|

|

市場調査レポート

商品コード

1715156

スマートロボットの世界市場:コンポーネント別、タイプ別、モビリティ別、動作環境別、用途別、地域別 - 2030年までの予測Smart Robots Market by Component (Sensors, Actuators, Power Sources, Control Systems, Software), Type (Industrial, Service), Operating Environment (Ground, Underwater), Mobility (Stationary, Mobile), Application and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| スマートロボットの世界市場:コンポーネント別、タイプ別、モビリティ別、動作環境別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年04月23日

発行: MarketsandMarkets

ページ情報: 英文 298 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のスマートロボットの市場規模は、2025年の162億米ドルから2030年には428億米ドルに成長し、2025年から2030年までのCAGRは21.5%になると予測されています。

この成長の原動力は、生産性の向上、コスト削減、効率性の向上を目的とした自動化に対する需要の高まりです。スマートロボットは、在庫管理や配送を支援するロジスティクスや、患者のモニタリング、調剤、手術を支援するヘルスケアなどの分野で、複雑な作業を正確かつ一貫して実行することを可能にし、労働力不足と正確さの必要性の両方に対処します。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | コンポーネント別、タイプ別、モビリティ別、動作環境別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

スマートロボットのソフトウェアは、知能、自律性、適応性を実現するために極めて重要です。固定されたプログラムを持つ従来のロボットとは異なり、スマートロボットは高度なソフトウェアを使用して、感覚データを処理し、リアルタイムの意思決定を行い、環境と相互作用し、経験から学習します。AI、機械学習、自然言語処理、コンピューター・ビジョンなどの技術がこれらの機能を推進し、ロボットが物体認識やナビゲーション・タスクを実行できるようにします。製造、ヘルスケア、物流などの業界でスマートロボットの導入が進むにつれ、専用ソフトウェア・プラットフォームの需要が高まっています。ハードウェアを交換することなく、ソフトウェアのアップデートによって性能が向上するため、カスタマイズとスマートな意思決定の重要性が強調されています。

産業用ロボット分野は、製造業における自動化の高まりに後押しされ、予測期間中、スマートロボット市場で最も高いCAGRを示すとみられます。自動車、電子機器、食品・飲料などの産業は、効率と精度を高め、コストを削減するためにスマートロボットを採用しています。従来のロボットとは異なり、スマート産業用ロボットは、AI、ML、コンピュータビジョンを使用して、複雑なタスクを実行し、環境の変化に適応し、人間と一緒に作業します。インダストリー4.0へのシフト、労働力不足、24時間365日稼働の需要は、この成長をさらに後押しします。

中国は、急速な工業化、技術の進歩、ロボット工学と自動化に対する政府の強力な支援により、予測期間中にアジア太平洋スマートロボット市場を独占します。世界最大の製造拠点である中国は、自動車、エレクトロニクス、ロジスティクス、ヘルスケア、農業などの分野で、効率を高め人件費を削減するためにスマートロボットの採用を増やしています。メイド・イン・チャイナ2025」やAI開発計画といった政府のイニシアティブは、AIの統合とロボット技術革新を促進しています。人口の高齢化も、ヘルスケアや高齢者介護におけるスマート・サービス・ロボットの需要を促進しています。

当レポートでは、世界のスマートロボット市場について調査し、コンポーネント別、タイプ別、モビリティ別、動作環境別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- AI/生成AIがスマートロボット市場に与える影響

第6章 スマートロボット市場(コンポーネント別)

- イントロダクション

- ハードウェア

- ソフトウェア

第7章 スマートロボット市場(タイプ別)

- イントロダクション

- サービスロボット

- 産業用ロボット

第8章 スマートロボット市場(モビリティ別)

- イントロダクション

- 可動型

- 据置型

第9章 スマートロボット市場(動作環境別)

- イントロダクション

- 地面

- 水中

第10章 スマートロボット市場(用途別)

- イントロダクション

- 個人および家庭

- プロ

第11章 スマートロボット市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州:マクロ経済見通し

- ドイツ

- イタリア

- スペイン

- フランス

- 英国

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- 韓国

- 日本

- インド

- その他

- その他の地域

- その他の地域:マクロ経済見通し

- 南米

- 中東

- アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2025年

- 収益分析、2022年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- 財務指標

- ブランド比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- IROBOT CORPORATION

- SOFTBANK ROBOTICS GROUP

- ABB

- KUKA AG

- FANUC CORPORATION

- YASKAWA ELECTRIC CORPORATION

- AMAZON.COM, INC.

- HANSON ROBOTICS LTD.

- BLUE FROG ROBOTICS

- KONGSBERG MARITIME

- その他の企業

- UNIVERSAL ROBOTS A/S

- ECA GROUP

- DELAVAL

- INTUITIVE SURGICAL

- NEATO ROBOTICS, INC.

- GENERAL DYNAMICS MISSION SYSTEMS, INC.

- RETHINK ROBOTICS

- AETHON, INC.

- SAMSUNG

- GECKOSYSTEMS

- SMART ROBOTICS

- RAPID ROBOTICS

- ANYBOTICS

- SOTA ROBOTICS(HK)LIMITED

- VECNA ROBOTICS

第14章 付録

List of Tables

- TABLE 1 SMART ROBOTS MARKET: RISK ANALYSIS

- TABLE 2 INDICATIVE PRICING OF SMART ROBOTS OFFERED FOR FLOOR CLEANING, 2024 (USD)

- TABLE 3 INDICATIVE PRICING OF SMART ROBOTS PROVIDED FOR DIFFERENT APPLICATIONS, BY KEY PLAYER, 2024 (USD)

- TABLE 4 AVERAGE SELLING PRICE TREND OF DOMESTIC ROBOTS, BY REGION, 2021-2024 (USD)

- TABLE 5 ROLE OF COMPANIES IN SMART ROBOTS ECOSYSTEM

- TABLE 6 SMART ROBOTS MARKET: LIST OF MAJOR PATENTS, 2024

- TABLE 7 IMPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 8 EXPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 9 SMART ROBOTS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 10 GREIF TEXTILE MIETSYSTEME AUTOMATED TEXTILE LOADING WITH SEWTS' INNOVATIVE VELUM ROBOTS

- TABLE 11 FANUC CORPORATION AND RECYCLEYE ENHANCED WASTE MANAGEMENT IN MATERIAL RECOVERY FACILITIES BY DEPLOYING ADVANCED ROBOTIC SYSTEMS

- TABLE 12 FRAUNHOFER AND LIEBHERR-VERZAHNTECHNIK INTRODUCED AI-POWERED BIN-PICKING PROCESS IN INDUSTRIAL PLANTS FOR AUTOMATED PART DETECTION AND LOCALIZATION

- TABLE 13 WIPRO'S AI-DRIVEN PACKING SOLUTION BOOSTED WAREHOUSE PRODUCTIVITY

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 SMART ROBOTS MARKET: REGULATORY STANDARDS

- TABLE 19 SMART ROBOTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS (%)

- TABLE 21 KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 22 SMART ROBOTS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 23 SMART ROBOTS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 24 SMART ROBOTS MARKET, BY HARDWARE COMPONENT, 2021-2024 (USD MILLION)

- TABLE 25 SMART ROBOTS MARKET, BY HARDWARE COMPONENT, 2025-2030 (USD MILLION)

- TABLE 26 HARDWARE: SMART ROBOTS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 27 HARDWARE: SMART ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 28 HARDWARE: SMART ROBOTS MARKET, BY SENSOR TYPE, 2021-2024 (USD MILLION)

- TABLE 29 HARDWARE: SMART ROBOTS MARKET, BY SENSOR TYPE, 2025-2030 (USD MILLION)

- TABLE 30 HARDWARE: SMART ROBOTS MARKET, BY ACTUATOR TYPE, 2021-2024 (USD MILLION)

- TABLE 31 HARDWARE: SMART ROBOTS MARKET, BY ACTUATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 32 HARDWARE: SMART ROBOTS MARKET, BY CONTROL SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 33 HARDWARE: SMART ROBOTS MARKET, BY CONTROL SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 34 DIFFERENCE BETWEEN PROCESSOR TYPES

- TABLE 35 HARDWARE: SMART ROBOTS MARKET, BY PROCESSOR TYPE, 2021-2024 (USD MILLION)

- TABLE 36 HARDWARE: SMART ROBOTS MARKET, BY PROCESSOR TYPE, 2025-2030 (USD MILLION)

- TABLE 37 SOFTWARE: SMART ROBOTS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 38 SOFTWARE: SMART ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 39 SMART ROBOTS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 40 SMART ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 41 SMART ROBOTS MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 42 SMART ROBOTS MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 43 SERVICE ROBOTS: SMART ROBOTS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 44 SERVICE ROBOTS: SMART ROBOTS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 45 INDUSTRIAL ROBOTS: SMART ROBOTS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 46 INDUSTRIAL ROBOTS: SMART ROBOTS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 47 SMART ROBOTS MARKET, BY MOBILITY, 2021-2024 (USD MILLION)

- TABLE 48 SMART ROBOTS MARKET, BY MOBILITY, 2025-2030 (USD MILLION)

- TABLE 49 MOBILE: SMART ROBOTS MARKET, BY OPERATING ENVIRONMENT, 2021-2024 (USD MILLION)

- TABLE 50 MOBILE: SMART ROBOTS MARKET, BY OPERATING ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 51 STATIONARY: SMART ROBOTS MARKET, BY OPERATING ENVIRONMENT, 2021-2024 (USD MILLION)

- TABLE 52 STATIONARY: SMART ROBOTS MARKET, BY OPERATING ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 53 SMART ROBOTS MARKET, BY OPERATING ENVIRONMENT, 2021-2024 (USD MILLION)

- TABLE 54 SMART ROBOTS MARKET, BY OPERATING ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 55 SMART ROBOTS MARKET, BY OPERATING ENVIRONMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 56 SMART ROBOTS MARKET, BY OPERATING ENVIRONMENT, 2025-2030 (THOUSAND UNITS)

- TABLE 57 GROUND: SMART ROBOTS MARKET, BY MOBILITY, 2021-2024 (USD MILLION)

- TABLE 58 GROUND: SMART ROBOTS MARKET, BY MOBILITY, 2025-2030 (USD MILLION)

- TABLE 59 GROUND: SMART ROBOTS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 60 GROUND: SMART ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 61 GROUND: SMART ROBOTS MARKET, BY PERSONAL & DOMESTIC APPLICATION, 2021-2024 (USD MILLION)

- TABLE 62 GROUND: SMART ROBOTS MARKET, BY PERSONAL & DOMESTIC APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 GROUND: SMART ROBOTS MARKET, BY PROFESSIONAL APPLICATION, 2021-2024 (USD MILLION)

- TABLE 64 GROUND: SMART ROBOTS MARKET, BY PROFESSIONAL APPLICATION, 2025-2030 (USD MILLION)

- TABLE 65 UNDERWATER: SMART ROBOTS MARKET, BY MOBILITY, 2021-2024 (USD MILLION)

- TABLE 66 UNDERWATER: SMART ROBOTS MARKET, BY MOBILITY, 2025-2030 (USD MILLION)

- TABLE 67 UNDERWATER: SMART ROBOTS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 68 UNDERWATER: SMART ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 69 UNDERWATER: SMART ROBOTS MARKET, BY PROFESSIONAL APPLICATION, 2021-2024 (USD MILLION)

- TABLE 70 UNDERWATER: SMART ROBOTS MARKET, BY PROFESSIONAL APPLICATION, 2025-2030 (USD MILLION)

- TABLE 71 SMART ROBOTS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 72 SMART ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 73 SMART ROBOTS MARKET, BY PERSONAL & DOMESTIC APPLICATION, 2021-2024 (USD MILLION)

- TABLE 74 SMART ROBOTS MARKET, BY PERSONAL & DOMESTIC APPLICATION, 2025-2030 (USD MILLION)

- TABLE 75 COMPANIONSHIP: SMART ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 COMPANIONSHIP: SMART ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 SMART ROBOTS MARKET, BY EDUCATION & ENTERTAINMENT APPLICATION, 2021-2024 (USD MILLION)

- TABLE 78 SMART ROBOTS MARKET, BY EDUCATION & ENTERTAINMENT APPLICATION, 2025-2030 (USD MILLION)

- TABLE 79 EDUCATION & ENTERTAINMENT: SMART ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 EDUCATION & ENTERTAINMENT: SMART ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 EDUCATION & ENTERTAINMENT: SMART ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 EDUCATION & ENTERTAINMENT: SMART ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 EDUCATION & ENTERTAINMENT: SMART ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 84 EDUCATION & ENTERTAINMENT: SMART ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 SMART ROBOTS MARKET, BY DOMESTIC APPLICATION, 2021-2024 (USD MILLION)

- TABLE 86 SMART ROBOTS MARKET, BY DOMESTIC APPLICATION, 2025-2030 (USD MILLION)

- TABLE 87 DOMESTIC: SMART ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 DOMESTIC: SMART ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 DOMESTIC: SMART ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 90 DOMESTIC: SMART ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 91 DOMESTIC: SMART ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 DOMESTIC: SMART ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 SMART ROBOTS MARKET, BY OTHER PERSONAL & DOMESTIC APPLICATION, 2021-2024 (USD MILLION)

- TABLE 94 SMART ROBOTS MARKET, BY OTHER PERSONAL & DOMESTIC APPLICATION, 2025-2030 (USD MILLION)

- TABLE 95 OTHER PERSONAL & DOMESTIC APPLICATIONS: SMART ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 OTHER PERSONAL & DOMESTIC APPLICATIONS: SMART ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 SMART ROBOTS MARKET, BY PROFESSIONAL APPLICATION, 2021-2024 (USD MILLION)

- TABLE 98 SMART ROBOTS MARKET, BY PROFESSIONAL APPLICATION, 2025-2030 (USD MILLION)

- TABLE 99 SMART ROBOTS MARKET, BY MILITARY & DEFENSE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 100 SMART ROBOTS MARKET, BY MILITARY & DEFENSE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 101 MILITARY & DEFENSE: SMART ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 MILITARY & DEFENSE: SMART ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 SMART ROBOTS MARKET, BY LAW ENFORCEMENT APPLICATION, 2021-2024 (USD MILLION)

- TABLE 104 SMART ROBOTS MARKET, BY LAW ENFORCEMENT APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 LAW ENFORCEMENT: SMART ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 LAW ENFORCEMENT: SMART ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 PUBLIC RELATIONS: SMART ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 PUBLIC RELATIONS: SMART ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 SMART ROBOTS MARKET, BY LOGISTICS MANAGEMENT APPLICATION, 2021-2024 (USD MILLION)

- TABLE 110 SMART ROBOTS MARKET, BY LOGISTICS MANAGEMENT APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111 LOGISTICS MANAGEMENT: SMART ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 LOGISTICS MANAGEMENT: SMART ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 LOGISTICS MANAGEMENT: SMART ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 LOGISTICS MANAGEMENT: SMART ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 115 LOGISTICS MANAGEMENT: SMART ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 LOGISTICS MANAGEMENT: SMART ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 SMART ROBOTS MARKET, BY INDUSTRIAL APPLICATION, 2021-2024 (USD MILLION)

- TABLE 118 SMART ROBOTS MARKET, BY INDUSTRIAL APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 INDUSTRIAL: SMART ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 120 INDUSTRIAL: SMART ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121 INSPECTION & MAINTENANCE: SMART ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 122 INSPECTION & MAINTENANCE: SMART ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 123 FIELD/AGRICULTURE: SMART ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 124 FIELD/AGRICULTURE: SMART ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 125 FIELD/AGRICULTURE: SMART ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 126 FIELD/AGRICULTURE: SMART ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 FIELD/AGRICULTURE: SMART ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 128 FIELD/AGRICULTURE: SMART ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 129 HEALTHCARE ASSISTANCE: SMART ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 130 HEALTHCARE ASSISTANCE: SMART ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 131 OTHER PROFESSIONAL APPLICATIONS: SMART ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 132 OTHER PROFESSIONAL APPLICATIONS: SMART ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 133 SMART ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 134 SMART ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135 SMART ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 136 SMART ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 137 SMART ROBOTS MARKET IN NORTH AMERICA, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 138 SMART ROBOTS MARKET IN NORTH AMERICA, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 139 SMART ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 SMART ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 SMART ROBOTS MARKET IN EUROPE, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 142 SMART ROBOTS MARKET IN EUROPE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 SMART ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 SMART ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 SMART ROBOTS MARKET IN ASIA PACIFIC, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 146 SMART ROBOTS MARKET IN ASIA PACIFIC, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 SMART ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 148 SMART ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 149 SMART ROBOTS MARKET IN ROW, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 150 SMART ROBOTS MARKET IN ROW, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 151 MIDDLE EAST: SMART ROBOTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 152 MIDDLE EAST: SMART ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 SMART ROBOTS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020-FEBRUARY 2025

- TABLE 154 SMART ROBOTS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 155 SMART ROBOTS MARKET: REGION FOOTPRINT

- TABLE 156 SMART ROBOTS MARKET: COMPONENT FOOTPRINT

- TABLE 157 SMART ROBOTS MARKET: TYPE FOOTPRINT

- TABLE 158 SMART ROBOTS MARKET: MOBILITY FOOTPRINT

- TABLE 159 SMART ROBOTS MARKET: APPLICATION FOOTPRINT

- TABLE 160 SMART ROBOTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 161 SMART ROBOTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 162 SMART ROBOTS MARKET: PRODUCT LAUNCHES, JANUARY 2020-FEBRUARY 2025

- TABLE 163 SMART ROBOTS MARKET: DEALS, JANUARY 2020-FEBRUARY 2025

- TABLE 164 IROBOT CORPORATION: COMPANY OVERVIEW

- TABLE 165 IROBOT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 IROBOT CORPORATION: PRODUCT LAUNCHES

- TABLE 167 SOFTBANK ROBOTICS GROUP: COMPANY OVERVIEW

- TABLE 168 SOFTBANK ROBOTICS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 SOFTBANK ROBOTICS GROUP: PRODUCT LAUNCHES

- TABLE 170 SOFTBANK ROBOTICS GROUP: DEALS

- TABLE 171 ABB: COMPANY OVERVIEW

- TABLE 172 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 ABB: PRODUCT LAUNCHES

- TABLE 174 ABB: DEALS

- TABLE 175 ABB: EXPANSIONS

- TABLE 176 KUKA AG: COMPANY OVERVIEW

- TABLE 177 KUKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 KUKA AG: PRODUCT LAUNCHES

- TABLE 179 KUKA AG: DEALS

- TABLE 180 FANUC CORPORATION: COMPANY OVERVIEW

- TABLE 181 FANUC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 FANUC CORPORATION: PRODUCT LAUNCHES

- TABLE 183 FANUC CORPORATION: DEALS

- TABLE 184 FANUC CORPORATION: EXPANSIONS

- TABLE 185 FANUC CORPORATION: OTHER DEVELOPMENTS

- TABLE 186 YASKAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 187 YASKAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 YASKAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 189 YASKAWA ELECTRIC CORPORATION: DEALS

- TABLE 190 YASKAWA ELECTRIC CORPORATION: EXPANSIONS

- TABLE 191 AMAZON.COM, INC: COMPANY OVERVIEW

- TABLE 192 AMAZON.COM, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 AMAZON.COM, INC: PRODUCT LAUNCHES

- TABLE 194 HANSON ROBOTICS LTD.: COMPANY OVERVIEW

- TABLE 195 HANSON ROBOTICS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 HANSON ROBOTICS LTD.: DEALS

- TABLE 197 BLUE FROG ROBOTICS: COMPANY OVERVIEW

- TABLE 198 BLUE FROG ROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 KONGSBERG MARITIME: COMPANY OVERVIEW

- TABLE 200 KONGSBERG MARITIME: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 KONGSBERG MARITIME: DEALS

List of Figures

- FIGURE 1 SMART ROBOTS MARKET SEGMENTATION

- FIGURE 2 SMART ROBOTS MARKET: RESEARCH DESIGN

- FIGURE 3 SMART ROBOTS MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 4 SMART ROBOTS MARKET: BOTTOM-UP APPROACH

- FIGURE 5 SMART ROBOTS MARKET: TOP-DOWN APPROACH

- FIGURE 6 SMART ROBOTS MARKET: DATA TRIANGULATION

- FIGURE 7 SMART ROBOTS MARKET: RESEARCH ASSUMPTIONS

- FIGURE 8 SMART ROBOTS MARKET: RESEARCH LIMITATIONS

- FIGURE 9 SERVICE ROBOTS TO DOMINATE SMART ROBOTS MARKET IN 2025

- FIGURE 10 HARDWARE SEGMENT TO ACCOUNT FOR LARGER SHARE OF SMART ROBOTS MARKET IN 2025

- FIGURE 11 PROFESSIONAL APPLICATIONS TO ACCOUNT FOR PROMINENT MARKET SHARE IN 2030

- FIGURE 12 GROUND ROBOTS TO HOLD MAJORITY OF MARKET SHARE IN 2025

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR SMART ROBOTS DURING FORECAST PERIOD

- FIGURE 14 RISING INTEGRATION OF IOT INTO ROBOTS FOR COST-EFFICIENT PREDICTIVE MAINTENANCE TO BOOST DEMAND FOR SMART ROBOTS

- FIGURE 15 MOBILE ROBOTS TO CAPTURE LARGER MARKET SHARE THAN STATIONARY ROBOTS IN 2030

- FIGURE 16 SERVICE ROBOTS TO HOLD LARGER MARKET SHARE THAN INDUSTRIAL ROBOTS IN 2030

- FIGURE 17 PROFESSIONAL APPLICATIONS TO EXHIBIT HIGHER CAGR THAN PERSONAL & DOMESTIC APPLICATIONS DURING FORECAST PERIOD

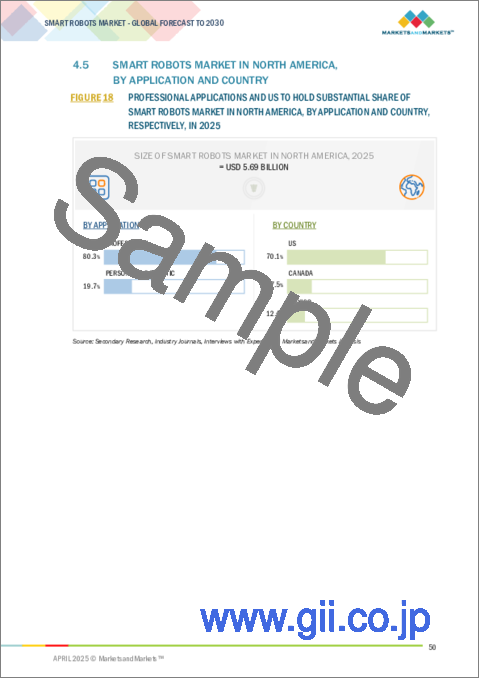

- FIGURE 18 PROFESSIONAL APPLICATIONS AND US TO HOLD SUBSTANTIAL SHARE OF SMART ROBOTS MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY, RESPECTIVELY, IN 2025

- FIGURE 19 CHINA TO RECORD HIGHEST CAGR IN GLOBAL SMART ROBOTS MARKET FROM 2025 TO 2030

- FIGURE 20 SMART ROBOTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 ROBOT DENSITY IN MANUFACTURING INDUSTRY, BY COUNTRY, 2023

- FIGURE 22 SMART ROBOTS MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 23 SMART ROBOTS MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 24 SMART ROBOTS MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 25 SMART ROBOTS MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 26 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 27 AVERAGE SELLING PRICE TREND OF DOMESTIC ROBOTS, BY REGION, 2021-2024

- FIGURE 28 SMART ROBOTS VALUE CHAIN ANALYSIS

- FIGURE 29 SMART ROBOTS ECOSYSTEM ANALYSIS

- FIGURE 30 INVESTMENT AND FUNDING IN SMART ROBOT TECHNOLOGY, 2023-2024 (USD BILLION)

- FIGURE 31 NUMBER OF PATENTS GRANTED EVERY YEAR, 2013-2023

- FIGURE 32 IMPORT SCENARIO FOR HS CODE 847950-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2019-2023

- FIGURE 33 EXPORT SCENARIO FOR HS CODE 847950-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2019-2023

- FIGURE 34 SMART ROBOTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- FIGURE 36 KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 37 IMPACT OF AI/GENERATIVE AI ON SMART ROBOTS MARKET

- FIGURE 38 SMART ROBOTS MARKET FOR SOFTWARE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 PIEZOELECTRIC ACTUATORS TO REGISTER HIGHEST CAGR IN SMART ROBOTS MARKET FOR HARDWARE DURING FORECAST PERIOD

- FIGURE 40 INDUSTRIAL ROBOTS TO EXHIBIT HIGHER CAGR IN SOFTWARE MARKET FOR SMART ROBOTS DURING FORECAST PERIOD

- FIGURE 41 INDUSTRIAL ROBOTS SEGMENT TO REGISTER HIGHER CAGR, IN TERMS OF VALUE, DURING FORECAST PERIOD

- FIGURE 42 SOFTWARE SEGMENT TO WITNESS HIGHER CAGR IN SMART INDUSTRIAL ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 43 MOBILE ROBOTS TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 44 SMART GROUND ROBOTS TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 45 SMART UNDERWATER ROBOTS MARKET FOR INSPECTION & MAINTENANCE APPLICATIONS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 46 PROFESSIONAL APPLICATIONS TO LEAD SMART ROBOTS MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 47 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN SMART ROBOTS MARKET FOR EDUCATION & ENTERTAINMENT APPLICATIONS DURING FORECAST PERIOD

- FIGURE 48 LOGISTICS MANAGEMENT SEGMENT TO CAPTURE PROMINENT MARKET SHARE OF PROFESSIONAL APPLICATIONS IN 2030

- FIGURE 49 SMART ROBOTS MARKET FOR LAW ENFORCEMENT APPLICATIONS IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN SMART ROBOTS MARKET FOR INSPECTION & MAINTENANCE APPLICATIONS DURING FORECAST PERIOD

- FIGURE 51 NORTH AMERICA TO HOLD LARGEST SHARE OF SMART ROBOTS MARKET FOR HEALTHCARE ASSISTANCE APPLICATIONS IN 2030

- FIGURE 52 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 53 NORTH AMERICA: SMART ROBOTS MARKET SNAPSHOT

- FIGURE 54 EUROPE: SMART ROBOTS MARKET SNAPSHOT

- FIGURE 55 ASIA PACIFIC: SMART ROBOTS MARKET SNAPSHOT

- FIGURE 56 SMART ROBOTS MARKET: REVENUE ANALYSIS OF FOUR KEY PLAYERS, 2022-2024

- FIGURE 57 MARKET SHARE ANALYSIS OF COMPANIES OFFERING SMART ROBOTS, 2024

- FIGURE 58 COMPANY VALUATION

- FIGURE 59 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 60 BRAND COMPARISON

- FIGURE 61 SMART ROBOTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 62 SMART ROBOTS MARKET: COMPANY FOOTPRINT

- FIGURE 63 SMART ROBOTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 64 IROBOT CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 ABB: COMPANY SNAPSHOT

- FIGURE 66 KUKA AG: COMPANY SNAPSHOT

- FIGURE 67 FANUC CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 AMAZON.COM, INC: COMPANY SNAPSHOT

- FIGURE 70 KONGSBERG MARITIME: COMPANY SNAPSHOT

The global smart robots market is expected to grow from USD 16.20 billion in 2025 to USD 42.80 billion by 2030 at a CAGR of 21.5% from 2025 to 2030. This growth is driven by rising demand for automation to boost productivity, reduce costs, and enhance efficiency. Smart robots enable precise, consistent execution of complex tasks in sectors, such as logistics, where they assist in inventory and delivery and healthcare, support patient monitoring, medication dispensing, and surgeries, and address both labor shortages and the need for accuracy.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, Type, Operating Environment, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Software component segment is expected to hold largest market share during the forecast period."

Smart robot software is crucial for enabling intelligence, autonomy, and adaptability. Unlike traditional robots with fixed programs, smart robots use advanced software to process sensory data, make real-time decisions, interact with their environment, and learn from experience. Technologies like AI, machine learning, natural language processing, and computer vision drive these capabilities, allowing robots to perform object recognition and navigation tasks. The demand for specialized software platforms grows as smart robots are increasingly adopted in industries like manufacturing, healthcare, and logistics. Software updates enhance performance without hardware replacement, emphasizing the importance of customization and smart decision-making.

"Industrial robots segment is projected to witness highest CAGR in smart robots market."

The industrial robots segment is likely to exhibit the highest CAGR in the smart robots market during the forecast period, driven by rising automation in manufacturing. Industries such as automotive, electronics, and food & beverage adopt smart robots to enhance efficiency and accuracy and reduce costs. Unlike traditional robots, smart industrial robots use AI, ML, and computer vision to perform complex tasks, adapt to changing environments, and work alongside humans. The shift toward Industry 4.0, labor shortages, and demand for 24/7 operations further fuel this growth.

"China is expected to hold the largest market share in 2030."

China will dominate the Asia Pacific smart robots market during the forecast period due to rapid industrialization, tech advancements, and robust government assistance for robotics and automation. As the world's largest manufacturing hub, China is increasingly adopting smart robots to boost efficiency and cut labor costs in sectors like automotive, electronics, logistics, healthcare, and agriculture. Government initiatives such as "Made in China 2025" and the AI Development Plan promote AI integration and robotics innovation. An aging population is also driving demand for smart service robots in healthcare and elderly care.

Extensive primary interviews were conducted with key industry experts in the smart robots market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The break-up of primary participants for the report has been shown below: The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Managers - 40%, Directors - 40%, and Others - 20%

- By Region: North America - 40%, Europe - 30%, Asia Pacific - 20%, and RoW - 10%

iRobot Corporation (US), SoftBank Robotics Group (Japan), ABB (Switzerland), KUKA AG (Germany), FANUC CORPORATION (Japan), YASKAWA ELECTRIC CORPORATION (Japan), Amazon.com, Inc. (US), Hanson Robotics Ltd. (US), Blue Frog Robotics (France), and Kongsberg Maritime (Norway) are some of the key players in the smart robots market.

Research Coverage: This research report categorizes the smart robots market based on component (hardware, software), type (service robots, industrial robots), mobility (stationary, mobile), operating environment (ground, underwater), application (personal & domestic, professional), and region (North America, Asia Pacific, Europe, and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the smart robots market and forecasts the same till 2030. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the smart robots ecosystem.

Key Benefits of Buying the Report The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall smart robots market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (growing adoption of AI- and advanced sensor technology-enabled robots in newer applications, rising deployment of IoT-integrated robots to ensure cost-efficient predictive maintenance, increasing government investments in advanced robotics development, surging demand for automation in manufacturing to improve productivity and reduce human errors), restraints (data privacy and cybersecurity concerns and lack of standardized regulatory framework, workforce resistance due to job displacement concerns), opportunities (growing adoption of smart robots for elderly care, disability assistance, and companionship, rising demand for cobots in human-robot work environments), and challenges (technical and environmental barriers restricting deployment in critical applications) influencing the growth of the smart robots market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the smart robots market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the smart robots market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the smart robots market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as iRobot Corporation (US), SoftBank Robotics Group (Japan), ABB (Switzerland), KUKA AG (Germany), and FANUC CORPORATION (Japan), in the smart robots market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE MARKET OPPORTUNITIES IN SMART ROBOTS MARKET

- 4.2 SMART ROBOTS MARKET, BY MOBILITY

- 4.3 SMART ROBOTS MARKET, BY TYPE

- 4.4 SMART ROBOTS MARKET, BY APPLICATION

- 4.5 SMART ROBOTS MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY

- 4.6 SMART ROBOTS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of AI- and advanced sensor technology-enabled robots in newer applications

- 5.2.1.2 Rising deployment of IoT-integrated robots to ensure cost-efficient predictive maintenance

- 5.2.1.3 Increasing government investments in advanced robotics development

- 5.2.1.4 Surging demand for automation in manufacturing to improve productivity and reduce human errors

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data privacy and cybersecurity concerns and lack of standardized regulatory framework

- 5.2.2.2 Workforce resistance due to job displacement concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of smart robots for elderly care, disability assistance, and companionship

- 5.2.3.2 Advancements in swarm intelligence enabling robots to execute complex tasks with ease

- 5.2.3.3 Rising demand for cobots in human-robot work environments

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical and environmental barriers restricting deployment in critical applications

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICING OF SMART ROBOTS OFFERED FOR DOMESTIC APPLICATIONS, BY KEY PLAYER 2024 (USD)

- 5.4.2 INDICATIVE PRICING OF SMART ROBOTS OFFERED FOR DIFFERENT APPLICATIONS, BY KEY PLAYER, 2024 (USD)

- 5.4.3 AVERAGE SELLING PRICE TREND OF DOMESTIC ROBOTS, BY REGION, 2021-2024 (USD)

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Artificial intelligence and machine learning

- 5.8.1.2 Robotics operating system

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Telepresence

- 5.8.2.2 Human-machine interface

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 IoT

- 5.8.3.2 Cloud computing

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 847950)

- 5.10.2 EXPORT SCENARIO (HS CODE 847950)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITION RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GENERATIVE AI ON SMART ROBOTS MARKET

6 SMART ROBOTS MARKET, BY COMPONENT

- 6.1 INTRODUCTION

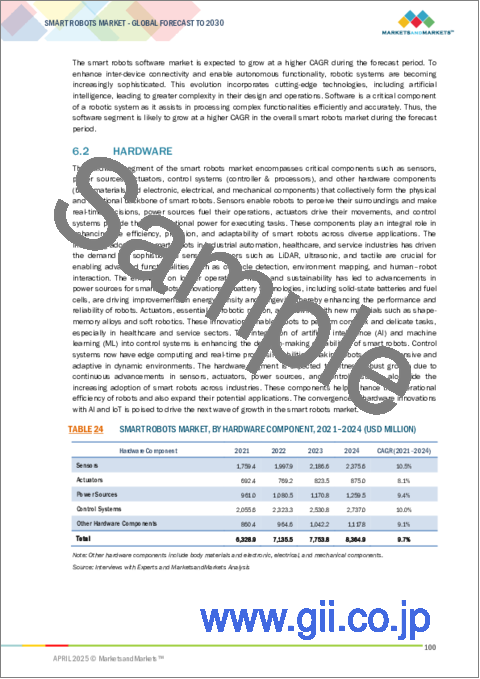

- 6.2 HARDWARE

- 6.2.1 SENSORS

- 6.2.1.1 Gyroscopes

- 6.2.1.1.1 Enhanced motion control, stability, safety, and collision avoidance features to boost demand

- 6.2.1.2 Microphones

- 6.2.1.2.1 Ability to process, analyze, and interpret acoustic environments with remarkable precision to fuel adoption

- 6.2.1.3 Accelerometers

- 6.2.1.3.1 Elevating demand for advanced robotic systems with enhanced navigation and motion control capabilities to support segmental growth

- 6.2.1.4 Tilt sensors

- 6.2.1.4.1 Necessity to optimize robot position, motion, and stability to foster segmental growth

- 6.2.1.5 Force/Torque sensors

- 6.2.1.5.1 Development of autonomous humanoid robots capable of navigating complex environments to contribute to market growth

- 6.2.1.6 Position sensors

- 6.2.1.6.1 Rising demand for surgical and telepresence robots to create growth opportunities

- 6.2.1.7 Vision/Image sensors

- 6.2.1.7.1 Ability to facilitate 2D and 3D image sensing in visible and nonvisible spectra to accelerate market growth

- 6.2.1.8 Other sensor types

- 6.2.1.1 Gyroscopes

- 6.2.2 ACTUATORS

- 6.2.2.1 Electrical

- 6.2.2.1.1 High energy efficiency, safety, sustainability, and eco-friendliness features to spur demand

- 6.2.2.2 Pneumatic

- 6.2.2.2.1 Ability to facilitate linear movement in robots and need for minimal maintenance to drive market

- 6.2.2.3 Hydraulic

- 6.2.2.3.1 Excellence in tasks requiring high force, speed, and precision to stimulate segmental growth

- 6.2.2.4 Piezoelectric

- 6.2.2.4.1 Capability to provide active and passive vibration suppression for high-performance robots to increase demand

- 6.2.2.5 Ultrasonic

- 6.2.2.5.1 Surging requirement for high-speed robotics in assembly lines and pick-and-place tasks to foster segmental growth

- 6.2.2.1 Electrical

- 6.2.3 POWER SOURCES

- 6.2.3.1 Significant focus on developing miniature robots for specialized tasks to facilitate adoption

- 6.2.4 CONTROL SYSTEMS

- 6.2.4.1 Processors

- 6.2.4.1.1 Increasing deployment of AI and ML algorithms in smart robots to foster segmental growth

- 6.2.4.2 Controllers

- 6.2.4.2.1 Capacity to respond dynamically to environmental changes and manage real-time operations to drive demand

- 6.2.4.1 Processors

- 6.2.5 OTHER HARDWARE COMPONENTS

- 6.2.1 SENSORS

- 6.3 SOFTWARE

- 6.3.1 RISING FOCUS OF MARKET PLAYERS ON DEVELOPING APPLICATION-SPECIFIC AND ADVANCED ROBOTS TO STIMULATE DEMAND

7 SMART ROBOT MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 SERVICE ROBOTS

- 7.2.1 STRONG FOCUS OF MANUFACTURING FIRMS ON SAVING LABOR COSTS TO FUEL SEGMENTAL GROWTH

- 7.3 INDUSTRIAL ROBOTS

- 7.3.1 EMPHASIS ON IMPROVING WORKPLACE SAFETY AND PRODUCTION EFFICIENCY TO FOSTER SEGMENTAL GROWTH

8 SMART ROBOTS MARKET, BY MOBILITY

- 8.1 INTRODUCTION

- 8.2 MOBILE

- 8.2.1 ABILITY TO HANDLE ERGONOMICALLY CHALLENGING TASKS AND OFFER CONSISTENT PERFORMANCE TO SPIKE DEMAND

- 8.3 STATIONARY

- 8.3.1 CAPACITY TO HANDLE DELICATE OR HAZARDOUS MATERIAL AND WORK CONTINUOUSLY WITHOUT FATIGUE TO DRIVE DEMAND

9 SMART ROBOT MARKET, BY OPERATING ENVIRONMENT

- 9.1 INTRODUCTION

- 9.2 GROUND

- 9.2.1 EXCELLENCE OF AI-POWERED AGVS IN OPTIMIZING SAFETY AND PERFORMANCE TO BOOST DEMAND

- 9.3 UNDERWATER

- 9.3.1 SURGING USE IN OIL & GAS EXPLORATION, PIPELINE INSPECTION, AND DEFENSE & MILITARY APPLICATIONS TO DRIVE MARKET

10 SMART ROBOTS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 PERSONAL & DOMESTIC

- 10.2.1 COMPANIONSHIP

- 10.2.1.1 Increasing need for emotional support and assistance in domestic and healthcare environments to drive market

- 10.2.2 EDUCATION & ENTERTAINMENT

- 10.2.2.1 Smart toys

- 10.2.2.1.1 Rising adoption of redefined methods of learning to support market growth

- 10.2.2.2 Robotic pets

- 10.2.2.2.1 Growing trend of urban families opting for virtual pets due to space and lifestyle constraints

- 10.2.2.1 Smart toys

- 10.2.3 DOMESTIC

- 10.2.3.1 Vacuum & floor cleaning

- 10.2.3.1.1 Surging demand for revolutionizing cleaning tools to drive market

- 10.2.3.2 Lawn mowing

- 10.2.3.2.1 Growing automation and low-maintenance home solutions to foster market growth

- 10.2.3.3 Pool cleaning

- 10.2.3.3.1 Increasing ownership of private pools to aid market growth

- 10.2.3.1 Vacuum & floor cleaning

- 10.2.4 OTHER PERSONAL & DOMESTIC APPLICATIONS

- 10.2.4.1 Elderly & disability assistance

- 10.2.4.1.1 Rising chronic diseases in older age and ability to aid people with disabilities in daily activities to drive adoption

- 10.2.4.2 Home security & surveillance

- 10.2.4.2.1 Increasing home security concerns to propel demand

- 10.2.4.1 Elderly & disability assistance

- 10.2.1 COMPANIONSHIP

- 10.3 PROFESSIONAL

- 10.3.1 MILITARY & DEFENSE

- 10.3.1.1 Spying

- 10.3.1.1.1 Increased deployment of micro-drones in high-risk surveillance operations to support market growth

- 10.3.1.2 Search & rescue operations

- 10.3.1.2.1 Ability to perform real-time mapping, victim detection, and environmental monitoring at faster rate to propel segmental growth

- 10.3.1.3 Border security

- 10.3.1.3.1 Increased cross-border threats and geopolitical instability to boost adoption

- 10.3.1.4 Combat operations

- 10.3.1.4.1 Pressing need for asymmetric warfare strategies, counterterrorism efforts, and border protection to foster adoption

- 10.3.1.1 Spying

- 10.3.2 LAW ENFORCEMENT

- 10.3.2.1 Patrolling

- 10.3.2.1.1 Multilinguality and ability to read facial expressions to facilitate demand

- 10.3.2.2 Riot control

- 10.3.2.2.1 Integration of non-lethal technology to ensure public safety to boost demand

- 10.3.2.1 Patrolling

- 10.3.3 PUBLIC RELATIONS

- 10.3.3.1 Redefining engagement and enhancing public relations to contribute to market growth

- 10.3.3.2 Reception management

- 10.3.3.3 Tour guidance

- 10.3.3.4 Telepresence

- 10.3.4 LOGISTICS MANAGEMENT

- 10.3.4.1 Pick & place

- 10.3.4.1.1 Significant focus on minimizing workers' walking time in warehouses to augment demand

- 10.3.4.2 Sorting

- 10.3.4.2.1 Need to improve order accuracy and delivery speed to accelerate deployment

- 10.3.4.1 Pick & place

- 10.3.5 INDUSTRIAL

- 10.3.5.1 Manufacturing

- 10.3.5.1.1 Ability to perform packaging & palletizing, bin-picking, and machine tending tasks to stimulate demand

- 10.3.5.2 Material handling

- 10.3.5.2.1 Requirement to move production materials from one location to another to drive adoption

- 10.3.5.1 Manufacturing

- 10.3.6 INSPECTION & MAINTENANCE

- 10.3.6.1 Escalating use to carry out hazardous tasks in hard-to-reach areas to contribute to market growth

- 10.3.7 FIELD/AGRICULTURE

- 10.3.7.1 Elevating demand for robots in crop monitoring, plant scouting, and milking livestock applications to foster market growth

- 10.3.8 HEALTHCARE ASSISTANCE

- 10.3.8.1 Aging population and emergence of telemedicine applications to create opportunities

- 10.3.9 OTHER PROFESSIONAL APPLICATIONS

- 10.3.1 MILITARY & DEFENSE

11 SMART ROBOTS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.2 US

- 11.2.2.1 Surging demand for smart robots across various industries to drive market

- 11.2.3 CANADA

- 11.2.3.1 Increasing adoption of smart robots in healthcare sector to support market growth

- 11.2.4 MEXICO

- 11.2.4.1 Rising deployment of automation in manufacturing sector to fuel market growth

- 11.3 EUROPE

- 11.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.2 GERMANY

- 11.3.2.1 Rapid transition toward electric and hybrid vehicles to contribute to market growth

- 11.3.3 ITALY

- 11.3.3.1 Emergence of nation as hub for innovations in robotics to create lucrative opportunities

- 11.3.4 SPAIN

- 11.3.4.1 Robust industrial base to boost demand

- 11.3.5 FRANCE

- 11.3.5.1 Significant investments in EV and hybrid vehicle manufacturing to foster market growth

- 11.3.6 UK

- 11.3.6.1 Rising investments in AI-integrated robotics to drive market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.2 CHINA

- 11.4.2.1 Strong emphasis on increasing domestic production to augment market growth

- 11.4.3 SOUTH KOREA

- 11.4.3.1 Rising use of smart robots in manufacturing and healthcare sectors to accelerate market growth

- 11.4.4 JAPAN

- 11.4.4.1 Increasing initiatives toward elderly assistance to boost adoption

- 11.4.5 INDIA

- 11.4.5.1 Rapidly evolving technological landscape to boost demand

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 ROW: MACROECONOMIC OUTLOOK

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Rising healthcare investments in surgical precision and patient care to accelerate adoption

- 11.5.3 MIDDLE EAST

- 11.5.3.1 Growing establishment of manufacturing units and free trade zones to drive market

- 11.5.3.2 GCC

- 11.5.3.3 Rest of Middle East

- 11.5.4 AFRICA

- 11.5.4.1 Increased investment in robotics and regional trade partnerships to contribute to market growth

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 FINANCIAL METRICS

- 12.7 BRAND COMPARISON

- 12.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.8.1 STARS

- 12.8.2 EMERGING LEADERS

- 12.8.3 PERVASIVE PLAYERS

- 12.8.4 PARTICIPANTS

- 12.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.8.5.1 Company footprint

- 12.8.5.2 Region footprint

- 12.8.5.3 Component footprint

- 12.8.5.4 Type footprint

- 12.8.5.5 Mobility footprint

- 12.8.5.6 Application footprint

- 12.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.9.1 PROGRESSIVE COMPANIES

- 12.9.2 RESPONSIVE COMPANIES

- 12.9.3 DYNAMIC COMPANIES

- 12.9.4 STARTING BLOCKS

- 12.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.9.5.1 Detailed list of key startups/SMEs

- 12.9.5.2 Competitive benchmarking of key startups/SMEs

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT LAUNCHES

- 12.10.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 IROBOT CORPORATION

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 SOFTBANK ROBOTICS GROUP

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 ABB

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 KUKA AG

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 FANUC CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Expansions

- 13.1.5.3.4 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 YASKAWA ELECTRIC CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.6.3.3 Expansions

- 13.1.6.4 MnM view

- 13.1.6.4.1 Key strengths/Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses/Competitive threats

- 13.1.7 AMAZON.COM, INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 HANSON ROBOTICS LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 BLUE FROG ROBOTICS

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 KONGSBERG MARITIME

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.1 IROBOT CORPORATION

- 13.2 OTHER PLAYERS

- 13.2.1 UNIVERSAL ROBOTS A/S

- 13.2.2 ECA GROUP

- 13.2.3 DELAVAL

- 13.2.4 INTUITIVE SURGICAL

- 13.2.5 NEATO ROBOTICS, INC.

- 13.2.6 GENERAL DYNAMICS MISSION SYSTEMS, INC.

- 13.2.7 RETHINK ROBOTICS

- 13.2.8 AETHON, INC.

- 13.2.9 SAMSUNG

- 13.2.10 GECKOSYSTEMS

- 13.2.11 SMART ROBOTICS

- 13.2.12 RAPID ROBOTICS

- 13.2.13 ANYBOTICS

- 13.2.14 SOTA ROBOTICS (HK) LIMITED

- 13.2.15 VECNA ROBOTICS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS