|

|

市場調査レポート

商品コード

1695350

製造実行システムの世界市場:オファリング別、導入形態別、業界別、地域別 - 2030年までの予測Manufacturing Execution System Market by Deployment Mode (On-premises, Cloud, Hybrid), Application (Production Management, Quality Management, Material and Inventory Management, Maintenance Management, Performance Analysis) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 製造実行システムの世界市場:オファリング別、導入形態別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年03月26日

発行: MarketsandMarkets

ページ情報: 英文 274 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

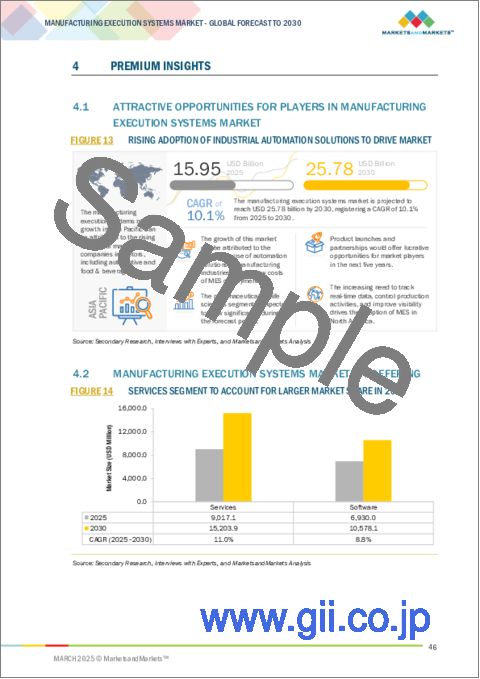

世界の製造実行システムの市場規模は、10.1%のCAGRで拡大し、2025年の159億5,000万米ドルから2030年には257億8,000万米ドルに増加すると予測されています。

主な成長要因は、インダストリー4.0、スマート工場、生産効率向上のためのリアルタイムデータ統合の採用拡大です。MESソリューションは、リソースの最大活用、規制遵守の徹底、品質管理の強化によって製造業務を自動化します。自動車、製薬、航空宇宙、エレクトロニクス業界からの需要の増加が、引き続き市場の成長を後押ししています。さらに、クラウドベースのMESへのシフトとAI、IoT、ビッグデータ分析の統合が生産管理を変革し、俊敏性とオペレーショナルインテリジェンスの向上を可能にしています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | オファリング別、導入形態別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

統合やサポートサービスに対するニーズの高まりが、製造実行システム(MES)市場でサービス分野が最大の市場シェアを占める原動力となっています。産業界がデジタルトランスフォーメーションとオートメーションに大きな賭けをする中、企業はMESソリューションの展開や、既存の基幹業務システム(ERP)および産業オートメーションシステムとのシームレスな統合において、専門家の支援を得たいと考えています。さらに、クラウドベースのMESは、リモート監視、セキュリティ、システム最適化などのマネージドサービスの需要にもつながっています。MESサービスは、定期的なソフトウェアアップデート、トレーニングプログラム、コンプライアンスサポートが重要な役割を果たすため、その意義も大きいです。しかし、メーカーがリアルタイムのデータ分析、予知保全、法規制順守の重要性を強調し続ける中、MESを確実に導入し、業種を問わず効率的なオペレーションを維持するためには、サービス分野が不可欠であることに変わりはありません。

製造実行システム(MES)のオンプレミス展開は、データセキュリティの確保、カスタマイズ、リアルタイムの運用管理に優れているため、予測期間を通じて最大の市場シェアを占めています。自動車、航空宇宙、食品、食品・飲料の各分野では、生産監視の強化、規制遵守、ダウンタイムの削減のためにオンプレミス型MESが使用されています。クラウドベースの製品と比べて、オンプレミス型MESは重要な生産データをより詳細に管理できるため、データ・プライバシーのニーズが高い業界で最も求められています。さらに、MESをレガシーの企業システムと統合できることも、大規模な生産施設での利用に貢献しています。クラウドテクノロジーの採用が進んでいるとはいえ、先行投資やメンテナンスコストが高いという欠点があるのも事実です。とはいえ、業務効率、低レイテンシー、セキュアなデータ処理を優先する業界では、オンプレミスのMESソリューションが引き続き支持されています。企業が生産の可視性を高め、リソースを最適化しようと努める中、オンプレミス型MESは今後も市場の主流となる展開モデルであり続けると予想されます。

厳しい規制要件、リアルタイムの生産モニタリングに対するニーズの高まり、より業務効率の高い製造部門へのシフトにより、製薬業界は製造実行システム(MES)市場において大幅なCAGR成長を遂げるでしょう。医薬品製造業界におけるMESソリューションは、製造プロセスの合理化、FDAやGMP基準への準拠、サプライチェーン全体のトレーサビリティをサポートします。また、これらのシステムは、スムーズなバッチ記録、自動レポート、ERPと品質管理(QM)システムの統合を提供します。MESは現在、AI、機械学習、予測分析の採用が拡大する中、最小限のダウンタイムでプロセスの最適化を可能にし、一貫した製品品質を保証しています。製薬企業がデジタルトランスフォーメーションとインダストリー4.0への取り組みを加速し続ける一方で、厳格な品質管理を維持し、生産コストを最小限に抑えながら廃棄物を削減するためにMESを使用する必要性は、今後もより高い需要を維持するとみられています。

北米は、産業オートメーションの急速な成長、デジタル化に対する政府の高いレベルの奨励、スマート製造の取り込みの高まりにより、製造実行システム市場で第2位のシェアを記録すると予測されています。重要な自動車航空宇宙産業や製薬産業が存在する北米は、企業がリアルタイムの生産管理、品質モニタリング、コンプライアンス追跡を必要としていることから、MESのトップ市場の1つとなっています。この地域ではloT技術、インダストリー4.0を活用し、クラウドベースのMESシステムを採用しているため、市場は急速に拡大しています。AI主導のアナリティクスやサイバーセキュリティ・ソリューションへの投資の増加により、MESと企業システムとの統合はよりシームレスになっています。強固な技術基盤を持つ北米は、今後数年間でMES市場の成長を大きく支配することになるでしょう。

当レポートでは、世界の製造実行システム市場について調査し、オファリング別、導入形態別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ

- 規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- AI/生成AIが製造実行システム市場に与える影響

第6章 製造実行システムの応用

- イントロダクション

- 生産管理

- 品質管理

- 資材および在庫管理

- メンテナンス管理

- パフォーマンス分析

第7章 製造実行システム市場、オファリング別

- イントロダクション

- ソフトウェア

- サービス

第8章 製造実行システム市場、導入形態別

- イントロダクション

- オンプレミス

- クラウド

- ハイブリッド

第9章 製造実行システム市場、業界別

- イントロダクション

- 食品・飲料

- 石油・ガス

- 化学薬品

- 医薬品・ライフサイエンス

- 自動車

- 航空宇宙

- 医療機器

- エレクトロニクス・半導体

- 金属・鉱業

- その他

第10章 製造実行システム市場、地域別

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- オランダ

- スイス

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- インドネシア

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- 南米

- アフリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年1月~2024年12月

- 収益分析、2019年~2023年

- 市場シェア分析、2024年

- 企業価値評価と財務指標

- 製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- SIEMENS

- DASSAULT SYSTEMES

- SAP SE

- ROCKWELL AUTOMATION

- HONEYWELL INTERNATIONAL INC.

- ABB

- APPLIED MATERIALS

- EMERSON ELECTRIC CO.

- GE VERNOVA

- ORACLE

- SCHNEIDER ELECTRIC

- KORBER AG

- YOKOGAWA ELECTRIC CORPORATION

- APTEAN

- EPICOR SOFTWARE CORPORATION

- INFOR

- その他の企業

- 42Q

- AEGIS INDUSTRIAL SOFTWARE CORPORATION

- CEREXIO

- CRITICAL MANUFACTURING SA

- EYELIT

- IBASE-T

- MPDV

- PARSEC AUTOMATION, LLC

- TEBIS TECHNISCHE INFORMATIONSSYSTEME AG

- THROUGHPUT CONSULTING INC.

- FORCAM ENISCO GMBH

- MIRACOM, INC.

- ANDEA

- MASTERCONTROL SOLUTIONS, INC.

第13章 付録

List of Tables

- TABLE 1 MANUFACTURING EXECUTION SYSTEMS MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 MANUFACTURING EXECUTION SYSTEMS MARKET: RISK ANALYSIS

- TABLE 3 INDICATING PRICING OF MES SOFTWARE SUBSCRIPTIONS PER MONTH OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 4 AVERAGE SELLING PRICE TREND OF MES SOFTWARE SUBSCRIPTIONS PER MONTH, BY OFFERING, 2021-2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF MES SOFTWARE SUBSCRIPTIONS PER MONTH, BY REGION, 2021-2024 (USD)

- TABLE 6 ROLE OF COMPANIES IN MANUFACTURING EXECUTION SYSTEMS ECOSYSTEM

- TABLE 7 LIST OF MAJOR PATENTS, 2020-2023

- TABLE 8 IMPORT DATA FOR HS CODE 903289-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 903289-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 10 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 STANDARDS

- TABLE 16 PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 19 MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 20 MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 21 SOFTWARE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 22 SOFTWARE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 23 SERVICES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 24 SERVICES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 25 MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 26 MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 27 ON-PREMISES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 28 ON-PREMISES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 29 CLOUD: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 30 CLOUD: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 31 HYBRID: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 32 HYBRID: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 33 MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 34 MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 35 FOOD & BEVERAGES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 36 FOOD & BEVERAGES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 37 FOOD & BEVERAGES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 38 FOOD & BEVERAGES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 39 FOOD & BEVERAGES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 FOOD & BEVERAGES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 OIL & GAS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 42 OIL & GAS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 43 OIL & GAS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 44 OIL & GAS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 45 OIL & GAS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 OIL & GAS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 CHEMICALS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 48 CHEMICALS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 49 CHEMICALS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 50 CHEMICALS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 51 CHEMICALS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 CHEMICALS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 PHARMACEUTICALS & LIFE SCIENCES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 54 PHARMACEUTICALS & LIFE SCIENCES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 55 PHARMACEUTICALS & LIFE SCIENCES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 56 PHARMACEUTICALS & LIFE SCIENCES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 57 PHARMACEUTICALS & LIFE SCIENCES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 PHARMACEUTICALS & LIFE SCIENCES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 AUTOMOTIVE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 60 AUTOMOTIVE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 61 AUTOMOTIVE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 62 AUTOMOTIVE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 63 AUTOMOTIVE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 AUTOMOTIVE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 AEROSPACE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 66 AEROSPACE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 67 AEROSPACE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 68 AEROSPACE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 69 AEROSPACE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 AEROSPACE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 MEDICAL DEVICES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 72 MEDICAL DEVICES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 73 MEDICAL DEVICES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 74 MEDICAL DEVICES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 75 MEDICAL DEVICES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 MEDICAL DEVICES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 ELECTRONICS & SEMICONDUCTOR: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 78 ELECTRONICS & SEMICONDUCTOR: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 79 ELECTRONICS & SEMICONDUCTOR: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 80 ELECTRONICS & SEMICONDUCTOR: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 81 ELECTRONICS & SEMICONDUCTOR: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 ELECTRONICS & SEMICONDUCTOR: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 METALS & MINING: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 84 METALS & MINING: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 85 METALS & MINING: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 86 METALS & MINING: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 87 METALS & MINING: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 METALS & MINING: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 OTHER INDUSTRIES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 90 OTHER INDUSTRIES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 91 OTHER INDUSTRIES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 92 OTHER INDUSTRIES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 93 OTHER INDUSTRIES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 OTHER INDUSTRIES: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 103 US: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 104 US: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 105 CANADA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 106 CANADA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 107 MEXICO: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 108 MEXICO: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 EUROPE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 112 EUROPE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 114 EUROPE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 115 UK: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 116 UK: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 117 GERMANY: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 118 GERMANY: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 119 FRANCE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 120 FRANCE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 121 ITALY: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 122 ITALY: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 123 SPAIN: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 124 SPAIN: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 NETHERLANDS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 126 NETHERLANDS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127 SWITZERLAND: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 128 SWITZERLAND: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 129 NORDICS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 130 NORDICS: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 131 REST OF EUROPE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 132 REST OF EUROPE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MANUFACTURING EXECUTION SYSTEMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MANUFACTURING EXECUTION SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 CHINA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 140 CHINA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 141 JAPAN: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 142 JAPAN: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 INDIA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 144 INDIA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 145 SOUTH KOREA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 146 SOUTH KOREA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 147 SINGAPORE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 148 SINGAPORE: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 MALAYSIA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 150 MALAYSIA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 INDONESIA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 152 INDONESIA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 155 ROW: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 156 ROW: MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 157 ROW: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 158 ROW: MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 159 ROW: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 160 ROW: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST: MANUFACTURING EXECUTION SYSTEMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 162 MIDDLE EAST: MANUFACTURING EXECUTION SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 164 MIDDLE EAST: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 SOUTH AMERICA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 166 SOUTH AMERICA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 167 SOUTH AMERICA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 168 SOUTH AMERICA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 169 AFRICA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 170 AFRICA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 171 AFRICA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 172 AFRICA: MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 173 MANUFACTURING EXECUTION SYSTEMS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-DECEMBER 2024

- TABLE 174 MANUFACTURING EXECUTION SYSTEMS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 175 MANUFACTURING EXECUTION SYSTEMS MARKET: REGION FOOTPRINT

- TABLE 176 MANUFACTURING EXECUTION SYSTEMS MARKET: OFFERING FOOTPRINT

- TABLE 177 MANUFACTURING EXECUTION SYSTEMS MARKET: DEPLOYMENT MODE FOOTPRINT

- TABLE 178 MANUFACTURING EXECUTION SYSTEMS MARKET: INDUSTRY FOOTPRINT

- TABLE 179 MANUFACTURING EXECUTION SYSTEMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 180 MANUFACTURING EXECUTION SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 181 MANUFACTURING EXECUTION SYSTEMS MARKET: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2024

- TABLE 182 MANUFACTURING EXECUTION SYSTEMS MARKET: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 183 SIEMENS: COMPANY OVERVIEW

- TABLE 184 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 SIEMENS: PRODUCT LAUNCHES

- TABLE 186 SIEMENS: DEALS

- TABLE 187 DASSAULT SYSTEMES: COMPANY OVERVIEW

- TABLE 188 DASSAULT SYSTEMES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 DASSAULT SYSTEMES: DEALS

- TABLE 190 SAP SE: COMPANY OVERVIEW

- TABLE 191 SAP SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 SAP SE: DEALS

- TABLE 193 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 194 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ROCKWELL AUTOMATION: PRODUCT LAUNCHES

- TABLE 196 ROCKWELL AUTOMATION: DEALS

- TABLE 197 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 198 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 200 ABB: COMPANY OVERVIEW

- TABLE 201 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 APPLIED MATERIALS: COMPANY OVERVIEW

- TABLE 203 APPLIED MATERIALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 205 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 207 EMERSON ELECTRIC CO.: DEALS

- TABLE 208 GE VERNOVA: COMPANY OVERVIEW

- TABLE 209 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 ORACLE: COMPANY OVERVIEW

- TABLE 211 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 213 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 KORBER AG: COMPANY OVERVIEW

- TABLE 215 KORBER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 217 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 218 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 219 APTEAN: COMPANY OVERVIEW

- TABLE 220 APTEAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 EPICOR SOFTWARE CORPORATION: COMPANY OVERVIEW

- TABLE 222 EPICOR SOFTWARE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 INFOR: COMPANY OVERVIEW

- TABLE 224 INFOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 MANUFACTURING EXECUTION SYSTEMS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MANUFACTURING EXECUTION SYSTEMS MARKET: RESEARCH DESIGN

- FIGURE 3 MANUFACTURING EXECUTION SYSTEMS MARKET: RESEARCH APPROACH

- FIGURE 4 MANUFACTURING EXECUTION SYSTEMS MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MANUFACTURING EXECUTION SYSTEMS MARKET: TOP-DOWN APPROACH

- FIGURE 6 MANUFACTURING EXECUTION SYSTEMS MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 7 MANUFACTURING EXECUTION SYSTEMS MARKET: DATA TRIANGULATION

- FIGURE 8 MANUFACTURING EXECUTION SYSTEMS MARKET SIZE, IN TERMS OF VALUE, 2021-2030

- FIGURE 9 SERVICES SEGMENT TO EXHIBIT HIGHER CAGR IN MANUFACTURING EXECUTION SYSTEMS MARKET FROM 2025 TO 2030

- FIGURE 10 ON-PREMISES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 PHARMACEUTICALS & LIFE SCIENCES SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 12 ASIA PACIFIC HELD LARGEST SHARE OF MANUFACTURING EXECUTION SYSTEMS MARKET IN 2024

- FIGURE 13 RISING ADOPTION OF INDUSTRIAL AUTOMATION SOLUTIONS TO DRIVE MARKET

- FIGURE 14 SERVICES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 15 AUTOMOTIVE SEGMENT TO HOLD LARGEST SHARE OF MANUFACTURING EXECUTION SYSTEMS MARKET IN 2025

- FIGURE 16 AUTOMOTIVE SEGMENT AND US ACCOUNTED FOR LARGEST SHARES OF NORTH AMERICAN MANUFACTURING EXECUTION SYSTEMS MARKET IN 2024

- FIGURE 17 INDIA TO RECORD HIGHEST CAGR IN GLOBAL MANUFACTURING EXECUTION SYSTEMS MARKET DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 IMPACT ANALYSIS: DRIVERS

- FIGURE 20 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 21 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 22 IMPACT ANALYSIS: CHALLENGES

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE TREND OF MES SOFTWARE SUBSCRIPTIONS PER MONTH, BY OFFERING, 2021-2024

- FIGURE 25 AVERAGE SELLING PRICE TREND OF MES SOFTWARE SUBSCRIPTIONS PER MONTH, BY REGION, 2021-2024

- FIGURE 26 VALUE CHAIN ANALYSIS

- FIGURE 27 MANUFACTURING EXECUTION SYSTEMS ECOSYSTEM

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 29 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 30 IMPORT DATA FOR HS CODE 903289-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 31 EXPORT DATA FOR HS CODE 903289-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 35 AI USE CASES IN MES SOFTWARE

- FIGURE 36 MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING

- FIGURE 37 SERVICES SEGMENT TO EXHIBIT HIGHER CAGR FROM 2025 TO 2030

- FIGURE 38 MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE

- FIGURE 39 HYBRID SEGMENT TO RECORD HIGHEST CAGR IN MANUFACTURING EXECUTION SYSTEMS MARKET BETWEEN 2025 AND 2030

- FIGURE 40 MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY

- FIGURE 41 PHARMACEUTICALS & LIFE SCIENCES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 42 ADVANTAGES OF MES AT DIFFERENT LEVELS IN AUTOMOTIVE INDUSTRY

- FIGURE 43 MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION

- FIGURE 44 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL MANUFACTURING EXECUTION SYSTEMS MARKET DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA: MANUFACTURING EXECUTION SYSTEMS MARKET SNAPSHOT

- FIGURE 46 US TO DOMINATE NORTH AMERICAN MANUFACTURING EXECUTION SYSTEMS MARKET FROM 2025 TO 2030

- FIGURE 47 EUROPE: MANUFACTURING EXECUTION SYSTEMS MARKET SNAPSHOT

- FIGURE 48 GERMANY TO DOMINATE EUROPEAN MANUFACTURING EXECUTION SYSTEMS MARKET FROM 2025 TO 2030

- FIGURE 49 ASIA PACIFIC: MANUFACTURING EXECUTION SYSTEMS MARKET SNAPSHOT

- FIGURE 50 INDIA TO RECORD HIGHEST CAGR IN ASIA PACIFIC MANUFACTURING EXECUTION SYSTEMS MARKET BETWEEN 2025 AND 2030

- FIGURE 51 SOUTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF ROW MANUFACTURING EXECUTION SYSTEMS MARKET IN 2025

- FIGURE 52 MANUFACTURING EXECUTION SYSTEMS MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2019-2023

- FIGURE 53 MARKET SHARE ANALYSIS OF COMPANIES OFFERING MANUFACTURING EXECUTION SYSTEMS, 2024

- FIGURE 54 COMPANY VALUATION

- FIGURE 55 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 56 PRODUCT COMPARISON

- FIGURE 57 MANUFACTURING EXECUTION SYSTEMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 58 MANUFACTURING EXECUTION SYSTEMS MARKET: COMPANY FOOTPRINT

- FIGURE 59 MANUFACTURING EXECUTION SYSTEMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 60 SIEMENS: COMPANY SNAPSHOT

- FIGURE 61 DASSAULT SYSTEMES: COMPANY SNAPSHOT

- FIGURE 62 SAP SE: COMPANY SNAPSHOT

- FIGURE 63 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 64 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 65 ABB: COMPANY SNAPSHOT

- FIGURE 66 APPLIED MATERIALS: COMPANY SNAPSHOT

- FIGURE 67 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 68 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 69 ORACLE: COMPANY SNAPSHOT

- FIGURE 70 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 71 KORBER AG: COMPANY SNAPSHOT

- FIGURE 72 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

With a CAGR of 10.1%, the worldwide Manufacturing execution systems market is expected to rise from USD 15.95 billion in 2025 to USD 25.78 billion in 2030. Primary growth drivers are the growing adoption of Industry 4.0, smart factories, and real-time data integration to improve production efficiency. MES solutions automate manufacturing operations by maximizing resource utilization, ensuring regulatory compliance, and enhancing quality control. Increasing demand from the automotive, pharmaceutical, aerospace, and electronics industries continues to drive market growth. In addition, the shift towards cloud-based MES and the integration of AI, IoT, and big data analytics are transforming production management, allowing for increased agility and operational intelligence.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Deployment Mode, Application, Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Services segment to maintain largest market share during the forecast period"

Increasing need for integration, and support services is driving the services segment to hold the largest market share in the Manufacturing Execution Systems (MES) market. With industries betting big on digital transformation and automation, companies are keen to have expert help in rolling out MES solutions and seamlessly integrating them with existing enterprise resource planning (ERP) and industrial automation systems. In addition, cloud-based MES has also led to demand for managed services such as remote monitoring, security, and system optimization. MES services are also significant because regular software updates, training programs, and compliance support play a crucial role. However, as manufacturers continue emphasizing the importance of real-time data analytics, predictive maintenance, and regulatory adherence, the services segment will remain vital for ensuring MES implementation and keeping operations running efficiently across industries.

"On-premises segment to maintain largest market share during the forecast period"

The on-premises deployment of Manufacturing Execution Systems (MES) will command a largest market share through the forecast period as it excels in ensuring data security, customization, and real-time operational control. Automotive, aerospace, pharmaceuticals, and food & beverages sectors use on-premises MES for enhanced production monitoring, regulatory adherence, and lower downtime. Compared to cloud-based offerings, on-premises MES provides greater control of vital production data and is, therefore, the most sought-after for industries with high data privacy needs. Moreover, the ability to integrate MES with legacy enterprise systems contributes to its use among large-scale production facilities. Although cloud technology is increasingly being adopted, the requirement for high up-front investment and maintenance costs remains a drawback for some organizations. Nevertheless, industries that prioritize operational efficiency, low latency, and secure data processing continue to favor on-premises MES solutions. As businesses strive to enhance production visibility and optimize resources, on-premises MES is expected to remain a mainstream deployment model in the market.

"Pharmaceutical industry expected to grow at highest CAGR during the forecast period in the Manufacturing execution systems market"

With strict regulatory requirements, a growing need for real-time production monitoring, and a shift towards a more operationally efficient manufacturing sector, the pharmaceutical industry will grow at significant CAGR in the Manufacturing Execution Systems (MES) market. MES solutions in the pharmaceutical manufacturing industry support production process streamlining, compliance with FDA and GMP standards, and traceability across the supply chain. Also these systems provide smooth batch records, automated reporting, and ERP and quality management (QM) system integration. MES now enables process optimization with minimal downtime, ensuring consistent product quality as the adoption of AI, machine learning, and predictive analytics expands. While pharmaceutical companies continue accelerating their digital transformation and Industry 4.0 initiatives, the necessity to use MES for maintaining stringent quality control, slashing waste while minimizing the costs of production will remain higher in demand in the future.

"North America to lead manufacturing execution systems market growth with the second largest share, driven by digital transformation and industrial automation"

North America is anticipated to register the second largest share in the manufacturing execution systems market because of the fast growth in industrial automation, the high level of government encouragement towards digitalization, and the rising uptake of smart manufacturing. The presence of important automobile aerospace and pharmaceutical industries makes North America one of the top market for MES as companies require real-time production control and quality monitoring and compliance tracking. The market is expanding quickly as the region leverages loT technology, Industry 4.0, and embraces cloud-based MES systems. MES integration with enterprise systems is becoming more seamless due to growing investments in AI-driven analytics and cybersecurity solutions. With its strong technological foundation, North America is set to dominate MES market growth significantly in the coming years.

Breakdown of primaries

A variety of executives from key organizations operating in the manufacturing execution systems market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 -45%, Tier 2 - 30%, and Tier 3 - 25%

- By Designation: C-level Executives - 35%, Directors - 45%, and Others - 20%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 35%, and RoW - 10%

Major players profiled in this report are as follows: Siemens (Germany), Dassault Systemes (France), SAP SE (Germany), Rockwell Automation (US), Honeywell International Inc. (US) and others. These leading companies possess a wide portfolio of products, establishing a prominent presence in established as well as emerging markets.

The study provides a detailed competitive analysis of these key players in the manufacturing execution systems market, presenting their company profiles, most recent developments, and key market strategies.

Key Market Players

Key players operating in manufacturing execution systems market are as follows:

1. Siemens (Germany)

2. Dassault Systemes (France)

3. SAP SE (Germany)

4. Rockwell Automation (US)

5. Honeywell International Inc.(US)

6. ABB (Switzerland)

7. Applied Materials (US)

8. Emerson Electric Co. (US)

9. GE Vernova (US)

10. Oracle (US)

11. Schneider Electric (France)

12. Korber AG (Germany)

13. Yokogawa Electric Corporation (Japan)

14. Aptean (Georgia)

15. Epicor Software Corporation (US)

16. Infor (US)

17. 42Q (US)

18. Aegis Industrial Software Corporation (UK)

19. Cerexio (Singapore)

20. Critical Manufacturing SA (Portugal )

21. Eyelit (US)

22. iBase-t (US)

23. MPDV (Germany)

24. Parsec Automation, LLC (US)

25. Tebis Technische Informationssysteme AG (Germany)

26. Throughput Consulting Inc.(US)

27. FORCAM ENISCO GmbH (Germany)

28. Miracom, Inc. (South Korea)

29. Andea (Poland)

30. MasterControl Solutions, Inc. (US)

Study Coverage

In this report, the manufacturing execution systems market has been segmented based on offering, deployment mode, application, industry and region. The offering segment consists of software and services. The deployment mode segment includes on-premises, cloud, and hybrid. The application segment consists of production management, quality management, material and inventory management, maintenance management and performance analysis. The industry segment comprises food & beverages, oil & gas, chemicals, pharmaceuticals & life sciences, automotive, aerospace, medical devices, electronics & semiconductor, metals & mining, other industries. The market has been segmented into four regions-North America, Asia Pacific, Europe, and RoW.

Key Benefits of Buying the Report

- Analysis of key drivers (rising population growth to fuel the need for connected supply chains and mass production in manufacturing, integration of information technology (IT) and operational technology (OT) systems, rising demand for industrial automation across industries, rising regulatory pressure related to safety and quality of manufacturing processes and products, rising emphasis on operational efficiency, growing complexity of manufacturing processes), restraints (high costs associated with upgrades and maintenance, MES integration complexities), opportunities (MES integration with ERP and PLM solutions, implementation of MES in the pharmaceutical and life sciences industries, MES solutions require customization to address the diverse demands of different industries, and rising implementation of MES in SMEs), and challenges (complexities associated in deployment of MES in various industries and data security concerns associated with MES) influencing the growth of the manufacturing execution systems market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the manufacturing execution systems market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the manufacturing execution systems market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the manufacturing execution systems market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Siemens (Germany), Dassault Systemes (France), SAP SE (Germany), Rockwell Automation (US), Honeywell International Inc. (US) and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MANUFACTURING EXECUTION SYSTEMS MARKET

- 4.2 MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING

- 4.3 MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY

- 4.4 MANUFACTURING EXECUTION SYSTEMS MARKET IN NORTH AMERICA, BY INDUSTRY AND COUNTRY

- 4.5 MANUFACTURING EXECUTION SYSTEMS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for connected supply chains

- 5.2.1.2 Rising integration of information technology (IT) with operational technology (OT) systems

- 5.2.1.3 Mounting demand for industrial automation solutions

- 5.2.1.4 Growing focus on adherence to strict regulations related to safety and quality

- 5.2.1.5 Rising emphasis on operational efficiency

- 5.2.1.6 Growing complexity of manufacturing processes

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs associated with MES upgrades and maintenance

- 5.2.2.2 Customization and integration issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising adoption of ERP and PLM solutions

- 5.2.3.2 Increasing need for regulatory compliance in pharmaceuticals & life sciences industry

- 5.2.3.3 Rising development of scalable and cost-effective solutions for SMEs

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities associated with deployment of MES in various industries

- 5.2.4.2 Data security concerns

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICING OF KEY PLAYERS, BY OFFERING, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF MES SOFTWARE SUBSCRIPTIONS, BY OFFERING, 2021-2024

- 5.4.3 AVERAGE SELLING PRICE TREND OF MES SOFTWARE SUBSCRIPTIONS, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Internet of Things (IoT)

- 5.8.1.2 Artificial intelligence (AI)

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Predictive maintenance

- 5.8.2.2 Big data analytics

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Digital twin

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 903289)

- 5.10.2 EXPORT SCENARIO (HS CODE 903289)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY

- 5.12.1 AGC PHARMA CHEMICALS ADOPTS SIEMENS' MES SOLUTIONS TO AUTOMATE PRODUCTION AND ACHIEVE PAPERLESS MANUFACTURING

- 5.12.2 SAFRAN CERAMICS IMPLEMENTS CT INFODREAM'S MES SOFTWARE TO MONITOR PRODUCTION AND DIGITIZE MANUFACTURING

- 5.12.3 LONZA LEVERAGES ROCKWELL AUTOMATION'S FACTORYTALK PRODUCTIONCENTRE MES SOLUTION TO IMPROVE COMPLIANCE AND REDUCE ERRORS

- 5.12.4 SHILOH INDUSTRIES USES PLEX SYSTEMS' MES SOLUTION TO UNIFY OPERATIONS IN FACILITIES

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON MANUFACTURING EXECUTION SYSTEMS MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT OF AI/GEN AI ON MANUFACTURING EXECUTION SYSTEMS MARKET

- 5.16.2.1 Impact of AI/Gen AI on key end-use industries

- 5.16.2.1.1 Pharmaceuticals

- 5.16.2.1.2 Automotive

- 5.16.2.2 Use cases

- 5.16.2.3 Future of AI/Gen AI in MES ecosystem

- 5.16.2.1 Impact of AI/Gen AI on key end-use industries

6 APPLICATIONS OF MANUFACTURING EXECUTION SYSTEMS

- 6.1 INTRODUCTION

- 6.2 PRODUCTION MANAGEMENT

- 6.3 QUALITY MANAGEMENT

- 6.4 MATERIAL AND INVENTORY MANAGEMENT

- 6.5 MAINTENANCE MANAGEMENT

- 6.6 PERFORMANCE ANALYSIS

7 MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING

- 7.1 INTRODUCTION

- 7.2 SOFTWARE

- 7.2.1 ABILITY TO LIMIT MANUAL WORK AND REDUCE ERRORS TO ACCELERATE SEGMENTAL GROWTH

- 7.3 SERVICES

- 7.3.1 NEED FOR ROUTINE BUSINESS MAINTENANCE AND UPGRADATION TO CONTRIBUTE TO SEGMENTAL GROWTH

- 7.3.2 IMPLEMENTATION

- 7.3.3 UPGRADATION

- 7.3.4 TRAINING

- 7.3.5 MAINTENANCE

8 MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT MODE

- 8.1 INTRODUCTION

- 8.2 ON-PREMISES

- 8.2.1 EMPHASIS ON ENHANCING SECURITY CONTROL THROUGH IN-HOUSE CONFIGURATIONS TO FUEL SEGMENTAL GROWTH

- 8.3 CLOUD

- 8.3.1 COST-EFFICIENCY AND RELIABILITY IN TERMS OF DATA RECOVERY TO DRIVE MARKET

- 8.4 HYBRID

- 8.4.1 ENHANCED OPERATIONAL EFFICIENCY THROUGH INTEGRATED INFRASTRUCTURE TO FOSTER SEGMENTAL GROWTH

9 MANUFACTURING EXECUTION SYSTEMS MARKET, BY INDUSTRY

- 9.1 INTRODUCTION

- 9.2 FOOD & BEVERAGES

- 9.2.1 RISING NEED TO ENSURE PRECISE INGREDIENT CONTROL AND ADHERENCE TO STRICT REGULATIONS TO DRIVE MARKET

- 9.3 OIL & GAS

- 9.3.1 INCREASING FOCUS ON MAINTAINING PRODUCT RELIABILITY AND ENSURING EMPLOYEE SAFETY TO FUEL SEGMENTAL GROWTH

- 9.4 CHEMICALS

- 9.4.1 GROWING EMPHASIS ON MAINTAINING OPERATIONAL TRANSPARENCY AND EFFICIENCY TO AUGMENT SEGMENTAL GROWTH

- 9.5 PHARMACEUTICALS & LIFE SCIENCES

- 9.5.1 INCREASING REQUIREMENT FOR IMPROVED DATA SECURITY AND EFFECTIVE REGULATORY COMPLIANCE TO FOSTER SEGMENTAL GROWTH

- 9.6 AUTOMOTIVE

- 9.6.1 RISING FOCUS ON STANDARDIZATION OF MANUFACTURING PROCESS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.7 AEROSPACE

- 9.7.1 GROWING EMPHASIS ON SHORTENING PRODUCTION CYCLES AND ENHANCING PRODUCT QUALITY TO BOOST SEGMENTAL GROWTH

- 9.8 MEDICAL DEVICES

- 9.8.1 INCREASING NEED TO MAINTAIN HYGIENE AND QUALITY TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.9 ELECTRONICS & SEMICONDUCTOR

- 9.9.1 RISING IMPLEMENTATION OF STRINGENT QUALITY STANDARDS AND COMPLEX SUPPLY CHAINS TO FUEL SEGMENTAL GROWTH

- 9.10 METALS & MINING

- 9.10.1 GROWING FOCUS ON OPTIMIZING LOGISTICS AND TRACKING INVENTORY LEVELS TO AUGMENT SEGMENTAL GROWTH

- 9.11 OTHER INDUSTRIES

10 MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Rising adoption of Industry 4.0 and smart manufacturing initiatives to drive market

- 10.2.3 CANADA

- 10.2.3.1 Rapid digitalization due to shortage of skilled labor to contribute to market growth

- 10.2.4 MEXICO

- 10.2.4.1 Thriving manufacturing sector and industrial automation to boost market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 UK

- 10.3.2.1 Burgeoning demand for autonomous vehicles and efficient manufacturing processes to augment market growth

- 10.3.3 GERMANY

- 10.3.3.1 Increasing digitization and automation of manufacturing processes to foster market growth

- 10.3.4 FRANCE

- 10.3.4.1 Rising popularity of low-emission autonomous vehicles to bolster market growth

- 10.3.5 ITALY

- 10.3.5.1 Rapid expansion of industrial facilities to offer lucrative opportunities

- 10.3.6 SPAIN

- 10.3.6.1 Increasing focus on smart manufacturing and industrial digitalization to contribute to market growth

- 10.3.7 NETHERLANDS

- 10.3.7.1 Rising need for predictive analytics and automation in industries to spur demand

- 10.3.8 SWITZERLAND

- 10.3.8.1 Growing emphasis on precision manufacturing to drive market

- 10.3.9 NORDICS

- 10.3.9.1 Increasing need to support real-time monitoring and predictive maintenance to accelerate market growth

- 10.3.10 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Mounting production and manufacturing of automobiles to facilitate market growth

- 10.4.3 JAPAN

- 10.4.3.1 Thriving industrial and manufacturing sectors to foster market growth

- 10.4.4 INDIA

- 10.4.4.1 Rapid industrialization and adoption of advanced technologies to boost market growth

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Mounting production of automobiles and electronic products to fuel market growth

- 10.4.6 SINGAPORE

- 10.4.6.1 Rising initiatives to support port automation and smart warehouses to drive market

- 10.4.7 MALAYSIA

- 10.4.7.1 Increasing export of electrical and electronics products to fuel market growth

- 10.4.8 INDONESIA

- 10.4.8.1 Rapid industrial growth and digital transformation to foster market growth

- 10.4.9 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Bahrain

- 10.5.2.1.1 Increasing investment in smart manufacturing technologies to drive market

- 10.5.2.2 Kuwait

- 10.5.2.2.1 Rising implementation of smart factories to augment market growth

- 10.5.2.3 Oman

- 10.5.2.3.1 Growing investment in advanced manufacturing technologies to boost market growth

- 10.5.2.4 Qatar

- 10.5.2.4.1 Rising emphasis on industrial automation and economic diversification to accelerate market growth

- 10.5.2.5 Saudi Arabia

- 10.5.2.5.1 Increasing focus on smart manufacturing to contribute to market growth

- 10.5.2.6 UAE

- 10.5.2.6.1 Rapid digital transformation and smart factory initiatives to fuel market growth

- 10.5.2.7 Rest of Middle East

- 10.5.2.1 Bahrain

- 10.5.3 SOUTH AMERICA

- 10.5.3.1 Brazil

- 10.5.3.1.1 Booming automotive, food & beverages, and oil & gas industries to drive market

- 10.5.3.2 Argentina

- 10.5.3.2.1 Growing focus on modernizing manufacturing facilities to boost market growth

- 10.5.3.3 Other South American countries

- 10.5.3.1 Brazil

- 10.5.4 AFRICA

- 10.5.4.1 South Africa

- 10.5.4.1.1 Rising emphasis on real-time tracking and predictive maintenance in industries to spur demand

- 10.5.4.2 Other African countries

- 10.5.4.1 South Africa

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-DECEMBER 2024

- 11.3 REVENUE ANALYSIS, 2019-2023

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Offering footprint

- 11.7.5.4 Deployment mode footprint

- 11.7.5.5 Industry footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SIEMENS

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 DASSAULT SYSTEMES

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 SAP SE

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 ROCKWELL AUTOMATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 HONEYWELL INTERNATIONAL INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 ABB

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.7 APPLIED MATERIALS

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.8 EMERSON ELECTRIC CO.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.9 GE VERNOVA

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 ORACLE

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.11 SCHNEIDER ELECTRIC

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.12 KORBER AG

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.13 YOKOGAWA ELECTRIC CORPORATION

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches

- 12.1.14 APTEAN

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.15 EPICOR SOFTWARE CORPORATION

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.16 INFOR

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Solutions/Services offered

- 12.1.1 SIEMENS

- 12.2 OTHER PLAYERS

- 12.2.1 42Q

- 12.2.2 AEGIS INDUSTRIAL SOFTWARE CORPORATION

- 12.2.3 CEREXIO

- 12.2.4 CRITICAL MANUFACTURING SA

- 12.2.5 EYELIT

- 12.2.6 IBASE-T

- 12.2.7 MPDV

- 12.2.8 PARSEC AUTOMATION, LLC

- 12.2.9 TEBIS TECHNISCHE INFORMATIONSSYSTEME AG

- 12.2.10 THROUGHPUT CONSULTING INC.

- 12.2.11 FORCAM ENISCO GMBH

- 12.2.12 MIRACOM, INC.

- 12.2.13 ANDEA

- 12.2.14 MASTERCONTROL SOLUTIONS, INC.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS