|

|

市場調査レポート

商品コード

1692594

環状オレフィンポリマー(COP)の世界市場:タイプ別、プロセスタイプ別、最終用途産業別、地域別 - 予測(~2029年)Cyclic Olefin Polymer Market by Type (Homopolymers, Copolymers), Process Type (Injection Molding, Extrusion), End-use Industry (Packaging, Automotive, Healthcare & Medical, Food & Beverages, Electrical & Electronics) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 環状オレフィンポリマー(COP)の世界市場:タイプ別、プロセスタイプ別、最終用途産業別、地域別 - 予測(~2029年) |

|

出版日: 2025年03月11日

発行: MarketsandMarkets

ページ情報: 英文 234 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の環状オレフィンポリマー(COP)の市場規模は、2024年の11億2,000万米ドルから2029年までに15億4,000万米ドルに達すると予測され、予測期間にCAGRで6.5%の成長が見込まれます。

環状オレフィン市場は、ポリマーとコポリマーの双方で、さまざまな産業における需要の増加によって刺激されています。その優れた透明性、耐薬品性、低吸水性により、この材料は高い性能と信頼性が要求される用途でますます価値あるものとなっています。環状オレフィンポリマー(COP)は、主に製薬部門や食品・飲料部門で包装に使用されています。この産業のもう1つの強力な促進要因は医療で、この材料の不活性な特性と滅菌能力により、医療機器、ドラッグデリバリーデバイス、診断ツールなどの第一の選択肢となっています。これらの用途以外では、電子産業と光学産業が、その精度と光学的透明性から環状オレフィンに注目し、高精細ディスプレイやレンズなどの最先端技術の要求に応えています。アジア太平洋の新興市場では都市化が加速し可処分所得が増加しており、産業の成長と工業化が進んでいることから、需要を促進しています。それでもなお、産業は課題に直面しています。価格を上昇させる可能性のある生産工程の複雑性や、より価格競争力のある代替品です。こうした課題に対し、持続可能な原材料への関心の高まりや、生産方式の継続的な革新により、新たな成長機会が生まれつつあります。環状オレフィン産業は、性能志向と環境意識が高まる世界を受け入れながら、変化する産業の需要を満たす能力に支えられ、将来を前向きに捉えています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 100万米ドル |

| セグメント | タイプ、プロセスタイプ、最終用途産業、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

「プロセスタイプ別では、射出成形の市場シェアがもっとも大きいです。」

射出成形が環状オレフィンポリマー(COP)の中でもっとも大きなシェアを占めているのは、その効率性、正確性、COP本来の特性との適合性によるものです。環状オレフィンポリマー(COP)は高い透明性、耐薬品性、低吸湿性を持ち、医療機器、包装、光学などの幅広い用途で使用されています。射出成形は複雑で精密な部品を比較的低いコストで大量に生産できるため、このような用途に適しており、製造工程として選ばれています。その大きな理由の1つは、COPの非常に優れた流動性を活用できることです。射出成形は、ポリマーを溶かして高圧で金型に押し込み、そこで冷却して固化させて成形します。COPの低い粘度と耐熱性は、複雑な金型に容易に流れ込むことを保証し、シリンジバレル、診断キュベット、傷の少ない光学レンズのような精密な部品を作ります。その他の技術に比べ、射出成形は材料の無駄を削減し、持続可能性と性能の目標に合致した速いサイクルタイムを生み出します。フィルム以外の中空部品はブロー成形に完璧に適合し、ブロー成形の可塑性は複雑な固体形状を使用し生成することができるため、ブロー成形は他のどの技術よりも優れています。高い性能によるCOPへのニーズの高まりに続いて、射出成形の調整可能性と手頃な価格が、この技術を上位に維持しています。

「北米は環状オレフィンポリマー(COP)市場で第3位の地域です。」

北米は、工業生産能力、技術革新、用途に対する多様な需要が混在しているため、環状オレフィン市場で第3位の地域となっています。この地域は、特に医療、包装、電子産業が盛んな米国とカナダの強力な製造基盤に支えられています。これらの市場は、透明性、耐薬品性、低吸水性に定評のある、特殊用途に最適な高機能ポリマーである環状オレフィンに大きく依存しています。

当レポートでは、世界の環状オレフィンポリマー(COP)(COP)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 環状オレフィンポリマー(COP)市場の企業にとって魅力的な機会

- 環状オレフィンポリマー(COP)市場:材料別

- 環状オレフィンポリマー(COP)市場:用途別

- 環状オレフィンポリマー(COP)市場:最終用途産業別

- 環状オレフィンポリマー(COP)市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済指標

- 世界のGDP動向

- 自動車産業の動向

第6章 産業動向

- イントロダクション

- バリューチェーン分析

- 規制情勢

- 規制

- 標準

- 規制機関、政府機関、その他の組織

- 貿易分析

- 輸入シナリオ(HSコード390290)

- 輸出シナリオ(HSコード390290)

- エコシステム分析

- ケーススタディ分析

- 技術分析

- 主要技術

- 補完技術

- 主な会議とイベント(2025年)

- 価格分析

- 平均販売価格の動向:地域別(2021年~2023年)

- 主要企業の平均販売価格の動向:最終用途産業別(2023年)

- 平均販売価格の動向:タイプ別(2021年~2023年)

- 顧客ビジネスに影響を与える動向/混乱

- 特許分析

- 投資と資金調達のシナリオ

- 環状オレフィンポリマー(COP)市場に対するAI/生成AIの影響

第7章 環状オレフィンポリマー(COP)市場:タイプ別

- イントロダクション

- コポリマー

- ホモポリマー

第8章 環状オレフィンポリマー(COP)市場:プロセスタイプ別

- イントロダクション

- 射出成形

- 押出成形

- ブロー成形

- その他のプロセスタイプ

第9章 環状オレフィンポリマー(COP)市場:最終用途産業別

- イントロダクション

- 包装

- 自動車

- 医療

- 食品・飲料

- 電気・電子

- 化学品

- 光学

- その他の最終用途産業

第10章 環状オレフィンポリマー(COP)市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- スペイン

- 英国

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- マレーシア

- その他のアジア太平洋

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業の評価と財務指標

- ブランド/製品の比較分析

- 企業の評価マトリクス:主要企業(2023年)

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- MITSUI CHEMICALS, INC.

- POLYPLASTICS CO., LTD.

- SUMITOMO BAKELITE CO., LTD.

- TUOXIN TECHNOLOGY (QUZHOU) CO., LTD. (TOPOLEFIN)

- ZEON CORPORATION

- JSR CORPORATION

- BOREALIS AG

- POLYSCIENCES, INC.

- BIOSYNTH

- CHINA PETROCHEMICAL DEVELOPMENT CORPORATION (CPDC)

第13章 付録

List of Tables

- TABLE 1 CAPITAL HEALTHCARE EXPENDITURE, 2020-2023 (USD MILLION)

- TABLE 2 HEALTHCARE SPENDING, 2023 (USD MILLION)

- TABLE 3 VEHICLE PRODUCTION STATISTICS, BY KEY COUNTRY, 2022-2023 (UNIT)

- TABLE 4 CYCLIC OLEFIN POLYMER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 6 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 7 TRENDS OF PER CAPITA GDP, BY COUNTRY, 2020-2023 (USD)

- TABLE 8 GDP GROWTH ESTIMATE AND PROJECTION, BY KEY COUNTRY, 2024-2027 (USD)

- TABLE 9 VEHICLE PRODUCTION STATISTICS, BY COUNTRY, 2022-2023 (UNIT)

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 IMPORT DATA FOR HS CODE 390290-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR HS CODE 390290-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 ROLE OF COMPANIES IN CYCLIC OLEFIN POLYMER ECOSYSTEM

- TABLE 16 CYCLIC OLEFIN POLYMER MARKET: KEY CONFERENCES AND EVENTS, 2025

- TABLE 17 TOP PATENT OWNERS, 2015-2024

- TABLE 18 CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2021-2023 (TONS)

- TABLE 19 CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2024-2029 (TONS)

- TABLE 20 CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 21 CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 22 CYCLIC OLEFIN POLYMER MARKET, BY PROCESS TYPE, 2021-2023 (TONS)

- TABLE 23 CYCLIC OLEFIN POLYMER MARKET, BY PROCESS TYPE, 2024-2029 (TONS)

- TABLE 24 CYCLIC OLEFIN POLYMER MARKET, BY PROCESS TYPE, 2021-2023 (USD MILLION)

- TABLE 25 CYCLIC OLEFIN POLYMER MARKET, BY PROCESS TYPE, 2024-2029 (USD MILLION)

- TABLE 26 CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 27 CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 28 CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 29 CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 30 CYCLIC OLEFIN POLYMER MARKET, BY REGION, 2021-2023 (TONS)

- TABLE 31 CYCLIC OLEFIN POLYMER MARKET, BY REGION, 2024-2029 (TONS)

- TABLE 32 CYCLIC OLEFIN POLYMER MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 33 CYCLIC OLEFIN POLYMER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 34 NORTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2021-2023 (TONS)

- TABLE 35 NORTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2024-2029 (TONS)

- TABLE 36 NORTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 37 NORTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 38 NORTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2021-2023 (TONS)

- TABLE 39 NORTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2024-2029 (TONS)

- TABLE 40 NORTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 41 NORTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 42 NORTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 43 NORTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 44 NORTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 45 NORTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 46 US: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 47 US: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 48 US: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 49 US: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 50 CANADA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 51 CANADA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 52 CANADA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 53 CANADA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 54 MEXICO: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 55 MEXICO: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 56 MEXICO: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 57 MEXICO: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 58 EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2021-2023 (TONS)

- TABLE 59 EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2024-2029 (TONS)

- TABLE 60 EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 61 EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 62 EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2021-2023 (TONS)

- TABLE 63 EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2024-2029 (TONS)

- TABLE 64 EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 65 EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 66 EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 67 EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 68 EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 69 EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 70 GERMANY: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 71 GERMANY: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 72 GERMANY: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 73 GERMANY: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 74 FRANCE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 75 FRANCE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 76 FRANCE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 77 FRANCE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 78 SPAIN: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 79 SPAIN: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 80 SPAIN: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 81 SPAIN: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 82 UK: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 83 UK: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 84 UK: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 85 UK: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 86 ITALY: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 87 ITALY: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 88 ITALY: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 89 ITALY: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 90 REST OF EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 91 REST OF EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 92 REST OF EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 93 REST OF EUROPE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 94 ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2021-2023 (TONS)

- TABLE 95 ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2024-2029 (TONS)

- TABLE 96 ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 97 ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 98 ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2021-2023 (TONS)

- TABLE 99 ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2024-2029 (TONS)

- TABLE 100 ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 101 ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 102 ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 103 ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 104 ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 105 ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 106 CHINA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 107 CHINA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 108 CHINA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 109 CHINA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 110 INDIA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 111 INDIA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 112 INDIA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 113 INDIA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 114 JAPAN: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 115 JAPAN: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 116 JAPAN: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 117 JAPAN: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 118 SOUTH KOREA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 119 SOUTH KOREA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 120 SOUTH KOREA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 121 SOUTH KOREA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 122 MALAYSIA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 123 MALAYSIA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 124 MALAYSIA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 125 MALAYSIA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 127 REST OF ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 128 REST OF ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2021-2023 (TONS)

- TABLE 131 MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2024-2029 (TONS)

- TABLE 132 MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2021-2023 (TONS)

- TABLE 135 MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2024-2029 (TONS)

- TABLE 136 MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 139 MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 140 MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 142 SAUDI ARABIA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 143 SAUDI ARABIA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 144 SAUDI ARABIA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 145 SAUDI ARABIA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 146 UAE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 147 UAE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 148 UAE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 149 UAE: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 150 REST OF GCC COUNTRIES: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 151 REST OF GCC COUNTRIES: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 152 REST OF GCC COUNTRIES: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 153 REST OF GCC COUNTRIES: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 154 SOUTH AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 155 SOUTH AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 156 SOUTH AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 157 SOUTH AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 158 REST OF MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 159 REST OF MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 160 REST OF MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 161 REST OF MIDDLE EAST & AFRICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 162 SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2021-2023 (TONS)

- TABLE 163 SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2024-2029 (TONS)

- TABLE 164 SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 165 SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 166 SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2021-2023 (TONS)

- TABLE 167 SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2024-2029 (TONS)

- TABLE 168 SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 169 SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 170 SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 171 SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 172 SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 173 SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 174 BRAZIL: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 175 BRAZIL: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 176 BRAZIL: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 177 BRAZIL: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 178 ARGENTINA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 179 ARGENTINA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 180 ARGENTINA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 181 ARGENTINA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 182 REST OF SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (TONS)

- TABLE 183 REST OF SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (TONS)

- TABLE 184 REST OF SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 185 REST OF SOUTH AMERICA: CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 186 CYCLIC OLEFIN MARKET: GLOBAL BUSINESS REVENUE ANALYSIS OF KEY COMPANIES, 2023 (USD BILLION)

- TABLE 187 CYCLIC OLEFIN POLYMER MARKET: DEGREE OF COMPETITION, 2023

- TABLE 188 CYCLIC OLEFIN MARKET: TYPE FOOTPRINT

- TABLE 189 CYCLIC OLEFIN MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 190 CYCLIC OLEFIN MARKET: REGION FOOTPRINT

- TABLE 191 CYCLIC OLEFIN MARKET: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 192 CYCLIC OLEFIN POLYMER.: PRODUCT LAUNCHES, JANUARY 2020-DECEMBER 2024

- TABLE 193 CYCLIC OLEFIN MARKET: EXPANSIONS, APRIL 2020-JUNE 2024

- TABLE 194 MITSUI CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 195 MITSUI CHEMICALS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 MITSUI CHEMICALS, INC.: EXPANSIONS

- TABLE 197 POLYPLASTICS CO., LTD.: COMPANY OVERVIEW

- TABLE 198 POLYPLASTICS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 POLYPLASTICS CO., LTD.: EXPANSIONS

- TABLE 200 SUMITOMO BAKELITE CO., LTD.: COMPANY OVERVIEW

- TABLE 201 SUMITOMO BAKELITE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 SUMITOMO BAKELITE CO., LTD.: PRODUCT LAUNCHES

- TABLE 203 SUMITOMO BAKELITE CO., LTD.: DEALS

- TABLE 204 TOPOLEFIN: COMPANY OVERVIEW

- TABLE 205 TOPOLEFIN PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 TOPOLEFIN.: EXPANSIONS

- TABLE 207 ZEON CORPORATION: COMPANY OVERVIEW

- TABLE 208 ZEON CORPORATION PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 ZEON CORPORATION: PRODUCT LAUNCHES

- TABLE 210 ZEON CORPORATION.: EXPANSIONS

- TABLE 211 JSR CORPORATION: COMPANY OVERVIEW

- TABLE 212 JSR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 BOREALIS AG: COMPANY OVERVIEW

- TABLE 214 BOREALIS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 BOREALIS AG: PRODUCT LAUNCHES

- TABLE 216 POLYSCIENCES, INC.: COMPANY OVERVIEW

- TABLE 217 POLYSCIENCES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 BIOSYNTH: COMPANY OVERVIEW

- TABLE 219 BIOSYNTH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 BIOSYNTH: DEALS

- TABLE 221 BIOSYNTH: EXPANSIONS

- TABLE 222 CHINA PETROCHEMICAL DEVELOPMENT CORPORATION: COMPANY OVERVIEW

- TABLE 223 CHINA PETROCHEMICAL DEVELOPMENT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 CYCLIC OLEFIN POLYMER MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 CYCLIC OLEFIN POLYMER MARKET: RESEARCH DESIGN

- FIGURE 3 CYCLIC OLEFIN POLYMER MARKET: BOTTOM-UP APPROACH

- FIGURE 4 CYCLIC OLEFIN POLYMER MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 CYCLIC OLEFIN POLYMER MARKET: DATA TRIANGULATION

- FIGURE 8 COPOLYMERS SEGMENT TO LEAD CYCLIC OLEFIN POLYMER MARKET IN 2029

- FIGURE 9 INJECTION MOLDING SEGMENT TO DOMINATE CYCLIC OLEFIN POLYMER MARKET IN 2029

- FIGURE 10 PACKAGING SEGMENT TO LEAD CYCLIC OLEFIN POLYMER MARKET IN 2029

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING CYCLIC OLEFIN POLYMER MARKET DURING FORECAST PERIOD

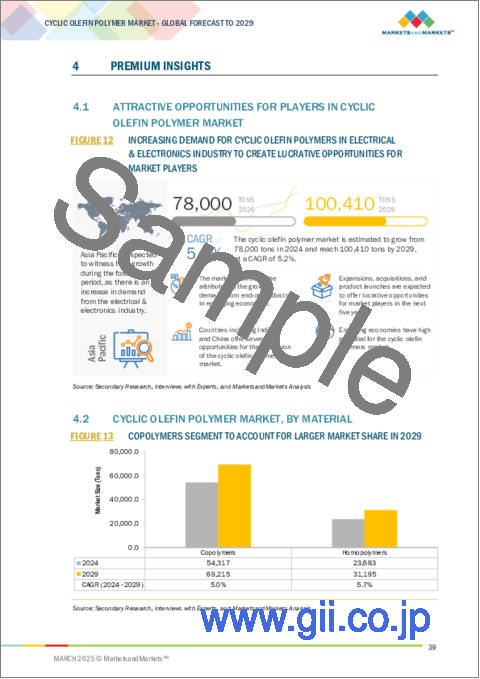

- FIGURE 12 INCREASING DEMAND FOR CYCLIC OLEFIN POLYMERS IN ELECTRICAL & ELECTRONICS INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 COPOLYMERS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2029

- FIGURE 14 INJECTION MOLDING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 15 PACKAGING INDUSTRY TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 CYCLIC OLEFIN POLYMER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 CYCLIC OLEFIN POLYMER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 20 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 21 CYCLIC OLEFIN POLYMER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 IMPORT DATA RELATED TO HS CODE 390290-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 23 EXPORT DATA RELATED TO HS CODE 390290-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 24 CYCLIC OLEFIN POLYMER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF CYCLIC OLEFIN POLYMERS, BY REGION, 2021-2023 (USD/KG)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF CYCLIC OLEFIN POLYMERS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2023 (USD/KG)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF CYCLIC OLEFIN POLYMERS, BY TYPE, 2021-2023 (USD/KG)

- FIGURE 28 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 29 CYCLIC OLEFIN POLYMER MARKET: GRANTED PATENTS, 2015-2024

- FIGURE 31 LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 32 TOP JURISDICTION, BY DOCUMENT, 2015-2024

- FIGURE 33 TOP PATENT APPLICANTS, 2015-2024

- FIGURE 34 CYCLIC OLEFIN POLYMER MARKET: INVESTMENT AND FUNDING SCENARIO, 2019-2023 (USD MILLION)

- FIGURE 35 COPOLYMERS SEGMENT TO HOLD LARGER MARKET SHARE IN 2024

- FIGURE 36 INJECTION MOLDING SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 37 PACKAGING SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 38 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: CYCLIC OLEFIN POLYMER MARKET SNAPSHOT

- FIGURE 40 EUROPE: CYCLIC OLEFIN POLYMER MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: CYCLIC OLEFIN POLYMER MARKET SNAPSHOT

- FIGURE 42 CYCLIC OLEFIN POLYMER MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- FIGURE 43 CYCLIC OLEFIN POLYMER MARKET: GLOBAL BUSINESS REVENUE ANALYSIS OF KEY COMPANIES, 2021-2023 (USD BILLION)

- FIGURE 44 CYCLIC OLEFIN POLYMER MARKET SHARE ANALYSIS, 2023

- FIGURE 45 CYCLIC OLEFIN POLYMER MARKET: COMPANY VALUATION OF LEADING COMPANIES, 2023 (USD BILLION)

- FIGURE 46 CYCLIC OLEFIN MARKET: FINANCIAL METRICS OF LEADING COMPANIES, 2023

- FIGURE 47 CYCLIC OLEFIN POLYMER MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 48 CYCLIC OLEFIN MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 49 CYCLIC OLEFIN MARKET: COMPANY FOOTPRINT

- FIGURE 50 MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT

- FIGURE 51 SUMITOMO BAKELITE CO., LTD.: COMPANY SNAPSHOT

- FIGURE 52 ZEON CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 JSR CORPORATION: COMPANY SNAPSHOT

The cyclic olefin polymers market is projected to reach USD 1.54 billion by 2029 from USD 1.12 billion in 2024, at a CAGR of 6.5% during the forecast period. The market for cyclic olefins, both polymers and copolymers, spurred on by increasing demand across various industries. Its excellent clarity, chemical resistance, and low water absorption have made this material ever more precious for uses demanding high performance and reliability. The market for cyclic olefins, both polymers and copolymers, spurred on by increasing demand across various industries. Its excellent clarity, chemical resistance, and low water absorption have made this material ever more precious for uses demanding high performance and reliability. Cyclic olefin polymers are mostly used in the pharmaceutical and food & beverage sector for packaging. Another strong driver of the industry is healthcare, where the inert properties of the material and its ability to be sterilized make it the first choice for medical equipment, drug delivery devices, and diagnostic tools. Other than these applications, the electronics and optics industries are turning to cyclic olefins for their accuracy and optical clarity, catering to the requirements of cutting-edge technologies such as high-definition displays and lenses. Acceleration of urbanization and increasing disposable incomes in the emerging markets of Asia-Pacific are fueling demand as industries are growing and industrializing. Still, the industry is confronted by challenges, among them being intricacy in processes of production that can increase prices, and more price-competitive substitutes. Against these challenges, continued innovations in production methods coupled with increasing concerns for sustainable raw materials are building new opportunities for growth. The future presents itself positively for the cyclic olefin industry, backed by its capacity to satisfy changing industrial demands while embracing an increasingly performance-oriented and environmentally conscious world.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | Type, Process Type, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

"The largest share of the cyclic olefin polymers market, by process type is that of injection molding."

Injection molding has the largest market share among cyclic olefin polymers because of its efficiency, accuracy, and compatability with COP's native characteristics. Cyclic olefin polymers possess high clarity, chemical resistance, and low moisture absorption and have a broad usage in medical devices, packaging, and optics. Injection molding is well-suited to such applications because it can produce complex, precise parts in high volume at relatively low cost, making it the manufacturing process of choice. One of the major reasons is the ability of the process to capitalize on COP's very good flow properties. Injection molding works by melting the polymer and forcing it into a mold at high pressure, where it cools and solidifies into shape. COP's low viscocity and heat resistance guarantee it flows easily into complex molds, creating precise parts such as syringe barrels, diagnostic cuvettes, or optical lenses with few blemishes. Relatively to other technologies, injection molding reduces waste on materials and produces fast cycle times, consistent with sustainability and performance objectives. Exclusion to the films, hollow parts fit perfectly in blow molding, whereas blow molding's plasticity to use and generate complicated solid shapes ranks it above all else. Following the increased needs for COP due to high performance, the adjustability and affordable nature of injection molding keep the technology on the top.

"North America is the third-largest region for cyclic olefin polymers market."

North America is the third largest region in the cyclic olefin market owing to a mix of industrial capabilities, technological innovations, and varied demands for applications. The region is supported by a strong manufacturing foundation, especially in the United States and Canada, where healthcare, packaging, and electronics industries flourish. These markets depend heavily on cyclic olefins-high-performance polymers with a reputation for transparency, chemical resistance, and low water absorption-ideally suited for specialist applications. In the healthcare field, for example, the biocompatibility of the material dictates its use in medical devices and drug-packaging applications, backed by an established medical technology infrastructure. The packaging sector is also an important driver, with North America's emphasis on sustainable, lightweight, and robust solutions corresponding to the attributes of cyclic olefins, particularly for food and beverages where product integrity and shelf life are paramount. In addition, North America's leadership in R&D and innovation are factors supporting its strong market position.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments and the information gathered through secondary research.

The break-up of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 45%, Asia Pacific: 20%, South America: 5%, Middle East & Africa 5%

Mitsui Chemicals, Inc. (Japan), Polyplastics Co., Ltd. (Japan), Sumitomo Bakelite Co., Ltd. (Japan), JSR Corporation (Japan), Borealis AG (Austria), Polysciences, Inc. (US), Biosynth (Switzerland), Tuoxin Technology (Quzhou) Co., Ltd. (China), Zeon Corporation (China), and China Petrochemical Development Corporation (China) among others are some of the key players in the cyclic olefin polymers market.

The study includes an in-depth competitive analysis of these key players in the authentication and brand

protection market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the cyclic olefin polymers market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on type, process type, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the cyclic olefin polymers market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall cyclic olefin polymers market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing demand in healthcare and pharmaceutical industry, Shift toward sustainable packaging, Advancements in electronics and optical components), restraints (High production cost of cyclic olefin polymers, Competition from alternative materials), opportunities (Increasing use of cyclic olefin polymers in optical applications, Rapid industrialization and rising consumer demand in emerging region), challenges (Volatility of raw material prices).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the cyclic olefin polymers market

- Market Development: Comprehensive information about lucrative markets - the report analyses the cyclic olefin polymers market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the cyclic olefin polymers market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Mitsui Chemicals, Inc. (Japan), Polyplastics Co., Ltd. (Japan), Sumitomo Bakelite Co., Ltd. (Japan), JSR Corporation (Japan), Borealis AG (Austria), Polysciences, Inc. (US), Biosynth (Switzerland), Tuoxin Technology (Quzhou) Co., Ltd. (China), Zeon Corporation (China), and China Petrochemical Development Corporation (China) among others are the top manufacturers covered in the cyclic olefin polymers market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants (demand and supply sides)

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CYCLIC OLEFIN POLYMER MARKET

- 4.2 CYCLIC OLEFIN POLYMER MARKET, BY MATERIAL

- 4.3 CYCLIC OLEFIN POLYMER MARKET, BY APPLICATION

- 4.4 CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY

- 4.5 CYCLIC OLEFIN POLYMER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand in healthcare and pharmaceutical industries

- 5.2.1.2 Shift toward sustainable packaging

- 5.2.1.3 Advancements in electronics and optical components

- 5.2.1.4 Growing demand for lightweight and high-performance materials

- 5.2.2 RESTRAINTS

- 5.2.2.1 High production cost

- 5.2.2.2 Competition from alternative materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for smartphone lenses

- 5.2.3.2 Rapid industrialization and rising consumer demand in emerging regions

- 5.2.4 CHALLENGES

- 5.2.4.1 Volatility in raw material prices

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.5.2 TRENDS IN AUTOMOTIVE INDUSTRY

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 REGULATORY LANDSCAPE

- 6.3.1 REGULATIONS

- 6.3.1.1 North America

- 6.3.1.2 Europe

- 6.3.1.3 Asia Pacific

- 6.3.2 STANDARDS

- 6.3.2.1 United States Pharmacopeia (USP) Standards

- 6.3.2.2 ISO 10993 Standard

- 6.3.2.3 USP <661.1> Standard

- 6.3.2.4 European Pharmacopoeia (Ph. Eur.) Standards

- 6.3.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.3.1 REGULATIONS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO (HS CODE 390290)

- 6.4.2 EXPORT SCENARIO (HS CODE 390290)

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 CYCLIC OLEFIN POLYMERS TO ADDRESS LIMITATIONS OF TRADITIONAL ACRYLIC POLYMERS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.1.1 Vat photopolymerization

- 6.7.1.2 Ring-opening metathesis polymerization (ROMP) and hydrogenation

- 6.7.1.3 Surface activation technologies

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.2.1 Melt blending technologies for COC/PA composites

- 6.7.2.2 Multilayer film extrusion

- 6.7.1 KEY TECHNOLOGIES

- 6.8 KEY CONFERENCES AND EVENTS, 2025

- 6.9 PRICING ANALYSIS

- 6.9.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2023

- 6.9.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2023

- 6.9.3 AVERAGE SELLING PRICE TREND, BY TYPE, 2021-2023

- 6.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.11 PATENT ANALYSIS

- 6.11.1 METHODOLOGY

- 6.11.2 DOCUMENT TYPES

- 6.11.3 PUBLICATION TRENDS IN LAST 10 YEARS

- 6.11.4 INSIGHTS

- 6.11.5 LEGAL STATUS OF PATENTS

- 6.11.6 JURISDICTION ANALYSIS

- 6.11.7 APPLICANTS

- 6.12 INVESTMENT AND FUNDING SCENARIO

- 6.13 IMPACT OF AI/GEN AI ON CYCLIC OLEFIN POLYMER MARKET

7 CYCLIC OLEFIN POLYMER MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 COPOLYMERS

- 7.2.1 HIGH GLASS TRANSITION TEMPERATURE AND DIMENSIONAL STABILITY TO DRIVE MARKET

- 7.3 HOMOPOLYMERS

- 7.3.1 EXCELLENT CHEMICAL RESISTANCE AND SUPERIOR THERMAL STABILITY TO DRIVE MARKET

8 CYCLIC OLEFIN POLYMER MARKET, BY PROCESS TYPE

- 8.1 INTRODUCTION

- 8.2 INJECTION MOLDING

- 8.2.1 EXCEPTIONAL CLARITY, CHEMICAL RESISTANCE, AND LOW MOISTURE ABSORPTION TO DRIVE MARKET

- 8.3 EXTRUSION

- 8.3.1 LONG-TERM STABILITY IN HUMID ENVIRONMENTS TO DRIVE MARKET

- 8.4 BLOW MOLDING

- 8.4.1 COST-EFFECTIVENESS IN LARGE-SCALE PRODUCTION, REDUCING MATERIAL WASTE AND LABOR COSTS TO DRIVE MARKET

- 8.5 OTHER PROCESS TYPES

9 CYCLIC OLEFIN POLYMER MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 PACKAGING

- 9.2.1 EXCEPTIONAL CHEMICAL RESISTANCE, OPTICAL CLARITY, AND MOISTURE BARRIER PROPERTIES TO DRIVE MARKET

- 9.2.1.1 Pharmaceutical blister packaging

- 9.2.1.2 Cosmetic containers

- 9.2.1.3 Other packaging

- 9.2.1 EXCEPTIONAL CHEMICAL RESISTANCE, OPTICAL CLARITY, AND MOISTURE BARRIER PROPERTIES TO DRIVE MARKET

- 9.3 AUTOMOTIVE

- 9.3.1 HIGH TRANSPARENCY, LOW DENSITY, AND SCRATCH-RESISTANCE PROPERTIES TO PROPEL MARKET

- 9.4 HEALTHCARE & MEDICAL

- 9.4.1 BIOCOMPATIBILITY AND EXCELLENT BARRIER AGAINST GASES AND MOISTURE TO FUEL DEMAND

- 9.4.1.1 Diagnostic devices

- 9.4.1.2 Surgical instruments

- 9.4.1.3 Other healthcare & Medical

- 9.4.1 BIOCOMPATIBILITY AND EXCELLENT BARRIER AGAINST GASES AND MOISTURE TO FUEL DEMAND

- 9.5 FOOD & BEVERAGE

- 9.5.1 EXCEPTIONAL MOISTURE BARRIER PROPERTIES FOR PRESERVING FRESHNESS AND SHELF LIFE OF FOOD AND BEVERAGES TO DRIVE DEMAND

- 9.6 ELECTRICAL & ELECTRONICS

- 9.6.1 EXCELLENT ELECTRICAL INSULATION AND LOW DIELECTRIC CONSTANT TO BOOST DEMAND

- 9.6.1.1 Displays

- 9.6.1.2 Semiconductors

- 9.6.1.3 Other electrical & electronics

- 9.6.1 EXCELLENT ELECTRICAL INSULATION AND LOW DIELECTRIC CONSTANT TO BOOST DEMAND

- 9.7 CHEMICALS

- 9.7.1 EXPOSURE TO AGGRESSIVE CHEMICALS, PRECISE MATERIAL PERFORMANCE, AND DURABILITY TO FUEL DEMAND

- 9.8 OPTICAL

- 9.8.1 UV RESISTANCE, OPTICAL CLARITY, AND LOW BIREFRINGENCE TO DRIVE DEMAND

- 9.9 OTHER END-USE INDUSTRIES

10 CYCLIC OLEFIN POLYMER MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Growing automotive industry to drive market

- 10.2.2 CANADA

- 10.2.2.1 Significant growth of healthcare sector to boost market

- 10.2.3 MEXICO

- 10.2.3.1 Booming automotive sector to drive market

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Strong industrial base and technological advancements to drive market

- 10.3.2 FRANCE

- 10.3.2.1 Foreign direct investments in healthcare sector to drive market

- 10.3.3 SPAIN

- 10.3.3.1 Growing pharmaceutical industry to propel market

- 10.3.4 UK

- 10.3.4.1 Rising demand from healthcare sector to drive market

- 10.3.5 ITALY

- 10.3.5.1 Strong pharmaceutical industry to drive market

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Booming healthcare industry to propel market

- 10.4.2 INDIA

- 10.4.2.1 Government-led investments and initiatives to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Booming automotive and healthcare sectors to drive market

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Strong leadership in pharmaceutical and display industries to drive market

- 10.4.5 MALAYSIA

- 10.4.5.1 Increased investments in pharmaceutical industry to drive market

- 10.4.6 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Strong government focus on healthcare sector to drive market

- 10.5.1.2 UAE

- 10.5.1.2.1 Shift toward generic drug manufacturing and strong focus on building pharmaceutical ecosystem to drive market

- 10.5.1.3 Rest of GCC countries

- 10.5.1.1 Saudi Arabia

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Strong growth in pharmaceutical sector to boost market

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 High investments in healthcare sector and booming automotive sector to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Strong focus on increasing drug production to drive market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Company footprint

- 11.7.5.2 Type footprint

- 11.7.5.3 End-use industry footprint

- 11.7.5.4 Region footprint

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 DEALS

- 11.8.2 PRODUCT LAUNCHES

- 11.8.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 MITSUI CHEMICALS, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 POLYPLASTICS CO., LTD.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Expansions

- 12.1.3 SUMITOMO BAKELITE CO., LTD.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 TUOXIN TECHNOLOGY (QUZHOU) CO., LTD. (TOPOLEFIN)

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 ZEON CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 JSR CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 MnM view

- 12.1.7 BOREALIS AG

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.4 MnM view

- 12.1.8 POLYSCIENCES, INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.9 BIOSYNTH

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.3.2 Expansions

- 12.1.9.4 MnM view

- 12.1.10 CHINA PETROCHEMICAL DEVELOPMENT CORPORATION (CPDC)

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.1 MITSUI CHEMICALS, INC.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS