|

|

市場調査レポート

商品コード

1684183

グリーン水処理薬品の世界市場:タイプ別、由来別、用途別、最終用途産業別、地域別 - 2029年までの予測Green Water Treatment Chemicals Market by Type, Source, Application, End-use Industry, and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| グリーン水処理薬品の世界市場:タイプ別、由来別、用途別、最終用途産業別、地域別 - 2029年までの予測 |

|

出版日: 2025年02月14日

発行: MarketsandMarkets

ページ情報: 英文 327 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

グリーン水処理薬品の市場規模は、予測期間中に7.2%のCAGRで拡大し、2025年の17億米ドルから2029年には22億5,000万米ドルに達すると予測されています。

この変化の背景には、持続可能な産業運営を目指す規制基準の強化と、世界の環境意識の高まりがあります。世界の水不足問題や環境汚染、気候変動の懸念に対処するため、各国政府は組織とともに、生分解性で環境的に安全な水処理薬品を使用するプロジェクトを奨励する規則を制定しています。様々な企業が、運用上のメリットと経済的リターンをもたらすと同時に、規制上の義務を満たす環境に優しいソリューションへの投資を増やしているため、物理的データは業界の重要な変化を示しています。様々な分野でグリーン水処理薬品の採用が加速しているのは、石油・ガスや電力生産、地方自治体の水道施設など、様々な領域で急速な工業化に伴う廃水管理ニーズの高まりに起因します。市場動向は、産業界が複数の分野のニーズに対応するために特別に設計された、環境に優しい新製品の開発にますます注力していることを示しています。

都市の成長の加速と発展途上国の人口増加は、持続可能な水供給のための効果的な廃水管理手段となるグリーン水処理方法に大きな展望をもたらします。グリーンケミストリー技術の進歩により、より効率的な凝集剤や凝集剤、殺菌剤の開発が可能になり、高い性能を維持しながら有害な残留物を減らすことができます。消費者の環境意識の高まりにより、産業界はより環境に優しい製品を導入する必要性に迫られており、これが市場成長の原動力となっています。科学的調査と顧客の関心の高まりは、国の規制とともに、今後一定期間のグリーン水処理薬品市場成長のための理想的な条件を作り出しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント | タイプ別、由来別、用途別、最終用途産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

廃水処理産業は、持続可能性の要求がより厳しい環境基準に適合するため、グリーン水処理薬品市場の急成長を牽引します。工業事業者は環境基準の上昇に直面しており、現行の処理に代わる生分解性で無害な化学薬品を採用することが極めて重要となっています。工業廃水排出は、持続可能な方法の採用を企業に迫る国家当局や国際機関の制限的な規制に直面しています。石油・ガス、発電、食品製造などの産業では、廃水管理の成功が環境要件を遵守するために不可欠であるため、この変革が不可欠となっています。環境に配慮した持続可能な実践を目指す消費者の動きは、生産効率の向上と運用コストの削減を同時に実現するグリーン水処理技術への投資を促します。廃水管理を目的としたグリーン水処理薬品市場は、水のリサイクルへの取り組みの増加により拡大を続けています。

都市の発展と人口の増加が相まって、持続可能な開発目標に適合した高度な処理ソリューションを求める水浄化の要求が高まっています。生分解性凝集剤と凝集剤で構成されるグリーン水処理薬品は、汚染物質のないクリーンな水源を維持しながら、都市廃水や工業廃水を効果的に処理します。持続可能な実践の進歩は、研究者がより高い効率を維持しながら、すべての要件を遵守する効率的な新製品を開発することを可能にするグリーンケミカル技術にかかっています。継続的な技術開発とともに、持続可能性に対する規制上の要求や顧客の関心と並んで、グリーン水処理薬品は、より広い水処理業界の中で急速に成長している分野です。

北米は、いくつかの要因によって、グリーン水処理薬品市場にとって第3位の地域になると予想されています。その背景には、広範な環境規制と重要な産業ニーズ、強力な水インフラ政策があります。同地域の環境規制は、水質浄化法とそれに対応する環境に優しい代替要件のため、産業界に従来の化学薬品からの移行を迫っています。石油・ガス事業、発電施設、自治体の廃水処理機関の3つの主要セクターは、いずれも水質基準を強化する一方で、産業廃水による汚染を減らすことが急務であることを示しています。持続可能性に関連する消費者と業界の動向は、組織が運用効果を最大化しながら規制を満たすのに役立つ生分解性凝集剤と無毒性凝集剤に対する市場の需要を高めています。北米市場は、環境保全と持続可能な産業慣行の増加により、グリーン水処理薬品業界を支配しています。

当レポートでは、世界のグリーン水処理薬品市場について調査し、タイプ別、由来別、用途別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界の動向

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- バリューチェーン分析

- マクロ経済指標

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 規制状況

- 技術分析

- 顧客ビジネスに影響を与える動向と混乱

- 貿易分析

- 価格分析

- 投資と資金調達のシナリオ

- 特許分析

- AI/生成AIの影響

第7章 グリーン水処理薬品市場、タイプ別

- イントロダクション

- 凝固剤と凝集剤

- 腐食防止剤およびスケール防止剤

- 殺生物剤と消毒剤

- キレート剤

- その他

第8章 グリーン水処理薬品市場、由来別

- イントロダクション

- 植物由来

- 動物由来

- ミネラル

第9章 グリーン水処理薬品市場、用途別

- イントロダクション

- 廃水処理

- 飲料水処理

- 工程用水処理

- その他

第10章 グリーン水処理薬品市場、最終用途産業別

- イントロダクション

- 市営

- 工業用

第11章 グリーン水処理薬品市場、地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業価値評価と財務指標

- ブランド/生産の比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- KEMIRA

- VEOLIA

- ECOLAB

- KURITA WATER INDUSTRIES LTD.

- SOLENIS

- NOURYON

- BASF

- THERMAX LIMITED

- SNF

- GREEN WATER TREATMENT SOLUTIONS

- その他の企業

- CORTEC CORPORATION

- ALUMICHEM

- GREEN GENRA

- CHEMBOND WATER TECHNOLOGIES LIMITED

- GREEN CHEMICALS A.S.

- BIOSTAR-CH

- SHANDONG GREEN TECHNOLOGIES CO., LTD.

- GENESIS WATER TECHNOLOGIES

- DOBER

- OSAKA GAS CHEMICALS CO., LTD.

- CHEMREADY

- ADVAYA CHEMICAL INDUSTRIES LIMITED(AQUAPHARM CHEMICALS PRIVATE LIMITED)

- AQUAFIX INC.

- CARBON ACTIVATED CORPORATION

- KURARAY CO., LTD.

第14章 付録

List of Tables

- TABLE 1 EXAMPLES OF GREEN WATER TREATMENT CHEMICALS FROM VARIOUS COMPANIES

- TABLE 2 EXAMPLES OF GREEN WATER TREATMENT CHEMICALS FROM KEMIRA

- TABLE 3 GROWTH OF GREEN WATER TREATMENT CHEMICALS DRIVEN BY ENVIRONMENTAL AWARENESS, REGULATIONS, AND SUSTAINABILITY DEMANDS

- TABLE 4 COMPANIES ADOPTING PLANT-BASED, MINERAL-BASED, AND ANIMAL-BASED GREEN WATER TREATMENT CHEMICALS

- TABLE 5 KEY REGULATIONS AND INDUSTRY EXAMPLES

- TABLE 6 TRANSITION TO GREEN WATER TREATMENT CHEMICALS AMID STRICTER REGULATIONS

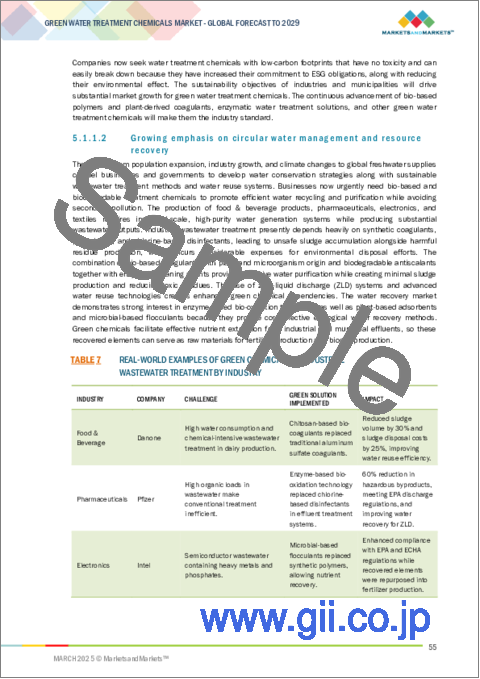

- TABLE 7 REAL-WORLD EXAMPLES OF GREEN CHEMICALS IN INDUSTRIAL WASTEWATER TREATMENT BY INDUSTRY

- TABLE 8 REAL-WORLD EXAMPLES OF GREEN CHEMICALS IN INDUSTRIAL WASTEWATER TREATMENT BY COMPANY

- TABLE 9 CHALLENGES AND STRATEGIES TO OVERCOME HIGH COSTS IN GREEN WATER TREATMENT CHEMICALS

- TABLE 10 REGULATORY FRAMEWORKS DRIVE COMPANIES TO ADOPT GREEN WATER TREATMENT CHEMICALS

- TABLE 11 GREEN WATER TREATMENT CHEMICALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS (%)

- TABLE 13 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2029

- TABLE 14 GREEN WATER TREATMENT CHEMICALS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST & AFRICA: DETAILED LIST OF REGULATORY BODIES, AGENCIES, AND ORGANIZATIONS

- TABLE 19 SOUTH AMERICA: DETAILED LIST OF REGULATORY BODIES, AGENCIES, AND ORGANIZATIONS

- TABLE 20 AVERAGE SELLING PRICE OF GREEN WATER TREATMENT CHEMICALS, BY REGION, 2022-2029

- TABLE 21 AVERAGE SELLING PRICE OF GREEN WATER TREATMENT CHEMICALS, BY TYPE

- TABLE 22 GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 23 GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 24 GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 25 GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 26 GREEN WATER TREATMENT CHEMICALS: KEY PRODUCTS & COMPANY INNOVATIONS

- TABLE 27 COMPARISON OF RENEWABLE RAW MATERIALS FOR GREEN WATER TREATMENT CHEMICALS

- TABLE 28 GREEN WATER TREATMENT CHEMICALS MARKET, BY SOURCE, 2021-2023 (USD MILLION)

- TABLE 29 GREEN WATER TREATMENT CHEMICALS MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 30 GREEN WATER TREATMENT CHEMICALS MARKET, BY SOURCE, 2021-2023 (KILOTON)

- TABLE 31 GREEN WATER TREATMENT CHEMICALS MARKET, BY SOURCE, 2024-2029 (KILOTON)

- TABLE 32 GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 33 GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 34 GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 35 GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 36 GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 37 GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 38 GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 39 GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 40 GREEN WATER TREATMENT CHEMICALS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 41 GREEN WATER TREATMENT CHEMICALS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 GREEN WATER TREATMENT CHEMICALS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 43 GREEN WATER TREATMENT CHEMICALS MARKET, BY REGION, 2024-2029 (KILOTONS)

- TABLE 44 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 45 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 46 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 47 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 48 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 49 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 50 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 51 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 52 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 53 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 54 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 55 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 56 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 57 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 58 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 59 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 60 US: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 61 US: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 62 US: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 63 US: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 64 CANADA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 65 CANADA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 66 CANADA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 67 CANADA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 68 MEXICO: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 69 MEXICO: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 70 MEXICO: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 71 MEXICO: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 72 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 73 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 74 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 75 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 76 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 77 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 78 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 79 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 80 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 81 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 82 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 83 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 84 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 85 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 86 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 87 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 88 GERMANY: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 89 GERMANY: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 90 GERMANY: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 91 GERMANY: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 92 UK: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 93 UK: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 94 UK: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 95 UK: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 96 FRANCE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 97 FRANCE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 98 FRANCE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 99 FRANCE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 100 ITALY: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 101 ITALY: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 102 ITALY: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 103 ITALY: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 104 SPAIN: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 105 SPAIN: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 106 SPAIN: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 107 SPAIN: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 108 REST OF EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 109 REST OF EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 110 REST OF EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 111 REST OF EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 112 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 113 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 114 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 115 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 116 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 117 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 118 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 119 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 120 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 121 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 122 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 123 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 124 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 125 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 126 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 127 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 128 CHINA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 129 CHINA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 130 CHINA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 131 CHINA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 132 JAPAN: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 133 JAPAN: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 134 JAPAN: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 135 JAPAN: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 136 INDIA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 137 INDIA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 138 INDIA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 139 INDIA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 140 SOUTH KOREA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 141 SOUTH KOREA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 142 SOUTH KOREA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 143 SOUTH KOREA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 144 REST OF ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 147 REST OF ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 148 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 151 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 152 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 155 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 156 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 159 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 160 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 163 MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 164 GCC COUNTRIES: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 165 GCC COUNTRIES: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 166 GCC COUNTRIES: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 167 GCC COUNTRIES: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 168 SAUDI ARABIA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 169 SAUDI ARABIA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 170 SAUDI ARABIA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 171 SAUDI ARABIA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 172 UAE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 173 UAE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 174 UAE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 175 UAE: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 176 REST OF GCC COUNTRIES: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 177 REST OF GCC COUNTRIES: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 178 REST OF GCC COUNTRIES: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 179 REST OF GCC COUNTRIES: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 180 SOUTH AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 181 SOUTH AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 182 SOUTH AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 183 SOUTH AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 188 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 189 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 190 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 191 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 192 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 193 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 194 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 195 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 196 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 197 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 198 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 199 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 200 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 201 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 202 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 203 SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 204 BRAZIL: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 205 BRAZIL: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 206 BRAZIL: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 207 BRAZIL: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 208 ARGENTINA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 209 ARGENTINA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 210 ARGENTINA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 211 ARGENTINA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 212 REST OF SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 213 REST OF SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 215 REST OF SOUTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 216 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN GREEN WATER TREATMENT CHEMICALS MARKET BETWEEN JANUARY 2020 AND DECEMBER 2024

- TABLE 217 GREEN WATER TREATMENT CHEMICALS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 218 GREEN WATER TREATMENT CHEMICALS MARKET: TYPE FOOTPRINT

- TABLE 219 GREEN WATER TREATMENT CHEMICALS MARKET: SOURCE FOOTPRINT

- TABLE 220 GREEN WATER TREATMENT CHEMICALS MARKET: APPLICATION FOOTPRINT

- TABLE 221 GREEN WATER TREATMENT CHEMICALS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 222 GREEN WATER TREATMENT CHEMICALS MARKET: REGION FOOTPRINT

- TABLE 223 GREEN WATER TREATMENT CHEMICALS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 224 GREEN WATER TREATMENT CHEMICALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 225 GREEN WATER TREATMENT CHEMICALS MARKET: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 226 GREEN WATER TREATMENT CHEMICALS MARKET: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 227 KEMIRA: COMPANY OVERVIEW

- TABLE 228 KEMIRA: PRODUCTS OFFERED

- TABLE 229 KEMIRA: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 230 KEMIRA: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 231 VEOLIA: COMPANY OVERVIEW

- TABLE 232 VEOLIA: PRODUCTS OFFERED

- TABLE 233 VEOLIA: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 234 VEOLIA: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 235 ECOLAB: COMPANY OVERVIEW

- TABLE 236 ECOLAB: PRODUCTS OFFERED

- TABLE 237 ECOLAB: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 238 ECOLAB: OTHER DEVELOPMENTS, JANUARY 2020-DECEMBER 2024

- TABLE 239 KURITA WATER INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 240 KURITA WATER INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 241 KURITA WATER INDUSTRIES LIMITED: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 242 KURITA WATER INDUSTRIES LIMITED: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 243 SOLENIS: COMPANY OVERVIEW

- TABLE 244 SOLENIS: PRODUCTS OFFERED

- TABLE 245 SOLENIS: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 246 NOURYON: COMPANY OVERVIEW

- TABLE 247 NOURYON: PRODUCTS OFFERED

- TABLE 248 NOURYON: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 249 BASF: COMPANY OVERVIEW

- TABLE 250 BASF: PRODUCTS OFFERED

- TABLE 251 THERMAX LIMITED: COMPANY OVERVIEW

- TABLE 252 THERMAX LIMITED: PRODUCTS OFFERED

- TABLE 253 THERMAX LIMITED: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 254 THERMAX LIMITED: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 255 SNF: COMPANY OVERVIEW

- TABLE 256 SNF: PRODUCTS OFFERED

- TABLE 257 SNF: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 258 GREEN WATER TREATMENT SOLUTIONS: COMPANY OVERVIEW

- TABLE 259 GREEN WATER TREATMENT SOLUTIONS: PRODUCTS OFFERED

- TABLE 260 CORTEC CORPORATION: COMPANY OVERVIEW

- TABLE 261 ALUMICHEM: COMPANY OVERVIEW

- TABLE 262 GREEN GENRA: COMPANY OVERVIEW

- TABLE 263 CHEMBOND WATER TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- TABLE 264 GREEN CHEMICALS A.S.: COMPANY OVERVIEW

- TABLE 265 BIOSTAR-CH: COMPANY OVERVIEW

- TABLE 266 SHANDONG GREEN TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 267 GENESIS WATER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 268 DOBER: COMPANY OVERVIEW

- TABLE 269 OSAKA GAS CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 270 CHEMREADY: COMPANY OVERVIEW

- TABLE 271 AQUAPHARM CHEMICALS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 272 AQUAFIX INC.: COMPANY OVERVIEW

- TABLE 273 CARBON ACTIVATED CORPORATION: COMPANY OVERVIEW

- TABLE 274 KURARAY CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 GREEN WATER TREATMENT CHEMICALS MARKET SEGMENTATION

- FIGURE 2 GREEN WATER TREATMENT CHEMICALS MARKET: RESEARCH DESIGN

- FIGURE 3 GREEN WATER TREATMENT CHEMICALS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 GREEN WATER TREATMENT CHEMICALS MARKET: TOP-DOWN APPROACH

- FIGURE 5 GREEN WATER TREATMENT CHEMICALS MARKET: DATA TRIANGULATION

- FIGURE 6 COAGULANTS & FLOCCULANTS SEGMENT TO REGISTER HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 7 PLANT-BASED SOURCES SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 8 WASTEWATER TREATMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 9 INDUSTRIAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 INCREASING ADOPTION OF SUSTAINABLE, RENEWABLE, AND ECO-FRIENDLY WATER TREATMENT SOLUTIONS TO DRIVE MARKET

- FIGURE 12 COAGULANTS & FLOCCULANTS SEGMENT TO REGISTER HIGHER CAGR IN TERMS OF VOLUME DURING FORECAST PERIOD

- FIGURE 13 PLANT-BASED SOURCES SEGMENT TO DOMINATE MARKET IN TERMS OF VOLUME DURING FORECAST PERIOD

- FIGURE 14 WASTEWATER TREATMENT SEGMENT TO REGISTER HIGHEST GROWTH RATE IN TERMS OF VOLUME DURING FORECAST PERIOD

- FIGURE 15 INDUSTRIAL SEGMENT TO REGISTER HIGHER GROWTH IN TERMS OF VOLUME FROM 2024 TO 2029

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 GREEN WATER TREATMENT CHEMICALS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF KEY APPLICATIONS

- FIGURE 20 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 21 OVERVIEW OF GREEN WATER TREATMENT CHEMICALS VALUE CHAIN

- FIGURE 22 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 EXPORT DATA FOR HS CODE 382499-COMPLIANT PRODUCTS, BY COUNTRY, 2017-2023 (USD MILLION)

- FIGURE 24 IMPORT SCENARIO FOR HS CODE 382499-COMPLIANT PRODUCTS, 2017-2023 (USD MILLION)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF GREEN WATER TREATMENT CHEMICALS, BY REGION, 2022-2024 (USD/KG)

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO

- FIGURE 27 GRANTED PATENTS ACCOUNTED FOR SIGNIFICANT SHARE OF GREEN WATER TREATMENT CHEMICAL PATENTS

- FIGURE 28 NUMBER OF PATENTS GRANTED YEAR-WISE IN LAST 10 YEARS

- FIGURE 29 APPLICANT ANALYSIS

- FIGURE 30 COAGULANTS & FLOCCULANTS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 31 PLANT-BASED SOURCES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 WASTEWATER TREATMENT SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 33 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 34 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: GREEN WATER TREATMENT CHEMICALS MARKET SNAPSHOT

- FIGURE 36 EUROPE: GREEN WATER TREATMENT CHEMICALS MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: GREEN WATER TREATMENT CHEMICALS MARKET SNAPSHOT

- FIGURE 38 GREEN WATER TREATMENT CHEMICALS MARKET: TOTAL AND SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2023 (USD BILLION)

- FIGURE 39 GREEN WATER TREATMENT CHEMICALS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD BILLION)

- FIGURE 41 GREEN WATER TREATMENT CHEMICALS MARKET: COMPANY VALUATION OF LEADING COMPANIES, 2024 (USD BILLION)

- FIGURE 42 FINANCIAL MATRIX: EV/EBITDA RATIO

- FIGURE 43 GREEN WATER TREATMENT CHEMICALS MARKET: BRAND/PRODUCTION COMPARISON

- FIGURE 44 GREEN WATER TREATMENT CHEMICALS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 GREEN WATER TREATMENT CHEMICALS MARKET: COMPANY FOOTPRINT

- FIGURE 46 GREEN WATER TREATMENT CHEMICALS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 KEMIRA: COMPANY SNAPSHOT

- FIGURE 48 VEOLIA: COMPANY SNAPSHOT

- FIGURE 49 ECOLAB: COMPANY SNAPSHOT

- FIGURE 50 KURITA WATER INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 51 SOLENIS: COMPANY SNAPSHOT

- FIGURE 52 NOURYON: COMPANY SNAPSHOT

- FIGURE 53 BASF: COMPANY SNAPSHOT

- FIGURE 54 THERMAX LIMITED: COMPANY SNAPSHOT

- FIGURE 55 SNF: COMPANY SNAPSHOT

The green water treatment chemicals market is projected to reach USD 2.25 billion by 2029 from USD 1.70 billion in 2025, at a CAGR of 7.2% during the forecast period. The primary force behind this shift is both stronger regulatory standards aiming to create sustainable industrial operations and growing environmental consciousness worldwide. Governments alongside organizations are establishing rules that stimulate projects using biodegradable and environmentally safe water treatment chemicals to address global water shortage issues and environmental pollution and climate change concerns. Physical data represent a key industry shift because various companies now increase their investments in environmentally friendly solutions which satisfy regulatory mandates while delivering operational benefits and economical returns. The acceleration of green water treatment chemical adoption in various sectors stems from rising wastewater management needs for rapid industrialization throughout different domains such as oil and gas and power production as well as municipal water facilities. Market trends show industries are increasingly concentrating on creating new environmentally friendly products specifically designed to tackle the needs of multiple sectors. The accelerating growth of cities and increasing populations in developing nations produces major prospects for green water treatment methods which serve as effective wastewater management tools for sustainable water supplies. The advancement of green chemistry technologies makes it possible to engineer more efficient coagulants and flocculants and disinfectants which reduce harmful residues while preserving high performance levels. A surge in consumer environmental awareness puts industries under increasing pressure to introduce greener products which drives market growth forward. Scientific research and growing customer interest together with national regulations create ideal conditions for significant green water treatment chemicals market growth during the upcoming period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Type, Source, Application, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

"The largest share of the green water treatment chemicals market, by application is that of wastewater treatment."

The wastewater treatment industry drives rapid growth of green water treatment chemicals markets because sustainability demands meet stricter environmental standards. Industrial operators face rising environmental standards that make it crucial for them to adopt biodegradable and non-toxic chemical replacements for their current treatments. Industrial wastewater discharge faces restrictive regulations from national authorities and international bodies which force businesses toward adopting sustainable methods. The transformation becomes essential for industries such as oil and gas and power generation and food manufacturing since successful wastewater management remains vital for adhering to environmental requirements. The consumer movement toward environmentally sustainable practices prompt industry investment in green water treatment technologies which simultaneously improves production efficiency and reduces operational expenses over time. The market for green water treatment chemicals serving wastewater management continues to expand due to increased water recycling efforts.

Urban growth coupled with expanding populations heightens water purification requirements demanding sophisticated treatment solutions compatible with sustainable development objectives. Green water treatment chemicals consisting of biodegradable coagulants and flocculating agents effectively handle municipal and industrial wastewater while maintaining clean pollutant-free water sources. The advancement of sustainable practices depends on green chemical technology which enables researchers to create efficient new products that adhere to all requirements while maintaining greater efficiency. Alongside regulatory demands and customer interest in sustainability along with continuous technological development green water treatment chemicals present a rapidly increasing sector inside the wider water treatment industry.

"North America is the third-largest region for green water treatment chemicals market."

North America is expected to be the third-largest region for green water treatment chemicals market, driven by several factors. This is due to its extensive environmental regulations combined with Significant industrial needs and strong water infrastructure policies. Environmental regulations in the region force industries to transition away from traditional chemicals because of the Clean Water Act and corresponding environment-friendly alternative requirements. The three primary sectors of oil & gas operations alongside power generation facilities together with municipal wastewater treatment agencies all demonstrate urgent needs to strengthen water quality standards while reducing their industrial wastewater contamination. Sustainability-related consumer and industry trends are raising market demands for biodegradable coagulants and non-toxic flocculants that help organizations meet regulations while maximizing operational effectiveness. The North American market dominates the green water treatment chemicals industry because of increasing environmental conservation and sustainable industrial practices throughout the region.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments and the information gathered through secondary research.

The break-up of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 45%, Asia Pacific: 20%, South America: 5%, Middle East & Africa 5%

Kemira (Finland), Veolia (France), Ecolab (US), Kurita (Japan), Solenis (US), BASF SE (Germany), Thermax (India), Nouryon (Netherlands), SNF (France), and Green Water Treatment Solutions (UAE) among others are some of the key players in the green water treatment chemicals market.

The study includes an in-depth competitive analysis of these key players in the authentication and brand

protection market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the green water treatment chemicals market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on type, source, application, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the green water treatment chemicals market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall green water treatment chemicals market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing regulatory pressure on wastewater discharge and chemical usage, Growing emphasis on circular water management and resource recovery), restraints (High production costs and limited economies of scale, Performance limitations compared to conventional chemicals), opportunities (Demand for sustainable and eco-friendly alternatives, Growing regulations on water quality and pollution control), challenges (High production costs and scalability issues).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the green water treatment chemicals market

- Market Development: Comprehensive information about lucrative markets - the report analyses the green water treatment chemicals market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the green water treatment chemicals market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Kemira (Finland), Veolia (France), Ecolab (US), Kurita (Japan), Solenis (US), BASF SE (Germany), Thermax (India), Nouryon (Netherlands), SNF (France), Green Water Treatment Solutions (UAE) among others are the top manufacturers covered in the green water treatment chemicals market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GREEN WATER TREATMENT CHEMICALS MARKET

- 4.2 GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE

- 4.3 GREEN WATER TREATMENT CHEMICALS MARKET, BY SOURCE

- 4.4 GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION

- 4.5 GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY

- 4.6 GREEN WATER TREATMENT CHEMICALS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.1.1 DRIVERS

- 5.1.1.1 Increasing regulatory pressure on wastewater discharge and chemical usage

- 5.1.1.2 Growing emphasis on circular water management and resource recovery

- 5.1.2 RESTRAINTS

- 5.1.2.1 High production costs and limited economies of scale

- 5.1.2.2 Performance limitations compared to conventional chemicals

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Demand for sustainable and eco-friendly alternatives

- 5.1.3.2 Growing regulations on water quality and pollution control

- 5.1.4 CHALLENGES

- 5.1.4.1 High production costs and scalability issues

- 5.1.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL

- 6.3.2 MANUFACTURING

- 6.3.3 DISTRIBUTION

- 6.3.4 END USE

- 6.4 MACROECONOMIC INDICATORS

- 6.4.1 GLOBAL GDP TRENDS

- 6.5 KEY CONFERENCES AND EVENTS IN 2025-2026

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 ADOPTION OF BIO-BASED COAGULANTS IN INDUSTRIAL WASTEWATER TREATMENT

- 6.6.2 ROLE OF BIO-BASED AND MINERAL-BASED WATER TREATMENT CHEMICALS IN ADDRESSING URBAN SEWAGE CHALLENGES

- 6.7 REGULATORY LANDSCAPE

- 6.7.1 REGULATIONS

- 6.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.1.1 Biobased nanomaterials

- 6.8.1.2 Bioelectrochemical remediation

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.2.1 Zero-valent Iron

- 6.8.1 KEY TECHNOLOGIES

- 6.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.10 TRADE ANALYSIS

- 6.10.1 EXPORT SCENARIO (HS CODE 382499)

- 6.10.2 IMPORT SCENARIO (HS CODE 382499)

- 6.11 PRICING ANALYSIS

- 6.11.1 AVERAGE SELLING PRICE, BY REGION

- 6.11.2 AVERAGE SELLING PRICE TREND OF GREEN WATER TREATMENT CHEMICALS, BY REGION

- 6.11.3 AVERAGE SELLING PRICE OF GREEN WATER TREATMENT CHEMICALS, BY TYPE

- 6.12 INVESTMENT AND FUNDING SCENARIO

- 6.13 PATENT ANALYSIS

- 6.13.1 METHODOLOGY

- 6.13.2 DOCUMENT TYPE

- 6.13.3 PUBLICATION TRENDS IN LAST 10 YEARS

- 6.13.4 INSIGHTS

- 6.13.5 JURISDICTION ANALYSIS

- 6.13.6 TOP 10 COMPANIES/APPLICANTS

- 6.13.7 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- 6.14 IMPACT OF AI/GEN AI

7 GREEN WATER TREATMENT CHEMICALS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 COAGULANTS & FLOCCULANTS

- 7.2.1 GROWING ENVIRONMENTAL REGULATIONS TO SUPPORT MARKET GROWTH

- 7.3 CORROSION & SCALE INHIBITORS

- 7.3.1 INCREASING NEED FOR SUSTAINABLE WATER TREATMENT SOLUTIONS TO DRIVE MARKET

- 7.4 BIOCIDES & DISINFECTANTS

- 7.4.1 INCREASING REGULATORY PRESSURE TO SUPPORT MARKET GROWTH

- 7.5 CHELATING AGENTS

- 7.5.1 RISING DEMAND FOR SUSTAINABLE WATER TREATMENT SOLUTIONS TO DRIVE MARKET

- 7.6 OTHER TYPES

8 GREEN WATER TREATMENT CHEMICALS MARKET, BY SOURCE

- 8.1 INTRODUCTION

- 8.2 PLANT-BASED SOURCES

- 8.2.1 BIODEGRADABILITY, ECO-FRIENDLINESS, AND EFFECTIVENESS IN WATER PURIFICATION TO DRIVE MARKET

- 8.2.2 STARCH

- 8.2.3 ESSENTIAL OILS

- 8.2.4 PLANT SAPS & GUMS

- 8.2.5 ALKALOIDS

- 8.2.6 TANNINS

- 8.2.7 OTHER PLANT-BASED SOURCES

- 8.3 ANIMAL-BASED SOURCES

- 8.3.1 CONTRIBUTE TO SUSTAINABLE WATER MANAGEMENT PRACTICES BY MINIMIZING ENVIRONMENTAL IMPACT

- 8.3.2 CHITOSAN

- 8.3.3 ALGINATE

- 8.3.4 POLYSACCHARIDES

- 8.3.5 OTHER ANIMAL-BASED SOURCES

- 8.4 MINERAL-BASED SOURCES

- 8.4.1 SUPPORT SUSTAINABLE WATER TREATMENT BY ENHANCING WATER QUALITY AND CREATING HEALTHIER ENVIRONMENTS

- 8.4.2 ALUM (ALUMINUM SULFATE)

- 8.4.3 LIME (CALCIUM HYDROXIDE)

- 8.4.4 ACTIVATED CARBON

- 8.4.5 BENTONITE CLAY

- 8.4.6 BIO-BASED SODA ASH

- 8.4.7 OTHER MINERAL-BASED SOURCES

9 GREEN WATER TREATMENT CHEMICALS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 WASTEWATER TREATMENT

- 9.2.1 INCREASING ADOPTION OF PLANT-BASED AND BIODEGRADABLE COAGULANTS & FLOCCULANTS TO DRIVE MARKET

- 9.3 DRINKING WATER TREATMENT

- 9.3.1 NEED FOR SUSTAINABLE AND BIODEGRADABLE SOLUTIONS TO ENSURE SAFE AND CLEAN DRINKING WATER TO PROPEL MARKET

- 9.4 PROCESS WATER TREATMENT

- 9.4.1 INTEGRATION OF ADVANCED TECHNOLOGIES WITH GREEN TREATMENT SOLUTIONS TO DRIVE GROWTH

- 9.5 OTHER APPLICATIONS

10 GREEN WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 MUNICIPAL

- 10.2.1 NEED TO ENHANCE QUALITY AND SUSTAINABILITY OF WATER SUPPLY AND WASTEWATER MANAGEMENT TO DRIVE MARKET

- 10.3 INDUSTRIAL

- 10.3.1 NEED TO SUPPORT SUSTAINABLE PRACTICES IN VARIOUS END-USE INDUSTRIES TO PROPEL MARKET

- 10.3.2 OIL & GAS

- 10.3.3 POWER GENERATION

- 10.3.4 CHEMICALS & FERTILIZERS

- 10.3.5 FOOD & BEVERAGE

- 10.3.6 TEXTILE

- 10.3.7 PULP & PAPER

- 10.3.8 OTHER END-USE INDUSTRIES

11 GREEN WATER TREATMENT CHEMICALS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Increasing demand from power generation industry to drive market

- 11.2.2 CANADA

- 11.2.2.1 Stringent environmental regulations to propel market

- 11.2.3 MEXICO

- 11.2.3.1 Need for effective and sustainable water management solutions to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Strong commitment to sustainability to fuel market growth

- 11.3.2 UK

- 11.3.2.1 Government focus on sustainability to support market growth

- 11.3.3 FRANCE

- 11.3.3.1 Growing focus on sustainability to drive demand

- 11.3.4 ITALY

- 11.3.4.1 Rising demand from water-intensive industries to drive market

- 11.3.5 SPAIN

- 11.3.5.1 Growing need for water conservation to boost market

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Increasing demand from power generation industry to drive market

- 11.4.2 JAPAN

- 11.4.2.1 Need to comply with stringent environmental regulations to fuel market

- 11.4.3 INDIA

- 11.4.3.1 Environmental concerns and regulatory pressure to drive market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Consumer demand for environmentally responsible practices to propel market

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Booming healthcare and food packaging industries to drive market

- 11.5.1.2 UAE

- 11.5.1.2.1 Adoption of innovative agricultural practices to drive demand

- 11.5.1.3 Rest of GCC Countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Growing food & beverage and pharmaceutical industries to propel market

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 High demand from energy sector to drive market

- 11.6.2 ARGENTINA

- 11.6.2.1 Implementation of stringent wastewater treatment standards to boost market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCTION COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Type footprint

- 12.7.5.3 Source footprint

- 12.7.5.4 Application footprint

- 12.7.5.5 End-use industry footprint

- 12.7.5.6 Region footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 DEALS

- 12.9.2 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 KEMIRA

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 VEOLIA

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 ECOLAB

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 KURITA WATER INDUSTRIES LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 SOLENIS

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 NOURYON

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.4 MnM view

- 13.1.6.4.1 Key strengths

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 BASF

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 MnM view

- 13.1.7.3.1 Key strengths

- 13.1.7.3.2 Strategic choices made

- 13.1.7.3.3 Weaknesses and competitive threats

- 13.1.8 THERMAX LIMITED

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.8.4 MnM view

- 13.1.8.4.1 Key strengths

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses and competitive threats

- 13.1.9 SNF

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.4 MnM view

- 13.1.9.4.1 Key strengths

- 13.1.9.4.2 Strategic choices

- 13.1.9.4.3 Weaknesses and competitive threats

- 13.1.10 GREEN WATER TREATMENT SOLUTIONS

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 MnM view

- 13.1.1 KEMIRA

- 13.2 OTHER PLAYERS

- 13.2.1 CORTEC CORPORATION

- 13.2.2 ALUMICHEM

- 13.2.3 GREEN GENRA

- 13.2.4 CHEMBOND WATER TECHNOLOGIES LIMITED

- 13.2.5 GREEN CHEMICALS A.S.

- 13.2.6 BIOSTAR-CH

- 13.2.7 SHANDONG GREEN TECHNOLOGIES CO., LTD.

- 13.2.8 GENESIS WATER TECHNOLOGIES

- 13.2.9 DOBER

- 13.2.10 OSAKA GAS CHEMICALS CO., LTD.

- 13.2.11 CHEMREADY

- 13.2.12 ADVAYA CHEMICAL INDUSTRIES LIMITED (AQUAPHARM CHEMICALS PRIVATE LIMITED)

- 13.2.13 AQUAFIX INC.

- 13.2.14 CARBON ACTIVATED CORPORATION

- 13.2.15 KURARAY CO., LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS