|

|

市場調査レポート

商品コード

1718859

環境試験製品の世界市場:タイプ別、技術別、用途別、エンドユーザー別、地域別 - 2030年までの予測Environmental Testing Products Market by Product (Instrument, Consumable), Technology (HPLC/LC, GC, Mass Spectrometry, NMR, IR, PCR), Application (Water (PFAS), Air, Soil (Pesticide)), End User (Industrial, Govt., Residential) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 環境試験製品の世界市場:タイプ別、技術別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年04月25日

発行: MarketsandMarkets

ページ情報: 英文 352 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の環境試験製品の市場規模は、2024年の38億米ドルから2030年には56億2,000万米ドルに達し、予測期間中のCAGRは7.1%になると予測されています。

環境試験製品の市場成長予測は、様々な利点によって支えられています。環境試験製品は、環境をモニタリングし、その品質を評価する上で重要です。環境検査製品は、規制遵守、公衆衛生保護、科学研究、産業用途の基礎を形成します。汚染物質と汚染物質に関する正確なデータの提供は、環境の健康と安全の達成を目指した意思決定に役立ちます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2023年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | タイプ別、技術別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

技術別では、液体クロマトグラフィ、ガスクロマトグラフィ、NMR分光法、赤外分光法、ラマン分光法、単体質量分析、PCR、イムノアッセイ、その他に分類されます。これらの技術は、市場全体を推定する際に考慮される環境検査製品に使用されます。液体クロマトグラフィ分野は、2024年~2030年の予測期間で最大の市場シェアを記録しました。超高性能液体クロマトグラフィ(UHPLC)は、分析時間を短縮し、分解能を高めて最高の分析スループットを実現します。また、モジュール式システムや溶媒消費量の少ないシステムなど、LC装置の進歩によりコストも削減されています。液体クロマトグラフィは、法規制への対応、新しい分析対象化学物質、技術の進歩、複雑なマトリックスを扱う際の汎用性などの理由から、環境検査に定着しつつあります。機器の進歩が進み、環境に対する社会の意識が高まるにつれ、液体クロマトグラフィは大気、水、土壌の安全性を確保するための主役であり続けています。

環境試験製品市場は、製品別に計器、化粧品、ソフトウェア・サービスに区分されます。2023年、世界の環境試験製品市場で最大のシェアを占めたのは、機器分野でした。環境試験機器市場は、高精度、高効率、高信頼性を備えた試験ソリューションの需要を後押しするさまざまな要因によって決定されます。さらに、技術の向上、新たな汚染物質の検出の必要性、産業活動の拡大、気候変動への取り組み、持続可能性の目標、政府の支援によって、人々の意識は急速に高まっています。これらの動向は需要を強化し続け、環境試験機器市場は今後数年間でかなりの成長が見込まれます。

エンドユーザー別では、環境試験製品市場は産業施設、受託試験ラボ、政府・自治体機関、住宅・商業施設、その他のエンドユーザーに区分されます。2023年、産業施設は、排出物、廃水排出、有害廃棄物生成のレベルが高く、厳格な規制遵守と継続的なモニタリングが必要なため、環境試験製品市場で最大のシェアを占めています。石油・ガス、化学製造、発電、鉱業、建設などの産業では、重金属、揮発性有機化合物(VOC)、粒子状物質を含む重大な汚染物質が発生するため、高度な大気、水、土壌検査ソリューションが必要となります。

予測期間の2024年~2030年において、欧州地域は予測期間を通じて大幅な成長を遂げると予測されています。欧州は、ドイツ、フランス、イタリア、スペイン、その他で構成されています。欧州地域は、環境試験製品の市場成長率が顕著に加速しています。欧州地域の環境試験製品市場の成長にはいくつかの要因が寄与しています。これは、厳しい管理規制、非常に速い産業と都市の成長、環境問題に対する社会的関心の高まり、技術の近代化と進歩、気候変動への取り組み、新たな汚染物質検出要件、政府の資金援助と持続可能性の目標によって提供されています。このような背景から、今後数年間はプロスペクト市場が高成長を遂げることが予想され、その結果、さまざまな分野から高度なモニタリング・ソリューションへの投資が大量に行われることになります。

当レポートでは、世界の環境試験製品市場について調査し、タイプ別、技術別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 価格分析

- 技術分析

- 特許分析

- 貿易データ分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 規制分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- アンメットニーズ

- 生成AI/AIが環境試験製品市場に与える影響

第6章 環境試験製品市場(タイプ別)

- イントロダクション

- 機器

- 消耗品

- ソフトウェアとサービス

- 市場の成長を支えるソフトウェアソリューションの技術進歩の高まり

第7章 環境試験製品市場(技術別)

- イントロダクション

- 液体クロマトグラフィ

- ガスクロマトグラフィ

- スタンドアロン質量分析

- 核磁気共鳴分光法

- 赤外線分光法

- ラマン分光法

- ポリメラーゼ連鎖反応

- 免疫アッセイ

- その他

第8章 環境試験製品市場(用途別)

- イントロダクション

- 水質検査

- 空気質検査

- 土壌品質試験

第9章 環境試験製品市場(エンドユーザー別)

- イントロダクション

- 産業施設

- 受託試験所

- 政府機関および地方自治体

- 住宅および商業施設

- その他

第10章 環境試験製品市場(地域別)

- イントロダクション

- 北米

- 北米のミクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

- ラテンアメリカ

- ラテンアメリカのミクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2019年~2023年

- 2023年の市場シェア分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- AGILENT TECHNOLOGIES, INC.

- THERMO FISHER SCIENTIFIC INC.

- WATERS CORPORATION

- DANAHER

- BRUKER

- SHIMADZU CORPORATION

- PERKINELMER

- JEOL LTD.

- HITACHI HIGH-TECH CORPORATION

- TELEDYNE TECHNOLOGIES INCORPORATED

- AMETEK, INC.

- JASCO CORPORATION

- MERCK KGAA

- LECO CORPORATION

- ANALYTIK JENA GMBH+CO. KG

- その他の企業

- HIDEN ANALYTICAL

- RIGAKU HOLDINGS CORPORATION

- YOUNGIN CHROMASS

- SCION INSTRUMENTS

- RESTEK CORPORATION

- KORE TECHNOLOGY

- PROCESS INSIGHTS, INC.

- MASSTECH

- ADVION, INC.

- SKYRAY INSTRUMENTS USA, INC.

- MICROSAIC

第13章 付録

List of Tables

- TABLE 1 ENVIRONMENTAL TESTING PRODUCTS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 ENVIRONMENTAL TESTING PRODUCTS MARKET: STUDY ASSUMPTIONS

- TABLE 3 ENVIRONMENTAL TESTING PRODUCTS MARKET: RISK ANALYSIS

- TABLE 4 ENVIRONMENTAL TESTING PRODUCTS MARKET: ROLE IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICING TREND OF MASS SPECTROMETERS, BY KEY PLAYER, 2022-2024 (THOUSAND USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF MASS SPECTROMETRY PRODUCTS, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 7 AVERAGE SELLING PRICING TREND OF ENVIRONMENTAL TESTING PRODUCTS, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 8 ENVIRONMENTAL TESTING PRODUCTS MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2023-2024

- TABLE 9 IMPORT DATA FOR HS CODE 9027, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 9027, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 11 ENVIRONMENTAL TESTING PRODUCTS MARKET: KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ENVIRONMENTAL TESTING PRODUCTS MARKET: PORTER'S FIVE FORCES

- TABLE 18 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP FOUR END USERS

- TABLE 19 KEY BUYING CRITERIA, BY END USER, 2023

- TABLE 20 ENVIRONMENTAL TESTING PRODUCTS MARKET: UNMET NEEDS

- TABLE 21 KEY COMPANIES IMPLEMENTING AI IN ENVIRONMENTAL TESTING PRODUCTS MARKET

- TABLE 22 ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 23 ENVIRONMENTAL TESTING INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 24 ENVIRONMENTAL TESTING INSTRUMENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 25 BENCHTOP INSTRUMENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 26 PORTABLE/MOBILE INSTRUMENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 27 HANDHELD INSTRUMENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 ENVIRONMENTAL TESTING CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 29 ENVIRONMENTAL TESTING CONSUMABLES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 CHROMATOGRAPHY COLUMNS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 BUFFERS & SOLVENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 REAGENTS & TEST KITS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 REFERENCE STANDARDS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 OTHER CONSUMABLES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 ENVIRONMENTAL TESTING SOFTWARE & SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 37 LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 38 LIQUID CHROMATOGRAPHY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 NORTH AMERICA: LIQUID CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 EUROPE: LIQUID CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 ASIA PACIFIC: LIQUID CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 LATIN AMERICA: LIQUID CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING PRODUCTS MARKET FOR LC-MS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 STANDALONE LIQUID CHROMATOGRAPHY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: STANDALONE LIQUID CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 EUROPE: STANDALONE LIQUID CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: STANDALONE LIQUID CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

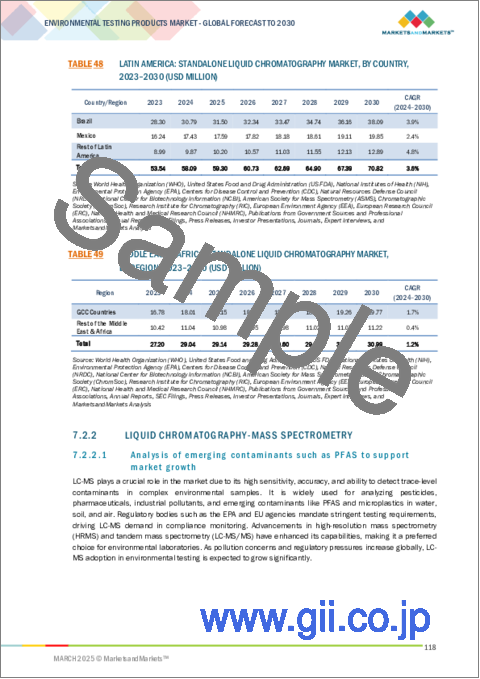

- TABLE 48 LATIN AMERICA: STANDALONE LIQUID CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 MIDDLE EAST & AFRICA: STANDALONE LIQUID CHROMATOGRAPHY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 EUROPE: LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 ASIA PACIFIC: LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 LATIN AMERICA: LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 MIDDLE EAST & AFRICA: LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 57 GAS CHROMATOGRAPHY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: GAS CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 EUROPE: GAS CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 ASIA PACIFIC: GAS CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 LATIN AMERICA: GAS CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 MIDDLE EAST & AFRICA: GAS CHROMATOGRAPHY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 STANDALONE GAS CHROMATOGRAPHY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: STANDALONE GAS CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 EUROPE: STANDALONE GAS CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 ASIA PACIFIC: STANDALONE GAS CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 LATIN AMERICA: STANDALONE GAS CHROMATOGRAPHY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 MIDDLE EAST & AFRICA: STANDALONE GAS CHROMATOGRAPHY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 69 GAS CHROMATOGRAPHY-MASS SPECTROMETRY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: GAS CHROMATOGRAPHY-MASS SPECTROMETRY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 EUROPE: GAS CHROMATOGRAPHY-MASS SPECTROMETRY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 ASIA PACIFIC: GAS CHROMATOGRAPHY-MASS SPECTROMETRY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 LATIN AMERICA: GAS CHROMATOGRAPHY-MASS SPECTROMETRY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 MIDDLE EAST & AFRICA: GAS CHROMATOGRAPHY-MASS SPECTROMETRY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 75 STANDALONE MASS SPECTROMETRY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: STANDALONE MASS SPECTROMETRY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 EUROPE: STANDALONE MASS SPECTROMETRY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 ASIA PACIFIC: STANDALONE MASS SPECTROMETRY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 LATIN AMERICA: STANDALONE MASS SPECTROMETRY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 MIDDLE EAST & AFRICA: STANDALONE MASS SPECTROMETRY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 81 NMR SPECTROSCOPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: NMR SPECTROSCOPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: NMR SPECTROSCOPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 ASIA PACIFIC: NMR SPECTROSCOPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 LATIN AMERICA: NMR SPECTROSCOPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 MIDDLE EAST & AFRICA: NMR SPECTROSCOPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 87 INFRARED SPECTROSCOPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: INFRARED SPECTROSCOPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 EUROPE: INFRARED SPECTROSCOPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: INFRARED SPECTROSCOPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 LATIN AMERICA: INFRARED SPECTROSCOPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 MIDDLE EAST & AFRICA: INFRARED SPECTROSCOPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 93 RAMAN SPECTROSCOPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: RAMAN SPECTROSCOPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 EUROPE: RAMAN SPECTROSCOPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 ASIA PACIFIC: RAMAN SPECTROSCOPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 LATIN AMERICA: RAMAN SPECTROSCOPY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: RAMAN SPECTROSCOPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 99 POLYMERASE CHAIN REACTION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: POLYMERASE CHAIN REACTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 EUROPE: POLYMERASE CHAIN REACTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: POLYMERASE CHAIN REACTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 LATIN AMERICA: POLYMERASE CHAIN REACTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: POLYMERASE CHAIN REACTION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 105 IMMUNOASSAYS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: IMMUNOASSAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 107 EUROPE: IMMUNOASSAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: IMMUNOASSAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 LATIN AMERICA: IMMUNOASSAYS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: IMMUNOASSAYS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 111 OTHER TECHNOLOGIES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: OTHER TECHNOLOGIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 EUROPE: OTHER TECHNOLOGIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: OTHER TECHNOLOGIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 115 LATIN AMERICA: OTHER TECHNOLOGIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: OTHER TECHNOLOGIES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 117 ENVIRONMENTAL TESTING PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 118 WATER QUALITY TESTING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 WATER QUALITY TESTING PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 120 WATER QUALITY TESTING PRODUCTS MARKET FOR ORGANIC POLLUTANTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 121 WATER QUALITY TESTING PRODUCTS MARKET FOR SOLID POLLUTANTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 122 WATER QUALITY TESTING PRODUCTS MARKET FOR HEAVY METALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 123 WATER QUALITY TESTING PRODUCTS MARKET FOR PFAS & MICROPLASTICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 124 WATER QUALITY TESTING PRODUCTS MARKET FOR MICROBIAL POLLUTANTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 125 WATER QUALITY TESTING PRODUCTS MARKET FOR OTHER WATER POLLUTANTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 126 AIR QUALITY TESTING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 AIR QUALITY TESTING PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 128 AIR QUALITY TESTING PRODUCTS MARKET FOR PARTICULATE MATTER, BY REGION, 2023-2030 (USD MILLION)

- TABLE 129 AIR QUALITY TESTING PRODUCTS MARKET FOR VOLATILE ORGANIC POLLUTANTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 130 AIR QUALITY TESTING PRODUCTS MARKET FOR OTHER AIR POLLUTANTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 131 SOIL QUALITY TESTING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 SOIL QUALITY TESTING PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 133 SOIL QUALITY TESTING PRODUCTS MARKET FOR PESTICIDES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 134 SOIL QUALITY TESTING PRODUCTS MARKET FOR HEAVY METALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 135 SOIL QUALITY TESTING PRODUCTS MARKET FOR ORGANIC POLLUTANTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 136 SOIL QUALITY TESTING PRODUCTS MARKET FOR OTHER SOIL POLLUTANTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 137 ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 138 ENVIRONMENTAL TESTING PRODUCTS MARKET FOR INDUSTRIAL FACILITIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 139 ENVIRONMENTAL TESTING PRODUCTS MARKET FOR CONTRACT TESTING LABS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 140 ENVIRONMENTAL TESTING PRODUCTS MARKET FOR GOVERNMENT & MUNICIPAL AGENCIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 141 ENVIRONMENTAL TESTING PRODUCTS MARKET FOR RESIDENTIAL & COMMERCIAL FACILITIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 142 ENVIRONMENTAL TESTING PRODUCTS MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 143 ENVIRONMENTAL TESTING PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 144 NORTH AMERICA: MACROINDICATORS

- TABLE 145 NORTH AMERICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 146 NORTH AMERICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 NORTH AMERICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 148 NORTH AMERICA: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 NORTH AMERICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 151 NORTH AMERICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 152 US: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 153 US: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 US: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 CANADA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 156 CANADA: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 CANADA: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 EUROPE: MACROINDICATORS

- TABLE 159 EUROPE: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 160 EUROPE: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 EUROPE: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 162 EUROPE LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 EUROPE: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 EUROPE: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 165 EUROPE: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 166 GERMANY: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 167 GERMANY: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 GERMANY: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 UK: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 170 UK: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 UK: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 FRANCE: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 173 FRANCE: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 FRANCE: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 ITALY: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 176 ITALY: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 ITALY: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 SPAIN: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 179 SPAIN: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 SPAIN: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 REST OF EUROPE: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 182 REST OF EUROPE: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 REST OF EUROPE: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 ASIA PACIFIC: MACROINDICATORS

- TABLE 185 ASIA PACIFIC: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 186 ASIA PACIFIC: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 ASIA PACIFIC: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 188 ASIA PACIFIC: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 ASIA PACIFIC: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 191 ASIA PACIFIC: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 192 CHINA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 193 CHINA: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 CHINA: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 JAPAN: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 196 JAPAN: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 JAPAN: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 INDIA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 199 INDIA: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 INDIA: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 SOUTH KOREA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 202 SOUTH KOREA: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 SOUTH KOREA: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 AUSTRALIA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 205 AUSTRALIA: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 AUSTRALIA: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 LATIN AMERICA: MACROINDICATORS

- TABLE 211 LATIN AMERICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 212 LATIN AMERICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 LATIN AMERICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 214 LATIN AMERICA: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 LATIN AMERICA: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 LATIN AMERICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 217 LATIN AMERICA: ENVIRONMENTAL PRODUCT TESTING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 218 BRAZIL: ENVIRONMENTAL PRODUCT TESTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 219 BRAZIL: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 BRAZIL: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 MEXICO: ENVIRONMENTAL PRODUCT TESTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 222 MEXICO: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 MEXICO: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 REST OF LATIN AMERICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 225 REST OF LATIN AMERICA: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 REST OF LATIN AMERICA: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: MACROINDICATORS

- TABLE 228 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 235 GCC COUNTRIES: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 236 GCC COUNTRIES: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 237 GCC COUNTRIES: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 238 REST OF MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 239 REST OF MIDDLE EAST & AFRICA: LIQUID CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 REST OF MIDDLE EAST & AFRICA: GAS CHROMATOGRAPHY MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 241 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ENVIRONMENTAL TESTING PRODUCTS MARKET

- TABLE 242 ENVIRONMENTAL TESTING PRODUCTS MARKET: DEGREE OF COMPETITION

- TABLE 243 ENVIRONMENTAL TESTING PRODUCTS MARKET: REGION FOOTPRINT

- TABLE 244 ENVIRONMENTAL TESTING PRODUCTS MARKET: TYPE FOOTPRINT

- TABLE 245 ENVIRONMENTAL TESTING PRODUCTS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 246 ENVIRONMENTAL TESTING PRODUCTS MARKET: APPLICATION FOOTPRINT

- TABLE 247 ENVIRONMENTAL TESTING PRODUCTS MARKET: END-USER FOOTPRINT

- TABLE 248 ENVIRONMENTAL TESTING PRODUCTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 249 ENVIRONMENTAL TESTING PRODUCTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 250 ENVIRONMENTAL TESTING PRODUCTS MARKET: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 251 ENVIRONMENTAL TESTING PRODUCTS MARKET: DEALS, JANUARY 2021-MARCH 2025

- TABLE 252 ENVIRONMENTAL TESTING PRODUCTS MARKET: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 253 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 254 AGILENT TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 255 AGILENT TECHNOLOGIES, INC.: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2021-MARCH 2025

- TABLE 256 AGILENT TECHNOLOGIES, INC.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 257 AGILENT TECHNOLOGIES, INC.: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 258 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 259 THERMO FISHER SCIENTIFIC INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 260 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2021-MARCH 2025

- TABLE 261 THERMO FISHER SCIENTIFIC INC.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 262 THERMO FISHER SCIENTIFIC INC.: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 263 WATERS CORPORATION: COMPANY OVERVIEW

- TABLE 264 WATERS CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 265 WATERS CORPORATION: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2021-MARCH 2025

- TABLE 266 WATERS CORPORATION: DEALS, JANUARY 2021-MARCH 2025

- TABLE 267 WATERS CORPORATION: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 268 DANAHER: COMPANY OVERVIEW

- TABLE 269 DANAHER: PRODUCTS/SOLUTIONS OFFERED

- TABLE 270 DANAHER: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2021-MARCH 2025

- TABLE 271 DANAHER: DEALS, JANUARY 2021-MARCH 2025

- TABLE 272 DANAHER CORPORATION: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 273 BRUKER: COMPANY OVERVIEW

- TABLE 274 BRUKER: PRODUCTS/SOLUTIONS OFFERED

- TABLE 275 BRUKER: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2021-MARCH 2025

- TABLE 276 BRUKER CORPORATION: DEALS, JANUARY 2021-MARCH 2025

- TABLE 277 BRUKER CORPORATION: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 278 SHIMADZU CORPORATION: COMPANY OVERVIEW

- TABLE 279 SHIMADZU CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 280 SHIMADZU CORPORATION: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2021-MARCH 2025

- TABLE 281 SHIMADZU CORPORATION: DEALS, JANUARY 2021-MARCH 2025

- TABLE 282 SHIMADZU CORPORATION: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 283 PERKINELMER: COMPANY OVERVIEW

- TABLE 284 PERKINELMER: PRODUCTS/SOLUTIONS OFFERED

- TABLE 285 PERKINELMER: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2021-MARCH 2025

- TABLE 286 PERKINELMER: DEALS, JANUARY 2021-MARCH 2025

- TABLE 287 JEOL LTD.: COMPANY OVERVIEW

- TABLE 288 JEOL LTD: PRODUCTS/SOLUTIONS OFFERED

- TABLE 289 JEOL LTD: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2021-MARCH 2025

- TABLE 290 HITACHI HIGH-TECH CORPORATION: COMPANY OVERVIEW

- TABLE 291 HITACHI HIGH-TECH CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 292 HITACHI HIGH-TECH CORPORATION: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 293 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 294 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SOLUTIONS OFFERED

- TABLE 295 TELEDYNE TECHNOLOGIES: DEALS, JANUARY 2021-MARCH 2025

- TABLE 296 AMETEK, INC.: COMPANY OVERVIEW

- TABLE 297 AMETEK, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 298 JASCO CORPORATION: COMPANY OVERVIEW

- TABLE 299 JASCO CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 300 MERCK KGAA: COMPANY OVERVIEW

- TABLE 301 MERCK KGAA: PRODUCTS/SOLUTIONS OFFERED

- TABLE 302 MERCK KGAA: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 303 LECO CORPORATION: COMPANY OVERVIEW

- TABLE 304 LECO CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 305 LECO CORPORATION: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2021- MARCH 2025

- TABLE 306 ANALYTIK JENA GMBH+CO. KG: COMPANY OVERVIEW

- TABLE 307 ANALYTIK JENA GMBH+CO. KG: PRODUCTS/SOLUTIONS OFFERED

- TABLE 308 HIDEN ANALYTICAL: COMPANY OVERVIEW

- TABLE 309 RIGAKU HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 310 YOUNGIN CHROMASS: COMPANY OVERVIEW

- TABLE 311 SCION INSTRUMENTS: COMPANY OVERVIEW

- TABLE 312 RESTEK CORPORATION: COMPANY OVERVIEW

- TABLE 313 KORE TECHNOLOGY: COMPANY OVERVIEW

- TABLE 314 PROCESS INSIGHTS, INC.: COMPANY OVERVIEW

- TABLE 315 MASSTECH: COMPANY OVERVIEW

- TABLE 316 ADVION, INC.: COMPANY OVERVIEW

- TABLE 317 SKYRAY INSTRUMENTS USA, INC.: COMPANY OVERVIEW

- TABLE 318 MICROSAIC: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ENVIRONMENTAL PRODUCTS TESTING MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 ENVIRONMENTAL TESTING PRODUCTS MARKET: RESEARCH DATA

- FIGURE 3 ENVIRONMENTAL TESTING PRODUCTS MARKET: RESEARCH DESIGN

- FIGURE 4 ENVIRONMENTAL TESTING PRODUCTS MARKET: PRIMARY SOURCES

- FIGURE 5 ENVIRONMENTAL TESTING PRODUCTS MARKET: KEY INDUSTRY INSIGHTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 8 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 9 ENVIRONMENTAL TESTING PRODUCTS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (REVENUE SHARE ANALYSIS)

- FIGURE 10 ENVIRONMENTAL TESTING PRODUCTS MARKET SIZE ESTIMATION: COMPANY REVENUE ESTIMATION

- FIGURE 11 ENVIRONMENTAL TESTING PRODUCTS MARKET: TOP-DOWN APPROACH

- FIGURE 12 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 13 ENVIRONMENTAL TESTING PRODUCTS MARKET: DATA TRIANGULATION

- FIGURE 14 ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 15 ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNIQUE, 2024 VS. 2030 (USD MILLION)

- FIGURE 16 ENVIRONMENTAL TESTING PRODUCTS MARKET, BY APPLICATION, 2024 VS. 2030 (USD MILLION)

- FIGURE 17 ENVIRONMENTAL TESTING PRODUCTS MARKET: REGIONAL SNAPSHOT

- FIGURE 18 INCREASED GOVERNMENT FUNDING AND STRINGENT ENVIRONMENTAL REGULATIONS TO DRIVE MARKET

- FIGURE 19 EUROPE TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 20 US AND INDUSTRIAL FACILITIES ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 21 GERMANY TO REGISTER HIGHEST CAGR FROM 2024 TO 2030

- FIGURE 22 ENVIRONMENTAL TESTING PRODUCTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 NUMBER OF PEOPLE LIVING IN COUNTRIES WITH AIR QUALITY CONCERNS (IN MILLIONS)

- FIGURE 24 ENVIRONMENTAL TESTING PRODUCTS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 25 ENVIRONMENTAL TESTING PRODUCTS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 ENVIRONMENTAL TESTING PRODUCTS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 ENVIRONMENTAL TESTING PRODUCTS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 ENVIRONMENTAL TESTING PRODUCTS MARKET: INVESTMENTS AND DEALS, 2019-2023

- FIGURE 29 ENVIRONMENTAL TESTING PRODUCTS MARKET: NUMBER OF DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 30 ENVIRONMENTAL TESTING PRODUCTS MARKET: VALUE OF DEALS, BY KEY PLAYER, 2019-2023 (USD)

- FIGURE 31 AVERAGE SELLING PRICE TREND OF ENVIRONMENTAL TESTING PRODUCTS, BY KEY PLAYER, 2022-2024 (USD THOUSAND)

- FIGURE 32 AVERAGE SELLING PRICE TREND OF MASS SPECTROMETRY PRODUCTS, BY REGION, 2022-2024 (USD THOUSAND)

- FIGURE 33 AVERAGE SELLING PRICE TREND OF ENVIRONMENTAL TESTING PRODUCTS, BY REGION, 2022-2024 (USD THOUSAND)

- FIGURE 34 ENVIRONMENTAL TESTING PRODUCTS MARKET: PATENT ANALYSIS, JANUARY 2014-DECEMBER 2024

- FIGURE 35 US: PREMARKET NOTIFICATION: 510(K) APPROVALS FOR MEDICAL DEVICES

- FIGURE 36 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

- FIGURE 37 ENVIRONMENTAL TESTING PRODUCTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT

- FIGURE 39 KEY BUYING CRITERIA, BY END USER, 2023

- FIGURE 40 KEY FEATURES OF GEN AI IN ENVIRONMENTAL TESTING PRODUCTS MARKET

- FIGURE 41 NORTH AMERICA: ENVIRONMENTAL TESTING PRODUCTS MARKET SNAPSHOT

- FIGURE 42 EUROPE: ENVIRONMENTAL TESTING PRODUCTS MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN ENVIRONMENTAL TESTING PRODUCTS MARKET, 2019-2023

- FIGURE 44 MARKET SHARE ANALYSIS OF KEY PLAYERS IN ENVIRONMENTAL TESTING PRODUCTS MARKET, 2023

- FIGURE 45 RANKING OF KEY PLAYERS IN ENVIRONMENTAL TESTING PRODUCTS MARKET, 2024

- FIGURE 46 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS, 2025

- FIGURE 47 EV/EBITDA OF KEY VENDORS, 2025

- FIGURE 48 ENVIRONMENTAL TESTING PRODUCTS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 ENVIRONMENTAL TESTING PRODUCTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 ENVIRONMENTAL TESTING PRODUCTS MARKET: COMPANY FOOTPRINT

- FIGURE 51 ENVIRONMENTAL TESTING PRODUCTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 53 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2023)

- FIGURE 54 WATERS CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 55 DANAHER: COMPANY SNAPSHOT (2023)

- FIGURE 56 BRUKER: COMPANY SNAPSHOT (2023)

- FIGURE 57 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 58 PERKINELMER: COMPANY SNAPSHOT (2023)

- FIGURE 59 JEOL LTD.: COMPANY SNAPSHOT (2023)

- FIGURE 60 HITACHI HIGH-TECH CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 61 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT (2023)

- FIGURE 62 AMETEK, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 63 MERCK KGAA: COMPANY SNAPSHOT (2023)

The global environmental testing products market is projected to reach USD 5.62 billion by 2030 from USD 3.80 billion in 2024, growing at a CAGR of 7.1% during the forecast period. The projected market growth for environmental testing products is supported by the covers of benefits. Environmental testing products are important in monitoring the environment and assessing its quality. They form the basis for regulatory compliance, public health protection, scientific research, and industrial applications. Their provision of accurate data on contaminants and pollutants helps make decisions aimed at achieving environmental health and safety.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2023 |

| Forecast Period | 2023-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Technology, Application, End User and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America and Middle East & Africa |

" Liquid Chromatography segment to register largest market share in 2023-2030."

Based on the technology, the environmental testing products market is segmented into - liquid chromatography, gas chromatography, NMR spectroscopy, Infra Red spectroscopy, Raman spectroscopy, standalone mass spectrometry, PCR, immunoassay and other technologies. These technologies are used in environmental testing products taken into account while estimating the entire market. The liquid chromatography segment registered the largest market share for the forecasted year of 2024-2030. Ultra-high-performance liquid chromatography (UHPLC) shortens the time for running and enhances resolution for best analysis throughput. Advances in LC Instruments have also reduced costs, such as modular systems and those that consume a less solvent. Liquid chromatography is taking root into environmental testing owing to regulatory compliance, new chemicals to be analyzed, technological advances, and the versatility offered in handling complex matrices. As advancements progress in instrumentation and public awareness on the environment increases, LC continues to be a mainstay for safety of air, water, and soil.

"instruments segment held the largest share of environmental testing products market in 2023, by product."

Based on the product, the environmental testing products market is segmented into instruments, cosumables, and software & services. In 2023, the instruments segment accounted the largest share of global environmental testing products market. The market for environmental testing instruments is determined by different factors that boost the demand of testing solutions with high precision, efficiency, and reliability. Further, public awareness is fast growing-up with technological improvements, need for detection of emerging contaminants, expansion of industrial activities, climate change initiatives, sustainability goals, and government support. These trends will keep strengthening the demand, and the market for environmental testing instruments is expected to witness considerable growth in the forthcoming years.

"Industry facilities segment held the largest share of environmental testing products market in 2023, by End-user."

Based on the end-user, the environmental testing products market is segmented into Industry facilities, contract testing labs, government & municipal agencies, residential & commercial facilities and Other end users. In 2023, Industrial facilities account for the largest share of the environmental testing products market due to their high levels of emissions, wastewater discharge, and hazardous waste generation, which necessitate strict regulatory compliance and continuous monitoring. Industries such as oil & gas, chemical manufacturing, power generation, mining, and construction produce significant pollutants, including heavy metals, volatile organic compounds (VOCs), and particulate matter, requiring advanced air, water, and soil testing solutions.

"Europe to register significant growth rate in the market during the forecast period."

For the forecasting period 2024-2030, The European region is anticipated to experience substantial growth throughout the forecast period. Europe comprises Germany, France, Italy, Spain, Rest of Europe. The European region has experienced a notable acceleration in the market growth rate for environmental testing products. Several factors have contributed to the growth of the environmental testing products market in the european region. This is offered by strict governing regulations, very fast industrial and urban growth, rising social concern for environmental issues, modernization and advancement in technologies, climate change initiatives, emerging contaminant detection requirements, and government funding support and sustainability objectives. With all this, prospect markets are expected to successfully grow highly over the next few years, resulting in a large amount of investment in advanced monitoring solutions from different sectors.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-40%, Tier 2-30%, and Tier 3- 30%

- By Designation: C-level-- 27%, Director-level-18%, and Others-55%

- By Region: North America-35%, Europe-32%, Asia Pacific-25%, Latin America-6%, and the Middle East & Africa-2%

Prominent players in this market are Agilent Technologies, Inc. (US), Thermo Fisher Scientific Inc. (US), Danaher (US), Waters Corporation (US), Bruker (US), Shimadzu Corporation (Japan), among others.

Research Coverage

- The report studies the environmental testing products market based on products, application, end user, and region.

- The report analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting the market growth.

- The report evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders.

- The report studies micro markets with respect to their growth trends, prospects, and contributions to the global environmental testing products market.

- The report forecasts the revenue of market segments with respect to five major regions.

Key Benefits of Buying the Report:

The report will help the new entrants/ market leaders/smaller firms in this market with investment evaluation viability within the environmental testing products market through a thorough analysis of comprehensive data, thereby facilitating robust risk assessment and enabling well-informed investment determinations. Benefit from meticulous market segmentation encompassing end-user, and regional dimensions, affording tailored insights for precise segment targeting. The report also provides an all-encompassing evaluation of encapsulating pivotal trends, challenges, growth catalysts and prospects, thereby empowering strategic decision-making with astute discernment.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing compliance requirement to monitor pollutants, growing need of monitoring solutions and integration with real-time monitoring systems), restraints (inconsistency in the availability of trained personnel. Additionally, requirement of significant capital investment), opportunities (innovation in digital connectivity and increasing investments in R&D), and challenges (Shortage of instruments due to disruption in supply chain) influencing the growth of the environmental testing products market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the environmental testing products market.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the environmental testing products market

- Market Development: Comprehensive information about lucrative markets - the report analyses the environmental testing products market across varied regions.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Agilent Technologies, Inc. (US), Thermo Fisher Scientific Inc. (US), Danaher (US), Waters Corporation (US), Bruker (US), Shimadzu Corporation (Japan), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 MARKET STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Objectives of secondary research

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH (REVENUE SHARE ANALYSIS)

- 2.2.1.1 Company revenue estimation approach

- 2.2.1.2 Customer-based market estimation

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH (REVENUE SHARE ANALYSIS)

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ASSESSMENT

- 2.5 STUDY ASSUMPTIONS

- 2.5.1 MARKET ASSUMPTIONS

- 2.5.2 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ENVIRONMENTAL TESTING PRODUCTS TESTING MARKET OVERVIEW

- 4.2 ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TYPE, 2024 VS. 2030 (USD MILLION)

- 4.3 NORTH AMERICA: ENVIRONMENTAL TESTING PRODUCTS MARKET, BY COUNTRY AND END USER, 2024

- 4.4 GEOGRAPHIC SNAPSHOT OF ENVIRONMENTAL TESTING PRODUCTS MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising technological innovations in environmental testing

- 5.2.1.2 Growing public awareness related to health impact of pollution

- 5.2.1.3 Development of portable and real-time environmental monitoring technologies

- 5.2.1.4 Increased participation of government and regulatory bodies in monitoring environmental conditions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Expensive consumables and high maintenance cost of mass spectrometry instruments

- 5.2.2.2 Technological limitations in mass spectrometry

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing government focus on contaminant detection

- 5.2.3.2 Increased utilization of AI-driven analytical tools to detect air and soil pollution

- 5.2.3.3 Advancements in environmental testing infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Increased operational complexity of mass spectrometry products

- 5.2.4.2 Lack of skilled professionals

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RESEARCH & PRODUCT DEVELOPMENT

- 5.4.2 RAW MATERIAL PROCUREMENT AND MANUFACTURING

- 5.4.3 DISTRIBUTION AND MARKETING & SALES

- 5.4.4 POST-SALES SERVICES

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 5.5.3 DISTRIBUTORS

- 5.5.4 END USERS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 ROLE IN ECOSYSTEM

- 5.7 INVESTMENT & FUNDING SCENARIO

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.8.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Mass spectrometry (MS)

- 5.9.1.2 Liquid chromatography-mass spectrometry (LC-MS)

- 5.9.1.3 Gas chromatography-mass spectrometry (GC-MS)

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Laboratory process automation

- 5.9.2.2 Cloud computing

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Environmental sensors

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE DATA ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 9027

- 5.11.2 EXPORT DATA FOR HS CODE 9027

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CASE STUDY 1: CREATION OF MASS SPECTROMETERS FOR CLINICAL DIAGNOSTICS AND PATHOLOGY

- 5.13.2 CASE STUDY 2: ROLE OF MASS SPECTROMETRY IN ENVIRONMENTAL SCIENCE

- 5.13.3 CASE STUDY 3: NORTHUMBRIAN WATER TO IMPLEMENT ATEX-COMPLIANT SYSTEM FOR RELIABLE FLOW MONITORING SYSTEM

- 5.14 REGULATORY ANALYSIS

- 5.14.1 REGULATORY LANDSCAPE

- 5.14.1.1 North America

- 5.14.1.2 Europe

- 5.14.1.3 Asia Pacific

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1 REGULATORY LANDSCAPE

- 5.15 PORTER'S FIVE FORCE ANALYSIS

- 5.15.1 BARGAINING POWER OF SUPPLIERS

- 5.15.2 BARGAINING POWER OF BUYERS

- 5.15.3 THREAT OF NEW ENTRANTS

- 5.15.4 THREAT OF SUBSTITUTES

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 KEY BUYING CRITERIA 2023

- 5.17 UNMET NEEDS

- 5.18 IMPACT OF GEN AI/AI ON ENVIRONMENTAL TESTING PRODUCTS MARKET

- 5.18.1 MARKET POTENTIAL OF ENVIRONMENTAL TESTING PRODUCTS

- 5.18.2 AI USE CASES

- 5.18.3 KEY COMPANIES IMPLEMENTING AI

- 5.18.4 FUTURE OF AI IN ENVIRONMENTAL TESTING PRODUCTS ECOSYSTEM

6 ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 INSTRUMENTS

- 6.2.1 BENCHTOP INSTRUMENTS

- 6.2.1.1 Ability to detect contaminants in water & soil with high sensitivity to drive market

- 6.2.2 PORTABLE/MOBILE INSTRUMENTS

- 6.2.2.1 Provision of real-time data with precise insights to fuel uptake

- 6.2.3 HANDHELD INSTRUMENTS

- 6.2.3.1 High adoption of handheld spectroscopy tools to support market growth

- 6.2.1 BENCHTOP INSTRUMENTS

- 6.3 CONSUMABLES

- 6.3.1 CHROMATOGRAPHY COLUMNS

- 6.3.1.1 Rising need for high-resolution separation & accurate detection to drive market

- 6.3.2 BUFFERS & SOLVENTS

- 6.3.2.1 Rising adoption of high-precision analytical techniques to fuel market

- 6.3.3 REAGENTS & TEST KITS

- 6.3.3.1 Growing focus on rapid on-site environmental testing to boost demand

- 6.3.4 REFERENCE STANDARDS

- 6.3.4.1 Stringent regulatory implementation for precise analytical results to fuel market

- 6.3.5 OTHER CONSUMABLES

- 6.3.1 CHROMATOGRAPHY COLUMNS

- 6.4 SOFTWARE & SERVICES

- 6.4.1 RISING TECHNOLOGICAL ADVANCEMENTS IN SOFTWARE SOLUTIONS TO SUPPORT MARKET GROWTH

7 ENVIRONMENTAL TESTING PRODUCTS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 LIQUID CHROMATOGRAPHY

- 7.2.1 STANDALONE LIQUID CHROMATOGRAPHY

- 7.2.1.1 Rising demand for high-throughput analytical solutions to fuel uptake

- 7.2.2 LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY

- 7.2.2.1 Analysis of emerging contaminants such as PFAS to support market growth

- 7.2.1 STANDALONE LIQUID CHROMATOGRAPHY

- 7.3 GAS CHROMATOGRAPHY

- 7.3.1 STANDALONE GAS CHROMATOGRAPHY

- 7.3.1.1 Analysis of VOCs to fuel uptake

- 7.3.2 GC-MS

- 7.3.2.1 Detection of semi-volatile organic compounds to boost demand

- 7.3.1 STANDALONE GAS CHROMATOGRAPHY

- 7.4 STANDALONE MASS SPECTROMETRY

- 7.4.1 INCREASING REQUIREMENT FOR ULTRA-SENSITIVE DETECTION OF HEAVY METALS TO BOOST MARKET

- 7.5 NUCLEAR MAGNETIC RESONANCE SPECTROSCOPY

- 7.5.1 PRECISE TECHNIQUE FOR ANALYSIS OF CHEMICAL POLLUTANTS TO FUEL MARKET

- 7.6 INFRARED SPECTROSCOPY

- 7.6.1 HIGH ADOPTION OF FTIR SPECTROMETERS TO BOOST DEMAND

- 7.7 RAMAN SPECTROSCOPY

- 7.7.1 ADVANCEMENTS IN PORTABLE RAMAN TECHNOLOGY TO FUEL MARKET

- 7.8 POLYMERASE CHAIN REACTION

- 7.8.1 WIDE APPLICATIONS FOR PATHOGEN DETECTION AND ENVIRONMENTAL CONTAMINANTS TO SUPPORT MARKET GROWTH

- 7.9 IMMUNOASSAYS

- 7.9.1 RAPID & COST-EFFICIENT RESULTS TO DRIVE DEMAND

- 7.10 OTHER TECHNOLOGIES

8 ENVIRONMENTAL TESTING PRODUCTS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 WATER QUALITY TESTING

- 8.2.1 ORGANIC POLLUTANTS

- 8.2.1.1 Increasing levels of effluent water to fuel market

- 8.2.2 SOLID POLLUTANTS

- 8.2.2.1 Increasing levels of urbanization to boost demand

- 8.2.3 HEAVY METALS

- 8.2.3.1 Increasing industrial pollution levels to support market growth

- 8.2.4 PFAS & MICROPLASTICS

- 8.2.4.1 Consumption through food & cosmetics to propel market

- 8.2.5 MICROBIAL CONTAMINATION

- 8.2.5.1 Increasing prevalence of waterborne diseases to fuel market

- 8.2.6 OTHER WATER POLLUTANTS

- 8.2.1 ORGANIC POLLUTANTS

- 8.3 AIR QUALITY TESTING

- 8.3.1 PARTICULATE MATTER

- 8.3.1.1 Growing health concerns over fine particulate matter exposure to support adoption

- 8.3.2 VOLATILE ORGANIC POLLUTANTS

- 8.3.2.1 High VOC levels to propel market

- 8.3.3 OTHER AIR POLLUTANTS

- 8.3.1 PARTICULATE MATTER

- 8.4 SOIL QUALITY TESTING

- 8.4.1 PESTICIDES

- 8.4.1.1 Implementation of Stockholm Convention policy to fuel market

- 8.4.2 HEAVY METALS

- 8.4.2.1 Presence of nickel, mercury, and arsenic to boost demand

- 8.4.3 ORGANIC POLLUTANTS

- 8.4.3.1 Utilization of advanced analytical testing techniques to drive market

- 8.4.4 OTHER SOIL POLLUTANTS

- 8.4.1 PESTICIDES

9 ENVIRONMENTAL TESTING PRODUCTS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 INDUSTRIAL FACILITIES

- 9.2.1 INCREASING NUMBER OF PETROCHEMICAL FACTORIES AND EXPANSION OF PHARMACEUTICAL INDUSTRY TO PROPEL MARKET

- 9.3 CONTRACT TESTING LABS

- 9.3.1 RISING ESTABLISHMENT OF PRIVATE TESTING LABORATORIES TO FUEL MARKET

- 9.4 GOVERNMENT & MUNICIPAL AGENCIES

- 9.4.1 GROWING FOCUS ON POLLUTION MONITORING CONTROL TO DRIVE MARKET

- 9.5 RESIDENTIAL & COMMERCIAL FACILITIES

- 9.5.1 RISING LEVELS OF INDOOR POLLUTANTS TO FUEL MARKET

- 9.6 OTHER END USERS

10 ENVIRONMENTAL TESTING PRODUCTS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MICROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 High expenditure on air & water quality testing to propel market

- 10.2.3 CANADA

- 10.2.3.1 Implementation of ECCC and favorable climate change initiatives to drive market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Focus on water quality management and wastewater treatment to propel market growth

- 10.3.3 UK

- 10.3.3.1 Stringent government regulations to augment market growth for environmental testing products

- 10.3.4 FRANCE

- 10.3.4.1 Increase in industrial contamination and agricultural wastes to propel market growth

- 10.3.5 ITALY

- 10.3.5.1 High pollutant levels to fuel demand for environmental testing products

- 10.3.6 SPAIN

- 10.3.6.1 Need for efficient wastewater and drinking water testing to aid market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Increasing pollution levels to facilitate growth

- 10.4.3 JAPAN

- 10.4.3.1 Growing focus on environmental pollution testing and control to drive market

- 10.4.4 INDIA

- 10.4.4.1 Favorable government regulations to aid growth

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Growing partnerships among international agencies to fuel market

- 10.4.6 AUSTRALIA

- 10.4.6.1 Favorable government regulations to aid growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MICROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Rising awareness of environmental sustainability to augment growth

- 10.5.3 MEXICO

- 10.5.3.1 Increasing water scarcity due to rapid urbanization to aid growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Expansion of oil & petrochemical industries to fuel market

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN ENVIRONMENTAL TESTING PRODUCTS MARKET

- 11.3 REVENUE ANALYSIS, 2019-2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.5.1 COMPANY VALUATION

- 11.5.2 FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Type footprint

- 11.7.5.4 Technology footprint

- 11.7.5.5 Application footprint

- 11.7.5.6 End-user footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 AGILENT TECHNOLOGIES, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches and upgrades

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 THERMO FISHER SCIENTIFIC INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches and upgrades

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 WATERS CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches and upgrades

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 DANAHER

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches and upgrades

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 BRUKER

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches and upgrades

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 SHIMADZU CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches and upgrades

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Expansions

- 12.1.7 PERKINELMER

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches and upgrades

- 12.1.7.3.2 Deals

- 12.1.8 JEOL LTD.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches and upgrades

- 12.1.9 HITACHI HIGH-TECH CORPORATION

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions offered

- 12.1.9.2.1 Other developments

- 12.1.10 TELEDYNE TECHNOLOGIES INCORPORATED

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.11 AMETEK, INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions offered

- 12.1.12 JASCO CORPORATION

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions offered

- 12.1.13 MERCK KGAA

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Expansions

- 12.1.14 LECO CORPORATION

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions offered

- 12.1.14.2.1 Product launches and upgrades

- 12.1.15 ANALYTIK JENA GMBH+CO. KG

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions offered

- 12.1.1 AGILENT TECHNOLOGIES, INC.

- 12.2 OTHER PLAYERS

- 12.2.1 HIDEN ANALYTICAL

- 12.2.2 RIGAKU HOLDINGS CORPORATION

- 12.2.3 YOUNGIN CHROMASS

- 12.2.4 SCION INSTRUMENTS

- 12.2.5 RESTEK CORPORATION

- 12.2.6 KORE TECHNOLOGY

- 12.2.7 PROCESS INSIGHTS, INC.

- 12.2.8 MASSTECH

- 12.2.9 ADVION, INC.

- 12.2.10 SKYRAY INSTRUMENTS USA, INC.

- 12.2.11 MICROSAIC

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS