|

|

市場調査レポート

商品コード

1718862

産業データ管理の世界市場:タイプ別、オファリング別、データ管理スタック別、展開別、組織タイプ別、データタイプ別、業界別、地域別 - 2030年までの予測Industrial Data Management Market by Type (Data Orchestration & Analytics, Data Storage & Integration, Data Sharing, Data Security, Data Visualization, Data Governance & Compliance), Data Type(Structured, Unstructured) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 産業データ管理の世界市場:タイプ別、オファリング別、データ管理スタック別、展開別、組織タイプ別、データタイプ別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年04月28日

発行: MarketsandMarkets

ページ情報: 英文 297 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の産業データ管理の市場規模は、2025年の1,051億米ドルから2030年には2,132億米ドルに成長すると予測され、予測期間中のCAGRは15.2%になるとみられています。

主な促進要因の1つは、産業オートメーションとインダストリー4.0の成長であり、インテリジェントな工場では、リアルタイムデータの保存と分析に依存して、オペレーションを最大化し、効率を高め、予知保全を促進しています。産業データ管理ソフトウェアは、評価と制御のために様々なデバイス、機器、システムからデータを収集する自動化において重要な役割を果たしています。さらに、モノのインターネット(IoT)デバイスの急速な成長により、効率的なデータ保存、分析、可視化、ガバナンスの要求など、産業データ管理ソフトウェアと相互運用可能なさまざまなシステムやセンサーの導入が業界全体で促進されています。エネルギー、自動車、航空宇宙、ヘルスケア、輸送、BFSIにおけるリアルタイムモニタリングへの注目の高まりは、正確なデータ収集と分析システムの需要をさらに高め、データ管理の必要性を高めています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | タイプ別、オファリング別、データ管理スタック別、展開別、組織タイプ別、データタイプ別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

BFSI(銀行、金融サービス、保険)事業は、産業データ管理市場の主要な成長要因となります。金融機関はデジタルトランスフォーメーションへの投資を拡大する一方で、膨大な量の機密データやトランザクションデータを生成・処理しており、堅牢な取り扱い、セキュリティ、リアルタイム分析が求められています。高度なデータ処理能力に対するこのような要件は、産業環境で使用されるものと同様の、最先端のデータ統合、ガバナンス、コンプライアンス・ソリューションの採用を業界に促しています。さらに、BFSI企業は、組み込み金融、リスク分析、予測分析を提供するために、産業界と協力し、2つの業界の境界をさらに取り払おうとしています。顧客インテリジェンス、不正検知、規制コンプライアンスに重点を置くこの業界は、データプラットフォームのイノベーションも推進し、一般的な産業データ管理の動向に影響を与えています。したがって、BFSIセクターの技術力と投資能力は、さまざまな業界におけるエンドツーエンドの統合データ管理システムの導入と開発を加速させるのに役立つと思われます。

データオーケストレーションとアナリティクスは、産業データ管理市場で最も急成長する分野と予想されます。産業業務のデジタル化と相互接続が進むにつれて、組織は機械、センサー、企業システム、サプライチェーンから膨大な量の生データを生成します。データ・オーケストレーションは、異種ソース間のデータの流れを合理化・自動化し、クリーンで一貫性があり、リアルタイムでアクセスできるようにする上で重要な役割を果たします。強力なアナリティクス・ツールと組み合わせることで、このオーケストレーションされたデータは、効率を促進し、機器の故障を予測し、リソースの使用を最適化し、意思決定を強化するための実用的な洞察に変換することができます。製造、エネルギー、物流などの業界全体で、予知保全、運用の可視化、リアルタイム監視に対する需要が高まっており、こうした技術の採用が加速しています。さらに、AIと機械学習の台頭は、高度なアナリティクスの価値を増幅し、データオーケストレーションとアナリティクスを産業競争力とイノベーションに不可欠なものにしています。

米国は、その高度な産業セットアップ、最新技術の早期導入、大手市場参入企業の強力な存在感により、産業データ管理市場をリードすると予測されています。製造業、石油・ガス、エネルギー産業が密集する米国では、大量の産業データが生成されており、効率的なデータ管理システムが不可欠となっています。同国はデジタル化、モノのインターネット(IIoT)、スマート製造に注力しており、データ管理システムの採用も増加しています。クラウドコンピューティング、AI、サイバーセキュリティへの高額投資も産業データ管理システムの機能を強化し、米国を世界の最前線に位置づけています。

当レポートでは、世界の産業データ管理市場について調査し、タイプ別、オファリング別、データ管理スタック別、展開別、組織タイプ別、データタイプ別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 2024年の投資・資金調達シナリオ

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- 関税と規制状況

- AI/生成AIが産業データ管理市場に与える影響

- 2025年の米国関税の影響- 概要

第6章 産業データ管理におけるデータのタイプ

- イントロダクション

- 運用およびプロセスデータ

- 情報技術データ

第7章 産業データ管理市場(タイプ別)

- イントロダクション

- データ統合とストレージ

- データオーケストレーションと分析

- データ共有

- データセキュリティ

- データガバナンスとコンプライアンス

- データ可視化

第8章 産業データ管理市場(オファリング別)

- イントロダクション

- ソフトウェア

- サービス

第9章 産業データ管理市場(データ管理スタック別)

- イントロダクション

- レガシー

- モダン

第10章 産業データ管理市場(展開別)

- イントロダクション

- クラウドベース

- オンプレミス

- ハイブリッド

第11章 産業データ管理市場(組織タイプ別)

- イントロダクション

- 小規模および中規模

- 大規模

第12章 産業データ管理(データタイプ別)

- イントロダクション

- 構造化

- 非構造化

- 半構造化

第13章 産業データ管理市場(業界別)

- イントロダクション

- ヘルスケア・ライフサイエンス

- BFSI

- 製造・加工

- 通信・ネットワーク

- エネルギー・公益事業

- 倉庫・物流

第14章 産業データ管理市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第15章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2022年~2024年

- 収益分析、2021年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標、2024年

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第16章 企業プロファイル

- 主要参入企業

- MICROSOFT

- ALPHABET INC.

- SAP

- IBM

- ORACLE

- AMAZON WEB SERVICES, INC.

- AVEVA GROUP LIMITED

- TALEND, INC.

- SNOWFLAKE INC.

- INFORMATICA INC.

- SIEMENS

- HONEYWELL INTERNATIONAL INC.

- HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- DELL INC.

- その他の企業

- DATABRICKS

- PALANTIR TECHNOLOGIES INC.

- ABB

- CLOUDERA, INC.

- ATACCAMA

- ASPEN TECHNOLOGY INC

- C3.AI, INC

- COGNITE AS

- ROCKWELL AUTOMATION

- GE VERNOVA

- HITACHI VANTARA LLC.

- HEXAGON AB

- SYMPHONYAI

- TERADATA

- CONFLUENT, INC.

第17章 付録

List of Tables

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH LIMITATIONS

- TABLE 3 RISK ANALYSIS

- TABLE 4 ROLE OF COMPANIES IN INDUSTRIAL DATA MANAGEMENT ECOSYSTEM

- TABLE 5 INDICATIVE PRICING OF INDUSTRIAL DATA MANAGEMENT SOLUTIONS, BY KEY PLAYER, 2024

- TABLE 6 INDUSTRIAL DATA MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 9 IMPORT DATA FOR HS CODE 8471-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 8471-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 LIST OF PATENTS, 2022-2024

- TABLE 12 INDUSTRIAL DATA MANAGEMENT MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 MFN TARIFF FOR HS CODE 8471-COMPLIANT PRODUCTS EXPORTED BY INDONESIA, 2023

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 SAFETY STANDARDS FOR INDUSTRIAL DATA MANAGEMENT

- TABLE 19 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 20 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 21 INDUSTRIAL DATA MANAGEMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 22 INDUSTRIAL DATA MANAGEMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 23 DATA INTEGRATION & STORAGE: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 24 DATA INTEGRATION & STORAGE: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 25 DATA ORCHESTRATION & ANALYTICS: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 26 DATA ORCHESTRATION & ANALYTICS: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 27 DATA SHARING: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 28 DATA SHARING: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

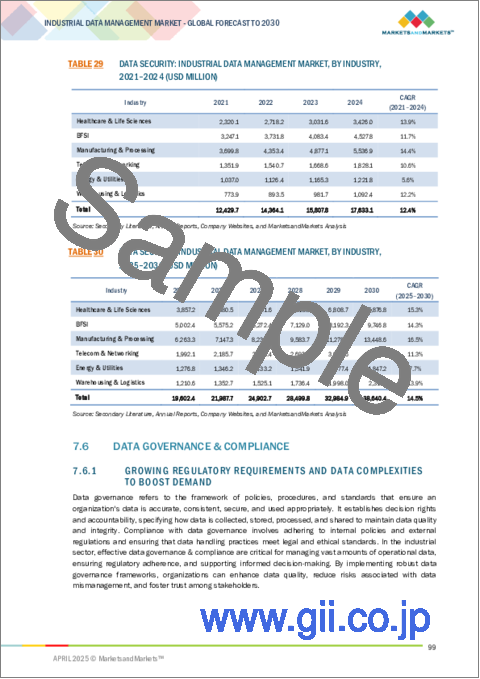

- TABLE 29 DATA SECURITY: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 30 DATA SECURITY: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 31 DATA GOVERNANCE & COMPLIANCE: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 32 DATA GOVERNANCE & COMPLIANCE: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 33 DATA VISUALIZATION: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 34 DATA VISUALIZATION: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 35 INDUSTRIAL DATA MANAGEMENT MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 36 INDUSTRIAL DATA MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 37 SOFTWARE: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 38 SOFTWARE: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 39 SERVICES: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 40 SERVICES: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 41 INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA STACK MANAGEMENT, 2021-2024 (USD MILLION)

- TABLE 42 INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA STACK MANAGEMENT, 2025-2030 (USD MILLION)

- TABLE 43 LEGACY: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 44 LEGACY: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 45 MODERN: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 46 MODERN: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 47 INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 48 INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 49 CLOUD-BASED: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 50 CLOUD-BASED: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 51 ON-PREMISES: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 52 ON-PREMISES: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 53 HYBRID: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 54 HYBRID: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 55 INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE, 2021-2024 (USD MILLION)

- TABLE 56 INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE, 2025-2030 (USD MILLION)

- TABLE 57 SMALL & MID-SIZED: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 58 SMALL & MID-SIZED: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 59 LARGE: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 60 LARGE: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 61 INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE, 2021-2024 (USD MILLION)

- TABLE 62 INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 63 STRUCTURED: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 64 STRUCTURED: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 65 UNSTRUCTURED: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 66 UNSTRUCTURED: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 67 SEMI-STRUCTURED: INDUSTRIAL DATA MANAGEMENT MARKET, BY SEMI-STRUCTURED, 2021-2024 (USD MILLION)

- TABLE 68 SEMI-STRUCTURED: INDUSTRIAL DATA MANAGEMENT MARKET, BY SEMI-STRUCTURED, 2025-2030 (USD MILLION)

- TABLE 69 INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 70 INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 71 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 72 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 73 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK, 2021-2024 (USD MILLION)

- TABLE 74 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK, 2025-2030 (USD MILLION)

- TABLE 75 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE, 2021-2024 (USD MILLION)

- TABLE 76 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 77 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE, 2021-2024 (USD MILLION)

- TABLE 78 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE, 2025-2030 (USD MILLION)

- TABLE 79 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 84 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 86 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 87 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 HEALTHCARE & LIFE SCIENCES: INDUSTRIAL DATA MANAGEMENT MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 90 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 91 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK, 2021-2024 (USD MILLION)

- TABLE 92 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK, 2025-2030 (USD MILLION)

- TABLE 93 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE, 2021-2024 (USD MILLION)

- TABLE 94 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 95 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE, 2021-2024 (USD MILLION)

- TABLE 96 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE, 2025-2030 (USD MILLION)

- TABLE 97 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 100 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 BFSI: INDUSTRIAL DATA MANAGEMENT MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 108 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 109 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK, 2021-2024 (USD MILLION)

- TABLE 110 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK, 2025-2030 (USD MILLION)

- TABLE 111 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE, 2021-2024 (USD MILLION)

- TABLE 112 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 113 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE, 2021-2024 (USD MILLION)

- TABLE 114 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE, 2025-2030 (USD MILLION)

- TABLE 115 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 120 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 122 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 123 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 124 MANUFACTURING & PROCESSING: INDUSTRIAL DATA MANAGEMENT MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 125 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 126 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 127 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK, 2021-2024 (USD MILLION)

- TABLE 128 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK, 2025-2030 (USD MILLION)

- TABLE 129 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE, 2021-2024 (USD MILLION)

- TABLE 130 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 131 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE, 2021-2024 (USD MILLION)

- TABLE 132 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE, 2025-2030 (USD MILLION)

- TABLE 133 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 134 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 136 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 137 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 142 TELECOM & NETWORKING: INDUSTRIAL DATA MANAGEMENT MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 143 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 144 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 145 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK, 2021-2024 (USD MILLION)

- TABLE 146 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK, 2025-2030 (USD MILLION)

- TABLE 147 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE, 2021-2024 (USD MILLION)

- TABLE 148 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 149 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE, 2021-2024 (USD MILLION)

- TABLE 150 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE, 2025-2030 (USD MILLION)

- TABLE 151 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 152 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 153 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 154 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 155 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 156 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 157 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 158 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 159 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 160 ENERGY & UTILITIES: INDUSTRIAL DATA MANAGEMENT MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 161 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 162 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 163 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK, 2021-2024 (USD MILLION)

- TABLE 164 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK, 2025-2030 (USD MILLION)

- TABLE 165 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE, 2021-2024 (USD MILLION)

- TABLE 166 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 167 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE, 2021-2024 (USD MILLION)

- TABLE 168 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE, 2025-2030 (USD MILLION)

- TABLE 169 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 170 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 171 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 172 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 173 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 174 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 175 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 176 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 177 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 178 WAREHOUSING & LOGISTICS: INDUSTRIAL DATA MANAGEMENT MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 179 INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 180 INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 181 NORTH AMERICA: INDUSTRIAL DATA MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 182 NORTH AMERICA: INDUSTRIAL DATA MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 NORTH AMERICA: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 184 NORTH AMERICA: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 185 EUROPE: INDUSTRIAL DATA MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 186 EUROPE: INDUSTRIAL DATA MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 187 EUROPE: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 188 EUROPE: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: INDUSTRIAL DATA MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 190 ASIA PACIFIC: INDUSTRIAL DATA MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 191 ASIA PACIFIC: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 192 ASIA PACIFIC: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 193 ROW: INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 194 ROW: INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 195 ROW: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 196 ROW: INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST: INDUSTRIAL DATA MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 198 MIDDLE EAST: INDUSTRIAL DATA MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 199 INDUSTRIAL DATA MANAGEMENT MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2022-2024

- TABLE 200 INDUSTRIAL DATA MANAGEMENT MARKET: DEGREE OF COMPETITION, 2024

- TABLE 201 INDUSTRIAL DATA MANAGEMENT MARKET: REGION FOOTPRINT

- TABLE 202 INDUSTRIAL DATA MANAGEMENT MARKET: TYPE FOOTPRINT

- TABLE 203 INDUSTRIAL DATA MANAGEMENT MARKET: OFFERING FOOTPRINT

- TABLE 204 INDUSTRIAL DATA MANAGEMENT MARKET: DEPLOYMENT FOOTPRINT

- TABLE 205 INDUSTRIAL DATA MANAGEMENT MARKET: INDUSTRY FOOTPRINT

- TABLE 206 INDUSTRIAL DATA MANAGEMENT MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 207 INDUSTRIAL DATA MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 208 INDUSTRIAL DATA MANAGEMENT MARKET: PRODUCT LAUNCHES, JANUARY 2022-DECEMBER 2024

- TABLE 209 INDUSTRIAL DATA MANAGEMENT MARKET: DEALS, JANUARY 2022-DECEMBER 2024

- TABLE 210 INDUSTRIAL DATA MANAGEMENT MARKET: OTHER DEVELOPMENTS, JANUARY 2022-DECEMBER 2024

- TABLE 211 MICROSOFT: COMPANY OVERVIEW

- TABLE 212 MICROSOFT: DEALS

- TABLE 213 MICROSOFT: OTHER DEVELOPMENTS

- TABLE 214 ALPHABET INC.: COMPANY OVERVIEW

- TABLE 215 ALPHABET INC.: DEALS

- TABLE 216 SAP: COMPANY OVERVIEW

- TABLE 217 SAP: DEALS

- TABLE 218 SAP: OTHER DEVELOPMENTS

- TABLE 219 IBM: COMPANY OVERVIEW

- TABLE 220 IBM: PRODUCT LAUNCHES

- TABLE 221 IBM: DEALS

- TABLE 222 IBM: OTHER DEVELOPMENTS

- TABLE 223 ORACLE: COMPANY OVERVIEW

- TABLE 224 ORACLE: DEALS

- TABLE 225 AMAZON WEB SERVICES, INC.: COMPANY OVERVIEW

- TABLE 226 AMAZON WEB SERVICES INC.: PRODUCT LAUNCHES

- TABLE 227 AVEVA GROUP LIMITED: COMPANY OVERVIEW

- TABLE 228 AVEVA GROUP LIMITED: PRODUCT LAUNCHES

- TABLE 229 AVEVA GROUP LIMITED: OTHER DEVELOPMENTS

- TABLE 230 TALEND, INC.: COMPANY OVERVIEW

- TABLE 231 TALEND, INC.: DEALS

- TABLE 232 TALEND, INC.: OTHER DEVELOPMENTS

- TABLE 233 SNOWFLAKE, INC.: COMPANY OVERVIEW

- TABLE 234 SNOWFLAKE INC.: PRODUCT LAUNCHES

- TABLE 235 SNOWFLAKE INC.: DEALS

- TABLE 236 INFORMATICA INC.: COMPANY OVERVIEW

- TABLE 237 INFORMATICA INC.: PRODUCT LAUNCHES

- TABLE 238 INFORMATICA INC.: DEALS

- TABLE 239 INFORMATICA INC.: OTHER DEVELOPMENTS

- TABLE 240 SIEMENS: COMPANY OVERVIEW

- TABLE 241 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 242 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: COMPANY OVERVIEW

- TABLE 243 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: DEALS

- TABLE 244 DELL INC.: COMPANY OVERVIEW

- TABLE 245 DELL INC.: PRODUCT LAUNCHES

List of Figures

- FIGURE 1 INDUSTRIAL DATA MANAGEMENT MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 INDUSTRIAL DATA MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 3 REVENUE GENERATED BY COMPANIES FROM SALES OF INDUSTRIAL DATA MANAGEMENT (SUPPLY SIDE)

- FIGURE 4 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 DATA INTEGRATION & STORAGE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 9 SOFTWARE SEGMENT SECURE LARGER MARKET SHARE IN 2030

- FIGURE 10 MANUFACTURING & PROCESSING INDUSTRY TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 RAPID ADOPTION OF INDUSTRY 5.0 TECHNOLOGIES TO DRIVE MARKET

- FIGURE 13 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

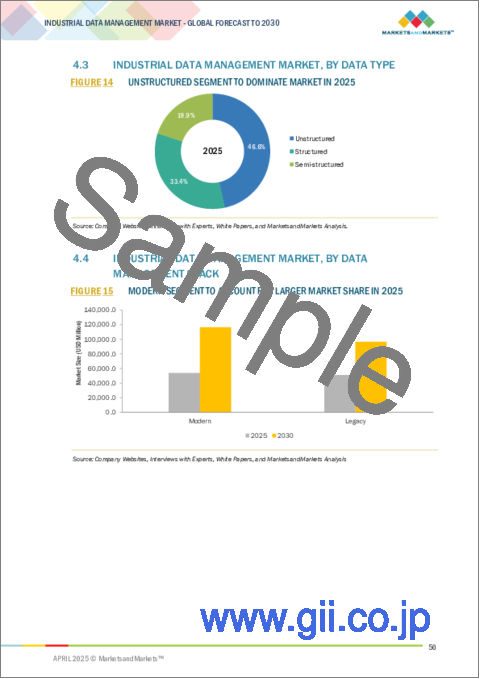

- FIGURE 14 UNSTRUCTURED SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 15 MODERN SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR IN INDUSTRIAL DATA MANAGEMENT MARKET DURING FORECAST PERIOD

- FIGURE 17 INDUSTRIAL DATA MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 INDUSTRIAL DATA MANAGEMENT MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 19 INDUSTRIAL DATA MANAGEMENT MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 20 INDUSTRIAL DATA MANAGEMENT MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 21 INDUSTRIAL DATA MANAGEMENT MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 22 INDUSTRIAL DATA MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 INDUSTRIAL DATA MANAGEMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 DATA ANALYTICS SERVICES STARTUP FUNDINGS, 2020-2024

- FIGURE 25 VC FUNDING, BY TECHNOLOGY

- FIGURE 26 AVERAGE SELLING PRICE TREND OF INDUSTRIAL DATA MANAGEMENT SOLUTIONS, BY REGION, 2020-2024

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 INDUSTRIAL DATA MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 31 IMPORT DATA FOR HS CODE 8471-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 32 EXPORT DATA FOR 8471-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 33 PATENTS APPLIED, OWENED, GRANTED, 2016-2025

- FIGURE 34 AI USE CASE IN INDUSTRIAL DATA MANAGEMENT MARKET

- FIGURE 35 INDUSTRIAL DATA MANAGEMENT MARKET, BY TYPE

- FIGURE 36 DATA INTEGRATION & STORAGE SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 37 INDUSTRIAL DATA MANAGEMENT MARKET, BY OFFERING

- FIGURE 38 SOFTWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 39 INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK

- FIGURE 40 MODERN SEGMENT TO GARNER LARGER MARKET SHARE IN 2030

- FIGURE 41 INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT

- FIGURE 42 ON-PREMISES SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 43 INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE

- FIGURE 44 SMALL & MID-SIZED SEGMENT TO DISPLAY HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 45 INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE

- FIGURE 46 UNSTRUCTURED SEGMENT TO LEAD MARKET IN 2030

- FIGURE 47 MANUFACTURING & PROCESSING SEGMENT TO LEAD MARKET IN 2030

- FIGURE 48 INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY

- FIGURE 49 MANUFACTURING & PROCESSING SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2030

- FIGURE 50 ASIA PACIFIC TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 51 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 52 NORTH AMERICA TO DOMINATE INDUSTRIAL DATA MANAGEMENT MARKET IN 2030

- FIGURE 53 NORTH AMERICA: INDUSTRIAL DATA MANAGEMENT MARKET SNAPSHOT

- FIGURE 54 EUROPE: INDUSTRIAL DATA MANAGEMENT MARKET SNAPSHOT

- FIGURE 55 ASIA PACIFIC: INDUSTRIAL DATA MANAGEMENT MARKET SNAPSHOT

- FIGURE 56 REVENUE ANALYSIS OF PLAYERS IN INDUSTRIAL DATA MANAGEMENT MARKET, 2020-2024

- FIGURE 57 INDUSTRIAL DATA MANAGEMENT MARKET ANALYSIS, 2024

- FIGURE 58 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 59 BRAND/PRODUCT COMPARISON

- FIGURE 60 INDUSTRIAL DATA MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 61 INDUSTRIAL DATA MANAGEMENT MARKET: COMPANY FOOTPRINT

- FIGURE 62 INDUSTRIAL DATA MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 63 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 64 ALPHABET INC.: COMPANY SNAPSHOT

- FIGURE 65 SAP: COMPANY SNAPSHOT

- FIGURE 66 IBM: COMPANY SNAPSHOT

- FIGURE 67 ORACLE: COMPANY SNAPSHOT

- FIGURE 68 AMAZON WEB SERVICES, INC.: COMPANY SNAPSHOT

- FIGURE 69 SNOWFLAKE, INC.: COMPANY SNAPSHOT

- FIGURE 70 INFORMATICA, INC.: COMPANY SNAPSHOT

- FIGURE 71 SIEMENS: COMPANY SNAPSHOT

- FIGURE 72 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 73 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: COMPANY SNAPSHOT

- FIGURE 74 DELL INC.: COMPANY SNAPSHOT

The global industrial data management market is expected to grow from USD 105.10 billion in 2025 to USD 213.20 billion by 2030, at a CAGR of 15.2% during the forecast period. One of the primary drivers is industrial automation and Industry 4.0 growth, where intelligent factories rely on real-time data storage and analytics to maximize operations, enhance efficiency, and facilitate predictive maintenance. Industrial data management software plays a critical role in automation in gathering data from various devices, equipment, and systems for evaluation and control. Furthermore, the rapid growth of Internet of Things (IoT) devices has promoted the adoption of various systems and sensors interoperable with industrial data management software across industries, ranging from demanding efficient data storage, analysis, visualization, and governance. The increased focus on real-time monitoring in energy, automotive, aerospace, healthcare, transportation, and BFSI further enhances the demand for precise data collection and analysis systems, thereby escalating the need for data management.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Data Type and Region |

| Regions covered | North America, Europe, APAC, RoW |

"BFSI is expected to contribute a significant share to the industrial data management market."

BFSI (banking, financial services, and insurance) business will be a key growth driver in the market for industrial data management. While financial institutions put greater investments into digital transformation, they generate and process huge amounts of sensitive as well as transactional data, which requires robust handling, security, and real-time analytics. This requirement for advanced data handling capabilities pushes the industry to employ cutting-edge data integration, governance, and compliance solutions, similar to those used in industrial environments. Moreover, BFSI firms are working with industrial companies to offer embedded finance, risk analysis, and predictive analytics offerings, further taking the boundaries out of the two industries. The industry's focus on customer intelligence, fraud detection, and regulatory compliance also drives innovation in data platforms, affecting general industrial data management trends. Therefore, the BFSI sector's technological strength and investment capability will be instrumental in accelerating the adoption and development of end-to-end integrated data management systems in various industries.

"Data orchestration & analytics segment is projected to register the highest CAGR in the industrial data management market."

Data orchestration and analytics are expected to be the fastest-growing segments in the industrial data management market. As industrial operations become increasingly digital and interconnected, organizations generate vast amounts of raw data from machines, sensors, enterprise systems, and supply chains. Data orchestration plays a critical role in streamlining and automating the flow of this data across disparate sources, ensuring it is clean, consistent, and accessible in real time. Coupled with powerful analytics tools, this orchestrated data can be transformed into actionable insights that drive efficiency, predict equipment failures, optimize resource usage, and enhance decision-making. The growing demand for predictive maintenance, operational visibility, and real-time monitoring across industries such as manufacturing, energy, and logistics is accelerating the adoption of these technologies. Furthermore, the rise of AI and machine learning amplifies the value of advanced analytics, making data orchestration and analytics essential for industrial competitiveness and innovation.

"The US is estimated to dominate the industrial data management market."

The US is anticipated to lead the industrial data management market due to its advanced industrial setup, early adoption of the latest technology, and the strong presence of major market players. With a high density of manufacturing, oil & gas, and energy industries, the US is generating massive volumes of industrial data, making efficient data management systems imperative. The country's focus on digitalization, Industrial Internet of Things (IIoT), and smart manufacturing also increases the adoption of data management systems. High investments in cloud computing, AI, and cybersecurity also augment the functionalities of industrial data management systems and place the US at the forefront globally.

In-depth interviews have been conducted with Chief Executive Officers (CEOs), Directors, and other executives from various key organizations operating in the industrial data management market.

- By Company Type: Tier 1 - 45%, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: C-level Executives - 40%, Directors - 35%, and Others - 25%

- By Region: North America- 45%, Europe - 25%, Asia Pacific- 20%, and RoW- 10%

The study includes an in-depth competitive analysis of these key players in the industrial data management market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the industrial data management market by offering, speed, application, vertical, and region (North America, Europe, Asia Pacific). The report scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the industrial data management market. A detailed analysis of the key industry players has provided insights into their business overview, solutions and services, key strategies, such as contracts, partnerships, agreements, new product and service launches, acquisitions, and other recent developments associated with the industrial data management market. This report covers a competitive analysis of upcoming industrial data management market startups.

Reasons to buy this report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the industrial data management market and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Expanding unstructured data, increasing cyber threats in industrial environments, growing popularity of IoT in industrial environments), restraints (Complexities associated with integrating industrial data management solutions into existing infrastructure, significant investments in hardware), opportunities (Convergence of information technology and operational technology, increasing adoption of cloud computing in industrial applications), and challenges (Ensuring high-quality and accurate data, lack of standardization in industrial data management) influencing the growth of the industrial data management market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product launches in the industrial data management market

- Market Development: Comprehensive information about lucrative markets-the report analyses the industrial data management market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the industrial data management market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the industrial data management market, such as Microsoft (US), Alphabet Inc. (US), SAP (Germany), Oracle (US), IBM (US), and AWS (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Intended participants and key opinion leaders

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 FACTOR ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL DATA MANAGEMENT MARKET

- 4.2 INDUSTRIAL DATA MANAGEMENT MARKET, BY DEPLOYMENT

- 4.3 INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA TYPE

- 4.4 INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK

- 4.5 INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding unstructured data

- 5.2.1.2 Increasing cyber threats in industrial environments

- 5.2.1.3 Growing popularity of IoT in industrial environments

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexities associated with integrating industrial data management solutions into existing infrastructure

- 5.2.2.2 Significant investments in hardware

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Convergence of information technology and operational technology

- 5.2.3.2 Increasing adoption of cloud computing in industrial applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Ensuring high-quality and accurate data

- 5.2.4.2 Lack of standardization in industrial data management

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO, 2024

- 5.6 PRICING ANALYSIS

- 5.6.1 INDICATIVE PRICING OF INDUSTRIAL DATA MANAGEMENT SOLUTIONS, BY KEY PLAYER, 2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF INDUSTRIAL DATA MANAGEMENT SOLUTIONS, BY REGION, 2020-2024

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 AI

- 5.8.1.2 IoT

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Industry 5.0

- 5.8.2.2 Predictive maintenance

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Process analytics

- 5.8.3.2 Industrial automation

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 THREAT OF NEW ENTRANTS

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 ADANI GROUP PARTNERED WITH SAP THAT ENSURED STANDARDIZED AND RELIABLE DATA ACROSS ALL BUSINESS UNITS

- 5.11.2 GLOBAL TRAVEL COMPANY IMPROVED SERVICE QUALITY AND OPERATIONAL EFFICIENCY WITH DYNAMICS 365

- 5.11.3 GLOBAL MANUFACTURING COMPANY IMPLEMENTED MASTER DATA MANAGEMENT TO TACKLE INCONSISTENT DATA ISSUES

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA (HS CODE 8471)

- 5.12.2 EXPORT DATA (HS CODE 8471)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 TARIFF ANALYSIS

- 5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.3 SAFETY STANDARDS FOR INDUSTRIAL DATA MANAGEMENT

- 5.16 IMPACT OF AI/GENERATIVE AI ON INDUSTRIAL DATA MANAGEMENT MARKET

- 5.16.1 INTRODUCTION

- 5.17 IMPACT OF 2025 US TARRIF - OVERVIEW

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 APAC

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 TYPES OF DATA IN INDUSTRIAL DATA MANAGEMENT

- 6.1 INTRODUCTION

- 6.2 OPERATIONAL & PROCESS DATA

- 6.2.1 ASSET INFORMATION MANAGEMENT

- 6.2.2 PRODUCTION DATA

- 6.2.3 DIGITAL TWIN & SIMULATION DATA

- 6.2.4 RESOURCE & ENERGY CONSUMPTION DATA

- 6.2.5 QUALITY CONTROL & INSPECTION DATA

- 6.3 INFORMATION TECHNOLOGY DATA

- 6.3.1 CYBER SECURITY & IT INFRASTRUCTURE DATA

- 6.3.2 SAFETY & COMPLIANCE DATA

- 6.3.3 CUSTOMER & MARKET DATA

- 6.3.4 SUPPLY CHAIN & LOGISTICS DATA

7 INDUSTRIAL DATA MANAGEMENT MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 DATA INTEGRATION & STORAGE

- 7.2.1 RISING DEMAND FOR CLOUD AND AI TECHNOLOGIES FOR INTEGRATING AND STORING DATA EFFECTIVELY TO FOSTER MARKET GROWTH

- 7.2.2 DATA LAKE

- 7.2.3 DATA WAREHOUSES

- 7.2.4 DATABASES

- 7.2.5 DATA MESH

- 7.2.6 DATA FABRIC

- 7.3 DATA ORCHESTRATION & ANALYTICS

- 7.3.1 NEED TO OPTIMIZE OPERATION AND ENHANCE EFFICIENCY IN INDUSTRIAL SETTINGS TO DRIVE MARKET GROWTH

- 7.4 DATA SHARING

- 7.4.1 GROWING NEED FOR IMPROVED SCALABILITY IN CLOUD ENVIRONMENTS TO FUEL MARKET GROWTH

- 7.5 DATA SECURITY

- 7.5.1 RISING EMPHASIS ON IMPLEMENTING ROBUST DATA SECURITY AND PROTECTION MEASURES TO ENSURE SAFEGUARDING OF SENSITIVE INFORMATION TO SUPPORT MARKET GROWTH

- 7.6 DATA GOVERNANCE & COMPLIANCE

- 7.6.1 GROWING REGULATORY REQUIREMENTS AND DATA COMPLEXITIES TO BOOST DEMAND

- 7.7 DATA VISUALIZATION

- 7.7.1 ABILITY TO TRANSFORM COMPLEX DATASETS INTO GRAPHICAL REPRESENTATIONS TO FOSTER MARKET GROWTH

8 INDUSTRIAL DATA MANAGEMENT MARKET, BY OFFERING

- 8.1 INTRODUCTION

- 8.2 SOFTWARE

- 8.2.1 RISING ADOPTION OF INDUSTRY 5.0 TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 8.3 SERVICES

- 8.3.1 INCREASING NEED FOR INTEROPERABILITY BETWEEN LEGACY AND MODERN INDUSTRIAL SYSTEMS TO BOOST DEMAND

9 INDUSTRIAL DATA MANAGEMENT MARKET, BY DATA MANAGEMENT STACK

- 9.1 INTRODUCTION

- 9.2 LEGACY

- 9.2.1 INCORPORATION OF CLOUD-BASED STORAGE TO ENHANCE PERFORMANCE AND DECISION-MAKING TO FUEL MARKET GROWTH

- 9.3 MODERN

- 9.3.1 RISING ADOPTION OF LOW-CODE AND NO-CODE DATA INTEGRATION TOOLS TO DRIVE MARKET

10 INDUSTRIAL DATA MANAGEMENT, BY DEPLOYMENT

- 10.1 INTRODUCTION

- 10.2 CLOUD-BASED

- 10.2.1 PRESSING NEED TO MANAGE AND PROCESS VAST AMOUNTS OF DATA TO FUEL MARKET GROWTH

- 10.3 ON-PREMISES

- 10.3.1 INCREASING DEMAND FOR LOW-LATENCY PROCESSING TO DRIVE MARKET

- 10.4 HYBRID

- 10.4.1 RISING NEED TO SECURE SENSITIVE DATA ON-PREMISES AND ENHANCE SCALABILITY TO SUPPORT MARKET GROWTH

11 INDUSTRIAL DATA MANAGEMENT MARKET, BY ORGANIZATION TYPE

- 11.1 INTRODUCTION

- 11.2 SMALL & MID-SIZED

- 11.2.1 ADVANCEMENTS IN CLOUD-HOSTED SCADA TO FUEL MARKET GROWTH

- 11.3 LARGE

- 11.3.1 INCREASING DEMAND FOR REAL-TIME ANALYTICS, AUTOMATION, AND PREDICTIVE MAINTENANCE TO FOSTER MARKET GROWTH

12 INDUSTRIAL DATA MANAGEMENT, BY DATA TYPE

- 12.1 INTRODUCTION

- 12.2 STRUCTURED

- 12.2.1 RISING FOCUS ON ENHANCING OPERATIONAL EFFICIENCY AND INFORMED DECISION-MAKING TO DRIVE MARKET

- 12.3 UNSTRUCTURED

- 12.3.1 EXPONENTIAL GROWTH OF MULTIMEDIA CONTENT AND SENSOR DATA TO BOOST DEMAND

- 12.4 SEMI-STRUCTURED

- 12.4.1 PROLIFERATION OF XML AND JSON FORMATS TO DRIVE MARKET

13 INDUSTRIAL DATA MANAGEMENT MARKET, BY INDUSTRY

- 13.1 INTRODUCTION

- 13.2 HEALTHCARE & LIFE SCIENCES

- 13.2.1 WIDESPREAD ADOPTION OF EHRS, TELEMEDICINE PLATFORMS, AND IOT-ENABLED MEDICAL EQUIPMENT TO DRIVE MARKET

- 13.3 BFSI

- 13.3.1 FOCUS ON FRAUD DETECTION AND RISK MITIGATION TO BOOST DEMAND

- 13.4 MANUFACTURING & PROCESSING

- 13.4.1 RISE OF INDUSTRY 5.0 TO SUPPORT MARKET GROWTH

- 13.4.2 AUTOMOTIVE

- 13.4.3 AEROSPACE

- 13.4.4 FOOD & BEVERAGE

- 13.4.5 CHEMICAL

- 13.4.6 MINING

- 13.4.7 OIL & GAS

- 13.5 TELECOM & NETWORKING

- 13.5.1 RAPID EXPANSION OF MOBILE DEVICES, IOT, 5G NETWORKS, AND CLOUD-BASED SERVICES TO FUEL MARKET GROWTH

- 13.6 ENERGY & UTILITIES

- 13.6.1 GROWING DEPENDENCE OF ENERGY SECTOR ON ROBUST DATA SOLUTIONS TO SUPPORT MARKET GROWTH

- 13.7 WAREHOUSING & LOGISTICS

- 13.7.1 PROLIFERATION OF E-COMMERCE, JUST-IN-TIME DELIVERY MODELS, AND COMPLEX INVENTORY NETWORKS TO BOOST DEMAND

14 INDUSTRIAL DATA MANAGEMENT MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 14.2.2 US

- 14.2.2.1 Rising demand for industrial automation in BFSI and manufacturing industries to fuel market growth

- 14.2.3 CANADA

- 14.2.3.1 Rapid adoption of digital tools across industries to drive market

- 14.2.4 MEXICO

- 14.2.4.1 Growing focus on innovative technologies such as autonomous systems and electric aircraft to support market growth

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 14.3.2 GERMANY

- 14.3.2.1 Transition from hybrid to public cloud infrastructure to fuel market growth

- 14.3.3 UK

- 14.3.3.1 Surge in automotive manufacturing to drive market

- 14.3.4 FRANCE

- 14.3.4.1 Government-led initiatives to boost digital transformation to drive market

- 14.3.5 ITALY

- 14.3.5.1 Rising emphasis on optimizing production processes to drive market

- 14.3.6 SPAIN

- 14.3.6.1 Expanding automotive sector to foster market growth

- 14.3.7 POLAND

- 14.3.7.1 Promotion of Industry 5.0 and automation to fuel market growth

- 14.3.8 NORDICS

- 14.3.8.1 Rapid adoption of AI and generative AI in manufacturing firms to drive market

- 14.3.9 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 14.4.2 CHINA

- 14.4.2.1 Integration of AI and big data in financial services to fuel market growth

- 14.4.3 JAPAN

- 14.4.3.1 Strong emphasis on advanced manufacturing and technological innovation to boost demand

- 14.4.4 SOUTH KOREA

- 14.4.4.1 Presence of established end-use sectors to offer lucrative growth opportunities

- 14.4.5 INDIA

- 14.4.5.1 Government-led initiatives to boost digital transformation to foster market growth

- 14.4.6 AUSTRALIA

- 14.4.6.1 Growing reliance of mining, energy, and manufacturing industries on advanced industrial data management technologies to drive market

- 14.4.7 INDONESIA

- 14.4.7.1 Rapid advancements in healthcare and manufacturing sectors to support market growth

- 14.4.8 MALAYSIA

- 14.4.8.1 Increasing complexity of manufacturing processes to drive market

- 14.4.9 THAILAND

- 14.4.9.1 Rising demand for sustainable packaging solutions to fuel market growth

- 14.4.10 VIETNAM

- 14.4.10.1 Expanding manufacturing, product assembly, and downstream services to support market growth

- 14.4.11 REST OF ASIA PACIFIC

- 14.5 ROW

- 14.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 14.5.2 MIDDLE EAST

- 14.5.2.1 Bahrain

- 14.5.2.1.1 Rising emphasis on modernizing industries to foster market growth

- 14.5.2.2 Kuwait

- 14.5.2.2.1 Expanding energy sector to drive market

- 14.5.2.3 Oman

- 14.5.2.3.1 Developing non-petroleum manufacturing sector to fuel market growth

- 14.5.2.4 Qatar

- 14.5.2.4.1 Diversification of production sector to offer lucrative growth opportunities

- 14.5.2.5 Saudi Arabia

- 14.5.2.5.1 Diversification of production sector to boost demand

- 14.5.2.6 UAE

- 14.5.2.6.1 Rising emphasis on developing industrial sector to fuel market growth

- 14.5.2.7 Rest of Middle East

- 14.5.2.1 Bahrain

- 14.5.3 AFRICA

- 14.5.3.1 South Africa

- 14.5.3.1.1 Presence of diverse industrial landscape to drive market

- 14.5.3.2 Rest of Africa

- 14.5.3.1 South Africa

- 14.5.4 SOUTH AMERICA

- 14.5.4.1 Thriving manufacturing sectors to boost demand

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- 15.3 REVENUE ANALYSIS, 2021-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 15.6 BRAND/PRODUCT COMPARISON

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Type footprint

- 15.7.5.4 Offering footprint

- 15.7.5.5 Deployment footprint

- 15.7.5.6 Industry footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.8.5.1 Detailed list of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 MICROSOFT

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Deals

- 16.1.1.3.2 Other developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths/Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses/Competitive threats

- 16.1.2 ALPHABET INC.

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths/Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses/Competitive threats

- 16.1.3 SAP

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Deals

- 16.1.3.3.2 Other developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths/Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses/Competitive threats

- 16.1.4 IBM

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Other developments

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths/Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses/Competitive threats

- 16.1.5 ORACLE

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Deals

- 16.1.5.4 MnM View

- 16.1.5.4.1 Key strengths/Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses/Competitive threats

- 16.1.6 AMAZON WEB SERVICES, INC.

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product launches

- 16.1.6.4 MnM view

- 16.1.6.4.1 Key strengths/Right to win

- 16.1.6.4.2 Strategic choices

- 16.1.6.4.3 Weaknesses/Competitive threats

- 16.1.7 AVEVA GROUP LIMITED

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches

- 16.1.7.3.2 Other developments

- 16.1.8 TALEND, INC.

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Deals

- 16.1.8.3.2 Other developments

- 16.1.9 SNOWFLAKE INC.

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.2.1 Product launches

- 16.1.9.2.2 Deals

- 16.1.10 INFORMATICA INC.

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches

- 16.1.10.3.2 Deals

- 16.1.10.3.3 Other developments

- 16.1.11 SIEMENS

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Solutions/Services offered

- 16.1.12 HONEYWELL INTERNATIONAL INC.

- 16.1.12.1 Business overview

- 16.1.12.2 Products/Solutions/Services offered

- 16.1.13 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- 16.1.13.1 Business overview

- 16.1.13.2 Products/Solutions/Services offered

- 16.1.13.3 Recent developments

- 16.1.13.3.1 Deals

- 16.1.14 DELL INC.

- 16.1.14.1 Business overview

- 16.1.14.2 Products/Solutions/Services offered

- 16.1.14.3 Recent developments

- 16.1.14.3.1 Product launches

- 16.1.1 MICROSOFT

- 16.2 OTHER PLAYERS

- 16.2.1 DATABRICKS

- 16.2.2 PALANTIR TECHNOLOGIES INC.

- 16.2.3 ABB

- 16.2.4 CLOUDERA, INC.

- 16.2.5 ATACCAMA

- 16.2.6 ASPEN TECHNOLOGY INC

- 16.2.7 C3.AI, INC

- 16.2.8 COGNITE AS

- 16.2.9 ROCKWELL AUTOMATION

- 16.2.10 GE VERNOVA

- 16.2.11 HITACHI VANTARA LLC.

- 16.2.12 HEXAGON AB

- 16.2.13 SYMPHONYAI

- 16.2.14 TERADATA

- 16.2.15 CONFLUENT, INC.

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS