|

|

市場調査レポート

商品コード

1718860

クロミック材料の世界市場:用途別、材料別、技術別、タイプ別、地域別 - 2030年までの予測Chromic Materials Market by Technology (Photochromism, Thermochromism, Electrochromism, Others), Material, Application (Smart Windows, Smart Fabrics, Others), End-use Industry, Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| クロミック材料の世界市場:用途別、材料別、技術別、タイプ別、地域別 - 2030年までの予測 |

|

出版日: 2025年04月25日

発行: MarketsandMarkets

ページ情報: 英文 271 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

クロミック材料の市場規模は、6.5%のCAGRで拡大し、2025年の46億4,000万米ドルから2030年には63億7,000万米ドルに達すると予測されています。

自動車分野ではスマート材料への需要が高まっており、メーカーが快適性、安全性、燃費を向上させるため、エレクトロクロミックウィンドウ、自動調光バックミラー、不透明度を調整できるサンルーフなどの新技術を採用していることが、クロミック材料市場を後押ししています。クロモジェニック技術は、光と熱のダイナミックな制御を可能にし、視界を向上させ、従来の遮光・冷却システムの必要性を低減します。このような特性は、美観と機能性の両方が要求される高級車や高性能車において特に望ましく、クロミック材料は現代の自動車スタイルと市場開拓の重要な刺激となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | トン、金額(100万米ドル) |

| セグメント | 用途別、材料別、技術別、タイプ別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

エレクトロクロミズムはクロミック材料分野で最も急成長している技術であり、光と熱の透過を動的に制御できることから、エネルギー効率の高いスマートウィンドウ、自動車用ミラー、将来のディスプレイなどに適しています。持続可能な製品に対する需要の高まりは、技術による性能と耐久性の向上と相まって、自動車、建築、家電市場での利用を促進しています。グリーンビルディングプロジェクトに対する規制支援や、IoTおよびスマートホームネットワークとの統合も、市場成長をますます促進しており、エレクトロクロミック技術は、予測期間中、大きな価値成長と高いCAGRに位置付けられています。

スマートウィンドウは、住宅、商業、輸送市場におけるエネルギー効率と快適性の向上への中心的な貢献により、予測期間を通じてクロミック材料市場で最大の用途になると予想されます。透明度や断熱性をダイナミックに変化させることで、照明や空調におけるエネルギー消費を最小限に抑え、世界の持続可能性の目標や規制要件に貢献します。

アジア太平洋は、中国、インド、日本の急速な工業化と電気、電子、自動車、建設分野の急成長に後押しされ、クロミック材料市場で最も高いシェアを占め、急成長している地域です。インテリジェント・コーティング、塗料、高級素材における用途の増加、都市化とインフラ整備の進展が需要を牽引しています。また、技術への支出の増加や、高性能で革新的な材料への需要の高まりも市場の成長に寄与しており、アジア太平洋地域のクロミック材料の世界最大シェアと最高成長率の地位を確固たるものにしています。

当レポートでは、世界のクロミック材料市場について調査し、用途別、材料別、技術別、タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 貿易分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 技術的制約- クロミック材料

- マクロ経済指標

- 平均販売価格の動向

- 規制状況

- クロミック材料市場における主要なスタートアップ企業および調査機関のリスト

- AI/生成AIの影響

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 特許分析

- 2025年の米国関税がクロミック材料市場に与える影響

第7章 クロミック材料市場(用途別)

- イントロダクション

- スマートウィンドウ

- スマートファブリック

- スマートラベルインジケーター

- ディスプレイ

- 眼科用レンズ

- その他

第8章 クロミック材料市場(材料別)

- イントロダクション

- 酸化タングステン

- 二酸化バナジウム

- 液晶ポリマー

- カルバゾール

- メトキシビフェニル

- インジウムスズ酸化物

- その他

第9章 クロミック材料市場(技術別)

- イントロダクション

- フォトクロミズム

- 熱変色

- 電気着色

- ピエゾクロミズム

- ガソクロミズム

- その他

第10章 クロミック材料市場(タイプ別)

- イントロダクション

- 透明

- カラードステート

第11章 クロミック材料市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2022年~2024年

- 市場シェア分析

- 企業評価と財務指標

- 製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- MERCK KGAA

- MILLIKEN & COMPANY

- TOKUYAMA CORPORATION

- FLINT GROUP

- NOVA BY SAINT-GOBAIN

- SPOTSEE

- MATSUI INTERNATIONAL COMPANY

- QCR SOLUTIONS CORP

- CHROMATIC TECHNOLOGIES INC.

- OLIKROM INDUSTRY

- KOLORTEK CO., LTD

- NEW PRISMATIC ENTERPRISE CO., LTD

- GEM'INNOV

- HALI PIGMENT CO., LTD.

- SMAROL INDUSTRY CO., LTD

- VIVIMED LABS LIMITED

- その他の企業

- FX PIGMENTS

- NEWCOLORCHEM

- SHANGHAI CAISON COLOR MATERIAL CO., LTD.

- H.W. SANDS CORP.

- YAMAMOTO CHEMICALS, INC.

- EPTANOVA S.R.L.

- INDESTRUCTIBLE PAINT LIMITED

- GOOD LIFE INNOVATIONS

- VIPUL CHEMICALS INDIA PVT LTD

- GUANGZHOU SHENGSE TECHNOLOGY CO., LTD.

- YAMADA CHEMICAL CO., LTD.

第14章 付録

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 VEHICLE PRODUCTION STATISTICS, BY COUNTRY, 2021-2023 (UNIT)

- TABLE 3 CHROMIC MATERIALS MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 4 CHROMIC MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 7 EXPORT SCENARIO FOR HS CODE 320620-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 8 IMPORT SCENARIO FOR HS CODE 320620-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 9 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2019-2023

- TABLE 10 ANNUAL GDP PERCENTAGE CHANGE AND PROJECTION OF KEY COUNTRIES, 2024-2029

- TABLE 11 CHROMIC MATERIALS MARKET: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 CHROMIC MATERIALS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 14 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR CHROMIC MATERIALS

- TABLE 15 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO IMPACT OF TARIFF

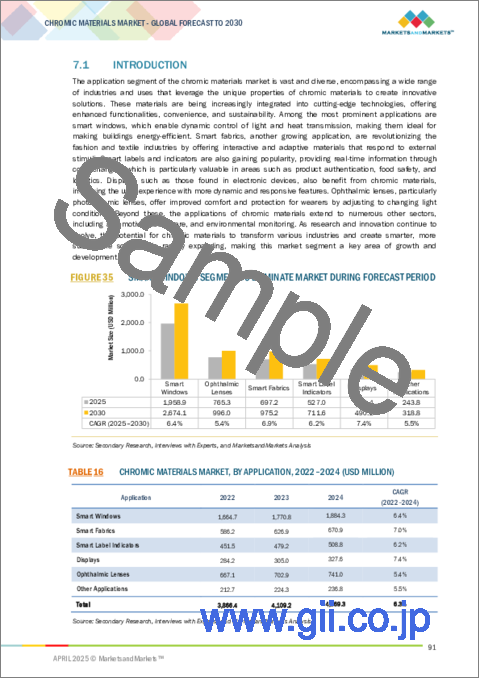

- TABLE 16 CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 17 CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 18 CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 19 CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 20 CHROMIC MATERIALS MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 21 CHROMIC MATERIALS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 22 CHROMIC MATERIALS MARKET, BY MATERIAL, 2022-2024 (TON)

- TABLE 23 CHROMIC MATERIALS MARKET, BY MATERIAL, 2025-2030 (TON)

- TABLE 24 CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 25 CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 26 CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2022-2024 (TON)

- TABLE 27 CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2025-2030 (TON)

- TABLE 28 CHROMIC MATERIALS MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 29 CHROMIC MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 30 CHROMIC MATERIALS MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 31 CHROMIC MATERIALS MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 32 CHROMIC MATERIALS MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 33 CHROMIC MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 CHROMIC MATERIALS MARKET, BY REGION, 2022-2024 (TON)

- TABLE 35 CHROMIC MATERIALS MARKET, BY REGION, 2025-2030 (TON)

- TABLE 36 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 37 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 38 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY COUNTRY, 2022-2024 (TON)

- TABLE 39 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 40 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 41 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 43 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 44 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 45 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY MATERIAL, 2022-2024 (TON)

- TABLE 47 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY MATERIAL, 2025-2030 (TON)

- TABLE 48 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 49 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 51 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 52 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 53 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2022-2024 (TON)

- TABLE 55 NORTH AMERICA: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2025-2030 (TON)

- TABLE 56 US: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 57 US: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 58 US: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 59 US: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 60 CANADA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 61 CANADA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 62 CANADA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 63 CANADA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 64 MEXICO: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 65 MEXICO: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 66 MEXICO: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 67 MEXICO: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 68 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 69 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 70 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY COUNTRY, 2022-2024 (TON)

- TABLE 71 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 72 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 73 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 74 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 75 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 76 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 77 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 78 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY MATERIAL, 2022-2024 (TON)

- TABLE 79 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY MATERIAL, 2025-2030 (TON)

- TABLE 80 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 81 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 82 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 83 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 84 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 85 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 86 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2022-2024 (TON)

- TABLE 87 ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2025-2030 (TON)

- TABLE 88 CHINA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 89 CHINA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 90 CHINA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 91 CHINA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 92 JAPAN: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 93 JAPAN: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 94 JAPAN: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 95 JAPAN: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 96 INDIA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 97 INDIA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 98 INDIA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 99 INDIA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 100 SOUTH KOREA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 101 SOUTH KOREA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 102 SOUTH KOREA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 103 SOUTH KOREA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 104 REST OF ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 107 REST OF ASIA PACIFIC: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 108 EUROPE: CHROMIC MATERIALS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 109 EUROPE: CHROMIC MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 110 EUROPE: CHROMIC MATERIALS MARKET, BY COUNTRY, 2022-2024 (TON)

- TABLE 111 EUROPE: CHROMIC MATERIALS MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 112 EUROPE: CHROMIC MATERIALS MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 113 EUROPE: CHROMIC MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: CHROMIC MATERIALS MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 115 EUROPE: CHROMIC MATERIALS MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 116 EUROPE: CHROMIC MATERIALS MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 117 EUROPE: CHROMIC MATERIALS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: CHROMIC MATERIALS MARKET, BY MATERIAL, 2022-2024 (TON)

- TABLE 119 EUROPE: CHROMIC MATERIALS MARKET, BY MATERIAL, 2025-2030 (TON)

- TABLE 120 EUROPE: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 121 EUROPE: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 123 EUROPE: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 124 EUROPE: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 125 EUROPE: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 126 EUROPE: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2022-2024 (TON)

- TABLE 127 EUROPE: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2025-2030 (TON)

- TABLE 128 GERMANY: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 129 GERMANY: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 GERMANY: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 131 GERMANY: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 132 UK: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 133 UK: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 UK: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 135 UK: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 136 FRANCE: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 137 FRANCE: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 FRANCE: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 139 FRANCE: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 140 ITALY: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 141 ITALY: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 142 ITALY: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 143 ITALY: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 144 SPAIN: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 145 SPAIN: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 146 SPAIN: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 147 SPAIN: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 148 REST OF EUROPE: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 149 REST OF EUROPE: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 150 REST OF EUROPE: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 151 REST OF EUROPE: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 152 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY COUNTRY, 2022-2024 (TON)

- TABLE 155 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 156 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 159 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 160 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY MATERIAL, 2022-2024 (TON)

- TABLE 163 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY MATERIAL, 2025-2030 (TON)

- TABLE 164 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 167 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 168 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2022-2024 (TON)

- TABLE 171 MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2025-2030 (TON)

- TABLE 172 SAUDI ARABIA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 173 SAUDI ARABIA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 174 SAUDI ARABIA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 175 SAUDI ARABIA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 176 REST OF GCC COUNTRIES: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 177 REST OF GCC COUNTRIES: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 178 REST OF GCC COUNTRIES: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 179 REST OF GCC COUNTRIES: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 180 SOUTH AFRICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 181 SOUTH AFRICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 182 SOUTH AFRICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 183 SOUTH AFRICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 188 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 189 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 190 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY COUNTRY, 2022-2024 (TON)

- TABLE 191 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 192 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 193 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 194 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 195 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 196 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 197 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 198 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY MATERIAL, 2022-2024 (TON)

- TABLE 199 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY MATERIAL, 2025-2030 (TON)

- TABLE 200 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 201 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 202 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 203 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 204 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 205 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 206 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2022-2024 (TON)

- TABLE 207 SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY TECHNOLOGY, 2025-2030 (TON)

- TABLE 208 BRAZIL: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 209 BRAZIL: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 210 BRAZIL: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 211 BRAZIL: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 212 ARGENTINA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 213 ARGENTINA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 214 ARGENTINA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 215 ARGENTINA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 216 REST OF SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 217 REST OF SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 218 REST OF SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 219 REST OF SOUTH AMERICA: CHROMIC MATERIALS MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 220 CHROMIC MATERIALS MARKET: DEGREE OF COMPETITION

- TABLE 221 CHROMIC MATERIALS MARKET: REGION FOOTPRINT

- TABLE 222 CHROMIC MATERIALS MARKET: TYPE FOOTPRINT

- TABLE 223 CHROMIC MATERIALS MARKET: MATERIAL FOOTPRINT

- TABLE 224 CHROMIC MATERIALS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 225 CHROMIC MATERIALS MARKET: APPLICATION FOOTPRINT

- TABLE 226 CHROMIC MATERIALS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 227 CHROMIC MATERIALS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 228 CHROMIC MATERIALS MARKET: PRODUCT LAUNCHES, JANUARY 2020- MARCH 2025

- TABLE 229 CHROMIC MATERIALS MARKET: DEALS, JANUARY 2020-MARCH 2025

- TABLE 230 MERCK KGAA: COMPANY OVERVIEW

- TABLE 231 MERCK KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 MILLIKEN & COMPANY: COMPANY OVERVIEW

- TABLE 233 MILLIKEN & COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 MILLIKEN & COMPANY: DEALS, JANUARY 2020-MARCH 2025

- TABLE 235 TOKUYAMA CORPORATION: COMPANY OVERVIEW

- TABLE 236 TOKUYAMA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 FLINT GROUP: COMPANY OVERVIEW

- TABLE 238 FLINT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 NOVA BY SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 240 NOVA BY SAINT-GOBAIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 SPOTSEE: COMPANY OVERVIEW

- TABLE 242 SPOTSEE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 SPOTSEE: DEALS, JANUARY 2020-MARCH 2025

- TABLE 244 MATSUI INTERNATIONAL COMPANY: COMPANY OVERVIEW

- TABLE 245 MATSUI INTERNATIONAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 MATSUI INTERNATIONAL COMPANY: PRODUCT LAUNCHES, JANUARY 2019- MARCH 2025

- TABLE 247 QCR SOLUTIONS CORP: COMPANY OVERVIEW

- TABLE 248 QCR SOLUTIONS CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 CHROMATIC TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 250 CHROMATIC TECHNOLOGIES INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 CHROMATIC TECHNOLOGIES INC.: PRODUCT LAUNCHES, JANUARY 2020- MARCH 2025

- TABLE 252 CHROMATIC TECHNOLOGIES INC: DEALS, JANUARY 2019-MARCH 2025

- TABLE 253 OLIKROM INDUSTRY: COMPANY OVERVIEW

- TABLE 254 OLIKROM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 KOLORTEK: COMPANY OVERVIEW

- TABLE 256 KOLORTEK CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 NEW PRISMATIC ENTERPRISE CO., LTD.: COMPANY OVERVIEW

- TABLE 258 NEW PRISMATIC ENTERPRISE CO., LTD: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 259 GEM'INNOV: COMPANY OVERVIEW

- TABLE 260 GEM'INNOV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 HALI PIGMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 262 HALI PIGMENT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 SMAROL INDUSTRY CO., LTD: COMPANY OVERVIEW

- TABLE 264 SMAROL INDUSTRY CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 VIVIMED LABS LIMITED: COMPANY OVERVIEW

- TABLE 266 VIVIMED LABS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 FX PIGMENTS: COMPANY OVERVIEW

- TABLE 268 NEWCOLORCHEM: COMPANY OVERVIEW

- TABLE 269 SHANGHAI CAISON COLOR MATERIAL CO., LTD: COMPANY OVERVIEW

- TABLE 270 H.W. SANDS CORP.: COMPANY OVERVIEW

- TABLE 271 YAMAMOTO CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 272 EPTANOVA S.R.L.: COMPANY OVERVIEW

- TABLE 273 INDESTRUCTIBLE PAINT LIMITED: COMPANY OVERVIEW

- TABLE 274 GOOD LIFE INNOVATIONS: COMPANY OVERVIEW

- TABLE 275 VIPUL CHEMICALS INDIA PVT LTD: COMPANY OVERVIEW

- TABLE 276 GUANGZHOU SHENGSE TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 277 YAMADA CHEMICAL CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 CHROMIC MATERIALS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 CHROMIC MATERIALS MARKET: RESEARCH DESIGN

- FIGURE 3 CHROMIC MATERIALS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 CHROMIC MATERIALS MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: CHROMIC MATERIALS MARKET TOP-DOWN APPROACH

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 CHROMIC MATERIALS MARKET: DATA TRIANGULATION

- FIGURE 8 COLORED STATE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 9 SMART WINDOWS APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 ELECTROCHROMISM TECHNOLOGY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 12 GROWING DEMAND FROM AUTOMOTIVE AND CONSTRUCTION INDUSTRIES TO DRIVE MARKET

- FIGURE 13 TRANSPARENT SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 14 INDIUM TIN OXIDE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 SMART WINDOWS TO BE LARGEST APPLICATION OF CHROMIC MATERIALS DURING FORECAST PERIOD

- FIGURE 16 THERMOCHROMISM TO BE LARGEST TECHNOLOGY DURING FORECAST PERIOD

- FIGURE 17 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CHROMIC MATERIALS MARKET

- FIGURE 19 CHROMIC MATERIALS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 CHROMIC MATERIALS MARKET: ECOSYSTEM

- FIGURE 21 CHROMIC MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 24 EXPORT DATA FOR HS-CODE 320620-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 25 IMPORT DATA FOR HS CODE 320620-COMPLIANT PRODUCTS, BY COUNTRY (USD THOUSAND)

- FIGURE 26 CHROMIC MATERIALS MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD/KG)

- FIGURE 28 AVERAGE SELLING PRICE TREND, BY TECHNOLOGY, 2021-2023 (USD/KG)

- FIGURE 29 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2022-2024 (USD/KG)

- FIGURE 30 AVERAGE SELLING PRICE TREND BY MATERIAL, 2022-2024 (USD/KG)

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD MILLION)

- FIGURE 32 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 33 LEGAL STATUS OF PATENTS, 2014-2024

- FIGURE 34 TOP JURISDICTIONS

- FIGURE 35 SMART WINDOWS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 36 VANADIUM DIOXIDE SEGMENT TO BE FASTEST-GROWING DURING FORECAST PERIOD

- FIGURE 37 THERMOCHROMISM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 38 COLORED STATE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 39 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA: CHROMIC MATERIALS MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: CHROMIC MATERIALS MARKET SNAPSHOT

- FIGURE 42 EUROPE: CHROMIC MATERIALS MARKET SNAPSHOT

- FIGURE 43 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN CHROMIC MATERIALS MARKET BETWEEN 2020 AND 2025

- FIGURE 44 REVENUE ANALYSIS OF TWO TOP PLAYERS IN CHROMIC MATERIALS MARKET, 2021-2024

- FIGURE 45 SHARE OF KEY COMPANIES IN CHROMIC MATERIALS MARKET, 2024

- FIGURE 46 VALUATION OF LEADING COMPANIES IN CHROMIC MATERIALS MARKET, 2024

- FIGURE 47 FINANCIAL METRICS OF LEADING COMPANIES IN CHROMIC MATERIALS MARKET, 2024

- FIGURE 48 CHROMIC MATERIALS MARKET: PRODUCT COMPARISON ANALYSIS

- FIGURE 49 CHROMIC MATERIALS MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 50 CHROMIC MATERIALS MARKET: OVERALL COMPANY FOOTPRINT

- FIGURE 51 CHROMIC MATERIALS MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- FIGURE 52 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 53 TOKUYAMA CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 VIVIMED LABS LIMITED: COMPANY SNAPSHOT

The chromic materials market is projected to reach USD 6.37 billion by 2030 from USD 4.64 billion in 2025, at a CAGR of 6.5%. The increasing demand for smart materials in the automotive sector is propelling the chromic materials market, as manufacturers are adopting new technologies, including electrochromic windows, auto-dimming rearview mirrors, and sunroofs with adjustable opacity to improve comfort, safety, and fuel economy. Chromogenic technologies enable dynamic control of light and heat, improving visibility and reducing the need for traditional shading and cooling systems. These properties are particularly desirable in luxury and high-performance cars, where both, esthetic and functional requirements are high, and chromic materials are thus an important stimulus of modern automobile style and market development.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Tons; Value (USD million) |

| Segments | Type, Material, Application, and Technology |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Based on technology, electrochromism is expected to be the fastest-growing technology in the chromic materials market during the forecast period, in terms of value"

Electrochromism is the fastest-growing technology in the chromic materials field, prompted by its ability to control dynamically the transmission of light and heat, and therefore, suitability for energy-efficient smart windows, automotive mirrors, and future displays. Increasing demand for sustainable products, combined with enhanced performance and durability due to technology, is promoting their use in the automotive, construction, and consumer electronics markets. Regulatory support for green building projects and integration with IoT and smart home networks are also increasingly driving market growth, positioning the electrochromic technology for strong growth in value and a high CAGR over the forecast period.

"Based on application, smart windows is expected to be the largest application in chromic materials market during the forecast period, in terms of value"

Smart windows are expected to be the largest application in the chromic materials market through the forecast period, fueled by their central contribution to enhancing energy efficiency and comfort in the residential, commercial, and transportation markets. Through dynamic modification in transparency and insulation, they minimize energy consumption in lighting and climate control, contributing to global sustainability objectives and regulatory requirements.

"Based on region, Asia Pacific accounts for the largest share and is the fastest-growing region in the chromic materials market, in terms of value"

Asia Pacific has the highest share and is the fastest-growing region in the chromic materials market, fueled by rapid industrialization and rapid growth in the electrical, electronics, automotive, and construction sectors of China, India, and Japan. Rising applications in intelligent coatings, paints, and premium materials, and growing urbanization and infrastructure growth are driving demand. Also, higher expenditure on technology and growing demand for high-performance, innovative materials further contribute to market growth, cementing Asia Pacific's position as the world's largest share of the market and highest growth rate for chromic materials.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive interviews with experts were conducted. A breakdown of the profiles of the interviews with experts are as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Directors- 35%, Managers - 25%, and Others - 40%

- By Region: North America - 22%, Europe - 22%, Asia Pacific - 45%, RoW - 11%

The key players in this market are Merck KGaA (Germany), Milliken & Company (US), Tokuyama Corporation (Japan), Flint Group (UK), Nova by Saint-Gobain (US), SpotSee (US), Matsui International Company (Japan), QCR Solutions Corp (US), Chromatic Technologies Inc (US), Olikrom Industry (France), Kolortek Co., Ltd (China), New Prismatic Enterprise Co., Ltd (Taiwan), GEM'INNOV (France), Hali Pigment Co., Ltd (China) Vivimed Labs Limited (India), and Smarol Industry Co., Ltd (China).

Research Coverage

This report segments the chromic materials market based on type, material, application, technology, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products and services, key strategies, product launches, expansions, and mergers & acquisitions associated with the chromic materials market.

Key benefits of buying this report

This research report focuses on various levels of analysis, including industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the chromic materials market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

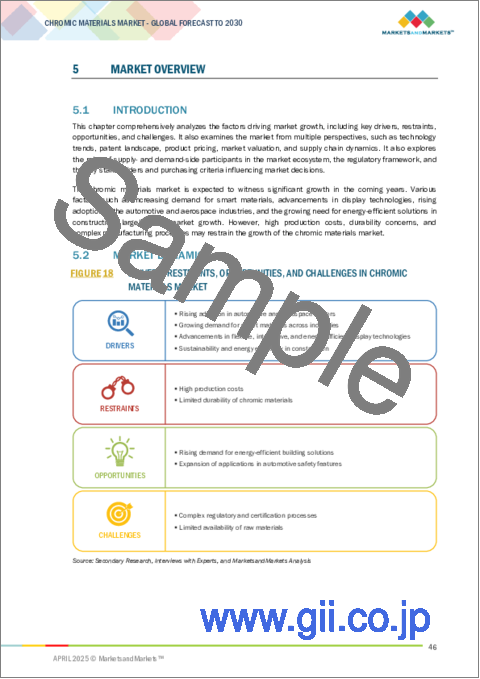

- Analysis of key drivers (Growing demand for smart materials across industries, advancements in display technologies, sustainability and energy efficiency in construction), restraints (High production costs, limited durability of chromic materials), opportunities (Rising demand for energy-efficient building solutions, expansion of applications in automotive safety features) and challenges (Complex regulatory and certification processes, limited availability of raw materials).

- Market Penetration: Comprehensive information on the chromic materials market offered by top players in the global chromic materials market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the chromic materials market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for chromic materials market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global chromic materials market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the chromic materials market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply side

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CHROMIC MATERIALS MARKET

- 4.2 CHROMIC MATERIALS MARKET, BY TYPE

- 4.3 CHROMIC MATERIALS MARKET, BY MATERIAL

- 4.4 CHROMIC MATERIALS MARKET, BY APPLICATION

- 4.5 CHROMIC MATERIALS MARKET, BY TECHNOLOGY

- 4.6 CHROMIC MATERIALS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption in automotive and aerospace sectors

- 5.2.1.2 Growing demand for smart materials across industries

- 5.2.1.3 Advancements in flexible, interactive, and energy-efficient display technologies

- 5.2.1.4 Sustainability and energy efficiency in construction

- 5.2.2 RESTRAINTS

- 5.2.2.1 High production costs

- 5.2.2.2 Limited durability of chromic materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for energy-efficient building solutions

- 5.2.3.2 Expansion of applications in automotive safety features

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex regulatory and certification processes

- 5.2.4.2 Limited availability of raw materials

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 VALUE CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTORS

- 6.1.4 END USERS

- 6.2 ECOSYSTEM ANALYSIS

- 6.3 PORTER'S FIVE FORCES ANALYSIS

- 6.3.1 THREAT OF NEW ENTRANTS

- 6.3.2 THREAT OF SUBSTITUTES

- 6.3.3 BARGAINING POWER OF SUPPLIERS

- 6.3.4 BARGAINING POWER OF BUYERS

- 6.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.4.2 QUALITY

- 6.4.3 SERVICE

- 6.4.4 BUYING CRITERIA

- 6.5 TRADE ANALYSIS

- 6.5.1 EXPORT SCENARIO (HS CODE 320620)

- 6.5.2 IMPORT SCENARIO (HS CODE 320620)

- 6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.1.1 Thermochromic liquid crystals (TLCs)

- 6.7.1.2 Photochromic polymers

- 6.7.1.3 Electrochromic thin films

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.2.1 Smart coatings

- 6.7.2.2 Nanostructured materials

- 6.7.2.3 Hybrid chromic systems

- 6.7.1 KEY TECHNOLOGIES

- 6.8 TECHNOLOGICAL CONSTRAINTS - CHROMIC MATERIALS

- 6.8.1 INTEGRATION CHALLENGES AND END USER PREFERENCE

- 6.9 MACROECONOMIC INDICATORS

- 6.9.1 GDP TRENDS AND FORECASTS

- 6.10 AVERAGE SELLING PRICE TREND

- 6.10.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 6.10.2 AVERAGE SELLING PRICE TREND, BY TECHNOLOGY, 2022-2024

- 6.10.3 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2022-2024

- 6.10.4 AVERAGE SELLING PRICE TREND BY MATERIAL, 2021-2023

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATIONS

- 6.11.2 NORTH AMERICA

- 6.11.3 ASIA PACIFIC

- 6.11.4 EUROPE

- 6.11.5 SOUTH AMERICA

- 6.11.6 MIDDLE EAST & AFRICA

- 6.11.7 STANDARDS

- 6.11.7.1 ISO 9001

- 6.11.7.2 ISO 14001

- 6.11.7.3 ISO 18001/ISO 45001

- 6.11.7.4 ISO 13485

- 6.11.7.5 ISO 175

- 6.11.7.6 ISO 4892

- 6.11.7.7 ASTM D2244

- 6.11.7.8 ASTM E2149

- 6.11.7.9 ASTM G154

- 6.11.8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12 LIST OF KEY STARTUPS AND RESEARCH INSTITUTES IN CHROMIC MATERIALS MARKET

- 6.12.1 KEY STARTUPS IN CHROMIC MATERIALS MARKET

- 6.12.1.1 KingChroma

- 6.12.1.2 ChromaGenics

- 6.12.1.3 Good Life Innovations

- 6.12.1.4 Chromatic Technologies

- 6.12.2 RESEARCH INSTITUTES IN CHROMIC MATERIALS MARKET

- 6.12.2.1 Fraunhofer Institute for Applied Polymer Research (IAP), Germany

- 6.12.2.2 Princeton Materials Institute (PMI), US

- 6.12.2.3 Advanced Materials Research Institute (AMRI), University of New Orleans, US

- 6.12.2.4 Institute of Materials Research (IMR), Washington State University, US

- 6.12.2.5 Joint Research Centre of Advanced Materials, Bournemouth University, UK, and Northeastern University, China

- 6.12.1 KEY STARTUPS IN CHROMIC MATERIALS MARKET

- 6.13 IMPACT OF AI/GEN AI

- 6.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 IMPROVING ENERGY PERFORMANCE WITH THERMOCHROMIC GLASS - WATES HOUSE RE-CLADDING

- 6.15.2 OPTIMIZING DAYLIGHT AND ENERGY EFFICIENCY - CHABOT COLLEGE ATRIUM

- 6.15.3 SUSTAINABLE CLIMATE CONTROL WITH SMART GLASS - RESEARCH SUPPORT FACILITY (RSF)

- 6.16 INVESTMENT AND FUNDING SCENARIO

- 6.17 PATENT ANALYSIS

- 6.17.1 INTRODUCTION

- 6.17.2 LEGAL STATUS OF PATENTS

- 6.17.3 JURISDICTION ANALYSIS

- 6.18 IMPACT OF 2025 US TARIFF ON CHROMIC MATERIALS MARKET

- 6.18.1 INTRODUCTION

- 6.18.2 KEY TARIFF RATES

- 6.18.3 PRICE IMPACT ANALYSIS

- 6.18.4 IMPACT ON COUNTRY/REGION

- 6.18.4.1 The US

- 6.18.4.2 Europe

- 6.18.4.3 Asia Pacific

- 6.18.5 IMPACT ON END-USE INDUSTRIES

7 CHROMIC MATERIALS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 SMART WINDOWS

- 7.2.1 ENERGY EFFICIENCY AND COMFORT TO DRIVE MARKET

- 7.3 SMART FABRICS

- 7.3.1 REAL-TIME HEALTH MONITORING AND SPORTS PERFORMANCE TO BOOST MARKET

- 7.4 SMART LABEL INDICATORS

- 7.4.1 EFFICIENT PRODUCT MONITORING TO PROPEL DEMAND

- 7.5 DISPLAYS

- 7.5.1 ENERGY-EFFICIENT, CUSTOMIZABLE SOLUTIONS TO FUEL MARKET

- 7.6 OPHTHALMIC LENSES

- 7.6.1 ENHANCED COMFORT AND FUNCTIONALITY IN EYEWEAR TO DRIVE DEMAND

- 7.7 OTHER APPLICATIONS

8 CHROMIC MATERIALS MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 TUNGSTEN OXIDE

- 8.2.1 USE IN SMART WINDOWS, ENERGY-EFFICIENT DISPLAYS, SENSORS, AND OPTICAL DEVICES TO BOOST MARKET

- 8.3 VANADIUM DIOXIDE

- 8.3.1 ABILITY TO CONTROL INFRARED RADIATION TO ENABLE ENERGY-EFFICIENT SOLUTIONS FOR BUILDINGS AND DEVICES

- 8.4 LIQUID CRYSTAL POLYMERS

- 8.4.1 HIGH OPTICAL, MECHANICAL, AND THERMAL PROPERTIES TO FUEL GROWTH

- 8.5 CARBAZOLES

- 8.5.1 FAST SWITCHING SPEEDS, REDUCED RESPONSE TIMES, AND HIGHER EFFICIENCY IN DEVICES TO DRIVE GROWTH

- 8.6 METHOXY BIPHENYLS

- 8.6.1 APPLICATIONS IN ELECTROCHROMIC DEVICES, OLEDS, PHOTOCHROMIC MATERIALS, AND ADVANCED DISPLAYS TO BOOST MARKET

- 8.7 INDIUM TIN OXIDE

- 8.7.1 DEMAND IN ELECTROCHROMIC DEVICES, ORGANIC LIGHT-EMITTING DIODES, LIQUID CRYSTAL DISPLAYS, AND PHOTOVOLTAIC CELLS TO DRIVE MARKET

- 8.8 OTHER MATERIALS

9 CHROMIC MATERIALS MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 PHOTOCHROMISM

- 9.2.1 REVOLUTIONIZING APPLICATIONS IN EYEWEAR, SMART WINDOWS, AUTOMOTIVE, AND HEALTHCARE TO BOOST GROWTH

- 9.3 THERMOCHROMISM

- 9.3.1 APPLICATIONS IN PACKAGING, TEXTILES, AUTOMOTIVE, AND SMART COATINGS TO BOOST MARKET

- 9.4 ELECTROCHROMISM

- 9.4.1 ENERGY EFFICIENCY, ENHANCED USER EXPERIENCE, AND SUSTAINABILITY TO BOOST GROWTH

- 9.5 PIEZOCHROMISM

- 9.5.1 DEMAND FOR SENSORS, DIAGNOSTICS, SMART TEXTILES, AND PRESSURE-SENSITIVE COATINGS TO PROPEL MARKET

- 9.6 GASOCHROMISM

- 9.6.1 CRUCIAL APPLICATIONS IN ENVIRONMENTAL MONITORING AND INDUSTRIAL SAFETY TO DRIVE DEMAND

- 9.7 OTHER TECHNOLOGIES

10 CHROMIC MATERIALS MARKET, BY TYPE

- 10.1 INTRODUCTION

- 10.2 TRANSPARENT

- 10.2.1 ENHANCED ENERGY EFFICIENCY AND COMFORT TO DRIVE GROWTH

- 10.3 COLORED STATE

- 10.3.1 GOVERNMENT EMPHASIS ON ENERGY-EFFICIENT INFRASTRUCTURE TO BOOST MARKET

11 CHROMIC MATERIALS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Strong emphasis on smart technologies, sustainability, and industrial innovation to drive market

- 11.2.2 CANADA

- 11.2.2.1 Expanding applications in multiple industries to boost market

- 11.2.3 MEXICO

- 11.2.3.1 Robust food and beverage sector to fuel market

- 11.2.1 US

- 11.3 ASIA PACIFIC

- 11.3.1 CHINA

- 11.3.1.1 Rapid industrialization and strong government initiatives to fuel market growth

- 11.3.2 JAPAN

- 11.3.2.1 Technological advancements and infrastructure development to boost market

- 11.3.3 INDIA

- 11.3.3.1 Industrial development and technological progress to propel market

- 11.3.4 SOUTH KOREA

- 11.3.4.1 Robust manufacturing sector and high-tech industries to fuel demand

- 11.3.5 REST OF ASIA PACIFIC

- 11.3.1 CHINA

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Strong industrial base, technological advancements, and commitment to sustainability to drive growth

- 11.4.2 UK

- 11.4.2.1 Innovations in smart and sustainable technologies and rising demand from end-use sectors to fuel market

- 11.4.3 FRANCE

- 11.4.3.1 Emphasis on innovation, sustainability, and strong industrial base to boost demand

- 11.4.4 ITALY

- 11.4.4.1 Strong industrial base, innovative applications, and increasing focus on sustainability to drive market

- 11.4.5 SPAIN

- 11.4.5.1 Technological innovation, sustainability initiatives, and demand from end-use sectors to fuel market

- 11.4.6 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Government initiatives to support market growth

- 11.5.1.2 Rest of GCC countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Semi-arid climate and temperature fluctuations to drive demand for adaptive solutions

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Government initiatives and energy-efficient technologies to boost market

- 11.6.2 ARGENTINA

- 11.6.2.1 Rich natural resources and emphasis on innovation to fuel market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Type footprint

- 12.7.5.4 Material footprint

- 12.7.5.5 Technology footprint

- 12.7.5.6 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 RESPONSIVE COMPANIES

- 12.8.2 PROGRESSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 MERCK KGAA

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 MnM view

- 13.1.1.3.1 Right to win

- 13.1.1.3.2 Strategic choices

- 13.1.1.3.3 Weaknesses and competitive threats

- 13.1.2 MILLIKEN & COMPANY

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 TOKUYAMA CORPORATION

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Right to win

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses and competitive threats

- 13.1.4 FLINT GROUP

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses and competitive threats

- 13.1.5 NOVA BY SAINT-GOBAIN

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 SPOTSEE

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.4 MnM view

- 13.1.6.4.1 Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 MATSUI INTERNATIONAL COMPANY

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.4 MnM view

- 13.1.7.4.1 Right to win

- 13.1.7.4.2 Strategic choices

- 13.1.7.4.3 Weaknesses and competitive threats

- 13.1.8 QCR SOLUTIONS CORP

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 MnM view

- 13.1.9 CHROMATIC TECHNOLOGIES INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.9.4 MnM view

- 13.1.10 OLIKROM INDUSTRY

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.10.3.1 Right to win

- 13.1.10.3.2 Strategic choices

- 13.1.10.3.3 Weaknesses and competitive threats

- 13.1.11 KOLORTEK CO., LTD

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.12 NEW PRISMATIC ENTERPRISE CO., LTD

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.13 GEM'INNOV

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.14 HALI PIGMENT CO., LTD.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 MnM view

- 13.1.15 SMAROL INDUSTRY CO., LTD

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 MnM view

- 13.1.15.3.1 Right to win

- 13.1.15.3.2 Strategic choices

- 13.1.15.3.3 Weaknesses and competitive threats

- 13.1.16 VIVIMED LABS LIMITED

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.1 MERCK KGAA

- 13.2 OTHER PLAYERS

- 13.2.1 FX PIGMENTS

- 13.2.2 NEWCOLORCHEM

- 13.2.3 SHANGHAI CAISON COLOR MATERIAL CO., LTD.

- 13.2.4 H.W. SANDS CORP.

- 13.2.5 YAMAMOTO CHEMICALS, INC.

- 13.2.6 EPTANOVA S.R.L.

- 13.2.7 INDESTRUCTIBLE PAINT LIMITED

- 13.2.8 GOOD LIFE INNOVATIONS

- 13.2.9 VIPUL CHEMICALS INDIA PVT LTD

- 13.2.10 GUANGZHOU SHENGSE TECHNOLOGY CO., LTD.

- 13.2.11 YAMADA CHEMICAL CO., LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS