|

|

市場調査レポート

商品コード

1715158

ヒト化マウス・ラットモデルの世界市場:タイプ別、エンドユーザー別、用途別、地域別 - 2030年までの予測Humanized Mouse and Rat Model Market by Type (Genetic Models, Cell-based Models, Rat Models), Application (Oncology, Immunology, Neuroscience, Toxicology, Infectious Diseases), End User (Pharma, Biotech), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ヒト化マウス・ラットモデルの世界市場:タイプ別、エンドユーザー別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年04月22日

発行: MarketsandMarkets

ページ情報: 英文 255 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のヒト化マウス・ラットモデルの市場規模は、2025年の2億7,620万米ドルから2030年には4億980万米ドルに達すると予測され、CAGRは8.2%と著しいものになると期待されています。

同市場は、製薬・バイオ医薬品企業の研究開発投資の増加により、高いCAGRで力強く成長しています。研究開発のパイプラインが拡大するにつれて、希少疾患やオーファンドラッグに関する研究イニシアチブに加えて、分析試験のアウトソーシングに対する要求も高まっています。さらに、自社での医薬品開発にかかるコストの高さも、この動向に拍車をかけています。業界各社は、技術の進歩、新たな創薬技術、特許切れ、エンドユーザーの専門的な検査サービスに対する需要の高まりにより、健全な成長機会を得ることになると思われます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント | タイプ別、エンドユーザー別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

タイプ別では、ヒト化マウス・ラットモデル市場はヒト化マウスモデルとヒト化ラットモデルに区分されます。2024年には、ヒト化マウスモデルが市場の収益面で最も高いシェアを獲得すると思われます。また、このセグメントは予測期間を通じて最も速いCAGRで成長する見込みです。細胞ベースのヒト化マウスモデルに対する需要の増加が、このセグメントの成長に寄与しています。これらのモデルは、潜在的な新薬の安全性や有効性の分析、免疫腫瘍学、感染症、移植片対宿主病における長期的な研究など、さまざまな用途で活用されています。

ヒト化マウス・ラットモデル市場は、用途別に腫瘍学、免疫・感染症学、神経科学、造血学、毒物学、その他の用途に区分されます。免疫・感染症分野は、売上高で市場第2位の分野です。マウスモデルは、実験的知見の生理学的妥当性を評価するのに役立つため、免疫学や炎症研究で使用されます。マウスモデルは、マウスのゲノムをランダムに、あるいは特定の領域で適切に変化させることができるため、免疫学的プロセスの詳細な研究が可能になります。

エンドユーザー別では、市場は製薬・バイオテクノロジー企業、CRO・CDMO、学術・研究機関に区分されます。2024年には製薬・バイオテクノロジー企業がこのセグメントを支配しています。ヒト化マウス・ラットモデル市場における製薬・バイオテクノロジー企業のシェアが最も高いのは、革新的な医薬品開発のための支出が増加していることと、個別化医療への嗜好が高まっているためです。しかし、医薬品開発のための前臨床試験や研究活動をこのエンドユーザーセグメントに委託する製薬・バイオテクノロジー企業が増加しているため、CRO &CDMOセグメントは予測期間中に最も高い成長を記録すると予想されます。

市場は地域別に北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカに区分されます。北米は2024年にヒト化マウス・ラットモデル市場を独占し、予測期間中も独占を続けると予測されます。米国が北米市場をリードしており、主要参入企業の存在がその原動力となっています。同市場の大きなシェアは、主にライフサイエンス研究への資金提供の増加、mAbsやバイオシミラーに関する研究の増加によってもたらされています。また、がんの罹患率の増加も市場の成長を支えるものと予想されます。

当レポートでは、世界のヒト化マウス・ラットモデル市場について調査し、タイプ別、エンドユーザー別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ヒト化マウス・ラットモデル市場へのAIの影響

第6章 ヒト化マウス・ラットモデル市場(タイプ別)

- イントロダクション

- ヒト化マウスモデル

- ヒト化ラットモデル

第7章 ヒト化マウス・ラットモデル市場(エンドユーザー別)

- イントロダクション

- 製薬・バイオテクノロジー企業

- CRO・CDMO

- 学術研究機関

第8章 ヒト化マウス・ラットモデル市場(用途別)

- イントロダクション

- 腫瘍学

- 免疫学と感染症

- 神経科学

- 毒物学

- 造血

- その他

第9章 ヒト化マウス・ラットモデル市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

- ラテンアメリカ

- 製薬会社とバイオテクノロジー企業の存在感が高まり、市場が拡大

- ラテンアメリカのマクロ経済見通し

- 中東

- 市場の成長を支える国々の医薬品市場の成長

- 中東のマクロ経済見通し

- アフリカ

- 成長する製薬業界が市場の成長を支える

- アフリカのマクロ経済見通し

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- CHARLES RIVER LABORATORIES

- THE JACKSON LABORATORY

- INOTIV

- GENOWAY

- TACONIC BIOSCIENCES, INC.

- JSR CORPORATION

- CHAMPIONS ONCOLOGY, INC.

- JANVIER LABS

- VITALSTAR BIOTECHNOLOGY

- INGENIOUS TARGETING LABORATORY

- HARBOUR BIOMED

- ONCODESIGN SERVICES

- PHARMATEST SERVICES

- その他の企業

- OZGENE PTY LTD.

- CLEA JAPAN, INC.

- ALTOGEN LABS

- REACTION BIOLOGY

- TRANSCURE BIOSERVICES

- CYAGEN

- ARAGEN LIFE SCIENCES LTD.

- BIOCYTOGEN

- GEMPHARMATECH

第12章 付録

List of Tables

- TABLE 1 HUMANIZED MOUSE AND RAT MODEL MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 IMPACT ANALYSIS OF SUPPLY AND DEMAND-SIDE FACTORS

- TABLE 3 HUMANIZED MOUSE AND RAT MODEL MARKET: RISK ANALYSIS

- TABLE 4 HUMANIZED MOUSE AND RAT MODEL MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 5 NUMBER OF R&D PRODUCTS, BY INDICATION (2024)

- TABLE 6 AVERAGE SELLING PRICE TREND OF PRODUCTS, BY KEY PLAYER, 2022-2024 (USD MILLION)

- TABLE 7 AVERAGE SELLING PRICE TREND OF KEY PRODUCTS, BY REGION, 2022-2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE TREND OF KEY PRODUCTS (HUMANIZED MOUSE MODELS), BY REGION, 2022-2024 (USD)

- TABLE 9 HUMANIZED MOUSE AND RAT MODEL MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 10 INVESTMENT AND FUNDING ACTIVITY, BY KEY PLAYER, 2021-2025

- TABLE 11 HUMANIZED MOUSE AND RAT MODEL MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2021-2024

- TABLE 12 IMPORT DATA FOR LABORATORY MOUSE

- TABLE 13 EXPORT DATA FOR LABORATORY MOUSE

- TABLE 14 HUMANIZED MOUSE AND RAT MODEL MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 HUMANIZED MOUSE AND RAT MODEL MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 21 KEY BUYING CRITERIA, BY END USER

- TABLE 22 HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 23 HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (THOUSAND UNITS)

- TABLE 24 HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 25 HUMANIZED MOUSE MODELS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 26 NORTH AMERICA: HUMANIZED MOUSE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 27 EUROPE: HUMANIZED MOUSE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 ASIA PACIFIC: HUMANIZED MOUSE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 GENETIC HUMANIZED MOUSE MODELS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 NORTH AMERICA: GENETIC HUMANIZED MOUSE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 EUROPE: GENETIC HUMANIZED MOUSE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 ASIA PACIFIC: GENETIC HUMANIZED MOUSE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 34 CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 EUROPE: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 ASIA PACIFIC: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 CD34 HUMANIZED MODELS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 NORTH AMERICA: CD34 HUMANIZED MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 EUROPE: CD34 HUMANIZED MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 ASIA PACIFIC: CD34 HUMANIZED MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 PBMC HUMANIZED MICE MODELS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: PBMC HUMANIZED MICE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 EUROPE: PBMC HUMANIZED MICE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: PBMC HUMANIZED MICE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 BLT HUMANIZED MOUSE MODELS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: BLT HUMANIZED MOUSE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 EUROPE: BLT HUMANIZED MOUSE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: BLT HUMANIZED MOUSE MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 HUMANIZED RAT MODELS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: HUMANIZED RAT MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 EUROPE: HUMANIZED RAT MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 ASIA PACIFIC: HUMANIZED RAT MODELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 55 USE OF HUMANIZED MICE MODELS IN DEVELOPED AND TESTED VACCINES

- TABLE 56 HUMANIZED MOUSE AND RAT MODEL MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 HUMANIZED MOUSE AND RAT MODEL MARKET FOR CROS AND CDMOS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET FOR CROS AND CDMOS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET FOR CROS AND CDMOS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET FOR CROS AND CDMOS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 HUMANIZED MOUSE AND RAT MODEL MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 69 HUMANIZED MOUSE AND RAT MODEL MARKET FOR ONCOLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 HUMANIZED MOUSE AND RAT MODEL MARKET FOR IMMUNOLOGY AND INFECTIOUS DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET FOR IMMUNOLOGY AND INFECTIOUS DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET FOR IMMUNOLOGY AND INFECTIOUS DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET FOR IMMUNOLOGY AND INFECTIOUS DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 HUMANIZED MOUSE AND RAT MODEL MARKET FOR NEUROSCIENCE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET FOR NEUROSCIENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET FOR NEUROSCIENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET FOR NEUROSCIENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 HUMANIZED MOUSE AND RAT MODEL MARKET FOR TOXICOLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET FOR TOXICOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET FOR TOXICOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET FOR TOXICOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 HUMANIZED MOUSE AND RAT MODEL MARKET FOR HEMATOPOIESIS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET FOR HEMATOPOIESIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET FOR HEMATOPOIESIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET FOR HEMATOPOIESIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 HUMANIZED MOUSE AND RAT MODEL MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 93 HUMANIZED MOUSE AND RAT MODEL MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 100 KEY MACROECONOMIC INDICATORS OF NORTH AMERICA

- TABLE 101 US: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 US: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 US: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 US: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 105 US: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 106 CANADA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 CANADA: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 CANADA: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 CANADA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 110 CANADA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 111 EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 EUROPE: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 EUROPE: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 116 EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 117 KEY MACROECONOMIC INDICATORS OF EUROPE

- TABLE 118 GERMANY: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 GERMANY: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 GERMANY: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 GERMANY: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 122 GERMANY: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 123 UK: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 UK: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 UK: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 UK: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 127 UK: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 128 FRANCE: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 129 FRANCE: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 FRANCE: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 FRANCE: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 132 FRANCE: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 133 ITALY: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 ITALY: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 ITALY: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 ITALY: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 137 ITALY: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 138 SPAIN: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 SPAIN: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 SPAIN: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 SPAIN: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 142 SPAIN: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 143 REST OF EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 REST OF EUROPE: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 REST OF EUROPE: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 REST OF EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 147 REST OF EUROPE: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 153 ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 154 KEY MACROECONOMIC INDICATORS OF ASIA PACIFIC

- TABLE 155 CHINA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 CHINA: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 CHINA: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 CHINA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 159 CHINA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 160 JAPAN: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 JAPAN: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 JAPAN: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 JAPAN: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 164 JAPAN: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 165 INDIA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 INDIA: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 INDIA: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 INDIA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 169 INDIA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 170 SOUTH KOREA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 SOUTH KOREA: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 SOUTH KOREA: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 SOUTH KOREA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 174 SOUTH KOREA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 175 AUSTRALIA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 AUSTRALIA: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 AUSTRALIA: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 AUSTRALIA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 179 AUSTRALIA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 REST OF ASIA PACIFIC: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 REST OF ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 185 LATIN AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 LATIN AMERICA: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 LATIN AMERICA: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 LATIN AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 189 LATIN AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 190 KEY MACROECONOMIC INDICATORS OF LATIN AMERICA

- TABLE 191 MIDDLE EAST: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 MIDDLE EAST: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 MIDDLE EAST: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 MIDDLE EAST: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 195 MIDDLE EAST: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 196 KEY MACROECONOMIC INDICATORS OF MIDDLE EAST

- TABLE 197 AFRICA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 AFRICA: HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 AFRICA: CELL-BASED HUMANIZED MOUSE MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 AFRICA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 201 AFRICA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 202 KEY MACROECONOMIC INDICATORS OF AFRICA

- TABLE 203 STRATEGIES ADOPTED BY KEY PLAYERS IN HUMANIZED MOUSE AND RAT MODEL MARKET, 2021-2024

- TABLE 204 HUMANIZED MOUSE AND RAT MODEL MARKET: DEGREE OF COMPETITION

- TABLE 205 HUMANIZED MOUSE AND RAT MODEL MARKET: REGION FOOTPRINT

- TABLE 206 HUMANIZED MOUSE AND RAT MODEL MARKET: TYPE FOOTPRINT

- TABLE 207 HUMANIZED MOUSE AND RAT MODEL MARKET: APPLICATION FOOTPRINT

- TABLE 208 HUMANIZED MOUSE AND RAT MODEL MARKET: KEY STARTUPS/SMES

- TABLE 209 HUMANIZED MOUSE AND RAT MODEL MARKET: COMPETITIVE BENCHMARKING OF KEY START UPS/SMES

- TABLE 210 HUMANIZED MOUSE AND RAT MODEL MARKET: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 211 HUMANIZED MOUSE AND RAT MODEL MARKET: DEALS, JANUARY 2021-MARCH 2025

- TABLE 212 HUMANIZED MOUSE AND RAT MODEL MARKET: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 213 CHARLES RIVER LABORATORIES: COMPANY OVERVIEW

- TABLE 214 CHARLES RIVER LABORATORIES: PRODUCTS OFFERED

- TABLE 215 CHARLES RIVER LABORATORIES: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 216 CHARLES RIVER LABORATORIES: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2025

- TABLE 217 THE JACKSON LABORATORY: COMPANY OVERVIEW

- TABLE 218 THE JACKSON LABORATORY: PRODUCTS OFFERED

- TABLE 219 THE JACKSON LABORATORY: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 220 INOTIV: COMPANY OVERVIEW

- TABLE 221 INOTIV: PRODUCTS OFFERED

- TABLE 222 INOTIV: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 223 GENOWAY: COMPANY OVERVIEW

- TABLE 224 GENOWAY: PRODUCTS OFFERED

- TABLE 225 GENOWAY: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2025

- TABLE 226 TACONIC BIOSCIENCES, INC.: COMPANY OVERVIEW

- TABLE 227 TACONIC BIOSCIENCES, INC.: PRODUCTS OFFERED

- TABLE 228 TACONIC BIOSCIENCES, INC.: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 229 TACONIC BIOSCIENCES, INC.: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 230 JSR CORPORATION: COMPANY OVERVIEW

- TABLE 231 JSR CORPORATION: PRODUCTS OFFERED

- TABLE 232 JSR CORPORATION: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 233 JSR CORPORATION: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 234 CHAMPIONS ONCOLOGY, INC.: COMPANY OVERVIEW

- TABLE 235 CHAMPIONS ONCOLOGY, INC.: PRODUCTS OFFERED

- TABLE 236 JANVIER LABS: COMPANY OVERVIEW

- TABLE 237 JANVIER LABS: PRODUCTS OFFERED

- TABLE 238 JANVIER LABS: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 239 VITALSTAR BIOTECHNOLOGY: COMPANY OVERVIEW

- TABLE 240 VITALSTAR BIOTECHNOLOGY: PRODUCTS OFFERED

- TABLE 241 INGENIOUS TARGETING LABORATORY: COMPANY OVERVIEW

- TABLE 242 INGENIOUS TARGETING LABORATORY: PRODUCTS OFFERED

- TABLE 243 HARBOUR BIOMED: COMPANY OVERVIEW

- TABLE 244 HARBOUR BIOMED: PRODUCTS OFFERED

- TABLE 245 HARBOUR BIOMED: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 246 ONCODESIGN SERVICES: COMPANY OVERVIEW

- TABLE 247 ONCODESIGN SERVICES: PRODUCTS OFFERED

- TABLE 248 PHARMATEST SERVICES: COMPANY OVERVIEW

- TABLE 249 PHARMATEST SERVICES: PRODUCTS OFFERED

- TABLE 250 OZGENE PTY LTD.: COMPANY OVERVIEW

- TABLE 251 CLEA JAPAN, INC.: COMPANY OVERVIEW

- TABLE 252 ALTOGEN LABS: COMPANY OVERVIEW

- TABLE 253 REACTION BIOLOGY: COMPANY OVERVIEW

- TABLE 254 TRANSCURE BIOSERVICES: COMPANY OVERVIEW

- TABLE 255 CYAGEN: COMPANY OVERVIEW

- TABLE 256 ARAGEN LIFE SCIENCES LTD.: COMPANY OVERVIEW

- TABLE 257 BIOCYTOGEN: COMPANY OVERVIEW

- TABLE 258 GEMPHARMATECH: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HUMANIZED MOUSE AND RAT MODEL MARKET SEGMENTATION AND REGIONS CONSIDERED

- FIGURE 2 HUMANIZED MOUSE AND RAT MODEL MARKET: YEARS CONSIDERED

- FIGURE 3 HUMANIZED MOUSE AND RAT MODEL MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY RESPONDENT, DESIGNATION, AND REGION

- FIGURE 5 GLOBAL HUMANIZED MOUSE AND RAT MODEL MARKET SIZE ESTIMATION, 2024

- FIGURE 6 COMPANY REVENUE ANALYSIS-BASED ESTIMATION, 2024

- FIGURE 7 REVENUE SHARE ANALYSIS: ILLUSTRATIVE EXAMPLE OF CHARLES RIVER LABORATORIES, 2024

- FIGURE 8 MARKET SIZE VALIDATION FROM PRIMARIES

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 10 HUMANIZED MOUSE AND RAT MODEL MARKET: CAGR PROJECTIONS, 2025-2030

- FIGURE 11 HUMANIZED MOUSE AND RAT MODEL MARKET: DATA TRIANGULATION

- FIGURE 12 HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 REGIONAL SNAPSHOT OF HUMANIZED MOUSE AND RAT MODEL MARKET, 2025-2030

- FIGURE 16 RISING USE OF HUMANIZED MODELS IN DRUG DISCOVERY RESEARCH TO DRIVE MARKET

- FIGURE 17 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN US IN 2024

- FIGURE 18 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES SEGMENT DOMINATED MARKET IN 2024

- FIGURE 20 HUMANIZED MOUSE AND RAT MODEL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 NUMBER OF CLINICAL TRIALS REGISTERED FOR CANCER IMMUNOTHERAPIES, 2020-2024

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF PRODUCTS, BY KEY PLAYER, 2022-2024 (USD)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF KEY PRODUCTS, BY REGION, 2022-2024 (USD)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF KEY PRODUCTS, BY REGION, 2022-2024 (USD)

- FIGURE 26 HUMANIZED MOUSE AND RAT MODEL MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 HUMANIZED MOUSE AND RAT MODEL MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 HUMANIZED MOUSE AND RAT MODEL MARKET ECOSYSTEM

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 30 HUMANIZED MOUSE AND RAT MODEL MARKET: PATENT ANALYSIS, 2014-2024

- FIGURE 31 HUMANIZED MOUSE AND RAT MODEL MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS

- FIGURE 33 KEY BUYING CRITERIA, BY END USER

- FIGURE 34 AI USE CASES

- FIGURE 35 HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE, 2023-2030 (THOUSAND UNITS)

- FIGURE 36 HUMANIZED MOUSE AND RAT MODEL MARKET: NORTH AMERICA SNAPSHOT

- FIGURE 37 HUMANIZED MOUSE AND RAT MODEL MARKET: ASIA PACIFIC SNAPSHOT

- FIGURE 38 REVENUE ANALYSIS OF KEY PLAYERS IN HUMANIZED MOUSE AND RAT MODEL MARKET, 2020-2024

- FIGURE 39 MARKET SHARE ANALYSIS OF HUMANIZED MOUSE AND RAT MODEL MARKET, 2024

- FIGURE 40 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS, 2024

- FIGURE 41 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- FIGURE 42 HUMANIZED MOUSE AND RAT MODEL MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 43 HUMANIZED MOUSE AND RAT MODEL MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 HUMANIZED MOUSE AND RAT MODEL MARKET: COMPANY FOOTPRINT

- FIGURE 45 HUMANIZED MOUSE AND RAT MODEL MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 CHARLES RIVER LABORATORIES: COMPANY SNAPSHOT (2024)

- FIGURE 47 THE JACKSON LABORATORY: COMPANY SNAPSHOT (2024)

- FIGURE 48 INOTIV: COMPANY SNAPSHOT (2024)

- FIGURE 49 JSR CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 50 CHAMPIONS ONCOLOGY, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 51 HARBOUR BIOMED: COMPANY SNAPSHOT (2024)

The global humanized mouse and rat model market is anticipated to reach USD 409.8 million in 2030 from USD 276.2 million in 2025, with a significant CAGR of 8.2%. The market is growing strongly at a high CAGR due to rising R&D investments of pharmaceutical and biopharmaceutical firms. As the pipeline of R&D expands, the requirement for outsourcing analytical testing is set to rise, in addition to the research initiatives on rare diseases and orphan drugs. Furthermore, the high costs of in-house drug development have also contributed to this trend. Industry players will likely witness healthy growth opportunities due to technological advancements, new drug discovery techniques, patent expirations, and rising demand for specialized testing services among end users.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD million) |

| Segments | Type, Application, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

"Humanized mouse model segment dominated the type segment in 2024"

Based on type, the humanized mouse and rat model market has been segmented into humanized mouse models and humanized rat models. In 2024, humanized mouse models will have garnered the highest share in terms of revenue in the market. This segment is also expected to grow with the fastest CAGR through the forecast period. An increase in demand for cell-based humanized mouse models has contributed to the segment's growth. These models are utilized in various applications, including the analysis of the safety and effectiveness of potential new drugs and in long-term studies in immuno-oncology, infectious diseases, and graft-versus-host disease.

"The immunology & infectious diseases segment accounted for the second largest share of the market in 2024"

The humanized mouse and rat model market is segmented based on application into oncology, immunology & infectious diseases, neuroscience, hematopoiesis, toxicology, and other applications. The immunology & infectious diseases segment is the second largest segment in the market in terms of revenue. Mouse models are used in immunology and inflammation studies as they help assess the physiological relevance of an experimental finding. Mouse models allow suitable alterations in the mouse genome at random or in specific regions, enabling a detailed study of immunological processes.

"Pharmaceutical & Biotechnology Companies will likely record the highest CAGR during the forecast period"

Based on the end users, the market is segmented into pharmaceutical & biotechnology companies, CROs & CDMOs, and academic & research institutes. Pharmaceutical & biotechnology companies dominated the segment in 2024. The largest share of pharmaceutical and biotechnology companies in the humanized mouse and rat model market is due to the rising expenditure for innovative drug development and the growing preference for personalized medicine. However, the CROs & CDMOs segment is expected to register the highest growth during the forecast period due to the increasing number of pharmaceutical & biotechnology companies outsourcing preclinical studies and research activities for drug development to this end user segment.

"US to record the highest CAGR during the forecast period"

The market is segmented by region into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. North America dominated the humanized mouse and rat model market in 2024 and is estimated to continue dominating during the forecast period. The US leads the North American market, driven by the presence of key players. The large share of the market is primarily driven by the rising funding for life sciences research and growing research on mAbs and biosimilars. The growing incidence of cancer is also expected to support market growth.

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the humanized mouse and rat model market.

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: C-level Executives - 45%, Directors - 30%, and Others - 25%

- By Region: North America - 45%, Europe - 30%, Asia Pacific - 20%, Latin America - 3% and Middle East & Africa - 2%

Charles River Laboratories (US), The Jackson Laboratory (JAX) (US), Taconic Biosciences, Inc. (US), JSR Corporation (US) (Crown Biosciences), Champions Oncology, Inc. (US), CLEA Japan Inc. (Japan), genOway (France), Inotiv (US), Janvier Labs (France), Altogen Labs (US), Vitalstar Biotechnology (China), Ingenious Targeting Laboratory (US), Reaction Biology (US), Harbour BioMed (Netherlands), Oncodesign Services (France), Pharmatest Services (Finland), Ozgene Pty Ltd. (Australia), TransCure bioServices (France), Cyagen Biosciences (US), Aragen Life Sciences Ltd. (India), GemPharmatech (China), and Biocytogen (US) are some of the key players in the humanized mouse and rat model market.

Research Coverage:

Humanized mouse and rat model market report is segmented based on type {[(humanized mouse models {genetic humanized mouse models and cell-based humanized mouse models (CD34 humanized mouse models, PBMC humanized mouse models, and BLT humanized mouse models)]} and humanized rat models), application (oncology, immunology and infectious diseases, neuroscience, hematopoiesis, toxicology, and other applications, end user (pharmaceutical & biotechnology companies, CROs & CDMOs, and academic & research institutes), and region (North America, Europe, Asia Pacific, Latin America, and the Middle East, Africa).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the humanized mouse and rat model market. A comprehensive analysis of the key players in the industry has been conducted to offer insights into their business overviews, products, key strategies, collaborations, partnerships, and agreements. This includes information about recent product launches, collaborations, acquisitions, and humanized mouse and rat model market developments.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing the closest approximations of the revenue numbers for the humanized mouse and rat model and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (rising use of humanized models in drug discovery research, emerging preclinical applications of humanized mouse models, government-funded initiatives for cancer research, and increasing R&D activities in the pharmaceutical & biotechnology industry), restraints (introduction of FDA Modernization Act 2.0/3.0, stringent regulatory compliance for ethical use of animal models), opportunities (growing preference for humanized PDX models, emergence of CRISPR in biomedical research), and challenges (alternatives for animal testing, limitations of humanized mouse models) influencing market growth.

- Product Development/Innovation: Detailed insights on upcoming technologies in humanized mouse and rat models, research and development activities, and new product launches in the humanized mouse and rat model market.

- Market Development: Comprehensive information about lucrative markets-the report analyses the market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the humanized mouse and rat model market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Charles River Laboratories (US), The Jackson Laboratory (JAX) (US), Inotiv (US), and genOway (France).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.4.3 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.2.2 SEGMENTAL MARKET ESTIMATION

- 2.3 GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 HUMANIZED MOUSE AND RAT MODEL MARKET OVERVIEW

- 4.2 NORTH AMERICA: HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER AND COUNTRY, 2024

- 4.3 HUMANIZED MOUSE AND RAT MODEL MARKET, BY KEY COUNTRY

- 4.4 HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising use of humanized models in drug discovery research

- 5.2.1.2 Emerging preclinical applications of humanized mouse models

- 5.2.1.3 Government-funded initiatives for cancer research

- 5.2.1.4 Increasing R&D activities in pharmaceutical & biotechnology industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Introduction of FDA Modernization Act 2.0/3.0

- 5.2.2.2 Stringent regulatory compliance for ethical use of animal models

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing preference for humanized PDX models

- 5.2.3.2 Emergence of CRISPR in biomedical research

- 5.2.4 CHALLENGES

- 5.2.4.1 Alternative methods for animal testing

- 5.2.4.2 Limitations of humanized mouse models

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF PRODUCTS, BY KEY PLAYER, 2022-2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF KEY PRODUCTS, BY REGION

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 CRISPR-Cas9

- 5.9.1.2 Tissue engineering

- 5.9.1.3 In vivo imaging

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 3D cell culture

- 5.9.2.2 Organs-on-Chips

- 5.9.2.3 Biomarker discovery

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Proteomics

- 5.9.3.2 Microfluidics

- 5.9.3.3 Regenerative medicine

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY FRAMEWORK

- 5.13.2 NORTH AMERICA

- 5.13.3 EUROPE

- 5.13.4 ASIA PACIFIC

- 5.13.4.1 China

- 5.13.4.2 Japan

- 5.13.4.3 India

- 5.13.4.4 Australia

- 5.13.5 LATIN AMERICA

- 5.13.6 MIDDLE EAST & AFRICA

- 5.13.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

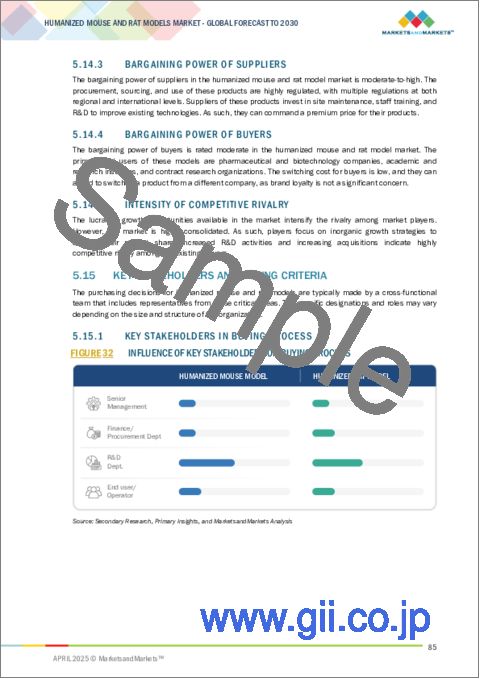

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 KEY BUYING CRITERIA, BY END USER

- 5.16 IMPACT OF AI ON HUMANIZED MOUSE AND RAT MODEL MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 MARKET POTENTIAL OF AI IN HUMANIZED MOUSE AND RAT MODELS

- 5.16.3 AI USE CASES

- 5.16.4 KEY COMPANIES IMPLEMENTING AI

- 5.16.5 FUTURE OF GENERATIVE AI IN HUMANIZED MOUSE AND RAT MODEL MARKET

6 HUMANIZED MOUSE AND RAT MODEL MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 HUMANIZED MOUSE MODELS

- 6.2.1 GENETIC HUMANIZED MOUSE MODELS

- 6.2.1.1 Advancements in genetical engineering technologies to drive market

- 6.2.2 CELL-BASED HUMANIZED MOUSE MODELS

- 6.2.2.1 CD34 humanized mouse models

- 6.2.2.1.1 Rising demand for stem cell therapy to propel market

- 6.2.2.2 PBMC humanized mouse models

- 6.2.2.2.1 Growing prevalence of infectious diseases to boost demand

- 6.2.2.3 BLT humanized mouse models

- 6.2.2.3.1 Surge in HIV cases to drive market

- 6.2.2.1 CD34 humanized mouse models

- 6.2.1 GENETIC HUMANIZED MOUSE MODELS

- 6.3 HUMANIZED RAT MODELS

- 6.3.1 PREFERENCE FOR SRG RAT MODELS FOR RESEARCH STUDIES WITH LARGE SAMPLE SIZE SUPPORTS THE SEGMENT GROWTH

7 HUMANIZED MOUSE AND RAT MODEL MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 7.2.1 GROWING ADOPTION OF HU-MICE MODELS IN VACCINE DEVELOPMENT TO BOOST SEGMENT GROWTH

- 7.3 CONTRACT RESEARCH ORGANIZATIONS AND CONTRACT DEVELOPMENT MANUFACTURING ORGANIZATIONS

- 7.3.1 OUTSOURCING OF DRUG DISCOVERY SERVICES BY PHARMA & BIOTECH COMPANIES TO PROPEL MARKET

- 7.4 ACADEMIC & RESEARCH INSTITUTES

- 7.4.1 SUPPORTIVE FUNDING INVESTMENTS FOR LIFE SCIENCE RESEARCH TO DRIVE MARKET

8 HUMANIZED MOUSE AND RAT MODEL MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 ONCOLOGY

- 8.2.1 UTILIZATION OF MOUSE MODELS IN CANCER RESEARCH TO DRIVE MARKET

- 8.3 IMMUNOLOGY AND INFECTIOUS DISEASES

- 8.3.1 DEVELOPMENT OF ADVANCED MODELS FOR TREATMENT OF RARE DISEASES TO DRIVE MARKET

- 8.4 NEUROSCIENCE

- 8.4.1 RISING INCIDENCE OF CNS DISORDERS TO DRIVE MARKET

- 8.5 TOXICOLOGY

- 8.5.1 INCREASING CLINICAL TRIALS FOR TOXICOLOGY STUDIES TO SUPPORT MARKET GROWTH

- 8.6 HEMATOPOIESIS

- 8.6.1 RISING DEMAND FOR STEM CELL THERAPY TO DRIVE MARKET

- 8.7 OTHER APPLICATIONS

9 HUMANIZED MOUSE AND RAT MODEL MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK OF NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Growing research initiatives on mAbs and biosimilars to drive market

- 9.2.3 CANADA

- 9.2.3.1 Government initiatives on stem cell research to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK OF EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Rising pharmaceutical R&D expenditure to drive market

- 9.3.3 UK

- 9.3.3.1 Growing investments in cancer research to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Rising initiatives for genomics research to support market growth

- 9.3.5 ITALY

- 9.3.5.1 Robust pharmaceutical production to fuel market

- 9.3.6 SPAIN

- 9.3.6.1 Rising growth in biotech industry to drive market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK OF ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 High growth in pharmaceutical industry to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Growing research collaborations among pharmaceutical companies to drive market

- 9.4.4 INDIA

- 9.4.4.1 Growth in biotech industry to drive market

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Rising government-funded investments for pharmaceutical R&D to drive market

- 9.4.6 AUSTRALIA

- 9.4.6.1 Rising biomedical research projects to drive market

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 GROWING PRESENCE OF PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES TO PROPEL MARKET

- 9.5.2 MACROECONOMIC OUTLOOK OF LATIN AMERICA

- 9.6 MIDDLE EAST

- 9.6.1 GROWING PHARMACEUTICAL MARKET IN COUNTRIES TO SUPPORT MARKET GROWTH

- 9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 9.7 AFRICA

- 9.7.1 GROWING PHARMACEUTICAL INDUSTRY TO SUPPORT MARKET GROWTH

- 9.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN HUMANIZED MOUSE AND RAT MODEL MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.4.1 HUMANIZED MOUSE AND RAT MODEL MARKET

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.5.1 FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Type footprint

- 10.7.5.4 Application footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES & APPROVALS

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 CHARLES RIVER LABORATORIES

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 THE JACKSON LABORATORY

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 INOTIV

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 GENOWAY

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 TACONIC BIOSCIENCES, INC.

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Expansions

- 11.1.6 JSR CORPORATION

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.3.2 Expansions

- 11.1.7 CHAMPIONS ONCOLOGY, INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 JANVIER LABS

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.9 VITALSTAR BIOTECHNOLOGY

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.10 INGENIOUS TARGETING LABORATORY

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.11 HARBOUR BIOMED

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.12 ONCODESIGN SERVICES

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.13 PHARMATEST SERVICES

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.1 CHARLES RIVER LABORATORIES

- 11.2 OTHER PLAYERS

- 11.2.1 OZGENE PTY LTD.

- 11.2.2 CLEA JAPAN, INC.

- 11.2.3 ALTOGEN LABS

- 11.2.4 REACTION BIOLOGY

- 11.2.5 TRANSCURE BIOSERVICES

- 11.2.6 CYAGEN

- 11.2.7 ARAGEN LIFE SCIENCES LTD.

- 11.2.8 BIOCYTOGEN

- 11.2.9 GEMPHARMATECH

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS