%, Latin America-9%, and the Middle East & Africa-3%

The key players profiled in the MRI systems market are Siemens Healthineers (Germany), GE HealthCare (US), Koninklijke Philips N.V. (Netherlands), FUJIFILM Corporation (Japan), Canon Inc. (Japan), Fonar Corporation (US), Esaote S.p.A (Italy), Shanghai United Imaging Healthcare Co., Ltd (China), Aspect Imaging Ltd. (US), and Time Medical Holding (Hong Kong).

Research Coverage

The research report examines the MRI systems market by product, sample preparation technique, application, end-users, and geography. This research covers factors that are driving market expansion, analyzes prospects and parameters faced by industries in the present time, and provides specifics on the competitive landscape considering market leaders and small and medium enterprises. This research also estimates the revenue of different market segments by considering five regions and micro-market analysis.

Rationale to Buy the Report

The report will provide market leaders and new entrants with valuable information regarding the revenue estimates for the overall MRI systems market and its subsegments. It will help stakeholders understand the competitive landscape, allowing them to position their businesses more effectively and develop appropriate go-to-market strategies. Additionally, the report offers insights into the market dynamics, including key drivers, restraints, challenges, and opportunities.

This report provides insightful data on the following points:

- Market Penetration: In-depth coverage of product portfolios offered by the top players in the MRI systems market

- Product Development/Innovation: In-depth coverage of product portfolios offered by the top players in the MRI systems market

- Market Development: Insightful data on profitable developing areas

- Market Diversification: Details about recent developments and advancements in the MRI systems market

- Competitive Assessment: Extensive assessment of the products, growth tactics, revenue projections, and market categories of the top competitors

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 RESEARCH LIMITATIONS

- 1.7 KEY STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH 1: COMPANY REVENUE ESTIMATION

- 2.2.2 APPROACH 2: CUSTOMER-BASED MARKET ESTIMATION

- 2.2.3 GROWTH FORECAST

- 2.2.4 CAGR PROJECTIONS

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN MRI SYSTEMS MARKET

- 4.2 EUROPE: MRI SYSTEMS MARKET, BY FIELD STRENGTH, 2025 VS. 2030 (USD MILLION)

- 4.3 NORTH AMERICA: MRI SYSTEMS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- 4.4 ASIA PACIFIC: MRI SYSTEMS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- 4.5 MRI SYSTEMS MARKET: GEOGRAPHICAL SNAPSHOT

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Public-private partnerships to scale diagnostic imaging landscape

- 5.2.1.2 Growing prevalence of MSDs and increasing geriatric population to boost demand

- 5.2.1.3 Integration of iMRI into surgery to catalyze growth of MRI systems market

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complex operations and maintenance of MRI systems

- 5.2.2.2 Premium pricing of MRI systems

- 5.2.2.3 Global helium shortage

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of helium-free MRI systems

- 5.2.3.2 AI integration with MRI technology for process optimization

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited capital budgets

- 5.2.4.2 Dearth of trained and skilled professionals

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.4 REGULATORY LANDSCAPE

- 5.4.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4.2 REGULATIONS, BY REGION

- 5.4.2.1 North America

- 5.4.2.1.1 US

- 5.4.2.1.2 Canada

- 5.4.2.2 Europe

- 5.4.2.3 Asia Pacific

- 5.4.2.3.1 Japan

- 5.4.2.3.2 China

- 5.4.2.3.3 India

- 5.4.2.1 North America

- 5.5 REIMBURSEMENT SCENARIO ANALYSIS

- 5.5.1 RELEVANT REIMBURSEMENT CODE, BY COUNTRY

- 5.5.2 REIMBURSEMENT TRENDS, BY REGION, 2022-2024

- 5.5.2.1 North America

- 5.5.2.2 Europe

- 5.5.2.3 Asia Pacific

- 5.5.2.4 Latin America

- 5.5.2.5 Middle East & Africa

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 VALUE CHAIN ANALYSIS

- 5.7.1 R&D

- 5.7.2 RAW MATERIAL PROCUREMENT AND PRODUCT DEVELOPMENT

- 5.7.3 MARKETING, SALES, AND DISTRIBUTION

- 5.7.4 AFTERMARKET SERVICES

- 5.8 SUPPLY CHAIN ANALYSIS

- 5.8.1 PROMINENT COMPANIES

- 5.8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 5.8.3 END USERS

- 5.8.4 SALES AND DISTRIBUTION

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER, 2022-2024

- 5.9.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- 5.11.2 EXPORT SCENARIO

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Ultrafast imaging technologies

- 5.12.1.2 Ultra-high-field MRI

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 Advanced coil technology

- 5.12.2.2 Weight-bearing MRI imaging

- 5.12.3 ADJACENT TECHNOLOGIES

- 5.12.3.1 AI and machine learning in MRI imaging

- 5.12.1 KEY TECHNOLOGIES

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 INVESTMENT & FUNDING SCENARIO

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 KEY BUYING CRITERIA

- 5.17 CASE STUDY ANALYSIS

- 5.17.1 EXPANDING ACCESS TO MRI SYSTEMS

- 5.18 MRI SCAN APPLICATIONS, 2022-2024

- 5.19 IMPACT OF AI ON MRI SYSTEMS MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 MARKET POTENTIAL OF MRI SYSTEMS

- 5.19.3 KEY COMPANIES IMPLEMENTING AI

- 5.19.4 FUTURE OF AI IN MRI SYSTEMS MARKET ECOSYSTEM

- 5.20 US TARIFF 2025

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.5 IMPACT ON END USE INDUSTRIES

6 MRI SYSTEMS MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 BRAIN & NEUROLOGICAL MRI

- 6.2.1 RISE IN NEURODEGENERATIVE DISEASES TO DRIVE MARKET

- 6.3 SPINE & MUSCULOSKELETAL MRI

- 6.3.1 GROWING PREVALENCE OF MUSCULOSKELETAL DISORDERS TO DRIVE MARKET

- 6.4 VASCULAR MRI

- 6.4.1 USE OF VASCULAR MRI AS ALTERNATIVE TO CT TO SUPPORT MARKET GROWTH

- 6.5 PELVIC & ABDOMINAL MRI

- 6.5.1 NEED FOR DETECTING PROSTATE AND CERVICAL CANCERS TO PROPEL MARKET

- 6.6 BREAST MRI

- 6.6.1 GROWING AWARENESS REGARDING EARLY BREAST CANCER SCREENING TO DRIVE MARKET

- 6.7 CARDIAC MRI

- 6.7.1 RISING INCIDENCE OF CVD TO SUPPORT MARKET GROWTH

- 6.8 PEDIATRIC MRI

- 6.8.1 NEED FOR EFFICIENT DIAGNOSTIC ACCURACY AND EARLY DETECTION TO PROMOTE USE OF PEDIATRIC MRI

- 6.9 OTHER APPLICATIONS

7 MRI SYSTEMS MARKET, BY ARCHITECTURE

- 7.1 INTRODUCTION

- 7.2 CLOSED MRI SYSTEMS

- 7.2.1 STANDARD BORE MRI SYSTEMS

- 7.2.1.1 High accuracy and improved sensitivity of systems to propel market

- 7.2.2 WIDE-BORE MRI SYSTEMS

- 7.2.2.1 High-quality MRI images and improved patient comfort to drive market

- 7.2.1 STANDARD BORE MRI SYSTEMS

- 7.3 OPEN MRI SYSTEMS

- 7.3.1 USE OF OPEN MRI SYSTEMS FOR CHILDREN AND OBESE PATIENTS TO DRIVE MARKET

8 MRI SYSTEMS MARKET, BY DESIGN

- 8.1 INTRODUCTION

- 8.2 FIXED/STATIONARY MRI SYSTEMS

- 8.2.1 FLOOR-FIXED MRI SYSTEMS

- 8.2.1.1 High flexibility and low initial installation costs to drive demand

- 8.2.2 CEILING-FIXED MRI SYSTEMS

- 8.2.2.1 Need for MRI systems with high stability and more space to drive market

- 8.2.1 FLOOR-FIXED MRI SYSTEMS

- 8.3 PORTABLE MRI SYSTEMS

- 8.3.1 ADOPTION OF PORTABLE/MOBILE MRI SYSTEMS DUE TO THEIR COST-EFFECTIVENESS AND FLEXIBILITY TO BOOST GROWTH

9 MRI SYSTEMS MARKET, BY FIELD STRENGTH

- 9.1 INTRODUCTION

- 9.2 HIGH-TO-VERY-HIGH-FIELD MRI SYSTEMS

- 9.2.1 1.5T

- 9.2.1.1 Rising use of 1.5T MRI systems for routine examinations to propel market

- 9.2.2 3T

- 9.2.2.1 Increasing use of 3T MRI systems to obtain high-quality images to drive market

- 9.2.1 1.5T

- 9.3 LOW-TO-MID-FIELD MRI SYSTEMS

- 9.3.1 RISING ADOPTION OF OXYGEN-ENHANCED MRI SYSTEMS TO DRIVE MARKET

- 9.4 ULTRA-HIGH-FIELD MRI SYSTEMS

- 9.4.1 RISING INNOVATION AND ADVANCEMENTS TO SUPPORT DEMAND FOR ULTRA-HIGH-FIELD SYSTEMS

10 MRI SYSTEMS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOSPITALS

- 10.2.1 INCREASING ADOPTION OF ADVANCED MRI SYSTEMS TO PROPEL MARKET

- 10.3 DIAGNOSTIC IMAGING CENTERS

- 10.3.1 RISING DEVELOPMENT OF PRIVATE IMAGING CENTERS TO FUEL MARKET

- 10.4 OTHER END USERS

11 MRI SYSTEMS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.2 US

- 11.2.2.1 Strategic reforms in reimbursements and partnerships to drive market

- 11.2.3 CANADA

- 11.2.3.1 Progressive government policies and growing pulse of diagnostic imaging to spur market

- 11.3 EUROPE

- 11.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.2 GERMANY

- 11.3.2.1 Digital push in healthcare access and supportive government policies to drive market

- 11.3.3 UK

- 11.3.3.1 Strategic developments in diagnostic imaging niche to propel market

- 11.3.4 FRANCE

- 11.3.4.1 Increasing patient population and reforms in MRI coverage policies to boost growth

- 11.3.5 ITALY

- 11.3.5.1 Progressive government initiatives and strong corporate collaborations to propel

- 11.3.6 SPAIN

- 11.3.6.1 Strategic policy reforms and technological advancements in preclinical MRI to drive market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.2 JAPAN

- 11.4.2.1 Strong healthcare infrastructure and supportive government reimbursement policies to boost growth

- 11.4.3 CHINA

- 11.4.3.1 Policy reforms, progressive infrastructure plans, and foreign collaborations to boost market

- 11.4.4 INDIA

- 11.4.4.1 Industry collaboration and public-private synergy to expand diagnostic imaging landscape

- 11.4.5 AUSTRALIA

- 11.4.5.1 New research initiatives and policy enhancements to promote growth

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Supportive government policies to promote growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.5.2 BRAZIL

- 11.5.2.1 Increased burden of diseases and growing adoption of healthcare insurance to drive market

- 11.5.3 MEXICO

- 11.5.3.1 Industry partnerships to drive market growth

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Favorable government initiatives to contribute to market growth

- 11.6.3 REST OF MIDDLE EAST & AFRICA

- 11.6.3.1 Increased adoption of mass spectrometers to contribute to growth

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE SHARE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS

- 12.5 RANKING OF KEY PLAYERS, 2024

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 BRAND/PRODUCT COMPARISON

- 12.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.8.1 STARS

- 12.8.2 PERVASIVE PLAYERS

- 12.8.3 EMERGING LEADERS

- 12.8.4 PARTICIPANTS

- 12.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.8.5.1 Company footprint

- 12.8.5.2 Field strength footprint

- 12.8.5.3 Application footprint

- 12.8.5.4 End user footprint

- 12.8.5.5 Region footprint

- 12.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.9.1 PROGRESSIVE COMPANIES

- 12.9.2 RESPONSIVE COMPANIES

- 12.9.3 DYNAMIC COMPANIES

- 12.9.4 STARTING BLOCKS

- 12.9.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024

- 12.9.5.1 Detailed list of key startups/SMEs

- 12.9.5.2 Competitive benchmarking of key startups/SMEs

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT LAUNCHES AND APPROVALS

- 12.10.2 DEALS

- 12.10.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SIEMENS HEALTHINEERS

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches and approvals

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 KONINKLIJKE PHILIPS N.V.

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches and approvals

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 GE HEALTHCARE

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches and approvals

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 CANON MEDICAL SYSTEMS

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches and approvals

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 FUJIFILM CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches and approvals

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 FONAR CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 ESAOTE S.P.A

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches and approvals

- 13.1.7.3.2 Deals

- 13.1.8 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches and approvals

- 13.1.8.3.2 Deals

- 13.1.8.3.3 Expansions

- 13.1.9 ASPECT IMAGING LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 TIME MEDICAL HOLDING

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches and approvals

- 13.1.10.3.2 Deals

- 13.1.10.3.3 Expansions

- 13.1.11 NEUSOFT MEDICAL SYSTEMS CO., LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.12 STERNMED GMBH

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.13 HYPERFINE, INC.

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Deals

- 13.1.14 SHENZHEN BASDA MEDICAL APPARATUS CO., LTD.

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 SHENZHEN ANKE HIGH-TECH., LTD.

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.1 SIEMENS HEALTHINEERS

- 13.2 OTHER PLAYERS

- 13.2.1 MAGNETICA LTD

- 13.2.2 AURORA HEALTHCARE US CORP

- 13.2.3 INNERVISION MRI LTD.

- 13.2.4 BEIJING WANDONG MEDICAL TECHNOLOGY CO., LTD.

- 13.2.5 MEDONICA CO., LTD

- 13.2.6 NEOSCAN SOLUTIONS GMBH

- 13.2.7 KANGDA INTERCONTINENTAL MEDICAL EQUIPMENT CO., LTD.

- 13.2.8 MINFOUND MEDICAL SYSTEMS CO., LTD.

- 13.2.9 SYNAPTIVE MEDICAL

- 13.2.10 XINGAOYI MEDICAL EQUIPMENT CO., LTD

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS