|

|

市場調査レポート

商品コード

1698624

客室管理システムの世界市場:航空機タイプ別、ソリューション別、エンドユーザー別、地域別 - 2029年までの予測Cabin Management System Market by Solution (Cabin Management Unit and Servers, Crew & Passenger Control Units, Network & Connectivity, Audio/Video System Units, Cabin Management Software), Aircraft Type, End User - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 客室管理システムの世界市場:航空機タイプ別、ソリューション別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2025年04月02日

発行: MarketsandMarkets

ページ情報: 英文 249 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

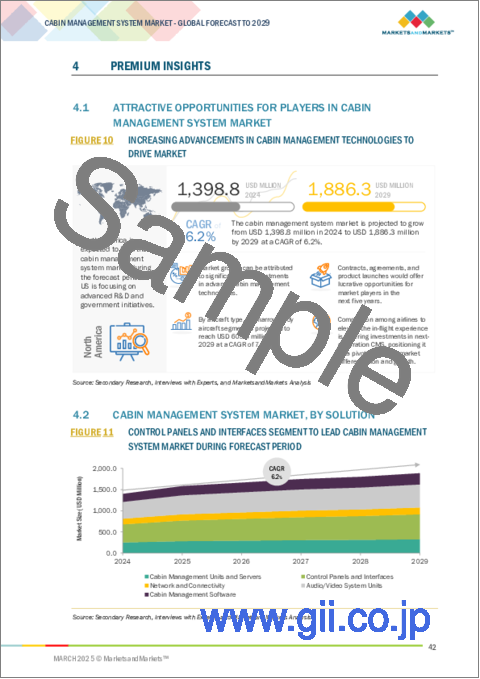

客室管理システムの市場規模は、2024年の13億9,000万米ドルから2029年には18億8,000万米ドルに成長し、2024年から2029年までのCAGRは6.2%と予測されています。

技術の進歩と市場環境の変化に伴い、客室管理システム(CMS)は急速に航空機内装の重要な促進要因になりつつあります。航空会社/運航会社は、カスタマイズ可能な客室環境、質の高い接続性、エンターテインメント、快適性、安全性が効果的に交差する充実した機内体験を通じて、より良い旅客体験を提供することに関心を寄せています。乗客の期待の高まり、既存の航空機の近代化、運航効率の向上が、この需要を後押ししています。新しい航空機が新しいCMSソリューションを搭載して納入され、既存の航空機が改修処置を受けるにつれて、CMS市場は、新しい機内体験を提供する、より包括的でデータ駆動型の直感的な客室管理システムへと移行しつつあります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 航空機タイプ別、ソリューション別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

航空機タイプ別では、客室管理システム市場はナローボディ、ワイドボディ、地域輸送、ビジネスジェットに分類されます。ナローボディ機は、世界的に飛行している航空機の数が多く、フルサービスキャリアとローコストキャリアの両方からの利用が多いことから、客室管理システムの市場規模は2番目に大きいと予想されます。ナローボディ機は、短距離から中距離まで段階的に航空路線を運航する上で重要な役割を担っており、一部の航空会社は、古いナローボディ機を新しいCMS技術(接続性の向上、新しいデジタル・インターフェース、エネルギー効率)で改修し、運航効率と乗客体験を向上させようとしています。レガシー機を新型CMSにアップグレードするための合理的なコストは、ナローボディ用に設計されたスケーラブルで非常にモジュール化されたCMSソリューションと相まって、この市場セグメントにおいて航空会社を将来に向けてより有利に位置づけるための投資を刺激しています。

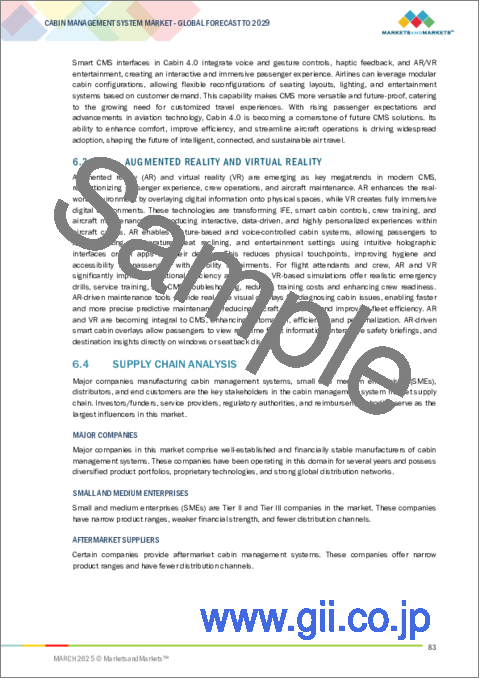

ソリューション別では、市場はさらに客室管理ユニットとサーバー、コントロールパネルとインターフェース、ネットワークと接続性、オーディオ/ビデオシステムユニット、客室管理ソフトウェアに区分されます。オーディオ/ビデオ・システム・ユニット市場は、高品質で没入感のある機内エンターテインメント体験に対する需要の高まりにより、客室管理システムの中で2番目に高い市場シェアを持つと推定されます。乗客がアクセスしやすく多様なデジタル・メディアを利用することを期待する中、航空会社はより良い画質、音質、双方向性を提供するオーディオ/ビデオ・オプションを強化することが求められています。古いシステムを新しい統合型双方向オーディオ・ビデオ・システムに置き換えることに加え、オーディオ・ビデオ業界は、最新のディスプレイとメディア・サーバーを含めることで、新しい航空機のアップグレードに貢献しています。航空機の改修は重要であるが、接続性と高解像度コンテンツの継続的な改善、およびインタラクティブ・スクリーンの採用によって生まれる機会は、オーディオ/ビデオ・システムを客室の近代化プロセスにとって重要なものとしてさらに確立すると思われます。

欧州は、厳格な要件を備えた重要な航空市場のため、客室管理システム市場が2番目に大きくなると予想されています。欧州の航空会社は最新型機からレガシー機まで様々な機材を保有しているが、それでも安全性、環境、乗客の快適性の仕様に対応するためにCMSの見直しが必要です。加えて、欧州の包括的なMRO能力と高度な技術エコシステムは、CMSを効率を最適化しダウンタイムを削減する手段として位置付けています。欧州におけるCMS導入の主要な推進力のひとつは、現地のサプライヤーとOEMです。ルフトハンザテクニックのような企業は、最先端でありながら欧州市場のニーズに適応可能なシステムを提供することで、欧州のオペレーターを積極的にサポートしています。

当レポートでは、世界の客室管理システム市場について調査し、航空機タイプ別、ソリューション別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向と混乱

- バリューチェーン分析

- エコシステム分析

- 規制状況

- 貿易データ分析

- 主要な利害関係者と購入基準

- 使用事例分析

- 2025年の主な会議とイベント

- 価格分析

- 投資と資金調達のシナリオ

- マクロ経済見通し

- 総所有コスト

- ビジネスモデル

- テクノロジーロードマップ

- 技術分析

- 部品表

- 生成AIの影響

- 客室管理システムの主な機能

- 運用データ

第6章 業界動向

- イントロダクション

- 技術動向

- メガ動向の影響

- サプライチェーン分析

- 特許分析

第7章 客室管理システム市場、航空機タイプ別

- イントロダクション

- ナローボディ機

- ワイドボディ機

- 地域輸送航空機

- ビジネスジェット

第8章 客室管理システム市場、ソリューション別

- イントロダクション

- 客室管理ユニットとサーバー

- コントロールパネルとインターフェース

- ネットワークと接続性

- オーディオ/ビデオシステムユニット

- 客室管理ソフトウェア

第9章 客室管理システム市場、エンドユーザー別

- イントロダクション

- ラインフィット

- 改造

第10章 客室管理システム市場、地域別

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- フランス

- ドイツ

- イタリア

- スペイン

- その他

- アジア太平洋

- PESTLE分析

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他

- 中東

- PESTLE分析

- GCC諸国

- その他

- ラテンアメリカ

- PESTLE分析

- ブラジル

- メキシコ

- その他

- アフリカ

- PESTLE分析

- 南アフリカ

- エジプト

- その他

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 客室管理システム市場の収益分析、2020年~2023年

- 客室管理システム市場シェア分析、2023年

- 客室管理システム市場:企業評価マトリックス(主要企業)、2023年

- 客室管理システム市場:企業評価マトリックス(スタートアップ/中小企業)、2023年

- ブランド/製品比較

- 企業評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- RTX

- HONEYWELL INTERNATIONAL INC.

- AIRBUS

- DIEHL STIFTUNG & CO. KG

- LUFTHANSA TECHNIK

- ASTRONICS CORPORATION

- ROSEN AVIATION, LLC

- DPI LABS, INC.

- BAE SYSTEMS

- HEADS UP TECHNOLOGIES

- CABIN MANAGEMENT SOLUTIONS, LLC(CMS)

- IDAIR GMBH

- DONICA AVIATION ENGINEERING CO., LTD

- HAVELSAN INC.

- PANASONIC CORPORATION

- その他の企業

- AEROSENS

- REDIMEC S.A.

- DUNCAN AVIATION INC.

- PERFORMANCE SOFTWARE CORPORATION

- TQ GROUP

- MECAER AVIATION GROUP(MAG)

- C&L AVIATION GROUP

- BURRANA

- SPIRIT AERONAUTICS

- FLIGHTSTAR

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2023

- TABLE 2 CABIN MANAGEMENT SYSTEM MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 3 AIRBUS AIRCRAFT DELIVERIES, 2023-2024

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 IMPORT DATA FOR HS CODE 8802, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR HS CODE 8801 OR 8802, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP 2 AIRCRAFT TYPES (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP 2 AIRCRAFT TYPES

- TABLE 14 CABIN MANAGEMENT SYSTEM MARKET: KEY CONFERENCES AND EVENTS, 2025

- TABLE 15 COMPARISON BETWEEN BUSINESS MODELS

- TABLE 16 BILL OF MATERIALS ANALYSIS FOR CABIN MANAGEMENT SYSTEMS

- TABLE 17 ACTIVE FLEETS, BY AIRCRAFT TYPE, 2020-2024

- TABLE 18 LIST OF MAJOR PATENTS FOR CABIN MANAGEMENT SYSTEMS, 2023-2024

- TABLE 19 CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 20 CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 21 CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 22 CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 23 ADVANCED CABIN MANAGEMENT UNITS BY CABIN MANAGEMENT SOLUTIONS, LLC (CMS)

- TABLE 24 BAE SYSTEMS' NETWORK ATTACHED STORAGE (NAS)

- TABLE 25 HEADS UP TECHNOLOGIES' I/O CONCENTRATORS

- TABLE 26 CONTROL PANELS AND INTERFACES: CABIN MANAGEMENT SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 27 CONTROL PANELS AND INTERFACES: CABIN MANAGEMENT SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 28 DIEHL STIFTUNG & CO. KG'S FLIGHT ATTENDANT PANEL

- TABLE 29 BAE SYSTEMS' ATTENDANT CONTROL PANEL (ACP)

- TABLE 30 COLLINS AEROSPACE'S TOUCH-SCREEN CONTROL SWITCH

- TABLE 31 ASTRONICS CORPORATION'S KEYBOARD TOUCH SCREEN-4

- TABLE 32 BAE SYSTEMS' NETWORK SWITCH

- TABLE 33 ASTRONICS CORPORATION'S AVENIR SYSTEM

- TABLE 34 DIEHL STIFTUNG & CO. KG'S INPUT / OUTPUT DISTRIBUTION NODES

- TABLE 35 ELITE HD AUDIO/VIDEO SYSTEM BY CABIN MANAGEMENT SOLUTIONS, LLC (CMS)

- TABLE 36 AEROSENS' CMS 2000

- TABLE 37 ASTRONICS CORPORATION'S SMART APPS

- TABLE 38 CABIN MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 39 CABIN MANAGEMENT SYSTEM MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 40 CABIN MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 41 CABIN MANAGEMENT SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 NORTH AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 43 NORTH AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 44 NORTH AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 45 NORTH AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 46 NORTH AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 47 NORTH AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 48 NORTH AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 49 NORTH AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 50 US: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 51 US: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 52 US: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 53 US: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 54 CANADA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 55 CANADA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 56 CANADA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 57 CANADA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 58 EUROPE: CABIN MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 59 EUROPE: CABIN MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 60 EUROPE: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 61 EUROPE: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 62 EUROPE: CABIN MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 63 EUROPE: CABIN MANAGEMENT SYSTEM MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 64 EUROPE: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 65 EUROPE: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 66 UK: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 67 UK: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 68 UK: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 69 UK: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 70 FRANCE: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 71 FRANCE: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 72 FRANCE: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 73 FRANCE: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 74 GERMANY: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 75 GERMANY: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 76 GERMANY: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 77 GERMANY: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 78 ITALY: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 79 ITALY: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 80 ITALY: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 81 ITALY: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 82 SPAIN: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 83 SPAIN: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 84 SPAIN: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 85 SPAIN: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 86 REST OF EUROPE: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 87 REST OF EUROPE: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 88 REST OF EUROPE: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 89 REST OF EUROPE: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 90 ASIA PACIFIC: CABIN MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 91 ASIA PACIFIC: CABIN MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 92 ASIA PACIFIC: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 93 ASIA PACIFIC: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 94 ASIA PACIFIC: CABIN MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 95 ASIA PACIFIC: CABIN MANAGEMENT SYSTEM MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 96 ASIA PACIFIC: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 97 ASIA PACIFIC: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 98 CHINA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 99 CHINA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 100 CHINA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 101 CHINA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 102 INDIA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 103 INDIA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 104 INDIA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 105 INDIA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 106 JAPAN: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 107 JAPAN: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 108 JAPAN: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 109 JAPAN: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 110 SOUTH KOREA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 111 SOUTH KOREA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 112 SOUTH KOREA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 113 SOUTH KOREA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 114 AUSTRALIA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 115 AUSTRALIA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 116 AUSTRALIA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 117 AUSTRALIA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 118 REST OF ASIA PACIFIC: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 122 MIDDLE EAST: CABIN MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 123 MIDDLE EAST: CABIN MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 124 MIDDLE EAST: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 125 MIDDLE EAST: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 126 MIDDLE EAST: CABIN MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 127 MIDDLE EAST: CABIN MANAGEMENT SYSTEM MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 128 MIDDLE EAST: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 129 MIDDLE EAST: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 130 UAE: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 131 UAE: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 132 UAE: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 133 UAE: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 134 SAUDI ARABIA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 135 SAUDI ARABIA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 136 SAUDI ARABIA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 137 SAUDI ARABIA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 138 QATAR: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 139 QATAR: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 140 QATAR: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 141 QATAR: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 142 REST OF MIDDLE EAST: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 143 REST OF MIDDLE EAST: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 144 REST OF MIDDLE EAST: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 145 REST OF MIDDLE EAST: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 146 LATIN AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 147 LATIN AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 148 LATIN AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 149 LATIN AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 150 LATIN AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 151 LATIN AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 152 LATIN AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 153 LATIN AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 154 BRAZIL: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 155 BRAZIL: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 156 BRAZIL: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 157 BRAZIL: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 158 MEXICO: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 159 MEXICO: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 160 MEXICO: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 161 MEXICO: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 162 REST OF LATIN AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 163 REST OF LATIN AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 164 REST OF LATIN AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 165 REST OF LATIN AMERICA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 166 AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 167 AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 168 AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 169 AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 170 AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 171 AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 172 AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 173 AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 174 SOUTH AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 175 SOUTH AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 176 SOUTH AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 177 SOUTH AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 178 EGYPT: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 179 EGYPT: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 180 EGYPT: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 181 EGYPT: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 182 REST OF AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 183 REST OF AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE, 2024-2029 (USD MILLION)

- TABLE 184 REST OF AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 185 REST OF AFRICA: CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 186 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 187 CABIN MANAGEMENT SYSTEM MARKET: DEGREE OF COMPETITION

- TABLE 188 CABIN MANAGEMENT SYSTEM MARKET: SOLUTION FOOTPRINT

- TABLE 189 CABIN MANAGEMENT SYSTEM MARKET: END USER FOOTPRINT

- TABLE 190 CABIN MANAGEMENT SYSTEM MARKET: AIRCRAFT TYPE FOOTPRINT

- TABLE 191 CABIN MANAGEMENT SYSTEM MARKET: REGION FOOTPRINT

- TABLE 192 CABIN MANAGEMENT SYSTEM MARKET: LIST OF START-UPS/SMES

- TABLE 193 CABIN MANAGEMENT SYSTEM MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 194 CABIN MANAGEMENT SYSTEM MARKET: PRODUCT LAUNCHES, JANUARY 2020-OCTOBER 2024

- TABLE 195 CABIN MANAGEMENT SYSTEM MARKET: DEALS, JANUARY 2020-FEBRUARY 2025

- TABLE 196 CABIN MANAGEMENT SYSTEM MARKET: OTHERS, JANUARY 2020- FEBRUARY 2025

- TABLE 197 RTX: COMPANY OVERVIEW

- TABLE 198 RTX: PRODUCTS OFFERED

- TABLE 199 RTX: PRODUCT LAUNCHES

- TABLE 200 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 201 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 202 AIRBUS: COMPANY OVERVIEW

- TABLE 203 AIRBUS: PRODUCTS OFFERED

- TABLE 204 AIRBUS: DEALS

- TABLE 205 DIEHL STIFTUNG & CO. KG: COMPANY OVERVIEW

- TABLE 206 DIEHL STIFTUNG & CO. KG: PRODUCTS OFFERED

- TABLE 207 DIEHL STIFTUNG & CO. KG: DEALS

- TABLE 208 DIEHL STIFTUNG & CO. KG: EXPANSIONS

- TABLE 209 LUFTHANSA TECHNIK: COMPANY OVERVIEW

- TABLE 210 LUFTHANSA TECHNIK: PRODUCTS OFFERED

- TABLE 211 LUFTHANSA TECHNIK: DEALS

- TABLE 212 ASTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 213 ASTRONICS CORPORATION: PRODUCTS OFFERED

- TABLE 214 ASTRONICS CORPORATION: DEALS

- TABLE 215 ROSEN AVIATION, LLC: COMPANY OVERVIEW

- TABLE 216 ROSEN AVIATION, LLC: PRODUCTS OFFERED

- TABLE 217 ROSEN AVIATION, LLC: DEALS

- TABLE 218 DPI LABS, INC.: COMPANY OVERVIEW

- TABLE 219 DPI LABS, INC: PRODUCTS OFFERED

- TABLE 220 DPI LABS, INC: PRODUCT LAUNCHES

- TABLE 221 DPI LABS, INC.: DEALS

- TABLE 222 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 223 BAE SYSTEMS: PRODUCTS OFFERED

- TABLE 224 HEADS UP TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 225 HEADS UP TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 226 HEADS UP TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 227 HEADS UP TECHNOLOGIES: DEALS

- TABLE 228 CABIN MANAGEMENT SOLUTIONS, LLC (CMS): COMPANY OVERVIEW

- TABLE 229 CABIN MANAGEMENT SOLUTIONS, LLC (CMS): PRODUCTS OFFERED

- TABLE 230 IDAIR GMBH: COMPANY OVERVIEW

- TABLE 231 IDAIR GMBH: PRODUCTS OFFERED

- TABLE 232 DONICA AVIATION ENGINEERING CO., LTD: COMPANY OVERVIEW

- TABLE 233 DONICA AVIATION ENGINEERING CO., LTD: PRODUCTS OFFERED

- TABLE 234 HAVELSAN INC.: COMPANY OVERVIEW

- TABLE 235 HAVELSAN INC.: PRODUCTS OFFERED

- TABLE 236 PANASONIC CORPORATION: COMPANY OVERVIEW

- TABLE 237 PANASONIC CORPORATION: PRODUCTS OFFERED

- TABLE 238 PANASONIC CORPORATION: PRODUCT LAUNCHES

- TABLE 239 PANASONIC CORPORATION: DEALS

- TABLE 240 PANASONIC CORPORATION: EXPANSIONS

- TABLE 241 AEROSENS: COMPANY OVERVIEW

- TABLE 242 REDIMEC S.A.: COMPANY OVERVIEW

- TABLE 243 DUNCAN AVIATION INC.: COMPANY OVERVIEW

- TABLE 244 PERFORMANCE SOFTWARE CORPORATION: COMPANY OVERVIEW

- TABLE 245 TQ GROUP: COMPANY OVERVIEW

- TABLE 246 MECAER AVIATION GROUP (MAG): COMPANY OVERVIEW

- TABLE 247 C&L AVIATION GROUP: COMPANY OVERVIEW

- TABLE 248 BURRANA: COMPANY OVERVIEW

- TABLE 249 SPIRIT AERONAUTICS: COMPANY OVERVIEW

- TABLE 250 FLIGHTSTAR: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 CABIN MANAGEMENT SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 BUSINESS JETS SEGMENT TO LEAD CABIN MANAGEMENT SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 7 CONTROL PANELS AND INTERFACES SEGMENT TO LEAD CABIN MANAGEMENT SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 8 LINEFIT SEGMENT TO DOMINATE CABIN MANAGEMENT SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 9 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF CABIN MANAGEMENT SYSTEM MARKET IN 2024

- FIGURE 10 INCREASING ADVANCEMENTS IN CABIN MANAGEMENT TECHNOLOGIES TO DRIVE MARKET

- FIGURE 11 CONTROL PANELS AND INTERFACES SEGMENT TO LEAD CABIN MANAGEMENT SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 12 LINEFIT SEGMENT TO CAPTURE LARGER MARKET SHARE THAN RETROFIT SEGMENT DURING FORECAST PERIOD

- FIGURE 13 BUSINESS JETS SEGMENT TO LEAD CABIN MANAGEMENT SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 14 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 CABIN MANAGEMENT SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 GLOBAL BUSINESS TRAVEL SPENDING, 2020-2024 (USD BILLION)

- FIGURE 17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 18 VALUE CHAIN ANALYSIS

- FIGURE 19 ECOSYSTEM ANALYSIS

- FIGURE 20 IMPORT DATA FOR HS CODE 8802, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 21 EXPORT DATA FOR HS CODE 8801 OR 8802, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 AIRCRAFT TYPES

- FIGURE 23 KEY BUYING CRITERIA FOR TOP 2 AIRCRAFT TYPES

- FIGURE 24 INDICATIVE PRICING ANALYSIS, BY AIRCRAFT TYPE (USD MILLION)

- FIGURE 25 INDICATIVE PRICING ANALYSIS, BY REGION

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 27 TOTAL COST OF OWNERSHIP FOR CABIN MANAGEMENT SYSTEMS

- FIGURE 28 COMPARISON OF TOTAL COST OF OWNERSHIP FOR CABIN MANAGEMENT SYSTEMS, BY AIRCRAFT TYPE

- FIGURE 29 BUSINESS MODELS IN CABIN MANAGEMENT SYSTEM MARKET

- FIGURE 30 EVOLUTION OF TECHNOLOGY IN CABIN MANAGEMENT SYSTEM MARKET

- FIGURE 31 CABIN MANAGEMENT SYSTEM MARKET: TECHNOLOGY ROADMAP

- FIGURE 32 BILL OF MATERIALS FOR CABIN MANAGEMENT SYSTEMS

- FIGURE 33 ADOPTION OF AI IN AVIATION BY TOP COUNTRIES

- FIGURE 34 IMPACT OF AI ON CABIN MANAGEMENT SYSTEM MARKET

- FIGURE 35 SUPPLY CHAIN ANALYSIS

- FIGURE 36 LIST OF MAJOR PATENTS RELATED TO CABIN MANAGEMENT SYSTEMS, 2014-2023

- FIGURE 37 BUSINESS JETS SEGMENT TO LEAD CABIN MANAGEMENT SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 38 CONTROL PANELS AND INTERFACES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 39 LINEFIT SEGMENT TO DOMINATE CABIN MANAGEMENT SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 40 CABIN MANAGEMENT SYSTEM MARKET, BY REGION, 2024-2029

- FIGURE 41 NORTH AMERICA: CABIN MANAGEMENT SYSTEM MARKET SNAPSHOT

- FIGURE 42 EUROPE: CABIN MANAGEMENT SYSTEM MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: CABIN MANAGEMENT SYSTEM MARKET SNAPSHOT

- FIGURE 44 MIDDLE EAST: CABIN MANAGEMENT SYSTEM MARKET SNAPSHOT

- FIGURE 45 LATIN AMERICA: CABIN MANAGEMENT SYSTEM MARKET SNAPSHOT

- FIGURE 46 AFRICA: CABIN MANAGEMENT SYSTEM MARKET SNAPSHOT

- FIGURE 47 CABIN MANAGEMENT SYSTEM MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020-2023 (USD MILLION)

- FIGURE 48 CABIN MANAGEMENT SYSTEM MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 49 CABIN MANAGEMENT SYSTEM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 50 CABIN MANAGEMENT SYSTEM MARKET: COMPANY FOOTPRINT

- FIGURE 51 CABIN MANAGEMENT SYSTEM MARKET COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 52 CABIN MANAGEMENT SYSTEM MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 53 CABIN MANAGEMENT SYSTEM MARKET: FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

- FIGURE 54 CABIN MANAGEMENT SYSTEM MARKET: VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 55 RTX: COMPANY SNAPSHOT

- FIGURE 56 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 57 AIRBUS: COMPANY SNAPSHOT

- FIGURE 58 DIEHL STIFTUNG & CO. KG: COMPANY SNAPSHOT

- FIGURE 59 LUFTHANSA TECHNIK: COMPANY SNAPSHOT

- FIGURE 60 ASTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 62 PANASONIC CORPORATION: COMPANY SNAPSHOT

The cabin management system market is estimated to grow to USD 1.88 billion by 2029, from USD 1.39 billion in 2024, at a CAGR of 6.2% from 2024 to 2029. With technological advancements and changing market conditions, Cabin Management Systems (CMS) are quickly becoming an important driver of aircraft interiors. Airlines/operators are interested in delivering a better passenger experience through an enriched onboard experience that has a customizable cabin environment, quality connectivity, and an effective intersection of entertainment, comfort, and safety. Increased passenger expectations, existing fleet modernization, and operational efficiencies drive this demand. As new aircraft are delivered with new CMS solutions and existing fleet aircraft undergo retrofit procedures, the CMS market is transitioning to a more comprehensive, data-driven, intuitive cabin management system that provides a new in-flight experience.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Solution, Aircraft Type, End User and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

"Narrow-body aircraft segment by aircraft is expected to hold the second highest market share in 2024."

Based on aircraft type, the cabin management system market is categorized into narrow-body, wide-body, regional transport, and business jets. Narrow-body aircraft is expected to have the second largest market for cabin management systems, depending on the large number of these aircraft flown globally and their high use from both full-service and low-cost carriers. Narrow-body aircraft play a critical role in operating airline routes incrementally from short- to medium-haul distances, leading some airlines to retrofit old narrow-body aircraft with new CMS technologies (improved connectivity, new digital interfaces, energy efficient) to improve operating efficiency and the passenger experience. The reasonable costs of upgrading legacy aircraft to the new CMS, coupled with scalable, very modular CMS solutions designed for narrow-body configurations, have stimulated investment to better position the airline into the future in this segment of the market.

"Audio/Video System units' segment by solution is estimated to hold the second highest market share in 2024."

Based on solution, the market is further segmented into cabin management units and servers, control panels and interfaces, network and connectivity, audio/video system units and cabin management software. The audio/video system units' market is estimated to have the second highest market share in cabin management systems, driven by the growing demand for a high-quality, immersive in-flight entertainment experience. As passengers expect to have accessible and diverse digital media, airlines are required to enhance audio/video options to provide better picture quality, audio quality, and interactivity. In addition to replacing older systems with new integrated interactive audio-video systems, the audio/video industry contributes to the upgrade of new aircraft by including modern displays and media servers. While retrofitting aircraft will be important, the opportunities created by the ongoing improvements in connectivity and higher resolution content, as well as the adoption of interactive screens, will further establish audio/video systems as critical to the cabin modernization process.

"Europe is expected to hold the second highest market share in 2024."

Europe is expected to have the second-largest Cabin Management System market due to its significant aviation market with stringent requirements. Although European airlines have a varied fleet of modern and legacy aircraft, they still need a CMS review to address safety, environmental, and passenger comfort specifications. In addition, Europe's comprehensive MRO capabilities and advanced tech ecosystem position CMS as a means to optimize efficiency and reduce downtime. One of the key drivers for CMS adoption in Europe is local suppliers and OEMs. Companies like Lufthansa Technik are actively supporting operators in Europe by providing systems that are state-of-the-art yet adaptable to the European market's needs.

The break-up of the profile of primary participants in the cabin management system market:

- By Company Type: Tier 1 - 49%, Tier 2 - 37%, and Tier 3 - 14%

- By Designation: Directors- 55%, Managers - 27%, Others - 18%

- By Region: North America - 32%, Europe - 32%, Asia Pacific - 16%, Latin America - 10%, and Rest of the World - 10%

Heads Up Technologies (US), BAE Systems (UK), RTX (US), DPI Labs, Inc. (US), ALTO Aviation (US). These key players offer connectivity applicable to various sectors and have well-equipped and strong distribution networks across North America, Europe, Asia Pacific, the Middle East, Africa, and the Rest of the World.

Research Coverage:

In terms of solution segment, the cabin management system market is divided into Cabin Management Units and Servers, Control Panels and Interfaces, Network and connectivity, Audio/Video System Units, and Cabin Management Software. The end user segment of the cabin management system market is Line fit and retrofit. The aircraft type segmentation includes Narrow-body Aircraft, Wide-body Aircraft, Regional Transport Aircraft, and Business Jets.

This report segments the cabin management system market across five key regions: North America, Europe, Asia Pacific, the Middle East, Latin America, Africa, and their respective key countries. The report's scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence the growth of the cabin management system market.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects like agreements, collaborations, new product launches, contracts, expansions, acquisitions, and partnerships associated with the cabin management system market.

Reasons to buy this report:

This report serves as a valuable resource for market leaders and newcomers in the cabin management system market, offering data that closely approximates revenue figures for both the overall market and its subsegments. It equips stakeholders with a comprehensive understanding of the competitive landscape, facilitating informed decisions to enhance their market positioning and formulating effective go-to-market strategies. The report imparts valuable insights into the market dynamics, offering information on crucial factors such as drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

The report provides insights on the following pointers:

- Analysis of the key driver (Advancements in smart cabin technologies, Growing business & private air travel, Increasing aircraft production and fleet expansion, and Increasing focus on enhancing passenger experience) restraint (Cybersecurity and data privacy concerns and High initial costs and installation complexity) opportunities (Growing demand for upgradable and modular designs, Advancements in in-flight entertainment and Increasing adoption of wireless and touchless technologies) and challenges (Stringent regulatory framework and certification procedures, and Limited standardization across aircraft models & airline fleets) there are several other factors that could contribute in the cabin management system market.

- Market Penetration: Comprehensive information on cabin management system solutions offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the cabin management system market

- Market Development: Comprehensive information about lucrative markets - the report analyses the cabin management system market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the cabin management system market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the cabin management system market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 CABIN MANAGEMENT SYSTEM MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY AND PRICING

- 1.5 INCLUSIONS AND EXCLUSIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Cabin management system market, by end user

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CABIN MANAGEMENT SYSTEM MARKET

- 4.2 CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION

- 4.3 CABIN MANAGEMENT SYSTEM MARKET, BY END USER

- 4.4 CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE

- 4.5 CABIN MANAGEMENT SYSTEM MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Advancements in smart cabin technologies

- 5.2.1.2 Growing business & private air travel

- 5.2.1.3 Increasing aircraft production and fleet expansion

- 5.2.1.4 Increasing focus on enhancing passenger experience

- 5.2.2 RESTRAINTS

- 5.2.2.1 Cybersecurity and data privacy concerns

- 5.2.2.2 High initial costs and installation complexity

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for upgradable and modular designs

- 5.2.3.2 Advancements in in-flight entertainment

- 5.2.3.3 Increasing adoption of wireless and touchless technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited standardization across aircraft models & airline fleets

- 5.2.4.2 Stringent regulatory framework and certification procedures

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 R&D ENGINEERS (10-20%)

- 5.4.2 COMPONENT/PRODUCT MANUFACTURING (20-40%)

- 5.4.3 TESTING & QUALITY ASSURANCE (40-60%)

- 5.4.4 END USERS (60-90%)

- 5.4.5 AFTER-SALES SERVICE (90-100%)

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7 TRADE DATA ANALYSIS

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 USE CASE ANALYSIS

- 5.9.1 HONEYWELL'S ADVANCED CABIN SYSTEMS FOR BOMBARDIER AIRCRAFT

- 5.9.2 DIEHL AEROSPACE INTRODUCED I+SCABIN2.0 FOR SMART CABIN CONNECTIVITY AND REAL-TIME MONITORING

- 5.9.3 AMAC AEROSPACE IMPLEMENTED HONEYWELL'S OVATION SELECT CABIN MANAGEMENT SYSTEM

- 5.10 KEY CONFERENCES AND EVENTS, 2025

- 5.11 PRICING ANALYSIS

- 5.11.1 INDICATIVE PRICING ANALYSIS, BY AIRCRAFT TYPE

- 5.11.2 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.11.3 FACTORS INFLUENCING PRICE OF CABIN MANAGEMENT SYSTEMS

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 MACROECONOMIC OUTLOOK

- 5.13.1 INTRODUCTION

- 5.13.2 NORTH AMERICA

- 5.13.3 EUROPE

- 5.13.4 ASIA PACIFIC

- 5.13.5 MIDDLE EAST

- 5.13.6 LATIN AMERICA

- 5.13.7 AFRICA

- 5.14 TOTAL COST OF OWNERSHIP

- 5.15 BUSINESS MODELS

- 5.16 TECHNOLOGY ROADMAP

- 5.17 TECHNOLOGY ANALYSIS

- 5.17.1 KEY TECHNOLOGIES

- 5.17.1.1 Integrated cabin systems

- 5.17.1.2 Edge computing and cloud integration

- 5.17.2 ADJACENT TECHNOLOGIES

- 5.17.2.1 Haptic feedback and smart touch surfaces

- 5.17.2.2 Voice-activated controls

- 5.17.3 COMPLEMENTARY TECHNOLOGIES

- 5.17.3.1 Biometric authentication

- 5.17.3.2 Wireless power transmission

- 5.17.1 KEY TECHNOLOGIES

- 5.18 BILL OF MATERIALS

- 5.19 IMPACT OF GENERATIVE AI

- 5.19.1 INTRODUCTION

- 5.19.2 ADOPTION OF AI IN AVIATION BY TOP COUNTRIES

- 5.19.3 IMPACT OF AI ON AVIATION INDUSTRY

- 5.19.4 IMPACT OF AI ON CABIN MANAGEMENT SYSTEM MARKET

- 5.20 KEY FUNCTIONALITIES OF CABIN MANAGEMENT SYSTEMS

- 5.21 OPERATIONAL DATA

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 AI-POWERED CABIN MONITORING

- 6.2.2 LIGHT FIDELITY

- 6.2.3 4K OLED DISPLAYS

- 6.2.4 INTERNET OF THINGS SENSORS

- 6.2.5 OVER-THE-AIR SOFTWARE UPDATE

- 6.3 IMPACT OF MEGA TRENDS

- 6.3.1 ADDITIVE MANUFACTURING

- 6.3.2 CABIN 4.0

- 6.3.3 AUGMENTED REALITY AND VIRTUAL REALITY

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 PATENT ANALYSIS

7 CABIN MANAGEMENT SYSTEM MARKET, BY AIRCRAFT TYPE

- 7.1 INTRODUCTION

- 7.2 NARROW-BODY AIRCRAFT

- 7.2.1 INCREASING DEMAND FOR MODERN, PASSENGER-CENTRIC CABIN EXPERIENCES TO DRIVE MARKET

- 7.3 WIDE-BODY AIRCRAFT

- 7.3.1 INCREASING INVESTMENTS IN NEXT-GEN CABIN MANAGEMENT SYSTEMS TO DRIVE MARKET

- 7.4 REGIONAL TRANSPORT AIRCRAFT

- 7.4.1 SURGING DEMAND FOR LIGHTWEIGHT AND COST-EFFECTIVE CABIN MANAGEMENT SYSTEMS TO DRIVE MARKET

- 7.5 BUSINESS JETS

- 7.5.1 HIGH DEMAND FOR PREMIUM PASSENGER EXPERIENCE TO DRIVE MARKET

8 CABIN MANAGEMENT SYSTEM MARKET, BY SOLUTION

- 8.1 INTRODUCTION

- 8.2 CABIN MANAGEMENT UNITS AND SERVERS

- 8.2.1 INCREASING DEMAND FOR SMART & CONNECTED CABINS TO DRIVE MARKET

- 8.2.2 CABIN CONTROL UNITS

- 8.2.3 CABIN MANAGEMENT SYSTEM SERVERS

- 8.2.4 DATA CONCENTRATORS

- 8.3 CONTROL PANELS AND INTERFACES

- 8.3.1 GROWING NEED FOR ENHANCED CREW CONTROL AND REAL-TIME MONITORING TO DRIVE MARKET

- 8.3.2 CREW CONTROL PANELS

- 8.3.2.1 Centralized control panels

- 8.3.2.2 Overhead control panels

- 8.3.2.3 Galley control panels

- 8.3.3 PASSENGER CONTROL UNITS

- 8.3.3.1 Switch panels

- 8.3.3.2 Overhead passenger service units

- 8.4 NETWORK AND CONNECTIVITY

- 8.4.1 AIRLINES INVESTING IN NEXT-GENERATION NETWORK TECHNOLOGIES TO DRIVE MARKET

- 8.5 AUDIO/VIDEO SYSTEM UNITS

- 8.5.1 ADVANCEMENTS IN WIRELESS AUDIO SOLUTIONS AND SMART CABIN INTEGRATION TO DRIVE MARKET

- 8.5.2 AUDIO/VIDEO DISTRIBUTION SYSTEMS

- 8.5.3 MULTIMEDIA SERVERS

- 8.5.4 AUDIO/VIDEO CONTROL UNITS

- 8.5.5 HEADPHONE AND SPEAKER CONTROL

- 8.6 CABIN MANAGEMENT SOFTWARE

- 8.6.1 RISING DIGITALIZATION TO ENHANCE OPERATIONAL EFFICIENCY TO DRIVE MARKET

9 CABIN MANAGEMENT SYSTEM MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 LINEFIT

- 9.2.1 GROWTH IN AIRCRAFT PRODUCTION AND FLEET EXPANSION TO DRIVE MARKET

- 9.3 RETROFIT

- 9.3.1 INCREASING DEMAND FOR AIRCRAFT REFURBISHMENT AND RETROFITTING TO DRIVE MARKET

10 CABIN MANAGEMENT SYSTEM MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 PESTLE ANALYSIS

- 10.2.2 US

- 10.2.2.1 Increasing trend of smart cabin aircraft to drive market

- 10.2.3 CANADA

- 10.2.3.1 Growing focus on cabin upgrades and enhancements to drive market

- 10.3 EUROPE

- 10.3.1 PESTLE ANALYSIS

- 10.3.2 UK

- 10.3.2.1 Increased R&D investments to drive market

- 10.3.3 FRANCE

- 10.3.3.1 Growing demand for customized features in commercial and business aviation to drive market

- 10.3.4 GERMANY

- 10.3.4.1 Increasing investment in aviation technology and engineering excellence to drive market

- 10.3.5 ITALY

- 10.3.5.1 Strong presence of business aviation to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Strong tourism industry to drive market

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 PESTLE ANALYSIS

- 10.4.2 CHINA

- 10.4.2.1 Growth of commercial aviation to drive market

- 10.4.3 INDIA

- 10.4.3.1 Airline fleet expansion and cabin upgrades to drive market

- 10.4.4 JAPAN

- 10.4.4.1 Focus on sustainable aviation to drive adoption of energy-efficient cabin management system technologies

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Development of next-generation cabin technologies to drive market

- 10.4.6 AUSTRALIA

- 10.4.6.1 Introduction of ultra-long-haul flights to drive market

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST

- 10.5.1 PESTLE ANALYSIS

- 10.5.2 GCC COUNTRIES

- 10.5.2.1 UAE

- 10.5.2.1.1 Growing focus on innovation and smart technologies to drive market

- 10.5.2.2 Saudi Arabia

- 10.5.2.2.1 Fleet expansion and refurbishment projects to drive market

- 10.5.2.3 Qatar

- 10.5.2.3.1 Increasing adoption of energy-efficient technologies to drive market

- 10.5.2.1 UAE

- 10.5.3 REST OF MIDDLE EAST

- 10.6 LATIN AMERICA

- 10.6.1 PESTLE ANALYSIS

- 10.6.2 BRAZIL

- 10.6.2.1 Modernization of aircraft interiors to drive market

- 10.6.3 MEXICO

- 10.6.3.1 Rapid expansion of business aviation to drive market

- 10.6.4 REST OF LATIN AMERICA

- 10.7 AFRICA

- 10.7.1 PESTLE ANALYSIS

- 10.7.2 SOUTH AFRICA

- 10.7.2.1 Growing demand for luxury-focused cabin management system upgrades to drive market

- 10.7.3 EGYPT

- 10.7.3.1 Investments in aircraft upgrades to drive market

- 10.7.4 REST OF AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 CABIN MANAGEMENT SYSTEM MARKET REVENUE ANALYSIS, 2020-2023

- 11.4 CABIN MANAGEMENT SYSTEM MARKET SHARE ANALYSIS, 2023

- 11.4.1 RTX (US)

- 11.4.2 HONEYWELL INTERNATIONAL INC. (US)

- 11.4.3 AIRBUS (FRANCE)

- 11.4.4 DIEHL STIFTUNG & CO. KG (GERMANY)

- 11.4.5 LUFTHANSA TECHNIK (GERMANY)

- 11.5 CABIN MANAGEMENT SYSTEM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.6 COMPANY FOOTPRINT

- 11.6.1 COMPANY FOOTPRINT

- 11.6.1.1 Solution footprint

- 11.6.1.2 End user footprint

- 11.6.1.3 Aircraft type footprint

- 11.6.1.4 Region footprint

- 11.6.1 COMPANY FOOTPRINT

- 11.7 CABIN MANAGEMENT SYSTEM MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING

- 11.7.5.1 List of start-ups/SMEs

- 11.7.5.2 Competitive benchmarking of start-ups/SMEs

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPANY VALUATION AND FINANCIAL METRICS

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES

- 11.10.2 DEALS

- 11.10.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 RTX

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 HONEYWELL INTERNATIONAL INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Key strengths

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses and competitive threats

- 12.1.3 AIRBUS

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 DIEHL STIFTUNG & CO. KG

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 LUFTHANSA TECHNIK

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 ASTRONICS CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 ROSEN AVIATION, LLC

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 DPI LABS, INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.9 BAE SYSTEMS

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 HEADS UP TECHNOLOGIES

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.11 CABIN MANAGEMENT SOLUTIONS, LLC (CMS)

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.12 IDAIR GMBH

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.13 DONICA AVIATION ENGINEERING CO., LTD

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 HAVELSAN INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.15 PANASONIC CORPORATION

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Product launches

- 12.1.15.3.2 Deals

- 12.1.15.3.3 Expansions

- 12.1.1 RTX

- 12.2 OTHER PLAYERS

- 12.2.1 AEROSENS

- 12.2.2 REDIMEC S.A.

- 12.2.3 DUNCAN AVIATION INC.

- 12.2.4 PERFORMANCE SOFTWARE CORPORATION

- 12.2.5 TQ GROUP

- 12.2.6 MECAER AVIATION GROUP (MAG)

- 12.2.7 C&L AVIATION GROUP

- 12.2.8 BURRANA

- 12.2.9 SPIRIT AERONAUTICS

- 12.2.10 FLIGHTSTAR

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 COMPANY LONG LIST

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS