|

|

市場調査レポート

商品コード

1696193

ドローン通信の世界市場 (~2029年):技術 (無線周波数・セルラー (LTE/4G・5G/6G)・衛星・メッシュネットワーク)・用途 (軍用 (ISR・戦闘)・商用)・コンポーネント (送受信機・アンテナ・データリンク)・地域別Drone Communication Market by Technology (Radio Frequency, Cellular (LTE/4G, 5G/6G), Satellite, Meshed Network), Application (Military (ISR, Combat), Commercial), Component (Transmitter, Receiver, Antenna, Data Link) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ドローン通信の世界市場 (~2029年):技術 (無線周波数・セルラー (LTE/4G・5G/6G)・衛星・メッシュネットワーク)・用途 (軍用 (ISR・戦闘)・商用)・コンポーネント (送受信機・アンテナ・データリンク)・地域別 |

|

出版日: 2025年03月19日

発行: MarketsandMarkets

ページ情報: 英文 291 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

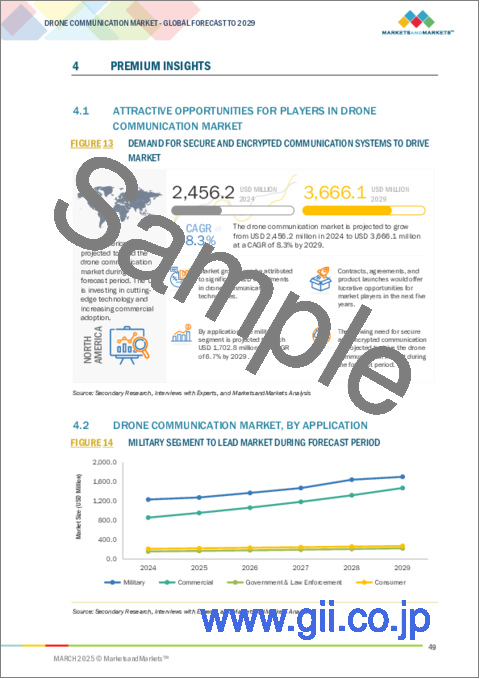

ドローン通信市場の市場規模は、2024年の24億6,000万米ドルから、予測期間中はCAGR 8.3%で推移し、2029年には36億7,000万米ドルに成長すると予測されています。

ドローン通信の促進要因としては、通信技術の進歩、軍事用途でのUAV調達の増加、安全で暗号化された通信へのニーズの高まりなどが挙げられます。ISR、戦闘作戦、情報収集のための無人航空機システム (UAS) に対する防衛支出の増加が、防衛産業におけるドローン通信の成長を促進しています。安全な衛星通信、AI主導の自律型ネットワーキング、データのエンドツーエンド暗号化の開発は、リアルタイムの戦場調整とBVLOS飛行を改善しています。さらに、地政学的緊張の高まりとドローンの高信頼性、長距離接続への要求が、各国政府に高度なドローン通信技術の搭載を迫っています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2023-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | 技術・用途・コンポーネント・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

"技術別では、無線周波数の部門が予測期間中に最大のシェアを示す見通し"

無線周波数は、その信頼性、柔軟性、軍事・商業用途での安全なデータ伝送により、予測期間中に最大のシェアを占める見通しです。RF技術は主に無人航空機システム (UAS) に使用され、これを通じてリアルタイムのコマンド、制御、データ転送が短距離でも長距離でも可能になります。防衛目的では、RF暗号化通信は、敵対的な環境やGPSが使えない環境での安全な作戦のためのISR (情報・監視・偵察)や戦闘作戦に不可欠です。RFベースの通信はVHF、UHF、ミリ波周波数帯を通じて自律的なドローン操作を可能にするため、商業市場では、ロジスティクス、農業、都市部の航空機動性で広く使用されています。ソフトウェア無線 (SDR) や周波数ホッピングスペクトラム拡散 (FHSS) 技術などの次世代RFモジュールの進化も干渉耐性と安全性をさらに高め、拡大するドローン通信市場におけるRFの優位性を確固たるものにしています。

"用途別では、商用セグメントが予測期間中に第2位の市場シェアを占める見通し"

商用セグメントは、物流、農業、インフラ点検、都市航空移動の分野でドローンの利用が増加していることから、予測期間中に2番目に大きなシェアを占めると考えられています。Amazon、UPS、DHLはドローンの配送業務を拡大しており、自律飛行、フリート管理、BVLOS運用のためにリアルタイムの通信ネットワークを必要としています。精密農業では、ドローンは作物追跡、土壌スキャン、水管理をサポートするために迅速なデータ通信を必要としています。また、建設・エネルギー分野では、低遅延でセキュアな通信を必要とする送電線、パイプ、工事現場の遠隔監視にドローンが使用されています。5G、衛星リンク、AI主導のネットワーキングの進化により、ドローンのスムーズで高性能な通信も可能になり、多くのビジネス用途に応用されるようになっています。

"アジア太平洋地域はもっとも急成長する市場となる見通し"

アジア太平洋地域は、中国、インド、日本、韓国などの国々における急速な工業化、防衛費の増加、ドローンのビジネス利用の増加により、予測期間中に最大の成長を示す市場になると予測されています。同地域の政府は、軍事・安全保障目的で無人航空機 (UAV) 技術に多額の投資を行っており、高度で安全な通信ネットワークの需要を生み出しています。ドローン製造の世界的リーダーである中国は、国内外の市場向けに高性能ドローン通信システムを確立しており、同地域の成長をさらに推進しています。

当レポートでは、世界のドローン通信の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 顧客ビジネスに影響を与える動向と混乱

- エコシステム分析

- 投資と資金調達のシナリオ

- 価格分析

- 規制状況

- HSコード

- 主なステークホルダーと購入基準

- 主な会議とイベント

- ケーススタディ

- 運用データ

- ビジネスモデル

- 総所有コスト

- 部品表 (BOM)

- 技術分析

- 技術ロードマップ

- マクロ経済見通し

第6章 業界の動向

- 技術動向

- BVLOS

- メッシュネットワーク

- ドローン通信の暗号化

- IOD (INTERNET OF DRONES) とV2X (VEHICLE-TO-EVERYTHING) 通信

- ハイブリッドコミュニケーション

- 衛星通信統合

- メガトレンドの影響

- AI

- 5G

- スマート製造

- 生成AI/AIの影響

- 特許分析

- ドローン通信のタイプ

第7章 ドローン通信市場:用途別

- 軍用

- 戦闘

- ISR

- デリバリー

- 商用

- マイクロ

- 小型

- 中型

- 大型

- 政府・法執行機関

- 消費者

第8章 ドローン通信市場:コンポーネント別

- 送信機・受信機

- アンテナ

- モデム

- データリンク

- その他

第9章 ドローン通信市場:接続性別

- 衛星接続

- セルラー接続

- ドローン通信サービス市場の主要企業

第10章 ドローン通信市場:技術別

- 無線周波数

- ハードウェアベース無線

- ソフトウェア定義無線

- セルラー

- LTE/4G

- 5G/6G

- 衛星

- メッシュネットワーク

第11章 ドローン通信市場 (地域別)

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- その他

- アジア太平洋

- PESTLE分析

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他

- 中東・アフリカ

- PESTLE分析

- GCC諸国

- イスラエル

- トルコ

- 南アフリカ

- その他

- ラテンアメリカ

- PESTLE分析

- ブラジル

- メキシコ

第12章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析、

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 企業価値評価と財務指標

- サプライヤー分析

- ブランド/製品比較

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- DJI

- RTX

- NORTHROP GRUMMAN

- ISRAEL AEROSPACE INDUSTRIES

- L3HARRIS TECHNOLOGIES, INC.

- ELBIT SYSTEMS LTD.

- BAE SYSTEMS

- AEROVIRONMENT, INC.

- HONEYWELL INTERNATIONAL INC.

- VIASAT, INC.

- IRIDIUM COMMUNICATIONS INC

- THALES

- GENERAL DYNAMICS CORPORATION

- ASELSAN A.S.

- ECHOSTAR CORPORATION

- その他の企業

- ELSIGHT

- DOODLE LABS LLC

- SKYTRAC SYSTEMS LTD.

- TRIAD RF SYSTEMS

- TUALCOM

- UAVIONIX

- ULTRA

- SILVUS TECHNOLOGIES

- PERSISTENT SYSTEMS, LLC

- METEKSAN DEFENCE INDUSTRY INC.

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2023

- TABLE 2 MARKET SIZE ESTIMATION AND METHODOLOGY FOR DRONE COMMUNICATION MARKET

- TABLE 3 KEY COMMUNICATION TECHNOLOGIES ENHANCING DRONE OPERATIONS

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 INDICATIVE PRICING ANALYSIS, BY APPLICATION, 2024 (USD)

- TABLE 6 INDICATIVE PRICING ANALYSIS, BY COMPONENT, 2024 (USD)

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LATIN AMERICA & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REGULATORY FRAMEWORK FOR DRONE COMMUNICATION MARKET, BY REGION

- TABLE 13 IMPORT DATA FOR HS CODE 8806-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR HS CODE 8806-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 16 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 17 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 PROCUREMENT OF UNMANNED AERIAL VEHICLES, BY TYPE, 2020-2023 (UNITS)

- TABLE 19 BREAKDOWN OF TCO FOR DRONE COMMUNICATION SYSTEMS

- TABLE 20 BILL OF MATERIALS (BOM) ANALYSIS FOR DRONE COMMUNICATION SYSTEMS

- TABLE 21 PATENTS PUBLISHED, 2021-2024

- TABLE 22 DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 23 DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 24 DRONE COMMUNICATION MARKET, BY MILITARY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 25 DRONE COMMUNICATION MARKET, BY MILITARY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 26 DRONE COMMUNICATION MARKET, BY COMBAT DRONE, 2020-2023 (USD MILLION)

- TABLE 27 DRONE COMMUNICATION MARKET, BY COMBAT DRONE, 2024-2029 (USD MILLION)

- TABLE 28 DRONE COMMUNICATION MARKET, BY COMMERCIAL APPLICATION, 2020-2023 (USD MILLION)

- TABLE 29 DRONE COMMUNICATION MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 30 DRONE COMMUNICATION MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 31 DRONE COMMUNICATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 32 DRONE COMMUNICATION SERVICE MARKET, BY CONNECTIVITY, 2020-2023 (USD MILLION)

- TABLE 33 DRONE COMMUNICATION SERVICE MARKET, BY CONNECTIVITY, 2024-2029 (USD MILLION)

- TABLE 34 MAJOR PLAYERS IN DRONE COMMUNICATION SERVICE MARKET

- TABLE 35 DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 36 DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 37 DRONE COMMUNICATION MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 DRONE COMMUNICATION MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 NORTH AMERICA: DRONE COMMUNICATION MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 40 NORTH AMERICA: DRONE COMMUNICATION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 41 NORTH AMERICA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 42 NORTH AMERICA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 43 NORTH AMERICA: DRONE COMMUNICATION MARKET, BY MILITARY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 44 NORTH AMERICA: DRONE COMMUNICATION MARKET, BY MILITARY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 45 NORTH AMERICA: DRONE COMMUNICATION MARKET, BY COMBAT DRONE, 2020-2023 (USD MILLION)

- TABLE 46 NORTH AMERICA: DRONE COMMUNICATION MARKET, BY COMBAT DRONE, 2024-2029 (USD MILLION)

- TABLE 47 NORTH AMERICA: DRONE COMMUNICATION MARKET, BY COMMERCIAL APPLICATION, 2020-2023 (USD MILLION)

- TABLE 48 NORTH AMERICA: DRONE COMMUNICATION MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 49 NORTH AMERICA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 50 NORTH AMERICA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 51 NORTH AMERICA: DRONE COMMUNICATION MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 52 NORTH AMERICA: DRONE COMMUNICATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 53 US: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 54 US: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 55 US: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 56 US: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 57 CANADA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 58 CANADA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 59 CANADA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 60 CANADA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 61 EUROPE: DRONE COMMUNICATION MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 62 EUROPE: DRONE COMMUNICATION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 63 EUROPE: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 64 EUROPE: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 65 EUROPE: DRONE COMMUNICATION MARKET, BY MILITARY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 66 EUROPE: DRONE COMMUNICATION MARKET, BY MILITARY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 67 EUROPE: DRONE COMMUNICATION MARKET, BY COMBAT DRONE, 2020-2023 (USD MILLION)

- TABLE 68 EUROPE: DRONE COMMUNICATION MARKET, BY COMBAT DRONE, 2024-2029 (USD MILLION)

- TABLE 69 EUROPE: DRONE COMMUNICATION MARKET, BY COMMERCIAL APPLICATION, 2020-2023 (USD MILLION)

- TABLE 70 EUROPE: DRONE COMMUNICATION MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 71 EUROPE: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 72 EUROPE: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 73 EUROPE: DRONE COMMUNICATION MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 74 EUROPE: DRONE COMMUNICATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 75 UK: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 76 UK: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 77 UK: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 78 UK: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 79 GERMANY: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 80 GERMANY: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 81 GERMANY: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 82 GERMANY: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 83 FRANCE: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 84 FRANCE: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 85 FRANCE: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 86 FRANCE: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 87 RUSSIA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 88 RUSSIA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 89 RUSSIA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 90 RUSSIA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 91 ITALY: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 92 ITALY: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 93 ITALY: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 94 ITALY: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 95 REST OF EUROPE: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 96 REST OF EUROPE: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 97 REST OF EUROPE: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 98 REST OF EUROPE: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 99 ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 100 ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 101 ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 102 ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 103 ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY MILITARY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 104 ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY MILITARY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 105 ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY COMBAT DRONE, 2020-2023 (USD MILLION)

- TABLE 106 ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY COMBAT DRONE, 2024-2029 (USD MILLION)

- TABLE 107 ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY COMMERCIAL APPLICATION, 2020-2023 (USD MILLION)

- TABLE 108 ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 109 ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 110 ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 111 ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 112 ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 113 CHINA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 114 CHINA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 115 CHINA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 116 CHINA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 117 INDIA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 118 INDIA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 119 INDIA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 120 INDIA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 121 JAPAN: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 122 JAPAN: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 123 JAPAN: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 124 JAPAN: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 125 SOUTH KOREA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 126 SOUTH KOREA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 127 SOUTH KOREA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 128 SOUTH KOREA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 129 AUSTRALIA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 130 AUSTRALIA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 131 AUSTRALIA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 132 AUSTRALIA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY MILITARY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY MILITARY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY COMBAT DRONE, 2020-2023 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY COMBAT DRONE, 2024-2029 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY COMMERCIAL APPLICATION, 2020-2023 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 151 UAE: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 152 UAE: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 153 UAE: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 154 UAE: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 155 SAUDI ARABIA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 156 SAUDI ARABIA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 157 SAUDI ARABIA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 158 SAUDI ARABIA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 159 ISRAEL: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 160 ISRAEL: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 161 ISRAEL: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 162 ISRAEL: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 163 TURKEY: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 164 TURKEY: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 165 TURKEY: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 166 TURKEY: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 167 SOUTH AFRICA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 168 SOUTH AFRICA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 169 SOUTH AFRICA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 170 SOUTH AFRICA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 174 REST OF MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 175 LATIN AMERICA: DRONE COMMUNICATION MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 176 LATIN AMERICA: DRONE COMMUNICATION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 177 LATIN AMERICA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 178 LATIN AMERICA: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 179 LATIN AMERICA: DRONE COMMUNICATION MARKET, BY MILITARY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 180 LATIN AMERICA: DRONE COMMUNICATION MARKET, BY MILITARY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 181 LATIN AMERICA: DRONE COMMUNICATION MARKET, BY COMBAT DRONE, 2020-2023 (USD MILLION)

- TABLE 182 LATIN AMERICA: DRONE COMMUNICATION MARKET, BY COMBAT DRONE, 2024-2029 (USD MILLION)

- TABLE 183 LATIN AMERICA: DRONE COMMUNICATION MARKET, BY COMMERCIAL APPLICATION, 2020-2023 (USD MILLION)

- TABLE 184 LATIN AMERICA: DRONE COMMUNICATION MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 185 LATIN AMERICA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 186 LATIN AMERICA: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 187 LATIN AMERICA: DRONE COMMUNICATION MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 188 LATIN AMERICA: DRONE COMMUNICATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 189 BRAZIL: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 190 BRAZIL: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 191 BRAZIL: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 192 BRAZIL: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 193 MEXICO: DRONE COMMUNICATION MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 194 MEXICO: DRONE COMMUNICATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 195 MEXICO: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 196 MEXICO: DRONE COMMUNICATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 197 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 198 DRONE COMMUNICATION MARKET: DEGREE OF COMPETITION

- TABLE 199 REGION FOOTPRINT

- TABLE 200 TECHNOLOGY FOOTPRINT

- TABLE 201 TYPE FOOTPRINT

- TABLE 202 APPLICATION FOOTPRINT

- TABLE 203 LIST OF STARTUPS/SMES

- TABLE 204 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 205 SUPPLIERS FOR DRONE MANUFACTURERS

- TABLE 206 DRONE COMMUNICATION MARKET: PRODUCT LAUNCHES, 2020-2024

- TABLE 207 DRONE COMMUNICATION MARKET: DEALS, 2020-2024

- TABLE 208 DRONE COMMUNICATION MARKET: OTHER DEVELOPMENTS, 2020-2024

- TABLE 209 DJI: COMPANY OVERVIEW

- TABLE 210 DJI: PRODUCTS OFFERED

- TABLE 211 RTX: COMPANY OVERVIEW

- TABLE 212 RTX: PRODUCTS OFFERED

- TABLE 213 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 214 NORTHROP GRUMMAN: PRODUCTS OFFERED

- TABLE 215 NORTHROP GRUMMAN: OTHER DEVELOPMENTS

- TABLE 216 ISRAEL AEROSPACE INDUSTRIES: COMPANY OVERVIEW

- TABLE 217 ISRAEL AEROSPACE INDUSTRIES: PRODUCTS OFFERED

- TABLE 218 ISRAEL AEROSPACE INDUSTRIES: OTHER DEVELOPMENTS

- TABLE 219 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 220 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 221 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 222 ELBIT SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 223 ELBIT SYSTEMS LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 224 ELBIT SYSTEMS LTD.: OTHER DEVELOPMENTS

- TABLE 225 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 226 BAE SYSTEMS: PRODUCTS OFFERED

- TABLE 227 BAE SYSTEMS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 228 BAE SYSTEMS: DEALS

- TABLE 229 BAE SYSTEMS: OTHER DEVELOPMENTS

- TABLE 230 AEROVIRONMENT, INC.: COMPANY OVERVIEW

- TABLE 231 AEROVIRONMENT, INC.: PRODUCTS OFFERED

- TABLE 232 AEROVIRONMENT, INC.: DEALS

- TABLE 233 AEROVIRONMENT, INC.: OTHER DEVELOPMENTS

- TABLE 234 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 235 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 236 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 237 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 238 HONEYWELL INTERNATIONAL INC.: OTHER DEVELOPMENTS

- TABLE 239 VIASAT, INC.: COMPANY OVERVIEW

- TABLE 240 VIASAT, INC.: PRODUCTS OFFERED

- TABLE 241 VIASAT, INC.: DEALS

- TABLE 242 IRIDIUM COMMUNICATIONS INC: COMPANY OVERVIEW

- TABLE 243 IRIDIUM COMMUNICATIONS INC: PRODUCTS OFFERED

- TABLE 244 THALES: COMPANY OVERVIEW

- TABLE 245 THALES: PRODUCTS OFFERED

- TABLE 246 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 247 GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

- TABLE 248 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 249 ASELSAN A.S.: COMPANY OVERVIEW

- TABLE 250 ASELSAN A.S.: PRODUCTS OFFERED

- TABLE 251 ECHOSTAR CORPORATION: COMPANY OVERVIEW

- TABLE 252 ECHOSTAR CORPORATION: PRODUCTS OFFERED

- TABLE 253 ECHOSTAR CORPORATION: DEALS

- TABLE 254 ECHOSTAR CORPORATION: OTHER DEVELOPMENTS

- TABLE 255 ELSIGHT: COMPANY OVERVIEW

- TABLE 256 DOODLE LABS LLC: COMPANY OVERVIEW

- TABLE 257 SKYTRAC SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 258 TRIAD RF SYSTEMS: COMPANY OVERVIEW

- TABLE 259 TUALCOM: COMPANY OVERVIEW

- TABLE 260 UAVIONIX: COMPANY OVERVIEW

- TABLE 261 ULTRA: COMPANY OVERVIEW

- TABLE 262 SILVUS TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 263 PERSISTENT SYSTEMS, LLC: COMPANY OVERVIEW

- TABLE 264 METEKSAN DEFENCE INDUSTRY INC.: COMPANY OVERVIEW

- TABLE 265 DRONE COMMUNICATION MARKET: LAUNDRY LIST OF OTHER MAPPED COMPANIES

List of Figures

- FIGURE 1 REPORT PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 IMPACT OF RUSSIA'S INVASION OF UKRAINE ON GLOBAL DEFENSE INDUSTRY

- FIGURE 4 IMPACT OF RUSSIA-UKRAINE WAR ON DRONE COMMUNICATION MARKET

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 COMMERCIAL TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 9 TRANSMITTERS & RECEIVERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 MESHED NETWORK TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 11 CELLULAR CONNECTIVITY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 DEMAND FOR SECURE AND ENCRYPTED COMMUNICATION SYSTEMS TO DRIVE MARKET

- FIGURE 14 MILITARY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 RADIO FREQUENCY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 TRANSMITTERS & RECEIVERS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 17 CELLULAR CONNECTIVITY SEGMENT TO LEAD MARKET IN 2024

- FIGURE 18 DRONE COMMUNICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 VALUE CHAIN ANALYSIS

- FIGURE 20 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 ECOSYSTEM ANALYSIS

- FIGURE 22 INVESTMENT & FUNDING SCENARIO, 2019-2024 (USD BILLION)

- FIGURE 23 IMPORT DATA FOR HS CODE 8806-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 24 EXPORT DATA FOR HS CODE 8806-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 26 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 27 DRONE COMMUNICATION MARKET: BUSINESS MODELS

- FIGURE 28 BILL OF MATERIALS FOR DRONE COMMUNICATION SYSTEMS

- FIGURE 29 EVOLUTION OF DRONE COMMUNICATION TECHNOLOGIES

- FIGURE 30 ROADMAP FOR DRONE COMMUNICATION TECHNOLOGIES

- FIGURE 31 EMERGING TECHNOLOGY TRENDS IN DRONE COMMUNICATION MARKET

- FIGURE 32 MACROECONOMIC OUTLOOK: NORTH AMERICA, EUROPE, ASIA PACIFIC, AND MIDDLE EAST

- FIGURE 33 MACROECONOMIC OUTLOOK FOR LATIN AMERICA AND AFRICA

- FIGURE 34 USE OF GENERATIVE AI IN DEFENSE AVIATION

- FIGURE 35 PARAMETERS DRIVING ADOPTION OF AI IN COMMERCIAL AVIATION, BY KEY COUNTRY

- FIGURE 36 PATENTS GRANTED, 2014-2023

- FIGURE 37 TYPES OF DRONE COMMUNICATION

- FIGURE 38 COMMERCIAL TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 39 TRANSMITTERS & RECEIVERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 40 SATELLITE CONNECTIVITY SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 41 MESHED NETWORK TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 42 DRONE COMMUNICATION MARKET, BY REGION, 2024-2029

- FIGURE 43 NORTH AMERICA: DRONE COMMUNICATION MARKET SNAPSHOT

- FIGURE 44 EUROPE: DRONE COMMUNICATION MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: DRONE COMMUNICATION MARKET SNAPSHOT

- FIGURE 46 MIDDLE EAST & AFRICA: DRONE COMMUNICATION MARKET SNAPSHOT

- FIGURE 47 LATIN AMERICA: DRONE COMMUNICATION MARKET SNAPSHOT

- FIGURE 48 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2023 (USD MILLION)

- FIGURE 49 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 50 DRONE COMMUNICATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 51 COMPANY FOOTPRINT

- FIGURE 52 DRONE COMMUNICATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 53 VALUATION OF PROMINENT PLAYERS

- FIGURE 54 FINANCIAL METRICS OF PROMINENT PLAYERS

- FIGURE 55 BRAND/PRODUCT COMPARISON

- FIGURE 56 RTX: COMPANY SNAPSHOT

- FIGURE 57 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 58 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 59 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 60 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 61 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 62 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

- FIGURE 63 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 64 VIASAT, INC.: COMPANY SNAPSHOT

- FIGURE 65 IRIDIUM COMMUNICATIONS INC: COMPANY SNAPSHOT

- FIGURE 66 THALES: COMPANY SNAPSHOT

- FIGURE 67 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 ASELSAN A.S.: COMPANY SNAPSHOT

- FIGURE 69 ECHOSTAR CORPORATION: COMPANY SNAPSHOT

The drone communication market is estimated in terms of market size to be USD 2.46 billion in 2024 to USD 3.67 billion by 2029, at a CAGR of 8.3%. The drivers for drone communication include advancements in communication technologies, increasing procurement of UAVs in military applications and growing need for secure and encrypted communication. Growing defense spending on unmanned aerial systems (UAS) for ISR, combat operations, and intelligence gathering is propelling growth in drone communication in the defense industry. Development of secure satellite communication, AI-driven autonomous networking, and end-to-end encryption of data is improving real-time battlefield coordination and BVLOS flight. Moreover, rising geopolitical tensions and requirements for highly reliable, extended-range connectivity of drones are compelling governments to take advanced drone communication technology aboard.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2023-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Application, Component and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The radio frequency will account for the largest market share in the drone communication market during the forecast period."

The radio frequency will account for the largest market share in the Drone Communication market during the forecast period due to its dependability, flexibility, and safe transmission of data in military as well as commercial applications. RF technology is primarily used in Unmanned Aerial Systems (UAS), through which real-time command, control, and data transfer are possible in short as well as long ranges. For defense purposes, RF-encrypted communications are critical to intelligence, surveillance, reconnaissance (ISR), and combat operations for secure operations in hostile or GPS-denied environments. For the commercial market, RF-based communication is widely used in logistics, agriculture, and urban air mobility to enable autonomous drone operation through VHF, UHF, and millimeter-wave frequency bands. The evolution of next-generation RF modules, such as software-defined radios (SDRs) and frequency-hopping spread spectrum (FHSS) technology, further increases interference immunity and security, cementing RF's dominance in the expanding drone communications market.

"The Commercial application segment will account for the 2nd largest market share in the Drone Communication market during the forecast period."

The Commercial application segment will account for the 2nd largest market share in the Drone Communication market during the forecast period due to the fact that drones are being increasingly used by logistics, agriculture, infrastructure inspection, and urban air mobility sectors. Amazon, UPS, and DHL are scaling up drone delivery operations, which require real-time communication networks for autonomous flight, fleet management, and BVLOS operations. In precision agriculture, drones need swift data communication for supporting crop tracking, soil scanning, and water management. Also, the construction and energy sectors use drones to remotely monitor power lines, pipes, and construction areas with the need for low-latency and secure communications. The evolution of 5G, satellite links, and artificial intelligence -driven networking is also enabling smooth and high-performance communication for drones to be applied across numerous business applications. With growing regulatory support and technology advancements, the commercial sector is a primary source of drone communication market growth around the world..

"The Asia Pacific market is estimated to be the fastest growing market in the drone communication market."

The Asia Pacific region is estimated to be the fastest growing market during the forecast period of 2024 - 2029 in the drone communication due to the rapid rate of industrialization, increasing defense expenditures, and increasing business use of drones in countries like China, India, Japan, and South Korea. The governments in the region are making significant investments in unmanned aerial vehicle (UAV) technology for military and security purposes, creating demand for advanced, secure communications networks. China, the world leader in drone production, is establishing high-performance drone communication systems for domestic and foreign markets, propelling regional expansion even further.

The commercial sector is also experiencing strong growth, with drones finding extensive use in logistics, agriculture, infrastructure surveillance, and urban air mobility. Japan and South Korea are embedding 5G-capable drone communication systems to enable real-time data transfer, making drones more efficient. India's emerging startup ecosystem is also fueling innovation in drone-based services, enabled by supportive government policies like the deregulation of drone rules.

With continued growth in satellite communication, AI networking, and BVLOS operations, the Asia Pacific region is turning into a center of drone communication technology innovation. Growing investments by governments as well as private investors are further contributing to the accelerated growth of the market, rendering it the fastest-growing one across the world.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- By Designation: C Level-35%; Directors-25%; and Others-40%

- By Region: North America-30%; Europe-20%; Asia Pacific-35%; Middle East & Africa-10%; Latin America-5%

DJI (US), RTX (US), Northrop Grumman (US), Israel Aerospace Industries (Israel), and L3Harris Technologies, Inc. (US) are some of the leading players operating in the drone communication market.

Research Coverage

The study covers the drone communication market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on application, component, technology drone communication service market by connectivity, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report:

This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall drone communication market and its subsegments. The report covers the entire ecosystem of the Drone communication market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and factors, such as advancements in communication technologies, increasing procurement of UAVs in military applications and growing need for secure and encrypted communication could contribute to an increase in the drone communication market.

- Product Development: In-depth analysis of product innovation/development by companies across various region.

- Market Development: Comprehensive information about lucrative markets - the report analyses the drone communication market across varied regions.

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in drone communication market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like market DJI (US), RTX (US), Northrop Grumman (US), Israel Aerospace Industries (Israel), and L3Harris Technologies, Inc. (US) among others in the drone communication market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & GEOGRAPHICAL SPREAD

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary insights

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.3 FACTOR ANALYSIS

- 2.1.3.1 Introduction

- 2.1.3.2 Demand-side indicators

- 2.1.3.3 Supply-side indicators

- 2.1.4 RUSSIA-UKRAINE WAR IMPACT ANALYSIS

- 2.1.4.1 Impact of Russia's invasion of Ukraine on global defense industry

- 2.1.4.2 Impact of Russia-Ukraine war on drone communication market

- 2.1.4.2.1 Surge in demand for secure communication systems

- 2.1.4.2.2 Growth in tactical and battlefield networking solutions

- 2.1.4.2.3 Shift in procurement strategies and defense spending

- 2.1.4.2.4 Impact on commercial drone communication market

- 2.1.4.2.5 Adoption of AI-driven autonomous communication systems

- 2.1.4.2.6 Conclusion

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DRONE COMMUNICATION MARKET

- 4.2 DRONE COMMUNICATION MARKET, BY APPLICATION

- 4.3 DRONE COMMUNICATION MARKET, BY TECHNOLOGY

- 4.4 DRONE COMMUNICATION MARKET, BY COMPONENT

- 4.5 DRONE COMMUNICATION SERVICE MARKET, BY CONNECTIVITY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Advancements in communication technologies

- 5.2.1.2 Increasing procurement of UAVs in military applications

- 5.2.1.3 Growing need for secure and encrypted communication

- 5.2.2 RESTRAINTS

- 5.2.2.1 Cybersecurity risks and data vulnerabilities

- 5.2.2.2 Regulatory and airspace restrictions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Commercial expansion in urban air mobility (UAM) and logistics

- 5.2.3.2 Emergence of swarm drone communication

- 5.2.3.3 Increasing adoption of drone-based emergency and humanitarian response system

- 5.2.4 CHALLENGES

- 5.2.4.1 Interoperability and standardization issues

- 5.2.4.2 Limited spectrum availability and frequency congestion

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 DRONE MANUFACTURERS

- 5.5.2 DRONE COMMUNICATION SYSTEM MANUFACTURERS

- 5.5.3 END USERS

- 5.6 INVESTMENT & FUNDING SCENARIO

- 5.7 PRICING ANALYSIS

- 5.7.1 INDICATIVE PRICING ANALYSIS, BY APPLICATION

- 5.7.2 INDICATIVE PRICING ANALYSIS, BY COMPONENT

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY FRAMEWORK

- 5.9 HS CODES

- 5.9.1 IMPORT SCENARIO

- 5.9.2 EXPORT SCENARIO

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 KEY CONFERENCES & EVENTS, 2025-2026

- 5.12 CASE STUDIES

- 5.12.1 SINE.ENGINEERING INTRODUCED MICROCHIPS, ENABLING DRONES TO NAVIGATE WITHOUT GPS SIGNALS

- 5.12.2 DRONEUP PARTNERED WITH ELSIGHT TO INTEGRATE ITS ADVANCED HALO CELLULAR CONNECTIVITY SOLUTION INTO ITS FLEET

- 5.12.3 MICRODRONES PROVIDED UAV SOLUTIONS FOR AERIAL PIPELINE INSPECTIONS, IMPLEMENTING DRONES EQUIPPED WITH ADVANCED SENSORS AND COMMUNICATION TECHNOLOGIES

- 5.12.4 MEDICAL DELIVERY TRIALS CONDUCTED THROUGH DRONES IN REMOTE REGIONS

- 5.13 OPERATIONAL DATA

- 5.14 BUSINESS MODELS

- 5.14.1 DIRECT SALES

- 5.14.1.1 Key features

- 5.14.1.2 Advantages

- 5.14.1.3 Challenges

- 5.14.2 OEM AND WHITE-LABELING

- 5.14.2.1 Key features

- 5.14.2.2 Advantages

- 5.14.2.3 Challenges

- 5.14.3 DISTRIBUTOR & CHANNEL PARTNER

- 5.14.3.1 Key features

- 5.14.3.2 Advantages

- 5.14.3.3 Challenges

- 5.14.4 CUSTOMIZED INTEGRATION SERVICES

- 5.14.4.1 Key features

- 5.14.4.2 Advantages

- 5.14.4.3 Challenges

- 5.14.1 DIRECT SALES

- 5.15 TOTAL COST OF OWNERSHIP

- 5.15.1 INITIAL ACQUISITION COSTS

- 5.15.2 OPERATING COSTS

- 5.15.3 MAINTENANCE & REPAIR COSTS

- 5.15.4 TRAINING & PERSONNEL COSTS

- 5.15.5 SECURITY & COMPLIANCE COSTS

- 5.15.6 LIFECYCLE & DEPRECIATION COSTS

- 5.16 BILL OF MATERIALS (BOM)

- 5.17 TECHNOLOGY ANALYSIS

- 5.17.1 KEY TECHNOLOGIES

- 5.17.1.1 Cognitive radio systems

- 5.17.1.2 Multiple-Input Multiple-Output (MIMO) Technology

- 5.17.1.3 Software-defined networking

- 5.17.2 COMPLEMENTARY TECHNOLOGIES

- 5.17.2.1 Antenna beamforming technology

- 5.17.3 ADJACENT TECHNOLOGIES

- 5.17.3.1 Advanced energy and battery storage systems

- 5.17.1 KEY TECHNOLOGIES

- 5.18 TECHNOLOGY ROADMAP

- 5.19 MACROECONOMIC OUTLOOK

- 5.19.1 INTRODUCTION

- 5.19.2 MACROECONOMIC OUTLOOK FOR NORTH AMERICA, EUROPE, ASIA PACIFIC, AND MIDDLE EAST

- 5.19.2.1 North America

- 5.19.2.2 Europe

- 5.19.2.3 Asia Pacific

- 5.19.2.4 Middle East

- 5.19.3 MACROECONOMIC OUTLOOK FOR LATIN AMERICA AND AFRICA

- 5.19.3.1 Latin America

- 5.19.3.2 Africa

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 BEYOND VISUAL LINE OF SIGHT (BVLOS) COMMUNICATION

- 6.2.2 MESH NETWORKING

- 6.2.3 DRONE COMMUNICATION ENCRYPTION

- 6.2.4 INTERNET OF DRONES (IOD) AND VEHICLE-TO-EVERYTHING (V2X) COMMUNICATIONS

- 6.2.5 HYBRID COMMUNICATIONS

- 6.2.6 SATCOM INTEGRATION

- 6.3 IMPACT OF MEGA TRENDS

- 6.3.1 AI

- 6.3.2 5G

- 6.3.3 SMART MANUFACTURING

- 6.4 IMPACT OF GEN AI/AI

- 6.4.1 INTRODUCTION

- 6.4.2 ADOPTION OF AI IN COMMERCIAL AVIATION BY TOP COUNTRIES

- 6.5 PATENT ANALYSIS

- 6.6 TYPES OF DRONE COMMUNICATION

- 6.6.1 DRONE-TO-DRONE

- 6.6.2 DRONE-TO-INFRASTRUCTURE

- 6.6.2.1 DRONE-TO-SATELLITE

- 6.6.2.2 DRONE-TO-NETWORK

- 6.6.3 DRONE-TO-GROUND STATION

7 DRONE COMMUNICATION MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 MILITARY

- 7.2.1 COMBAT

- 7.2.1.1 Need for secure communication, real-time data transmission, and electronic warfare protection to drive segment

- 7.2.1.2 Use case: LAC-12 Terminal, from General Atomics, provides secure, high-speed, anti-jamming laser communication

- 7.2.1.3 Lethal drones

- 7.2.1.4 Stealth drones

- 7.2.1.5 Loitering munitions

- 7.2.1.6 Target drones

- 7.2.2 ISR

- 7.2.2.1 Increasing demand for secure, real-time data transmission and network resilience to drive segment

- 7.2.2.2 Use case: MxC-Mini data links, from Tomahawk, provide secure and AI-enhanced communication for ISR operations

- 7.2.3 DELIVERY

- 7.2.3.1 Drone communication systems support military logistics by securing supplies

- 7.2.3.2 Use case: Verizon's Airborne LTE operations establish communication infrastructure for drone delivery

- 7.2.1 COMBAT

- 7.3 COMMERCIAL

- 7.3.1 MICRO

- 7.3.1.1 Demand for cost-effective, real-time communication systems to drive market

- 7.3.1.2 Use case: Microdrones equipped with miniature Identification Friend or Foe (IFF) transponders enhance situational awareness

- 7.3.2 SMALL

- 7.3.2.1 Need for secure, high-bandwidth communication and real-time data transmission to drive market

- 7.3.2.2 Use case: CNPC-1000 UAS Command and Control Data Link, from Collins Aerospace, provides secure and efficient communication solution

- 7.3.3 MEDIUM

- 7.3.3.1 Need for high-capacity communication systems for large-scale operations to drive segment

- 7.3.3.2 Use case: IMS, from SKYTRAC, delivers advanced, lightweight satellite communication for medium UAVs

- 7.3.4 LARGE

- 7.3.4.1 Rising demand for long-range, high-capacity communication for heavy cargo and large-scale operations to propel growth

- 7.3.4.2 Use case: Velaris, from Viasat, provides satellite communication for large uncrewed aerial vehicles (UAVs) and advanced air mobility (AAM) aircraft

- 7.3.1 MICRO

- 7.4 GOVERNMENT & LAW ENFORCEMENT

- 7.4.1 NEED FOR SECURE, REAL-TIME COMMUNICATION IN SECURITY AND EMERGENCY OPERATIONS TO DRIVE SEGMENT

- 7.4.2 USE CASE: HONEYWELL'S VERSAWAVE PROVIDES LIGHTWEIGHT, COMPACT SATELLITE COMMUNICATION SYSTEM

- 7.5 CONSUMER

- 7.5.1 DEMAND FOR SMART DRONES FOR PERSONALIZED DELIVERY APPLICATIONS TO DRIVE SEGMENT

- 7.5.2 USE CASE: DJI LIGHTBRIDGE 2 OFFERS ADVANCED COMMUNICATION SYSTEM FOR CONSUMER APPLICATIONS

8 DRONE COMMUNICATION MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 TRANSMITTERS & RECEIVERS

- 8.2.1 GROWING DEMAND FOR SECURE SIGNAL TRANSMISSION AND RECEPTION TO SUPPORT BVLOS OPERATIONS

- 8.3 ANTENNAS

- 8.3.1 ADVANCEMENTS IN MULTI-BAND AND DIRECTIONAL TECHNOLOGY FOR LONG-RANGE CONNECTIVITY TO DRIVE MARKET

- 8.4 MODEMS

- 8.4.1 GROWING NEED FOR HIGH-SPEED DATA TRANSMISSION WITH FIRMWARE UPGRADES TO BOOST GROWTH

- 8.5 DATA LINKS

- 8.5.1 EXPANSION OF BVLOS OPERATIONS REQUIRING HIGH-BANDWIDTH, LOW-LATENCY NETWORKS TO PROPEL DEMAND

- 8.6 OTHER COMPONENTS

9 DRONE COMMUNICATION SERVICE MARKET, BY CONNECTIVITY

- 9.1 INTRODUCTION

- 9.1.1 SATELLITE CONNECTIVITY

- 9.1.1.1 Need for long-range, beyond-line-of-sight operations to drive demand

- 9.1.2 CELLULAR CONNECTIVITY

- 9.1.2.1 Demand for modern drone operations to boost growth

- 9.1.1 SATELLITE CONNECTIVITY

- 9.2 MAJOR PLAYERS IN DRONE COMMUNICATION SERVICE MARKET

10 DRONE COMMUNICATION MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 RADIO FREQUENCY

- 10.2.1 HARDWARE-BASED RADIO

- 10.2.1.1 Hardware-based radio systems serve as critical foundation in drone communication

- 10.2.1.2 Use case: Common Data Link (CDL) radios, from BAE Systems, provide secure and interoperable communication for drone operations

- 10.2.2 SOFTWARE-DEFINED RADIO

- 10.2.2.1 Software-defined radios (SDRs) are reshaping drone communication by offering flexible, reconfigurable, and multi-band capabilities

- 10.2.2.2 Use case: E-LynX Airborne Radio (AR), from Elbit Systems, enables seamless integration with airborne platforms

- 10.2.1 HARDWARE-BASED RADIO

- 10.3 CELLULAR

- 10.3.1 LTE/4G

- 10.3.1.1 Need for extensive coverage and low-latency connectivity to drive market

- 10.3.1.2 Use case: ELK-1888, from IAI, can be deployed as private network or integrated with commercial service providers

- 10.3.2 5G/6G

- 10.3.2.1 Ultra-low latency and high-bandwidth connectivity of real-time drone operations to drive market

- 10.3.2.2 Use case: Skyline S2, from Airbus, enables high-bandwidth 5G/6G connectivity for drone operations

- 10.3.1 LTE/4G

- 10.4 SATELLITE

- 10.4.1 ADVANCEMENTS IN HIGH-THROUGHPUT SATELLITES (HTS) AND MULTI-ORBIT NETWORKING TO DRIVE MARKET

- 10.4.2 USE CASE: E-LYNX SAT, FROM ELBIT SYSTEMS, ENABLES BEYOND-LINE-OF-SIGHT (BLOS) VOICE, DATA, AND VIDEO TRANSMISSION OVER KA- AND KU-BAND GEO, MEO, AND LEO SATELLITES

- 10.5 MESHED NETWORK

- 10.5.1 NEED FOR RESILIENT AND SCALABLE COMMUNICATION FOR AUTONOMOUS DRONE OPERATIONS TO DRIVE SEGMENT

- 10.5.2 USE CASE: COGNITIVE MULTI-MODAL MESH, FROM FLY4FUTURE, ENABLES REAL-TIME COMMUNICATION ACROSS VARIOUS ENVIRONMENTS

11 DRONE COMMUNICATION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 PESTLE ANALYSIS

- 11.2.2 US

- 11.2.2.1 Substantial investments from Department of Defense to drive market

- 11.2.3 CANADA

- 11.2.3.1 Rapid integration of drones into national airspace to drive market

- 11.3 EUROPE

- 11.3.1 PESTLE ANALYSIS

- 11.3.2 UK

- 11.3.2.1 Collaborations between domestic companies and international partners to drive market

- 11.3.3 GERMANY

- 11.3.3.1 Surge in defense spending to drive market

- 11.3.4 FRANCE

- 11.3.4.1 Commitment to building advanced drone communication networks to drive market

- 11.3.5 RUSSIA

- 11.3.5.1 Ongoing advancements in drone communication to drive market

- 11.3.6 ITALY

- 11.3.6.1 Rising adoption of drone communication systems across passenger transport and logistics to drive market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 PESTLE ANALYSIS

- 11.4.2 CHINA

- 11.4.2.1 Focus on integrating drones into diverse sectors to drive market

- 11.4.3 INDIA

- 11.4.3.1 Investments in domestic UAV manufacturing to drive market

- 11.4.4 JAPAN

- 11.4.4.1 Strategic industry collaborations to drive market

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Policies supporting urban air mobility and smart city projects to drive market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Implementation of Emerging Aviation Technology Partnerships Program to drive market

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 PESTLE ANALYSIS

- 11.5.2 GCC

- 11.5.2.1 UAE

- 11.5.2.1.1 Strategic government initiatives and advanced infrastructure to drive market

- 11.5.2.2 Saudi Arabia

- 11.5.2.2.1 Defense modernization and infrastructure development projects to drive market

- 11.5.2.1 UAE

- 11.5.3 ISRAEL

- 11.5.3.1 Advanced defense sector and strong government backing to drive market

- 11.5.4 TURKEY

- 11.5.4.1 Focus on developing indigenous UAVs to drive market

- 11.5.5 SOUTH AFRICA

- 11.5.5.1 Vast mining and agriculture sectors to drive market

- 11.5.6 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 PESTLE ANALYSIS

- 11.6.2 BRAZIL

- 11.6.2.1 Need for advanced drone communication for environmental monitoring to drive market

- 11.6.3 MEXICO

- 11.6.3.1 Increasing demand for drones with secure communication systems to drive market

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 12.3 REVENUE ANALYSIS, 2020-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT

- 12.5.5.1 Region footprint

- 12.5.5.2 Technology footprint

- 12.5.5.3 Type footprint

- 12.5.5.4 Application footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING

- 12.6.5.1 List of startups/SMEs

- 12.6.5.2 Competitive benchmarking of startups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8 SUPPLIER ANALYSIS

- 12.9 BRAND/PRODUCT COMPARISON

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT LAUNCHES

- 12.10.2 DEALS

- 12.10.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 DJI

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 MnM view

- 13.1.1.3.1 Right to win

- 13.1.1.3.2 Strategic choices

- 13.1.1.3.3 Weaknesses and competitive threats

- 13.1.2 RTX

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Right to win

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses and competitive threats

- 13.1.3 NORTHROP GRUMMAN

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 ISRAEL AEROSPACE INDUSTRIES

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 L3HARRIS TECHNOLOGIES, INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 ELBIT SYSTEMS LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches/developments

- 13.1.6.3.2 Other developments

- 13.1.7 BAE SYSTEMS

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches/developments

- 13.1.7.3.2 Deals

- 13.1.7.3.3 Other developments

- 13.1.8 AEROVIRONMENT, INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Other developments

- 13.1.9 HONEYWELL INTERNATIONAL INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches/developments

- 13.1.9.3.2 Deals

- 13.1.9.3.3 Other developments

- 13.1.10 VIASAT, INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.11 IRIDIUM COMMUNICATIONS INC

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.12 THALES

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 GENERAL DYNAMICS CORPORATION

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Deals

- 13.1.14 ASELSAN A.S.

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 ECHOSTAR CORPORATION

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Deals

- 13.1.15.3.2 Other developments

- 13.1.1 DJI

- 13.2 OTHER PLAYERS

- 13.2.1 ELSIGHT

- 13.2.2 DOODLE LABS LLC

- 13.2.3 SKYTRAC SYSTEMS LTD.

- 13.2.4 TRIAD RF SYSTEMS

- 13.2.5 TUALCOM

- 13.2.6 UAVIONIX

- 13.2.7 ULTRA

- 13.2.8 SILVUS TECHNOLOGIES

- 13.2.9 PERSISTENT SYSTEMS, LLC

- 13.2.10 METEKSAN DEFENCE INDUSTRY INC.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 ANNEXURE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS