|

|

市場調査レポート

商品コード

1719530

コアリングの世界市場:坑井タイプ別、技術別、用途別、最終用途産業別、地域別 - 2029年までの予測Coring Market by Technology (Rotary, Wireline, Sidewall Coring), Well Type (Exploration, Appraisal, Development), Application (Onshore, Offshore), End-use Industry (Oil & Gas, Geothermal, Carbon Capture & Storage), Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| コアリングの世界市場:坑井タイプ別、技術別、用途別、最終用途産業別、地域別 - 2029年までの予測 |

|

出版日: 2025年05月05日

発行: MarketsandMarkets

ページ情報: 英文 159 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

コアリングの市場規模は、2024年の4億8,930万米ドルから2029年には6億8,870万米ドルに達すると予測され、予測期間中のCAGRは7.1%になるとみられています。

コアリング市場は、シェール層探査の拡大とコアリング技術の進歩によって牽引されています。デジタルツインテクノロジーのコアリングサービスへの統合は、コアリング市場の重要な促進要因になると考えられています。デジタルツインは、物理的資産の仮想レプリカを作成し、複雑な環境でのコアリング作業の監視と分析を強化することを可能にします。ワイヤラインコアリングシステムは、コストを削減し、プロジェクトの経済性を改善し、高度なサービスの需要を促進することによって、コアの旅を減らします。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント | 坑井タイプ別、技術別、用途別、最終用途産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

予測期間中、探査井戸セグメントは最も高い成長率が見込まれます。世界のエネルギー需要の高まりは、新しい海盆、特に沖合や深海地域での探査に拍車をかけています。エネルギー需要の増加により、石油・ガス会社は未開拓地域や開拓地域に新たな埋蔵量を求めています。コアリングは、このセグメントで重要な役割を果たし、地下の地質、貯留層特性、流体含有量に関する重要な洞察を提供します。これらは、未開拓地域の商業的可能性を評価するために不可欠な情報です。特にオフショアや深海地域での探査活動の急増に伴い、コアリングは不可欠なものとなっています。2022年11月末現在、世界で178の新鉱区ワイルドキャット(NFW)が発見され、回収可能な在来型資源は石油換算で187億バレル(Bboe)以上に達します。この発見資源量は2019年以降で最高となり、北米以外では過去5年間で最も重要なものになる可能性があります。

オンショアセグメントは、掘削活動の多さにより、コアリング市場で強力な地位を保持し続けています。オンショアコアリング部門は、費用対効果が高く、効率的な資源抽出に不可欠ないくつかの重要な要因によって牽引されています。オンショア貯留層は、通常、沖合での操業と比較して、初期資本投資が少なく、インフラが単純であるため、大規模なコアリング・キャンペーンを実施することがより現実的です。これらの利点は、オンショアで見られる複雑で変化に富んだ地層と相まって、操業リスクを低減し、坑井の生産性を高めるために、頻繁で詳細なコア分析が必要となります。米国とカナダでは、特にパーミアン盆地、バッケン層、カナダの非在来型埋蔵量のようなシェールガスとタイトオイル層で、現在進行中の探鉱・生産活動が、高度なコアリング技術への需要を高めています。

北米は、堅調な石油・ガス活動と再生可能エネルギー(特に地熱)への関心の高まりの組み合わせによって、コアリング市場をリードすると予想されます。この地域は、パーミアン・ベースンやマーセラス・シェールのような、世界最大かつ最も生産性の高いシェールオイル・ガス層を擁しており、コアリングを通じて詳細な地質データを得ることは、効果的な貯留層管理と生産の最適化に不可欠です。タイトオイル、シェールガス、その他の非在来型炭化水素資源の台頭は、複雑な岩層を評価し、回収率を高めるための高度なコアリング技術の需要をさらに高めています。北米、特に米国とカナダにおける地熱の潜在力は大きく、地熱探査と開発プロジェクトをサポートするために、コアリングによる正確な地下評価の必要性を煽っています。エネルギー転換が勢いを増すにつれ、再生可能エネルギー源、特に地熱へのシフトは、高品質のコア分析への需要をさらに加速させています。これらの要因から、北米は世界のコアリング市場の成長を牽引する重要な地域となっています。

コアリング市場は、幅広い地理的プレゼンスを持つ少数の主要参入企業によって独占されています。コアリング市場の大手企業は、SLB(米国)、Halliburton(米国)、Baker Hughes(米国)、Boart Longyear(米国)、NOV(米国)、Deep Industries Limited(インド)、Geotek Limited(英国)、US Coring LLC(米国)、Reservoir Group(米国)、ProDirectional(米国)、ConeTec(米国)、Foothills Resource Services(米国)、Andalas Petroleum Services(米国)、Summit International(米国)、Canamera Coring, Inc.(米国)、GulfTek(サウジアラビア)、Timberwolf Environmental Services Ltd.(カナダ)、OilTools Inc.(カナダ)、OilTools Services(カザフスタン)、CoreAll AS(ノルウェー)などです。

当レポートでは、世界のコアリング市場について調査し、さまざまな地域の坑井タイプ別、技術別、用途別、最終用途産業別の動向を予測しています。また、市場の詳細な質的・量的分析も行っています。主な市場促進要因・抑制要因・機会・課題を包括的にレビューし、市場の様々な重要な側面もカバーしています。これらには、競合情勢の分析、市場力学、金額ベースの市場推定、コアリング市場の将来動向などが含まれます。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要考察

第4章 調査手法

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- サプライチェーン分析

- テクノロジー分析

- ケーススタディ分析

- 価格分析

- 特許分析

- 2025年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第6章 コアリング市場(坑井タイプ別)

- イントロダクション

- 探査井戸

- 評価井戸

- 開発井戸

第7章 コアリング市場(技術別)

- イントロダクション

- ロータリーコアリング

- ワイヤーラインコアリング

- サイドウォールコアリング

第8章 コアリング市場(用途別)

- イントロダクション

- オンショア

- オフショア

第9章 コアリング市場(最終用途産業別)

- イントロダクション

- 石油・ガス

- 地熱

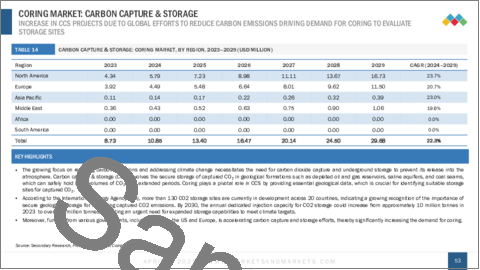

- 炭素回収・貯留(CCS)

第10章 コアリング市場(地域別)

- イントロダクション

- 北米

- アジア太平洋

- 欧州

- 中東

- アフリカ

- 南米

第11章 競合情勢

- 主要参入企業の戦略/強み、2021年~2024年

- 市場評価フレームワーク

- 主要企業の市場シェア分析(2023年)

- 2019~2023年におけるトップ5企業の収益分析

- 企業評価と財務指標

- 企業評価マトリックス:主要参入企業、2023年

第12章 企業プロファイル

- サービスプロバイダー

- SLB BUSINESS OVERVIEW

- HALLIBURTON

- BAKEHUGHESES

- NOV

- BOART LONGYEAR

- DEEP INDUSTRIES LIMITED

- GEOTEK LIMITED

- US CORING LLC

- RESERVOIR GROUP

- PRODIRECTIONAL

- CONETEC

- FOOTHILLS RESOURCE SERVICES

- ANDALAS PETROLEUM SERVICES

- SUMMIT INTERNATIONAL

- CANAMERA CORING, INC.

- GULFTEK

- OILTOOLS SERVICES

- TIMBERWOLF ENVIRONMENTAL SERVICES LTD

- COREALL AS

- IOT HOLLAND

- GASINVESTPROJECT

- HARRIS EXPLORATION

- NEBRASCO

- オペレーター

- BP P.L.C.

- SHELL PLC

- CHEVRON CORPORATION

- ENEL SPA

- SAUDI ARABIAN OIL CO.

- EQUINOR ASA

- OIL AND NATURAL GAS CORPORATION LIMITED

- PETROLIAM NASIONAL BERHAD(PETRONAS)

- EXXON MOBIL CORPORATION

- TOTALENERGIES

第13章 付録

List of Tables

_

List of Figures

_

The coring market is projected to reach USD 688.7 million by 2029 from an estimated value of USD 489.3 million in 2024, at a CAGR of 7.1% during the forecast period. The coring market is driven by growing shale exploration and advancements in coring technologies. The integration of digital twin technology into coring services is poised to be a significant driver for the coring market. Digital twins create virtual replicas of physical assets, enabling enhanced monitoring and analysis of coring operations in complex environments. Wireline coring systems reduce core trips by cutting costs, improving project economics, and driving demand for advanced services.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | Well Type, Technology, Application, End-use Industry, Region |

| Regions covered | North America, Europe, Asia Pacific, South America, Middle East, and Africa |

"Exploration well segment expected to grow at highest rate during forecast period"

The exploration well segment is expected to grow at the highest rate during the forecast period. The rising global energy demand has spurred exploration in new basins, especially offshore and deepwater regions. The increasing demand for energy has prompted oil and gas companies to seek new reserves in underexplored and frontier regions. Coring plays a crucial role in this segment, providing critical insights into subsurface geology, reservoir characteristics, and fluid content, which are information vital for evaluating the commercial potential of unexplored areas. With a surge in exploration activities, particularly in offshore and deepwater regions, coring has become indispensable. At the end of November 2022, 178 new-field wildcat (NFW) discoveries were made globally, amounting to over 18.7 billion barrels of oil equivalent (Bboe) in recoverable conventional resources. This volume of discovered resources is poised to be the highest since 2019 and potentially the most significant in the last five years outside North America.

"Based on application, onshore segment to lead coring market "

The onshore segment continues to hold a strong position in the coring market due to the high volume of drilling activities. The onshore coring segment is driven by several key factors that make it both cost-effective and essential for efficient resource extraction. Onshore reservoirs typically require lower initial capital investments and simpler infrastructure compared to offshore operations, making it more feasible to conduct extensive coring campaigns. These advantages, coupled with the complex and varied geological formations found in onshore settings, necessitate frequent and detailed core analyses to reduce operational risks and enhance well productivity. In the US and Canada, ongoing exploration and production activities-particularly in shale gas and tight oil plays like the Permian Basin, Bakken Formation, and Canada's unconventional reserves-are fueling the demand for advanced coring technologies.

"North America to lead coring market during forecast period"

North America is expected to lead the coring market, driven by a combination of robust oil and gas activity and the growing focus on renewable energy, particularly geothermal. The region hosts some of the world's largest and most productive shale oil and gas formations, such as the Permian Basin and Marcellus Shale, where obtaining detailed geological data through coring is essential for effective reservoir management and production optimization. The rise of tight oil, shale gas, and other unconventional hydrocarbon resources has further increased the demand for advanced coring techniques to evaluate complex rock formations and enhance recovery rates. North America's significant geothermal potential, especially in the US and Canada, is fueling the need for accurate subsurface assessment through coring to support geothermal exploration and development projects. As the energy transition gains momentum, the shift toward renewable energy sources, particularly geothermal, is further accelerating the demand for high-quality core analysis. These factors make North America a key region driving the growth of the global coring market.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 65%, Tier 2 - 24%, and Tier 3 - 11%

By Designation: C-Level Executives - 30%, Directors - 25%, and Other Designations - 45%

By Region: North America - 20%, Europe - 28%, Asia Pacific - 35%, South America - 8%, Middle East - 5%, and Africa - 4%

Note: Other designations include product engineers, product specialists, and engineering leads.

The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: >USD 1 billion, Tier 2: from USD 500 million to USD 1 billion, and Tier 3: <USD 500 million.

The coring market is dominated by a few major players that have a wide geographical presence. The leading players in coring market are SLB (US), Halliburton (US), Baker Hughes (US), Boart Longyear (US), NOV (US), Deep Industries Limited (India), Geotek Limited (UK), US Coring LLC (US), Reservoir Group (US), ProDirectional (US), ConeTec (US), Foothills Resource Services (US), Andalas Petroleum Services (US), Summit International (US), Canamera Coring, Inc. (US), GulfTek (Saudi Arabia), Timberwolf Environmental Services Ltd. (Canada), OilTools Services (Kazakhstan), and CoreAll AS (Norway).

Research Coverage:

The report defines, describes, and forecasts the coring market by well type, technology, end-use industry, and application for various regions. It also offers detailed qualitative and quantitative analyses of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the coring market.

Key Benefits of Buying the Report

- The coring market report provides comprehensive insights that help make informed strategic decisions. The report includes the market size and forecasts, key trends, growth drivers, competitive landscape, and detailed segmentation by product, application, and region. It also highlights emerging opportunities, supply chain dynamics, and recent technological developments. These insights enable businesses to identify growth areas, assess competitive positioning, reduce risks, and plan investments for market entry effectively.

- Product Development/Innovation: The coring market is experiencing rapid advancements aimed at improving precision, efficiency, and safety in subsurface data acquisition. Companies are investing in next-generation coring systems equipped with automated handling, real-time data acquisition, and digital monitoring tools to enhance core sample integrity and operational accuracy. Innovations include rotary sidewall coring and advanced wireline systems that reduce core retrieval time and minimize operational disruption. The integration of digital twin technology and AI-driven analytics allows predictive insights into coring performance and geomechanical behavior, supporting more informed drilling decisions. Lightweight, corrosion-resistant materials are being incorporated into coring tools to increase durability and reduce tool wear in harsh drilling environments. Additionally, remote-control capabilities and modular coring systems are enabling operations in high-risk or offshore areas, enhancing worker safety and operational flexibility. These technological advancements are positioning coring as a critical enabler of efficient exploration in both conventional oil & gas and renewable energy sectors, such as geothermal, ultimately supporting more sustainable and cost-effective resource development.

- Market Development: In January 2024, the ConeTec Group acquired the Geotech Drilling Group, which includes Geotech Drilling Services Ltd. and Gregg Drilling and Testing Canada Ltd.

- Market Diversification: Baker Hughes and Petrobras signed an agreement. Under this agreement, Baker Hughes has deployed wireline, coiled tubing, cementing, tubular running, wellbore intervention, fishing, and geosciences services in all of Petrobras' offshore fields.

- Competitive Assessment: Assessment of rankings of some key players, including SLB (US), Halliburton (US), Baker Hughes (US), Boart Longyear (US), NOV (US), Deep Industries Limited (India), Geotek Limited (UK), US Coring LLC (US), and Reservoir Group (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVE OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 YEARS CONSIDERED

- 1.4 MARKET SCOPE

- 1.4.1 MARKET & REGIONAL SEGMENTATION

2 EXECUTIVE SUMMARY

3 PREMIUM INSIGHTS

4 RESEARCH METHODOLOGY

- 4.1 RESEARCH DATA

- 4.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 4.2.1 SECONDARY DATA

- 4.2.1.1 KEY DATA FROM SECONDARY SOURCES

- 4.2.2 PRIMARY DATA

- 4.2.2.1 KEY DATA FROM PRIMARY SOURCES

- 4.2.2.2 BREAKDOWN OF PRIMARY INTERVIEWS

- 4.2.1 SECONDARY DATA

- 4.3 MARKET SIZE ESTIMATION

- 4.3.1 BOTTOM-UP APPROACH

- 4.3.2 TOP-DOWN APPROACH

- 4.3.3 DEMAND-SIDE ANALYSIS

- 4.3.3.1 DEMAND-SIDE METRICS

- 4.3.3.2 ASSUMPTIONS FOR DEMAND-SIDE ANALYSIS

- 4.3.3.3 CALCULATION FOR DEMAND-SIDE ANALYSIS

- 4.3.4 SUPPLY-SIDE ANALYSIS

- 4.3.4.1 ASSUMPTION FOR SUPPLY-SIDE ANALYSIS

- 4.3.4.2 CALCULATION FOR SUPPLY-SIDE

- 4.4 FORECAST

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 5.6.1 PRESSURE CORING

- 5.6 CASE STUDY ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE PRICING ANALYSIS, BY REGION, 2023-2029 (USD/FT)

- 5.8 PATENT ANALYSIS

- 5.9 KEY CONFERENCES & EVENTS IN 2025

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATORY FRAMEWORK

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN THE BUYING PROCESS

- 5.12.2 BUYING CRITERIA

6 CORING MARKET, BY WELL TYPE

- 6.1 INTRODUCTION

- 6.2 EXPLORATION WELL

- 6.3 APPRAISAL WELL

- 6.4 DEVELOPMENT WELL

7 CORING MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 ROTARY CORING

- 7.3 WIRELINE CORING

- 7.4 SIDEWALL CORING

8 CORING MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 ONSHORE

- 8.3 OFFSHORE

9 CORING MARKET, BY END-USER INDUSTRY

- 9.1 INTRODUCTION

- 9.2 OIL & GAS

- 9.3 GEOTHERMAL

- 9.4 CARBON CAPTURE & STORAGE (CCS)

10 CORING MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 WELL TYPE

- 10.2.2 TECHNOLOGY

- 10.2.3 APPLICATION

- 10.2.4 END-USER INDUSTRY

- 10.2.5 BY COUNTRY

- 10.2.5.1 US

- 10.2.5.2 CANADA

- 10.3 ASIA PACIFIC

- 10.3.1 WELL TYPE

- 10.3.2 TECHNOLOGY

- 10.3.3 APPLICATION

- 10.3.4 END-USER INDUSTRY

- 10.3.5 BY COUNTRY

- 10.3.5.1 china

- 10.3.5.2 India

- 10.3.5.3 AUSTRALIA

- 10.3.5.4 jAPAN

- 10.3.5.5 mALAYSIA

- 10.3.5.6 REST OF ASIA PACIFIC

- 10.4 EUROPE

- 10.4.1 WELL TYPE

- 10.4.2 TECHNOLOGY

- 10.4.3 APPLICATION

- 10.4.4 END-USER INDUSTRY

- 10.4.5 BY COUNTRY

- 10.4.5.1 Germany

- 10.4.5.2 UK

- 10.4.5.3 FRANCE

- 10.4.5.4 Italy

- 10.4.5.5 REST OF EUROPE

- 10.5 MIDDLE EAST

- 10.5.1 WELL TYPE

- 10.5.2 TECHNOLOGY

- 10.5.3 APPLICATION

- 10.5.4 END-USER INDUSTRY

- 10.5.5 BY COUNTRY

- 10.5.5.1 GCC Countries

- 10.5.5.1.1 Qatar

- 10.5.5.1.2 UAE

- 10.5.5.1.3 Saudi Arabia

- 10.5.5.1.4 Rest of GCC

- 10.5.5.2 Rest of Middle East

- 10.5.5.1 GCC Countries

- 10.6 AFRICA

- 10.6.1 WELL TYPE

- 10.6.2 TECHNOLOGY

- 10.6.3 APPLICATION

- 10.6.4 END-USER INDUSTRY

- 10.6.5 BY COUNTRY

- 10.6.5.1 Nigeria

- 10.6.5.2 Algeria

- 10.6.5.3 Angola

- 10.6.5.4 Rest of Africa

- 10.7 SOUTH AMERICA

- 10.7.1 WELL TYPE

- 10.7.2 TECHNOLOGY

- 10.7.3 APPLICATION

- 10.7.4 END-USER INDUSTRY

- 10.7.5 BY COUNTRY

- 10.7.5.1 BRAZIL

- 10.7.5.2 ARGENTINA

- 10.7.5.3 REST OF SOUTH AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 11.2 MARKET EVALUATION FRAMEWORK

- 11.3 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- 11.4 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2019-2023

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Well type footprint

- 11.6.5.4 Application footprint

- 11.6.5.5 End-user industry footprint

- 11.6.5.6 Application footprint

12 COMPANY PROFILES

- 12.1 SERVICE PROVIDERS

- 12.1.1 SLB BUSINESS OVERVIEW

- 12.1.1.1 PRODUCTS & SERVICES

- 12.1.1.2 RECENT DEVELOPMENTS

- 12.1.1.3 MNM VIEW

- 12.1.1.3.1 Key strength/Right to win

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses/Competitive Threats

- 12.1.2 HALLIBURTON

- 12.1.3 BAKEHUGHESES

- 12.1.4 NOV

- 12.1.5 BOART LONGYEAR

- 12.1.6 DEEP INDUSTRIES LIMITED

- 12.1.7 GEOTEK LIMITED

- 12.1.8 US CORING LLC

- 12.1.9 RESERVOIR GROUP

- 12.1.10 PRODIRECTIONAL

- 12.1.11 CONETEC

- 12.1.12 FOOTHILLS RESOURCE SERVICES

- 12.1.13 ANDALAS PETROLEUM SERVICES

- 12.1.14 SUMMIT INTERNATIONAL

- 12.1.15 CANAMERA CORING, INC.

- 12.1.16 GULFTEK

- 12.1.17 OILTOOLS SERVICES

- 12.1.18 TIMBERWOLF ENVIRONMENTAL SERVICES LTD

- 12.1.19 COREALL AS

- 12.1.20 IOT HOLLAND

- 12.1.21 GASINVESTPROJECT

- 12.1.22 HARRIS EXPLORATION

- 12.1.23 NEBRASCO

- 12.1.1 SLB BUSINESS OVERVIEW

- 12.2 OPERATORS

- 12.2.1 BP P.L.C.

- 12.2.2 SHELL PLC

- 12.2.3 CHEVRON CORPORATION

- 12.2.4 ENEL SPA

- 12.2.5 SAUDI ARABIAN OIL CO.

- 12.2.6 EQUINOR ASA

- 12.2.7 OIL AND NATURAL GAS CORPORATION LIMITED

- 12.2.8 PETROLIAM NASIONAL BERHAD (PETRONAS)

- 12.2.9 EXXON MOBIL CORPORATION

- 12.2.10 TOTALENERGIES

13 APPENDIX

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE