|

|

市場調査レポート

商品コード

1688889

軍用プラットフォームの世界市場:プラットフォームタイプ別、エンドユーザー別、技術別、地域別 - 2030年までの予測Military Platforms Market by Platform Type (Military Aircraft, Military Vessels, Military Vehicles), Technology (Conventional, Next-Gen ), End-User (Army, Navy, Air-force) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 軍用プラットフォームの世界市場:プラットフォームタイプ別、エンドユーザー別、技術別、地域別 - 2030年までの予測 |

|

出版日: 2025年03月01日

発行: MarketsandMarkets

ページ情報: 英文 448 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

軍用プラットフォームの市場規模は、6.8%のCAGRで拡大し、2024年の518億7,000万米ドルから2030年には770億8,000万米ドルに達すると予測されています。

地政学的緊張、国防費の増加、空・海・陸の各領域における急速な技術進歩が、軍用プラットフォーム市場の成長促進要因です。世界各国は、防空、海軍近代化、装甲車のアップグレードに重点を置いた軍事力強化を継続し、それによって先進的な軍用プラットフォームが求められます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | プラットフォームタイプ別、エンドユーザー別、技術別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

このように、安全保障ダイナミクスの変化と、より洗練された防衛システムへの需要に伴い、軍は、高度なステルス機能、精密誘導照準システム、指揮統制統合などの最先端技術を備えた統合プラットフォームを購入する傾向にあります。業界大手は、北米、欧州、アジア太平洋、中東を中心に、世界の主要国の戦略的防衛構想に関連する次世代ソリューションの開発に向けた研究開発投資を強化しています。

軍用プラットフォーム市場では、予測期間中、軍用車両セグメントが市場で最も高いシェアを占めると予測されています。これは、地政学的緊張や国境紛争が高まっている地域を中心に、強力な地上型プラットフォームへの需要が高まっているためです。主力戦車、歩兵戦闘車、装甲兵員輸送車、地雷抵抗性待ち伏せ防護車などの軍用車両は、効果的な近代陸戦の基盤を提供し、地上部隊が利用できる機動性、火力、防護を強化します。

各国政府は、移り変わる防衛ニーズに適応するため、軍用車両を全面的に見直すことに、世界中で多大な出費をしています。ほとんどの国は、レガシー車両を、アクティブ保護システム、自動照準システム、先進装甲ソリューションなど、さまざまな先進技術を搭載した次世代プラットフォームに置き換えています。こうした先進技術のひとつひとつが、戦闘における軍用車両の生存性と殺傷力を高めています。

非対称戦やその他の対反乱作戦が高く評価されている結果、より小型で機敏な車両が課題となっています。軍用車両メーカーはまた、軍隊が攻撃的にも防御的にも備えるために、ロジスティクスとサプライチェーン管理の重要性が高まっていることからも利益を得る立場にあります。

北米、欧州、アジア太平洋では、国防の近代化という点で主導的な役割を担っているため、このセグメントは良好な市場ポジションを維持することができると思われます。さらに、General Dynamics、BAE Systems、Oshkosh Defenseなどの企業が存在するこのセグメントの主要企業は、先進的な軍用車両を導入するために研究開発に多額の投資を行っており、この市場の成長をさらに促進しています。

当レポートでは、世界の軍用プラットフォーム市場について調査し、プラットフォームタイプ別、エンドユーザー別、技術別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 顧客ビジネスに影響を与える動向と混乱

- 貿易分析

- 規制状況

- ケーススタディ分析

- 主な利害関係者と購入基準

- 2025年の主な会議とイベント

- 投資と資金調達のシナリオ

- 運用データ

- 技術ロードマップ

- 総所有コスト

- ビジネスモデル

- 部品表

- AI/生成AIの影響

- マクロ経済見通し

第6章 業界の動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- サプライチェーン分析

- 特許分析

第7章 軍用プラットフォーム市場、プラットフォームタイプ別

- イントロダクション

- 軍用航空機

- 軍艦

- 軍用車両

第8章 軍用プラットフォーム市場、エンドユーザー別

- イントロダクション

- 陸軍

- 海軍

- 空軍

第9章 軍用プラットフォーム市場、技術別

- イントロダクション

- 従来型

- 次世代型

第10章 軍用プラットフォーム市場、地域別

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- ドイツ

- フランス

- イタリア

- アジア太平洋

- PESTLE分析

- インド

- 日本

- 韓国

- オーストラリア

- ラテンアメリカ

- PESTLE分析

- ブラジル

- メキシコ

- アフリカ

- PESTLE分析

- 南アフリカ

- 中東

- PESTLE分析

- 湾岸協力会議(GCC)

- イスラエル

- トルコ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析

- 市場シェア分析

- ブランド/製品比較

- 企業価値評価と財務指標

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- BAE SYSTEMS

- LOCKHEED MARTIN CORPORATION

- HUNTINGTON INGALLS INDUSTRIES(HII)

- BOEING

- RHEINMETALL AG

- GENERAL DYNAMICS CORPORATION

- TEXTRON INC.

- SAAB AB

- LEONARDO S.P.A.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- FINCANTIERI S.P.A.

- HD HYUNDAI HEAVY INDUSTRIES CO., LTD.

- HANWHA OCEAN CO., LTD.

- NAVAL GROUP

- RTX

- ST ENGINEERING

- THALES

- NORTHROP GRUMMAN

- ISRAEL AEROSPACE INDUSTRIES

- DASSAULT AVIATION

- AIRBUS

- その他の企業

- KALYANI STRATEGIC SYSTEMS LTD.

- MAHINDRA EMIRATES VEHICLE ARMOURING FZ LLC

- TATA ADVANCED SYSTEMS LIMITED

- INKAS ARMORED VEHICLE MANUFACTURING

- STREIT GROUP

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2023

- TABLE 2 US NAVY FIVE-YEAR SHIPBUILDING PLAN, 2025-2029

- TABLE 3 RAPID TECHNOLOGICAL ADVANCEMENTS IN DEFENSE PLATFORMS IN LAST FIVE YEARS

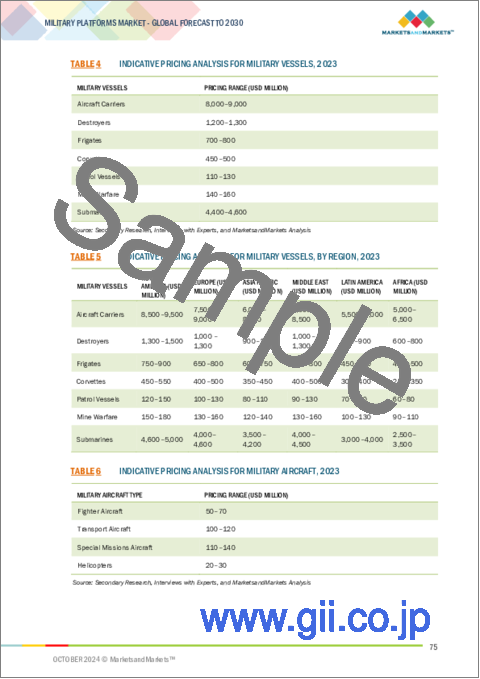

- TABLE 4 INDICATIVE PRICING ANALYSIS FOR MILITARY VESSELS, 2023

- TABLE 5 INDICATIVE PRICING ANALYSIS FOR MILITARY VESSELS, BY REGION, 2023

- TABLE 6 INDICATIVE PRICING ANALYSIS FOR MILITARY AIRCRAFT, 2023

- TABLE 7 INDICATIVE PRICING ANALYSIS FOR MILITARY AIRCRAFT, BY REGION, 2023

- TABLE 8 INDICATIVE PRICING ANALYSIS FOR MAIN BATTLE TANKS, BY REGI0N, 2023

- TABLE 9 INDICATIVE PRICING ANALYSIS FOR INFANTRY FIGHTING VEHICLES, BY REGION, 2023

- TABLE 10 INDICATIVE PRICING ANALYSIS FOR ARMORED PERSONNEL CARRIERS, BY REGION, 2023

- TABLE 11 INDICATIVE PRICING ANALYSIS FOR MINE-RESISTANT AMBUSH-PROTECTED VEHICLES, BY REGION, 2023

- TABLE 12 ROLE OF COMPANIES IN MARKET ECOSYSTEM

- TABLE 13 IMPORT DATA FOR HS CODE 89-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR HS CODE 89-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 15 EXPORT DATA FOR HS CODE 8710-COMPLIANT PRODUCTS, BY REGION, 2020-2022 (USD THOUSAND)

- TABLE 16 IMPORT DATA FOR HS CODE 8710-COMPLIANT PRODUCTS, BY REGION, 2020-2022 (USD THOUSAND)

- TABLE 17 IMPORT DATA FOR HS CODE 8802-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 18 EXPORT DATA FOR HS CODE 8802-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY KEY PLATFORM TYPE (%)

- TABLE 20 KEY BUYING CRITERIA, BY PLATFORM TYPE

- TABLE 21 KEY CONFERENCES AND EVENTS, 2025

- TABLE 22 LAND FLEET VOLUME, BY COUNTRY, 2023

- TABLE 23 NAVAL FLEET VOLUME, BY COUNTRY, 2023

- TABLE 24 AIRBORNE FLEET VOLUME, BY KEY COUNTRY, 2023

- TABLE 25 TOTAL COST OF OWNERSHIP OF MAIN BATTLE TANKS

- TABLE 26 COMPARISON BETWEEN BUSINESS MODELS

- TABLE 27 BUSINESS MODELS OF ARMORED VEHICLES

- TABLE 28 KEY GREEN TECHNOLOGIES AND THEIR IMPACT

- TABLE 29 PATENT ANALYSIS, 2020-2024

- TABLE 30 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

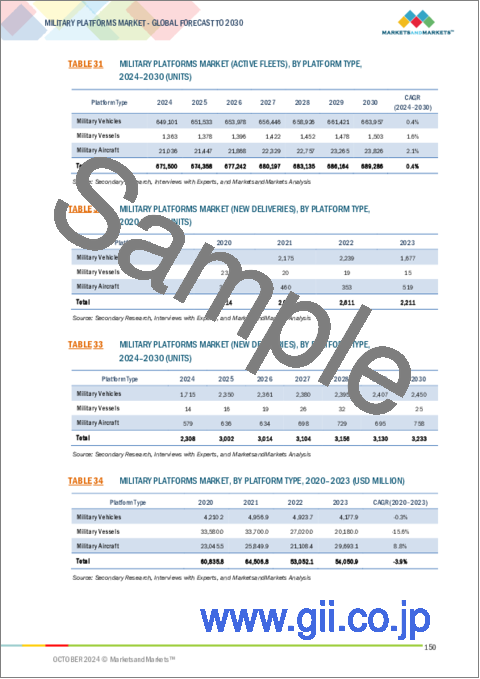

- TABLE 31 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 32 MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 33 MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 34 MILITARY PLATFORMS MARKET, BY PLATFORM TYPE, 2020-2023 (USD MILLION)

- TABLE 35 MILITARY PLATFORMS MARKET, BY PLATFORM TYPE, 2024-2030 (USD MILLION)

- TABLE 36 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 37 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 38 MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 39 MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 40 MILITARY PLATFORMS MARKET, BY MILITARY AIRCRAFT, 2020-2023 (USD MILLION)

- TABLE 41 MILITARY PLATFORMS MARKET, BY MILITARY AIRCRAFT, 2024-2030 (USD MILLION)

- TABLE 42 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 43 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 44 MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 45 MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 46 MILITARY PLATFORMS MARKET, BY MILITARY VESSEL, 2020-2023 (USD MILLION)

- TABLE 47 MILITARY PLATFORMS MARKET, BY MILITARY VESSEL, 2024-2030 (USD MILLION)

- TABLE 48 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 49 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 50 MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 51 MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 52 MILITARY PLATFORMS MARKET, BY MILITARY VEHICLE, 2020-2023 (USD MILLION)

- TABLE 53 MILITARY PLATFORMS MARKET, BY MILITARY VEHICLE, 2024-2030 (USD MILLION)

- TABLE 54 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY END USER, 2020-2023 (UNITS)

- TABLE 55 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY END USER, 2024-2030 (UNITS)

- TABLE 56 MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY END USER, 2020-2023 (UNITS)

- TABLE 57 MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY END USER, 2024-2030 (UNITS)

- TABLE 58 MILITARY VEHICLES MARKET (ACTIVE FLEETS), BY END USER, 2020-2023 (UNITS)

- TABLE 59 MILITARY VEHICLES MARKET (ACTIVE FLEETS), BY END USER, 2024-2030 (UNITS)

- TABLE 60 MILITARY VESSELS MARKET (ACTIVE FLEETS), BY END USER, 2020-2023 (UNITS)

- TABLE 61 MILITARY VESSELS MARKET (ACTIVE FLEETS), BY END USER, 2024-2030 (UNITS)

- TABLE 62 MILITARY AIRCRAFT MARKET (ACTIVE FLEETS), BY END USER, 2020-2023 (UNITS)

- TABLE 63 MILITARY AIRCRAFT MARKET (ACTIVE FLEETS), BY END USER, 2024-2030 (UNITS)

- TABLE 64 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY TECHNOLOGY, 2020-2023 (UNITS)

- TABLE 65 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY TECHNOLOGY, 2024-2030 (UNITS)

- TABLE 66 MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY TECHNOLOGY, 2020-2023 (UNITS)

- TABLE 67 MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY TECHNOLOGY, 2024-2030 (UNITS)

- TABLE 68 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY REGION, 2020-2023 (UNITS)

- TABLE 69 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY REGION, 2024-2030 (UNITS)

- TABLE 70 MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY REGION, 2020-2023 (UNITS)

- TABLE 71 MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY REGION, 2024-2030 (UNITS)

- TABLE 72 MILITARY PLATFORMS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 73 MILITARY PLATFORMS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY COUNTRY, 2020-2023 (UNITS)

- TABLE 75 NORTH AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS) BY COUNTRY, 2024-2030 (UNITS)

- TABLE 76 NORTH AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY COUNTRY, 2020-2023 (UNITS)

- TABLE 77 NORTH AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY COUNTRY, 2024-2030 (UNITS)

- TABLE 78 NORTH AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 79 NORTH AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 80 NORTH AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 81 NORTH AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 82 NORTH AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 83 NORTH AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 84 NORTH AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 85 NORTH AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 86 NORTH AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 87 NORTH AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 88 NORTH AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 89 NORTH AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 90 NORTH AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 91 NORTH AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 92 NORTH AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 93 NORTH AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 94 US: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 95 US: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 96 US: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 97 US: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 98 US: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 99 US: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 100 US: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 101 US: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 102 US: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 103 US: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 104 US: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 105 US: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 106 US: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 107 US: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 108 US: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 109 US: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 110 CANADA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 111 CANADA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 112 CANADA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 113 CANADA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 114 CANADA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 115 CANADA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 116 CANADA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 117 CANADA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 118 CANADA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 119 CANADA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 120 CANADA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 121 CANADA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 122 CANADA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 123 CANADA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 124 CANADA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 125 CANADA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 126 EUROPE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY COUNTRY, 2020-2023 (UNITS)

- TABLE 127 EUROPE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY COUNTRY, 2024-2030 (UNITS)

- TABLE 128 EUROPE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY COUNTRY, 2020-2023 (UNITS)

- TABLE 129 EUROPE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY COUNTRY, 2024-2030 (UNITS)

- TABLE 130 EUROPE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 131 EUROPE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 132 EUROPE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 133 EUROPE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 134 EUROPE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 135 EUROPE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 136 EUROPE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 137 EUROPE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 138 EUROPE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 139 EUROPE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 140 EUROPE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 141 EUROPE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 142 EUROPE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 143 EUROPE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 144 EUROPE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 145 EUROPE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 146 UK: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 147 UK: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 148 UK: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 149 UK: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 150 UK: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 151 UK: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 152 UK: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 153 UK: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 154 UK: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 155 UK: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 156 UK: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 157 UK: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 158 UK: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 159 UK: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 160 UK: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 161 UK: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 162 GERMANY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 163 GERMANY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 164 GERMANY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 165 GERMANY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 166 GERMANY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 167 GERMANY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 168 GERMANY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 169 GERMANY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 170 GERMANY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 171 GERMANY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 172 GERMANY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 173 GERMANY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 174 GERMANY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 175 GERMANY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 176 GERMANY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 177 GERMANY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 178 FRANCE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 179 FRANCE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 180 FRANCE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 181 FRANCE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 182 FRANCE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 183 FRANCE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 184 FRANCE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 185 FRANCE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 186 FRANCE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 187 FRANCE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 188 FRANCE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 189 FRANCE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 190 FRANCE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 191 FRANCE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 192 FRANCE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 193 FRANCE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 194 ITALY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 195 ITALY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 196 ITALY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 197 ITALY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 198 ITALY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 199 ITALY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 200 ITALY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 201 ITALY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 202 ITALY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 203 ITALY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 204 ITALY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 205 ITALY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 206 ITALY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 207 ITALY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 208 ITALY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 209 ITALY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 210 ASIA PACIFIC: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY COUNTRY, 2020-2023 (UNITS)

- TABLE 211 ASIA PACIFIC: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY COUNTRY, 2024-2030 (UNITS)

- TABLE 212 ASIA PACIFIC: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY COUNTRY, 2020-2023 (UNITS)

- TABLE 213 ASIA PACIFIC: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY COUNTRY, 2024-2030 (UNITS)

- TABLE 214 ASIA PACIFIC: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 215 ASIA PACIFIC: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 216 ASIA PACIFIC: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 217 ASIA PACIFIC: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 218 ASIA PACIFIC: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 219 ASIA PACIFIC: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 220 ASIA PACIFIC: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 221 ASIA PACIFIC: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 222 ASIA PACIFIC: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 223 ASIA PACIFIC: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 224 ASIA PACIFIC: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 225 ASIA PACIFIC: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 226 ASIA PACIFIC: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 227 ASIA PACIFIC: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 228 ASIA PACIFIC: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 229 ASIA PACIFIC: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 230 INDIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 231 INDIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 232 INDIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 233 INDIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 234 INDIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 235 INDIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 236 INDIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 237 INDIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 238 INDIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 239 INDIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 240 INDIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 241 INDIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 242 INDIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 243 INDIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 244 INDIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 245 INDIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 246 JAPAN: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 247 JAPAN: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 248 JAPAN: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 249 JAPAN: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 250 JAPAN: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 251 JAPAN: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 252 JAPAN: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 253 JAPAN: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 254 JAPAN: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 255 JAPAN: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 256 JAPAN: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 257 JAPAN: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 258 JAPAN: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 259 JAPAN: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 260 JAPAN: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 261 JAPAN: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 262 SOUTH KOREA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 263 SOUTH KOREA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 264 SOUTH KOREA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 265 SOUTH KOREA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 266 SOUTH KOREA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 267 SOUTH KOREA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 268 SOUTH KOREA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 269 SOUTH KOREA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 270 SOUTH KOREA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 271 SOUTH KOREA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 272 SOUTH KOREA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 273 SOUTH KOREA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 274 SOUTH KOREA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 275 SOUTH KOREA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 276 SOUTH KOREA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 277 SOUTH KOREA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 278 AUSTRALIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 279 AUSTRALIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 280 AUSTRALIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 281 AUSTRALIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 282 AUSTRALIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 283 AUSTRALIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 284 AUSTRALIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 285 AUSTRALIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 286 AUSTRALIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 287 AUSTRALIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 288 AUSTRALIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 289 AUSTRALIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 290 AUSTRALIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 291 AUSTRALIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 292 AUSTRALIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 293 AUSTRALIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 294 LATIN AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY COUNTRY, 2020-2023 (UNITS)

- TABLE 295 LATIN AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY COUNTRY, 2024-2030 (UNITS)

- TABLE 296 LATIN AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY COUNTRY, 2020-2023 (UNITS)

- TABLE 297 LATIN AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY COUNTRY, 2024-2030 (UNITS)

- TABLE 298 LATIN AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 299 LATIN AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 300 LATIN AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 301 LATIN AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 302 LATIN AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 303 LATIN AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 304 LATIN AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 305 LATIN AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 306 LATIN AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 307 LATIN AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 308 LATIN AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 309 LATIN AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 310 LATIN AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 311 LATIN AMERICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 312 LATIN AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 313 LATIN AMERICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 314 BRAZIL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 315 BRAZIL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 316 BRAZIL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 317 BRAZIL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 318 BRAZIL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 319 BRAZIL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 320 BRAZIL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 321 BRAZIL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 322 BRAZIL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 323 BRAZIL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 324 BRAZIL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 325 BRAZIL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 326 BRAZIL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 327 BRAZIL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 328 BRAZIL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 329 BRAZIL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 330 MEXICO: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 331 MEXICO: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 332 MEXICO: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 333 MEXICO: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 334 MEXICO: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 335 MEXICO: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 336 MEXICO: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 337 MEXICO: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 338 MEXICO: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 339 MEXICO: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 340 MEXICO: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 341 MEXICO: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 342 MEXICO: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 343 MEXICO: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 344 MEXICO: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 345 MEXICO: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 346 SOUTH AFRICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 347 SOUTH AFRICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 348 SOUTH AFRICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 349 SOUTH AFRICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 350 SOUTH AFRICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 351 SOUTH AFRICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 352 SOUTH AFRICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 353 SOUTH AFRICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 354 SOUTH AFRICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 355 SOUTH AFRICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 356 SOUTH AFRICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 357 SOUTH AFRICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 358 SOUTH AFRICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 359 SOUTH AFRICA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 360 SOUTH AFRICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 361 SOUTH AFRICA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 362 MIDDLE EAST: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY COUNTRY, 2020-2023 (UNITS)

- TABLE 363 MIDDLE EAST: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY COUNTRY, 2024-2030 (UNITS)

- TABLE 364 MIDDLE EAST: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY COUNTRY, 2020-2023 (UNITS)

- TABLE 365 MIDDLE EAST: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY COUNTRY, 2024-2030 (UNITS)

- TABLE 366 MIDDLE EAST: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 367 MIDDLE EAST: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 368 MIDDLE EAST: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 369 MIDDLE EAST: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 370 MIDDLE EAST: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 371 MIDDLE EAST: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 372 MIDDLE EAST: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 373 MIDDLE EAST: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 374 MIDDLE EAST: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 375 MIDDLE EAST: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 376 MIDDLE EAST: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 377 MIDDLE EAST: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 378 MIDDLE EAST: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 379 MIDDLE EAST: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 380 MIDDLE EAST: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 381 MIDDLE EAST: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 382 UAE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 383 UAE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 384 UAE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 385 UAE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 386 UAE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 387 UAE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 388 UAE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 389 UAE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 390 UAE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 391 UAE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 392 UAE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 393 UAE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 394 UAE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 395 UAE: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 396 UAE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 397 UAE: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 398 SAUDI ARABIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 399 SAUDI ARABIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 400 SAUDI ARABIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 401 SAUDI ARABIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 402 SAUDI ARABIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 403 SAUDI ARABIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 404 SAUDI ARABIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 405 SAUDI ARABIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 406 SAUDI ARABIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 407 SAUDI ARABIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 408 SAUDI ARABIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 409 SAUDI ARABIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 410 SAUDI ARABIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 411 SAUDI ARABIA: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 412 SAUDI ARABIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 413 SAUDI ARABIA: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 414 ISRAEL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 415 ISRAEL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 416 ISRAEL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 417 ISRAEL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 418 ISRAEL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 419 ISRAEL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 420 ISRAEL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 421 ISRAEL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 422 ISRAEL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 423 ISRAEL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 424 ISRAEL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 425 ISRAEL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 426 ISRAEL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 427 ISRAEL: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 428 ISRAEL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 429 ISRAEL: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 430 TURKEY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 431 TURKEY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 432 TURKEY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2020-2023 (UNITS)

- TABLE 433 TURKEY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY PLATFORM TYPE, 2024-2030 (UNITS)

- TABLE 434 TURKEY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 435 TURKEY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 436 TURKEY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2020-2023 (UNITS)

- TABLE 437 TURKEY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VEHICLE, 2024-2030 (UNITS)

- TABLE 438 TURKEY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 439 TURKEY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 440 TURKEY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2020-2023 (UNITS)

- TABLE 441 TURKEY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY VESSEL, 2024-2030 (UNITS)

- TABLE 442 TURKEY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 443 TURKEY: MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 444 TURKEY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2020-2023 (UNITS)

- TABLE 445 TURKEY: MILITARY PLATFORMS MARKET (NEW DELIVERIES), BY MILITARY AIRCRAFT, 2024-2030 (UNITS)

- TABLE 446 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 447 MILITARY AIRCRAFT MARKET: DEGREE OF COMPETITION

- TABLE 448 MILITARY VEHICLES MARKET: DEGREE OF COMPETITION

- TABLE 449 MILITARY VESSELS MARKET: DEGREE OF COMPETITION

- TABLE 450 COMPANY PLATFORM TYPE FOOTPRINT

- TABLE 451 COMPANY TECHNOLOGY FOOTPRINT

- TABLE 452 COMPANY END USER FOOTPRINT

- TABLE 453 COMPANY REGIONAL FOOTPRINT

- TABLE 454 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 455 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 456 MILITARY PLATFORMS MARKET: PRODUCT LAUNCHES, MAY 2021-DECEMBER 2024

- TABLE 457 MILITARY PLATFORMS MARKET: DEALS, SEPTEMBER 2023-JANUARY 2025

- TABLE 458 MILITARY PLATFORMS MARKET: OTHER DEVELOPMENTS, FEBRUARY 2020-JANUARY 2025

- TABLE 459 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 460 BAE SYSTEMS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 461 BAE SYSTEMS: DEALS

- TABLE 462 BAE SYSTEMS: OTHER DEVELOPMENTS

- TABLE 463 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 464 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 465 LOCKHEED MARTIN CORPORATION: OTHER DEVELOPMENTS

- TABLE 466 HUNTINGTON INGALLS INDUSTRIES: COMPANY OVERVIEW

- TABLE 467 HUNTINGTON INGALLS INDUSTRIES: PRODUCTS/SOLUTIONS OFFERED

- TABLE 468 HUNTINGTON INGALLS INDUSTRIES: OTHER DEVELOPMENTS

- TABLE 469 BOEING: COMPANY OVERVIEW

- TABLE 470 BOEING: PRODUCTS/SOLUTIONS OFFERED

- TABLE 471 BOEING: OTHER DEVELOPMENTS

- TABLE 472 RHEINMETALL AG: COMPANY OVERVIEW

- TABLE 473 RHEINMETALL AG: PRODUCTS/SOLUTIONS OFFERED

- TABLE 474 RHEINMETALL AG: PRODUCT LAUNCHES

- TABLE 475 RHEINMETALL AG: DEALS

- TABLE 476 RHEINMETALL AG: OTHER DEVELOPMENTS

- TABLE 477 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 478 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 479 GENERAL DYNAMICS CORPORATION: OTHER DEVELOPMENTS

- TABLE 480 TEXTRON INC.: COMPANY OVERVIEW

- TABLE 481 TEXTRON INC.: PRODUCTS /SOLUTIONS OFFERED

- TABLE 482 TEXTRON INC.: OTHER DEVELOPMENTS

- TABLE 483 SAAB AB: COMPANY OVERVIEW

- TABLE 484 SAAB AB: PRODUCTS/SOLUTIONS OFFERED

- TABLE 485 SAAB AB: DEALS

- TABLE 486 SAAB AB: OTHER DEVELOPMENTS

- TABLE 487 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 488 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 489 LEONARDO S.P.A.: DEALS

- TABLE 490 LEONARDO S.P.A.: OTHER DEVELOPMENTS

- TABLE 491 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 492 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 493 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCT LAUNCHES

- TABLE 494 MITSUBISHI HEAVY INDUSTRIES, LTD.: OTHER DEVELOPMENTS

- TABLE 495 FINCANTIERI S.P.A.: COMPANY OVERVIEW

- TABLE 496 FINCANTIERI S.P.A.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 497 FINCANTIERI S.P.A.: PRODUCT LAUNCHES

- TABLE 498 FINCANTIERI S.P.A.: DEALS

- TABLE 499 FINCANTIERI S.P.A.: OTHER DEVELOPMENTS

- TABLE 500 HD HYUNDAI HEAVY INDUSTRIES CO., LTD.: COMPANY OVERVIEW

- TABLE 501 HD HYUNDAI HEAVY INDUSTRIES CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 502 HD HYUNDAI HEAVY INDUSTRIES CO., LTD.: DEALS

- TABLE 503 HD HYUNDAI HEAVY INDUSTRIES CO., LTD.: OTHER DEVELOPMENTS

- TABLE 504 HANWHA OCEAN CO., LTD.: COMPANY OVERVIEW

- TABLE 505 HANWHA OCEAN CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 506 HANWHA OCEAN CO., LTD.: DEALS

- TABLE 507 HANWHA OCEAN CO., LTD.: OTHER DEVELOPMENTS

- TABLE 508 NAVAL GROUP: COMPANY OVERVIEW

- TABLE 509 NAVAL GROUP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 510 NAVAL GROUP: PRODUCT LAUNCHES

- TABLE 511 NAVAL GROUP: OTHER DEVELOPMENTS

- TABLE 512 RTX: COMPANY OVERVIEW

- TABLE 513 RTX: PRODUCTS/SOLUTIONS OFFERED

- TABLE 514 RTX: OTHER DEVELOPMENTS

- TABLE 515 ST ENGINEERING: COMPANY OVERVIEW

- TABLE 516 ST ENGINEERING: PRODUCTS/SOLUTIONS OFFERED

- TABLE 517 ST ENGINEERING: PRODUCT LAUNCHES

- TABLE 518 ST ENGINEERING: DEALS

- TABLE 519 ST ENGINEERING: OTHER DEVELOPMENTS

- TABLE 520 THALES: COMPANY OVERVIEW

- TABLE 521 THALES: PRODUCTS/SOLUTIONS OFFERED

- TABLE 522 THALES: OTHER DEVELOPMENTS

- TABLE 523 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 524 NORTHROP GRUMMAN: PRODUCTS/SOLUTIONS OFFERED

- TABLE 525 ISRAEL AEROSPACE INDUSTRIES: COMPANY OVERVIEW

- TABLE 526 ISRAEL AEROSPACE INDUSTRIES: PRODUCTS/SOLUTIONS OFFERED

- TABLE 527 ISRAEL AEROSPACE INDUSTRIES: OTHER DEVELOPMENTS

- TABLE 528 DASSAULT AVIATION: COMPANY OVERVIEW

- TABLE 529 DASSAULT AVIATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 530 DASSAULT AVIATION: OTHER DEVELOPMENTS

- TABLE 531 AIRBUS: COMPANY OVERVIEW

- TABLE 532 AIRBUS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 533 AIRBUS: OTHER DEVELOPMENTS

- TABLE 534 KALYANI STRATEGIC SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 535 MAHINDRA EMIRATES VEHICLE ARMOURING FZ LLC: COMPANY OVERVIEW

- TABLE 536 TATA ADVANCED SYSTEMS LIMITED: COMPANY OVERVIEW

- TABLE 537 INKAS ARMORED VEHICLE MANUFACTURING: COMPANY OVERVIEW

- TABLE 538 STREIT GROUP: COMPANY OVERVIEW

- TABLE 539 MILITARY PLATFORMS MARKET: ALL MAPPED COMPANIES

List of Figures

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 MILITARY VEHICLES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 CONVENTIONAL SEGMENT TO ACCOUNT FOR LARGER SHARE THAN NEXT-GEN SEGMENT BY 2030

- FIGURE 9 AIR FORCE SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 REGIONAL CONFLICTS, INCREASING DEFENSE EXPENDITURE, AND NEED FOR MODERNIZATION IN DEFENSE FORCES TO DRIVE MARKET

- FIGURE 12 ARMY SEGMENT TO LEAD MARKET BY 2024

- FIGURE 13 PATROL VESSELS SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2030

- FIGURE 14 ARMORED SUPPLY TRUCKS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 HELICOPTERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 CONVENTIONAL SEGMENT TO ACCOUNT FOR LARGER SHARE THAN NEXT-GEN SEGMENT DURING FORECAST PERIOD

- FIGURE 17 US TO REPORT HIGHEST NUMBER OF ACTIVE FLEETS IN 2024

- FIGURE 18 MILITARY PLATFORMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 GLOBAL MILITARY EXPENDITURE, BY REGION, 2014-2024

- FIGURE 20 IMPACT OF CONFLICT, BY REGION, 2021-2024

- FIGURE 21 VALUE CHAIN ANALYSIS

- FIGURE 22 ECOSYSTEM ANALYSIS

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 IMPORT DATA FOR HS CODE 89-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 25 EXPORT DATA FOR HS CODE 89-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 26 EXPORT DATA FOR HS CODE 8710-COMPLAINT PRODUCTS, BY REGION, 2020-2022 (USD THOUSAND)

- FIGURE 27 IMPORT DATA FOR HS CODE 8710-COMPLIANT PRODUCTS, BY REGION, 2020-2022 (USD THOUSAND)

- FIGURE 28 IMPORT DATA FOR HS CODE 8802-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 29 EXPORT DATA FOR HS CODE 8802-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY PLATFORM TYPES

- FIGURE 31 KEY BUYING CRITERIA, BY PLATFORM TYPE

- FIGURE 32 VC FUNDING IN AEROSPACE AND DEFENSE TECH, 2020-2024 (USD MILLION)

- FIGURE 33 EVOLUTION OF MILITARY VESSEL TECHNOLOGIES

- FIGURE 34 TECHNOLOGY ROADMAP OF MILITARY VESSELS

- FIGURE 35 EMERGING TRENDS IN MILITARY VESSELS

- FIGURE 36 TECHNOLOGY ROADMAP OF MILITARY VEHICLES

- FIGURE 37 EMERGING TRENDS IN MILITARY VEHICLES

- FIGURE 38 TECHNOLOGY ROADMAP OF MILITARY AIRCRAFT

- FIGURE 39 EMERGING TRENDS IN MILITARY AIRCRAFT

- FIGURE 40 TOTAL COST OF OWNERSHIP FOR MILITARY VESSELS

- FIGURE 41 TOTAL COST OF OWNERSHIP (TCO): COMPARISON BETWEEN VESSELS (BY PROPULSION)

- FIGURE 42 TOTAL COST OF OWNERSHIP OF ARMORED VEHICLES

- FIGURE 43 PERCENTAGE BREAKDOWN OF TOTAL COST OF OWNERSHIP

- FIGURE 44 TOTAL COST OF OWNERSHIP ASSOCIATED WITH ACQUISITION OF SPECIFIC MILITARY ASSETS

- FIGURE 45 AIRCRAFT LIFECYCLE PHASES

- FIGURE 46 AVERAGE BREAKDOWN OF MAJOR COST CATEGORIES AS PERCENTAGE OF TOTAL LIFE-CYCLE COST

- FIGURE 47 TOTAL COST OF OWNERSHIP FOR INDIVIDUAL AIRCRAFT

- FIGURE 48 FIGHTER AIRCRAFT TOTAL THROUGH LIFE COSTING, BY AIRCRAFT MODEL (USD MILLION)

- FIGURE 49 FIGHTER AIRCRAFT OPERATIONS AND MAINTENANCE COST PER FLIGHT HOUR (USD MILLION/YEAR)

- FIGURE 50 BUSINESS MODELS OF MILITARY VEHICLES

- FIGURE 51 BUSINESS MODELS OF MILITARY AIRCRAFT

- FIGURE 52 BILL OF MATERIALS FOR MILITARY VESSELS

- FIGURE 53 BILL OF MATERIALS FOR ARMORED VEHICLES

- FIGURE 54 BILL OF MATERIALS FOR MAIN BATTLE TANKS

- FIGURE 55 BILL OF MATERIALS FOR ARMORED PERSONNEL CARRIERS

- FIGURE 56 BILL OF MATERIALS FOR INFANTRY FIGHTING VEHICLES

- FIGURE 57 BILL OF MATERIALS FOR FIGHTER AIRCRAFT F-35

- FIGURE 58 BILL OF MATERIALS FOR COMBAT HELICOPTER APACHE AH-64

- FIGURE 59 MACROECONOMIC OUTLOOK FOR NORTH AMERICA, EUROPE, ASIA PACIFIC, AND MIDDLE EAST

- FIGURE 60 TECHNOLOGY TRENDS

- FIGURE 61 SUPPLY CHAIN ANALYSIS

- FIGURE 62 PATENT ANALYSIS, 2015-2024

- FIGURE 63 MILITARY VEHICLES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 64 ARMY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 65 CONVENTIONAL SEGMENT TO ACCOUNT FOR LARGER SHARE THAN NEXT-GEN SEGMENT DURING FORECAST PERIOD

- FIGURE 66 MILITARY PLATFORMS MARKET, BY REGION, 2024-2030

- FIGURE 67 NORTH AMERICA: MILITARY PLATFORMS MARKET SNAPSHOT

- FIGURE 68 EUROPE: MILITARY PLATFORMS MARKET SNAPSHOT

- FIGURE 69 ASIA PACIFIC: MILITARY PLATFORMS MARKET SNAPSHOT

- FIGURE 70 LATIN AMERICA: MILITARY PLATFORMS MARKET SNAPSHOT

- FIGURE 71 AFRICA: MILITARY PLATFORMS MARKET SNAPSHOT

- FIGURE 72 MIDDLE EAST: MILITARY PLATFORMS MARKET SNAPSHOT

- FIGURE 73 MILITARY AIRCRAFT MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2023

- FIGURE 74 MILITARY VEHICLES MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2023

- FIGURE 75 MILITARY VESSELS MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2023

- FIGURE 76 MILITARY AIRCRAFT MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- FIGURE 77 MILITARY VEHICLES MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- FIGURE 78 MILITARY VESSELS MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- FIGURE 79 BRAND/PRODUCT COMPARISON

- FIGURE 80 FINANCIAL METRICS OF PROMINENT PLAYERS

- FIGURE 81 VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 82 MILITARY AIRCRAFT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 83 MILITARY VEHICLES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 84 MILITARY VESSELS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 85 COMPANY FOOTPRINT

- FIGURE 86 MILITARY PLATFORMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 87 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 88 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 89 HUNTINGTON INGALLS INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 90 BOEING: COMPANY SNAPSHOT

- FIGURE 91 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 92 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 93 TEXTRON INC.: COMPANY SNAPSHOT

- FIGURE 94 SAAB AB: COMPANY SNAPSHOT

- FIGURE 95 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 96 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 97 FINCANTIERI S.P.A.: COMPANY SNAPSHOT

- FIGURE 98 HD HYUNDAI HEAVY INDUSTRIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 99 HANWHA OCEAN CO., LTD.: COMPANY SNAPSHOT

- FIGURE 100 RTX: COMPANY SNAPSHOT

- FIGURE 101 ST ENGINEERING: COMPANY SNAPSHOT

- FIGURE 102 THALES: COMPANY SNAPSHOT

- FIGURE 103 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 104 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 105 DASSAULT AVIATION: COMPANY SNAPSHOT

- FIGURE 106 AIRBUS: COMPANY SNAPSHOT

The military platforms market is projected to reach USD 77.08 billion by 2030, from USD 51.87 billion in 2024, at a CAGR of 6.8%. Major Growth Drivers for Military Platforms Market Geopolitical tensions, increasing defense expenditure, and rapid technological advancements across air, sea, and land domains are the growth drivers for the military platforms market. Countries in the world would continue to build up their military capabilities with a focus on air defense, naval modernization, and armored vehicle upgrades, thereby demanding advanced military platforms.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By platform type, end-user, technology and Region |

| Regions covered | North America, Europe, APAC, RoW |

As such, with the change in security dynamics and the demand for more sophisticated defense systems, the military forces will tend to buy integrated platforms with cutting-edge technologies, including advanced stealth capabilities, precision-guided targeting system, and command and control integration. Industry majors are indeed enhancing their R&D investments in developing next-generation solutions relevant to strategic defense initiatives of the world's leading countries, specially in North America, Europe, Asia-Pacific, and the Middle East.

"Based on platform type, military vehicle segment estimated to have the largest share in the market during the forecast period"

The military vehicle segment is expected to have the highest share of market in the military platforms market during the forecast period. This is because of increasing demands for strong ground-based platforms, mainly in regions with rising geopolitical tensions and border conflicts. Military vehicles, including Main Battle Tanks, Infantry Fighting Vehicles, Armored Personnel Carriers, and Mine-Resistant Ambush Protected vehicles, give the base for effective modern land warfare, thus enhancing mobility, firepower, and protection available for ground forces.

Governments are spending significantly across the globe in overhauling their military vehicle fleets to adapt to shifting defense needs. Most of the countries replace the legacy fleets with next-generation platforms that feature various advanced technologies, such as active protection systems, automated targeting systems, and advanced armor solutions. Every one of these advanced technologies enhances the survivability as well as lethality of the military vehicle in a battle.

A growing need for smaller, more agile vehicles to operate in challenging environments is a result of the high regard given to asymmetric warfare and other counterinsurgency operations. Military vehicle manufacturers also stand to gain from the heightening importance placed on logistics and supply chain management in order for the armies to be prepared offensively as well as defensively.

The leading charge for North America, Europe, and Asia-Pacific, in terms of defence modernization, will help this segment retain its good market position. Moreover, key players in this segment, with the presence of companies such as General Dynamics, BAE Systems, and Oshkosh Defense, have been heavily investing in R&D to introduce advanced military vehicles, further driving growth in this market.

"Based on end-user, the air-force segment forecasted to grow at highest CAGR during forecast period "

The air-force segment is likely to achieve the highest CAGR in the forecast period as there have been massive investments in the modernization of air-defense programs. Countries around the world have been increasing their air power with next-generation fighter jets, multi-role combat aircraft, and strategic surveillance platforms. These new aircraft will have stealth technology, advanced avionics, and high-precision weaponry for air superiority in newer warfare. Another driver for the market in this segment is the rising demand for AEWS with advanced capabilitie for ISR missions. There is a great focus on accuracy in an airstrike and long-range operational capabilities, which pushes governments to upgrade their air force infrastructure. This is where the induction of fifth and sixth-generation fighter aircraft will play the most significant role in changing the face of air power and consequently accelerate growth in the segment further.

" The North-America region is estimated to be the largest CAGR in market during the forecast period"

The highest CAGR in the military platforms market are expected during the forecast period in the North America region. This is due to significant investments done by the United States on defense budget, which upgrade its air, land, and naval platforms significantly. The US also leads in innovations of global defense with high investments in next-generation technologies including hypersonic missiles, advanced radar systems, and cyber defence solutions. Furthermore, the continent has some key defence manufacturers like Lockheed Martin, Raytheon Technologies, and General Dynamics, which add more weight to North America's lead in the market. Companies are developing advanced military advanced platforms, which will be needed to meet the changing security concerns in the region and around the world. The area's focus on these new-age threats like cyber warfare, space militarization, and precision-guided munitions will ensure that the North America market will continue to dominate the global military platforms market.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the military platforms marketplace.

- By Company Type: Tier 1 - 49%, Tier 2 - 37%, and Tier 3 - 14%

- By Designation: C-level - 55%, Director Level - 27%, and Others - 18%

- By Region: North America- 32%, Europe - 32%, Asia Pacific- 16%, Middle East - 10% and Rest of the World - 10%

BAE Systems (UK), Thales (France), Leonardo S.p.A (Italy), Rheinmetall AG (Germany), Boeing (US), Huntington Ingalls Industries (US)and Lockheed Martin Corporation, (US), and are some of the leading players operating in the military platforms market.

Research Coverage

This research report categorizes the military platforms market by platform type, end-user, technology, and by Region. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the military platforms market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, and services; key strategies; Contracts, partnerships, agreements, new product launches, and recent developments associated with the military platforms market. Competitive analysis of upcoming startups in military platforms market ecosystem is covered in this report.

Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall military platforms market and its subsegments. The report covers the entire ecosystem of the military platforms market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key Drivers (Increased Global Defense Expenditure, Leveraging Rapid Technological Advancements, Growing demand for armored vehicles to tackle cross-border conflicts, Increasing Regional Conflicts), restrains (High capital cost of military platforms, Regulatory Compliance), opportunities (Increasing Modernization Programs, Modular and Scalable Armored Vehicles) and challenges (Supply Chain Disruptions, Lifecycle Maintenance Costs) influencing the growth of the market.

- Product Development/Innovation: Detailed Insights on upcoming technologies, R&D activities, and new products/solutions launched in the market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the military platforms market across varied regions

- Market Diversification: Exhaustive information about new solutions, recent developments, and investments in the military platforms market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players including BAE Systems (UK), Thales (France), Leonardo S.p.A (Italy), Rheinmetall AG (Germany), Boeing (US), Huntington Ingalls Industries (US), Lockheed Martin Corporation, (US), Leonardo S.p.A (Italy) and among others in the military platforms market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 MILITARY AIRCRAFT

- 1.2.2 MILITARY VESSELS

- 1.2.3 MILITARY VEHICLES

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation and methodology

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MILITARY PLATFORMS MARKET

- 4.2 MILITARY PLATFORMS MARKET, BY END USER

- 4.3 MILITARY PLATFORMS MARKET, BY MILITARY VESSEL

- 4.4 MILITARY PLATFORMS MARKET, BY MILITARY VEHICLE

- 4.5 MILITARY PLATFORMS MARKET, BY MILITARY AIRCRAFT

- 4.6 MILITARY PLATFORMS MARKET, BY TECHNOLOGY

- 4.7 MILITARY PLATFORMS MARKET (ACTIVE FLEETS), BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased global defense expenditure

- 5.2.1.2 Need for leveraging rapid technological advancements

- 5.2.1.3 Growing demand for armored vehicles to tackle cross-border conflicts

- 5.2.1.4 Increasing regional conflicts

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital cost of military platforms

- 5.2.2.2 Regulatory compliance

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid increase in modernization programs

- 5.2.3.1.1 Aircraft manufacturing and engine development

- 5.2.3.1.2 Naval and maritime propulsion systems

- 5.2.3.1.3 Submarine modernization

- 5.2.3.2 Demand for modular and scalable armored vehicles

- 5.2.3.1 Rapid increase in modernization programs

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain disruptions

- 5.2.4.2 Lifecycle maintenance costs

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Avionics systems

- 5.6.1.2 Propulsion systems

- 5.6.1.3 Armament systems

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Electronic warfare systems

- 5.6.2.2 Advanced sensor technologies

- 5.6.2.3 Integrated Logistics Support (ILS)

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Unmanned aerial vehicles (UAVs)

- 5.6.3.2 Battle management systems (BMSs)

- 5.6.3.3 Autonomous systems

- 5.6.1 KEY TECHNOLOGIES

- 5.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TRADE ANALYSIS

- 5.8.1 MARINE VESSELS: IMPORT SCENARIO (HS CODE 89)

- 5.8.2 MARINE VESSELS: EXPORT SCENARIO (HS CODE 89)

- 5.8.3 MILITARY VEHICLES: EXPORT SCENARIO (HS CODE 8710)

- 5.8.4 MILITARY VEHICLES: IMPORT SCENARIO (HS CODE 8710)

- 5.8.5 MILITARY AIRCRAFT: IMPORT SCENARIO (HS CODE 8802)

- 5.8.6 MILITARY AIRCRAFT: EXPORT SCENARIO (HS CODE 8802)

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.3 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.4 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.5 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 HHI IMPLEMENTED SIEMENS DIGITAL INDUSTRIES SOFTWARE SOLUTIONS FOR DIGITAL MANUFACTURING AND TEAM CENTER FOR PRODUCT LIFECYCLE MANAGEMENT

- 5.10.2 MHI IMPLEMENTED PTC'S WINDCHILL PRODUCT LIFECYCLE MANAGEMENT (PLM) SOLUTION TO CREATE CENTRALIZED SYSTEM FOR MANAGING ALL PRODUCT DATA

- 5.10.3 INDIAN AIR FORCE ADOPTED NEXT-GENERATION TECHNOLOGIES' AIRBORNE EARLY WARNING AND CONTROL SYSTEM (AEW&C) TO MEET SAFETY AND OPERATIONAL EFFECTIVENESS

- 5.10.4 DEVELOPING LIGHTWEIGHT TANKS AND OTHER ARMORED VEHICLES

- 5.10.5 FUTURE OF COMBAT: HYBRID AND ELECTRIC MILITARY VEHICLES

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS, 2025

- 5.13 INVESTMENTS AND FUNDING SCENARIO

- 5.14 OPERATIONAL DATA

- 5.15 TECHNOLOGY ROADMAP

- 5.15.1 MILITARY VESSELS

- 5.15.2 MILITARY VEHICLES

- 5.15.3 MILITARY AIRCRAFT

- 5.16 TOTAL COST OF OWNERSHIP

- 5.16.1 TOTAL COST OF OWNERSHIP OF MILITARY VESSELS

- 5.16.1.1 Acquisition costs

- 5.16.1.2 Operating costs

- 5.16.1.3 Downtime and disruption costs

- 5.16.1.4 Lifecycle extension costs

- 5.16.1.5 End-of-life costs

- 5.16.1.6 Risk management costs

- 5.16.1.7 Opportunity costs

- 5.16.2 TOTAL COST OF OWNERSHIP OF MILITARY VEHICLES

- 5.16.3 TOTAL COST OF OWNERSHIP OF MILITARY AIRCRAFT

- 5.16.1 TOTAL COST OF OWNERSHIP OF MILITARY VESSELS

- 5.17 BUSINESS MODELS

- 5.17.1 MILITARY VESSELS: BUSINESS MODELS

- 5.17.2 MILITARY VEHICLES: BUSINESS MODELS

- 5.17.3 MILITARY AIRCRAFT: BUSINESS MODELS

- 5.18 BILL OF MATERIALS

- 5.18.1 BILL OF MATERIALS: MILITARY VESSELS

- 5.18.2 BILL OF MATERIALS: MILITARY VEHICLES

- 5.18.3 BILL OF MATERIALS: MILITARY AIRCRAFT

- 5.18.4 AIRFRAME AND STRUCTURAL MATERIALS

- 5.18.5 PROPULSION SYSTEM

- 5.18.6 AVIONICS AND ELECTRONICS

- 5.18.7 WEAPON SYSTEMS

- 5.18.8 SENSORS AND POWER SYSTEMS

- 5.18.9 LANDING GEAR AND HYDRAULIC SYSTEMS

- 5.18.10 OTHER SYSTEMS

- 5.19 IMPACT OF AI/GEN AI

- 5.20 MACROECONOMIC OUTLOOK

- 5.20.1 INTRODUCTION

- 5.20.2 NORTH AMERICA

- 5.20.3 EUROPE

- 5.20.4 ASIA PACIFIC

- 5.20.5 MIDDLE EAST

- 5.20.6 ROW

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 AERODYNAMIC REFINEMENTS

- 6.2.2 SMART SKIN TECHNOLOGY

- 6.2.3 ACTIVE PROTECTION SYSTEMS

- 6.2.3.1 Soft-kill technology

- 6.2.3.2 Electro-optical jammers

- 6.2.3.3 Hard-kill technology

- 6.2.4 REACTIVE ARMOR TECHNOLOGY

- 6.2.5 DIGITAL TWIN TECHNOLOGY

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 SUPERCRUISE TECHNOLOGY

- 6.3.2 ARTIFICIAL INTELLIGENCE (AI)