|

|

市場調査レポート

商品コード

1719524

北米の銅管市場:タイプ別、形状別、用途別、国別 - 2030年までの予測North America Copper Tubes Market by Type (Type K, Type L, Type M), Form (Straight Tubes, Coils, Capillary Tubes), Application (HVACR, Plumbing, Industrial, Automotive, Medical) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 北米の銅管市場:タイプ別、形状別、用途別、国別 - 2030年までの予測 |

|

出版日: 2025年04月30日

発行: MarketsandMarkets

ページ情報: 英文 171 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の銅管の市場規模は、2024年の31億8,000万米ドルから2030年には34億4,000万米ドルに成長し、予測期間中のCAGRは4.0%になると予測されています。

北米での銅管市場の成長は、エネルギー効率のよいHVACR製品への需要の高まり、ヘルスケア・インフラの拡大、持続可能な建物への関心の高まりに起因しています。銅の強度、熱伝導性、リサイクル性から、医療、配管、工業用途で好まれる素材となっています。スマートシティの開発、既存のインフラの改修、高度な熱管理システムを必要とする電気自動車の利用増は、市場開拓の好機です。さらに、国内生産は政府の政策やグリーンビルディング認証を通じて市場開拓を後押ししています。効率と持続可能性を最適化する産業界への働きかけにより、銅管は次善の策として、実績があり将来性のある代替品として、その座を奪いつつあります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント | タイプ別、形状別、用途別、国別 |

| 対象地域 | 北米 |

L型銅管は、強度、柔軟性、手頃な価格という完璧な組み合わせにより、幅広い用途に対応できるため、北米の銅管市場で最も急成長しているセグメントです。太く高価なタイプK型とは対照的に、L型は中圧から高圧まで対応できる十分な肉厚があり、なおかつ軽量で安価であるため、商業用、住宅用を問わず好まれます。この多用途性により、配管システム、HVACR設備、医療用ガス配管、改修プロジェクトなど、性能は最重要ですが(K型のような)極端な耐久性は必ずしも要求されない分野で人気が高まっています。第二に、L型の銅管は曲げ、切断、設置が簡単で、労働時間と工期を節約できます。さらにL型の銅管は北米のほとんどの配管法規に適合し、耐食性も向上しているため、メンテナンスの必要がほとんどなく、飲料水や冷媒の輸送に最適です。都市人口の増加とインフラの老朽化に伴い、効率的でコンプライアンスが高く、手頃な価格の配管ソリューションへの需要が高まっています。これはL型銅管の使用拡大に直結し、長期的な信頼性を競合他社に負けない価格で確保できるL型銅管は、請負業者、エンジニア、建設業者に最初の選択肢として選ばせ、北米全域で急成長をもたらしています。

特に新築の建物や市場セグメンテーションでは、その高い柔軟性、簡単な運搬、効率的な設置により、コイル・セグメントが北米の銅管市場で最も高い成長を記録するとみられています。柔軟性のあるコイル状銅管は、障害物の上で曲げたり、狭い場所にフィットするように成形することができ、いくつもの接合部や継手を必要としません。住宅や商業ビルの配管システム、冷凍装置、空調ダクトでは、複雑な構成や制限の多い場所が多いため、柔軟性は特に重要な役割を果たします。コスト削減の工法やエネルギー効率のよいビル・システムが注目されるにつれ、人件費や材料の無駄を最小限に抑えたいと考える業者やシステム設計者に、コイル状銅管の人気が高まっています。コイル状銅管はまた、長く、切れ目のない配線が可能で、スプライスを何度もする必要がありません。これは、システムの信頼性を高めるだけでなく、メンテナンス問題のリスクも低減し、メンテナンスが少なく長持ちするインフラ・ソリューションの必要性に合致しています。

配管は北米の銅管市場において、もっとも急成長している用途分野です。配管工事は、飲料水を安全に供給する素材に大きく依存しており、銅が本来持っている抗菌性、耐腐食性、圧力安定性から、新築や改修のニーズに好まれる素材となっています。北米では都市部の人口が増加しているため、既存の配管は老朽化し、交換が必要となっています。銅はこうしたニーズに容易に応えることができます。加えて、水の純度の問題がより厳しくなったため、多くの都市や建設業者は、数十年にわたる水の純度に関する実績から、安価なプラスチック製を拒否し、銅製を選ぶようになりました。配管に銅が多く使われるようになったのは、環境に配慮した建築や、LEED認証への要求が高まったためでもあります。銅管は完全にリサイクルできるため、性能を犠牲にすることなく、環境保護の理念にも適合しています。住宅、商業、施設での用途では、銅の柔軟性、設置されている配管製品との互換性、そして長寿命が、比類のない価値ある提案となります。CPVCとPEXが市場シェアを競い合う中、銅の信頼性という評判は、社会的・規制的な信頼もあり、配管用途では強い勢いを維持しています。インフラへの出費が増え、健康に配慮した建築規準が厳しくなるにつれ、配管市場は北米の銅管メーカーにとって重要な促進要因であり続けるとみられています。

当レポートでは、北米の銅管市場について調査し、タイプ別、形状別、用途別、国別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 生成AI

第6章 業界動向

- イントロダクション

- 顧客ビジネスに影響を与える動向/混乱

- サプライチェーン分析

- 投資と資金調達のシナリオ

- 価格分析

- エコシステム分析

- 2025年の米国関税の影響- 北米の銅管市場

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 北米の銅管市場:2025~2026年における主要会議・イベント一覧

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済見通し

- ケーススタディ分析

第7章 北米の銅管市場(タイプ別)

- イントロダクション

- タイプK型

- タイプL型

- タイプM型

- その他

第8章 北米の銅管市場(形状別)

- イントロダクション

- コイル

- ストレートチューブ

- 毛細管

- その他

第9章 北米の銅管市場(用途別)

- イントロダクション

- HVACR

- 配管

- 工業

- 医療

- 自動車

- その他

第10章 北米の銅管市場(国別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析、2024年

- 2020~2024年におけるトップ5社の収益分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- ブランド/製品比較分析

- 企業評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- MUELLER INDUSTRIES

- WIELAND GROUP

- HAILIANG GROUP

- KME GROUP SPA

- LUVATA

- CERRO FLOW PRODUCTS LLC

- KOBE STEEL, LTD.

- CAMBRIDGE-LEE INDUSTRIES LLC

- GOLDEN DRAGON PRECISE COPPER TUBE GROUP INC.

- AMERICAN ELEMENTS

- その他の企業

- AVIVA METALS

- INTERSTATE METAL, INC.

- REVERE COPPER PRODUCTS INC.

- PMX INDUSTRIES, INC.

- JV PRECISION, INC.

- GLOBAL METALS

- AMERITUBE LLC

- DRAWN METAL TUBE

- OCTA INC.

- NACOBRE USA

第13章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF COPPER TUBES IN NORTH AMERICA, BY REGION, 2021-2023 (USD/KILOGRAM)

- TABLE 2 AVERAGE SELLING PRICE TREND OF COPPER TUBES IN NORTH AMERICA, BY TYPE, 2021-2023 (USD/ KILOGRAM)

- TABLE 3 AVERAGE SELLING PRICE TREND OF COPPER TUBES OFFERED BY KEY PLAYERS IN NORTH AMERICA, 2023 (USD/ KILOGRAM)

- TABLE 4 ROLE OF COMPANIES IN NORTH AMERICAN COPPER TUBES ECOSYSTEM

- TABLE 5 NORTH AMERICAN COPPER TUBES MARKET: KEY TECHNOLOGIES

- TABLE 6 NORTH AMERICAN COPPER TUBES MARKET: COMPLEMENTARY TECHNOLOGIES

- TABLE 7 TOTAL NUMBER OF PATENTS, 2015-2024

- TABLE 8 TOP OWNERS OF PATENTS RELATED TO COPPER TUBES IN NORTH AMERICA, 2015-2024

- TABLE 9 NORTH AMERICAN COPPER TUBES MARKET: LIST OF KEY PATENTS, 2015-2024

- TABLE 10 NORTH AMERICAN COPPER TUBES MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 TARIFF DATA RELATED TO HS CODE 741110-COMPLIANT PRODUCTS, BY COUNTRY, 2023

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICAN COPPER TUBES MARKET: STANDARDS AND REGULATIONS

- TABLE 14 NORTH AMERICAN COPPER TUBES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 16 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 17 GDP TRENDS AND FORECASTS, BY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 18 NORTH AMERICA: COPPER TUBES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 19 NORTH AMERICA: COPPER TUBES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 20 NORTH AMERICA: COPPER TUBES MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 21 NORTH AMERICA: COPPER TUBES MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 22 NORTH AMERICA: COPPER TUBES MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 23 NORTH AMERICA: COPPER TUBES MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 24 NORTH AMERICA: COPPER TUBES MARKET, BY FORM, 2021-2024 (KILOTON)

- TABLE 25 NORTH AMERICA: COPPER TUBES MARKET, BY FORM, 2025-2030 (KILOTON)

- TABLE 26 NORTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 27 NORTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 28 NORTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 29 NORTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 30 NORTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 31 NORTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 32 NORTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 33 NORTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 34 US: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 35 US: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 36 US: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 37 US: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 38 CANADA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 39 CANADA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 40 CANADA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 41 CANADA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 42 MEXICO: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 43 MEXICO: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 44 MEXICO: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 45 MEXICO: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 46 NORTH AMERICAN COPPER TUBES MARKET: DEGREE OF COMPETITION

- TABLE 47 NORTH AMERICAN COPPER TUBES MARKET: REGION FOOTPRINT

- TABLE 48 NORTH AMERICAN COPPER TUBES MARKET: TYPE FOOTPRINT

- TABLE 49 NORTH AMERICAN COPPER TUBES: FORM FOOTPRINT

- TABLE 50 NORTH AMERICAN COPPER TUBES MARKET: APPLICATION FOOTPRINT

- TABLE 51 NORTH AMERICAN COPPER TUBES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 52 NORTH AMERICAN COPPER TUBES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 53 NORTH AMERICAN COPPER TUBES MARKET: PRODUCT LAUNCHES, JANUARY 2020-MARCH 2025

- TABLE 54 NORTH AMERICAN COPPER TUBES MARKET: DEALS, JANUARY 2020- MARCH 2025

- TABLE 55 NORTH AMERICAN COPPER TUBES MARKET: OTHER DEVELOPMENTS, JANUARY 2020-MARCH 2025

- TABLE 56 MUELLER INDUSTRIES: COMPANY OVERVIEW

- TABLE 57 MUELLER INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 58 MUELLER INDUSTRIES: DEALS, JANUARY 2020-MARCH 2025

- TABLE 59 WIELAND GROUP: COMPANY OVERVIEW

- TABLE 60 WIELAND GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 61 WIELAND GROUP: PRODUCT LAUNCHES, JANUARY 2020-MARCH 2025

- TABLE 62 WIELAND GROUP: DEALS, JANUARY 2020-MARCH 2025

- TABLE 63 WIELAND GROUP: OTHER DEVELOPMENTS, JANUARY 2020-MARCH 2025

- TABLE 64 HAILIANG GROUP: COMPANY OVERVIEW

- TABLE 65 HAILIANG GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 66 HAILIANG GROUP: OTHER DEVELOPMENTS, JANUARY 2020-MARCH 2025

- TABLE 67 KME GROUP SPA: COMPANY OVERVIEW

- TABLE 68 KME GROUP SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 69 LUVATA: COMPANY OVERVIEW

- TABLE 70 LUVATA: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 71 LUVATA: OTHER DEVELOPMENTS, JANUARY 2020-MARCH 2025

- TABLE 72 CERRO FLOW PRODUCTS LLC: COMPANY OVERVIEW

- TABLE 73 CERRO FLOW PRODUCTS LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 74 CERRO FLOW PRODUCTS LLC: OTHER DEVELOPMENTS, JANUARY 2020- MARCH 2025

- TABLE 75 KOBE STEEL, LTD.: COMPANY OVERVIEW

- TABLE 76 KOBE STEEL, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 77 CAMBRIDGE-LEE INDUSTRIES LLC: COMPANY OVERVIEW

- TABLE 78 CAMBRIDGE-LEE INDUSTRIES LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 79 GOLDEN DRAGON PRECISE COPPER TUBE GROUP INC.: COMPANY OVERVIEW

- TABLE 80 GOLDEN DRAGON PRECISE COPPER TUBE GROUP INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 81 AMERICAN ELEMENTS: COMPANY OVERVIEW

- TABLE 82 AMERICAN ELEMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 83 AVIVA METALS: COMPANY OVERVIEW

- TABLE 84 INTERSTATE METAL, INC.: COMPANY OVERVIEW

- TABLE 85 REVERE COPPER PRODUCTS INC.: COMPANY OVERVIEW

- TABLE 86 PMX INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 87 JV PRECISION, INC.: COMPANY OVERVIEW

- TABLE 88 GLOBAL METALS: COMPANY OVERVIEW

- TABLE 89 AMERITUBE LLC: COMPANY OVERVIEW

- TABLE 90 DRAWN METAL TUBE: COMPANY OVERVIEW

- TABLE 91 OCTA INC.: COMPANY OVERVIEW

- TABLE 92 NACOBRE USA: COMPANY OVERVIEW

List of Figures

- FIGURE 1 NORTH AMERICAN COPPER TUBES MARKET SEGMENTATION

- FIGURE 2 NORTH AMERICAN COPPER TUBES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS, 2024

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 NORTH AMERICAN COPPER TUBES MARKET: DATA TRIANGULATION

- FIGURE 9 TYPE K SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 10 STRAIGHT TUBES SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 HVACR SEGMENT TO REGISTER HIGHEST GROWTH BETWEEN 2025 & 2030

- FIGURE 12 GROWING USE OF COPPER TUBES IN HVACR AND PLUMBING APPLICATIONS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 TYPE K SEGMENT TO WITNESS HIGH CAGR DURING FORECAST PERIOD

- FIGURE 14 STRAIGHT TUBES SEGMENT TO REGISTER HIGHEST CAGR, IN TERMS OF VOLUME, DURING FORECAST PERIOD

- FIGURE 15 HVACR SEGMENT TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 16 MEXICO TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 NORTH AMERICAN COPPER TUBES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 USE OF GENERATIVE AI IN COPPER TUBES MARKET

- FIGURE 19 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 20 NORTH AMERICAN COPPER TUBES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 NORTH AMERICAN COPPER TUBES MARKET: INVESTMENT AND FUNDING SCENARIO, 2024-2025 (USD MILLION)

- FIGURE 22 AVERAGE SELLING PRICE TREND OF COPPER TUBES IN NORTH AMERICA, BY REGION, 2021-2023 (USD/KILOGRAM)

- FIGURE 23 AVERAGE SELLING PRICE TREND OF COPPER TUBES OFFERED BY KEY PLAYERS IN NORTH AMERICA, BY TYPE, 2023 (USD/ KILOGRAM)

- FIGURE 24 NORTH AMERICAN COPPER TUBES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 PATENTS GRANTED OVER LAST 10 YEARS, 2015-2024

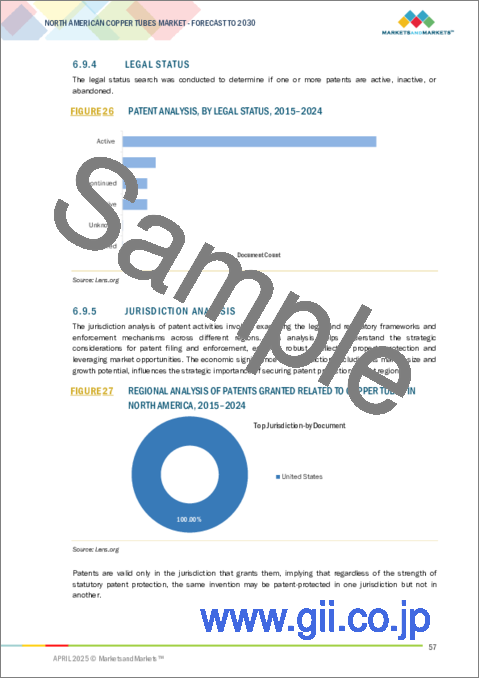

- FIGURE 26 PATENT ANALYSIS, BY LEGAL STATUS, 2015-2024

- FIGURE 27 REGIONAL ANALYSIS OF PATENTS GRANTED RELATED TO COPPER TUBES IN NORTH AMERICA, 2015-2024

- FIGURE 28 TOP COMPANIES WITH SUBSTANTIAL NUMBER OF PATENTS, 2015-2024

- FIGURE 29 IMPORT DATA RELATED TO HS CODE 741110-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 30 EXPORT DATA RELATED TO HS CODE 741110-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 31 NORTH AMERICAN COPPER TUBES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 33 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 34 TYPE K SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 35 STRAIGHT TUBES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 36 HVACR SEGMENT TO LEAD NORTH AMERICAN COPPER TUBES MARKET IN 2025

- FIGURE 37 NORTH AMERICA: COPPER TUBES MARKET SNAPSHOT

- FIGURE 38 NORTH AMERICAN COPPER TUBES MARKET SHARE ANALYSIS, 2024

- FIGURE 39 NORTH AMERICAN COPPER TUBES MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 40 NORTH AMERICAN COPPER TUBES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 41 NORTH AMERICAN COPPER TUBES MARKET: COMPANY FOOTPRINT

- FIGURE 42 NORTH AMERICAN COPPER TUBES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 43 BRAND/PRODUCT COMPARATIVE ANALYSIS FOR NORTH AMERICAN COPPER TUBE PRODUCTS

- FIGURE 44 EV/EBITDA OF KEY MANUFACTURERS OF NORTH AMERICAN COPPER TUBES

- FIGURE 45 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN

- FIGURE 46 MUELLER INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 47 KOBE STEEL, LTD.: COMPANY SNAPSHOT

The North American copper tubes market is projected to grow from USD 3.18 billion in 2024 to USD 3.44 billion by 2030, registering a CAGR of 4.0% during the forecast period. The growth of the copper tubes market in North America can be attributed to the rising demand for energy-efficient HVACR products, expanding healthcare infrastructure, and increasing focus on sustainable buildings. The strength, ability to conduct heat, and recyclability of copper have made it a preferred material in medical, plumbing, and industrial applications. Smart city development, retrofitting of existing infrastructure, and increasing electric vehicle usage requiring advanced thermal management systems present opportunities for market growth. Furthermore, domestic production pushes through government policies as well as green building certifications to fuel market development. With a push toward industries optimizing efficiency and sustainability, copper tubes are taking over as the next best bet, being a proven and future-proof alternative.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Type, Form, Application, and Country |

| Regions covered | North America |

Type L to register the fastest growth in the North American copper tubes market during the forecast period

The Type L copper tubes segment is the most rapidly growing segment in the North American copper tubes market because its perfect combination of strength, flexibility, and affordability renders it extremely versatile across a broad portfolio of applications. In contrast to the thicker and higher-priced Type K tubes, Type L tubes have enough thickness in the wall to manage moderate to high pressures and are still lighter and cheaper, a factor that makes them desirable for both commercial and residential applications. This versatility increased their popularity in plumbing systems, HVACR installations, medical gas piping, and retrofit projects, where performance is paramount but extreme durability (as provided by Type K) is not always required. Second, Type L copper tubes are also simpler to bend, cut, and install, saving labor time and construction periods, which, in today's world of fast-moving building sites, is a great advantage. In addition, Type L tubes meet most plumbing codes across North America and offer enhanced corrosion resistance, which is why they are perfectly suited for the transportation of drinking water and refrigerants with little need for maintenance. With urban population increases and aging infrastructure, the demand for efficient, compliant, and affordable piping solutions is on the rise. This directly translates into the growing use of Type L tubes, whose ability to ensure reliability in the long term at a competitive rate is forcing contractors, engineers, and builders to opt for them as their first choice, leading to their rapid growth across the North American region.

Coils to register the fastest growth in the North American copper tubes market during the forecast period.

The coils segment will register the highest growth in the North American copper tubes market due to its high flexibility, easy transportation, and efficient installation, particularly in new construction buildings and HVACR applications. Flexible coiled copper tubing can be bent over obstructions and formed to fit into tight areas without requiring several junctions and fittings, a feature that conserves installation time but also diminishes the potential for leaks and provides a less segmented, more dependable piping solution. Flexibility is particularly worth its weight because of the intricate configurations and restrictive areas common to residential and commercial building plumbing systems, refrigeration equipment, and air conditioning ducts. As more attention is being focused on cost-saving construction methods and energy-efficient building systems, coiled copper is becoming increasingly popular with contractors and system designers looking to minimize labor costs and material wastage. Coiled tubes also allow for long, unbroken runs without the need for many splices that can weaken a system's integrity in the long run. This not only increases system reliability but also reduces the risk of maintenance issues, and that is well in keeping with the imperative of low-maintenance, long-lasting infrastructure solutions.

The plumbing segment to register the highest growth rate in the North American copper tubes market, by application

Plumbing is the fastest-growing application segment of the North American copper tubes market because copper remains the most dependable material for water supply systems, providing safety, durability, and long-term value. Plumbing relies heavily on materials offering safe delivery of potable water, and the inherent antimicrobial properties, resistance to corrosion, and pressure stability of copper position it as the preferred material for new construction and retrofitting needs. With the increasing urban population in North America, existing pipes have become outdated and have to be replaced, and demands are higher than ever for secure piping solutions fulfilling stringent health and building codes. Copper is easily able to meet these needs. In addition, more stringent water purity issues have led many cities and contractors to reject less expensive plastic options in favor of copper based on its established water purity track record spanning decades. The extensive use of copper in plumbing is also being supported by greater demand for green building practices and LEED certification. Copper tubing can be completely recycled, which is compatible with the green philosophy without sacrificing performance. In residential, commercial, and institutional applications, copper's flexibility, compatibility with installed plumbing products, and extended service life offer an unparalleled value proposition. As CPVC and PEX are competing for market share, copper's reputation for reliability, as well as public and regulatory confidence, continues to maintain its strong momentum in plumbing applications. As expenditures on infrastructure increase and as health-based building codes become more stringent, the plumbing market will remain a key growth driver for North American copper tube producers.

In-depth interviews were conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the North American copper tubes market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers - 15%, Directors - 20%, and Others - 65%

- By Region: North America - 100%

Major players in the North American copper tubes market include Mueller Industries (US), Wieland Group (Germany), Hailiang Group (China), KME Group SpA (Italy), Luvata (Finland), Cerro Flow Products LLC (US), KOBE STEEL, LTD. (Japan), Cambridge-Lee Industries LLC (US), Golden Dragon Precise Copper Tube Group Inc. (China), and American Elements (US). The study includes an in-depth competitive analysis of these key players in the North American copper tubes market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the North American copper tubes market on the basis of type, form, application, and country and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the North American copper tubes market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the North American copper tubes market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Dynamics: Analysis of drivers (growing need for HVAC systems in buildings), restraints (high cost and vulnerability of copper to corrosion, making aluminum tubing more durable and affordable alternative), opportunities (urban retrofitting initiatives and development of smart cities), and challenges (winter conditions accelerate cracking and leakage in copper tubes systems) influencing the growth of the North American copper tubes market.

- Market Penetration: Comprehensive information on the North American copper tubes market offered by top players in the market.

- Product Development/Innovation: Detailed insights on the upcoming technologies, research & development activities, product launches, expansions, and partnerships in the North American copper tubes market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the North American copper tubes market across regions.

- Market Capacity: Production capacities of companies producing copper tubes in North America are provided wherever upcoming capacities are available.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the North American copper tubes market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Key primary sources

- 2.2.2.3 Key participants for primary interviews

- 2.2.2.4 Breakdown of primary interviews

- 2.2.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.3.2 DEMAND-SIDE ANALYSIS

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 MARKET SIZE ESTIMATION

- 2.5.1 BOTTOM-UP APPROACH

- 2.5.2 TOP-DOWN APPROACH

- 2.6 DATA TRIANGULATION

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 GROWTH FORECAST

- 2.9 RISK ASSESSMENT

- 2.10 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NORTH AMERICAN COPPER TUBES MARKET

- 4.2 NORTH AMERICAN COPPER TUBES MARKET, BY TYPE

- 4.3 NORTH AMERICAN COPPER TUBES MARKET, BY FORM

- 4.4 NORTH AMERICAN COPPER TUBES MARKET, BY APPLICATION

- 4.5 NORTH AMERICAN COPPER TUBES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing need for HVAC systems in buildings

- 5.2.1.2 High recyclability of copper tubes

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing dependence of US on imports

- 5.2.2.2 High cost and vulnerability of copper to corrosion

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Urban retrofitting initiatives and development of smart cities

- 5.2.3.2 Growing construction of hospitals

- 5.2.4 CHALLENGES

- 5.2.4.1 Winter conditions accelerate cracking and leakage in copper tube systems

- 5.2.1 DRIVERS

- 5.3 GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.3.2 IMPACT OF GENERATIVE AI ON NORTH AMERICAN COPPER TUBES MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 INVESTMENT AND FUNDING SCENARIO

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND, BY REGION

- 6.5.2 AVERAGE SELLING PRICE TREND, BY TYPE

- 6.5.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 IMPACT OF 2025 US TARIFF - NORTH AMERICAN COPPER TUBES MARKET

- 6.7.1 INTRODUCTION

- 6.7.2 PRICE IMPACT ANALYSIS

- 6.7.3 IMPACT ON REGION

- 6.7.4 IMPACT ON APPLICATIONS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 GRANTED PATENTS

- 6.9.2.1 Patent publication trends

- 6.9.3 INSIGHTS

- 6.9.4 LEGAL STATUS

- 6.9.5 JURISDICTION ANALYSIS

- 6.9.6 TOP APPLICANTS

- 6.10 TRADE ANALYSIS

- 6.10.1 IMPORT SCENARIO (HS CODE 741110)

- 6.10.2 EXPORT SCENARIO (HS CODE 741110)

- 6.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.12 NORTH AMERICAN COPPER TUBES MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- 6.13 TARIFF AND REGULATORY LANDSCAPE

- 6.13.1 TARIFF ANALYSIS

- 6.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.14 PORTER'S FIVE FORCES ANALYSIS

- 6.14.1 THREAT OF NEW ENTRANTS

- 6.14.2 THREAT OF SUBSTITUTES

- 6.14.3 BARGAINING POWER OF SUPPLIERS

- 6.14.4 BARGAINING POWER OF BUYERS

- 6.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.15.2 BUYING CRITERIA

- 6.16 MACROECONOMIC OUTLOOK

- 6.16.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.17 CASE STUDY ANALYSIS

- 6.17.1 DESIGN INNOVATION WITH 5 MM COPPER TUBES FOR ENHANCED HEAT EXCHANGER EFFICIENCY IN DISPLAY CABINETS

- 6.17.2 PERFORMANCE OPTIMIZATION USING INNER-GROOVED COPPER TUBES IN HVAC/R HEAT EXCHANGERS

- 6.17.3 MAXIMIZING DEHUMIDIFIER EFFICIENCY WITH SMALL-DIAMETER COPPER TUBES: A TECHNOLOGICAL ADVANCEMENT IN HVAC SYSTEMS

7 NORTH AMERICAN COPPER TUBES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 TYPE K

- 7.2.1 THICKEST AND MOST DURABLE COPPER TUBING FOR HIGH-PRESSURE AND LONG-TERM PERFORMANCE-KEY FACTOR DRIVING ADOPTION

- 7.3 TYPE L

- 7.3.1 RESISTANCE TO WEAR FROM HIGH-PRESSURE WATER FLOW TO SUPPORT MARKET GROWTH

- 7.4 TYPE M

- 7.4.1 LIGHTWEIGHT AND COST-EFFECTIVENESS TO DRIVE ADOPTION

- 7.5 OTHER TYPES

- 7.5.1 DRAIN, WASTE, AND VENT

- 7.5.2 AIR CONDITIONING AND REFRIGERATION

- 7.5.3 MEDICAL GAS TUBING

8 NORTH AMERICAN COPPER TUBES MARKET, BY FORM

- 8.1 INTRODUCTION

- 8.2 COILS

- 8.2.1 FLEXIBILITY OF COILED TUBES TO DRIVE ADOPTION

- 8.3 STRAIGHT TUBES

- 8.3.1 STRENGTH, RELIABILITY, AND VERSATILITY TO DRIVE MARKET

- 8.4 CAPILLARY TUBES

- 8.4.1 COMPACT AND EFFICIENT PERFORMANCE IN REFRIGERATION UNITS TO SUPPORT MARKET GROWTH

- 8.5 OTHER FORMS

- 8.5.1 INNER-GROOVED

- 8.5.2 FINNED

- 8.5.3 FLATTENED

9 NORTH AMERICAN COPPER TUBES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 HVACR

- 9.2.1 GROWING DEMAND FOR HVACR SYSTEMS TO DRIVE MARKET

- 9.3 PLUMBING

- 9.3.1 NEED FOR SAFE AND HYGIENIC WATER FLOW IN PLUMBING SYSTEMS TO DRIVE MARKET

- 9.4 INDUSTRIAL

- 9.4.1 NEED FOR EFFICIENT HEAT TRANSFER AND DURABILITY IN INDUSTRIAL SYSTEMS TO DRIVE MARKET

- 9.5 MEDICAL

- 9.5.1 NEED FOR SAFE MEDICAL GAS DELIVERY AND PREVENTION OF CONTAMINATION IN HEALTHCARE SETTINGS TO SUPPORT MARKET GROWTH

- 9.6 AUTOMOTIVE

- 9.6.1 NEED FOR OPTIMAL PERFORMANCE IN AIR CONDITIONING TO DRIVE MARKET

- 9.7 OTHER APPLICATIONS

- 9.7.1 MARINE

- 9.7.2 ELECTRICAL AND ELECTRONICS

- 9.7.3 SOLAR ENERGY SYSTEMS

10 NORTH AMERICAN COPPER TUBES MARKET, BY COUNTRY

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.3 US

- 10.3.1 GOVERNMENT FOCUS ON IMPROVING AGING INFRASTRUCTURE, INCLUDING WATER SYSTEMS AND HVAC SYSTEMS, TO DRIVE MARKET

- 10.4 CANADA

- 10.4.1 GREEN BUILDING INITIATIVES AND RENEWABLE ENERGY GOALS TO SUPPORT MARKET GROWTH

- 10.5 MEXICO

- 10.5.1 GROWTH IN AUTOMOTIVE PRODUCTION TO PROPEL MARKET

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY NORTH AMERICAN COPPER TUBE MANUFACTURERS

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.3.1 MUELLER INDUSTRIES

- 11.3.2 WIELAND GROUP

- 11.3.3 CERRO FLOW PRODUCTS LLC

- 11.3.4 GOLDEN DRAGON PRECISE COPPER TUBE GROUP INC.

- 11.3.5 KME GROUP SPA

- 11.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 Form footprint

- 11.5.5.5 Application footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 MUELLER INDUSTRIES

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 WIELAND GROUP

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 HAILIANG GROUP

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 KME GROUP SPA

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 LUVATA

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 CERRO FLOW PRODUCTS LLC

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Other developments

- 12.1.6.4 MnM view

- 12.1.6.4.1 Right to win

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses and competitive threats

- 12.1.7 KOBE STEEL, LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 MnM view

- 12.1.7.3.1 Right to win

- 12.1.7.3.2 Strategic choices

- 12.1.7.3.3 Weaknesses and competitive threats

- 12.1.8 CAMBRIDGE-LEE INDUSTRIES LLC

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.8.3.1 Right to win

- 12.1.8.3.2 Strategic choices

- 12.1.8.3.3 Weaknesses and competitive threats

- 12.1.9 GOLDEN DRAGON PRECISE COPPER TUBE GROUP INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.9.3.1 Right to win

- 12.1.9.3.2 Strategic choices

- 12.1.9.3.3 Weaknesses and competitive threats

- 12.1.10 AMERICAN ELEMENTS

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.10.3.1 Right to win

- 12.1.10.3.2 Strategic choices

- 12.1.10.3.3 Weaknesses and competitive threats

- 12.1.1 MUELLER INDUSTRIES

- 12.2 OTHER PLAYERS

- 12.2.1 AVIVA METALS

- 12.2.2 INTERSTATE METAL, INC.

- 12.2.3 REVERE COPPER PRODUCTS INC.

- 12.2.4 PMX INDUSTRIES, INC.

- 12.2.5 JV PRECISION, INC.

- 12.2.6 GLOBAL METALS

- 12.2.7 AMERITUBE LLC

- 12.2.8 DRAWN METAL TUBE

- 12.2.9 OCTA INC.

- 12.2.10 NACOBRE USA

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS